- United States

- United Kingdom

Webjet Travel Insurance

Webjet travel insurance offers competitive limits on trip cancellation costs and overseas medical expenses along with a low standard excess payment..

In this guide

Summary of Webjet's Travel Safe Plus International policy

How does webjet travel insurance cover covid-19, what policies does webjet offer, here's a breakdown of webjet travel insurance features, standard features, optional add-on, how to make a webjet travel insurance claim, here's the bottom line about webjet travel insurance, frequently asked questions, compare your travel insurance quotes.

Destinations

- We compared a slew of travel insurance providers and Webjet was one of 26 providers to offer some sort of cover for COVID-19. This includes situations where you, or your travel companion, test positive for coronavirus and have to cancel your trip as a result.

- Webjet Travel Insurance offers a generous 21-day cooling-off period, nearly a week longer than the industry standard of 14 days. This is a huge plus if you're not quite sure about its cover but are keen to start your policy straight away.

- Webjet's rate of up to $2,500,000 for personal liability cover isn't market leading - brands such as Medibank and Fast Cover offer double that amount.

Compare other options

Table updated October 2022

Webjet joins the ranks of a growing list of insurers that offer some cover for COVID-19. The key benefits covered are:

- Overseas medical and dental expenses

- Additional accommodation and transport expenses

- Amendment or cancellation costs

There are some scenarios that are not covered and you should review the Webjet Travel Insurance product disclosure statement (PDS) before deciding on whether this cover meets your needs. Exclusions to be aware of include claims related to:

- Government travel bans and "do not travel" warnings.

- Mandatory quarantine or self-isolation requirements related to cross area, border, region or territory travel

- Travel delays, missed connections or special events arising from a multi-night cruise being affected by COVID-19

In addition to a standard excess that applies to your policy, Webjet also has a special excess for COVID-19 claims. The excess varies from $150 to $500 depending on the type of policy you choose.

What this means is that if you have, for example, a $250 standard excess and claim for cancellation costs because you're diagnosed with COVID-19, Webjet would deduct an excess of $750 in total from your claim ($250 standard excess + $500 special excess).

If Webjet's COVID-19 cover isn't quite hitting the mark, we've compared all the providers that offer cover for COVID-19 here .

Webjet has five different plans available: Travel Safe International, Travel Safe Plus International, Domestic, Domestic Cancellation and Inbound. If you're planning more than one trip for the year, Webjet offers an annual multi-trip option for some of its plans.

Travel Safe International

Travel Safe Plus International

Domestic Cancellation

Annual Multi-trip

Webjet travel insurance is administered by Cover-More Insurance Services Pty Ltd and issued by Zurich Australian Insurance Limited.

The cooling-off period is 21 days which means if you cancel your policy within this period, Webjet will refund your premium in full provided you haven't started your trip or intend to make a claim. You also have your choice of standard excess that applies when claiming for an insured event . An excess is an amount you need to pay when you make a claim, and you can lower the cost of your policy by selecting a higher excess.

These are some of the features that Webjet will cover you for if something goes wrong on or before your trip. Some of these inclusions only apply to certain levels of cover (e.g. Travel Safe Plus vs a domestic policy ).

- Accidental death and disabililty

- Additional expenses including accommodation or travel expenses

- Delayed luggage allowance

- Loss of income

- Luggage and travel documents

- Rental car insurance excess

- Travel delay

- Travel services provider insolvency

If you're looking for a bit more flexibility, Webjet offers a range of add-on options. These will help you create a travel insurance policy that meets your needs and gives you peace of mind.

- Adventure activities. Cover for riskier activities , including outdoor rock climbing, skydiving, and trekking more challenging routes.

- Cruise cover. Extend your cover to also include any claims related to cruise travel , including onboard and ship to shore medical expenses, cabin confinement and missed shore excursions.

- Increase luggage item limits. Travelling with high-value items? You can increase the individual item limits so you can claim the full value if one of your expensive items is lost, damaged or stolen.

- Motorcycle/moped riding. Cover if you're riding a motorcycle - including injuries as a rider or pillion, and any damages you might cause.

- Snow sports. Cover for skiing, snowboarding and snowmobiling - including injuries on the slopes, stolen equipment, and lost lift passes.

All travel insurers have some exclusions – and they're usually pretty similar – but it's still important to read your PDS carefully. Here are a few key things Webjet won't cover you for:

- Any claims that were due to recklessness or an unlawful act committed by you

- Self harm, suicide, or drug and alcohol abuse

- Body modification, including tattoos and piercings

- A pre-existing medical condition not approved by Webjet

- Claims related to war, rebellion or revolution

- Pregnancy after the start of the 24th week

- Riding a motorbike or scooter without a helmet or suitable licence

- Elective medical or dental treatment

- If you're travelling against the advice of a medical professional

- Hunting, running with the bulls or trekking greater than 6,000 metres above sea level

Make sure you review Webjet's PDS for a detailed breakdown of what isn't covered, found under its list of general exclusions .

You can submit your claim by downloading a claim form online and posting it to:

Cover-More Travel Insurance Claims Department Private Bag 913, North Sydney NSW 2059 Australia

Alternatively, you can submit a claim online by following these steps:

- Head to https://claims.covermore.com.au/default

- Enter your full name and policy number to log in

- Describe the incident and provide expenses

- Upload supporting documents relevant to your claim

- Submit, and you should hear back within 10 business days

Webjet is a one-stop shop for travel where you can do everything from booking flights and accommodation to arranging car hire and travel insurance. That convenience extends into Webjet's straightforward policy offering and flexibility to choose your excess, cancellation cover and optional add-ons.

Where Webjet falls short is with the limited cover for pregnant travellers and lower than average limits for personal liability cover. If these are important to you, you'll want to run through the fine print to make sure you'll have enough cover when you need it the most.

If you're still not sure about Webjet, you can compare other travel insurance companies here .

Can I cancel my policy if I change my mind?

Yes, Webjet travel insurance offers a 21-day cooling-off period if you decide you're not happy with the policy.

What qualifies for trip cancellation?

Trip cancellation covers you when you need to cancel your trip for a variety of reasons. These include being medically unfit to travel, the death of a non-travelling family member and involuntary redundancy.

How do I contact Webjet Australia?

For emergency assistance, you can contact Webjet at +61 2 8907 5619. For other enquiries, you can reach its customer service line on 1300 468 601 or [email protected].

Use a comma or space to separate ages. Add kids under the age of 1 by typing a “0” 0 traveller(s)

Include travel deals and helpful personal finance content from Finder

By submitting this form, you agree to our Privacy & Cookies Policy and Terms of Service

Cristal Dyer

Cristal Dyer is a travel writer at Finder. She has been writing about travel for over five years and has visited over 40 countries around the world. Cristal currently travels full-time, writing about her favourite cities and food finds, and she is always on the lookout for amazing flight deals to share.

More guides on Finder

Will you pay over the odds for choc biscuit goodness?

With inflation still high and the annual indexation looming, should you make some extra repayments to your debt?

Are runes and ordinals about to be the next big thing in crypto?

Save $1,297 by investing some of your savings in an exchange-traded fund.

Find all the weekly tips from our Dollar Saver newsletter and see how you could save.

Drive a banger that needs some TLC?

More Australians are resorting to theft as they struggle with the rising cost of living, according to new research by Finder.

No one wants to spend years and years paying off what ends up being mostly interest. Here are several tips on how to pay off your home loan faster.

SPONSORED: We take a look at how term deposits can help you save more cash and build wealth.

Australian pet owners would fork out an eye-watering amount before considering putting their pet down, according to new research by Finder.

Ask a Question

Click here to cancel reply.

You are about to post a question on finder.com.au:

- Do not enter personal information (eg. surname, phone number, bank details) as your question will be made public

- finder.com.au is a financial comparison and information service, not a bank or product provider

- We cannot provide you with personal advice or recommendations

- Your answer might already be waiting – check previous questions below to see if yours has already been asked

12 Responses

Hi. Is Webjet travel insurance any good if you’re skiing in America? Thanks!

