How to Become a Millionaire: Step-by-Step Guide

While it will take disciple and hard work to get there, you don’t have to win the lottery or build the next great invention to become a millionaire.

In this post, we’ll share some proven strategies you can use to increase your income, reduce your expenses, and invest wisely to achieve millionaire status.

9 Ways to Become a Millionaire

- Boost Your Income

- Avoid Bad Debt

- Start Investing Early

- Take Advantage of Employer Matches

- Slash Your Expenses

- Prioritize Savings

- Avoid Lifestyle Inflation

- Get Professional Advice

- Be Consistent

1. Boost Your Income

One of the best ways to increase your income is to start a side hustle . By starting a side hustle or launching your own business, you’ll add another income stream and gain valuable skills along the way.

Although launching your business might take significant work upfront, the benefits are exponential. Whether you start an online business or make money with a rideshare driver app , every additional income stream you create will significantly help your journey to becoming a millionaire.

Look for passive income opportunities that continually make you money and take minimum effort to keep up.

You may eventually need to leave your job or set up lucrative side hustles to reach millionaire status. In the meantime, make sure you’re getting paid as much as you can for the work you’re currently performing.

Scope out your salary on Glassdoor . If you’re not getting paid a competitive rate, negotiate for a raise or find a job that pays more.

Increasing your income is the best method for building wealth, allowing you to pump more into your monthly investments and accelerate your journey toward becoming a millionaire.

Learn More:

- Jobs That Will Make You Rich

2. Avoid Bad Debt

All debt falls into one of two categories—good debt or bad. If there’s one thing the average millionaire is good at, it’s avoiding bad debt and capitalizing on good debt.

Real estate can fall into the good debt category as it allows you to own your own home or investment properties and add to your net worth .

Student loan debt could also be considered positive because it can help you advance your career and bring in more money, although some high-interest-rate loans can negatively affect your finances.

Even credit card debt can be positive if you pay down your balances every month. Not only does this boost your credit score, but you can also collect cash back and travel rewards points just for making everyday purchases.

However, you want to avoid debt like high-interest credit card balances that you can’t afford to pay off at all costs. Bad debt can also include high-interest debt like car loans or personal loans that set you back hundreds of dollars each month.

Once you’re free and clear from bad debt, you can start saving and investing to reach total financial independence .

- Ways to Get Out of Debt Fast

- How to Get Out of Credit Card Debt

3. Start Investing Early

If you want to make real strides, you have to invest in the stock market and take advantage of compounding interest. To get started, open an investment account filled with stocks, index funds, mutual funds, exchange-traded funds (ETFs), and bonds.

There are two ways to do this:

- Brokerage account: You can open a brokerage account for short-term and medium-term growth, but you’ll have to pay taxes on any capital gains and dividend yields you bring in each year.

- Retirement account: You can also open a tax-friendly retirement plan like a traditional IRA, Roth IRA, 401(k), Roth 401(k), Solo 401(k), or SEP IRA if you’re self-employed. Retirement plans are the best way to maximize long-term tax advantages.

Whether you’re in your 20s or your 40s, the best move you can make is to start investing in your financial future today.

- How to Start Investing

J.P. Morgan Self-Directed Investing

Limited Time Offer: up to $700 Bonus

Get unlimited commission-free trades on ETFs, stocks and options.

For a limited time, earn up to $700 through J.P. Morgan when you open and fund a new J.P. Morgan Self-Directed Investing account.

4. Take Advantage of Employer Matches

According to our statistics about millionaires , most people who have seven figures say they reached millionaire status by investing in a 401(k) at work.

It’s important to maximize all available resources on your path to becoming a millionaire. One way to do this is by taking advantage of employer matches on your retirement plan.

Oftentimes, employers will match your contributions to your retirement plan up to a set percentage. When you contribute enough to receive the full match, you can potentially double your retirement savings.

It’s important to understand your employer’s matching policy and take advantage of it to ensure you’re doing everything you can to fast-track your financial goals.

Contributing enough to your retirement account to qualify for your employer’s match could help you to retire early as a millionaire, shaving years of work from your life.

5. Slash Your Expenses

When you think of a millionaire, you may envision a lavish lifestyle of yacht parties and popping bottles. The truth is that most millionaires are experts at being frugal, myself included. And billionaire Warren Buffett is famous for driving affordable cars.

To become a millionaire, it’s vital to cut unnecessary expenses and avoid waste so you can pump those dollars into high-yield investments or into launching your own startup.

Try cutting subscription services you’re not using, like video streaming or food delivery. If you live near solid public transportation, consider ditching your car.

By trimming your basic expenses, you may be able to put $50 to $200 a month back into your pocket. Then, you can invest that money so it multiplies on your journey to seven figures.

To become a millionaire, you need to put every dollar to work, which requires budgeting . Creating a budget helps you maximize savings and investments while reducing unnecessary spending.

Once you build your net worth up, sticking to a budget helps you maintain and grow that wealth. If you need some help, look into You Need a Budget (YNAB) , which make it easy to track and manage your finances.

- How to Create a Budget

- Best Budgeting Apps for 2024

6. Prioritize Savings

Most millionaires have access to cash whenever they need it. That’s because they’ve saved it up.

You don’t have to be a millionaire to consistently save money. Each month, try to stash away a few hundred dollars into your high-yield savings accounts (HYSAs) and health savings accounts (HSAs) for qualified medical expenses if you have them.

The best part about having an emergency fund built up is that you’ll be able to cover unexpected expenses that might throw other people into bad debt.

A good rule is to have at least six months’ worth of expenses accessible in your emergency fund.

- Ways to Save Money

7. Avoid Lifestyle Inflation

One of the easiest ways to derail your plans to become a millionaire is to fall prey to lifestyle inflation.

Lifestyle inflation is what happens when you spend more because your income increases. This can lead to financial instability and prevent you from reaching your long-term financial goals.

An example would be getting a raise or a second job only to buy a new car or sign a lease on a pricer apartment when you don’t actually need to.

To avoid lifestyle inflation, it’s important to create a budget and stick to it. Prioritize saving and investing, and resist the urge to upgrade or buy unnecessary items just because you can.

By living below your means, you’ll be able to build wealth and achieve financial success in the long run.

8. Get Professional Advice

When you’re working your way to seven figures, hiring a financial planner can be a smart choice.

A certified financial planner can help you create a personalized plan based on your financial goals and situation.

They can provide advice on investment strategies, retirement, tax planning, and more, all of which can help you become a millionaire.

By working with a financial planner, you can stay on track and make informed decisions that could help you achieve millionaire status. It’s important to choose a reputable financial planner who has your best interests in mind and is transparent about their fees and services.

With a solid plan and guidance from a professional, you could be on your way to becoming a millionaire.

9. Be Consistent

One of the biggest keys to becoming a self-made millionaire is consistency. You need to prioritize your financial goals and make daily decisions that propel you toward your goals.

That means sticking to your budget, putting excess funds into your investment accounts, savings, or business opportunities, and regularly contributing to your retirement account.

As you continually make smart disciplined financial decisions year in and year out, you’ll be able to see the fruits of your labors as interest compounds and your wealth advances closer and closer to seven figures.

That discipline and determination will continue to carry you through well after you hit the $1 million milestone.

Frequently Asked Questions

Is it hard to become a millionaire.

Yes. Becoming a millionaire can take years of hard work and patience. However, with a solid investing strategy, healthy financial habits, and a clear goal, reaching millionaire status is very doable.

