- Airport Transfer

Things to Do

Traveloka PH

14 Apr 2022 - 5 min read

Travel Tax in the Philippines: Everything a Traveler Needs to Know

Paying the travel tax is one of the steps a traveler must do before flying out for an international trip. Here's a guide on what you need to know about this tax.

What is Travel Tax?

The Philippine travel tax is an additional fee you need to pay every time you go abroad.

You can read up on it in greater detail under Presidential Decree 1183 , but all you need to know about it is that you are required to pay this fee no matter which country you are headed to.

Who is required to pay the travel tax?

If you fall under any of the following demographic, you are required to pay the travel tax:

Who is exempted from paying the travel tax?

Manila to singapore flight.

Jetstar Asia Airways

Start from ₱ 2,849.85

Manila (MNL) to Singapore (SIN)

Sat, 4 May 2024

Cebu Pacific

Start from ₱ 3,082.00

Tue, 7 May 2024

AirAsia Berhad (Malaysia)

Start from ₱ 3,750.03

Tue, 14 May 2024

There are also other individuals who are exempted from paying the travel tax:

I fall under the travel tax exemption. What do I need to avail of it?

Depending on your case, you will need:

1. Original documents required by your embassy or agency , which can include but are not limited to:

2. Travel to the nearest TIEZA Travel Tax Field Office in the Philippines , either in the airports or in the provincial field offices.

Show your original documents, as well as photocopies.

3. Pay a PHP 200 processing fee.

Wait for your Travel Tax Exemption Certificate to be released, and present this to the authorities at the airport.

How much do I have to pay?

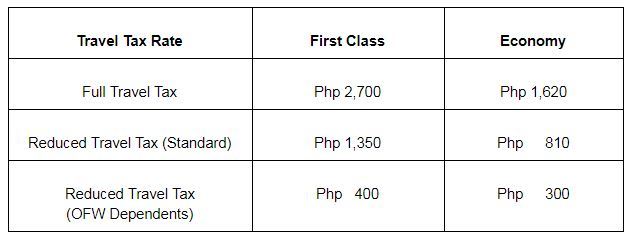

Depending on your ticket, your travel tax will vary. See the table below:

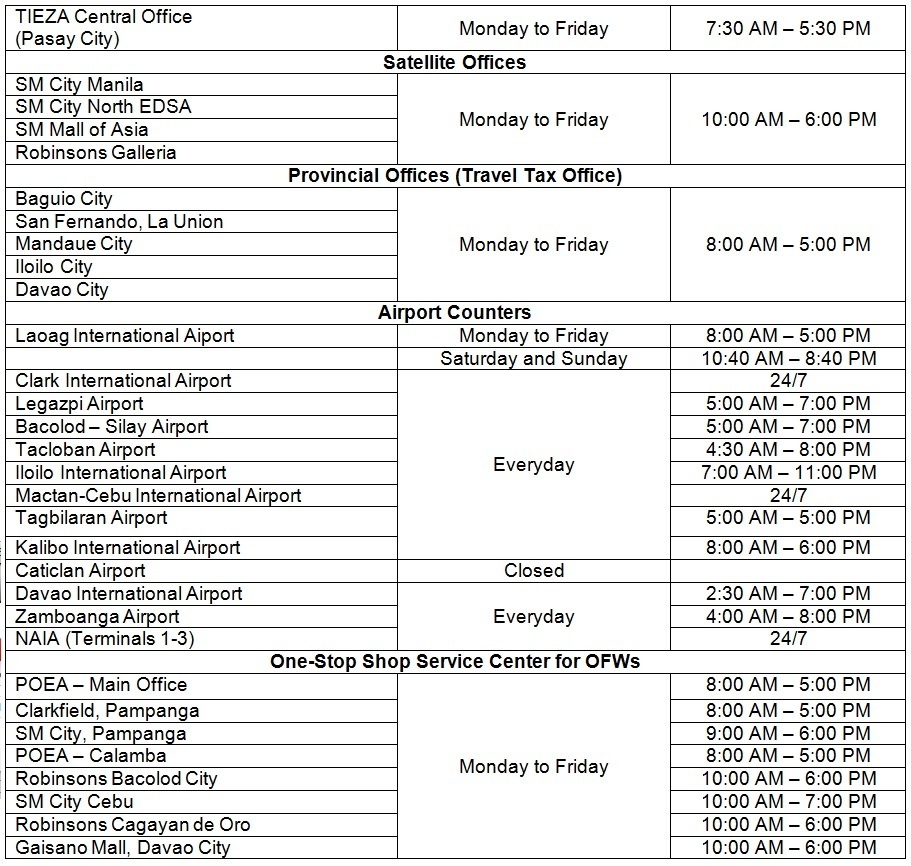

Where do I pay the Philippine travel tax?

You can pay your travel tax in advance in several malls. Check out these mall counters that accept travel tax payments:

You can also pay your travel tax on the day of your flight in the airport counters. You need to show your ticket and passport.

Meanwhile, there are also provincial offices and other government offices where you can pay the travel tax:

You can also pay online. Here's how:

Where does that money go.

As per Section 73 of the Republic Act No. 9593 , the money earned from the travel tax is divided accordingly:

How do I get a refund?

You qualify for a refund if you fall under one of the following conditions:

What do you need to present to get a refund?

Depending on your case, prepare the following:

Now you know your travel tax basics. Make sure you keep them in mind when you plan and book your trips with Traveloka!