Thank you for getting in touch with Finder.

Webjet offers snow sports cover which includes injuries on the slopes, stolen equipment, and lost lift passes. While we are unable to tell if Webjet is the best ski travel insurance provider in the market, we can help you find the best ski travel insurance using our online tool and some things to keep a close eye on when purchasing a policy.

- Pay close attention to how the insurer reimburses you for damaged snow equipment, lost lift passes, rental excesses, resort closures, trip cancellations, and injuries.

- Check for exclusions that might impact your trip. For example, some insurers won’t cover injuries that happen while off-piste skiing, unless you’re with an instructor.

- Most policies have a maximum limit that you can claim for any one item. If you’ve got the top-of-the-range gear, you might have to let your insurer know.

- You shouldn’t buy a policy based solely on price, but we know it’s an important deciding factor. Keep an eye on the cost to make sure you’re getting value for money.

To compare your options, please enter your travel details on our travel insurance quotes form and press “Get my quote”. You should be able to compare quotes from different insurers. When you are ready, you may then click on the “Go to site” button and you will be redirected to the insurer’s website where you can proceed with the application or get in touch with their representatives for further inquiries you may have.

If you prefer to purchase Ski travel insurance from Webjet, you may directly reach out to them using their contact details above.

As a gentle reminder, before purchasing please ensure you review the relevant Product Disclosure Statements/Terms and Conditions.

I hope this helps.

Have a great day!

Cheers, Jeni

Hi Guys please advise if this travel insurance covers car rental excess for example CDW when travelling in the USA. thanks Russ

Thank you for contacting finder.com. We are a comparison website and general information service, we’re more than happy to offer general advice.

Webjet Travel insurance does cover rental vehicle excess – up to $3000. You may refer to Webjet’s website directly for additional information or to speak with one of their customer service representatives.

Cheers, Danielle

how can i change a policy ? Brent

Thanks for getting in touch. You will need to contact Webjet directly about any changes you want to make to your policy.

Cheers, Zubair

What about pre existing conditions.?

Does this cover cruise ships sailing to New Zealand and USA for 70 and 77 years old?

Thank you for your question.

Webjet Travel Insurance does provide cover for sailing from 11 to 15 nautical miles off any land mass under adventure pack they do provide cruise cover under cruise pack. Webjet Travel Insurance has different age limits for different plans, comprehensive and domestic plans are available for all ages. Essentials, basic and multi-trip plans have age limit of maximum 74 years old.

It’s a good idea contact Webjet directly to verify if they can cover you for sailing as well cruise to your trip destinations.

Please make sure though to read the eligibility criteria, features and details of the policy, as well as the relevant Product Disclosure Statement PDS/T&C’s of the policy before making a decision and consider whether the product is right for you.

Thanks for your question. finder.com.au is a comparison service and not an insurer. Webjet Travel Insurance provide cover for 43 pre-existing conditions under its standard medical cover.

I hope this was helpful, Richard

i completed travel ins. with you 2-3 days ago. do i get some confirmation or policy details together with a @ $50 voucher?

Thanks for your question. You may want to contact Webjet directly to get confirmation or policy details for this.

How likely would you be to recommend finder to a friend or colleague?

Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve.

Important information about this website

Advertiser disclosure.

finder.com.au is one of Australia's leading comparison websites. We are committed to our readers and stands by our editorial principles

We try to take an open and transparent approach and provide a broad-based comparison service. However, you should be aware that while we are an independently owned service, our comparison service does not include all providers or all products available in the market.

Some product issuers may provide products or offer services through multiple brands, associated companies or different labeling arrangements. This can make it difficult for consumers to compare alternatives or identify the companies behind the products. However, we aim to provide information to enable consumers to understand these issues.

How we make money

We make money by featuring products on our site. Compensation received from the providers featured on our site can influence which products we write about as well as where and how products appear on our page, but the order or placement of these products does not influence our assessment or opinions of them, nor is it an endorsement or recommendation for them.

Products marked as 'Top Pick', 'Promoted' or 'Advertisement' are prominently displayed either as a result of a commercial advertising arrangement or to highlight a particular product, provider or feature. Finder may receive remuneration from the Provider if you click on the related link, purchase or enquire about the product. Finder's decision to show a 'promoted' product is neither a recommendation that the product is appropriate for you nor an indication that the product is the best in its category. We encourage you to use the tools and information we provide to compare your options.

Where our site links to particular products or displays 'Go to site' buttons, we may receive a commission, referral fee or payment when you click on those buttons or apply for a product. You can learn more about how we make money .

Sorting and Ranking Products

When products are grouped in a table or list, the order in which they are initially sorted may be influenced by a range of factors including price, fees and discounts; commercial partnerships; product features; and brand popularity. We provide tools so you can sort and filter these lists to highlight features that matter to you.

Terms of Service and Privacy Policy

Please read our website terms of use and privacy policy for more information about our services and our approach to privacy.

Home » News » Webjet and Cover-More form new travel insurance partnership

Webjet and Cover-More form new travel insurance partnership

Cover-More has become the exclusive provider of travel insurance and assistance for Webjet’s online travel agency business across Australia and New Zealand.

The new partnership commenced officially on 1 February 2020.

Webjet OTA chief executive David Galt said: “We are a digital travel business, and Cover-More has very strong digital capability in personalising travel insurance for travellers’ needs, so this is a partnership which reinforces Webjet’s leadership position in online travel.”

Cover-More’s CEO for the Asia Pacific, Judith Crompton, said the new partnership would employ the latest evolution of the travel insurance provider’s purpose-built online sales and optimisation engine, Impulse.

“To lead the travel insurance sector in any market, you need to get the product, coverage and technology right,” she said.

“And Cover-More’s technology can deliver Webjet customers the greatest variety of offers and the most appropriate cover available.”

“We pride ourselves on putting the customer at the heart of our product offering. And we back up our offer and our products with an exceptional team of people and a 24-hour medical assistance team who know how to help if trouble strikes.”

Featured image: iStock/vinnstock

Email the Travel Weekly team at [email protected]

Latest news, tourism western australia md carolyn turnbull departs.

Tourism Western Australia MD Carolyn Turnbull is departing the agency with effect from Friday May 10. Over the past three years, Turnbull played an instrumental role in driving growth, with one of the agency’s most significant achievements being the increase in visitor spend. Under her leadership, Tourism WA achieved a record breaking $17.7 billion in […]

- Travel Agents

DriveAway launches Brit-Euro Blitz campaign

DriveAway has launched its Brit-Euro Blitz: Explore the UK, Europe & Ireland campaign, designed to inspire travellers to uncover the beauty and diversity of those destinations during May and June. The campaign arrives amidst a surge in popularity for destinations across the UK, Europe and Ireland, with year-to-date increases averaging around 30%. Notably, cities such […]

- Road & Rail

Fly and Stay Free with the Great Southern

Great Southern’s Fly and Stay Free special offer will have travellers taking in the views along the east coast between Adelaide and Brisbane next summer. This bright orange locomotive chases the summer sun, sharing the incredible coastline with those who want to experience it by train. The journey reflects the best of Australia, from charming […]

Sober travel and TikTok guide Australian Gen Z trips

Gen Z travellers prefer to limit alcohol when overseas and have an increased reliance on TikTok when planning a trip, according to a report by StudentUniverse, the world’s largest online travel retailer for young people. The State of Student & Youth Travel Report for 2024 delved into the latest travel sentiments amongst those aged 18-25 […]

- Travel DAZE

Travel DAZE Exec Agenda REVEALED: top execs to speak on airline competition

As the industry reels from Bonza's implosion, it is more important than ever to ask the big questions.

- Tour Operators

TTC: Deals are driving up demand for September trips

The latest market research from TTC Tour Brands shows interest in international leisure travel remains high for 2024, with 77 per cent of Australians over 18 still planning trips this year. Notably, 28 per cent of those travellers are eyeing September for their journeys. Europe continues to be the most popular destination, with 68 per […]

Skroo says Rex will need deep pockets to fill lost Bonza slots

The door is open for Rex, and anyone else who wants to launch a regional Aussie airline...

