Cash payment limitations

29 September, 2022

Many consumers use cash. However there are limitations on cash payments within the EU and entering or leaving a country with cash may be subject to customs declarations. Check before you travel!

ECCs advise consumers to carefully check the methods of payment accepted by traders and to ensure that transactions are as secure as possible. Some traders might ask for a deposit and accept a deposit in cash, others might ask for a debit or credit card payment and others still might accept cheques , money transfers or postal orders. Consumer credit might also be used widely.

In some countries debit cards may be an option, but as they often have limits on the amount that can be spent, consumers must check with their banks prior to purchase and, if necessary, increase the amount for a short period.

Remember: A trader in the EU is not obligated to accept more than 50 metal coins for the same payment.

Good to know: You are entering or leaving a country with cash. Do you know if you have a duty to declare this sum of money ? Check the requirements for each EU Member state!

For goods and services, the limit for cash payments is EUR 3,000. This restriction does not apply to payments between consumers.

According to Belgian law , special regulations include the following:

- The purchase price for the acquisition of real estate may not be paid in cash.

- If copper cables are sold to a entrepreneur, the entrepreneur may not pay the purchase price in cash. Not even if the seller is a consumer.

- When buying and selling scrap metal and items containing valuable materials, cash payments between entrepreneurs are prohibited.

- If a consumer sells such valuable materials to an entrepreneur, the payment may only be made in cash up to an amount of 500 euros. The entrepreneur must also verify the identity of the selling consumer.

These restrictions do not apply if the execution of the contract takes place under the supervision of a bailiff.

Violations of the above restrictions are punishable by fines ranging from 250 euros to 225,000 euros.

Amounts of 10,000 levs (approx. 5,108 euros) or more may not be paid in cash. This also applies if this limit is only reached through several related payments.

Violations can be punished with a fine of up to 25 percent of the sum concerned (for entrepreneurs up to 50 percent).

For payments in another currency, the limit of 10,000 levs is set according to the exchange rate of the Bulgarian National Bank on the day of payment.

Cash payment limitation: 15 000 €

Czech Republic

Cash payments are possible up to and including 270,000 Czech crowns (approx. € 10,509) per day.

Violations of this rule are punishable by a fine of up to 500,000 kroner for consumers and up to 5,000,000 kroner for companies.

No limit on cash payments between private individuals.

As soon as an entrepreneur is involved, however, there is in fact a maximum limit.

Because in Danish law there are, among other things, the following special regulations:

- Traders are not allowed to accept cash payments of 20,000 Danish kroner (approx. 2689 euros) or more. This does not apply to banks and other financial service providers.

- Traders are obliged to accept cash up to 20,000 kroner between 6 a.m. and 10 p.m. (in areas with a high crime rate until 8 p.m.). The obligation applies when traders accept certain types of payment, especially card payment.

- The use of 500-euro notes as well as 25-Øre coins is prohibited.

- When paying an amount in coins, a maximum of 25 coins per transaction may be used. The maximum amount that may be paid exclusively in coins is DK 962.50 (approx. 129 euros).

- For services or purchases of goods related to services, cash payment is not recommended for amounts of DK 8,000 (approx. 1075 euros) or more. The reason: if the trader does not pay the income tax and VAT on the purchase price, the consumer can be held jointly responsible. The buyer can exempt himself from this liability by reporting the purchase to the competent tax office (within 14 days after payment, at the latest one month after receipt of the invoice).

No limit on cash payments.

Cash can be rejected from 50 coins or banknotes, regardless of the value.

The Estonian central bank as well as credit institutions, on the other hand, must accept cash / banknotes without any restriction.

There is no legal limit for cash payments.

However, the trader is also not legally obliged to always accept cash payments. Such procedures must be clearly communicated, for example in the form of signs at the entrance of a shop, e.g. refusing to accept more than 50 coins or a large banknote.

Read more about paying cash in Finland.

The limits for cash payments are as follows:

- The cash limit is 1,000 euros for taxpayers resident in France.

- For non-resident taxpayers acting as consumers, the limit increases to an amount of 10,000 euros (up to and including 15,000 euros in special cases, e.g. payments to banks).

- Payments in connection with property purchases that are notarised may be paid in cash up to a maximum of 3,000 euros.

- Cash payments between private individuals, for example when buying a car , are not limited. The issuing of an invoice is mandatory for amounts over 1,500 euros in order to be able to prove payment.

- Taxes can be paid in cash up to a maximum of 300 euros.

Traders are obliged to accept cash, otherwise a fine of max. 150 euros may be imposed.

Traders may refuse to accept damaged banknotes. The same applies if there are safety concerns (for example, if a payment is made at night). If there is any doubt about the authenticity of the banknote, the merchant may ask you for your identity and the origin of the banknote.

Traders are allowed to refuse payments with more than 50 coins, as well as banknotes that significantly exceed the amount to be paid.

More information on our article: Means of payment in France

No limit on cash payments for the purchase of goods.

Consumers who want to pay amounts which are higher than 10. 000 Euro in cash, have to show their ID card. And the trader has to document the surname, first name, place of birth, date of birth, the home address and the nationality.

The maximum limit for cash payments is 500 euros.

Higher amounts must be paid by bank transfer, bank card or cheque.

There is no cash limit for car purchases. However, a change in the law is already being discussed in Greece.

Consumers can pay in cash without restriction.

A limit of 1.5 million Hungarian HUF (approx. 41,695 euros) per month applies to legal entities, business associations and individuals who are subject to VAT.

According to the law, there is no limit for cash payments.

In practice, however, it may well happen that traders only accept cash up to a certain amount.

The maximum limit for cash payments in Italy is 1,000 euros.

The maximum amount that can be paid in cash is 7,200 euros.

Violations are sanctioned with fines amounting to 15 percent of the sum concerned.

Land purchase contracts may generally not be carried out with cash.

The limit for cash payments is 3,000 euros.

Certain items and goods may not be paid for in cash for an amount of 10,000 euros or more. This includes antiques, real estate, jewelry, precious metals, pearls, precious stones, automobiles, boats, and works of art.

Violations will be punished with a fine of at least 40 percent of the amount in question.

To the Maltese legal text (in English).

Netherlands

For private individuals, there is currently no limit for cash payments.

However, there is a legislative proposal to prohibit cash payments from an amount of € 3,000 or more.

There is also an obligation to report irregular payments over € 2,000. This applies to professions in the banking sector, freelancers, insurance companies, casinos and others.

In Norway there is a right to pay with cash.

There is no limit for cash payments between individuals.

However, as soon as an entrepreneur is involved, there is in fact a maximum limit.

The Norwegian law sets the following restrictions:

- When paying for items with a value of up to and including 40,000 Norwegian kroner (approx. 3841 euros), the seller may not accept a cash payment. This also applies if the amount is paid in several installments.

- When purchasing services or goods related to services, cash payments are not recommended if the amount exceeds 10,000 Norwegian kroner (approx. € 958). The reason: if the service provider does not pay income tax, VAT and social security contributions, the consumer can be held responsible.

- When paying an amount in cash, no more than 25 coins per unit must be accepted.

For payments between traders, the limit for cash payments is PLN 15,000 (approx. EUR 3267).

There are no restrictions for private individuals.

Payments of a value of 3,000 euros or more may not be made in cash.

The Portuguese law also contains the following separate regulations:

- For a person liable to income or corporate tax in Portugal, cash payments of 1,000 euros or more are not permitted.

- If the payment is made by a consumer who does not have a place of residence in Portugal, cash payments are only prohibited from an amount of 10,000 euros or more.

- Taxes may only be paid in cash up to and including 500 euros.

Payments to entrepreneurs may only be made in cash as long as they do not exceed 5,000 Romanian lei (approx. € 1016) per day.

For the delivery of goods and services, this limit is 10,000 lei (approx. € 2033) per day.

Payments between consumers, e.g. for the purchase of a good, service or for rent, may only be made in cash as long as the amount is below 50,000 lei (approx. €10,165) per day.

Cash payments of up to 5000 euros are possible for transactions between traders and for a purchase between a consumer and a trader.

For private individuals, the maximum limit is 15,000 euros.

Traders are only allowed to accept cash payments up to and including 5,000 euros.

