Best Travel Insurance for Vietnam

Buying travel insurance can be confusing. There are many options with thousands of different companies all offering different policies. How do you decide which is the best policy for you?

We have crawled the web for the best travel insurance providers for Vietnam. The clear winners are IM Global , AIA , World Nomad , AXA , and Allianz Liberty Travel . Each of these providers offers safe and reliable policies for travel in Vietnam.

This guide to travel insurance in Vietnam will give everything you need to stay safe on your trip.

Why Travel Insurance?

It doesn’t matter where you go on this planet, travel insurance is essential. The real world is unpredictable. Accidents happen and not everyone is friendly. It’s always best to get covered for the unexpected.

Those who have long traveling plans in Vietnam or South East Asia must get travel insurance.

Your insurance will cover any unexpected financial or health problems. It will also give you peace of mind as you take on some risky and exciting adventures.

One of the biggest draws to Vietnam is the chance to motorcycle from North to South or vice versa. While this is an incredible experience it’s also highly dangerous.

Read more about: how to rent a motorbike in Vietnam

If you are going to ride a motorcycle in Vietnam, you MUST get appropriate travel insurance. to cover you (more on this later.)

Accidents are very common in Vietnam. Accidents can occur both on the road and off the road much like every other Southeast Asian country. It’s best to be safe and get yourself covered.

What Am I Covered For?

Travel insurance can cover anything from a stolen wallet to a motorbike accident. Insurance plans are adaptable. It’s important to understand what cover you will need before your arrival.

Apart from the basics that come with all cover plans, here are some specific things you will want to cover too.

Medical Insurance

Healthcare in Vietnam is vastly different from what you are probably used to at home. Walk into any public hospital and you are in for a big surprise. Huge waiting lines and a lack of beds is common.

You have two choices: cheap and basic or expensive and international. International hospitals in Vietnam are of good quality. We recommended them if you should get into an accident.

International hospitals are much more hygienic and operated by international doctors. The equipment is up to date and the medical advice given is usually sound.

You may not have the luxury of an international hospital and will have to settle for a public hospital. International hospitals are in major cities such as Hanoi, Ho Chi Minh City, and Da Nang.

Failure to insure yourself could result in an astronomical hospital bill. Do not risk it.

Motorbike Insurance

Driving a motorbike in Vietnam is a wonderful but dangerous experience. The roads in Vietnam are chaotic and very few rules exist.

You will discover that the biggest vehicle always has right of way. They care very little for your safety on a bike.

If you are thinking that you will be fine because you’re only driving out of the city, then think again. The roads are just as dangerous outside of the cities.

Motorbike accidents are the number one cause of accidents and injuries for travelers. If you have never driven a motorbike before, it’s advised that you do not start in Vietnam.

You may have the opportunity to learn how to drive. But, learning road awareness takes years of practice. Vietnam’s roads demand great awareness skills to stay safe.

In fact, the second biggest killer of Vietnamese people is traffic accidents. If you decide to drive a motorbike in Vietnam, you should buy a comprehensive insurance plan.

Motorcycle cover in Vietnam requires a valid motorcycle license. This is not required if you are driving a motorbike with an engine of 50cc or less.

Above 50cc you will need your valid motorcycle license and a Vietnamese license. To get a Vietnamese license, you need:

- A residence visa

- Work permit or business visa (30 days or more)

If you are planning to take a motorcycle trip through Vietnam, you will need a motorcycle that is at least 125cc. To be fully insured you must have:

- A valid license from your country of residence

- A Vietnamese motorcycle license

Without these, no insurance company will payout for a motorbike accident.

You can not legally drive anything more than a 50cc bike without a license.

If you have both valid licenses your insurance company will not pay out for if:

- You were not wearing a helmet.

- You were under the influence of alcohol/drugs.

- You were violating Vietnamese road laws.

Cancellations and Delay Insurance

Cancellations and delays are common throughout Vietnam no matter your mode of travel.

You will likely experience delays when you take a domestic flight within the country. Popular domestic airlines like VietJetAir and Jetstar are often canceled and delayed.

It is important to get covered for both scenarios. You can then reclaim any money for pre-paid tickets, hotels, or tour bookings.

Cancellations are not always the fault of an airline or ferry service. You may have a family emergency and will need to get home immediately. You will then need to cancel future flights already booked.

Always make sure you read the small print on your cancellations and delay policy. Many insurers need proof that you made the best effort possible to continue your trip.

You may have to submit notes, announcements, letters, or emails to prove it was not possible. Without these forms of proof, you may not get refunded a single cent.

Loss and Theft

Loss is an inevitable part of your travel experience. Losing a few socks in a hostel is a lot different from leaving your MacBook on a coach in central Vietnam.

If you are carrying lots of valuable items such as a laptop, camera, phones, and cash you should get them covered.

Theft is not that common in Vietnam but it’s always best to be safe than sorry. Most thefts happen in the major cities when men on bikes snatch purses or bags from locals or travelers.

Again, this is rare but it’s worth getting covered anyway.

Catching DHF (Dengue Hemorrhagic Fever)

Read also: Sharks, jellyfish, snakes, and other dangers in Vietnam .

Dengue fever is a dangerous mosquito-borne disease. It can cause the infected to suffer from many symptoms including:

- Pain behind the eyes

- Joint and muscle pain

- Skin rash that appears after 2-5 days after fever

The best way to avoid DHF is to wear an appropriate bug mosquito repellent. This does not 100% protect you and you could still contract DHF.

Healthy adults can recover within a few weeks. You must go to the hospital immediately after noticing the symptoms above.

Travel insurance policies will cover you for inpatient and outpatient treatment of DHF. Double-check your policy to make sure it is included.

Contracting dengue fever is unlikely but possible. If traveling in areas of the country with a high number of mosquitoes such as the Mekong Delta, you are at a higher risk.

Food Poisoning

Food poisoning is a common issue for travelers in South East Asia. Your travel policy will cover you for any treatment but you should always make sure before you buy.

Most street food in Vietnam safe and cooked fresh right in front of your eyes. Getting food poisoning is more likely in restaurants where food is improperly stored.

A comprehensive travel insurance policy will usually provide you with dental coverage. This includes:

- Severe emergency (broken tooth, extreme and sudden tooth pain)

- Chipped tooth

- Severe toothache

Those with bad toothache or teeth issues should take their specialist toothpaste. You may not find it in Vietnam.

How to Pick the Right Travel Insurance

Plan your travels as much as possible so you know what type of activities you will be taking part in. Make a list of the activities you want to do.

Start looking for plans that include all these plus the basics. Add any special items such as:

- Health/medical

- Motorbiking

- Cancellation/delay

You don’t need to plan your trip down to a tee. Have a good idea of the activities you want to take part in so you can get covered before arriving.

Don’t decide to go white water rafting in Dalat on day three of your trip with no insurance cover already in place.

Always read your policy documents. Research into anything you don’t understand and make sure you know your rights before buying.

Some insurance policies look great when glancing at the “what’s covered” section. Always check the small print which details scenarios in which they won’t payout.

Make sure you understand all the following before you take out the plan:

- What’s included and excluded in the policy?

- How do you contact your provider?

- What paperwork should you travel with?

- What are the monetary limits for each item?

- What excess (if any) will you need to pay for each item if claimed?

- What proof do you need should you make a claim?

- What number is the international 24/7 hotline number?

Always spend a significant amount of time reading all the details. Unfortunately, some insurance companies don’t have your best interest at heart.

It’s on you to make an informed decision and not jump for the cheapest option.

Who Do You Contact in Case of an Insurance Emergency?

When you buy your travel insurance policy you will get an email with all the relevant paperwork. In the paperwork, you will find an emergency contact number that you can call 24/7 for help.

If you don’t see this, contact your provider immediately for the details.

Once you have the details you should save the number on your phone. Keep the paper with you on your travels too and give the number to a close relative. This way, they can contact your provider on your behalf if needed.

What Do You Do in the Case of an Insurance Emergency?

