- Search Search Please fill out this field.

- Definitions O - Z

Round Trip Transaction Costs: Meaning, Profitability, Example

Julia Kagan is a financial/consumer journalist and former senior editor, personal finance, of Investopedia.

:max_bytes(150000):strip_icc():format(webp)/Julia_Kagan_BW_web_ready-4-4e918378cc90496d84ee23642957234b.jpg)

What Are Round Trip Transaction Costs?

Round trip transaction costs refer to all the costs incurred in a securities or other financial transaction. Round trip transaction costs include commissions , exchange fees, bid/ask spreads, market impact costs, and occasionally taxes. Since such transaction costs can erode a substantial portion of trading profits, traders and investors strive to keep them as low as possible. Round trip transaction costs are also known as round turn transaction costs.

Key Takeaways

- Round trip transaction costs refer to all the costs incurred in a financial transaction, such as commissions and exchange fees.

- Over the past two decades, round trip transaction costs have declined significantly due to the termination of fixed brokerage commissions, but still remain a factor to consider in purchasing a security.

- The concept of 'round trip transaction costs' is similar to that of the 'all-in cost,' which is every cost involved in a financial transaction.

How Round Trip Transaction Costs Work

The impact of round trip transaction costs depends on the asset involved in the transaction. Transaction costs in real estate investment, for instance, can be significantly higher as a percentage of the asset compared to securities transactions. This is because real estate transaction costs include registration fees, legal expenses, and transfer taxes, in addition to listing fees and agent's commission.

Round trip transaction costs have declined significantly over the past two decades due to the abolition of fixed brokerage commissions and the proliferation of discount brokerages . As a result, transaction costs are no longer the deterrent to active investing that they were in the past.

The concept of 'round trip transaction costs' is similar to that of the ' all-in cost ,' which is every cost involved in a financial transaction. The term 'all-in costs' is used to explain the total fees and interest included in a financial transaction, such as a loan or CD purchase, or in a securities trade.

Round Trip Transaction Costs and Profitability

When an investor buys or sells a security, they may enlist a financial advisor or broker to help them do so. That advisor or broker most likely will charge a fee for their services. In some cases, an advisor will enlist a broker to execute the transaction, which means the advisor, as well as the broker, will be able to charge a fee for their services in the purchase. Investors will have to factor in the cumulative costs to determine whether an investment was profitable or caused a loss.

Round Trip Transaction Costs Example

Shares of Main Street Public House Corp. have a bid price of $20 and an ask price of $20.10. There is a $10 brokerage commission . If you bought 100 shares, then quickly sell all of them at the bid and ask prices above, what would the round-trip transaction costs be?

Purchase: ($20.10 per share x 100 shares) + $10 brokerage commission = $2,020

Sale: ($20 per share x 100 shares) - $10 brokerage commission = $1,990

The round-trip transaction cost is: $2,020 - $1,990 = $30

Morningstar. " Morningstar's Annual Fund Fee Study Finds Investors Saved Nearly $6 Billion in Fund Fees in 2019 ."

:max_bytes(150000):strip_icc():format(webp)/Regularlyscheduledinvestments-ac483b861b3f4f8f83dfc56d70e80d14.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

What are Round-Trip Transactions?

Complete Explanation of Round Tripping including Purpose, Example, & Risks

Home › Finance › Corporate Finance › What are Round-Trip Transactions?

In the complex world of financial markets and corporate accounting, the term “round-trip transactions” often surfaces amidst discussions of financial ethics, regulatory compliance, and corporate governance.

These transactions, while not inherently illicit, tread a fine line between strategic financial management and the murky waters of manipulative practices.

This comprehensive guide aims to unravel the intricacies of round-trip transactions, shedding light on their purposes, risks, and the legal and ethical considerations they entail.

- Round-Trip Transactions Meaning

Key Takeaways

The purpose of round-trip transactions, how is round tripping used, round tripping example, the risks and implications of round-trip transactions, legal and regulatory framework, ethical considerations of round trip transactions, detecting and preventing round-trip transactions, what exactly defines a round-trip transaction in financial terms, why might a company engage in round-trip transactions, what are the potential risks of engaging in round-trip transactions, how can round-trip transactions be identified or prevented.

Round-trip transactions refer to a series of transactions in which a company sells an asset to another party with the agreement that the asset will be bought back at a later date, usually at a similar or predetermined price.

This cycle creates the appearance of genuine business activity without any substantive change in the company’s financial position or the asset’s ownership. While round-trip transactions span various industries, they are notably prevalent in the energy sector and financial markets, where companies might engage in these deals to inflate revenue figures or to create a facade of heightened market activity.

The distinction between legitimate and manipulative uses of round-trip transactions hinges on intent and disclosure. Legitimate uses are typically transparent and aim to achieve lawful financial or operational objectives, such as hedging against price fluctuations. Conversely, manipulative practices are designed to deceive stakeholders or regulatory bodies about a company’s true financial health or market activity.

Manipulative Impact on Financial Statements : Round-tripping is primarily used to artificially inflate a company’s revenue and trading volume, misleading stakeholders about the company’s true financial performance and market activity.

Legal and Ethical Risks : Engaging in round-trip transactions carries significant legal and ethical risks, including regulatory penalties and reputational damage, as these practices can be considered deceptive and manipulative.

Importance of Transparency and Regulation : The detection and prevention of round-trip transactions highlight the importance of transparent accounting practices and stringent regulatory oversight to ensure the integrity of financial markets and protect investor interests.

Round tripping is often used to artificially inflate a company’s revenue and trading volume, creating the appearance of a higher level of business activity than actually exists.

This practice can be employed to meet financial targets, influence stock prices, or enhance the attractiveness of the company to investors by manipulating financial statements. By artificially inflating revenue, a company can appear more financially robust and liquid than it truly is, potentially influencing stock prices and investor perception.

The allure of round-trip transactions lies in their ability to temporarily enhance a company’s financial standing without necessitating actual business growth or operational improvements. This can make a company more attractive to investors, lenders, and analysts in the short term, albeit at significant risk.

Companies might engage in round-trip transactions in several different ways. Here are the most common round-trip transactions:

Inflating Revenue : A company may engage in round-tripping by selling an asset to another entity and buying it back at a similar price. These transactions can be recorded as legitimate sales and purchases, artificially inflating the company’s revenue and sales volume without any real change in its economic situation, misleading stakeholders about the company’s financial performance.

Boosting Asset Turnover : By repeatedly selling and repurchasing assets in round-trip transactions, a company can give the impression of higher asset turnover than is actually the case. This can make the company appear more efficient in its use of assets, potentially misleading investors about its operational effectiveness.

Manipulating Market Activity: In the case of publicly traded companies, round-trip transactions can be used to create an illusion of heightened trading activity for the company’s shares. This can influence stock prices by suggesting a higher demand for the shares than actually exists, potentially attracting more investors based on misleading information.

An example of round-tripping involves a company, Company A, selling an asset to Company B for $1 million. Shortly thereafter, Company B sells the same asset back to Company A for approximately the same price, say $1.01 million.

This sequence of transactions makes it appear as though Company A has engaged in $1 million worth of sales, thereby inflating its revenue figures, even though there has been no real change in the economic position of either company.

This practice can be used to manipulate financial statements and give an inflated impression of the company’s financial health and trading volume, potentially misleading investors and regulators.

The primary risk associated with round-trip transactions is the potential for legal repercussions and loss of investor trust. Regulatory bodies in many jurisdictions scrutinize such practices closely, and companies found guilty of using round-trip transactions to manipulate financial outcomes can face hefty fines, legal sanctions, and reputational damage.

Notable incidents, such as the Enron scandal, highlight the catastrophic impact that deceptive financial practices can have on stock prices, market stability, and investor confidence.

Moreover, round-trip transactions can distort market perceptions, leading to inefficient capital allocation and undermining the integrity of financial markets. The artificial inflation of activity or liquidity can mislead stakeholders about market demand, price stability, and the true value of assets involved.

The legal status of round-trip transactions varies by jurisdiction, but there is a growing trend towards stricter regulation and oversight. Financial regulatory bodies worldwide have implemented guidelines and reporting requirements to curb the abuse of such transactions.

The role of auditors and financial regulators is pivotal in detecting manipulative practices, necessitating rigorous examination of financial records, transaction trails, and disclosure statements.

Beyond legal implications, round-trip transactions pose significant ethical dilemmas. The fine line between creative accounting and outright fraud is often blurred, challenging companies to maintain integrity and transparency in their financial reporting.

Ethical business practices and robust corporate governance structures are crucial in mitigating the temptation to engage in deceptive financial maneuvers.

Companies must foster a culture of honesty and accountability, ensuring that all stakeholders can rely on the veracity of financial statements and market activities.

For investors and regulators, identifying potential round-trip transactions involves scrutinizing sudden spikes in revenue or trading volume without corresponding changes in market conditions or company operations. Vigilance and due diligence are essential in assessing the authenticity of reported financial health and operational activity.

