Hand-Picked Top-Read Stories

Travel Log: Everything You Need to Know (FAQs)

9 Tips For Keeping a Perfect Travel Log

How to Create a Travel Log (Tips and Examples)

45 travel log templates and examples (100% free).

A good friend of mine once said she learned more about the world, its history, its cultures, and its beauty from traveling than she ever did in school or from books or videos. Experiencing something out of your comfort zone is an exhilarating experience. Exposure to new cultures and their food and customs teaches us to accept those cultures and appreciate the world around us.

Once you are home and friends ask you about your trip, at first, it is all current, and you have lots to talk about, but within a few weeks or months, some places you visited may be forgotten, or the names of cities, museums, different foods are hard to recall. This is where a travel log is very useful to help everyone appreciate the trip even years later. A Vlog or video log on a social media platform can provide instant gratification to you and your friends. They can keep tabs on you and experience your experiences almost as if they were with you.

Preparing a great travel log in booklet form or video form takes some effort and organization; however, it is worth having this record that can be referred to over and over again. In this post, we will explore some of the concepts about travel logs, how they are used, and tips for maintaining a travel log.

What Is a Travel Log?

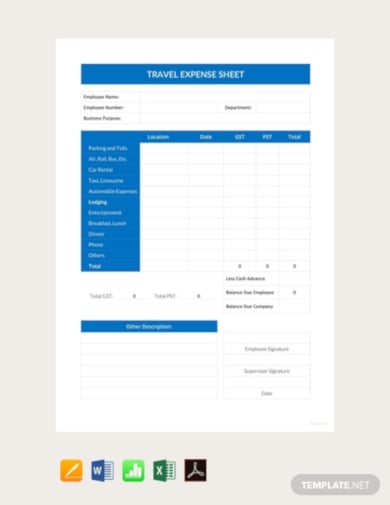

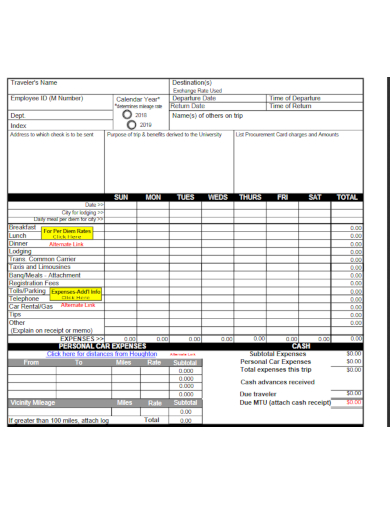

Both companies and individuals use travel logs to track their travel. Many companies ask their employees to complete spreadsheets or online tracking systems to track the dates, locations, and expenses for their travel. These travel logs are data-driven and used by the company to track their employee’s travel, to repay employees for their expenses, and to claim these expenses on their annual tax filing.

Travel logs for individuals may contain all of the same information and a lot more. They are also known as travel journals. In a personal travel log or travel journal, travelers write about their experiences on their trips, the places they visited, meals they enjoyed, events, and historic locations they visited. Many will also include pictures of these locations and people they met along the way. These memories, stories, and adventures are captured in their travel log/journal and referred to for years after they return from their trip.

What is a Travel Log Template?

A travel log template is a blank, editable sheet that helps users create a friendly business travel log or personal travel journal according to their needs. Travel log templates save time and provide consistency for both employees and individuals who want to keep track of their travel and expenses. Companies use templates and make them available to their employees to use whenever they are traveling and need to report their expenses. Company travel log templates include basic information such as the date, time, expense, location, the reason for travel, and miscellaneous such as project or tracking codes needed for tax purposes.

Individuals traveling around the world on various trips use a travel log template to save them time and help them keep track of their budget, memorialize their experiences, and include both narrative and photos. The template can be used to begin a new record on a daily, weekly, or monthly basis.

Why Keep a Travel Log When Traveling?

There are many reasons to keep a travel log while traveling. They include the following:

- Staying Organized

- Managing Stress

- Remembering Your Trip

- Achieving Goals

- Improving Memory

- Improving Writing Skills

Staying Organized – writing in a travel log helps everyone organize their thoughts and focus on things they still want to see or do. You may plan to see a variety of events in a given location. Writing about them helps compare and keep track of what you have seen and what you need to prioritize in the remaining time you have before moving on to the next location.

Managing Stress – many people find that writing about their day, both good and bad is a great way to vent and obtain relief from stressful situations. Writing about your experiences is a great way to reduce tensions that many people would internalize otherwise.

Remembering Your Trip – over time, we all lose memories of important details about our trips and experiences. Writing about your experiences, especially those that made an impression at the time, helps you to remember them by referring back to your journal regularly.

Achieving Goals – many travelers write down their goals for their trip, the places they want to see, and the activities they want to do. As you complete them, tick off these items, write about them and review those goals you still have to complete.

Improving Memory – seeing something, talking about it, and then writing about it is considered one of the best ways to strengthen memories of your experiences.

Improving Writing Skills – when we write something, we also know that other people may also read this material. Our pride ensures that we take the time to write well, clearly with good punctuation, spelling, and grammar.

Business Travel Log Vs. Personal Travel Log

Business travel log.

A business travel log is a record of business expenses, purposes, and outcomes of a business trip. You can use a business travel log for official reasons, such as tax deductions by the IRS.

Personal Travel Log

A personal travel journal is a time capsule of your experiences, emotions, scenes, and reflections of your vacation. You write any exciting details of your trip in a personal travel log.

Essential Elements of a Travel Log

Essential elements of a travel log for companies often include basic information compared to a tourist travel log. Corporate travel logs include:

- Reason for travel and

- Miscellaneous items – Project or tracking codes – Tax information

Individuals include much of the same information; however, there is more focus on their experiences on the trip as well as planning details for their trip. In addition to the above topics, including items such as:

- Destination plans

- Room for documenting experiences

- Room for adding photos and other items of interest

How to Keep a Travel Log (Video)

How to keep a business travel log.

Before writing a travel log, you need the proper documentation essential for any tax benefits or compensation.

Step 1) Mileage Records

Record all mileage expenses during your trip. Use a well-calibrated odometer to document the distance traveled using a car. Alternatively, when using air, water, or train transport, record travel duration and indicate the start and endpoints of your journey.

Warning: Don’t use estimates to record your mileage. The IRS has the mandate to review your log during tax inquisitions ; therefore, only write what you can prove.

The case of the Moores (Moore vs. Comm’r, TC Summ. OP. 2012_16) shows the grave nature of mileage records. The tax court and the IRS declined their deduction in the ruling due to questionable and erroneous entries. Mr. and Mrs. Moore recorded all their mileage on a logbook for their real estate brokerage firm on 12 separate pages, one for each month of the year.

Tip: Use reputable mileage apps that record accurate mileage.

Step 2) Other Expense Respites

In addition to mileage records, gather hotel, food, stationery, and other minor expense receipts. Separate the receipts from personal expenses and the business’s expenses.

Step 3) Chronological Order

A well-designed business travel log employs good chronological order. No rule restricts you to using the exact sequence of events; however, when referencing your journal in the future and you are pressed for time, it saves the hassle.

Step 4) Review and Verification

Review the cost at the end of each trip and send the log to the accounts department for verification.

It is good practice to have multiple copies of the travel journal. Always keep the original business trip log in a secured file cabinet .

How to Start a Personal Travel Journal

There is no right way to keep a travel journal. Whether you are artistic or prefer to keep things simple, all you need is your thoughts, a good pen, and a notebook. Let’s guide you through how to set up an evocative travel journal.

Step 1) Collect Data

Collect all your photos, brochures, maps, plane tickets on the table.

Step 2) Collect Essentials

Choose a good pen that doesn’t blot the paper. Also, buy a travel journal, scissors, highlighters, and glue.

Step 3) Start Writing

Write your thoughts about the journey and attach descriptive photos and illustrations. Write about the smells of street food, the texture of the sand, and any sensory aspect you feel will best document your experiences.

Step 4) Attach Mementos

Pressed leaves, flowers, and rock fragments are some mementos you can include. Downsize the larger pictures and fix them on the matching page of the trip.

Step 5) Review

Review your log after every trip and constantly update it. The early evening before dinner is an opportune time to update a personal travel journal.

Tip: You can write the expectations of your trip beforehand and then compare the notes with the actual experience after on for a more exciting journal.

Travel Log Templates and Examples

- Travel Logs (MS Excel)

- Travel Logs (MS Word)

- Travel Logs (PDF Format)

Travel Log Templates (MS Excel)

Travel Log Templates (MS Word)

Travel Log Templates (PDF)

Materials You May Want to Purchase for Your Travels

Buy a hardcover lightweight journal that has a strong binding and can also hold photos and postcards. Include pens , markers , and highlighters to write about your trip and highlight some of those you want to draw attention to. If you are so inclined, include tools for sketching as well. You will need adhesives to attach photos, postcards, and other mementos to your journal. Other tools include scissors for trimming items, a ruler , a clear folder to collect and hold mementos, a map of the area you are visiting, and writing as you go in your journal.

How to Prepare a Travel Log

Follow these general steps the first time you use a travel log on one of your trips. After you gain some experience with travel logs, feel free to make adjustments to fit your likes and dislikes, travel style, and time to make entries in your travel log.

Remember that you are traveling and may not have room for extensive materials . Take the essentials and be prepared to replenish them along the way, particularly if it is a long trip . The following will help you prepare for beginning your trip with your travel log.

Start by planning your trip and use your journal to record your travel plans. Places to visit, restaurants you want to try, and various sights that are on your itinerary.

Leave room to add those you discover along the way. You can also record contact information for hotels and places you will be staying as well as transportation.

Write as you travel. It is easier to recall your experiences if you write about them immediately. Even after a few days, you may not recall details that were important to you at the time. You will not miss them if you write about them in your journal.