Sno’n’Ski Holidays unveils 2025 mega famil to Colorado!

Let the games begin - this is certainly not a famil that you will want to miss!

Walk Japan launches Kyoto: Mountains to the sea walking tour

There are two types of people, one who enjoys walking on holiday and another who enjoys sipping Mojitos by the pool.

- Destinations

Which destination had a 48% boost in bookings following 10 MILLION TikTok views?

Here's a clue: it's not Malabar Beach.

Asher Telford appointed General Manager of SeaLink Whitsundays

Telford has plenty of reasons to smile after SeaLink doubles down and makes him GM after buying his tourism operation.

Qantas ‘working urgently’ to fix app data leak

Qantas is looking into customer reports that passengers have this morning been able to access other passengers’ personal information on the airlines app. X user Lachlan posted that he was able log into different accounts every time he opened the app. My @Qantas app logs me in to a different person each time I open […]

Hilton Expands Presence in North Queensland with the signing of Hilton Garden Inn Townsville

Heading to a North Queensland Cowboys clash? Hilton Garden Inn Townsville is set to open, but not until 2026.

- Partner Content

Rail Europe ANZ: making dream journeys come true

Rail Europe's running a lottery! You're not going to win millions, but you might just snag a free holiday.

by Travel Weekly

Bonza’s future on knife edge

It would seem a long road back from here, perhaps a knife's edge is too much credit.

Revamped Wailoaloa Beach hotel opens as Crowne Plaza Fiji Nadi Bay Resort & Spa

Crowne Plaza Fiji Nadi Bay Resort & Spa is open and ready for bookings after the first phase of a multi-million-dollar transformation. Part of IHG Hotels & Resorts’ premium collection, the transformation has seen the completion of 106 guestrooms showcasing contemporary interiors reflective of the premium Crowne Plaza brand and is a first for the […]

Nielsen Data reveals brands spending big to attract Aussie tourists

Trip A Deal, Virgin and Ignite Travel walk into a bar, blow their cash on travel advertising instead of the pokies.

Kamalaya Koh Samui clinches clutch of wellness awards

Kamalaya Wellness Sanctuary & Holistic Spa has so far clinched five prestigious awards in 2024, including being inducted into the ‘Hall of Fame’ at the World Spa & Wellness Awards in London. Founders of the Koh Samui sanctuary and spa John and Karina Stewart expressed their heartfelt gratitude for the awards. “We are profoundly honoured […]

- Attractions

Jetstar offers 200,000 return for free flights to celebrate 20th anniversary

Jetstar hits 20 and everyone else gets the presents with free return flights to domestic and international destinations.

Amora Hotels & Resorts set to double APAC portfolio, announces new Sydney office

Staff in the new Sydney office have been welcomed by a week of rain on the forecast.

RIU opens Chicago hotel and rooftop bar a few steps from the world-famous Magnificent Mile

Rooftop cocktails hold a dear place in your heart? Look no further than RIU Chicago.

- Travel Weekly TV

How can travel agents best sell cruises? Uniworld’s Alice Ager tells all: Travel Weekly TV

Agents, you don't want to miss this. Yes, that's the case with everything in the newsletter, but we really mean it here!

South Africa bookings are back in action

It's a wrap! South Africa in the news with resumed flights, film fest and booking tech.

Agents’ chance to score free spot on Intrepid trip to Antarctica

This is the trip of a lifetime, even if you are scared of the cold!

Bonza nosediving amid mass cancellations and reports of repossessed planes

Bonza's days appear to be numbered as the low-cost carrier today announced mass cancellations around the country.

Amy Poehler joins Vivid Sydney event

Oh Joy! Hit comedian Amy Poehler will make an emotional appearance at the Sydney Opera House for Vivid.

Pullman Sydney Penrith ties up with Trilogy Hotels, announces new GM

The crew from Trilogy hotels doing their best impression of the Penrith front row here.

Linkd appoints Carolyn Nightingale and Lawson Dibb to new roles

Linkd Tourism sings praises of Carolyn Nightingale and dubs Lawson Dibb as Kyushu Tourism Office guru.

Celebrity Ascent makes its European debut

Choosing to cruise this northern summer? Celebrity Ascent promises to raise the bar.

NCL opens sales for Norwegian Sun’s APAC debut, announces 14 new voyages

It was to be 13 new voyages we heard, but given the numbers unlucky nature, an extra had to be thought up.

Inside Travel Group appoints Tom Welland Global Trade Marketing Manager

Heidi's Tom Welland heads to Inside Travel Group as its new Global Trade Marketing Manager.

Federal Government rolls out $1.4m program to promote careers in tourism across regional NSW

The Government taking a break from some of its pointier issues with some work in our incredible industry!

Australian visitors to South Korea surge

Japanned out? Aussies are adding South Korea to their bucket list.

G Adventures celebrates Dr. Jane Goodall’s 90th with new wildlife-focused trips

Fancy yourself as a bit of a conservationist? Put your skills to the test on the Jane Goodall collection.

Virgin Australia says suspended flights to Bali result of Boeing MAX delays

If only we had a company like Boeing to blame our mistakes on. Any takers? Get in touch!

Airline Review: Singapore Airlines Business Class – A380-800

The iconic Singapore Airlines' A380-800 is in a class of its own - business class that is.

You are using an outdated browser

Please upgrade your browser or activate Google Chrome Frame to improve your experience.

Signing in with LinkedIn

Please wait while we sign you in with LinkedIn.

This may take some time.

Please be patient and do not refresh the page.

(A new window from LinkedIn should open for you to authorize the Travel Weekly login. If you don't see this please check behind this window, and if it is still not there check your browser settings and turn off the pop-up blocker.)

SUBSCRIBE NOW FOR FREE

Never miss a story again. Sign up for daily newsletter now.

Webjet Travel Insurance

Important information on terms, conditions and sub-limits.

Are you wondering if Webjet travel insurance will be the right choice for your next overseas trip? Here’s a detailed look at questions you might have about Webjet, its travel insurance policies, useful inclusions as well as easy-to-miss exclusions, so you can make a more informed decision about travel insurance for your holiday.

About Webjet

Based out of Melbourne for over 20 years, Webjet is an online travel agency that uses online travel tools and technology to help its customers in Australia and New Zealand compare and book flights, accommodation, holiday packages as well as travel insurance worldwide. Webjet Travel Insurance is issued and underwritten by Allianz Australia Insurance Limited, one of the largest Underwriters of travel insurance in Australia.

Webjet plans

Depending on your destination and itinerary, you can look at purchasing one of these travel insurance policy options from Webjet, which include - Comprehensive, Essential, Basic and Worldwide Multi Trip . Here’s a quick look at the features of the different Webjet travel insurance policies that you can choose from:

- Single Duo Family Group

Limits shown apply

Covid medical cover

Covid cancellation cover

Overseas emergency hospital expense

Overseas emergency medical assistance

Maximum excess

Cancellation fees

Pay extra for no excess

Luggage and personal effects

Additional accomodation & travel

Emergency companion

Resumption of journey

Hospital cash allowance

Accidental death

Permanent disability

Loss of income

Credit Card fraud and replacement

Travellers cheques

Travel documents

Rental vehicle excess

Alternative travel expenses

Personal liability

Pre existing conditions

Cardiovascular disease

Mental health illness

High cholesterol

High blood pressure

Blood thinning medication

Activities covered

Bungee jumping

Conservation work

Mountain biking

Mountaineering

Rock climbing

Scuba diving

Snow sports

Ocean Cruise

Travel Safe Plus

Choose $0 to unlimited

Assessment required, may cost extra

Travel Safe Plus Multi Trip

Travel safe, travel safe multi trip.

Any information provided on this page should be considered a summary and general advice only. All information should be verified before purchase via the relevant Product Disclosure Statement (PDS).