You must find the emergency contact details of your provider. Call them and introduce yourself, tell them where you are and describe the situation you are in.

A member of your provider should then give you instructions on what to do next. They may provide you with a specific list of hospitals to attend, and this service you can receive.

Some providers may even be able to provide you with an ambulance. They may even arrange a doctor’s visit to your accommodation.

Your medical expenses are covered by your provider. You will most likely need to pay for those expenses first. You will then get refunded the money by your provider. This is why it is important to have cash in the bank for emergencies.

Keep all the documents you receive from any hospital or doctor. Some of this paperwork will need to go to your insurance provider.

Can I Buy Insurance During Your Trip

Yes, it is possible to buy travel insurance or extend it during your trip. You may be limited to only a select few international providers. These may cost much more than other domestic providers back home.

Once you have bought your insurance it will take 3-5 days for the paperwork to activate. This is a precaution taken by the provider against any fraudulent claims.

It’s advised that you buy your comprehensive insurance before you take your trip.

In What Circumstances Will an Insurance Provider Not Pay Out

Alcohol inebriation.

You will not get covered if intoxicated when your accident occurred. It’s advised that you do not drink and drive during your time in Vietnam.

Riding a Motorcycle Without a License

You are only covered for motorcycle accidents if you have a driving license. You must have a license from your home country and a Vietnamese driving license.

Improper Coverage

If your expenses outweigh your cover you will need to make up any difference with your own money.

The Best Travel Insurance for Vietnam

Here are the best providers and policies for Vietnam travel. These companies are reputable, well-reviewed, and trust-worthy. Their policies may cost more than most but they are the safest options.

Click the company, go through the quote process and then start to compare. Each policy is different.

Make sure you add any specific adventurous activities you may want to enjoy on your travels. You can add these later while traveling but it’s cheaper to get covered right from the start.

We recommend that you start your policy at least a week in advance to your departure date. This will ensure the verification process for your policy is complete. You are then covered for the day you leave and the entirety of your trip.

World Nomad

Allianz Liberty Travel

Final Thoughts

Travel insurance for your trip to Vietnam is a no brainer. We’re confident you will explore the country without a single problem but it’s always best to be safe than sorry.

These are the most comprehensive and reliable travel insurance companies out there. It’s worth spending a good amount of money on a solid policy that covers you completely. You can then be free to enjoy your travels with complete peace of mind.

Vietnam Jack

Travel and discover the best things to do in Vietnam!

Vietnam Travel Insurance Guide: Top 5 Insurance Options for Your Trip

Embarking on a journey to Vietnam, with its captivating landscapes and rich cultural tapestry, is an adventure filled with excitement and discovery. Ensuring a safe and worry-free experience involves choosing the right travel insurance. From comprehensive coverage to specific needs for exploring Vietnam, this guide explores the best travel insurance options, providing peace of mind for every traveler’s unique journey.

1. World Nomads: Comprehensive Coverage

World Nomads stands out as a top choice for adventurous travelers exploring Vietnam’s diverse terrains. Offering extensive coverage for medical emergencies, trip cancellations, and adventure activities like trekking and motorcycling, it caters to the thrill-seekers. Their flexible policies and user-friendly online platform make it easy for travelers to customize plans based on their specific needs. With 24/7 customer support and a reputation for reliability, World Nomads ensures that adventurers can explore Vietnam with confidence.

2. Allianz Global Assistance: Versatile Coverage for Every Traveler

Allianz Global Assistance provides versatile coverage suitable for a range of travel styles, making it an excellent choice for Vietnam-bound tourists. Their comprehensive plans include coverage for medical emergencies, trip interruptions, and baggage loss. Allianz offers a user-friendly online interface for easy policy management and claims processing. With a global network of medical providers and assistance services, travelers can trust Allianz to provide reliable support throughout their journey in Vietnam.

3. AXA Assistance: Tailored Coverage with Global Support

AXA Assistance offers tailored travel insurance with a global support network, making it a reliable choice for Vietnam-bound travelers. Their plans cover a spectrum of needs, including medical emergencies, trip cancellations, and baggage protection. AXA Assistance’s emphasis on customer service ensures that travelers have access to assistance whenever needed. With a user-friendly online platform for policy management and claims, AXA Assistance provides a seamless experience for those prioritizing personalized coverage and global support.

4. Travel Guard: Customizable Plans for Personalized Protection

Travel Guard, powered by AIG, provides customizable travel insurance plans to suit individual preferences and needs. Their coverage includes medical expenses, trip disruptions, and comprehensive protection against unexpected events. With flexible options for coverage enhancements, travelers can tailor their policies for specific activities or preferences. Travel Guard’s commitment to customer satisfaction, coupled with its global presence, ensures that Vietnam-bound tourists have access to personalized protection for a worry-free exploration.

5. SafetyWing: Affordable and Flexible Coverage

For budget-conscious travelers seeking reliable coverage, SafetyWing emerges as an affordable and flexible option. With comprehensive medical insurance, SafetyWing is a practical choice for those exploring Vietnam on a budget. Their policies are available to travelers of all nationalities, and the coverage extends even during brief returns to the home country. SafetyWing’s affordability and flexibility make it an attractive option for those prioritizing financial considerations without compromising on essential coverage .

Choosing the Right Travel Insurance: Considerations and Tips

Selecting the best travel insurance for Vietnam involves considering factors like coverage for medical emergencies, trip cancellations, and specific activities such as adventure sports. Assess your individual needs, duration of stay, and the type of activities you plan to engage in. Read policy details carefully. Additionally, consider the ease of claims processing and customer support. Comparing quotes and reviews can guide you in making an informed decision tailored to your travel requirements.

Conclusion: Safeguarding Your Vietnam Adventure

Choosing the best travel insurance for your Vietnam adventure ensures a safety net for unforeseen circumstances. Whether you’re exploring off-the-beaten-path destinations or immersing yourself in cultural experiences, reliable coverage from providers like World Nomads, Allianz Global Assistance, SafetyWing, AXA Assistance, and Travel Guard ensures you can focus on creating lasting memories with peace of mind.

Featured Image: View of Hanoi at Night | Photo by Quang Nguyen Vinh

The ultimate guide to buying travel insurance in Vietnam

Travel insurance has been gaining popularity during the covid-19 pandemic. you might wonder what benefits this type of insurance brings or why you need to buy it. so, let’s have a look at this below post for an overview and select the most suitable coverage for your trip., what is travel insurance.

Travel insurance is considered a financial plan used for protection against risks and loss of money or property in your trip. In detail, insurance companies will reimburse you in those circumstances or in any medication-related issue and additional cost during the journey.

Should you buy travel insurance?

As mentioned above, travel insurance helps you a lot on your vacation. You will obtain different amounts of compensation and benefits based on the companies and coverage you choose. Now let’s examine the cases below and give answers to the questions above.

Cases are covered by travel insurance

In general, 5 popular cases occurring during the trip you can make a claim are:

- Trip cancellation

If you have to suddenly change or cancel your trip, insurance companies will reimburse the prepaid for flights, accommodation or travel tickets. Yet, the coverage is valid only if your reasons for canceling are listed in the policy. For instance, natural disasters happen at your destination or you are too sick to join the trip.

- Accidents and medical emergencies

Accidents and injuries during the journey are not rare, especially when you partake in physical challenge activities. In case of abroad travel, medical expenses can cost you an arm and a leg if you get food poisoning or face other health-related issues. An insurance package can cover those problems.

- Loss luggage

Risks of lost luggage probably happen in both domestic and overseas travel. In this case, travel insurance with luggage coverage will pay for stolen or lost items with a respective amount of money.

- Missed departure time

Missed flights or trains might lead to lots of troubles and cost you a great deal of money for buying other tickets. Owning missed connection travel insurance can help you receive compensation in specific circumstances listed in the policy.

- Travel delays

Travel delays might result in missed connecting flights or planned tourism activities. In those cases, a policy with travel delay coverage can reimburse you for unused trip expenses including flight tickets and accommodation that are prepaid and nonrefundable.

