- ATO Community

- Legal Database

- What's New

Log in to ATO online services

Access secure services, view your details and lodge online.

Cents per kilometre method

Check how sole traders and some partnerships can use the cents per kilometre method for car-related business expenses.

Last updated 29 June 2023

This method

Only use this method if you are a sole trader or partnership (where at least one partner is an individual) claiming for a car .

The cents per kilometre method:

- uses a set rate for each kilometre travelled for business

- allows you to claim a maximum of 5,000 business kilometres per car, per year

- doesn't require written evidence to show exactly how many kilometres you travelled (but we may ask you to show how you worked out your business kilometres, for example diary records)

- uses a rate that takes all your vehicle running expenses (including registration, fuel, servicing and insurance) and depreciation into account.

Rates are reviewed regularly. The rate is:

- 85 cents per kilometre for 2023–24

- 78 cents per kilometre for 2022–23

- 72 cents per kilometre for 2020–21 and 2021–22

- 68 cents per kilometre for 2018–19 and 2019–20

- 66 cents per kilometre for 2017–18.

How you use this method

To work out how much you can claim, multiply the total business kilometres you travelled by the rate.

Things to remember

- Apportion for private and business use

- Understand the expenses you can claim

- Keep the right records

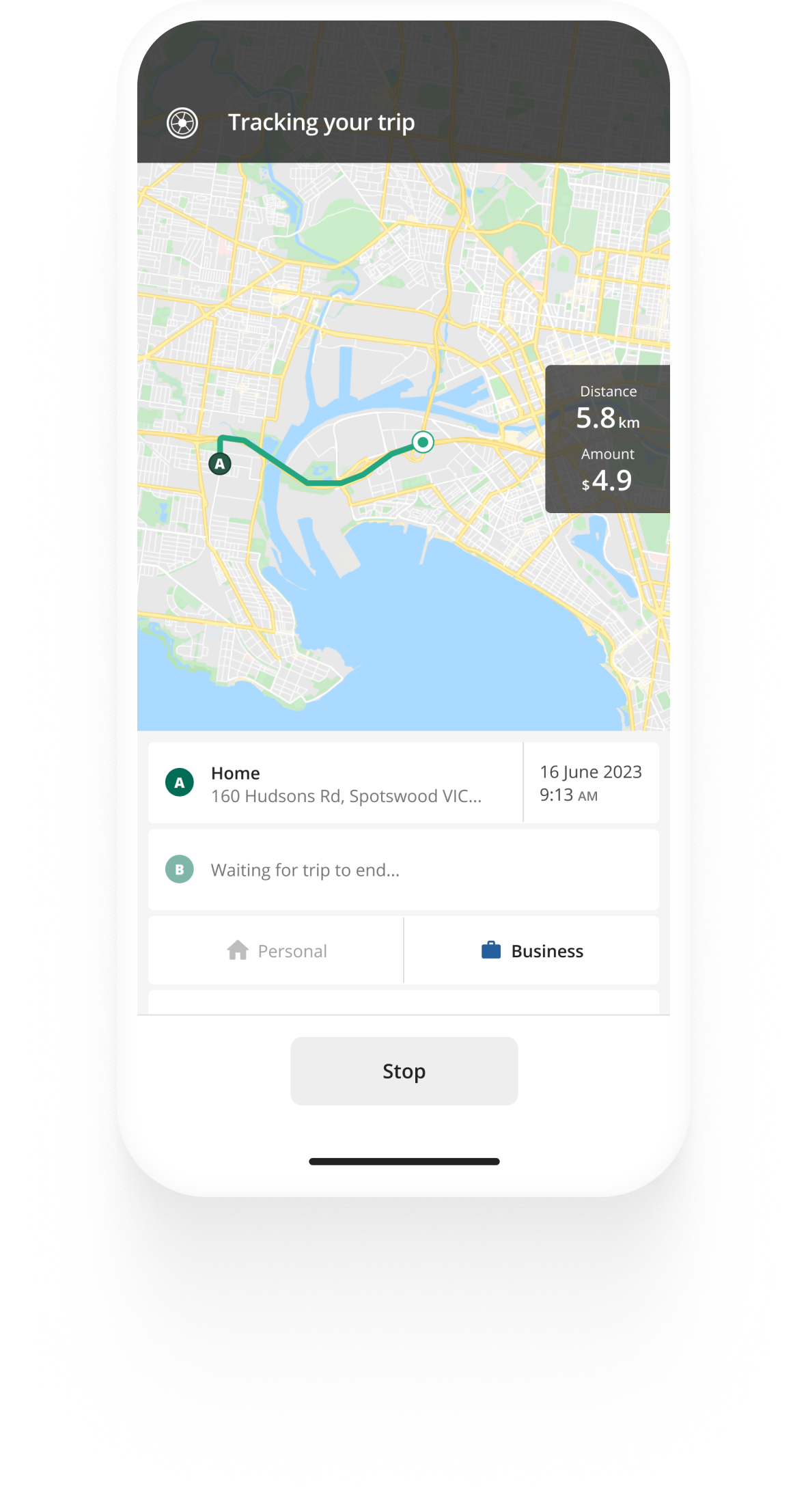

Track mileage automatically

Work-related car expenses for employees, in this article, the car allowance and the cents per kilometre method, how to log information for your work-related car expenses, will your mileage reimbursement be taxed.

