- Travel, Tourism & Hospitality

Luxury travel and tourism worldwide - statistics & facts

What are the leading luxury hotel brands in the world, how is the luxury cruise market faring, what are the preferences of affluent travelers, key insights.

Detailed statistics

Value of various global luxury markets 2022, by market type

Growth rates of the luxury cruise market value worldwide 2023

Affluent consumers' preferred holiday activities worldwide Q4 2023

Editor’s Picks Current statistics on this topic

Current statistics on this topic.

Luxury Goods

Highest-rated luxury hotel brands in North America 2023

Full-Service Retaurants

Selected countries with the most Michelin-starred restaurants worldwide 2023

Related topics

Affluent consumers.

- Billionaires around the world

- Millionaires in the U.S.

- High net worth individuals in Europe

- High-net-worth collectors

Hotel industry

- Hotel industry worldwide

- Hotel industry in the U.S.

- Marriott International

Cruise industry

- Cruise industry worldwide

- Cruise industry in the United States

- Cruise industry in Europe

Recommended statistics

- Premium Statistic Luxury travel market size worldwide 2022-2032

- Premium Statistic Value of various global luxury markets 2022, by market type

- Premium Statistic Growth rates of the luxury hospitality market value worldwide 2022

- Premium Statistic Growth rates of the luxury cruise market value worldwide 2023

- Premium Statistic Fashion and luxury goods M&A deals worldwide in 2022, by product category

- Premium Statistic Fashion and luxury goods: average M&A deal value worldwide 2022, by product category

Luxury travel market size worldwide 2022-2032

Estimated size of the luxury travel market worldwide in 2022, with a forecast for 2032 (in billion U.S. dollars)

Value of various global luxury markets in 2022, by market type (in billion euros)

Growth rates of the luxury hospitality market value worldwide 2022

Growth rates of the luxury hospitality market value worldwide in 2022

Growth rates of the luxury cruise market value worldwide in 2023

Fashion and luxury goods M&A deals worldwide in 2022, by product category

Number of merger and acquisition deals in the fashion and luxury goods sector worldwide in 2022, by sector

Fashion and luxury goods: average M&A deal value worldwide 2022, by product category

Average merger and acquisition deal value in the fashion and luxury goods sector worldwide in 2022, by sector (in million U.S. dollars)

Luxury accommodation market

- Premium Statistic Global luxury hotel supply 1983-2023

- Premium Statistic Supply of ultra-luxury hotels worldwide 1983-2023

- Premium Statistic Share of luxury hotel supply worldwide 2023, by brand

- Premium Statistic Share of luxury hotel supply in the Americas 2023, by brand

- Premium Statistic Highest-rated luxury hotel brands in North America 2023

- Premium Statistic Luxury hotels: average M&A deal value worldwide 2022

Global luxury hotel supply 1983-2023

Luxury hotel supply worldwide from 1983 to 2023, with a forecast for 2033 (in 1,000s)

Supply of ultra-luxury hotels worldwide 1983-2023

Ultra-luxury hotel supply worldwide from 1983 to 2023 (in 1,000s)

Share of luxury hotel supply worldwide 2023, by brand

Distribution of the luxury hotel supply worldwide as of February 2023, by brand

Share of luxury hotel supply in the Americas 2023, by brand

Distribution of the luxury hotel supply in the Americas as of February 2023, by brand

Highest-rated luxury hotel brands in North America as of May 2023

Luxury hotels: average M&A deal value worldwide 2022

Average merger and acquisition deal value in the luxury hotel market worldwide from 2016 to 2022 (in million U.S. dollars)

Company focus: Inspirato

- Premium Statistic Number of active Inspirato subscribers worldwide 2017-2022

- Premium Statistic Total revenue of Inspirato worldwide 2012-2022

- Premium Statistic Quarterly number of nights booked through Inspirato worldwide 2020-2023

Number of active Inspirato subscribers worldwide 2017-2022

Total number of active Inspirato subscribers worldwide from 2017 to 2022 (in 1,000s)

Total revenue of Inspirato worldwide 2012-2022

Total revenue of Inspirato worldwide from 2012 to 2022 (in million U.S. dollars)

Quarterly number of nights booked through Inspirato worldwide 2020-2023

Total number of nights booked through Inspirato worldwide from 1st quarter 2020 to 1st quarter 2023

Luxury cruise market

- Premium Statistic Luxury cruises: average M&A deal value worldwide 2022

- Premium Statistic Passenger capacity of luxury cruise brands worldwide 2022

- Premium Statistic Number of ships operated by luxury cruise brands worldwide 2022

- Basic Statistic Most expensive luxury cruise trips on Tripadvisor worldwide 2023

Luxury cruises: average M&A deal value worldwide 2022

Average merger and acquisition deal value in the luxury cruise market worldwide from 2016 to 2022 (in million U.S. dollars)

Passenger capacity of luxury cruise brands worldwide 2022

Passenger capacity of selected luxury cruise brands worldwide in 2022

Number of ships operated by luxury cruise brands worldwide 2022

Number of ships operated by selected luxury cruise brands worldwide in 2022

Most expensive luxury cruise trips on Tripadvisor worldwide 2023

Most expensive luxury cruise trips listed on Tripadvisor worldwide as of August 2023 (in U.S. dollars)

Affluent travelers

- Premium Statistic Share of affluent consumers buying travel products worldwide Q4 2023, by age

- Premium Statistic Affluent consumers expecting to take a vacation worldwide H2 2022, by type

- Premium Statistic Preferred types of holiday in the Americas for affluent consumers worldwide Q4 2023

- Premium Statistic Preferred types of holiday in Europe among affluent consumers worldwide Q4 2023

- Premium Statistic Affluent consumers' preferred holiday activities worldwide Q4 2023

- Premium Statistic Interest of affluent consumers in travel and luxury brand partnerships worldwide 2022

- Premium Statistic Interest of affluent consumers in technology to improve holidays worldwide H2 2022

Share of affluent consumers buying travel products worldwide Q4 2023, by age

Share of affluent consumers that purchased travel products worldwide as of 4th quarter 2023, by age

Affluent consumers expecting to take a vacation worldwide H2 2022, by type

Share of affluent consumers that expected to take a holiday within the next year in selected regions worldwide as of 2nd half 2022, by type of vacation

Preferred types of holiday in the Americas for affluent consumers worldwide Q4 2023

Share of global affluent consumers willing to take a holiday in the Americas as of 4th quarter 2023, by type

Preferred types of holiday in Europe among affluent consumers worldwide Q4 2023

Share of global affluent consumers willing to take a holiday in Europe as of 4th quarter 2023, by type

Affluent consumers' preferred holiday activities worldwide Q4 2023

Main holiday activities done by affluent consumers worldwide as of 4th quarter 2023

Interest of affluent consumers in travel and luxury brand partnerships worldwide 2022

Share of affluent consumers that were interested in travel brands partnering with other luxury brands in selected regions worldwide as of 2nd half 2022

Interest of affluent consumers in technology to improve holidays worldwide H2 2022

Share of affluent consumers that were interested in the use of technology to improve their holidays in selected regions worldwide as of 2nd quarter 2022

Further reports Get the best reports to understand your industry

Get the best reports to understand your industry.

Mon - Fri, 9am - 6pm (EST)

Mon - Fri, 9am - 5pm (SGT)

Mon - Fri, 10:00am - 6:00pm (JST)

Mon - Fri, 9:30am - 5pm (GMT)

- Report Store

- AMR in News

- Press Releases

- Request for Consulting

- Our Clients

Luxury Travel Market Size, Share, Competitive Landscape and Trend Analysis Report by Types of Tour, by Age Group, by Types of Traveler : Global Opportunity Analysis and Industry Forecast, 2021-2031

CG : Sports, Fitness and Leisure

Report Code: A01337

Tables: 122

Get Sample to Email

Thank You For Your Response !

