- Hospitality Industry

Top 10 Trends in the Hospitality Industry in 2024

January 10, 2024 •

15 min reading

What are the latest trends in the hospitality industry? As a testament to its resilience, agility and innovative spirit, this article reflects today’s increasingly dynamic hospitality industry in terms of its long, medium and short-term evolution. Discover the industry's adaptability and forward-thinking approach, shaping its trajectory in the face of challenges and opportunities, while staying attuned to the latest hospitality trends.

Best-selling author, Will Guidara, claims “We are entering into a hospitality economy” – suggesting that what underpins the essence of hospitality, (service excellence, human interaction, personalization and the co-creation of memorable experiences), is actually what many sectors of industry are desperately in need of today.

As we charge at break neck speed towards an ever-more digitalized society , the hospitality industry stands out as the successful hybrid that balances the implementation of tech innovation for improved operations whilst preserving the human need for connection, authenticity and real-life discovery.

With statistics predicting a healthy expansion of the sector (e.g., the bleisure and wellness markets on the up, room demand set to reach an all-time high, booking.com as the most valuable tourism brand in the world, and new positions opening up in the sector), we can confirm that the hospitality industry is poised for a significant transformation in 2024.

So what new trends are emerging? Driven by interlinked factors, including technological progress, evolving consumer preferences and a deeper focus on sustainability, hospitality businesses can capitalise on emerging opportunities to enhance guest experiences and position themselves for long-term success.

10 hospitality trends 2024 - Elevate experiences, embrace evolution

- Workforce empowerment: Transforming challenges into opportunities

- Artificial intelligence and technology: Choosing the best tech to revolutionize hospitality

- Culinary experiences: Putting experiences, authenticity and the senses first

- Bars and drinks redefined: Adding creativity and design to the drinks' menu

- Fine dining: In need of reinvention but full of potential

- Fine wine prices: Navigating the fluctuating vineyard market

- Rising interest rates: The impact on hotel property values and transactions

- Green hospitality: Beyond sustainability to net positivity

- Data-driven decision-making: Data-analytics for optimum personalization

- The power of social media: Crafting authentic narratives

1. Workforce empowerment: Transforming challenges into opportunities

Over the past two years, the industry's biggest challenge has not been attracting customers but rather finding and retaining staff. To address this issue, many hotel groups have begun to make improvements, and there has never been a better time for newcomers to the industry to negotiate better working conditions and salaries.

Today, many hotels offer their staff free or low-cost accommodation , increased wages and reduced peak-time working hours. They also invest in training programs to motivate staff and allow mobility up the corporate ladder. Empowered employees not only have a positive impact on how guests feel and their decision to become repeat guests, but also help attract other employees to build a cohesive, high-quality workforce.

2. Artificial intelligence and technology: Choosing the best tech to revolutionize hospitality

As Chat GPT celebrates its first birthday, we can only surrender to the fact that, like it or not, we have entered into an AI-accelerated world, and consequently, the pace at which the industry adapts has become a pressing issue. But which forms of AI best harness hospitality stakeholder outcomes?

Contactless services: Effortless technology, impeccable stay

Embracing contactless technologies is about redefining the hospitality experience to cater to modern travelers, not just adapting to the pandemic-driven shift toward touchless interactions. Contactless services simplify the guest journey by reducing wait times and physical contact points. Mobile check-in, digital keys and voice or tablet-controlled room automation allow guests to move seamlessly through the hospitality experience. The citizenM hotel brand has pioneered this minimum-fuss check-in and room experience with a hugely successful UX-friendly app.

Other popular tools such as WhatsApp allow hotel staff to remain in constant contact with customers during their stay, respond immediately to requests and thus provide bespoke services. It also streamlines operations by reducing the need for face-to-face interactions and human error, improving service delivery and lowering the burden on a scarce workforce. In line with contactless services , hospitality companies need to prioritise data privacy and security, putting solid safeguards in place to protect guest information against cyber threats.

Technology-driven innovation: Beyond boundaries

At the heart of technology innovation is the ability for managers and employees to centralize information at all times. Migrating to a fully cloud-based solution is a first but essential step . This enables real-time sharing, better service orientation and personalisation of the guest experience, improving all hotel departments.

Robotic systems (as used in the Henn-na Hotels in Japan) optimise processes and increase efficiency in back-of-house operations such as housekeeping or F&B outlets, reducing staffing requirements and allowing managers to respond to problems in real-time and with accountability.

The use of augmented reality helps with staff onboarding, allowing new employees to be put in real-life situations and trained before even entering a room. Pedagogically speaking, as practiced at EHL in the Virtual Housekeeping class, AR provides a more interactive and complete learning environment. Augmented reality also allows hotels and airlines to market themselves in an ad hoc style - an innovative and sustainable approach. Potential customers can better immerse themselves in the facilities and make more informed decisions.

Hyper-personalization: Tailored moments, lasting loyalty

In a world of commoditised practices, guests are increasingly looking for personalized experiences that cater to individual preferences and aspirations . In the hospitality industry, hyper-personalisation means relying on technology-based micro-segmentation to tailor each guest interaction to real-time needs and behaviours. For example, eliminating 'deadlines' such as check-in/check-out/F&B closing times, knowing whether a customer wants to be accompanied through check-in or do it contactless, personalizing room temperature, lighting and amenities or tailoring F&B options promptly and accurately. At Fauchon l'Hotel in Paris clients suggest the menu and define their portion sizes. From a hotel perspective, this enables better dynamic pricing strategies, higher guest-spent for experiences, or tailored loyalty programmes with commercial partners.

3. Culinary experiences: Putting experiences, authenticity and the senses first

The desire to experience rather than simply consume means that experiential dining has today evolved in new ways. Hotels are now required to offer a range of dining options to cater to different customer tastes and, when correctly done, can become a culinary destination where the restaurant is at the heart of the experience and not just an extension of the hotel. A good example is the Grand Resort Bad Ragaz in Switzerland which boasts seven restaurants, three bars, a bistro, a café and a sushi takeaway, (plus an array of Michelin stars and GaultMillau points), unsurprisingly making it a mecca for traveling gourmets.

Experiential design can also allow customers to taste food in a multi-sensory environment that stimulates all the senses, not just the taste buds (e.g., Ultraviolet by Paul Pairet in Shanghai ). Some hotels have started to provide experiences even on a smaller and more dynamic scale. E.g., They offer four-hand dinners (an invited chef cooks with the in-house chef), organise kitchen parties (clients eat in the kitchen), or have a front-cooking area. Specialist cooking classes can complement this. The key here is to offer a unique experience like how to make your own gin, cook local food , or bake bread with the experts.

Another trend relates to children . A menu of unimaginative, standard food à la burger and chips is no longer enough; parents want their children to eat healthier, globally-inspired food with high-quality ingredients. Adding world food or plant-based products and packaging them in innovative ways will make for happy families likely to return.

A final significant trend in the food sector is off-premise dining and digitalisation. Although customers have returned to eating in restaurants since the pandemic, a large proportion mix on- and off-premise dining. Restaurants need to cater to this clientele to increase revenues, as takeaways are no longer limited to fast food but also exist for traditional and even fine dining. This means that restaurants need to reorganise their workflows and operations to cater to in-house diners and delivery, alongside designing appropriate, creative, high-quality packaging and optimising delivery or collection methods to be easy and inexpensive without competing with traditional delivery platforms.

This can also include ghost kitchens focusing only on food production for delivery and takeaway. Post-Covid, ghost kitchens have become an increasingly popular trend in the restaurant industry with statistics showing that they are projected to be a $157 billion market by 2030. As of 2021, there are over 100,000 ghost kitchens operating worldwide .

