eLevy Support Contacts

1. 0202714900/1

2. 0717363411

3. 0728337499

1. 0412249829

2. 0703287808

1. 0703288464

2. 0753058836

1. 07553058744

2. 0703289367

1. 0717359988

2. 0780400117

1. 0705395118

2. 0780400118

Core Values

Legal Provisions

The Tourism Act, 2011 and Tourism Regulatory Authority, Regulations 2014 make the following provisions for licensing:

- Section 7(1) (c) requires tourist-related activities and services including cottages and private residences engaged in guest house services to be licensed by TRA.

- Section 98(1) requires any person carrying out a tourism business or service specified in the Ninth Schedule to get a license from TRA.

- Section 19(1) requires TRA licenses to be renewed three months before expiry.

- Section 19(2) stipulates a penalty of 10% of the license fee for every month’s delay in renewing a license.

- Section 29(1) mandates TRA officers to regularly inspect tourism facilities and services where non-compliance is suspected or for purposes of granting or renewing a license.

- Section 112 imposes a fine not exceeding one hundred thousand shillings, imprisonment for a term not exceeding eighteen months, or both for any person contravening this Act.

- The Fourth Schedule lists the license fee for various tourism activities and services.

The Authority derives its powers to regulate the tourism sector from the Tourism Act, 2011. The objective and purpose of the Authority is to regulate the tourism sector. The functions of The Regulatory Authority as provided by the Act are:

To formulate guidelines and prescribe measures for sustainable tourism throughout the country. To regulate tourism activities and services countrywide, in accordance with the national tourism strategy. To register, license and grade all sustainable tourism and tourist-related activities and services including cottages and private residences engaged in guest house services. To develop and implement, in consultation with relevant stakeholders, criteria for standardization and classification of tourism facilities and services. To develop and regulate, in consultation with the Ministry for the time being responsible for matters relating to education, tourism and hospitality curriculum, examination and certification. To develop and implement a code of practice for the tourism sector. To ensure the development and implementation of high-quality tourism sector. To monitor and assess tourist activities and services to enhance continuous improvement and adherence to sound principles and practices of sustainable tourism. To undertake annual assessment and audit of tourism activities and services, measures and initiatives at national level, and prepare and publish an annual national tourism sector status report, in consultation with the minister and relevant lead agencies, and Perform any other functions that are ancillary to the object and purpose for which the Authority is established.

Tourism Act & Regulations.

Click here to read or download the Tourism Act.

The Board of Directors

The Authority’s Board comprises of ten (10) members led by a non-executive and independent Chairperson, four (4) independent non-executive directors, representatives of the Principal Secretaries responsible for The National Treasury, State department of Planning and Statistics, State department for Tourism & Wildlife, Ministry of Environment and Forestry, and the Director General of the Authority. The Composition of the Board is as stipulated in Section 8 of the Tourism Act 2011 and below are their individual profiles.

Hon. Benjamin J. Washiali, CBS

Mr. Peterson Muriithi Njenga

Mr. Kennedy Olwasi

Grace Wangui Kamau

Mr. Alex K. Munyao

Josephine Kinyuti

Mr. Alex Cleland Atingo

Mr. Eric M. Kiniti

Mr. Joseph Kamau

Mr. James Sitieney

Mr. Norbert K. Talam

Directorates

Standards and Quality Assurance

The department plays a pivotal role in enhancing the standards, professionalism and quality of products and services delivery in the tourism sector and supporting the regulatory function of the Authority as stipulated under section 7 (a) of the Tourism Act, 2011. The activities are coordinates through two divisions; Standards and Quality Assurance divisions based at the headquarters of the Authority.

Compliance and Trade Facilitation

This is one of the technical departments of the Authority and is responsible for the development, review and implementation of policies, regulations, guidelines and strategies in line with TRA mandates; registration and licensing of tourism-regulated enterprises; enforcement of compliance to regulatory provisions, national directory of regulated tourism activities and services; specialist/expert regulatory advisory services; continuous improvement of tourist activities and services and adherence to sound principles and practices of sustainable tourism; and duty waiver exemptions; and annual tourism status report per Tourism Act, 2011.

