- Destinations

- Hotels & Homestays

- Food & Drink

- People & Culture

- Mindful Travel

- Readers' Travel Awards

- Escape to Rajasthan

- READERS TRAVEL AWARDS

- #LOVEGREATBRITAIN

- TAJ SAFARIS

- BOUTIQUE HOTELS

- CNT TOP RESTAURANT AWARDS

- DESTINATION WEDDING GUIDE

- DON’T TRAVEL WITHOUT IT

- #UNDISCOVERAUSTRALIA

- ESSENTIALLY RAJASTHAN

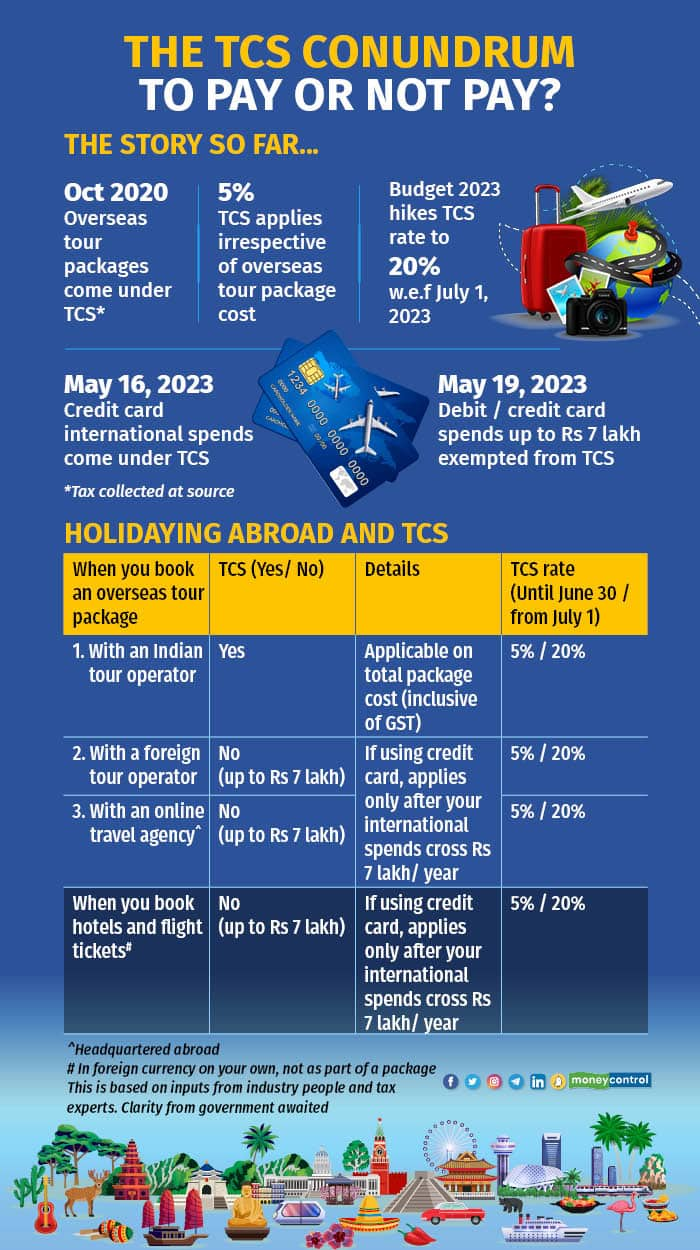

Will you have to pay 20% extra for international travel? New TCS rule explained

By Condé Nast Traveller

The Finance Ministry has introduced amended rules under the Foreign Exchange Management Act (FEMA), increasing the Tax Collected at Source (TCS) for international spending from 5% to 20%. This increased tax will apply from 1 July, and there are also new rules regarding international credit card transactions. Here’s a handy explainer on what the new 20% TCS rule means, and how things will change for you:

What is TCS?

Tax Collected at Source is a tax payable by a seller which he collects from the buyer at the time of sale of goods so that it can be deposited with the tax authorities.

What is the new 20% TCS rule?

Previously, the TCS on international spending was 5%. Starting 1 July, this will increase to 20%. This means that any travel bookings you make, July onwards, will cost 20% more upfront. Any international travel package, airline and accommodation bookings will be 20% higher in cost than before. “Suppose you’re booking a package that costs Rs100, it will now cost Rs120—with Rs20 being collected as tax,” says Aliasgar A Khumosi, a chartered accountant. This applies for all forms of payments.

What kind of transactions will attract the 20% TCS?

Any spending through a debit card, credit card or forex card outside of India will attract the 20% TCS. This includes meals at restaurants, Ubers, flight bookings, hotel bookings, shopping and more. However, the Ministry of Finance has issued a clarification stating that “any payments by an individual using their international Debit or Credit cards up to Rs7 lakh per financial year will be excluded from the LRS (Liberalized Remittance Scheme) limits and hence, will not attract any TCS”.

Can you book through a travel agent to save TCS?

The rule also applies to bookings made through a travel agency—you will pay 20% more to your travel agency for their services as a result of the new rule. Beyond foreign travel, the rule applies to money sent abroad as well as any other remittances.

Will a forex card save you the TCS?

No. Transactions on forex cards and debit cards will also attract the 20% TCS.

How does it affect international credit card transactions?

In consultation with the RBI, the Finance Ministry has omitted Rule 7 of the Foreign Exchange Management (Current Account Transactions) Rules, 2000. Under this rule, forex spending through international credit cards was exempted from the Liberalized Remittance Scheme (LRS). This scheme enables Indian residents to remit funds abroad for certain specified purposes up to a limit of $2,50,000 (Rs2 crore). Until now, the scheme only included debit cards, forex cards and bank transfers. Since international credit card transactions were not included, they were also exempt from the TCS levies that came under the scheme. With the new rule, transactions made with credit cards outside of India will also fall under the LRS. Until 1 July, the transactions will carry a 5% TCS levy, following which the TCS for transactions above Rs7 lakh (per financial year) will increase to 20%.

Are there any foreign expenses that are exempted from the 20% TCS?

Yes. There is no change in the TCS rate for remittances made for the purpose of any education or medical treatment abroad.

Can you claim the 20% TCS back?

“You can get your tax back once you file your returns. It’s essentially an advance tax paid by you,” says A Khumosi. While you will have to pay more for international travel upfront, you can claim the tax back through your Form 26AS—your annual tax statements—when you file your returns.