Companies, on their part, can prevent misuse by adopting transparent accounting practices, regularly auditing financial records, and ensuring that all transactions are conducted at arm’s length and properly disclosed. As the financial landscape evolves, so too must the strategies for maintaining fairness and integrity in corporate reporting and market transactions.

Round-trip transactions, while a legitimate tool in certain contexts, present a complex challenge in the realm of financial ethics and regulation. As companies navigate the pressures of financial performance and market competitiveness, the temptation to engage in such practices underscores the importance of robust regulatory frameworks, corporate governance, and ethical leadership.

The future of round-trip transactions will undoubtedly be shaped by ongoing efforts to balance financial innovation with transparency and integrity, ensuring the stability and trustworthiness of markets and corporate institutions. In this ever-changing environment, the collective responsibility of companies, regulators, and investors to foster transparency and integrity has never been more critical.

Frequently Asked Questions

A round-trip transaction refers to a set of transactions where an asset is sold and subsequently repurchased by the original seller, often at a similar price, to artificially inflate volume or revenue without any real change in asset ownership.

Companies may use round-trip transactions to meet financial targets or create the illusion of increased business activity, thereby enhancing their financial statements or market valuation temporarily.

Round-trip transactions can lead to legal penalties, reputational damage, and a loss of investor trust if used to manipulate financial statements or deceive stakeholders.

Identifying round-trip transactions involves scrutinizing financial records for transactions that inflate company activity without real economic substance, while prevention requires transparent accounting practices and rigorous financial oversight.

Accounting & CPA Exam Expert

Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching. After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career.

The Meaning of "Round Tripping" in Accounting

- Small Business

- Accounting & Bookkeeping

- ')" data-event="social share" data-info="Pinterest" aria-label="Share on Pinterest">

- ')" data-event="social share" data-info="Reddit" aria-label="Share on Reddit">

- ')" data-event="social share" data-info="Flipboard" aria-label="Share on Flipboard">

Does a Sales Discount Go on an Unadjusted Trial Balance?

Advantages and disadvantages of for-profit companies, accounting for an operating patent.

- What Does a Debit Balance in Manufacturing Overhead Do?

- How to Calculate Market Value of a Corporation

The accounting slang term "round tripping" refers to a series of transactions between companies that bolster the revenue of the companies involved but that, in the end, don't provide real economic benefit to either company. While not necessarily illegal, round tripping is at best disingenuous. It's important for a scrupulous businessperson to be able to recognize when a transaction may amount to round tripping – and, just as important, to know when a transaction that may look like round tripping is in fact legitimate.

Name Origins of "Round Tripping"

The name for the practice comes from "round trip" – a journey that takes you from one place to another and then back to your starting point. In essence, that's what's happening with financial round tripping: The companies involved start out in a certain financial position, and then they engage in a series of transactions. When all those transactions are settled, they're in the same financial position they were in when they started. They've made a "round trip." Such deals are also known as "lazy Susans."

Round Tripping: Meaning

A common round-tripping maneuver involves reciprocal sales of identical assets. Imagine you own an office supply store, and the owner of a stationery store comes to you with a proposal. He'll buy a pallet (40 cases) of copy paper from you at your retail price of $30 a case, for a total of $1,200. Meanwhile, you'll buy a pallet of the identical paper from him at the same price, $1,200. He's proposing a round-tripping deal. Other, more flagrant examples might include mutual payments for nonexistent "services," or one company "investing" in another, with the second company turning around and using the money to buy goods or services from the first.

Purpose of Round Tripping

According to Accounting Tools , the point of round tripping is to inflate revenue – to make a company look like it's doing more business than it really is. Although the bottom line for any company is profit, observers often judge a company's growth and size by its sales revenue. Round-trip deals generally don't inflate profit; after all, the $1,200 in revenue you would earn from selling paper to the stationery store would be offset by the $1,200 expense of buying an equal amount of paper. But each company gets that additional $1,200 in revenue, so it appears a little bigger and more active than it would without the round trip.

Legitimate Round Tripping Transactions

Say your office supply store has a delivery van whose tires are shot. You go to the tire shop next door and buy a new set of radials for $600. Three weeks later, the owner of the tire shop comes in and buys paper, printer ink, pens and other stuff worth $600 for his business. This would not be a round-trip situation. Each of you had a legitimate business purpose for these transactions; the fact that you both wound up with $600 in revenue and $600 in expenses, for a net profit of zero, is immaterial. Round tripping is about setting up reciprocal deals with no legitimate business purpose.

Legality of Round Tripping

The fact that legitimate deals can look like lazy Susans makes it hard to simply outlaw the practice. That said, WallStreet Mojo indicates that if a company is using self-canceling transactions to make its numbers look better to investors or lenders (which is the purpose of round tripping), it can be prosecuted for fraud. For instance, the Securities and Exchange Commission might charge several software companies relating to a round tripping fraud scheme for a series of transactions that an agency says provides no economic benefit and are intended only to boost the company's reported revenue.

- Accounting Tools: Round Tripping Definition

- WallStreet Mojo: Round Tripping

Related Articles

Why is the accrual basis of accounting accepted by gaap, difference between cash flow & sales revenue, is it ethical to record the transactions directly into the general ledger accounts, accounting definition of self balancing accounts, post-dump buyout strategy, difference in validate & verify in accounting, examples of aggressive accounting, examples of corporate malfeasance, what is a negative goodwill in accounting, most popular.

- 1 Why Is the Accrual Basis of Accounting Accepted by GAAP?

- 2 Difference Between Cash Flow & Sales Revenue

- 3 Is It Ethical to Record the Transactions Directly Into the General Ledger Accounts?

- 4 Accounting Definition of Self Balancing Accounts

- Round Trip Transaction

Get free proposals from vetted lawyers in our marketplace.

Technology Terms Glossary

- Personal License

- Public Domain

- Pull Strategy

- Pump and Dump

- Push Strategy

- Reverse Engineering

- Semiconductor

- Smart Contracts

- Software Bugs

- Source Code

What is a Round Trip Transaction?

Round trip transaction refers to the total incurred cost in a securities or similar financial transaction. Round trip transactions ultimately increase money flow in the market during the recession. These transactions also increase liquidity in an adverse market situation. You can use round-trip transactions in standard tax planning programs.

Round Trip Transaction Examples

Examples of the round trip transaction include:

- Example 1: Exchange fees

- Example 2: Commissions

- Example 3: Market impact costs

- Example 4: Bid or Ask spreads

- Example 5: Occasional taxes

Here is a comprehensive article about the round trip transaction.

Meet some of our Technology Lawyers

I was born and raised in Wayne, New Jersey and attended Seton Hall University, graduating cum laude. I followed my family down to Florida to attend Ave Maria School of Law where I graduated cum laude. I was admitted to the Florida Bar in 2018. During law school, I participated in the Certified Legal Internship program with the State Attorney's Office of the 20th Judicial Circuit and litigated 5 jury trials, 1 non jury trial and argued various motions before the court under the supervision of an Assistant State Attorney. I was an Assistant States Attorney for Collier County from 2018 to 2020 before moving into private practice in the areas of real estate and first party property from 2020 to 2021. As of November 2021, I started my own law practice that focuses on business planning, real estate and estate planning.

I work with private tech companies on entity formation, corporate governance, and commercial agreements. I was an in-house counsel for a unicorn fintech startup and am currently associated with a startup boutique while operating my solo practice. I received my JD from Berkeley Law, and served in the US Navy for 5 years as a combat linguist. I am fluent in Korean.

Whitney L. Smith's journey from entrepreneur to advocate is fueled by a profound understanding of the business world. With a decade of firsthand entrepreneurial experience, she entered law school driven by a mission to protect others' businesses. However, her passion for real estate law blossomed as she recognized the tremendous benefits rental property ownership offers to individuals seeking passive income and community development. Blending her deep understanding of transactional law with zealous courtroom advocacy, she empowers landlords to thrive. Born and raised in St. Petersburg, Florida, she is a proud graduate of Stetson College of Law and cherishes her role as a devoted parent to two children and a beloved pit bull companion.

Business, Real Estate, Tax, Estate Planning and Probate attorney with over 20 years experience in private practice in Colorado. Currently owner/operator of John M. Vaughan, Attorney at Law solo practitioner located in Boulder, CO. My practice focuses on transactional matters only.

I have 20-plus years of experience as a corporate general counsel, for public and private corporations, domestic and international. I have acted as corporate secretary for a publicly-held corporation and have substantial experience in corporate finance, M&A, corporate governance, incorporations, corporate maintenance, complex transactions, corporate termination and restructuring, as well as numerous aspects of regulatory and financial due diligence. In my various corporate roles, I have routinely drafted complex corporate contracts and deal-related documents such as stock purchase agreements, option and warrant agreements, MSAs, SOWs, term sheets, joint venture agreements, tender agreements purchase and sale agreements, technology licensing agreements, vendor agreements, service agreements, IP and technology security agreements, NDAs, etc. and have managed from both a legal and business perspective many projects in the financial, technology, energy and venture capital fields.

