- Auto Insurance Best Car Insurance Cheapest Car Insurance Compare Car Insurance Quotes Best Car Insurance For Young Drivers Best Auto & Home Bundles Cheapest Cars To Insure

- Home Insurance Best Home Insurance Best Renters Insurance Cheapest Homeowners Insurance Types Of Homeowners Insurance

- Life Insurance Best Life Insurance Best Term Life Insurance Best Senior Life Insurance Best Whole Life Insurance Best No Exam Life Insurance

- Pet Insurance Best Pet Insurance Cheap Pet Insurance Pet Insurance Costs Compare Pet Insurance Quotes

- Travel Insurance Best Travel Insurance Cancel For Any Reason Travel Insurance Best Cruise Travel Insurance Best Senior Travel Insurance

- Health Insurance Best Health Insurance Plans Best Affordable Health Insurance Best Dental Insurance Best Vision Insurance Best Disability Insurance

- Credit Cards Best Credit Cards 2024 Best Balance Transfer Credit Cards Best Rewards Credit Cards Best Cash Back Credit Cards Best Travel Rewards Credit Cards Best 0% APR Credit Cards Best Business Credit Cards Best Credit Cards for Startups Best Credit Cards For Bad Credit Best Cards for Students without Credit

- Credit Card Reviews Chase Sapphire Preferred Wells Fargo Active Cash® Chase Sapphire Reserve Citi Double Cash Citi Diamond Preferred Chase Ink Business Unlimited American Express Blue Business Plus

- Credit Card by Issuer Best Chase Credit Cards Best American Express Credit Cards Best Bank of America Credit Cards Best Visa Credit Cards

- Credit Score Best Credit Monitoring Services Best Identity Theft Protection

- CDs Best CD Rates Best No Penalty CDs Best Jumbo CD Rates Best 3 Month CD Rates Best 6 Month CD Rates Best 9 Month CD Rates Best 1 Year CD Rates Best 2 Year CD Rates Best 5 Year CD Rates

- Checking Best High-Yield Checking Accounts Best Checking Accounts Best No Fee Checking Accounts Best Teen Checking Accounts Best Student Checking Accounts Best Joint Checking Accounts Best Business Checking Accounts Best Free Checking Accounts

- Savings Best High-Yield Savings Accounts Best Free No-Fee Savings Accounts Simple Savings Calculator Monthly Budget Calculator: 50/30/20

- Mortgages Best Mortgage Lenders Best Online Mortgage Lenders Current Mortgage Rates Best HELOC Rates Best Mortgage Refinance Lenders Best Home Equity Loan Lenders Best VA Mortgage Lenders Mortgage Refinance Rates Mortgage Interest Rate Forecast

- Personal Loans Best Personal Loans Best Debt Consolidation Loans Best Emergency Loans Best Home Improvement Loans Best Bad Credit Loans Best Installment Loans For Bad Credit Best Personal Loans For Fair Credit Best Low Interest Personal Loans

- Student Loans Best Student Loans Best Student Loan Refinance Best Student Loans for Bad or No Credit Best Low-Interest Student Loans

- Business Loans Best Business Loans Best Business Lines of Credit Apply For A Business Loan Business Loan vs. Business Line Of Credit What Is An SBA Loan?

- Investing Best Online Brokers Top 10 Cryptocurrencies Best Low-Risk Investments Best Cheap Stocks To Buy Now Best S&P 500 Index Funds Best Stocks For Beginners How To Make Money From Investing In Stocks

- Retirement Best Gold IRAs Best Investments for a Roth IRA Best Bitcoin IRAs Protecting Your 401(k) In a Recession Types of IRAs Roth vs Traditional IRA How To Open A Roth IRA

- Business Formation Best LLC Services Best Registered Agent Services How To Start An LLC How To Start A Business

- Web Design & Hosting Best Website Builders Best E-commerce Platforms Best Domain Registrar

- HR & Payroll Best Payroll Software Best HR Software Best HRIS Systems Best Recruiting Software Best Applicant Tracking Systems

- Payment Processing Best Credit Card Processing Companies Best POS Systems Best Merchant Services Best Credit Card Readers How To Accept Credit Cards

- More Business Solutions Best VPNs Best VoIP Services Best Project Management Software Best CRM Software Best Accounting Software

- Manage Topics

- Investigations

- Visual Explainers

- Newsletters

- Abortion news

- Coronavirus

- Climate Change

- Vertical Storytelling

- Corrections Policy

- College Football

- High School Sports

- H.S. Sports Awards

- Sports Betting

- College Basketball (M)

- College Basketball (W)

- For The Win

- Sports Pulse

- Weekly Pulse

- Buy Tickets

- Sports Seriously

- Sports+ States

- Celebrities

- Entertainment This!

- Celebrity Deaths

- American Influencer Awards

- Women of the Century

- Problem Solved

- Personal Finance

- Small Business

- Consumer Recalls

- Video Games

- Product Reviews

- Destinations

- Airline News

- Experience America

- Today's Debate

- Suzette Hackney

- Policing the USA

- Meet the Editorial Board

- How to Submit Content

- Hidden Common Ground

- Race in America

Personal Loans

Best Personal Loans

Auto Insurance

Best Auto Insurance

Best High-Yields Savings Accounts

CREDIT CARDS

Best Credit Cards

Advertiser Disclosure

Blueprint is an independent, advertising-supported comparison service focused on helping readers make smarter decisions. We receive compensation from the companies that advertise on Blueprint which may impact how and where products appear on this site. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Blueprint. Blueprint does not include all companies, products or offers that may be available to you within the market. A list of selected affiliate partners is available here .

Credit Cards

A traveler’s guide to the Chase Travel portal

Tamara Aydinyan

Julie Sherrier

“Verified by an expert” means that this article has been thoroughly reviewed and evaluated for accuracy.

Robin Saks Frankel

Updated 5:23 p.m. UTC Nov. 28, 2023

- path]:fill-[#49619B]" alt="Facebook" width="18" height="18" viewBox="0 0 18 18" fill="none" xmlns="http://www.w3.org/2000/svg">

- path]:fill-[#202020]" alt="Email" width="19" height="14" viewBox="0 0 19 14" fill="none" xmlns="http://www.w3.org/2000/svg">

Editorial Note: Blueprint may earn a commission from affiliate partner links featured here on our site. This commission does not influence our editors' opinions or evaluations. Please view our full advertiser disclosure policy .

hocus-focus, Getty Images

For qualifying Chase cardholders, the easy-to-use Chase Travel℠ portal offers a flexible and convenient way to book hotels, flights, rental cars, cruises and more using points or a combination of points and cash.

What is the Chase travel portal?

A favorite among frequent travelers for its versatility and redemption options, Chase Ultimate Rewards® (UR) is one of the major transferable credit card rewards points programs and UR points are Chase’s flexible rewards currency.

The Chase travel portal works much like an online travel agency (OTA) similar to Orbitz or Priceline where you can book hotels, flights, cars, activities and cruises. But unlike a traditional OTA, with the Chase travel portal you can book travel with your Chase card’s rewards points, cash or a combination of the two.

Who can use the portal?

A handful of exclusively Chase-issued credit cards grant cardholders access to the Chase travel portal, but how you can utilize the portal and the value you can receive is card-specific.

The following credit cards are the only cards that earn Chase Ultimate Rewards points outright:

- Chase Sapphire Reserve®

- Chase Sapphire Preferred® Card

- Ink Business Preferred® Credit Card * The information for the Ink Business Preferred® Credit Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

But if you or a household member own at least one of the cards above, the rewards on the following cash-back credit cards can be combined with any of the cards listed above and used as Chase Ultimate Rewards points:

- Chase Freedom Flex℠ * The information for the Chase Freedom Flex℠ has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

- Chase Freedom Unlimited®

- Ink Business Cash® Credit Card

- Ink Business Unlimited® Credit Card

And while the points earned cannot be combined with any of the UR-earning cards, the following pay-in-full card does have access to the Chase travel portal:

- Ink Business Premier℠ Credit Card * The information for the Ink Business Premier℠ Credit Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

Is the portal worth using?

It’s often said that having the right travel credit card is important, but knowing how to redeem your miles and points can be as paramount as which card you use to earn them. However, not everybody has the patience or interest to learn the intricacies of different rewards programs to maximize the value of every mile and point.