Payment Partners

About Traveloka

- How to Book

- Help Center

Follow us on

- Traveloka Affiliate

- Privacy Notice

- Terms & Conditions

- Register Your Accommodation

- Register Your Experience Business

- Traveloka Press Room

Download Traveloka App

- Top University in USA

- Top University in Canada

- Top University in Ireland

- Top Universities in UK

- Top Universities in Australia

- Best MBA Colleges in Abroad

- Business Management Studies Colleges

Top Countries

- Study in USA

- Study in UK

- Study in Canada

- Study in Australia

- Study in Ireland

- Study in Germany

- Study in China

- Study in Europe

Student Visas

- Student Visa Canada

- Student Visa UK

- Student Visa USA

- Student Visa Australia

- Student Visa Germany

- Student Visa New Zealand

- Student Visa Ireland

- JEE Main 2024

- MHT CET 2024

- JEE Advanced 2024

- BITSAT 2024

- View All Engineering Exams

- Colleges Accepting B.Tech Applications

- Top Engineering Colleges in India

- Engineering Colleges in India

- Engineering Colleges in Tamil Nadu

- Engineering Colleges Accepting JEE Main

- Top IITs in India

- Top NITs in India

- Top IIITs in India

- JEE Main College Predictor

- JEE Main Rank Predictor

- MHT CET College Predictor

- AP EAMCET College Predictor

- GATE College Predictor

- KCET College Predictor

- JEE Advanced College Predictor

- View All College Predictors

- JEE Main Question Paper

- JEE Main Cutoff

- JEE Main Answer Key

- JEE Main Result

- Download E-Books and Sample Papers

- Compare Colleges

- B.Tech College Applications

- JEE Advanced Registration

- MAH MBA CET Exam

- View All Management Exams

Colleges & Courses

- MBA College Admissions

- MBA Colleges in India

- Top IIMs Colleges in India

- Top Online MBA Colleges in India

- MBA Colleges Accepting XAT Score

- BBA Colleges in India

- XAT College Predictor 2024

- SNAP College Predictor

- NMAT College Predictor

- MAT College Predictor 2024

- CMAT College Predictor 2024

- CAT Percentile Predictor 2023

- CAT 2023 College Predictor

- CMAT 2024 Registration

- TS ICET 2024 Registration

- CMAT Exam Date 2024

- MAH MBA CET Cutoff 2024

- Download Helpful Ebooks

- List of Popular Branches

- QnA - Get answers to your doubts

- IIM Fees Structure

- AIIMS Nursing

- Top Medical Colleges in India

- Top Medical Colleges in India accepting NEET Score

- Medical Colleges accepting NEET

- List of Medical Colleges in India

- List of AIIMS Colleges In India

- Medical Colleges in Maharashtra

- Medical Colleges in India Accepting NEET PG

- NEET College Predictor

- NEET PG College Predictor

- NEET MDS College Predictor

- DNB CET College Predictor

- DNB PDCET College Predictor

- NEET Application Form 2024

- NEET PG Application Form 2024

- NEET Cut off

- NEET Online Preparation

- Download Helpful E-books

- LSAT India 2024

- Colleges Accepting Admissions

- Top Law Colleges in India

- Law College Accepting CLAT Score

- List of Law Colleges in India

- Top Law Colleges in Delhi

- Top Law Collages in Indore

- Top Law Colleges in Chandigarh

- Top Law Collages in Lucknow

Predictors & E-Books

- CLAT College Predictor

- MHCET Law ( 5 Year L.L.B) College Predictor

- AILET College Predictor

- Sample Papers

- Compare Law Collages

- Careers360 Youtube Channel

- CLAT Syllabus 2025

- CLAT Previous Year Question Paper

- AIBE 18 Result 2023

- NID DAT Exam

- Pearl Academy Exam

Animation Courses

- Animation Courses in India

- Animation Courses in Bangalore

- Animation Courses in Mumbai

- Animation Courses in Pune

- Animation Courses in Chennai

- Animation Courses in Hyderabad

- Design Colleges in India

- Fashion Design Colleges in Bangalore

- Fashion Design Colleges in Mumbai

- Fashion Design Colleges in Pune

- Fashion Design Colleges in Delhi

- Fashion Design Colleges in Hyderabad

- Fashion Design Colleges in India

- Top Design Colleges in India

- Free Sample Papers

- Free Design E-books

- List of Branches

- Careers360 Youtube channel

- NIFT College Predictor

- UCEED College Predictor

- NID DAT College Predictor

- IPU CET BJMC

- JMI Mass Communication Entrance Exam

- IIMC Entrance Exam

- Media & Journalism colleges in Delhi

- Media & Journalism colleges in Bangalore

- Media & Journalism colleges in Mumbai

- List of Media & Journalism Colleges in India

- Free Ebooks

- CA Intermediate

- CA Foundation

- CS Executive

- CS Professional

- Difference between CA and CS

- Difference between CA and CMA

- CA Full form

- CMA Full form

- CS Full form

- CA Salary In India

Top Courses & Careers

- Bachelor of Commerce (B.Com)

- Master of Commerce (M.Com)

- Company Secretary

- Cost Accountant

- Charted Accountant

- Credit Manager

- Financial Advisor

- Top Commerce Colleges in India

- Top Government Commerce Colleges in India

- Top Private Commerce Colleges in India

- Top M.Com Colleges in Mumbai

- Top B.Com Colleges in India

- IT Colleges in Tamil Nadu

- IT Colleges in Uttar Pradesh

- MCA Colleges in India

- BCA Colleges in India

Quick Links

- Information Technology Courses

- Programming Courses

- Web Development Courses

- Data Analytics Courses

- Big Data Analytics Courses

- RUHS Pharmacy Admission Test

- Top Pharmacy Colleges in India

- Pharmacy Colleges in Pune

- Pharmacy Colleges in Mumbai

- Colleges Accepting GPAT Score

- Pharmacy Colleges in Lucknow

- List of Pharmacy Colleges in Nagpur

- GPAT Result

- GPAT 2024 Admit Card

- GPAT Question Papers

- NCHMCT JEE 2024

- Mah BHMCT CET

- Top Hotel Management Colleges in Delhi

- Top Hotel Management Colleges in Hyderabad

- Top Hotel Management Colleges in Mumbai

- Top Hotel Management Colleges in Tamil Nadu

- Top Hotel Management Colleges in Maharashtra

- B.Sc Hotel Management

- Hotel Management

- Diploma in Hotel Management and Catering Technology

Diploma Colleges

- Top Diploma Colleges in Maharashtra

- UPSC IAS 2024

- SSC CGL 2024

- IBPS RRB 2024

- Previous Year Sample Papers

- Free Competition E-books

- Sarkari Result

- QnA- Get your doubts answered

- UPSC Previous Year Sample Papers

- CTET Previous Year Sample Papers

- SBI Clerk Previous Year Sample Papers

- NDA Previous Year Sample Papers

Upcoming Events

- NDA Application Form 2024

- UPSC IAS Application Form 2024

- CDS Application Form 2024

- CTET Admit card 2024

- HP TET Result 2023

- SSC GD Constable Admit Card 2024

- UPTET Notification 2024

- SBI Clerk Result 2024

Other Exams

- SSC CHSL 2024

- UP PCS 2024

- UGC NET 2024

- RRB NTPC 2024

- IBPS PO 2024

- IBPS Clerk 2024

- IBPS SO 2024

- CBSE Class 10th

- CBSE Class 12th

- UP Board 10th

- UP Board 12th

- Bihar Board 10th

- Bihar Board 12th

- Top Schools in India

- Top Schools in Delhi

- Top Schools in Mumbai

- Top Schools in Chennai

- Top Schools in Hyderabad

- Top Schools in Kolkata

- Top Schools in Pune

- Top Schools in Bangalore

Products & Resources

- JEE Main Knockout April

- NCERT Notes

- NCERT Syllabus

- NCERT Books

- RD Sharma Solutions

- Navodaya Vidyalaya Admission 2024-25

- NCERT Solutions

- NCERT Solutions for Class 12

- NCERT Solutions for Class 11

- NCERT solutions for Class 10

- NCERT solutions for Class 9

- NCERT solutions for Class 8

- NCERT Solutions for Class 7

- CUET PG 2024

- IGNOU B.Ed Admission 2024

- DU Admission 2024

- UP B.Ed JEE 2024

- DDU Entrance Exam

- IIT JAM 2024

- IGNOU Online Admission 2024

- Universities in India

- Top Universities in India 2024

- Top Colleges in India

- Top Universities in Uttar Pradesh 2024

- Top Universities in Bihar

- Top Universities in Madhya Pradesh 2024

- Top Universities in Tamil Nadu 2024

- Central Universities in India

- CUET Exam City Intimation Slip 2024

- IGNOU Date Sheet

- CUET Mock Test 2024

- CUET Admit card 2024

- CUET PG Syllabus 2024

- CUET Participating Universities 2024

- CUET Previous Year Question Paper

- CUET Syllabus 2024 for Science Students

- E-Books and Sample Papers

- CUET Exam Pattern 2024

- CUET Exam Date 2024

- CUET Syllabus 2024

- IGNOU Exam Form 2024

- IGNOU Result

- CUET Courses List 2024

Engineering Preparation

- Knockout JEE Main 2024

- Test Series JEE Main 2024

- JEE Main 2024 Rank Booster

Medical Preparation

- Knockout NEET 2024

- Test Series NEET 2024

- Rank Booster NEET 2024

Online Courses

- JEE Main One Month Course

- NEET One Month Course

- IBSAT Free Mock Tests

- IIT JEE Foundation Course

- Knockout BITSAT 2024

- Career Guidance Tool

Top Streams

- IT & Software Certification Courses

- Engineering and Architecture Certification Courses

- Programming And Development Certification Courses

- Business and Management Certification Courses

- Marketing Certification Courses

- Health and Fitness Certification Courses

- Design Certification Courses

Specializations

- Digital Marketing Certification Courses

- Cyber Security Certification Courses

- Artificial Intelligence Certification Courses

- Business Analytics Certification Courses

- Data Science Certification Courses

- Cloud Computing Certification Courses

- Machine Learning Certification Courses

- View All Certification Courses

- UG Degree Courses

- PG Degree Courses

- Short Term Courses

- Free Courses

- Online Degrees and Diplomas

- Compare Courses

Top Providers

- Coursera Courses

- Udemy Courses

- Edx Courses

- Swayam Courses

- upGrad Courses

- Simplilearn Courses

- Great Learning Courses

Access premium articles, webinars, resources to make the best decisions for career, course, exams, scholarships, study abroad and much more with

Plan, Prepare & Make the Best Career Choices

Student Visa Philippines 2024: A Complete Guide to Requirements and Application Process

A student visa in Philippines grants temporary permission to international students to study and stay in Philippines for higher education. Indian students who are planning higher studies in Philippine universities must obtain a student visa to enter the country. Student visa Philippines is valid for the period of the duration of the study in Philippines, however, potential students can apply for an extension articulating genuine reasons for the extension.

Latest Updates on Student Visa Philippines

Eligibility criteria for philippines student visa, documents required for student visa in philippines, student visa philippines fees, interview tips for philippines student visa, philippines student visa renewal.

Students applying for a visa in Philippines must demonstrate their eligibility by producing the necessary student visa Philippines requirements following a scheduled interview with the visa officer. Read the article on Philippines student visa to know the eligibility, application process, and fee details.

E-visa system has included more countries to apply for student visa Philippines online.

Increased focus has been placed on English language proficiency.

E-visa system has been updated with advanced technical modifications to ensure a smooth processing of the student visa application.

The application form for student visa Philippines has been revised and updated for international students.