Employers will often reimburse employees as they incur work-related car expenses for business-related driving. While employers can decide themselves how to reimburse these expenses, they do follow rules set by the ATO you should also be aware of.

With Driversnote you can share your vehicle log book with the ATO or your employer at the touch of a button. Try the logbook app for free.

Kilometre tracking made easy

Trusted by millions of drivers

Your employer will likely use one of these two methods of reimbursing you for your work-related car expenses. They differ in their types of compensation and payout structure.

Car allowance

If you get an ATO car allowance from your employer, it needs to be shown on your payment summary, as allowances are considered taxable income. You can use the allowance to purchase a vehicle, keep it for expenses associated with your current vehicle or spend it in any other way you see fit. The car allowance offers employees the highest level of flexibility when it comes to spending it.

When you receive a taxable car allowance, you can still deduct your business-related driving expenses at your tax return. The deduction is meant to cover the costs of running your vehicle, such as fuel, oil, tyres etc.

In case you are not reimbursed for the car operating expenses, you can claim them from the ATO on your annual tax return. You will be able to use either the cents per km method or the logbook method to deduct your eligible work-related car expenses. Read more about deducting motor vehicle expenses from the ATO .

The administrative burden of paying an allowance and accounting for all expenses afterwards can be cumbersome for a company. Instead, many employers provide a cents per kilometre rate as reimbursement. Under a cents per kilometre reimbursement arrangement, you are reimbursed at a specific rate for each kilometre you drive for business.

Why is car allowance taxable?

Car allowances are taxable because they are considered an employment benefit. You don't need to provide proof of kilometres you've driven for work to receive it, and can use it as you see fit e.g. it is not a justified reimbursement to remain untaxed.

What tax do you pay on car allowance?

Car allowance is a benefit included in your income statements or payslips, and is taxed at your income tax rate.

The cents per kilometre reimbursement

The simplest mileage reimbursement arrangement is to use a flat rate per kilometre driven. It is supposed to cover all work-related car expenses. That's what the ATO’s rate does; it is meant to cover both the costs of owning (fixed costs) and driving (variable costs) your vehicle for business-related travel.

Keep in mind that your employer can set any rate they like - they do not have to use the ATO’s rate. For rates higher than the ATO’s standard per kilometre rate, the excess is taxed as part of your income.

See the new cents per km 2023 rate , applicable for the 2023/2024 tax year.

There's a lot to be said for using a standard rate, chief among them that it's simple and avoids a fairly big administrative burden.

The vehicle you use

If you use your own car (including a leased or hired car under a hire-to-purchase agreement), you can claim all work-related travel expenses from your employer or on your tax return. The two most common methods for employee reimbursement are a cents per kilometre rate or a car allowance.

If you use someone else's vehicle , i.e. a company car for work purposes, you will be able to claim only the actual expenses you have covered for operating the car (such as fuel, maintenance and parking) as a work-related travel expense from your employer or on your tax return. You won’t be able to use the cents per km rate, as it accounts for the cost of owning a vehicle.

There are no exact requirements for how you keep track of travel as an employed individual. Your employer might require you to use a certain method or provide certain records, and they need to inform you of it. A lot of people have to choose for themselves.

However, if you claim work-related car expenses from the ATO on your tax return, you need to adhere to the requirements for a logbook based on the method you use.

Most people use a mobile application to both track their trips and generate reports for them. Other alternatives are spreadsheets, like Excel or Google Sheets, that you can share with your manager and/or accountants, but then you might need to take down odometer readings every trip to figure out your mileage accurately.

This depends on how your employer processes your claim.

- If your employer provides an allowance for car expenses, this would be taxed as it is considered a benefit and needs to be declared as income.

- If your employer reimburses your specific car expenses and they are taxed as a part of your income, you can claim these as a deduction in your tax return.

- If your employer reimburses your specific car expenses and these are not taxed, you cannot claim a deduction as you have already been fully reimbursed by your employer.

How to automate your mileage logbook

ATO Mileage Guide

- For Self-Employed

- For Employees

- For Employers

- The Cents per Kilometre Method

- ATO Log Book Requirements

- Claim Car Expenses In 5 Simple Steps

- Calculate Your Car Expenses Reimbursement

- ATO Car Expenses Deductions

- Is Mileage Reimbursement Taxed?