So while transferring UR points to individual loyalty programs is still one of the best ways to get the most cents per point at a 1:1 basis, for those who value simplicity, the Chase travel portal offers a straightforward way to book travel, earn and redeem points and still receive a great deal. Best of all, you won’t be limited by any loyalty program or award space availability.

When transferring points, the minimum you can transfer is 1,000 points to the following UR travel partners with either the Chase Sapphire Reserve, Chase Sapphire Preferred or the Ink Business Preferred cards:

Regardless of how you’re using the Chase travel portal, it’s worth considering the pros and cons.

- The standard rate for Ultimate Rewards points when redeemed for travel through the Chase travel portal is 1 UR point = 1 cent, but can be worth significantly more with the UR-earning cards. The Chase Sapphire Reserve gets a redemption value of 1.5 cents per point through the Chase Travel℠ portal while the Chase Sapphire Preferred and Chase Ink Business Preferred cards each get 1.25 cents per point.

- Since you’re not limited to any loyalty programs, you can use your UR points to book boutique hotels that you’d otherwise only be able to book with cash.

- Flights booked through the Chase travel portal can earn frequent flyer miles and can be used toward advancing your elite status.

- You can earn a substantial amount of bonus points when booking through the Chase portal depending on the card you’re using.

- You can use a combination of points plus cash to purchase your reservation.

- Hotels booked through the Chase travel portal do not earn hotel points or credits toward elite status. Any elite status perks you’d receive if booking directly with the hotel will likely be forgone.

- If you experience any issues while traveling, you’d have to go through Chase to resolve the issue. For example, if there is a problem with your hotel reservation, you’ll have to contact a Chase representative for help resolving it since you didn’t book directly with the hotel. Dealing with a middleman during travel emergencies is less than ideal and something to be wary of when considering booking through the portal.

- Southwest Airlines flights do not show up in the UR travel portal, but can be reserved by calling the Chase Travel Center at 855-233-9462.

How to book travel through the Chase travel portal

You can access the Chase travel portal by logging into your Chase account and clicking on the Rewards balance on the right or by going to the Chase Ultimate Rewards website .

Once you’re logged in, if you have more than one UR-earning Chase card, you’ll be asked to select one to proceed with — a crucial step as each card has different earning and redemption rates.

After clicking on your selection, you will be taken to the Ultimate Rewards dashboard. If you click on the Earn / Use dropdown button, all of your Ultimate Rewards options will be presented. Click on Travel to proceed to the portal.

Once in the travel portal, you’ll have the option of selecting the type of booking you’d like to make.

From there, your user experience will be similar to any other OTA where you can search your travel options.

Because the Chase travel portal doesn’t limit you to transfer partners or loyalty programs, you’ll be able to search almost all major airlines. One notable exception is Southwest Airlines, which is still bookable using UR points but will require a phone call to the Chase Travel Center to reserve your flight.

One difference compared to a traditional OTA is the option to buy in cash, points or a combination of both.

If you’re short on points or if you’d like to offset the cash price with some points, you’re given the option to choose how to pay.

After that, you’ll be prompted to enter your traveler information and you’re all booked. However, you will have to log into the specific airline with your reservation code in order to reserve seats.

Booking hotels through the Chase travel portal is a similar process. And with the portal’s easy-to-use search function, you can find boutique hotels that would otherwise be unbookable with loyalty-program-based points.

However, if you have elite status with a hotel chain, you’ll want to book directly rather than going through the Chase portal in order to access status benefits and have that hotel stay count toward achieving a higher status. Or, you can transfer UR points to one of three UR hotel loyalty program transfer partners, including Marriott Bonvoy, World of Hyatt or IHG One Rewards.

Rental cars can also be booked through the portal in a similar fashion. And as in many cases, being aware of which card you’re booking your car rental with can make a big difference in case of an accident as both the Chase Sapphire Reserve and Chase Sapphire Preferred offer primary car insurance , an uncommon, money-saving benefit, which saves you from having to file a claim with your private car insurance carrier first.

A quick guide to the Chase Ultimate Rewards program

As some of the most sought-after flexible points, Chase Ultimate Rewards can be accrued through several avenues. The most lucrative way is by applying for Chase credit cards and earning their respective welcome bonuses — but be wary of Chase’s 5/24 rule , which blocks applicants from opening a Chase credit card if they’ve opened five or more cards from any issuer in the past 24 months.

If you have two Chase cards that earn UR points, you can then transfer the rewards earned to the card that carries the most redemption value. For example, you can open the Chase Sapphire Preferred card and then the Chase Freedom Flex and move any points earned on the Flex card to the Preferred card, which has a boosted value of 25% more when redeemed through the portal.

Looking to add more than one new credit card to your wallet? Here’s why you shouldn’t apply for multiple cards at the same time.

Outside of regular credit card spending, you can also grow your Ultimate Rewards pile by using the Chase shopping portal. By adding just one extra step to your online shopping, you can earn bonus points for your future travels.

While transferring points to partners is one option to maximize the value of your Chase Ultimate Rewards points, there are numerous other ways to use the Chase Ultimate Rewards program to your benefit. Whether it’s redeeming your points as a statement credit for eligible, rotating categories throughout the year through the “Pay Yourself Back” feature, booking special dining experiences with your points or using the portal to book your next vacation, the Chase Ultimate Rewards program’s flexibility makes it a great option regardless of your lifestyle.

Frequently asked questions (FAQs)

Chase Ultimate Rewards (UR) are Chase Bank’s flexible rewards currency that can be earned on several of its credit cards.

The Chase travel portal can be accessed through the Chase app or the Chase website. After logging in, you can select the option to book travel.

