Urgent Care Visit Cost: Insurance vs. No Insurance

Due to lower costs and convenience, urgent care centers and stand-alone health clinics are becoming more popular. As of 2019, across the United States, there were around 9,616 urgent care centers . But what do they treat at an urgent care clinic ? How much does it cost compared to going to the ER? What if you don’t have insurance? We’ll cover these questions and more, plus offer cost-saving advice.

What is Urgent Care?

Healthcare .gov defines urgent care as “Care for an illness, injury or condition serious enough that a reasonable person would seek care right away, but not so severe it requires emergency room care.”

In other words, it’s the middle ground between assessing bug bites and performing surgery. Urgent care centers provide relief without the wait or expense of going to your hospital’s emergency department.

Urgent Care Visit vs. Emergency Room Visit

Hospital emergency rooms are usually busier and always more expensive than urgent care centers . The cost of an ER visit varies, but the average cost is around $1,200. So when you can’t see your primary care physician or normal health care provider , a trip to urgent care is usually the most cost-friendly move.

Typical urgent care services include minor medical treatments that you can get at the doctor’s office such as:

- Urinary tract infections

- Upper respiratory infections

- Sore throat

- Strep throat

- STD treatment and diagnosis

When should you go to the ER ?

- Chest pain and other signs of a heart attack

- Problems breathing

- Weakness or numbness on one side

- Slurred speech

- Serious burns

- Head injury

- Broken bones

- Dislocated joints

Types of Procedures Offered at Urgent Care Facilities

Besides physical exams, urgent care may provide the following procedures:

- Minor surgical procedures (stitches, mole removal, cauterization, incision and drainage, cyst extraction, fingernail or toenail removal)

- Pap smear testing

- STD testing

- Pregnancy tests

- Blood tests (complete blood count, metabolic panels, enzymes, cholesterol, triglyceride)

- Flu tests and COVID-19 tests

Interested in learning more about procedure costs? Use this price comparison tool to quickly access the costs of these procedures (and lots of others) from providers in your area.

Compare Procedure Costs Near You

How Much Does a Trip to Urgent Care Cost if You Have Insurance?

All ACA-compliant health insurance plans cover emergency care, though not all insurers define what emergency care is in the same way. So, most insurance plans cover urgent care , and your out-of- pocket costs will likely be cheaper than an ER visit.

Most insurance plan providers encourage the use of urgent care clinics during off-hours, weekends, and holidays — when you can’t see your regular doctor — by charging fees and copays similar to an office visit with a primary care provider. However, some plan providers, like TRICARE, only allow you to visit urgent care clinics that are within your network up to two times each year without prior authorization.

The typical copay for urgent care is between $25 and $50. Your insurance company sets the rates, and they may vary.

The average out-of- pocket costs for an urgent care visit if you have insurance breaks down like this:

Copay and/or coinsurance + deductible (if applicable) = out-of- pocket costs

To find out exactly how much you will have to pay, consult your health insurance plan policy’s explanation of benefits (EOB).

How Much Does Urgent Care Cost for Uninsured Patients ?

In the United States, 5.4 million laid-off workers became uninsured between February and May 2020, an increase that is 39% higher than any other in modern history.

The average cost of an urgent care visit is $100 to $200, according to American Family Care, the largest urgent care clinic in the United States.

Depending on your medical needs , this could be much higher. Procedures like lab tests and X-rays will increase the amount of your final bill.

Urgent Care Alternatives

Many people go to the ER for simple medical care when they are between paychecks or have a high deductible insurance plan, because an emergency department (unlike urgent care) is obligated to provide care to all patients regardless of their ability to pay.

If you fall into this category or have no insurance , the following urgent care alternatives may fit your needs:

- Free clinics: Many communities offer free or low-cost health care clinics. The cost of using these clinics usually depends on your income or ability to pay. State and local health departments also offer deeply discounted services similar to urgent care clinics . Additionally, there are around 1,400 charity hospitals and clinics across the United States.

- Retail health clinics: Chains like CVS and Walgreens, as well as big-box stores like Target and Walmart, offer minor medical care via retail health clinics (RHC). RHCs offer walk-in health care services in select stores across the United States. The average cost for treatment at an RHC is around $100.

- Telehealth: This is one of the most budget-friendly ways to access health care today. According to United Healthcare , the average cost for telehealth, currently around $50, is about 50% less than most urgent care visit costs. You don’t need to have insurance to use telehealth either. CVS offers telehealth visits via the Minute Clinic .

How to Save on Your Urgent Care Visit Cost

If you are covered by insurance, make certain to go to an urgent care clinic that accepts your specific insurance plan . Calling your provider is the best way to avoid the unhappy surprise of unmet urgent care costs.

If you’re wondering how you can save money on your out-of- pocket costs , you have a few options. For one, many urgent care clinics offer discounted rates of up to 20% off when you pay in cash. And you can always visit Aunt Bertha , the website that connects you with partners in your area. Their mission is to provide community support, including financial help for medical bills, prescriptions, copays , and deductibles .

Sometimes when you have to go to an urgent care center , you don’t have time to worry about the costs of tests and procedures. But when possible, looking up prices on Compare.com puts you in control of your health care , helping you make better, more informed decisions.

Disclaimer: Compare.com does not offer medical advice and is in no way a substitute for any medical advice received from health professionals. Compare.com is unable to offer any advice on any medical procedure you may need.

Compare Car Insurance Quotes

Get free car insurance quotes, recent articles.

How much does urgent care cost without insurance?

$150 – $250 average urgent care visit cost.

Average cost of urgent care without insurance

The average urgent care visit costs $150 to $250 without insurance. Most urgent care clinics charge a $100 to $150 office visit fee that includes an evaluation by a healthcare professional and treatment for minor illnesses or injuries. Additional tests, X-rays, medications, treatments, and procedures cost extra.

Cost data is from research and project costs reported by BetterCare members.

Urgent care visit cost by level

The total cost of an urgent care visit depends on the number and severity of issues and what is needed to diagnose and treat you. Most urgent care centers used tiered pricing based on the amount of time or number of tests and treatments. Some facilities have more than three pricing levels.

Factors the affect the cost of urgent care

Factors that impact the cost include:

Office visit cost – Urgent care centers charge a base visit cost of $100 to $150 on average just to walk in and see a healthcare professional for evaluation. This office visit cost typically does not include X-rays, tests, medications, or procedures.

Location – Urgent care costs are fairly standard across the country, but you may pay slightly more in a major city like New York or Los Angeles.

Level of care – More serious or complex health issues require more expertise and take longer to diagnose and treat, increasing the cost.

Insurance – While lack of insurance coverage often means higher out-of-pocket healthcare costs, many urgent care facilities offer discounted self-pay or cash rates for individuals with no insurance.

Tests & treatments – Each X-ray, medication, treatment, or procedure adds to the total urgent care bill.

Labs – Some urgent care centers include in-house lab testing in their self-pay office visit price. When not included, lab tests cost $20 to $200+ each , depending on the test and whether it can be done in-house or requires sending to an off-site testing facility.

Urgent care services

In addition to treating common illnesses and injuries, urgent care centers provide a wide range of healthcare services. The table below shows the average cost for some of the most common services. Depending on the facility, some of these services may be included in the office visit fee.

Urgent care vs. emergency room cost

While emergency rooms can handle non-life-threatening health issues, going to an urgent care center instead will typically cost much less, especially for individuals with no insurance. Your wait time will also likely be much shorter at an urgent care center.

A typical urgent care visit costs $150 to $250 , while an ER visit costs $1,500 to $3,000 on average for the same service without insurance. Check out our guide comparing urgent care costs vs. the emergency room for a more in-depth look at the differences.