Payments to traders or from traders may no longer be made in cash from an amount of 1,000 euros or more.

For a consumer who does not have a tax residence in Spain, the ban on cash only applies to an amount of 10,000 euros or more.

If this rule is violated, the penalty is 25 percent of the sum concerned.

There is no limit for paying with cash.

However, a trader can refuse to accept cash. This must then be made known clearly and in good time (for example by means of a corresponding sign in front of a shop).

Healthcare services must always accept cash payments.

United Kingdom

The consumers can make cash payments without any limits.

The traders, however, need to register themselves with tax authorities as 'High Value Dealers' if accepting cash payments in excess of €10,000. Exclusions apply.

Good to know: In England and Wales, you pay with English pound notes. However, in Scotland and Northern Ireland, the English pound notes may not be accepted. Likewise, the Scottish and Northern Irish pound notes may not be accepted in shops in England and Wales.

With regard to the change, there are unlimited payments of £ 5, £ 2 and £ 1. Coins with a face value of 50p, 25p and 20p can pay amounts up to £ 10, with 10p and 5p up to £ 5 and with 2p and 1p up to 20p.

We thank the European Consumer Centers for the provided information. Utmost care has been dedicated to their composition. However, the ECC France does not guarantee the accuracy of the information.

Funded by the European Union. Views and opinions expressed are however those of the author(s) only and do not necessarily reflect those of the European Union or the European Innovation Council and Small and Medium-sized Enterprises Executive Agency (EISMEA). Neither the European Union nor the granting authority can be held responsible for them.

You might also be interested in

- 14 days to withdraw

- Sales periods

- Guarantees and warranties

- Internet fraud and scams

Thank you for your time!

Thank You For Your Feedback.

What are you looking for?

Obligation to declare cash when travelling to or from germany.

Banknotes of various international currencies, © Colourbox

Cash sums totalling 10,000 or more euros on trips to and from Germany must be declared to the customs authorities. This applies to both cash and equivalent means of payment.

Obligation to declare cash or equivalent means of payment when entering or leaving the EU

Any person entering Germany from a country which is not a member state of the European Union ( EU ) or leaving Germany for a non-member state and who is carrying cash or an equivalent means of payment with a total value of 10,000 or more euros is obliged to declare this amount unsolicited and in writing to the competent German customs authorities. The customs control units carry out inspections both at the border and within Germany to monitor compliance with this obligation. A substantial fine may be imposed on anyone who does not declare sums of cash or equivalent means of payment in excess of this limit or makes a false declaration.

Obligation to declare cash or equivalent means of payment when travelling within the EU

Any person entering Germany from an EU member state or leaving Germany for an EU member state and who is carrying cash or an equivalent means of payment with a total value of 10,000 or more euros, must orally declare this amount on entering or leaving the country when questioned by a customs official . A substantial fine may be imposed on anyone who does not declare sums of cash or equivalent means of payment in excess of this limit or makes a false declaration.

Information on a declaration within the EU :

- Information on the obligation to verbally declare cash money and equivalent means of payment upon frontier passage within the EU

Information on a declaration when coming from third countries (non-member of the EU ):

- Information sheet on the duty to declare cash/funds when entering Germany from a non- EU country or leaving Germany for a non- EU country

Declaration form :

- Cash declaration form

- Top of page

Declaring cash you are carrying into or out of the European Union (EU)

If you are entering or leaving the EU and carrying cash worth €10,000 or more, you must declare it. Cash can be banknotes and/or coins. Declare your cash with customs in the country where you are entering or leaving the EU. If you leave or enter the EU via the Netherlands you should declare the amount with the Douane (Dutch Customs).

Last updated on 4 April 2023

Lees deze informatie in het Nederlands

When do you need to declare cash amounts?

The Belastingdienst (Tax and Customs Administration) provides more information on the situations when you have to declare cash amounts . You do not have to declare cash amounts if you are travelling within the EU.

Declaring cash amounts

You must declare cash amounts to the Douane (Dutch Customs).

Laws and regulations (in Dutch)

Algemene douanewet, artikel 3:2

Found what you were looking for?

- Skip to primary navigation

- Skip to main content

- Skip to primary sidebar

Money in Europe: What you need to know about getting cash in Europe

February 11, 2019 by Karen Turner Leave a Comment

As an American abroad, one of the most common questions that I’m asked by visiting friends and family what is the best way to get cash out in Europe. It depends a bit on your country, but this post will discuss European currency, what you need to do before your trip, best practices for getting cash out at the best rates, whether you need to carry around lots of cash, using ATMs in Europe, how to get the best exchange rates, and some tips for various European countries.

- 1 European currency

- 2.1 Notify your bank and credit cards

- 2.2 Set your withdrawal limit

- 2.3 Do you need to carry a lot of cash on you?

- 2.4 Bring a wallet or change purse that can handle more coins

- 2.5 Check the ATM withdrawal policies of your bank

- 2.6 Avoid taking out cash before your trip for when you arrive

- 3.1 Avoid traveler’s checks

- 3.2 Know the rough rate for conversion

- 3.3 Ensure you have at least one debit card with Visa or Mastercard, if not more.

- 3.4 Make sure your card is chip and pin

- 4.1 ATMs in Airports are convenient, however they usually have high fees attached to them

- 4.2 Try to look up banks, rather than ATMs, as these ATMs will have lower fees

- 4.3 Be aware of your surroundings and try to use ATMs within residential neighborhoods

- 4.4 Check the ATM before using it

- 5.1 Large bills may not be broken in many shops

- 5.2 Avoid exchanging money

- 5.3 It’s generally cheaper to pay in cash for small items and meals. I typically use a credit card for hotels.

- 5.4 Americans: Avoid keeping excess US dollars, most places will not accept them

- 5.5 In countries that don’t use the euro, you might be able to use euros in some cases*

- 5.6 Be careful about handing off your cards to be run in the back

- 6 Any other questions about taking out money in Europe?

European currency

Within the European Union, the euro is the dominant currency used, however, the euro is not the only currency. Certain countries within the EU have chosen to keep their own currency. Similarly, there are countries within Europe that aren’t part of the European Union that do not use the euro. ( Kosovo is not part of the EU, but they choose to use the euro as their currency.)

These countries use the euro : Austria, Belgium, Cyprus, Estonia, Finland, France, Germany, Greece, Ireland, Italy, Kosovo, Latvia, Lithuania, Luxembourg, Malta, the Netherlands (my home!), Portugal, Slovakia, Slovenia, and Spain.

These countries in Europe do not use the euro: Albania, Belarus, Bulgaria, Croatia, Czech Republic, Denmark, FYR Macedonia, Moldova, Hungary, Iceland, Liechtenstein, Poland, Norway, Romania, Russia, Serbia, Sweden, Switzerland, Ukraine, and United Kingdom.

Both one and two euro are coins, however beyond that, you’ll receive bills for the various denominations: 5, 10, 20, 50, 100, 500. In terms of coins, some European countries do not use the penny coin (e.g. the Netherlands), so your amount might be rounded to the nearest even amount.

What you need to do before your trip

Notify your bank and credit cards.

This is the most important notes that I have for travelers visiting Europe! If you don’t put on a travel notice for your cards, you won’t be able to use your cards. It’s disappointing and it’s happened to family members of mine. Inform your bank/credit card companies of travel plans.

Set your withdrawal limit

One pro tip of mine is to set your withdrawal limit a bit lower by default in case your card is stolen. I have my withdrawal limit at 150 euros per day and it can be updated easily if I had an emergency. As a traveler, I’d recommend maybe 200 euros if you’re concerned about needing to pay for a hotel in cash.

Do you need to carry a lot of cash on you?

No, you do not. Carrying a lot of cash on you is a liability whether it’s leaving it vulnerable in your hotel room and carrying it around with you on the street (making you more prone to pickpockets). It depends on your travel style, but you will be surprised how many European establishments will accept cards.

Some European countries like Germany and Albania tend to be more cash-based. Similarly, some countries (like the Netherlands) prefer a card system that is not used by many other countries (Maestro debit card). Generally, larger capital cities tend to be more oriented towards tourists, but you might see a shift once you visit smaller cities. Similarly, regional transit may not accept cards.

