Guide to VAT refund for visitors to the EU

If you are a visitor to the EU and are about to leave EU territory to go home or to some other place outside the EU, you may be able to buy goods free of VAT.

"Tax-free" shopping: who is a ‘visitor’?

What is vat.

Value added tax (VAT) is a multi-stage sales tax, the final burden of which is borne by the private consumer. VAT at the appropriate rate will be included in the price you pay for the goods you purchase. As a visitor to the EU who is returning home or going on to another non-EU country, you may be eligible to buy goods free of VAT in special shops.

Who is a ‘visitor’?

A ‘visitor’ is any person who permanently or habitually lives in a country outside the EU. Your address as shown in your passport or other identity document will be taken as the place where you permanently or habitually live.

Example: Eduardo lives and works in Brazil but spends three months every summer in Portugal, where he has a time-share in a villa. Eduardo’s permanent address is in Brazil, so he is a ‘visitor’ to the EU while in Portugal.

In some countries, you may also qualify as a ‘visitor’ if you are living in an EU country for a defined period of time for a specific purpose, but your permanent home is outside the EU and you are not intending to return to the EU in the immediate future. EU citizens permanently living in non-EU countries are also eligible for the VAT refund.

Example: Paul is a Belgian citizen but lives permanently in Canada. Once a year, he returns to Belgium to visit his parents. Paul is a ‘visitor’ and can apply for a refund on a basis of his Canadian residence card.

‘Tax-free’ shopping: how is the VAT refunded?

Can’t i just pay the vat-free price in the shop.

No. You must pay the full, VAT-inclusive price for the goods in the shop; you will get the VAT refunded once you have complied with the formalities and can show proof of export.

How do I go about this?

- When you are in the shop, ask the shop assistant in advance whether they provide this service.

- Ask the shop assistant what threshold applies to the purchase in order to be eligible for a refund.

- At the check-out, the shop assistant will ask you to provide proof that you are a visitor to the EU. You will need to show your passport or other identity document proving your residence outside the EU.

- The shop assistant will ask you to fill in a form with the necessary details. You may be asked to show your ticket as proof you are leaving the EU within the required time. The shop assistant will fill in the shop’s part of the form.

- Make sure you understand exactly what you need to do and how you receive the refund. In some cases, the shop itself will refund you. In other cases, the shop will use a third party to organise the refunds on its behalf.

- Make sure you understand whether the shop takes an administrative fee for this service (which will be later deducted from the refunded amount) and if so what is the fee.

- You will receive an invoice for the goods. You must show the invoice, the refund form, the goods and any other necessary documents to the customs officers of the last EU country you leave. The customs officers must stamp the form as proof of export. Without the stamp, you will not obtain the refund.

- You must then follow the steps explained at your refund document or by the shop assistant. You can claim your VAT refund in bigger airports immediately, otherwise you will have to send the refund form to the address given in the shop.

Attention! The precise details will depend on how that particular shop organises the refund procedure.

Example: John came from the US for a vacation in Europe. He bought a designer bag in Paris; some clothes and shoes in Milan and Budapest. In each shop, he got refund forms filed. Within a month, John leaves to US from Budapest. At the airport, he shows the purchased goods to the customs officer and gets the refund documents stamped. Some of the refund documents were provided by a refund intermediary- he finds their refund counter in the airport and gets the refund immediately. An administrative cost is deducted from the refund amount. The remaining stamped refund document he has to send back to the shop where he purchased the goods.

Will I get all the VAT refunded?

This is unlikely. In the great majority of cases, there will be an administrative charge for the service. Make sure you find out how much you will be charged when still in the shop.

Can someone else go to the shop for me?

No. You must be there in person in order to make a VAT-free purchase, although you do not have to pay for the goods yourself.

Will I have to wait until I am home to receive the refund?

Not necessarily. In some larger ports and airports, you may be able to obtain a refund straight away once the customs officers have stamped your form, provided the shop in which you bought the goods uses this facility.

Where can I complain if I did not receive the refund?

You can complain to the company in which you bought the goods because this company has a principal responsibility to give the refund. If however that company used an intermediary you may first apply to the intermediary. European Commission does not intervene in particular cases of VAT refund to foreign visitors. ‘Tax-free shopping’: tax-free shops and qualifying goods

Can I buy goods VAT-free from any shop?

No. Shops do not have to offer a VAT-free facility. Those that choose to do so must make the appropriate arrangements with the tax authorities.

How shall I know whether a shop is a VAT-free shop?

The shop will usually display a prominent sign in the window, advertising that it is a ‘tax-free’ or ‘VAT-free’ shop. This may of course be in the local language.

Can all goods be bought VAT-free?

No. There are some goods that do not qualify. The facility is intended for goods that could in principle be carried in personal luggage. Goods that have to be exported as freight, for example, and cars and yachts are excluded. Some countries may also exclude other categories of goods.

Is there a threshold on each purchase?

To avoid administrative burdens over small-value items, there is a minimum value of EUR 175 (or the equivalent in national currency outside the euro zone) for the total purchase, but EU countries may set lower thresholds. The threshold applies to the total amount of goods bought in a certain shop. Normally, you cannot cumulate purchases in different shops to reach the threshold. You will receive a separate form in each shop in which you buy goods. You can enquire national tax authorities on the thresholds applicable in a particular EU country. You will be able to find the contact addresses for all national tax administrations in the document " VAT in the European Union ".

How soon do the goods have to leave the EU?

The goods you buy VAT-free must leave the EU by the end of the third month after that in which you buy them.

Example Bruce, who lives in Canada, has been on holiday in Italy for two weeks. He buys a designer suit from a VAT-free shop on 10 September. The suit must leave EU territory no later than 31 December.

Do I need to take the goods with me when I leave the EU?

Yes. The goods must accompany you when you leave the EU. You cannot buy VAT-free goods if for any reason, you cannot or do not wish to take the goods with you when leaving the EU. Moreover, you have to be ready to demonstrate those goods to the customs officer who will stamp your VAT refund form.

Do I have to leave the EU straight away from the country where I purchased goods?

No. You can buy VAT-free goods even if you are going to be visiting other EU countries before you finally return home, as long as you actually leave the EU with the goods within the time limit. You have to get your documents stamped by a customs officer at the point of exit of the EU – not necessary in the same EU country where you bought it.

Be careful if you leave the EU by train!

You may be able to get the VAT refund documents stamped at certain train stations of the departure. However, you might as well need to get off the train at the last station within the EU to get this stamp. Other methods could also apply (e.g. a customs officer might be boarding the train) .

This depends on the trains’ route and the internal arrangements in each EU country.

We therefore strongly advise you to consult in advance the national authorities or your refund company on the arrangements applicable in our concrete route.

What if I did not get a stamp?

In principle, the stamped VAT refund document is obligatory for VAT refund. Contact the entity in which you bought goods for the information whether they would accept other documents as a proof that the goods were exported in a due time and give you a refund.

Whom should I contact for questions related to my refund?

Your primary contact is the supplier / VAT refund agent mentioned in your VAT refund documents. If you have questions on VAT refund rules applicable in a particular EU country, contact national tax authorities . For questions on customs arrangements at a particular border, contact national customs authorities . The European Commission does not provide advice on particular situations.

Share this page

What are you looking for?

German vat refund.

Before you purchase any goods in Germany you should inform the retailer that you intend to export the goods to the United States of America . With your receipt you will receive a so-called “Ausfuhrbescheinigung” (export papers) or a Tax Free Shopping Check.

When leaving the European Union – through Germany only – the export papers or the Tax Free Shopping Check plus

- the original receipt of the store,

- the purchased goods (unused/unworn in its original packaging and with price tag),

- your passport showing residence outside the EU and

- the used flight tickets as proof of stay in Germany

have to be presented to the Customs Service at the airport (you must leave Germany on a non-stop flight to a country outside the EU ). The export papers will be stamped after the goods have been examined. As you do have to show the goods please make sure that they are in your carry on (your suitcases will already have been checked in!).