You should buy travel insurance!

A detailed itinerary can lessen the possibility of unexpected events during the trip. Yet, risks are unpredictable so you should seriously consider buying travel insurance. In addition, the pandemic leads to the anxiety of exposure to the COVID-19 in the trip. Therefore, purchasing travel coverage is the right decision.

Who should buy travel insurance?

Travel insurance covers a wide range of people from 6 weeks to 85 years old depending on the companies’ policies. If you find yourself in one of the travel groups below, you might need travel coverage:

- Broad travel

Overseas trips often bear more risks than domestic travel, including lost luggage/personal paper, and more expenses as well. So if you are an abroad traveler, it is worth thinking about suitable coverage.

- Valuable trip

If you planned and pre-booked for your luxurious trip with an expensive resort, nonrefundable flights, and a 5-star cruise, you definitely should add travel insurance. In case you have to cancel your trip and prepaid services decline to refund, the coverage will reimburse you all those costs.

- Challenge activities included in the trip

Physical challenge activities and cave/jungle/waterfall exploration trips are appealing to tourists all over the world, and potential for injuries as well. This type of coverage is not compulsory, however, insurance companies often recommend it because of its necessity.

Some popular types of travel insurance

There are various ways to classify travel insurance, including by region and by insured.

Travel insurance by region

- Domestic travel insurance

This insurance package is designed for tourists traveling to destinations within the territory of Vietnam. Its cost is quite cheap but benefits are various, especially in medical and health issues.

- Global travel insurance

This type of insurance covers trips abroad and usually offers many benefits for travelers such as lost luggage, lost personal paper, or flight issues.

Travel insurance by the insured

- Individuals

It is suitable for travelers with private requests of criteria for their vacation. This coverage often provides a wide variety of benefits and compensation amounts for choosing.

- Family/groups

This coverage is applied to a group of tourists or a family traveling together. Prices for those packages are often cheaper than ones for individuals.

- Enterprises

This type of travel insurance is designed for business traveling purposes. The term in policies is usually by year for saving time and money.

- Travel tours

This travel coverage is specifically designed for travel agencies, generally included in total tour expense.

Some notices for buying travel insurance

- Not every trip needs travel insurance

This is a suggestion for you: if you plan an economically domestic trip with a limited budget and no valuable luggage, you might skip travel insurance. By contrast, in case the total cost for your trip is significant, you definitely should have one.

- Carefully read the policies

You should spend time reading every term of your coverage contract to know exactly what is covered and what is not. Then, you can add or narrow the list as needed. Moreover, choose the insurance companies with 24/7 support service so you can contact them anytime you get into trouble.

- Try not to overlap

If you already had life insurance or medical insurance, you might need to check that coverage’s policies to make sure you won’t pay for one benefit twice. For instance, your medical insurance possibly covers the hospital fees in case of your sickness and accident during the trip.

- You might need to buy it soon

After planning and pre-booking every service for the journey, you should get travel insurance as soon as possible, at least coverage with a cancellation policy. In the event of irresistibly canceling, you can be reimbursed by the insurance company.

- Don’t fall for tourist traps

Note that again, to not fall for sales tactics with additional terms, you need to read the policy carefully to identify what you want to be covered. Also, it is necessary to remove the benefits you already had.

Some reliable travel insurance in Vietnam

In Vietnam, many prestigious insurance companies are providing comprehensive solutions for travel, business trips, and study abroad. Some reliable ones are:

Renowned with many coverage packages that are financially suitable for travelers, Baoviet TravelCare is your reliable companion on every trip. Global travel insurance Flexi is one of the most outstanding solutions of Baoviet, designed for individuals and customers of Saigontourist.

Bao Minh is renowned for many insurance packages for domestic and international travel with 22 compensatory benefits, which is appropriate for applying for a worldwide Visa.

Vietnam National Aviation Insurance Corporation provides both domestic and global coverage for individuals and corporations. In unexpected events, VNI will reimburse you the amount of money fixed in the insurance certificate.

A well-known product of Chubb and PVI is TripCARE – the comprehensive travel insurance for customers of Vietnam Airlines.

BIC is BIDV’s insurance company, covering all customers from 1 to 70 years old in the event of accidental death, dismemberment, medical assistance, as well as any luggage and trip issues.

Insurance coverage Travel Guard of AIG offers various solutions with lots of benefits and professional compensation services.

Liberty company sells a great variety of insurance products. International travel insurance TravelCare is popular for its wide coverage for customers traveling individually and in groups.

As you can see, almost all insurance companies offer qualified domestic and global coverage packages. Each business gains the advantage over others on specific products, yet, all of their solutions focus on improving customers’ benefits.

Here is the overview of travel insurance. This post is expected to help you have a better understanding of the importance of travel coverage for your trip and get more useful information for choosing the most suitable coverage.

Leave a Reply Cancel reply

Save my name, email, and website in this browser for the next time I comment.

You Might Also Like

10 Tips To Visit Vietnam In 2023 – 2024

Key Benefits To Choosing Private Car Rental (Update 2023)

15 Festivals in Vietnam Must Visit

Travel Insurance Plans

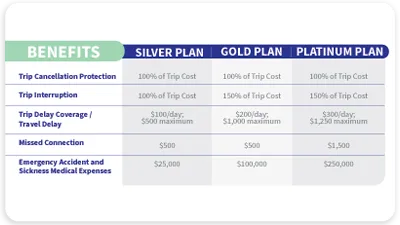

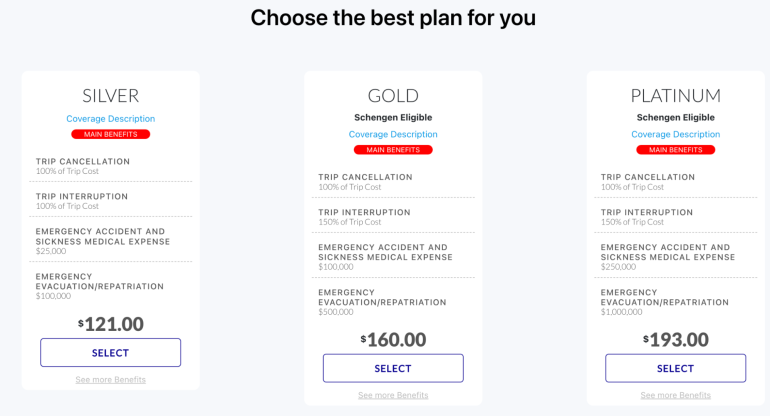

Choose the best travel protection plan for your trip.

We offer three plans that will help protect you on your next trip. Whether traveling domestically or internationally, you want to plan for the unexpected. Our travel protection plans include many benefits such as Trip Cancellation, Trip Interruption, Emergency Medical Expense, Emergency Evacuation and Baggage Delay to help give you peace of mind before and during your trip. Optional travel insurance benefits are also available to enhance our travel plans and offer additional protection for your trip. In addition, our 24/7 emergency assistance and support services can help you deal with unforeseen circumstances during your trip.

SILVER PLAN

Best for Domestic Travel

- 100% of Insured Trip Cost for Trip Cancellation

- $25,000 Emergency Accident & Sickness Medical

- $750 Baggage & Personal Effects

Best for Cruise

- $100,000 Emergency Accident & Sickness Medical

- $1,500 Baggage & Personal Effects

PLATINUM PLAN

Optional Cancel For Any Reason Coverage

- $250,000 Emergency Accident & Sickness Medical

- $3,000 Baggage & Personal Effects

Silver Plan

Platinum plan.

Compare Travel Insurance Plans

Get covered against Trip Delays, Medical Emergencies, Lost Baggage, and more!

Do I need Travel Insurance?

Do these travel insurance plans cover pre-existing medical conditions.

Need Help Choosing a Plan?

Speak with one of our licensed representatives or our 24/7 multilingual Insurance advisors to find the coverage you need for your next trip. From Medical Coverage to Trip Cancellation Protection, our team of travel experts will help you choose the right coverage.