Is it worth it to become a millionaire?

Once you become a millionaire, it can open a lot of new doors, giving you freedom and options. The more money you have, the more freedom and choices come along. Suddenly, making $5 million becomes easily attainable. And once you have $5 million, you can make $10 million, and so on.

What’s more, you’ll learn a lot about yourself during your quest towards millionaire status. It’s worth becoming a millionaire not just for the money, but the lessons that you learn and the work ethic you develop along the way.

What’s the best way to become a millionaire?

The best way to become a millionaire, hands down, is through hard work and strategic investments . Work as hard as possible, create as many streams of income as you can, and save and invest aggressively along the way.

- How to Become a Millionaire by 30

- How to Become a Millionaire by 40

- Millennial Millionaire Strategy

- Millionaire Statistics

The Bottom Line

A million dollars is a lot of money, and it takes careful financial planning to get there.

Over time, your personal finances will improve as the nest egg in your bank account grows. Before you know it, you’ll have a million dollars saved, and that’s just the beginning.

No comments yet. Add your own

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Advertiser Disclosure

This website is an independent, advertising-supported comparison service. We want to help you make personal finance decisions with confidence by providing you with free interactive tools, helpful data points, and by publishing original and objective content.

We work hard to share thorough research and our honest experience with products and brands. Of course, personal finance is personal so one person’s experience may differ from someone else’s, and estimates based on past performance do not guarantee future results. As such, our advice may not apply directly to your individual situation. We are not financial advisors and we recommend you consult with a financial professional before making any serious financial decisions.

How We Make Money

We make money from affiliate relationships with companies that we personally believe in. This means that, at no additional cost to you, we may get paid when you click on a link.

This compensation may impact how and where products appear on this site (including, for example, the order in which they appear), but does not influence our editorial integrity. We do not sell specific rankings on any of our “best of” posts or take money in exchange for a positive review.

At the end of the day, our readers come first and your trust is very important to us. We will always share our sincere opinions, and we are selective when choosing which companies to partner with.

The revenue these partnerships generate gives us the opportunity to pay our great team of writers for their work, as well as continue to improve the website and its content.

Editorial Disclosure

Opinions expressed in our articles are solely those of the writer. The information regarding any product was independently collected and was not provided nor reviewed by the company or issuer. The rates, terms and fees presented are accurate at the time of publication, but these change often. We recommend verifying with the source to confirm the most up to date information.

Learn more in our full disclaimer

How to become a millionaire: 7 steps to reach your goal

Advertiser disclosure.

We are an independent, advertising-supported comparison service. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence.

Our articles, interactive tools, and hypothetical examples contain information to help you conduct research but are not intended to serve as investment advice, and we cannot guarantee that this information is applicable or accurate to your personal circumstances. Any estimates based on past performance do not a guarantee future performance, and prior to making any investment you should discuss your specific investment needs or seek advice from a qualified professional.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Editorial disclosure

All reviews are prepared by our staff. Opinions expressed are solely those of the reviewer and have not been reviewed or approved by any advertiser. The information, including any rates, terms and fees associated with financial products, presented in the review is accurate as of the date of publication.

- Share this article on Facebook Facebook

- Share this article on Twitter Twitter

- Share this article on LinkedIn Linkedin

- Share this article via email Email

- • Personal finance

- Connect with Karen Bennett on Twitter Twitter

- Connect with Karen Bennett on LinkedIn Linkedin

The Bankrate promise

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here's an explanation for how we make money .

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. We’ve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy , so you can trust that we’re putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts , who ensure everything we publish is objective, accurate and trustworthy.

Our investing reporters and editors focus on the points consumers care about most — how to get started, the best brokers, types of investment accounts, how to choose investments and more — so you can feel confident when investing your money.

The investment information provided in this table is for informational and general educational purposes only and should not be construed as investment or financial advice. Bankrate does not offer advisory or brokerage services, nor does it provide individualized recommendations or personalized investment advice. Investment decisions should be based on an evaluation of your own personal financial situation, needs, risk tolerance and investment objectives. Investing involves risk including the potential loss of principal.

Editorial integrity

Bankrate follows a strict editorial policy , so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

Key Principles

We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Editorial Independence

Bankrate’s editorial team writes on behalf of YOU – the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information.

How we make money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey.

Bankrate follows a strict editorial policy , so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

In this article

1. Develop a written financial plan

2. get into the habit of saving, 3. live below your means, 4. stay out of debt, 5. invest in ways that work for you, 6. start your own business, 7. get professional advice.

The pursuit of wealth should be motivated by a desire for financial security, not a longing for status or a luxurious lifestyle. If you start young and develop the right financial habits, a seven-digit net worth is an attainable goal.

In his work with wealthy clients, Jason Flurry, CFP, founder and president of Legacy Partners Financial Group in Woodstock, Georgia, has found that those he calls “true millionaires,” people who gain wealth and keep it, see the role of money in their lives very differently than those who focus on what money can buy.

“Having money for the sake of having money or ‘being rich’ never leaves a person feeling fulfilled,” he says. “Ironically, it can actually lead to a different set of problems most people haven’t thought about much in their pursuit of more.”

With help from financial experts, we have come up with seven tips on how to become a millionaire. The advice is really simple, but reaching the goal is challenging.

Saying you want to be wealthy won’t get you there. You must come up with a workable plan on how to become rich, put it on paper and then execute it.

“The written plan forces you to do something; calculate what you need to earn and how to invest,” says Stewart Welch, founder of The Welch Group, a wealth management firm in Birmingham, Alabama.

“The plan isn’t just the goal: it’s the whole thing,” says Welch. “The dream, the goals, the options.”

The options require “scenario planning” — coming up with all the ways you can accomplish that goal, such as opening a Roth IRA or contributing to a 401(k) , says Welch. Bankrate’s investment calculator can show you how much you’ll need to contribute and earn over time to reach your goal.

“Saving money really means putting your own personal finances first,” says Mark Hamrick, senior economic analyst at Bankrate. “So, think of saving money as a way of paying yourself first. By making saving money a priority, you are boosting the chances that your financial future is going to be stronger than your financial present or past.”

Start by building an emergency fund in a savings account so you don’t have to raid the rest of your savings and investments when a big expense arises unexpectedly.

Make a point of saving at least half of every pay raise. Explore high-yield savings account options to make sure you get the best returns on the money.

Additionally, take advantage of your retirement fund. Max out your 401(k) and put any additional funds into a traditional IRA or Roth IRA.

Diversifying your savings is critical to getting the most out of what you put in. If you have a long time horizon before you plan to retire, seek out growth investments like stocks to increase your nest egg over time.

“Don’t be among the many Americans whose top financial regret is the failure to save, either for emergencies or for retirement,” Hamrick says.

Buying a big house or driving a very expensive car is too big a price to pay if it will reduce the amount of money you can save and invest.

“This is really one of my favorite financial mantras,” Hamrick says. “Too many individuals, or consumers, are conditioned to think — or allow themselves to think — that their self-worth is somehow tied to their personal possessions.”

Hamrick offers an alternative way to think.

“But wouldn’t we really like for others to admire our resourcefulness and wealth-building, rather than our spending?” he says. “Financial success will be dictated, to a large degree, by how we manage our money, not by overspending.”

People who are serious about becoming a millionaire for financial security are less likely to blow money on expensive cars and lavish vacations.