MET Institute of International Studies BBA Admissions 2024

B.Sc (Hons)/BA (Hons) Business Administration, is an International BBA programme offered at MET Institute of International Studies, Mumbai

Universities inviting applications | Get expert guidance

Student visa New Zealand

Student visa Ireland

Student visa USA

Student visa Australia

To apply for a student visa in the Philippines, you must meet a few requirements. The official visa authorization of the Philippines has mentioned a few mandatory student visa Philippines requirements for international students. Candidates who are applying to study in Philippines must fulfill the following requirements to apply for a student visa in Philippines.

The candidates must be at least 18 years old or above at the time of enrollment.

Students must be enrolled in a full-time academic programme in an authorized Philippines university, seminary, academy, college, or school.

Applicants must demonstrate sufficient financial resources to cover their tuition fees, and living expenses for the study duration in Philippines.

Students need to check specific course requirements for the institution.

Shortlist best ranked universities & get expert guidance

Want to study in Ireland? Explore Universities & Courses

According to the Philippine Visa Online Portal, candidates who are applying for a student visa in Philippines must demonstrate their eligibility through authentic documentation. The specific student visa Philippines requirements can vary depending on the nationality and situation of the student. Students are advised to consult with the Philippine embassy or consulate in their home country before applying for the same.

Check the list of required documents to apply for a student visa Philippines:

A valid passport or travel document for at least six (6) months beyond the intended period of stay in the Philippines.

Duly Accomplished Visa application form.

Notice of Acceptance (NOA) from school (original copy).

Original copy of the Certificate of Eligibility for Admission (CEA) issued by the Commission on Higher Education (CHED).

Police Clearance.

Medical Health Certificate.

How to Apply for a Philippines Student Visa?

Students who intend to study in Philippines need to apply for a student visa. The application process for a Philippines student visa is straightforward and can be processed through both online and in-person application submission.

International students applying for a student visa Philippines can browse the Philippines government visa portal to get detailed information about the application process. Students can apply for a visa in Philippines to pursue their studies by following the below-mentioned steps:

Students must ensure the basic eligibility requirements including age, academic qualifications, and other details before submitting the visa application.

Choose your desired visa application method: The application process for a student visa in Philippines can be processed through two methods.

Philippine Embassy/Consulate in student’s home country : Traditional method involving in-person submission and interview.

E-visa system : Students can also apply for E-visa on the Philippines government visa portal.

Gather all the necessary documents required for student visa application.

Download the appropriate visa application form (FA Form No. 2) from the embassy/consulate website or e-visa system and fill out the form with accurate information.

Pay the required student visa Philippines fees to complete the application. The application fee may vary depending on the nationality of the student. Check with the embassy or consulate for specific fees.

Apply online or schedule an appointment for document submission and interview.

Attend the visa interview and answer questions clearly about your study plans, finances, and travel goals.

Wait for the visa processing decision and collect the visa by following the instructions provided by the embassy/consulate or e-visa system once your application gets approved.

Also Read: Student visa processing time for study abroad

Applying for a student visa Philippines to pursue higher studies is associated with multiple costs including application fees, medical examination charges, passport costs, and many more. A detailed breakdown of the total student visa Philippines fees is given below. Students must analyse all the expenses carefully before applying for a visa to study in Philippines.

Student Visa Philippines Application Fees: Typically around USD 250 payable during the application submission process.

Student Visa Extension Fee: Students who wish to apply for an extension of their visa have to pay an additional extension fee around the same range i.e., USD 250.

Medical Examination Fee: The range may vary depending on the clinic or hospital.

Travel Costs include flights, transportation to the embassy/consulate, and local travel charges.

Documents translation fees.

Student visa Canada

Student visa Germany

Netherlands student visa

The interview is a crucial part of attaining a student visa Philippines. Applicants will be called to the assigned office to appear in person for a consular officer interview after successfully submitting and clearing their visa application form. Through interviews, students can demonstrate their genuine intentions and suitability for the programme.

Therefore, it will be easier to establish openness and confidence in the consular to ascertain the visa status sooner if the students concentrate on providing honest answers to the interview questions. A few simple interview tips for a higher chance of student visa approval in Philippines are given below:

Maintain a proper dress code.

Articulate the reason behind studying in Philippines.

Be polite and courteous.

Maintain eye contact and smile.

Have supporting documents ready.

Be honest and truthful.

Explain the financial plan properly.

Candidates studying in Philippines can also apply for an extension of their student visa by applying for a visa extension. However, students must fulfil some basic student visa Philippines requirements before applying for an extension legally.

Check the basic eligibility requirements for student visa extension in Philippines:

Students must be enrolled in a recognised Philippine educational institution as a full-time student.

The applicant's current student visa must be valid for at least 3 months before the renewal application.

Students must have maintained good academic standing.

After successful completion of the visa renewal submission, at least 30 days are required for processing. Students might also need to appear for an interview by the official authorities. Once approved, they will receive a student visa Philippines extension receipt and their passport will be updated.

Students are advised to secure good grades and a clean disciplinary record to strengthen their renewal application. Try to explore various scholarships to manage the financial aspects of your studies.

Frequently Asked Question (FAQs)

Students can apply via two methods to get a student visa Philippines:

Philippine Embassy/Consulate in the student’s home country

E-visa system on the Philippines government visa portal.

Students must submit a filled application form attaching the necessary documents to apply for a student visa Philippines.

All international students who fulfil the basic requirements as per the Philippines visa authority. All candidates aged 18 years or over who have been enrolled in a full-time course in Philippines can apply for a student visa in Philippines.

Applying for a student visa in Philippines to pursue higher education incurs a variety of costs, including application fees, medical examination fees, passport fees, and many others. Student visa application fees in the Philippines are normally approximately USD 250.

- Latest Articles

Related E-books & Sample Papers

Study mbbs in the philippines.

2 + Downloads

Explore Career Options (By Industry)

- Construction

- Entertainment

- Manufacturing

- Information Technology

Data Administrator

Database professionals use software to store and organise data such as financial information, and customer shipping records. Individuals who opt for a career as data administrators ensure that data is available for users and secured from unauthorised sales. DB administrators may work in various types of industries. It may involve computer systems design, service firms, insurance companies, banks and hospitals.

Bio Medical Engineer

The field of biomedical engineering opens up a universe of expert chances. An Individual in the biomedical engineering career path work in the field of engineering as well as medicine, in order to find out solutions to common problems of the two fields. The biomedical engineering job opportunities are to collaborate with doctors and researchers to develop medical systems, equipment, or devices that can solve clinical problems. Here we will be discussing jobs after biomedical engineering, how to get a job in biomedical engineering, biomedical engineering scope, and salary.

Ethical Hacker

A career as ethical hacker involves various challenges and provides lucrative opportunities in the digital era where every giant business and startup owns its cyberspace on the world wide web. Individuals in the ethical hacker career path try to find the vulnerabilities in the cyber system to get its authority. If he or she succeeds in it then he or she gets its illegal authority. Individuals in the ethical hacker career path then steal information or delete the file that could affect the business, functioning, or services of the organization.

GIS officer work on various GIS software to conduct a study and gather spatial and non-spatial information. GIS experts update the GIS data and maintain it. The databases include aerial or satellite imagery, latitudinal and longitudinal coordinates, and manually digitized images of maps. In a career as GIS expert, one is responsible for creating online and mobile maps.

Data Analyst

The invention of the database has given fresh breath to the people involved in the data analytics career path. Analysis refers to splitting up a whole into its individual components for individual analysis. Data analysis is a method through which raw data are processed and transformed into information that would be beneficial for user strategic thinking.

Data are collected and examined to respond to questions, evaluate hypotheses or contradict theories. It is a tool for analyzing, transforming, modeling, and arranging data with useful knowledge, to assist in decision-making and methods, encompassing various strategies, and is used in different fields of business, research, and social science.

Geothermal Engineer

Individuals who opt for a career as geothermal engineers are the professionals involved in the processing of geothermal energy. The responsibilities of geothermal engineers may vary depending on the workplace location. Those who work in fields design facilities to process and distribute geothermal energy. They oversee the functioning of machinery used in the field.

Database Architect

If you are intrigued by the programming world and are interested in developing communications networks then a career as database architect may be a good option for you. Data architect roles and responsibilities include building design models for data communication networks. Wide Area Networks (WANs), local area networks (LANs), and intranets are included in the database networks. It is expected that database architects will have in-depth knowledge of a company's business to develop a network to fulfil the requirements of the organisation. Stay tuned as we look at the larger picture and give you more information on what is db architecture, why you should pursue database architecture, what to expect from such a degree and what your job opportunities will be after graduation. Here, we will be discussing how to become a data architect. Students can visit NIT Trichy , IIT Kharagpur , JMI New Delhi .