- No products in the cart.

Vietnam Travel Insurance: The best guide before you go

Should I need Vietnam travel insurance ? What are the benefits that I got? In this post, Prime Trave l will help you address all your concerns about travel insurance when visiting Vietnam, ensuring you have the safest and most enjoyable trip.

Why do you need travel insurance in Vietnam?

Do you really need to purchase travel insurance? If not, what are the disadvantages? Here are some several reasons:

- Vietnam has a different health care system than your home country. You may not be able to access the same quality of care or facilities that you are used to. And you also may have to pay upfront for medical services, which can be expensive and difficult to claim back from your regular health insurance.

- Vietnam has various natural and man-made hazards that could affect your travel plans. You could encounter typhoons, floods, landslides, fires, civil unrest, terrorism, or crime. These could cause injuries, damages, delays, or cancellations that could cost you a lot of money and stress.

- You need to meet strict entry requirements, such as visa, passport, vaccination.

- Vietnam has different laws and customs than your home country. You may not be aware of some of the rules or regulations that apply to you as a visitor. You could unknowingly break the law or offend the local culture and face legal consequences or social backlash.

Why do you need Vietnam travel insurance ? ( Source: Internet )

Read more>>> How to apply Vietnam E-visa 2023

What does travel health insurance in Vietnam cover?

Each Vietnam travel medical plan varies just as each trip and traveler varies. A travel medical insurance plan for Vietnam can be purchased as a standalone plan or as a part of a comprehensive travel insurance plan. A comprehensive travel insurance policy offers coverage for various travel-related expenses, such as cancellation, lost baggage, or delays.

Travel insurance provides a safe experience for travelers ( Source: Internet )

Some common coverages to consider for a trip to Vietnam include:

- Motorcycle/Motorbike travel insurance

- Coverage for pre-existing conditions (obtaining a waiver for the condition before traveling)

- Emergency Medical Evacuation

- Accidental Death & Dismemberment

Read more>>> Things to do in Hanoi

What do Vietnam travel insurance not include ? ( Source: Internet )

There are a few eventualities a standard travel insurance policy is unlikely to cover, including:

- Pre-existing conditions: Make sure you declare any pre-existing medical conditions to your provider when you buy your policy, otherwise you won’t be covered.

- Drugs or alcohol: But be aware that if your belongings are stolen or you’re injured while you’re under the influence, you might find your insurance provider won’t pay out.

- Natural disasters: Vietnam’s long coastline makes it prone to storms and flooding, particularly in the cyclone season from May to November. While it’s unlikely that extreme weather will affect your trip, it’s worth knowing that you may not be covered if it does.

- Terrorism: Vietnam doesn’t have a history of terrorist attacks, but it still pays to be vigilant. Although your travel insurance will cover the cost of any medical care you might need following an attack, it won’t cover much else.

How much is travel insurance to Vietnam?

The price of Vietnam travel protection can vary depending on the age, health status, and number of travelers being covered, as well as the duration of the trip and type of coverage.

Tourists experience boat rowing on Trang An ( Source: Internet )

As risk involved with the trip increases, prices may also increase. For example, a trip to Vietnam that lasts one week may cost less than a two-week trip, even if the type of coverage is the same, due to the extended length of the trip. Additionally, a traveler with pre-existing health conditions can usually expect to pay higher rates than a traveler who does not have any diagnosed pre-existing conditions.

In general, the cost of purchasing travel insurance in Vietnam for foreigners will range from $40 to $80 for a trip lasting from 7 to 10 days in Vietnam.

Read more>>> Vietnam trip cost for Australian

How to choose the best travel insurance in Vietnam?

There are many travel insurance providers and plans available for Vietnam, but not all of them are suitable for your needs. Here are some tips on how to choose the best travel insurance in Vietnam:

- Compare different plans and providers online. You can use websites like: Chubs, Luma, or Care to compare different features, benefits, prices, and reviews of various travel insurance plans and providers for Vietnam.

- Check the coverage limits and exclusions. Make sure that the plan you choose covers you adequately for the risks you face in Vietnam. For example, if you plan to ride a motorbike in Vietnam, make sure that your plan covers motorbike accidents.

- Check the customer service and claims process. Make sure that your provider has a reliable and accessible customer service team that can assist you 24/7 in case of an emergency. Also check how easy and fast it is to file and settle a claim with your provider.

How to choose the best travel insurance in Vietnam ? ( Source: Internet )

Read more>>> Top 5 best Vietnamese traditional food

How to use travel insurance in Vietnam?

Using travel insurance in Vietnam is simple and straightforward if you follow these steps:

- Keep your policy documents and certificate of insurance handy at all times. You may need to show them at the airport or immigration checkpoints when entering or leaving Vietnam.

- Contact your provider or their assistance company as soon as possible if you encounter any emergency or problem during your trip. They will guide you on what to do next and how to access their network of medical providers or other services.

- Keep all receipts and evidence related to your claim. You may need to submit them along with a completed claim form to your provider within a certain time frame after your trip.

- Enjoy your trip with peace of mind knowing that you are covered by travel insurance in Vietnam.

Tips for using travel insurance ( Source: Internet )

Read more>>> Hanoi street food – Top 10 delicious dishes

How to buy travel insurance in Vietnam?

Buying travel insurance in Vietnam is easy and convenient with online platforms. You can follow these steps to buy travel insurance in Vietnam online:

- Visit one of the websites mentioned above or search for other reputable online travel insurance providers for Vietnam.

- Enter your personal details and travel information, such as your name, age, nationality, destination, duration, and purpose of travel.

- Choose the plan that suits your needs and budget from the options available.

- Review the policy details and terms and conditions carefully before confirming your purchase.

- Pay securely online with your credit card or other payment methods.

- Receive your policy documents and certificate of insurance instantly by email.

Capturing best moment with safe journey in Vietnam ( Source: Internet )

You can also choose to purchase travel insurance directly in your home country through travel companies. Additionally, if you have already arrived in Vietnam, you can consider buying it from providers like Liberty , Chubb , etc….

Read more>>> Top 5 best tours in Hanoi

To conclude, travel insurance is not mandatory when traveling to Vietnam, but considering its various uses and benefits, it’s something you should contemplate purchasing. With the information shared by Prime Travel above, it is hoped that it will give you a detailed understanding of this type of travel insurance.

Check out Prime Travel’s tours here:

Dinner with Locals

Authentic Vietnamese coffee workshop

Best of Vietnam from North to South

primetravel

Political Situation in Vietnam: Safety Tips for Travelers

Vietnam weather in december: a traveler’s guide to the best trip.

Leave a Reply: Cancel Reply

Save my name, email, and website in this browser for the next time I comment.

Please Sign In

You don't have permission to register.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

AXA Travel Insurance Review: Is it Worth The Cost?

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

What is AXA?

Axa travel insurance plans, which axa travel insurance plan is best for me, can you buy axa travel insurance online, is axa legit, what isn't covered by axa travel insurance, is axa travel insurance worth it.

- Lowest-cost plan includes some medical coverage.

- Pre-existing conditions waiver add-on available for higher-cost plans.

- No add ons are available for Silver-level policyholders.

- CFAR upgrade is only available for highest-cost plan.

In the era of staff shortages and extreme weather, your trip may not go exactly to plan. When that happens, travel insurance can be a big help. Although an insurance policy can’t prevent a delay or cancellation from happening, it can help relieve the financial burden if something unpredictable does occur on your trip.

But how do you know which insurance provider to go with? Here's a look at AXA travel insurance to help you determine if one of its plans is right for you.

AXA is a French insurance company that does business in over 200 countries. It offers many different types of insurance, including policies for travelers. These include coverage for baggage loss , trip cancellation and interruption, emergency evacuation and emergency medical costs. Cancel for any reason coverage is also offered.

AXA Assistance USA is part of the AXA Group.

» Learn more: How much is travel insurance?