4. Bars and drinks redefined: Adding creativity and design to the drinks' menu

Today's bars need to stand out by offering unique drinks paired with a special, Instagrammable atmosphere to create an immersive experience for their customers. E.g., Ashley Sutton Design Bars are known across Asia for their ability to transport guests to enchanting, immersive worlds, offering not just a place to drink but an entire experience that stimulates the senses and sparks curiosity.

Gone are the days of a simple wine list and international beer and spirit brands. Bars and restaurants need to specialise and cater to an international clientele with evolving tastes. A dedicated beer menu with local craft beers, wines from specific vintages and terroirs with a narrative, eclectic spirits collections (after whisky and gin, look out for rum in the coming years), and fresh hyper-locally sourced juices are what customers want.

Mixology has been around for some time, but offering mocktails and non-alcoholic food pairings is also becoming essential due to stricter alcohol laws and healthier lifestyles driven by Gen Z and millennials. Faux booze has gone mainstream and now it’s not just a case of ‘dry January’, but mocktails all year long! Cocktail and mocktail innovations should go beyond traditional recipes to include unique ingredients, techniques and presentation styles (e.g., Bar Benfiddich in Tokyo ) and be taught to customers in mixology classes.

The effect of economic uncertainty on hotels, restaurants and fine wines

5. fine dining: in need of reinvention but full of potential.

The pandemic has unexpectedly affected consumer behaviors: they now organize themselves on short notice, have become increasingly spoilt for choice and no-shows are today the norm . More and more restaurants are responding by asking for a credit card at the time of reservation. But this only treats one of the symptoms without solving the problem. "A full house one day, but only four tables occupied the next" , is an observation that led Antoine Lecefel to shut his restaurant – sadly one of many fine dining establishments to do so.

Inflation and declining purchasing power play a part, but more generally, the fundamental problem lies in the inability of fine-dining restaurants to reinvent themselves. Unlike hotels and other players in the hospitality industry that increasingly compete with them through ambitious and innovative culinary projects, they have to contend with limited financial and human resources. They have neither the capacity to implement and manage a proactive strategy nor the means to invest in cutting-edge, highly experiential concepts. Initiatives such as Eatrenalin , which create a unique experience by combining gastronomy, décor and entertainment, offer a glimpse of this changing industry and the new competition facing traditional players.

Solutions? A strong, contemporary concept plus a business-oriented management that understands consumers, connects with them and is thought through from the outset to generate margins and create synergies and/or economies of scale. The Igniv chain is a shining example of this, driven by an extraordinary chef and based on the principle of “we love to share”, Andreas Caminada has created a unique and fully coherent concept, the success of which is now being rolled out in various locations, all of which have been rewarded with rave reviews from customers and expert guides.

6. Fine wine prices: Navigating the fluctuating vineyard market

Another challenge facing restaurants is cellar and wine list management. Restaurants with limited financial resources may even wonder whether fine wines still have their place on their menu . Indeed, fine wine prices have risen almost exponentially since the Global Financial Crisis of 2008. But here, too, the situation appears to have changed.

A year ago, fine wine prices were at record highs. Demand for rare, artisanal wines from regions with long-standing terroir reputations was at its peak. One could go on about Burgundy, but many other examples are as revealing. For example, the Châteauneuf-du-Pape Réserve cuvée from Rayas, worth between 150 and 200 euros (for young vintages) less than a decade ago, has soared to reach and exceed the 2’000 euro mark. At this point, voices suggested that this was normal; inflation should also positively impact the prices of fine wines. But there is no reason this should be the case: demand drives prices, not production costs. Fine wines attract wealthy people, collectors and investors. For them, the resources that can be invested in wine depend on economic conditions and financial markets. The latter have fallen sharply since the beginning of 2022. Not surprisingly, wine prices have followed the same trend.

The most spectacular move was in Burgundy wines. Prices had become so high that these wines had detached from the rest of the market. Just a year ago, many wines from the 2019 vintage were selling for several thousand euros a bottle. One wondered whether these wines had permanently changed their status and would never be traded at lower prices again. Today, the trend has abruptly reversed, and it appears more like a speculative bubble that has begun to implode. Time will tell. The fine wine market offers an almost perfect setting for this kind of phenomenon: herding behaviour is common, and, in the end, price levels depend not on financial arguments but simply on what people are willing to pay for a bottle.

7. Rising interest rates: The impact on hotel property values and transactions

As we have seen with wine, economic conditions considerably impact on the value of tangible assets. The same applies to real estate . The market proved relatively resilient last year, thanks to the ability of hotels to pass on (sometimes more than proportionally) higher costs to their customers, while maintaining high occupancy rates. The increase in RevPar thus more than offsets the rise in discount rates.

Today, consumers having finished dipping into their COVID-19 savings and interest rates remaining high, the very long upward cycle in hotel property values has ended. What remains as a stabilising factor is the fact that the pipeline of hotel projects is thin. In other words, supply is likely to stagnate over the coming years and should thus not contribute to aggravating the supply-demand imbalance. Nonetheless, we can expect pressure on prices. Refinancing transactions will further exacerbate this, which will take place on far less favourable terms over the next 12-24 months. As is always the case in this type of environment, we can expect forced sales, sometimes at substantial discounts to current valuations.

Another consideration is sustainability . The residential real estate market is becoming highly selective, making it hard to rent and make profitable properties with an unfavourable environmental record. This trend has already begun and will likely intensify, affecting commercial real estate in a major way. In other words, hotels that have not been renovated and adapted to today's standards and expectations will likely suffer more than proportionately.

Other trends that have been, still are, and will continue to shape hospitality

8. green hospitality: beyond sustainability to net positivity.

After a period of harvesting low-hanging fruit, hospitality groups are increasingly looking for more innovative and meaningful ways to implement, measure and communicate their sustainability practices . In the F&B industry, local sourcing has become standard in many outlets. However, it has now started to scale up more by offering better traceability of products (e.g., The Europe Hotel in Ireland has its own farm with livestock, fish, and produce ). In addition, guests are increasingly being educated on sustainable practices, e.g., cooking classes on how to use the entire ingredients and avoid food waste. It is no longer about doing good but rather showing customers how to do good.

Hospitality groups are also increasingly adopting sustainable building techniques and are generally trying to adopt a 360-degree strategy that allows them to be sustainable from the first brick up to the operation (e.g., the Beyond Now Network where industry experts have joined forces to transform hospitality businesses into environmentally friendly, efficient and profitable enterprises). Some are going even further, not content with being net zero but aiming to become net positive, exemplified by ‘regenerative tourism’ practices .

9. Data-driven decision-making: Data-analytics for optimum personalization

"Information is the oil of the 21st century, and analytics is the combustion engine" (Peter Sondergaard, senior vice president and global head of Research at Gartner, Inc.). The current trend is moving away from simply collecting data to engineering and analysing the vast amount of data efficiently into actionable decisions and gaining an edge over competitors.

Today's successful early-adopter hospitality companies have a data-driven business model . For example, through its platform, Booking.com has extensive knowledge of guest and hotel behaviour, which it can use in real-time to adapt its offers and displays and negotiate better deals with hoteliers. The Marriott International hotel chain uses data analytics to personalize guest experiences, with their loyalty program as a major source of data collection.

Data is reshaping hotel marketing, allowing hotels to better monitor guest satisfaction and desires to personalise experiences and better target the customer base . Finally, it enables hotels to increase revenue through more accurate yield and revenue practices by better forecasting demand and thus offering more dynamic pricing strategies.