Urgent care FAQs

What is urgent care.

Urgent care refers to medical clinics that provide same-day, non-emergency healthcare services. This includes treating common ailments like colds, the flu, ear or bladder infections, bronchitis, strains, or sprains. Urgent care centers also offer other healthcare services like lab tests, vaccines, and physicals.

When should I go to an urgent care facility?

Consider going to an urgent care center if you are experiencing a non-life-threatening health issue and your primary doctor's office is closed or cannot fit you on the schedule. Urgent care facilities provide many healthcare services, including:

Treatment for minor illnesses and injuries

Physicals needed for sports, school, or employment

Diagnostic lab testing

Medications

Medical equipment

Is a walk-in clinic the same as an urgent care center?

A walk-in clinic is similar to an urgent care center in that both provide basic medical care services. However, most urgent care centers can handle a broader range of health issues and more serious non-life-threatening illnesses or injuries, like a severe burn or broken bone.

What is the difference between urgent care and the emergency room?

Urgent care centers are same-day clinics meant for illnesses and injuries that are not life-threatening. The emergency room is intended for serious, life-threatening situations that need immediate attention, such as a heart attack, stroke, uncontrollable bleeding, or major injury.

Does urgent care bill you later without insurance?

Most urgent care facilities require payment at the time of service. Depending on the testing and treatment you receive, you may also receive a bill after your visit.

Tips to save on your urgent care visit

Healthcare services can add up quickly, especially without insurance. Here are some guidelines to ensure you are not overpaying for your care:

Look online – Most urgent care centers have information on their website about self-pay rates, and many list the prices for individual services.

Call ahead – Call the facility beforehand to confirm their current wait time and find out their rates and payment options. You can also speak with them about your specific issue to determine if urgent care is the best choice.

Ask the right questions – Consider asking these important questions before your visit to ensure you are not surprised by the bill later:

Do you have discounted pricing for patients without insurance?

Will it cost less if I pay with cash?

What do you charge for an office visit?

What does the office visit fee include?

Will I need additional tests, and what will they cost?

How much do you charge for X-rays?

If I need medication, how much will it cost?

We use our proprietary database of project costs, personally contact industry experts to compile up-to-date pricing and insights, and conduct in-depth research to ensure accuracy in all our guides.

Ad-free. Influence-free. Powered by consumers.

The payment for your account couldn't be processed or you've canceled your account with us.

We don’t recognize that sign in. Your username maybe be your email address. Passwords are 6-20 characters with at least one number and letter.

We still don’t recognize that sign in. Retrieve your username. Reset your password.

Forgot your username or password ?

Don’t have an account?

- Account Settings

- My Benefits

- My Products

- Donate Donate

Save products you love, products you own and much more!

Other Membership Benefits:

Suggested Searches

- Become a Member

Car Ratings & Reviews

2024 Top Picks

Car Buying & Pricing

Which Car Brands Make the Best Vehicles?

Car Maintenance & Repair

Car Reliability Guide

Key Topics & News

Listen to the Talking Cars Podcast

Home & Garden

Bed & Bath

Top Picks From CR

Best Mattresses

Lawn & Garden

TOP PICKS FROM CR

Best Lawn Mowers and Tractors

Home Improvement

Home Improvement Essential

Best Wood Stains

Home Safety & Security

HOME SAFETY

Best DIY Home Security Systems

REPAIR OR REPLACE?

What to Do With a Broken Appliance

Small Appliances

Best Small Kitchen Appliances

Laundry & Cleaning

Best Washing Machines

Heating, Cooling & Air

Most Reliable Central Air-Conditioning Systems

Electronics

Home Entertainment

FIND YOUR NEW TV

Home Office

Cheapest Printers for Ink Costs

Smartphones & Wearables

BEST SMARTPHONES

Find the Right Phone for You

Digital Security & Privacy

MEMBER BENEFIT

CR Security Planner

Take Action

When You Should Go to an Urgent Care or Walk-in Health Clinic

Knowing your options in advance can help you get the right care and save money, sharing is nice.

We respect your privacy . All email addresses you provide will be used just for sending this story.

When you need medical care fast, who ya gonna call?

Not that long ago, you'd probably have dialed 911 or headed to the nearest emergency room, especially if it was after your regular doctor's business hours.

Today, depending on the severity of your medical situation, you have other options besides the ER, including an urgent care facility or even a "minute clinic" at a drugstore.

Both forms of quick care are growing fast. The number of urgent care facilities increased from 6,400 in 2014 to 8,100 today, with another 500 to 600 expected to open next year. Pharmacy- and retail-based clinics are also on the fast track for growth. One example is CVS, which operates more than 1,100 MinuteClinics, and is trying to buy health insurer Aetna. If that deal is approved by federal regulators, the company plans to expand the number of stores with these services.

These alternatives reflect a major evolution in how healthcare is delivered. But experts say it's important for consumers to know when each is appropriate—and when it isn't. When used properly, these newer options can make it easier for you to get the care you need, when you need it—and save you time and money, too.

Here's what you need to know to make smart choices for you and your family.

What's Behind the New Options?

Emergency room care is expensive. A 2016 study in the Annals of Emergency Medicine found that, even for people with the same diagnosis, treatment costs about 10 times more in the ER (an average of about $2,200) than in an urgent care center (about $168).

Partly for that reason, some insurers now aggressively steer people away from the ER. Anthem, which insures some 40 million Americans, has told its members in several studies, including Georgia, Kentucky, Missouri, and Ohio that the company reserves the right to deny coverage for ER visits that don't meet its definition of a true emergency.

Consumers have their own motivations to avoid the ER. For one thing, more of them are now enrolled in high-deductible health insurance plans , which require people to pay thousands of dollars out of pocket before insurance kicks in. And insurers increasingly require hefty copays for ER care.

To make matters worse, about two-thirds of ER doctors are not directly employed by the hospitals where they work, and can bill separately, according to the American College of Emergency Physicians. So, even when the ER is in your insurer's network, you could still get stuck with a much higher than expected emergency room bill if it turns out that the physician who treats you is out of your network.

Insurers, however, typically do cover urgent care and walk-in clinics, with copays similar to what you would pay at your doctor's office. And even if you have to pay out of your own pocket, the cost for services is much lower in these newer options than they are in the ER. Finally, they are often conveniently located, and have shorter wait times than ERs—all of which makes them attractive options for when you need care fast but aren't having a life-threatening emergency.

It Pays to Plan Ahead

As urgent care centers and walk-in clinics become more common, consumers are getting a better understanding of when they are appropriate, says Laurel Stoimenoff, CEO of the Urgent Care Association of America in Warrenville, Ill.

"More people are using urgent care and now know how we differ from ERs," she says. "Consumers are figuring it out, and that's important medically and financially." Only about 2 to 4 percent of people who come to an urgent care center need to be taken to an ER, Stoimenoff says.

Ryan Stanton, M.D., a spokesperson for American College of Emergency Physicians and an ER doctor in Lexington, Ky., agrees that walk-in clinics and urgent care centers are good choices for millions of patients with health problems that should be treated quickly but aren't life-threatening emergencies.

And, he says, consumers should do some research ahead of time, so that when they need care, they know where to go. "Every family should know the facilities in their area and when to go to one versus the other," Stanton says.

A Quick Guide to Quick Care

The first step is to check with your regular doctor's office to see if they offer walk-in or same-day visits. Some practices now do that. And our medical experts say that it's best to get your care from your primary-care provider when possible, as that makes it easier to keep track of prescriptions and monitor chronic health problems you may have.