My practice focuses on business and commercial litigation. I have worked with companies of all sizes from sole member LLCs to those in the Fortune 500. I've advised clients on mergers, equity issuances, commercial transactions, joint ventures, employment issues, and non-competition. I've also drafted and negotiated the underlying agreements for these transactions and more.

Find the best lawyer for your project

Technology lawyers by city.

- Atlanta Technology Lawyers

- Austin Technology Lawyers

- Boston Technology Lawyers

- Chicago Technology Lawyers

- Dallas Technology Lawyers

- Denver Technology Lawyers

- Fort Lauderdale Technology Lawyers

- Houston Technology Lawyers

- Las Vegas Technology Lawyers

- Los Angeles Technology Lawyers

- Memphis Technology Lawyers

- Miami Technology Lawyers

- New York Technology Lawyers

- Oklahoma City Technology Lawyers

- Orlando Technology Lawyers

- Philadelphia Technology Lawyers

- Phoenix Technology Lawyers

- Richmond Technology Lawyers

- Salt Lake City Technology Lawyers

- San Antonio Technology Lawyers

- San Diego Technology Lawyers

- San Francisco Technology Lawyers

- Seattle Technology Lawyers

- Tampa Technology Lawyers

Quick, user friendly and one of the better ways I've come across to get ahold of lawyers willing to take new clients.

Contracts Counsel was incredibly helpful and easy to use. I submitted a project for a lawyer's help within a day I had received over 6 proposals from qualified lawyers. I submitted a bid that works best for my business and we went forward with the project.

I never knew how difficult it was to obtain representation or a lawyer, and ContractsCounsel was EXACTLY the type of service I was hoping for when I was in a pinch. Working with their service was efficient, effective and made me feel in control. Thank you so much and should I ever need attorney services down the road, I'll certainly be a repeat customer.

I got 5 bids within 24h of posting my project. I choose the person who provided the most detailed and relevant intro letter, highlighting their experience relevant to my project. I am very satisfied with the outcome and quality of the two agreements that were produced, they actually far exceed my expectations.

How It Works

Post Your Project

Get Free Bids to Compare

Hire Your Lawyer

Find lawyers and attorneys by city

- it Italiano

- fr Français

- ru Русский

- es Español

- zh 中文

- hi हिन्दी

- ar العربية

- pt Português

- ms Bahasa Melayu

- ko 한국어

- tr Türkçe

- ja 日本語

- nl Nederlands

- is Íslenska

Round Trip Transaction Costs

What Are Round Trip Transaction Costs?

Round trip transaction costs allude to all the costs incurred in a securities or other financial transaction. Round trip transaction costs include commissions , exchange fees, bid/ask spreads, market impact costs, and occasionally taxes. Since such transaction costs can dissolve a substantial portion of trading profits, traders and investors endeavor to keep them as low as could really be expected. Round trip transaction costs are otherwise called round turn transaction costs.

How Round Trip Transaction Costs Work

The impact of round trip transaction costs relies upon the asset involved in the transaction. Transaction costs in real estate investment, for instance, can be fundamentally higher as a percentage of the asset compared to securities transactions. This is on the grounds that real estate transaction costs include registration fees, legal expenses, and transfer taxes, as well as listing fees and specialist's commission.

Round trip transaction costs have declined fundamentally throughout the course of recent a long time due to the nullification of fixed brokerage commissions and the multiplication of discount brokerages . Subsequently, transaction costs are at this point not the obstacle to active investing that they were in the past.

The concept of 'round trip transaction costs' is like that of the ' all-in cost ,' which is each cost involved in a financial transaction. The term 'all-in costs' is utilized to explain the total fees and interest included in a financial transaction, like a loan or CD purchase, or in a securities trade.

Round Trip Transaction Costs and Profitability

At the point when an investor trades a security, they might enroll a financial advisor or broker to assist them with doing so. That advisor or broker undoubtedly will charge a fee for their services. At times, an advisor will enroll a broker to execute the transaction, and that means the advisor, as well as the broker, will actually want to charge a fee for their services in the purchase. Investors should factor in the cumulative costs to determine whether an investment was profitable or caused a loss.

Round Trip Transaction Costs Example

Shares of Main Street Public House Corp. have a bid price of $20 and a ask price of $20.10. There is a $10 brokerage commission . In the event that you bought 100 shares, immediately sell all of them at the bid and ask prices above, what might the round-trip transaction costs be?

Purchase: ($20.10 per share x 100 shares) + $10 brokerage commission = $2,020

Deal: ($20 per share x 100 shares) - $10 brokerage commission = $1,990

The round-trip transaction cost is: $2,020 - $1,990 = $30

- The concept of 'round trip transaction costs' is like that of the 'all-in cost,' which is each cost involved in a financial transaction.

- Throughout recent many years, round trip transaction costs have declined fundamentally due to the termination of fixed brokerage commissions, yet at the same time remain a factor to think about in purchasing a security.

- Round trip transaction costs allude to all the costs incurred in a financial transaction, for example, commissions and exchange fees.

We couldn’t find any results matching your search.

Please try using other words for your search or explore other sections of the website for relevant information.

We’re sorry, we are currently experiencing some issues, please try again later.

Our team is working diligently to resolve the issue. Thank you for your patience and understanding.

Round-trip transactions costs

Costs of completing a transaction , including commissions , market impact costs , and taxes.

- Earnings per share (EPS)

- Market capitalization

- Outstanding

- Market value

- Over-the-counter (OTC)

- Sexvigintillion

- National Association of Securities Dealers (NASD)

Copyright © 2018, Campbell R. Harvey. All Worldwide Rights Reserved. Do not reproduce without explicit permission.

- Type a symbol or company name. When the symbol you want to add appears, add it to My Quotes by selecting it and pressing Enter/Return.

These symbols will be available throughout the site during your session.

Your symbols have been updated

Edit watchlist.

- Type a symbol or company name. When the symbol you want to add appears, add it to Watchlist by selecting it and pressing Enter/Return.

Opt in to Smart Portfolio

Smart Portfolio is supported by our partner TipRanks. By connecting my portfolio to TipRanks Smart Portfolio I agree to their Terms of Use .

Financial Tips, Guides & Know-Hows

Home > Finance > What Are Transaction Costs? Definition, How They Work, And Example

What Are Transaction Costs? Definition, How They Work, And Example

Published: February 10, 2024

Learn about transaction costs in finance, including their definition, how they work, and example scenarios. Enhance your financial knowledge with this comprehensive guide.

- Definition starting with T

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more )

Understanding Transaction Costs in Finance

Whether you’re a seasoned investor or just starting to dip your toes into the world of finance, understanding transaction costs is crucial. As an expert in finance, I’m here to demystify this concept and shed light on what transaction costs are, how they work, and provide a real-life example. So, let’s dive in!

Key Takeaways:

- Transaction costs refer to the expenses incurred when buying or selling financial assets.

- They can include brokerage fees, commissions, bid-ask spreads, and taxes.

What Are Transaction Costs?

Transaction costs are the expenses associated with buying or selling financial assets such as stocks, bonds, or mutual funds. These costs can eat into your investment returns, so it’s essential to factor them into your decision-making process. While they may seem insignificant at first, transaction costs can add up over time, impacting your overall investment performance.

How Do Transaction Costs Work?

Transaction costs encompass various fees and charges that investors pay during the buying or selling process. Let’s break down some of the most common transaction costs:

- Brokerage Fees: When you trade through a broker, they charge a fee for their services. These fees can be fixed or based on a percentage of the trade value.

- Commissions: Commissions are fees paid to brokers or agents for facilitating trade. They can also be fixed or variable based on the size of the transaction.

- Bid-Ask Spreads: This refers to the difference between the highest price a buyer is willing to pay (bid) and the lowest price a seller is willing to accept (ask). The bid-ask spread represents a cost since you might have to buy at a slightly higher price or sell at a slightly lower price.

- Taxes: Depending on your jurisdiction, you may be subject to tax liabilities when buying or selling certain financial assets.

It’s important to note that transaction costs can vary depending on the size of the trade, the type of financial asset, and the specific brokerage firm or platform used. So, it’s crucial to research and understand the fee structure of your chosen broker before making any transactions.

An Example of Transaction Costs:

Let’s say you’re an investor looking to buy 100 shares of a company’s stock. Each share is valued at $50. Here’s a breakdown of the transaction costs involved:

- Brokerage fee: $10 flat fee per trade

- Commission: 1% of the trade value ($50 x 100 x 1% = $50)

- Bid-Ask Spread: $0.20 per share on both the buy and sell side ($0.20 x 100 = $20)

- Taxes: Assuming a tax rate of 10%, the tax liability would be $5 ($50 x 100 x 10% = $500 x 10% = $5)

Adding up these costs, we get:

- Total transaction costs = $10 (brokerage fee) + $50 (commission) + $20 (bid-ask spread) + $5 (taxes) = $85

So, in this example, the transaction costs amount to $85. It’s important to consider these costs when evaluating the profitability of your investment.