Our Executive will get back to you soon

The global luxury travel market size was valued at $638.2 billion in 2021, and is projected to reach $1650.5 billion by 2031, growing at a CAGR of 8.9% from 2022 to 2031.Luxury travel services cover most desirable and premium experience in terms of luxurious accommodations, convenient transport facilities, and authentic travel experience. The service providers aim to provide outstanding services to its travelers. Private jet planes, spas, special menus, private island rentals, and private yacht are some of the unique services offered by the stakeholders to the travelers. Travelers, nowadays, focus on experimenting with destinations to gain experience in terms of cultures, foods, and other experiences. To gain a valuable and unforgettable experience, people increasingly opt for unique trips, which include cultural visit, cruising, and adventure activities. The luxury travel industry has emerged as one of the fastest growing sectors to contribute significantly to the global economic growth and development. Growth in disposable income and increase in upper middle class expenditure has raised the demand for higher service standards. To capitalize the same, market players formulate unique strategies to target the growth in middle class segment; for instance, hiring qualified individuals who can speak international language and communicate easily with travelers. This rise in demand for unique travel experiences offers tremendous opportunities for the market players to remain competitive.

The luxury travel market size is projected to be the fastest growing segment of the travel industry worldwide during the forecast period. The key drivers of rising luxury travel trend include inclination of people toward unique and exotic holiday experiences, increase in the middle- & upper-class disposable income & related expenditure, and growth in need and interest of people to spend more time with family. The growth luxury travel market is attributed to the increase in disposable income and growth in middle class population in countries such as China, Hong Kong, India, and Malaysia. As per recent statistics, Asia-Pacific millionaires now control more wealth than their peers in North America. In terms of future spending options, travel has been recognized as the top priority with greater focus on unique luxury experiences and adventure activities. Although the key developed countries such as the U.S. hold a highest revenue share of the luxury travel market, there has been a rise in demand for international luxury travel in developing countries such as China and India. This drift is due to the increase in the per capita income of middle-class travelers in the developing countries.

COVID-19 pandemic has impacted all industries globally. The tourism industry has been hit hard all over the world, impacting its associated sectors such as travel agencies, hospitality, tour operators, all kinds of transportation services. Around 90% of the global population was adjusted to their lifestyle under several travel restrictions and remaining population stayed home in fear of the virus itself. Thus, the tourism sector came to a near standstill. According to the article published by the World Travel and Tourism Council (WTCC) in August 2020, the COVID-19 pandemic is likely to cost the tourism industry revenue loss of almost $25 billion and a loss of almost 100 million jobs worldwide. Furthermore, owing to the implementation of lockdown and social distancing norms in almost every country of the world, flights were grounded, trains stopped running, and almost all public transport services were halted. With social distancing becoming the new lifestyle in public places and masks & gloves turning to be daily wear accessories, people prefer to remain safe at homes, thereby declining the number of travelers.

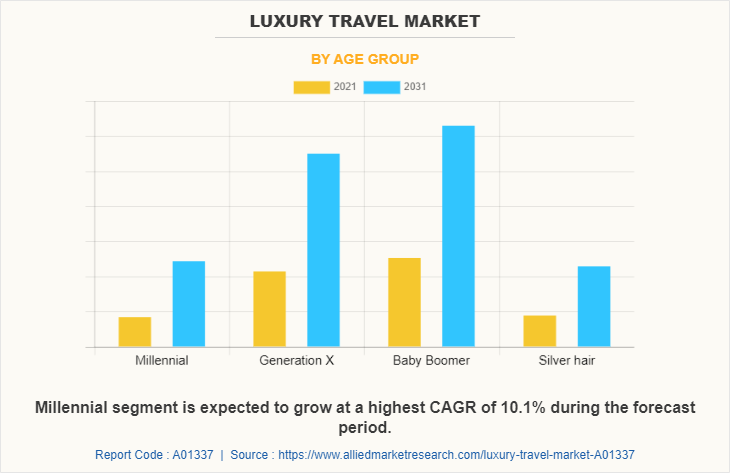

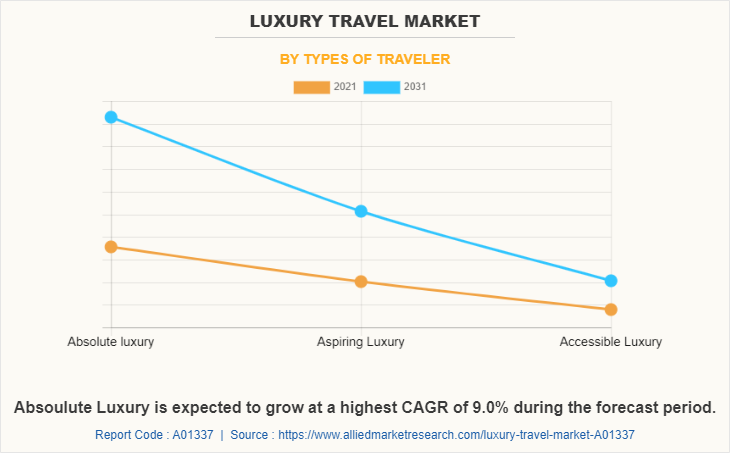

According to the market analysis, the luxury travel market is segmented into types of tour, age group, types of travelers, and region. As per types of tour, the market is categorized into customized and private vacations, adventure and safari, cruise/ship expedition, small group journey, celebration and special events and culinary travel and shopping. By age group, it is segregated into millennial, generation x, baby boomer and silver hair. Depending on types of travelers, it is segmented into absolute luxury, aspiring luxury and accessible luxury. Region wise, it is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, Spain, Italy and Rest of Europe), Asia-Pacific (China, India, Singapore and Rest of Asia-Pacific), and LAMEA (Middle East, Latin America and Africa).

On the basis of type of tour, the cruise/ship expedition segment accounted for around 4.6% of global luxury travel market share in 2021, and is expected to sustain its share throughout luxury travel market forecast period. Luxury cruising is gaining attraction and is expected to get tripled by the next decade. From the growth perspective, Asia-Pacific and LAMEA are the two potential markets, expected to witness considerably higher growth rates during the forecast period. Introduction of innovative cruise design concepts, new ship lengths, new and more exotic destinations around the globe, and new on-board and on-shore activities and themes drive the growth of the market for cruise/ship expedition. Luxury cruising is mostly opted by silver hair group since it is much more convenient, relaxing, and more glorious mode of traveling. With the advent of Crystal Cruises’ luxury travel portfolio has expanded into the luxury river cruise market and yachting & air market. Thus, aforementioned factors are likely to supplement for the growth of the luxury travel market through cruise/ship expedition segment during forecast period.

On the basis of age group, the millennial segment was valued at $83,842.5 million in 2021, and is expected to reach $242,050.1 million by 2031, with a CAGR of 10.1%. North America and Europe together accounted for about 67.4% of the millennial luxury travel market revenue in 2021, with the former constituting around 28%. From a growth perspective, Asia-Pacific and LAMEA are the two potential markets, expected to witness considerably higher growth rates over the forecast period. Millennial’s are avid travelers comprising of maximum number of population of traveling, on an average, millennial’s spend $527 a day on a trip which is 62% less than their older counterparts. They generally look for cultural and leisure breaks. Millennial’s are driven by wanderlust and breaking life’s monotony, these group of youngsters prefer short trips to culturally rich and different countries, also local shopping is a major factor of their traveling. Honeymoons and romantic gateways are also some important factors driving this category. Thus, above factors collectively increase luxury travel market demand through the millennial segment.

According to the luxury travel market trends, depending on types of travelers, the aspiring luxury segment was valued at $202,139.7 million in 2021, and is expected to reach $513,454.9 million by 2031, with a CAGR of 8.7%. Aspiring luxury class majorly comprises the millennial generation who prefer short, luxury trips, as they are moderately wealthy. This segment also comprise of ‘newly rich’, which are willing to pour money into the luxury travel industry and are the front-runner of this segment. Aspiring luxury travelers take an average of five business and leisure trips per year, owing to their high spending power and the potential to afford luxury traveling. Mid-income and aspirational shoppers are fostering the growth of upper premium brands and the second-hand market. Destinations such as Dubai have initiated programs to encourage investments in midmarket hotels such as releasing government land plots for three and four star hotel projects. Aspiring luxury prefer exclusive and unique destinations for their shopping which are specifically abroad destinations, while they have ample resources to spend, they are comparative don’t go all out for luxury services. This segment includes young, aspirational individuals who earn significantly and have limited family responsibilities. Increasing aspiring luxury travelers are likely to supplement the luxury travel market growth during forecast period.