- Historic Cents Per KM Rates

- ATO Cents Per KM Rate 2021/2022

- ATO Cents Per KM Rate 2020/2021

Automate your logbook

Choose your country or region.

- United States

- United Kingdom

NRMA Travel Insurance

Our verdict: nrma has some particularly high benefit limits and offers 5% off if you already have insurance with them..

In this guide

Summary of NRMA International Comprehensive policy

How does nrma travel insurance cover covid-19, what policies does nrma offer, here's a breakdown of nrma travel insurance features, standard features, optional add-ons, how to make an nrma travel insurance claim, here's the bottom line about nrma travel insurance, frequently asked questions, request travel insurance quotes and compare policies.

Destinations

- NRMA covers up to $10,000 of your rental car excess, higher than many other brands.

- NRMA covers up to $45,000 for loss of income. We didn't find another brand that offered more cover in this area.

- There's no option to add higher-risk activities to your policy, such as outdoor rock-climbing, which might rule NRMA out for some travellers.

- NRMA offers limited coverage for expenses related to COVID-19.

Compare other options

Travel insurance customer satisfaction finalist

NRMA ranked in second place, with an overall score of 4.24/5. 89% of those surveyed said they'd recommend NMRA travel insurance to a friend. NRMA scored highly for customer service and ease of application, but it wasn't as impressive in the value for money category.

Best Travel Insurance - Comprehensive finalist

NRMA Travel Insurance ranked in second-place for comprehensiveness out of the 28 international policies we analysed. It scored highly for features including hospital cash allowance, COVID cover and rental car excess insurance.

Table updated September 2023

NRMA offers some cover in relation to COVID-19, including:

- Appropriate overseas medical, emergency, evacuation or repatriation costs if you're diagnosed with COVID-19.

- Additional expenses if you're diagnosed or admitted to hospital with COVID-19.

- Additional expenses if a relative or your business partner not travelling with you becomes sick as a result of COVID-19.

- Amendment or cancellation costs if you or your travelling companion are diagnosed with COVID-19 before you leave.

- Amendment or cancellation costs if your non-travelling relative or business partner becomes sick due to COVID-19.

- Amendment or cancellation costs if you're are an essential health care worker whose leave is revoked due to COVID-19.

- Amendment or cancellation costs if you or your travelling companion are diagnosed with COVID-19 on your trip.

There are some scenarios that are not covered by NRMA Travel Insurance, including if your accommodation or tour cancels due to COVID-19 or if you travel knowing you have COVID-19.

NRMA offers six insurance policies to travellers - International Multi-Trip, International Comprehensive, International Essentials, Domestic Multi-Trip, Domestic Comprehensive, and Domestic Cancellation.

International Multi-Trip

International Comprehensive

International Essentials

Domestic Multi-Trip

Domestic Comprehensive

Domestic Cancellation

The insurer of this product is Zurich Australian Insurance Limited. It comes with a cooling-off period of 21 days and choice of $250 standard excess for international plans.

These are some of the main insured events that NRMA will cover. These benefits apply across all international policies.

- Overseas medical treatment

- Lost, damaged or stolen property

- Trip cancellation or amendment

- Additional accommodation and transport

- Delayed luggage allowance

- Rental car insurance excess

- Emergency dental costs

- Kidnap and hijack

- Personal liability

- Accidental death

NRMA also offers opportunities to tailor your cover to suit your needs. It has a specific Cruise Cover option but otherwise you just have to request a quote for your other needs.

- Cruise cover. Mandatory if you are going on a multi-night cruise, includes extra cover for some cruise-related risks such as cabin confinement and missed ports.

- Medical Conditions and Pregnancy. NRMA may consider covering your pregnancy or pre-existing condition following a health questionnaire.

- Increase luggage item limits. You may be able to increase the item limit by paying an additional premium.

- Motorcycle/moped riding. Extends your insurance policy to cover some motorcycle and moped-related claims, but not personal liability.

- Snow skiing, snowboarding and snowmobiling. If you want your policy to cover you while on the slopes, you'll need to pay an additional premium.

Unfortunately, travel insurance doesn't cover everything. Generally, NRMA will not pay your claim if it relates to:

- Unlawful, wreckless or unreasonably unsafe behaviour by you

- Behaviour while you were drunk or under the influence of drugs

- Expenses related to a pre-existing medical condition

- An act of war, invasion or revolution

- Insolvency of a travel agent , tour operator or accommodation provider

- Mandatory quarantines or isolations

- You being unfit to travel or travelling against medical advic

- Childbirth or pregnancy complications before the 24th week of gestation or if you have had previous pregnancy complications

- An elective medical or dental treatment , cosmetic procedure or body modification (including tattoos or piercing)

- Self-inflicted injury or illness, suicide or attempted suicide

Make sure you review the NRMA PDS for a detailed breakdown of what won't be covered, found under its list of general exclusions .