How is Webjet Travel Insurance rated by the Mozo Community?

Read how the Mozo community has rated Webjet Travel Insurance policies and services on a number of factors ranging from value for money to customer satisfaction.

Webjet travel insurance

Overall 5.7

Value for money

Policy coverage

Customer service

Claims handling

Recent Webjet travel insurance customer reviews Recent Webjet travel insurance customer reviews

Webjet Travel Insurance review

Overall rating 1 / 10

Webjet travel insurance is a joke!

Had to travel one day earlier than booked and return one day earlier due to hospital operation scheduled unexpectantly. When I contacted Webjet to advise to change dates of policy, was told that if we intended to claim the difference charged by...

Full review

Had to travel one day earlier than booked and return one day earlier due to hospital operation scheduled unexpectantly. When I contacted Webjet to advise to change dates of policy, was told that if we intended to claim the difference charged by airline ($470) that they could not change the policy to include the day we flew out. Also, if we put in a claim, there was no guarantee it would be accepted. So we had to choose to either change the dates on the policy and forfeit the claim or put in a claim and leave t h e policy dates as they were. Why bother with insurance then?

Value for money 4 / 10

Policy coverage 3 / 10

Customer service 1 / 10

Trust 1 / 10

Del, New South Wales, reviewed 28 days ago

Overall rating 7 / 10

Trustworthy and a good level of integrity.

Not the cheapest out there but are an honest company and I trust them the most. They sent me a cheque to reimburse me for a mistake they made on a charge 2/3 years before that I hadn't even realised. I appreciate that they went above and beyond to...

Not the cheapest out there but are an honest company and I trust them the most. They sent me a cheque to reimburse me for a mistake they made on a charge 2/3 years before that I hadn't even realised. I appreciate that they went above and beyond to do the right thing. Also Webjet is a really easy and user friendly website to book flights/trips on ensuring you can get the best prices so it is really convenient to use their insurance as well as it is only an extra click away for peace of mind.

Value for money 5 / 10

Policy coverage 5 / 10

Customer service 10 / 10

Claims handling 5 / 10

Trust 10 / 10

Mariel, Queensland, reviewed about 3 years ago

Overall rating 2 / 10

Policies say coverage for delays and flight cancellations are covered. We lost $1300 due to a flight delay to an expensive resort on Lord Howe Island for a week. Put in a claim and claim was "declined" on the basis that the cancellation was due to...

Policies say coverage for delays and flight cancellations are covered. We lost $1300 due to a flight delay to an expensive resort on Lord Howe Island for a week. Put in a claim and claim was "declined" on the basis that the cancellation was due to "mechanical breakdown". What a joke.

Claims handling 10 / 10

Peter, New South Wales, reviewed about 4 years ago

Value for money 7 / 10

Trust 7 / 10

Sue, Victoria, reviewed over 9 years ago

Peace of mind

It covered everything that could have happened. Peace of mind.

Value for money 8 / 10

Trust 8 / 10

Kellie , , reviewed over 9 years ago

Compare Webjet Travel Insurance policies with other Australian insurance providers

Still not sure if Webjet Travel Insurance is the best option for your overseas trip? Don’t worry, we understand that with so many providers in the market it can be confusing to pick one. That’s why, we’re here to help with our travel insurance comparison tool , which lets you compare and shortlist the best policy based on your travel plans. All you need to do is type in some basic details like your destination, travel dates, number and age of travellers, and we’ll give you a list of insurance providers with their respective policies and pricing including Webjet to make the comparison easier.

We’ve got a lot more information in our detailed guides on topics like pre-existing conditions , seniors travel insurance and family travel insurance . You can also head over to our travel section for more tips on thrifty travel as well the best $20 series where real travellers share their money savvy secrets from across the world.

Compare Travel Insurance from major brands including:

Terms, conditions, exclusions, limits and sub-limits may apply to any of the insurance products shown on the Mozo website. These terms, conditions, exclusions, limits and sub-limits could affect the level of benefits and cover available under any of the insurance products shown on the Mozo website. Please refer to the relevant Product Disclosure Statement and the Target Market Determination on the provider's website for further information before making any decisions about an insurance product.

Who we are and how we get paid

Our goal at Mozo is to help you make smart financial decisions and our award-winning comparison tools and services are provided free of charge. As a marketplace business, we do earn money from advertising.

We do not compare all brands in the market, or all products offered by all brands. At times certain brands or products may not be available or offered to you. If you proceed with a travel insurance policy through Mozo, Mozo may receive a referral fee.

- Join CHOICE

Travel insurance

International travel insurance comparison

Buy smarter with choice membership.

Or Learn more

Reviews and ratings you can trust

Based on intensive lab testing across 200+ product and service categories.

Easy side-by-side comparison

Sort, compare and filter to find the right product to match your needs.

Find the best product for you

Our expert advice outlines the best brands and ones to avoid.

Fact-checked

Checked for accuracy by our qualified fact-checkers and verifiers. Find out more about fact-checking at CHOICE .

If you're going overseas, travel insurance is just as essential as your passport. Use our free comparison tool to narrow down international single trip and annual multi-trip policies from 27 insurers, offering cover for COVID-19, existing medical conditions, car rental and more.

Travel insurance is a portable version of health, home, contents, life, public liability, and car rental excess insurance all packaged in one to take on holidays with you. But with all those insurances piled into one product, navigating your way through the terms and conditions to find the loopholes can be very challenging.

Use our travel insurance comparison to narrow down your options and make sure you're getting the best cover for your needs when on holiday.

List of brands we tested in this review.

- Battleface 2

- Cover-More 5

- FastCover 4

- Flight Centre 4

- Go Insurance 4

- InsureandGo 3

- Southern Cross Travel Insurance (SCTI) 3

- Tick Travel Insurance 4

- Travel Insurance Direct 3

- Virgin Australia 5

- WAS Insurance 2

- World Nomads 2

- World2Cover 4

The average cost of the policy compared to other policies of the same type (single trip or annual multi-trip). One $ sign is the cheapest through to five $$$$$ the most expensive. NA means the policy wasn't included in the price rating.

enter value/s in increments of 1 between 0 and 0

Policy type

- One trip 65

- Policy age limit

In years (up to and including the number stated). For policies listed as '100+', there is no age limit.

Does the policy cover international cruises?

- Optional 71

Medical expenses for COVID-19

Whether the policy covers you for medical and emergency evacuation and repatriation expenses for claims arising directly or indirectly from COVID-19. Cover is assessed on individual circumstances.

Cancellation expenses for mental health

Whether the policy covers you for cancellation expenses for claims arising directly from recognised mental health disorders experienced for the first time such as depression, anxiety, schizophrenia, bipolar disorder or PTSD. Cover is assessed on individual circumstances.

- Cancellation for insolvency of a travel services provider

Whether the policy covers you for losses arising out of insolvency of a travel services provider (e.g. airline, accomodation provider, bus line, shipping line, railway company, motor vehicle rental agency). Cover is assessed on individual circumstances.

Cancellation expenses for a natural disaster

Whether the policy covers you for cancellation expenses for claims arising directly or indirectly from a natural disaster. Cover is assessed on individual circumstances.

Cancellation expenses for civil unrest

Whether the policy covers you for cancellation expenses for claims arising directly or indirectly from civil unrest such as political protests, riots and strikes. Cover is assessed on individual circumstances.

- Baggage cover

Are stolen or damaged personal belongings covered

- Limit for baggage expenses

The overall limit for stolen or damaged personal belongings.

- Limit for a smartphone

Limit for a smartphone. Cover is assessed on individual circumstances.

- Limit for a laptop or tablet

Limit for a laptop or tablet. Cover is assessed on individual circumstances.

- Limit for rental car excess

Limit for collision damage excess for a hire car. Cover is assessed on individual circumstances.

- Scuba diving

Does the policy cover scuba diving if you are appropriately certified or diving with a qualified instructor?

Skiing and snowboarding on-piste

Does the policy cover skiing and snowboarding on-piste?