Region wise, the North America was valued at $152,531.4 million in 2021, and is expected to reach $354,846.3 million by 2031, with a CAGR of 7.8%. The U.S. is driving the luxury travel market in North American region, with wealthiest of population and most outbound trips. Canada and Mexico’s luxury travel market also show a hike in the number of people opting for luxury travel owing to serene winter destinations in Canada and glittering white Caribbean beaches and private luxury resorts in Mexico. The luxury travelers are attracted to Mexico due to its established and highly exclusive resorts like Four Seasons and St. Regis in Punta Mita and high-end resorts in Los Cabos. Luxury travel is also expected to see vigorous growth across North America due to increasing income trends, strong dollar, and growing middle class segment. Thus, above mentioned factors are likely to support the North America luxury travel market during forecast period.

The players operating in the global luxury travel market have adopted various developmental strategies to expand their market share, increase profitability, and remain competitive in the market. The key players profiled in this report include Abercrombie & Kent USA, LLC, Cox & Kings Ltd, Travcoa, Micato Safaris, Ker & Downey, Tauck, Thomas Cook Group PLC, Scott Dunn Ltd., Kensington Tours, Butterfield & Robinson Inc., TUI Group, Zicasso, Inc., Black Tomato, Backroads, Lindblad Expeditions and Exodus travels.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the luxury travel market analysis from 2021 to 2031 to identify the prevailing luxury travel market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the luxury travel market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global luxury travel market trends, key players, market segments, application areas, and market growth strategies.

Luxury Travel Market Report Highlights

Analyst Review

The global luxury travel market is anticipated to witness robust growth in regions such as Asia-Pacific and LAMEA. The growth in the number of HNI’s global population and easy availability of on-arrival visa propel the growth of the overall luxury travel market.

According to industry experts, French, Germans, Spaniards, and Australians opt for adventure and safari trips. In addition, Russian travelers opt for places like Goa in India, where they can relax and enjoy the tropical weather as they spend most of their time in a cold region. Culinary tours are also witnessing significant growth in the travel market. There is an increase in the number of private and culinary trips in Europe, owing to growth in interest of people in local culture and their aspiration to have a better understanding of local cuisines and people.

Countries such as China and India have huge growth potential and are the major investment pockets in the luxury travel market. Affluent Arabs prefer to spend their holidays in the most luxurious way like visiting London and splurging on high-end shopping. In addition, they opt for destinations, where they can spend huge amount on shopping. Affluent Chinese millennial travelers prefer to have quality travel experience, thus they opt for high-end accommodation and luxurious ways of traveling, thus propelling the growth of the overall luxury travel market. Key market players are adopting various growth strategies such as product launch (tour packages) and acquisition to sustain in the competitive market.

- Outdoor Adventures

- Leisure Activities

- Outdoor Activities

The global luxury travel market size was valued at $638,206.8 million in 2021, and is estimated to reach $1,650,447.7 million by 2031.

8.9% is the CAGR of luxury travel market.

You can request sample from the website (www.alliedmarketresearch.com) or you can call our sales representative on U.S. - Canada toll free - +1-800-792-5285, Int'l : +1-503-894-6022 and for Europe region + 44-845-528-1300.

2021 is the base year calculated in the luxury travel market report.

Abercrombie & Kent USA, LLC, Cox & Kings Ltd, Travcoa, Micato Safaris, Ker & Downey, Tauck and Thomas Cook Group PLC are some of the top companies in the luxury travel market report.

The luxury travel market is segmented into types of tour, age group, types of travellers and region.

The inclination of people toward unique and exotic holiday experiences, increase in the middle- & upper-class disposable income & related expenditure, and growth in need and interest of people to spend more time with family are the latest trends in the luxury travel market.

Europe region holds the maximum market share of the luxury travel market.

Outbreak of COVID-19 was negatively impacted the growth of the luxury travel market in 2020.

Loading Table Of Content...

- Related Report

- Global Report

- Regional Report

- Country Report

Enter Valid Email ID

Verification code has been sent to your email ID

By continuing, you agree to Allied Market Research Terms of Use and Privacy Policy

Advantages Of Our Secure Login

Easily Track Orders, Hassel free Access, Downloads

Get Relevent Alerts and Recommendation

Wishlist, Coupons & Manage your Subscription

Have a Referral Code?

Enter Valid Referral Code

An Email Verification Code has been sent to your email address!

Please check your inbox and, if you don't find it there, also look in your junk folder.

Luxury Travel Market

Global Opportunity Analysis and Industry Forecast, 2021-2031

- Transportation and Logistics

Luxury Travel Market

Luxury travel market report by type of tour (customized and private vacation, adventure and safari, cruise and ship expedition, small group journey, celebration and special event, culinary travel and shopping), age group (millennial (21-30), generation x (31-40), baby boomers (41-60), silver hair (60 and above)), type of traveller (absolute luxury, aspiring luxury, accessible luxury), and region 2024-2032.

- Report Description

- Table of Contents

- Methodology

- Request Sample

Market Overview:

The global luxury travel market size reached US$ 2,143.5 Billion in 2023. Looking forward, IMARC Group expects the market to reach US$ 3,088.0 Billion by 2032, exhibiting a growth rate (CAGR) of 4% during 2024-2032. The rising demand for exclusive and personalized travel experiences, expanding high-net-worth individual (HNWI) population seeking luxury travel options, and increasing focus on wellness and sustainability in luxury travel offerings are some of the major factors propelling the market.

Luxury travel represents a premium and exclusive segment of the tourism industry that caters to discerning travelers seeking exceptional and opulent experiences. It goes beyond basic amenities and comfort, offering personalized services, exquisite accommodations, gourmet dining, and unique, immersive activities. Luxury travel often includes stays in luxurious hotels, private villas, or upscale resorts in picturesque destinations. Travelers can indulge in spa treatments, fine dining at Michelin-starred restaurants, private yacht charters, and cultural excursions tailored to their interests. Luxury travel is characterized by a focus on exclusivity, attention to detail, and a commitment to delivering the utmost in comfort and satisfaction, making it a sought-after choice for those seeking the pinnacle of travel experiences.

-(1).webp)

The increasing affluence of high-net-worth individuals (HNWIs) and affluent consumers around the world that expands the clientele seeking exclusive and opulent travel experiences, will stimulate the growth of the luxury travel market during the forecast period. These travelers seek to indulge in lavish accommodations, personalized services, and unique adventures. Moreover, the rising desire for experiential and transformative travel is propelling the luxury market, as travelers prioritize immersive cultural experiences, wellness retreats, and eco-conscious journeys. Apart from this, the enhanced convenience and accessibility of private jet and yacht charters has augmented the appeal of luxury travel, offering exclusivity and flexibility, thereby driving the market growth. Furthermore, the rise of remote working and digital nomadism that enables travelers to explore luxury destinations while maintaining their professional lives, contributing to the growth of extended-stay luxury experiences.

Luxury Travel Market Trends/Drivers:

Growing affluence of high-net-worth individuals (HNAWIs)

The increasing affluence of high-net-worth individuals (HNWIs) and affluent consumers is a primary driving force behind the luxury travel market's expansion. As economies grow and prosperity spreads globally, more individuals are gaining access to higher disposable incomes, enabling them to indulge in luxury travel experiences. This demographic seeks exclusivity, comfort, and premium services when exploring the world. They are willing to invest in opulent accommodations, private transportation, and curated itineraries that cater to their preferences. The luxury travel industry capitalizes on this trend by continuously innovating and offering top-notch services to meet the discerning tastes of affluent travelers. This growing affluence fuels demand for luxury travel and encourages the development of new destinations and experiences that cater to the evolving desires of this segment.