Bring a wallet or change purse that can handle more coins

Not everyone thinks about this, however you’ll need a change purse that can carry lots of coins . Both the euro as well as the 2 euro are coins, so I recommend bringing a coin purse at minimum ! You’ll be surprised how heavy your wallet can get if you are dealing with euros as well as several other currencies within Europe (especially in the Czech Republic).

Check the ATM withdrawal policies of your bank

Find out how much it will cost you per ATM visit. I recommend looking for a bank that has no ATM fees, which will make it easier to take out cash more often. In terms of US banks, I use Charles Schwab, which doesn’t charge ATM fees anywhere.

If you’re in a similar situation, I’d recommend visiting the ATM every few days (or as needed) to take out 100 euros (or 200 as needed) to minimize how much you’re carrying on you. If you have higher fees, I’d limit your cash to 300 euros at one time.

Avoid taking out cash before your trip for when you arrive

Although it seems natural to go to your bank to get some money, you’re going to get a less ideal exchange rate than if you use an ATM in Europe! There are generally ATMs (described as cash machines/cash points depending on the country) within most major airports, so don’t worry too much!

Best practices for getting cash out in Europe

Avoid traveler’s checks.

Although traveler’s checks have long been sold as the safest choice for paying for travel in Europe, however, you might be surprised how many places do not take them anymore. Save yourself the effort of gathering traveler’s checks and look into credit cards that do not charge foreign transaction fees before your trip to pay for hotels (and other extras).

Know the rough rate for conversion

On my first trip to Europe, I obsessed over the currency exchange rate, but unless you’re making a very large purchase in the thousands, you don’t need to check the currency rate obsessively. It will change a bit, but most likely not as markedly as you’d expect.

Even checking the rate every couple days or before you travel to a country that doesn’t use the euro will save you some hassle and help you figure out how much you’re spending in your home currency. This is particularly helpful in terms of using cash machines ( ATMS ), so you can estimate how much money you’re taking out in your home currency. (Google will instantly convert amounts for you in real time on your phone if needed.)

Ensure you have at least one debit card with Visa or Mastercard, if not more.

You never know when your cards will stop working, an ATM eats your card, or you forgot to clear your card for travel. It’s always good to always have a backup card. Visa and Mastercard are the two most popular card types in Europe, so if you have more than one, you’ll save yourself a lot of effort!

Make sure your card is chip and pin

European cards by default are chip and pin, so if your debit or credit card is not set up with chip and pin, you might want to check how to use it and/or replace it with a chip and pin card.

Without a chip and pin card, you might have some issues with card machines specifically designed for this purpose. (Many card readers in the Netherlands where I live are not designed for swiping.)

ATMs in Europe

ATMs in Airports are convenient , however they usually have high fees attached to them

One of the most convenient places to find an ATM is at the airport, however I recommend checking for the relevant fees as well as the exchange rate as these ATMS tend to be less than ideal. I sometimes take out a small bit of cash (40 euros) to allow me to get into the city center and/or my hotel before finding an ATM at a bank.

Try to look up banks, rather than ATMs, as these ATMs will have lower fees

Whenever you’re looking for a cash machine/ATM, I recommend searching for banks! There’s usually an ATM run by the bank itself and compared to third-party items, their fees might be lower (beyond your own international banking fees). Avoid Euronet ATMs at all costs!

Be aware of your surroundings and try to use ATMs within residential neighborhoods

This is a big one! When I was in Paris, someone on the free walking tour with me chose to use an ATM at a heavily trafficked corner near the Louvre. While he was using it, a man tried to extort him to take the cash while another lingered nearby.

I try to use cash machines in residential neighborhoods (where it’s quieter) and if I have to use an ATM in a popular area, I try to ensure that nobody else is close to me prior to quickly putting the money away.

Check the ATM before using it

Before using a cash machine, I generally will pull on the card reader portion. A skimmer is a device put on top of a card reader (for a restaurant or an ATM) in order to read your card and save that data for thieves. They’re harder to spot, but since watching this video of removing a skimmer in Vienna , I always tug a bit on the ATM and inspect the machine a bit before using it.

Other tips for money in Europe

Large bills may not be broken in many shops

If you’re taking out quite a bit of cash, be warned that many smaller shops and even commercial shops may refuse to break your bill that is 100 euros (and more). It’s frustrating, so avoid getting bills more than 100 euros (beyond paying for accomodation). I generally recommend getting out your money in twenties or fifties.

Avoid exchanging money

Although it seems like a good ideal to have some extra cash on you, the exchange rate at most money exchange booths is far less favorable than using an ATM. I recommend leaving your home currency money at home and waiting until you arrive. You’ll get more money to keep!

It’s generally cheaper to pay in cash for small items and meals. I typically use a credit card for hotels.

You’ll have an easier time paying for smaller meals as well as small items in cash. I typically use a credit card (that doesn’t charge foreign transaction fees) to pay for hotels, car rentals, and large purchases (e.g. flights).

Americans: Avoid keeping excess US dollars, most places will not accept them

Although it used to be that you should carry some US dollars just in case, I can tell you that people will think you’re an idiot if you try to pay in US dollars. Pay in euros (or the applicable local currency). You’ll get a better exchange rate and they’ll be readily accepted.

In countries that don’t use the euro, you might be able to use euros in some cases*

In not all countries, the euro is accepted (at a markup) on the local currency at shops. I saw this at Cesky Krumlov, which is very close to the Austrian border, as well as in Albania . In Albania, most tours and hotels quoted the price in euros and would give you a more favorable exchange rate if you paid in lek.

Be careful about handing off your cards to be run in the back

If you’re paying with a card, I generally prefer to pay at the front where I can watch my card be run. If your card is taken to the back, you don’t really know what they’re doing with it and it might provide someone the opportunity to write down your card information. I generally request that I come to the front desk to pay, which is a good precaution.

Any other questions about taking out money in Europe?

- Two months in Europe itinerary

- Packing list for two weeks in Europe

- How to use your phone abroad

- How to dress more European

- Your perfect Amsterdam itinerary

About Karen Turner

New Yorker–born and raised. Currently living in the Hague, the Netherlands after stints in Paris and Amsterdam. Lover of travel, adventure, nature, city, dresses, and cats.

Who needs to declare?

Any natural person entering or leaving the EU and carrying cash of a value of €10 000 or more is required to declare that sum to the competent authorities of the Member State through which he/she is entering or leaving the EU.

- Any natural person is any traveller or crewmember that enters or leaves the EU by air, road, rail or sea.

- If this person is carrying cash for a legal entity (e.g. the company for which he/she works), that person must give the name of the company in the declaration.

- For persons travelling in a group the € 10 000 limit applies to each person individually.

- The obligation to declare cash also applies to minors through their parents or legal guardians, and to mentally incompetent persons or protected adult persons through their legal representation.

- If you are unsure if you have to declare or not, it is important to spontaneously approach and seek advice from the competent authorities at the point of entry or exit of the EU.

Share this page

- Work & Careers

- Life & Arts

Become an FT subscriber

Try unlimited access Only $1 for 4 weeks

Then $75 per month. Complete digital access to quality FT journalism on any device. Cancel anytime during your trial.

- Global news & analysis

- Expert opinion

- Special features

- FirstFT newsletter

- Videos & Podcasts

- Android & iOS app

- FT Edit app

- 10 gift articles per month

Explore more offers.

Standard digital.

- FT Digital Edition

Premium Digital

Print + premium digital, weekend print + standard digital, weekend print + premium digital.

Essential digital access to quality FT journalism on any device. Pay a year upfront and save 20%.

- Global news & analysis

- Exclusive FT analysis

- FT App on Android & iOS

- FirstFT: the day's biggest stories

- 20+ curated newsletters

- Follow topics & set alerts with myFT

- FT Videos & Podcasts

- 20 monthly gift articles to share

- Lex: FT's flagship investment column

- 15+ Premium newsletters by leading experts

- FT Digital Edition: our digitised print edition

- Weekday Print Edition

- Videos & Podcasts

- Premium newsletters

- 10 additional gift articles per month

- FT Weekend Print delivery

- Everything in Standard Digital

- Everything in Premium Digital

Complete digital access to quality FT journalism with expert analysis from industry leaders. Pay a year upfront and save 20%.