You can claim online via the NRMA website, following these instructions:

- Describe the incident

- Enter your expenses or losses

- Upload any supporting documents

- Provide your bank details

- Review and finalise your claim

You can save and return to an incomplete claim for up to 28 days. Once you've lodged your claim, NRMA will update you within 10 working days.

You can also phone NRMA on 1300 135 640 between 9am-5pm, Monday to Friday. Or you can fill out a claim form and post it to:

NRMA Travel Insurance c/o Cover-More Claims Department Private Bag 913 North Sydney NSW 2059

NRMA offers particularly high benefit limits, so if you're travelling with expensive items or have a high rental car excess, it could be a good option.

However, any travellers keen to take part in risky or high-adrenaline activities may want to look elsewhere as NRMA doesn't offer an opportunity to add an adventure pack to its policies, whereas many other insurance brands do.

If you're still not sure about NRMA, you can compare other travel insurance companies here .

What type of documentation do I need when making a claim?

NRMA may ask you to provide a range of documents including receipts, valuation certificates, credit card or bank statements, photos or an emergency services report.

Does NRMA cover pre-existing conditions?

NRMA covers a range of pre-existing conditions as standard, including asthma, coeliac disease, and bunions. Some additional conditions are covered with specific conditions, such as not being hospitalised within a certain time period, while others you will need to apply for specific cover and pay an extra premium..

Use a comma or space to separate ages. Add kids under the age of 1 by typing a “0” 0 traveller(s)

Include travel deals and helpful personal finance content from Finder

By submitting this form, you agree to our Privacy & Cookies Policy and Terms of Service

- NRMA International Multi-Trip, International Comprehensive, International Essentials, Domestic Multi-Trip, Domestic Comprehensive, and Domestic Cancellation Travel Insurance information page

- NRMA International Multi-Trip, International Comprehensive, International Essentials, Domestic Multi-Trip, Domestic Comprehensive, and Domestic Cancellation Travel Insurance information PDF

- NRMA International Multi-Trip, International Comprehensive, International Essentials, Domestic Multi-Trip, Domestic Comprehensive, and Domestic Cancellation Travel Insurance TMD

Nicola Middlemiss

Nicola Middlemiss is a contributing writer at Finder, with a special interest in personal finance and insurance. Formerly a business and finance journalist, Nicola has written thousands of articles helping Australians better understand insurance and grow their personal wealth. She has contributed to a wide range of publications, including Domain, the Educator, Financy, Fundraising and Philanthropy, Insurance Business, MoneyMag, Mortgage Professional, Yahoo Finance, Your Investment Property, and Wealth Professional. Nicola has a Tier 1 General Insurance (General Advice) certification and a Bachelor's degree from the University of Leeds.

More guides on Finder

Australians are gearing up for a big Easter spending spree, according to new research by Finder.

Finder's Credit Card Report investigates the emerging consumer behaviours and industry trends in Australia's credit card market.

SPONSORED: Business expansion can be risky – both inside and outside your organisation – so it's essential to have the right resources in play.

Millions of Australians are being forced to take second jobs to keep up with soaring costs, according to new research by Finder.

Aussies are planning to spend $1,185 this Easter according to Finder research.

Everything we know about the D3 Energy IPO, plus information on how to buy in.

Steps to owning and managing Novo Resources Corp shares.

This road rule is easier to forget about than you think.

Do your sums carefully before paying more purely for the points.

Millions of Australians have less than a grand to their name, according to new research by Finder.

Ask a Question

Click here to cancel reply.

You are about to post a question on finder.com.au:

- Do not enter personal information (eg. surname, phone number, bank details) as your question will be made public

- finder.com.au is a financial comparison and information service, not a bank or product provider

- We cannot provide you with personal advice or recommendations

- Your answer might already be waiting – check previous questions below to see if yours has already been asked

2 Responses

Travelling to Bankok Singapore

Thanks for reaching out to Finder.

If you are looking to apply for a travel insurance with NRMA , you may directly visit their website to request a quote or to speak to a representative who can help with your insurance enquiries.

Alternatively, you may compare policies from different brands from our Travel insurance for Singapore page. Simply enter your travel details and press “Get my quote”. Once you have chosen a particular cover, you may then click on the “Go to site” button and you will be redirected to the insurer’s website where you can proceed with your application or get in touch with their representatives for further assistance.

Before applying, please ensure that you read through the relevant Product Disclosure Statements/Terms and Conditions when comparing your options before making a decision on whether it is right for you. You can also contact the provider if you have specific questions.

Cheers, Joanne

How likely would you be to recommend finder to a friend or colleague?

Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve.

