- Auto Insurance Best Car Insurance Cheapest Car Insurance Compare Car Insurance Quotes Best Car Insurance For Young Drivers Best Auto & Home Bundles Cheapest Cars To Insure

- Home Insurance Best Home Insurance Best Renters Insurance Cheapest Homeowners Insurance Types Of Homeowners Insurance

- Life Insurance Best Life Insurance Best Term Life Insurance Best Senior Life Insurance Best Whole Life Insurance Best No Exam Life Insurance

- Pet Insurance Best Pet Insurance Cheap Pet Insurance Pet Insurance Costs Compare Pet Insurance Quotes

- Travel Insurance Best Travel Insurance Cancel For Any Reason Travel Insurance Best Cruise Travel Insurance Best Senior Travel Insurance

- Health Insurance Best Health Insurance Plans Best Affordable Health Insurance Best Dental Insurance Best Vision Insurance Best Disability Insurance

- Credit Cards Best Credit Cards 2024 Best Balance Transfer Credit Cards Best Rewards Credit Cards Best Cash Back Credit Cards Best Travel Rewards Credit Cards Best 0% APR Credit Cards Best Business Credit Cards Best Credit Cards for Startups Best Credit Cards For Bad Credit Best Cards for Students without Credit

- Credit Card Reviews Chase Sapphire Preferred Wells Fargo Active Cash® Chase Sapphire Reserve Citi Double Cash Citi Diamond Preferred Chase Ink Business Unlimited American Express Blue Business Plus

- Credit Card by Issuer Best Chase Credit Cards Best American Express Credit Cards Best Bank of America Credit Cards Best Visa Credit Cards

- Credit Score Best Credit Monitoring Services Best Identity Theft Protection

- CDs Best CD Rates Best No Penalty CDs Best Jumbo CD Rates Best 3 Month CD Rates Best 6 Month CD Rates Best 9 Month CD Rates Best 1 Year CD Rates Best 2 Year CD Rates Best 5 Year CD Rates

- Checking Best High-Yield Checking Accounts Best Checking Accounts Best No Fee Checking Accounts Best Teen Checking Accounts Best Student Checking Accounts Best Joint Checking Accounts Best Business Checking Accounts Best Free Checking Accounts

- Savings Best High-Yield Savings Accounts Best Free No-Fee Savings Accounts Simple Savings Calculator Monthly Budget Calculator: 50/30/20

- Mortgages Best Mortgage Lenders Best Online Mortgage Lenders Current Mortgage Rates Best HELOC Rates Best Mortgage Refinance Lenders Best Home Equity Loan Lenders Best VA Mortgage Lenders Mortgage Refinance Rates Mortgage Interest Rate Forecast

- Personal Loans Best Personal Loans Best Debt Consolidation Loans Best Emergency Loans Best Home Improvement Loans Best Bad Credit Loans Best Installment Loans For Bad Credit Best Personal Loans For Fair Credit Best Low Interest Personal Loans

- Student Loans Best Student Loans Best Student Loan Refinance Best Student Loans for Bad or No Credit Best Low-Interest Student Loans

- Business Loans Best Business Loans Best Business Lines of Credit Apply For A Business Loan Business Loan vs. Business Line Of Credit What Is An SBA Loan?

- Investing Best Online Brokers Top 10 Cryptocurrencies Best Low-Risk Investments Best Cheap Stocks To Buy Now Best S&P 500 Index Funds Best Stocks For Beginners How To Make Money From Investing In Stocks

- Retirement Best Gold IRAs Best Investments for a Roth IRA Best Bitcoin IRAs Protecting Your 401(k) In a Recession Types of IRAs Roth vs Traditional IRA How To Open A Roth IRA

- Business Formation Best LLC Services Best Registered Agent Services How To Start An LLC How To Start A Business

- Web Design & Hosting Best Website Builders Best E-commerce Platforms Best Domain Registrar

- HR & Payroll Best Payroll Software Best HR Software Best HRIS Systems Best Recruiting Software Best Applicant Tracking Systems

- Payment Processing Best Credit Card Processing Companies Best POS Systems Best Merchant Services Best Credit Card Readers How To Accept Credit Cards

- More Business Solutions Best VPNs Best VoIP Services Best Project Management Software Best CRM Software Best Accounting Software

- Manage Topics

- Investigations

- Visual Explainers

- Newsletters

- Abortion news

- Coronavirus

- Climate Change

- Vertical Storytelling

- Corrections Policy

- College Football

- High School Sports

- H.S. Sports Awards

- Sports Betting

- College Basketball (M)

- College Basketball (W)

- For The Win

- Sports Pulse

- Weekly Pulse

- Buy Tickets

- Sports Seriously

- Sports+ States

- Celebrities

- Entertainment This!

- Celebrity Deaths

- American Influencer Awards

- Women of the Century

- Problem Solved

- Personal Finance

- Small Business

- Consumer Recalls

- Video Games

- Product Reviews

- Destinations

- Airline News

- Experience America

- Today's Debate

- Suzette Hackney

- Policing the USA

- Meet the Editorial Board

- How to Submit Content

- Hidden Common Ground

- Race in America

Personal Loans

Best Personal Loans

Auto Insurance

Best Auto Insurance

Best High-Yields Savings Accounts

CREDIT CARDS

Best Credit Cards

Advertiser Disclosure

Blueprint is an independent, advertising-supported comparison service focused on helping readers make smarter decisions. We receive compensation from the companies that advertise on Blueprint which may impact how and where products appear on this site. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Blueprint. Blueprint does not include all companies, products or offers that may be available to you within the market. A list of selected affiliate partners is available here .

Credit Cards

The complete guide to the Amex Travel portal

Carissa Rawson

Allie Johnson

“Verified by an expert” means that this article has been thoroughly reviewed and evaluated for accuracy.

Robin Saks Frankel

Published 7:39 a.m. UTC Feb. 28, 2024

- path]:fill-[#49619B]" alt="Facebook" width="18" height="18" viewBox="0 0 18 18" fill="none" xmlns="http://www.w3.org/2000/svg">

- path]:fill-[#202020]" alt="Email" width="19" height="14" viewBox="0 0 19 14" fill="none" xmlns="http://www.w3.org/2000/svg">

Editorial Note: Blueprint may earn a commission from affiliate partner links featured here on our site. This commission does not influence our editors' opinions or evaluations. Please view our full advertiser disclosure policy .

onurdongel, Getty Images

The American Express Travel portal offers valuable benefits to American Express cardholders, including special prices. Depending on which card you hold, you may also be able to pay for travel with Membership Rewards® points and get access to perks such as discounted airfare and specialty benefits at luxury hotels. Let’s take a look at how the Amex Travel portal works, whether the benefits are worthwhile and who can access Amex Travel’s website.

- American Express Travel offers hotels, vacation rentals, flights, rental cars and cruises.

- Luxury hotel benefits and discounted airfare are two benefits of booking through Amex’s travel portal.

- American Express cardholders can access Amex Travel.

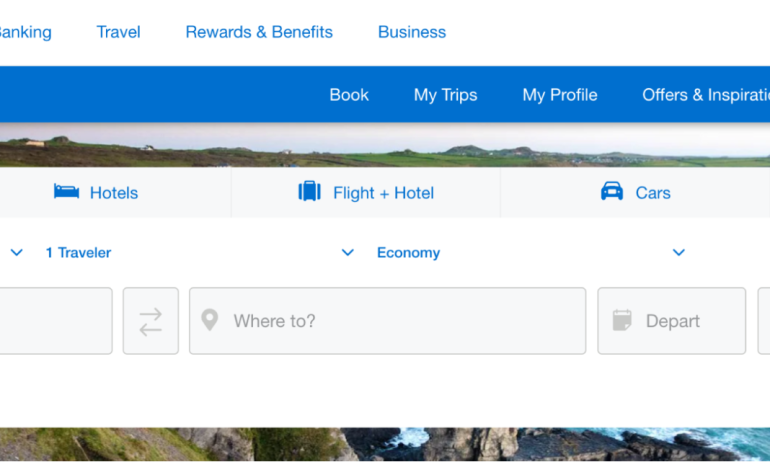

How to book travel through the Amex Travel portal

Booking travel through the Amex Travel portal requires you to have an online account associated with an Amex card. While you can complete a search on the Amex Travel website without logging in, you will need to do so in order to make a booking.

After you choose whether to book a flight, hotel, vacation rental, vacation package, rental car or cruise, you’ll need to enter your travel details.

For example, if you want to book a flight through Amex Travel, you’ll need to put in your departure airport and destination as well as your dates of travel. The site will then bring up a list of matching results.

You can filter based on when the flights take off as well as how many stops you’re willing to tolerate, among other options.

The Amex Travel site offers a wide variety of hotel stays and flights, but you’ll always want to double check elsewhere before booking since it doesn’t always feature every option.

Once you’ve selected a booking, you’ll be taken through the checkout process. This includes providing your personal information and can also include seat requests and adding in loyalty program numbers.

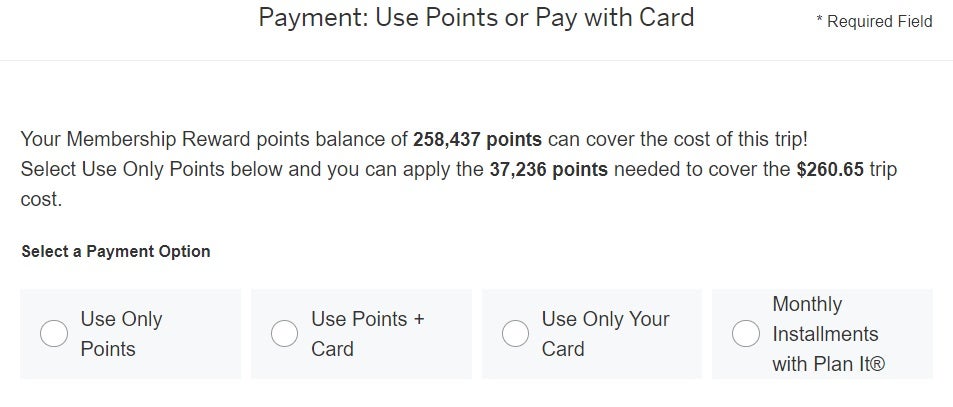

To pay for your booking, you can use your American Express Membership Rewards, if you have a card that earns them, or your American Express card or a combination of both.