Rising desire for unique experiences

Luxury travelers today are not satisfied with mere comfort; they seek meaningful and distinctive experiences that set their journeys apart. This driver has led to the rise of experiential luxury travel, where travelers immerse themselves in local cultures, traditions, and landscapes. They opt for bespoke itineraries that cater to their interests, from culinary adventures and private art tours to wildlife safaris and wellness retreats. The desire for unique experiences has given rise to a trend where luxury travel becomes a form of self-expression, allowing travelers to collect memories and stories that differentiate them from conventional tourists. The luxury travel industry responds by providing exclusive access to hidden gems, private guides, and off-the-beaten-path adventures, ensuring that each journey is a one-of-a-kind experience tailored to individual preferences.

Increasing sustainability and wellness consciousness

Sustainability and wellness have emerged as crucial drivers in the luxury travel market. As travelers become more socially and environmentally conscious, they seek accommodations and experiences that align with their values. Luxury travelers now expect eco-friendly practices, responsible tourism, and sustainable accommodations, which include everything from eco-lodges in remote natural settings to sustainable cruises that minimize environmental impact. Additionally, the wellness aspect of luxury travel emphasizes physical and mental well-being, with travelers seeking spas, fitness centers, meditation retreats, and nutrition-focused experiences during their trips. The luxury travel industry recognizes these trends and is incorporating sustainable and wellness-focused offerings into its portfolio, ensuring that travelers can enjoy guilt-free luxury experiences that promote both personal well-being and environmental responsibility. This shift is an ethical choice and a competitive advantage for luxury travel providers, as it meets the evolving preferences of a socially conscious and health-focused clientele.

Note: Information in the above chart consists of dummy data and is only shown here for representation purpose. Kindly contact us for the actual market size and trends.

To get more information about this market, Request Sample

Luxury Travel Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global luxury travel market report, along with forecasts at the global, regional and country levels from 2024-2032. Our report has categorized the market based on type of tour, age group, and type of traveller.

Breakup by Type of Tour:

- Customized and Private Vacation

- Adventure and Safari

- Cruise and Ship Expedition

- Small Group Journey

- Celebration and Special Event

- Culinary Travel and Shopping

Adventure and safari hold the largest market share

The report has provided a detailed breakup and analysis of the market based on the type of tour. This includes customized and private vacation, adventure and safari, cruise and ship expedition, small group journey, celebration and special event, and culinary travel and shopping. According to the report, adventure and safari represented the largest segment.

Adventure and safari experiences are key drivers in the luxury travel market, attracting travelers seeking unique and exhilarating journeys. Adventure travel offers activities such as trekking, mountain climbing, scuba diving, and wildlife encounters in remote and often challenging environments. Safari adventures, on the other hand, focus on wildlife observation in natural habitats, with opportunities to see iconic species like lions, elephants, and rhinos. These experiences drive the luxury travel market by offering exclusivity and personalized adventures that cater to the desires of affluent travelers.

Furthermore, luxury adventure and safari providers offer private guided tours, high-end accommodations in pristine locations, and customized itineraries that combine adventure with comfort. They ensure travelers can enjoy thrilling experiences while maintaining the highest standards of safety and comfort. Moreover, the demand for sustainability in adventure and safari experiences is rising, with eco-friendly practices and conservation efforts playing a significant role, attracting travelers who value responsible and immersive encounters with nature.

Breakup by Age Group:

- Millennial (21-30)

- Generation X (31-40)

- Baby Boomers (41-60)

- Silver Hair (60 and above)

Baby boomers (41-60) represents the leading age group segment

A detailed breakup and analysis of the market based on the age group has also been provided in the report. This includes millennial (21-30), generation X (31-40), baby boomers (41-60), and silver hair (60 and above). According to the report, baby boomers (41-60) accounted for the largest market share.

Baby boomers, typically aged between 41 and 60, represent a generation known for its significant impact on various industries, including luxury travel. This demographic is characterized by its strong work ethic, higher disposable income, and a desire for fulfilling experiences during their retirement years. Baby boomers are fueling the luxury travel market by seeking personalized and experiential journeys that cater to their interests and preferences. They value comfort, quality, and authenticity, often opting for upscale accommodations, premium cruise experiences, and immersive cultural encounters. Many baby boomers are avid travelers, using their retirement years to explore the world and fulfill their travel bucket lists. Their influence extends to the rise of wellness-focused luxury travel, as they prioritize health and well-being in their journeys.

Moreover, baby boomers are early adopters of travel technology, embracing digital tools for booking, research, and staying connected while on the road. Their significant presence in the luxury travel market continues to shape the industry, catalyzing the demand for tailored, high-end experiences that align with their desires for exploration and relaxation in their golden years.

Breakup by Type of Traveller:

- Absolute Luxury

- Aspiring Luxury

- Accessible Luxury

Absolute luxury is the most popular type of traveler

A detailed breakup and analysis of the market based on the type of traveler has also been provided in the report. This includes absolute, aspiring and accessible luxury. According to the report, absolute luxury accounted for the largest market share.

The absolute luxury traveler is characterized by an unwavering pursuit of the finest experiences and the highest level of exclusivity. These travelers seek unparalleled opulence, from stays in ultra-luxurious accommodations like private villas on secluded islands or boutique hotels in historic city centers to bespoke itineraries that include private yacht charters, exclusive access to cultural events, and Michelin-starred dining experiences.

Moreover, absolute luxury travelers are the trendsetters and taste-makers in the luxury travel industry, fueling demand for innovation and pushing the boundaries of what constitutes a lavish travel experience. Their influence extends to the development of new, extraordinary destinations and the creation of entirely customized journeys that cater to their unique preferences. Their commitment to luxury and their willingness to invest in once-in-a-lifetime adventures shape the luxury travel market by inspiring providers to continuously elevate their offerings, ensuring that the absolute luxury traveler's appetite for the extraordinary is consistently met.

Breakup by Region:

To get more information on the regional analysis of this market, Request Sample

United States

- South Korea

United Kingdom

- Middle East and Africa

Europe exhibits a clear dominance in the market

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Europe accounted for the largest market share.

Europe held the biggest share in the market since the region is home to an array of iconic and culturally rich destinations, from the historical cities of Rome, Paris, and Prague to the scenic beauty of the Swiss Alps and the Mediterranean coast, offering a diverse range of luxury experiences. Apart from this, Europe boasts a long history of luxury hospitality, with its heritage luxury hotels and boutique properties, providing travelers with opulent accommodations and impeccable service.

Moreover, rising emphasis of the region on gastronomy and fine dining attracts luxury travelers seeking culinary excellence, with numerous Michelin-starred restaurants and local gourmet experiences. Furthermore, Europe's efficient transportation infrastructure and access to exclusive cultural events, from fashion shows to art exhibitions, enhance its appeal to luxury travelers. Additionally, Europe's commitment to sustainability and responsible tourism aligns with the values of eco-conscious luxury travelers, ensuring that the region continues to lead the way in delivering high-end, sustainable travel experiences that resonate with the evolving preferences of affluent global travelers.

Competitive Landscape:

The market is experiencing steady growth as key players are continually innovating to meet the evolving preferences of discerning travelers. Recent innovations include the integration of advanced technology to enhance the booking and travel experience, with virtual reality (VR) and augmented reality (AR) being used to provide immersive previews of accommodations and destinations. Additionally, there is a growing focus on sustainability, with luxury hotels and resorts adopting eco-friendly practices and designing carbon-neutral properties to cater to environmentally conscious travelers. Personalization remains a key trend, with luxury travel providers leveraging data analytics and artificial intelligence (AI) to curate bespoke itineraries and offer highly tailored services. Furthermore, luxury cruise lines are introducing cutting-edge amenities such as underwater lounges and sustainable ship designs. These innovations collectively aim to elevate the luxury travel experience, providing travelers with unique, sustainable, and personalized journeys that align with their values and preferences.

The market research report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Abercrombie & Kent USA LLC.

- Butterfield & Robinson Inc.