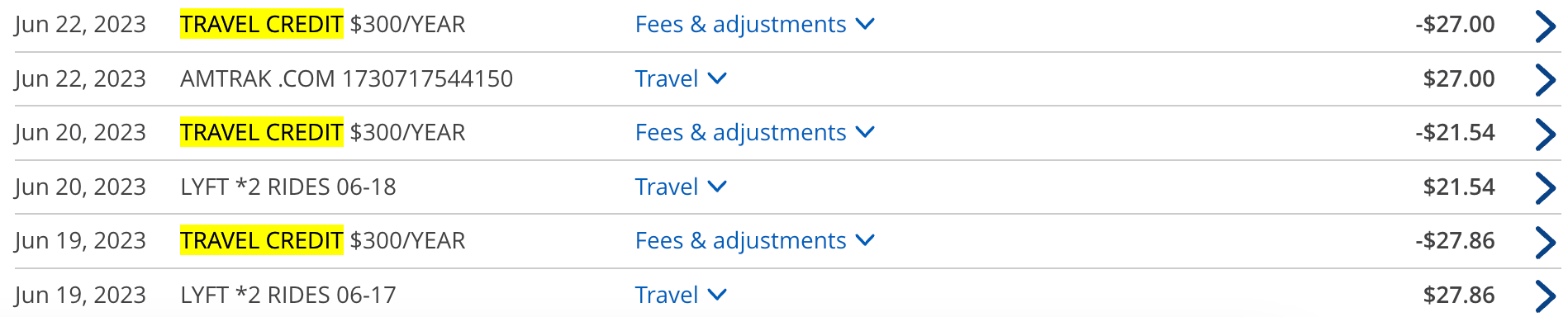

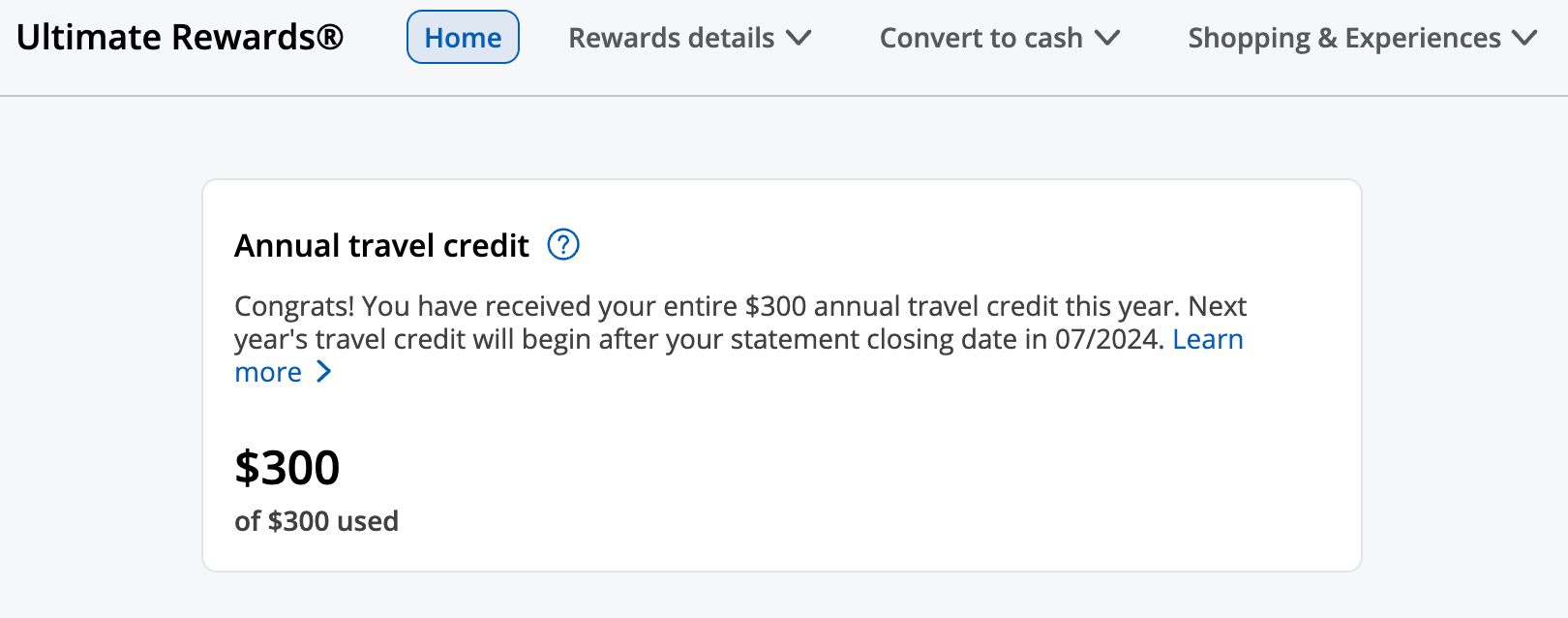

You can use your Chase travel credit, like the up to $50 annual hotel statement credit offered by the Chase Sapphire Preferred, by booking your travel through the Chase travel portal. The statement credit will automatically be applied to your account within one to two billing cycles after your purchase posts to your account — up to an annual maximum accumulation of $50.

You can redeem your Chase Ultimate Rewards directly through the travel portal with almost all major airlines with the exception of Southwest Airlines, which can be booked over the phone. With Southwest, select the flight you want at Southwest.com and then call Chase Travel Center at 855-233-9462 with the flight details.

The value you receive from the Chase travel portal will depend on the credit card you’re using. For example, if you have either the Chase Sapphire Reserve or the Chase Sapphire Preferred, your points are worth either 50% or 25% more, respectively, when redeemed for travel.

*The information for the Chase Freedom Flex℠, Ink Business Preferred® Credit Card and Ink Business Premier℠ Credit Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

Blueprint is an independent publisher and comparison service, not an investment advisor. The information provided is for educational purposes only and we encourage you to seek personalized advice from qualified professionals regarding specific financial decisions. Past performance is not indicative of future results.

Blueprint has an advertiser disclosure policy . The opinions, analyses, reviews or recommendations expressed in this article are those of the Blueprint editorial staff alone. Blueprint adheres to strict editorial integrity standards. The information is accurate as of the publish date, but always check the provider’s website for the most current information.

Tamara Aydinyan has been traveling the world with the help of miles and points for over a decade and enjoys teaching others to do the same. When she's not on the move, you can find her in Los Angeles or New York City, or on Instagram @deadlytravel.

Julie Stephen Sherrier is a personal finance writer and editor based in Austin, TX. She is the former senior managing editor for LendingTree, responsible for all credit card and credit health content. Before joining LendingTree, Julie spent more than a decade as the managing editor and then editorial director at Bankrate and CreditCards.com. She also served as an adjunct journalism instructor at the University of Texas at Austin.

Robin Saks Frankel is a credit cards lead editor at USA TODAY Blueprint. Previously, she was a credit cards and personal finance deputy editor for Forbes Advisor. She has also covered credit cards and related content for other national web publications including NerdWallet, Bankrate and HerMoney. She's been featured as a personal finance expert in outlets including CNBC, Business Insider, CBS Marketplace, NASDAQ's Trade Talks and has appeared on or contributed to The New York Times, Fox News, CBS Radio, ABC Radio, NPR, International Business Times and NBC, ABC and CBS TV affiliates nationwide. She holds an M.S. in Business and Economics Journalism from Boston University. Follow her on Twitter at @robinsaks.

How to do a balance transfer with Discover

Credit Cards Louis DeNicola

9 ways to maximize the Citi Custom Cash card’s 5% cash-back categories

Credit Cards Lee Huffman

American Express Business Platinum benefits guide 2024

Credit Cards Chris Dong

Why I applied for the new Wells Fargo Autograph Journey℠ Visa® Card

Credit Cards Jason Steele

Which Citi balance transfer card should I get?

Credit Cards Julie Sherrier

5 reasons why the Citi Diamond Preferred is great for paying down debt

Credit Cards Michelle Lambright Black

Welcome offer on Chase’s IHG One Rewards Premier Business card soars to 175K points

Credit Cards Carissa Rawson

You might be a small business owner and not even know it

Chase Freedom Flex benefits guide 2024

6 ways to maximize the Citi Double Cash Card

Credit Cards Ben Luthi

How to use the Citi trifecta to maximize your rewards

Credit Cards Ryan Smith

Hilton Honors American Express business card unveils new profile, plumps up annual fee

Why my Citi Double Cash Card keeps getting better

Is the Citi Premier worth the annual fee?

Credit Cards Juan Ruiz

6 little known perks of the Citi Custom Cash Card

Credit Cards Harrison Pierce

- What is the Chase Travel Portal?

Benefits of Using the Chase Travel Portal

Chase ultimate rewards credit cards.

- Points Value

- How to Use the Portal to Book Travel

Chase Travel: Explore Destinations and Savings with Chase Ultimate Rewards

Affiliate links for the products on this page are from partners that compensate us and terms apply to offers listed (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate credit cards to write unbiased product reviews .

The information for the following product(s) has been collected independently by Business Insider: Chase Freedom Flex℠, Chase Freedom® Student credit card. The details for these products have not been reviewed or provided by the issuer.

- The Chase Travel℠ portal works just like an online travel agency.

- You can use points, cash, or a combination of both to book flights, hotels, rental cars, and more.

- Several Chase cards offer better redemption values or bonus points when you book through the portal.

The Chase Travel Portal℠ is an online booking platform for flights, hotels, rental cars, cruises, activities, and vacation rentals, similar to an Online Travel Agency (OTA). If you're a Chase Ultimate Rewards® cardholder, you can use points to book travel through the portal — or pay with your card or a combination of points and cash.

Chase Ultimate Rewards is one of the most flexible and lucrative credit card rewards programs, and its benefits can be even greater depending on the Chase cards you have. With a no-annual-fee card like the Chase Freedom Flex℠ or Chase Freedom Unlimited® , your points are worth 1 cent each toward travel booked through the portal.

But if you have a Chase travel credit card like the Chase Sapphire Reserve® , Chase Sapphire Preferred® Card , or Ink Business Preferred® Credit Card , you'll get 25% to 50% more value when you redeem your points for travel, plus the ability to transfer your points to Chase airline and hotel partners .

Some Chase cards also offer bonus points for paid bookings you make through the portal. Chase added lucrative new bonus categories to the Chase Sapphire Reserve® and Chase Sapphire Preferred® Card, including certain types of travel booked through the portal.

Here's everything you need to know about booking airfare, hotels, and more through the Chase travel portal — and how to make the most of your Chase Ultimate Rewards points.

What Is the Chase Travel Portal?

The Chase Travel portal works like any other Online Travel Agency (such as Travelocity or Priceline), and the searches you do for hotels, airfare, and more will produce similar results to what you see on that OTA.

You must be a Chase credit card customer to use Chase travel to book with cash or with points. In fact, you'll only access the Chase Travel portal when you log into your account management page with Chase.