Remote Sensing Technician

Individuals who opt for a career as a remote sensing technician possess unique personalities. Remote sensing analysts seem to be rational human beings, they are strong, independent, persistent, sincere, realistic and resourceful. Some of them are analytical as well, which means they are intelligent, introspective and inquisitive.

Remote sensing scientists use remote sensing technology to support scientists in fields such as community planning, flight planning or the management of natural resources. Analysing data collected from aircraft, satellites or ground-based platforms using statistical analysis software, image analysis software or Geographic Information Systems (GIS) is a significant part of their work. Do you want to learn how to become remote sensing technician? There's no need to be concerned; we've devised a simple remote sensing technician career path for you. Scroll through the pages and read.

Budget Analyst

Budget analysis, in a nutshell, entails thoroughly analyzing the details of a financial budget. The budget analysis aims to better understand and manage revenue. Budget analysts assist in the achievement of financial targets, the preservation of profitability, and the pursuit of long-term growth for a business. Budget analysts generally have a bachelor's degree in accounting, finance, economics, or a closely related field. Knowledge of Financial Management is of prime importance in this career.

Underwriter

An underwriter is a person who assesses and evaluates the risk of insurance in his or her field like mortgage, loan, health policy, investment, and so on and so forth. The underwriter career path does involve risks as analysing the risks means finding out if there is a way for the insurance underwriter jobs to recover the money from its clients. If the risk turns out to be too much for the company then in the future it is an underwriter who will be held accountable for it. Therefore, one must carry out his or her job with a lot of attention and diligence.

Finance Executive

Product manager.

A Product Manager is a professional responsible for product planning and marketing. He or she manages the product throughout the Product Life Cycle, gathering and prioritising the product. A product manager job description includes defining the product vision and working closely with team members of other departments to deliver winning products.

Operations Manager

Individuals in the operations manager jobs are responsible for ensuring the efficiency of each department to acquire its optimal goal. They plan the use of resources and distribution of materials. The operations manager's job description includes managing budgets, negotiating contracts, and performing administrative tasks.

Stock Analyst

Individuals who opt for a career as a stock analyst examine the company's investments makes decisions and keep track of financial securities. The nature of such investments will differ from one business to the next. Individuals in the stock analyst career use data mining to forecast a company's profits and revenues, advise clients on whether to buy or sell, participate in seminars, and discussing financial matters with executives and evaluate annual reports.

A Researcher is a professional who is responsible for collecting data and information by reviewing the literature and conducting experiments and surveys. He or she uses various methodological processes to provide accurate data and information that is utilised by academicians and other industry professionals. Here, we will discuss what is a researcher, the researcher's salary, types of researchers.

Welding Engineer

Welding Engineer Job Description: A Welding Engineer work involves managing welding projects and supervising welding teams. He or she is responsible for reviewing welding procedures, processes and documentation. A career as Welding Engineer involves conducting failure analyses and causes on welding issues.

Transportation Planner

A career as Transportation Planner requires technical application of science and technology in engineering, particularly the concepts, equipment and technologies involved in the production of products and services. In fields like land use, infrastructure review, ecological standards and street design, he or she considers issues of health, environment and performance. A Transportation Planner assigns resources for implementing and designing programmes. He or she is responsible for assessing needs, preparing plans and forecasts and compliance with regulations.

Environmental Engineer

Individuals who opt for a career as an environmental engineer are construction professionals who utilise the skills and knowledge of biology, soil science, chemistry and the concept of engineering to design and develop projects that serve as solutions to various environmental problems.

Safety Manager

A Safety Manager is a professional responsible for employee’s safety at work. He or she plans, implements and oversees the company’s employee safety. A Safety Manager ensures compliance and adherence to Occupational Health and Safety (OHS) guidelines.

Conservation Architect

A Conservation Architect is a professional responsible for conserving and restoring buildings or monuments having a historic value. He or she applies techniques to document and stabilise the object’s state without any further damage. A Conservation Architect restores the monuments and heritage buildings to bring them back to their original state.

Structural Engineer

A Structural Engineer designs buildings, bridges, and other related structures. He or she analyzes the structures and makes sure the structures are strong enough to be used by the people. A career as a Structural Engineer requires working in the construction process. It comes under the civil engineering discipline. A Structure Engineer creates structural models with the help of computer-aided design software.

Highway Engineer

Highway Engineer Job Description: A Highway Engineer is a civil engineer who specialises in planning and building thousands of miles of roads that support connectivity and allow transportation across the country. He or she ensures that traffic management schemes are effectively planned concerning economic sustainability and successful implementation.

Field Surveyor

Are you searching for a Field Surveyor Job Description? A Field Surveyor is a professional responsible for conducting field surveys for various places or geographical conditions. He or she collects the required data and information as per the instructions given by senior officials.

Orthotist and Prosthetist

Orthotists and Prosthetists are professionals who provide aid to patients with disabilities. They fix them to artificial limbs (prosthetics) and help them to regain stability. There are times when people lose their limbs in an accident. In some other occasions, they are born without a limb or orthopaedic impairment. Orthotists and prosthetists play a crucial role in their lives with fixing them to assistive devices and provide mobility.

Pathologist

A career in pathology in India is filled with several responsibilities as it is a medical branch and affects human lives. The demand for pathologists has been increasing over the past few years as people are getting more aware of different diseases. Not only that, but an increase in population and lifestyle changes have also contributed to the increase in a pathologist’s demand. The pathology careers provide an extremely huge number of opportunities and if you want to be a part of the medical field you can consider being a pathologist. If you want to know more about a career in pathology in India then continue reading this article.

Veterinary Doctor

Speech therapist, gynaecologist.

Gynaecology can be defined as the study of the female body. The job outlook for gynaecology is excellent since there is evergreen demand for one because of their responsibility of dealing with not only women’s health but also fertility and pregnancy issues. Although most women prefer to have a women obstetrician gynaecologist as their doctor, men also explore a career as a gynaecologist and there are ample amounts of male doctors in the field who are gynaecologists and aid women during delivery and childbirth.

Audiologist

The audiologist career involves audiology professionals who are responsible to treat hearing loss and proactively preventing the relevant damage. Individuals who opt for a career as an audiologist use various testing strategies with the aim to determine if someone has a normal sensitivity to sounds or not. After the identification of hearing loss, a hearing doctor is required to determine which sections of the hearing are affected, to what extent they are affected, and where the wound causing the hearing loss is found. As soon as the hearing loss is identified, the patients are provided with recommendations for interventions and rehabilitation such as hearing aids, cochlear implants, and appropriate medical referrals. While audiology is a branch of science that studies and researches hearing, balance, and related disorders.

An oncologist is a specialised doctor responsible for providing medical care to patients diagnosed with cancer. He or she uses several therapies to control the cancer and its effect on the human body such as chemotherapy, immunotherapy, radiation therapy and biopsy. An oncologist designs a treatment plan based on a pathology report after diagnosing the type of cancer and where it is spreading inside the body.

Are you searching for an ‘Anatomist job description’? An Anatomist is a research professional who applies the laws of biological science to determine the ability of bodies of various living organisms including animals and humans to regenerate the damaged or destroyed organs. If you want to know what does an anatomist do, then read the entire article, where we will answer all your questions.

For an individual who opts for a career as an actor, the primary responsibility is to completely speak to the character he or she is playing and to persuade the crowd that the character is genuine by connecting with them and bringing them into the story. This applies to significant roles and littler parts, as all roles join to make an effective creation. Here in this article, we will discuss how to become an actor in India, actor exams, actor salary in India, and actor jobs.

Individuals who opt for a career as acrobats create and direct original routines for themselves, in addition to developing interpretations of existing routines. The work of circus acrobats can be seen in a variety of performance settings, including circus, reality shows, sports events like the Olympics, movies and commercials. Individuals who opt for a career as acrobats must be prepared to face rejections and intermittent periods of work. The creativity of acrobats may extend to other aspects of the performance. For example, acrobats in the circus may work with gym trainers, celebrities or collaborate with other professionals to enhance such performance elements as costume and or maybe at the teaching end of the career.

Video Game Designer

Career as a video game designer is filled with excitement as well as responsibilities. A video game designer is someone who is involved in the process of creating a game from day one. He or she is responsible for fulfilling duties like designing the character of the game, the several levels involved, plot, art and similar other elements. Individuals who opt for a career as a video game designer may also write the codes for the game using different programming languages.