- Cox & Kings Ltd.

- Exodus Travels Limited (Travelopia)

- Kensington Tours Ltd.

- Micato Safaris

- Scott Dunn Ltd.

- Thomascook.in (Fairbridge Capital (Mauritius) Limited)

Recent Developments:

- In August 2023, Abercrombie & Kent introduced a new private jet journey to meet increased demand for wildlife experiences. This exclusive adventure is designed to captivate the hearts of discerning travelers who seek to explore the world's most breathtaking natural wonders while indulging in unparalleled luxury and comfort. This unique expedition takes travelers on a globe-spanning odyssey, whisking them away on a meticulously planned itinerary that delves deep into some of the planet's most pristine and wildlife-rich regions.

- In February 2020, Kensington Tours, a leading luxury travel company, introduced new itineraries that showcase the natural wonders and cultural richness of Iceland and Wales. These meticulously crafted journeys promise travelers unforgettable experiences in two distinct yet equally captivating destinations. The Iceland itinerary invites adventurers to explore the land of fire and ice, where dramatic landscapes meet geothermal wonders. It offers a perfect blend of outdoor exploration and relaxation in Iceland's geothermal baths.

- In February 2023, Tauck, a renowned leader in guided travel experiences, announced the expansio of its small group land departures by an impressive 35%, catering to the growing demand for intimate and immersive travel adventures. This increase in small group departures signifies Tauck's dedication to providing travelers with the chance to delve deeper into the destinations they visit.

Luxury Travel Market Report Scope:

Key benefits for stakeholders:.

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the luxury travel market from 2018-2032.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global luxury travel market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the luxury travel industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global luxury travel market was valued at US$ 2,143.5 Billion in 2023.

We expect the global luxury travel market to exhibit a CAGR of 4% during 2024-2032.

The growing consumer inclination towards leisure activities and exotic holiday destinations is primarily driving the global luxury travel market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across several nations, resulting in the temporary restrictions on intra- and inter-national travel activities, thereby negatively impacting the global market for luxury travel.

Based on the type of tour, the global luxury travel market can be categorized into customized and private vacation, adventure and safari, cruise and ship expedition, small group journey, celebration and special event, and culinary travel and shopping. Currently, adventure and safari accounts for the majority of the global market share.

Based on the age group, the global luxury travel market has been segregated into millennial (21-30), generation X (31-40), baby boomers (41-60), and silver hair (60 and above). Among these, baby boomers (41-60) currently exhibit a clear dominance in the market.

Based on the type of traveler, the global luxury travel market can be bifurcated into absolute luxury, aspiring luxury, and accessible luxury. Currently, absolute luxury holds the largest market share.

On a regional level, the market has been classified into North America, Asia-Pacific, Europe, Latin America, and Middle East and Africa, where Europe currently dominates the global market.

Some of the major players in the global luxury travel market include Abercrombie & Kent USA LLC., Butterfield & Robinson Inc., Cox & Kings Ltd., Exodus Travels Limited (Travelopia), Kensington Tours Ltd., Micato Safaris, Scott Dunn Ltd., Tauck, Thomascook.in (Fairbridge Capital (Mauritius) Limited), and TUI Group.

India Dairy Market Report Snapshots Source:

Statistics for the 2022 India Dairy market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports.

- India Dairy Market Size Source

- --> India Dairy Market Share Source

- India Dairy Market Trends Source

- India Dairy Companies Source

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Purchase options

Benefits of Customization

Personalize this research

Triangulate with your data

Get data as per your format and definition

Gain a deeper dive into a specific application, geography, customer, or competitor

Any level of personalization

Get in Touch With Us

UNITED STATES

Phone: +1-631-791-1145

Phone: +91-120-433-0800

UNITED KINGDOM

Phone: +44-753-713-2163

Email: [email protected]

Client Testimonials

IMARC made the whole process easy. Everyone I spoke with via email was polite, easy to deal with, kept their promises regarding delivery timelines and were solutions focused. From my first contact, I was grateful for the professionalism shown by the whole IMARC team. I recommend IMARC to all that need timely, affordable information and advice. My experience with IMARC was excellent and I can not fault it.

The IMARC team was very reactive and flexible with regard to our requests. A very good overall experience. We are happy with the work that IMARC has provided, very complete and detailed. It has contributed to our business needs and provided the market visibility that we required

We were very happy with the collaboration between IMARC and Colruyt. Not only were your prices competitive, IMARC was also pretty fast in understanding the scope and our needs for this project. Even though it was not an easy task, performing a market research during the COVID-19 pandemic, you were able to get us the necessary information we needed. The IMARC team was very easy to work with and they showed us that it would go the extra mile if we needed anything extra

Last project executed by your team was as per our expectations. We also would like to associate for more assignments this year. Kudos to your team.

.webp)

We would be happy to reach out to IMARC again, if we need Market Research/Consulting/Consumer Research or any associated service. Overall experience was good, and the data points were quite helpful.

The figures of market study were very close to our assumed figures. The presentation of the study was neat and easy to analyse. The requested details of the study were fulfilled. My overall experience with the IMARC Team was satisfactory.

The overall cost of the services were within our expectations. I was happy to have good communications in a timely manner. It was a great and quick way to have the information I needed.

My questions and concerns were answered in a satisfied way. The costs of the services were within our expectations. My overall experience with the IMARC Team was very good.

I agree the report was timely delivered, meeting the key objectives of the engagement. We had some discussion on the contents, adjustments were made fast and accurate. The response time was minimum in each case. Very good. You have a satisfied customer.

.webp)

We would be happy to reach out to IMARC for more market reports in the future. The response from the account sales manager was very good. I appreciate the timely follow ups and post purchase support from the team. My overall experience with IMARC was good.

IMARC was a good solution for the data points that we really needed and couldn't find elsewhere. The team was easy to work, quick to respond, and flexible to our customization requests.

- Competitive Intelligence and Benchmarking

- Consumer Surveys and Feedback Reports

- Market Entry and Opportunity Assessment

- Pricing and Cost Research

- Procurement Research

- Report Store

- Aerospace and Defense

- Agriculture

- Chemicals and Materials

- Construction and Manufacturing

- Electronics and Semiconductors

- Energy and Mining

- Food and Beverages

- Technology and Media

Quick Links

- Press Releases

- Case Studies

- Our Customers

- Become a Publisher

134 N 4th St. Brooklyn, NY 11249, USA

+1-631-791-1145

Level II & III, B-70, Sector 2, Noida, Uttar Pradesh 201301, India

+91-120-433-0800

30 Churchill Place London E14 5EU, UK

+44-753-713-2163

Level II & III, B-70 , Sector 2, Noida, Uttar Pradesh 201301, India

We use cookies, including third-party, for better services. See our Privacy Policy for more. I ACCEPT X

- [email protected]

- +1 9726644514

- +91 9665341414

Adroit Market Research - Industry Insights

Frequently Asked Questions (FAQ) :

What is the market value of luxury travel market in 2032, what is the growth rate of luxury travel market, which region accounted for the largest luxury travel market share, which are the top companies hold the market share in luxury travel market, how can i get sample report of luxury travel market.

1. Introduction o Introduction o Market Definition and Scope o Units, Currency, Conversions, and Years Considered o Key Stakeholders o Key Questions Answered 2. Research Methodology o Introduction o Data Capture Sources o Market Size Estimation o Market Forecast o Data Triangulation o Assumptions and Limitations 3. Market Outlook o Introduction o Market Dynamics ? Drivers ? Restraints ? Opportunities ? Challenges o Porter’s Five Forces Analysis o PEST Analysis 4. Luxury Travel Market by Type, 2022-2029 (USD Billion) o Customized and Privet o Adventure and Safari o Cruise/Ship Expedition o Small Group Journey o Celebration and Special Events o Culinary Travel and Shopping 5. Luxury Travel by Distribution Channel, 2022-2029 (USD Billion) o Online o Offline 6. Luxury Travel by Region 2022-2029 (USD Billion) o North America ? US ? Canada ? Mexico o Europe ? Germany ? France ? Italy ? Spain ? Rest of Europ o Asia Pacific ? China ? Japan ? India ? Malaysia ? Indonesia ? Rest of Asia Pacific o South America ? Brazil ? Mexico ? Argentina o Middle East & Africa ? Saudi Arabia ? UAE ? Israel ? South Africa 7. Competitive Landscape o Company Ranking o Market Share Analysis o Strategic Initiatives ? Mergers & Acquisitions ? New Product Launch ? Others 9. Company Profiles o Fresh Origins o Products Portfolio o Recent Initiatives o Company Financials 10. Appendix o Primary Research Approach ? Primary Interview Participants ? Primary Interview Summary o Questionnaire o Related Reports ? Published ? Upcoming

Leaving without a Sample Report?