AXA Assistance USA offers travelers three insurance plans: Silver, Gold and Platinum. The plans are underwritten by Nationwide Mutual Insurance Company and their affiliates in Columbus, Ohio. Here's the coverage you can expect from each policy.

Silver: This is the least expensive plan that offers 100% trip cancellation and trip interruption coverage, $25,000 in emergency accident and sickness medical coverage and $100,000 in emergency evacuation and repatriation coverage.

Gold: The mid-range Gold policy comes with 100% trip cancellation and 150% trip interruption coverage, $100,000 in emergency accident and sickness medical coverage and $500,000 in emergency evacuation and repatriation coverage.

Platinum: The AXA Platinum travel insurance plan includes 100% trip cancellation and 150% trip interruption coverage, $250,000 in emergency accident and sickness medical coverage and $1,000,000 in emergency evacuation and repatriation coverage.

If you want to add Cancel For Any Reason coverage, you’ll need to select the Platinum plan and purchase a policy within 14 days of paying the initial trip deposit. It’ll cover 75% of the prepaid nonrefundable expenses for your travel.

If you’d like coverage for pre-existing medical conditions , a waiver is available on the Gold and Platinum plans as long as you buy coverage within 14 days of your first trip payment.

» Learn more: How does travel insurance work?

Let’s compare AXA’s plans, the costs and coverage for a 19-day trip to Indonesia that costs $1,500 for a 36-year-old traveler who lives in Utah.

Coverage and limits for the Silver-level plan include:

Trip delay: $100 per day, with a $500 maximum.

Trip cancellation: 100% of the trip cost.

Trip interruption: 100% of the trip cost.

Baggage delay: $200.

Lost baggage: $750, up to $150 per article.

Missed connection: $500.

Emergency evacuation: $100,000.

Accidental death and dismemberment: $10,000 ($25,000 if on a common carrier).

Emergency accident and medical expense: $25,000.

The plan cost for our sample trip is $55.

For $79, the Gold-level tier offers the following coverage and limits:

Trip delay: $200 per day, with a $1,000 maximum.

Trip interruption: 150% of the trip cost.

Baggage delay: $300.

Lost baggage: $1,500, up to $250 per article.

Missed connection: $1,000.

Emergency evacuation: $500,000.

Accidental death and dismemberment: $25,000 ($50,000 if on a common carrier).

Emergency accident and medical expense: $100,000.

Collision damage waiver: $35,000.

Platinum is AXA’s highest tier level. This plan includes:

Trip delay: $300 per day, with a $1,250 maximum.

Baggage delay: $600.

Lost baggage: $3,000, up to $500 per article.

Missed connection: $1,500.

Emergency evacuation: $1,000,000.

Accidental death and dismemberment: $50,000 ($100,000 if on a common carrier).

Emergency accident and medical expense: $250,000.

Collision damage waiver: $50,000.

Lost golf rounds: $500.

Lost skier days: $25 per day.

Pet boarding fees: $25 per day (up to five days).

This level of coverage costs $95.

» Learn more: The best credit cards for travel insurance benefits

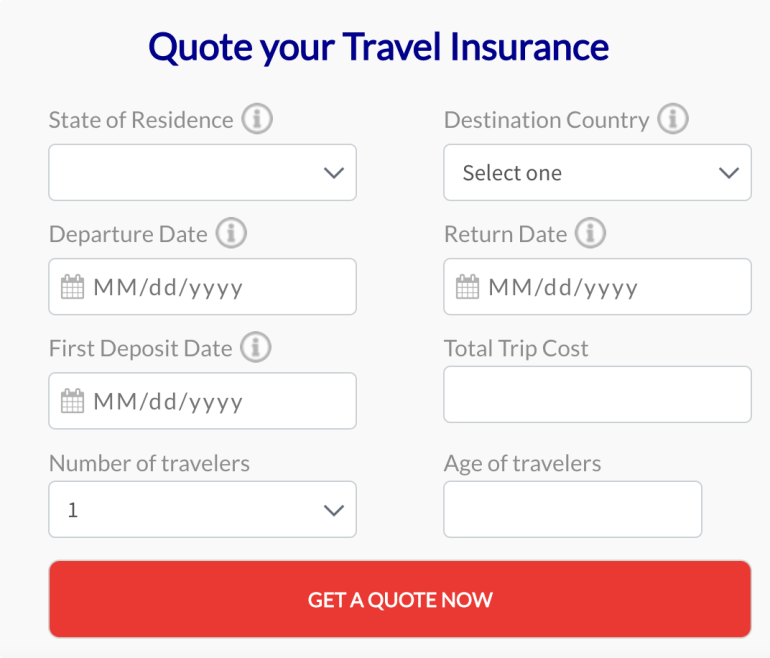

To get an AXA travel insurance quote, go to AXATravelInsurance.com and start by inputting your information in the quote box. Enter your state of residence, destination country, trip dates, date of first trip deposit, total trip cost, the number of travelers and their ages.

Once you’ve filled out the form, click on the “Get a quote now” button.

You’ll be presented with three quotes, one for each plan level. Make sure to click on the “See more benefits” link to get more information on each plan’s coverage limits. The plans with the highest coverage limits will be the most expensive.

If you need a pre-existing conditions waiver, select the Gold or Platinum plan. You’ll also have to purchase the plan within 14 days of making your initial trip deposit to be eligible.

The Gold and Platinum levels are also the two plans that offer Schengen zone coverage and a collision damage waiver . The Platinum plan is the only one that offers a Cancel For Any Reason add-on, so keep that in mind if you need more protection.

Overall, if you’re looking for emergency medical and emergency evacuation coverage specifically, the limits are good on all the plans, including the least expensive one.

To compare plans from multiple insurance providers at once, we recommend checking out Squaremouth, a travel insurance comparison site and a NerdWallet partner. The website helps you pick the right plan by displaying multiple quotes from many insurance providers, including AXA, in one spot.

AXA began in the early 19th century as a small insurance company specializing in property and casualty insurance.

Since then, the company has evolved, changing names and acquiring other insurance brands, until it became AXA in the 1980s. It is now one of the largest insurance companies in the world. In other words, yes, AXA is a legitimate travel insurance provider.

» Learn more: The best travel insurance companies

Every plan has different exclusions, so it's important to look at your coverage summary. Generally, pre-existing conditions without a previously purchased waiver are not covered.

Other limitations include:

Intentionally self-inflicted injuries.

Participation in bodily contact or extreme sports.

Traveling for the purpose of securing medial treatment.

Accidental injury or sickness when traveling against the advice of a physician.

Non-emergency treatment or surgery.

AXA handles more than 14 million cases each year, and every plan includes access to their 24/7 assistance hotline. The company is well established and has three plans for travelers to choose from.

AXA travel insurance covers several benefits including but not limited to 100% trip cancellation and trip interruption, medical emergencies, emergency evacuations, baggage delay or lost baggage, and accidental death and dismemberment. The Platinum plan also lets you add Cancel For Any Reason coverage.

AXA's least expensive plan, Silver, and its mid-range Gold policy do not have the option to add-on Cancel For Any Reason coverage. For travelers who opt to purchase the Platinum insurance plan, you can add Cancel For Any Reason coverage a la carte within 14 days of paying the initial trip deposit.

In the event that you need to make a claim, you can upload supporting documents online. If the claim is accepted, you will receive reimbursement within 30 days.

It's said that travel is the only thing you buy that makes you richer. But you don’t want to become poorer if something goes wrong before or during a trip. We don’t know what the universe has in store for us, so buying a travel insurance policy is one way we can protect our investment.

AXA offers budget, mid-range and premium policies that are easy to understand, provide adequate coverage and don’t cost a fortune.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

- Travel Insurance

The journalists on the editorial team at Forbes Advisor Australia base their research and opinions on objective, independent information-gathering.

When covering investment and personal finance stories, we aim to inform our readers rather than recommend specific financial product or asset classes. While we may highlight certain positives of a financial product or asset class, there is no guarantee that readers will benefit from the product or investment approach and may, in fact, make a loss if they acquire the product or adopt the approach.