- 10 monthly gift articles to share

- Everything in Print

Terms & Conditions apply

Explore our full range of subscriptions.

Why the ft.

See why over a million readers pay to read the Financial Times.

International Edition

Cash payment: Cash limits in Europe

January 19, 2024

If you want to pay large sums of money abroad in the EU, for example when buying a car, there are a few rules you need to follow.

This is because many EU countries have cash limits. This means that cash payments can only be made up to a certain amount.

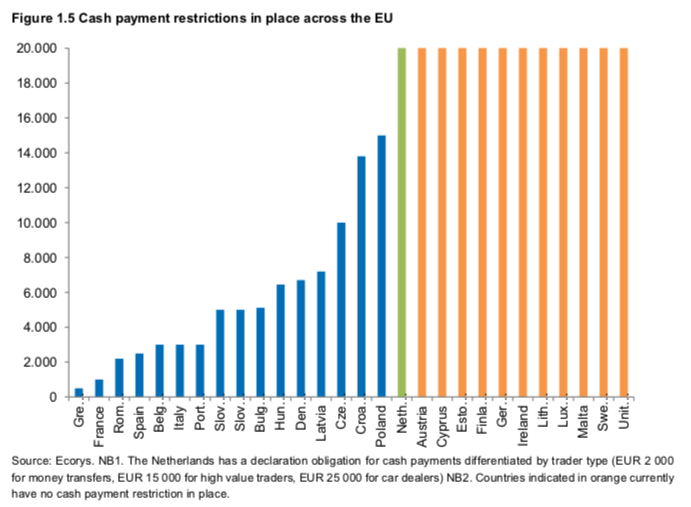

No single EU-wide limit for cash payments yet

There is still no standardised upper limit for cash payments in the EU. But this will come.

In the fight against money laundering and terrorist financing, the European Parliament and the Council of Ministers, in which the representatives of the member states sit, have agreed on a standardised upper limit of 10,000 euros. The law still needs to be formally adopted. Read more here.

Member states that already have lower cash limits can retain them.

Important to know

- In euro countries, there is no obligation to accept more than 50 coins at a time.

- It may also happen that traders refuse larger euro notes (e.g. a €200 note).

- Anyone entering or leaving the EU with a total of more than €10,000 in cash must declare it to national customs.

Please click on the country to get more information.

For goods and services, the limit for cash payments is EUR 3,000. This restriction does not apply to payments between consumers.

According to Belgian law , special regulations include the following:

- The purchase price for the acquisition of real estate may not be paid in cash.

- If copper cables are sold to a entrepreneur, the entrepreneur may not pay the purchase price in cash. Not even if the seller is a consumer.

- When buying and selling scrap metal and items containing valuable materials, cash payments between entrepreneurs are prohibited.

- If a consumer sells such valuable materials to an entrepreneur, the payment may only be made in cash up to an amount of 500 euros. The entrepreneur must also verify the identity of the selling consumer.

These restrictions do not apply if the execution of the contract takes place under the supervision of a bailiff.

Violations of the above restrictions are punishable by fines ranging from 250 euros to 225,000 euros.

Amounts of 10,000 levs (approx. 5,108 euros) or more may not be paid in cash. This also applies if this limit is only reached through several related payments.

Violations can be punished with a fine of up to 25 percent of the sum concerned (for entrepreneurs up to 50 percent).

For payments in another currency, the limit of 10,000 levs is set according to the exchange rate of the Bulgarian National Bank on the day of payment.

From January 2023 the following will apply: Legal or natural persons carrying out a registered activity in Croatia may not accept cash payments of 10,000 euros or more.

Czech Republic

Cash payments are possible up to and including 270,000 Czech crowns (approx. € 10,509) per day.

Violations of this rule are punishable by a fine of up to 500,000 kroner for consumers and up to 5,000,000 kroner for companies.

Here you can read the Czech legal text (in English).

No limit on cash payments between private individuals.

As soon as an entrepreneur is involved, however, there is in fact a maximum limit.

Because in Danish law there are, among other things, the following special regulations:

- Traders are not allowed to accept cash payments of 20,000 Danish kroner (approx. 2689 euros) or more. This does not apply to banks and other financial service providers.

- Traders are obliged to accept cash up to 20,000 kroner between 6 a.m. and 10 p.m. (in areas with a high crime rate until 8 p.m.). The obligation applies when traders accept certain types of payment, especially card payment.

- The use of 500-euro notes as well as 25-Øre coins is prohibited.

- When paying an amount in coins, a maximum of 25 coins per transaction may be used. The maximum amount that may be paid exclusively in coins is DK 962.50 (approx. 129 euros).

- For services or purchases of goods related to services, cash payment is not recommended for amounts of DK 8,000 (approx. 1075 euros) or more. The reason: if the trader does not pay the income tax and VAT on the purchase price, the consumer can be held jointly responsible. The buyer can exempt himself from this liability by reporting the purchase to the competent tax office (within 14 days after payment, at the latest one month after receipt of the invoice).

Below you will find the relevant Danish laws (in Danish):

- LBK nr 1062 af 19/05/2021

- 2020/1 LSF 193

- LOV nr 652 af 08/06/2017

- BEK nr 928 af 19/09/2008

- LBK nr 1803 af 12/12/2018

No limit on cash payments.

Cash can be rejected from 50 coins or banknotes, regardless of the value.

The Estonian central bank as well as credit institutions, on the other hand, must accept cash / banknotes without any restriction.

There is no legal limit for cash payments.

However, the trader is also not legally obliged to always accept cash payments. Such procedures must be clearly communicated, for example in the form of signs at the entrance of a shop, e.g. refusing to accept more than 50 coins or a large banknote.

Read more about paying cash in Finland.

The limits for cash payments are as follows:

- The cash limit is 1,000 euros for taxpayers resident in France.

- For non-resident taxpayers acting as consumers, the limit increases to 15,000 euros.

- Payments in connection with property purchases that are notarised may be paid in cash up to a maximum of 3,000 euros.

- Cash payments between private individuals, for example when buying a car , are not limited. The issuing of an invoice is mandatory for amounts over 1,500 euros in order to be able to prove payment.

- Taxes can be paid in cash up to a maximum of 300 euros.

Traders are obliged to accept cash, otherwise a fine of max. 150 euros may be imposed.

Traders may refuse to accept damaged banknotes. The same applies if there are safety concerns (for example, if a payment is made at night). If there is any doubt about the authenticity of the banknote, the merchant may ask you for your identity and the origin of the banknote.

Traders are allowed to refuse payments with more than 50 coins, as well as banknotes that significantly exceed the amount to be paid.

Below you will find corresponding French laws and further information (in French):

- Art. R642-3 - Code penal

- Art. 1680 Code général des impôts

- Art. L.112-6 - Code monétaire et financier

- Paiement en espèces

There is no upper limit for cash payments.

However, anyone wishing to pay more than €10,000 in cash must show identification. The merchant must then collect the following information Name, first name, place and date of birth, nationality and home address. This information must be recorded and retained by the dealer.

For the anonymous purchase of precious metals (gold, silver, platinum, etc.), a cash payment limit of 1,999.99 euros has applied since January 2020. For precious metal purchases above this amount that are paid for in cash, the retailer must verify the identity of the customer.

Since 1 April 2023, cash payment for the purchase of real estate has been prohibited.

The maximum limit for cash payments is 500 euros.

Higher amounts must be paid by bank transfer, bank card or cheque.

There is no cash limit for car purchases.

In Greece, there is talk of changing the law to limit cash payments to 200 euros.

Consumers can pay in cash without restriction.

A limit of 1.5 million Hungarian HUF (approx. 41,695 euros) per month applies to legal entities, business associations and individuals who are subject to VAT.

According to the law, there is no limit for cash payments.

In practice, however, it may well happen that traders only accept cash up to a certain amount.

Italy has raised the limit for cash payments.

From January 2023, the limit for cash payments will be €5,000 (previously €2,000).

The maximum amount that can be paid in cash is 7,200 euros.

Violations are sanctioned with fines amounting to 15 percent of the sum concerned.

Land purchase contracts may generally not be carried out with cash.

As of November 2022, the cash payment limit for natural and legal persons will be 5000 euros.

No limit for cash payments.