- Optional 82

Skiing and snowboarding off-piste

Does the policy cover skiing and snowboarding off-piste withing the resort boundaries?

- Optional 72

Tobogganing

Does the policy cover tobogganing on snow?

- Optional 50

Does the policy cover riding a moped with an engine capacity 50cc or below, with a helmet and driving license valid in the country the policy holder is in, but without an Australian motorcycle license

- Optional 32

Moped 125cc

Does the policy cover riding a moped with an engine capacity 125cc or below, with a helmet and driving license valid in the country the policy holder is in, but without an Australian motorcycle license

- Optional 28

Does the policy cover riding a motorcycle with an engine capacity above 125cc with an Australian motorcycle license and a helmet?

- Optional 34

Included in this comparison

- Price rating

- Dependant age limit

- Cancellation

- Pregnancy stage covered

- Childbirth costs

- Pre-existing conditions covered without application

- Pre-existing conditions covered on application

- Time period for existing conditions

- Medical expenses

- Expenses for a person to accompany a sick policyholder

- Daily hospital cash allowance

- Hours of hospitalisation before receiving allowance

- Dental expenses for accident or injury

- Dental expenses for acute pain

- Overseas funeral costs

- Additional travel expenses for injury or sickness

- Additional expenses for interrupted travel

- Travel insurance extension for a delayed trip

- Additional expenses for a lost passport

- Additional expenses for a sick relative

- Additional expenses for resumption of journey interrupted for a relative

- Cancellation covered

- Cancellation expenses

- Cancellation for frequent flyer points

- Cancellation expenses for travel agent fees

- Cancellation for insolvency of a travel agent

- Cancellation expenses for redundancy

- Cancellation expenses for defence and emergency workers

- Cancellation expenses for cancellation of work leave

- Cover for transport incidents

- Cover for strikes

- Cover for mental health

- Cover for COVID-19

- Cover for pandemics

- Cover for natural disasters

- Cover for civil unrest

- Cover for terrorism

- Cover for war

- Additional expenses for a special event

- Additional expenses for pre-paid travel arrangements

- Limit for travel delay expenses

- Hours before travel delay covered

- Limit per 24 hours for travel delay

- Limit for a single unspecified item

- Limit for a video or photo camera

- Limit for prescribed medications

- Overall limit for specified items

- Cover for baggage in a car during the day

- Cover for baggage in a car overnight

- Cover for valuables in a car

- Cover for lost or stolen cash

- Limit for baggage lost temporarily

- Hours before cover applies for baggage lost temporarily

- Rental car excess

- Snow sports

- Mopeds and motorcycles

- Bungee jumping

- Horse riding

- High altitude hiking

- White water rafting

- Paragliding

- Hot air ballooning

- Hang gliding

Displaying all 91 products

- Brand (A-Z)

Limit for additional meal and accommodation expenses if scheduled transport is delayed.

Your filters

This overall score is based on our expert assessment of what the policy covers, price and how easy it is to understand and buy. A higher score is better.

1Cover Comprehensive

1Cover Frequent Traveller

1Cover Medical Only

AANT Annual Multi-Trip

AANT Basics

AANT Essentials

AANT Premium

AHM Comprehensive

AHM Comprehensive Multi-Trip

AHM Medical Only

Battleface Covid Essentials

Battleface Discovery

Cover-More Basic

Cover-More Comprehensive

Cover-More Comprehensive Multi-Trip

Cover-More Comprehensive Plus

Cover-More Comprehensive Plus Multi-Trip

FastCover Basics

FastCover Comprehensive

FastCover Frequent Traveller Saver

FastCover Standard Saver

Flight Centre Multi-Trip YourCover Essentials

Flight Centre Multi-Trip YourCover Plus

Flight Centre YourCover Essentials

Flight Centre YourCover Plus

Go Insurance Go Basic

Go Insurance Go Basic Annual Multi-Trip

Go Insurance Go Plus

Go Insurance Go Plus Annual Multi-Trip

InsureandGo Bare Essentials

InsureandGo Gold

InsureandGo Silver

Jetstar Comprehensive

Medibank Comprehensive

Medibank Medical Only

Medibank Multi-Trip Comprehensive

NIB Annual Multi-Trip

NIB Comprehensive

NIB Essentials

NRMA Comprehensive

NRMA Comprehensive Multi-Trip

NRMA Essentials

Qantas Annual Multi-Trip

Qantas International Comprehensive

RAA Essentials

RAA Multi-Trip

RAA Premium

RAC Annual Multi-Trip

RAC Comprehensive

RAC Essentials

RAC Medical Only

RACQ Annual Multi-Trip

RACQ Premium

RACQ Standard

RACT Annual Multi-Trip

RACT Comprehensive

RACT Essentials

RACV Annual Multi-Trip

RACV Basics

RACV Comprehensive

RACV Essentials

Southern Cross Travel Insurance (SCTI) Annual Multi-Trip

Southern Cross Travel Insurance (SCTI) Comprehensive

Southern Cross Travel Insurance (SCTI) Medical Only

Tick Travel Insurance Basic

Tick Travel Insurance Budget

Tick Travel Insurance Standard

Tick Travel Insurance Top

Travel Insurance Direct Annual Multi-Trip

Travel Insurance Direct Basics

Travel Insurance Direct The Works

Virgin Australia International Plan (bought with flight purchase)

Virgin Australia Travel Safe International

Virgin Australia Travel Safe International Multi-Trip

Virgin Australia Travel Safe Plus International

Virgin Australia Travel Safe Plus International Multi-Trip

WAS Insurance Covid Essentials

WAS Insurance Discovery

Webjet Travel Safe International

Webjet Travel Safe International Multi-Trip

Webjet Travel Safe Plus International

Webjet Travel Safe Plus International Multi-Trip

World Nomads Explorer

World Nomads Standard

World2Cover Annual Multi-Trip

World2Cover Basics

World2Cover Essentials

World2Cover Top

- Insurance provider

Product selected for a detailed comparison

- " id="mainPhoneNumber">

- Annual Travel Insurance

- Cruise Travel Insurance

- Family Travel Insurance

- Seniors Travel Insurance

- Ski Travel Insurance

- Budget Direct

- Fast Cover Travel Insurance

- Insure4Less

- InsureandGo

- Simply Travel Insurance

- Ski-Insurance

- Travel Insurance Saver

- Travel Insuranz

- Wise Traveller

- Zoom Travel Insurance

- See more companies...

- Travel Insurance Tips

- Covid-19 Help

- Read Reviews

- Write a Review

Need Quotes?

Use our travel insurance comparison to help you save time, worry & loads of money!

Please Note - If you are cruising around Australia you need to select Pacific. With Regions, variances can apply for Bali, Indonesia, Japan and Middle East. You are not required to enter stop-over countries if your stop-over is less than 48 hours.

If you don’t know where you’re traveling to within the next 12 months, choose Worldwide to ensure you’re covered no matter where you go. If you’re travelling to multiple countries choose the region that you are visiting that is furthest away (excluding stopovers less than 48 hours). In most cases you will be covered for the closer regions as well. For example, if you choose Europe, you will also be covered in the Middle East, Asia and Pacific.

Worldwide means anywhere in the world

Americas means USA, Canada, South America, Latin America, Hawaii and the Caribbean

Europe means all European countries, including UK

Middle East refers to the area from Syria to Yemen; Egypt to Iran

Asia generally means Asia and the Indian subcontinent. For some insurers this excludes Japan*

Pacific means the South West Pacific, Australia and Indonesia/Bali*. Select Pacific for domestic cruises in New Zealand waters

New Zealand means domestic travel within New Zealand only

*Note: Variances apply for Bali, Indonesia, Japan and Middle East. Check that your destination is covered once directed to your chosen insurer’s site.

CTI warmly welcomes Webjet

Date published: 14 Oct 2014

Travel insurance quotes from Webjet are now available online through our comparison.