Jotting things down in point form will help the memory and make it easier to expand on each point later on. Add pictures to each point or section if possible.

Friends and family who read your journal will appreciate it if you write about what it was like to visit a location, what you learned, the things that surprised you, and what you found disappointing. Everyone gets so much more out of a journal when they can immerse themselves in your trip vicariously.

Tips for keeping a Travel Log

The following are a collection of tips that many readers may find useful:

- Begin writing in your journal before you leave home about the planning and the places you intend to visit

- Instead of making lists of things you did, tell a story about your experiences

- Include information about what you thought or felt about the places you visited

- Include the not so great experiences

- Write your thoughts while they are still fresh in your mind

- Take lots of pictures to help you recall your many experiences

- Summarize the best parts of your trip

- Include your experiences – the food, the people, excursions, impressions, and things of beauty around you

- Include funny moments

- Set aside time every day to write in your journal and summarize your day

- Jot down points if you are tight for time. These will be great memory joggers for later when you have time to fill out your journal

Other Types of Travel Logs

Technology and social media have progressed significantly. Today’s smartphones can take excellent photos, narrate videos, and convert spoken words into text. Various platforms support Vlogs and videos that can be uploaded in real-time. Your followers can see and hear your experiences instantly. Using a smartphone is convenient, and many provide excellent quality images which can be labeled with titles and notes. You may still want to carry a journal to make manual notes to help you, later on, add audio and text to your videos and pictures.

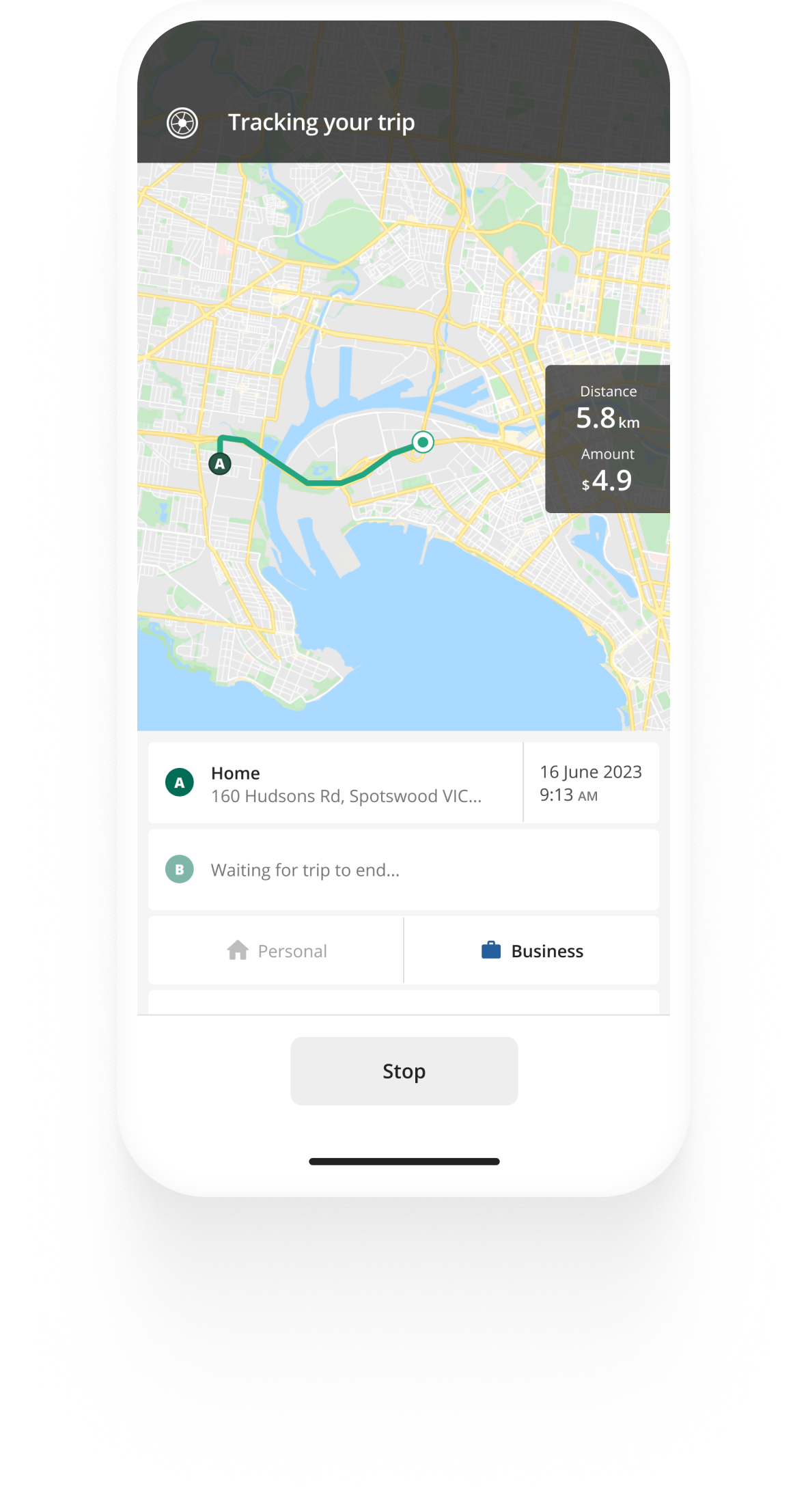

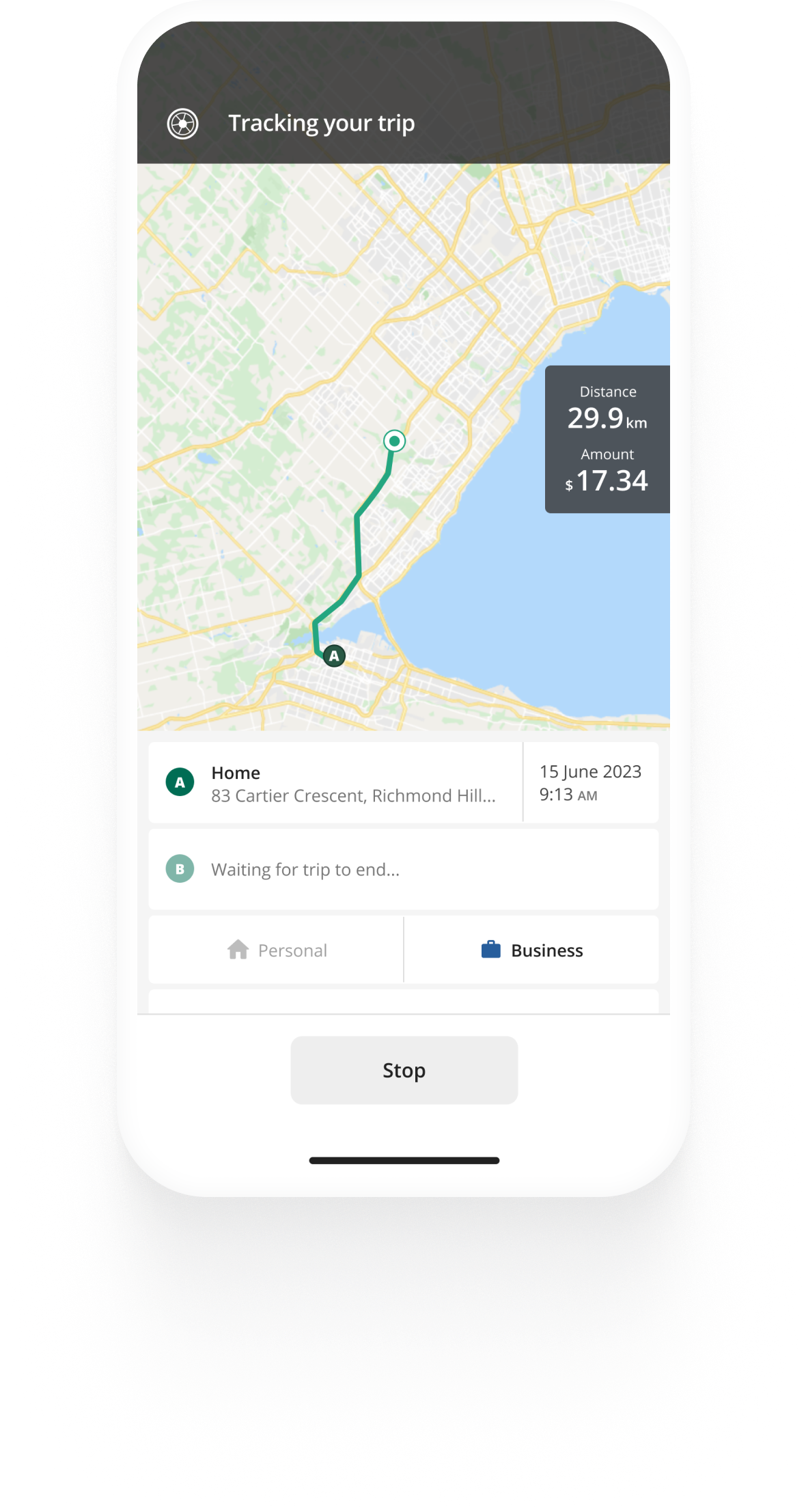

There are also purpose-built apps that can be downloaded to your smartphone to help document your travels. Add notes, videos, and photos along with captions to your images. Links to images can be added for your readers to explore online websites if they want more information. These apps also automatically capture the current weather conditions and the GPS location, which helps create a detailed online log for your readers and yourself.

Once you are home, you will have all of the details to update your manual journal with notes and images.

Travel Log Ideas to Inspire You

It helps to think about why you are keeping a travel journal. Of course, you are writing for yourself so that you can refer to your trip notes many times after you return home. Add sufficient details and information that will trigger great memories of your trips years later when you are doing a trip down memory lane.