Depending on the video game designer job description and experience they may also have to lead a team and do the early testing of the game in order to suggest changes and find loopholes.

Radio Jockey

Radio Jockey is an exciting, promising career and a great challenge for music lovers. If you are really interested in a career as radio jockey, then it is very important for an RJ to have an automatic, fun, and friendly personality. If you want to get a job done in this field, a strong command of the language and a good voice are always good things. Apart from this, in order to be a good radio jockey, you will also listen to good radio jockeys so that you can understand their style and later make your own by practicing.

A career as radio jockey has a lot to offer to deserving candidates. If you want to know more about a career as radio jockey, and how to become a radio jockey then continue reading the article.

Choreographer

The word “choreography" actually comes from Greek words that mean “dance writing." Individuals who opt for a career as a choreographer create and direct original dances, in addition to developing interpretations of existing dances. A Choreographer dances and utilises his or her creativity in other aspects of dance performance. For example, he or she may work with the music director to select music or collaborate with other famous choreographers to enhance such performance elements as lighting, costume and set design.

Social Media Manager

A career as social media manager involves implementing the company’s or brand’s marketing plan across all social media channels. Social media managers help in building or improving a brand’s or a company’s website traffic, build brand awareness, create and implement marketing and brand strategy. Social media managers are key to important social communication as well.

Photographer

Photography is considered both a science and an art, an artistic means of expression in which the camera replaces the pen. In a career as a photographer, an individual is hired to capture the moments of public and private events, such as press conferences or weddings, or may also work inside a studio, where people go to get their picture clicked. Photography is divided into many streams each generating numerous career opportunities in photography. With the boom in advertising, media, and the fashion industry, photography has emerged as a lucrative and thrilling career option for many Indian youths.

An individual who is pursuing a career as a producer is responsible for managing the business aspects of production. They are involved in each aspect of production from its inception to deception. Famous movie producers review the script, recommend changes and visualise the story.

They are responsible for overseeing the finance involved in the project and distributing the film for broadcasting on various platforms. A career as a producer is quite fulfilling as well as exhaustive in terms of playing different roles in order for a production to be successful. Famous movie producers are responsible for hiring creative and technical personnel on contract basis.

Copy Writer

In a career as a copywriter, one has to consult with the client and understand the brief well. A career as a copywriter has a lot to offer to deserving candidates. Several new mediums of advertising are opening therefore making it a lucrative career choice. Students can pursue various copywriter courses such as Journalism , Advertising , Marketing Management . Here, we have discussed how to become a freelance copywriter, copywriter career path, how to become a copywriter in India, and copywriting career outlook.

In a career as a vlogger, one generally works for himself or herself. However, once an individual has gained viewership there are several brands and companies that approach them for paid collaboration. It is one of those fields where an individual can earn well while following his or her passion.

Ever since internet costs got reduced the viewership for these types of content has increased on a large scale. Therefore, a career as a vlogger has a lot to offer. If you want to know more about the Vlogger eligibility, roles and responsibilities then continue reading the article.

For publishing books, newspapers, magazines and digital material, editorial and commercial strategies are set by publishers. Individuals in publishing career paths make choices about the markets their businesses will reach and the type of content that their audience will be served. Individuals in book publisher careers collaborate with editorial staff, designers, authors, and freelance contributors who develop and manage the creation of content.

Careers in journalism are filled with excitement as well as responsibilities. One cannot afford to miss out on the details. As it is the small details that provide insights into a story. Depending on those insights a journalist goes about writing a news article. A journalism career can be stressful at times but if you are someone who is passionate about it then it is the right choice for you. If you want to know more about the media field and journalist career then continue reading this article.

Individuals in the editor career path is an unsung hero of the news industry who polishes the language of the news stories provided by stringers, reporters, copywriters and content writers and also news agencies. Individuals who opt for a career as an editor make it more persuasive, concise and clear for readers. In this article, we will discuss the details of the editor's career path such as how to become an editor in India, editor salary in India and editor skills and qualities.

Individuals who opt for a career as a reporter may often be at work on national holidays and festivities. He or she pitches various story ideas and covers news stories in risky situations. Students can pursue a BMC (Bachelor of Mass Communication) , B.M.M. (Bachelor of Mass Media) , or MAJMC (MA in Journalism and Mass Communication) to become a reporter. While we sit at home reporters travel to locations to collect information that carries a news value.

Corporate Executive

Are you searching for a Corporate Executive job description? A Corporate Executive role comes with administrative duties. He or she provides support to the leadership of the organisation. A Corporate Executive fulfils the business purpose and ensures its financial stability. In this article, we are going to discuss how to become corporate executive.

Multimedia Specialist

A multimedia specialist is a media professional who creates, audio, videos, graphic image files, computer animations for multimedia applications. He or she is responsible for planning, producing, and maintaining websites and applications.

Quality Controller

A quality controller plays a crucial role in an organisation. He or she is responsible for performing quality checks on manufactured products. He or she identifies the defects in a product and rejects the product.

A quality controller records detailed information about products with defects and sends it to the supervisor or plant manager to take necessary actions to improve the production process.

Production Manager

A QA Lead is in charge of the QA Team. The role of QA Lead comes with the responsibility of assessing services and products in order to determine that he or she meets the quality standards. He or she develops, implements and manages test plans.

Process Development Engineer

The Process Development Engineers design, implement, manufacture, mine, and other production systems using technical knowledge and expertise in the industry. They use computer modeling software to test technologies and machinery. An individual who is opting career as Process Development Engineer is responsible for developing cost-effective and efficient processes. They also monitor the production process and ensure it functions smoothly and efficiently.

AWS Solution Architect

An AWS Solution Architect is someone who specializes in developing and implementing cloud computing systems. He or she has a good understanding of the various aspects of cloud computing and can confidently deploy and manage their systems. He or she troubleshoots the issues and evaluates the risk from the third party.

Azure Administrator

An Azure Administrator is a professional responsible for implementing, monitoring, and maintaining Azure Solutions. He or she manages cloud infrastructure service instances and various cloud servers as well as sets up public and private cloud systems.

Computer Programmer

Careers in computer programming primarily refer to the systematic act of writing code and moreover include wider computer science areas. The word 'programmer' or 'coder' has entered into practice with the growing number of newly self-taught tech enthusiasts. Computer programming careers involve the use of designs created by software developers and engineers and transforming them into commands that can be implemented by computers. These commands result in regular usage of social media sites, word-processing applications and browsers.

Information Security Manager

Individuals in the information security manager career path involves in overseeing and controlling all aspects of computer security. The IT security manager job description includes planning and carrying out security measures to protect the business data and information from corruption, theft, unauthorised access, and deliberate attack

ITSM Manager

Automation test engineer.

An Automation Test Engineer job involves executing automated test scripts. He or she identifies the project’s problems and troubleshoots them. The role involves documenting the defect using management tools. He or she works with the application team in order to resolve any issues arising during the testing process.

Applications for Admissions are open.

SAT® | CollegeBoard

Registeration closing on 19th Apr for SAT® | One Test-Many Universities | 90% discount on registrations fee | Free Practice | Multiple Attempts | no penalty for guessing

TOEFL ® Registrations 2024

Thinking of Studying Abroad? Think the TOEFL® test. Register now & Save 10% on English Proficiency Tests with Gift Cards

GRE ® Registrations 2024

Apply for GRE® Test now & save 10% with gift card | World's most used Admission Test for Graduate & Professional Schools

PTE Exam 2024 Registrations

Register now for PTE & Save 5% on English Proficiency Tests with Gift Cards

GMAT™ Exam-Focus Edition

Register for GMAT™ Exam- Focus Edition| Shortest GMAT ever | Valid for 5 Years | Multiple attempts | Wide Acceptance

Explore Universities, Courses & Subjects | Work while study

Everything about Education

Latest updates, Exclusive Content, Webinars and more.