10. The power of social media: Crafting authentic narratives

This consistent trend is entering a new phase of maturity. First, marketers need to find more innovative ways to capture the attention of customers who are constantly bombarded with messages. With their short video content, the rise of TikTok and Instagram seems promising. It allows the sharing of stories to enhance the storytelling of hospitality outlets (e.g., the customer becomes part of the act through employee or behind-the-scenes videos).

Second, the use of influencers has gained traction in the industry. On average, businesses generate $6.50 in revenue for each $1 invested in influencer marketing . Here, marketers need to find the needle in the haystack with influencers who have enough reach and best fit the hotel's values and story.

Third, with advances in technology and the many options available, marketers need to accurately measure the impact of their social media efforts and finetune the message accordingly. They also need to balance customer and organic content creation and paid or free content. Overall, the cost of social media must be commensurate with the benefits, be professional, authentic and follow a clear strategy in line with traditional marketing efforts.

Master in Hospitality Management

Key takeaway from ehl's hospitality industry trends 2024 - crafting experiences, influencing lives, and paving the way to tomorrow.

In today’s hospitality landscape, it is difficult to confine ourselves to an annual update. Certainly, several general trends have been in place for years and continue to evolve, but by and large, this once cozy industry is constantly innovating and reinventing itself. It is not just adapting to customers. It is creating its own momentum, helping to shape the society and economy of 2024 and beyond.

From computer games to popular films and TV shows, the hospitality industry impacts our daily lives more than we realize. As a sector that thrives on personalized, immersive encounters, it caters not just to our desires for leisure, travel and memorable life experiences but also influences the way we interact, socialize and dream.

Associate Professor of Finance at EHL Lausanne

Associate Professor at EHL

Keep reading

What does a Hotel Manager do?

May 02, 2024

Luxury hotels and a ‘sense of place’: The challenge for hoteliers

May 01, 2024

Enhancing hotel guests’ well-being: Academic insights for hoteliers

Apr 25, 2024

The best step-up for a successful career in hospitality

Our Master's in Hospitality Management is an internationally recognized MSc qualification. You will have a choice of four academic routes: CSR & Sustainable Transformation, Finance, Real Estate & Consulting, Food & Beverage Management, or Luxury Experience Management. These routes enable you to specialize through your studies.

This is a title

This is a text

More articles

- Bachelor Degree in Hospitality

- Pre-University Courses

- Master’s Degrees & MBA Programs

- Executive Education

- Online Courses

- Swiss Professional Diplomas

- Culinary Certificates & Courses

- Fees & Scholarships

- Bachelor in Hospitality Admissions

- EHL Campus Lausanne

- EHL Campus (Singapore)

- EHL Campus Passugg

- Host an Event at EHL

- Contact our program advisors

- Join our Open Days

- Meet EHL Representatives Worldwide

- Chat with our students

- Why Study Hospitality?

- Careers in Hospitality

- Awards & Rankings

- EHL Network of Excellence

- Career Development Resources

- EHL Hospitality Business School

- Route de Berne 301 1000 Lausanne 25 Switzerland

- Accreditations & Memberships

- Privacy Policy

- Legal Terms

© 2024 EHL Holding SA, Switzerland. All rights reserved.

UN Tourism | Bringing the world closer

Share this content.

- Share this article on facebook

- Share this article on twitter

- Share this article on linkedin

Tourism’s Importance for Growth Highlighted in World Economic Outlook Report

- All Regions

- 10 Nov 2023

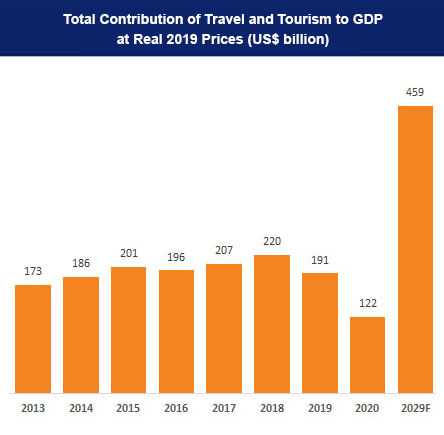

Tourism has again been identified as a key driver of economic recovery and growth in a new report by the International Monetary Fund (IMF). With UNWTO data pointing to a return to 95% of pre-pandemic tourist numbers by the end of the year in the best case scenario, the IMF report outlines the positive impact the sector’s rapid recovery will have on certain economies worldwide.

According to the World Economic Outlook (WEO) Report , the global economy will grow an estimated 3.0% in 2023 and 2.9% in 2024. While this is higher than previous forecasts, it is nevertheless below the 3.5% rate of growth recorded in 2022, pointing to the continued impacts of the pandemic and Russia's invasion of Ukraine, and from the cost-of-living crisis.

Tourism key sector for growth

The WEO report analyses economic growth in every global region, connecting performance with key sectors, including tourism. Notably, those economies with "large travel and tourism sectors" show strong economic resilience and robust levels of economic activity. More specifically, countries where tourism represents a high percentage of GDP have recorded faster recovery from the impacts of the pandemic in comparison to economies where tourism is not a significant sector.

As the report Foreword notes: "Strong demand for services has supported service-oriented economies—including important tourism destinations such as France and Spain".

Looking Ahead

The latest outlook from the IMF comes on the back of UNWTO's most recent analysis of the prospects for tourism, at the global and regional levels. Pending the release of the November 2023 World Tourism Barometer , international tourism is on track to reach 80% to 95% of pre-pandemic levels in 2023. Prospects for September-December 2023 point to continued recovery, driven by the still pent-up demand and increased air connectivity particularly in Asia and the Pacific where recovery is still subdued.

Related links

- Download the News Release on PDF

- UNWTO World Tourism Barometer

- IMF World Economic Outlook

Category tags

Related content, international tourism to reach pre-pandemic levels in 2024, international tourism to end 2023 close to 90% of pre-p..., international tourism swiftly overcoming pandemic downturn, tourism on track for full recovery as new data shows st....

Reimagining the $9 trillion tourism economy—what will it take?

Tourism made up 10 percent of global GDP in 2019 and was worth almost $9 trillion, 1 See “Economic impact reports,” World Travel & Tourism Council (WTTC), wttc.org. making the sector nearly three times larger than agriculture. However, the tourism value chain of suppliers and intermediaries has always been fragmented, with limited coordination among the small and medium-size enterprises (SMEs) that make up a large portion of the sector. Governments have generally played a limited role in the industry, with partial oversight and light-touch management.

COVID-19 has caused an unprecedented crisis for the tourism industry. International tourist arrivals are projected to plunge by 60 to 80 percent in 2020, and tourism spending is not likely to return to precrisis levels until 2024. This puts as many as 120 million jobs at risk. 2 “International tourist numbers could fall 60-80% in 2020, UNWTO reports,” World Tourism Organization, May 7, 2020, unwto.org.

Reopening tourism-related businesses and managing their recovery in a way that is safe, attractive for tourists, and economically viable will require coordination at a level not seen before. The public sector may be best placed to oversee this process in the context of the fragmented SME ecosystem, large state-owned enterprises controlling entry points, and the increasing impact of health-related agencies. As borders start reopening and interest in leisure rebounds in some regions , governments could take the opportunity to rethink their role within tourism, thereby potentially both assisting in the sector’s recovery and strengthening it in the long term.

In this article, we suggest four ways in which governments can reimagine their role in the tourism sector in the context of COVID-19.

1. Streamlining public–private interfaces through a tourism nerve center

Before COVID-19, most tourism ministries and authorities focused on destination marketing, industry promotions, and research. Many are now dealing with a raft of new regulations, stimulus programs, and protocols. They are also dealing with uncertainty around demand forecasting, and the decisions they make around which assets—such as airports—to reopen will have a major impact on the safety of tourists and sector employees.