After you’ve booked, you’ll receive a confirmation email containing your reservation information. You can also find your bookings under the My Trips section of Amex Travel.

Who can use the portal?

Any American Express cardholder can use the Amex Travel portal to book travel. But those whose cards don’t earn Amex Membership Rewards points will need to pay with their Amex card.

However, many American Express cards earn Membership Rewards points that can be redeemed for travel through the Amex Travel portal. These cards include (terms apply):

The Platinum Card® from American Express

- American Express® Gold Card

- American Express® Green Card * The information for the American Express® Green Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

- Amex EveryDay® Credit Card * The information for the Amex EveryDay® Credit Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

- The Business Platinum Card® from American Express * The information for the The Business Platinum Card® from American Express has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

- American Express® Business Gold Card * The information for the American Express® Business Gold Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

All information about American Express® Green Card, Amex EveryDay® Credit Card, The Business Platinum Card® from American Express and American Express® Business Gold Card has been collected independently by Blueprint.

our partner

Blueprint receives compensation from our partners for featured offers, which impacts how and where the placement is displayed.

Welcome Bonus

Earn 80,000 Membership Rewards® Points after you spend $8,000 on purchases on the Card in your first 6 months of Card Membership.

Regular APR

Credit score.

Credit Score ranges are based on FICO® credit scoring. This is just one scoring method and a credit card issuer may use another method when considering your application. These are provided as guidelines only and approval is not guaranteed.

Editor’s Take

- Over $1,500 in travel and entertainment credits can offset the annual fee.

- Comprehensive lounge access benefit.

- Generous travel and purchase protections.

- High annual fee and spending requirements.

- Amex’s once-per-lifetime rule limits welcome bonus eligibility.

- Annual statement credits have limited use.

Card Details

- Earn 80,000 Membership Rewards® Points after you spend $8,000 on purchases on your new Card in your first 6 months of Card Membership. Apply and select your preferred metal Card design: classic Platinum Card®, Platinum x Kehinde Wiley, or Platinum x Julie Mehretu.

- Earn 5X Membership Rewards® Points for flights booked directly with airlines or with American Express Travel up to $500,000 on these purchases per calendar year and earn 5X Membership Rewards® Points on prepaid hotels booked with American Express Travel.

- $200 Hotel Credit: Get up to $200 back in statement credits each year on prepaid Fine Hotels + Resorts® or The Hotel Collection bookings with American Express Travel when you pay with your Platinum Card®. The Hotel Collection requires a minimum two-night stay.

- $240 Digital Entertainment Credit: Get up to $20 back in statement credits each month on eligible purchases made with your Platinum Card® on one or more of the following: Disney+, a Disney Bundle, ESPN+, Hulu, The New York Times, Peacock, and The Wall Street Journal. Enrollment required.

- $155 Walmart+ Credit: Cover the cost of a $12.95 monthly Walmart+ membership (subject to auto-renewal) with a statement credit after you pay for Walmart+ each month with your Platinum Card®. Cost includes $12.95 plus applicable local sales tax. Plus Up Benefits are excluded.

- $200 Airline Fee Credit: Select one qualifying airline and then receive up to $200 in statement credits per calendar year when incidental fees are charged by the airline to your Platinum Card®.

- $200 Uber Cash: Enjoy Uber VIP status and up to $200 in Uber savings on rides or eats orders in the US annually. Uber Cash and Uber VIP status is available to Basic Card Member only. Terms Apply.

- $300 Equinox Credit: Get up to $300 back in statement credits per calendar year on an Equinox membership, or an Equinox club membership (subject to auto-renewal) when you pay with your Platinum Card®. Enrollment required. Visit https://platinum.equinox.com/ to enroll.

- $189 CLEAR® Plus Credit: Breeze through security with CLEAR Plus at 100+ airports, stadiums, and entertainment venues nationwide and get up to $189 back per calendar year on your Membership (subject to auto-renewal) when you use your Platinum Card®. Learn more.

- $100 Global Entry Credit: Receive either a $100 statement credit every 4 years for a Global Entry application fee or a statement credit up to $85 every 4.5 years for a TSA PreCheck® (through a TSA official enrollment provider) application fee, when charged to your Platinum Card®. Card Members approved for Global Entry will also receive access to TSA PreCheck at no additional cost.

- Shop Saks with Platinum: Get up to $100 in statement credits annually for purchases in Saks Fifth Avenue stores or at saks.com on your Platinum Card®. That’s up to $50 in statement credits semi-annually. Enrollment required.

- $300 SoulCycle At-Home Bike Credit: Get a $300 statement credit for the purchase of a SoulCycle at-home bike with your Platinum Card®. An Equinox+ subscription is required to purchase a SoulCycle at-home bike and access SoulCycle content. Must charge full price of bike in one transaction. Shipping available in the contiguous U.S. only. Enrollment Required.

- Unlock access to exclusive reservations and special dining experiences with Global Dining Access by Resy when you add your Platinum Card® to your Resy profile.

- $695 annual fee.

- Terms Apply.

Is the portal worth using?

The Amex Travel portal can be worth using in certain cases, though it won’t always make sense. For example, some flights aren’t bookable via Amex Travel, so if what you need isn’t available you’ll want to look elsewhere.

That being said, those with certain cards are entitled to exclusive benefits that can lower prices or allow them to redeem points for travel. There are also perks for booking luxury hotels within the portal. In these cases, Amex Travel is definitely worth investigating.

How to maximize your Amex Travel benefits through the portal

International airline program.

Available to those who hold a high-end American Express card, including The Platinum Card from American Express, The Business Platinum Card from American Express and the American Express Centurion Black Card * The information for the American Express Centurion Black Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer. , the International Airline Program (IAP) can save you money on certain international flights booked via the Amex Travel portal.

All information about American Express Centurion Black Card has been collected independently by Blueprint.

This benefit is only available on tickets booked in premium economy, business or first class, but the savings can be significant.

For example, we looked at a round-trip flight in premium economy from San Francisco (SFO) to Tokyo (NRT). Booking with Japan Airlines (JAL) directly resulted in a cost of $4,431.40, while the Amex Travel portal and the IAP charged just $3,797.40 for a savings of over $600.

Fine Hotels + Resorts ® and The Hotel Collection

American Express also offers the Fine Hotels and Resorts and The Hotel Collection to eligible cardholders.

Fine Hotels and Resorts allows guests to book luxury hotels with special benefits. These include room upgrades, complimentary breakfast, an experience credit, late check-out, early check-in and more.

The Hotel Collection offers similar but less exorbitant benefits. It’s directed toward more midscale properties and includes an experience credit as well as a room upgrade.

35% rebate on redeemed points

Those who hold The Business Platinum Card from American Express are able to get a 35% rebate on points redeemed for eligible flights booked through the Amex Travel portal (up to 1,000,000 points per calendar year).

Eligible flights include all fare classes on an airline that you select each year. It also includes first and business class tickets on any airline.

Quick guide to Amex Membership Rewards

American Express Membership Rewards are the points you earn with eligible Amex cards. These highly flexible and valuable points can be redeemed in a number of ways, though they tend to be most valuable when transferred to Amex airline partners.

Other ways of redeeming Amex points include:

- Gift cards.

- Travel booked via Amex Travel.

- Online shopping.

- Statement credits.

While these are nice options to have, you’ll generally get much less value from your Membership Rewards points by redeeming them in these ways. Finally, although you can redeem your points in the Amex Travel portal, this isn’t necessarily a good idea if you aim to reap maximum value. Even if you’re taking advantage of the 35% rebate on redeemed points for flights, you’ll only ever receive a value of 1.54 cents per point. This is lower than you’d expect when transferring your Amex points to many airline and hotel partners.

Frequently asked questions (FAQs)

No, travel insurance is not automatically included when booking through the Amex portal. But many of the best credit cards feature complimentary travel insurance when using your card to pay, including those from American Express. Otherwise, you may be able to opt in to travel insurance during the booking process or via a third party provider.

Those with the The Platinum Card from American Express can earn 5 Membership Rewards® points per $1 for flights booked directly with airlines or with American Express Travel on up to $500,000 per calendar year, 5 points per $1 on prepaid hotels booked with American Express Travel and 1 point per $1 on other purchases. The card has an annual fee of $695 ( rates & fees ).

Those with the The Business Platinum Card® from American Express * The information for the The Business Platinum Card® from American Express has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer. , meanwhile, earn 5 Membership Rewards points per $1 on flights and prepaid hotels through American Express Travel, 1.5 points per $1 at U.S. construction material & hardware suppliers, electronic goods retailers and software and cloud system providers, shipping providers, and purchases of $5,000 or more on up to $2 million per calendar year and 1 point per $1 on other eligible purchases. The card has a $695 annual fee.

All information about The Business Platinum Card® from American Express has been collected independently by Blueprint.

The phone number for American Express Travel is: 1-800-297-2977.

The number of Amex points that you’ll need to redeem for a flight will depend on the cash cost of your flight and whether you’re booking through Amex Travel or transferring your Membership Rewards points to an Amex airline partner. Amex Points are worth about one cent when booking flights through the portal, so a flight that costs $500 in cash would require about 50,000 Amex points. You’ll typically get a better deal with transfer partners than booking through the portal.