In Conclusion

Transaction costs are a reality of the financial markets. Understanding how they work and factoring them into your investment decisions is crucial for achieving your financial goals. By being aware of the various costs involved and considering them in your calculations, you can make more informed investment choices. Remember, every dollar saved on transaction costs adds to your overall returns in the long run.

20 Quick Tips To Saving Your Way To A Million Dollars

Our Review on The Credit One Credit Card

How Must A Replacing Producer Respond To An Applicant Wishing To Replace Existing Life Insurance?

Why Is Using Debt In Capital Structure Good

Latest articles.

Understanding XRP’s Role in the Future of Money Transfers

Written By:

Navigating Post-Accident Challenges with Automobile Accident Lawyers

Navigating Disability Benefits Denial in Philadelphia: How a Disability Lawyer Can Help

Preparing for the Unexpected: Building a Robust Insurance Strategy for Your Business

Custom Marketplace Development: Creating Unique Online Shopping Experiences

Related post.

By: • Finance

Please accept our Privacy Policy.

We uses cookies to improve your experience and to show you personalized ads. Please review our privacy policy by clicking here .

- https://livewell.com/finance/what-are-transaction-costs-definition-how-they-work-and-example/

Understanding ETFs

ETF premiums and discounts, explained

August 07, 2023

Various expenses make up the total cost of ownership of an exchange-traded fund (ETF), including its expense ratio and bid-ask spread . Here, we examine a third element of the total cost of ETF ownership—premiums and discounts, which occur when an ETF’s market price differs from the net asset value of its underlying securities.

We dispel some myths about ETF premiums and discounts, explain why they can occur, and suggest how investors can make informed decisions. We also look at how premiums and discounts differ by asset class.

How exchange-traded funds are valued

The value of an ETF is determined in a number of ways, each of which can affect an investor’s experience. First, there’s the net asset value (NAV). As with mutual funds, NAV is the assessed value of all of an ETF’s underlying securities. 1

In other words, a fund’s NAV is its fair value. But unlike with mutual funds, ETF investors don’t transact at NAV. 2 Instead, ETF prices are determined by the market.

An ETF’s market price is the most important price for investors—the one at which they buy and sell shares in the secondary market. Since market prices are ruled by supply and demand, an ETF’s market price can diverge from its NAV.

If there’s heavy demand from buyers, the price of an ETF can increase above its NAV (a premium). Conversely, if there’s heavy sell-side pressure, the price can dip below the NAV (a discount).

The ETF creation-redemption mechanism

The beauty of the ETF structure is the “creation-redemption” mechanism, which allows new ETF shares to be created to meet demand or redeemed to reduce supply as needed. Creations and redemptions help keep an ETF’s market price in line with its fair value and limits severe premiums and discounts. As long as the mechanism is running smoothly, ETF prices should stay near fair values.

Focus on what's most important

The biggest risk related to ETF premiums and discounts is realized when an investor purchases an ETF when it’s trading at a substantial premium and then sells it at a substantial discount. This is why it’s important to focus on the volatility of a fund’s premium or discount.

Many investors focus on an ETF’s average premium, but the stability of premiums and discounts over time will have a much more significant impact.

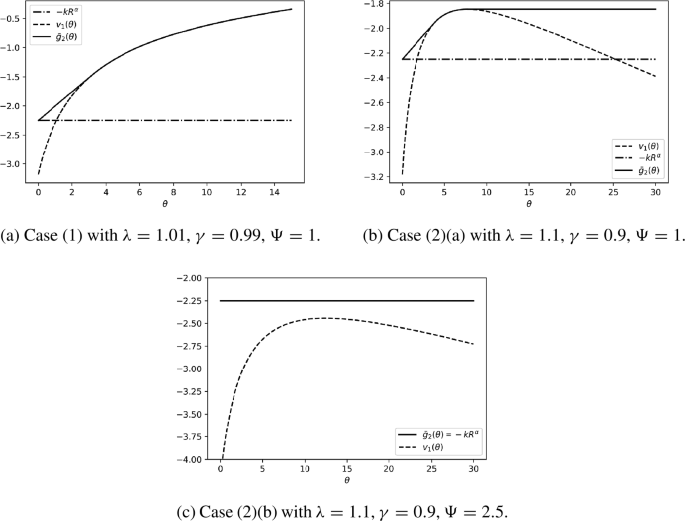

The following charts help illustrate this point:

Source: Morningstar, based on data from July 2018 through November 2019.

ETF A has an average premium of 18 basis points (0.18 percentage point), and ETF B has an average premium of 0 basis points. An investor looking at those averages might assume ETF B is a better product.

This would be incorrect.

Although ETF A does have a larger average premium, the premium is more stable, which reduces the investor’s risk and potential costs. If investors buy and sell at a stable premium, the cost is likely to be predictable and relatively modest. As the graph illustrates, an investor might buy ETF A at a premium of 22 basis points and sell at a premium of 18 basis points, incurring only 4 basis points of round-trip transactions costs. While it may seem a disadvantage to buy an ETF at a premium of 22 basis points, selling at a similar premium can offset this initial cost.

Conversely, ETF B has a smaller but more volatile premium, which exposes investors to the possibility of buying at a significant premium and selling at a significant discount. An investor who purchased at a premium of 64 basis points and sold at a discount of 61 basis points would incur 125 basis points (1.25 percentage points) of round-trip transaction costs. Selling at a steep discount only adds to the initial transaction cost.

Again, a larger but stable premium is often preferable to a lesser, volatile one. The standard deviation of historical premiums is arguably a clearer way to estimate transaction costs than the average premium.

It’s also worth noting that any ETF premium or discount published at the end of a trading day generally represents only the closing snapshot, comparing the ETF’s NAV to its closing price on its primary exchange. A premium or discount at the close may not accurately depict where the ETF traded relative to its NAV during the trading day.

Differences in ETF premiums and discounts across asset classes

Domestic etfs.

Domestic equity ETFs generally trade in line with their NAVs. Premiums and discounts are typically slight for a variety of reasons, including the lower cost of buying and selling the underlying domestic equities, the relative ease of pricing underlying stocks and ETFs simultaneously, and the lower fixed fees incurred.

In other words, pricing domestic ETFs is relatively straightforward and can frequently be achieved without too much deviation from NAV.

International ETFs

International ETFs may have more pronounced premiums and discounts. It’s more challenging to determine the fair value of the underlying constituents, partly because the markets where they’re listed may not be open during hours when U.S.-listed ETFs are trading.

Other costs may include larger fixed fees, higher commissions, stamp taxes and associated fees, foreign exchange hedging costs, and the imprecise nature of fair value factors. This makes the process to create or redeem international ETFs less precise, which translates to larger premiums and discounts.

Fixed income ETFs

Fixed Income ETFs usually trade at inherent premiums. Their NAVs are based on the bid prices of all their underlying securities, or the prices at which the funds could sell all of their holdings.

A fixed income ETF’s market price will typically be near the midpoint of all the underlying bonds in the ETF’s basket. This represents what it would cost market makers to buy the underlying bonds to create new ETF shares, though sometimes an ETF can trade up toward the cost to create new shares.

Key takeaways

Premiums and discounts are important components of the total cost of ETF ownership, and they vary by asset class. Their stability can be considerably more meaningful than their size . A larger, but stable, premium is often preferable to a lesser, volatile one.

While the existence of premiums and discounts should not lead investors to avoid ETFs, extremely volatile premiums and discounts can erode longer-term returns significantly. Investors can steer clear of relatively elevated ETF premiums and discounts by avoiding trading on days when markets are roiled. In any case, they should understand good ETF trading practices .

1 Certain funds may apply a fair value pricing methodology that will set NAV at different levels than the underlying securities’ official closing value.

2 ETF investors can make NAV trades; however, these trades typically need to be placed by a high-touch trade desk and are often executed with a markup or markdown to the stated NAV depending on the asset class and trade direction.

Related links:

- Case studies in the cost of ETF ownership (article, issued July 2023)

- On its 30th birthday, the ETF looms large (article, issued February 2023)

- Trading tips for ETF investors grappling with market volatility (article, issued November 2022)

All investing is subject to risk, including the possible loss of the money you invest.

Bond funds are subject to the risk that an issuer will fail to make payments on time, and that bond prices will decline because of rising interest rates or negative perceptions of an issuer's ability to make payments.

Investments in stocks or bonds issued by non-U.S. companies are subject to risks including country/regional risk and currency risk. These risks are especially high in emerging markets.

Contributors

David Sharp

Patrick Hooper

Vanguard Information and Insights

Subscribe to portfolio considerations., get vanguard news, insights, and timely analysis on the market, delivered straight to your inbox..

Read our privacy policy to learn about how we keep personal information private. * Indicates a required field

Thank you for subscribing to Portfolio considerations.

You'll be notified when new content is published, but will only ever receive one email a day from vanguard insights., you’re already a subscriber, thank you what would you like to do next.