Chase travel lets you book travel directly with Chase Ultimate Rewards points, use your credit card to pay, or combine the two. This is one of the main benefits of using Chase travel — you can spend the rewards points you earn directly on the travel you want without having to worry about dealing with specific hotel or airline loyalty programs.

There are a few other key benefits to know:

- You'll still earn airline miles and work toward elite airline status: You won't earn points or elite night credits when you book a hotel stay with Chase travel because it's considered a third-party booking. However, you can earn airline and elite-qualifying miles on flights you book as long as your frequent flyer number is attached to the reservation.

- Your points are worth more with certain Chase credit cards: Also be aware that some Chase credit cards give you more than the standard rate of 1 cent per point when you redeem your rewards for travel through Chase. We'll go into more detail on the cards that offer this perk below.

- The Chase Travel portal is easy to use: If you don't want to deal with a bunch of hotel and airline award charts, booking through Chase travel can help keep your rewards game simple. You'll always be able to use your points for any booking you want without having to worry about blackout dates or capacity controls you would normally encounter with loyalty programs.

To be eligible to use the Chase Travel portal, you'll need a Chase credit card that earns Chase Ultimate Rewards points .

No-annual-fee Chase cards open to new applicants (points are worth 1 cent each through the Chase Travel portal):

- Chase Freedom Unlimited® (read our Chase Freedom Unlimited review )

- Chase Freedom Flex℠ (read our Chase Freedom Flex review )

- Chase Freedom® Student credit card (read our Chase Freedom Student review )

- Ink Business Unlimited® Credit Card (read our Chase Ink Business Unlimited review )

- Ink Business Cash® Credit Card (read our Chase Ink Business Cash review )

Chase travel rewards cards open to new applicants (points are worth more with Chase travel, plus these cards allow you to transfer points to airline and hotel partners):

- Chase Sapphire Reserve® (read our Chase Sapphire Reserve review )

- Chase Sapphire Preferred® Card (read our Chase Sapphire Preferred review )

- Ink Business Preferred® Credit Card (read our Chase Ink Business Preferred review )

If you have more than one Chase card, you can transfer your Chase Ultimate Rewards points between accounts. It makes the most sense to pool your points in the account that gives you the best redemption value — for example, if you pair the Chase Freedom Unlimited® and Chase Sapphire Reserve®, moving all of your Chase Ultimate Rewards to your Sapphire Reserve account will increase the value of your points when you redeem through the Chase Travel portal.

To pool your points onto one card, log into your Chase online account, navigate to the "Redeem" section for your Chase Ultimate Rewards card, then select the option to combine points in the "Earn/Use" tab:

From there, you can move your Chase points between accounts in any increments you want.

Points Value in the Chase Travel Portal

Some Chase credit cards give you a bonus when you redeem points through the Chase Travel portal. Here's a summary of how much your points are worth with each Chase card:

It's important to note that Chase Ultimate Rewards points are worth, on average, 1.8 cents apiece based on Personal Finance Insider's points and miles valuations . That's because it's possible to get outsized value when you transfer points to partners for award travel.

How to Use the Chase Travel Portal

Using the Chase Travel portal is a breeze, but it all starts with logging into your online account management page. From there, you'll click on the right side of your screen where it shows your Chase Ultimate Rewards account balance.

Once you click on the account balance, you'll have the option to select the card you want to access. And remember, this step can be important because some cards give you more value from your points when you redeem them for travel.

How to book a flight through Chase travel

Once you are logged into your Chase Ultimate Rewards account, you'll see different travel options to search for at the top of the page.

To search for a flight, make sure the prompt is on "Flights" and begin searching for the flight you want. Enter your departure airport, destination, travel dates, and the number of passengers.

Once your flight options pop up on the screen, you can filter your results by the number of stops, the airlines you want to fly, and arrival times.

Note that each of your flight options will include a payment amount in points as well as a cash price.

You can also click on "Details and baggage fees" in order to find out the cost of carry-on luggage or checked baggage, as well as whether your flight charges any change fees.

When you click to "Select" a flight option, you'll get a rundown of what is and isn't included in the fare you selected. You may also get a note that you can upgrade before you check out.

Once you settle on a flight you want, you'll be taken to the "Trip Details" page that shows the final cost of your flight in points or in cash, as well as a summary of the added costs you may be charged for baggage or change fees.

After you agree to the terms, you'll be taken to a final payment page where you can decide how you want to pay. You have the option to cover your flight entirely in points if you want, but you can also choose to pay with your Chase credit card or with a combination of points and your credit card.

During the booking process, make sure to add your frequent flyer number to your reservation. That way, you can earn miles on your booking and your flight will count toward elite status requirements. You'll also want to add your Known Traveler Number or Redress number if either applies to you.

If you forget to do it during your booking, however, you can add your frequent flyer information to your flight later on using the airline's website.

How to book a hotel through Chase travel

Booking a hotel through Chase is similarly easy, and you'll find a lot of different types of lodging options available. For example, you'll find properties from major hotel brands, but you'll also find rental condo options and boutique hotels.

To search for a hotel, enter the destination, dates, and the number of people you want to have in your room. Once you're presented with your options, you can filter hotels based on the hotel name you're looking for, the area or neighborhood, price point, guest rating, property type, and more.

Once again, you'll see a price listed in points as well as a cash price per night.

These prices do not include taxes and fees, however, so your price in points or cash will be higher by the time you get to the final booking page. Also be aware that the price listed is the lowest you can get for the property, but that better or upgraded rooms and suites will cost more in points.

The major downside to booking a hotel through the Chase portal is that you won't earn hotel points or elite night credits for your stay, because it's considered a third-party booking. There's also a risk that the property won't recognize your hotel elite status or give you the perks you'd normally be entitled to, like late checkout or free breakfast . This shouldn't be an issue if you're booking an independent or boutique hotel, but if you're looking for hotel points or status, it's something to be aware of.

You'll have the option to select a hotel you want as well as a room type at the property you're considering. You can also pay with your booking with points, your Chase credit card, or a combination of the two.

How to book a rental car through Chase travel

You can also book a rental car through Chase travel using the same set of steps. Once you log into your Chase Ultimate Rewards account, click on "Cars" and then select the destination and dates.

Once you are presented with your search results, you can select the types of cars you prefer, like an economy car or an SUV. You can also filter results based on a price range, the number of passengers you have, the rental car company, and the type of transmission you prefer (manual or automatic), as well as the total area you want to search in.

Note that, once again, taxes and fees are not included on the initial search page. Instead, they are added to your total cost when you select a rental car. You can also pay for a rental car through Chase with points, your credit card, or a combination of the two.

How to book activities with the Chase Travel portal

Chase also lets you book a variety of activities through the portal, which they refer to as "Things to Do." Chase activities can include excursions like snorkeling or scuba diving, as well as tours of museums and historic sites. But you can also book more practical options through their activities tab, including airport pickups and other types of transportation.

To search for activities, enter the destination and dates for your trip. You'll be shown a price in points and in cash that does include taxes and fees. You can also filter options based on the type of activity, your interests, and more. Once again, you have the option to pay for activities with your points, your credit card, or a combination of the two.

How to book a cruise through Chase travel

If you're a cruise enthusiast, you should know you can also book cruises through Chase travel. When you select "Cruises" at the top of the Chase Ultimate Rewards search page, you'll be presented with a list of featured cruises and cruise specials.

You can also search for cruises based on the destination or the name of the cruise line. Note, however, that only cash prices are listed for each cruise on the portal, and that you'll have to call Chase to make a booking.

Either way, you can absolutely use your Chase points to pay for all or part of your cruise. Just have your credit card number handy and call their customer service line at 855-234-2542.

How to book a vacation rental through Chase

Chase also offers a selection of vacation rentals, which can include vacation condos, luxury villas, and more. To search, click on "Vacation Rentals" at the top of the main page, then enter your destination, dates, and the number of people in your party.

Once you start your search, you'll have the option to filter results based on the local neighborhood you want, star ratings, price range, guest rating, property type, and more. Like hotels through Chase, the price you are shown excludes taxes and fees, but they will be added to your total once you make a selection.

Also be aware that the price shown in your search results is for the lowest-tier option for each property, and that a larger rental or upgraded rental may cost more in points.

When you book vacation rentals through Chase, you can pay with points, your Chase card, or a combination of the two.