Coordination between the public and private sectors in tourism was already complex prior to COVID-19. In the United Kingdom, for example, tourism falls within the remit of two departments—the Department for Business, Energy, and Industrial Strategy (BEIS) and the Department for Digital, Culture, Media & Sport (DCMS)—which interact with other government agencies and the private sector at several points. Complex coordination structures often make clarity and consistency difficult. These issues are exacerbated by the degree of coordination that will be required by the tourism sector in the aftermath of the crisis, both across government agencies (for example, between the ministries responsible for transport, tourism, and health), and between the government and private-sector players (such as for implementing protocols, syncing financial aid, and reopening assets).

Concentrating crucial leadership into a central nerve center is a crisis management response many organizations have deployed in similar situations. Tourism nerve centers, which bring together public, private, and semi-private players into project teams to address five themes, could provide an active collaboration framework that is particularly suited to the diverse stakeholders within the tourism sector (Exhibit 1).

We analyzed stimulus packages across 24 economies, 3 Australia, Bahrain, Belgium, Canada, Egypt, Finland, France, Germany, Hong Kong, Indonesia, Israel, Italy, Kenya, Malaysia, New Zealand, Peru, Philippines, Singapore, South Africa, South Korea, Spain, Switzerland, Thailand, and the United Kingdom. which totaled nearly $100 billion in funds dedicated directly to the tourism sector, and close to $300 billion including cross-sector packages with a heavy tourism footprint. This stimulus was generally provided by multiple entities and government departments, and few countries had a single integrated view on beneficiaries and losers. We conducted surveys on how effective the public-sector response has been and found that two-thirds of tourism players were either unaware of the measures taken by government or felt they did not have sufficient impact. Given uncertainty about the timing and speed of the tourism recovery, obtaining quick feedback and redeploying funds will be critical to ensuring that stimulus packages have maximum impact.

2. Experimenting with new financing mechanisms

Most of the $100 billion stimulus that we analyzed was structured as grants, debt relief, and aid to SMEs and airlines. New Zealand has offered an NZ $15,000 (US $10,000) grant per SME to cover wages, for example, while Singapore has instituted an 8 percent cash grant on the gross monthly wages of local employees. Japan has waived the debt of small companies where income dropped more than 20 percent. In Germany, companies can use state-sponsored work-sharing schemes for up to six months, and the government provides an income replacement rate of 60 percent.

Our forecasts indicate that it will take four to seven years for tourism demand to return to 2019 levels, which means that overcapacity will be the new normal in the medium term. This prolonged period of low demand means that the way tourism is financed needs to change. The aforementioned types of policies are expensive and will be difficult for governments to sustain over multiple years. They also might not go far enough. A recent Organisation for Economic Co-operation and Development (OECD) survey of SMEs in the tourism sector suggested more than half would not survive the next few months, and the failure of businesses on anything like this scale would put the recovery far behind even the most conservative forecasts. 4 See Tourism policy responses to the coronavirus (COVID-19), OECD, June 2020, oecd.org. Governments and the private sector should be investigating new, innovative financing measures.

Revenue-pooling structures for hotels

One option would be the creation of revenue-pooling structures, which could help asset owners and operators, especially SMEs, to manage variable costs and losses moving forward. Hotels competing for the same segment in the same district, such as a beach strip, could have an incentive to pool revenues and losses while operating at reduced capacity. Instead of having all hotels operating at 20 to 40 percent occupancy, a subset of hotels could operate at a higher occupancy rate and share the revenue with the remainder. This would allow hotels to optimize variable costs and reduce the need for government stimulus. Non-operating hotels could channel stimulus funds into refurbishments or other investment, which would boost the destination’s attractiveness. Governments will need to be the intermediary between businesses through auditing or escrow accounts in this model.

Joint equity funds for small and medium-size enterprises

Government-backed equity funds could also be used to deploy private capital to help ensure that tourism-related SMEs survive the crisis (Exhibit 2). This principle underpins the European Commission’s temporary framework for recapitalization of state-aided enterprises, which provided an estimated €1.9 trillion in aid to the EU economy between March and May 2020. 5 See “State aid: Commission expands temporary framework to recapitalisation and subordinated debt measures to further support the economy in the context of the coronavirus outbreak,” European Commission, May 8, 2020, ec.europa.eu. Applying such a mechanism to SMEs would require creating an appropriate equity-holding structure, or securitizing equity stakes in multiple SMEs at once, reducing the overall risk profile for the investor. In addition, developing a standardized valuation methodology would avoid lengthy due diligence processes on each asset. Governments that do not have the resources to co-invest could limit their role to setting up those structures and opening them to potential private investors.

3. Ensuring transparent, consistent communication on protocols

The return of tourism demand requires that travelers and tourism-sector employees feel—and are—safe. Although international organizations such as the International Air Transport Association (IATA), and the World Travel & Tourism Council (WTTC) have developed a set of guidelines to serve as a baseline, local regulators are layering additional measures on top. This leads to low levels of harmonization regarding regulations imposed by local governments.

Our surveys of traveler confidence in the United States suggests anxiety remains high, and authorities and destination managers must work to ensure travelers know about, and feel reassured by, protocols put in place for their protection. Our latest survey of traveler sentiment in China suggests a significant gap between how confident travelers would like to feel and how confident they actually feel; actual confidence in safety is much lower than the expected level asked a month before.

One reason for this low level of confidence is confusion over the safety measures that are currently in place. Communication is therefore key to bolstering demand. Experience in Europe indicates that prompt, transparent, consistent communications from public agencies have had a similar impact on traveler demand as CEO announcements have on stock prices. Clear, credible announcements regarding the removal of travel restrictions have already led to increased air-travel searches and bookings. In the week that governments announced the removal of travel bans to a number of European summer destinations, for example, outbound air travel web search volumes recently exceeded precrisis levels by more than 20 percent in some countries.

The case of Greece helps illustrate the importance of clear and consistent communication. Greece was one of the first EU countries to announce the date of, and conditions and protocols for, border reopening. Since that announcement, Greece’s disease incidence has remained steady and there have been no changes to the announced protocols. The result: our joint research with trivago shows that Greece is now among the top five summer destinations for German travelers for the first time. In July and August, Greece will reach inbound airline ticketing levels that are approximately 50 percent of that achieved in the same period last year. This exceeds the rate in most other European summer destinations, including Croatia (35 percent), Portugal (around 30 percent), and Spain (around 40 percent). 6 Based on IATA Air Travel Pulse by McKinsey. In contrast, some destinations that have had inconsistent communications around the time frame of reopening have shown net cancellations of flights for June and July. Even for the high seasons toward the end of the year, inbound air travel ticketing barely reaches 30 percent of 2019 volumes.

Digital solutions can be an effective tool to bridge communication and to create consistency on protocols between governments and the private sector. In China, the health QR code system, which reflects past travel history and contact with infected people, is being widely used during the reopening stage. Travelers have to show their green, government-issued QR code before entering airports, hotels, and attractions. The code is also required for preflight check-in and, at certain destination airports, after landing.

4. Enabling a digital and analytics transformation within the tourism sector

Data sources and forecasts have shifted, and proliferated, in the crisis. Last year’s demand prediction models are no longer relevant, leaving many destinations struggling to understand how demand will evolve, and therefore how to manage supply. Uncertainty over the speed and shape of the recovery means that segmentation and marketing budgets, historically reassessed every few years, now need to be updated every few months. The tourism sector needs to undergo an analytics transformation to enable the coordination of marketing budgets, sector promotions, and calendars of events, and to ensure that products are marketed to the right population segment at the right time.