Vanguard is the trusted name in investing. Since our founding in 1975, we've put investors first.

Speculative trading, prospect theory and transaction costs

- Open access

- Published: 15 December 2022

- Volume 27 , pages 49–96, ( 2023 )

Cite this article

You have full access to this open access article

- Alex S. L. Tse 1 &

- Harry Zheng 2

2256 Accesses

1 Altmetric

Explore all metrics

A speculative agent with prospect theory preference chooses the optimal time to purchase and then to sell an indivisible risky asset to maximise the expected utility of the round-trip profit net of transaction costs. The optimisation problem is formulated as a sequential optimal stopping problem, and we provide a complete characterisation of the solution. Depending on the preference and market parameters, the optimal strategy can be “buy and hold”, “buy low, sell high”, “buy high, sell higher” or “no trading”. Behavioural preference and market friction interact in a subtle way which yields surprising implications on the agent’s trading patterns. For example, increasing the market entry fee does not necessarily curb speculative trading, but instead may induce a higher reference point under which the agent becomes more risk-seeking and in turn is more likely to trade.

Similar content being viewed by others

Fundamental theorem of asset pricing with acceptable risk in markets with frictions

Maria Arduca & Cosimo Munari

Semimartingale price systems in models with transaction costs beyond efficient friction

Christoph Kühn & Alexander Molitor

Creation and Control of Bubbles: Managers Compensation Schemes, Risk Aversion, and Wealth and Short Sale Constraints

Avoid common mistakes on your manuscript.

1 Introduction

When it comes to modelling trading behaviour, the standard economic paradigm is the maximisation of risk-averse agents’ expected utility in a frictionless market. This criterion, however, has been criticised on many levels. In terms of trading environment, financial friction is omnipresent in reality where transactions are subject to various costs. In terms of agents’ preferences, the behavioural economics literature suggests that many individuals do not make decisions in accordance to expected utility theory. First, utilities are not necessarily derived from final wealth, but typically what matters is the change in wealth relative to some reference point. Second, individuals are usually risk-averse over the domain of gains, but risk-seeking over the domain of losses—this can be captured by an S-shaped utility function. Finally, individuals may fail to take portfolio effects into account when making investment decisions, and this phenomenon is known as narrow framing. These psychological ideas are explored for example in the seminal work of Kahneman and Tversky [ 16 ], Tversky and Kahneman [ 26 , 27 ] and Kahneman and Lovallo [ 15 ].

In this paper, we develop a tractable dynamic trading model which captures a number of stylised behavioural biases of individuals as well as market frictions. In our setup, trading is costly due to proportional transaction costs as well as a fixed market entry fee. The goal of an agent is to find the optimal time to buy and then to sell an indivisible risky asset to maximise the expected utility of the round-trip profit under the prospect theory preference of Tversky and Kahneman [ 27 ]. While a realistic economy can consist of multiple assets, we can interpret the assumption of a single indivisible asset as a manifestation of narrow framing such that the trading decisions associated with one particular unit of indivisible asset can be completely isolated from the other investment opportunities. We believe the model is the best suitable to describe the trading behaviour of speculative agents. These “less-than-fully rational” agents purchase and sell an asset with a narrow objective of making a one-off round-trip profit rather than supporting consumption or stipulating a long-term portfolio growth.

A sequential optimal stopping problem featuring an S-shaped utility function is solved to identify the entry and exit time of the market by the agent. The solution approach is based on a backward induction idea. In the first stage, we focus on the exit strategy of the agent: Conditionally on the ownership of the asset purchased at a given price level (which determines the agent’s reference point), the optimal liquidation problem is solved. Then the value function of this exit problem reflects the utility value of purchasing the asset at a different price level. Upon comparison against the utility value of inaction, we obtain the payoff function of the real option to purchase the asset which is then used in the second stage problem concerning the entry decision of the agent: The agent picks the optimal time to enter the trade so as to maximise the expected payoff of this real option to purchase the asset.

The traditional route to analyse an optimal stopping problem is to first conjecture a candidate optimal stopping rule, and then the dynamic programming principle is invoked to derive a free boundary value problem that the value function should satisfy. Then one can attempt to solve for the free boundaries via value matching and smooth pasting. For this approach to work, we need to correctly identify the form of the optimal stopping rule, but this exercise may be not trivial. As it turns out, the optimal continuation region of our entry problem can either be connected or disconnected, depending on the model parameters. It is thus difficult to adopt such a guess-and-verify approach since we do not know the correct form of the optimal stopping rule upfront. In our analysis, a martingale method is employed to solve the underlying optimal stopping problems, which has the important advantage that no a priori conjecture on the optimal strategy is required. The optimal continuation/stopping set can be deduced directly by studying the smallest concave majorant of a suitably scaled payoff function.

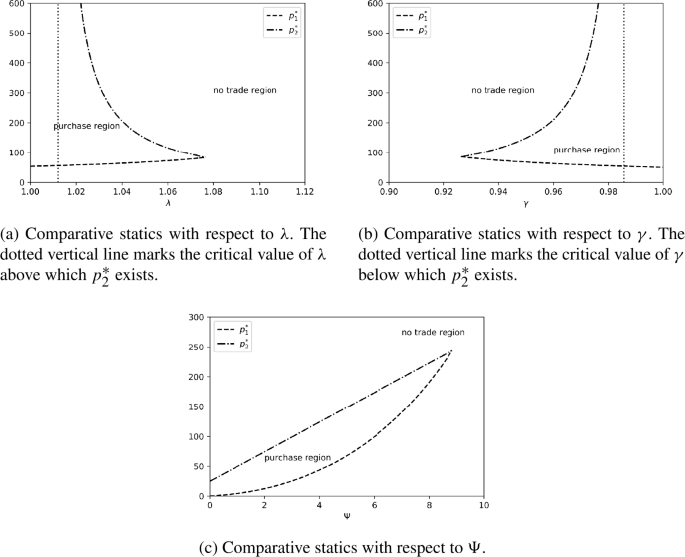

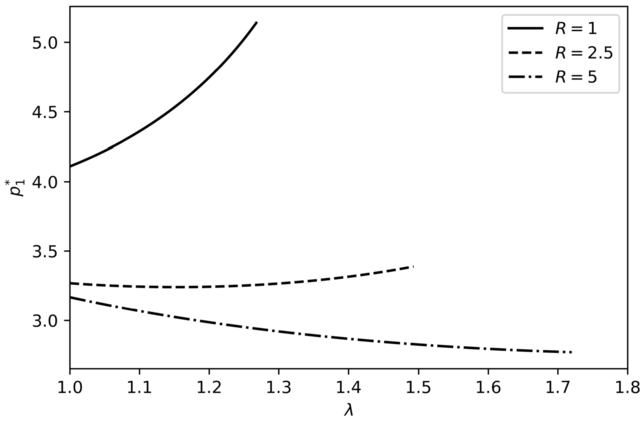

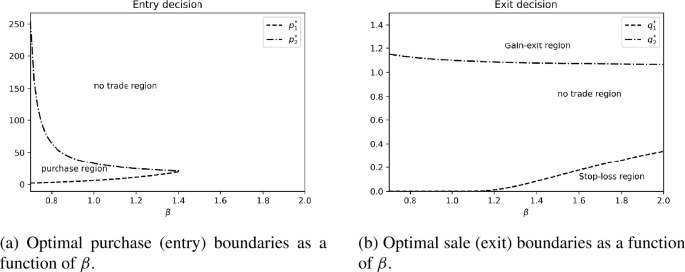

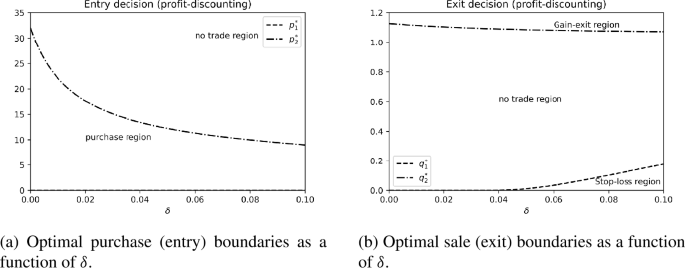

Despite its relatively simple nature, our model is capable of generating a rich variety of trading behaviours such as “buy and hold”, “buy low, sell high”, “buy high, sell higher” and “no trading”. The risk-seeking preference of a behavioural agent over the loss domain will typically encourage him to enter the trade, but his precise trading behaviour depends crucially on the level of transaction costs relative to his preference parameters. Generally speaking, a high proportional (fixed) transaction cost discourages trading at a high (low) nominal price. When proportional costs are high and the asset is expensive, the agent prefers waiting until the price level declines, and hence he is more inclined to consider a “buy low, sell high” strategy. But if instead the fixed entry fee is high and the asset is cheap, the agent might prefer delaying the purchase decision until the asset reaches a higher price level, and this leads to a trading pattern of “buy high, sell higher”.