But if you don't have a primary-care doctor, or when your doctor is not available or when you're traveling, here's what you need to know about other options for walk-in care, as well as advice on when you should still head to the ER.

Pharmacy or Retail Walk-in Clinic A clinic inside a retail store with an on-site pharmacy; major players include CVS, Target, Walgreens, and Walmart. They don't require appointments, and are often open on nights and weekends.

- When to go: Walk-in clinics are good for some common but not serious problems, such as bronchitis, ear infections, sore throats, urinary tract infections, rashes, minor sprains, and cuts that don't require stitches. They can also provide some preventive care, such as vaccinations, and might be able help you monitor certain chronic health problems, such as high blood pressure or diabetes, through screening tests. But any chronic health problem should be overseen by a regular physician.

- Who works there: These clinics are typically staffed mainly by nurse practitioners , nurses who have advanced training and can prescribe drugs. And because these facilities are usually located in stores that also have pharmacies, you can often fill prescriptions at the same time.

- Cost: Low, usually less than $100 if you are paying out of pocket. If you have insurance, including Medicare, you will likely have to cover only your copay (provided you have met your deductible), though it's good to check with your insurer first about any restrictions.

Urgent Care Center A walk-in center owned by a hospital, group of doctors, or independent investors that provides extended hours and is usually open on weekends.

- When to go: Urgent-care centers can handle all the same problems as a retail clinic, as well as some that are more serious but not necessarily severe enough to warrant a trip to the ER (see below). Examples include cuts requiring stitches, a suspected fracture, or a minor asthma attack. Consider visiting urgent care centers near your home to see where you are most comfortable, suggests Roger Hicks, M.D., CEO of Yubadocs Urgent Care, in Grass Valley, Calif. Ask if they are certified or accredited by the Urgent Care Association of America or another entity.

- Who works there: A physician who specializes in family or emergency medicine, plus often a physician assistant or nurse practitioner, nurse, and radiologist. Urgent care centers often provide standard X-ray and laboratory services, including blood testing, though not more sophisticated imaging tests such as MRIs or CT scans. In some states, staff there can also dispense needed medication.

- Cost: Moderate—usually less than $200 if you are paying out of pocket. If you are insured, including on Medicare, you will typically have to cover just your copay (provided you have met your deductible), though check with your insurer first for any restrictions.

Emergency Room Most ERs are attached to a hospital, though there are now about 600 "freestanding" ERs around the country. Freestanding ERS provide the same level of care as hospital-based ERs, though you will have to be transferred to a hospital if you need to be admitted for any reason. All ERs are open around the clock, treat patients by severity of care (not when they came in), and are required by law to care for anyone who comes in, regardless of insurance or ability to pay.

- When to go: The ER is where you should go for problems that threaten "life and limb," such as difficulty breathing, chest pain, seizures, head trauma, vomiting blood, severe allergic reactions, loss of consciousness, badly broken bones, and deep or badly bleeding cuts. They can also handle a mental health or substance abuse crisis, especially if accompanied by suicidal thoughts. It's best to determine which ERs near your home accept your insurance before you have an emergency, and to map out the quickest route to that ER.

- Who works there: Emergency-medicine physicians, nurses, physician assistants, and specialists.

- Cost: High. If you have to pay out of pocket, it could cost you in the thousands: A 2016 study from Texas found that the average ER visit cost $2,259 in hospital-based ERs and $2,199 in freestanding ones. If you are insured, you will likely have a much higher copay in the ER than you do at your doctor's office or at an urgent care or walk-in clinic.

Tips to Handle a Medical Emergency

Health emergencies can happen at any time. On the " Consumer 101 " TV show, Consumer Reports expert Lauren Friedman explains how you can be best prepared.

More From Consumer Reports

Be the first to comment

How Much Does Urgent Care Cost: With and Without Insurance?

Sidecar Health

October 19, 2021

First things first: what is “urgent care”? Say, you have a sudden health condition that’s concerning to you but doesn’t necessarily rise to the level of a true emergency in your opinion, like a troubling rash or gnarly bug bite. You call your primary doctor, and they are booked for three weeks solid. Enter urgent care.

Urgent care may be warranted when you feel you’re in a situation that isn’t necessarily an emergency but you would like to see a medical provider before you’d be able to make it in to see your primary doctor. The types of services generally provided by urgent care include providing treatment and prescribing medication for fevers, allergic reactions, ear infections, urinary tract infections, sprains and strains.

Now that we’ve established a few of the use cases for urgent care, the question of cost remains. So, how much is urgent care with or without insurance?

It’s best to explore the differences and generalized costs to determine the right option in the event that you need care, so that you can make a good choice for yourself when it is necessary. Because of that, we’re glad you’re here! Comparing the cost of urgent care visits with emergency care, as well as what it costs for an appointment with your primary care provider will help you decide when to schedule a visit for each in relation to your situation. That said, you should never compromise your healthcare needs based on the financial implications for treatment alone. Your health should always be the number one priority.

Cost of Urgent Care Visits and Treatment

Urgent care centers are considered a half-way measure between a primary care physician and a visit to the emergency room for services. They are convenient because they primarily take walk-in appointments and offer services during extended times beyond that of the typical doctor’s office.

If you are covered by a traditional health insurance plan, urgent care may be covered in full. This depends on the details of your individual plan: if you have a deductible and the deductible has been met, if you have coinsurance, if the urgent care center you visit is in-network or out-of-network, and so forth.

If you don’t have insurance, it’s another story of course. An urgent care visit is often a fraction of what an emergency room visit would cost. However, most patients are looking at a minimum of $100 to $150 for a walk-in urgent care visit depending on their copay–even at relatively affordable clinics. On top of this, there may be additional costs for lab work, X-rays or prescriptions needed, depending on the situation.

The quality of the care you may receive is also something to consider. Urgent care facilities are generally staffed by family care physicians who can provide the same types of services as offered in a general practitioner’s office. Keep in mind, they do not keep medical histories as your primary care provider does. Although they perform a similar intake during your visit regarding symptoms, allergies, and previous ailments or medical history, they do not keep this on file for every time you return.

Additionally, urgent care facilities are not equipped with the same sophisticated equipment and technology as a primary care provider or emergency room necessary to handle critical conditions. Many urgent care centers have X-ray machines and perform lab testing. However, certain urgent care clinics may not have this availability. If this is relevant to your situation, you may want to call ahead of time to determine if they have the machinery or services that you think you may require.

Walk-in clinics are also largely staffed by nurse practitioners versus family medicine doctors and can be found in most local pharmacies or grocery stores, making it more convenient to find a location where you can be seen right away.

Cost of Emergency Care and Treatment

Emergency care and medical treatment costs are much higher and more advanced due to the nature of the condition and the convenience of care. Although urgent care service facilities and walk-in clinics often offer extended evening hours and weekend times, emergency rooms are open 24 hours a day, 365 days of the year. Seeking emergency room treatment should be limited to life-threatening injuries or symptoms only. These may include but aren’t limited to:

- Trouble breathing

- Severe abdominal or chest pain

- Internal bleeding

- Spiked fevers, especially among children

- Severe head or eye injuries

Emergency room visits may also be covered under most health insurance plans, though there is a co-pay, which is higher than the cost of an urgent care visit. As an example, visiting the ER for a respiratory infection costs approximately $100 for an urgent care visit, while it could cost over $1,000 for treatment at the emergency room.

Furthermore, you’ll want to consider the cost of an ambulance ride, if applicable, which may be separate from the visit itself. The cost of an ambulance ride can range from $25 to $1,200 depending on if the individual has insurance coverage. Similar to urgent care, you can be admitted to the ER without insurance, although you will be responsible for full payment for care upon being discharged.