Enter your details and we shall send you a free sample report

- Global Locations -

Headquarters

Future Market Insights, Inc.

Christiana Corporate, 200 Continental Drive, Suite 401, Newark, Delaware - 19713, United States

616 Corporate Way, Suite 2-9018, Valley Cottage, NY 10989, United States

Future Market Insights

1602-6 Jumeirah Bay X2 Tower, Plot No: JLT-PH2-X2A, Jumeirah Lakes Towers, Dubai, United Arab Emirates

3rd Floor, 207 Regent Street, W1B 3HH London United Kingdom

Asia Pacific

IndiaLand Global Tech Park, Unit UG-1, Behind Grand HighStreet, Phase 1, Hinjawadi, MH, Pune – 411057, India

Consumer Product

- Food & Beverage

- Chemicals and Materials

- Travel & Tourism

- Process Automation

- Industrial Automation

- Services & Utilities

- Testing Equipment

- Thought Leadership

- Upcoming Reports

- Published Reports

- Contact FMI

Luxury Travel Market

Luxury Travel Market Analysis by Phone Booking, Online Booking, and In Person Booking from 2024 to 2034

Introducing the Opulent Odyssey where Luxury Travel Soars, Offering Affluent Travelers Exquisite Experiences and Unforgettable Journeys.

- Report Preview

- Request Methodology

Luxury Travel Market Overview

Embark on a journey through the opulent realm of luxury travel , where every experience is a masterpiece crafted to indulge the senses. Future Market Insights presents an alluring forecast. In 2024, the current valuation of the market is US$ 2.26 trillion. By 2034, this market is forecasted to burgeon into a blazing inferno, with a valuation of US$ 4.24 trillion, fostering a moderate CAGR of 6.5%.

Don't pay for what you don't need

Customize your report by selecting specific countries or regions and save 30%!

Historical Insights into the Luxury Travel Market's Performance

The historical CAGR of the luxury travel market stands at 5.80%, reflecting steady expansion propelled by the allure of bespoke experiences and unparalleled indulgence.

From exclusive retreats to tailor-made adventures, the market has evolved to cater to the discerning tastes of affluent travelers seeking nothing short of perfection.

The forecasted CAGR of 6.50% paints a picture of continued growth and prosperity in the luxury travel sector. As consumer expectations evolve and demand for immersive, authentic experiences surges, the market is thus poised for further expansion.

With a blend of tradition and innovation, luxury travel providers are primed to unlock new vistas of luxury, captivating travelers with unforgettable journeys and elevating the art of travel to new heights of sophistication and indulgence.

Reasons to Guide the Luxury Travel Market Forward

- From private yacht cruises to immersive culinary tours, luxury travel providers elevate experiences to new heights, cater to the evolving tastes of discerning travelers, and seek authenticity and meaning in their journeys.

- As awareness of environmental and social issues grows, luxury travelers are widely seeking destinations and experiences that prioritize sustainability and responsible tourism practices.

- Luxury travel providers are embracing eco-friendly practices, from offering carbon-neutral trips to partnering with conservation organizations to meet the demand for sustainable luxury experiences.

Principal Consultant

Talk to Analyst

Find your sweet spots for generating winning opportunities in this market.

Key Factors Hindering the Luxury Travel Market

- Geopolitical tensions, natural disasters, and global health crises can significantly impact the luxury travel market by disrupting travel patterns, deterring affluent travelers from visiting certain destinations, and imposing travel restrictions.

- Uncertainty surrounding safety and security dampens demand for luxury travel experiences, leading to reduced bookings and revenue losses for luxury travel providers.

- Economic downturns, currency fluctuations, and market volatility can pose challenges for the luxury travel market by affecting consumer spending habits, disposable incomes, and investment portfolios.

Comparative View of Adjacent Markets

This section compares the luxury travel industry, the luxury packaging market, and the luxury hotel market . Luxury brands are recognizing the importance of environmental responsibility and are actively seeking sustainable packaging solutions for reducing their carbon footprint and minimizing waste.

Luxury hotels respond by offering curated experiences, exclusive amenities, and personalized services that go beyond traditional hospitality offerings, creating unforgettable stays for their guests.

Luxury Travel Market:

Luxury Packaging Market:

Luxury Hotel Market:

Get the data you need at a Fraction of the cost

Personalize your report by choosing insights you need and save 40%!

Category-wise Insights

The below section shows the leading segment. Based on booking channel, the online booking segment is accounted to hold a market share of 46.3% in 2024. Based on tour type, the package traveler segment is accounted to hold a market share of 48.5% in 2024.

Online Booking Segment to Hold a Significant Share in the Market

Based on booking channel, the online booking segment stands out, capturing a significant market share of 46.3%. The trend reflects the boom in preference among luxury travelers for the convenience and accessibility offered by online platforms when planning and booking their upscale experiences.

From personalized itineraries to seamless transactions, online booking channels cater to the advancing needs of affluent travelers, propelling their popularity in the luxury travel market.

Package Traveler Segment to Hold a Dominant Share in the Market

Based on tour type, the package traveler segment is accounted to hold a market share of 48.5% in 2024. Packaged tours provide a hassle-free and curated experience, offering a blend of exclusive amenities, cultural immersion, and expert guidance.

As luxury travelers continue to seek curated experiences without compromising on comfort and exclusivity, the package traveler segment maintains its stronghold in the dynamic landscape of luxury travel.

Country-wise Insights

The table describes the top five countries ranked by revenue, with Australia holding the top position. Australia dominates the luxury travel market with its natural beauty, diverse landscapes, and unique experiences.

Affluent travelers indulge in luxury vacations for iconic destinations like the Great Barrier Reef and luxury eco-lodges, essaying the temptation as a premier luxury travel destination.

Forecast CAGRs from 2024 to 2034

Extensive Usage of Luxury Travels Boosts the United States Market

In the United States, the luxury travel market is predominantly utilized for a variety of purposes, including leisure travel, business travel, and special occasions such as weddings and milestone celebrations.

The United States boasts a vibrant luxury travel market catering to discerning travelers seeking unique experiences, from luxury wilderness retreats in national parks to opulent urban escapes in cosmopolitan cities like New York and Los Angeles.

Extensive Usage of Luxury Travel Services Booms the Market in Germany

In Germany, the luxury travel market is utilized by affluent travelers seeking refined and sophisticated travel experiences both domestically and internationally. German travelers often indulge in luxury vacations to iconic destinations such as the French Riviera, the Italian countryside, or exotic tropical islands.

The affluent business community often utilizes luxury travel services for corporate events, incentive trips, and executive retreats, reflecting the demand for exclusive and tailored travel experiences.

Luxury Travelers Rising in Popularity is Ensuring Market Growth in China

In China, the luxury travel market is primarily utilized by affluent travelers seeking prestigious and extravagant travel experiences both domestically and abroad. Luxury travelers often seek high-end accommodations, private tours, and VIP services that showcase luxury and exclusivity.

Luxury travel services are frequently utilized by the business elites of China for corporate meetings, luxury events, and incentive travel programs, reflecting the country's growing affluence and sophistication in luxury travel preferences.

Burgeoning Middle Class Raise the Demand for Luxury Travels in India

Rising affluence, a burgeoning middle class, and a desire for unique experiences fuel the luxury travel market in India.