- Many people find inspiration from comments they receive from others. Family members and friends enjoy reading about your travels. Writing interesting content in your travel log, which inspires your readers to keep coming back for more, drives many travelers to create excellent content.

- Add content as you go every day, even if it is just a quick note to jog your memory later. Add a date to each entry, the location, and any details that are important to you. Aim to set aside a time each day to complete your travel log to avoid getting behind and missing details that would be interesting to you and your readers.

- Inspiring others to travel and visit some of the locations you talk about in your journal can be very motivating. Add addresses, describe what you saw and experienced. Readers with like-minded travel objectives will appreciate this information and build their trip around your information.

- Creativity is the spice of life. Get your creative juices in gear and inspire others through your writing, images, and videos. Edit the images and videos to portray the most attractive and interesting content. In a way, you become the director and producer of creative content that will be appreciated by many.

Best Apps for Creating a Digital Travel Log

There are many digital travel apps available. They are handy and easy to use, and always available since most travelers always carry their smartphones with them to stay in touch and make travel plans. Family and friends appreciate that they can stay updated with your travels and even add comments on social media platforms. The following is a list of some of the best travel apps for smartphones currently available.

- Day One Journal

- Travel Diaries

Day One Journal – is available in a free version format and a premium format. The premium version provides unlimited storage for photos and journal entries, cloud-based storage, recording by audio, and the ability to print your journal in book format. The free version allows entry by hand and observes entries by calendar, timeline, or photos.

Travel Diaries – comes with lots of features such as enhancing text with photos, keeping entries private or public, the ability to convert the diary to a blog, and sharing automatically on social media platforms. It also has a book creation and printing capability from 40 pages up to 320 pages.

Drifter – the app was created by travelers who wanted a social network that supports photos, videos and encourages travel advice and reviews. It is great for solo travelers and folks that like to share experiences. There is still room for improvement, and the developers appreciate feedback and support.

Bonjournal – is available for iPhone users and provides a simple interface to record activities while on your trip. There are privacy settings to control what content is seen by whom. A great app for keeping track of your journey and sharing photos and ideas.

Momento – organizes your social networks connecting to eleven different platforms, including Facebook, Instagram, Twitter, Flickr, Swarm, and YouTube. Your information can be kept private, or you can add your travel information publicly for your friends and family to see. Momento can also be used as a work/project journal to keep track of meetings, milestones, and project notes.

Mistakes to Avoid When Keeping a Business Travel Log

1. not including the business purpose.

Error: It is a business travel journal for a reason. Telling us the sequence of events for the entire trip does not make us better understand your travel log without the purpose for the trip. Writing a business travel journal without the business purpose is a common novice mistake that makes you seem inept as the go-to person for a business trip.

Solution: Succinctly outline your business purpose at the beginning of the travel log. Usually, the managerial cadre will review your travel log after a business trip. Keep that in mind and provide them with a guiding light to what your trip entails via a reason. No one wants to read up to page seven of any document unless it promises them an undervalued asset in crypto that will 100x in the next month. After you have established your aim for business travel, you can document.

2. Documenting every Tom, Dick, and Harry you meet

Error: “I met Ryan Reynolds today, and we bonded over our mutual friend Ryan Gosling.” We understand that it isn’t every day you meet the Ryans on a business trip; however, telling us your interaction with them while disregarding their relevance to the business is outright trivial.

Solution: Write down if you meet an exciting person who introduces you to a new business model. However, if you meet Ryan Reynolds and he doesn’t tell you how to maximize your business’s productivity, save that for a personal journal. Only write insightful interactions about people who affect your business trip purpose.

3. Using estimations

Error: Using business trip estimations instead of the actual cost.

Solution: Save all the slips. In the journal, stick all the tickets for all your purchases relevant to the business. Please do not ignore the minor expenses as they accrue over time and cause a significant dent in the company’s travel budget. Include any other proper documentation, such as online transaction records, in the business travel log.

4. Being ‘Fanciful.’

Error: Including too much business jargon that your business travel log readers have a difficult time comprehending.

Solution: Write your travel log in straightforward language and brief sentences. Try to write only business trip details such as a conference by the sea. Don’t write, “The Sea was cerulean while the orator propagated his voice.” However, do not sacrifice your unique writing style in a bid to use modest vocabulary.

5. A business travel journal without a travel itinerary is a scrapbook

Error: Failing to include the travel itinerary makes tracking through your business trip challenging.

Solution: Attach your travel itinerary that is relevant to the business purpose. Try to make the itinerary brief.

The following are some of the frequently asked questions that many travelers have when they are making decisions about using a travel log and sharing the information with friends and family.

A travel log is either a hardcopy travel book/binder or an online system to keep track of interesting experiences about your trip. Include all of your adventures, stories, and memories to help remember everything you experienced and also share with your friends and family.

There are many names used in the industry in addition to the travel log. These include: ᐅ Travel Journal ᐅ Journey Log ᐅ Journey Plan ᐅ Log Book ᐅ Travelers notebook

Purchase a diary, writing tools, and any other materials you may need for your travel adventure. Use your diary or journal to plan your trip. Make notes of the places you want to see, places you want to stay, and how you will travel – by car, bus, train, air. Add other notes as appropriate for your trip. You may decide on using a combination of both written tools and online social media systems. Download the app and become familiar with the app before your trip. Enter all of the same information into the app. During your familiarization of the app, confirm that your smartphone has all of the required features needed to meet your travel log entries.

A travel log is either an online app or a document containing all of the details regarding your trip. A travel log can be used by companies for corporate travel as well as for folks embarking on a vacation. The travel journal can contain whatever you want it to. Most people add some or all of the following depending on their needs: ᐅ Date ᐅ Place ᐅ Memories or stories and adventures ᐅ Places they stayed ᐅ People they met ᐅ Budget and/or cost ᐅ Photos ᐅ And more

What you need for a travel journal depends to some extent on what your objectives are, what you think you would like to remember and whether you are using a social media system/smartphone or a physical journal, or a combination of both. Items that you may need for your travel journal include: ᐅ Durable, lightweight journal. Hardcovers are considered better than soft covers ᐅ Art materials if you plan to add sketches of your travel ᐅ Adhesives to secure photos, postcards, and other mementos to your journal ᐅ Include a straight edge such as a ruler and a small pair of scissors ᐅ Include a map that can be added to your journal ᐅ Choose an app for your smartphone and verify compatibility with the phone and the social media system you use

Many people tend to add photos, maps, postcards, and mementos picked up along the way. Add notes about your experiences and plan to write every day to avoid missing essential memories about your trip.

Some folks will paste a map on the front of their journal for easy reference as they travel. Others add decals commemorating the locations and events they attended. Sketch artists add their portrayal of their trip, especially places they visited that made an impact on them.

One of the activities associated with planning your trip is to choose a travel journal for your trip. Give some thought about what you want to record and who you are writing for. How much time do you have, will you share some or all of the information online, and is it to be kept private or with limited sharing? Once you have determined the audience for your journal, write accordingly and provide information that will be interesting to those readers.

Some consumers use diaries and travel journals interchangeably. However, they are different and are aimed at different purposes. A diary is a structured book used to enter records as they occur or to plan for events in the future. Many people use a diary as a daily planner to stay organized, while others use them to jot down notes and thoughts every day. A journal is unstructured used most often for recording ideas, creative ideas, and jotting down notes on thoughts, travel, and goals. Many people add their structure based on how they intend to use the travel journal and their travel plans.

A traveler’s notebook can be softcover or hardcover, with pockets to keep mementos in and add pages if you need to add more writing space. Some include elastic bands to hold additional smaller notebooks and documents.

Documenting a road trip should be handled like any other trip unless, of course, you are the driver. Take breaks along the way to make notes in your travel log, take a few pictures, and add decals or mementos that you pick up along the way. Spend some time each night after you stop for the day to add notes to your travel log about your experiences and thoughts for the day.

- Deciding why you are keeping a travel log will help you to make choices about materials to purchase and the type of travel journal you wish to purchase.

- Decide who you are writing for, yourself, family, friends, and/or the public. Writing about personal items may dictate that you do not want to share all of your information publicly.

- Will you use a written journal, or online social media system, or both? Your decision will help you decide what materials to purchase and how you will make recordings daily.

- Use your log/journal for planning your trip in advance, and then add notes as you complete your travels.

- Many people find the best approach is to write in their logs each day. Your memories and thoughts are fresh from the day’s events, and you avoid missing key details that you found interesting.

- If you are using a physical travel log, ensure that you have room to add photos and mementos as well as decals from your trip.

- Evaluate a travel log app before you travel and add the app to your phone. Test drive the app and ensure you are comfortable with it before you leave.

- Many people use their smartphones to take photos and videos and then upload them to a social media platform or a dedicated online travel log. Before traveling, test your phone with the app you plan to use and become familiar with the app. You don’t want to waste time while traveling to figure out how to use your phone with the travel log app.

Travel logs are a great way to recall memories about your trip for many years. You and your family members will refer to your travel log/journal many times, especially if you want to compare notes with a friend who traveled with you.

Is this article helpful?