For rates and fees for The Platinum Card® from American Express please visit this page .

*The information for the American Express Centurion Black Card, American Express® Business Gold Card, American Express® Green Card, Amex EveryDay® Credit Card and The Business Platinum Card® from American Express has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

Blueprint is an independent publisher and comparison service, not an investment advisor. The information provided is for educational purposes only and we encourage you to seek personalized advice from qualified professionals regarding specific financial decisions. Past performance is not indicative of future results.

Blueprint has an advertiser disclosure policy . The opinions, analyses, reviews or recommendations expressed in this article are those of the Blueprint editorial staff alone. Blueprint adheres to strict editorial integrity standards. The information is accurate as of the publish date, but always check the provider’s website for the most current information.

Carissa Rawson is a credit cards and award travel expert with nearly a decade of experience. You can find her work in a variety of publications, including Forbes Advisor, Business Insider, The Points Guy, Investopedia, and more. When she's not writing or editing, you can find her in your nearest airport lounge sipping a coffee before her next flight.

Allie is a journalist with a passion for money tips and advice. She's been writing about personal finance since the Great Recession for online publications such as Bankrate, CreditCards.com, MyWalletJoy and ValuePenguin. She's also written personal finance content for Discover, First Horizon Bank, The Hartford, Travelers and Synovus.

Robin Saks Frankel is a credit cards lead editor at USA TODAY Blueprint. Previously, she was a credit cards and personal finance deputy editor for Forbes Advisor. She has also covered credit cards and related content for other national web publications including NerdWallet, Bankrate and HerMoney. She's been featured as a personal finance expert in outlets including CNBC, Business Insider, CBS Marketplace, NASDAQ's Trade Talks and has appeared on or contributed to The New York Times, Fox News, CBS Radio, ABC Radio, NPR, International Business Times and NBC, ABC and CBS TV affiliates nationwide. She holds an M.S. in Business and Economics Journalism from Boston University. Follow her on Twitter at @robinsaks.

Can you pay off one credit card with another?

Credit Cards Louis DeNicola

Amex Gold vs. Platinum

Credit Cards Harrison Pierce

Why I chose the Chase Sapphire Preferred as my first ever rewards card

Credit Cards Sarah Li Cain

How to use Alaska Airlines Companion Fare

Credit Cards Ariana Arghandewal

How I maximize my Chase Ink Business Unlimited Card

Credit Cards Lee Huffman

How to do a balance transfer with Discover

9 ways to maximize the Citi Custom Cash card’s 5% cash-back categories

American Express Business Platinum benefits guide 2024

Credit Cards Chris Dong

Why I applied for the new Wells Fargo Autograph Journey℠ Visa® Card

Credit Cards Jason Steele

Which Citi balance transfer card should I get?

Credit Cards Julie Sherrier

5 reasons why the Citi Diamond Preferred is great for paying down debt

Credit Cards Michelle Lambright Black

Welcome offer on Chase’s IHG One Rewards Premier Business card soars to 175K points

Credit Cards Carissa Rawson

You might be a small business owner and not even know it

Chase Freedom Flex benefits guide 2024

6 ways to maximize the Citi Double Cash Card

Credit Cards Ben Luthi

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

The Guide to the AmEx Travel Portal

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

Who can use the American Express Travel portal?

Benefits of booking travel on amex travel, how to book travel in the portal, is travel insurance included when booking through amex travel, downsides of booking via amex travel, final thoughts on the amex travel portal.

The American Express Travel portal is similar to many other online booking sites in that it allows you to purchase flights, hotels and other travel reservations. The main difference is that only those who hold an American Express card can use it.

Certain cards come with additional perks for booking in the portal. For instance, some AmEx cards allow travelers to earn extra points for bookings, receive a 35% points rebate, pay for a portion of the reservation with points, get room upgrades and more. Terms apply.

Here's a look at what the AmEx Travel portal offers and how to use it to maximize your benefits.

American Express Travel flights, hotels and other reservations are available for American Express cardholders. Depending on which American Express card you have, you may earn additional points on your reservation or unlock additional features. Terms apply.

For example, The Platinum Card® from American Express cardholders earn 5x points on flights booked directly with an airline or through AmEx Travel and 5x points on prepaid hotels booked through AmEx Travel. They also have access to the Fine Hotels & Resorts collection through the travel portal. Additionally, American Express® Gold Card and The Platinum Card® from American Express cardholders can book room reservations with The Hotel Collection . Terms apply.

Here are eight reasons why booking with AmEx travel could be a good idea.

1. Earn up to 5x points

When you book flight through the AmEx Travel portal, your credit card may earn additional points for the purchase. In addition, prepaid hotel reservations through the AmEx travel portal also earn extra points. These are a few of the cards that offer a bonus when making reservations through AmEx travel:

on American Express' website

• 5 points per $1 on flights booked directly with airlines or with American Express Travel, on up to $500,000 spent per year.

• 5 points per $1 on prepaid hotels booked with American Express Travel.

• 1 point per $1 on other eligible purchases.

Terms apply.

• 4 points per $1 at restaurant plus takeout and delivery in the U.S.

• 4 points per $1 at U.S. supermarkets (on up to $25,000 in purchases per year).

• 3 points per $1 on flights booked directly with airlines or with American Express Travel.

• 3 points per $1 on eligible travel purchases.

• 3 points per $1 on restaurants worldwide.

• 1 point per $1 on other purchases.

• 2 points per $1 on the first $50,000 in purchases each calendar year.

• 1 point per $1 on purchases above $50,000 in a calendar year.

» Learn more: AmEx Membership Rewards: How to earn and use them

2. Pay for reservations using Pay with Points

With American Express Travel, flights, hotels and more can be paid for with points instead of cash. Members can even choose to pay a portion of the trip with points and the rest with cash. Once your reservations have been booked, the full amount of your trip will be charged to your American Express credit card, and then a credit will be posted for the points redeemed within 48 hours.

You must redeem at least 5,000 points in order to use Pay with Points. Points are redeemed at a value of 1 cent per point when booking flights or making Fine Hotels & Resorts reservations. Other eligible travel receives only 0.7 cents per point. NerdWallet values Membership Rewards points at 2.8 cents per point if you take advantage of transferring to and booking through travel partners, so the redemption rates in the travel portal are significantly below our ideal value.

If you need to cancel your reservation, you'll receive a statement credit on your card for the cash equivalent. Members who would rather have the unused Membership Rewards points returned to their accounts must contact American Express customer service at 800-297-3276. Terms apply.

3. Upgrade flights with points

Eligible flights booked with cash can be upgraded using your American Express Membership Rewards points. You'll receive 1 cent per point credit towards the cost when upgrading a flight with points (which is again below our AmEx point valuation ).

To upgrade your flight with points, select your airline and provide your reservation details in the AmEx travel portal. You will be notified if your flight is eligible or not. If your flight is eligible, you can submit an offer to the airline for the upgrade. The airline will accept or reject your bid between one and five days of your flight's departure and you'll receive a decision via email.

If your upgrade offer is accepted, the points will be deducted from your account. Your statement will show a charge and a credit for the corresponding points.

» Learn more: You can now use AmEx points to bid on flight upgrades

4. Discounted international flights through AmEx IAP

Platinum cardholders have access to discounted flights through International Airline Program (IAP) , which allows members to book first, business and premium economy at a discount on select airlines and routes. Plus, you'll receive 5x Membership Rewards points on the booking when using your The Platinum Card® from American Express or The Business Platinum Card® from American Express to pay for the flight. Terms apply.

There are 25 airlines that participate in this program. You can book refundable and nonrefundable tickets for up to eight passengers through the IAP. Tickets can be paid with your card, points or a combination of the two. You will have to pay a $39 nonrefundable ticketing fee, however the discount received on these tickets should outweigh the fee.

5. Cancel For Any Reason insurance

CFAR is shorthand for an insurance policy that allows you to cancel your trip for any reason whatsoever and receive a refund. In May 2022, AmEx launched its own version of CFAR coverage for airfare booked through the travel portal using an AmEx card.

This feature, called Trip Cancel Guard, will get you up to a 75% reimbursement on nonrefundable airfare costs, provided you cancel at least two calendar days out from your departure. You'll need to purchase Trip Cancel Guard coverage at the point of booking and if you cancel, whether through the airline directly or through AmEx Travel, you can request reimbursement online or over the phone.

» Learn more: The guide to Cancel For Any Reason (CFAR) travel insurance

6. 35% points rebate with The Business Platinum Card® from American Express

When The Business Platinum Card® from American Express cardholder book flights using points through the AmEx travel portal, they can receive up to 35% of their points back . The benefit is available on first or business class flights on any airline and all economy flights with their chosen airline. This benefit provides up to 500,000 points back per calendar year.

However, as with all AmEx credits , it's not as straightforward as you may hope. You will have to designate the airline for the 35% rebate and the airline must be the same as the one chosen for the $200 airline incidental credit .

» Learn more: The best travel credit cards right now

7. Fine Hotels & Resorts

The Loews Portofino Bay Hotel at Universal Orlando. (Photo by Sally French)

Fine Hotels & Resorts (FHR) is a collection of resorts and benefits available only to Platinum Card members. There are over 2,000 properties worldwide that participate in this program. When making reservations with Fine Hotels & Resorts for one night or more, you'll receive the following benefits:

$200 statement credit provided once per year.

Noon check-in (when available).

Room upgrade upon arrival (when available).

Daily breakfast for two.

Guaranteed 4 pm late checkout.

Complimentary in-room WiFi.

Unique property benefit valued at least $100.

These benefits rival those that many travelers receive when booking directly with hotels to obtain elite status perks. Some locations also offer a last-night free benefit, depending upon when you make your reservation. And some of the best hotels to book using FHR credits offer especially-unique amenities.