To the extent any recommendations or statements of opinion or fact made in a story may constitute financial advice, they constitute general information and not personal financial advice in any form. As such, any recommendations or statements do not take into account the financial circumstances, investment objectives, tax implications, or any specific requirements of readers.

Readers of our stories should not act on any recommendation without first taking appropriate steps to verify the information in the stories consulting their independent financial adviser in order to ascertain whether the recommendation (if any) is appropriate, having regard to their investment objectives, financial situation and particular needs. Providing access to our stories should not be construed as investment advice or a solicitation to buy or sell any security or product, or to engage in or refrain from engaging in any transaction by Forbes Advisor Australia. In comparing various financial products and services, we are unable to compare every provider in the market so our rankings do not constitute a comprehensive review of a particular sector. While we do go to great lengths to ensure our ranking criteria matches the concerns of consumers, we cannot guarantee that every relevant feature of a financial product will be reviewed. We make every effort to provide accurate and up-to-date information. However, Forbes Advisor Australia cannot guarantee the accuracy, completeness or timeliness of this website. Forbes Advisor Australia accepts no responsibility to update any person regarding any inaccuracy, omission or change in information in our stories or any other information made available to a person, nor any obligation to furnish the person with any further information.

Travel Insurance For Vietnam: Everything You Need To Know

Published: Apr 25, 2024, 12:17am

Table of Contents

Do australians need travel insurance for vietnam, what does travel insurance for vietnam cover, frequently asked questions (faqs).

Vietnam is an increasingly popular travel destination for Australians, with the country even hoping to encourage more Aussies to visit by potentially waiving visa requirements in due time.

The Southeast Asian country is set to be high on the list for Aussies going overseas in 2024. The number of Australian tourists in Vietnam now exceeds pre-pandemic levels: more than 317,000 Australians visited Vietnam in 2019 , while there were 390,000 Aussie visitors in 2023.

Plus, as more and more flights become available, such as low-cost carrier Vietjet Air launching a direct service between Hanoi and Melbourne earlier this year, getting to Vietnam is becoming easier for Australians.

If the direct flights, fascinating history, vast scenery and delicious food aren’t enough to convince Australian travellers, the cost may be. Vietnam is considered one of the cheapest travel destinations in the world for Australian tourists due to our strong conversion rate against the Vietnamese Dong and the nation’s low cost of living in comparison to our own.

And while cheap thrills may be what you’re after on your vacation, it’s important not to skimp on the necessities that may cost that little bit extra—such as travel insurance. This guide outlines what you need to know regarding travel insurance in Vietnam.

Featured Partners

Fast Cover Travel Insurance

On Fast Cover’s Secure Website

Medical cover

Unlimited, 24/7 Emergency Assistance

Cancellations

Unlimited, (Trip Disruption $50,000)

Key Features

25-Day Cooling Off Period, Australian Based Call Centre, 4.6 Star Product Review Rating

Cover-More Travel Insurance

On Cover-more’s secure website

Unlimited, with a $2000 limit to dental

Yes, amount chosen by customer

Southern Cross Travel Insurance

Medical Cover

Including medical treatment, doctors’ visits, prescribed medication, specialist treatment & medical transport costs

$2,500 with option to increase to unlimited

Investing in travel insurance is a good idea for any overseas trip. Travel insurance policies can help protect you from having to dive deep into your pockets, with many offering unlimited medical treatment while abroad and cancellation cover for your trip should the unexpected occur.

Travel insurance is not just handy for medical purposes or travel changes, either. Your personal items can be covered, should any baggage go missing or an important item be stolen—which, unfortunately, often occurs in Vietnam.

Smarttraveller warns Australians to be alert at all times in Vietnam, considering petty theft–including bag slashing–is common in tourist areas and crowded places, especially during holiday times. Snatch-and-grab theft by thieves on motorcycles is also common, the website states.

Like most international travel insurance policies, you will be able to find basic coverage for your trip to Vietnam, or choose to opt for a more comprehensive, albeit more expensive, policy.

While a basic policy will often cover medical expenses and lost luggage,a comprehensive policy includes a lot more. Most basic policies also likely won’t offer compensation for travel delays, stolen cash, accidental death and more.

Additionally, if you are going on a trip to multiple countries within the year, it may be worth opting for an ‘annual multi trip’ insurance instead—making sure that there are no exclusions to the regions you are wishing to visit.

Visa Requirements For Australians Travelling to Vietnam

You’ll still be allowed to travel to Vietnam if you don’t invest in travel insurance, but you do so at your own risk—and, as stated, it is highly advised to have a travel insurance policy for any overseas trip.

However, what you cannot do is enter Vietnam as an Australian tourist without a tourist visa. While Vietnam will grant Australian citizens visas on arrival, applying for one online is much easier.

A tourist visa costs under $100 AUD; however the exact price depends on your length of stay.

The Vietnamese government may consider waiving visas for Australian citizens, especially since many other SEA countries have done so such as Indonesia and Thailand .

However, at the time of writing, Forbes Advisor Australia has confirmed that Australian citizens must still obtain a visa to visit Vietnam for tourism purposes.

The exact inclusions of your travel insurance will be dependent on your personal policy and the provider.

However, generally speaking, you can expect a travel insurance policy for Vietnam to offer some level of cover for:

- Medical expenses;

- Lost, damaged or stolen luggage;

- Travel cancellations or delays ;

- Personal liability;

- Credit card fraud;

- Covid-19 expenses;

If you are partaking in certain sports and activities, you will need to make sure that you choose a policy that covers them. You’ll also need to make sure that your policy covers any pre-existing medical conditions as well.

Plus, if you are travelling with valuables, you may wish to opt for a policy that lets you increase the protection cover on your items.

Ultimately, you need to consider what your trip consists of, what you will be taking with you, and your physical health to establish what policies would be appropriate for you.

From there, you can compare quotes of different policies and providers to ensure you have the optimal—yet affordable—cover for your trip to Vietnam.

Does Travel Insurance Cover The Ha-Giang Loop?

Considered one of the most scenic motorcycle routes in the world, the Ha-Giang Loop is a popular tourist activity in Vietnam for adventurous travellers. If the Ha-Giang Loop is one of your goals, you’ll need to make sure you have travel insurance that covers motorcycling.

Occasionally a policy may include this as one of their included ‘sports and activities’, but it is more often the case that you will need to purchase an additional ‘adventure pack’ that is either specific to, or includes, motorsports.

Even so, when purchasing an additional pack to cover motorbikes, you need to be cautious of the conditions. For example, some policies will only cover motorcycle riding if the bike you are riding has an engine under a certain size.

Often, coverage will cease and claims won’t be accepted if you haven’t been wearing the correct safety equipment such as boots and a helmet, or have been under the influence of drugs and alcohol.

What Does Travel Insurance Exclude?

Your travel insurance policy may exclude some activities that you wish to partake in, unless you can opt-in to purchase an additional adventure pack as explained above in regards to motorbike riding.

Just like with the inclusions of a policy, the exclusions depend on what type of policy you choose, and what provider you go with.

Commonly, however, you won’t be covered for instances where you:

- Break the law;

- Are under the influence of alcohol or drugs;

- Partake in an excluded activity;

- Receive medical treatment for a pre-existing condition that was not disclosed;

- Travel to a ‘Do Not Travel’ destination as outlined by Smarttraveller.

As always, it is essential to read the product disclosure statement (PDS) of your travel insurance policy carefully to understand what you will and won’t be covered for while overseas.

Do I need a visa to travel to Vietnam?

Yes, as of April 2024, Australian tourists still need a visa to travel to Vietnam. This visa can be obtained on arrival, or purchased online prior to travel. The visa takes approximately three days to process online, and the cost depends on how long you intend to stay in the country.

Does international travel insurance cover Covid-19?