- 2024 Calendar

- 2025 Calendar

- Monthly Calendar

- Blank Calendar

- Julian Calendar 2024

- Medication Schedule

- Bank Statement

- 100 Envelope Challenge

- Landscaping Invoice

- Credit Application Form

- Plane Ticket

- Personal Letter

- Personal Reference Letter

- Collection Letter

- Landlord Reference Letter

- Letter of Introduction

- Notarized Letter

- Lease Renewal Letter

- Child Support Agreement

- Payment Agreement

- Cohabitation Agreement

- Residential Lease Agreement

- Land Lease Agreement

- Real Estate Partnership Agreement

- Master Service Agreement

- Profit Sharing Agreement

- Subcontractor Agreement

- Military Time

- Blood Sugar Chart

- Reward Chart

- Foot Reflexology

- Hand Reflexology

- Price Comparison Chart

- Baseball Score Sheet

- Potluck Signup Sheet

- Commission Sheet

- Silent Auction Bid Sheet

- Time Tracking Spreadsheet

Free Printable Travel Log Templates [PDF, Excel, Word]

A travel log can quickly become an un-tracked mess if you don’t organize it. But you’ll soon realize that keeping a travel log is almost like a lifestyle for anyone who goes on many trips. There’s so much to write down, from flights to hotels and miscellaneous expenses.

Table of Contents

What is a travel log?

![Free Printable Travel Log Templates [PDF, Excel, Word] 1 Travel Log](https://www.typecalendar.com/wp-content/uploads/2022/05/Travel-Log.jpg)

A travel log is a way of documenting your travels, whether personal or professional. A travel log can be beneficial in helping you recall memories of your trips and also act as an excellent guide to help you plan your next. It enables you to keep track of all the information you need on each trip so that when it comes to following up with it, you can do so.

The travel log only travels within the framework of a route. Rather than ordinary diaries, it is an object that tries to convey the ambiance of the places visited. People can keep a travel diary for themselves or share their journey with a community. The language to be preferred in travel diaries is entirely up to the individual, but if shared with a community, fluency in the language to be created and the chronological order of events are of great importance.

Travel Log Templates

Document your adventures and keep track of your travel experiences with our comprehensive collection of Travel Log Templates . A travel log is a journal or diary where you can record details about your trips, including destinations, activities, accommodations, and memorable moments . Our customizable and printable templates provide a structured framework for organizing and preserving your travel memories. Whether you’re a globetrotter, an avid explorer, or a digital nomad, our templates offer various layouts and designs to suit your style.

By utilizing our Travel Log Templates , you can capture important details, reflect on your experiences, and create a personal keepsake of your journeys. With visually appealing designs and user-friendly layouts, our templates make it easy to document and share your travel stories. Enhance your travel documentation, relive your adventures, and create a lasting record of your wanderlust with our user-friendly templates. Download now and embark on a journey of preserving your travel memories with our Travel Log Templates .

How to write the perfect travel log?

“How to write a travel log?” It is the most logical option for travelers searching for an answer to the question to start by obtaining a notebook set first. One of the notebook sets should be divided into days directly with its pages or sections, and the travel notes for each day should be transferred to the relevant sections. Other essential features of the travel book are that it is easily portable, has a stylish structure, and is of high quality. The successful storage of the notes obtained during the trip will be possible with the travel book.

- Flow is a significant detail in a travel diary to be created from scratch. To prepare the flow according to the route and to make the events consist of a pattern, the “chronological” order is of great importance. Just before the creation of the travel book or diary, there are various notes, photographs, sound recordings, etc., that individuals must do. It is to obtain records that will facilitate the recall of the moments put into the memory with the elements. Thanks to these records, creating the final version of a travel diary will become much more perfect.

- Of course, every traveler takes a lot of photos during travels, and from time to time, he may not even be able to find a space to fit his photos. While preparing a travel diary, the inability to fit the images on the pages is a bigger problem than the pictures cannot be stored in the digital space. It is of great importance that the images of the days are chosen very well in the travel diaries. The most crucial photo of the day should be on the page related to that day, not to exceed a few.

- What’s a good travel log be like? Individuals looking for an answer to the question should pay attention that photographs tell much more than words. On the other hand, it is a much better reminder of the details of that moment. Therefore, doing a little photography training before preparing a travel diary or even before traveling will improve your travel diary. Afterward, it will be straightforward to decide on the photos to be chosen while organizing a travel diary and the photos taken at critical moments and times during the trip. Then, the travel diary can obtain photographs that contain the most important and most profound meanings of the days or contain the most details and describe much more than words.

- A street, a monument, a museum, a garden, a historical place, etc. You may have visited many places. Unfortunately, boring your diary with details while talking about these visited areas will make it difficult to read. It will disrupt the flow of the log and make it boring. Only the necessary details should be included in the travel diary to avoid such a situation.

- Avoiding telling personal details will be one of the best moves when writing a travel journal. For example, I did my hair like this today, chose that color bag, etc. Instead of unnecessary details, more details should be given about the cultures of the places visited during the trip or the ambiance of the events at that moment. With accurate descriptions, one of the primary purposes should be to make the reader live that moment in his mind with the diary and feel himself in that journey.

To better convey the feelings or experiences you have experienced while traveling a place, you need to include the sense organs in writing. Details such as talking about the smell of the environment during the trip, indicating the condition of the air temperature, giving information about the taste of what you eat and drink, conveying the details that catch your eye, and being descriptive about the general sound of the environment are the elements that should be included in the diary when writing a travel log.

Have you learned how to write but haven’t gone anywhere yet? Then hit the road, travel, roam, and share your experience with us!

How do you write a trip log?

A trip log records details during travel, including dates, locations, transportation, accommodation, activities, food, costs, weather, and personal experiences. Write down notes each day in a journal or log template. Supplement with photos, ticket stubs, etc.

What is the travel log?

A travel log is a diary where travelers document details about their trips, often including where they went, what they did, who they met, how they felt, and more. It helps preserve memories from vacations and adventures.

How do I create a key log spreadsheet?

To create a key log spreadsheet, make columns for the date, employee name, key number, time checked out, time returned, purpose/area accessed, and notes. Use rows to log each instance a key is used. This tracks key usage.

What is a log template?

A log template is a pre-made document with fields to enter repetitive data over time, allowing the user to track details, patterns, and progress. Logs help organize information like project tasks, exercise routines, work hours, expenses, etc.

What are the benefits of keeping a detailed travel log?

Benefits include preserving memories, recording expenses, writing down tips for future travelers, reflecting on experiences, maintaining a catalog of places visited, and appreciating how much you accomplished.

Should you write in your travel log during or after your trip?

It’s best to write frequent, brief log entries during your trip so details are fresh, then expand on them afterwards. In-the-moment notes capture true thoughts.

What makes a good travel log?

A good log is consistent, personalized with stories and anecdotes, has fun mementos attached or inserted, highlights new discoveries about people/places/yourself, and evokes the feeling of the experiences.

![%100 Free Printable Venn Diagram Templates [PDF, Word] 2 Venn Diagram](https://www.typecalendar.com/wp-content/uploads/2023/06/Venn-Diagram-150x150.jpg)

Hey there! I recently learned about Venn diagrams and thought they were pretty neat. Just wanted to share a bit in case you weren't familiar. Venn diagrams are those images…

![Free Printable Payment Schedule Templates [PDF, Excel, Word] 3 Payment Schedule](https://www.typecalendar.com/wp-content/uploads/2023/05/Payment-Schedule-1-150x150.jpg)

According to salary.com, the average payroll cycle is two weeks. However, large companies employ vast numbers of workers according to labor demands. In such cases, some individuals get contracted to…

![Free Printable Indemnification Agreement Templates [PDF, Word] Hold Harmless 4 Indemnification Agreement](https://www.typecalendar.com/wp-content/uploads/2023/05/Indemnification-Agreement-150x150.jpg)

Are you planning on protecting your company or business against any loss? Say hello to indemnification agreements. No doubt you might have thought of the term liability, which can connect…

![Free Printable Congratulation Letter Templates [PDF, Word] Examples 5 Congratulation Letter](https://www.typecalendar.com/wp-content/uploads/2023/05/Congratulation-Letter-150x150.jpg)

Congratulations can be used in a speech or writing. To write a letter, however, you will have to start from scratch. A well-written letter of congratulations can serve as an…

Betina Jessen

Leave a reply cancel reply.

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

- Agreement Templates

- Budget Templates

- Certificate Templates

Travel Log Templates

- November 5, 2019 February 4, 2023

A Travel Log which is also called a travel or road journal is a written or documented proof to record every step of your journey i.e. places, destinations important milestones. Whenever someone goes on a road trip or travels to another place, he always wants to share the excitement with his family and friends after the trip is over. But it’s not possible or that easy to remember every place, point, or a destination all by yourself without any external help so it’s essential that you keep all the records in written form. This way you can take notes, put names of important places in the book, and remember amazing stuff about a particular destination and once you are back, you can easily share those moments with your friends and family.

A Travel Log is just a piece of paper on which you write according to your convenience. You can do it on a simple sheet or type it on your computer, laptop, or cell phone. If you have access to the internet, it’s very easy to record every destination with its coordinates and important history about it. Also, it’s not just a personal thing to record your travel information as there are some employees who are hired to travel. They are required to record every detail of their voyage in a documented form so that they can pass it on to their superiors or other staff members. There are some firms like a magazine or newspapers that hire traveling staff to travel to different destinations to gather information or to report important incidents. Also, there are some organizations that offer their web portal visitors to look for any destination in the world or to find interesting stuff about it. This way, they travel to different places to get interesting information which later will be placed on the official website of that company.

There are many websites that offer you to create a Travel Log free of cost and it’s also very easy if you don’t want to do much effort. Although you have to do it on the internet so it will be a problem if you don’t have any access to the internet. Also, you can do it by yourself at home by using just paper and pen or do it on the computer by creating a new spreadsheet which will be used as a log in the future. The log may vary according to the type of traveling or the purpose but generally, it contains the name of the destination, its coordinates, the date of the visit, important stuff about that destination, and special comments if any.

Here is a preview of this Free Sample Travel Log Template created using MS Excel,

General uses of a Travel Log in our daily lives:

- A travel log is the best way of inspiration both during and after the trip or traveling.

- It’s the best way to remember or recall different places or interesting facts about a destination.