After having returned to the USA the stamped invoice should be sent back to the store in Germany where the merchandise was purchased. For the Tax Free Shopping Check you may be able to obtain a cash refund if they have an office at the airport. Otherwise the check should be sent to the address on the back of the Tax Free Shopping Check where you will find detailed instructions for the refund.

Certification by German diplomatic or consular mission (exception)

In very rare exceptional cases a certification by a German diplomatic or consular mission is possible. A plausible explanation has to be given in writing why it was not possible to receive the export stamp at the port of departure from Germany.

The same procedure as at the customs service applies:

- original receipt

- export papers or Tax Free Shopping Check

- purchased goods (unused/unworn in its original packaging and with price tag)

- and your passport together with proof of residency

have to be presented to a consular officer for inspection.

Please note that the certification can only be issued for goods purchased in Germany (for goods purchased in other EU member states please consult the respective Embassy/ Consulate).

Make sure to present the goods to the correct German mission. There are nine German missions in the United States. Each of them covers a specific geographic area. To find out which one can assist you, please use our Consulate Finder .

Please note, that one of the criteria to receive the tax exemption is that the article(s) must be exported before the end of the third calendar month following the month of the purchase.

If the purchased goods are presented to the competent German foreign mission later than that, the time of export has to be substantiated through appropriate documentation (e.g. airline ticket, entry stamp in your passport).

There is a fee of 34.07 Euro for the seal on each individual export paper. The fee is payable either in cash (equivalent in US-$ according to the daily exchange rate) or by internationally accepted credit card (card will be charged in Euro, additional charges by the credit card company may apply).

- Top of page

How to get your maximum VAT refund when traveling abroad

While a European vacation is undoubtedly an unforgettable experience, it can be expensive.

That's why savvy travelers have various strategies in place to save money on flights, hotels and rental cars (hopefully by reading some of TPG's great money-saving advice ).

One of the most overlooked ways travelers miss out on saving money is by forgetting to apply for a VAT refund.

VAT is a Value Added Tax . Let's say, for example, you just went on a shopping spree in Rome or splurged on gifts at the El Corte Ingles department store near Las Ramblas in Barcelona. You more than likely paid VAT on your purchases, but the good news is that visitors to the European Union can often get a refund on that tax. Think of it as the traveler's tax break.

Despite the obvious savings that can come with VAT refunds, the amount of money Americans leave on the table each year in unclaimed refunds is estimated to be in the billions. Don't be one of those travelers.

Getting your VAT refund is worth the time and effort it takes, especially if you're traveling within the EU .

The rules surrounding VAT refunds have somewhat changed in recent years, so it's important to read up on the latest rules (including the U.K.'s discontinuation of VAT refunds for international visitors since Brexit). Here's everything you need to know about getting your maximum VAT refund when traveling in Europe.

What is a VAT?

VATs and goods and services taxes (GSTs) are common worldwide; more than 160 countries have them.

In the EU, the VAT is similar to the sales taxes imposed in the U.S., but there are also some big differences. One of the biggest: VAT rates are much higher than those you pay in state and local sales taxes in the U.S.

The EU's minimum standard VAT rate is 15% — far more than the combined state and local sales tax rates you'll find anywhere in the U.S. However, the average standard VAT rate in the EU currently sits around 21%. All EU countries have standard VAT rates above the 15% threshold; Luxembourg has the lowest rate at 16%, and Hungary has the highest at 27%.

"The VAT is a major income revenue for the tax authorities in Europe," said Britta Eriksson, a VAT expert and CEO of Euro VAT Refund , a Los Angeles-based company that helps companies manage VAT in their overseas operations. "[VAT] represents almost as much as the income tax in terms of revenue for the government."

Many EU countries offer lower VAT rates on certain goods. Sweden, for example, has a standard VAT rate of 25%. However, for some food items, restaurant services and even hotels, a reduced VAT of 12% is offered.

France has reduced the VAT on certain agricultural products and even some cultural events to 5.5%. In other nations, items such as books, newspapers, and bike and shoe repairs receive a reduced VAT rate of only 6%.

As you can see, these "special rates" vary from country to country, so make sure you do your homework before your trip. The EU also exempts some goods and services from VAT; some exemptions include educational services, financial services and medical care.

What are the refund rules?

Prices in the EU always have the VAT included. If you're visiting an EU country, you'll generally have to pay the price of an item, VAT and all, and get your refund after the fact.

There are several requirements to follow to claim your refund. For instance, you must take your new item or items home within three months of the purchase. VAT refunds are not available for large items like cars. EU visitors also cannot get a VAT refund for services like hotel stays and meals.

Some countries require that your purchase exceeds a certain amount to be eligible for a VAT refund. Like the VAT rates, this minimum purchase amount varies from country to country.

For example, in France, the minimum amount is now 100.01 euros (about $107) for the total amount of purchases you buy on the same day in the same shop. In Belgium, the minimum is 50 euros (about $54); in Spain, there is no minimum purchase amount to claim a VAT refund.

One important thing to note is that you can only claim a VAT refund on new items. Your merchandise must be new and still in its packaging when you leave Europe. The goods can't be unpacked, consumed or worn. If you want to claim your refund, you should pack away whatever you purchase and wait until you get home to open it.

Getting your refund

Thousands of European stores do what they can to accommodate tourists seeking refunds and will usually have signs in the window reading "tax-free" or "VAT-free" shop.

As you pay for your item, inform the clerk that you're an EU visitor and intend to get a VAT refund. The store will have some paperwork for you to fill out. Have your passport ready to prove your visitor status. You may also need to show your airline ticket as proof you're leaving Europe in the allotted time in order to claim a VAT refund.

Some stores will refund your VAT, but in most cases, you'll likely have to take your refund forms and get your refund processed elsewhere.

Many stores work with third-party agencies, such as Global Blue or Planet , to process VAT refunds, and these agencies usually have facilities in major cities where you can take your completed forms and get your refund.

When purchasing your items, check to see if your merchant is partnered with these agencies.

On departure day, be sure to take your receipts, the refund forms the shops filled out, the items you bought and all your other travel documents with you to the airport so that you can present everything to customs.

If you're touring multiple EU countries during your trip, you'll complete this process at the last EU country you visit. That means if you visit France and Italy before ending your trip in Spain, you will apply for the VAT refund on your purchases in Spain.

Customs may inspect your purchases, so make sure they're available and not in your checked baggage. Also, make sure the goods are unused and unworn.

If all goes well, the customs office will stamp your refund forms. If either the store or one of the third-party refund agencies has already given you your refund, you'll have to mail this stamped form back to them to prove you left Europe within the mandated three-month period. Otherwise, you risk having your refund canceled and your credit card charged for the VAT you owe.

If you haven't done so already, you can also get your refund at the airport. The big refund agencies have facilities at all the major EU airports, sometimes at a currency exchange. Just show them your stamped customs forms and your passport to get your refund, minus a fee.

No VAT refund in the UK

Before we share some advice on getting your VAT refunds, we want to remind everyone that the U.K. no longer has VAT-free shopping for international tourists. In fact, Great Britain is now the only European country that doesn't offer the savings opportunity for international visitors.

The VAT retail export scheme was eliminated when the U.K. exited the EU in 2021. It resumed briefly before being axed, supposedly for good, in 2022.

Although there's some optimism that VAT refunds could return to Britain in the future — the U.K.'s tourism industry is lobbying for its return — it's not an option for now.

While VAT refunds are no longer available in England, Scotland and Wales, you can still claim refunds if you're visiting Northern Ireland. There are also several exceptions and rules to know; for example, it doesn't apply to services like hotel bills. You can find the list of restrictions here . You should also be aware that some merchants and refund companies in Northern Ireland charge a fee for using tax-free shopping. Still, if you're planning a visit, you could save some money on your shopping.

Tips for maximizing your savings with a VAT refund

Here are some do's and don'ts for getting your VAT refunds.