And they’re not going to buy a house that stretches their budget too thin. Use Bankrate’s house calculator to determine how much house you can really afford.

Paying yourself is better than paying a bank or a credit card company. Debt is your enemy.

“When you are in debt, it is very hard to make progress toward securing your financial future because you have to pay your taxes and your debts before you can use any of your money for yourself,” Legacy Partners’ Flurry says.

Flurry says you should avoid what he calls “dumb debt,” such as credit cards, car loans and most student loans.

If you have a stack of credit card bills, pay them off and keep just one or two. Try not to put anything on your cards that you can’t pay off in two or three months.

“Debt holds people back,” Flurry says. “They buy liabilities, and they make those payments forever.”

You don’t need a lot of money to start investing . Open an account with a mutual fund company that has no-load funds and low expense ratios.

You can also invest your money in the stock market by using an online broker like TD Ameritrade or E-Trade , which charge zero commissions for online stock trades.

If you have the cash to buy property, consider investing in real estate . You can create an additional income stream by leasing a rental property and benefit from the appreciation in property value.

It’s best not to invest all your money in one thing. Diversification , or owning many different types of investments, is less risky and will smooth out the ride.

“Stick with the basics (a mix of stocks, bonds, cash and real estate) and not what your friends are doing. Everyone’s situation is different,” says Dana Twight, CFP, founder of Twight Financial Education in Seattle.

“Your employer retirement plan is often a good place to begin,” says Twight. “It has automatic contributions, allowing you to invest without being concerned about today’s news.”

If you want to increase your investments or diversify further, look into passive income opportunities , such as rental property or peer-to-peer lending.

“Investing in different asset classes helps you weather all the storms, floods and calm moments in between,” Twight says.

Build a diversified stock portfolio, and you can reasonably expect to earn 10 percent annually on your equity investments over the long haul.

In their book “The Millionaire Next Door: The Surprising Secrets of America’s Wealthy,” authors Thomas Stanley and William Danko say that two-thirds of millionaires are self-employed, and that entrepreneurs represent the majority of that group.

The authors note that most millionaires have worked a long time, lived on less than they made, saved money and made smart investments.

Entrepreneurs create most of the country’s wealth. In 1984, less than half of the people on the Forbes 400 list of richest Americans were self-made millionaires, but by 2018, Americans who had built their own fortunes made up 67 percent of the list.

A good financial advisor can steer you to the right investments and strategies and help you build and preserve wealth.

But don’t sit back and let your advisor do all the thinking. Take an active interest in where your money is being invested and why.

“We are all lifelong learners when it comes to personal finance,” Twight says. “Be willing to update your knowledge periodically and relate it to what is going on in the world, but keep your eyes on the prize.”

If you can’t afford to have a financial planner manage your money, find one who will review your portfolio and make recommendations for a one-time fee.

Bankrate’s “ Save a million dollars calculator ” can show you how long it will take for you to reach your goal.

Bottom line

If you’re going to start working toward a seven-figure net worth, you must take a long view. Think about the importance of securing your financial future.

“Naturally, having enough money to enjoy nice things and creating memorable experiences for yourself and those you care about the most are wonderful options to have, but having lasting financial security is far more valuable,” Flurry says.

“When you don’t have to worry about money to meet your needs or provide for your lifestyle, you are free to think bigger and focus on the things in life that matter most.”

Related Articles

7 best ways to increase your net worth

8 ways to invest like a millionaire

How to build wealth

7 tips to build wealth in your 30s

How to Become a Millionaire: 9 Proven Strategies [2024]

- Updated April 6, 2024

Disclosure: This post may receive compensation from partners listed through affiliate partnerships, at no cost to you. This doesn’t influence our ratings, and the opinions are our own. Learn more here .

I spent 7 years in Wealth Management and advised 453 Millionaires.

During this time, I studied the strategies these millionaires used to build wealth.

And in this guide, I’m going to break down those exact strategies so you can apply them too.

Let’s dive in.

The Secret to Becoming a Millionaire

Before we dive into these strategies, I have a question for you:

Do you believe that becoming a millionaire is unattainable?

If you said yes, then think again.

Because there are over 1,700 new millionaires created every single day!

Source: Bloomberg

In today’s world of entrepreneurship, almost anyone who is willing to put in the:

Will likely see results – over the long term.

And here’s another crazy statistic:

80% of millionaires are self-made.

Source: RamseySolutions.com

In other words, they started from $0 and built their wealth from the ground up.

Through hard work, grit, and determination.

The secret is this: To build a better tomorrow, you have to give up a little today.

If you’re not able to sacrifice a little today, then you shouldn’t plan on building a successful future.

How to Become a Millionaire

Becoming a millionaire (unless you win the lottery or receive an inheritance) will take a lot of hard work, patience, and effort.

If you follow the strategies below, you’ll have a real chance to become a millionaire, the legit way.

Step #1: Analyze Your Current Situation

Before you even think about your action plan to build your millionaire future, you first need to analyze your current situation.

Below are a few things I’d recommend for you to analyze:

Let’s start by discussing your net worth.

Your net worth = assets – liabilities.

In other words, your net worth is equal to what you own (your assets) minus what you owe (your liabilities).

You’ll want to work toward a positive net worth – but even if you have a net worth equal to $0, that’s an awesome start.

The median net worth for Americans age 35 to 44 is $91,300.

Source: CNBC

Your net worth will typically increase as you age (that’s because as you age, you likely increase your income).

When was the last time you checked your net worth?

If you’ve never checked your net worth before, that’s totally OK – you can get started with my net worth template below.

Remember: Your net worth = assets – liabilities.

Fill out the template and be honest with yourself.

FREE RESOURCE

Net Worth Template

This net worth template will help you figure out how much you own/owe.

Don’t get a panic attack if your net worth is negative.

That’s ok – and it’s actually pretty typical if you’re in your 20’s or even in your early 30’s, just because we have student debt, credit card debt, mortgage debt, car debt, etc. to offset our assets.

Some typical examples of debt include:

- Student loans

- Business loans

- Credit card debt

Some typical examples of assets include:

- Equity in home

- Savings accounts

- Investment accounts

Now it’s time to add your net worth together.

It’s probably a good idea to check your net worth every quarter or every month at the most.

Now that you have a rough picture of your net worth, it’s time to determine where you want to be in X amount of years.

And if your goal is to be a millionaire by 35, then that would be your net worth goal.

Now that you have an overarching goal, it’s time to break it down into smaller, more actionable goals.

Here’s an example:

- Invest $3,500 every month

- Stay out of high-interest debt

- Build 3 passive income streams

- Contribute the maximum to an HSA

- Contribute the maximum to Roth IRAs

- Save and invest 75% of annual income

- Maintain an adequate emergency fund

As you can see, these goals are actionable, they are precise, and they give some guidance on what you need to do to accomplish your ultimate goal.

Now, take some time to think about the mini-goals you need to pursue to make your millionaire dream a reality.

The Bottom Line: If you want to become a millionaire in your 30’s, you need to commit and relentlessly pursue your mini-goals.

It’s not going to be easy, and you’ll need to put in 100% of your efforts.

Step #2: Become a Master Budgeter

If your ultimate goal is to become a millionaire, then you really need to improve your budgeting.