- If you are going to a lot of places, by keeping a travel journal, you can remember each and every detail about the traveling or the places.

- This way you will have saved stories to share with your family and friends around special occasions like Christmas or New Year.

- If one of your friends is going on a trip too, you can tell him about the best places to stay, eat and visit. Also once you have saved it all, it’s very easy to tell someone about a particular culture or local rules and regulations.

Related Templates:

Catering Quotations

Painting job quotation, maintenance quotations, photography quotations, construction services quotation, computer service quotation, bid quotations, price quotations, product quotations, service quotations.

Excel Templates

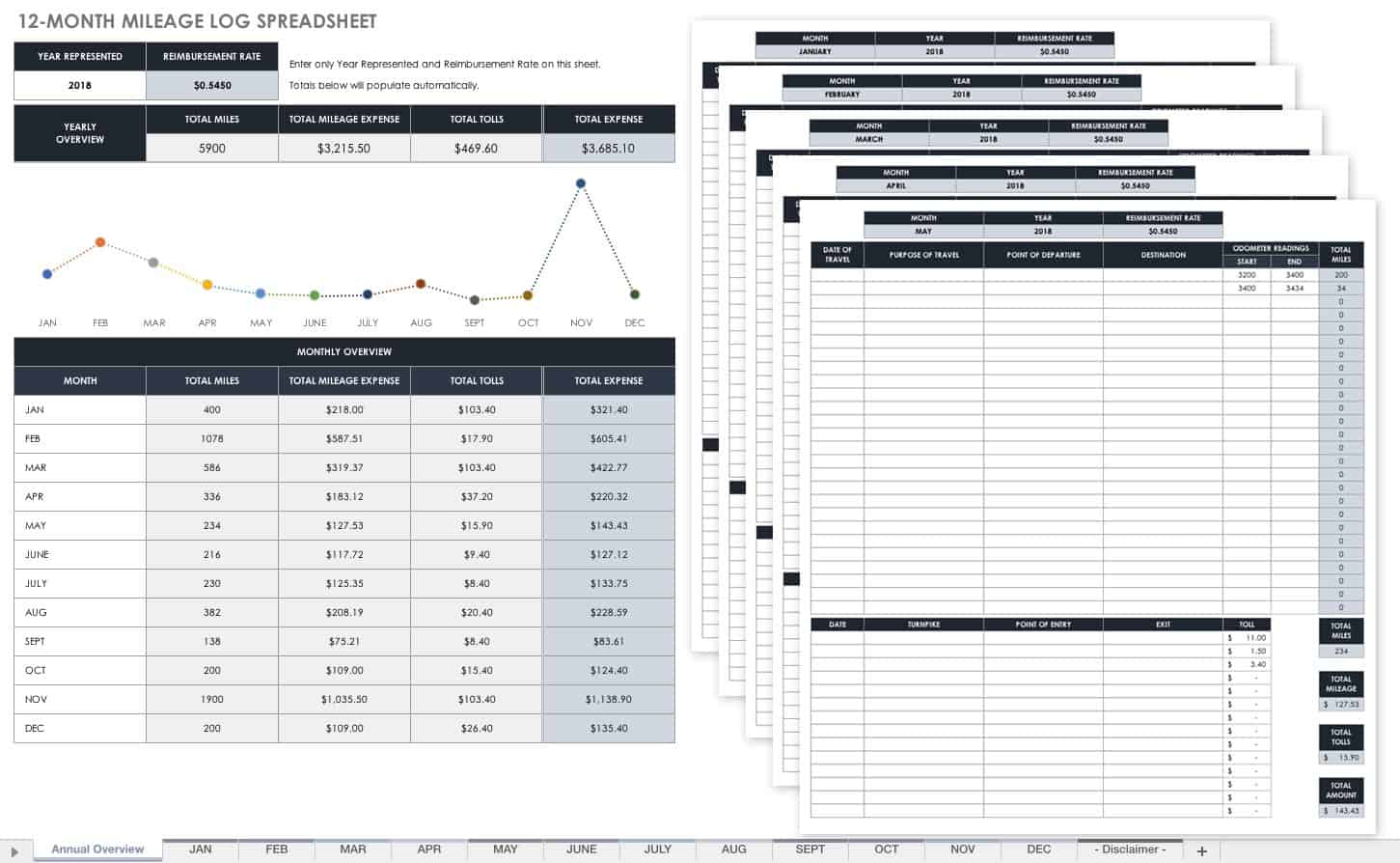

Microsoft excel worksheets and templates, vehicle log book.

Your vehicle is probably one of the most expensive assets you have. If you don’t take care of your vehicle and perform its regular maintenance, you will have to face the consequences. One of the most effective strategies to take care of a vehicle is to use a logbook.

What is a vehicle logbook?

Opposing its name, the vehicle logbook is not a book. It is a record sheet in which you put down all the details regarding your vehicle. Just as you use the logbook for any specific purpose, using it for your vehicle is also going to help you in a number of ways.

Why does someone need a vehicle logbook?

There are so many details of your vehicle that you would like to add to the vehicle logbook. This makes the log more detailed. Some people deliberately make the logbook more comprehensive because it lets them keep track of every aspect of the vehicle. When there are so many details, no normal human being can remember them. This is where the vehicle logbook becomes even more useful.

What does a common vehicle logbook look like?

In general, this logbook resembles a common record sheet the primary job of which is to keep the data in it for a longer period of time. You can keep a physical book for keeping the details safe. However, some people have more trust in electronic records as they can be kept at various places without investing money or making arrangements for space. These days, there are also many apps that people can download on their smartphones and can consult the data as and when they want.

What information is provided by the vehicle logbook?

The main details that are provided are:

Basic details of the vehicle:

This part of the logbook gives introductory details of the vehicle such as the name of the company, year of manufacturing, model name, color, and much more.

Details of the maintenance:

No matter which brand you drive and for which purpose you use this vehicle, it will always need maintenance after some time. For instance, the vehicle needs the replacement of oil and air filters after it has been run for approximately 5000 km. A person can’t remember the exact date of filter replacement and the name of the oil that was filled in the engine. Therefore, every detail regarding the maintenance can be recorded in it.

Mileage details:

There are a few vehicle-related responsibilities that require the owner of the vehicle to remember the total mileage of the vehicle.

What is the benefit of keeping the vehicle record sheet?

Every owner of the vehicle is recommended to keep the record book with them due to the many benefits they can reap. Some of the benefits have been given below:

It maintains the vehicle:

Just like anything else, your vehicle also goes through regular wear and tear. It is very important to fix the problem before it takes a turn for the worse. Your logbook keeps reminding you of the maintenance work your vehicle requires. This way, you manage to keep your vehicle in the best working condition.

The car owner keeps track of the efficiency:

The efficiency of the vehicle greatly depends on how much fuel it has consumed, how many miles it has been run, and many other factors. Since the logbook keeps a record of all these details, it becomes very easy for a person to determine how efficiently his vehicle is working and what kind of improvements his vehicle actually needs. This way, he can ensure that his vehicle stays in the best condition always.

You can access it whenever you want:

These days, it is more common for people to use the application that they keep on their smartphones. Since a smartphone stays with you all the time, it is very easy for you to access this logbook whenever you require it. Some applications also allow the user to take a photograph of the maintenance details or meter that is directly uploaded to the app and the user can consult them.

It gives accurate details:

When you use a record sheet, you can be 100% sure and confident about the details that you get your hands on.

Uses of Vehicle Logbook

A logbook is basically used to keep a record of some entity. A vehicle log book is a document that keeps a record of ownership. It is helpful when a vehicle is sold from one person to another. The buyer and seller both need to fill out sections in a logbook so that there is a record of the deal before coming to an agreement.

This vehicle logbook is also used for business purposes. Businessmen use this book to keep a record of their business travel or trip, the description of the destination, the number of kilometers, or the distance traveled. The logbook keeps a record of the expense of the work-related vehicle. By using this vehicle log book one can claim the percentage amount of true car expense by recording the number of business kilometers traveled.

There are some requirements of a log book such as it cannot be kept for a whole year. One can keep it for only 12 weeks. It doesn’t matter if the owner has one or two cars, the 12-week period will remain the same.

If a car is replaced with another, then again the same log book works but there should be mentioned the details about the starting and ending readings.

The vehicle log book requires the following set of information.

- It must show the vehicle type, its registration number, and its engine capacity

- It must be recorded for a 12-week period

- It must record starting and ending dates and odometer readings of travel

- The total business kilometers traveled and their percentage

New Excel Templates…

- Monthly Study Reminder & Planner

- Move-in Checklist Template

- Camping Checklist Template

- Employee Orientation Checklist Template

- Salon Startup Checklist Template

- Project Completion Checklist

- Construction Site Checklist Template

- Rental Inventory Checklist Template

- Customer Support Representative Duty List

- Party Attire Inventory Template

- Kids Morning Checklist

- Fuel Station Inspection Checklist

- Bakery Cleaning Checklist

- Bakery Employee Responsibility Sheet

- Kids Screen Time Checklist

Make Professional Life Easier!

Printable Travel Log Templates 100% Free [Excel+Word+PDF]

Home / Log Templates / Printable Travel Log Templates 100% Free [Excel+Word+PDF]

A travel log template is used by various businesses for payments to employees for their business trips. People can also use it to track their travel moments and determine the type of chores carried out during a trip. Furthermore, it enables you to monitor data such as distance, travel cost, time, and petrol prices. All this information helps you to maintain the vehicle.

Table of Contents

- 1 What is a travel log?

- 2 Why do people use travel log?