Many comprehensive travel insurance policies now cover Covid-19, including medical conditions related to Covid-19 or trip cancellations due to a Covid-19 diagnosis. However, it is not guaranteed that all policies will. It’s important to check your policy’s PDS carefully to understand what it will and will not cover in regards to Covid-19 for both you and your travelling companions.

Related: Travel Insurance And Covid: Are You Covered?

How much does travel insurance cost for Vietnam?

The cost of your travel insurance for a trip to Vietnam will depend on your age, your health, the activities you wish to partake in, and the length of your stay.

For example, for a 34 year old with no pre-existing medical conditions travelling to Vietnam for two weeks, a policy from some of our top choices for comprehensive travel insurance would cost around $130 (based on quotes from Cover-More , 1Cover , and Fast Cover ).

The prices of these quotes would change depending on a chosen excess, cancellation cover, and any additional coverage options you may choose to purchase such as adventure packs or cruise cover.

Related: How Much Does Travel Insurance Cost?

- Best Comprehensive Travel Insurance

- Best Seniors Travel Insurance

- Best Domestic Travel Insurance

- Best Cruise Travel Insurance

- Best Family Travel Insurance

- Travel Insurance Cost

- Pregnancy Travel Insurance Guide

- Travel Insurance Cancellation Cover

- Travel Insurance For Bali

- Travel Insurance For Fiji

- Travel Insurance For The USA

- Travel Insurance For Thailand

- Travel Insurance For New Zealand

- Travel Insurance For Japan

- Travel Insurance For Europe

- Travel Insurance For Singapore

- Travel Insurance For Indonesia

- Cover-More Travel Insurance Review

- Fast Cover Travel Insurance Review

- Travel Insurance Saver Review

- Allianz Comprehensive Travel Insurance Review

- 1Cover Comprehensive Travel Insurance Review

- Australia Post Comprehensive Travel Insurance Review

More from

Tick travel insurance top cover review: pros and cons, was discovery travel insurance review: features, pros and cons, fast cover comprehensive travel insurance review: pros and cons, our pick of the best domestic travel insurance for australians, travel insurance for indonesia: everything you need to know, travel insurance for singapore: the complete guide.

Sophie Venz is an experienced editor and features reporter, and has previously worked in the small business and start-up reporting space. Previously the Associate Editor of SmartCompany, Sophie has worked closely with finance experts and columnists around Australia and internationally.

WARNING RE COVID-19

Policies purchased after 8 Apr, 2020 will not provide any cover for claims directly or indirectly arising from, relating to or in any way connected with COVID-19 (or any mutation or variation thereof or any related strain). We will not therefore cover claims relating to any inability to travel, any decision not to travel or any changes to travel plans, nor any medical or health related loss or expense incurred, as a result of COVID-19.

Please note that the application service will be temporarily unavailable from 8:00PM on 1 March 2024 to 2:00AM on 2 March 2024 for maintenance works.

- What is covered?

- What is not covered?

- When am I covered?

- Where can I travel?

- Who is covered?

- Planning Your Travel

- Preparing to Travel

- At Your Destination

- When the Unexpected Happens

Chubb Assistance

- WORLDWIDE TRAVEL PROTECTION PLAN

- CHUBB FLIGHT INSURANCE – DOMESTIC PLAN

Travel Smarter with Chubb Travel Insurance

24 Hour Emergency Hotline +84 (28) 38228779

No matter where you are in the world. Ask for a reverse charge call in your visiting location and we’ll help you through with access to medical and dental treatment and emergency evacuation as the situation demands.

Claims Made Easy

Process your claim as quickly as possible.

Choose from 3 Levels of Quality Cover. Select from our Silver, Gold or Platinum cover to match your personal travel needs.

Quality travel cover at an affordable price

With more than 50 years of insurance experience and many millions of travellers served, Chubb Travel Insurance offers high-quality insurance to Vietnam travellers. We have plan options for all types of travellers, from frequent flyers and families to holidaymakers on a budget, adventure seekers and sports enthusiasts.

Access to a global team of travel experts

Purchasing travel insurance from Chubb means access to a truly global network. In addition to our wealth of local expertise, Chubb's operation in Australia is backed by our extensive global travel network and breadth of resources to serve your every need.

Fast, fair and efficient handling of claims

Experience has taught us the importance of being proactive when managing claims. Chubb understands that a fast, fair and efficient approach to claims handling will bring about an expedited outcome, and can help to deliver an improved result.

24 hour emergency assistance

When you purchase Chubb Travel Insurance, you are instantly covered by Chubb Assistance, our 24-hour emergency hotline that provides the support that you expect in your time of need, anywhere, anytime.

Travel Smarter with Chubb Travel Insurance. Get an instant quote now!

You may contact us via email or telephone..

Chubb Insurance Vietnam Company Limited

Head Office Saigon Finance Center, 9 Dinh Tien Hoang Str., 8/F, Da Kao Ward, District 1, Ho Chi Minh City, Vietnam

Chubb Customer Center

Tel: +84 (28) 3910 7300 (Mondays to Fridays, 8:30am to 5:30pm) Fax: +84 (28) 3910 7228

E-mail: [email protected]

For 24-hour emergency medical and travel assistance, call Chubb Assistance +84 28 3822 8779

Chubb Worldwide Offices

For the mailing address, telephone number and email address of any Chubb office in our global network, use our office locator.

Chubb. Insured.™

- About Chubb

- Terms of Use

- Chubb Insurance

© Chubb Insurance Vietnam Company Limited (Chubb). This policy is underwritten by Chubb. Full details of the terms, conditions and exclusions of this insurance are provided for in the Policy Wording documentation. Please read our Personal Data Protection Policy .

Travel Insurance for your holidays in Japan and abroad

Travel insurance for japan.

If your dream vacation is a trip to Japan, you will want to be sure you can enjoy every moment of it even if things do not go as planned. Discover all the ins and outs with this guide to Japan with travel insurance . Will discuss the details on costs, requirements, essential coverage, COVID-19 restrictions, and some handy tips for your trip.

- What should your Travel insurance cover for a trip to Japan?

How does Travel Insurance for Japan work?

How much does travel insurance cost for japan.

- Our Suggested AXA Travel Protection Plan

What types of Medical Conditions do AXA Travel Protection Plans cover?

Any covid-19 restrictions for u.s. visitors, what if i have a pre-existing medical condition, how do axa travel protection plans work, what should your travel insurance cover for a trip to japan.

At a minimum, your travel insurance to Japan should cover trip cancellation, trip interruption and emergency medical expenses. When it comes to international travel, the US Department of State outlines key components that should be included in your travel insurance coverage. AXA Travel Protection plans are designed with these minimum recommended coverages in mind.

- Medical Coverage – The top priority is making sure your health is in order. With AXA Travel Protection, you can have access to quality healthcare during your trip overseas in the event of unexpected medical emergencies.

- Trip Cancellation & Interruptions – Assistance against unexpected trip disruptions can dampen the mood, AXA Travel Protection offers coverage against unforeseen events.

- Emergency Evacuations and Repatriation – In situations where transportation is dire, AXA Travel Protection offers provisions for emergency evacuation and repatriation.

- Coverage for Personal Belongings – AXA offers coverage for your belongings with assistance against lost or delayed baggage.

- Optional Cancel for Any Reason – For added flexibility, AXA offers optional Cancel for Any Reason coverage, allowing you to cancel your trip for non-traditional reasons. Exclusive to Platinum Plan holders.

In just a few seconds, you can get a free quote and purchase the best travel insurance for Japan.

Imagine this: you are exploring Japan’s plethora of vending machines in the city of Tokyo. From ramen noodles to exotic drinks, you can’t help but try it all. Suddenly, you feel queasy and uneasy. The snacks from a vending machine must have been spoiled. With AXA Travel Protection, we can help assist or guide you to the nearest hospital. Whether the situation goes from bad to worse, AXA is there to help you create a plan of action. Here’s how travelers can benefit from an AXA Travel Protection Plan:

Medical Benefits:

- Emergency Medical Expenses: Should you fall ill or have an accident during your trip, your policy may offer coverage for medical expenses, including hospital stays and doctor's fees.

