We couldn’t find any results matching your search.

Please try using other words for your search or explore other sections of the website for relevant information.

We’re sorry, we are currently experiencing some issues, please try again later.

Our team is working diligently to resolve the issue. Thank you for your patience and understanding.

- Edit my quotes

Trip.com Group Limited American Depositary Shares (TCOM)

- Nasdaq Listed

- Nasdaq 100

- Summary Live

- Real-Time Live

- After-Hours Live

- Pre-Market Live

- Charts Live

NEWS & ANALYSIS

- Press Releases Live

- Analyst Research Live

- Dividend History

- Historical Quotes

- Historical NOCP

- P/E & PEG Ratios

- Option Chain

- Short Interest

- Institutional Holdings

- Insider Activity

- SEC Filings

- Revenue EPS

Bid Price and Ask Price

The bid & ask refers to the price that an investor is willing to buy or sell a stock. The bid is the highest amount that a buyer is currently willing to pay, whereas the ask is the lowest ... Read More. amount that a seller is currently willing to sell. The numbers next to the bid/ask are the “ size ”. The bid size displays the total amount of desired shares to buy at that price, and the ask size is the number of shares offered for sale at that price. The data displayed in the quote bar updates every 3 seconds; allowing you to monitor prices in real-time. The bid-ask spread can indicate a stock’s liquidity, which is how easy it is to buy and sell in the marketplace. Often, a smaller spread suggests higher liquidity, meaning more buyers and sellers in the market are willing to negotiate. In contrast, a larger spread suggests lower liquidity, as there are fewer investors willing to negotiate. You can use the bid-ask spread to determine whether to place a market order or limit order when trading, helping you to optimize your price and have a successful order execution. Real-time bid and ask information is powered by Nasdaq Basic, a premier market data solution. This data feed is available via Nasdaq Data Link APIs; to learn more about subscribing, visit Nasdaq Data Link's products page . ... Read Less.

Analyze your stocks, your way

Leverage the Nasdaq+ Scorecard to analyze stocks based on your investment priorities and our market data.

*Data is provided by Barchart.com. Data reflects weightings calculated at the beginning of each month. Data is subject to change.

**Green highlights the top performing ETF by % change in the past 100 days.

- Real-time Data is provided using Nasdaq Last Sale Data

Data provided by Nasdaq Data Link, a premier source for financial, economic and alternative datasets. Data Link's cloud-based technology platform allows you to search, discover and access data and analytics for seamless integration via cloud APIs. Register for your free account today at data.nasdaq.com .

- Type a symbol or company name. When the symbol you want to add appears, add it to My Quotes by selecting it and pressing Enter/Return.

These symbols will be available throughout the site during your session.

Your symbols have been updated

Edit watchlist.

- Type a symbol or company name. When the symbol you want to add appears, add it to Watchlist by selecting it and pressing Enter/Return.

Opt in to Smart Portfolio

Smart Portfolio is supported by our partner TipRanks. By connecting my portfolio to TipRanks Smart Portfolio I agree to their Terms of Use .

We've detected unusual activity from your computer network

To continue, please click the box below to let us know you're not a robot.

Why did this happen?

Please make sure your browser supports JavaScript and cookies and that you are not blocking them from loading. For more information you can review our Terms of Service and Cookie Policy .

For inquiries related to this message please contact our support team and provide the reference ID below.

- Get 7 Days Free

Trip.com Group Ltd 09961

Company report, trip.com begins to aggressively ramp international revenue as it explores new growth drivers.

Narrow-moat Trip.com competes in China’s crowded online travel agent, or OTA, industry by leveraging the largest selection of both domestic and international hotels in China on its platform and relying on user stickiness as a one-stop shop for travel ticketing, accommodations, and packaged tours. The platform is now also generating revenue from advertisement in which it hopes to take 3%-5% of the ad market, but nearly all its revenue streams are travel-related, and coronavirus lockdowns in China has cratered demand due to the inability to travel or unwillingness to quarantine.

Price vs Fair Value

Bulls say, bears say.

The company can eventually reach its 20%-30% long-term operating margin target as COVID-19 subsides.

Operating margins fall short of long-term outlook due to snags from COVID-19 or government policies. Continued lockdown will further complicate the outlook for the entire travel industry in China.