Natalie Ball, Director, Compare Travel Insurance said:

“We’re delighted to be partnering with Webjet. Their addition to Comparetravelinsurance.com.au provides our customers the opportunity to compare even more quotes. This further cements our commitment to help holiday makers find the best cover for their trip.”

David Galt, Webjet CEO said:

“As an Australian-based company, we are proud to see Webjet Travel Insurance policies being featured on Compare Insurance in Australia and New Zealand. We believe in offering customers unparalleled travel choice and our comprehensive selection of travel insurance products caters to a wide variety of traveller’s needs.” About Webjet

Webjet is Australia and New Zealand's leading online travel agency. Webjet enables customers to compare, combine and book the best domestic and international travel flight deals, hotel accommodation, holiday package deals, travel insurance and car hire worldwide.

Our Travel Insurance Comparision Helps You

Save time, worry and loads of money.

Stay up to date with our latest news, deals and special offers.

Your privacy is important to us.

Comparetravelinsurance.com.au is Australia’s leading comparison site solely focused on travel insurance.

Our comparison is a free service that allows users to compare quotes in a few simple steps based on limited personal criteria. Comparisons supplied are not a recommendation or opinion about the suitability of a policy for a user. Comparisons are default ranked according to price and users have the ability to sort by popular cover levels. Whilst we compare a vast range of policies, we do not compare all providers in the market. This site compares the following brands: 1Cover, AllClear, Budget Direct, Downunder, Fast Cover Travel Insurance, Insure4Less, InsureandGo, iTrek, Simply Travel Insurance, Ski-Insurance, Travel Insurance Saver, Travel Insuranz, Wise Traveller, Zoom Travel Insurance . The directors and shareholders are common with companies i-Trek Pty Ltd, Zoom Travel Insurance and 1Cover Pty Ltd including it’s subsidiary brand Ski-insurance. CoverDirect takes all reasonable care when preparing this information but does not warrant its accuracy. Pricing information is supplied by the providers who participate on this site and should be verified with the insurer before you purchase. This site links users to the website of the provider to verify quotes and access the relevant PDS to understand what is, and is not, covered by a policy prior to purchase.

CoverDirect Pty Ltd owns and operates this website under AFS Licence 383590. Located at Level 12, 338 Pitt Street, Sydney, NSW 2000 Australia.

For further information view our FSG and Terms of Use . Contact us by calling 1300 659 411.

Loading Quotes...

Please login or register to continue. It'll only take a minute.

Login with Facebook

Login with Google

- There was an error logging in, please try again.

Enter your email and password

- There was an error on your registration, please try again.

Don't you have an account?

Just checking you are a human

- Travel Insurance Compare Our Plans Popular Benefits COVID-19 Benefits International Plans Domestic Plans Comprehensive Insurance Annual Multi-Trip Inbound Plan Cruise Ski & Snowboard Motorcycle & Moped Adventure Activities Seniors Medical Conditions

- Emergency Assistance

- Travel Alerts COVID-19 International Travel Tool Cover-More App

- Manage Policy

Travel insurance that’s always by your side

- travel_explore Not sure? See region list.

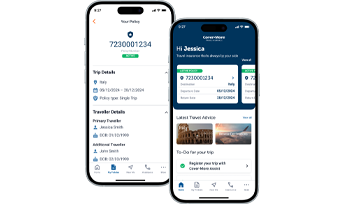

Your policy in your pocket... and more

Register your trip in our app for access to your travel insurance policy details, as well as up-to-date travel advice, real-time safety alerts and 24/7 emergency assistance, all in the palm of your hand.

Travel's back on - and we've got your back

Feel in control by choosing the most suitable plan for you

Feel safe with 24/7 access to Emergency Assistance

Feel joy with 80+ adventure activities included

Feel confident with our 35+ years of travel expertise

Looking for the best travel insurance plan for your holiday?

Whatever your travel budget, style or needs, let's travel the world together - safely.

International Basic

Essential cover designed for Australian travellers on a budget.

Pre-trip cover if you're diagnosed with COVID-19

On-trip cover if you're diagnosed with COVID-19^##

Unlimited~ overseas emergency medical expenses^

Up to $5,000 luggage cover

Existing medical conditions cover available

Optional cancellation cover

Single Trip policies

Annual Multi-Trip policies^

Rental vehicle insurance excess

International Comprehensive

Extensive cover and benefit limits to provide extra financial protection.

Pre-trip cover if you're diagnosed with COVID-19#

On-trip cover if you’re diagnosed with COVID-19 while travelling^##

Up to $15,000 luggage cover*

Optional cancellation cover with Cancellation Extensions

Single Trip or Annual Multi-Trip^^ policies

Rental vehicle comprehensive cover

International Comprehensive +

Everything our Comprehensive Plan includes and more + higher benefit limits.

Pre-trip cover if you’re diagnosed with COVID-19 before travelling#

Up to $25,000 luggage cover*

Business trip benefits

* Item limits apply.

~ Cover will not exceed 12 months from onset of the illness, condition, or injury.

^ For cruise-related expenses, Cruise Cover must be included in the policy. There is no cover for cabin confinement related to COVID-19.

^^ Policy availability subject to age, trip duration and area of travel. Policies may not be available to all travellers.

# Up to $5,000 per policy (or the amount chosen if this is less) applies to International Comprehensive Plan and Comprehensive+ Plan policyholders with Amendment or Cancellation Costs cover included. You must be diagnosed with COVID-19 and certified by a qualified medical practitioner as being not fit to travel for cover to apply.

## Up to $5,000 per policy (or the amount chosen if this is less) applies per policy for policyholders with Amendment or Cancellation Costs cover included. You must be diagnosed with COVID-19 and certified by a qualified medical practitioner as being not fit to travel for cover to apply. A special excess applies.

Searching for COVID-19 cover?

To help you explore the world with confidence, our travel insurance provides cover for COVID-19-related:

Overseas medical costs*~#

Amendment and cancellation costs*^

Additional expenses*#^

*Limits, sub-limits, conditions, and exclusions apply.

~Medical cover will not exceed 12 months from onset.

#Cover for medical costs related to COVID-19 is not available on our Domestic Plans.

^A special excess will apply.

Holiday hasn't gone to plan?

You can submit a Cover-More travel insurance claim online at any time – and from anywhere.

Get emergency support, fast. We're here 24/7.

When adventure awaits... we can help provide cover.

Setting sail for two or more nights? You'll need to let us know and Cruise Cover will be added to your policy.

Snow Sports

Hitting the slopes? Consider protecting your winter getaway with one of our two levels of Snow Sports Cover.

Adventure Activities

Planning on engaging in extreme activities? We've got two additional Adventure Activities Cover options for you.

Motorcycle & Moped

Want to take to the road on two wheels? See if one of our Motorcycle/Moped Riding Cover options is right for your trip.

We're by your side when you need us most

We've been protecting Australian travellers for over 35 years. Read our customers' Cover-More travel insurance reviews to discover how our expert team provides exceptional care during uncertain times.

Mosquito bite in Bali

Shannon was bitten by a mosquito in Bali, which caused Dengue Fever.

"Cover-More were absolutely fantastic. I wasn't responding well to medical treatment, so they flew in a specialist from Singapore to accompany me all the way home. I'm so glad I had Cover-More travel insurance."

Boat crash in Thailand

Natalie was involved in a speedboat crash in Thailand, which resulted in a fractured pelvis and a brain haemorrhage.

"Luckily I had Cover-More insurance. They took care of everything and made sure we had the best medical treatment available."

Accidental fall in Poland

Irene was visiting family in Poland when she had a fall, which resulted in a bad fracture and extensive medical costs.

"Amazing. I can't praise them highly enough. Wonderful, wonderful people... Nobody should travel without insurance."

Protect your trip with us - get a free travel insurance quote now.

How can we help you travel smarter.

Whether you’re a seasoned traveller or a first-timer, we’re here to help you feel empowered to travel further, safely.

Finding cover for Existing Medical Conditions (EMCs)

Have an EMC? We can provide cover for various conditions to help keep you exploring, safely.