Important information about this website

Advertiser disclosure.

finder.com.au is one of Australia's leading comparison websites. We are committed to our readers and stands by our editorial principles

We try to take an open and transparent approach and provide a broad-based comparison service. However, you should be aware that while we are an independently owned service, our comparison service does not include all providers or all products available in the market.

Some product issuers may provide products or offer services through multiple brands, associated companies or different labeling arrangements. This can make it difficult for consumers to compare alternatives or identify the companies behind the products. However, we aim to provide information to enable consumers to understand these issues.

How we make money

We make money by featuring products on our site. Compensation received from the providers featured on our site can influence which products we write about as well as where and how products appear on our page, but the order or placement of these products does not influence our assessment or opinions of them, nor is it an endorsement or recommendation for them.

Products marked as 'Top Pick', 'Promoted' or 'Advertisement' are prominently displayed either as a result of a commercial advertising arrangement or to highlight a particular product, provider or feature. Finder may receive remuneration from the Provider if you click on the related link, purchase or enquire about the product. Finder's decision to show a 'promoted' product is neither a recommendation that the product is appropriate for you nor an indication that the product is the best in its category. We encourage you to use the tools and information we provide to compare your options.

Where our site links to particular products or displays 'Go to site' buttons, we may receive a commission, referral fee or payment when you click on those buttons or apply for a product. You can learn more about how we make money .

Sorting and Ranking Products

When products are grouped in a table or list, the order in which they are initially sorted may be influenced by a range of factors including price, fees and discounts; commercial partnerships; product features; and brand popularity. We provide tools so you can sort and filter these lists to highlight features that matter to you.

Terms of Service and Privacy Policy

Please read our website terms of use and privacy policy for more information about our services and our approach to privacy.

Looks like JavaScript is disabled

To interact with our website properly, you can enable JavaScript in your browser settings.

Travel services from NRMA*

Car rental discounts with Sixt

NRMA* Members get 15% off day rates, a free upgrade and more.

Making a claim?

To find out if you can get a hire car as part of your Comprehensive Car Insurance claim, call 132 132 (7am–8pm).

Holiday Parks and Hotels

Thinking about a holiday in Australia? NRMA* members get discounts on holiday accommodation, from holiday parks to hotels.

More from NRMA*:

- Roadside assistance

- Car services

International Driving Permits

NRMA* Members get discounts on cruises, rail tours, Australian and overseas holidays, and more.

Discounted tickets

NRMA* Members can save on over 3,000 experiences across Australia and New Zealand. Get discounts on Gold Coast theme parks, zoos, wildlife parks, sightseeing cruises and more.

Driving overseas and need an International Driving Permit (IDP)? Pick one up from a participating branch or apply online to get it in as few as five business days (through Domestic Express Post).

Things you should know

* National Roads and Motorists' Association Limited, ABN 77 000 010 506, trading as NRMA, is a separate and independent company from Insurance Australia Limited, ABN 11 000 016 722, trading as NRMA Insurance. “NRMA” provides Membership, the “my nrma app” and other services.

- Get a quote

- Make a claim

- Membership and roadside assistance

- Download the app

An official website of the United States government

Here’s how you know

Official websites use .gov A .gov website belongs to an official government organization in the United States.

Secure .gov websites use HTTPS A lock ( ) or https:// means you’ve safely connected to the .gov website. Share sensitive information only on official, secure websites.

- Explore sell to government

- Ways you can sell to government

- How to access contract opportunities

- Conduct market research

- Register your business

- Certify as a small business

- Become a schedule holder

- Market your business

- Research active solicitations

- Respond to a solicitation

- What to expect during the award process

- Comply with contractual requirements

- Handle contract modifications

- Monitor past performance evaluations

- Explore real estate

- 3D-4D building information modeling

- Art in architecture | Fine arts

- Computer-aided design standards

- Commissioning

- Design excellence

- Engineering

- Project management information system

- Spatial data management

- Facilities operations

- Smart buildings

- Tenant services

- Utility services

- Water quality management

- Explore historic buildings

- Heritage tourism

- Historic preservation policy, tools and resources

- Historic building stewardship

- Videos, pictures, posters and more

- NEPA implementation

- Courthouse program

- Land ports of entry

- Prospectus library

- Regional buildings

- Renting property

- Visiting public buildings

- Real property disposal

- Reimbursable services (RWA)

- Rental policy and procedures

- Site selection and relocation

- For businesses seeking opportunities

- For federal customers

- For workers in federal buildings

- Explore policy and regulations

- Acquisition management policy

- Aviation management policy

- Information technology policy

- Real property management policy

- Relocation management policy

- Travel management policy

- Vehicle management policy

- Federal acquisition regulations

- Federal management regulations

- Federal travel regulations

- GSA acquisition manual

- Managing the federal rulemaking process

- Explore small business

- Explore business models

- Research the federal market

- Forecast of contracting opportunities

- Events and contacts

- Explore travel

Per diem rates

- Transportation (airfare rates, POV rates, etc.)