Research the country

Before your trip, look up the VAT rules for the country you're visiting and check the standard and reduced VAT rates, as well as the minimum purchase points.

As we mentioned earlier, the rates and rules of what qualifies for a VAT refund can vary depending on where you visit, so make sure you're aware before you get there.

Remember that many countries outside the EU also charge a VAT, and their refund policies can differ greatly from what you'll find in Europe.

Research the store

Stores aren't required to provide VAT refund assistance of any kind.

"If you have a store that doesn't have this program, then getting a refund is very complicated," Eriksson warned.

Keep an eye out for stores displaying "tax-free" or "VAT-free" signs. Ask the store employees which third-party agencies they partner with for refunds. Also, ask how they process refunds and what fees they charge. As we noted above, some retailers in some countries may charge a fee to visitors using tax-free shopping.

Allow extra airport time for your refunds

Don't expect to be the only traveler at the airport seeking a VAT refund before heading home. Expect to wait in line for a bit. Plan ahead and give yourself extra time at the airport, as the line can be long.

If you're strapped for time after leaving customs, some agencies will let you drop your stamped forms in one of their mailboxes, and they'll issue your refund later.

Consider shipping your purchases home to avoid VAT entirely

If you don't want to deal with any of this stuff, Eriksson suggests another option.

"You can also have the store ship [your items] to you directly," she said. "Then, they won't charge you VAT."

But there's a catch.

"You still have to pay for the freight," Erikkson added.

Shipping costs from Europe to anywhere in the U.S. can get wildly expensive. So, you have to weigh that shipping cost against the VAT and the time and effort it would take to get your refund to decide if it's worth it.

Make sure the refund is worth the trouble

"If you buy expensive clothing and china, then it's absolutely worth it," Eriksson said.

While many VAT countries have purchase minimums for refunds, in others, any purchase a visitor makes qualifies, no matter how small. So, you should ask yourself if it's worth applying for a VAT refund for that cheap tchotchke you bought as a souvenir.

Bottom line

All this talk of forms, looking for signs, standing in line and getting stamped can take the impulse out of your impulse buy. However, it could save you a lot of money in the long run.

If you pay attention and budget your time wisely, you might get back enough money through VAT refunds to help pay for your next visit across the Atlantic.

Related reading:

- When is the best time to book flights for the cheapest airfare?

- The best airline credit cards

- What exactly are airline miles, anyway?

- 6 real-life strategies you can use when your flight is canceled or delayed

- Maximize your airfare: The best credit cards for booking flights

- The best credit cards to reach elite status

- What are points and miles worth? TPG's monthly valuations

- Shop search

- Flight search

VAT Refunds

Tips on getting value-added tax refunded

If you don’t live in the EU, you can get a refund on the *value-added tax (VAT). The VAT is paid on purchases within the EU.

Information

Please Note:

VAT Refunds are only available on purchases of more than € 50. For further information please look at our download.

The following providers offer a tax refund service:

Global Blue

From May 4, 2023 Global Blue is located in Terminal 1, Departure Hall C, close to the Customs Export Station.

Website: www.globalblue.com

Email: [email protected]

Phone: +49 800 32 111 111

Get more information about the locations of Global Blue at Frankfurt Airport.

Website: www.travelex.de

Email: [email protected]

Phone: +49 69 348 738 70

Click here for further information about Travelex at Frankfurt Airport.

Planet Payment

From May 4, 2023 Planet Payment is located in Terminal 1, Departure Hall C, close to the Customs Export Station.

Website: www.planetpayment.com

Phone: +49 89 244 109 810

Get more information about Planet Payment .

The tax refund service of Reisebank is available at all six airport locations.

Website: www.reisebank.de

Email: [email protected]

Phone: +49 69 697 198 92

Here you will find everything you need to know about Reisebank at Frankfurt Airport.

This is how it works:

1. what you need for a tax refund.

- Get a tax free exemption form from the shop

- Fill it out completely (using the Latin alphabet)

Advice, information and assistance on VAT-free shopping is available at all stores at Frankfurt Airport. In the duty-free stores, prices are already reduced by VAT.

2a. Merchandise in checked luggage

- Inform the check-in staff of your airline about any merchandise and VAT refunds

- They will separately tag your bags and return them to you for presentation at the customs office

No bag tag - no tax refund

2b. Merchandise in hand luggage

- Go through the security check

3. Get a customs stamp

- Got to the customs office and allow enough time for the formalities

- Present your purchased items, your passport, the receipts and the completed forms

- The customs officer will stamp your voucher and have your luggage transferred to a belt within the customs area

4. Get the refund

- Go to a refund counter

- Present the completed and stamped tax exemption forms

- Get a cash refund (a small processing fee is already deducted)

For more information, visit zoll.de or call +49 351 44834 510

General information

* What is VAT?

All goods sold in Europe are subject to EU VAT. In Germany, the VAT is 7 or 19 percent. If your place of residence is outside the European Union (EU), you have the possibility to get this tax refunded when leaving the EU. For you as a passenger, this makes goods in Germany even cheaper.

- Attention: VAT Refunds are only available on purchases of more than € 50 294 KB (PDF)

You may also be interested in

Foreign VAT Refunds Guide from Germany

The following information details the requirements needed to be eligible for a VAT refund in Germany. These include claimable expense types, the Germany VAT rates and deadlines, as well as claiming periods.

What Expenses are Claimable for VAT Refund in Germany?

What are the germany vat rates.

Germany divides VAT rates into four categories:

Standard Rate - 19%

The standard rate, applied to most goods and services., reduced rate - 7%, there is a reduced rate of 7% that applies to certain goods and services, such as specific food items, books, and public transportation., zero rate - 0%, some specific goods and services, like exports and intra-community supplies, are subject to a 0% vat rate., there are also certain goods and services that are completely exempt from vat, such as health services and financial services., how to get vat refunds from the germany for your business, vat refunds guide for eu companies.

- Check Eligibility: The company should be established in the EU, but not in Germany.

- Gather Documentation: Compile all necessary invoices and documentation relating to VAT.

- Submit Application for Refund: You need to file your electronic application through the online portal of your home country's tax authorities. Your respective national tax authority will transfer your application to the German Federal Central Tax Office.

- Await Processing: The German Federal Central Tax Office will handle the VAT refund process.

VAT Refunds Guide for Non-EU Companies

- Check Eligibility: Companies must be based outside the EU without VAT registration in Germany.

- Gather Documentation: Gather necessary original invoices and documentation to support your VAT claim.

- Submit Application for Refund: Submit a written application for refund to the German Federal Central Tax Office. The application must be in German and must include the required documentation.

- Await Processing: Wait for the German Federal Central Tax Office to process your VAT refund.

Frequently Asked Questions About Germany VAT Recovery

September 30 for all EU countries and Jun 30 for Non-EU countries.

All EU countries and Non EU-Countries such as Andorra, Antigua, Barbuda, Australia, Bahamas, Bahrain, Bermudas, British Virgin Islands, Brunei Darussalam, Bosnia & Herzegovina, Canada, Cayman Islands, China(Taiwan), Gibraltar, Greenland, Grenada, Guernsey, Hong Kong, Iceland, Iran, Iraq, Israel, Jamaica, Japan, Jersey, Korea (People?s Rep), Korea(ROK), Kuwait, Lebanon, Liberia, Libya, Liechtenstein, Macao, Maldives, Marshal Islands, Macedonia, Norway, New Zealand, Oman, Qatar, Pakistan, St Vincent, San Marino, Saudi Arabia, Serbia, Solomon Islands, Swaziland, Switzerland, United Arab Emirates, the United Kingdom, United States of America, Vatican City.

January-December of the previous year.

It can take up to 6 months for EU companies and 10 months for Non-EU companies depending on complexity of the VAT claim.

Need Help with Your VAT Refund from Germany?

We have helped companies reclaim €200+ M in VAT refunds over the last eight years. Our expertise and technology allow us to process your refund quickly and automatically.