Governments have an opportunity to reimagine their roles in providing data infrastructure and capabilities to the tourism sector, and to investigate new and innovative operating models. This was already underway in some destinations before COVID-19. Singapore, for example, made heavy investments in its data and analytics stack over the past decade through the Singapore Tourism Analytics Network (STAN), which provided tourism players with visitor arrival statistics, passenger profiling, spending data, revenue data, and extensive customer-experience surveys. During the COVID-19 pandemic, real-time data on leading travel indicators and “nowcasts” (forecasts for the coming weeks and months) could be invaluable to inform the decisions of both public-sector and private-sector entities.

This analytics transformation will also help to address the digital gap that was evident in tourism even before the crisis. Digital services are vital for travelers: in 2019, more than 40 percent of US travelers used mobile devices to book their trips. 7 Global Digital Traveler Research 2019, Travelport, marketing.cloud.travelport.com; “Mobile travel trends 2019 in the words of industry experts,” blog entry by David MacHale, December 11, 2018, blog.digital.travelport.com. In Europe and the United States, as many as 60 percent of travel bookings are digital, and online travel agents can have a market share as high as 50 percent, particularly for smaller independent hotels. 8 Sean O’Neill, “Coronavirus upheaval prompts independent hotels to look at management company startups,” Skift, May 11, 2020, skift.com. COVID-19 is likely to accelerate the shift to digital as travelers look for flexibility and booking lead times shorten: more than 90 percent of recent trips in China were booked within seven days of the trip itself. Many tourism businesses have struggled to keep pace with changing consumer preferences around digital. In particular, many tourism SMEs have not been fully able to integrate new digital capabilities in the way that larger businesses have, with barriers including language issues, and low levels of digital fluency. The commission rates on existing platforms, which range from 10 percent for larger hotel brands to 25 percent for independent hotels, also make it difficult for SMEs to compete in the digital space.

Governments are well-positioned to overcome the digital gap within the sector and to level the playing field for SMEs. The Tourism Exchange Australia (TXA) platform, which was created by the Australian government, is an example of enabling at scale. It acts as a matchmaker, connecting suppliers with distributors and intermediaries to create packages attractive to a specific segment of tourists, then uses tourist engagement to provide further analytical insights to travel intermediaries (Exhibit 3). This mechanism allows online travel agents to diversify their offerings by providing more experiences away from the beaten track, which both adds to Australia’s destination attractiveness, and gives small suppliers better access to customers.

Governments that seize the opportunity to reimagine tourism operations and oversight will be well positioned to steer their national tourism industries safely into—and set them up to thrive within—the next normal.

Download the article in Arabic (513KB)

Margaux Constantin is an associate partner in McKinsey’s Dubai office, Steve Saxon is a partner in the Shanghai office, and Jackey Yu is an associate partner in the Hong Kong office.

The authors wish to thank Hugo Espirito Santo, Urs Binggeli, Jonathan Steinbach, Yassir Zouaoui, Rebecca Stone, and Ninan Chacko for their contributions to this article.

Explore a career with us

Related articles.

Make it better, not just safer: The opportunity to reinvent travel

Hospitality and COVID-19: How long until ‘no vacancy’ for US hotels?

A new approach in tracking travel demand

US Hospitality Industry Size & Share Analysis - Growth Trends & Forecasts (2024 - 2029)

The Report Covers US Hospitality Industry Trends, Overview and the Market is Segmented by Type (Chain Hotels and Independent Hotels) and Segment (Service Apartments, Budget and Economy Hotels, Mid and Upper Mid-scale Hotels, and Luxury Hotels)

United States Hospitality Market Size

Need a report that reflects how COVID-19 has impacted this market and its growth?

United States Hospitality Market Analysis

The hospitality industry in the United States has been growing, with the rising number of international travelers visiting the country for leisure trips and with the rising business travel within the country. The total value of bookings increased from USD 116 billion in 2009 to USD 185 billion in 2017. The international arrivals in the country increased by 0.7% in 2017. Cities, like New York, managed to record high numbers of both leisure travelers and business travellers. Growth in digital innovation helped in recording this increasing number and it also helped the players who operate shared spaces, like Airbnb, to be able to reach out to their target audience. The total expenditure of international travellers recorded an all-time high value of USD 251 billion in 2017. Gross hotel bookings recorded a value of USD 185 billion in 2017, which was USD 116 billion in 2009. All these growing numbers, together, inspired the Department of Commerce to target 95.5 million international visitor arrivals, annually, by 2023, which is twice the number it recorded in 2000.

United States Hospitality Market Trends

This section covers the major market trends shaping the United States Hospitality Market according to our research experts:

The Y-o-Y Growth in Revenue is Driving the Market

The hospitality industry in the United States always managed to score a growing number, over the past few years. Though the occupancy rates fluctuate from month to month, the overall revenue generated from the segment keeps increasing. The region recorded USD 280 billion in terms of the revenue generated in 2018, which was almost double the revenue it generated in the early 2000s. Since 2000, the region recorded positive growth in revenue, which dropped to USD 133 billion in 2009, due to the global recession, from USD 152 billion in 2008.

Airbnb has Changed the Face of the Hospitality Industry in the United States

When it entered the hospitality industry in the United States in 2008, Airbnb was barely known to the general public. Yet, with its innovative space sharing idea and digitalization technique, it attracted the younger generation and reached a break-even point after a year from its inception. Currently, more than 60% of the accounts in Airbnb belong to millennials. It succeeded in attracting a greater number of customers, through its pricing strategy. Airbnb is offering shared spaces at fairly cheaper rates in the leading cities of the United States and the United Kingdom. There are spaces available for USD 14 per night, even in the prime cities of the world. According to recent statistics, Airbnb has approximately 150 million users and covers more than 65,000 cities in the world, with more than 5 million listings.

United States Hospitality Industry Overview

The hospitality industry in the United States is dynamic. The region hosts a high number of brands with global footprints. Airbnb has been attracting a large consumer base and it recorded an increasing number of listings and bookings over the past few years. The entry of the concept of shared space has been giving a tough competition to the major players, over the past 3 to 4 years.

United States Hospitality Market Leaders

Marriott International

Hilton Worldwide

Wyndham Hotels & Resorts

InterContinental Hotels Group (IHG)

Choice Hotels International

*Disclaimer: Major Players sorted in no particular order

United States Hospitality Market Report - Table of Contents

1. INTRODUCTION

1.1 Study Deliverables

1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET INSIGHTS AND DYNAMICS

4.1 Market Overview

4.2 Market Dynamics

4.2.1 Drivers

4.2.2 Restraints

4.2.3 Opportunities

4.3 Impact of COVID-19 on the Hospitality Industry

4.4 Insights on Revenue Flows from the Accommodation and Food and Beverage Sectors

4.5 Leading Cities in the United States, with Respect to the Number of Visitors

4.6 Investments (Real Estate, FDI, and Others) in the Hospitality Industry

4.7 Technological Innovations in the Hospitality Industry

4.8 Insights on the Impact of Shared Living Spaces on the Hospitality Industry

4.9 Insights on Other Economic Contributors to the Hospitality Industry

4.10 Value Chain Analysis

4.11 Porter's Five Forces Analysis

5. MARKET SEGMENTATION

5.1 By Type

5.1.1 Chain Hotels

5.1.2 Independent Hotels

5.2 By Segment

5.2.1 Service Apartments

5.2.2 Budget and Economy Hotels

5.2.3 Mid and Upper Mid-scale Hotels

5.2.4 Luxury Hotels

6. COMPETITVE INTELLIGENCE

6.1 Market Concentration

6.2 Company Profiles

6.2.1 Marriott International

6.2.2 Hilton Worldwide

6.2.3 Wyndham Hotels & Resorts

6.2.4 InterContinental Hotels Group (IHG)

6.2.5 Choice Hotels International

6.2.6 Best Western Hotels & Resorts

6.2.7 Hyatt Hotels Corporation

6.2.8 G6 Hospitality

6.2.9 Aimbridge Hospitality

6.2.10 Airbnb

- *List Not Exhaustive

6.3 Loyalty Programs Offered by Major Hotel Brands

7. INVESTMENT ANALYSIS

8. FUTURE OUTLOOK OF THE INDUSTRY

9. APPENDIX

United States Hospitality Industry Segmentation

A complete background analysis of the hospitality industry in the United States, which includes an assessment of the industry associations, the overall economy and the emerging market trends based on segments, significant changes in the market dynamics, and the market overview, is covered in the report.