Trading Information

Key statistics, company profile, competitors.

- Meituan Class B 03690

- TripAdvisor Inc TRIP

- Booking Holdings Inc BKNG

- Tongcheng Travel Holdings Ltd 00780

Financial Strength

Profitability, travel services industry comparables, sponsor center.

trading lower

trading higher

Trip.com Group Ltd

Key statistics.

1.74 mean rating - 27 analysts

2024 (millions HKD)

About Trip.com Group Ltd (TCOM.O)

Company information.

Trip.com Group Ltd is a China-based company mainly engaged in the operation of one-stop travel platform. The Company's platform integrates a comprehensive suite of travel products and services and differentiated travel content. Its platform aggregates its product and service offerings, reviews and other content shared by its users based on their real travel experiences, and original content from its ecosystem partners to enable leisure and business travelers to have access to travel experiences and make informed and cost-effective bookings. Users come to its platform for any type of trip, from in-destination activities, weekend getaways, and short-haul trips, to cross-border vacations and business trips.

Contact Information

+ 86 ( 21 ) 34064880

https://www.ctrip.com/

Personal Services

Executive Leadership

Markets performance, commodities chevron, currencies chevron, rates & bonds chevron, stocks chevron.

Source: LSEG New Tab , opens new tab - data delayed by at least 15 minutes

Latest News

Wall Street securities analysts revised their ratings and price targets on several U.S.-listed companies, including Embark Technology, Innovage Holding and IRhythm Technologies, on Friday.

Trip.com Group Ltd (TCOM)

- Performance

- Fundamental Chart

- Scatter Plot

- Stress Test

Price Chart

- Consumer Services

Trip.com Group NasdaqGS:TCOM Stock Report

Trip.com Group Limited

NasdaqGS:TCOM Stock Report

Market Cap: US$32.2b

TCOM Stock Overview

Trip.com Group Limited operates as a travel service provider for accommodation reservation, transportation ticketing, packaged tours and in-destination, corporate travel management, and other travel-related services in China and internationally.

About the company

Trading at 5.9% below our estimate of its fair value

Earnings are forecast to grow 12.2% per year

Earnings grew by 606.9% over the past year

Risk Analysis

No risks detected for TCOM from our risk checks.

Trip.com Group Limited Competitors

Expedia Group

NasdaqGS:EXPE

Hilton Worldwide Holdings

Marriott International

NasdaqGS:MAR

H World Group

NasdaqGS:HTHT

Price history & performance, recent news & updates, does trip.com group (nasdaq:tcom) deserve a spot on your watchlist.

Co-Founder notifies of intention to sell stock

Does trip.com group (nasdaq:tcom) have a healthy balance sheet.