- Business Today

- India Today

- India Today Gaming

- Cosmopolitan

- Harper's Bazaar

- Brides Today

- Aajtak Campus

- Magazine Cover Story Editor's Note Deep Dive Interview The Buzz

- BT TV Market Today Easynomics Drive Today BT Explainer

- Market Today Trending Stocks Indices Stocks List Stocks News Share Market News IPO Corner

- Tech Today Unbox Today Authen Tech Tech Deck Tech Shorts

- Money Today Tax Investment Insurance Tools & Calculator

- Mutual Funds

- Industry Banking IT Auto Energy Commodities Pharma Real Estate Telecom

- Visual Stories

INDICES ANALYSIS

Mutual funds.

- Cover Story

- Editor's Note

- Market Today

- Drive Today

- BT Explainer

- Trending Stocks

- Stocks List

- Stocks News

- Share Market News

- Unbox Today

- Authen Tech

- Tech Shorts

- Tools & Calculator

- Commodities

- Real Estate

- Election with BT

- Economic Indicators

- BT-TR GCC Listing

Tax collected at source on foreign travel: All you need to know about TCS, consequences of late, incorrect filing

Tax collected at source on foreign travel: all you need to know about tcs, penalties on late, incorrect filing.

- Updated Sep 26, 2023, 12:40 PM IST

- TCS is the tax collected by the seller from the buyer

- It isn’t an additional tax

- You can claim it back while filing ITR

Do you know that from October 1, the Government of India (GOI) will levy 20 per cent Tax Collected at Source (TCS) on foreign tour packages?

Don’t worry. First, you must understand what TCS is. It isn’t an additional tax. You can adjust it against your total income tax liability or claim it back while filing income tax returns (ITR).

In simple terms, it is a tax collected by the agent (issuer) from you (buyer) on booking tour packages, and the agent then deposits the TCS with the tax authorities. Agents can collect this tax from you upfront and are not liable for paying it themselves.

In this piece, Archit Gupta, Founder and CEO of ClearTax, explains TCS in detail.

BT: What is TCS?

AG: TCS is the tax collected by the seller from the buyer on sale so that it can be deposited with the tax authorities. Section 206C of the Income-tax Act governs the goods on which the seller has to collect tax from the buyers. Such persons must have the Tax Collection Account Number to be able to collect TCS.

BT: Should sellers collect TCS on an amount inclusive of GST?

AG: As per income tax law, the seller shall collect TCS from the buyer at the time of debiting the amount payable to the buyer’s account or at the time of receipt of such amount from the said buyer by any mode, whichever is earlier. So, the amount debited to the buyer’s account or payment received by the seller shall be inclusive of VAT/excise/GST. Hence, one should collect the TCS inclusive of GST.

Also read: Here is how you can save on foreign travels if you’re planning to visit abroad before September 30

Also read: Here’s how you can reduce the TCS hit on your foreign trip

Also read: I’m 57 and work for a private firm. How much should I to invest to get Rs 25,000 monthly after retirement?

BT: What are the consequences of late filing of a TCS return?

AG: If the person fails to file the TCS return on or before the due date prescribed in the income tax law, a fee of Rs 200 per day must be paid, during which the failure continues. However, the amount of late fees shall not exceed the amount of TCS. One should deposit the late filing fees before filing the TCS return. Note that Rs 200 per day is a late filing fee, not a penalty.

BT: Is there any penalty for incorrect filing of the TCS return?

AG: Penalty under Section 271H can also be levied if the tax collector files an incorrect TCS return. In other words, a minimum penalty of Rs 10,000 and a maximum penalty of up to Rs 1,00,000 can be levied if the collector files an incorrect TCS return.

BT: Is tax collected at source refundable?

AG: Yes, the TCS collected on a buyer’s PAN is available for adjustment just like the TDS.

- #Tax Collected at Source

- #ITR filing

- #Tax collected at source on foreign travel

- #TCS on foreign travel

TOP STORIES

- Advertise with us

- Privacy Policy

- Terms and Conditions

- Press Releases

Copyright©2024 Living Media India Limited. For reprint rights: Syndications Today

Add Business Today to Home Screen

- Business News

- Budget News

From studying abroad to holidaying overseas: How foreign remittance will be taxed from July 1

Visual Stories

PPF Calculator

This financial tool allows one to resolve their queries related to Public Provident Fund account.

FD Calculator

When investing in a fixed deposit, the amount you deposit earns interest as per the prevailing...

NPS Calculator

The National Pension System or NPS is a measure to introduce a degree of financial stability...

Mutual Fund Calculator

Mutual Funds are one of the most incredible investment strategies that offer better returns...

Other Times Group News Sites

Popular categories, hot on the web, trending topics, living and entertainment, latest news.

The Economic Times daily newspaper is available online now.

How tax will be collected at source from individuals on these transactions from oct 1.

TCS will be levied on foreign remittances made through the Liberalised Remittance Scheme (LRS) of the Reserve Bank of India (RBI) and for buying foreign travel packages. Here is a look at the rules regarding the applicability of TCS and how much tax is leviable.

Read More News on

(Your legal guide on estate planning, inheritance, will and more.)

Download The Economic Times News App to get Daily Market Updates & Live Business News.

A treasure trove of renewable energy is hiding beneath Ladakh’s cold deserts

Five reasons why your Sahara refund claim may be rejected and how to address them.

A small step by IRDAI. A giant leap for senior citizens.

Ok, Tata, bye: Six things that can treat India’s EV range-anxiety.

This app is striking at the core of Uber, Ola business model and succeeding.

What India’s most powerful investigative agency is about

Find this comment offensive?

Choose your reason below and click on the Report button. This will alert our moderators to take action

Reason for reporting:

Your Reason has been Reported to the admin.

To post this comment you must

Log In/Connect with:

Fill in your details:

Will be displayed

Will not be displayed

Share this Comment:

Uh-oh this is an exclusive story available for selected readers only..

Worry not. You’re just a step away.

Prime Account Detected!

It seems like you're already an ETPrime member with

Login using your ET Prime credentials to enjoy all member benefits

Log out of your current logged-in account and log in again using your ET Prime credentials to enjoy all member benefits.

To read full story, subscribe to ET Prime

₹34 per week

Billed annually at ₹2499 ₹1749

Super Saver Sale - Flat 30% Off

On ET Prime Membership

Unlock this story and enjoy all members-only benefits.