For example, many theme park fans consider Loews Portofino Bay Hotel as the best FHR hotel in Orlando . That's because — on top of all the above benefits — guests receive complimentary Universal Express Unlimited ride access, which allows you to skip the lines inside the Universal theme parks .

8. The Hotel Collection

The Loews Sapphire Falls at Universal Orlando falls under The Hotel Collection. (Photo by Sally French)

AmEx Gold and Platinum cardholders receive elite status-level perks at more than 600 hotels worldwide. When you stay for two nights or more, you'll receive a $100 resort credit and an upgrade upon arrival (when available). In addition, you can use your AmEx Membership Rewards credit card to book and pay for your reservation entirely or partially with your points.

While you can book travel over the phone with an agent, it is often quicker and more convenient to make your reservations through the AmEx Travel portal.

Here's how to book travel in the American Express travel portal:

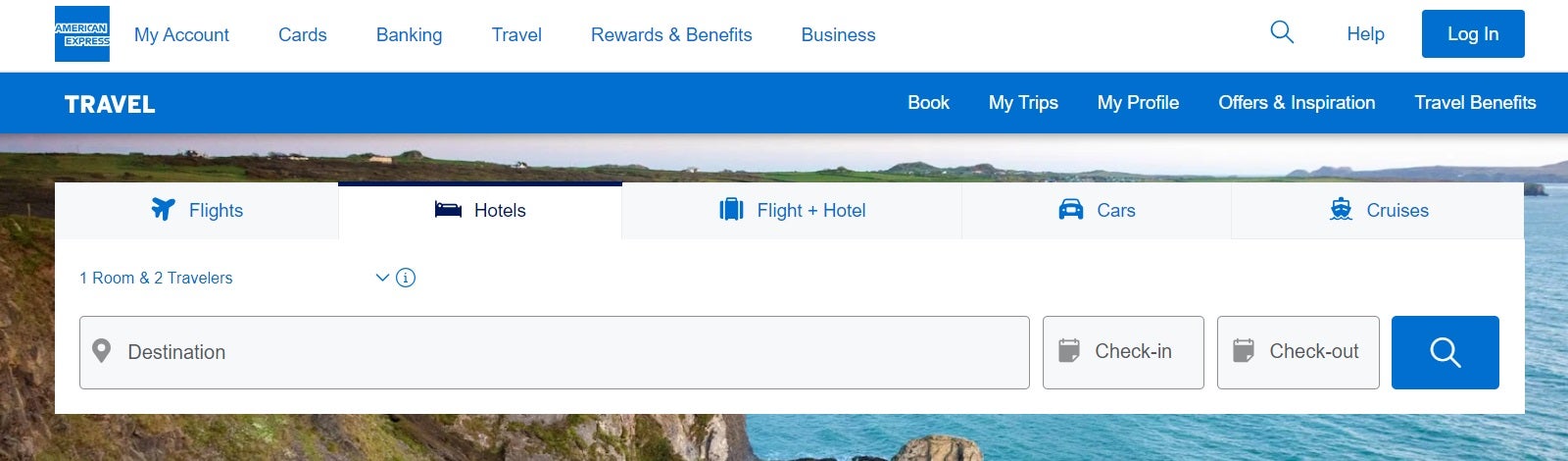

Go to americanexpress.com/en-us/travel/ .

Log in with your username and password.

Select flights, hotels, flight + hotel, cars, or cruises.

Enter your travel dates, cities and other relevant information.

Choose options based on your trip.

Pay with your American Express credit card, points, or a combination.

Since you need an American Express card to make reservations through AmEx travel, you may already hold a card that offers complimentary travel insurance . If you don’t get travel insurance perks through your AmEx card, you can purchase Trip Cancel Guard through when making your booking.

Trip Cancel Guard works similarly to CFAR in that it allows you to cancel your trip for any reason whatsoever and get up to a 75% reimbursement of your travel costs as long as the cancellation is made two full days before your trip.

What is the AmEx Travel cancellation policy?

When you book travel through the American Express travel portal, you may be eligible to cancel your reservation within 24 hours and get a full refund. However, the cancellation policy is determined by the airline.

As such, AmEx instructs travelers to refer to the cancellation policy on the itinerary or reach out to customer service with any questions. Terms apply.

There are many appealing reasons why travelers want to book reservations with the AmEx travel portal. However, there are some downsides as well. These are some of the most common reasons why you shouldn't:

Low value for your points. Redeeming points through the AmEx travel portal yields a value of 1 cent per point or less. That's at least a 50% reduction compared to our value of Membership Rewards points.

Complicated customer service. Resolving flight or hotel reservation issues becomes more complicated when you book through a third party such as AmEx travel. The airline or hotel blames the booking agency and may not immediately resolve the problem in some instances. However, providers have no scapegoat when you book direct.

No hotel elite status benefits or loyalty credits. Most hotels require you to book directly to receive elite status benefits, stay credits or earn points. For travelers looking to take advantage of their elite status or earn status for the next year, booking AmEx travel hotel reservations is not a good idea.

Despite the above policy, hotels booked through Fine Hotels & Resorts allow you to earn elite night credit and earn loyalty perks associated with your elite status level on any hotel reservations — regardless if you book in the portal or not.

The AmEx travel portal offers numerous benefits for all American Express cardholders. If you have a Membership Rewards credit card, you can pay for all or part of eligible travel reservations using your points.

And any portion that you pay with your Membership Rewards card can earn up to 5x points. AmEx Travel also offers two hotel collections that provide additional perks similar to elite status benefits.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

On a similar note...

- Credit Cards

- All Credit Cards

- Find the Credit Card for You

- Best Credit Cards

- Best Rewards Credit Cards

- Best Travel Credit Cards

- Best 0% APR Credit Cards

- Best Balance Transfer Credit Cards

- Best Cash Back Credit Cards

- Best Credit Card Sign-Up Bonuses

- Best Credit Cards to Build Credit

- Best Credit Cards for Online Shopping

- Find the Best Personal Loan for You

- Best Personal Loans

- Best Debt Consolidation Loans

- Best Loans to Refinance Credit Card Debt

- Best Loans with Fast Funding

- Best Small Personal Loans

- Best Large Personal Loans

- Best Personal Loans to Apply Online

- Best Student Loan Refinance

- Best Car Loans

- All Banking

- Find the Savings Account for You

- Best High Yield Savings Accounts

- Best Big Bank Savings Accounts

- Best Big Bank Checking Accounts

- Best No Fee Checking Accounts

- No Overdraft Fee Checking Accounts

- Best Checking Account Bonuses

- Best Money Market Accounts

- Best Credit Unions

- All Mortgages

- Best Mortgages

- Best Mortgages for Small Down Payment

- Best Mortgages for No Down Payment

- Best Mortgages for Average Credit Score

- Best Mortgages No Origination Fee

- Adjustable Rate Mortgages

- Affording a Mortgage

- All Insurance

- Best Life Insurance

- Best Life Insurance for Seniors

- Best Homeowners Insurance

- Best Renters Insurance

- Best Car Insurance

- Best Pet Insurance

- Best Boat Insurance

- Best Motorcycle Insurance

- Travel Insurance

- Event Ticket Insurance

- Small Business

- All Small Business

- Best Small Business Savings Accounts

- Best Small Business Checking Accounts

- Best Credit Cards for Small Business

- Best Small Business Loans

- Best Tax Software for Small Business

- Personal Finance

- All Personal Finance

- Best Budgeting Apps

- Best Expense Tracker Apps

- Best Money Transfer Apps

- Best Resale Apps and Sites

- Buy Now Pay Later (BNPL) Apps

- Best Debt Relief

- Credit Monitoring

- All Credit Monitoring

- Best Credit Monitoring Services

- Best Identity Theft Protection

- How to Boost Your Credit Score

- Best Credit Repair Companies

- Filing For Free

- Best Tax Software

- Best Tax Software for Small Businesses

- Tax Refunds

- Tax Brackets

- Taxes By State

- Tax Payment Plans

- Help for Low Credit Scores

- All Help for Low Credit Scores

- Best Credit Cards for Bad Credit

- Best Personal Loans for Bad Credit

- Best Debt Consolidation Loans for Bad Credit

- Personal Loans if You Don't Have Credit

- Best Credit Cards for Building Credit

- Personal Loans for 580 Credit Score Lower

- Personal Loans for 670 Credit Score or Lower

- Best Mortgages for Bad Credit

- Best Hardship Loans

- All Investing

- Best IRA Accounts

- Best Roth IRA Accounts

- Best Investing Apps

- Best Free Stock Trading Platforms

- Best Robo-Advisors

- Index Funds

- Mutual Funds

- Home & Kitchen

- Gift Guides

- Deals & Sales

- Sign up for the CNBC Select Newsletter

- Subscribe to CNBC PRO

- Privacy Policy

- Your Privacy Choices

- Terms Of Service

- CNBC Sitemap

Follow Select

Our top picks of timely offers from our partners

Find the best credit card for you

How to use the amex travel portal: booking flights, hotels and more, you can use amex points to book flights, hotels, car rentals and more through its travel portal..

Terms apply to American Express benefits and offers. Visit americanexpress.com to learn more. Information about the American Express® Green Card has been collected independently by Select and has not been reviewed or provided by the issuer of the card prior to publication.

Using American Express Membership Rewards (MR) points to book prepaid flights, hotels, cruises, rental cars and vacation packages through the Amex Travel portal can be a great way to save money on your next vacation. But are you really getting the best value by redeeming your hard-earned points this way?

Whether you use the portal or transfer points to an American Express travel partner is up to you, as are other factors — from travel date flexibility, award availability and the type of credit card you're using to personal preferences for brands, seat class and comfort level. These will all come into play during the booking process.

Below, CNBC Select breaks down the best ways to book prepaid flights, hotels, cruises, rental cars and vacation packages with Amex points through the Amex Travel portal.