However, for cash payments of €10,000 or more, merchants must verify the identity of the customer, keep the documents for at least 5 years and inform the competent authority in Luxembourg if money laundering is suspected.

Certain items and goods may not be paid for in cash for an amount of 10,000 euros or more. This includes antiques, real estate, jewelry, precious metals, pearls, precious stones, automobiles, boats, and works of art.

Violations will be punished with a fine of at least 40 percent of the amount in question.

To the Maltese legal text (in English).

Netherlands

There is currently no limit on cash payments to private individuals.

However, for cash payments of €10,000 or more, the seller is obliged to carry out a detailed check on the customer (customer due diligence).

The seller can also decide whether to accept cash at all or only up to a certain amount.

There is an obligation to report suspicious payments over €2,000. This applies, for example, to the banking sector, freelancers, insurance companies and casinos.

The Dutch government is working on a bill that would ban cash payments above €3,000.

In Norway there is a right to pay with cash.

There is no limit for cash payments between individuals.

However, as soon as an entrepreneur is involved, there is in fact a maximum limit.

The Norwegian law sets the following restrictions:

- When paying for items with a value of up to and including 40,000 Norwegian kroner (approx. 3841 euros), the seller may not accept a cash payment. This also applies if the amount is paid in several installments.

- When purchasing services or goods related to services, cash payments are not recommended if the amount exceeds 10,000 Norwegian kroner (approx. € 958). The reason: if the service provider does not pay income tax, VAT and social security contributions, the consumer can be held responsible.

- When paying an amount in cash, no more than 25 coins per unit must be accepted.

You can find relevant Norwegian laws here (in Norwegian):

- Lov om Norges Bank og pengevesenet mv . (sentralbankloven)

- Lov om tiltak mot hvitvasking og terrorfinansiering ( hvitvaskingsloven)

- Lov om betaling og innkreving av skatte- og avgiftskrav (skattebetalingsloven)

For payments between traders, the limit for cash payments is PLN 15,000 (approx. EUR 3300).

If natural persons are involved, there are no limits.

Changes to cash limits in Poland planned for January 2024 have been abandoned.

Payments of a value of 3,000 euros or more may not be made in cash.

The Portuguese law also contains the following separate regulations:

- For a person liable to income or corporate tax in Portugal, cash payments of 1,000 euros or more are not permitted.

- If the payment is made by a consumer who does not have a place of residence in Portugal, cash payments are only prohibited from an amount of 10,000 euros or more.

- Taxes may only be paid in cash up to and including 500 euros.

Payments to entrepreneurs may only be made in cash as long as they do not exceed 5,000 Romanian lei (approx. € 1016) per day.

For the delivery of goods and services, this limit is 10,000 lei (approx. € 2033) per day.

Payments between consumers, e.g. for the purchase of a good, service or for rent, may only be made in cash as long as the amount is below 50,000 lei (approx. €10,165) per day.

From 1 July 2023, the cash payment limit for all natural and legal persons in Slovakia will be €15,000.

Traders are only allowed to accept cash payments up to and including 5,000 euros.

Payments to traders or from traders may no longer be made in cash from an amount of 1,000 euros or more.

For a consumer who does not have a tax residence in Spain, the ban on cash only applies to an amount of 10,000 euros or more.

If this rule is violated, the penalty is 25 percent of the sum concerned.

You can find relevant Spanish laws here (in Spanish):

- Ley 11/2021

There is no limit for paying with cash.

However, a trader can refuse to accept cash. This must then be made known clearly and in good time (for example by means of a corresponding sign in front of a shop).

Healthcare services must always accept cash payments.

More information in Swedish can be found here.

United Kingdom

The consumers can make cash payments without any limits.

The traders, however, need to register themselves with tax authorities as 'High Value Dealers' if accepting cash payments in excess of € 10,000. Exclusions apply.

Good to know : In England and Wales, you pay with English pound notes. However, in Scotland and Northern Ireland, the English pound notes may not be accepted. Likewise, the Scottish and Northern Irish pound notes may not be accepted in shops in England and Wales.

With regard to the change, there are unlimited payments of £ 5, £ 2 and £ 1. Coins with a face value of 50p, 25p and 20p can pay amounts up to £ 10, with 10p and 5p up to £ 5 and with 2p and 1p up to 20p.

Below you will find relevant UK legislation and further information:

- Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017

- Coinage Act 1971

- Currency and Bank Notes Act 1954

- What is legal tender? | Bank of England

The information is provided by our colleagues in the European Consumer Centres Network . It does not claim to be exhaustive.

Funded by the European Union. Views and opinions expressed are however those of the author(s) only and do not necessarily reflect those of the European Union or the European Innovation Council and Small and Medium-sized Enterprises Executive Agency (EISMEA). Neither the European Union nor the granting authority can be held responsible for them.

You might also be interested in

- Sales periods in Europe

- Guarantees and warranties in the EU

- Border controls and customs

- Counterfeit products

Useful links

- EU Parliament press release 17.01.2024

- EU Commission: Beating financial crime

Our website uses cookies. These have two functions: Firstly, they are necessary for the basic functionality of our website. On the other hand, we can use the cookies to constantly improve our content for you. For this purpose, only anonymised data is collected and evaluated from you. These are, for example, your country, your screen resolution, your terminal device or which pages you were particularly interested in. We store these values on our own server in Germany, which runs an open source software (Matomo), so no data is transferred to third parties such as Google or Microsoft. Social-Media-Plugins are generally (pre-)deactivated by us to prevent an unwanted traffic. Find more information regarding cookies on our Data Protection Declaration and regarding us on the Imprint .

These cookies are needed for a smooth operation of our website.

With the help of these cookies we strive to improve our offer for our users. By means of providing video content or other useful content like maps to enhance the user experience.

Thank you for your time!

Thank You For Your Feedback.

UponArriving

How Much Cash Can You Travel With? (TSA & International Rules) [2023]

So you have a load of cash and you want to transport it across the country or perhaps even internationally. But exactly how much cash are you allowed to travel with?

In this article, I will break down everything you need to know about traveling with cash including important rules and limitations when flying.

I’ll also cover a number of key considerations you will want to think about before taking your cash with you when going through TSA or even traveling internationally.

Table of Contents

How much cash can you travel with?

There are no limits on the amount of cash you can travel with but there are some major considerations you need to think about when doing so.

If you are traveling domestically, your primary concern is avoiding forfeiture of your cash.

If you are traveling internationally, forfeiture is a concern but you should also be focused on remembering to declare the value of your currency and monetary instruments totaling above $10,000. Keep reading to find out more.

Tip: Use the free app WalletFlo to help you travel the world for free by finding the best travel credit cards and promotions!

Legal risks of traveling with cash

TSA is concerned about dangerous threats such as explosives and not with enforcing laws and penal codes. (This is why they do not check for arrest warrants .)

Your cash money does not present a dangerous threat and so there should be no legitimate concern about it harming other passengers on the plane.

However, in the past there have been reports of TSA agents initiating the process for seizing cash from passengers under the suspicion that it is money gained from an illegal activity or money that is intended to be used on illegal activity.

Think drugs, weapons, and organized crime activities.

The seizing of cash can be accomplished under a number of different statutes including 21 U.S. Code § 881(a)(6) which governs forfeitures.

It states that you have no property right for:

(6) All moneys, negotiable instruments, securities, or other things of value furnished or intended to be furnished by any person in exchange for a controlled substance or listed chemical in violation of this subchapter, all proceeds traceable to such an exchange, and all moneys, negotiable instruments, and securities used or intended to be used to facilitate any violation of this subchapter.

It’s possible that if a TSA agent spots a lot of cash on you or in your bag (especially a lot of smaller bills like $20 bills) they could refer you to authorities (i.e., DEA) for some type of questioning.

The authorities may check to see if you are on some type of watchlist but even if you are not they may still deem that your cash is subject to civil forfeiture, which means that it will all be taken from you.

This can happen even if you have not been charged or convicted of any crime.

Some dogs that patrol airports have a nose for cash and a lot of cash has come into contact with illegal narcotics.

In fact, a study by Yuegang Zuo of the University of Massachusetts Dartmouth in 2009 found that about 90 percent of banknotes contain traces of cocaine . Traces of other drugs have also been found on cash like codeine, amphetamines and methamphetamines .