Offer Exclusively For You

Save up to Rs. 700/-

ON ET PRIME MEMBERSHIP

Get 1 Year Free

With 1 and 2-Year ET prime membership

Get Flat 40% Off

Then ₹ 1749 for 1 year

ET Prime at ₹ 49 for 1 month

Stay Ahead in the New Financial Year

Get flat 20% off on ETPrime

90 Days Prime access worth Rs999 unlocked for you

Exclusive Economic Times Stories, Editorials & Expert opinion across 20+ sectors

Stock analysis. Market Research. Industry Trends on 4000+ Stocks

Get 1 Year Complimentary Subscription of TOI+ worth Rs.799/-

Stories you might be interested in

- Uncategorized

Different ways you can avoid the 20% TCS on overseas tour packages

- 5 minute read

Here’s why you should file your ITR even when you do not have tax liability

- Posted on June 19, 2023 June 19, 2023

- Mayashree Acharya

Samiksha Swayambhu

Share article.

Prepare to allocate more funds for your upcoming foreign vacation starting next month. Commencing on July 1, 2023, an increased tax collected at source (TCS) rate of 20% will apply to overseas tour packages. Currently, when booking a foreign tour package, a TCS of 5% is imposed. As a result, you will encounter a higher initial cost when travelling abroad.

Although you can seek a refund for the TCS while filing your income tax return, the refunded amount will remain inaccessible until it is processed in the subsequent financial year.

However, it is worth noting that strategies are available to help you mitigate this avoidable expense and potentially save on the additional cost. Continue reading to find out.

What is the new TCS rule that kicks in from July 1, 2023

If you have an upcoming international trip in your plans, it is crucial to familiarise yourself with this new regulation and explore how you can leverage it effectively to safeguard your hard-earned finances.

Starting from July 1, 2023, if you book a foreign trip through an Indian tour operator, they will impose a tax collected at source (TCS) of 20% on the entire tour package. For example, if you plan a trip to Europe with a total cost of Rs 3,00,000 through a local travel agent, the agent will be obligated to collect a TCS of 20% on the tour package. Consequently, you will need to pay an additional amount of Rs 60,000 as TCS when booking the tour.

While the standalone cost of the tour package remains unchanged, the total expense for you will rise due to the imposition of a 20% TCS. This additional levy will increase the overall cost of the tour.

It is important to note that the obligation of collecting and remitting the TCS rests with the travel agent or authorised dealer in the case of overseas tour packages. Therefore, if you book a foreign tour package through an offline or online travel agent in India and pay Indian rupees, the travel agent will still deduct the applicable TCS.

Similarly, if you purchase foreign currency from an authorised dealer for your international vacation, a TCS of 20% will be levied. Additionally, if you load a Forex card with funds before your trip to utilise overseas, a TCS of 20% will also be imposed on it.

Three ways to avoid 20% TCS during your next international trip

1) Use the Rs 7 lakh limit of international debit or credit card

As you can observe, a substantial TCS amount must be borne if you book your foreign trip through domestic travel agents or online platforms within India. However, choose to book a tour package offered by international websites and make payments through an international debit or credit card.

You will be exempt from TCS as long as the payments remain below the threshold of Rs 7 lakh. On May 19, 2023, the finance ministry announced that starting from July 1, 2023, no TCS will be imposed on individual payments made using international debit or credit cards up to Rs 7 lakh in a financial year. It is essential to remember that the threshold for exemption is set at Rs 7 lakh.

According to Ankit Jain, Partner at Ved Jain & Associates, the method of booking chosen for international travel can impact the applicability of TCS (Tax Collected at Source). There are two options: booking through an Indian travel agent with a domestic payment or utilising an international travel website with an international credit card. In both cases, TCS is generally applicable.

However, there is a potential exemption when using an international credit card to book through an international tour operator. In such cases, TCS will not be charged for transactions up to Rs 7 lakh, as the credit card company would levy it. Consequently, TCS can be avoided up to Rs 7 lakh when booking online through an international travel website.

2) Separate booking and payments can help you save TCS

Another critical point is that a 20% TCS is levied on overseas tour packages. However, the definition of a “tour package” under the law is unclear. In light of the proposed increase in TCS, individuals may choose to book their flights, hotels, and sightseeing components separately to avoid forming a package and attracting the TCS levy.

Ankit Jain further explains that no TCS will be applicable if you directly purchase your flight ticket from airlines such as Air India, Vistara, or IndiGo. Similarly, if you book your hotel directly through the hotel’s website and make payment with a debit or credit card, you will not be subject to TCS as long as the amount remains within the threshold of Rs 7 lakh.

By opting for segregated bookings, you can utilise the Rs 7 lakh limit separately for each individual, especially when travelling with friends or family. This allows you to divide the total cost to ensure each person stays within the Rs 7 lakh limit, thus avoiding TCS implications.

3) Buying foreign exchange by June 30, 2023, to avoid high TCS

Many individuals purchase foreign currency or utilise a forex card rather than relying solely on their debit or credit cards when travelling internationally.

Purchasing foreign currency or a Forex card by June 30, 2023, is advisable to avoid paying higher TCS. Sudarshan Motwani, Founder & CEO of BookMyForex.com, explains that the Reserve Bank of India (RBI) permits the purchase of foreign currencies or forex travel cards up to 60 days before the travel date.

If you have plans to travel anytime from now until the end of August, you can take advantage of this opportunity and buy your foreign currencies or Forex travel cards before the end of June. This way, you can save 20% on TCS.

It is essential to be aware that there could be a significant increase in the number of individuals seeking to exchange currency in June, which may lead to delays in currency delivery. As a precautionary measure, exchanging your currency well before your departure date is recommended to avoid any potential last-minute inconveniences at the airport. By planning ahead, you can save both time and money while ensuring a smooth travel experience.

When using international debit or credit cards, it is essential to note that there is an aggregated threshold exemption limit of Rs 7 lakh in a financial year. If the total payment made through all cards combined exceeds this threshold, a TCS of 20% will be applicable.

To avoid the 20% TCS, you can utilise multiple debit or credit cards for booking your flight or hotel, but ensure that the total payment across all cards remains within the limit of Rs 7 lakh. By staying within this threshold, you can prevent the imposition of the TCS.

For any clarifications/feedback on the topic, please contact the writer at [email protected]

I am an engineer passionate about literature, content, books, feline companions, and practising yoga. I love navigating diverse genres, which led me to my work here at ClearTax.