Use the Chase Travel portal to book Luxury Hotel & Resort Collection properties

If you have the Chase Sapphire Reserve®, you can book properties within the Luxury Hotel & Resort Collection. This list of more than 1,000 properties can be reserved ahead of time, and you'll get extra benefits with each stay such as:

- Daily breakfast for two

- A special benefit worth up to $100

- Complimentary internet access

- Room upgrades when available

- Early check-in and late checkout

One detail to note with this program is the fact that you cannot pay with points. Instead, your online booking will reserve your room, and you'll be charged for the stay when you check out from the hotel.

Should you transfer Chase points instead?

While you can book travel through the Chase Travel portal directly, many people prefer to transfer points to Chase airline and hotel partners instead. Doing so could let you get more value for each point you redeem , but you'll have to run the numbers to find out for sure.

Here's a good example of how transferring points to a Chase airline or hotel partner can be a better deal, as well as the math you'll need to do to figure this out on your own. Take this one-way flight on Air France from Chicago to Paris, for example, and assume you have the Chase Sapphire Reserve® card, so you're getting 50% more value when you redeem points through the Chase Travel portal.

If you were to book this flight through Chase Travel, you would owe 39,607 points with the Chase Sapphire Reserve®, compared with the cash price of $594.10.

However, you could book an award ticket on the exact same flight through Flying Blue (Air France's loyalty program) directly if you transferred your Chase points there first. In this case, the identical flight would set you back 22,000 miles plus $109.44. This means you would transfer 22,000 miles from Chase to your Flying Blue account, and pay the taxes and fees in cash, or by redeeming points for a statement credit to your account.

When you compare, you'll find that booking with miles directly is a better deal. After you subtract the taxes and fees from the cost of booking through Flying Blue, you wind up with a value of around 2.2 cents per mile.

With the Chase Travel portal, on the other hand, you're forking over 39,607 points for the same flight, and you're getting a value of 1.5 cents for each point if you have the Chase Sapphire Reserve®.

Accessing Chase Travel is simple. If you're a Chase credit cardholder with Chase Ultimate Rewards points, you can log in to your Chase online account. Once logged in, navigate to the 'Travel" or "Rewards" section, where you'll find the Chase Travel portal. From there, you can search and book flights, hotels, and other travel services using your earned points or card benefits. It's a convenient way to plan and manage your travel adventures.

Chase Travel refers to the travel booking and rewards platform offered by Chase Bank. It's part of the Chase Ultimate Rewards program, allowing cardholders to use their earned points to book flights, hotels, car rentals, and other travel-related expenses. Chase Travel provides a convenient way to plan and book your trips while taking advantage of the rewards and benefits associated with Chase credit cards.

To earn 5% on Chase Travel, consider using a Chase credit card that offers bonus rewards on travel purchases. Cards like the Chase Sapphire Preferred or Chase Sapphire Reserve often offer 5 points per dollar spent on travel booked through the Chase Travel portal. Additionally, taking advantage of limited-time promotions and special offers can also help you maximize your rewards when booking travel with Chase.

Bottom Line

Keep in mind that, no matter which Chase credit card you have, there are other ways you can use your rewards points. You can redeem Chase points for statement credits or cash back, or cash them in for gift cards or merchandise. And if you have a premier Chase travel credit card, you can transfer your points to Chase airline and hotel partners at a 1:1 ratio.

However, booking travel through Chase can make your life considerably easier — especially if you don't like dealing with complicated hotel and airline programs. You may not get as much value from your points as you would if you booked a premium flight with airline miles, but the Chase Travel portal does offer the flexibility to book the flight you want without any blackout dates or hoops to jump through.

The Chase Travel portal offers yet another way to maximize rewards earned with a Chase credit card. Just make sure to consider all your options and the value you're getting for your points before you pull the trigger.

Editorial Note: Any opinions, analyses, reviews, or recommendations expressed in this article are the author’s alone, and have not been reviewed, approved, or otherwise endorsed by any card issuer. Read our editorial standards .

Please note: While the offers mentioned above are accurate at the time of publication, they're subject to change at any time and may have changed, or may no longer be available.

**Enrollment required.

- Main content

- Credit Cards

- All Credit Cards

- Find the Credit Card for You

- Best Credit Cards

- Best Rewards Credit Cards

- Best Travel Credit Cards

- Best 0% APR Credit Cards

- Best Balance Transfer Credit Cards

- Best Cash Back Credit Cards

- Best Credit Card Sign-Up Bonuses

- Best Credit Cards to Build Credit

- Best Credit Cards for Online Shopping

- Find the Best Personal Loan for You

- Best Personal Loans

- Best Debt Consolidation Loans

- Best Loans to Refinance Credit Card Debt

- Best Loans with Fast Funding

- Best Small Personal Loans

- Best Large Personal Loans

- Best Personal Loans to Apply Online

- Best Student Loan Refinance

- Best Car Loans

- All Banking

- Find the Savings Account for You

- Best High Yield Savings Accounts

- Best Big Bank Savings Accounts

- Best Big Bank Checking Accounts

- Best No Fee Checking Accounts

- No Overdraft Fee Checking Accounts

- Best Checking Account Bonuses

- Best Money Market Accounts

- Best Credit Unions

- All Mortgages

- Best Mortgages

- Best Mortgages for Small Down Payment

- Best Mortgages for No Down Payment

- Best Mortgages for Average Credit Score

- Best Mortgages No Origination Fee

- Adjustable Rate Mortgages

- Affording a Mortgage

- All Insurance

- Best Life Insurance

- Best Life Insurance for Seniors

- Best Homeowners Insurance

- Best Renters Insurance

- Best Car Insurance

- Best Pet Insurance

- Best Boat Insurance

- Best Motorcycle Insurance

- Travel Insurance

- Event Ticket Insurance

- Small Business

- All Small Business

- Best Small Business Savings Accounts

- Best Small Business Checking Accounts

- Best Credit Cards for Small Business

- Best Small Business Loans

- Best Tax Software for Small Business

- Personal Finance

- All Personal Finance

- Best Budgeting Apps

- Best Expense Tracker Apps

- Best Money Transfer Apps

- Best Resale Apps and Sites

- Buy Now Pay Later (BNPL) Apps

- Best Debt Relief

- Credit Monitoring

- All Credit Monitoring

- Best Credit Monitoring Services

- Best Identity Theft Protection

- How to Boost Your Credit Score

- Best Credit Repair Companies

- Filing For Free

- Best Tax Software

- Best Tax Software for Small Businesses

- Tax Refunds

- Tax Brackets

- Taxes By State

- Tax Payment Plans

- Help for Low Credit Scores

- All Help for Low Credit Scores

- Best Credit Cards for Bad Credit

- Best Personal Loans for Bad Credit

- Best Debt Consolidation Loans for Bad Credit

- Personal Loans if You Don't Have Credit

- Best Credit Cards for Building Credit

- Personal Loans for 580 Credit Score Lower

- Personal Loans for 670 Credit Score or Lower

- Best Mortgages for Bad Credit

- Best Hardship Loans

- All Investing

- Best IRA Accounts

- Best Roth IRA Accounts

- Best Investing Apps

- Best Free Stock Trading Platforms

- Best Robo-Advisors

- Index Funds

- Mutual Funds

- Home & Kitchen

- Gift Guides

- Deals & Sales

- Best of Wellness Awards 2024

- Sign up for the CNBC Select Newsletter

- Subscribe to CNBC PRO

- Privacy Policy

- Your Privacy Choices

- Terms Of Service

- CNBC Sitemap

Follow Select

Our top picks of timely offers from our partners

Find the best credit card for you

How to use the chase travel portal, you can use chase points to book flights, hotels, car rentals and more through its travel portal..

With the right amount of planning, it's possible to book your entire vacation, including flights , hotels , cruises , car rentals , tours and other activities, entirely on points through the Chase travel portal.

But are you getting the best deal by doing this instead of transferring Chase Ultimate Rewards® points to travel partners and booking directly? It turns out there's a lot more to consider — everything from travel date flexibility and brand variety to the credit card you're using — if you want to get more value for your points by booking through Chase Travel SM .

Below, CNBC Select breaks down the best ways to book flights, hotels, cruises, tours and vacation activities through the Chase travel portal with Ultimate Rewards® points.

How to use the Chase travel portal

- How to earn and redeem Chase Ultimate Rewards points

How to get started with the Chase travel portal

How to book flights through the chase travel portal, how to book rental cars, cruises, and other travel activities, bottom line, how to earn and redeem chase ultimate rewards® points.