- 3.1 Destination:

- 3.3 Expenditure:

- 3.4 Experience:

- 3.5 Pictures:

- 4.1 Daily travel log

- 4.2 Business travel log sheet

- 4.3 Vacation travel log

- 4.4 Student travel log template

- 5.1 Vlogs and Videos

- 6.1 Buy a durable but it should be lightweight journal with a hardcover

- 6.2 Buy art materials

- 6.3 Buy adhesives too

- 6.4 Pack a ruler and scissors

- 6.5 Search for a clear folder that’s expandable

- 6.6 Purchase or print out a map

- 6.7 Write as you go

- 6.8 Consider to who you’re writing the log

- 6.9 Come up with a theme

- 6.10 Collect mementos

- 6.11 Capture a lot of photos

- 7 How to create travel log?

- 8 Difference between a business travel log and a personal travel log:

- 9 Reasons for using the travel log:

- 10 Some tips for keeping a travel log:

- 11 What to avoid while keeping a business travel log?

- 12 Conclusion:

- 13 Faqs (Frequently Asked Questions)

What is a travel log?

A travel log is a sheet or a document that keeps a track of the traveler. It is used for non-formal purposes such as travelers used it for personal reasons, to rate their experiences. Nowadays, companies have made a strategy to keep the database of their employee’s trips. Companies use the travel log to keep track of their employees. Moreover, it is drafted in the form of a database that contains columns, rows, and tables where you record the information. Also, it is self-updating as it updates information automatically.

Why do people use travel log?

Individuals use the travel log to remember the experiences that they had at that time. Here you can also insert pictures of the things or places you enjoyed a lot. In addition, people use it to share the time they had enjoyed with their families and friends.

Travel log is used by organizations or companies to keep track of the expenses used. By knowing these expenses, they create a detailed report for compensation. With the help of this log, companies know the amount spent over a particular time period. Moreover, employees use it to show in detail where the money dispatched went. If they don’t do this then they will have to pay from their salaries and may be accountable for it. You may also like Vehicle Maintenance Log Template .

What to include in a travel log?

Let us discuss what should a travel log contain;

Destination:

In this section, you have to mention the place you intend to visit. State how far you are from that particular place and how you intend to get there. Additionally, you can also mention the places you are going to visit and the things you are likely to see.

It includes the spending time that you will spend at a specific place when you will be traveling to your destination. Also, discuss when you intend to come back. However, some organizations make a schedule on which the time is allocated for a particular event.

Expenditure:

In this part, indicate the amount of money that will be required for a trip. You can estimate the amount before going on the trip or you can also use a detailed method where everything you spend is recorded to the activity.

Experience:

Everything you do on the trip should be recorded in this part. This section is very broad because it may include the place, the food, the culture, and everything you don’t have with prior experience.

This part is optional and also an informal one. You can share your pictures here to remember everything you did while in that place. You should also check the Mileage Log Template .

Different types of travel log template:

There are various types of travel log templates, few them are mentioned below;

Daily travel log

In this template, you can record all your expenses information daily and keep a record of your spending. Hence, it helps you to organize your travel expenditures.

Business travel log sheet

As its name implies, it is for a business trip where you can track your movement. You just have to mention the leaving and returning time, the purpose of the trip, and the gasoline consumed.

Vacation travel log

If you are on a vacation to your favorite place with your relatives then a travel log can help you a lot. You can use this template to record the activities you did, brief descriptions of the places, etc.

Student travel log template

This type of travel log is used by the students when they are going on a trip with their educational institution.

Other types of travel logs:

You can use different types of travel logs if you love travelling such as;

Vlogs and Videos

On social media platforms, this type of travel log example has become very popular. You can make a vlog, make videos of your travels, and talk directly to the camera. They can be a lot easier to share with others as this can be less visceral than a written trip log sheet. Furthermore, the worry of carrying heavy and expensive camera equipment is the disadvantage of vlogging. Another disadvantage is to find the right lighting and sound to capture the perfect moment.

To document your travels, it is great to use apps. These days, we have purpose-built journal apps. In which, you can take notes, upload photos, record videos, and add captions. The destination you have visited, you can also auto-link the website that destination.

How to record my travels?

Here are the steps to follow to record your travels on travel log templates;

Buy a durable but it should be lightweight journal with a hardcover

You should ensure that the journal you select has a strong binding. It is very easy to write or sketch on. Also, select one that’s large enough to hold photos and postcards.

Buy art materials

The things that you know you will feel comfortable writing with bring them such as pens, markers, or highlighters. Since there may be sights worth portraying on paper, bring with you tools used for sketching. For embellishing your tip log template, highlighters are cool.

Buy adhesives too

You have to attach postcards, photos, and other mementos to your log. Adhesives will assist you. Since glue sticks aren’t messy and they occupy very little space so they are a great option. To attach your travel souvenirs to your journal, use decorative tapes.

Pack a ruler and scissors

You can trim with these some of the things you will place in your log.

Search for a clear folder that’s expandable

You might not have the time to attach them all right away as you will collect mementos for your journal. Without losing any of your mementos, you can keep everything organized by bringing along a clear expandable folder. Here, you can collect your mementos and keep them secure.

Purchase or print out a map

You can search several cool retro maps online. Select one that’s appealing and unique. After that, paste this on the cover of your log. In order to fit it perfectly, adjust the size of the map particularly if your itinerary includes various destinations.

Write as you go

It’s recommended to write down events as you travel in order for your log to capture the mood and the tone of your travels. This is because you might find it difficult to remember the most essential details later when your trip is over.

Definitely, this doesn’t indicate that you have to draft diary-style entries that describe everything that transpired every day. To write down sights, experiences, and activities that come to your mind right away, try to bring out your log a few times a day.

Consider to who you’re writing the log

To serve as a personal memento of your exciting and interesting experiences in life, travel journals are mainly intended. The log in many cases is also meant for sharing with your friends and family.

In this way, if they make a decision to take a similar venture in the future, they can vicariously experience or get ideas. If you know who you’re writing for, you can think of the best tone of writing and style.

Come up with a theme

If people have the main mood or idea to focus on, they find it easier to compose entries. Consider all of the things you have done and seen. After that, try to see in case you can spot a recurring theme that will assist to shape your log entries.

Collect mementos

At the beginning of your trip, chronicling your journey should start. The materials that will fill the pages of your log, start gathering them. This can involve the following;

- Boarding passes

- Tickets to tourist attractions

- Business cards from hotels or restaurants

- Logo napkins

- Paper menus from restaurants

- Local newspaper clippings

- Local beverage and food products, from labels

- Receipts from the things you have bought

Capture a lot of photos

Without pictures, no trip will be truly complete. These assist you recall what transpired for many years to come and what you have done and what you saw. From these visual reminders of your escapade, it will be your log that will benefit most.

How to create travel log?

You need to download the template in order to make a travel log. Then, start editing the important fields that might need. On the basis of your requirements, you can create daily, weekly or monthly travel logs. Select the one that suits you as it comes in both generic and professional format. Edit the needed field to include own figures and details. You can record a lot of things in it such as;

- Date of travel

- A vehicle used

- Vehicle registration number

- Contact, and destination

- A purpose of the trip

- Return time

- Odometer readings

- Signature of the corned persons

Difference between a business travel log and a personal travel log:

A business travel log is used for official reasons like tax deductions by IRS. This log contains a record of business expenses, purposes, and outcomes of a business trip.

On the other hand, a personal travel log includes an exciting detail of your trip, your experiences, emotions, scenes, and reflections on your vacation.

Reasons for using the travel log:

Personal travel logs use by people to assist them to remember the experiences they had at that time. You can insert pictures of the place or of things you enjoyed doing there. It assists anyone in sharing the time they had with their families and friends.

A travel log helps an organization to keep track of the expenses used. They can now present a detailed report for compensation when they have that amount. In addition to this, the log helps the businesses in identifying the cash spent over a time period.

Employees have to report about travel logs. This is because they require to show in detail where the money dispatched went. They will be held accountable for it if they don’t. Also, they will have to pay from their wages and salaries.

Some tips for keeping a travel log:

Here are some tips for keeping a travel log;

- Before you leave, start writing in your log about the planning and the places you want to visit.

- Explain a story about your experiences rather than making lists of things you did.

- State how you felt and thought while visiting the places.

- You should also specify your not-so-good experiences.

- When the thoughts are fresh in your mind, write them immediately.

- To recall your many experiences, take lots of pictures.

- Summarize your experiences, funny moments, and the best part of your trip.

- Fix a specific time every day to write in your log and summarize your day.

What to avoid while keeping a business travel log?

You should avoid the following mistakes while keeping a business travel log;

- Not including the business purpose in the travel log. Just telling the sequence of events for the entire trip doesn’t make sense without stating the purpose of the trip. It is a common novice mistake to write a business travel log without the business purpose.

- Rather than the actual cost, use business trip estimations. Stick all the tickets in your log for all your purchases related to the business.

- Including too much business jargon which makes your business travel log difficult to read. Instead, use straightforward language in your log and keep sentences precise. Just include the business trip details.

- Tracking your business trip is challenging without including the travel itinerary. The travel itinerary that is relevant to the business purpose, attach it.

Conclusion:

In conclusion, a travel log template is a helpful tool for a company or any traveler. With the help of this document, you can share your experience and also keep a record of your expenditures. Moreover, there are various types of travel log templates, you can easily download your desired template from our portal bestcollections.org.

Faqs (Frequently Asked Questions)

Unlike a travel log, a travel journal contains whatever you want to include about your tips. Depending on the people’s needs, they may include the date, place, memories, places they stayed, budget, cost, and more.

These are as follows; 1- Travel Journal 2- Journey Log 3- Journey Plan 4- Log Book 5- Travelers notebook

The main purpose of a travel log is to keep track of interesting experiences about your trip. You can include your adventures, stories, and memories in your travel log so that you remember everything you experienced.

How useful was this post?

Click on a star to rate it!

Average rating / 5. Vote count:

No votes so far! Be the first to rate this post.

As you found this post useful...