Regardless of whether you have health insurance coverage or not, it’s important to evaluate whether or not the treatment you need is truly an emergency. The decision may vary depending on the person and the condition. If you’re unsure about whether or not to make a visit to the ER, consider the severity of the pain, condition, or injury and whether the cost is worth it.

Primary Care Provider Cost and Treatment

What is a PCP (primary care physician)? A primary care physician is generally your main point of contact in terms of healthcare. They help you with preventive care and ongoing treatment. Although they may handle emergency situations, at times, they are likely not fully equipped or fully staffed to handle life-threatening situations. They may have a preferred urgent care or ER to recommend when those types of situations arise. However, to meet the standard of care required for an emergency situation is not what a primary care doctor is trained for.

The cost of a PCP visit depends on the level of your health insurance plan, the reason and frequency of visits, type of provider network, as well as the particulars of your health insurance plan, like your deductible and copay.

Some PCPs offer primary care plans, which often allow members to pay a flat or discounted cost to be seen by their primary physician. This is not a form of insurance, to be clear, but may help to curb costs over time if you seek care regularly.

If your symptoms aren’t too severe or life-threatening but you don’t have a designated PCP at the time when you need assistance, you may be better off seeking medical care at an urgent care clinic. For one, it can take some time to find the right PCP for you and once you do, it could be a bit of a wait before they have availability to see you.

If you do have a PCP, your best bet is to give their office and call and ask for a recommendation. After all, the call is free.

Negotiating Medical Bills

Did you know you can actually negotiate your medical bills? In fact, with just a little effort, you can actually cut your bill quite a bit. When it comes to reducing the price of your medical bill, make sure you study all costs and do your research. Procedures, services, supplies, and transportation can all influence the overall price. Make sure you review all charges to make sure they are accurate before making a payment.

Once you have all the facts, pick up the phone and call your health insurance provider. While speaking to a representative, learn about your different options and ask plenty of questions. In some cases, you may be able to ask for medical forgiveness. Regardless of your situation, the best thing you can do is talk to your provider and learn about the different options available to you.

https://www.debt.org/medical/emergency-room-urgent-care-costs/

Related Posts

It’s time to embrace a new kind of insurtech platform .

By Jason Delimitros, Vice President, Insurance Operations, Sidecar Health It’s clear we need innovative options for health insurance. More than 70 percent of U.S. adults report the current healthcare system is

Why prior authorization and formulary restrictions should be a thing of the past

Prior authorization and formulary restrictions are two common health insurance practices that can make it difficult for patients to get the care they need. Prior authorization requires patients to get

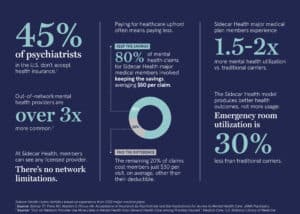

Rising Mental Health Demands Require an Innovative Insurance Model

If there’s anything we’ve learned in the past couple of years, it’s that Americans need accessible mental health services more than ever. According to Mental Health America, 20 percent of

Get a Quote

Want to know how much you can save with Sidecar Health? Enter your zip code to find quotes in your area.

Find Urgent Care today

Find and book appointments for:.

- Urgent Care

- Pediatric Urgent Care

- COVID Testing

- COVID Vaccine

Is Urgent Care Covered by Insurance?

- Most insurance plans cover urgent care visits, but coverage specifics depend on the plan and the chosen urgent care center. Familiarity with insurance terms like premiums, copays, and deductibles is essential.

- Urgent care is generally more cost-effective than emergency rooms, with ER visits costing significantly more due to their capability to handle severe emergencies.

- Before visiting, it's crucial to check if the urgent care accepts your insurance, understand potential out-of-pocket expenses, and always bring your insurance card. Some clinics might require upfront payment or even deny treatment for non-payment.

Understanding Common Insurance Terms

When does insurance cover urgent care, urgent care vs. emergency room, going to urgent care with out-of-state insurance, going to urgent care without insurance card, can urgent care deny you treatment for non-payment, what to expect during an urgent care visit, recap: going to urgent care with insurance.

- Frequently Asked Questions

Illness and injuries happen unexpectedly—often causing you to need medical care on short notice. When you’re dealing with a sudden need for medical care, going to urgent care is a great way to avoid the high costs of an emergency room and long wait times for an appointment with your primary care physician.

Before you head out to urgent care, you might be wondering if your insurance will cover your visit. The good news is that most insurance plans do offer coverage for urgent care visits. However, it will depend on your specific plan and the urgent care you visit.

Below you’ll find a comprehensive guide to assist in understanding when your insurance will cover urgent care and how much you can expect in out-of-pocket fees.

Before we dig into how insurance and urgent care work together, it's important to understand some of the terms you will come across frequently.

Premiums, Copays, and Deductibles

Even if your insurance plan covers urgent care, you may still be responsible for out-of-pocket expenses known as copays and deductibles.

A premium is the monthly cost of staying enrolled in an insurance plan. For some employees, your employer may help cover some of the costs of your premium.

A copay is a fixed amount that you pay for a medical service. For example, you may have a $20 copay for an urgent care visit or a $100 copay for an emergency room visit.

A deductible is the amount you pay before your insurance starts covering costs. For example, you may have a $1000 deductible, which means you will need to pay for $1000 worth of health services before your insurance kicks in.

Each insurance plan has a predetermined amount for copays and deductibles. You should get all this information during the insurance enrollment process.

Different Types of Insurance Coverage

Insurance coverage refers to what services and treatments your insurance plan will pay for. These services may include urgent care visits, hospitalizations, prescription medications, lab tests, X-rays, and more. Depending on your plan, you may have different levels of coverage for different types of services, according to Investopedia.

Health Maintenance Organizations (HMOs)

HMO plans require you to stay with in-network providers. This means that you are unable to visit a provider or urgent care that is not included on their list of approved providers. If you need to see a specialist, you will need a referral from an in-network provider.

Preferred Provider Organizations (PPOs)

According to Insurance.com, the PPO plan is a popular coverage type for employees. In 2021, around 46% of employed adults have a PPO plan through their employer-provided insurance company, according to Insurance.com. With a PPO plan, you can be flexible with what providers you see. This is because you can see out-of-network providers without a referral or pre-approval. Additionally, PPO plans offer a higher premium charge in exchange for lower co-pays.

Point of Service Plan (POS)

POS plans are less popular (accounting for around 9% of health plans in 2021, according to Insurance.com). They allow freedom in choosing where you get care, however, you will need to file your own claims if you choose to go to an out-of-network provider.

Medicare is a federal insurance plan for those who are over the age of 65 or with certain disabilities or conditions, according to Health and Human Services.

The Health and Human Services Department defines Medicaid as a joint federal and state program that offers health coverage to some people with limited income. This includes pregnant and postpartum women, as well as children under the age of 18.

High Deductible Health Plan (HDHP)

HDHP plans have grown in popularity over the last several years, according to Insurance.com. They are popular because of their lower premium costs and the addition of a Health Savings Account (HSA) to help offset the higher deductible costs.

Exclusive Provider Organization (EPO)

EPOs require you to take in-network and often have a limited number of in-network providers, according to Insurance.com. You will also need to get pre-approval for some services.

Where to Find Insurance

Many employers offer insurance plans as a benefit of working for them. However, if you are unemployed, self-employed, or work for a small company that doesn’t offer insurance benefits, you may want to consider getting health insurance on your own. Companies that are popular for health insurance include:

- Blue Cross Blue Shield

- United Healthcare

Additionally, you can get affordable healthcare coverage through the Affordable Care Act (ACA) through their marketplace.