Our best selections in your inbox. Shopping recommendations that help upgrade your life, delivered weekly. Sign-up here .

Earning and redeeming Amex Membership Rewards points

You can access the Amex Travel portal and pay for flights, hotels and other travel needs with cash as long as you have an American Express branded credit card, but you will need one that earns Membership Rewards (MR) points to view the number of MR points required for a booking.

Luckily, American Express has several travel rewards cards that you can earn lucrative welcome offers to help you get started:

- The Platinum Card® from American Express : Earn 80,000 Membership Rewards® points after spending $8,000 within the first six months of card membership.

- American Express® Gold Card : Earn 60,000 Membership Rewards® points after you spend $6,000 on eligible purchases with your new card within the first 6 months of card membership.

- American Express® Green Card : Earn 60,000 Membership Rewards® Points after you spend $3,000 on purchases on your new Card in your first 6 months of Card Membership. Plus, earn 20% back on eligible travel and transit purchases made during your first 6 months of Card Membership, up to $200 back in the form of a statement credit.

- Blue Business® Plus Credit Card from American Express : Earn 15,000 Membership Rewards® points after you spend $3,000 in eligible purchases on the card within your first 3 months of card membership.

- The Business Platinum Card from American Express : Earn 120,000 Membership Rewards® points after you spend $15,000 in eligible purchases on the card within your first 3 months of card membership.

- American Express® Business Gold Card : Earn 70,000 Membership Rewards® points after you spend $10,000 in eligible purchases on the card within your first 3 months of card membership.

Depending on which credit card you have, there may be opportunities to earn bonus points or receive partial rebates when redeeming MR points for flights. The Platinum Card , for instance, lets cardholders earn 5X points on flights booked through the Amex Travel portal or directly with the airline on up to $500,000 worth of flights per calendar year.

The Business Platinum Card also gives cardholders redeeming MR points for economy flights with their preferred airline or booking premium-class flights through the portal a 35% points rebate (up to 500,000 points per calendar year). Those booking with the American Express Business Gold Credit Card receive a similar rebate of 25% back on up to 250,000 points each year.

Another valuable perk of having The Platinum Card or The Business Platinum Card is the up to $200 annual airline credit you can use to cover checked bag fees, change fees, charges for pet's flights, choosing your seat and inflight amenities with your preferred airline, all of which can quickly add up.

The Platinum Card® from American Express

Earn 5X Membership Rewards® Points for flights booked directly with airlines or with American Express Travel up to $500,000 on these purchases per calendar year, 5X Membership Rewards® Points on prepaid hotels booked with American Express Travel, 1X points on all other eligible purchases

Welcome bonus

Earn 80,000 Membership Rewards® Points after you spend $8,000 on purchases on your new Card in your first 6 months of Card Membership. Apply and select your preferred metal Card design: classic Platinum Card®, Platinum x Kehinde Wiley, or Platinum x Julie Mehretu.

Regular APR

See Pay Over Time APR

Balance transfer fee

Foreign transaction fee, credit needed.

Excellent/Good

See rates and fees , terms apply.

Read our The Platinum Card® from American Express review .

Getting started with the American Express Travel portal

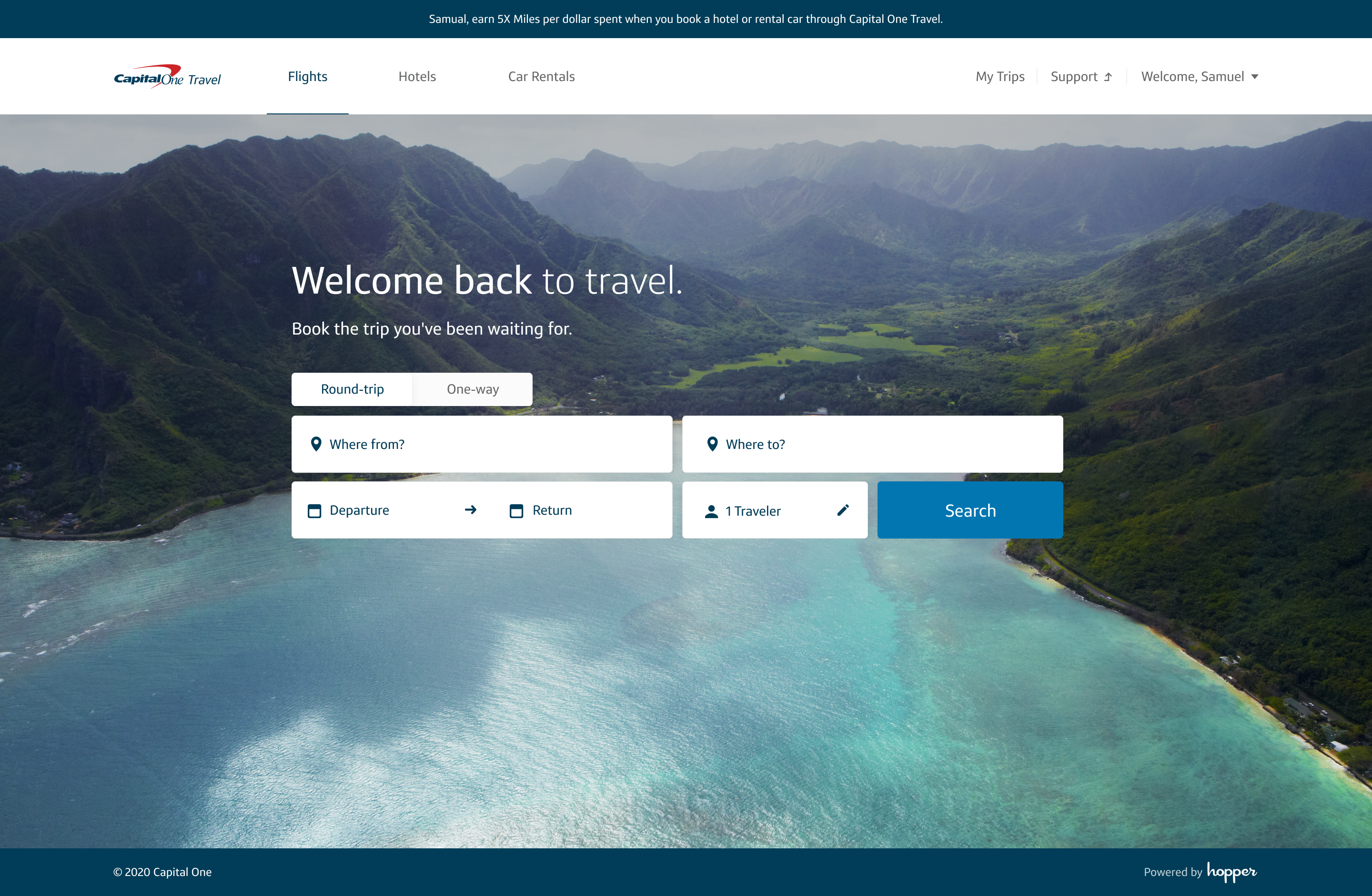

Start by logging in to your American Express account. If you're coming from your account's dashboard page, click "Menu" in the top left corner, then select "Travel" to access more options (pictured below) and select "Book a Trip" to head to the main travel portal.

The Amex Travel portal's front page resembles your average travel booking interface, with options to search for flights, hotels, vacation packages, rental cars and cruises.

Below the main search engine, you'll find current information about cancellation policies and other important pandemic travel details. There's also an interactive map showing Covid-19 testing and vaccination requirements around the world.

Hovering over the "Book" button at the top of the page opens a separate menu with shortcuts to various portal perks, like the International Airline Program (IAP), Amex Fine Hotels + Resorts and The Hotel Collection.

Hovering over the "Explore" button in the main menu leads to many of the same shortcuts, plus options for finding a Travel Insider, Special Offers through Fine Hotels + Resorts and information about destinations and premium hotel packages.

Whether you're booking flights, hotels or other travel through the portal, you'll be given an option to "Use Only Points" or "Use Points + Card" so it's up to you if you want to redeem all your points or just some. Either way, your credit card will be charged the full amount and you'll see a credit for the value of the points used posted separately to your account within 48 hours. Be aware that you will have to use an Amex credit card that's enrolled in the Membership Rewards program and redeem at least 5,000 MR points in order to activate the Pay with Points feature.

Should you need to cancel a booking made with MR points, call 1-800-297-3276 to get them returned. You'll receive a statement credit for any bookings made with your American Express Membership Rewards card through the portal.

How to book flights through the American Express Travel portal

While you're more likely to get the best redemption value by transferring MR points to one Amex's airline partners and taking advantage of airline alliances (Oneworld, SkyTeam, Star Alliance) to book flights, there are still some considerations to keep in mind when it comes to booking through the portal.

Note that with most Amex Travel Portal bookings your MR points will only be worth 1 cent each towards flights. So if you were booking a $100 flight, you'd need to redeem 10,000 points to cover the cost.

For starters, you'll have more flexibility as far as travel dates and brands, which comes in handy when award availability is limited on certain dates through certain airlines. Flights booked with MR points through the portal are treated as paid bookings, so you won't miss out on earning elite miles or status credits. You'll also be able to see which type of seat you're booking right away, as it's listed on the right side of each search result.

It's always a good idea to shop around before settling on a redemption method, so price out how many points each flight costs through the Amex Travel portal vs. on the airline's website. Taxes and fees may also be tacked on. Unless you have the Platinum Card or Business Platinum Card , be aware that airline ticket fees of $6.99 for domestic flights and $10.99 for international flights apply when you're booking through the Amex Travel portal.

Note that low-cost carriers like Allegiant Air, Frontier Airlines and Spirit Airlines aren't part of the Amex Travel portal, though you will be able to find flights with other major American carriers like Delta and United, among other international airline partners.