- Emergency Evacuation & Repatriation: In case of a serious medical emergency, your policy may include provisions for evacuation to the nearest appropriate medical facility or repatriation.

- Non-Emergency Evacuation & Repatriation : In non-medical crises (e.g., political unrest), your policy may cover evacuation or repatriation, subject to policy terms.

Baggage Benefits:

- Luggage Delay: If the airline delays your checked baggage, your policy might offer reimbursement for essential items like clothing and toiletries.

- Lost or Stolen Luggage: In the unfortunate event of permanent loss or theft of your luggage, your policy may offer reimbursement for its value, assisting you in replacing your belongings.

Pre-Departure Travel Benefits:

- Trip Cancellation: You may be eligible for reimbursement if you cancel your trip due to a sudden illness or injury.

- COVID-19 Travel Insurance: Coverage is available for trip cancellation and medical expenses related to COVID-19, subject to policy terms and conditions.

- Trip Delay: If your flight faces delays due to unforeseen circumstances, you may have coverage for additional expenses such as meals and accommodations.

Post-Departure Travel Benefits

- Trip Interruption: In case of an unexpected event, you could be eligible for reimbursement for the unused portion of your trip.

- Missed Connection: If you miss a connecting flight due to delays or cancellations, this coverage may help with expenses like rebooking fees and accommodations.

Additional Optional Travel Benefits:

- Rental Car (Collision Damage Waiver): Exclusive to Gold & Platinum plan policy holders, this optional benefit gives travelers extra coverage on their rental car against damage and theft.

- Cancel for Any Reason: Exclusive to Platinum plan policy holders; this optional benefit gives travelers more flexibility to cancel their trip for any reason outside of their standard policy.

- Loss Skier Days: Exclusive to Platinum plan policy holders, this optional benefit offers reimbursement to mitigate some costs associated with pre-paid ski tickets that you or your traveling companion cannot use due to specified slope closures.

- Loss Golf Days: Exclusive to Platinum plan policy holders, this optional benefit offers reimbursement to mitigate the expenses linked to prepaid golf arrangements that you or your travel companion are unable to utilize due to specified golf closures.

In general, travel insurance to Japan costs about 3 – 10% of your total prepaid and non-refundable trip expenses. The cost of travel insurance depends on two factors for AXA Travel Protection plans:

- Total Trip cost: The total non-prepaid and non-refundable costs you have already paid for your upcoming trip. This includes prepaid excursions, plane tickets, cruise costs, etc.

- Age: Like any other insurance type, the correlation is rooted in increased health risks associated with older individuals. It's important to note that this doesn't make travel insurance unattainable for older individuals.

With AXA Travel Protection, travelers to Japan will be offered three tiers of insurance: Silver, Gold and Platinum . Each provides varying levels of coverage to cater to individual's preferences and travel needs.

Our suggested AXA Travel Protection Plan

AXA presents travelers with three travel plans – the Silver Plan , Gold Plan , and Platinum Plan , each offering different levels of coverage to suit individual needs. Given that Brazilian hospitals often do not accept U.S. health insurance or Medicare, we genuinely recommend travelers consider purchasing any of these plans, particularly for the crucial coverage they offer for emergency accident and sickness medical expenses. If you're seeking added protection for your Japan adventure, opt for the Platinum Plan. With the optional Cancel for Any Reason addition, enjoy increased flexibility for unforeseen changes in your travel agenda. Plus, Rental Car (Collision Damage Waiver) can offer coverage as you navigate the breathtaking landscapes of Thailand in your rental vehicle.

AXA covers three essential types of medical expenses:

- Emergency Medical

- Emergency evacuation & repatriation

- Non-medical emergency evacuation & repatriation

Emergency Medical: Can cover medical expenses, hospital stays, and even emergency evacuations, covering the expenses of hefty bills and ensuring access to quality healthcare while away from home.

Emergency Evacuation and Repatriation: Can cover your immediate transportation home in the event of an accidental injury or illness.

Non-Medical Emergency Evacuation and Repatriation: Offers assistance in unexpected situations such as political unrest or natural disasters, ensuring safe and timely relocation to a secure location or repatriation back home.

There are no restrictions related to COVID-19 for U.S. visitors traveling to or from Japan at this time. U.S. travelers will not have to show proof of COVID-19 testing or vaccination records and you do not have to quarantine either. Regulations change regularly, so it is best to double-check right before you go. For up-to-date information on requirements for COVID-19 and other travel restrictions visit the Ministry of Foreign Affairs of Japan website.

Traveling with pre-existing medical conditions can complicate your plans, but with AXA Travel Protection, we're here to support you during your trip. Our Gold and Platinum Plans offer coverage for pre-existing medical conditions. The Platinum plan, in particular, is our highest-offered choice for travelers who want our highest coverage limits and optional add-ons Whether your pre-existing medical condition is covered on a travel insurance plan depends on when you were diagnosed with the condition. Any condition you had within 60 days before your policy began is not covered, although if your physician diagnoses you with a condition after the effective date of the policy, your travel insurance coverage applies. NOTE: – Your state of residency may affect your coverage, so be sure to read your policy thoroughly.

Suppose you are traveling from Houston to Japan with a layover in New York City. The snow is pelting down, and the airline cancels your connecting flight in New York. A quick call to AXA's concierge services will get you a referral for a hotel and a ride to get you there. You also get reimbursed for extra expenses like meals, toiletries and other incidental expenses (up to the per-day limit) until you can get a new flight to Japan.

FAQs About International Travel Insurance for Japan

1. can you buy travel insurance after booking a flight.

You can buy travel insurance even after your flight is booked.

2. When should I buy Travel Insurance for Japan?

It's advisable to purchase travel insurance for your trip as soon as you have made your initial trip deposit (prepaid and non-refundable trip costs.) AXA Travel Protection offers coverage as soon as you purchase your protection plan. We can give coverage against unforeseen events before you leave for your trip. Additionally, our policies offer coverage for preexisting medical conditions and Cancel for Any Reason if you purchase your protection within 14 days of making your initial trip deposit.

3. What is needed to visit Japan from the USA?

To visit Japan, you will need a valid passport for the duration of your stay, a visa (unless you are visa-exempt), an onward or return ticket, and a QR code from the Visit Japan Web website . While travel insurance is not required, it is valuable to have.

4. What happens if a tourist gets sick in Japan?

If you become sick in Japan, travelers with AXA Travel protection can contact the AXA Assistance hotline at 855-327-1442 . Contact information is typically provided within the insurance documentation. Please ensure to read through your policy details and information.

5. Does Japan have free health care for travelers?

No. Japan has a public health care system, but it is not available for tourists.

Disclaimer: It is important to note that Destination articles are for editorial purposes only and are not intended to replace the advice of a qualified professional. Specifics of travel coverage for your destination will depend on the plan selected, the date of purchase, and the state of residency. Customers are advised to carefully review the terms and conditions of their policy. Contact AXA Travel Insurance if you have any questions. AXA Assistance USA, Inc.© 2023 All Rights Reserved.

AXA already looks after millions of people around the world

With our travel insurance we can take great care of you too

Get AXA Travel Insurance and travel worry free!

Travel Assistance Wherever, Whenever

Speak with one of our licensed representatives or our 24/7 multilingual insurance advisors to find the coverage you need for your next trip.

IMAGES

VIDEO

COMMENTS

In general, travel insurance costs about 3 - 10% of your total prepaid and non-refundable trip expenses. The cost of travel insurance depends on two factors for AXA Travel Protection plans: Total Trip cost: The total non-prepaid and non-refundable costs you have already paid for your upcoming trip. This includes prepaid excursions, plane ...

Traveling to Vietnam? Better get AXA Travel Insurance and protect your trip to Italy from any unforeseen events File Claim Our Plans Our Plans ... All visitors entering Vietnam are required to have travel insurance with a minimum of $10,000. It is wise to purchase a complete travel insurance policy because of the unpredictable nature of ...