To access Chase Travel SM , you'll need to have a credit card that earns Chase Ultimate Rewards® points, like the Chase Sapphire Preferred® Card , Chase Sapphire Reserve® , Ink Business Preferred® Credit Card , Ink Business Unlimited® Credit Card , Ink Business Cash® Credit Card , Chase Freedom Unlimited® or Chase Freedom Flex℠ .

The easiest way to earn Chase Ultimate Rewards points quickly is by taking advantage of the lucrative welcome bonuses offered by certain rewards cards:

- You'll earn 60,000 points by signing up for the Chase Sapphire Preferred and spending $4,000 within the first three months of opening your account.

- With the Ink Business Preferred Credit Card 's welcome bonus, you'll earn 100k bonus points after you spend $8,000 on purchases in the first 3 months from account opening. That's $1,000 cash back or $1,250 toward travel when redeemed through Chase Travel SM.

- The Chase Sapphire Reserve 's welcome bonus gives you 60,000 bonus points after you spend $4,000 on purchases in the first three months from account opening.

The card you're using to redeem UR points will also affect your point redemption value . For instance, if you're using the Chase Sapphire Preferred to book through the Chase Travel SM portal, points are worth 25% more (1.25 cents per point). But if you're booking through Chase Travel℠ with the Chase Sapphire Reserve , points are worth 50% more (1.5 cents per point) — the other $0 annual fee Chase cards each carry a redemption rate of 1 cent per point.

That means the bonus points you'd earn from either the Chase Sapphire Preferred's welcome bonus is worth $750 towards travel and the Chase Sapphire Reserve's is worth $900 towards travel.

Chase Sapphire Preferred® Card

Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, and $50 annual Chase Travel Hotel Credit, plus more.

Welcome bonus

Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

Regular APR

21.49% - 28.49% variable on purchases and balance transfers

Balance transfer fee

Either $5 or 5% of the amount of each transfer, whichever is greater

Foreign transaction fee

Credit needed.

Excellent/Good

Terms apply.

Read our Chase Sapphire Preferred® Card review .

Ink Business Preferred® Credit Card

Earn 3X points per $1 on the first $150,000 spent in combined purchases in select categories each account anniversary year (travel; shipping purchases; internet, cable and phone services; and advertising purchases with social media sites and search engines), 1X point per $1 on all other purchases

Earn 100,000 bonus points after you spend $8,000 on purchases in the first 3 months from account opening.

21.24% - 26.24% variable

Good/Excellent

Read our Ink Business Preferred® Credit Card review.

Chase Sapphire Reserve®

Earn 5X total points on flights and 10X total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3X points on other travel and dining & 1 point per $1 spent on all other purchases plus, 10X points on Lyft rides through March 2025

Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

22.49% - 29.49% variable

5%, minimum $5

Read our Chase Sapphire Reserve® review.

To reach the Chase travel portal, log into your Chase account, then click the area near the right side of the screen where it says the amount of your Chase UR points. Depending on how many Chase credit cards you have, you may be asked to choose which one you want to proceed with.

The next screen is your credit card's main dashboard, showing how many UR points you currently have, as well as any deals or bonus opportunities. On the top of the page, you'll see several menus with redemption options.

While not the best redemption in terms of overall value, you could choose to use your Chase points for Apple and Amazon purchases, cash them in for gift cards and experiences, or reimburse yourself for certain recent charges through Chase's Pay Yourself Back tool . This is also where you can transfer points directly to one of Chase's 14 travel partners if you have a specific flight or hotel in mind. Otherwise, click "book travel" to enter the Chase travel portal.

From here, you'll be able to search for flights, hotels, rental cars, activities and cruises. Simply choose your category, plug in your desired dates and details, and book with points, cash or some combination of the two.

There are a few pros and cons to consider when booking flights through the Chase travel portal. You won't have to worry about blackout dates or limited award availability, which makes it great if you're not flexible with dates and flight times. Just make sure you compare the number of points needed through the Chase travel portal with how many points the airline would require if you were using its own miles, especially if you're hunting for a good deal on economy seats.

The catch with using the Chase travel portal is you won't be able to shop for tickets on low-cost carriers like Spirit Airlines, Frontier Airlines, or Allegiant Air — you can search for flights on Alaska, Southwest, Delta, JetBlue, American, and United. You'll also be able to book flights on most international carriers.

Remember that you can still earn miles and elite credits on flights, as tickets booked through the Chase travel portal are categorized as "paid" rather than as an award flight since you're "paying" for them with points instead of cash. Consider the taxes and fees you might have to pay if you were to transfer the points straight to one of Chase's travel partners versus booking directly through the portal, and to calculate and compare how many points and miles you'd earn by booking with either method.

You'll be able to search, filter, and sort by price, airline, booking class, departure time, arrival time, and departure airport. For this example, below, consider a round-trip flight from Seattle to Austin with sample dates of Feb. 1–7, 2024, booked through the travel portal with a Chase Sapphire Preferred card (redemptions are worth 1.25 cents per point):

Results included 107 results with an economy mix-and-match United and Delta fare for $370 or about 29,600 points being the most affordable option. For comparison's sake, the points price is about the same as what United and Delta are currently charging if you were to book the awards directly through the airlines, but Delta isn't a transfer partner of Chase. You also won't earn miles if you were to book these awards through the airlines, whereas you will earn miles when booking through Chase.

To finish booking your flight through the travel portal, select your route(s), review the details, choose how many points you'd like to use and complete your purchase.

How to book hotels through the Chase travel portal

While the best redemption rates are usually realized when you transfer Chase Ultimate Rewards points at a 1:1 ratio to hotel partner World of Hyatt, if you're not a huge fan of chain hotels or prefer boutiques or brands like Hilton, Choice Hotels, or Wyndham, it can be a good idea to book them through the travel portal.

As with flights, you won't have to worry about blackout dates or limited award night availability. However, keep in mind that hotels treat the Chase travel portal as a third-party booking agency, so you won't be able to earn hotel points on stays as you might by booking your stay directly with the hotel.

Hyatt hotels usually offer better deals when you book directly, and since it's one of Chase's hotel partners, you can transfer UR points instantly at a 1:1 ratio. Marriott and IHG are usually more varied, so you may score a better deal by booking via the Chase travel portal instead of transferring points over. For this reason, it's a good idea to ring up how much your hotel stay would cost in points through the portal as well as the hotel's website.

Start by searching by destination so you can see a list of all the available hotels. For this example, let's try looking for hotels in Downtown Austin from Feb. 1–7, 2024. Once the results appear, you'll be able to narrow down your search with filters based on price, star ratings, guest ratings, amenities and neighborhood.

Let's go over a couple of options within the Chase travel portal, each booked with a Chase Sapphire Preferred credit card. One option is the Four Seasons Hotel Austin, which is listed for $556 or about 44,500 points per night through Chase. If you book through Four Seasons, directly, you'll pay $561 per night. The hotel chain also doesn't have a rewards program but going through Chase provides a way to pay with points.

Another example is the Hyatt Place Austin Downtown for $288 or about 23,000 points per night through Chase. If you were to book this directly through Hyatt, you'd pay $279 per night as a member of its loyalty program or just 15,000 World of Hyatt points per night if you booked with points. Since you can transfer your Ultimate Rewards points to Hyatt at a 1:1 ratio, in this case, transferring would make more sense.

As you can see, it's worth comparing points required by the travel portal and each hotel's website, as the time of year, location, and other factors may play a part in pricing. To book your stay through the travel portal, select your room type, review the details, choose how many points you'd like to use and complete your purchase.

It's a pretty similar process if you want to book rental cars, tours and other travel activities through the Chase travel portal. Cruises can also be booked as well, but you'll need to call.

As far as car rentals, make sure you're booking through the travel portal with points that are connected to Chase Sapphire Preferred or Chase Sapphire Reserve to take advantage of extra perks like primary rental car insurance — you'll also need to decline the rental car company's auto collision damage waiver when you book to activate this. You'll want to charge at least a few dollars to the card and not use points to cover the entire booking which ensures that you're still "paying" for the car rental with your Sapphire card, which means you'll be entitled to the card's rental car insurance.