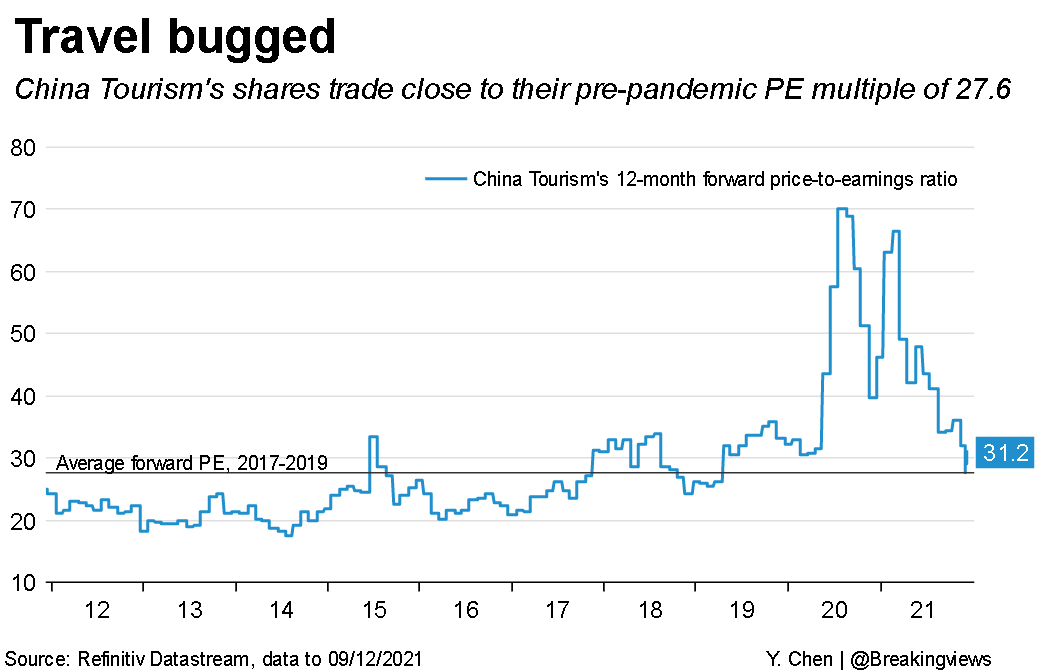

Trip.com: Untangling Rebound Momentum From Rich Valuation

Consensus eps estimates increase by 15%, recent updates, trip.com group limited (nasdaq:tcom) looks just right with a 27% price jump.

Full year 2023 earnings: EPS exceeds analyst expectations

An intrinsic calculation for trip.com group limited (nasdaq:tcom) suggests it's 25% undervalued.

Trip.com Group Limited to Report Q4, 2023 Results on Feb 21, 2024

Investors will want trip.com group's (nasdaq:tcom) growth in roce to persist.

Shareholders Should Be Pleased With Trip.com Group Limited's (NASDAQ:TCOM) Price

Consensus EPS estimates increase by 21%

Third quarter 2023 earnings: eps and revenues exceed analyst expectations, is there an opportunity with trip.com group limited's (nasdaq:tcom) 28% undervaluation.

Trip.com Group Limited to Report Q3, 2023 Results on Nov 21, 2023

Trip.com group (nasdaq:tcom) might have the makings of a multi-bagger.

Chief Operating Officer notifies of intention to sell stock

Now 22% undervalued after recent price drop, second quarter 2023 earnings: revenues exceed analysts expectations while eps lags behind, trip.com group limited to report q2, 2023 results on sep 04, 2023, now 20% undervalued, estimating the intrinsic value of trip.com group limited (nasdaq:tcom).

Trip.com Group Limited Announces Resignation of Robin Yanhong Li as Director

Trip.com group (nasdaq:tcom) will be hoping to turn its returns on capital around.

Trip.com Group (NASDAQ:TCOM) Seems To Use Debt Quite Sensibly

Consensus revenue estimates increase by 22%

First quarter 2023 earnings released: eps: cn¥5.18 (vs cn¥1.53 loss in 1q 2022), trip.com group limited to report q1, 2023 results on jun 07, 2023, trip.com group limited, annual general meeting, jun 01, 2023, trip.com group limited's (nasdaq:tcom) intrinsic value is potentially 37% above its share price.

Now 21% undervalued after recent price drop

Some investors may be worried about trip.com group's (nasdaq:tcom) returns on capital.

Now 23% undervalued

Full year 2022 earnings: eps exceeds analyst expectations, would trip.com group (nasdaq:tcom) be better off with less debt.

Third quarter 2022 earnings: Revenues exceed analysts expectations while EPS lags behind

Trip.com group limited to report q3, 2022 results on dec 14, 2022, are investors undervaluing trip.com group limited (nasdaq:tcom) by 48%.

Less than half of directors are independent

Trip.com gets boost from reopening global borders, trip.com group limited provides revenue guidance for the third quarter 2022, trip.com non-gaap epads of -$0.05 misses by $0.07, revenue of $599m beats by $86.91m, trip.com: too early to turn bullish, trip.com group limited to report q2, 2022 results on sep 21, 2022, trip.com group limited announces changes to its board, trip.com sees glittery travel gold rush at the end of its covid tunnel, first quarter 2022 earnings: revenues exceed analysts expectations while eps lags behind, trip.com group limited to report q1, 2022 results on jun 27, 2022, consider trip.com as a turnaround bet, consensus eps estimates fall by 19%, trip.com group limited, annual general meeting, jun 30, 2022, trip.com group: artificial technologies and new products could push the price up, consensus forecasts updated, full year 2021 earnings: revenues exceed analysts expectations while eps lags behind, consensus revenue estimates fall by 16%, investor sentiment deteriorated over the past week, trip.com group limited to report q4, 2021 results on mar 23, 2022, now 20% undervalued after recent price drop, a look at the fair value of trip.com group limited (nasdaq:tcom).