First, you need to figure out:

- How much debt you owe

- How much you’re spending

- How much money you already have saved (and invested)

What needs to happen next:

- Reduce high-interest debt to $0

- Spend less than you earn and use frugal habits

- Increase saving and investing as much as possible

If your goal is to become a millionaire, you’re going to have to give up a lot in order to make your goals a reality.

And that’s why you will need a partner who’s on board with your plan.

So, first and foremost, you need to create a budget to track your income and expenses.

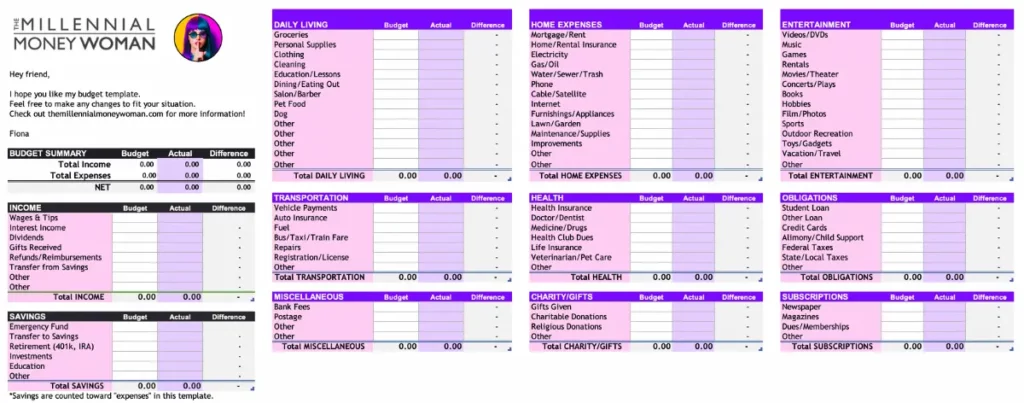

If you don’t have a budget yet, get my free spreadsheet below 👇

Budget Spreadsheet

This budget spreadsheet will help you track where your money is coming from, and where it is going.

Once you’ve completed your budget, see if your spending aligns with my budgeting rules of thumb:

- Monthly housing debt: < 28% gross monthly income

- Total monthly consumer debt: < 20% of net monthly income

- Total monthly debt payments: < 36% of gross monthly income

These rules are fairly accurate – but only if your goal is to continue on your current path.

If your goal is to become a millionaire, then we will need to make some serious modifications to this chart.

You will need to decrease your expenses drastically.

And by drastically, I mean this:

- Cut the cord

- Stop eating out

- Go thrift shopping

- Don’t buy new cars

- Stop taking vacations

- Stop buying new clothes

- Consider downsizing your home

- Find a roommate to split housing costs

If you want to become a millionaire, you must align your words with your actions.

However, this is the part where becoming a millionaire might not be so much fun.

Because you’ll likely see these things happen, while you’re dramatically cutting back on all expenses:

- Your friends buying big homes

- Your colleagues buying the newest cars

- Your colleagues buying designer outfits

- Your friends traveling to hot vacation spots

- Your friends going out to the hottest restaurants

Yes, it’s going to sting a bit, but after a while, you get used to it.

Because you have to remind yourself of your goal: Becoming a millionaire.

And chances are that your friends and colleagues will NOT be millionaires in the same time frame, because they’re spending money on luxury things.

Make sure to keep an eye on those monthly expenses and cut them when possible.

Some examples of recurring monthly expenses include:

- Internet bills

- Car payments

- Cable TV costs

- Cellphone bills

The Bottom Line: One of the fastest and most effective ways you can ensure becoming a millionaire is by becoming a master budgeter.

Create a budget, stick to your budget, and remember to always spend less than you earn.

To become a millionaire, you must stick to your goal and stay strong.

Step #3: Pay Off High-Interest Debt

If you have high-interest debt, you’re making your millionaire journey harder.

Do you want to become a millionaire?

If the answer is yes, then you’ll need to eliminate bad debt…NOW.

Here are 2 types of debt:

- Bad debt – High-interest debt often used for depreciating assets

- Smart debt – Debt used for appreciating assets

Some common examples of bad debt include:

- Payday loans

And although car debt may not always be high-interest debt (which is typically defined as debt with interest rates of over 10%), cars, in general, are depreciating assets.

This is why I would categorize car debt under the “bad debt” scenario.

Some common examples of smart debt include:

- Business debt

There are several ways to pay off debt and you should start paying off your bad debt ASAP.

One option you could consider when paying down your debt, is debt consolidation.

Debt Consolidation Defined: Debt consolidation is when you take out 1 loan (typically at lower interest rates) to pay off all your other, high-interest debt.

Remember that debt consolidation only solves the issue at hand: Your debt.

But, it doesn’t solve the root of the issue (if there is one), which could be your spending habits.

If you feel like your spending habits were the reason you fell into the debt trap in the first place, it might be time to seek out professional help.

Debt consolidation can be helpful – only if you are 100% dedicated to paying off your loans.

You need to be 100% committed to your goal, which might mean that you may have to make paying off your debt the priority over investing and/or saving.

The Bottom Line: One easy way to guarantee that you won’t achieve your millionaire goal is by keeping high-interest debt (like credit card debt).

High-interest debt will rob you of your future self.

Step #4: Invest as Early as Possible

I used to think that all millionaires were made because they invested in some glamorous investment, like:

- The next “Apple”

- A hot new real estate project

You get the point.

The fact of the matter is that most millionaires don’t earn their money through exotic investment opportunities.

Instead, they earn their money through:

- Long-term investing

- Consistent investing

- Low-cost index fund investing

In fact, 80% of millionaires invested in their company’s 401k, which helped them achieve their financial success.

Even more important – becoming a millionaire takes a lot of time.

In fact, it took the average millionaire about 28 years of hard work, saving, and investing before they cracked the million-dollar marker.

The last thing I want you to keep in mind is that the majority of millionaires actually don’t have super high-paying C-Suite jobs.

In fact, the top 5 careers for millionaires include:

Once again, I want to prove to you that you don’t need to have a job that pays $100,000 or more for you to become a millionaire.

In fact, only 31% of millionaires stated their income averaged $100,000 or more over the entire course of their careers.

How do most millionaires make their money?

Here’s how:

- They invest early

- They invest consistently

- They increase investments as their income increases

What if you’re not sure how to start investing?

Just open an investment account with a platform like M1 Finance .

You can either build your own portfolio or you can select from 80 professional portfolios.

This is the sure-fire way to become a millionaire.

The Bottom Line: One advantage that early investors have is time.

The earlier you invest, the faster your investments will grow over time, and that’s because of the power of compound interest .

Even with just a $100 investment , you’ll see results in the long run.

Step #5: Save & Invest as Much as Possible

If you want to become a millionaire, then you need to start saving and investing as much as humanly possible.

Sadly, however, the median checking account balance for American households was just $3,400.

And the statistics become even worse…

About 38% of Americans are unable to come up with $500 of cash (without selling something of theirs or taking out a loan) for an emergency.

If you find yourself falling into one of these statistics, then stop right now and figure out how you can increase your savings.

So many rules of thumb say that you should save 10% to 15% of your income.

If you want to be a millionaire, those rules of thumb will likely not cut it.

Instead, set your sights higher, so you save (and invest) around 50% to 80% of your gross annual income.

No, I’m not kidding.

If you feel like you’re having trouble even saving 10% of your gross annual income, first, start a budget with top apps like YNAB .