What are you looking for?

Under certain conditions, tourists can apply for a VAT refund for goods purchased in the European Union and exported to a country outside of the European Union within three months after the date of the purchase.

General Information

You would like to visit Germany and purchase souvenirs? Under certain circumstances the value-added tax you paid can be refunded to you. All goods purchased in Germany are subject to a value-added tax (VAT) of 19%. The VAT can be refunded if the merchandise is purchased and exported by a customer whose residence is outside the European Union. Please note that in order to qualify for tax-refund the merchandise has to be exported within three months of purchase.

What do I have to do in order to be eligible for VAT refund?

1. Before you purchase any goods in Germany you should inform the retailer that you wish to export the goods to Canada. Ask whether the company is willing to offer VAT refund. With your receipt you will receive a so-called “Ausfuhrbescheinigung” (export papers) or an application form, if a private service provider is handling the VAT refund for the retailer.

2. When leaving Germany the purchased goods have to be presented together with the export papers and your passport showing residence outside the EU to the customs service at the airport. The export papers will be stamped after the goods have been examined. As you have to present the goods please make sure that you complete the customs formalities before check-in.

3. After having returned to Canada the stamped export paper should be sent back to the store in Germany where the merchandise was purchased. In the case of some private VAT refund providers you may be able to obtain a cash refund if they have an office at the airport. If you used an application form by a private VAT refund provider please submit it to the address mentioned on the form.

Certification by the German Foreign Missions in exceptional cases only

You visited Germany and purchased souvenirs but did not obtain an export certification at the customs office? Only in exceptional cases a certification by the competent German Foreign Mission is possible. A plausible explanation has to be given why it was not possible to receive the export stamp at the port of departure from Germany.

The German Foreign Mission can only certify the export of goods if the following conditions apply:

• The goods were purchased in Germany and no other EU member state • you reside in Canada and you are not a permanent resident of Germany • the goods have been exported in the personal luggage of the buyer • you left Germany less than 3 months after purchasing the relevant goods • you were unable to obtain an export certification at the port of departure for reasons that are not your fault • the goods are intended for private, non-commercial use

In addition, you must present the following:

• the exported goods in their original packaging (unused/unworn and with price tags) • filled out and signed application form (please see download link below) • original receipt and export papers issued to you by the vendor • flight ticket in your name which serves as proof for the time of export • passport together with proof of your permanent residency in Canada (i.e. Canadian drivers licence)

There is a fee for each individual export paper . Please note that the fee is not refundable to you by German tax authorities. Consular fees

Please note that the certification can only be issued for goods purchased in Germany (for goods purchased in other EU member states please consult the respective consulate).

Download the tax refund form here (German language form)

Antrag auf erteilung einer ausfuhrbescheinigung durch die deutsche auslandsvertretung / form for the export approval at the german foreign mission, book an appointment with the consular section.

Please book an appointment for the consular services at the German Consulates in Toronto and Vancouver online in advance for services that require a personal appointment and cannot be done via mail.

Contact in consular matters

Please use this form to contact us in consular matters

- Top of page

Jump to navigation

- refund calculator

Refund calculator

After a Tax Free Shopping, you can possibly calculate your VAT reimbursement on the refund calculator. The refund calculator is updated regularly, but it may experience periodic deviations. Tax Free Germany assumes no liability over the full accuracy of the amounts and therefore no liability for any damage caused by the use of refund calculator. Thank you for your understanding.

- Privacy Policy Statement

Tax Free Germany GmbH * Im Birkes 13 * D-64859 Eppertshausen * Telefon: +49 6074 - 48 52 865

Official websites use .gov A .gov website belongs to an official government organization in the United States.

Secure .gov websites use HTTPS A lock ( A locked padlock ) or https:// means you’ve safely connected to the .gov website. Share sensitive information only on official, secure websites.

- Search ITA Search

German VAT Refunds

Vat refunds.

VAT Refunds: If you are a registered company, your business location is in the United States, and you are interested in applying for a VAT refund, you must electronically submit a VAT refund via the BZSt online portal (BOP) of the Federal Central Tax Office (BZSt).

An explanation of the application process can be found here: VAT Refund Information

For more detailed information as well as the application form (referred to as ‘Form: Registration with the BZSt Online Portal’ under the section ‘Form’) please visit: VAT refunds to foreign businesses

In case you would like to send applications via mail please use the following address:

Bundeszentralamt für Steuern Außenstelle Schwedt Passower Chaussee 3b D - 16303 Schwedt/Oder Email: [email protected] Phone: +49 228/406-0 Fax: +49 228/406 4722 http://www.steuerliches-info-center.de/EN http://www.bzst.de

For a quarter of the year (e.g. January-March) the VAT refund minimum is EUR 1000. For a complete calendar year the VAT refund minimum is EUR 500. A company with high quarterly expenditures might opt for the quarterly refund, companies with lower VAT cost might collect their bills for a year and then turn them in for a refund.

VAT refunds can also be recovered by using a service provider. Please review our directory of Business Service Providers .

What are you looking for?

General information on german vat refunds, certification by german diplomatic or consular mission (exception).

In Germany the amount paid for merchandise includes 19 % value added tax (VAT). The VAT can be refunded if the merchandise is purchased and exported by a customer whose residence is outside the European Union. Please note that in order to qualify for tax-refund the merchandise has to be exported within three months of purchase.

Before you purchase any goods in Germany you should inform the retailer that you intend to export the goods to the United Kingdom. With your receipt you will receive a so-called “Ausfuhrbescheinigung” (export papers) or a Tax Free Shopping Check.

When leaving the European Union – on a non-stop flight to the UK – the export papers or the Tax Free Shopping Check plus

- the original receipt of the store

- the purchased goods (unused/unworn in its original packaging and with price tag)

- and your passport showing residence outside the EU

have to be presented to the Customs Service at the airport. The export papers will be stamped after the goods have been examined. As you do have to show the goods, please make sure that they are in your carry on luggage (your suitcases will already have been checked in!).

After having returned to the UK the stamped invoice should be sent back to the store in Germany where the merchandise was purchased. For the Tax Free Shopping Check you may be able to obtain a cash refund if they have an office at the airport. Otherwise the check should be sent to the address on the back of the Tax Free Shopping Check where you will find detailed instructions for the refund.

In very rare exceptional cases , you might get the export papers certified by a German diplomatic or consular mission. A plausible explanation has to be given in writing why it was not possible to receive the export stamp at the port of departure from Germany.

If you believe that such an exceptional case applies to you, please check here if you live in the London or the Edinburgh consular district.

Then, please contact the relevant German mission so that we can check your request:

Contact form For applicants living in the London consular district please select the following topic: Embassy London: Certifications For applicants living in the Edinburgh consular district please select the following topic: Consulate General Edinburgh: All other enquiries

Please do not book an appointment before you receive a confirmation message from us.

- Top of page

Tax Return Germany 2023: All you need to Know

- Living in Germany , Settling in Germany

- July 12, 2023

Who has to file a tax return in Germany?

In Germany, the requirement to file a tax return is based on various factors. While it may not be the most enjoyable task, filing your tax return can be financially rewarding. If you’re new to this process or feeling apprehensive, take solace in the fact that nine out of ten people who file a tax return in Germany receive a refund from the government.

In many cases, individuals who voluntarily submit their tax return are likely to receive a refund, especially when using user-friendly tax programs that guide you through each step. These programs provide clear instructions, often available in simple language and partially in English, making the tax return process more manageable. Additionally, many tax software applications offer valuable tips on maximizing deductions and saving on taxes. With these resources, the annual tax return can become a less daunting task and even an opportunity for financial optimization.

It’s important to understand your specific circumstances to determine whether you are required to file a tax return in Germany. Factors such as your income level, marital status, and additional sources of income can influence your tax return obligations. Consulting with a tax professional or utilizing reliable tax software can help you navigate these requirements and ensure compliance with German tax regulations.

What is the income tax “Einkommenststeuer”?