Trip.com: A Growth King In The Travel Industry

Consensus eps estimates have been downgraded., trip.com group limited (nasdaq:tcom) analysts are reducing their forecasts for next year.

Third quarter 2021 earnings: EPS and revenues exceed analyst expectations

What is trip.com group limited's (nasdaq:tcom) share price doing.

Here's Why Trip.com Group (NASDAQ:TCOM) Can Manage Its Debt Responsibly

A Look At The Intrinsic Value Of Trip.com Group Limited (NASDAQ:TCOM)

Second quarter 2021 earnings released: CN¥1.02 loss per share (vs CN¥0.79 loss in 2Q 2020)

The current valuation of trip.com offers a 25% upside potential, is now the time to look at buying trip.com group limited (nasdaq:tcom).

Investor sentiment improved over the past week

Trip.com group: first ota to watch post-delta, consensus eps estimates increase to cn¥4.16, first quarter 2021 earnings released: eps cn¥2.94 (vs cn¥8.98 loss in 1q 2020), is now an opportune moment to examine trip.com group limited (nasdaq:tcom).

Is Trip.com Group (NASDAQ:TCOM) Using Too Much Debt?

New 90-day high: US$41.41

Trip.com group limited (nasdaq:tcom) analysts are cutting their estimates: here's what you need to know.

Price target raised to US$42.30

Full year 2020 earnings released: cn¥5.40 loss per share (vs cn¥12.35 profit in fy 2019), revenue beats expectations, earnings disappoint, analysts lower eps estimates to cn¥1.08, trip.com group limited to report q4, 2020 results on mar 03, 2021, new 90-day high: us$36.50, shareholder returns.

Return vs Industry : TCOM exceeded the US Hospitality industry which returned 28% over the past year.

Return vs Market : TCOM exceeded the US Market which returned 24.2% over the past year.

Price Volatility

Stable Share Price : TCOM's share price has been volatile over the past 3 months.

Volatility Over Time : TCOM's weekly volatility (5%) has been stable over the past year.

About the Company

Trip.com Group Limited operates as a travel service provider for accommodation reservation, transportation ticketing, packaged tours and in-destination, corporate travel management, and other travel-related services in China and internationally. The company acts as an agent for hotel-related transactions and selling air tickets, as well as provides train, long-distance bus, and ferry tickets; travel insurance products, such as flight delay, air accident, and baggage loss coverage; and air-ticket delivery, online check-in and seat selection, express security screening, real-time flight status tracker, and airport VIP lounge services. It also provides independent leisure travelers bundled packaged-tour products comprising group, semi-group, and customized and packaged tours with various transportation arrangements, including air, cruise, bus, and car rental services.

Trip.com Group Limited Fundamentals Summary

Is TCOM overvalued?

Earnings & Revenue

Last Reported Earnings

Dec 31, 2023

Next Earnings Date

How did TCOM perform over the long term?

English (USA)

English (UK)

English (Canada)

English (India)

Deutsch (Deutschland)

Deutsch (Österreich)

Deutsch (Schweiz)

Français (France)

Français (Suisse)

Nederlands (Nederland)

Nederlands (België)

- Top Capitalization

- United States

- North America

- Middle East

- Sector Research

- Earnings Calendar

- Equities Analysis

- Most popular

- NIPPON ACTIVE VALUE FUND PLC

- AMD (ADVANCED MICRO DEVICES)

- THE EDINBURGH INVESTMENT TRUST PLC

- MORGAN STANLEY

- GLOBE LIFE INC.

- Index Analysis

- Indexes News

- EURO STOXX 50

- Currency Cross Rate

- Currency Converter

- Forex Analysis

- Currencies News

- Precious metals

- Agriculture

- Industrial Metals

- Livestock and Cattle

- CRUDE OIL (WTI)

- CRUDE OIL (BRENT)

- Developed Nations

- Emerging Countries

- South America

- Analyst Reco.