During the booking process, you'll have a chance to use MR points to upgrade from economy to nonrefundable or refundable seats in premium classes, though it may not provide the best redemption value. If, however, you do have plenty of MR points lying around and crave a fancier flight experience, this is a good option. Again, it all comes down to personal preference and comfort level.

Deals on international flights can also be found by booking through the International Airline Program (IAP), which offers discounts on non-economy tickets when you book flights through one of 26 participating airlines through the Amex Travel portal with a Platinum Card or Business Platinum Card . Flights must begin in the U.S. or select cities in Canada in order to qualify for this perk and you'll have to pay a $39 service fee per ticket.

Filter search results by the number of stops, departure and landing time, airline or flight number, or sort them according to lowest price, flight duration, departure time or Amex recommendation (which usually means Delta flights will appear first, even if they're not necessarily your cheapest option).

Consider the example below, a search for a round-trip nonstop flight from Washington, D.C. to Paris from November 5-12, 2021, booked with the Amex Platinum Card. The results included a Delta flight from $674 or 67,425 MR points.

Alternatively, if you wanted to transfer your Amex MR points directly to Delta (since it's one of American Express' travel partners and you can switch them over at a 1:1 ratio) and redeem them through Delta's website, a round-trip flight would set you back 58,000 Delta SkyMiles plus another $96 in taxes and fees.

In this case, for 9,425 miles less, you'd end up with a better redemption by transferring MR points to Delta instead of going through the Amex Travel portal. But that's not necessarily the case for every flight, so always test it out first to see if using the portal makes the most sense for your travel needs.

To finish booking your flight through the portal, chose your desired route(s), review the details, select your upgrade option and pick how many MR points you'd like to put toward your purchase.

How to book hotels through the American Express Travel portal

As with flights, it's important to make sure you're getting the best deal on your MR points redemption. Consider transferring them to one of Amex's three hotel partners — Hilton Honors at a 1:2 ratio, Marriott Bonvoy at a 1:1 ratio, or Choice Privileges (Choice Hotels) at a 1:1 ratio, though there's a special promotion now through October 31, 2021, that bumps up Hilton and Marriott transfers by 30 percent.

Note that with most Amex Travel Portal bookings your MR points will only be worth .7 cent each towards hotel stays. So if you were booking a $100 hotel you'd need to redeem about 14,300 points to cover the cost. However, if you book a stay through Amex's Fine Hotels & Resorts program your points will be worth a little more, at 1 cent apiece.

Unlike MR points redemptions for flights, hotels booked through the portal are viewed as third-party reservations, so you won't be able to earn hotel points or enjoy status-related perks you'd have by booking directly through the hotel.

Begin your search by plugging in your travel dates and destination. Then, filter results by hotel or brand, star rating, price per night, neighborhood, amenities or accessibility, and sort by name, price, star rating or Amex recommendation.

For the following example, we searched for a seven-night stay booked November 5–12, 2021, with the Amex Platinum Card . The Renaissance Paris Arc De Triomphe Hotel, a Marriott Bonvoy property, was one of the best options, with rates from $306 or 43,723 MR points per night.

When booking the same stay through the Marriott website, you'd need 340,000 Marriott Bonvoy points for seven nights (which breaks down to 48,571 points per night), with nightly cash rates starting at 367 euros or $433. In this case, it would make more sense to book it through the portal. You could also earn 5X points for the stay by paying with the Amex Platinum Card or Business Platinum Card.

Make it a habit to compare the number of points required by the portal with the number of points needed to redeem through each hotel's website, as pricing may be affected by location and time of year, among other factors. To complete your booking through the Amex Travel portal, choose your room type, review the details and select how many points you'd like to use.

Premium cardholders also have access to the Fine Hotels & Resorts program, which adds extra benefits per stay at more than 1,200 properties around the world, based on availability:

- 12 p.m. check-in and guaranteed 4 p.m. late check-out

- Complimentary room upgrades and Wi-Fi

- Daily breakfast for two

- A $100 credit to use toward on-property activities, dining or other perks like airport transfers, depending on your hotel

Additionally, those with the Amex Gold Card, Business Gold Card, Platinum Card, Business Platinum Card , and in some cases, the Centurion Card, can book trips through The Hotel Collection. Note that Amex Gold Card members earn 2X points, while Platinum Card members earn 5X points on such bookings, but all receive the following benefits per stay of two or more nights:

- A credit of up to $100 to use toward on-property dining, spa, or activities

- Room upgrades (based on availability)

- Discounted rates, depending on the hotel

The Amex Travel portal also lets you search for and book vacation packages, which, depending on what kinds of sales are happening at the time, can save you a bundle or end up costing about the same as it would be to book your flight and hotel separately. If you do book a package, note that the same airline ticket fees apply as when you book separately (not for Platinum and Business Platinum cardholders, who have them waived). Cards earning MR points will score 2X points on packages, while those with Amex Platinum and Business Platinum cards will earn 5X points.

How to book cruises and car rentals

While cashing in a ton of MR points for a cruise or car rental may not yield the best redemption (your points will be worth just .7 cents each), it may still be a good option depending on your travel needs.

Click on the "Cruises" tab of the Amex Travel portal homepage to search by cruise line, destination, travel dates and sailing duration. Below, for example, are some results for Mediterranean cruises in November 2021.

The prices shown reflect the cost per person, based on double occupancy cabins. Depending on which card you're using and the cruise options available, you should be able to redeem Amex MR points for a portion of or all of your sailing.

Those booking with Membership Rewards credit cards can earn 2X points per dollar spent on cruises booked through the portal, while folks with Platinum Cards or Business Platinum Cards can score stateroom credits of $100–$300 and other onboard perks through the Cruise Privileges program.

As far as car rentals, it's a pretty similar search process — just plug in your destination, whether you want to drop the car off in the same place or in a different location, your dates and the time you want to begin and end your rental.

Once the results appear, you can filter by the type of car (standard, compact, premium, etc), the option to pay now or later, price per day, pick-up location, rental car company and features like unlimited mileage, automatic vs. manual transmission, Hybrid/Electric cars or 4WD. Sort results by distance or total price.

After choosing your car, you'll be asked if you want to pay now, which means you'll be able to use MR points to book part of or all of your prepaid rental, or pay later, which means you'll have to pay cash at rental car counter — doing so can earn you 2X points per dollar, so it's an easy way to rack up some more MR points.

Next, enter information about the driver, pick how you want to pay (how many points or with cash), and review the rental car policies. As always, it doesn't hurt to comparison shop, so run the numbers through the actual rental car companies before you book to make sure you're getting the biggest bang for your buck.

Bottom line

Booking through the Amex Travel portal is a simple way to redeem your MR points, however you'll usually get much more value from Amex points if you transfer them to an airline or hotel partner's loyalty program. If you do book through Amex's Travel Portal remember that your points are worth 1 cent per point towards flights and .7 cents apiece towards other travel (except when booking a Fine Hotels + Resort property).

Catch up on CNBC Select's in-depth coverage of credit cards , banking and money , and follow us on TikTok , Facebook , Instagram and Twitter to stay up to date.

Money matters — so make the most of it. Get expert tips, strategies, news and everything else you need to maximize your money, right to your inbox. Sign up here .

For rates and fees of The Platinum Card® from American Express, click here .

- 5 things to avoid if you’re applying for a mortgage Kelsey Neubauer

- Best sole proprietorship business credit cards Jason Stauffer

- This is the best budgeting app to help investors track their money Jasmin Suknanan

American Express travel portal guide

Advertiser disclosure.

We are an independent, advertising-supported comparison service. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence.

Bankrate has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover.

- Share this article on Facebook Facebook

- Share this article on Twitter Twitter

- Share this article on LinkedIn Linkedin

- Share this article via email Email

- • Credit cards

- • Rewards credit cards

The Bankrate promise

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here's an explanation for how we make money . The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired. Terms apply to the offers listed on this page. Any opinions, analyses, reviews or recommendations expressed in this article are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by any card issuer.

At Bankrate, we have a mission to demystify the credit cards industry — regardless or where you are in your journey — and make it one you can navigate with confidence. Our team is full of a diverse range of experts from credit card pros to data analysts and, most importantly, people who shop for credit cards just like you. With this combination of expertise and perspectives, we keep close tabs on the credit card industry year-round to:

- Meet you wherever you are in your credit card journey to guide your information search and help you understand your options.

- Consistently provide up-to-date, reliable market information so you're well-equipped to make confident decisions.

- Reduce industry jargon so you get the clearest form of information possible, so you can make the right decision for you.

At Bankrate, we focus on the points consumers care about most: rewards, welcome offers and bonuses, APR, and overall customer experience. Any issuers discussed on our site are vetted based on the value they provide to consumers at each of these levels. At each step of the way, we fact-check ourselves to prioritize accuracy so we can continue to be here for your every next.

Editorial integrity

Bankrate follows a strict editorial policy , so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

Key Principles

We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Editorial Independence

Bankrate’s editorial team writes on behalf of YOU — the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information.

How we make money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey.

Bankrate follows a strict editorial policy , so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service.

Key takeaways

- The American Express travel portal (AmexTravel.com) lets individuals book airfare, hotel stays, cruises and more with cash or points.

- In order to book travel with rewards through this portal, you need an American Express credit card that earns Amex Membership Rewards points.

- While booking through the portal can make sense, there are scenarios where you can save points by transferring them to Amex airline and hotel partners instead.

- Make sure to familiarize yourself with Amex transfer partners so you can make an informed decision on the best ways to use your rewards.

Most popular travel credit cards let you redeem your points in more than one way, including the option to use points to book travel through a portal.

This is true of Chase Ultimate Rewards credit cards like the Chase Sapphire Reserve® and Chase Freedom Flex℠ *, both of which let you book travel directly through the Chase travel portal. But it’s also true for Citi credit cards like the Citi Prestige® Card *, which lets you book airfare, hotels and more through the Citi ThankYou travel portal.