That means that “false positives” could be triggered, which could potentially be used as further evidence about your illegal activity (reportedly dogs don’t usually sniff out these faint traces).

If your money is seized you should have the opportunity to petition the process and to retrieve your funds.

It’s an odd legal proceeding where your cash is literally the defendant: “United States of America v. $50,000 in United States currency.”

That’s important because it means that the legal burden of proof is at the civil level which only requires it to be more likely than not that you were up to no good.

This petition process may not be very fun, could last a long time, and could be very costly. For example, you will likely need to hire an attorney which might cost you as much money as you have at stake.

Your success rate could also be very low.

In March 2017, the Justice Department’s Office of Inspector General reported that over the course of 10 years, the DEA only returned money in 8% of cases.

And if you do get your money back, if you owe taxes or judgments, those will likely have to be paid out first.

For these reasons, I would try to limit the cash I take through TSA security to maybe just a couple of thousand dollars (If that).

Personally, the most cash I ever carry on me is a couple of hundred bucks.

This may be problematic for people who want to gamble at their destination or who are looking to do things like purchase a car with cash but you should make alternative arrangements to receive your cash at your destination if possible.

Tips for traveling domestically with cash

If you are thinking about traveling through TSA with cash my advice would be the following:

Keep the amount as small as possible

First, avoid bringing more than $2,000 in cash if possible. That should be well below the level considered to be suspicious, as the lowest amount I saw subject to forfeiture was $6,000.

Also, try to avoid $20 bills since those are customarily used in drug deals.

Notify a TSA agent

If you do bring cash consider notifying a TSA agent when you enter the line and see if you can get some type of private or secondary screening.

If you have TSA Pre-Check , an agent might consider you to be less likely to be engaged in criminal activity but that is not a guarantee.

But note that cash has been seized in cases where people notified a TSA agent themselves so this is not a full proof method.

And it goes without saying but do not attempt to conceal the cash on your body such as strapping it to your chest because the full body scanners will find this quite easily.

Avoid checked baggage

You might be thinking about putting the cash in your checked baggage but that is not a good idea.

For one, if the cash was detected you will not be there to explain the situation and you may be caught off guard later when you are brought in for questioning by the DEA.

Second, if your cash is detected it’s possible that an unethical TSA agent could simply decide to take your cash.

And finally, if your luggage is lost you will not be able to retrieve that cash and cash is almost always an exception to baggage insurance policies.

Bring documentation

If you are traveling with a lot of cash because you want to purchase a vehicle or take care of some other transaction make sure that you have all of the supporting documentation already with you in case you are brought in for questioning.

Presenting anything less than an airtight explanation for transporting cash can mean instant forfeiture.

Avoid transporting suspicious items

It is a good idea to avoid transporting other items such as marijuana along with your cash since that will only reinforce the image that you are up to some type of criminal drug activity.

This is even the case if the state you are flying out of has legalized marijuana.

Consider your criminal history

And finally, if you have any type of criminal history — especially cases related to drug infractions — the odds of you encountering an issue with forfeiture go up.

That’s because it will be that much easier for them to make a case against you. Remember, we are talking about a civil court burden of proof — not criminal court.

So you should really reconsider bringing a lot of cash if that applies to you.

The International cash limit of $10,000 and the need to declare

US Customs and Border Protection is clear that you can transport “any amount of currency or other monetary instruments into or out of the United States.”

The caveat is that if the amount of currency exceeds $10,000 or it’s for an equivalent then you will need to file a FinCEN Form 105 (“Report of International Transportation of Currency or Monetary Instruments”) with U.S. Customs and Border Protection.

This is a pretty simple form to fill out and basically just requires you to input the following information:

- Contact information including passport number

- Export/import information

- Shipping information if applicable

- Details of the currency or monetary instrument

You can file this form electronically at FinCEN Form 105 CMIR, U.S. Customs and Border Protection (dhs.gov) but you can also file it in paper form.

In addition, if you are entering the United States you must declare if you are carrying currency or any other monetary instruments if they total over $10,000.

You can make this declaration on your Customs Declaration Form (CBP Form 6059B) and then file a FinCEN Form 105.

Do not blow off this requirement because failing to declare could mean forfeiture of your money and some pretty serious criminal penalties.

And remember each country has its own policy regarding traveling with cash so you have to make sure you are in compliance with the country you are headed to.

Monetary instrument

Unless you went to law school for three years you might be wondering what a “monetary instrument” is as it’s found on the FinCEN Form 105 .

US Customs and Border Protection defines it as:

- Traveler’s checks in any form

- All negotiable instruments (including personal checks, business checks, official bank checks, cashier’s checks, third-party checks, promissory notes, and money orders) that are either, in bearer form, endorsed without restriction, made out to a fictitious payee, or otherwise in such form that title passes upon delivery

- Incomplete instruments (including personal checks, business checks, official bank checks, cashiers’ checks, third-party checks, promissory notes, and money orders) signed but with the payee’s name omitted

- securities or stock in bearer form or otherwise, in such form that title passes thereto upon delivery.

In this article we are mostly focused on cash which would most definitely fall under “currency.”

Specifically, 19 CFR § 1010.100(m) defines “currency” as the coin and paper money of the United States or of any other country that:

- (1) is designated as legal tender, (2) circulates, and (3) is customarily used and accepted as a medium of exchange in the country of issuance.

- Currency includes U.S. silver certificates, U.S. notes, and Federal Reserve notes.

- Currency also includes official foreign bank notes that are customarily used and accepted as a medium of exchange in a foreign country.

The big take away here is that this restriction applies to cash of the US and also other countries.

The cash of pretty much every developed country is going to meet the requirements for currency listed above so it doesn’t matter if you are transporting Great Britain Pounds, Euros, etc.

Keep in mind that each form of currency and monetary instrument counts separately, as well. So if you have $6,000 in cash and a $5,000 traveler’s check, you are above the limit.

And members of a family residing in one household entering the United States that submit a joint or family declaration must declare if the members are collectively above the $10,000 limit.

So if a husband has $4,000 and the wife has $7,000, that family must declare because they are collectively above the limit.

Items that don’t count as currency

Some items related to currency do not officially count as currency but you still may have to declare them as “merchandise.”

For example, coins of precious metals, including silver and gold, do not fall into the definition of “monetary instrument” or “currency.”

However, coins of precious metals must be declared as merchandise if they are acquired abroad.

Other articles of precious metals (including gold bullion, gold bars, and gold jewelry) also do not fall into the definition of “monetary instrument” or “currency.”

However, these articles must also be declared as merchandise if they are acquired abroad.

They also have a list of excluded items which includes:

- Warehouse receipts and bills of lading

- Monetary instruments that are made payable to a named person, but are not endorsed or which bear restrictive endorsements

- Credit cards and prepaid cards

- Virtual currencies including Bitcoin

So if you are traveling around with credit limits above $50,000 or a nice stash of cryptocurrency you don’t have to worry about declaring those items.

Factors to consider when traveling with cash

When you are traveling chances are you are going to want to spend some money on various expenses like dining and excursions. It is highly recommended to use a good travel rewards credit card for these expenses for a few reasons.

Getting through security

If you have a bag full of cash money, that bag is going to have to get through security at some point. This may be at the airport, a train station, etc.

As explained in detail above, if a screening agent notices that you have wads of cash in a bag this could potentially raise a red flag and a worst-case scenario of you losing your cash and never getting it back.

The theft risk

Traveling with cash is risky whether you keep that cash on you or you stored in your hotel room.

If you are walking around with cash on you there is always that chance that you could run into a thief. This could be someone who could pick pocket your wallet or cash right out of your clothes or bag.

Or in a more serious case, this could be someone who holds you up with some type of weapon and forces you to handover your cash.

If you are going to travel with cash on your person it’s recommended to have some type of hidden wallet and a dummy wallet in your pocket. Your dummy wallet will have a small amount of cash, perhaps a duplicate credit card and even a duplicate ID to make it look as realistic as possible.

The idea is that if someone were to take that dummy wallet they would only get away with a minimal amount of your valuables. You could then have your real stash of cash hidden beneath your clothing.

If you choose to store your cash in your hotel room you also need to be careful. Putting your cash into a hotel safe is not quite as secure as you might think . In some cases you may actually want to just hide your cash somewhere in the room where a thief would not think to look.