- State tax exemption

- Travel charge card

- Conferences and meetings

- E-gov travel service (ETS)

- Travel category schedule

- Federal travel regulation

- Travel policy

- Explore technology

- Cloud computing services

- Cybersecurity products and services

- Data center services

- Hardware products and services

- Professional IT services

- Software products and services

- Telecommunications and network services

- Work with small businesses

- Governmentwide acquisition contracts

- MAS information technology

- Software purchase agreements

- Cybersecurity

- Digital strategy

- Emerging citizen technology

- Federal identity, credentials, and access management

- Mobile government

- Technology modernization fund

- Explore about us

- Annual reports

- Mission and strategic goals

- Role in presidential transitions

- Get an internship

- Launch your career

- Elevate your professional career

- Discover special hiring paths

- Events and training

- Agency blog

- Congressional testimony

- GSA does that podcast

- News releases

- Leadership directory

- Staff directory

- Office of the administrator

- Federal Acquisition Service

- Public Buildings Service

- Staff offices

- Board of Contract Appeals

- Office of Inspector General

- Region 1 | New England

- Region 2 | Northeast and Caribbean

- Region 3 | Mid-Atlantic

- Region 4 | Southeast Sunbelt

- Region 5 | Great Lakes

- Region 6 | Heartland

- Region 7 | Greater Southwest

- Region 8 | Rocky Mountain

- Region 9 | Pacific Rim

- Region 10 | Northwest/Arctic

- Region 11 | National Capital Region

- Per Diem Lookup

FY 2024 Per Diem Rates Now Available

Please note! The FY 2024 rates are NOT the default rates until October 1, 2023.

You must follow these instructions to view the FY 2024 rates. Select FY 2024 from the drop-down box above the “Search By City, State, or ZIP Code” or “Search by State" map. Otherwise, the search box only returns current FY 2023 rates.

Rates are set by fiscal year, effective Oct. 1 each year. Find current rates in the continental United States, or CONUS rates, by searching below with city and state or ZIP code, or by clicking on the map, or use the new per diem tool to calculate trip allowances .

Search by city, state, or ZIP code

Required fields are marked with an asterisk ( * ).

Search by state

Have travel policy questions? Use our ' Have a Question? ' site

Have a question about per diem and your taxes? Please contact the Internal Revenue Service at 800-829-1040 or visit www.irs.gov. GSA cannot answer tax-related questions or provide tax advice.

Need a state tax exemption form?

Per OMB Circular A-123, federal travelers "...must provide a tax exemption certificate to lodging vendors, when applicable, to exclude state and local taxes from their hotel bills." GSA's SmartPay team maintains the most current state tax information , including any applicable forms.

PER DIEM LOOK-UP

1 choose a location.

Error, The Per Diem API is not responding. Please try again later.

No results could be found for the location you've entered.

Rates for Alaska, Hawaii, U.S. Territories and Possessions are set by the Department of Defense .

Rates for foreign countries are set by the State Department .

2 Choose a date

Rates are available between 10/1/2021 and 09/30/2024.

The End Date of your trip can not occur before the Start Date.

Traveler reimbursement is based on the location of the work activities and not the accommodations, unless lodging is not available at the work activity, then the agency may authorize the rate where lodging is obtained.

Unless otherwise specified, the per diem locality is defined as "all locations within, or entirely surrounded by, the corporate limits of the key city, including independent entities located within those boundaries."

Per diem localities with county definitions shall include "all locations within, or entirely surrounded by, the corporate limits of the key city as well as the boundaries of the listed counties, including independent entities located within the boundaries of the key city and the listed counties (unless otherwise listed separately)."

When a military installation or Government - related facility(whether or not specifically named) is located partially within more than one city or county boundary, the applicable per diem rate for the entire installation or facility is the higher of the rates which apply to the cities and / or counties, even though part(s) of such activities may be located outside the defined per diem locality.

An official website of the United States Government

- Kreyòl ayisyen

- Search Toggle search Search Include Historical Content - Any - No Include Historical Content - Any - No Search

- Menu Toggle menu

- INFORMATION FOR…

- Individuals

- Business & Self Employed

- Charities and Nonprofits

- International Taxpayers

- Federal State and Local Governments

- Indian Tribal Governments

- Tax Exempt Bonds

- FILING FOR INDIVIDUALS

- How to File

- When to File

- Where to File

- Update Your Information

- Get Your Tax Record

- Apply for an Employer ID Number (EIN)

- Check Your Amended Return Status

- Get an Identity Protection PIN (IP PIN)

- File Your Taxes for Free

- Bank Account (Direct Pay)

- Payment Plan (Installment Agreement)

- Electronic Federal Tax Payment System (EFTPS)

- Your Online Account

- Tax Withholding Estimator

- Estimated Taxes

- Where's My Refund

- What to Expect

- Direct Deposit

- Reduced Refunds

- Amend Return

Credits & Deductions

- INFORMATION FOR...