Income tax, referred to as “Einkommensteuer” in Germany, is a crucial component of the country’s tax system. It is imposed by the government on individuals and is determined based on their annual earnings, taking into account factors such as marital status and family situation. The income tax system in Germany follows a progressive scale, meaning that higher income levels are subject to higher tax rates.

When you receive your income, your employer typically withholds a portion of it as income tax. This is done through the payroll system, ensuring that taxes are paid throughout the year. However, the exact amount of income tax you owe may need to be adjusted through an annual tax return. By filing a tax return, you can take advantage of deductions, allowances, and tax credits that may lower your taxable income and potentially result in a refund.

Navigating the complexities of the income tax system can be challenging, especially when considering various deductions and credits that may apply to your specific situation. Seeking professional advice or using tax software can help ensure accurate calculations and maximize your tax benefits. Remember, it is essential to fulfill your tax obligations and comply with the regulations set forth by the German tax authorities.

What is a tax class “Lohnsteuerklasse”?

All taxpayers in Germany, including foreigners living and working in the country, are assigned a tax class (Lohnsteuerklasse). The tax class determines the amount of income tax an individual is required to pay.

Tax Class 1: If you are single, permanently separated, or divorced, you belong to tax class 1. This tax class generally has the highest income tax rate, which is approximately 42% of your salary.

Tax Class 2: Tax class 2 is designed for single parents who live alone and apply for tax relief.

Tax Class 3: Married employees or those in a registered civil partnership can choose tax class 3 if one spouse earns significantly less or does not work. The other spouse or partner will then be assigned tax class 5. If both spouses have similar incomes, tax class 4 may be more beneficial.

Tax Class 4: Married couples and civil partners can opt for income splitting, where the higher-earning individual pays taxes at the rate of the lower-earning spouse/partner. This arrangement helps to reduce the overall tax burden for the couple.

Tax Class 5: Tax class 5 applies to professionals who are married or in a civil partnership, and their spouse or partner falls into tax class 3.

Tax Class 6: Tax class 6 is applicable to individuals who have a second job or multiple jobs.

Can I change my tax class in Germany?

Absolutely! If you experience significant life changes such as marriage, divorce, or starting a new job, you have the option to request a tax class change in Germany. If the tax office has incorrectly assigned you to a tax class, you can also request a change.

To initiate a tax class change, you simply need to complete an “Antrag auf Lohnsteuerklassenwechsel” (application for tax class change) form. The most convenient way to do this is by visiting your local tax office in person. It’s crucial to bring along all relevant certificates and documents to ensure accurate placement in the appropriate tax class from the beginning.

Can You Expect a Tax Refund in Germany?

Here are some common scenarios that may result in a tax refund:

- Commute: If your daily commute to work exceeds half an hour.

- Education : If you have undertaken further education or training courses during the tax year.

- Equipment: If you have purchased technical equipment, such as a computer, for work-related purposes.

- Marital Status: If you are married and fall into tax class III or IV.

- Self-Employment: If you have additional income from self-employment alongside your main job.

- Relocation: If you have moved for professional reasons during the tax year (especially relevant for expats).

If multiple factors apply to your situation, it is likely that filing a tax return will be beneficial for you. Using a tax refund calculator to estimate your potential refund is recommended. If you anticipate a substantial amount, it is advisable not to forgo this opportunity.

Can you do an Online Tax Return in Germany?

Yes, you can definitely do an online tax return in Germany. The German tax authorities provide an online platform called ELSTER (Elektronische Steuererklärung), which allows taxpayers to submit their tax returns electronically. ELSTER is free to use and offers a convenient and secure way to file your tax return from the comfort of your own home.

Advantages of Online Tax Return in Germany:

- Accelerated Process: Online tax returns allow for faster processing and turnaround times.

- Paperless Approach: Say goodbye to piles of paperwork as online tax returns eliminate the need for physical forms.

- Simplified Language: Tax returns can be prepared using user-friendly language, making it easier for individuals to understand and complete the process.

- Tax Saving Tips: Online tax programs often provide valuable tips and suggestions to help you maximize your tax savings.

- Instant Refund Forecasts: Get immediate estimates of your tax refund amount before submitting your return.

- Plausibility Checks: Many online platforms offer automated checks to ensure the accuracy and consistency of your tax return before submission.

- Secure Data Transmission: Your data is securely transmitted to the appropriate tax authority, protecting your personal information.

The downside:

- Cost of Tax Software: Some online tax programs require a fee or subscription. Additionally, certain programs may require installation and periodic updates.

While using online tax software may involve an additional investment compared to using free forms, it can be highly beneficial, especially for those unfamiliar with tax terminology. It not only speeds up the process but also makes it more enjoyable and rewarding, as these programs often identify potential areas for tax savings.

When is the deadline for the 2023 tax return?

The deadlines for filing income tax returns have undergone changes in recent years. Traditionally, the deadline for the previous year’s tax return was May 31, but due to the Corona Pandemic, adjustments have been made.

For the 2022 tax return, the deadline is now October 2, 2023, while for the 2023 tax return, the deadline is September 2, 2024. The filing deadline will then return to the regular schedule, with July 31, 2025, being the deadline for the 2024 tax year.

If you have a tax advisor, the deadlines are also extended. The deadline for the 2021 tax return is August 31, 2023, for the 2022 tax return it is July 31, 2024, and for the 2023 tax return, it is June 2, 2025. The normal filing deadline will apply again from 2025, requiring tax advisors to submit the 2025 tax declaration by Monday, March 1, 2027. It is important to be aware of these deadlines to ensure timely submission of your tax returns.

For whom is the voluntary submission of a tax return worthwhile?

Opting for a voluntary tax return in Germany can often be advantageous, as it opens up the possibility of receiving a refund for overpaid taxes. Several scenarios make a voluntary tax return worthwhile:

- High advertising costs, special fees, or specific charges were incurred.

- Expenses were made for household services, artisans, or household help.

- You commenced a new employment during the tax year.

- Your monthly salary varies.

- Your tax class changed within the tax year.

Moreover, a voluntary tax return proves beneficial even if the tax office demands an additional payment. By submitting a voluntary tax return and initiating an appeal procedure, you can contest the request and avoid making any payments. Overall, a voluntary tax return offers an opportunity to optimize your tax situation and potentially receive financial benefits.

Choosing the Right Approach: Tax Accountant, Income Tax Help Club, or Tax Software?

When it comes to preparing your tax return, you have several options to choose from. You can manually fill out the forms or use tax software to streamline the process. Alternatively, you may opt to enlist the services of a tax accountant. The choice depends on your specific needs and circumstances.

Engaging a tax consultant is recommended if you have a complex tax situation requiring expert guidance. They provide personalized assistance and can navigate intricate tax matters. However, it’s important to note that individual cases may incur additional costs.

For simpler tax returns, an income tax help club, such as the “Lohnsteuerhilfeverein,” can be a cost-effective option. They offer essential advice and professional assistance at a lower fee compared to a tax consultant.

Another approach is utilizing tax software, which is widely available at affordable prices. These programs provide support and guidance throughout the tax preparation process. With the right software, you can ensure accuracy and efficiency in organizing your tax return.

Ultimately, the best choice depends on your preferences and the complexity of your tax situation. Consider your specific needs and select the method that suits you best.

Related Posts

How to send money from Germany

- Louisa Anger

- July 27, 2023

- Living in Germany

How to get your Tax ID in Germany

- Moving to Germany , Settling in Germany

9 Facts about Banking and Money in Germany

- July 11, 2023

- Settling in Germany

Social Security in Germany: Social Benefits and State Aids

Moving to Germany: A Comprehensive Guide for Expats

- July 20, 2023

- Moving to Germany

How much does it cost to move to Germany ?

German tax refund – What I can claim to return. I-N

Last Updated on September 27, 2023

Futher with all German tax deductible expenses. Not forget: außergewöhnliche Belastungen (Exceptional costs) are deducted, if they over individual limit.