American Express also makes it possible for cardholders to book travel through its own portal, found at AmexTravel.com. This portal works similarly to most of the other travel booking portals you can find online, with the exception that you can shop with American Express Membership Rewards points, cash or a combination of the two.

To book travel with points through AmexTravel.com, all you need is a credit card that earns points in the American Express Membership Rewards program. That said, anyone can book travel through this portal and pay with another form of payment, such as a credit card.

What are the benefits of booking through AmexTravel.com?

AmexTravel.com is a third-party booking site that works similarly to competitors like Expedia.com or Orbitz.com. You can use it to compare prices for airfare, hotels and more across the web, just like you would with another booking site.

But there are more benefits to using this portal if you’re an American Express cardholder. If you have The Business Platinum Card® from American Express , for example, you can get 35 percent of your points back (up to 1,000,000 points per calendar year) when you use rewards to book first or business class tickets or any flight with your selected airline.

Also, note that both the business version and The Platinum Card® from American Express for consumers let you earn 5X points when you purchase prepaid flights or prepaid hotels through American Express Travel (on up to $500,000 in airfare spending with the consumer card). Meanwhile, the popular American Express® Gold Card lets you earn 3X points on flights booked through AmexTravel.com.

Beyond specific cardholder benefits, AmexTravel.com makes it easy to compare flight and hotel options. You may also find offers that include additional benefits when you book a cruise through the portal, such as onboard credits or free specialty meals.

How to use the Amex travel portal to book flights and hotels

Using the Amex travel portal to book flights, hotels, cruises and other travel is a lot like using any other travel booking site. AmexTravel.com is set up to make it easy to search for travel and compare multiple flight and hotel options in one place.

Besides flights, hotels and cruises, you can also use AmexTravel.com to book rental cars and vacation packages. All you have to do is head to AmexTravel.com and enter some basic details on the travel you want to book. From there, you’ll be shown a selection you can choose from.

Cash vs. points

When using the Amex travel portal to pay for hotels, flights and other bookings, you have the option to pay with points, cash or a combination of the two.

To fully or partially pay with points, all you have to do is head to the American Express website and log in to your account. Once you find the travel you want and prepare to book, you can select the option to “Use only points” or to “Use points + card.” You can also pay for travel through AmexTravel.com with only your credit card as payment or use the Amex “Plan it” feature for your booking.

Once you book and choose how you want to pay, your credit card will be charged the full dollar amount of your booking. A credit for any points you used, however, will be applied to your account within 48 hours, per American Express.

Note that you’ll need at least 5,000 Membership Rewards points to pay with points. This rule makes it a little more difficult to use up any leftover points you might have from other bookings. However, it shouldn’t be too hard to reach the 5,000 point threshold for travel if you have an American Express card that earns Membership Rewards points.

When it comes to booking flights, there are a few interesting details to note. If you have an Amex card that offers access to Centurion Lounges or Delta Sky Clubs, for example, you’ll see a note showing qualification for lounge access on flights that apply. You can use Amex points to book a business or first class flight or to upgrade your flight.

You also have the option to transfer your American Express Membership Rewards points to Amex airline and hotel partners . Using the American Express travel portal may or may not be a better deal, but you do get the benefit of booking any travel you want without having to worry about award availability.

Booking flights through Amex

Before you book flights through AmexTravel.com with your points, find out if you could get a better deal by transferring your rewards to an Amex airline partner instead. Fortunately, you can easily find this out by comparing award flights with your favorite airline to what the cost would be for airfare through AmexTravel.com.

Here’s an example of how this could work. Let’s say you want to fly from Indianapolis, Indiana to Miami, Florida on Delta Air Lines on a specific travel date in February of 2024. In that case, you could easily see how many miles you would need on the Delta website by searching for the travel you want and clicking on the button that says “Shop with Miles.”

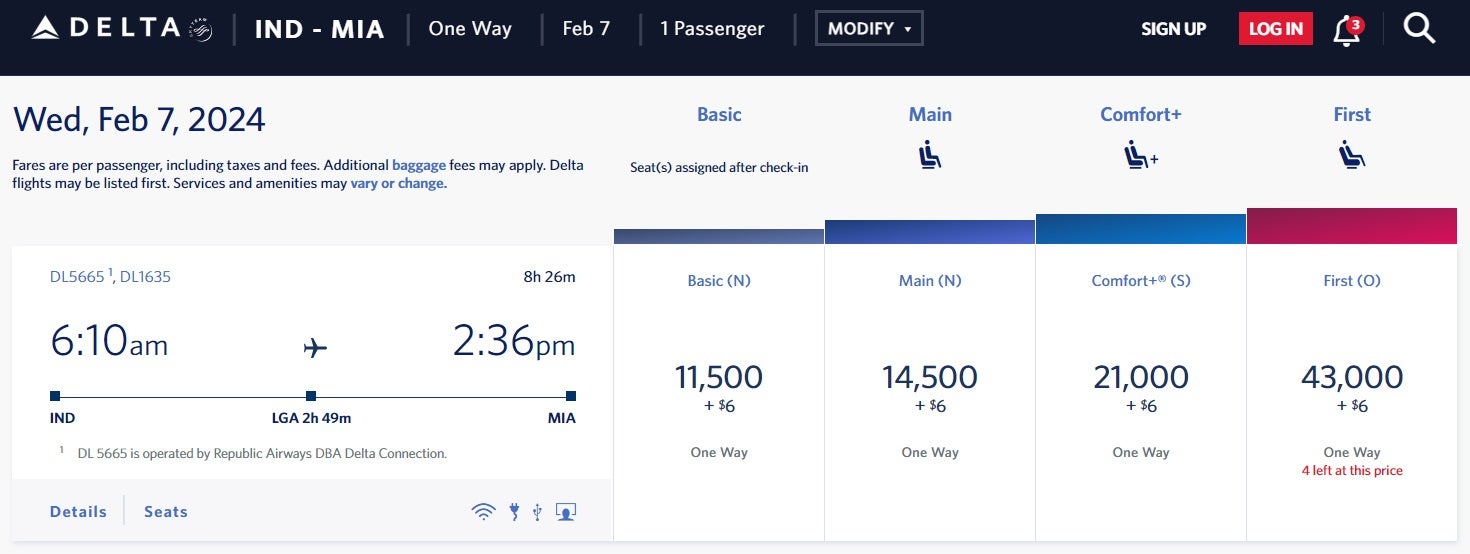

As you can see, the flight in question starts at 11,500 miles plus $6 in basic economy and 14,500 miles plus $6 in main cabin economy through the Delta website.

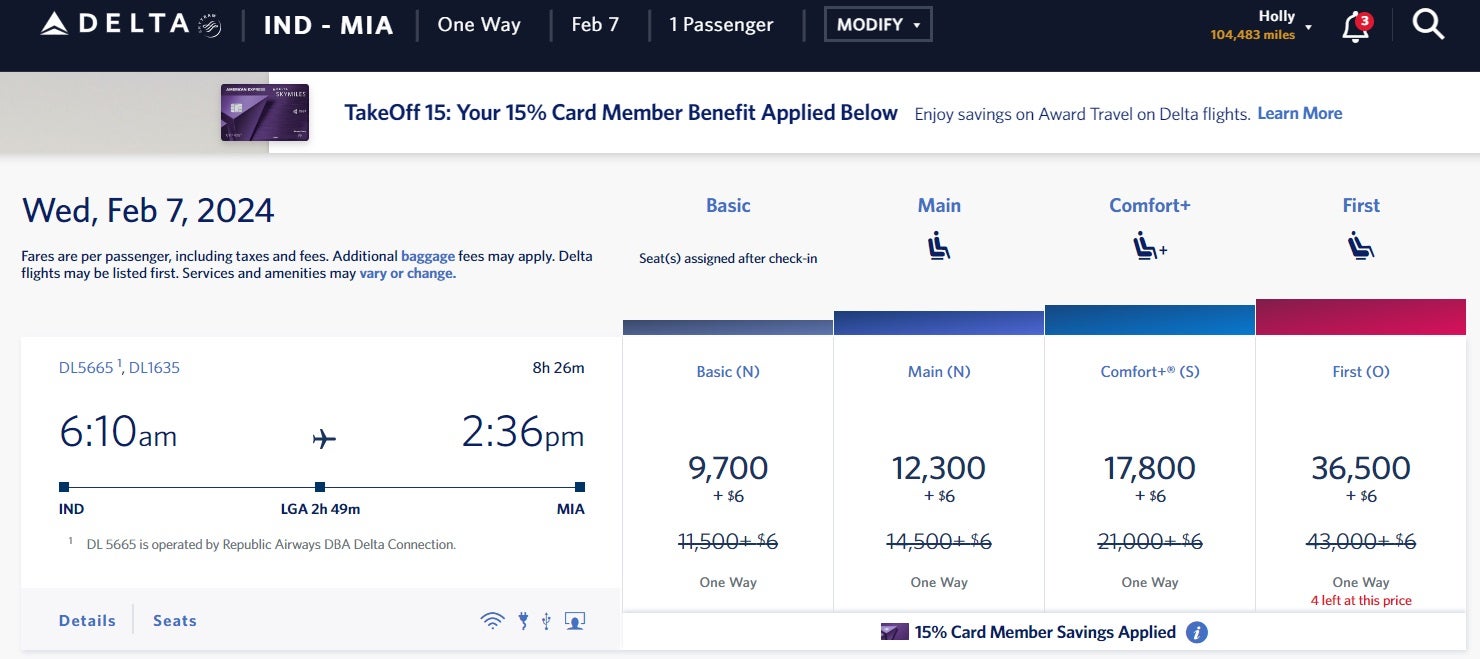

Interestingly, whether or not you have a Delta credit card can also come into play here. This is due to the fact that Delta credit cards offer a feature called “TakeOff 15” that automatically grants cardholders 15 percent off flights they book with miles. If you were a Delta credit card customer, this flight would cost you 9,700 miles in basic economy or 12,300 miles in main cabin economy instead.