Explore on Careers360

- Explore Top Study Abroad Exams

- Study Destinations and Visa

- TOEFL Syllabus

- TOEFL Exam Pattern

- TOEFL Eligibility

- TOEFL Registration

- TOEFL Result

- LSAT Eligibility

- LSAT Scores

- LSAT Test Dates

- LSAT Test Centres

- LSAT Eligibility Criteria

- LSAT Sample Papers

- LSAT Exam Pattern

- LSAT Preparation Tips

- LSAT Syllabus

- LSAT Selection Process

- IELTS Application Form

- IELTS Cut Off

- IELTS Eligibility Criteria

- IELTS Preparation Books And Study Materials

- IELTS Preparation Tips

- IELTS Sample Paper

- IELTS Selection Procedure

- IELTS Syllabus

- IELTS Test Dates

- IELTS Test Pattern

- GRE Test Syllabus

- GRE Sample Paper

- GRE Eligibility Criteria

- GRE Registration

- GRE Test Pattern

- GRE Test Dates

- GRE Test Centres

- GRE Preparation Tips

- GRE Selection Procedure

- SAT Preparation Tips

- SAT Syllabus

- SAT Test Centres

- SAT Exam Pattern

- SAT Test Eligibility

- SAT Registration

- SAT Exam Dates

- SAT Sample Papers

- USMLE Exam Dates

- USMLE Test Centres

- USMLE Scores

- USMLE Application Form

- USMLE Eligibility Criteria

- ACT Test Dates

- ACT Registration

- ACT Eligibility Criteria

- ACT Exam Pattern

- ACT Test Centres

- MCAT Test Dates

- MCAT Exam Pattern

- MCAT Syllabus

- MCAT Registration

- MCAT Eligibility

- MCAT Scores

- GMAT Test Dates

- GMAT Exam Pattern

- GMAT Syllabus

- GMAT Registration

- GMAT Eligibility

- GMAT Scores

Popular Study Abroad Countries

- Study in Singapore

- Student Visa For Canada

- Student Visa For UK

- Student Visa For USA

- Student Visa For Australia

- Germany Student Visa

- New Zealand Student Visa

- Student Visa For Ireland

Download Careers360 App's

Regular exam updates, QnA, Predictors, College Applications & E-books now on your Mobile

Cetifications

We Appeared in

Articles airasia Flights: All You Need to Know about Travel Tax in the Philippines

Explore other articles and discussions on this topic.

14/12/2023 • FAQs

Information.

What is the Philippine Travel Tax? The Philippine Travel Tax is a fee you need to pay before leaving the country for international flights. The amount of the travel tax may vary depending on the type of flight ticket you have. Travelers are typically required to pay the travel tax before they check in for their international flight. Please note that policies and fees are subject to change, and it's advisable to check with relevant authorities or official sources for the most latest information on Philippine Travel Tax.

How much is the Philippine Travel Tax? Your travel tax varies according to the type of ticket you have. Check the table below for more information.

Who is required to pay the Philippine travel tax?

The obligation to pay travel tax applies to:

Who is exempted from paying the travel tax? The payment of travel tax is exempted for the following categories of Filipino citizens:

Where to pay the Philippine travel tax? To process your travel tax payment online, you may refer to this link: https://tieza.gov.ph/online-travel-tax-payment-system/ . Please be informed that Philippine Travel Tax will not be offered online if the transaction is for a child or with a child/infant. You also can pay your travel tax at the airport counters on the day of your flight by presenting your ticket and passport.

How do I get a refund ? You may visit https://tieza.gov.ph/travel-tax-refund/ for more information on Travel Tax Refund Policies and Requirements.

We’re sorry, this site is currently experiencing technical difficulties. Please try again in a few moments. Exception: request blocked

- Toggle Accessibility Statement

- Skip to Main Content

WHAT IS TRAVEL TAX?

The travel tax is a levy imposed by the Philippine government on individuals who are leaving the country irrespective of the place where the air ticket is issued and the form or place of payment, as provided for by Presidential Decree (PD) 1183, as amended.

Pursuant to Section 73 of Republic Act No. 9593, fifty percent (50%) of the proceeds from travel tax collections shall accrue to the TIEZA, forty percent (40%) shall accrue to the Commission on Higher Education (CHED) for tourism-related educational programs and courses, and ten percent (10%) shall accrue to the National Commission for Culture and Arts (NCCA).

How much is the Travel Tax?

Taxable individuals may be charged the full travel tax, the standard reduced travel tax and the privileged reduced travel tax:

Philippine Consulate General Los Angeles California

Student visa – 9(f).

Procedures and Requirements for the Issuance of Student Visa Under Section 9(f) of the Philippine Immigration Law, as amended, and Executive Order No. 423

A. Policies

Any Philippine Higher Education Institution (HEI) whose programs/courses are recognized by the Commission on Higher Education (CHED) is authorized to accept foreign students.

A bonafide foreign student is one who is at least eighteen years (18) of age at the time of enrolment; has sufficient means for his education and support; and seeks to enter the Philippines temporarily to take up higher education course/program.

Spouses and unmarried dependent children below 21 years old of aliens who are permanent foreign residents, holders of valid working permits under Section 9(d), 9(g) and 47(a) (2) of the Philippine Immigration Act of 1940, as amended, personnel of foreign diplomat and consular missions residing in the Philippines, personnel of duly accredited international organizations residing in the Philippines, holders of Special Investor;’s Resident Visa (SIRV) and Special Retiree’s Resident Visa (SRRV) and foreign students coming to the Philippines with 47 (a) (2) visas issued pursuant to existing laws, e.g. P.D. 2021 are exempted from securing student visa and Bureau of Immigration Special Study permit.

The Certificate of Eligibility of Admission issued by CHED-Office of Student Services (OSS) is required only in courses where restrictions or quota on enrollment may exist due to shortage of facilities as in Medicine and Dentistry

B. Procedures in the Issuance of Student Visa

Step 1 – Foreign student who is at least 18 years of age at the time of enrollment communicates directly with his choice of any Philippine HEI authorized to admit foreign students and complies with the school’s institutional requirements, including submission of the following documents:

- Duly accomplished Visa Application Form (FA Form No. 2)

- Certified true copy of Personal History Statement

- Certified true copy of Notice of Acceptance (NOA) and CEA where necessary (to be duly noted by Consular Officer)

- Medical Certificate ( FA Form No. 11 ), duly notarized, together with laboratory reports of urine (urinalysis), stool (ova/parasites and occult blood) and blood (routine)

- Chest x-ray plates and chest x-ray results

- Police clearance certificate bearing the signature of issuing police officer and seal of law enforcement agency

- Passport (minimum validity of 6 months)

- $250.00 fee in cash, money order or cashier’s check (personal checks are not accepted)

- Six (6) 2×2 photos, taken within the last 6 months.

Step 2 – The HEI, satisfied with the student’s compliance with its requirements, issues a Notice of Acceptance (NOA) to the student and submits the original and photocopy to the Department of Foreign Affairs (DFA), together with all the documents and shall be hand carried to the DFA by the HEI’s designated Liaison Officer

Step 3 – The DFA endorses the documents to the Philippine Consulate General (or embassy as the case may be) located in the student’s country of origin or residence for the issuance of the student visa. Request for issuance of the student Visa in places other than the student’s country of origin shall not be entertained.

Step 4 – The Philippine Consulate General notifies the student of the receipt of the documents and requests him to appear in person before a consular officer for interview and compliance with consular requirements. In addition to the documents transmitted to the post by the DFA, students must submit the following requirements to the Philippine Consulate in triplicate:

- Medical Health Certificate (FA Form No. 11), duly notarized, together with laboratory reports of urine (urinalysis), stool (ova/parasites and occult blood) and blood (routine)

- Six 2×2 photos, taken within the last 6 months

Step 5 – Upon arrival in the Philippines, the student shall report immediately to the accepting HEI which shall assist him to obtain the Alien Certificate of Registration (ACR) and Certificate of Residence for Temporary Students (CRTS) from the Bureau of Immigration (BI)

Step 6 – The DFA notifies the HEI, copy furnished CHED, BI, NICA and NBI, of the issuance of a student visa to the student as soon as it receives a report to this effect from the issuing post

Note: A foreigner wishing to study in the Philippines may also lodge a student visa application if he/she is already in the Philippines. The application may be made at the Bureau of Immigration in Manila. A prospective student must ensure that all the required documents or scholastic records issued by foreign schools must be authenticated by the Philippine Embassy or Consulate exercising jurisdiction of the place where the school is located.

See also Bureau of Immigration Comprehensive Guidelines on 9(f)/Student Visas

The Philippines Today

The Philippines Today, Yesterday, and Tomorrow

Philippine Travel Tax (11 Commonly Asked Questions)

The Philippine Travel tax has become one of the most reliable sources of funding for the government.

In fact, 50 percent of the total travel tax collected is retained by TIEZA. TIEZA or Tourism Infrastructure and Enterprise Zone Authority replaced the PTA or Philippine Tourism Authority.

The CHED (Commission on Higher Education) gets 40 percent of the collected tax and the National Commission For Culture and the Arts get the remaining 10 percent of travel tax collected.