How to calculate the limit of außergewöhnliche Belastungen read here Other parts: A-D , E-H , P-W How to fill German income tax declaration – # steuererklaerung

German tax deductible expenses in this post: Insurance Internet, phone Kindergarten, nanny Language classes Maitntenance of relatives Medical treatment Moving change of housing Natural disaster

Notice that there is a limit, which is almost always or always chosen by compulsory insurance. Therefore, you cannot deduct much in this part. The following insurances can be deducted (mainly in Anlage Vorsorgeaufwand ):

- pension insurance (basic state insurance, fees in Versorgungswerk / Alterskassen, private insurance (Rürup-Vertrage)

up to 22,767 euros for singles and double the amount for families (from 2016, up to 80 percent)).

- loss of work insurance (Arbeitslosigkeitsversicherung),

- health insurance,

- care insurance,

- supplementary dental insurance,

- responsibility insurance (personal and automobile, Haftpflichtversicherung),

- disability insurance,

- accident insurance (not at work),

- travel health insurance,

- supplementary health insurance ,

- Krankentagegeld- / Krankenhaustagegeld-Versicherung,

- Life Insurance (Risikolebensversicherung),

- Kapitallebensversicherung (concluded before January 1, 2005),

- Sterbegeldversicherung.

Up to € 1.900 for employees and Beamte / up to € 2.800 for individual self-employees (doubled for married people).

Anlage Vorsorgeaufwand

- Riester-Vertrage (additional insurance)

up to 2,100 euros as Sonderausgaben (both – own investment and payments from government) – in Anlage AV.

Anlage Sonderausgaben

- insurance for work: against accidents (in part at work), responsibility, legal assistance – as Werbungskosten (Anlage N).

Werbungskosten in Anlage N

Not deducted

- legal assistance (in privat part, not for work’s conflicts – Privat- / Mietrechtsschutz- / Verkehrsrechtsschutzversicherung)

- property insurance (Hausratversicherung)

- full insurance for car

- individual pension insurance (with capital investment)

- life insurance with capital investment

- betriebliche Altersvorsorge (bAV) – already taken into account.

Internet, phone

May be deducted in part related to work. This means only if on your work is expected that you use a phone at home (for example teacher).

There are two ways to deduct.

- 20 percent of expenses monthly, but not more than 20 euros per month. Each month must be counted separately.

- You calculate the actual usage as a percentage. In this case, the write-off amount is not limited. And you can write off more types of expenses, for example, for repairs.

Read more about Werbungskosten in Anlage N

Kindergarten, nanny

Accepted up to two-thirds of the cost, but not more than 4 thousand per year per child. Condition – money is transfered only through account. Money in cash is not counted.

You can also deduct from taxes the refund of the cost of travel of the grandmother to the grandchildren (30 cents per kilometer). For this, it is advisable to conclude an agreement with the grandmother and transfer money to her through the bank.

Where: Anlage Kind , Page 3

Language classes

Integration courses can be deducted as außergewöhnliche Belastungen only if the courses were compulsory and not voluntary (and also not refunded by Arbeitsamt or Ausländeramt).

The cost of studying other (evening or intensive) German courses cannot be deducted, because although you need German for work, you also need it for personal purposes.

For other languages, courses fees can only be deducted if you can justify their need for the job. Business-specific courses are the easiest to subtract as they are only for work. Courses without specialization must be justified by references from work. The costs of learning a language abroad can also be written off. But it must be substantiate and has a schedule for your business trip, since in this case part of the trip is spent for personal purposes.

Language learning for work is counted in Werbungskosten in the amount not compensated by the employer.

Maitntenance of relatives

Deduction of maintenance costs is a complex topic that often leads to disputes with the tax authorities. If there is a significant amount, it is better to contact a specialist.

1. Maintenance of former spouses

1. as Sonderausgaben (up to 13805 euros per year)

- in the main part on page 2 (until 2019)

- in a separate application from 2019 + in Anlage U in part A.

The ex-spouse must agree to this option (put his signature in part B) and enter the amount received in his / her declaration in Anlage SO.

2. Or as außergewöhnliche Belastung en (if the spouse does not agree) – up to 9,000 euros per year, in the Anlage Unterhalt.

Expenses for the Kranken- and / or Pflegeversicherung of the former spouses can be deducted separately.

2. Maintenance of children

Up to € 9.000 can be deducted as außergewöhnliche Belastungen . This is possible only if none of the parents receives Kindergeld (that is, we are mainly talking about grown-up children). If a child earns more than 624 euros per year, his earnings over this amount are substracted from 9,000.

3. Maintenance of other relatives

These can be direct relatives (parents, grandparents – if their own children cannot support them), other relatives (if they live in your house and have refused benefits), as well as the mother of an extramarital child during pregnancy before going to work.

You can deduct up to € 8,652 per year (including hospital and nursing insurance costs). If a person has an income of more than 624 euros, the maximum deduction amount is reduced. A person with a capital of more than 15,500 euros (this amount does not include the house in which this person lives) does not need help, therefore, no help is deducted.

Helping parents living abroad requires careful documentation.

The maximum amount of assistance is limited:

- the month of the start of the assistance (the later in the calendar year you started paying, the less can be deducted, even if the amount of the one-time payment is large)

- the amount deducted for each month (it is better to make several small transfers than one large one)

- an estimate of the subsistence level in a particular country (there is a list of countries with amounts)

4. Keeping relatives in Pflegeheim

If a pensioner has to live in Pflegeheim for health reasons, his allowance can be partially deducted. But on condition that he receives less than 9.726 euros per year.

The amount deducted as Unterhaltung is: 9.000 / annual pension minus 102 Euro Werbungskostenpauschale, 180 Euro Kostenpauschale and 624 Euro Freigrenze

If the spending is higher, then it can be deducted as außergewöhnliche Belastung. But first, all income of the pensioner is substracted from them.

If a pensioner moves to Pflegeheim for age rather than health reasons, the deductions are even lower.

If a pensioner with Pflegegrad 4 or 5 is kept at home with relatives, a flat rate of 924 euros per year is deducted – that is the rule before 2021. From 2021 you can deduct as Pflegepauschalbetrag:

- for 2 grad – 600 euro

- for 3 grad – 1100 euro

- for 4 and 5 grad – 1800 euro

What else was changed from 2021 read here .

Medical treatment

You can deducted as außergewöhnliche Belastungen for example:

- Krankengymnastik

- speech therapist

- Herbal medicine (Pflanzenheilkunde)

- abortion (Schwangerschaftsabbruch)

- dental treatment

- addiction treatment (if there is a doctor’s prescription)

- stroller, prostheses, hearing aids (other aids, such as special beds), are written off when there is a report from the district doctor

- prescriptions for medicines you pay for yourself

Not taken into account if they are not recognized by Amtsarzt before starting treatment:

- not recognized by science methods

- water treatment

- psychotherapist

Many of these activities are called IGel (individuelle Gesundheitsleistungen). You can find in Internet, whether you really need them.

Moving (change of housing)

Moving not for work does not deducted in any way, with the exception of the cost of labor, if you hire a company to move – in haushaltsnahe Aufwendungen

About Anlage Haushaltshane Aufwendungen.

- find a new job in another city,

- or the boss transfers you to another city,

- or when you move, you save more than an hour of travel to work,

- or you move to a second apartment that you rented / bought so as not to go home every time,

than you can write off much more expenses as Werbungskosten .

Moving costs are divided into two groups.

General expenses:

- first trip to a new apartment

- hiring a company to move

- broker costs (not for purchase a haus)

- rent for old appartment (up to 6 months)

- tutor for a child (Nachhilfe) up to a certain amount (see for a specific year)

For general expenses, you need to collect all accounts. They are deducted in full.

Special expenses:

- newspaper ads

- phone connection

- new license plates for car

- fees for registration at a new place of residence

There is no need to collect checks for special expenses, you can use the Umzugskostenpauschale. The pauschal sum changes regularly, always see the current version for the year and even month you need (in 2020 it changed gradually several times). Widowers and single people with children are also considered married.