United States Hospitality Market Research FAQs

What is the current us hospitality market size.

The US Hospitality Market is projected to register a CAGR of 5.5% during the forecast period (2024-2029)

Who are the key players in US Hospitality Market?

Marriott International, Hilton Worldwide, Wyndham Hotels & Resorts, InterContinental Hotels Group (IHG) and Choice Hotels International are the major companies operating in the US Hospitality Market.

What years does this US Hospitality Market cover?

The report covers the US Hospitality Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the US Hospitality Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Our Best Selling Reports

- Artificial Intelligence in Healthcare Market

- Global Patient Registry Software Market

- Thailand Energy Market

- Thermal Energy Storage Market

- Fitness Tracker Market

- Global Computerized Physician Order Entry (CPOE) Systems Market

- Operating Room Equipment Market

- Global Immunohistochemistry Market

- Facial Recognition Market

- Smart Waste Management Market

US Hospitality Industry Report

Statistics for the 2024 US Hospitality market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. US Hospitality analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.

US Hospitality Market Report Snapshots

- US Hospitality Market Size

- US Hospitality Market Share

- US Hospitality Market Trends

- US Hospitality Companies

- US Hospitality News

Please enter a valid email id!

Please enter a valid message!

US Hospitality Market Get a free sample of this report

Please enter your name

Business Email

Please enter a valid email

Please enter your phone number

Get this Data in a Free Sample of the US Hospitality Market Report

Please enter your requirement

Thank you for choosing us for your research needs! A confirmation has been sent to your email. Rest assured, your report will be delivered to your inbox within the next 72 hours. A member of our dedicated Client Success Team will proactively reach out to guide and assist you. We appreciate your trust and are committed to delivering precise and valuable research insights.

Please be sure to check your spam folder too.

Sorry! Payment Failed. Please check with your bank for further details.

Add Citation APA MLA Chicago

➜ Embed Code X

Get Embed Code

Want to use this image? X

Please copy & paste this embed code onto your site:

Images must be attributed to Mordor Intelligence. Learn more

About The Embed Code X

Mordor Intelligence's images may only be used with attribution back to Mordor Intelligence. Using the Mordor Intelligence's embed code renders the image with an attribution line that satisfies this requirement.

In addition, by using the embed code, you reduce the load on your web server, because the image will be hosted on the same worldwide content delivery network Mordor Intelligence uses instead of your web server.

More From Forbes

The travel and tourism industry by 2030.

- Share to Facebook

- Share to Twitter

- Share to Linkedin

Oscar White is the Founder & CEO of Beyonk , the experiences booking platform: empowering events, activities & experience providers to thrive

The ever-increasing speed of technological advancements and changing consumer expectations makes it arguably more difficult to forecast the future of the tourism industry than ever before. However, looking at macro-trends, there is a clear direction of travel that could substantially change the industry as we know it. The trends favor the end consumers and organizations that, paraphrasing Darwin, are “most adaptable to change.” They will be more likely to survive and thrive. As an ex-strategy consultant and public speaker on digital and technology trends, and now running venture-backed, travel-tech startup Beyonk , here are my predictions for the state of the industry by 2030.

1. Customers will become empowered through more choice and control.

As the tech giants lead the way in designing products that provide the best customer experience, from Amazon with single-click buying of every sort of product to Uber with quick and simple pickups, our expectations continue to evolve. Customers will want more, in less time and with less effort. Millions of bookings, analyzed by Beyonk, show 65% of consumers book within 48 hours of their events and activities. This will likely shorten as the friction of finding and booking in-destination experiences reduces.

2. Connectivity will become commoditized.

Since 2006, the travel industry has benefited from the General Transit Feed Specification, a standard for how data is accessible across industry stakeholders. While it’s unlikely that the rest of the tourism industry will get a similar standard, connectivity will continue to grow between suppliers, resellers and customers. This is a natural evolution of the tourism industry and will likely continue to make consumers more powerful with their decision-making and as a whole, make it easier to find and book with long-tail providers or book multiple categories at once. A series of application programmable interfaces could give access to a large portion of the supply. Many online travel agents could then access similar supply, making branding, differentiation and customer experience even more important to compete.

3. Personalization will become more important.

With the explosion of available data, services that are able to meaningfully present the relevant data in a constructive way will probably thrive. The more companies can tailor their offering to suit personal preferences, the more they’ll win. From the pre-sales aspect, they’ll be able to target suitable audiences with a compelling offer and lead them into personalized customer journeys — from building itineraries to selecting the room package and flight.

Best Travel Insurance Companies

Best covid-19 travel insurance plans.

The challenge of Apple and Google changing their privacy policies and ability to use third-party cookies has made it more difficult to personalize offers, ads and communications to relevant audiences. Companies are investing more to build up more first-person data such as emails. But they are struggling too, as Apple has introduced masking and obfuscation of email addresses, including in-browser privacy protection, which masks users’ IP addresses. An opportunity for personalization may come through Web 3.0 — where each person could have a single profile that follows you across the internet, that can be shared to allow websites to show you content specific to your profile to give you the best browsing experience and allow you to control the data you share. Those who are able to keep responding to the ever-changing privacy changes, but still build out strong personalization strategies, will build more loyal customer bases, have more efficient spending and reduce the cost of acquiring new customers.

4. Online channels will become seamless with offline channels.

As augmented and virtual reality technology improves, the price point for such devices in this space will drop significantly. AR and VR will become the new way to experience destinations, travel and things to do. For the initial pre-buying process, there will be a more immersive experience, moving closer to a “try before you buy” approach, as witnessed in retail over the last decade, with more brands adopting such features. See my article, “Ecommerce Trends for the Tourism and Travel Industry,” for a more in-depth discussion of this.

It is clear we are moving toward in-destination experiences where you can have an overlay of reviews for each menu item, or have a virtual tour guide giving you tips wherever you are via your wearable device. We, as both consumers and providers, will become more equipped with data to have better experiences. Those organizations that can cater to a more seamless online and offline experience could win big.

While it’s impossible to predict the future, the trends suggest the future of the industry could be grounded in further maturity of timely, relevant data and making it consumable across channels to delight customers.

Forbes Business Council is the foremost growth and networking organization for business owners and leaders. Do I qualify?

- Editorial Standards

- Reprints & Permissions

Online MS in Hospitality & Tourism

Hospitality and tourism industry prepares for post-pandemic rebound.

Before COVID-19 turned the world upside down, the hospitality and tourism industry was responsible for more than 10 percent of global GDP and one in every 10 jobs worldwide, according to the World Travel & Tourism Council (WTTC). It was also one of the fastest-growing fields, accounting for one in four new jobs created over the previous five years.

The pandemic changed all that, at least temporarily. While few segments of the economy were spared, hospitality and tourism were particularly hard hit. The WTTC reported that the sector lost $4.5 trillion in 2020, with its contribution to GDP plummeting 49.1 percent, compared with just a 3.7 percent decline in the overall global economy.