Follow us on social media!

You Might Also Like

30+ ready-to-use daily time study templates (excel / word), 32+ free printable driver log book templates (excel / word), printable vehicle maintenance log templates free download (excel / word).

- Real Estate

Home » Business » Vehicle Log Book Template (Word, Excel, PDF)

Vehicle Log Book Template (Word, Excel, PDF)

The vehicle log book template (Word, Excel, PDF) is maybe a standout amongst the most vital instruments for your vehicle support. It is a key record that guarantees an immaculate venture on your benefit. Any guarantee related issues for an auto can be effectively taken care of in the event that you keep up an impeccable log book for it. It is in actuality a proof of your vehicle condition.

A log book is fundamental for your vehicle particularly when you plan to sell your auto. The primary inquiry by the purchaser is continual with respect to the log book. It is basically on the grounds that the log book is proof of how well you have kept up your vehicle. You may also like Vehicle Maintenance Checklist Template .

Keeping a vehicle log book layouts in an electronic structure can bring bunches of advantages for the proprietor or an owner. A greatly manufactured spreadsheet intended for the log book is an extraordinary apparatus for keeping yourself overhauled on your vehicle’s execution. Through this special device, you can survey the mileage, fuel costs, support issues, repair, and numerous other center issues identified with your vehicle.

Table of Contents

Printable Vehicle Log Book Templates Free Download

The templates of any vehicle log book intended for such a log is an immaculate device for vehicle proprietors. It is a pre-outlined template where you are required to enter a particular arrangement of data in regard to your vehicle.

When you dole out undertakings to each of the areas, the product naturally overhauls them for client comfort. You should also check the Car Sale Invoice Template .

Free Vehicle Log Book Template Excel

Vehicle log book template word, fuel log book template excel, motor vehicle log book template, printable vehicle log book template, vehicle repair record template.

Vehicle log book template can be to a great degree valuable particularly on the off chance that you claim an auto rental business or you have your own car selling business. It will guarantee that your car or any other vehicle is in great shape and have the right kind of documents.

You May also Like

Sharing is caring!

I am Ryan Duffy and legal writer. I received a bachelor of business administration (BBA) degree from London Business School. I have 8+ years of writing experience in the different template fields and working with ExcelTMP.com for 7 years. I work with a team of writers and business and legal professionals to provide you with the best templates.

Free Mileage Log Templates

By Kate Eby | April 13, 2018

- Share on Facebook

- Share on LinkedIn

Link copied

A well-maintained mileage log can make a huge difference for salespeople, service workers, or anyone who spends a significant time on the road for their job, especially if you are self-employed. Those miles translate into dollars, either as reimbursement from your employer or as a deduction from the IRS, and they can add up quickly. You can simplify the task of keeping these expenses in order by using mileage templates. The free, easy-to-use, and customizable templates below track vehicle maintenance, gas mileage, and more transportation-related expenses, and they’re available for download as Microsoft Excel and Word, PDF, or Google Docs files.

Mileage Report Templates

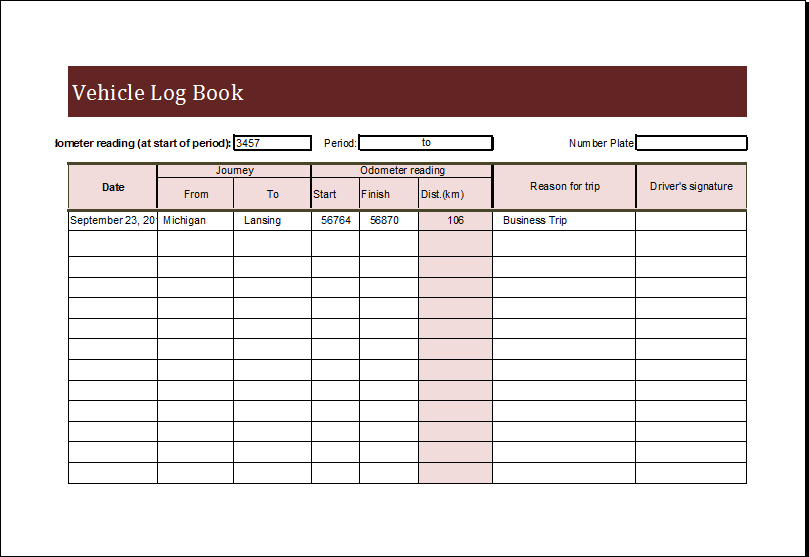

Business vehicle mileage log.

This Excel mileage log provides a simple layout for easy mileage reporting and automatic calculations for daily miles, total miles, and reimbursement amounts. It includes columns to list the date and purpose of a trip, odometer start and finish readings, and relevant notes about trip details, which can provide important documentation during an audit. Use this template as a daily and monthly mileage log.

Download Business Vehicle Mileage Log Template - Excel

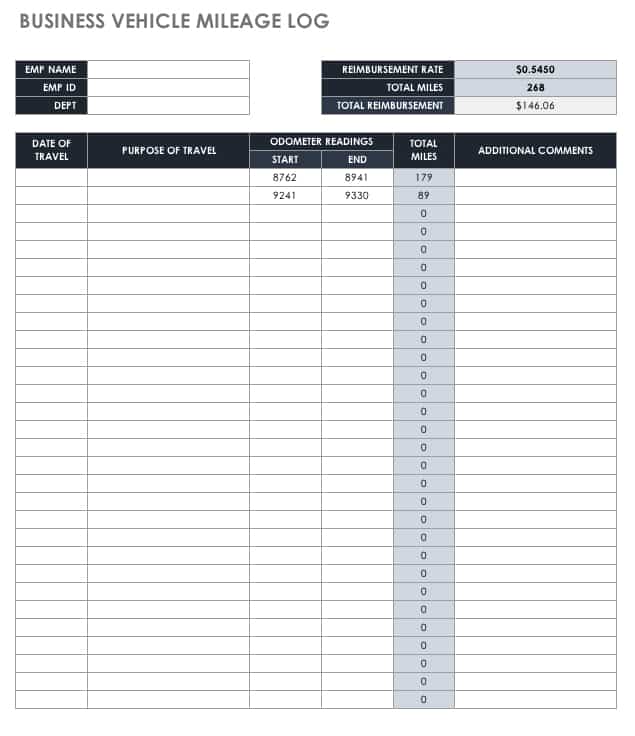

12-Month Mileage Log Spreadsheet

Each month gets its own mileage log sheet in this template, so you can record daily, monthly, and yearly miles. Keep track of your overall mileage as well as business miles that can be deducted. In addition to monthly log sheets, the template provides an annual mileage summary so that you can get a quick overview. This template can easily be edited to track other information, such as tolls and other fees, or personal miles that can be deducted, such as expenses related to moving or medical appointments. Save this Google Sheets log to your Drive account for cloud storage and easy access from a mobile device.

Download 12-Month Mileage Log Spreadsheet Template - Excel

Monthly Mileage Report Form

This monthly mileage report template can be used as a mileage calculator and reimbursement form. Template features include sections to list starting and ending locations, daily and total miles driven, employee information, and approval signatures. This spreadsheet report can be customized to include whatever details are relevant to your business, including mileage rates. It’s available as an Excel, Word, or PDF file.

Download Monthly Mileage Report Form Template

Excel | Word | PDF

More Log Templates: Weekly Expenses, Gas Mileage, and Vehicle Maintenance

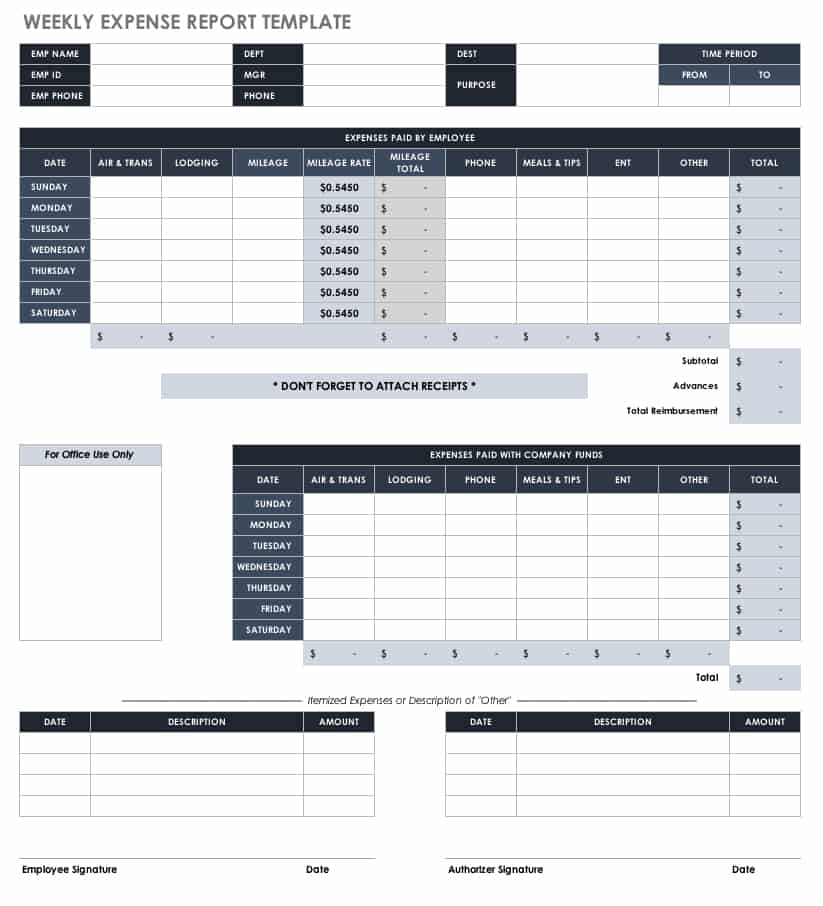

Weekly expense report template.