If this is not the first move for work in the last five years, then the amount doubles.

However, if you close or begin using the second working apartment with your move in this declaration, then you should not use the Umzugskostenpauschale.

Natural disaster

They can be included in the außergewöhnliche Belastungen , but each time by decision of the FA:

- cleaning the territory

- the acquisition of new things

All this applies to housing, but not, for example, a garage or a terrace.

You cannot deduct:

- if you are to blame for the damage

- if a third party is to blame (you must first demand from him)

- if there is property insurance (Gebäudeversicherung or Hausratversicherung)

- if the repair is started later than 3 years after the damage

Next – part 4 P-W Other post about german tax return – #steuererklaerung

All I can return from tax: A-D , E-H , I-N , P-W Anlage N Part 1 , Part 2 , Anlage N-Aus , Anlage Wa-Est, Homeoffice Anlage Kind Anlage Vorsorgeaufwand Anlage Sonderausgaben Anlage Haushaltnahe Diensleistungen 35a Who should file a tax return in Germany Pre-filled declaration in Elster How to calculate tax in Germany. What is written in Berechnung in Elster Freiberufler in Germany: how to fill in Anlage S and Fragebogen zur steuerlichen Erfassung

Do you enjoy the site without cookies and maybe without ads? This means that I work for you at my own expense. Perhaps you would like to support my work here . Or Cookie settings change: round sign bottom left

Leave a comment Cancel reply

Email is not compulsory

Save my name, email, and website in this browser for the next time I comment.

You need to load content from reCAPTCHA to submit the form. Please note that doing so will share data with third-party providers.

- How it works

- Try it out for free

- Expenses from Your Profession

Claim Travel Expenses on Your Tax Return

Travel expenses for professional-related commutes can be claimed as income-related expenses (Werbungskosten) on your tax return and help increase your chances of a tax refund. These expenses can include business trips, trips home in the case of double household management, or simply your daily commute to work – To learn more about deducting these on your tax return, keep reading this article!

Which travel expenses can be claimed?

Travel expenses incurred for professional reasons can be claimed on your tax return by entering the appropriate lump sums or flat rate and in some cases, these costs are fully deductible. These can be divided into 3 categories:

- Expenses for the commute from your residence to your primary workplace

- Travel costs from your secondary to primary residence in the case of double household management

- Travel costs for external activities & business trips

Traditional employees can deduct all of these costs as income-related expenses while freelancers/self-employed persons can claim their travel expenses as business expenses (Betriebsausgaben).

1. Your work commute

Primary profession: commuter allowance.

You can claim a commuter allowance (Entfernungs-/Pendlerpauschale) for the commutes between your residence and your primary profession . Primary profession refers to your main and permanent job. Freelancers can claim the commuter allowance for commutes to their first business location while students/trainees can claim it for commutes to their place of education.

The commuter allowance amounts to 30 cents per kilometer for the first 20 kilometers of one-way travel to or from your workplace, regardless of means of transportation or actual incurred expenses. That means this can be claimed whether you walk, ride a bike, drive a car, ride passenger, or take public transportation – just keep in mind that you can only claim one-way per working day. The tax office will only accept deductions for the shortest possible route (regardless of means of transport) and long detours would have to be justified, for example, if it’s more convenient and is a faster route (due to the shorter route having heavy traffic etc.).

Note: As of January 2021, the commuter allowance was increased to 35 cents from the 21st kilometer of one-way travel for long-distance commuters and from 2022 to 2026 it is increased again to 38 cents from the 21st kilometer of one-way travel.

Commuter allowance: Maximum limit

Generally, the tax office accepts a flat rate of 230 trips per year for a 5-day work week, and 280 trips for a 6-day work week. Commuter expenses can not be deducted for days spent home sick, on vacation, or working from home – days spent working from home can instead be claimed using the home office lump sum . A maximum of 4,500 euros per year can be deducted, unless you meet one of the following two exceptions :

- If you commute to work in your own personal or business vehicle and exceed 4,500 euros per year with the commuter allowance, the excess amount may be deducted.

- If you commute to work with public transportation and the costs exceed 4,500 euros per year, you can enter and claim the actual expenses on your tax return (not as a part of the commuter allowance).

If you meet either of these exceptions, hang on to your receipts as proof must be submitted upon the tax office’s request.

Commuter costs for multiple workplaces or professions

There can only be one primary workplace per profession, if you work at several locations they are considered external activity (Auswärtstätigkeit). Expenses for commuting to external activities can be reimbursed if you travel by public transport and the kilometer allowance (Kilometerpauschale) can be used if you travel by car. This applies to both the outward and return journey and amounts to 30 cents per kilometer.

If you have several professions , the commuter allowance can only be used for your primary profession if you travel between there and home on the same day. If you travel from workplace to workplace, the distances can be added, but then the commuter allowance can only be used for half of the total distance .

Mobility premium for long-distance commuters

As of 2021, long-distance commuters with a daily commute of 21 kilometers or more can apply for the new mobility premium (Mobilitätsprämie). In order to apply, your taxable income must not exceed the basic tax-free allowance (Grundfreibetrag) of 9,744 euros (as of 2021). The bonus is based on the 2021 commuter allowance increase and will remain valid until 2026. If eligible, you can apply for this premium directly on your tax return and receive it directly to your bank account. The premium grants a bonus of 14% to the already increased commuter allowance from the 21st kilometer of one-way travel to work and the assessment basis for the premium varies upon the difference between your annual taxable income and the basic tax-free allowance.

2. Commutes to your main residence with two households

Many employees manage two households for professional purposes and shorter commutes to the office, leading to common trips between their primary and secondary residences. One trip per week (or a total of 46 per calendar year) back to your primary residence can be deducted using the commuter allowance regardless of means of transportation. The same rules apply: either the outward or return journey can be deducted. The allowance can be deducted even if no costs were incurred from the trip, such as if you were given a ride.

In order to be eligible to deduct costs for double household management , your “life core” must take place at your primary residence, where you regularly stay and contribute at least 10% of the costs. It is not a prerequisite to have a spouse, partner, or child(ren) living at your primary residence.

The commuter allowance increase to 35 cents (2021) / 38 cents (2022) from the 21st kilometer also applies to trips home to your primary residence to see your family. Note: The maximum of 4,500 euros per year doesn’t apply to family trips home.

If you travel with public transportation and the costs exceed the benefits from the commuter allowance, you can instead deduct those costs individually on your tax return. If you fly home, you can only claim the price of the plane ticket.

Note: Weekly trips to your primary residence cannot be deducted if made with a company car. No tax must be paid on the first trip home with a company car as a non-cash benefit (geldwerter Vorteil), but it must be taxed from the second trip onwards.

3. Costs for business trips

Employers often pay for business trip expenses out of their own pocket – whether it be field service, further education, or visits to a trade fair. If the costs aren’t covered by your employer, it’s definitely worthwhile to claim them on your tax return. Means of transport are irrelevant unless you’ve traveled in a company car , which is not tax-deductible.

Expenses for travel by public transport, ship, or airplane are all reimbursed based on the lowest class available. Train journeys exceeding two hours in the next higher class can be reimbursed.

If you traveled by car, you can either determine the actual incurred costs and claim them or use the kilometer allowance (Kilometerpauschale). Unlike the commuter allowance, the kilometer allowance can be applied to both the outward and return journey .

Per kilometer traveled, the kilometer allowance amounts to:

- 30 cents for trips by car

- 20 cents for trips by motorcycle, scooter, moped, or e-bike

Tip: If your business trip away from home and your workplace exceeds 8 hours, you can claim a flat rate of 14 euros for room and board as well as meals (Verpflegungsmehraufwand). If the trip exceeds 24 hours, you can claim a flat rate of 28 euros.

Please note: The portion of travel expenses covered by your employer can no longer be included in your tax return. You can alternatively declare the costs in full if you also claim the employer subsidies for your travel costs.