You May Also Like

GST Applies on the Sale of Developed Plots of Land: Gujarat AAR

- Annapoorna M

- Posted on June 23, 2020 June 24, 2020

Mandatory disclosing of LTCG making ITR filing tough

- Abhilash ST

- Posted on July 19, 2019 July 21, 2019

SEBI lowers minimum subscription norms for REIts, InvIts

- Vidushi Kala

- Posted on May 2, 2019

SEBI panel exploring Differential Voting Rights on par with the global norm

- Nidaa Chakkittammal

- Posted on December 21, 2018 January 10, 2019

- Kotak Mahindra Bank share price

- 1,658.95 -9.99%

- Tata Steel share price

- 165.00 -0.30%

- Axis Bank share price

- 1,114.00 4.73%

- State Bank Of India share price

- 785.55 1.60%

- Power Grid Corporation Of India share price

- 292.50 0.67%

Do you have to pay tax on foreign travel expenses?

Foreign travel expenditure above ₹2 lakh has to be disclosed in the itr.

As the pandemic recedes, traveling is on everyone’s mind. As foreign travel gains momentum in 2022, it helps to be aware of the implications of foreign travel on income tax return filing and disclosures.

Individuals are required to disclose any foreign travel expenditure above ₹ 2 lakh in their income tax return (ITR). This expenditure may be incurred by the individuals themselves or spent on behalf of any other person. For example, Madhu travels to Dubai in March 2022 and spends ₹ 2.1 lakh on this. Her income from business/profession is ₹ 2.4 lakh and so she believes she is not required to file her tax returns.

Generally, individuals are required to file tax returns only if their total income exceeds the maximum amount not chargeable to tax, subject to certain conditions. In the Finance Bill, 2019, with the objective of ensuring better governance, the government has through an amendment included the following categories and widened the scope of income tax-return filing requirement for individuals/HUFs who were otherwise not required to file a tax return:

1. Those with an electricity consumption bill of over ₹ 1 lakh.

2. Those with foreign travel expenditure for self or someone else of ₹ 2 lakh or more.

3. Those with a deposit of an amount or an aggregate of the amounts exceeding ₹ 1 crore in a current account.

4. Persons claiming the benefit of tax exemption for long-term capital gains (LTCG) under various provisions of section 54 of the income tax (I-T) Act.

This amendment ensured that people who have the ability to incur large expenditure do not evade the liability of filing tax returns or escape from paying tax.

Now, since for FY 2021-22, Madhu has spent more than ₹ 2 lakh on foreign travel, she will be required to file tax returns and disclose the expenditure in her ITR.

Let’s take another example. Suppose, Mina travels to Dubai in March 2022 and spends ₹ 2.1 lakh. She does not have any income and hence does not regularly file income tax returns (ITR). All the expenses for the trip are sponsored by her son, Alpesh. Now, since for the FY 2021-22, Alpesh has spent more than ₹ 2 lakh on foreign travel, he will be required to file an ITR and disclose the expenditure in his ITR even though he has not travelled but has only spent the amount.

Here’s another example. Say, Asha travels to Dubai on a company sponsored trip in March 2022 and the company incurs an expense of ₹ 2.1 lakh on this trip. She believes that since it is foreign travel, she will have to file an ITR and disclose this in it. However, the requirements stated above are only for expenditure incurred from one’s own source of income and hence company-sponsored foreign travel is out of its purview. Now, suppose after her official trip, she plans to extend her visit and go to Abu Dhabi and her personal expenditure comes to ₹ 2.5 lakh. She will have to file ITR and make the disclosure for ₹ 2.5 lakh spent out of her own source of income.

It is pertinent to note that even if the amount is spent in foreign currency and is equivalent to ₹ 2 lakh or more, the aforementioned income tax-return filing and disclosure requirements are applicable. Also, the limit of ₹ 2 lakh stated above is the aggregate limit for a financial year.

Suppose, during FY 2021-22 Harsh travelled to Nepal and spent ₹ 80,000 and then he travelled to Dubai where he spent ₹ 1 lakh. After that, he visited Singapore and spent ₹ 90,000. He believes that he is not required to file an ITR or disclose these expenses as he spent less than ₹ 2 lakh on each trip. This belief of Harsh is incorrect as the limit of ₹ 2 lakh is at the aggregate level for the financial year.

Since his aggregate foreign travel expenditure exceeds ₹ 2 lakh, Harsh will be required to file an ITR and disclose these expenses.

Nitesh Buddhadev is founder of Nimit Consultancy.

Milestone Alert! Livemint tops charts as the fastest growing news website in the world 🌏 Click here to know more.

Unlock a world of Benefits! From insightful newsletters to real-time stock tracking, breaking news and a personalized newsfeed – it's all here, just a click away! Login Now!

Wait for it…

Log in to our website to save your bookmarks. It'll just take a moment.

You are just one step away from creating your watchlist!

Oops! Looks like you have exceeded the limit to bookmark the image. Remove some to bookmark this image.

Your session has expired, please login again.

Congratulations!

You are now subscribed to our newsletters. In case you can’t find any email from our side, please check the spam folder.

Subscribe to continue

This is a subscriber only feature Subscribe Now to get daily updates on WhatsApp

India seals higher tax plan for foreign trips

T he Interim Budget 2024 has paved the way for the formal inclusion of the increased Tax Collected at Source (TCS) rates on foreign remittances, as previously announced in the 2023 Budget, into the Income Tax Act. The adjustment is set to come into effect following the parliamentary approval of the corresponding amendment.

Finance Minister Nirmala Sitharaman, in her last Budget, had proposed a hike in the TCS rate on foreign remittances under the Liberalised Remittance Scheme (LRS) and on bookings for foreign tour packages, hiking it from 5 per cent to 20 per cent for foreign expenditures exceeding Rs 7 lakh annually per individual.

Originally slated for implementation on July 1, 2023, it was deferred and enforced on October 1, 2023.

Currently, the majority of foreign remittances and expenditures through various payment modes, such as debit cards, forex cards, or others, are subject to a 20 per cent TCS when surpassing the Rs 7 lakh per person per financial year threshold. Credit card transactions remain exempt from this provision. This aggregate limit applies universally to all remittances by an individual, regardless of the chosen payment method.

After Sitharaman's Budget 2023 announcement , international expenditures using credit cards were brought within the ambit of LRS in May, falling under the TCS ambit for the first time. However, in June 2023, the government rescinded its May circular, excluding international credit card spends once again from TCS obligations.

The progression in the Interim Budget marks a critical step towards the formal integration of the revised TCS rates on foreign remittances into the legal framework, with the impending parliamentary approval determining the timeline for its implementation.