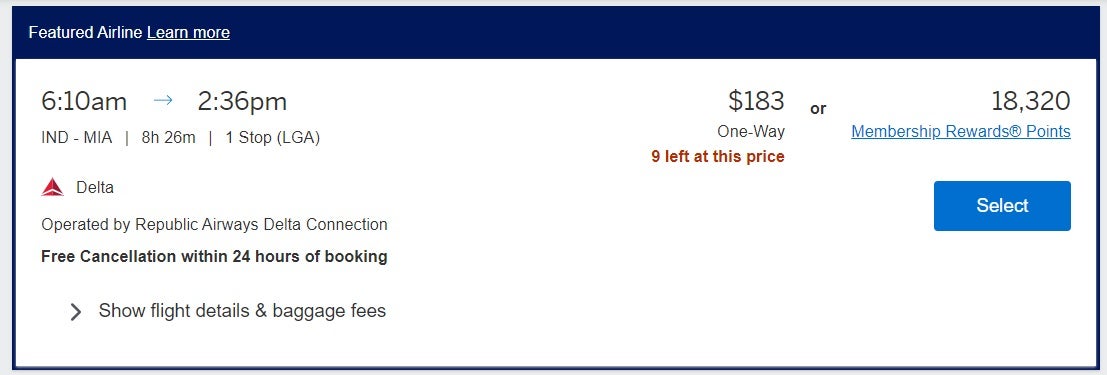

When you compare this cost to what you would pay for the same flight through AmexTravel.com, it’s easy to see where transferring your Amex points to Delta makes more sense even if you don’t have a Delta credit card. For the same flight on the same travel date, AmexTravel.com wants 18,320 miles.

In the meantime, Amex lets you transfer points to Delta Air Lines at a ratio of 1,000:1,000 in increments of 1,000. This means you would transfer as little as 10,000 Amex points to your Delta SkyMiles account (as a Delta card customer) and make this booking.

This is just one example of how transferring your Amex points to a partner can make more sense than booking a flight through AmexTravel.com. That said, you’ll want to run the numbers with each booking you make before deciding, as there may be scenarios where booking through Amex is a considerably better deal — and you won’t know unless you do the research upfront.

It can also help to familiarize yourself with Amex transfer partners ahead of time so you know what your options are.

Booking hotels through Amex

Using AmexTravel.com to book a hotel or resort stay works similarly, requiring you to enter your travel information to identify properties in the destinations you plan to visit. Once again, you can pay for your booking with points, cash or a combination of the two. You’ll need to have at least 5,000 Membership Rewards points in your account in order to pay with points.

Again, you’ll want to compare your options when deciding whether to book hotels with hotel loyalty points or directly through Amex. That’s because, in addition to the many frequent flyer programs Amex partners with, the program lets you transfer Amex points to the Choice Privileges program, Hilton Honors and Marriott Bonvoy.

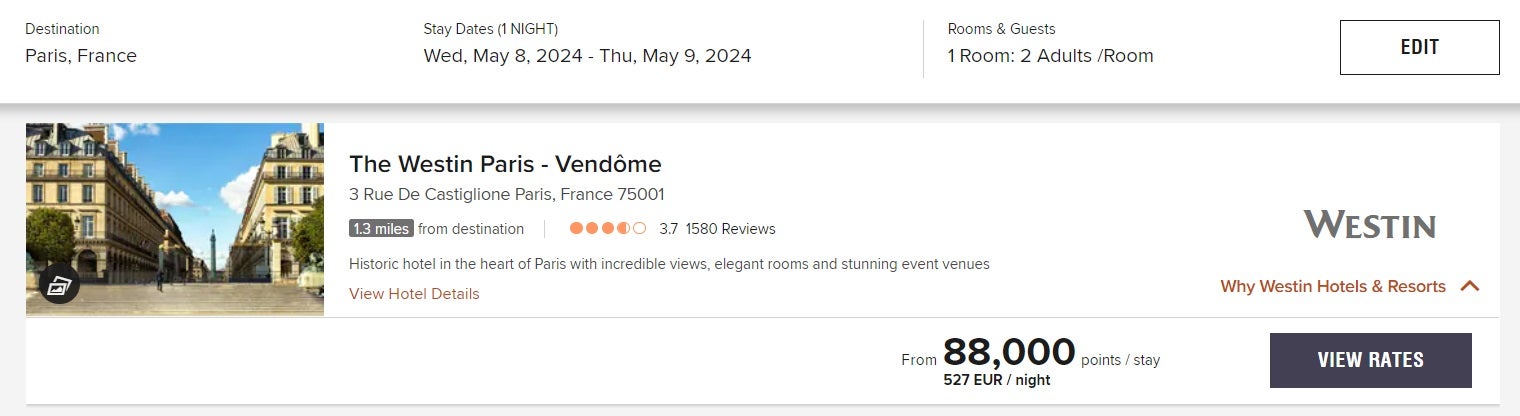

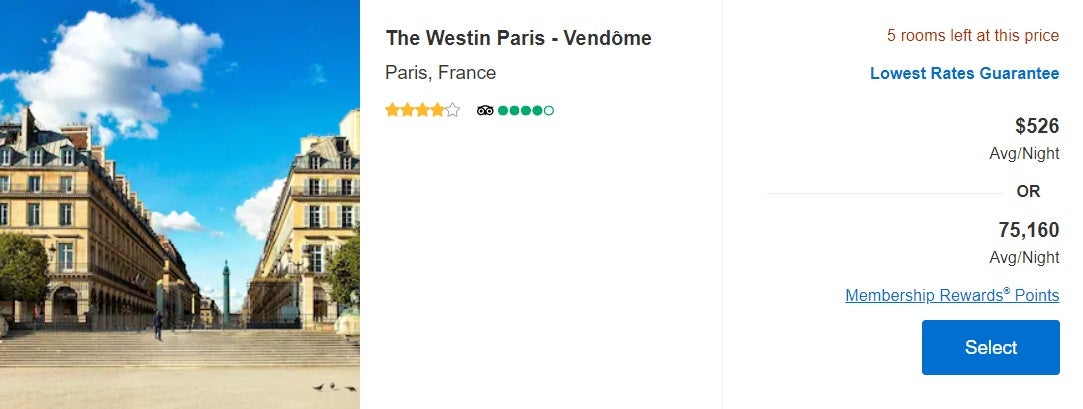

Consider the following example: Let’s say you’re planning a trip to Paris, France, and that you want to splurge with Amex points for a stay at the Westin Paris – Vendôme in May of 2024. If you do a quick search on the Marriott Bonvoy website, you can see that free night awards start at 88,000 points per night over your travel dates, and that the cash rate works out to 527 euros per night (around $570 USD, as of this writing).

When you search for the same hotel through AmexTravel.com, however, you can see that a free night award will set you back 75,160 points.

Since Amex points transfer to Marriott Bonvoy at a ratio of 1,000:1,000, this is a scenario where you’re better off using your Amex points to book this hotel directly through the portal. In fact, doing so will save you more than 12,000 points per night.

Pay It Plan It

You can now pay for airline tickets with Pay It Plan It. Amex’s Pay It Plan It is a flexible payment option that allows cardholders to make payments on large purchases over time. With this option, cardholders can avoid interest charges and pay down balances with predictable, monthly payments.

The payment option is only for airline tickets booked through the American Express travel website. At checkout, cardholders are presented with up to three different plans to pay for any flight purchase of $100 or more. Note that the installment payment plan doesn’t have any interest associated with it, but there is a fixed monthly fee based on the card’s APR.

International Airline Program

The business and personal Platinum cards let you access a newer Amex program for frequent flyers known as the International Airline Program. This program was created to increase access to lower fares on 24 participating airlines, but it’s only good for international premium class tickets.

To search for fares that qualify, log in to your personal or business Platinum account. From there, use AmexTravel.com to search for First Class, Business Class or Premium Economy to an international destination. At that point, you may see some flight options that show an International Airline Program banner.

Amex Fine Hotels and Resorts program

Note that select premium American Express credit cards, like the Business Platinum Card from American Express and the Platinum Card from American Express, let you access an additional hotel program known as American Express Fine Hotels and Resorts .

This program lets cardholders book stays at over 1,300 luxury hotels in the world with added benefits worth up to $550 per stay. Amex Fine Hotels and Resorts perks can include:

- Daily breakfast for two people

- 4 p.m. late checkout

- Complimentary internet access

- Noon check-in, based on availability

- Room upgrades based on availability

- Unique resort amenity worth up to $100

The Amex Fine Hotels and Resorts program is available only for eligible premium cardholders. Using this program also typically means going without elite hotel benefits or points for paid stays.

Does American Express cover trip cancellations?

Individual airlines and hotels have their own policies that cover cancellations. AmexTravel.com, however, does offer the option to view all your booked travel and cancel or rebook a flight with ease using your My Trips page. You will still be subject to any change or cancellation fees imposed by the carrier if you’re not covered by a flexible policy or existing waiver.

Some American Express credit cards offer trip cancellation and interruption insurance, which could apply in some situations where you have to cancel or rebook your plans.

Popular cards that offer this benefit include the Business Platinum Card and the Platinum Card, as well as co-branded airline and hotel credit cards like the Marriott Bonvoy Brilliant® American Express® Card and the Delta SkyMiles® Reserve American Express Card .

Is booking through AmexTravel.com worth it?

Only you can decide which travel booking option works best for your needs. Regardless of the value of rewards earned, some travelers like being able to book directly through a portal that offers multiple options.