After setting up your budget, you’ll need to focus on:

- Cutting costs as much as possible

- Increasing income as much as possible

- Investing the difference as consistently as possible

Even if you can only afford a $5 investment every week, then do it.

The Bottom Line: Invest as much as humanly possible if your goal is truly to become a millionaire.

Don’t just invest 20% of your income.

Plan to invest 50% or more of your income to truly accomplish your millionaire goal.

Step #6: Invest in Yourself

Investing in the stock market is one thing, but investing in yourself is a completely different ballgame.

The highest return on your investment will be when you invest in yourself.

No, you don’t need a formal college degree (or an Ivy League degree) to become a millionaire.

In fact, there is so much information out there, at your fingertips through:

Cutting your expenses is limiting. Increasing your income is limitless.

To increase your income, you need to invest in yourself.

Remember the following:

- Increase your knowledge

- Increase your value

- Increase income

In other words, the more knowledge you have, the more money you make.

And that’s why you should always continue to invest in yourself.

The most important thing is to start investing in yourself.

Starting today.

The Bottom Line: Start by reading books, listening to self-improvement podcasts, or even continuing your education to increase your knowledge, add value, and increase your income.

Step #7: Surround Yourself with Winners

If you want to think like a millionaire, then you have to surround yourself with millionaires.

And that’s just the truth.

If you want to:

- Be a millionaire

- Act like a millionaire

- Think like a millionaire

Then chances are, you’ll need to surround yourself with millionaires to learn from them.

In many cases, you can find millionaires (or at minimum, people who are well-known winners) in some of the following places:

- Your local university

- Your community events

- Your Chamber of Commerce

When you meet various people in your life, you’ll want to make sure to keep their contact information or business card.

Periodically, reach out to them to:

- Wish them happy holidays

- Wish them happy birthday

- Ask them how their pet is doing

- Ask them about their recent vacation

Why should you put so much effort into keeping your network close?

Your network will be much more inclined to help you if you stay up to date with them.

The more you stay in their forefront vision, the more likely it is that they will help you should you need their help.

Here are some additional networking tips:

- Keep a network diary

- Always ask for a business card

- Reach out to your contact every quarter or so

- Set important dates as recurring in your calendar

- Note some items you remember from your conversation

- Note their physical appearance on the business card to remember how they look

If you haven’t already, it’s time to find a mentor to help you on your way.

Mentors are the ultimate shortcut in life.

Mentors help:

Essentially, mentors help you in life because they’ve already “been there, done that,” and they can give you guidance for your personal, financial, and professional life.

I would not be where I am today if it wasn’t for my mentor.

The Bottom Line: If you want to be a millionaire, then chances are, you’ll have to think like a millionaire.

The fastest way to understand how millionaires think is by surrounding yourself with them and other winners.

Step #8: Become Your Own Boss

School teaches us to become excellent employees.

But what schools fail to teach, is how to become an employer.

An entrepreneur.

And let me tell you something:

If you want to improve your chances of becoming a millionaire, then you need to become your own boss.

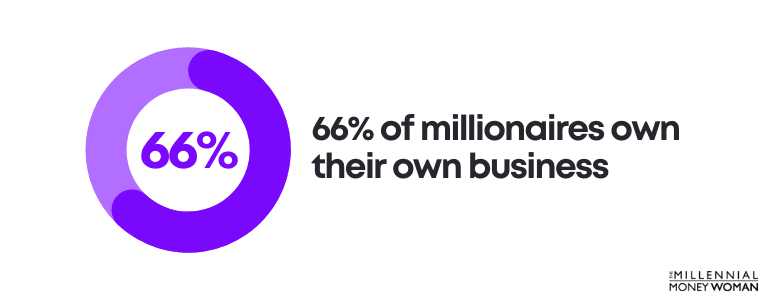

In fact, 66% of millionaires own their own businesses.

If you’re an employee, your income is limited to:

- How much your boss likes you

- The time you spend in the office

- How well you get along with your co-workers

In other words, your income as an employee is always limited.

However, when you become your own boss, your income potential becomes unlimited – both on the upside and on the downside.

Becoming your own boss doesn’t necessarily mean you have to start a multi-million dollar business.

In fact, becoming your own boss may just mean starting your own side hustle.

I can’t tell you how many people I know who have started their own side hustle who later quit their day jobs to work on their business full time.

Some side hustles can pay you some serious money down the road.

The downside is that some side hustles typically take years to build – often with 0% returns – or even negative returns – in the first few months/years.

However, in the long run (if you are consistent and stick with your plan), you could probably make north of $10,000 per month.

Whatever amount of money you earn from side hustles, make sure you:

- Pay off high-interest debt

- Save and invest as much as possible

Be consistent, be relentless, and be focused.

If you stick with your plan, you’ll have a very good chance of making your millionaire goal a reality.

The Bottom Line: Increasing your income is unlimited – and you can virtually do anything when you become your own boss.

That doesn’t necessarily mean starting your own company, you can also become a sidepreneur and start a side hustle.

Step #9: Choose Your Partner Carefully

One of the most important financial decisions of your life will involve who you choose as your long-term partner.

In fact, your long-term partner could make or break your financial future.

About 60% of relationship fights are about one partner’s spending habits.

And, there really is a formula to a successful relationship: Be open with your finances and discuss your financial dreams with your partner.

In fact, 94% of respondents say they have a “great” marriage because they openly discuss their financial dreams with their partners.

Clearly, there is a link between the success of your financial future (in this case, achieving millionaire status) and the quality of your relationship.

Becoming a millionaire with a supportive spouse by your side will be so much easier than if you have a partner working against you.

The Bottom Line: One of the best things you can do for your future self is to find a partner who supports you and who also shares your frugal financial mindset.

Marrying the right person is the most important part of building wealth.

Closing Thoughts

To recap, here are the steps you need to take to become a millionaire:

- Analyze Your Current Situation

- Become a Master Budgeter

- Pay off High-Interest Debt

- Invest as Early as Possible

- Save & Invest as Much as Possible

- Invest in Yourself

- Surround Yourself with Winners

- Become Your Own Boss

- Choose Your Partner Carefully

Now you have all the information you need to crush it.

Follow the steps above with consistency and discipline.

Your bank account will thank me later.

Join 30,000+ People That Get My Weekly Tips via Email

Every Saturday morning, you’ll get 1 actionable tip to help you save more money, increase your income, and multiply your wealth 👇

No spam. Just the highest quality tips on the web.

Join over 30,000+ others who receive my weekly newsletter, where I share the secrets to creating modern wealth 👇

Unlock the Secrets to Modern Wealth

Join 30,000+ others and get access to exclusive tips, strategies and techniques that I don’t share anywhere else 👇

You can unsubscribe at any time.

- Personal Development

- Sales Training

- Business Training

- Time Management

- Leadership Training

- Book Writing

- Public Speaking

- Live Speaker Training With Brian

- See Brian Speak

- Coaching Programs

- Become a Coach

- Personal Success

- Sales Success

- Business Success

- Leadership Success

How To Become A Millionaire: A Step By Step Guide

- Financial Success

I think you’ll agree with me when I say that everybody wants to know how to become a millionaire .

Unfortunately, some people just don’t know where to start.

Well, imagine if you could learn how to grow your income in your own way, starting today, that will set you on the right path toward becoming a millionaire…

I’ve put together my very own tips and strategies to help you visualize the road ahead and set goals to make more money.