For more news like this visit The Economic Times .

The Economic Times daily newspaper is available online now.

New 20% tcs rule from october 1, 2023: 4 tips to bring down tcs to zero during your next international trip.

20% TCS on overseas tour package: When you book, offline or online, overseas tour packages, offline or online, of more than Rs 7 lakh in a financial year, you have to pay TCS at 20% from October 1, 2023. Is there any way to reduce this additional upfront cost? Here are a few tips which will help you lower your TCS burden while travelling abroad. Read on to find out.

What is the new TCS rule on overseas tour packages from October 1, 2023?

How to plan your travel abroad to bring down tcs to zero, going on an international vacation how to use rs 7 lakh tcs threshold, no tcs on international credit card transactions, limit of rs 7 lakh for the purchase of an overseas tour package is independent of the lrs threshold, will tcs be levied if you book international trips from foreign websites, tcs is not an additional tax, read more news on.

(Your legal guide on estate planning, inheritance, will and more.)

Download The Economic Times News App to get Daily Market Updates & Live Business News.

Europe must solve this problem for Indians. Else they will lose out big time.

A statistical oddity shines the spotlight on MGNREGA this election season

Taking a loan? This small paper can save you big

Trucks taking trains! This is how Amul milk is reaching you faster, cheaper

What the rise and rise of the Big Mac Index foretells for Indian equities

Five reasons why your Sahara refund claim may be rejected and how to address them.

Find this comment offensive?

Choose your reason below and click on the Report button. This will alert our moderators to take action

Reason for reporting:

Your Reason has been Reported to the admin.

To post this comment you must

Log In/Connect with:

Fill in your details:

Will be displayed

Will not be displayed

Share this Comment:

Uh-oh this is an exclusive story available for selected readers only..

Worry not. You’re just a step away.

Prime Account Detected!

It seems like you're already an ETPrime member with

Login using your ET Prime credentials to enjoy all member benefits

Log out of your current logged-in account and log in again using your ET Prime credentials to enjoy all member benefits.

To read full story, subscribe to ET Prime

₹34 per week

Billed annually at ₹2499 ₹1749

Super Saver Sale - Flat 30% Off

On ET Prime Membership

Unlock this story and enjoy all members-only benefits.

Offer Exclusively For You

Save up to Rs. 700/-

ON ET PRIME MEMBERSHIP

Get 1 Year Free

With 1 and 2-Year ET prime membership

Get Flat 40% Off

Then ₹ 1749 for 1 year

ET Prime at ₹ 49 for 1 month

Stay Ahead in the New Financial Year

Get flat 20% off on ETPrime

90 Days Prime access worth Rs999 unlocked for you

Exclusive Economic Times Stories, Editorials & Expert opinion across 20+ sectors

Stock analysis. Market Research. Industry Trends on 4000+ Stocks

Get 1 Year Complimentary Subscription of TOI+ worth Rs.799/-

Stories you might be interested in

India’s Travel Tax Rules Keep Changing — and It’s Hurting Domestic Companies

Peden Doma Bhutia , Skift

July 13th, 2023 at 11:55 PM EDT

The Indian government has introduced a layer of complexity and confusion for travel companies in the country.

Peden Doma Bhutia

In the past five months in India, there have been four announcements from the government regarding taxes for international tour packages — each completely different, none clearly stated.

It’s wreaking havoc on India’s travel industry as the country is emerging as a major source of outbound travel.

February 2023: The Indian government announces that on July 1 it would be raising the tax collected for international tour packages bought from an Indian tour operator to 20% from the earlier 5%.

That means if an Indian traveler books a foreign tour package to Italy for Rs 200,000 ($2,500) through an Indian travel agent or an online travel agency in the country, there would be a tax of Rs 40,000 ($500).

May 2023: The finance ministry announces that if one chooses to pay for a tour package offered by international websites using an international debit or credit card, no tax would be imposed as long as the payments remain below Rs 700,00 ($8,500).

June 2023: Overseas transactions through international credit cards will not be subjected to tax for now , except for overseas tour program packages, which would continue to incur 5% tax. This is valid for all modes of payment regardless of the purpose.

June 2023: The government “suspends” its tax decision days before July 1 and says new rates would kick in from October 1.

The flip-flops have left the industry frustrated and confused. Skift spoke to several India-based travel companies to better understand the concern of the new tax policy.

Mahendra Vakharia, the managing director of Pathfinders Holidays, described the frequent changes as “amateurish” and “poorly executed.”

The complexity of the travel and tour industry, with its various booking and payment modes, makes it difficult to impose a blanket 20% tax, said Vakharia.

Isha Goyal, CEO of STIC Travel Group, considers these policy changes an inconvenience for small and medium-sized travel companies trying to expand their outbound travel business.

The ambiguity in tax policies has made it challenging for businesses to effectively plan their operations, according to Rikant Pittie, co-founder of EaseMyTrip. However, Pittie is relieved that with every new development, the policies are being relaxed.

How Does This Render Indian Companies Non-Competitive?

It’s not just about the inconvenience: The taxes put Indian travel companies at a disadvantage to international operators.

The proposed increased tax on overseas travel deters holiday-goers, family visitors, and entrepreneurs from traveling. For individuals relying on monthly income, the 20% tax credit, which they can later claim in their tax return given at the end of the year, does little to alleviate the immediate cash flow challenges.

Furthermore, the unequal imposition of taxes affects Indian travel companies in another way. By implementing the tax for Indian tour operators, travel agents and overseas credit card payments, the policy encourages travelers to book with international companies.

“Such a regressive step goes against the Make In India policy,” said Vakharia, a reference to the prime minister’s Make In India mantra. “It seems illogical to impose a 20% tax on international travel when luxury cars attract only a 1% tax.”

Goyal said it not only hurts small local entrepreneurs and businesses, but also leads to potential revenue losses as overseas bookings increase through international credit cards and prepaid foreign exchange cards.

Rohan Mittal, chief financial officer of Yatra Online, thinks the government should ensure fair competition between Indian travel companies and international aggregators by bringing foreign companies under the same tax rules.

Vishal Suri, the managing director of SOTC Travel, supports this idea and suggests implementing revised credit card guidelines to ensure fairness for India-based travel companies.

Goyal further emphasized the need for a consistent ruling applicable to all payment channels and modes, rather than staggering or selectively defining inclusions and exclusions.

The TCS imposition has caused mixed reactions within the industry. Some smaller leisure-focused agents are shifting their focus to domestic and regional packages to mitigate risks.