Both behavioural preferences and market frictions are studied extensively as separate topics in the mathematical finance literature. To the best of our knowledge, however, their interaction has not been explored to date. Under prospect theory, the risk attitude of the agent is heavily influenced by the reference point. In our model, the reference point is endogenised so that it depends on the cost of purchase including the transaction cost paid. The level of transaction cost therefore has a direct impact on the agent’s risk preference. This subtle interaction between risk preference and transaction cost leads to interesting policy implications on how speculative trading can be curbed effectively. For example, a surprising result is that imposing a fixed market entry fee might indeed accelerate rather than cool down trading participation.

Our paper is closely related to the literature on optimal stopping under an S-shaped utility function. Kyle et al. [ 18 ] and Henderson [ 9 ] consider a one-off optimal liquidation problem in which the agent solves for the optimal time to liquidate an endowed risky asset to maximise an expected prospect theory utility. They do not consider the purchase decision, and the reference point is taken as some exogenously given status quo. A main contribution of our paper is that we further endogenise the reference point which depends on the purchase price of the asset, and the optimal purchase price must be determined as a part of the optimisation problem. The recent work of Henderson and Muscat [ 11 ] extends the model of Henderson [ 9 ] by considering partial liquidation of multiple indivisible assets. Both the present paper and [ 11 ] consider a sequential optimal stopping problem as the underlying mathematical framework. However, the economic natures of the problems are completely different—we study the sequential decision of purchase and sale, while they exclusively focus on sales.

Another relevant class of works is the realisation utility model which further incorporates a reinvestment possibility within a behavioural optimal stopping model, such as Barberis and Xiong [ 2 ], Ingersoll and Jin [ 14 ], He and Yang [ 8 ], Kong et al. [ 17 ] and Dai et al. [ 3 ]. In such models, the agent repeatedly purchases and sells an asset to maximise the sum of utility bursts realised from the gain and loss associated with each round-trip transaction. In a certain sense, these models consider an endogenised reference point which is continuously updated based on the historical prices within each trading episode. However, the purchase decision is exogenously given in many of the models where the agent is simply assumed to buy the asset again immediately after a sale. These cited papers on realisation utility models all feature transaction costs which are required to make the problems well posed. As a result, the purchase pattern is not entirely realistic: If the agent is willing to sell an asset and then instantaneously repurchase an identical (or a different, but statistically identical) asset, then the agent is essentially throwing away money in the form of transaction costs without altering his own financial position. Only He and Yang [ 8 ] carefully analyse the purchase decision of the agent, but in any case they find that the purchase strategy is trivial—the agent either buys the asset immediately after a sale or never enters the trade again. Our model differs from the realisation utility model in that we do not consider perpetual reinvestment opportunities (which can be understood as narrow framing that the agent only focuses on a single episode of the trading experience when evaluating the entry and exit strategies). Nonetheless, the optimal purchase region of our model is non-trivial under typical parameters and encapsulates many realistic trading strategies.

Beyond the context of behavioural economics, there are a few works attempting to model the sequential purchase and sale decisions under an optimal switching framework. However, identification of a modelling setup which can generate reasonable trading patterns proves to be much more difficult than expected. On the one hand, Zervos et al. [ 29 ] report that “… the prime example of an asset price process, namely, the geometric Brownian motion, does not allow optimal buying and selling strategies that have a sequential nature”. Indeed, existing literature which gives “buy low, sell high” as an optimal trading strategy often relies on extra statistical features of the asset price process such as mean reversion. See for example Zhang and Zhang [ 30 ], Song et al. [ 25 ], Leung et al. [ 20 ] and Leung and Li [ 19 ]. On the other hand, momentum-based trading strategies are also rarely studied in the mathematical finance literature. The scarce examples include the work of Dai et al. [ 5 ] and Dai et al. [ 4 ] who find that a trend-following strategy is optimal under a regime-switching model for the asset price. We contribute to this strand of literature by showing that a trading model based on a simple geometric Brownian motion can also generate many realistic trading patterns including both a reversal strategy (buy low, sell high) and a momentum strategy (buy high, sell higher). This is achieved via incorporating standard elements of behavioural preferences and market frictions.

The optimal investment rule in the classical Merton [ 23 , 24 ] portfolio selection problem can also be viewed as a buy low, sell high strategy: Since the agent keeps a constant fraction of wealth invested in the risky asset, extra units of risky asset are sold (purchased) when the price increases (falls), ceteris paribus. In our paper, we focus on a single indivisible asset and do not consider portfolio effects.

The rest of the paper is organised as follows. Section 2 provides a description of the model and the underlying optimisation problem. In Sect. 3 , we outline the solution methods to a standard optimal stopping problem and discuss heuristically how the solution to our sequential optimal stopping problem can be characterised via the idea of backward induction. The main results are collected in Sect. 4 . Some comparative statics results and their policy implications are discussed in Sect. 5 . Several extensions of the baseline model are discussed in Sect. 6 . Section 7 concludes. A few technical proofs are deferred to the Appendix .

2 Problem description

Let \((\Omega , \mathcal{F}, (\mathcal{F}_{t}),\mathbb{P})\) be a filtered probability space satisfying the usual conditions and supporting a one-dimensional Brownian motion \(B=(B_{t})_{t\geq 0}\) . There is a single indivisible risky asset in the economy. Its price process \(P=(P_{t})_{t\geq 0}\) is modelled by a one-dimensional diffusion with state space \(\mathcal{J}\subseteq \mathbb{R}_{+}\) and dynamics of

where \(\mu :\mathcal{J}\to \mathbb{R}\) and \(\sigma :\mathcal{J}\to (0,\infty )\) are Borel functions. We assume that \(\mathcal{J}\) is an interval with endpoints \(0\leq a_{\mathcal{J}}< b_{\mathcal{J}}\leq \infty \) and that \(P\) is regular in \((a_{\mathcal{J}},b_{\mathcal{J}})\) , i.e., for any \(p,y\in (a_{\mathcal{J}},b_{\mathcal{J}})\) , we have \(\mathbb{P}[\tau _{y}<\infty |P_{0}=p]>0\) , where \(\tau _{y}:= \inf \{t\geq 0: P_{t}=y\}\) .

We assume that the interest rate is zero in our exposition. For the non-zero interest rate case, one can interpret the process \(P\) as the numéraire-adjusted price of the asset. Then the drift term \(\mu (\,\cdot \,)\) can be viewed as the instantaneous excess return of the risky asset.

Trading in the asset is costly. If the agent wants to purchase the asset at its current price \(p\) , he will need to pay \(\lambda p + \Psi \) to initiate the trade, where \(\lambda \in [1,\infty )\) so that \(\lambda - 1\) represents the proportional transaction cost on purchases and \(\Psi \geq 0\) represents a fixed market entry fee. When the agent sells the asset at price \(p\) , he will only receive \(\gamma p\) , where \(\gamma \in (0,1]\) so that \(1-\gamma \) represents the proportional transaction cost on sales.

The preference of the agent is described by the prospect theory of Tversky and Kahneman [ 27 ]. Under this framework, utility is derived from gains and losses relative to some reference point rather than from the total wealth. Individuals are typically risk-averse over the domain of gains and risk-seeking over the domain of losses. This can be captured by an S-shaped utility function \(U:\mathbb{R}\to \mathbb{R}\) with \(U(0)=0\) and such that \(U\) is concave (resp. convex) over \(\mathbb{R}_{+}\) (resp. \(\mathbb{R}_{-}\) ). Finally, individuals also exhibit loss-aversion so that the negative utility increment brought by a unit of loss is much larger in magnitude than the positive utility increment from a unit of gain.

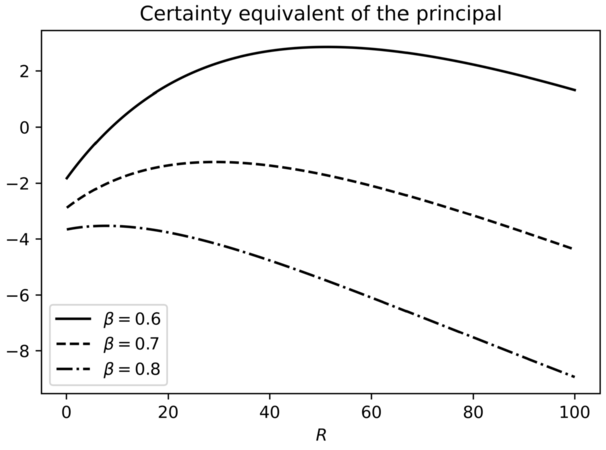

In the behavioural optimal liquidation literature such as Kyle et al. [ 18 ] and Henderson [ 9 ], the liquidation payoff is always compared against some exogenously given constant reference point. In our setup, we assume the reference point depends on both an exogenous constant \(R\) as well as on the amount paid by the agent to purchase the asset. Suppose the agent has executed a speculative round-trip trade where he has bought and then sold the asset at stopping times \(\tau \) and \(\nu \) (with \(\tau \leq \nu \) ), respectively. The liquidation payoff \(\gamma P_{\nu}\) is evaluated against \(\lambda P_{\tau}+\Psi +R\) as the reference point, where \(\lambda P_{\tau}+\Psi \) is the capital spent on purchasing the asset and \(R\) is a constant outside the model specification. The parameter \(R\) can be interpreted as a preference parameter of the agent which reflects his “aspiration level” in the sense of Lopes and Oden [ 21 ], where a more motivated agent will set a higher economic benchmark as a profit target to beat. The realised utility of this round-trip trade is \(U(\gamma P_{\nu}-\lambda P_{\tau}-\Psi -R)\) .