Below is my guide on how to become a millionaire.

Table of Contents

The millionaire mindset, how to become a millionaire in 9 steps, how to become a millionaire fast, is being a millionaire worth it, take action.

If you want to reach a net worth of $1 million, having the right mindset is everything.

Before we do anything else, I want to discuss how to lay a strong foundation with your mindset and habits. Everything else will build on top of this.

Believe me: Making a million dollars doesn’t happen overnight. In fact, the average age of millionaires is 57 years old, which shows that it can easily take three or four decades to build wealth.

Don’t let this discourage or deter you though! Instead, take this as a golden opportunity to start developing patience.

Practice mindfulness and gratitude at every step along the way. When you focus on being thankful for the goals you’ve reached, you’ll be content with your current situation while still keeping your ultimate goal (millionaire status) in mind.

Determination

Most millionaires are highly determined. Be more determined by eliminating distractions and fully pursuing your goal.

If your determination starts to slip, go back to the drawing board and remind yourself why you started and why you wanted to reach this goal in the first place.

Having a focused mindset is similar to determination, yet different. Focus is about single-mindedly pouring all of your energy toward one goal. Determination relates more to motivation and knowing that your specific goal is what you want to achieve.

Being focused naturally comes after your determination.

People who have a strong sense of focus will be able to accomplish more work in less time. Whether you’re making your millions by running a business, strategically investing, opening a high-yield savings account, or all of the above, you’ll get it done more effectively if you have the ability to focus on what you’re doing.

Flexibility

Not everything is going to go perfectly in the process of becoming a millionaire. In fact, you should expect to hit several bumps along the road.

That’s where flexibility comes in.

Be willing to pivot and do something different if needed, while remaining focused on your final goal. There isn’t just one road to becoming a millionaire. There are many strategies you can follow to boost your wealth. Know when to let go of control and choose a different path.

The final piece to having a millionaire mindset is growth.

When you have a growth-oriented mindset, you won’t settle for being an average millionaire. You won’t settle for the way things are right now.

Instead, you’ll be motivated to continue growing, doing whatever you have to do to reach your final goal.

Now that you know how to create a millionaire mindset, it’s time to learn how to become a millionaire. Here are nine steps I recommend that can help you get there.

Earn More Money

The most obvious answer to knowing how to become a millionaire is to start earning more money .

There are virtually endless routes you can take to boost your income. You can make more money by:

- Getting the education needed for a higher-paying job

- Setting up a source of passive income

- Building an investment portfolio

- Taking advantage of compound interest

- Getting a second job

- Starting a small business or side hustle

- Selling your home and downsizing

- Becoming a coach or tutor

We’ll discuss some of these tactics in more detail later. But for now, I want you to get in the habit of w

riting down every idea you can possibly think of that could help you make more money.

Sometimes, one idea that you have while you are driving along, sitting, reading, watching television, or in a conversation may be the insight that will lead you to the start of your fortune.

If your goal is to make more money, write down all of your ideas as to how you’ll achieve it.

The rule is, “Catch the idea and write it down.” If you don’t write it down fast, you’ll often lose it.

So my first tip to become a millionaire: Write down your ideas to earn money so you can act on them.

To be a millionaire, you need to be good at setting goals. Learning how to set attainable goals for your personal finances will help you secure your financial future.

When it comes to setting financial goals, the same general principles apply that are important for all goal-setting strategies.

First, I recommend setting long-term goals and then breaking those up into short-term goals. Of course, your primary long-term goal is to “become a millionaire.” But there are going to be many other steps along the way.

Identify milestones such as hitting a net worth of $100,000 or $500,000. Then break those mile markers up into even smaller goals that will ultimately help you get to your end goal.

Make sure these goals have a realistic timeline in light of your current income streams, savings accounts, and financial situation. You want to challenge yourself, but you don’t want them to be completely out of reach.

I also recommend taking regular “time-outs” to reflect on your goals and the obstacles that are holding you back from achieving them. During these times of relaxation, ideas will often pop into your mind that can save you hours, days, and sometimes years of hard work.

Start Investing

Investing is one of the most popular methods to become a millionaire, and for good reason: if you learn how to do it right, it will generate a great fortune.

The key is to start investing early. Take advantage of compound interest—when you earn interest on both the money you’ve saved and the interest you earn.

One way to invest your money is through retirement accounts, such as a 401(k), Roth IRA, or traditional IRA.

Other options are the stock market, bonds, mutual funds, or even real estate. If you feel unsure of where to start or what’s right for you, talk to a financial advisor to get help.

Use A Magic Wand

You can’t actually wave a magic wand and instantly become a millionaire. If it were that easy, everyone would do it. But you can use something I like to call the “magic wand technique” to visualize your future success.

Imagine you have a magic wand and you can wave it over your current situation or problem. As a result of waving this magic wand, all the obstacles between you and your financial goals are removed.

If your goal is to build a successful business in a particular field, try to project forward three to five years and imagine it’s become your reality.

What would it look like? How big would it be? What kind of people would you be working with? What kind of reputation would you have in the marketplace? What would be your level of sales and profitability? How would you be running this business?

So think, what could you start doing right now to make this future dream a reality?

Use visualization tactics like these to imagine that you’re already a millionaire. This will help further develop the millionaire mindset we talked about earlier. Remember, you become what you think about most of the time.

Live Below Your Means

Living below your means refers to spending less money than you earn every month. For instance, maybe you earn $8,000 per month, but your housing expenses and other necessary payments cost no more than $6,000.

This leaves you with $2,000 left over every month to save or invest. And with a little work to cut back on unnecessary expenses, you could get that number down even lower.

Living below your means is a helpful and effective method of saving money and building wealth. Maybe you could ask for a raise at work. But don’t spend the extra chunk of your paycheck on unnecessary things—save or invest it to help reach your goal of becoming a millionaire.

If you’re new to living below your means, budgeting and setting good financial goals will be essential strategies to help you.

You could also try adding another income stream or downsizing into a smaller home.

Think Like A Millionaire

I’m sharing several tactics in this article that have to do with your mind and your thoughts, and for good reason: This is incredibly important in your journey to become a millionaire.

Self-made millionaires have something in common. They have the habit of thinking in terms of financial independence most of the time. They’re focused on achieving their financial goals, and they think about it often.

This mindset naturally leads to discipline. Self-made millionaires reorganize their financial lives where needed to ensure they reach their goals.

Financial success does not happen by accident. It takes a very deliberate design. It takes thinking like a millionaire.

Practice “Mind-Storming”

Perhaps the most powerful method of stimulating creative thinking is called “mind-storming,” or the 20-idea method.

Many people have become wealthy, including me, using this idea. In fact, this technique alone could enable you to gain financial independence.

It’s simple. Take any problem or goal that you have and write it at the top of a sheet of paper in the form of a question. For example, if your goal is to double your income over the next 12 months, then you would write, “How can I double my income over the next 12 months?”

Then discipline yourself to write at least 20 answers to that question. You can write more than 20 answers if you like, but you must write at least 20. They don’t all need to be perfect, just get something on the page.

Mind-storming is an excellent way to continue moving forward if you’re feeling stuck on how to earn more income or advance your financial future.

Save Your Money

When it comes to saving money , there are two keys that will help you become a millionaire more quickly. The first is to start early. And the second is to save for retirement.