7 ways COVID-19 has changed the way we travel

Worried about travel risks during COVID-19? Discover how you can help ensure a safer trip.

What you should know before you hit the slopes

Planning a ski trip at home or abroad? Don't depart without reading our expert advice.

Got a question about travel insurance? We're here to help

What is travel insurance.

Travel insurance is a specific type of insurance that helps cover several costs and disruptions when travelling both domestically and overseas. Levels of cover differ per plan; however, travel insurance typically protects against trip cancellation, delays, lost luggage and personal belongings, overseas medical expenses and repatriation, and personal liability.

Most travel insurance providers offer single or multi-trip policies, which can cover multiple countries within a specific timeframe. Things like the destination, length of trip, optional additional cover for specific activities and pre-existing medical conditions all help determine the cost of a travel insurance policy.

How much does travel insurance cost?

The cost of a travel insurance policy varies from traveller to traveller because various factors affect the amount payable.

At Cover-More, we consider a number of factors when calculating the total amount payable. The following is a guide on these key factors, how they combine and how they may impact the assessment of risk and therefore the premium paid:

- Area: higher risk areas cost more.

- Departure date and trip duration: the longer the period until you depart and the longer your trip duration, the higher the cost may be.

- Age: higher risk age groups cost more.

- Plan: International Comprehensive+, which provides more cover, costs more than International Comprehensive or Domestic.

- Excess: the higher the excess the lower the cost.

- Cruise cover: additional premium applies.

- Cancellation cover: on some policies you can choose your own level of cancellation cover. The more cancellation cover you require, the higher the cost may be.

- Adding cover for Existing Medical Conditions and pregnancy (where available): additional premium may apply if a medical assessment is completed and cover is accepted by us.

- Options to vary cover (where available): additional premium applies.

While a cheaper policy cost upfront may seem appealing, always read the Product Disclosure Statement to ensure your needs are adequately covered should an incident occur.

How does travel insurance work?

Travel insurance protects you when travelling domestically or internationally by providing coverage against unforeseen circumstances that may impact your travel plans. By purchasing travel insurance with cancellation cover prior to departure, your policy can help by providing cover for the costs of trip cancellations should you no longer be able to travel, as well as the costs of overseas medical treatment, lost passports, and personal items while you’re travelling.

The customer usually pays for these costs upfront, before being reimbursed by the travel insurer upon claim approval. To approve a claim, travel insurers require documentation such as medical reports, itemised medical bills or police reports to confirm the incident occurred.

However, at Cover-More, if our customer becomes ill overseas, they can also contact our 24-Hour Emergency Assistance team for support and to seek approval for expensive medical bills to be paid directly by us to the medical care provider/s instead.

Always read the Product Disclosure Statement before purchasing a travel insurance policy to ensure it provides adequate coverage for your circumstances.

What does – and doesn’t – travel insurance cover?

Unfortunately, travel insurance can’t cover absolutely everything. This highlights the importance for travellers to read the Product Disclosure Statement before purchasing to avoid becoming frustrated if claims are unsuccessful. It will contain details on the situations you likely won’t be covered in, including cancellation, pre-existing medical conditions, theft or loss of belongings, adventure sports, COVID-19 scenarios and more.

For full details of the exclusions within our Cover-More travel insurance plans, consult the Product Disclosure Statement .

When is the best time to purchase travel insurance?

The best time to purchase travel insurance is as soon as a trip is booked, as this can increase protection. When purchased ahead of time, a Cover-More customer can cancel their travel insurance policy for a full refund within the 21-day cooling-off period. If the policy is purchased before departing on the trip, claims for rearrangements and cancellations caused by unforeseen circumstances can also be made where cancellation cover is added to the policy.

- Travel Insurance

The journalists on the editorial team at Forbes Advisor Australia base their research and opinions on objective, independent information-gathering.

When covering investment and personal finance stories, we aim to inform our readers rather than recommend specific financial product or asset classes. While we may highlight certain positives of a financial product or asset class, there is no guarantee that readers will benefit from the product or investment approach and may, in fact, make a loss if they acquire the product or adopt the approach.

To the extent any recommendations or statements of opinion or fact made in a story may constitute financial advice, they constitute general information and not personal financial advice in any form. As such, any recommendations or statements do not take into account the financial circumstances, investment objectives, tax implications, or any specific requirements of readers.

Readers of our stories should not act on any recommendation without first taking appropriate steps to verify the information in the stories consulting their independent financial adviser in order to ascertain whether the recommendation (if any) is appropriate, having regard to their investment objectives, financial situation and particular needs. Providing access to our stories should not be construed as investment advice or a solicitation to buy or sell any security or product, or to engage in or refrain from engaging in any transaction by Forbes Advisor Australia. In comparing various financial products and services, we are unable to compare every provider in the market so our rankings do not constitute a comprehensive review of a particular sector. While we do go to great lengths to ensure our ranking criteria matches the concerns of consumers, we cannot guarantee that every relevant feature of a financial product will be reviewed. We make every effort to provide accurate and up-to-date information. However, Forbes Advisor Australia cannot guarantee the accuracy, completeness or timeliness of this website. Forbes Advisor Australia accepts no responsibility to update any person regarding any inaccuracy, omission or change in information in our stories or any other information made available to a person, nor any obligation to furnish the person with any further information.

Travel Insurance For South Africa: Everything You Need To Know

Updated: Apr 30, 2024, 1:13pm

Table of Contents

Featured Partners

Do I Need Travel Insurance for South Africa?

What does travel insurance for south africa cover, frequently asked questions (faqs).

Tourism is on the rise in South Africa according to the local government , with more than four million tourists visiting the nation in the first half of 2023 alone. Australians form a sizable chunk of those numbers, with an estimated 125,000 Australians touring the country each year pre-pandemic.

With travel still high on the agenda for many Australians, that figure is expected to rise in the coming years.

If you’re considering a trip to South Africa, you’ll want to purchase travel insurance. Our guide explains everything you need to know.

Fast Cover Travel Insurance

On Fast Cover’s Secure Website

Medical cover

Unlimited, 24/7 Emergency Assistance

Cancellations

Unlimited, (Trip Disruption $50,000)

Key Features

25-Day Cooling Off Period, Australian Based Call Centre, 4.6 Star Product Review Rating

Cover-More Travel Insurance

On Cover-more’s secure website

Unlimited, with a $2000 limit to dental

Yes, amount chosen by customer

Southern Cross Travel Insurance

Medical Cover

Including medical treatment, doctors’ visits, prescribed medication, specialist treatment & medical transport costs

$2,500 with option to increase to unlimited

Yes, Australians should purchase travel insurance for South Africa. While not a legal requirement to enter the country, it is highly recommended from the Australian government—especially for medical care.

The standard of medical facilities in South Africa can vary by region, but medical facilities are generally of a much lower standard than Australia. In fact, many regional hospitals only provide basic facilities, meaning you may have to be relocated in order to receive the right medical attention.

There is no shared healthcare agreement between Australia and South Africa, which makes travel insurance even more essential. If you need to be transferred by air evacuation to a major city in order to receive treatment, and you don’t have travel insurance, you’ll likely face a hefty bill out of your own pocket.

As Smartraveller advises all Australians, if you can’t afford travel insurance, you can’t afford to travel.

Vaccinations to Consider for Your Trip to South Africa

There is a high risk of certain diseases in South Africa, so it is worth making sure your vaccinations are up to date before you travel and taking any preventative measures with you, such as medications.

This can help reduce your chances of needing to seek medical attention.

There is a risk of Hepatitis A and B throughout South Africa, so vaccinations for Australian travellers are recommended. There is also a moderate risk for most travellers of typhoid, so a vaccination is also recommended if you are travelling to smaller cities, villages and rural areas.

Malaria is present throughout the country, so it could be a good idea to equip yourself with malaria tablets before you travel.

It is essential that you consult a medical practitioner regarding your need for vaccinations before you travel to South Africa, especially as some medical conditions can predispose travellers to certain infections.