While COVID-19 has caused significant disruption, the hospitality and tourism industry is resilient and is coming back stronger following previous downturns, such as those caused by the 9/11 terrorist attacks and the 2008 economic crash, according to Dr. Hicham Jaddoud , who teaches Global Hospitality and Tourism in the USC Bovard College’s Online Master of Science in Hospitality and Tourism program.

“Growth in the sector has become greater after each crisis,” he says. “Why? Because hospitality takes advantage of that slow time to retrain, refresh and develop new concepts that are even more appealing to consumers.”

In spite of the recent tumult—and in many ways because of it—Jaddoud and other experts say the industry is now accelerating some of its longstanding priorities in the areas of sustainability, efficiency, innovation and technology.

Renewed Focus on Renewables

The Environmental Protection Agency estimates an average of 63 million tons of food waste per year in the United States alone, with some 40 percent of that accounted for by hotels and other consumer-facing businesses, according to the American Hotel and Lodging Association. Meanwhile, daily water usage per occupied hotel room averages 100 to 400 gallons.

While many hospitality organizations were introducing more sustainable practices pre-pandemic, in reality it remained challenging for large parts of the sector.

“The industry was moving at such a quick pace,” says Diana C. Beltran , a hospitality management executive who teaches Managing Service Quality in Hospitality and Tourism at USC Bovard. “Tourism was growing exponentially every year. There was just no time to focus on reducing energy consumption, for instance. We should have always been operating smartly and efficiently yet many in the industry were just operating as fast as they could with the priority of making sales. There was no incentive nor time to operate efficiently. Now we really have to buckle our belts and cut costs since the sales are no longer there and there is more time to look at details in the operation.”

“Weaker players are exiting the marketplace or are being absorbed by stronger players,” Leonard Jackson , a specialist in business development and financial management who teaches at USC Bovard, adds. “Some companies are using available government funding to retool, renovate and get their properties ready to come back once this pandemic is over. In a sense, the industry is righting itself.”

This includes upgrades to laundry facilities, showers and toilets in individual rooms, and other methods to reduce water consumption.

Beltran agrees. “Renovations are taking place left and right,” she says. “Facilities that have been closed are taking the time to renovate and become more efficient.”

The industry is fully embracing corporate social responsibility initiatives, says Jackson. “New buildings are incorporating sustainable practices,” he says. “That was becoming the norm, even prior to COVID, but it will increase. This is all consumer-driven. Consumers generally want to stay and host their events at green facilities.”

“Now there’s the opportunity for tourism and hospitality brands to evolve and become more conscientious to attract people who understand why they need to pay extra for a specific initiative that’s sustainable and more mindful of long-term impact,” notes Anna Abelson , a destination marketing expert who teaches Marketing Strategies for Hospitality and Tourism at USC Bovard.

“Guests know what they want from a business, which is to be sustainably and environmentally responsible, and they only support businesses that go that route,” Jaddoud adds. “That goes for minimizing food waste, consumption of water, use of soap and chemicals, and choosing local produce and supplies.”

The Challenge of Disposables

The industry had been retreating from single-use plastics—including flatware and straws—to meet both consumer demand and increased restrictions on such products in environmentally conscious locales. But with the advent of COVID-19, companies returned to disposables for safety reasons and to boost confidence among consumers.

“Single-use utensils are something you want to get away from if you want to protect the climate, but it’s something we have to have right now,” Abelson notes.

“When companies go back to normal flatware, there will be an additional cost,” Jaddoud adds. “Now flatware has to be cleaned in very specific temperatures, using specific chemicals and processes. But at the end of the day, it’s safety that counts.”

He observes that such corporate decision-making revolves around market specifics as well as venue type. For example, he says a steakhouse or other upscale restaurant will avoid disposables whereas in a grab-and-go setting, consumers find them acceptable.

Beltran, however, says she is seeing more travelers willing to pack their own utensils and straws, as well as coffee mugs and water bottles. “The culture of the consumer is changing,” she says. “In addition to being more conscientious about bacteria, germs and viruses, they also want to reduce waste. It’s still going to take some time before we all get there. But it’s changing on both ends—the consumer and the industry.”

This move toward more sustainable practices will only increase, experts predict.

“Changes to operational practices that consumers were asking for during COVID are going to become the norm,” says Jackson. For instance, many restaurants have eliminated printed menus entirely, using QR codes scanned by customers to electronically access menu options. More patrons have opted to forgo hotel room cleaning. “If these trends continue, hotels and restaurants will benefit from an operational standpoint, while reducing their carbon footprint,” he says.

High-Tech vs. High-Touch

Meanwhile, certain trends already underway have sped up. For example, the pandemic expedited the industry’s move to contactless interactions—from hotel check-in to food ordering to booking and boarding flights, Jaddoud notes.

“COVID is reorganizing our industry, and we’re going to emerge stronger, leaner and more technologically savvy,” Jackson adds.

Yet that doesn’t mean the field will lose its human aspect. “Hospitality will always be a human interaction-driven industry but the pandemic has changed the preferences and tastes of the consumer,” Jaddoud says.

“Technology will be important, but hospitality brands should certainly keep that high-touch focus at the forefront, because technology is just one side of the coin,” Abelson agrees. “To build loyalty with customers, you need to make sure that you understand and customize their experience based on their needs and preferences so you really create that meaningful relationship for years to come.”

Retraining the Hospitality Workforce

Personnel must also keep pace with these changes. The WTTC notes that 68 percent of the travel and tourism workforce require some re-skilling in light of innovations occurring throughout the industry. Hospitality companies are also amping up efforts to attract and retain a more diverse talent pool.

The sector is training staff to implement contactless service and heightened hygiene measures, from sophisticated room cleaning approaches to and other protocols that build consumer confidence while protecting customer and employee safety. At many locations, employees will need to be taught how to take guests’ temperatures or how to manage visitors who refuse to comply with health-related policies. Other venues are introducing robots and other advanced technology to aid in the disinfecting process, and staff need to be educated on those efforts as well as encouraged to suggest new innovations.

“Hospitality is becoming more of a career path and not just a paycheck,” Jaddoud says. “This shift has happened in just the last few years—from both the employee and employer standpoint. It has made the hospitality industry better because when you have higher retention, you have more engagement and loyalty from the guests—and reduced training and turnover costs.”

Tourism and hospitality degree programs have seen a surge in applications as a result.

“New job profiles are emerging,” Beltran notes. “These include new positions that merge safety, quality and sustainability.”

The result will be more opportunity.

“I believe it’s the perfect time to be studying the hospitality environment,” Jaddoud says. “When companies come back, they’re going to be looking for more educated, critically thinking employees who are able to drive the industry forward.”

Students in the USC Bovard MS program come from a wide range of sectors within hospitality and tourism, including food and beverage, hotels, government tourism authorities, airlines, cruises, resorts and casinos. “It adds a lot of value,” Jaddoud says of the breadth of backgrounds represented. “Skills are transferable between all segments of hospitality and tourism.”

“Our industry is multifaceted. Students also learn from each other because everybody brings a different perspective,” says Abelson, who adds that students also vary in terms of their expertise and current roles within the industry. “Some have significant experience but want validation or to fine-tune their skills, and some are learning from the ground up,” she notes. “They’re a very impressive group of people who learn and apply the skills or knowledge right away.”

Learn more about the MS in Hospitality & Tourism program .

Request more information

The future of career advancement in the hospitality industry: trends and predictions

Catherine Schwartz

According to the World Travel & Tourism Council , before the pandemic, the hospitality industry accounted for about 1 in 4 jobs created worldwide, 10.3% of all jobs, and 10.3% of global GDP.