Imagine if you were to save $100 per month from the time you started work at the young age of 20 until the time you retired at age 65. You invested that $100 per month in a mutual fund that yielded you an average of 10%. At this rate, you would be worth approximately $1,118,000 by the time you retired.

Chances are, your discipline to continue saving at any age, year in and year out would have such an effect on your character and your personality that you would end up earning far more than 10% per year.

But don’t be discouraged if you’re further along in life and haven’t started saving yet. There’s no time like the present to begin seriously investing and saving for your future.

Pay Off Your Debt

If you have any debt, pay it off as soon as possible so you can fully focus on working towards becoming a millionaire. There are multiple methods you can use to pay off debt.

These include…

- The avalanche method. Pay your most expensive debt first. Once it’s paid in full, move on to your other debts, going in order according to which ones are most expensive.

- The snowball method. Start with your smallest balance. After paying it, work up toward the next smallest balance. Keep going until all of your debts are paid.

- Pay your credit card bills more than once a month. This will help you ensure you don’t miss anything you owe.

- Get rid of debt more quickly by paying more than your minimum payment each month.

- See if you can refinance your debt and shorten the length of your loan. However, be aware that this may increase your monthly payments.

- Consolidate multiple debts, rolling them together into just one loan with a lower interest rate.

Finally, this should go without saying, but once you’ve paid off your debt, don’t accumulate any more. Live below your means and budget well. Any time you use a credit card, pay off the balance in full.

Take the Right Road

At some point, most people hit a crossroads in their financial life.

One road leads in the direction of earning, saving, and accumulating.

The other leads to earning, spending, and getting into debt.

It’s clear which road will ultimately end up with becoming a millionaire. But the second road sure looks like fun a lot of the time.

Don’t fall prey to temptation! The second road is much easier. But it will not help you reach your goal. And, there’s good news: You can pivot and choose the right road at any time. It doesn’t matter where you’re coming from, just where you’re going.

All self-made millionaires take responsibility for their financial life and take the first road. If you want to be a millionaire, you’ll need to do the same.

Be Disciplined

Commit to the process and stick with it. Becoming a millionaire won’t happen overnight.

As you set up a stream of passive income, funnel money into your retirement account, and pay off high-interest debt, the most important thing is to remain disciplined.

Sometimes, becoming more disciplined is a matter of identifying harmful habits and replacing them with new ones. Maybe you’re trying to start a business to earn more money, but you’re used to spending your weekends goofing off with friends.

Introduce new behaviors, such as scheduling blocks of time to work on your product, on Saturdays and Sundays. Sticking to these new habits will help you improve your discipline as you work toward becoming a millionaire.

Once you learn how to set financial goals and stay disciplined enough to achieve them, you won’t have to stop at a million dollars. You’ll be capable of earning your second and third million as well.

Making the first million is very hard. But the second million is almost inevitable. And that’s good news for you.

Once you become the type of person who can become a millionaire, that’s something you will never lose.

Looking to speed up the process? Here are some additional tips to help you reach that magic $1M mark as quickly as possible.

Save More Than 20%

Many experts recommend saving 20% of your income. But you can always save more if you’re able. The more money you save, the faster your savings account will reach one million dollars.

If you’re hoping to become a millionaire by a certain age, you can do the math to work out the monthly savings you’d need to tuck away each month to get there in time. If you can’t save that much right now, however, don’t worry! Whatever you can save will benefit you in the future. The important thing is simply to stock away as much of your own money as you can.

Advance Your Career

Consider investing in yourself through continuing education in your career field that will give you the skills and expertise needed to get a raise or a whole new job.

Depending on your industry, your job title, and your current level of education, this might look like a formal MBA program, a certification, or simply brushing up on your soft skills in the workplace.

Then you’ll be equipped with what you need to angle for a higher-paying job.

You can also consider starting your own business, as two-thirds of millionaires are self-employed . Think about your skills and experiences up to this point—both in the workplace, and simply in life.

Your own expertise and personal experiences can guide you as you decide what kind of business to start—either as a side hustle in addition to your job or simply as your new job.

Work With A Professional

A financial advisor can help you see what changes you might need to make in your financial life to become a millionaire more quickly. Depending on your needs and preferences, you could choose to work with:

- Investment advisors

- Certified financial planners

- Financial consultants

- Financial coaches

- investment managers

- Wealth advisors

Each of these professionals has a slightly different specialty that will allow them to hone in on your situation and provide specific advice for your financial planning needs.

Whether you’re feeling confused about investing, retirement, saving, or something else, a financial advisor can help you reach millionaire status more quickly. Look for a financial planner in your area that fits your budget. If you don’t live in a big city and can’t find any prospects close to you, you may also be able to find someone who will conduct remote sessions via phone or video.

By this point, it’s clear that becoming a millionaire is a lot of hard work. You may have to change your entire lifestyle. And you may be wondering if all this work is really worth it.

I want to tell you that the answer is yes.

When you become a millionaire, you’ll feel less stressed and worried about your financial future. You’ll have the time and freedom to pursue the things that matter most to you. And you’ll be able to buy anything you want or go wherever you want–in addition to helping people who need it.

The benefits of living as a millionaire are 100% worth every moment of hard work you put in to get there. Plus, the process of achieving such an enormous, impressive goal will foster your growth as a person.

If you can put in the hard work necessary to become a millionaire, you can do anything.

By following the steps I’ve outlined in this blog post, you’ll be well on your way to becoming a millionaire. It’s hard work, but you can do it. I believe in you!

Remember, one of the most important pillars in your journey is setting good financial goals. If you want to learn how to set better goals, I encourage you to check out my 14-Step Goal-Setting Guide. This free resource includes powerful tips and keys to success that will help you achieve any goal you could imagine.

Download here and learn how to set the right kind of goals to help you become a millionaire–faster than you ever thought possible.

« Previous Post Why Risk-Taking Is Required To Achieve Your Goals Next Post » The Qualities Of A Successful Entrepreneur

About Brian Tracy — Brian is recognized as the top sales training and personal success authority in the world today. He has authored more than 60 books and has produced more than 500 audio and video learning programs on sales, management, business success and personal development, including worldwide bestseller The Psychology of Achievement. Brian's goal is to help you achieve your personal and business goals faster and easier than you ever imagined. You can follow him on Twitter , Facebook , Pinterest , Linkedin and Youtube .

- Most Recent

- The Art of Business Success: A Blueprint for Entrepreneurs

- How to Develop a Habit That Will Last

- How to Write an Author Bio (Examples Included)

- Personal Development Plan Templates for Success

- How to Sell and Become a Master Salesperson

- Free Webinar: How To Write a Book and Become a Published Author

- Free Video Series: 3-Part Sales Mastery Training Series

- Free Assessment: The Confidence Factor

- Free Assessment: Discovering Your Talents

Browse Categories

Follow Brian & Join the Discussion

- Free Resources

- Best Sellers

- Knowledge Base

- Shipping & Returns

- Privacy Policy

- About Brian

- Brian Recommends

Your Privacy is Guaranteed. We will never give, lease or sell your personal information. Period!

© Copyright 2001-2024 Brian Tracy International. All Rights Reserved.

- SUGGESTED TOPICS

- The Magazine

- Newsletters

- Managing Yourself

- Managing Teams

- Work-life Balance

- The Big Idea

- Data & Visuals

- Reading Lists

- Case Selections

- HBR Learning

- Topic Feeds

- Account Settings

- Email Preferences

How to Build Wealth When You Don’t Come from Money

- Anne-Lyse Wealth

You are worthy of wealth, despite the systems designed to keep it from you.