Beyond that, simply plug in your itinerary and search. Here's an example for a rental in Austin from February 1–7, 2024, booked with a Chase Sapphire Preferred credit card:

You'll be able to filter your search by capacity, car type, price per day, company, and car options (like air conditioning and automatic transmission). For a seven-day rental, it would cost around 24,800 points or $310 for the cheapest option. As with other travel portal purchases, you'll be able to enter how many Chase Ultimate Rewards points you wish to put toward the final price. It works the same way for booking tours and other travel activities, so you could potentially enjoy a free — or nearly free — vacation solely on Chase points if you were to plan it all out properly.

Booking through the Chase travel portal can be a great use of your Ultimate Rewards® points, but make sure to compare the rates against booking directly with an airline or hotel itself. Finally, consider transferring your points to one of Chase's travel partners, especially if you're looking to book a luxury hotel or flight in business class.

Money matters — so make the most of it. Get expert tips, strategies, news and everything else you need to maximize your money, right to your inbox. Sign up here .

Why trust CNBC Select?

At CNBC Select, our mission is to provide our readers with high-quality service journalism and comprehensive consumer advice so they can make informed decisions with their money. Every credit card guide is based on rigorous reporting by our team of expert writers and editors with extensive knowledge of credit card products . While CNBC Select earns a commission from affiliate partners on many offers and links, we create all our content without input from our commercial team or any outside third parties, and we pride ourselves on our journalistic standards and ethics.

Catch up on CNBC Select's in-depth coverage of credit cards , banking and money , and follow us on TikTok , Facebook , Instagram and Twitter to stay up to date.

Information about the Chase Freedom Flex℠ has been collected independently by Select and has not been reviewed or provided by the issuer of the card prior to publication.

- 5 hidden insurance fees to avoid Liz Knueven

- Can I pay my mortgage with a credit card? Kelsey Neubauer

- How can I get homeowners insurance after nonrenewal? Liz Knueven

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

The Complete Guide To Using the Chase Travel Portal — Maximize Your Options

Katie Seemann

Senior Content Contributor and News Editor

343 Published Articles 46 Edited Articles

Countries Visited: 28 U.S. States Visited: 29

Senior Editor & Content Contributor

84 Published Articles 646 Edited Articles

Countries Visited: 41 U.S. States Visited: 28

Flexibility

You can earn frequent flyer miles, cards that earn chase ultimate rewards points, transfer your points between credit cards for maximum value, earning chase points by booking travel, how to access the chase travel portal, how to book a flight through chase travel, the luxury hotel and resort collection, how to book a rental car through the chase travel portal, how to book activities through chase travel, how to book a cruise through the portal, car rentals, earn bonus ultimate rewards points, pay with points, apple purchases, experiences, pay yourself back, transfer to travel partners, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

Chase Ultimate Rewards is one of the major transferrable points programs and a favorite among many travelers. Points are easy to earn and can be transferred to many different hotel and airline partners. But you can also book travel directly through Chase’s travel portal using Ultimate Rewards points.

Booking travel through the Chase Travel portal is simple and can be a great way to use your points.

We’ll show you everything you need to know about how to redeem your points, including the benefits, how to know what your points are worth, and how to book airlines, hotels, and more through the Chase Travel portal.

Why Book Travel Through the Chase Travel Portal?

Generally, you can get maximum value from your Chase Ultimate Rewards points by transferring them to the Chase airline and hotel partners , so why are we talking about using points through a travel portal? While it’s true that the only way to get the highest value redemptions is by transferring, there is still a lot of value to be had by booking directly through the Chase Travel portal.

Flexibility is not often available with points bookings. Unlike an award booking, booking through Chase Travel is like using any other online travel agency (OTA) . There are no blackout dates or limited inventory award seats. If a flight or hotel is available, you can book it with points through the Chase travel portal.

One of the major bummers of booking flights with frequent flyer miles is that you don’t earn miles on award bookings. You can end up doing a lot of travel without earning miles. However, any booking you make with your Chase Ultimate Rewards points through the Chase Travel portal will earn frequent flyer miles and accrue status points. Unfortunately, hotel and car rental bookings still won’t earn points.

We have talked to so many people over the years that love the idea of collecting points and miles but don’t want to deal with the hassle. While many don’t mind putting a little work into getting an awesome redemption, others are just looking for a simple way to book travel and hopefully save some money in the process.

That’s where the Chase Travel portal comes in. With this method of redeeming points, there is no transferring, comparing points values, blackout dates, limited award availability, or multiple travel accounts. You only have to deal with 1 type of point and 1 travel portal but can still retain many of the benefits of collecting points and miles in the first place.

Bottom Line: You can book flights, hotels, rental cars, activities, and cruises through the Chase Travel portal.

If you like the idea of using the Chase Travel portal, you’ll need a credit card that earns Chase Ultimate Rewards points:

Chase Sapphire Preferred ® Card

A fantastic travel card with a huge welcome offer, good benefits, and perks for a moderate annual fee.

The Chase Sapphire Preferred ® card is one of the best travel rewards cards on the market. Its bonus categories include travel, dining, online grocery purchases, and streaming services, which gives you the opportunity to earn lots of bonus points on these purchases.

Additionally, it offers flexible point redemption options, no foreign transaction fees, and excellent travel insurance coverage including primary car rental insurance . With benefits like these, it’s easy to see why this card is an excellent choice for any traveler.

- 5x points on all travel booked via the Chase Travel portal

- 5x points on select Peloton purchases over $150 (through March 31, 2025)

- 5x points on Lyft purchases (through March 31, 2025)

- 3x points on dining purchases, online grocery purchases, and select streaming services

- 2x points on all other travel worldwide

- $50 annual credit on hotel stays booked through the Chase Travel portal

- 6 months of complimentary Instacart+ (activate by July 31, 2024), plus up to $15 in statement credits each quarter through July 2024

- Excellent travel and car rental insurance

- 10% annual bonus points

- No foreign transaction fees

- 1:1 point transfer to leading airline and hotel loyalty programs like United MileagePlus and World of Hyatt

- $95 annual fee

- No elite benefits like airport lounge access or hotel elite status

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

- Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, $50 Annual Chase Travel Hotel Credit, plus more.

- Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Travel℠. For example, 60,000 points are worth $750 toward travel.

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2024.

- Member FDIC

Financial Snapshot

- APR: 21.49%-28.49% Variable

- Foreign Transaction Fees: None

Card Categories

- Credit Card Reviews

- Credit Cards

- Travel Rewards Credit Cards

- Best Sign Up Bonuses

Rewards Center

Chase Ultimate Rewards

- The Chase Sapphire Preferred 80k or 100k Bonus Offer

- Benefits of the Chase Sapphire Preferred

- Chase Sapphire Preferred Credit Score Requirements

- Military Benefits of the Chase Sapphire Preferred

- Chase Freedom Unlimited vs Sapphire Preferred

- Chase Sapphire Preferred vs Reserve

- Amex Gold vs Chase Sapphire Preferred

Chase Sapphire Reserve ®

A top player in the high-end premium travel credit card space that earns 3x points on travel and dining while offering top luxury perks.

If you’re looking for an all-around excellent travel rewards card, the Chase Sapphire Reserve ® is one of the best options out there.

The card combines elite travel benefits and perks like airport lounge access , with excellent point earning and redemption options. Plus it offers top-notch travel insurance protections to keep you covered whether you’re at home or on the road.

Don’t forget the $300 annual travel credit which really helps to reduce the annual fee!

- 10x total points on hotels and car rentals when you purchase travel through Chase TravelSM immediately after the first $300 is spent on travel purchases annually

- 10x points on Lyft purchases March 31, 2025

- 10x points on Peloton equipment and accessory purchases over $250 through March 31, 2025

- 5x points on airfare booked through Chase Travel SM

- 3x points on all other travel and dining purchases; 1x point on all other purchases

- $300 annual travel credit

- Priority Pass airport lounge access

- TSA PreCheck, Global Entry, or NEXUS credit

- Access to Chase Luxury Hotel and Resort Collection

- Rental car elite status with National and Avis

- $550 annual fee

- Does not offer any sort of hotel elite status

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

- $300 Annual Travel Credit as reimbursement for travel purchases charged to your card each account anniversary year.

- Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases

- Get 50% more value when you redeem your points for travel through Chase Travel℠. For example, 60,000 points are worth $900 toward travel.