However, larger group operators remain confident in the demand for overseas travel, believing that the India outbound growth story will continue to thrive despite the challenges posed by the international travel tax.

Skift India Report

The Skift India Report is your go-to newsletter for all news related to travel, tourism, airlines, and hospitality in India.

Have a confidential tip for Skift? Get in touch

Tags: asia monthly , holiday packages , india , taxes , tour operators , tourism tax , travel agents , yatra

Photo credit: The new tax rates for international travel would kick in from October 1. kitzcorner / Getty Images

- Submit Post

- Union Budget 2024

Amendment in TCS Provisions for Foreign Travel Packages

Amendment in TCS Provisions for Collection of Tax from Customers on Foreign Travel Packages – The Finance Act of 2023 brought significant changes to the Tax Collection at Source (TCS) provisions for the purchase of foreign travel packages in India. Under the amended section 206C(1G) of the Income-tax Act, 1961, the rate of TCS was increased from 5% to 20% for overseas tour program packages. However, this increase in TCS is not uniform and is subject to certain thresholds. The TCS shall continue to apply at the rate of 5% for the first ₹ 700,000 per individual per annum ; the 20% rate will only apply for expenditure above this limit .

The above provision requires the seller of the foreign travel package to collect tax from its customers at the time of receiving the payment for the tour package and deposit it with the government. We have tried to explain the key features of these provisions and answer some frequently asked questions.

What is a foreign travel package?

A foreign travel package is defined as any package that includes at least two of the following components: international travel ticket, hotel accommodation (with or without food, boarding or lodging), or any other expenditure of similar nature or in relation thereto. This means that if the seller sells only an international travel ticket or only a hotel booking to its customer, it will not be considered as a foreign travel package and TCS will not apply.

What is the rate and threshold of TCS on Overseas tour program package?

Please note, if the buyer does not furnish PAN/ Aadhar to you, then the rate of TCS is double until the threshold and 20% thereafter, i.e. 10% till ₹ 7 Lakh and 20% thereafter (With effect from 01-07-2023, TCS rate shall not be more than 20%, in case collectee does not provide PAN to collector or he is a non-filer).

The above threshold of ₹ 7 Lakh is per person per annum. A customer can opt for segregated bookings, in order to utilise the ₹ 7 Lakh per person threshold separately for each individual.

For example a customer has approached for a tour package of ₹ 13 Lakhs for himself and his friends.

Scenario 1 – The customer remits the amount for entire package. In this case the TCS should be collected at 5% upto ₹ 7 Lakhs and 20% thereafter.

Scenario 2 – The customer insists on segregated billing for himself and his friends. In this scenario the customer can utilise the ₹ 7 lakhs for each person separately and TCS shall be applicable at 5% unless the threshold of ₹ 7 lakhs is breached.

How do you know whether an individual has already crossed the threshold during the year and accordingly will be covered under the 20% TCS?

Currently there is no mechanism in place to understand the actual amount spent by the customer on foreign tours. Hence, the CBDT has recommended an option to obtain an ‘undertaking’ to be provided by the customer to the seller about the previous remittances made for foreign travel. This would enable the seller to apply the correct rate of TCS.

What happens in the case of a false declaration?

The onus to collect TCS is on the seller. On a preliminary basis, seller’s reliance on the undertaking provided by the customer is accepted. However, on a high level basis, in case the seller is in possession of the customers’ passports, wherein the details of foreign travel during the year are clearly evident, the seller can be said to be at default. A default to collect TCS could attract consequences such as interest levy at 1 percent per month of delay, a penalty of up to the TCS amount.

How to calculate and collect TCS?

The seller has to calculate and collect TCS on the amount paid by the customer for the foreign travel package, excluding GST and other taxes. Tax should be collected at the time of receiving the payment from the customer, either in cash or by cheque or draft or electronic mode.

How to remit and report TCS?

The seller has to remit the TCS collected from its customers to the government within seven days from the end of the month in which TCS is collected. This will be followed by a quarterly statement of TCS in Form No. 27EQ filed online within one month from the end of each quarter. The seller also has to file an annual statement of TCS in Form No. 27E within six months from the end of each financial year.

Who can claim credit for TCS?

The customer who has paid TCS can claim credit for it against his or her income tax liability in his or her income tax return.

The new TCS provisions for collection of tax from customers on foreign travel packages are aimed at ensuring compliance and preventing tax evasion by individuals who spend large amounts on overseas travel. The seller of foreign travel packages would be required to comply with these provisions and collect and deposit TCS from its customers as per the prescribed rates and thresholds. The seller will also have to issue TCS certificates to its customers and file TCS statements with the government. The customers can claim credit for TCS paid against their income tax liability.

- « Previous Article

- Next Article »

Name: CA Kaushik Khandekar

Qualification: ca in practice, company: kaushik khandekar & co, location: belagavi, karnataka, india, member since: 25 aug 2023 | total posts: 2, my published posts, join taxguru’s network for latest updates on income tax, gst, company law, corporate laws and other related subjects..

- Join Our whatsApp Channel

- Join Our Telegram Group

Leave a Comment

Your email address will not be published. Required fields are marked *

Post Comment

Notice: It seems you have Javascript disabled in your Browser. In order to submit a comment to this post, please write this code along with your comment: a54f5c6589a64a83cc52520e150f8fc7

Subscribe to Our Daily Newsletter

Latest posts.

Live Webinar with Book on Section 43B(h) (Financial Fitness)

Basic Customs Duty exempt on imported Zinc Oxide used in manufacture of PCFP

GST Order Not Sustainable if Reply Is Rejected Without Proper Reasons: Delhi HC

Courts Authorized To Modify Child Custody Orders: Kerala HC

Domination of AI on Corporate Boardrooms & Decision-Making

Madras HC Allows Statutory Appeal on GST Penalty

Mere Omission Not Suppression Unless Deliberate to Evade Duty Payment

Orissa HC grants bail to Senior Journalist in Economic Offence Case

18% IGST on Nutrition/Dietary Supplements (HSN 21069099): CESTAT Ahmedabad

Imported Second-Hand Medical Devices with 5+ Years’ Residual Life Exempt from ‘Waste’ Definition

Tax Planning: Strategies for Maximizing Returns and Minimizing Liabilities

Featured posts.