According to the Affordable Care Act (ACA), emergency care is one of the required essential health benefits for all long-term health insurance. However, not all insurance companies view urgent care visits as emergency care.

Because insurance providers have specific provider networks, you might find that some urgent care centers are within the network and others are not. Going to a clinic that’s within the insurance plan’s network is a vital way to ensure you get the coverage you need.

How Urgent Care Clinics Work With Insurance Companies

Each insurance provider determines if it covers urgent care centers or not. In many cases, insurance providers will cover urgent care, but patients will be expected to pay a co-payment or co-insurance. In some rare cases, an urgent care clinic may not accept your insurance, even if your insurance provider would otherwise pay for the care.

Because of this, it is always best to call ahead and check to see if your urgent care clinic accepts your insurance, and to be aware of your out-of-pocket expenses when it comes to urgent care.

In general, emergency room visits are more expensive than urgent care visits. In fact, an NIH study in Texas showed emergency room costs over $2,000 per visit, while urgent care was only around $165 per visit.

This is because emergency rooms are equipped to handle severe medical emergencies and thus, they have more advanced medical equipment and resources available. As a result, insurance plans may have higher co-pays or deductibles for emergency room visits when compared to urgent care visits.

If you are traveling out of state or you work for an employer that is based in another state, your insurance coverage may change slightly. Some insurance plans cover services in other states, while others may not, according to Insurance.com. This is another reason why it is so important to understand your coverage details.

Even when your insurance plan does cover urgent care services in other states, you still need to be prepared to pay your deductible or co-pays. The amount you pay may be different than what you would pay for the same services in your home state, according to Insurance.com.

Finding an Urgent Care Center That Accepts Your Out-Of-State Insurance

If you’re traveling, you should check with your insurance provider before you go. They can explain your out-of-state coverage and even help you find providers who are along your route or at your destination that accept your insurance. Don’t forget to also bring your insurance card and prescription card (if you have one) along with you.

If you find yourself going to urgent care without your insurance card, don't worry—there are still options available to you. However, there are a few extra steps involved.

First, you can check for your insurance information by logging into your online portal through your insurance’s website. You may be able to download a digital copy of your insurance card this way. If not, you can still get your policy number, group number, and other information.

If you are unable to find your information through an online portal, you can call your insurance provider and get the information from them over the phone.

When you visit an urgent care clinic, you may be asked to pay your copay upfront. Some urgent care clinics may require you to pay the full price of the visit if you do not have insurance or if they don’t accept your insurance.

According to Debt.org, some urgent care clinics can turn you away if you are unable to pay. Keep in mind that most urgent care clinics accept cash or credit cards. Some clinics may also offer payment plans or financial assistance programs for patients who can't afford to pay their bills in full.

When you arrive at urgent care, you will first check-in at the registration desk. Here you will provide your personal information, insurance information, and a brief detail of why you need to get medical care. During this process, you may be asked to pay your copay or the price of your visit if your deductible hasn’t been met yet.

Some urgent care clinics have a triage area. Once you are checked in, a triage nurse will quickly evaluate you and decide how your condition ranks compared to others who need care. For example, if you have a minor illness and someone else has more severe symptoms, they will likely be seen sooner than you.

Either in triage or when you see your provider, you will need to give a more detailed description of your medical history and current symptoms. You will also need to provide a list of medications that you currently take—including any supplements and vitamins.

During your visit, a medical provider will examine you and may order diagnostic testing if needed. Depending on your condition, you may be prescribed medication (such as antibiotics) or you may be referred to a specialist for further treatment. The length of your visit will depend on the severity of your condition and the type of treatment you require.

There are some key things to remember when you are going to urgent care as an insured person.

- First, you should be aware of which urgent care clinics accept your insurance, and what your copays and deductibles are.

- Come prepared to pay your copay or the total cost of your visit if your urgent care doesn’t accept your insurance or if your deductible isn’t met.

- Bring your insurance card and identification card with you when you go to urgent care.

Now all you need to do is find urgent care clinics near you! We can help—start your search with Solv .

Frequently asked questions

Does insurance cover urgent care visits, what are premiums, copays, and deductibles in health insurance, what are the different types of insurance coverage, how do urgent care clinics work with insurance companies, is urgent care more expensive than the emergency room, can i go to urgent care with out-of-state insurance, what happens if i go to urgent care without my insurance card, can urgent care deny treatment for non-payment.

Michael is an experienced healthcare marketer, husband and father of three. He has worked alongside healthcare leaders at Johns Hopkins, Cleveland Clinic, St. Luke's, Baylor Scott and White, HCA, and many more, and currently leads strategic growth at Solv.

Dr. Rob Rohatsch leverages his vast experience in ambulatory medicine, on-demand healthcare, and consumerism to spearhead strategic initiatives. With expertise in operations, revenue cycle management, and clinical practices, he also contributes his knowledge to the academic world, having served in the US Air Force and earned an MD from Jefferson Medical College. Presently, he is part of the faculty at the University of Tennessee's Haslam School of Business, teaching in the Executive MBA Program, and holds positions on various boards, including chairing The TJ Lobraico Foundation.

Solv has strict sourcing guidelines and relies on peer-reviewed studies, academic research institutions, and medical associations. We avoid using tertiary references.

- Insurance Coverage: Major Types and How They Work. (July 23, 2023) https://www.investopedia.com/terms/i/insurance-coverage.asp

- Understanding HMO, PPO, HDHP, POD, and EPO. (July 23, 2023) https://www.insurance.com/health-insurance/difference-between-ppo-hmo-hdhp-pos-epo.html

- Medicare and Medicaid. (July 23, 2023) https://www.hhs.gov/answers/medicare-and-medicaid/index.html

- Urgent Care vs. Emergency Care Costs. (July 23, 2023) https://www.debt.org/medical/emergency-room-urgent-care-costs/

- Urgent Care: The evolution of a Revolution. (July 23, 2023) https://www.ncbi.nlm.nih.gov/pmc/articles/PMC3817457/

- EMTALA. (July 23, 2023) https://www.cms.gov/medicare/provider-enrollment-and-certification/certificationandcomplianc/downloads/emtala.pdf

- healthcare costs

- health insurance

- urgent care

Quality healthcare is just a click away with the Solv App

Book same-day care for you and your family

Find top providers near you

Choose in-person or video visits, manage visits on-the-go, related articles.

Five Ways to be a Better Patient at an Urgent Care

If you want to get in and out of an urgent care visit as quickly and successfully as possible, you need to be...

How Much Does Urgent Care Cost Without Insurance?

When you have a pressing medical issue, your first priority is getting to see a doctor, quickly. Getting an...

The Ultimate Checklist: What to Bring to Urgent Care Visit

To make your visit to urgent care as smooth and efficient as possible, it's important to come prepared with...

Beware of the Mobs: How to Stay Safe on Black Friday

In many ways, Black Friday turns shopping malls and outlet stores into cage fighting arenas. Armed with heavy...

Health Insurance 101: Key terms and plan types

The lack of transparency and easily accessible information can sometimes make it feel almost impossible to...

Navigating Urgent Care with Humana Insurance: In-Network Facilities...

If you're a Humana member, you may be wondering what kind of coverage your plan provides for urgent care....

How much does urgent care cost?

As a parent, you know that unexpected illnesses and injuries can happen at any time—and the cost of urgent care...

Understanding Medicaid Coverage for Urgent Care: What You Need to Know

Urgent care centers provide quick access to medical attention for non-life-threatening conditions. The...