- Capital Markets Transactions

- New Contracts

- Profit Warnings

- Appointments

- Press Releases

- Security Transactions

- Earnings reports

- New markets

- New products

- Corporate strategies

- Legal risks

- Share buybacks

- Mergers and acquisitions

- Call Transcripts

- Currency / Forex

- Commodities

- Cryptocurrencies

- Interest Rates

- Asset Management

- Climate and ESG

- Cybersecurity

- Geopolitics

- Central Banks

- Private Equity

- Business Leaders

- All our articles

- Most Read News

- All Analysis

- Satirical Cartoon

- Today's Editorial

- Crypto Recap

- Behind the numbers

- All our investments

- Asia, Pacific

- Virtual Portfolios

- USA Portfolio

- European Portfolio

- Asian Portfolio

- My previous session

- My most visited

- Undervalued stocks

- Quality stocks

- Momentum stocks

- Dividend Kings

- The Internet of Things

- 3D Printing

- Unusual volumes

- New Historical Highs

- New Historical Lows

- Top Fundamentals

- Sales growth

- Earnings Growth

- Profitability

- Rankings Valuation

- Enterprise value

- Top Consensus

- Analyst Opinion

- Target price

- Estimates Revisions

- Top ranking ESG

- Environment

- Visibility Ranking

- Stock Screener Home

- The future of mobility

- The food of tomorrow

- Europe's family businesses

- Circular economy

- Oversold stocks

- Overbought stocks

- Close to resistance

- Close to support

- Accumulation Phases

- Most volatile stocks

- Top Investor Rating

- Top Trading Rating

- Top Dividends

- Low valuations

- All my stocks

- Stock Screener

- Stock Screener PRO

- Portfolio Creator

- Event Screener

- Dynamic Chart

- Economic Calendar

- ProRealTime Trading

- Our subscriptions

- Our Stock Picks

- Thematic Investment Lists

Trip.com Group Limited Stock

Us89677q1076, leisure & recreation, financials cny usd, chart trip.com group limited, latest news about trip.com group limited, latest transcript on trip.com group limited.

Analyst Recommendations on Trip.com Group Limited

Press releases trip.com group limited, news in other languages on trip.com group limited, quotes and performance, highs and lows.

Managers and Directors - Trip.com Group Limited

Etfs positioned on trip.com group limited.

Delayed Quote Nasdaq, April 12, 2024 at 04:00 pm EDT

Company Profile

Income statement evolution, analysis / opinion.

Jane Sun, CEO of Trip.com: €200,000 luxury stays sold out in seconds

January 18, 2024 at 03:57 pm EST

Ratings for Trip.com Group Limited

Analysts' consensus, eps revisions, quarterly earnings - rate of surprise, sector travel agents.

- Stock Market

- Trip Com Group-stock

Trip Com Group Ltd Registered Shs Reg S Stock , TRPCF

Trip Com Group News More News

Here's what to expect from trip com group's earnings report, what wall street expects from trip com group's earnings, here's what wall street expects from trip com group's earnings, historical prices for trip com group, trip com group analyst opinions, trip com group estimates* in hkd, trip com group dividend calendar, trip com group ltd registered shs reg s calendar, trip com group ltd registered shs reg s past events, trip com group profile, moody’s daily credit risk score, trip com group shareholder.

IMAGES

VIDEO

COMMENTS

Find the latest Trip.com Group Limited (TCOM) stock quote, history, news and other vital information to help you with your stock trading and investing.

Trip.com stock price target raised to $38 from $33 at Mizuho. Dec. 7, 2020 at 6:51 a.m. ET by Tomi Kilgore.

Get the latest Trip.com Group Ltd (9961) real-time quote, historical performance, charts, and other financial information to help you make more informed trading and investment decisions.

Get the latest Trip.com Group Ltd (TCOM) real-time quote, historical performance, charts, and other financial information to help you make more informed trading and investment decisions.

Trip.com Group Limited American Depositary Shares (TCOM) Stock Quotes - Nasdaq offers stock quotes & market activity data for US and global markets.

Trip.com Group Limited to Report Fourth Quarter and Full Year of 2023 Financial Results on February 21, 2024 U.S. Time. SHANGHAI , Feb. 8, 2024 /PRNewswire/ -- Trip.com Group Limited (Nasdaq: TCOM; HKEX: 9961), a leading one-stop travel service provider of accommodation reservation, transportation ticketing, packaged t... 2 months ago - PRNewsWire.