Either way you go, carrying a lot of cash on you is a risk that you need to weigh very carefully.

Travel insurance

You can get travel insurance by paying for your excursions and travels with a good travel credit card.

So if for some reason you purchase a nonrefundable hotel or tour and then you have to cancel because you get sick or for some other covered reason, you can get fully reimbursed for your purchase. In some cases this could put thousands of dollars back in your pocket.

But if you paid for something like your hotel with cash there is a good chance that you will simply be out of luck and get hit with the loss.

Also, you might struggle to even be able to pay cash for certain travel expenses like rental cars .

Foreign conversion fees

When you convert your cash into a foreign currency you will be paying some type of conversion fee and in some cases may be dealing with a subpar rate, especially at those kiosks .

Certain types of ATM cards will allow you to withdraw cash in the local currency with minimal fees but the best way to make purchases abroad is to simply have a credit card with no foreign transaction fees.

Travel credit cards are great about offering rewards on purchases made abroad.

You don’t have to look very far to find a credit card that will earn you extra bonus points on flights, hotels, and even your tours and events. Earning extra points on dining, even when dining abroad, is also easy with cards like the Amex Gold Card.

By paying with cash you are missing out on all of these valuable rewards.

Traveling with a lot of cash can be problematic because that is often how actors travel who are engaged in criminal activities.

Your best bet is to avoid bringing a lot of cash but if you must, try to bring as much supporting documentation as possible and be prepared for questioning and the possibility of you having to fight against the government to retrieve your money.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo . He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio .

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Privacy Overview

Customs Cash Limits: How Much Cash Can You Carry On A Plane

Customs cash limits, how much cash can you carry on a plane.

If you thinking of flying with money you need to check how much cash you can take on your flight. This will depend on what country your are flying from and where you are going.

You can use our handy guide find customs cash limits for the country you are travelling to. Data supplied by the IATA Travel center .

Worldwide Currency Import Regulations Tool

Same regulations as for export apply.

Local currency (Afghani-AFA): in banknotes or coins up to AFA 50,000.-. Foreign currencies: up to the amount imported and declared. For amounts over AFA 1,000,000.- and "Ansari Application Form" is required.

Local currency (Albanian Lek-ALL): prohibited. Foreign currencies: no restrictions.

Local currency (Albanian Lek-ALL): prohibited. Foreign currencies: up to USD 5,000.- or up to the amounts imported and declared on arrival.

Foreign currencies: unlimited, to be changed at the nearest bank.

Foreign currencies: up to the amount imported and declared. It is necessary to submit the currency declaration issued on arrival. Declaration of exchange to be presented upon departure.

Local currency (Euro - EUR) and foreign currencies: no restrictions.

1. Local currency (Kwanza-AOA): up to AOA 50,000.- for residents and non-residents. 2. Foreign currencies: up to USD 15,000.- or equivalent (residents) and up to USD 10,000.- or equivalent (non-residents).

1. Local currency (Kwanza-AOA): up to AOA 50,000.- for residents and non-residents. 2. Foreign currencies: a. Residents (18 years of age and above): up to USD 15,000.- or equivalent; b. Residents (below 18 years of age): up to USD 5,000.- or equivalent; c. Non Residents (18 years of age and above): up to USD 10,000.- or equivalent; d. Non Residents (below 18 years of age): up to USD 3,000.- or equivalent. Exempt: a. If holding a letter (certified by B.N.A./D.O.I.) from a company or entity which took care of payment of all expenses during stay in Angola: foreign currencies up to the amount imported. b. Amounts left with receipts of bills paid or money exchange vouchers.

Local currency (East Caribbean Dollar-XCD) and foreign currencies: unlimited, if a declaration has been made upon arrival.

Antigua and Barbuda

Local currency East Caribbean Dollar (XCD) and foreign currencies: up to USD 10,000.- or equivalent. Higher amounts must have been declared on arrival.

Local currency (Argentine Peso-ARS) and foreign currencies: no restrictions. However, amounts exceeding USD 10,000.- (or equivalent) must be declared. Gold must be declared.

Local currency (Argentine Peso-ARS) and foreign currencies: prohibited unless exportation is made through authorized financial and foreign exchange entities, for amounts above: -USD 10,000.- (or equivalent) for travelers aged over 21 or independent minors; or -USD 2,000.- (or equivalent) for travelers aged between 16 and 21 years; or -USD 1,000.- (or equivalent) for travelers aged under 16 years.

Local currency (Armenian Dram - AMD) and foreign currencies: no restrictions. Cash in amounts exceeding USD 10,000.- or equivalent must be declared. Exempt from cash import declaration are passengers arriving from the Eurasian Customs Union ( Belarus, Kazakhstan, Russian Fed.)

Local currency (Armenian Dram -AMD) and foreign currencies: no restrictions up to USD 10,000.-or equivalent. Warning: More than USD 10,000- must be transferred via a bank. Exempt are passengers departing to the Eurasian Customs Union ( Belarus, Kazakhstan, Russian Fed.)

Local currency (Aruban Florin-AWG) and foreign currencies: no restrictions. However, amounts exceeding AWG 20,000.- (USD 11,000.- or equivalent) must be declared.

Local currency (Australian Dollar-AUD) and foreign currencies: no restrictions up to AUD 10,000.- (or equivalent in freely convertible currency). Warning: Any amount of Australian or foreign currency in coins and bank notes exceeding AUD 10,000.-(or equivalent in freely convertible currency) has to be declared in a Cross Border Movement Report (CBMR) . Other than coins and bank notes: travelers entering/departing Australia must declare, if requested, any of the following Bearer Negotiable Instrument (BNI): bills of exchange; cheques; promissory notes; bearer bonds; traveler's cheques; money orders, postal orders or similar orders; negotiable instruments not covered by any of the above paragraphs.

Same regulations as per Export apply.

Local currency (Euro - EUR) and foreign currencies: no restrictions if arriving from or traveling to another EU Member State . If arriving directly from or traveling to a country outside the EU: amounts exceeding EUR 10,000.- or more or the equivalent in another currency (incl. banker's draft and cheques of any kind) must be declared.

1. Residents: a. Local currency (New Azeri Manat-AZN): allowed, if the amount has been declared on the customs declaration when leaving the country. b. Foreign currencies: up to USD 10,000.- or equivalent. Higher amounts must be declared. 2. Non-residents: Foreign currencies: up to USD 10,000.- or equivalent. Higher amounts must be declared.

1. Residents: a. Local currency (New Azeri Manat-AZN): no restrictions if the amount is declared on departure. b. Foreign currencies: max. USD 10,000.- (or equivalent). All amounts higher than USD 1,000.- are subject to tax (1%). Amounts higher than USD 10,000.- have to be approved by the Central Bank of Azerbaijan. 2. Non-residents: up to the amount imported and declared (proof of import must be presented otherwise a max. of USD 1,000.- may be exported).

Local currency (Bahamian Dollar - BSD): not permitted. Foreign currencies: no restrictions.

Local currency (Bahamian Dollar - BSD): banknotes: a max. of BSD 200.- per person, higher amounts require permission of the Central Bank of the Bahamas; coins: no restrictions. Foreign currencies: no restrictions.

Local currency (Bahrain Dinar-BHD) and foreign currencies: no restrictions . Passengers arriving/departing Bahrain can be requested by the Customs or Security Authorities to disclose the value of any local or foreign currencies, gold or other negotiable instruments that are in their possession.

1. Residents: a. Local currency (Bangladesh Taka-BDT): up to BDT 100.-. b. Foreign currencies: no limit. 2. Non Residents: a. Local currency: up to BDT 100.-. b. Foreign currencies: no limit. Amounts over USD 5,000.- (or equivalent) must be declared.

1. Residents: a. Local currency (Bangladesh Taka-BDT): up to BDT 100.-. b. Foreign currencies: up to USD 25.- or equivalent. Higher amounts must be endorsed on the passport by Bangladesh Bank/Authorized Dealers in foreign exchange. 2. Non Residents: a. Local currency: up to BDT 100.-. b. Foreign currencies: up to USD 150.- or equivalent. Higher amounts if declared on arrival.