When purchasing a travel insurance policy for South Africa, you will have the option to choose a basic policy or a comprehensive policy. A basic policy is cheaper , but may turn out to be more expensive in the long run if you aren’t covered for the things you need.

While a basic policy will usually cover medical needs, it may not provide cover for things such as lost luggage and cancellations (or, if it does, will provide it at a much lower claim level).

That’s why a comprehensive policy is highly recommended for travel to South Africa, as you will receive cover for stolen items, lost luggage, delays and more, in addition to medical and emergency dental care.

Smartraveller asks Australians to exercise a high degree of caution due to the threat of violent crime in South Africa, which includes robbery and carjacking.

The government website warns that opportunistic criminals will target travellers at the approaches to tourist-hotspot Kruger National Park, at well-known resorts, and on public transport.

Additionally, as ATM and credit card fraud are common crimes in South Africa, a comprehensive policy can be the more financially sound choice to give you peace of mind.

Going on a Safari?

South Africa is a popular tourist region for many reasons, including wildlife safaris. If you wish to partake in a safari or a game walk—walking with wild animals and a professional guide—you will need to ensure that these activities are covered in your policy’s list of included sports and activities.

If they are not, you will not receive cover for anything that occurs during the safari.

However, your policy may offer the option for you to choose an ‘adventure pack’ at an additional cost, which can include many activities that aren’t covered in the standard offering.

This can also include hiking or trekking to certain altitudes.

It’s important to consider which activities you may be participating in during your trip to South Africa in order to ensure you have the appropriate coverage, and purchase an additional add-on if necessary.

What Travel Insurance Won’t Cover

Your travel insurance policy won’t cover anything that is set out in its exclusions, as per the product disclosure statement (PDS). This could include certain sports and activities (such as a safari), or travel to certain regions in South Africa due to safety.

While each travel insurance policy differs on the fine-print, it is standard for most policies not to cover:

- Cancellations due to ‘disinclination to travel’, being if you change your mind about your holiday;

- Accidents or injuries that occur when not following the appropriate safety guidance or official guidelines;

- Intoxicated behaviour, including recreational drugs;

- Any illegal activity.

Be sure to carefully read the PDS of your policy so you know exactly what you can and cannot claim on your trip to South Africa.

Is it safe to travel to South Africa?

Smartraveller recommends that Australians exercise a high degree of caution when travelling to South Africa, due to the threat of violent crime. This includes armed robbery, mugging, carjacking, credit card theft, and more.

There is a higher risk of violent crime in major cities after dark, or during “rolling blackout” periods.

For these reasons (and more), Smartraveller urges Australians to take out a travel insurance policy before travelling to South Africa.

Do Australians need a visa for South Africa?

No, Australians do not need a visa for South Africa if they are visiting for tourism for stays of up to 90 days.

Where can I buy travel insurance for South Africa?

Most Australian travel insurance providers will cover Aussies wanting to head abroad to South Africa. When shopping around for a policy, you will be able to choose your destination when you request a quote. If there is no option to choose South Africa, this would be a clear indicator that the insurance provider does not provide policies to this region.

At the time of writing, a few of our top picks for comprehensive travel insurance cover South Africa, including Allianz and Cover-More .

Travel insurance providers can revoke the issuing of new policies to certain destinations at any time, especially if Smartraveller changes the alert warning for a country to ‘Do Not Travel’.

- Best Comprehensive Travel Insurance

- Best Seniors Travel Insurance

- Best Domestic Travel Insurance

- Best Cruise Travel Insurance

- Best Family Travel Insurance

- Travel Insurance Cost

- Pregnancy Travel Insurance Guide

- Travel Insurance Cancellation Cover

- Travel Insurance For Bali

- Travel Insurance For Fiji

- Travel Insurance For The USA

- Travel Insurance For Thailand

- Travel Insurance For New Zealand

- Travel Insurance For Japan

- Travel Insurance For Europe

- Travel Insurance For Singapore

- Travel Insurance For Indonesia

- Travel Insurance For Vietnam

- Travel Insurance For Canada

- Cover-More Travel Insurance Review

- Fast Cover Travel Insurance Review

- Travel Insurance Saver Review

- Allianz Comprehensive Travel Insurance Review

- 1Cover Comprehensive Travel Insurance Review

- Australia Post Comprehensive Travel Insurance Review

- Tick Travel Insurance Review

More from

Do frequent flyer points expire, travel insurance for canada: what you need to know before you go, travel insurance for vietnam: everything you need to know, tick travel insurance top cover review: features, pros and cons, was discovery travel insurance review: features, pros and cons, fast cover comprehensive travel insurance review: pros and cons.

Sophie Venz is an experienced editor and features reporter, and has previously worked in the small business and start-up reporting space. Previously the Associate Editor of SmartCompany, Sophie has worked closely with finance experts and columnists around Australia and internationally.

IMAGES

VIDEO

COMMENTS

Find out how to choose the best travel insurance for your needs and avoid common pitfalls. Learn about cover, exclusions, claims, and tips from Webjet and Zurich.

Webjet travel insurance is administered by Cover-More Insurance Services Pty Ltd and issued by Zurich Australian Insurance Limited. The cooling-off period is 21 days which means if you cancel your ...

We independently review and compare Webjet Travel Safe International Multi-Trip against 90 other international travel insurance comparison products from 27 brands to help you choose the best.

Webjet Reviews. Webjet offers a broad range of travel insurance products, with the opportunity to tailor your excess and control your premium to suit your needs. Policies are available to those under 86 years. Dependants travel for free with parent or grandparent. They offer 24/7 emergency assistance no matter where you are in the world.

Allianz insurance provider. Create an account to write a review. We independently review and compare Webjet Domestic against 23 other domestic travel insurance comparison products from 21 brands to help you choose the best.

Cover-More has become the exclusive provider of travel insurance and assistance for Webjet's online travel agency business across Australia and New Zealand. The new partnership commenced ...

About Webjet. Based out of Melbourne for over 20 years, Webjet is an online travel agency that uses online travel tools and technology to help its customers in Australia and New Zealand compare and book flights, accommodation, holiday packages as well as travel insurance worldwide.

When traveling abroad, look for a policy with a short waiting period. The most generous travel plans provide $2,000 in trip delay benefits, per person, but you can buy policies with less if you ...

webjet.com.au for Your travel departing from a place in Australia and You do not have a return fare booked on webjet.com.au for Your return travel in Australia. "Period of Insurance" means from the time You commence the Journey or the travel start date shown on Your Certificate of

Webjet booking T&Cs & Fees apply.Travel restrictions and conditions may apply, please refer to smarttraveller.gov.au for latest advice. Webjet Travel Insurance is administered by Cover-More Insurance (NZ) Ltd and issued by Zurich Australian Insurance Limited (ZAIL) incorporated in Australia, ABN 13 000 296 640, trading as Zurich New Zealand.

Cover-More (NZ) Limited (Cover-More) administers the policy (including customer service, medical assessments and claims management). Webjet Marketing Pty Ltd ABN 84 063 430 848 AR 301380 arranges this insurance as an authorised representative of Cover-More Insurance Services. For further Information on ZAIL's financial strength rating, please ...

Find the best product for you. If you're going overseas, travel insurance is just as essential as your passport. Use our free comparison tool to narrow down international single trip and annual multi-trip policies from 27 insurers, offering cover for COVID-19, existing medical conditions, car rental and more.

Insurance administered by Cover-More Insurance Services Pty Ltd (ABN 95 003 114 145, AFSL 241713) and issued by Zurich Australian Insurance Limited (ABN 13 000 296 640, AFSL 232507). Any advice is general advice only. Please consider your financial situation, needs and objectives and read the Combined FSG/PDS before deciding to buy this insurance.

Purchased Webjet travel insurance for our family of 4. It was very cost effective with optional excess fees to reduce the upfront premium cost. Additional extras at reasonable cost. Will be using them again in the future. Southern Cross Travel Insurance 4.7. RentalCover.com 4.6. Fast Cover Travel Insurance 4.6.