Is it worth it for you to file a tax return?

Related articles.

- Tax Forms for your 2021 Tax Return

- What exactly is double household maintenance?

- How to Deduct Bahncard from Tax with Travel Expenses

- NETHERLANDS

- SWITZERLAND

Expat Info News

Tourists could soon be charged “overnight tax” in more German cities

The German Federal Constitutional Court recently ruled that hotels are obliged to collect Bettensteuern (bed taxes) on behalf of local authorities. This could lead to more municipalities charging “tourist taxes”.

Germany’s tourist taxes

In Germany, local taxes known as Bettensteuern , or bed taxes, have been in place since 2005. Visitors staying in cities with these taxes are obliged to pay if they are staying in paid accommodation overnight, which is usually a percentage of the overnight cost per guest. The percentage is typically 5 percent and is normally added automatically to the bill. In some places, a fixed rate is paid, for example, 3 euros per guest per night. In some cities, such as Hamburg , the tax is based on a sliding scale, so guests staying in more expensive accommodation pay more tax.

The tax is levied by German cities and municipalities due to the reduced VAT tax rate. Since 2010, hotel accommodation has been subject to the reduced tax rate of 7 percent, rather than the regular rate of 19 percent. In response, some municipalities and local authorities started introducing “overnight taxes”. The taxes are known by different names in different cities and districts, such as “tourist tax”, “lodging tax” or “city tax”. Berlin , for example, introduced its “hotel occupancy tax” in 2014.

The tax is only levied on tourists, as a ruling by the Federal Administrative Court in 2012 stipulated that all “professionally compulsory” overnight stays were exempt from the tax nationwide.

Court rules that “tourist taxes” are compatible with Basic Law

The Bettensteuern are collected by hotels on behalf of the municipalities. Recently, a number of hotel owners in Hamburg, Freiburg and Bremen complained to the Federal Constitutional Court that their basic rights were being infringed upon by being obligated to collect the taxes from their own guests. They also complained that collecting the taxes involved too much admin work, as the tax is only applied to leisure travellers, not people on business trips.

The court ruled that the Bettensteuern are compatible with Basic Law. It also stated that it was not practical for state authorities to collect the tax, meaning that hotel operators are obliged to collect it on their behalf. The court did acknowledge the extra work that this meant for hotels but likened this work to other obligatory tasks for entrepreneurs , like filling out registration forms or paying VAT .

It has been suggested that the court’s ruling could lead to more cities and districts in Germany charging overnight taxes to tourists. The court also made no distinction between people travelling for business or leisure, leading some to speculate that all overnight guests could be subject to the tax in the future.

WE HAVE MORE NEWS FOR YOU!

Subscribe to our weekly newsletter

By clicking subscribe, you agree that we may process your information in accordance with our privacy policy. For more information, please visit this page .

William Nehra

William studied a masters in Classics at the University of Amsterdam. He is a big fan of Ancient History and football, particularly his beloved Watford FC.

JOIN THE CONVERSATION (0)

Leave a comment

What are you looking for?

German customs and tax refund, german customs, tax refund from germany.

German Customs Infocenter (Zoll-Infocenter) Information and Knowledge Management Section of the German Customs Administration Central Information Unit Carusufer 3-5 01099 Dresden Inquiries in English: Tel.: 011 49 351/44834-530 Fax: 011 49 351/44834-590 [email protected] Monday-Friday 08:00-17:00 h (MEZ)

Website of the German Customs Infocenter (English Version)

Information for frequently asked questions can be found on the following websites:

Travelling with medicines Travelling with cash money

VAT can be refunded if the merchandise is purchased and exported by a customer whose residence is outside the European Union.

How to get a tax refund from Germany

In Germany the amount paid for merchandise includes 19 % value added tax (VAT). The VAT can be refunded if the merchandise is purchased and exported by a customer whose residence is outside the European Union. Please note that in order to qualify for tax-refund the merchandise has to be exported within three months of purchase.

Before you purchase any goods in Germany you should inform the retailer that you intend to export the goods. With your receipt you will receive a so-called “Ausfuhrbescheinigung” (export papers) or a Tax Free Shopping Check.

When leaving the European Union – through Germany only – the export papers or the Tax Free Shopping Check plus the following documents have to be presented to the Customs Service at the airport (you must leave Germany on a non-stop flight to a country outside the EU ):

customs online - tax free shopping

- the original receipt of the store

- the purchased goods (unused/unworn in its original packaging and with price tag)

- and your passport showing residence outside the EU

The export papers will be stamped after the goods have been examined. As you do have to show the goods please make sure that they are in your carry on (your suitcases will already have been checked in!). After having returned to your country of origin, the stamped invoice should be sent back to the store in Germany where the merchandise was purchased. For the Tax Free Shopping Check you may be able to obtain a cash refund if they have an office at the airport. Otherwise the check should be sent to the address on the back of the Tax Free Shopping Check where you will find detailed instructions for the refund.

Certification by German diplomatic or consular mission (exception)

In very rare exceptional cases a certification by a German diplomatic or consular mission is possible. A plausible explanation has to be given in writing why it was not possible to receive the export stamp at the port of departure from Germany.

The same procedure as at the customs service applies.

The following requirements must be met:

- You can prove that you live in Australia.

- The goods were bought in Germany.

- The goods were transported to Australia in your personal baggage.

- There is a maximum of 3 months between the purchase of the goods and your departure from Germany.

- Obtaining the export certificate from the competent customs office was not possible or unreasonable for reasons for which you were not responsible.

- Goods/goods are for personal, non-commercial use

If the above requirements are met, the responsible German mission abroad can issue the export certificate in exceptional cases. Please bring the following documents with you:

- The completed application form

- Your passport used to travel to Germany

- Flight ticket in your name / proof of the date of the return flight

- Proof of your place of residence in Australia (e.g. Australian driver's license)

- The goods purchased in Germany in their original packaging

- Original invoices with the associated forms filled out by the seller

There is a fee of 34,07 Euro for each individual export paper.

Please read our general information about fees and methods of payment

- Top of page

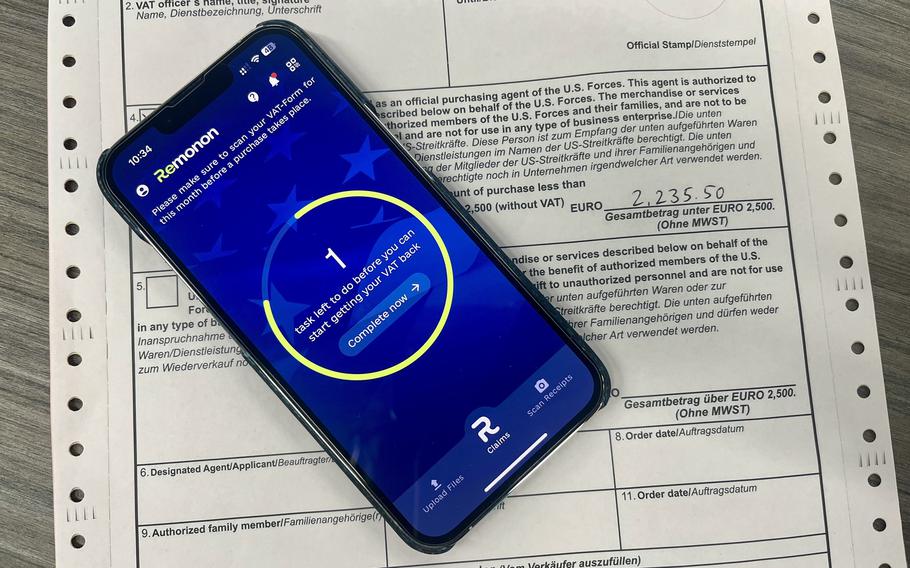

- - K-town Now

- Asia-Pacific

- - Storm Tracker

- Middle East

- Map of Memorials

- Entertainment

- - Video Games