Local currency (Barbadian Dollar-BBD): no restrictions, if declared on arrival. Foreign currencies: no restrictions if declared on arrival.

1. Residents: a. Local currency (Barbadian Dollar-BBD): up to BBD 200.-. b. Foreign currencies: up to the equivalent of BBD 1,500.-. 2. Non-residents: a. Local currency (Barbadian Dollar-BBD): prohibited. b. Foreign currencies: up to the amount imported and declared.

Local currency (Belarus Ruble - BYR)(Belarus Ruble - BYN) and foreign currencies: no restrictions. Amounts over USD 10,000.- or equivalent must be declared. Effective up to and including 31 December 2016 the old and new Belarus Ruble will be in circulation.

Foreign currencies: up to the amount imported and declared. Foreign banknotes and coins must be exported within 2 months after import.

Local (Euro - EUR) and foreign currencies: 1. No restrictions if arriving from or traveling to another EU Member State . 2. If arriving from or traveling to a country outside the EU: amounts exceeding EUR 10,000.- or the equivalent in another currency (incl. banker's draft and cheques of any kind) must be declared.

Local currency (Belize Dollar-BZD) BZD and foreign currencies: up to BZD 10,000.- or equivalent. Higher amounts must be declared on arrival.

Local currency (Belize Dollar-BZD) and foreign currencies: up to BZD 10,000.- or equivalent. In case of higher amounts: up to the amount imported and declared.

Benin (Republic)

Local currency (Bermudian Dollar-BMD) and foreign currencies: up to BMD 10,000.- or equivalent. Higher amounts must be declared on arrival.

Local currency (Bermudian Dollar-BMD) and foreign currencies: up to BMD 10,000.- or equivalent. In case of higher amounts: up to the amount imported and declared.

Local currency is Bhutan Ngultrum - BTN. However, Indian Rupee (INR) is also in use. Foreign currency: up to a max. of USD 10,000.- (or equivalent). Foreign hard currency like USD, JPY, GBP, EUR, CHF, AUD, HKD, SGD will be acceptable at the Bank of Bhutan.

Local currency (Bolivian Boliviano-BOB) and foreign currencies: no restrictions.

Local currency (Bolivian Boliviano-BOB) and foreign currencies: up to the amounts imported and declared.

Bonaire, St. Eustatius and Saba

Local currency: (US dollar-USD) and foreign currencies: amounts exceeding USD 10,000.- or its equivalent must be declared.

Bosnia and Herzegovina

Local currency (Convertible Mark - BAM) up to BAM 200,000.-. Foreign currencies: no restrictions.

Local currency (Botswana Pula-BWP) and foreign currencies: no restrictions, if declared.

Local currency (Botswana Pula-BWP): up to BWP 50.-. Foreign currencies: up to the amounts imported and declared.

Local currency (Brazilian Real-BRL) and foreign currency: no restrictions up to BRL 10,000. - or equivalent. Amounts higher than BRL 10,000. - or equivalent: must be declared.

Brunei Darussalam

Local currency (Brunei Dollar-BND): no restrictions. Foreign currencies: 1. Banknotes of Singapore: up to the equivalent of BND 1,000.- no restrictions between Brunei Darussalam/Singapore on direct import/export of currency. 2. Banknotes of India: Prohibited; 3. Other foreign currencies: no restrictions.

1. Residents: a. Local currency (Brunei Dollar-BND) and Singapore currency banknotes: up to BND 1,000.- or equivalent. (no restrictions on direct import/export of Brunei Darussalam and Singapore currency notes from/to Singapore). b. Foreign currencies: -. Sterling notes up to GBP 15.-. -. Other currencies to a maximum of BND 350.-. Higher amounts in traveler's cheques or letters of credit. 2. Non residents: a. Local currency and Singapore currency banknotes: up to BND 1,000.- or equivalent (no restrictions on direct import/export of Brunei Darussalam and Singapore currency notes from/to Singapore); b. Other foreign currencies: up to the amount imported and declared.

Local currency (Bulgarian new Leva - BGN) and foreign currencies: 1. No restrictions if arriving from or traveling to another EU Member State . 2. If arriving directly from or traveling to a country outside the EU: amounts exceeding EUR 10,000.- or more or the equivalent in another currency (incl. banker's draft and cheques of any kind) must be declared.

Burkina Faso

Local currency (CFA Franc-XOF) and foreign currencies: no restrictions if declared on arrival.

Residents: Local currency (CFA Franc-XOF) and foreign currencies: 1. Up to XOF 400,000.- or equivalent for commercial travel. 2. Up to XOF 175,000.- or equivalent for other purposes. Non-Residents: Local currency and foreign currencies: up to the amount imported and declared.

Local currency (Burundese Franc-BIF): up to BIF 2000.-. Foreign currencies: no restrictions.

Up to a max. of USD 10,000.- or equivalent is allowed. Exceeding amounts must be declared on arrival.

1. Residents: a. Local currency (CFA Franc-XAF) if arriving from: - The French monetary area there are no restrictions. - Outside the French monetary area: up to XAF 20,000.-. b. Foreign currencies: no restrictions. 2. Non-Residents: a. Local currency: up to XAF 20,000.-. b. Foreign currencies: no restrictions.

Local currency (CFA Franc-XAF). If coming for: 1. Touristic purposes: up to XAF 20,000.- per journey. 2. Business purposes: up to XAF 450,000.- per journey. Foreign currencies: no restrictions.

Local currency (Canadian Dollar-CAD) and foreign currencies: no restrictions up to CAD 10,000.-. Amounts equal to or greater than CAD 10,000.- must be declared.

Cape Verde Islands

Local currency (Cape Verde Escudo - CVE): prohibited. Foreign currencies: no restrictions, if the amounts imported are declared on arrival.

Local currency (Cape Verde Escudo - CVE): prohibited. Foreign currencies are allowed up to the equivalent of CVE 20,000.- unless a higher amount has been declared on arrival.

Cayman Islands

Local currency (Cayman Isl. Dollar-KYD): no restrictions. Foreign currencies: Jamaican currency: up to JAD 20. - per person. Other foreign currencies: no restrictions.

Local currency (Cayman Isl. Dollar-KYD) and foreign currencies: no restrictions.

Central African Republic

1. Local currency (CFA Franc-XAF): a. From Benin, Burkina Faso, Cote d'Ivoire, Mauritania, Niger, Senegal or Togo: no restrictions. b. From other countries: up to an amount of XAF 75,000.- (if re-imported: unlimited). 2. Foreign currencies: no restrictions, if declared on arrival.

1. Residents: a. Local currency (CFA Franc-XAF): - To countries of the French monetary area: unlimited. - To other countries: up to an amount of XAF 75,000.-. b. Foreign currencies: - To countries of the French monetary area: apply to the "Office des Changes". - To other countries: up to an amount of XAF 150,000.- per year. 2. Non-Residents: a. Local currency: - To Benin, Burkina Faso, Cote d'Ivoire, Mauritania, Niger, Senegal and Togo: no restrictions. - To other countries of the French monetary area: up to an amount of XAF 75,000.-. b. Foreign currencies: up to the amounts imported and declared.

1. Residents: a. Local currency (CFA Franc-XAF) and foreign currencies: -If coming from a country in the French monetary area: no restrictions, -If coming from other countries: up to the amounts exported. 2. Non-Residents: a. Local currency: no restrictions. b. Foreign currencies: no restrictions, if declared on arrival.

1. Residents: a. Local currency (CFA Franc-XAF): - If traveling to a country in the French monetary area: no restrictions. - If traveling to other countries: up to XAF 10,000.-. b. Foreign currencies: up to the equivalent of XAF 100,000.- a year. 2. Non-Residents: a. Local currency: up to XAF 10,000.-. b. Foreign currencies: up to the amounts imported and declared.

Local currency (Chilean Peso-CLP) and foreign currencies: no restrictions. Amounts exceeding USD 10,000.- must be declared.

Local currency (Chinese Ren Min Bi-CNY): max. CNY 20,000.- in cash. Foreign currencies: Amounts exceeding USD 5,000.- in cash must be declared.

Local currency (Colombian Peso-COP) and foreign currencies: up to USD 10,000.- or equivalent. Amounts exceeding USD 10,000.- must be declared on arrival.