Enumerated hereunder are the common questions asked by Filipinos and Tourists alike about the Philippines travel tax.

1. What is the Philippine Travel Tax ?

Philippine travel tax is a levy imposed by the Philippine government on individuals who are leaving the Philippines irrespective of the place where the air ticket is issued and form or place of payment.

2. Who Must Pay The Travel Tax?

- Citizens of the Philippines

- Taxable Foreign Passport Holders

- Non-immigrant foreign passport holders who have stayed in the Philippines for more than one (1) year

3. Which Philippine government agency has the power to collect Travel Tax?

The TIEZA or Tourism Infrastructure and Enterprise Zone Authority is the government agency mandated by law to collect the travel tax.

4. What is the Travel Tax For?

The Philippine Travel Tax was originally imposed to curtail unnecessary foreign travel and to conserve foreign exchange. Later, the tax was used to generate much-needed funds for tourism-related programs and projects. It is recognized that tourism promotion alone is not enough to attract tourists to the Philippines. Adequate tourism facilities and infrastructures need to be provided for the growth of the tourism industry. The Travel Tax plays an important role in funding the development and maintenance of these tourism facilities and infrastructures to enhance the countries competitiveness as a major tourism destination.

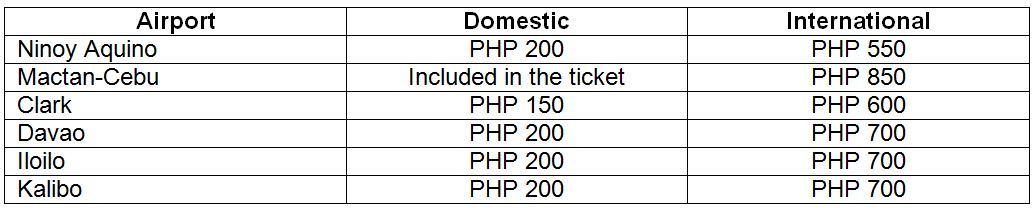

5. Are those exempted from paying travel tax also exempted from paying terminal fee?

Under the law, only the following are exempted from paying terminal fee

- OFW (Overseas Filipino Worker)

- Pilgrims endorsed by the National Commission of Muslim Affairs

- Athletes endorsed by the Philippine Sports Commission

- Others authorized by the Office of the President

6. How Much Is The Travel Tax?

Under the law, the rate for a 1st class passenger is 2,700 pesos and the rate for economy class is 1,620 pesos. This rate is the full travel tax.

7. Where to pay Travel Tax in the Philippines?

The Following Companies operating in the Philippines are delegated to collect the tax upon issuance of tickets: 1. Airline Companies 2. Shipping companies 3. Travel agencies

For tickets issued outside the Philippines or for internet-booked tickets, pay the travel tax directly at 1. TIEZA Travel Tax Offices 2. Travel Tax Counter at major international airports like NAIA or Mactan-Cebu international airport or Clark International Airport.

Philippine Travel Tax Online Payment now available.

8. What are the documents required when paying travel tax?

Bring your original passport and airline ticket

9. Who are exempted from paying the Philippine Travel Tax?

- Overseas Filipino workers

- Filipino permanent residents abroad whose stay in the Philippines is less than one year Family members accompanying such are also exempted

- Infants (2 years and below

- Foreign Diplomatic and Consular Officials and Members of their Staff

- Officials, Consultants, Experts, and Employees of the United Nations (UN) Organization and its agencies

- United States (US) Military Personnel including dependents and other US nationals with fares paid for by the US government or on US Government-owned or chartered transport facilities

- Crew members of airplanes plying international routes

- Filipino permanent residents abroad whose stay in the Philippines is less than one (1) year

- Philippine Foreign Service Personnel officially assigned abroad and their dependents

- Officials and Employees of the Philippine Government traveling on official business (excluding Government-Owned and Controlled Corporations)

- Grantees of foreign government-funded trips

- Bona-fide Students with approved scholarships by the appropriate government agency

- Personnel (and their dependents) of multinational companies with regional headquarters, but not engaged in business, in the Philippines

- Those authorized by the President of the Republic of the Philippines for reasons of national interest

10. May a travel tax be refunded? Yes, travel tax can be refunded like

- When there is undue tax – you are exempt but you paid

- Tax inadvertently paid twice for the same ticket

- Entitled to exemption or reduced tax

- Offloaded passengers /canceled flights

- Downgraded ticket

- Reduced Travel Tax

- Travel Tax Exemption

- Unused ticket

11. Where are the locations of TIEZA travel tax offices?

Provincial Offices

Laoag Travel Tax Unit Departure Lobby Laoag International Airport Laoag City, Ilocos Norte Telefax: (077) 772-1162 Monday to Friday, 8 am – 5 pm Saturday and Sunday, 8 am – 9 pm

Baguio Travel Tax Unit Department of Tourism Building Governor Pack Road Baguio City Tel. No.: (074) 442-6226 Monday to Friday, 8 am – 5 pm

San Fernando, La Union Travel Tax Unit Mabanag Hall, San Fernando, La Union Telefax: (072) 607-1963 Monday to Friday, 8 am – 5 pm

Clark/DMIA Travel Tax Unit Departure Lobby Diosdado Macapagal International Airport Clarkfield Pampanga Monday to Sunday, 4 am – 1 am

SM City San Fernando, Pampanga Travel Tax Unit 3/F Government Service Center, SM City Pampanga San Fernando, Pampanga Monday to Friday, 10 am – 6 pm

Kalibo Travel Tax Unit Departure Area Kalibo International Airport Kalibo, Aklan Monday to Sunday, 8 am – 12midnight

New Bacolod-Silay Airport Travel Tax Unit Departure Area New Bacolod-Silay Airport Brgy. Bagtic, Silay City Monday to Sunday, 5 am – 7 pm

Iloilo Travel Tax Unit DOT Region VI Bldg., Capitol Grounds, Bonifacio Drive, Iloilo City Tel. No.: (033) 366-0480 Telefax: (033) 335-0245 Monday to Friday, 8 am – 5 pm

Iloilo International Airport Travel Tax Unit Departure Area IIA Cabatuan, Iloilo M-T-TH-F-Sunday, 8 am – 11 pm Wednesday and Saturday 8 am – 5 pm

MCIA Travel Tax Unit International Departure Area Mactan Cebu International Airport Lapu-Lapu City, Cebu Tel. No.: (032) 236-3481 24/7 Operation

Cebu Travel Tax Unit Cebu Travel Tax Field Office Andres Soriano Avenue, cor P.J. Burgos Street, Centro, Mandaue City Telefax: (032) 253-3532 Monday to Friday, 8 am – 5 pm

Cagayan de Oro Travel Tax Unit 2nd Floor Lingkod Pinoy Center Robinsons Cagayan De Oro Rosario Crescent, cor. Florentino St. Limketkai Center, Cagayan De Oro City Monday to Friday, 10 am – 6 pm

Davao Travel Tax Unit Door 12, Tourism Complex, Ramon Magsaysay Park, Davao City Telefax: (082) 221-7123 Monday to Friday, 8 am – 5 pm

Davao International Airport Travel Tax Unit Departure Area, Davao International Airport Sasa, Davao City Monday to Sunday, 3 am – 6 pm

SM City Cebu Travel Tax Service Counter Government Service Center North Reclamation Area, Cebu City 6000 Metro Cebu Monday to Saturday, 10 am – 7 pm

Zamboanga Travel Tax Unit NSValderosa Street, Zamboanga City Tel. No.: (062) 991-8687 Telefax: (062) 992-6246 c/o Lantaka Hotel Monday to Friday, 8 am – 5 pm

Metro Manila Travel Tax Offices

TIEZA CENTRAL OFFICE TIEZA Building 6th & 7th Floors, Tower 1, DoubleDragon Plaza Macapagal Avenue corner EDSA extension 1302 Bay Area, Pasay City Philippines Tel. No.: (02) 512-0485 Email.: [email protected] Monday to Friday, from 07:30 am – 05:30 pm

SM CITY MANILA TRAVEL TAX SERVICE COUNTER 5/F Government Service Center, SM City Manila Tel. No.: (632) 463-9934 Monday to Friday, 10 am – 5 pm

NAIA TERMINAL 1 TRAVEL TAX COUNTER Departure Lobby, NAIA, Pasay City Tel. No.: (632) 879-6038 24/7 Operation

SM CITY NORTH EDSA TRAVEL TAX SERVICE COUNTER Government Service Express The Annex Lower Ground Floor, Beside SM Bowling Center

Tel. No.:(632)533-5026 Monday to Friday, 10 am – 5 pm

NAIA TERMINAL 2 TRAVEL TAX COUNTER Departure Lobby, Centennial Terminal 2, Pasay City Tel. No.: (632) 879-5160 24/7 Operation

ROBINSONS GALLERIA TRAVEL TAX SERVICE COUNTER Edsa Cor. Ortigas Ave., Ugong Norte, Quezon CityTel. No.:(632)475-6347 Monday to Friday, 10 am – 6 pm

NAIA TERMINAL 3 TRAVEL TAX COUNTER Departure Lobby, NAIA Terminal 3, Pasay City Tel. No.: (632) 877-7888 loc. 8166 24/7 Operation

POEA MAIN TRAVEL TAX COUNTER Ortigas Ave., Mandaluyong City Tel. No.: (632) 533-5174 Monday to Friday, 8 am – 5 pm

You may want to read:

- Where do Filipino emigrants in Germany come from the regions of the Philippines?