- Businesses & Self-Employed

- Earned Income Credit (EITC)

- Child Tax Credit

- Clean Energy and Vehicle Credits

- Standard Deduction

- Retirement Plans

Forms & Instructions

- POPULAR FORMS & INSTRUCTIONS

- Form 1040 Instructions

- Form 4506-T

- POPULAR FOR TAX PROS

- Form 1040-X

- Circular 230

IRS issues standard mileage rates for 2024; mileage rate increases to 67 cents a mile, up 1.5 cents from 2023

More in news.

- Topics in the News

- News Releases for Frequently Asked Questions

- Multimedia Center

- Tax Relief in Disaster Situations

- Inflation Reduction Act

- Taxpayer First Act

- Tax Scams/Consumer Alerts

- The Tax Gap

- Fact Sheets

- IRS Tax Tips

- e-News Subscriptions

- IRS Guidance

- Media Contacts

- IRS Statements and Announcements

IR-2023-239, Dec. 14, 2023

WASHINGTON — The Internal Revenue Service today issued the 2024 optional standard mileage rates used to calculate the deductible costs of operating an automobile for business, charitable, medical or moving purposes.

Beginning on Jan. 1, 2024, the standard mileage rates for the use of a car (also vans, pickups or panel trucks) will be:

- 67 cents per mile driven for business use, up 1.5 cents from 2023.

- 21 cents per mile driven for medical or moving purposes for qualified active-duty members of the Armed Forces, a decrease of 1 cent from 2023.

- 14 cents per mile driven in service of charitable organizations; the rate is set by statute and remains unchanged from 2023.

These rates apply to electric and hybrid-electric automobiles as well as gasoline and diesel-powered vehicles.

The standard mileage rate for business use is based on an annual study of the fixed and variable costs of operating an automobile. The rate for medical and moving purposes is based on the variable costs.

It is important to note that under the Tax Cuts and Jobs Act, taxpayers cannot claim a miscellaneous itemized deduction for unreimbursed employee travel expenses. Taxpayers also cannot claim a deduction for moving expenses, unless they are members of the Armed Forces on active duty moving under orders to a permanent change of station. For more details see Moving expenses for members of the armed forces .

Taxpayers always have the option of calculating the actual costs of using their vehicle rather than using the standard mileage rates.

Taxpayers can use the standard mileage rate but generally must opt to use it in the first year the car is available for business use. Then, in later years, they can choose either the standard mileage rate or actual expenses. Leased vehicles must use the standard mileage rate method for the entire lease period (including renewals) if the standard mileage rate is chosen.

Notice 2024-08 PDF contains the optional 2024 standard mileage rates, as well as the maximum automobile cost used to calculate the allowance under a fixed and variable rate (FAVR) plan. In addition, the notice provides the maximum fair market value of employer-provided automobiles first made available to employees for personal use in calendar year 2024 for which employers may use the fleet-average valuation rule in or the vehicle cents-per-mile valuation rule.

VIDEO

COMMENTS

Rates. Rates are reviewed regularly. The rate is: 85 cents per kilometre for 2023-24. 78 cents per kilometre for 2022-23. 72 cents per kilometre for 2020-21 and 2021-22. 68 cents per kilometre for 2018-19 and 2019-20. 66 cents per kilometre for 2017-18.

The current ATO mileage rate 2021. Starting from the 2021 financial year, the mileage rate for cars (motorcycles or vehicles with a carrying capacity of one tonne or more, or nine or more passengers, such as a utility truck or panel van) using the cents per km method is $0.72 per km driven for business. You can use this rate with the cents per ...

How to use the cents per km 2022/2023 rate If you use the cents per kilometre method to claim car expenses for your business-related driving as an employee or a self-employed individual, you should use the newly revised ATO cents per km reimbursement rate for the 2022/2023 tax year, starting on July 1st, 2022.

See pages 49-50 for depreciation rates and an example of how a claim is worked out. International Comprehensive Plan International Essentials Plan Domestic Comprehensive Plan Cameras and video cameras. CLAIMS NRMA Travel Insurance . 24 - Zurich Australian Insurance Limited, , ,, Certificate of Insurance. ^ ^ ^ ^ $200. STATEMENT. NRMA CONTACT ...

The cents per kilometre reimbursement. The simplest mileage reimbursement arrangement is to use a flat rate per kilometre driven. It is supposed to cover all work-related car expenses. That's what the ATO's rate does; it is meant to cover both the costs of owning (fixed costs) and driving (variable costs) your vehicle for business-related travel.