A caveat, however, is that the agent is not obliged to enter or exit the trade at all if it is undesirable to do so. A realisation of \(\tau =\infty \) refers to the case that the purchase decision is deferred indefinitely, which is economically equivalent to not entering the trade at all. The liquidation value is zero because there is nothing to be sold, and the reference point becomes \(R\) since the required cash outflow \(\lambda P_{\tau}+\Psi \) for the purchase has never materialised. Thus the prospect theory value under this strategy is simply \(U(-R)\) . Similarly, the agent may enter the trade at some time point but never liquidate the asset. This corresponds to a realisation of \(\tau <\infty \) and \(\nu =\infty \) . In this case, the liquidation value is again zero and evaluated against the reference point \(\lambda P_{\tau}+\Psi +R\) . To summarise all the possibilities, the realised prospect theory utility associated with a trading strategy \((\tau ,\nu )\) is written as

The objective of the agent is to find the optimal purchase time \(\tau \) and sale time \(\nu \) to maximise the expected value of ( 2.1 ). Define the objective function as

Formally, the agent is solving the sequential optimal stopping problem

where \(\mathcal{T}\) is the set of \((\mathcal{F}_{t})\) -stopping times valued in \(\mathbb{R}_{+}\cup \{+\infty \}\) . Problem ( 2.3 ) has two features which make it non-standard relative to a typical optimal stopping problem. First, the decision space is two-dimensional. Second, the objective function has an explicit dependence on the stopping times \(\tau ,\nu \) via the indicator functions, which further complicates the analysis.

Similarly to Henderson [ 9 ], Xu and Zhou [ 28 ] and Henderson et al. [ 10 ], we do not explicitly consider subjective discounting in our baseline model. On the one hand, our model features cash flows at different time points and it is not entirely clear what is the most appropriate way to apply subjective discounting, because the standard prospect theory framework is not directly applicable to intertemporal choices. On the other hand, under discounting, an impatient agent is much more inclined to delay losses and to realise profits earlier, which will lead to an extreme disposition effect which is not consistent with the empirical trading pattern of retail investors; see the discussion in Henderson [ 9 ]. At a mathematical level, introducing subjective discounting also makes our problem harder to be analysed in full generality. We briefly discuss in Sect. 6.2 how subjective discounting might be incorporated and explore (numerically in some cases) how it affects the optimal trading behaviour.

3 The solution methods

In this section, we give an overview of how problem ( 2.3 ) can be solved. We begin by offering a short summary about the solution approach to solve a standard optimal stopping problem for a one-dimensional diffusion.

3.1 The martingale method for optimal stopping problems

We review the martingale method to solve an undiscounted optimal stopping problem; this is based on Dayanik and Karatzas [ 6 ].

Consider a general problem in the form of

for some payoff function \(G\) . In the standard theory of optimal stopping, the optimal stopping time can be characterised as the first exit time of the process from some open set \(\mathcal{C}\) , so that \(\tau =\inf \{t\geq 0: P_{t}\notin C\}\) . In a one-dimensional diffusion setting, it is sufficient to consider stopping times which have the form \(\tau _{a,b}:= \tau _{a} \wedge \tau _{b}\) , where \(\tau _{a}:= \inf \{t\geq 0: P_{t}=a\}\) and \(\tau _{b}:= \inf \{t\geq 0: P_{t}=b\}\) with \(a\leq p\leq b\) . Here \([a,b]\subseteq \mathcal{J}\) is an unknown interval to be identified (and it depends on \(p\) in general).

Let \(s(\,\cdot \,)\) be the scale function of the process \(P\) (it is unique up to an affine transformation), defined as a strictly increasing function such that \(\Theta :=s(P)\) is a local martingale. A simple application of Itô’s lemma shows that \(s(\,\cdot \,)\) should solve the second order differential equation

Let \(\theta :=s(p)\) . Then

where \(\phi :=G\circ s^{-1}\) . The above can be maximised with respect to \(a\) and \(b\) . Moreover, the dummy variables \(a\) and \(b\) can be replaced by \(a'=s(a)\) and \(b'=s(b)\) . Hence

and thus \(V(p)=v(s(p))\) . The scaled value function \(v(\theta )\) can be characterised as the smallest concave majorant of \(\phi (\theta )=G(s^{-1}(\theta ))\) , the scaled payoff function over \(s(\mathcal{J})\) , which is defined as an interval with endpoints \(s(a_{\mathcal{J}})\) and \(s(b_{\mathcal{J}})\) . The continuation and stopping set associated with the optimal stopping rule are given by \(\mathcal{C}=\{p\in \mathcal{J}:v(s(p))>\phi (s(p))\}\) and \(\mathcal{S}=\{p\in \mathcal{J}:v(s(p))=\phi (s(p))\}\) , respectively.

3.2 Decomposition of the sequential optimal stopping problem

In the following two subsections, we discuss heuristically how the value function of ( 2.3 ) can be constructed by considering two sub-problems based on the idea of backward induction. The wellposedness conditions as well as a formal verification of optimality are explored in Sect. 4 when we specialise the modelling setup.

3.2.1 Exit problem

Suppose for the moment that the agent has already purchased the asset at some known price level \(q\) via paying \(\lambda q+\Psi \) at some time in the past. Conditionally on this information, the reference point has been fixed at the known constant level \(H:=\lambda q + \Psi +R\) . Suppose the current time is labelled as \(t=0\) and the current price of the asset is \(P_{0}=p\) . The goal of the agent in the exit problem is to find the optimal time to sell this owned asset to maximise the expected prospect theory value of the sale proceeds relative to the reference point \(H\) . If the asset is (ever) sold at time \(\nu \) , the utility of gain and loss relative to the reference point is U ( γ P ν 1 { ν < ∞ } − H ) after taking the transaction cost on a sale into account. Since the realised utility is increasing in \(P_{\nu}\) and the process \(P\) is nonnegative, there is in general no incentive for the agent to forgo the sale opportunity. Hence heuristically, one can drop the indicator function 1 { ν < ∞ } and it is sufficient to consider the objective function \(G_{1}(P_{\nu};H):=U(\gamma P_{\nu}-H)\) . The agent then solves the optimal stopping problem

to determine the optimal time of the asset sale. The value function of the exit problem is then given by \(V_{1}(p; H)=\bar{g}_{1}(s(p); H)\) , where \(\bar{g}_{1}=\bar{g}_{1}(\theta ;H)\) is the smallest concave majorant of

We write the optimiser to problem ( 3.2 ) as \(\nu ^{*}(p;H)\) ; it depends on the initial price level \(p\) and the given reference point \(H\) .

3.2.2 Entry problem

Now we assume the agent does not own any asset to begin with. His objective is to determine the optimal time to purchase (and then to sell) the asset to maximise the expected utility of the liquidation proceeds relative to the endogenised reference point.

At a given current asset price level \(p\) , there are two possible actions for the agent. First, he can opt to initiate the speculative trade by buying the asset now, which fixes the reference point as \(\lambda p+\Psi +R\) , and then sell it later in the future. When the asset is liquidated at his choice of the sale time \(\nu \) , the realised utility is \(U(\gamma P_{\nu}-\lambda p-\Psi -R)\) . Conditionally on the decision to purchase the asset today at price \(p\) , the agent can find the best time of sale to maximise his expected utility by solving problem ( 3.2 ) for \(H=\lambda p + \Psi +R\) . Then the best possible expected utility he can attain is

provided that he decides to enter the trade at the given price of \(p\) .

Alternatively, the agent can forgo the opportunity to enter the trade and stay away from the market forever. In this case, the payoff is zero and the reference point is simply equal to \(R\) . The utility he will receive is just the constant \(U(-R)\) .

Therefore, the opportunity to enter the speculative trade can be viewed as a real option. At a given price level \(p\) , the agent is willing to enter the trade only if the maximal expected utility of trading is not less than that of inaction, i.e., if

This is similar to a financial option being in the money. The payoff of this real option to the agent in utility terms as a function of the price level \(p\) is given by

The entry problem for the agent is to find the optimal time to initiate the trade so as to maximise the expected value of ( 3.3 ). This is equivalent to solving

if the exit problem value function \(V_{1}\) is well defined. We identify \(\bar{g}_{2}=\bar{g}_{2}(\theta )\) as the smallest concave majorant of

Then the value function of the entry problem is \(V_{2}(p)=\bar{g}_{2}(s(p))\) .