- 28th World Travel Awards Nominees

Share this:

- Click to share on Twitter (Opens in new window)

- Click to share on Pinterest (Opens in new window)

- Click to share on Facebook (Opens in new window)

- Click to share on WhatsApp (Opens in new window)

Travel Tax in the Philippines & Terminal Fees: Cost, Exemptions, Refunds

Traveling is not cheap. Although we Filipinos, sometimes budget our way when going out of the country, there are certain expenses that we need to pay. One of those things we can’t seem to escape during our vacation is the Travel Tax and Terminal Fees in the Philippines .

According to Presidential Decree 1183, the Travel tax is imposed on individuals leaving the Philippines . But not all have to pay; certain people are exempted from the Travel Tax or have reduced payment. The proceeds are for TIEZA (Tourism Infrastructure and Enterprise Zone Authority), CHED’s tourism-related programs (Commission on Higher Education), and NCCA (National Commission for Culture and Arts).

This article will discuss Philippine Travel tax; how much is the payment, who needs to pay, and who is exempted, how to get a refund or exemption. This will also discuss the Terminal fees of the Philippine Airports.

- How to Schedule a DFA Online Appointment to Get a Philippines Passport

- One year Visa-free Balikbayan Stay in the Philippines for the Foreign Spouse/ Children of Filipino Citizens

- OFW Guide – List of Work Abroad Websites To Help You Find Jobs Overseas

- Philippines Tourist Visa – How to Get a Tourist Visa to Visit the Philippines

- How to Teach English Abroad – Get 60% OFF Your TEFL Certification Online

Table of Contents

Travel Tax in the Philippines

How much is the travel tax in the Philippines?

Who needs to pay a travel tax?

- Filipino Citizens

- Foreign Nationals who are Permanent Residents of the Philippines

- Non-Resident Foreign Nationals who stayed for more than 1 year in the Philippines

What are the Requirements Needed for paying the Travel Tax?

- Airline Ticket

- Travel Tax Payment (maybe in Cash or Credit)

How to Pay Travel Tax?

- Included when booking an airline ticket

- At Travel Tax Centers or Counters

- Online: https://tieza.gov.ph/online-travel-tax-payment-system/

If you are in a hurry, I recommend paying ahead to avoid the long queues at the counters. However, refunds may take time but it is still possible.

Philippine Travel Tax Exemption

Who are exempted from payment of travel tax in the philippines what are the requirements needed.

Main Requirement: Passport

Overseas Filipino Workers

- If hired through POEA: Original Overseas Employment Certificate

- If directly hired: Certificate of Employment issued by the Philippine Embassy or Consulate in the country where you are working or a copy of Employment Contract authenticated by the PH Embassy or Consulate

Filipino Permanent Residents Abroad whose stay in the Philippines is less than a year

- Bio page of passport and stamp of the last arrival in the Philippines

- Permanent Residency Card or any proof that you reside permanently in a foreign country

- Certification of Residence issued by Philippine Embassy or Consulate in case the country you are staying doesn’t grant permanent residency

Balikbayan whose stay in the Philippines is less than a year

- Airline Ticket used to travel to the Philippines

Balikbayan who is a former Filipino Citizens and naturalized to another citizenship whose stay in the Philippines is less than a year (including spouse and children)

- Philippine and Foreign Passport

- For Children: certified true copy or authenticated copy of birth certificate or adoption papers

- For Spouse: certified true copy or authenticated copy of marriage certificate

Infants who are two years old and below (if two years old and one day, then standard reduced travel tax is paid)

- If no passport, PSA copy of birth certificate

Foreign Diplomatic, consular officials, and staff accredited in the Philippines. Immediate members of the family and household staff are included as long as there is an authorization from the Philippine Government.

- Certification from their respective Embassy or Consulate, from the Department of Foreign Affairs or Office of Protocol

United Nations organization and its agencies’ Officials, Consulates, Experts, and employees and those exempt under Laws, Treaties or International Agreements

- UN Passport or Certificate of Employment from UN office or agencies with international agreements with the Philippines

US military personnel and their dependents. US nationals with fares paid by the US government or on US government-owned transports. Filipinos in US military service and their dependents. Filipino employees of US government or US State department visitors traveling to the US for government business.

- Government Transport Request for airline tickets or certification from the US Embassy that the US government paid for the fare

Airline crew of international routes

- Crew’s Name

- Location of aircraft

Philippine Foreign Service personnel assigned abroad and their dependents

- Certification from the Department of Foreign Affairs

Officials and employees of Philippine Government on official business (except GOCCs)

- Certified True Copy of Travel Authority or Travel Order from Department Secretary

Grantees of foreign government-funded trip

- Proof that the foreign government funds travel

A student with an approved scholarship from a Philippine Government Agency

- Certification from the government agency

Personnel and their dependents of a multinational company with regional headquarters but not engaged in business in the Philippines

- Certificate of Board of Investments

Authorized by the President of the Philippines for national interest

- Written authorization stating that the passenger is exempt from travel tax

How to get Tax Exemption?

- Present passport and documents to the Travel Tax officer

- Get Travel Tax Exemption Certificate

Reduced Travel Tax

Certain people don’t need to pay the full amount of travel tax. There are two types; standard and privilege reduce travel tax. Here are the qualifications.

Who can avail Standard Reduced Travel Tax in the Philippines ? What are the requirements?

Minors – 2 years and one day – twelve years old (it must be exact, if twelve years old and one day, no more exemption).

- Airline Ticket, if already issued

Accredited Filipino Journalist (writers, editors, reporters, announcers) in pursuit of assignment

- Certification from an editor or station manager that passenger is an accredited journalist

- Certification from the Office of the Press Secretary

- Written authorization from Office of the Presidents stating the passenger is entitled to Reduced Travel Tax

Who can avail of Privilege Reduced Travel Tax in the Philippines ? What needs to be submitted?

If you are a dependent of an OFW traveling to the country where your spouse or parent is at, then you can avail of this.

Main Requirements: Passport and any of the following:

- Original Overseas Employment certificate

- Certified true copy of Balik-Manggagwa Form or OFW’s Travel Exit Permit

- Certification of Accreditation or Registration

- OFW’s Work Visa or Work Permit

- Valid Employment Contract or Company ID of the OFW

- Recent payslip of OFW

Legitimate spouse of an OFW

- PSA Marriage Certificate

- Certificate from the agency that the dependent is joining the seaman’s vessel

Unmarried children of an OFW who are 21 years old and below (legitimate or illegitimate)

- PSA Birth Certificate

Child of an OFW who is a Persons With Disability (any age)

- PWD ID Card issued by an office of National Council of Disability Affairs

How to get Reduced Travel Tax?

- Present passport and documents to the Travel Tax officer.

- Pay the fee.

- Get the Reduced Travel Tax Certificate (RTTC).

Philippine Travel Tax Refund

In case you have paid tax refund or are qualified for such but have paid. You can get a tax refund. You can claim if within two years from your date of payment.

Who can get a tax refund? What are the requirements?

Main Requirements: Passport and Airline Ticket with travel tax payment or If travel tax was paid at TIEZA, official receipt (passenger copy and airline copy)

Owners of an Unused ticket

- Fare refund voucher or certification from airline signatory that ticket is unused, non-rebookable and has no fare refund value

Owners of a Downgraded Ticket

- Certification from the airline that the ticket was downgraded or the airline flight manifest

Non-immigrant foreign nationals who have not stayed in the Philippines for more than a year

- If passport can’t be presented; a certification from the Bureau of Immigration indication passenger’s identity, status, and applicable date of arrival