Affluent Indian travelers are seeking personalized and immersive experiences both domestically and internationally, driving demand for luxury accommodations, boutique hotels, and experiential stays.

Presence of Pristine Destinations Impresses the Luxury Travel Market in Australia

In Australia, the luxury travel market is utilized by affluent travelers seeking unique and exclusive travel experiences that showcase the natural beauty and cultural heritage of the country.

Luxury travel experiences in Australia often emphasize outdoor adventures, wildlife encounters, and luxury eco-lodges that offer sustainable and immersive experiences in nature.

Luxury travel services are utilized by business elites of Australia for corporate retreats, luxury events, and incentive travel programs, reflecting the affluent and adventurous travel preferences of the country.

Competitive Landscape

In the competitive landscape of the luxury travel market, a blend of established players and boutique providers vie for affluent travelers' attention. Boutique operators specializing in niche segments like adventure travel or wellness retreats carve out their niche.

Differentiation through unique experiences, personalized service, and exclusive access to hidden gems defines success in this dynamic and discerning market. Some of the key developments are:

- In June 2023, Lindblad Expeditions partnered with FOOD & WINE magazine to disclose an enticing eight-day voyage through the Pacific Northwest, tracing the Columbia and Snake Rivers.

- In February 2023, Australia-based Flight Centre Travel Group acquired Scott Dunn Ltd. for approximately US$ 149 million. This strategic move marked Flight Centre's foray into the luxury travel market in the United Kingdom and the United States, which curated a portfolio of premier luxury travel brands across global markets.

Key Coverage in the Luxury Travel Industry Report

- Adjacent Study on Luxury Travel Market, Luxury Tourism Market

- European Luxury Tourism Market

- Luxury Travel Market Size, Current Insights, and Demographic Trends

- United States Luxury Travel Market

- Key Opportunities of the Global Luxury Travel Market

Report Scope

Key segments, by mode of transportation type:.

- Air Transportation

- Water Transportation

- Land Transportation

By Booking Channel:

- Phone Booking

- Online Booking

- In Person Booking

By Tour Type:

- Independent Traveller

- Package Traveller

By Consumer Orientation:

By age group:.

- 15-25 Years

- 26-35 Years

- 36-45 Years

- 46-55 Years

- 56-65 Years

- 66-75 Years

- North America

- Latin America

- Western Europe

- Eastern Europe

- South Asia and Pacific

- The Middle East and Africa

Frequently Asked Questions

What is the expected worth of the luxury travel market in 2024.

As of 2024, the market for luxury travel is expected to be valued at US$ 2.26 trillion.

What is the market potential for luxury travel?

The luxury travel market is projected to expand at a CAGR of 6.5% from 2024 and 2034.

Which booking channel segment dominates the luxury travel market?

The online booking segment is projected to dominate the industry.

What is the anticipated market value for luxury travel in 2034?

By 2034, the market value of the luxury travel is expected to reach US$ 4.24 trillion.

Which country is likely to dominate the luxury travel market?

Australia is likely the top-performing market, with a CAGR of 8.1%.

Table of Content

List of tables, list of charts.

Recommendations

Luxury Products for Kids Market

Published : November 2023

Travel and Tourism

Luxury Hotel Market

Published : July 2023

Luxury Packaging Market

Published : February 2023

Travel Advertising Market

Published : October 2022

Explore Travel and Tourism Insights

Talk To Analyst

Your personal details are safe with us. Privacy Policy*

- Talk To Analyst -

This report can be customized as per your unique requirement

- Get Free Brochure -

Request a free brochure packed with everything you need to know.

- Customize Now -

I need Country Specific Scope ( -30% )

I am searching for Specific Info.

- Download Report Brochure -

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

- Search Please fill out this field.

- Manage Your Subscription

- Give a Gift Subscription

- Sweepstakes

These Destinations From Italy to Antarctica Will Be Major in 2024, According to a New Report

Here's what to expect in luxury travel for 2024.

:max_bytes(150000):strip_icc():format(webp)/Stacey-Leasca-2000-631fabdcfe624115bea0ce8e25fdec96.jpg)

Elizabeth Rhodes/Travel + Leisure

The global luxury experts at Virtuoso surveyed its travel agency members and advisors spanning 50 countries to help predict what the next year holds for our adventures. And if their findings prove correct, 2024 will be all about fulfilling our biggest travel aspirations .

According to the 2024 Virtuoso Luxe Report, advisors are forecasting that travelers will be more interested in visiting far-flung destinations and having once-in-a-lifetime experiences than ever before. In the report, shared with Travel + Leisure , the team identified five key trends: New Frontiers, which highlights travelers' desire to reach new destinations outside the well-traveled path; The Party Continues, which showcases people's wish to travel with family and their closest friends; Honoring the Earth, pointing toward travelers' love for eco-conscious destinations; Small Ships, Big Possibilities, which forecasts a big year for small-vessel cruising; and At Ease, which also shows a popular year ahead for "exclusive-use experiences," like private jets , yachts , and villas .

However, there is one tried and true favorite destination the team at Virtuoso says will remain at the top of everyone's travel list: Italy .

“Perennially popular, Italy remains the global favorite destination, whether for families or honeymooners,” the report stated, adding that Portugal and Croatia will also remain popular go-to spots in 2024.

Also listed as a reemerging destination in 2024 is Japan, which Virtuoso noted is specifically high on travelers’ must-see lists for “its refined culture and in-demand cuisine.” Virtuoso also noted that Antarctica, about as far-flung and luxurious a destination as it gets, will also make a major resurgence in the coming year. In fact, the company listed Antarctica as the number one adventure destination for 2024.

As for the must-see cities of 2024, Paris tops the list thanks to it playing host to the Olympics, followed by the forever favorites Rome, Barcelona, Florence, and London rounding out the top five.

And, perhaps unsurprising but still a good reminder, Virtuoso noted the top five forecasted reasons to travel in 2024: Excitement of discovering something new, celebrating a milestone, experiencing something on our must-see list, spending time with loved ones, and the all-important “rest and relaxation.” Even if we get to check one of those boxes in 2024, we’ll all be happy travelers indeed.

Luxury Travel Market

Luxury travel market size, share & trends analysis report by type of tour (cruise/ship expedition, adventure & safari, celebration & special events, customized & private vacations, culinary travel & shopping, business tours, small group journey), by age group (millennial (21–30), generation x (31–40), baby boomers (41–60), silver hair (60 and above)), by type of traveller (absolute luxury, aspiring luxury, accessible luxury), booking channel (phone booking, online booking, in booking), by tourist type (domestic, international), by tour type (independent traveller, package traveller, tour group), by consumer orientation (men, women) and by region(north america, europe, apac, middle east and africa, latam) forecasts, 2024-2032.

Market Dynamics

Regional analysis, report scope, segmental analysis, top key players.

- Report Overview

- Table of Content

- Segmentation

Download Free Sample

Market overview.

The luxury travel industry has been growing at an unprecedented rate in the last few years on account of increasing spending power, growing middle-class population, debouching luxury trends, and expanding luxury hotels. Recently, Marriott International announced to expand its luxury footprint across Asia-Pacific by establishing nearly 100 new luxury hotels in the coming years. As recorded by UNWTO, international tourism arrivals grew by 7% in 2017, which are about 1,322 million arrivals. In 2019, Virtuoso, Ltd registered a 12% growth in the total sales, which was over USD 23 billion, up from USD 12.5 billion in 2013.

Rising Internet Access and Competitive Travel Packages to Drive the Market Growth

Rising internet access is subsequently driving online research in terms of luxury holiday planning. In line with this, the leading players are offering exclusive deals at competitive prices to gain a competitive edge. As per the Travel and Tourism Statistic, around 83% of people use the internet for luxury travel planning, whereas 40% of people prefer travel agencies for luxury travel planning.

As per the data published by Our World in Data Organization, the number of internet users increased from 413 million in 2000 to over 3.4 billion in 2016. The online marketing strategy and strong internet presence of travel agencies such as TripAdvisor, Zoover, and Black Tomato Group drive the market growth. For instance, in 2018, eDreams Odigeo, a leading European e-commerce travel company, attended to over 18.5 million customer's travel needs.