4 Reasons to Pay Attention to Open Enrollment During a Pandemic

Open Enrollment Season Open enrollment is undoubtedly one of the most critical times of the year for those in...

Is Urgent Care Covered by Medicare?

If you require urgent medical care, you might wonder if urgent care centers accept your insurance. In the case...

Related Health Concerns

Abdominal Pain

COVID-19 Test

COVID-19 Vaccine

Cataract Surgery

Dental Bridges

Pinched Nerve

Rotator Cuff Injury

Sexually Transmitted Diseases

Urine Culture

This site uses cookies to provide you with a great user experience. By using Solv, you accept our use of cookies.

- Personal Information

- Favorite Clinics

Home Plan Your Visit Insurance We Accept

Urgent Care Insurance Plans & Information

We accept most insurance plans., bringing affordable medical care to everyone..

NextCare accepts all major insurance plans to make sure that you get the professional, compassionate care you need when feeling great just can’t wait. If you would like to verify that your specific insurance plan is accepted before your visit, click on your state below to see the entire list or feel free to call 1-888-381-4858 to speak with one of our Customer Service Representatives.

- Insurance We Accept

- Arizona Insurance

- Colorado Insurance

- Kansas Insurance

- Michigan Insurance

- Missouri Insurance

- New Mexico Insurance

- Nebraska Insurance

- North Carolina Insurance

- Oklahoma (Tulsa) Insurance

- Oklahoma Insurance

- Texas Insurance

- Virginia Insurance

- Wyoming Insurance

No Insurance or High Deductibles?

NextCare and its family of brands are the ideal alternative for your health care needs. Clinics are operated by top quality medical professionals, so our patients can be confident that they’re getting the highest level of care. With our Medical Discount Programs, we offer a cost-effective solution for customers who don’t have health insurance or have a high-deductible health insurance plan. When you pay out of pocket, your urgent care visit costs can average $250. Using an emergency room could cost you $800 or more and could take hours for you to see a provider. With a NextCare Medical Discount Program, you have access to a cost-effective solution that gets you the immediate healthcare assistance you need for non-life-threatening illness and injuries.

Trouble paying your bill? Please contact us at (888) 705-8558 to hear about our payment plans.

Learn more about medical discount programs.

Plan Your Visit

- Virtual Care

- Pre-Visit Forms

- Medical Discount Programs

- Pay Your Bill

Get Back to Your Life Quickly

Health Spending

- Quality of Care

Access & Affordability

- Health & Wellbeing

- Price Transparency

- Affordability

- Prescription Drugs

Emergency department visits exceed affordability threshold for many consumers with private insurance

By Hope Schwartz Twitter , Matthew Rae Twitter , Gary Claxton , Dustin Cotliar, Krutika Amin , and Cynthia Cox Twitter

December 16, 2022

Stay Connected

Get the best of the Health System Tracker delivered to your inbox.

Introduction

The high cost of emergency care may impact patients’ ability to afford treatment , with almost half of US adults reporting they have delayed care due to costs. Almost 1 in 10 Americans have medical debt , and about half of American households do not have the liquid assets to afford an average employer sponsored plan deductible. More than one third of US adults are unable to afford a $400 medical expense without borrowing.

Costs of medical emergencies present an additional financial burden on top of already costly health insurance premiums ranging $1,327 for single coverage and $6,106 for family coverage, on average, for workers with employer sponsored insurance. Variation in emergency department billing may make it difficult to predict the cost of an emergency department visit and subsequent financial liability. Recently, the No Surprises Act legislation aimed to curb unexpected emergency medical costs by prohibiting out-of-network billing for emergency services.

In this analysis, we use 2019 insurance claims data from the Merative MarketScan Commercial Database, which captures privately insured individuals with large employer health plans. We look at the total and out-of-pocket costs of emergency department visits for this group, overall and by diagnosis and severity level. We also look at which services contribute most to the costs of emergency department visits and examine regional variation in emergency department costs. Finally, we look at the demographic profile of consumers who visited the emergency department and the relationship between emergency department spending and annual spending for enrollees.

We find that enrollees spend $646 out-of-pocket, on average, for an emergency department visit. Enrollees with high annual health spending were more likely to visit the emergency department; the majority of enrollees in the top 10% of annual health care spending had at least one emergency department visit during the year. The most expensive components of most emergency department visits include evaluation and management charges, imaging, and laboratory studies, and facility fees make up 80% of the cost of visits. Cost varies by disease, visit complexity, and geographic region.

Large employer plan enrollees’ emergency department visits cost $2,453, on average, with enrollees responsible for $646 in out-of-pocket costs

On average, enrollees in large employer health plans who have an emergency department visit spend $646 out-of-pocket on the visit. There is significant variation in emergency department spending, with 25% of visits costing over $907 out-of-pocket and another quarter costing less than $128 out-of-pocket. These out-of-pocket costs for a single emergency department visit may be more than some people with private insurance can afford and, in some cases, could entirely deplete a consumer’s savings. For example, about 1-in-5 people (21%) with private insurance living in single-person households have less than $1,000 in liquid assets.

Related Content:

How does health spending in the U.S. compare to other countries?

The burden of medical debt in the United States

These amounts only include out-of-pocket spending required by the insurer. Before the No Surprises Act went into effect in January 2022, privately insured patients who visited the emergency department frequently had out-of-network claims on their visit, putting them at risk of providers sending them surprise balance bills. The No Surprises Act now prohibits most surprise out-of-network billing, but does not apply to ground ambulances . Any balance bill that a patient received from a provider would not appear in claims data and therefore would have been in addition to the out-of-pocket amounts shown here.

In total, enrollees and insurers paid $2,453, on average, per visit, with one quarter of visits costing $970 or less and another quarter costing $3,043 or more. All the costs described in this analysis are for the emergency department visits only, including professional services and facility fees, and do not include any spending on subsequent hospitalizations.

Facility fees contribute significantly more than professional fees to total visit cost

Emergency department bills are categorized as facility fees or professional fees. Professional fees are for services provided by clinicians, and facility fees include bills for services rendered using equipment owned by the facility, including laboratory or imaging studies. These fees are considered “overhead” for emergency departments and help facilities maintain appropriate staffing levels and technical resources. Evaluation and management charges also have a facility fee component for the equipment, staffing, and administrative resources used by the physician in their management. We find that facility fees make up 80% of total visit cost.

Evaluation and management charges make up the largest share of costs

Including both the professional fee and facility fee components of charges, the largest contributor to spending on a typical emergency department visit is the evaluation and management charge, which accounts for almost half (44%) of average visit costs. Evaluation and management charges are bills for the assessment of a patient that are not related to specific procedures or treatments provided; these services cost over $1,100 per visit, on average.

Imaging charges, including radiologist interpretation fees, make up an additional 19% of the average emergency department visit charge and cost $483, on average. The highest cost routinely performed imaging services include x-rays of the chest and CT scans of the head, chest, abdomen, and pelvis. Over half of visits (55%) include a charge for imaging services. About half of patients (49%) are charged for laboratory studies, including blood tests, which cost $230 on average. Other high cost but less common charges include surgical charges for patients with appendicitis and other conditions requiring surgery without inpatient admission, as well as ambulance charges for transport.