Complexities of sending goods for Job work- Filing of Form GST ITC- 04

RBI Bars Kotak Bank from Onboarding New Online Customers & Issuing New Credit Cards

Arrest & Bail Under GST

GST Case Law Compendium – April 2024 Edition

FAQ On Reporting of Share Market Transaction in Income Tax Return

WhatsApp Image Cannot Be the Sole Basis for Additions: ITAT Surat

Who is our “Sankatmochan” during Financial “Sankat” ?

An Overview of ITR 4 – Presumptive Taxation Scheme

New FVUs and Return Preparation Utility for e-TDS/TCS Statements

You are using an outdated browser. Please upgrade your browser to improve your experience and security.

- Moneycontrol Trending Stock

- Infosys INE009A01021, INFY, 500209

- State Bank of India INE062A01020, SBIN, 500112

- Yes Bank INE528G01027, YESBANK, 532648

- Bank Nifty

- Nifty 500

- Mutual Funds

- Commodities

- Futures & Options

- Cryptocurrency

- My Portfolio

- My Watchlist

- FREE Credit Score ₹100 Cash Reward

- My Messages

- Price Alerts

- Chat with Us

- Download App

Follow us on:

Holidays booked with foreign tour operators escape 20% TCS, but Indian tour operators must collect this tax

The 20% tax collected at source (tcs) rule for overseas tour packages seems to have a loophole. booking such a package with an indian tour operator attracts tcs right away. with a foreign tour operator, you can escape tcs until international payments on your credit card cross rs 7 lakh a year..

No TCS applicable on overseas tour packages booked with foreign travel agencies.

The rule to impose 20 per cent Tax Collected at Source (TCS) on foreign spending has a loophole when it comes to booking foreign holidays.

According to changes brought about in the Finance Act 2023, buying an overseas tour package from an Indian tour operator will attract 20 percent TCS from July 1. Currently, the rate of TCS is 5 percent. But it’s not clear whether this TCS will apply to holiday packages booked with foreign tour operators or online travel agencies that are headquartered outside India. Moneycontrol had asked the Ministry of Finance questions on TCS and was asked to wait for further clarifications. TCS on overseas tour packages came under the spotlight recently after the government brought international spending via credit cards when travelling abroad under the RBIs’ Liberalised Remittance Scheme (LRS), and hence, under the TCS.

Also, if you make international flight and hotel bookings yourself, then TCS won’t apply until you cross the Rs 7 lakh threshold set for debit and credit cards. This is for bookings made in foreign currency, not in INR. In the latter case, no TCS applies.

Currently, if you book an overseas tour package – whether with local tour operators such as Veena World and Kesari Tours or online travel aggregators (OTAs) such as MakeMy Trip, EaseMyTrip and the like – you pay 5 percent TCS.

Related stories

From July 1, 2023, 20 percent TCS will apply on such foreign holiday packages. This becomes applicable from the very first spend – there is no minimum threshold for TCS exemption on overseas tour packages.

But will this 20 percent TCS impact overseas tour packages that are booked with international tour operators (Cosmos, Globus, Scanam Tours, Intrepid Travel etc.)? Not necessarily.

That apart, there’s one other way of holidaying abroad without having to pay TCS up to an extent – by making your own foreign hotel and flight bookings. In this case, TCS will apply only on spends exceeding Rs 7 lakh a year if the bookings are made in foreign currency. If you pay in INR, no TCS will apply.

Holiday booking with a foreign tour operator

Rajiv Mehra, President, Indian Association of Tour Operators (IATO), highlights a possible loophole in the applicability of TCS. According to him, if you book an overseas holiday package with a tour operator based outside India, then this 20 percent TCS won’t apply. “You can pay a foreign tour operator using your credit card. Unless you cross the Rs 7 lakh limit for credit cards, TCS will not apply,” explains Mehra. He says that IATO has made a representation to the Finance Ministry pointing to the need for a level-playing field between domestic and foreign tour operators.

According to Sandeep Jhunjhunwala, Partner, Nangia Andersen LLP, an anomaly exists with respect to the obligation of TCS collection on overseas tour packages by foreign travel booking e-commerce platforms as they are non-residents in India based on their tax residency status. However, as the use of credit cards beyond Rs 7 lakh comes under the TCS ambit, even customers accessing foreign tour operators would ultimately end up paying 20 percent TCS on such transactions. Russell Gaitonde, Partner, Deloitte India, however, has a somewhat different view. He says, “I believe, TCS ought to apply in this situation (booking via an overseas tour operator). Although operationalising this process and complying with this requirement might prove to be a challenge for overseas tour operators, especially when they deal with Indian resident customers.”

But TCS or no TCS, many holiday travellers may still prefer to go with an Indian tour operator, even when booking for foreign holidays. The possibility of having to follow up with a tour operator in a foreign country in case of any disputes may deter some from taking this route.

Also read: TCS rules on foreign tours, magazine subscriptions, iTunes, international equities… all doubts clarified

Do-it-yourself traveller

Forget foreign tour packages – if you are the Do-It-Yourself (DIY) traveller who likes to book hotels, rail tickets, and air tickets on your own, you may be spared TCS if you book in INR.

If you pay for the bookings in foreign currency, then once your credit card spends on international transactions cross the Rs 7 lakh threshold, 20 percent TCS will kick in even in this case. What is, however, not yet clear is whether this TCS will get collected at the time of making a payment or will it later reflect in your credit card statement. Tax experts whom we spoke with believe the latter is more likely.

To be sure, Moneycontrol’s search for international flights and hotel rooms on OTAs such as MakeMyTrip, EaseMyTrip, and Expedia, among others, for travel in July does not show TCS in the cost break-up for such bookings. On the other hand, searching for holiday packages on a few Indian OTA websites does show TCS as part of the booking cost, even if your holiday cost is less than Rs 7 lakh. TCS is added to the holiday package price which is inclusive of GST.

Until there is more clarity from the government on many of these aspects, it’s a wait-and-watch situation for those planning foreign holidays.

Also read: TCS doesn’t apply only to your foreign currency spending, domestic purchases too can bear its brunt

Discover the latest business news , Sensex , and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Trending news

- Zerodha's Nithin Kamath shares 'trick' to becoming a successful trader: 'This alone won't help'

- Emirates calls teen's father at 4 am after she misses flight: 'Communication delivery was so effective'

- Ashneer Grover: 'Tax payers are the meaningless minority as far elections are concerned'

- These 30 companies are hiring for 100% remote roles. Some jobs pay over Rs 80 lakh pa

You got 30 Day’s Trial of

- Ad-Free Experience

- Actionable Insights

- MC Research

- Economic Calendar

You are already a Moneycontrol Pro user.