The luxury travel market's most prominent driver is the burgeoning spending power across the globe. As per the Investopedia, around 22.8 million people fall under the high net worth income category and contribute over 30% to the global annual spending on travel. Apart from this, shifting preference towards sustainable traveling drives the market growth.

Increasing Number of Solo Travelers Drive the Market Growth

Travelers around the world are exploring ways to de-stress and restore mental health. In line with this, cruise lines are offering wellness luxury travel packages with restorative spa experiences, healthy menu choices, onboard oxygen bars, and the latest fitness equipment. Experiential traveling and access to new destinations and places by cruise drive the luxury travel market. An increasing number of solo travelers and female-centered cruises provide an impetus to the market growth

Germany: An Ideal International Luxury Travel Destination

Europe's tourism market witnessed an 8% growth in 2017. Germany, France, and Spain are at the forefront of the regional luxury travel market due to its rich cultural heritage. Germany has been witnessing a significant hike in tourism from international and domestic traveler's, further driving the market growth. As stated by the Internationale Tourismus-Börse (ITB), around 3.6 million luxury travel trips are taken by the British. Germany is considered a cultural travel destination and a suitable destination for international trade fairs across the globe. The country also secures the top position as a destination for international luxury travel in Europe by the German National Tourist Board. South East Asian countries such as Thailand, Malaysia, Singapore, and Indonesia are countries showing great potential to drive the luxury market in the European region, as there were 2.1 million trips being generated by these main markets to Europe in 2016. The below info graph depicts the global international arrivals in 2030 estimated by the United Nations World Tourism Organization.

Luxury travel is booming in the Asia-Pacific region due to its rich cultural heritage and developed adventure activities. According to United Nations World Tourism Organization (UNWTO), Asia-Pacific is the world’s fastest-growing regional tourist destination since 2005. The number of international tourists arrivals grew by 6% in 2017 to reach 323 million, which is above the world average of 4%. Traditional Asian beach hotspots like Thailand, Bali and the Maldives are gaining traction than ever before owing to the strong presence of world-class hotels and the best of cuisine. Among the Asia-Pacific region, China has emerged as the growing market for luxury travel in recent years, and also a top spender in international tourism. The region witnessed a spur in business tours cause of strong industrialization and favorable FDI policies, further boosting the luxury travel market sector.

Wellness luxury travel is a significant factor in driving market growth in the Asian region. According to the Global Wellness Institute, Asia-Pacific is the fastest-growing wellness tourism market and is expected to double from 2017-2020, from USD 137 billion to USD 252 billion. In the midst of the growth, Asia-Pacific recorded over 250 million wellness trips annually, backed by changing lifestyle and spending behaviors.

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports

Millennial's Contribute to Over 20% of the International Tourists

By age group, the millennial (21–30) segment holds the largest market share. The millennial and generation X are reshaping the luxury travel industry due to social media influence. Around 72% of millennials prefer spending money on experiences than material objects and account for over 20% of all international tourists. Scott Dun, a leading luxury traveling company, has been witnessing significant growth in the last few years.

Adventure & Safari Segment to Grow at an Exponential Rate in the Luxury Travel Market

The adventure and safari segment is projected to grow at an exponential rate during the forecast period on account of rising demand for nature-based holidays. The high-income travelers are inclining towards unique personalized vacations such as educational tours, adventure & safari, and cruise/ship expedition. As per Skift, a travel industry media company, the cruising sector experienced a 7% growth in 2018. Today, activities such as mountain climbing, jungle safaris, and sky diving are witnessing huge popularity among the traveler’s. As per the Adventure Travel Trade Association (ATTA), the adventure travel market was valued at USD 683 billion in 2018 and is projected to double in the coming years.

Market Size By Type of Tour

Frequently asked questions (faqs), sample details.

- You will receive a link to download the sample pages on your email immediately after filling out a form

- A sample report will help you understand the structure of our full report

- The sample shared will be for our off-the-shelf market report

- The off-the-shelf report is curated considering a broader audience for this market, we have insights extending well beyond the scope of this report. Please reach out to discuss

- Should the sample pages not contain the specific information you seek, we extend the option to request additional details, which our dedicated team will incorporate.

- The sample is free of cost, while the full report is available for a fee.

Custom Scope

Connect with our analyst, we are featured on :.

- Terms & Conditions

- Privacy Policy

- Return Policy

- [email protected]

- +1 909 414 1393

- Report Details

- Table Of Content

- Request Free Sample

Global Luxury Travel Market by Type (Customized and Private Vacation, Adventure and Safari, Cruise/Ship Expedition, Small Group Journey, Celebration and Special Event, Others, The Customized and Private Vacation type occupies the largest market share segment and enjoys the fastest growth, Luxury Trave), By Application (Millennial, Generation X, Baby Boomers, Generation X is the most widely used area, accounting for 47% of all applications, while Millennial is growing) And By Region (North America, Latin America, Europe, Asia Pacific and Middle East & Africa), Forecast From 2022 To 2030

- Table of Content

- Free Sample

The global luxury travel market is expected to grow at a CAGR of 6.2% from 2021 to 2030. The customized and private vacation type occupies the largest market share segment and enjoys the fastest growth, with a CAGR of 7.5%. Generation X is the most widely used area, accounting for 47% of all applications, while Millennial is growing at a CAGR of 8%. North America leads in terms of revenue generation with an estimated $1 billion in 2020.

Some Of The Growth Factors Of This Market:

- The global economy is recovering and the luxury travel market is expected to grow as a result.

- The number of millionaires in the world has increased by 10% since 2008, which means more people are able to afford luxury travel.

- Luxury hotels are opening up in emerging markets such as China and India, which will increase demand for luxury travel services from these countries.

- There has been an increase in the number of wealthy individuals who want to invest their money into experiences rather than material goods, which will lead to an increase in demand for luxury travel services.

- The rise of social media has led to a greater awareness of luxurious destinations and experiences, which will lead to an increased demand for these types of trips.

Industry Growth Insights published a new data on “Luxury Travel Market”. The research report is titled “ Luxury Travel Market research by Types (Customized and Private Vacation, Adventure and Safari, Cruise/Ship Expedition, Small Group Journey, Celebration and Special Event, Others, The Customized and Private Vacation type occupies the largest market share segment and enjoys the fastest growth, Luxury Trave), By Applications (Millennial, Generation X, Baby Boomers, Generation X is the most widely used area, accounting for 47% of all applications, while Millennial is growing), By Players/Companies TUI Group, Thomas Cook Group, Jet2 Holidays, Cox & Kings Ltd, Lindblad Expeditions, Travcoa, Scott Dunn, Abercrombie & Kent Ltd, Micato Safaris, Tauck, Al Tayyar, Backroads, Zicasso, Exodus Travels, Butterfield & Robinson, Luxury Trave ”.

Scope Of The Report

Global luxury travel market report segments:.

The global Luxury Travel market is segmented on the basis of:

Customized and Private Vacation, Adventure and Safari, Cruise/Ship Expedition, Small Group Journey, Celebration and Special Event, Others, The Customized and Private Vacation type occupies the largest market share segment and enjoys the fastest growth, Luxury Trave

The product segment provides information about the market share of each product and the respective CAGR during the forecast period. It lays out information about the product pricing parameters, trends, and profits that provides in-depth insights of the market. Furthermore, it discusses latest product developments & innovation in the market.

Applications

Millennial, Generation X, Baby Boomers, Generation X is the most widely used area, accounting for 47% of all applications, while Millennial is growing

The application segment fragments various applications of the product and provides information on the market share and growth rate of each application segment. It discusses the potential future applications of the products and driving and restraining factors of each application segment.

Some of the companies that are profiled in this report are:

- Thomas Cook Group

- Jet2 Holidays

- Cox & Kings Ltd

- Lindblad Expeditions

- Abercrombie & Kent Ltd

- Micato Safaris

- Exodus Travels