- 1:1 point transfer to leading airline and hotel loyalty programs

- Access to 1,300+ airport lounges worldwide after an easy, one-time enrollment in Priority Pass™ Select and up to $100 application fee credit every four years for Global Entry, NEXUS, or TSA PreCheck ®

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more

- APR: 22.49%-29.49% Variable

- Chase Sapphire Reserve 100k Bonus Offer

- Chase Sapphire Reserve Benefits

- Chase Sapphire Reserve Airport Lounge Access

- Chase Sapphire Reserve Travel Insurance Benefits

- Chase Sapphire Reserve Military Benefits

- Amex Gold vs Chase Sapphire Reserve

- Amex Platinum vs Chase Sapphire Reserve

Ink Business Preferred ® Credit Card

The Ink Business Preferred card is hard to beat, with a huge welcome bonus offer and 3x points per $1 on the first $150,000 in so many business categories.

The Ink Business Preferred ® Credit Card is a powerhouse for earning lots of points from your business purchases , especially for business owners that spend regularly on ads.

Plus the card offers flexible redemption options, including access to Chase airline and hotel transfer partners where you can achieve outsized value.

Business owners will also love the protections the card provides like excellent cell phone insurance , rental car insurance, purchase protection, and more.

- 3x Ultimate Rewards points per $1 on up to $150,000 in combined purchases on internet, cable and phone services, shipping expenses, travel, and ads purchased with search engines or social media sites

- Cell phone protection

- Purchase protection

- Trip cancellation and interruption insurance

- Rental car insurance

- Extended warranty coverage

- No elite travel benefits like airport lounge access

- Earn 100k bonus points after you spend $8,000 on purchases in the first 3 months from account opening. That's $1,000 cash back or $1,250 toward travel when redeemed through Chase Travel℠

- Earn 3 points per $1 on the first $150,000 spent on travel and select business categories each account anniversary year. Earn 1 point per $1 on all other purchases

- Round-the-clock monitoring for unusual credit card purchases

- With Zero Liability you won't be held responsible for unauthorized charges made with your card or account information.

- Redeem points for cash back, gift cards, travel and more - your points don't expire as long as your account is open

- Points are worth 25% more when you redeem for travel through Chase Travel℠

- Purchase Protection covers your new purchases for 120 days against damage or theft up to $10,000 per claim and $50,000 per account.

- APR: 21.24%-26.24% Variable

- Best Business Credit Cards

- The Chase Ink Business Preferred 100k Bonus Offer

- Benefits of the Ink Business Preferred

- Chase Ink Business Preferred Cell Phone Protection

- Chase Ink Business Preferred vs Amex Business Gold

- Ink Business Cash vs Ink Business Preferred

- Amex Business Platinum vs. Chase Ink Business Preferred

- Ink Business Preferred vs Ink Business Unlimited

- Best Chase Business Credit Cards

- Best Business Credit Card for Advertising

- High Limit Business Credit Cards

- Best Credit Cards with Travel Insurance

- Best Credit Cards for Car Rental Insurance

There are also some great cash-back cards from Chase that can be used to book travel through Chase Travel. The points earned on these cards can be converted into cash-back or alternatively, they can be used in the Chase travel portal.

- Chase Freedom Flex℠

- Chase Freedom Unlimited ®

- Chase Freedom ® card (no longer open to new applicants)

- Ink Business Cash ® Credit Card

- Ink Business Plus ® Credit Card (no longer open to new applicants)

- Ink Business Unlimited ® Credit Card

- Ink Business Premier ® Credit Card

What Are Chase Ultimate Rewards Points Worth?

It’s easy to earn lots of Chase Ultimate Rewards points , but do you know how much they are worth ? If you’re transferring your Chase Ultimate Rewards points to a travel partner, their value will go up or down depending on the type of redemption.

However, when you are booking your travel directly through Chase’s travel portal, each Chase Ultimate Rewards point has a set value that won’t change . The credit card you have will determine the value of your Chase Ultimate Rewards points.

If you have multiple Chase credit cards, it makes sense to transfer your points to the card with the most valuable redemption rate. The only exception to this is the Ink Business Premier card because points earned on this card can’t be transferred to any other card.

1. To transfer your points between 2 cards, log on to the Chase dashboard and select Combine Points .

2. Then you will be able to select the card you want to transfer points from and the card you want to receive the points. After you choose, click Next.

3. You can transfer all of your points or just what you need. Click Review to continue.

4. Double-check the details and click on the Submit button to complete the transfer.

Bottom Line: Your credit card will determine the value of your Chase Ultimate Rewards points. Your points are worth between 1 to 1.5 cents each depending on which credit card you’re redeeming points through.

What if you’d prefer to pay for your travel with a Chase credit card to earn Ultimate Rewards points? The number of points you’ll earn through the Chase travel portal is dependent on which credit card you have and what type of travel you’re purchasing.

You can log into your account in 2 ways.

First, you can go directly to the Ultimate Rewards website to log in or you can log in through your Chase account .

If you’re in your Chase account, click on one of your Ultimate Rewards credit cards and then click on Redeem next to the card’s Ultimate Rewards balance.

Then choose the card you want to use.

From here you can access Chase Travel by clicking on Travel in the top search box or you can switch to another card’s account by clicking on the 3-line icon in the upper left-hand corner.

1. In the Travel section of your Ultimate Rewards account, click on Flights to start your search for a flight. As with any other OTA, you begin your search by inputting basic information such as departure and arrival city, travel dates, and the number of passengers.

2. Next, you will be able to narrow your search results . At the left-hand side of the page, you can filter your results by things like airline or flight times. Then you can sort your results by price, trip duration, or times using the drop-down box at the top of the search results.

3. For each flight option, you’ll be able to see the price in dollars and in points on the right-hand side of the results box.

4. Once you’ve found the flight you want, click the blue Select button. Next, you can choose your return flight using the same process as you did for selecting the outbound flight. Click the blue Select button once you have made your choice.

5. From here you can confirm your flight details and select a fare upgrade if you wish. Then, you’ll be able to choose how to pay for your flight . You can pay for the entire purchase with points or a Chase credit card, or you can split your payment between points and a Chase credit card.

6. Finally, input your passenger information next. Don’t forget to add a frequent flyer number, a Known Traveler Number, or a Redress number if you have them.

Hot Tip: When purchasing travel through the Chase travel portal, you can split your payment between Chase Ultimate Rewards points and a Chase credit card.

How To Book a Hotel Through Chase Travel

1. To book a hotel through the Chase Travel portal , you’ll need to start by clicking on the Hotels tab in the main search box. Then, input your destination, check-in and check-out dates, and the number of travelers. Next, click on the blue Search button.

2. Your search results will look like other sites that you may be familiar with. You’ll see filtering options to the left and sorting options above your search results.

3. Each search result will show the price in both dollars and Chase Ultimate Rewards points. These prices include taxes and fees with the exception of resort fees.

4. Once you select your hotel, click on Add to Itinerary . You can choose to pay for all or part of your hotel cost using Ultimate Rewards points. Click Begin Checkout to input your reservation details and finalize your booking.

Hot Tip: When booking a hotel through the Chase Travel portal, you won’t be eligible to earn points in the hotel’s loyalty program or take advantage of any elite status you may have.

The Luxury Hotel and Resort Collection (LHRC) is exclusively for Chase Sapphire Reserve cardholders. From the Ultimate Rewards travel home page, just click on The Luxury Hotel & Resort Collection tab.

Once you are on the LHRC homepage, type in your destination and click Search to view available properties. Each listing will display the property’s unique cardmember benefits. Click on the listing for more information and to continue the booking process.

When booked through the Chase Travel portal, these properties offer the following benefits:

- Daily breakfast for 2

- Special amenity (varies by property)

- Room upgrades (based on availability)

- Early check-in and late checkout (based on availability)

The Luxury Hotel and Resort Collection properties are reservation-only bookings. You’ll make your reservations online and payment doesn’t happen until you check out from the hotel. These bookings will not take Chase Ultimate Rewards points as payment.

Bottom Line: Luxury Hotel and Resort Collection properties are only available to Chase Sapphire Reserve cardmembers. These properties can’t be booked with points.

1. To rent a car through the Chase Travel portal, start by clicking on the Cars tab in the main search box. Then, input your pick-up location, drop-off location, dates, times, and age of the driver. Click on the blue Search box to continue.