However, despite its vital role, career advancement in the hospitality industry has posed a significant challenge to many professionals. The long-standing traditional job hierarchies and a lack of clear career paths have left many in the dark, hindering their ability to reach their full potential.

As the hospitality industry continues to develop further and adapt to changing consumer demands and technological advancements, it’s vital to explore what the future of hospitality holds regarding career advancements.

This article will explore the emerging trends and predictions for the hospitality industry and provide professionals with practical strategies for navigating the industry’s dynamic landscape.

The current state of career advancement in the hospitality industry

Career advancement in the hospitality industry is challenging for many. Even with the magnitude of the industry and its significance, many professionals have encountered challenges in advancing their careers due to the traditional job hierarchy and the constrained capacity for growth.

The traditional career ladder is somewhat straightforward at the lower levels of the industry, such as housekeeping, front desk, and food services. Individuals at this level typically start their employment in an entry-level position and work up to supervisory roles and, eventually, management positions.

But beyond this point, it’s a different story entirely. The career path is much less lucid, and growth opportunities can be limited.

A significant part of the problem may be attributed to the fact that many hospitality organizations have a rigid job hierarchy that discourages lateral moves or career changes. And this can leave individuals feeling stuck and out of place in their current roles, with little to no room for advancement.

The COVID-19 pandemic also contributed to its quota, as it caused massive disruptions in the industry, leading to massive layoffs and reduced opportunities for expansion and growth. Many individuals with big dreams have been forced to put their aspirations on hold or switch to new industries altogether.

However, despite all of these obstacles, there have also been a few promising advancements over time. For example, the industry is beginning to attach more importance to employee development. It is now investing in programs that provide staff with the necessary skills to advance in their careers.

Richard Mace, CEO at Malvern House , adds, “There is also more emphasis on mentorship in the hospitality industry, with experienced professionals actively guiding and supporting the development of younger colleagues.”

Emerging trends in the hospitality industry

As the hospitality sector emerges as a highly fluid industry, it is increasingly important to remain up-to-date with the latest developments that could influence professional growth.

One of the most noteworthy developments in the sector is the increasing effect of technological progress. With the surge of online travel agencies, mobile reservation platforms, and other digital solutions, how customers engage with the sector has acquired a new aspect.

Consequently, professionals in the sector need to have a robust comprehension of the influence of technology and its implications for maintaining competitiveness.

Also, with the growing number of international travelers, language skills have become increasingly important. Learning a new language can help professionals provide exceptional customer service and enhance their career prospects.

A further up-and-coming development within the hospitality industry is the amplified significance of sustainability . A growing number of customers are presently giving more significant consideration to how their activities affect the environment. Consequently, there is a swiftly expanding requirement for ecologically responsible resolutions in the industry.

Consequently, hospitality professionals who can proficiently execute eco-friendly practices will experience a surge in demand, thereby initiating a fresh wave of career advancement opportunities.

Alterations in consumer preferences and expectations are further influencing career progression within the hospitality industry. Numerous customers demand more personalized experiences , leading to an escalating desire for professionals with exceptional communication and social skills.

Professionals who show exceptional ability to connect with guests and provide top-notch customer service will be highly valued in the industry.

Finally, the COVID-19 pandemic has also accelerated specific trends in the hospitality industry, including a growing demand for contactless technology and hygiene practices. As this transforms into the norm in the industry, specialists who possess expertise in these areas will be better situated for career advancement.

By keeping up-to-date with emerging patterns in the hospitality industry, professionals can ensure they stay on the right path to success in the constantly fluctuating hospitality industry.

Predictions for the future of career advancement in the hospitality industry

So, what exactly will the future of career advancement in the hospitality industry look like? Here are a few predictions for the future of hospitality careers.

• Use of Automation and Artificial Intelligence : With the introduction of self-help kiosks and chatbots, it is probable that numerous regular tasks will become automated , enabling personnel to concentrate on more demanding and value-enhancing duties.

According to Catherine Schwartz, Finance Editor at Crediful , “Despite the potential elimination of some positions, this shift will also generate fresh opportunities for experts who possess the skill to operate and exploit this novel yet extremely sophisticated technologies.”

• Increased demand for soft skills : Soft skills such as emotional intelligence, resilience, adaptability, and creativity will likely be more critical in the hospitality industry. As more and more routine tasks are automated, the personal touch will become even more essential to creating an exceptional guest experience. Professionals who can effectively communicate, solve problems, and be team players will be highly valued in the industry.

• Creation of new job roles : The traditional career progression in the hospitality sector is expected to transform, resulting in fresh employment positions and career paths. For example, the rise of home-sharing platforms like Airbnb has led to the growth and spread of vacation rental management companies, thus, creating new opportunities for professionals who can manage and market properties.

Various trends will likely shape the future of career advancement in the hospitality industry. By staying up to date with all the trends and developing the necessary skills and knowledge, professionals in the industry can set themselves up for success in the coming years.

Strategies for advancing in the hospitality industry

When it comes to advancing in the hospitality industry and achieving desired goals, there are proven strategies that individuals can take advantage of to reach their full potential.

• Networking and Mentorship : These are essential strategies for career advancement in almost every industry. Professionals should always look for opportunities to meet and connect with others in the industry.

Janelle Owens, Human Resource Director at Test Prep Insight , states, “Attending conferences and industry events and participating in online forums and social media groups is a great idea. This can help build positive relationships that may lead to potential job opportunities or career advancement.”

In addition, mentorship can be a precious tool for career development. Seeking guidance from experienced professionals in the industry never hurts, and it will only help to navigate career challenges and provide valuable insights and advice.

• Education and Upskilling : As the industry continues to evolve, professionals must stay up to date with the latest practices so that they are not left behind. Putting in the extra effort to expand your language skills by learning Koine Greek for example, and getting more education or certifications can help professionals stand out in an already saturated job market and provide opportunities for career advancement.

Upskilling or acquiring new skills relevant to emerging trends is also very beneficial. For example, acquiring knowledge about sustainability practices, data analysis, or customer experience design can give professionals a competitive edge and open new career paths.

• Taking on new challenges : Being proactive and taking on new challenges is another fundamental strategy for career advancement in hospitality. Rather than lying around and waiting for opportunities to come to them, professionals should actively seek out new responsibilities and projects that will help them develop their skills.

One option is to take on leadership roles, spearhead new initiatives, and look out for new and creative solutions to problems. This can demonstrate value and potential to employers and position individuals for career growth.

As the hospitality industry continues to evolve, so will career advancement opportunities. Even though challenges and barriers to career advancement in the industry exist, emerging trends and predictions suggest that the future of career advancement is bright.

Technological advancements, changes in consumer preferences and needs, and sustainability concerns are driving massive changes in the industry, leading to new job roles and career advancement opportunities. However, it is more apparent than ever that professionals will need to up their game, adapt and upskill continuously to thrive.

Undoubtedly, the future of career advancement in the hospitality industry is promising. Professionals who continue to develop their skills and competencies will be In a pole position to succeed in this fascinating and dynamic sector.

Related Articles

Navigating challenges of AI and maximizing value in the service sector

The future of hotel safety: Integrating advanced security solutions

Digital disruption: how hotels are embracing change

UNWTO Ministers Summit in London: Transforming tourism through education and youth empowerment

Related courses.

You might also like:

Green check-in: strategies for hotels to adopt and promote sustainability

Imagine a day in the life of a Revenue Manager….without using acronyms

Booking insights reveal the top 10 places most likely to have already booked their 2025 holiday

Forbes Travel Guide ratings opinion on the new relevance of luxury

Join over 60,000 industry leaders.