More than just a mileage expense report, this template can be used for tracking other business travel expenses for reimbursement on a weekly basis. Enter company and employee information at the top along with a time period, and then keep track of mileage and other expenses for each day of the week. This is a detailed template that allows you to create a thorough expense report for accounting and record keeping.

Download Weekly Expense Report Template - Excel

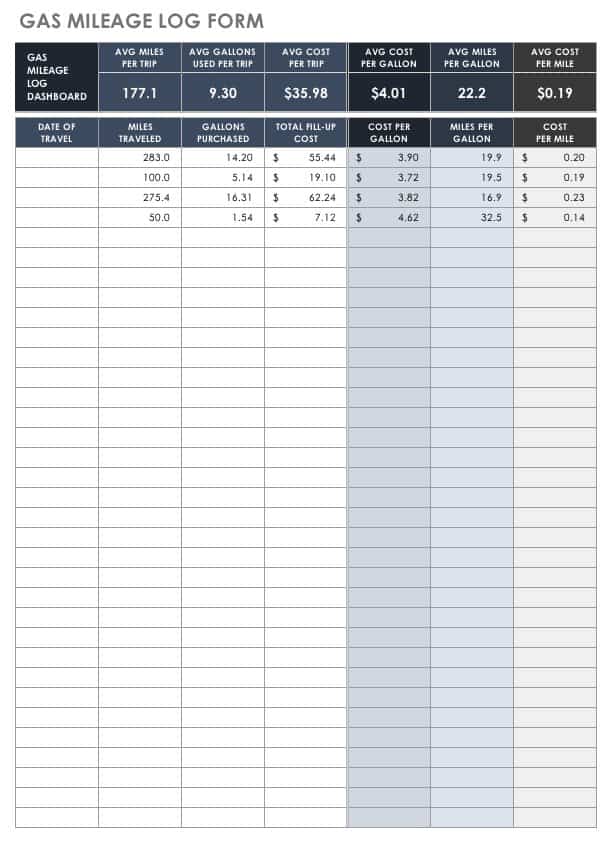

Gas Mileage Log Form

If you’re keeping track of business-related gas expenses, this gasoline log can calculate the cost of a trip based on the distance traveled, the price of gas, and your vehicle’s gas mileage. This is useful both for anticipating the cost of a trip and for tracking actual expenses. Use this template for your own personal budgeting or to support tax documentation along with receipts.

Download Gas Mileage Log Form Template - Excel

Vehicle Maintenance Log Template

Keep track of vehicle maintenance, repairs, and related expenses with this log template for Google Sheets. Get a quick view of services performed over the course of a year, along with itemized and total costs. Combine this with invoices and receipts to help organize your records. Keep a printed version in your vehicle for a reminder of what services have been completed.

Download Vehicle Maintenance Log Template - Excel

What Is a Mileage Log?

A mileage log provides a record of vehicle miles traveled for business over a given time period. This documentation may be used to collect reimbursement from an employer or to claim mileage as a tax deduction. Mileage logs may also be used to keep track of other deductible miles, such as those related to travel for medical appointments, when moving, or as part of work for charitable organizations. Employers may set their own reimbursement rates, while the IRS updates mileage rates each year for taxpayers to follow.

If you plan to deduct miles on your tax return, it’s important to keep track of mileage on a daily basis and maintain accurate records in case of an audit. A mileage log could be any form, spreadsheet, or online application that helps you keep track of miles.

What Business Driving Can Be Deducted?

The most likely candidates for deducting business miles are self-employed individuals who use their vehicles for work purposes. Employees may also be able to deduct part of the cost of mileage if their employers are not reimbursing them at the full rate set by the IRS. However, no taxpayer can deduct mileage for commuting to and from work.

In addition to tracking the number of miles driven, you also need to document the purpose of business travel. Here are some types of business vehicle use that are allowable for mileage deductions:

- Driving from one work location to another, such as an office or other work site

- Visiting customers or clients

- Going to a business meeting that is away from one’s workplace

- Traveling to a temporary workplace

You may also be able to deduct mileage for job-related errands, such as picking up supplies, and for business entertainment. Keep in mind that certain variables may affect how a deduction needs to be claimed, including whether a work location is within your home area or if the travel involves an extended overnight stay. Check the current IRS rules or consult with a tax accountant to ensure that your deductions are accurate and allowable.

Standard Mileage Deduction vs. Actual Expenses

Taxpayers can choose to take a standard mileage deduction by multiplying the number of qualified business miles by the IRS mileage rate. In addition to this standard amount, they may be able to deduct tolls and parking fees that are related to business travel.

Alternatively, taxpayers can choose to deduct actual expenses they accrued over a given year, including business costs related to vehicle depreciation, registration fees, lease and insurance payments, gas, repairs, tolls, and other expenses. When deducting actual expenses, it’s important to keep receipts and other supporting documentation.

A mileage log can be used to track both business and personal miles in order to show what percentage of vehicle use is work related. Again, check with the IRS or your tax preparer to get the most accurate and up-to-date rules for tax deductions each year.

What Is the Mileage Reimbursement Rate for 2017?

The standard mileage rates set by the IRS fluctuate from year to year. For 2017, the rate per mile for deducting business travel is 53.5 cents. For miles accrued as part of charitable work, the rate is 14 cents per mile. And for mileage related to medical or moving purposes, the rate is 17 cents per mile.

What Is the Mileage Reimbursement Rate for 2018?

In 2018, the standard mileage rates increased slightly from those in 2017 for travel related to business, medical, or moving needs. For business miles driven, the rate is 54.5 cents per mile. For medical and moving mileage, the rate is 18 cents per mile. And for charitable mileage, the rate is the same as the previous year, at 14 cents per mile.

For more information, see this quick overview of standard mileage rates from the IRS .

Using a Mileage App: Pros and Cons

Several apps, such as MileIQ, Quickbooks Self-Employed, and TripLog, are designed for calculating and tracking mileage. These apps offer the benefit of automatic mileage tracking using GPS, so drivers can simply rely on the app to detect routes and add up miles. Some apps also calculate other expenses and allow you to categorize the type of trip in order to separate personal and business miles.

However, this convenience comes with drawbacks, including cost. Prices vary, but a fee is often required to get the benefit of automatic mileage tracking. Another potential con is the amount of storage space required to support one of these apps, which may clog up your phone quickly and wear down the battery. Before you opt for an online mileage service, be sure to read through user reviews to get a better idea of what to expect, how well they work, and whether the cost is worth the potential hassle.

Mileage Tracking Tips

Keeping track of mileage is important and doesn’t have to be overwhelming. Here are a few tips for creating an easy process while maintaining accuracy.

- Calculate mileage daily. This can’t be emphasized enough. Try to make it a daily habit so that your records are accurate and detailed, and nothing is overlooked. This may be especially important if you are audited.

- Use maps as a backup. Humans make mistakes, and mileage apps can have their own issues. If you use your vehicle for business and forget or lose the mileage information, look up the route with an online map to estimate the miles traveled, and then print a copy for documentation.

- Hold on to your mileage records. The IRS recommends holding on to mileage logs and other supporting documentation for at least three years. To help ensure that records are not lost, consider keeping digital versions in a safe and easily accessible location.

- Keep a paper log in your car: A paper copy of your mileage log can serve as a backup if technology fails or if you think of a note during your trip that you want to add to a digital log at a later time.

No matter how you track your business miles or store your records, aim for accuracy so that you’re not missing out on deductions and the full reimbursement amount you are owed.

Manage Your Mileage and Business Expenses Better in Smartsheet

Empower your people to go above and beyond with a flexible platform designed to match the needs of your team — and adapt as those needs change.

The Smartsheet platform makes it easy to plan, capture, manage, and report on work from anywhere, helping your team be more effective and get more done. Report on key metrics and get real-time visibility into work as it happens with roll-up reports, dashboards, and automated workflows built to keep your team connected and informed.

When teams have clarity into the work getting done, there’s no telling how much more they can accomplish in the same amount of time. Try Smartsheet for free, today.

Discover why over 90% of Fortune 100 companies trust Smartsheet to get work done.

Track mileage automatically

Ato compliant vehicle log book template , in this article, download the free log book template here as a pdf or excel, do you need a vehicle log book template for your team , what to include in the car log book template, how to use the car log book template.

If you are claiming vehicle expenses for business purposes, you must keep proper records in order for the ATO to approve your claim.

You can download the free Driversnote template as an Excel, Sheet, or printable PDF.

The Excel and Sheets versions include a vehicle log example so you can see how to fill out your logbook, as well as an empty sheet you can use for your own log.

Alternatively, you can try the Driversnote logbook app for logging your trips even quicker. The app helps you get ATO-compliant tax log books for your claims and is recommended by accountants in Australia.

Kilometre tracking made easy

Trusted by millions of drivers

If you are a manager or an employer in need of a solution for your entire team, you can try Driversnote Teams . While using the Sheet or Excel car log book template may suffice for your team to report their mileage, an app will save you and your employees a lot of time by automating the reporting and reimbursement process. Some of the benefits of using a mileage tracking app for your team are:

- Your team will provide you with accurate and consistent mileage reports;

- In seconds, you can approve or reject mileage reports:

- Invite and remove users, as well as assign roles quickly;

- Your team will save time by having all trips tracked for them automatically.

According to the logbook method, there are a few things that you must always remember to include in your log book. The ATO outlines clear rules on what information you need to fill out in your log book template.

When using the logbook method, the following information is required:

- The time span being tracked

- The odometer readings at the start and end of the period

- The total number of kilometres driven

- The percentage of business-related kilometres travelled.

For each trip recorded, the following information is required:

- Start and end times

- Odometer readings

- Distance travelled in total

- The reason for the trip