Let the optimiser to ( 3.4 ) be \(\tau ^{*}(p)\) . With \(p\) being the initial price of the asset at \(t= 0\) , the agent will purchase the asset at the time \(t=\tau ^{*}(p)\) . Then conditionally on the realisation of the entry price level \(P_{\tau ^{*}(p)}\) , the agent solves the exit problem ( 3.2 ) with initial value \(P_{\tau ^{*}(p)}\) and reference point \(H=\lambda P_{\tau ^{*}(p)}+ \Psi +R\) . The corresponding optimiser is given by \(\nu ^{*}(P_{\tau ^{*}(p)};\lambda P_{\tau ^{*}(p)}+ \Psi +R)\) and reflects the time lapse between the initiation and closure of the trade. In particular, the agent will sell the asset at the time \(t=\tau ^{*}(p)+\nu ^{*}(P_{\tau ^{*}(p)};\lambda P_{\tau ^{*}(p)}+ \Psi +R)\) . This gives a complete characterisation of the optimal entry and exit strategy of the agent. Note that it is possible to have \(\mathbb{P}[\tau ^{*}(p)<\infty ]<1\) . In other words, there is a possibility that the entry strategy is not executed in finite time, and hence there is no decision to sell (see the discussion in Sect. 4 ).

Intuitively, we expect \(\mathcal{V}(p)=V_{2}(p)\) , where \(\mathcal{V}\) is the value function of the original sequential optimal stopping problem ( 2.3 ). This must be verified formally. Without any further specifications of the utility function \(U\) and the underlying price process \(P\) , however, it is hard to make further progress. For example, it is not even clear upfront whether ( 2.3 ) is a well-posed problem with a finite value function.

4 Main results

The procedures described in Sect. 3 are very generic and can guide us to write down a candidate for the value function of the sequential optimal stopping problem under a range of model specifications. To derive stronger analytical results, we specialise in the rest of this paper to the piecewise power utility function of Tversky and Kahneman [ 27 ] in the form

Here \(\alpha \in (0,1)\) so that \(1-\alpha \) is the level of risk-aversion and risk-seeking on the domains of gains and losses, and \(k>1\) controls the degree of loss-aversion. Experimental results in [ 27 ] give estimates of \(\alpha =0.88\) and \(k=2.25\) .

The price process of the risky asset \(P=(P_{t})_{t\geq 0}\) is assumed to be a geometric Brownian motion,

with \(\mu \geq 0\) and \(\sigma >0\) being the constant drift and volatility of the asset. Define \(\beta :=1-\frac{2\mu}{\sigma ^{2}}\leq 1\) . Then by substituting \(\mu (p)=\mu p\) and \(\sigma (p)=\sigma p\) in ( 3.1 ), the scale function of \(P\) can be found as

Finally, we assume \(R>0\) so that the aspiration level of the agent is always positive. This is not unreasonable since this parameter can be understood as some performance benchmark that an agent wants to outperform, and such a goal is typically positive.

We begin with a necessary condition under which ( 2.3 ) is well posed.

If \(\beta \leq 0\) or \(0<\beta <\alpha \) , then there exists a sequence of stopping times \((\tau _{n},\nu _{n})_{n=1,2,\dots }\) such that \(J(p;\tau _{n},\nu _{n})\to +\infty \) as \(n \to \infty \) , where \(J(p;\,\cdot \,,\,\cdot \,)\) is defined in ( 2.2 ).

Consider the sequence of stopping times defined by

If \(\beta \leq 0\) , then

so that the Brownian motion in the exponent has nonnegative drift. Hence \(P\) can reach any positive level in finite time, and so \(\nu _{n}<\infty \) and \(P_{\nu _{n}}=n\) , almost surely. Hence

as \(n\to \infty \) .

If \(\beta >0\) , then instead \(P\) cannot reach any arbitrary level above its starting value in finite time and we have \(\lim _{t\to \infty}P_{t}=0\) almost surely. Then \(\{v_{n}< \infty \}=\{P_{\nu _{n}}=n\}\) , and for sufficiently large \(n>p\) , one can compute that

as \(n\to \infty \) if \(\beta <\alpha \) . □

Mathematically speaking, the sequential optimal stopping problem ( 2.3 ) is ill posed under the parameter combination in Lemma 4.1 , and its value function diverges to infinity. This arises when the performance of the asset is too good relative to the agent’s risk-aversion level over gains. Equation ( 4.1 ) corresponds to a “buy and hold” trading rule as a possible optimal strategy: the agent purchases the asset immediately from the outset, and the profit-target level of sale can be set arbitrarily high.

Empirically, historical returns on equities are excessively high relative to their risk level. For example, the annualised mean and standard deviation of the equity premium (i.e., excess return above the risk-free rate) of the U.S. market over the time period 1889–1978 are 6.18% and 16.67%, respectively (see Mehra and Prescott [ 22 ]), so that \(\beta =1-2\mu /\sigma \approx -3.45\) , while the estimates based on the more recent time period 1950–2015 are 7.15% and 16.83% (see Bai and Lu [ 1 ]) so that \(\beta \approx -4.05\) . Although this may cast doubt on the practical relevance of the condition \(0<\alpha \leq \beta \) (where buy and hold is an optimal strategy if the condition does not hold), we should like to emphasise that \(\beta \) in general is a noisy statistical quantity which is hard to forecast. In our model, \(\beta \) should be interpreted as the agent’s subjective assessment of the asset performance which can be much more conservative than the historical estimates. The parameter \(\mu \) may also encapsulate subjective discounting which further lowers its value; see Sect. 6.2 .

From here onwards , we focus on the case \(0<\alpha \leq \beta \) which is a necessary condition for ( 2.3 ) to be well posed. The form of the solutions to the exit problem ( 3.2 ) and entry problem ( 3.4 ) are first provided, and then we discuss the economic intuition behind the associated trading strategies. Towards the end of this section, the optimality of the value function of the entry problem is formally verified to show that it indeed corresponds to the solution of the sequential optimal stopping problem ( 2.3 ).

We first state the solution to the exit problem ( 3.2 ); a similar result can be found in Henderson [ 9 ].

For the exit problem ( 3.2 ), if \(0<\alpha \leq \beta \) , the agent will sell the asset when its price level first reaches \(\frac{cH}{\gamma}\) or above , where \(c>1\) is a constant given by the solution to the equation

The value function is given by

Recall the notation introduced in Sect. 3.2.1 . For \(\beta >0\) , the scaled payoff function of the exit problem is given by

It is straightforward to work out the derivatives of \(g_{1}\) as

Given the standing assumption \(\beta \leq 1\) and the condition \(0<\alpha \leq \beta \) , \(g_{1}\) is increasing concave for \(\theta >(\frac{H}{\gamma})^{\beta}\) and increasing convex for \(0\leq \theta <(\frac{H}{\gamma})^{\beta}\) . The smallest concave majorant of \(g_{1}\) can be formed by drawing a straight line from \((0,g_{1}(0))\) which touches \(g_{1}\) at some \(\theta ^{*}>(\frac{H}{\gamma})^{\beta}\) . In particular, \(\theta ^{*}\) is a solution to \(\frac{g_{1}(\theta )-g_{1}(0)}{\theta}=g_{1}'(\theta )\) for \(\theta >(\frac{H}{\gamma})^{\beta}\) , i.e.,

We conjecture that the solution has the form \(\theta ^{*}=c^{\beta }(\frac{H}{\gamma})^{\beta}\) for some constant \(c>1\) . Then direct substitution shows that the constant \(c\) should solve ( 4.2 ). The smallest concave majorant of \(g_{1}\) is then

The value function is given by \(V_{1}(p;H)=\bar{g}_{1}(s(p))=\bar{g}_{1}(p^{\beta})\) , leading to ( 4.3 ). The corresponding optimal stopping time is

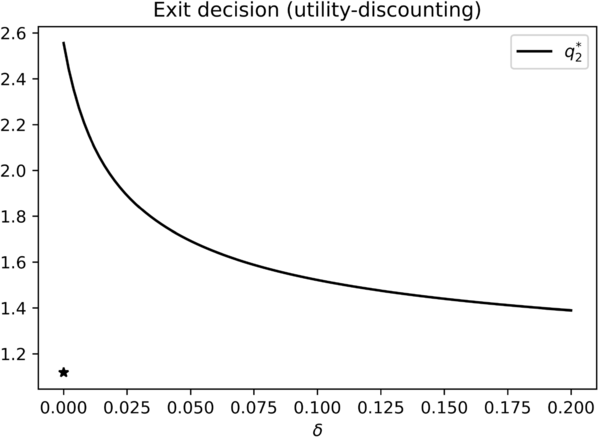

The optimal sale strategy is a gain-exit rule where the agent is looking to sell the asset when its price is sufficiently high without considering stop-loss. Note that the gain-exit target \(\frac{cH}{\gamma}\) is increasing in transaction costs (i.e., decreasing in \(\gamma \) ). This means that the agent tends to delay the sale decision in a more costly trading environment.