Heart attacks and appendicitis among the most expensive common conditions treated in the emergency department

Costs of emergency department visits depend on diagnosis. We selected nine common reasons to visit the emergency department that vary in complexity of management. More severe conditions, or those with more intervention required, are the most expensive. Of the nine specific diagnoses that we evaluated, the lower-cost diagnoses were those that generally do not require imaging or extensive treatment in the emergency department. These included upper respiratory tract infections ($1,535 total, $523 out-of-pocket), skin and soft tissue infections ($2,005 total, $572 out-of-pocket), and urinary tract infections ($2,726 total, $683 out-of-pocket). While these diagnoses can occasionally require admission to the hospital, in otherwise healthy adults they are typically evaluated with basic laboratory studies and discharged with prescriptions.

The most expensive emergency department diagnosis among those we examined is appendicitis, which, on average, costs $9,535 ($1,717 out-of-pocket) per visit. Appendicitis is almost two times as expensive as the next most expensive diagnosis we looked at, heart attack. 11% of enrollees with a diagnosis of appendicitis had surgical charges associated with their emergency department visit. Surgical costs may be included in emergency department outpatient billing because these patients are often discharged after surgery without being admitted to the hospital. In contrast, other emergency department visits requiring surgery are often admitted to the hospital and have surgical charges during their inpatient visit. Enrollees who had surgery had more expensive visits by over $2,000 compared to those who did not; however even without surgery, visits for appendicitis were almost four times as expensive as the average emergency department visit (and more than twice as expensive out-of-pocket).

Enrollees with emergency department visits have variable annual spending depending on diagnosis

In addition to the costs of the emergency department visit itself, enrollees who visit the emergency department at least once during the year have higher annual health care spending. Annual spending includes the cost of all claims for each patient in 2019, either before or after their emergency department visit. Though appendicitis was the most expensive emergency department visit among the diagnoses we analyzed, enrollees with appendicitis in 2019 incurred an average of $24,333 in additional health care spending, which was comparable to lower cost diagnoses. Enrollees with heart attacks had at least two times more annual spending than any other diagnosis ($52,993), while enrollees with upper respiratory tract infections had the lowest annual spending ($13,727).

These differences in annual costs may reflect spending both directly related and unrelated to the emergency department visit. For example, enrollees with heart attack emergency department visits may have high annual spending because of follow-up, medications, or hospitalizations after their heart attacks. However, their high annual spending may also reflect more comorbidities and higher healthcare utilization at baseline. In contrast, appendicitis, the most expensive emergency department visit, is correlated with relatively lower annual costs; unlike heart attacks, appendicitis often occurs in younger, healthier people and requires comparatively little additional post-surgical follow-up or treatment.

The most complex emergency visits are more than 6 times as expensive as the least expensive visits, but insurers pay an increasing share of the visit as complexity increases

Emergency department visits are coded by complexity during the billing process, from 1 (least complex) to 5 (most complex). Each evaluation and management charge is associated with a procedure code ranging from level 1 to level 5 (99281 to 99285), which are generated by hospital coding professionals based on the physicians’ medical note. Criteria are defined by the Centers for Medicare and Medicaid Services ( CMS ) and based on the complexity of documentation and medical decision making. Patients with level 1 complexity codes require straightforward medical decision making, with self-limited or minor presenting problems, such as rashes or medication refills. Patients with level 5 codes require high complexity medical decision making and present with life- or limb-threatening conditions, such as severe infections or cardiac arrests.

The lowest complexity visits cost $592 on average, with enrollees responsible for $205, or about one-third of the total visit cost. As visits increase in complexity, both out-of-pocket costs and costs covered by insurance increase. For the highest complexity visits, the health plan covers $3,015 on average, or eight times the cost of the lowest complexity visits. On average, patients pay $840 out-of-pocket for the highest complexity visits, which is four times their out-of-pocket costs for the lowest complexity visits.

Higher complexity visits are more expensive for multiple reasons. In general, evaluation and management charges are higher cost for more complex patients. Also, patients with more complex medical conditions generally receive more diagnostic tests, medication, and other treatment, which increases the cost of the visit. For the lowest complexity visits, evaluation and management charges account for almost half (47%) of the overall visit cost. In contrast, evaluation and management charges for the highest complexity visits account for about one-fourth (27%) of the total visit cost, with additional services including tests and treatment making up a larger share of the cost.

Emergency department costs vary by geographic region

We analyzed the top 20 metropolitan statistical areas (MSAs) by population, where data are available. Overall, the San Diego, CA area had the most expensive average ED visits ($3,761 on average). San Diego ED visits were more than twice as expensive as Baltimore, MD, the least expensive MSA in our analysis ($1,645 on average). Expensive MSAs were geographically distributed in all regions of the country including the South, West, Northeast, and Midwest. Within each MSA, there was significant variation in visit costa. For example, 25% of visits in Oakland, CA cost less than $1,236 on average, while 25% cost more than $4,436 on average.

Some variation may be based on the distribution of diagnoses in each area, with more serious or complex diagnoses leading to higher cost visits. For example, if a metro area sees higher than average volume of appendicitis, heart attacks, or other high-cost diagnoses, that would drive up regional emergency department costs.

For common diagnoses, Texas and Florida MSAs are among the most expensive

If we examine costs for specific diagnoses, we can minimize some of this variation in reasons for visits and gain a better understanding of how prices and service intensity affect the rankings. We selected two common, moderate-cost reasons for emergency department visits: low back pain and lower respiratory infections. While these visits can range in complexity and treatment required, they usually do not require hospital admission or high-cost treatment. Low back pain includes patients who present with the symptom of low back pain, regardless of diagnosis. Lower respiratory tract infection includes infectious causes of pneumonia and bronchitis. This analysis was limited to MSAs in which there were >500 cases of each diagnosis in 2019.

Visit costs for both diagnoses in Dallas, TX, Houston, TX, Fort Worth, TX, and Orlando, FL are in the top five most expensive MSAs with >500 cases. For low back pain visits, the Orlando, FL, Fort Worth, TX, Dallas, TX, and Houston, TX areas are each more than twice as expensive as the Warren, MI and Detroit, MI areas, on average. This trend is similar for lower respiratory tract infections. Within MSAs, variation in costs exist for both diagnoses. For example, for low back pain visits, there is more than a $3,000 difference between the least expensive and most expensive quarter of visits in Fort Worth, TX, Dallas, TX, and Houston, TX.

12% of large employer group enrollees went to the emergency department in 2019

We find that 12% of large group enrollees under age 65 had at least one emergency department visit in 2019, and of enrollees with emergency department visits, 80% had only one visit. 20% had more than one visit, and 7% had more than two visits. Emergency department visits were associated with higher annual health care spending, with almost half of enrollees in the top 25% of annual spending having at least one emergency department visit during the year.

We find that the average emergency department visit exceeds the threshold that some consumers can pay without borrowing, and even one emergency department visit in a year may create financial hardship for enrollees in large employer plans. For example, one quarter of emergency department visits for large employer enrollees cost over $907 out-of-pocket. Meanwhile, about 1-in-5 people with private insurance do not have $1,000 in liquid assets, and almost half of US adults report that they would not be able to pay a $500 medical bill without going into debt. Emergency department visits range significantly in cost depending on diagnosis, visit complexity, and geographic area. These variations may present challenges for consumers trying to predict the cost of their emergency department visit prior to going to the emergency department.

Several factors contribute to the variability of emergency department charges. First, unlike other forms of outpatient care including primary care or urgent care visits, emergency departments charge facility fees to offset the cost of keeping emergency departments open and staffed 24/7. These fees vary widely and are increasing at a faster rate than overall health care spending. The facility component represented 80% of total emergency department spending in our analysis. Many hospitals and health care providers consider these costs necessary given their mandate to provide emergency triage and treatment to allcomers. A second contributor to variation is that services are often billed at different complexity levels, and visits that are billed as more complex are more expensive . In some cases, even similar services are billed at different prices by different facilities. Notably, surprise out-of-network medical bills from emergency departments have contributed to high emergency costs for consumers, though the cost of any balance bills would be outside the scope of our claims data. The implementation of the No Surprises Act in January 2022 will generally curb surprise medical billing for emergency care.