Stock analysis for Trip.com Group Ltd (TCOM:NASDAQ GS) including stock price, stock chart, company news, key statistics, fundamentals and company profile.

See the latest Trip.com Group Ltd stock price (09961:XHKG), related news, ... Trip.com Group Ltd 09961. Morningstar Rating Unlock. Stock XHKG Rating as of Apr 3, 2024. Summary; Chart; News;

Discover historical prices for TCOM stock on Yahoo Finance. View daily, weekly or monthly format back to when Trip.com Group Limited stock was issued.

The Investor Relations website contains information about Trip.com Group Limited's business for stockholders, potential investors, and financial analysts.

The latest Trip Com Group stock prices, stock quotes, news, and TCOM history to help you invest and trade smarter. ... On Thursday 04/04/2024 the closing price of the Trip Com Group Ltd (spons ...

Get Trip.com Group Ltd (TCOM.O) real-time stock quotes, news, price and financial information from Reuters to inform your trading and investments

The competes in a crowded OTA industry in China, including Meituan, Alibaba-backed Fliggy, Tongcheng, and Qunar. The company was founded in 1999 and listed on the Nasdaq in December 2003. In depth view into TCOM (Trip.com Group) stock including the latest price, news, dividend history, earnings information and financials.

Website. 1999. 32,202. Jane Sun. https://group.trip.com. Trip.com Group Limited operates as a travel service provider for accommodation reservation, transportation ticketing, packaged tours and in-destination, corporate travel management, and other travel-related services in China and internationally.

Trip.com Group Limited (9961.HKG): Stock quote, stock chart, quotes, analysis, advice, financials and news for Stock Trip.com Group Limited | Hong Kong S.E.: 9961 | Hong Kong S.E. ... Trip.com Group Limited is one of the leading Chinese travel agencies. The activity is organized around four sectors: - airline ticket sale; - hotel booking sale ...

11 brokerages have issued 1-year price objectives for Trip.com Group's stock. Their TCOM share price targets range from $45.00 to $60.00. On average, they predict the company's share price to reach $53.67 in the next year. This suggests a possible upside of 9.9% from the stock's current price.

Citigroup Raises Price Target on Trip.com to $55 From $53, Maintains Buy Rating. Apr. 01. MT. TD Cowen Raises Trip.com Price Target to $53 From $45, Maintains Outperform Rating. Mar. 07. MT. Barclays Raises Trip.com's Price Target to $60 From $56, Keeps Overweight Rating. Feb. 23.

Trip.com Group's (NASDAQ:TCOM) stock is up by a considerable 27% over the past three months. We wonder if and what role the company's financials play in that price change as a company's long-term ...

NOTE: The Closing Price, Day's High, Day's Low, and Day's Volume have been adjusted to account for any stock splits and/or dividends which may have occurred for this security since the date shown. The Split Adjustment Factor is a cumulative factor which encapsulates all splits since the date shown.

Historical daily share price chart and data for Trip Group since 2003 adjusted for splits and dividends. The latest closing stock price for Trip Group as of April 08, 2024 is 48.82.. The all-time high Trip Group stock closing price was 59.73 on July 31, 2017.; The Trip Group 52-week high stock price is 49.72, which is 1.8% above the current share price.

According to the issued ratings of 10 analysts in the last year, the consensus rating for Trip.com Group stock is Moderate Buy based on the current 2 hold ratings and 8 buy ratings for TCOM. The average twelve-month price prediction for Trip.com Group is $52.88 with a high price target of $60.00 and a low price target of $45.00.

The latest Trip Com Group stock prices, stock quotes, news, and TRPCF history to help you invest and trade smarter.

Trip.com Group ( NASDAQ:TCOM - Get Free Report) had its target price increased by research analysts at HSBC from $50.00 to $60.00 in a report issued on Friday, Benzinga reports. The brokerage currently has a "buy" rating on the stock. HSBC's target price would suggest a potential upside of 19.76% from the company's current price.

Find the latest Tripadvisor, Inc. (TRIP) stock quote, history, news and other vital information to help you with your stock trading and investing.