Access your Detailed Credit Report - absolutely free

IMAGES

VIDEO

COMMENTS

In such a case, you are obliged to file an income tax return in India for the FY 2021-22 and disclose the amount of foreign travel expenses. If the expenditure would have been less than Rs 2 lakh, it is not necessary to file ITR. It is important to understand that the requirement of filing ITR and disclosure of foreign travel details shall ...

The new Tax Collected at Source (TCS) rules will also apply to transactions made with credit cards, added Pittie. Undoubtedly, it is anticipated that foreign travel will incur greater expenses ...

Starting from July 1, 2023, a tax collected at sources (TCS) of 20 per cent will apply to overseas tour packages. ... So, if you are booking a foreign tour package from an offline or online travel agent in India and paying in rupees, even then the travel agent will deduct the TCS. Even if you purchase foreign currency from an authorised dealer ...

If you are buying a foreign tour package from a travel agent, you have to pay a tax collection at source (TCS) of 20% from July 1, 2023. Budget 2023 has hiked the TCS rate for foreign remittances under the LRS from 5% to 20% (except for education and medical purposes). With this sharp rise in TCS, foreign trips are likely to become costlier soon.

The Finance Ministry has introduced amended rules under the Foreign Exchange Management Act (FEMA), increasing the Tax Collected at Source (TCS) for international spending from 5% to 20%. This increased tax will apply from 1 July, and there are also new rules regarding international credit card transactions.

Get insights into the new Tax Collection at Source (TCS) rules effective from October 1, 2023, impacting foreign trips. Discover tips to reduce TCS on global journeys, understand the Liberalised Remittance Scheme (LRS) changes, and unlock the complexities for international travelers. Learn how TCS applies to various expenses, including education, medical purposes, and overseas tour packages.

Do you know that from October 1, the Government of India (GOI) will levy 20 per cent Tax Collected at Source (TCS) on foreign tour packages? Don't worry. First, you must understand what TCS is.

Any payments done in the foreign land exceeding ₹ 7 lakh a year through international credit and debit cards will be subject to TCS levy at the rate of 20 per cent effective 1 October 2023. Can ...

Here's what taxpayers should know. In Budget 2023, the government said, for foreign remittances for other purposes under LRS and purchase of overseas tour program, it is proposed to increase the ...

Grant Thornton Bharat / Mar 1, 2023, 10:47 IST. Union Budget 2023: From July 1, you may have to shell out more in case you are planning to travel abroad. The government has decided to increase the ...

From July 1 2023, investing overseas or a foreign trip is going to cost you more as the Union Budget 2023 has proposed that any outward remittances for purposes other than medical treatment and ...

Foreign Tour Operator is a person who typically combines travel and tour components to create a package holiday. Overseas Tour Package is proposed to be defined to mean any tour package which offers visit to a country or countries or territory or territories outside India.

TCS rates on foreign travel. The TCS will be collected by the seller of the foreign tour package at 5 per cent if the buyer has furnished PAN card details. If the buyer doesn't, then the TCS is 10 per cent, as per Section 206CC. The tax collected is on the full amount of the package. The tour operator would need to deposit the TCS against ...

From October 1, 2020, tax will be collected at source from individuals for foreign remittances made through the Liberalised Remittance Scheme and for buying foreign travel packages.TCS or tax collected at source will be leviable on these transactions/payments if they are above specified limits as per section 206C(1G) of the Income-tax Act, 1961. . TCS was imposed on these transactions by the ...

Three ways to avoid 20% TCS during your next international trip. 1) Use the Rs 7 lakh limit of international debit or credit card. As you can observe, a substantial TCS amount must be borne if you book your foreign trip through domestic travel agents or online platforms within India. However, choose to book a tour package offered by ...

Maruti Suzuki India share price; 12,669.35 2.20%; Wipro share price; 452.85 1.92%; ... it helps to be aware of the implications of foreign travel on income tax return filing and disclosures.

Updates on foreign remittance tax India. In the 2023 Budget address, Finance Minister Nirmala Sitharaman announced that the Tax Collection at Source (TCS) for foreign remittances would increase from 5% to 20% of the transaction amount. The tax increase on foreign remittance falls under the Liberalised Remittance Scheme (LRS) and will be ...

Impact of 20% TCS. Starting from July 1, 2023, the rate of TCS on international credit card transactions has been increased from 5% to 20%, as announced in the Budget 2023-24. This means that foreign currency transactions made using an international credit card within the limit of USD 2,50,000 will be subject to a hefty TCS of 20%.

India seals higher tax plan for foreign trips. T he Interim Budget 2024 has paved the way for the formal inclusion of the increased Tax Collected at Source (TCS) rates on foreign remittances, as ...

TCS on Foreign Travel under Income Tax Act, 1961. 1. INTRODUCTION. Now foreign trip is also taxable. Govt. is taking step towards increasing tax base. Before Corona virus hampered our life, UN World Tourism Organization (UNWTO) predicted that India will account for 50 million outbound tourists by 2020. Operators said that at present around 25 ...

If you are planning to go on an international trip with your family, be ready to bear a higher cost upfront due to a new tax collected at source rule.When you book, offline or online, overseas tour packages of more than Rs 7 lakh in a financial year, you have to pay TCS at 20% from October 1, 2023. If the foreign tour packages cost up to Rs 7 lakh, TCS will be levied at 5%.

That means if an Indian traveler books a foreign tour package to Italy for Rs 200,000 ($2,500) through an Indian travel agent or an online travel agency in the country, there would be a tax of Rs ...

What are the Latest Updates on the Foreign Remittance Tax in India? The Finance Minister, Smt. Nirmala Sitharaman announced an update on the tax rates on foreign remittances in budget 2023. ... Remittances made for foreign travel for medical treatment are also taxed at 5%. Overseas Tour Packages - Any overseas tour package also attracts TCS on ...

Amendment in TCS Provisions for Collection of Tax from Customers on Foreign Travel Packages- The Finance Act of 2023 brought significant changes to the Tax Collection at Source (TCS) provisions for the purchase of foreign travel packages in India.Under the amended section 206C(1G) of the Income-tax Act, 1961, the rate of TCS was increased from 5% to 20% for overseas tour program packages.

The 20% Tax Collected at Source (TCS) rule for overseas tour packages seems to have a loophole. Booking such a package with an Indian tour operator attracts TCS right away. With a foreign tour ...