As seen in non-emergency spending , we find that emergency department costs vary by geographic area. Among the most expensive MSAs in our analysis were MSAs located in Texas, Florida, California, Colorado, and New York. Interestingly, the most expensive regions for ED care do not align with the most expensive regions for overall health care spending. These comparisons suggest that our findings are not solely related to overall high health care prices in these areas and may reflect other factors including the age and medical complexity of the population or differences in local norms and practice patterns. State-level emergency department regulation may also play a role—states with higher numbers of freestanding , non-hospital affiliated emergency departments (which are associated with higher spending on emergency care) were among the most costly in our analysis.

The financial implications of visiting the emergency department vary widely. Not all the variation in total charges is reflected in out-of-pocket costs, since differences in cost by complexity level are smaller after insurance covers its portion of the bill. However, the most complex emergency department visits have four times higher out-of-pocket costs than the least complex visits. Even the least complex visits, some of which could be treated by a primary care office or urgent care center, cost an average of $205 out-of-pocket ($592 total). Given facility fees and relatively high evaluation and management charges in emergency departments, insurers and patients are paying more when receiving care for these conditions at emergency departments than they would using primary or urgent care. These lower complexity visits may represent a substantial avoidable cost to patients and the health care system at large.

High health care costs are of foremost concern for US adults, leading people to skip recommended medical treatment or delay necessary care. Even in the era of new price transparency regulation , which aims to improve consumer access to prices for elective care, emergency department consumers often do not know what testing or treatment they will need, so it is difficult to assess the costs of a visit upfront. Further, in an emergency situation, patients may not be able to choose their provider or facility if they are brought in by ambulance or otherwise unable to direct their care. Lastly, lack of availability and standardization in data may make it difficult for patients to use price transparency data in real time to make decisions about accepting tests and treatment in an emergency. The high and variable cost of emergency department visits represents an opportunity for future policy changes to protect consumers from unaffordable medical bills.

This analysis is based on data from the Merative MarketScan Commercial Database, which contains claims information provided by a sample of large employer plans. Enrollees in MarketScan claims data were included if they were enrolled for 12 months. This analysis used claims for almost 14 million people representing about 17% of the 85 million people in large group market plans (employers with a thousand or more workers) from 2004-2019. To make MarketScan data representative of large group plans, weights were applied to match counts in the Current Population Survey for enrollees at firms of a thousand or more workers by sex, age, state, and whether the enrollee was a policy holder or dependent.

Emergency department visits were flagged if an enrollee had an emergency department evaluation and management claim in the emergency department or the hospital on a given day. If an enrollee had either an emergency evaluation and management claim or another claim originating in the emergency department on the day prior to or after the flagged day, we added the previous and or following day’s outpatient spending to the visit cost. This was to capture all emergency department services for visits that may have spanned overnight or multiple days. Over half (53%) of the spending in this analysis occurred in the emergency department, with another 42% occurring in the hospital, which may occur when a patient receives a test or procedure in a location outside the emergency department during their visit.

Claims were included if they were above $100 and below the 99.5 th percentile of cost. Selected conditions were generated from a literature review of common emergency department diagnoses and defined using ICD10 codes. Enrollees were considered to have a certain diagnosis if the relevant ICD10 code appeared in the “Diagnosis 1” column in one or more claims on an emergency department visit day. While emergency department claims have up to four diagnoses, diagnoses listed in 2-4 were not used to identify relevant conditions because these diagnoses were most often incidentally found rather than related to the reason for presenting to the emergency department. For specific diagnosis definitions: Heart attack includes acute STEMI and NSTEMI, and excludes complications from prior heart attacks or angina; UTI includes acute cystitis, UTI and pyelonephritis; Kidney stone includes renal calculus in any location and renal colic; Lower respiratory infection includes pneumonia and bronchitis. Surgical charges for acute appendicitis include both open and laparoscopic surgical charges. Annual spending was defined as the total spending for each enrollee in the year 2019, which could occur before and/or after their emergency department visit depending on the time of year of the emergency department visit.

This analysis has some limitations. First, there is a chance that we could incorrectly include non-emergency outpatient care (such as a next-day, follow up primary care appointment) in our estimate of emergency department visit costs. Secondly, when accounting for annual spending, we do not control for health status prior to the emergency department visit. Therefore, the increase in annual health spending for patients who visit the emergency department for certain conditions may be because these patients are sicker and higher healthcare utilizers at baseline, rather than specific follow-up costs incurred for the emergency department visit itself. For selecting relevant diagnoses, we only include claims in which a particular diagnosis occurs as the primary diagnosis. Third, the MarketScan database includes only charges incurred under the enrollees’ plan and do not include balance billing to enrollees which may have occurred. Lastly, our findings only represent enrollees in large group employer sponsored plans and may not be generalizable to other groups.

About this site

The Peterson Center on Healthcare and KFF are partnering to monitor how well the U.S. healthcare system is performing in terms of quality and cost.

More from Health System Tracker

Privately insured people with depression and anxiety face high out-of-pocket costs.

Health Cost and Affordability Policy Issues and Trends to Watch in 2024

Looking for more data?

Find out more details about U.S. healthcare from our updated dashboard.

A Partnership Of

Share health system tracker.

Care Cash aims to help members make healthier choices and save on care costs

When employees receive financial support for health care expenses through Care Cash, they may be able to save money, stay healthier and take ownership of their health.

Care Cash is available today in Washington D.C. for fully insured 2–99 employer groups with employees enrolled on UnitedHealthcare health plan benefits. Eligible employees can register, activate and use now.

How Care Cash works

Employees request the card on myuhc.com® . Once received, they must activate the Care Cash card using the instructions provided. The Care Cash card can then be used to pay for certain eligible network health care expenses (UnitedHealth Premium® providers visits, 1 PCP visits, urgent care visits, 24/7 Virtual Visits and Outpatient Behavioral Health visits).

Employees can access the preloaded debit card designed with $200 for the benefit year for those with individual coverage only or $500 for family coverage. Unused funds roll over each plan year toward a $2,000 maximum, available on the reloadable card for continued Care Cash eligible and participating members.

Care Cash may help support employees in making more informed health care decisions. When employees receive financial support for health care expenses through Care Cash, they may be able to save money, take ownership of their health and stay healthier.

- Gives an employee $200 for the year for individual coverage or $500 for family coverage

- Rolls over remaining card balances each plan year 2

- Reloads new funds each plan year 2

For more information or questions, please contact your UnitedHealthcare representative or refer to the Care Cash flier , and view the Care Cash video below.

Video transcript

A blue u-shaped logo appears over a white background, then swirls around, and text appears as upbeat music plays.

ONSCREEN TEXT: Care Cash®

Over a white background, a wallet with a coin inside appears. A dark blue circle appears around it.

Around the wallet, four symbols appear in different corners. A Hospital, a person’s head with their brain highlighted, a stethoscope, and a red plus sign. Text appears in the corner.

The plus sign and hospital connect to another icon, a figure in a white coat with a pen in their pocket. The figure’s head and the stethoscope connect to an icon of a figure in scrubs with a plus sign on their chest.

NARRATOR: Imagine having extra funds ready, right when you need it, to put toward your portion of certain eligible health care expenses.

A hand holds a credit card out with “United Healthcare” and “Care Cash” printed on it.