For policies that started from 28 November 2021-9 September 2023, and have a policy number starting with TVLN refer to Travel Insurance PDS November 2021. Call us on 1300 135 640 to start your travel insurance claim. We're available 24 hours a day, 7 days a week.

If you have a single-trip policy, to cancel your policy and request a refund, send an email to [email protected] with your policy number, name and contact details. If you have an annual multi-trip policy, NRMA Travel Insurance will discuss your refund with you. To arrange a refund for one of these policies, call 1300 135 826.

The NRMA offers holiday and travel packages and itineraries with savings for Members, along with travel insurance, advice and IDPs. ... Get 15% off daily rates* Rent a vehicle from SIXT to save. Find out more > 24/7 Roadside assistance 13 11 22 or request online What are you looking for? ...

Get 15% off daily rates* Rent a vehicle from SIXT to save. Find out more > 1300 838 105. What are you looking for? 1300 838 105. Travel; Up to 5% discount on NRMA travel insurance ... To get the 5% member discount, the new NRMA Travel Insurance Policy must be started, completed and paid in full online. The discount will be applied to the total ...

Once you've lodged your claim, NRMA will update you within 10 working days. You can also phone NRMA on 1300 135 640 between 9am-5pm, Monday to Friday. Or you can fill out a claim form and post it ...

NRMA Travel Insurance, c/o Cover-More Claims Department, Private Bag 913 North Sydney NSW 2059 (registered or express post recommended) 02 9202 8098 (scanning and emailing your claim is recommended over faxing) ... Your travel agent's name Name of the travel agency Signature of policyholder(s) Date / / 1. Were all of your travel arrangements ...

GSA has adjusted all POV mileage reimbursement rates effective January 1, 2024. Modes of transportation. Effective/applicability date. Rate per mile. Airplane*. January 1, 2024. $1.76. If use of privately owned automobile is authorized or if no government-furnished automobile is available. January 1, 2024.

Travel services from NRMA* Hire car. Car rental discounts with Sixt. NRMA* Members get 15% off day rates, a free upgrade and more. Hire a car. Making a claim? To find out if you can get a hire car as part of your Comprehensive Car Insurance claim, call 132 132 (7am-8pm). Read more.

The U.S. General Services Administration (GSA) establishes the per diem reimbursement rates that federal agencies use to reimburse their employees for subsistence expenses incurred while on official travel within the continental U.S. (CONUS), which includes the 48 contiguous states and the District of Columbia.

2023 mileage rates. The standard mileage rates for 2023 are: Self-employed and business: 65.5 cents/mile. Charities: 14 cents/mile. Medical: 22 cents/mile. Moving ( military only ): 22 cents/mile. Find out when you can deduct vehicle mileage.

Personal Vehicle (approved business/travel expense) $0.67. Personal Vehicle (state-approved relocation) $0.21. Private Aircraft (per statute mile)*. *$1.76 . *Unless otherwise stated in the applicable MOU, the personal aircraft mileage reimbursement rate is the applicable "Private Aircraft" rate provided in this chart .

You received full reimbursement for your expenses. Your employer required you to return any excess reimbursement and you did so. There is no amount shown with a code L in box 12 of your Form W-2, Wage and Tax Statement. ... For travel in 2023, the rate for most small localities in the United States is $59 per day.

File a claim for general health care travel reimbursement online. General health care travel reimbursement covers these expenses for eligible Veterans and caregivers: Regular transportation, such as by car, plane, train, bus, taxi, or light rail. Approved meals and lodging expenses. You can file a claim online through the Beneficiary Travel ...

Rates are set by fiscal year, effective Oct. 1 each year. Find current rates in the continental United States, or CONUS rates, by searching below with city and state or ZIP code, or by clicking on the map, or use the new per diem tool to calculate trip allowances.

Leased vehicles must use the standard mileage rate method for the entire lease period (including renewals) if the standard mileage rate is chosen. Notice 2024-08 PDF contains the optional 2024 standard mileage rates, as well as the maximum automobile cost used to calculate the allowance under a fixed and variable rate (FAVR) plan. In addition ...

Save up to 5% off travel insurance. Get peace of mind when travelling. Choose domestic or international travel insurance and save. Find out more. Tick off all the essentials for your next holiday from flights and insurance to car hire and accommodation. Start organising your next trip and save as an NRMA Member.

The purpose of this policy is to ensure that (a) adequate cost controls are in place, (b) travel and other expenditures are appropriate, and (c) to provide a uniform and consistent approach for the timely reimbursement of authorized expenses incurred by Personnel. It is the policy of NAMMA to reimburse only reasonable and necessary expenses ...

Call your servicing Prime Travel Benefit office before booking airfare or traveling more than 400 miles one-way. You must confirm the maximum amount you may be reimbursed. Your reimbursement only includes the actual costs of lodging and meals. This is not to exceed the government per diem rate for the ZIP code of your specialty care provider ...