The first step to attaining wealth — at least for people who are not born into it — is much more personal than building millionaire habits or investing wisely. Such approaches often fail to address the systemic and mental barriers faced by many of the marginalized groups who grew up without access to wealth. The author argues that changing your mindset, or building a mindset conducive to wealth, is the real first step.

- To start, let go of limiting beliefs. When you grow up lacking money or the resources to make enough of it, thinking that there is a shortage of resources, or watching people around you live paycheck to paycheck, you may be more likely to believe that wealth is reserved for a select few.

- To overcome this mindset, and believe that you deserve abundance, practice thought work on a daily basis. This is the act of consciously paying attention to your thoughts and then choosing to entertain different ones instead.

- Next, accept that money can do as much good as it can evil. Don’t let fear stop you from pursuing wealth, or the kind of paycheck you need to support you and what you want to accomplish in your lifetime.

- Finally, understand that a high income is not enough. Building wealth requires being intentional about managing your expenses — and, yes, investing. Investing is for everyone and it can help even the playing field.

Where your work meets your life. See more from Ascend here .

Do you want to be a millionaire? Most people probably do — but it is, famously, not an easy pursuit. The growing wealth gap between the rich and the poor makes it seem impossible for most of us.

- Anne-Lyse Wealth is a writer, personal finance educator, and certified public accountant. She is the founder of Dreamoflegacy.com , a platform dedicated to inspiring millennials to build wealth with purpose, and the ALW Communications Agency . She is the author of Dream of Legacy, Raising Strong and Financially Secure Black Kids and the host of The Dreamers Podcast .

Partner Center

GOBankingRates works with many financial advertisers to showcase their products and services to our audiences. These brands compensate us to advertise their products in ads across our site. This compensation may impact how and where products appear on this site. We are not a comparison-tool and these offers do not represent all available deposit, investment, loan or credit products.

The ‘Shark Tank’ Cast’s Best Tips on How To Become a Millionaire

Commitment to Our Readers

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services - our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology .

20 Years Helping You Live Richer

Reviewed by Experts

Trusted by Millions of Readers

“Shark Tank” has been helping promising entrepreneurs launch their products since 2009 — and has created many millionaires.

And the “Shark Tank” cast speaks for itself in terms of financial success: Whether it’s investor and entrepreneur Kevin O’Leary — Mr. Wonderful — billionaire entrepreneur Mark Cuban or real estate mogul Barbara Corcoran, they are all successful entrepreneurs and businesspeople in their own right, even though they each took different paths to become wealthy .

Here are their best tips to become a millionaire .

Be Competitive

Barbara Corcoran — who has a net worth of more than $100 million — told Entrepreneur that being competitive is key to success.

“If you want to be really rich, you better decide early to start a business of your own,” she told Entrepreneur. “It’s only when you put yourself in charge that you have a shot at becoming rich.”

According to her, while you need a passion to succeed, you will also need a strong work ethic and to put in as many hours as possible.

“But, if you’re competitive and pigheaded enough to get over the failures without wasting time feeling sorry for yourself, and if you can inspire enough good people to join you, you can pretty much become as rich as you want,” she said.

This is something she has reiterated several times — for instance, in a March 2023 TikTok video, Corcoran said that her struggles at school at a young age — “I couldn’t do letters and numbers my whole life” — taught her resilience.

“I learned how to rebound,” she said in the video. “Get through any obstacle. I try harder than the next guy, and I work twice as hard as the next guy. But that’s OK. That’s exactly what built my business and got me rich.”

That’s the motto of Mark Cuban, who has a $5.4 billion net worth, according to Forbes.

“To become a millionaire, you’ve really got to find something that you love to do, because it’s going to take so much work that you can’t just say, “OK, this is the one industry I can make a lot of money in.’ Or, and I get this all the time, which is crazy: ‘I want to be rich. What kind of company should I start?’ You can’t do that. It doesn’t work like that,” Cuban told Entrepreneur.

Cuban added that you not only have to be good at something, but you also need to be willing to work hard and “and do whatever it takes.”

“Then, if you’re fortunate, that turns into something that creates wealth for you,” he said.

Work for Yourself

Kevin O’Leary — who has a $400 million net worth, according to Entrepreneur — argued that you cannot become a millionaire if you work for someone else.

“That’s a highly unlikely outcome, unless it’s an entrepreneurial situation where you’re getting some equity in the company,” he told Entrepreneur. “If you can afford to take a risk and you’re young enough, either start your own company or be involved with one where you’re racking up equity. There’s no other path to becoming a millionaire. No employer is going to let you make a million dollars off of their business. They don’t have to.”

Stay Out of Debt

Chris Sacca, founder and partner of Lowercase Capital, has a $1.2 billion net worth, according to Forbes. According to him, staying out of debt is a key component of building wealth and becoming a millionaire.

“People get out ahead of themselves in debt with spending on all of their desires,” Sacca told Entrepreneur. “But if you learn to live pretty simply and well, well under your means, you feel incredibly, incredibly rich and that frees you up and gives you the option to start something new, to leave the job you’re not excited about, where there might be a glass ceiling on you.”

Other cast members agree that staying out of debt is the way to wealth.

For instance, O’Leary said in a Facebook post that this is the way to achieve financial freedom.

“Money might not buy happiness but I can promise you one thing…it’s A LOT easier to be happy with financial freedom!! I challenge you to start your journey toward financial freedom today by taking three steps: spend less, save more, invest the rest,” he wrote in the post.

More From GOBankingRates

- 6 Expensive Costco Items That Are Definitely Worth the Cost

- 5 Unnecessary Bills You Should Stop Paying in 2024

- 5 Reasons You Should Consider an Annuity For Your Retirement Savings

- 10 New Cars to Avoid Buying in 2024

Share This Article:

- Best Side Gigs

- Best Side Hustle Ideas

- Best Online Side Hustles

- Best Games That Pay Real Money

- Best Games That Pay Instantly

- Best Money-Making Apps

- Best Ways To Make $1,000 Fast

- Best Things To Sell To Make Money

Related Content

Uncategorized

Airbnb vs. Vrbo: Which Makes More Sense Financially for Hosts?

May 01, 2024

6 Financial Tools and Apps 5 Money Experts Swear By

Here's How Much the Definition of Rich Has Changed in Every State

I'm an Economist: Here Are My Predictions for Inflation If Biden Wins Again

May 02, 2024

Fiverr Failures: 6 Mistakes That Could Cost You Clients and Cash

Think You're Financially Literate? Here's What You May Not Know

Why the Fed's Attempts To Curb Inflation Might Lead to Recession -- and How To Prepare

Suze Orman's 9 Steps to Financial Freedom

3 Key Signs You've Finally Reached Your Financial Goals

7 Items From the 1940s That Are Worth a Lot of Money Now

Elon Musk or Warren Buffett? Here's What Jim Cramer Says About the Money Experts

April 30, 2024

6 States People Are Moving to Due to Lower Rent

How the Middle Class Is Financially Different Now Than in the 1980s

'Automatic Millionaire' David Bach: 6 Books To Read If You Want To Get Rich

5 Different Types of Life Insurance -- and Which One Is Right for You

9 Things Wealthy People Spend Too Much Money On

Sign Up For Our Free Newsletter!