Corporate Support Services

The department is responsible for overall support services and its functions include Finance and Accounts; Human Resource Management, Information Communication Technology (ICT) management, corporate strategy and planning, Records Management and general administration functions of the Authority.

Hon. Washiali is the Board Chairman, Tourism Regulatory Authority. He is a self-driven, innovative, analytical, fast learner and a team player with over 40 years of experience both in the private and public sectors.

Prior to joining Tourism Regulatory Authority, Hon. Washiali served for 15 years as a member of Parliament for Mumias Constituency and a Majority Whip in the National Assembly. He runs a logistics company and has previously served in various departments at the National Cereals and Produce Board and uplands bacon factory for over 20 years.

He holds a Bachelor of Business Administration from The University impresario de Costa Rica and a Diploma in Export Practice & International Marketing from the Kenya School of Exports and Imports. During his career progression, he has acquired various skills and attended several training programs both locally and internationally.

Hon. Washiali has Proven success in leadership and Governance with a keen understanding of legislation and representation.

Mr. Peterson Muriithi Njenga holds a Bachelor’s Degree in Economics and currently undertaking a Master’s Degree in Economics.

He joined the then Ministry of Planning, National Development and Vision 2030 in April 2008 as an economist/statistician II and has risen over the years to the level of Chief Economist in the State Department for Planning During his working career, he has gotten extensive training and experience in Economic Development, Policy Formulation & Analysis and Strategic Planning and Budgeting in the public sector.

Mr. Kennedy Olwasi is currently an Assistant Director Programmes & Strategic Initiatives, Ministry of Environment & Forestry, Kenya having previously worked as District Agricultural Officer in a number of stations in Kenya. He has also worked as a Policy and Institutional Capacity specialist for over 5 years and a further 4 years as a Research Assistant at the International Centre for Insect Physiology and Ecology (ICIPE, Kenya). Mr. Kennedy Olwasi is currently the technical lead in the development of Integrated Masterplans for Rehabilitation and Restoration of Cherangany Elgeyo Hills ecosystem as well as the Tsavo landscape. He also represents the Ministry of Environment & Forestry in a number of platforms including technical Committee on Environment and Forestry at the EAC Sectoral Council of Ministers (SECOM)) and Intergovernmental Relations Technical Committee, he is a member of the International Association of Impact Assessments (IAIA) and the Environment Institute of Kenya.

He holds a BSc and MSc degree in Agronomy from Egerton University and currently undertaking a PhD on climate change Adaptation, Institute of climate Change Adaptation, University of Nairobi. He also holds a number of certificates including on Green and Circular Economy, Copenhagen University, Denmark, Strategic Leadership, Kenya School of Government Kenya, Environmental Impact assessment and Audit, Kenya School of Agriculture and multidisciplinary, Monitoring and Evaluation and adaptive learning, Egerton University. He holds a certificate in ISO Audit by Bureau veritas International among other trainings.

Grace Wangui Kamau is a lawyer by profession and an Advocate of the High Court with 19 years experience. She holds a Bachelor of Laws degree (LLB) from University of Nairobi and Certified Secretaries (CS) foundation level, qualification.

She is currently a Deputy Chief State Counsel in the Ministry of Tourism & Wildlife and has previously worked at Ministry of Transport and Infrastructure. While at Ministry of Transport and Infrastructure she was a member of the Secretariat to the Steering Committee that established Nairobi Metropolitan Area Transport Authority (NaMATA). She has worked as Ag. Corporation Secretary for NaMATA and legal advisor to the Engineers Board of Kenya. She also worked as a litigation lawyer at the Office of the Attorney General for 6 years.

She is a member of the Ministerial Human Resource Management and Advisory Committee (MHRMAC) and Medium Term Plan Committee and has served in various other key committees in Ministries.

Mr. James Sitieney holds a Master of Arts in Public Policy and Administration (MPPA) from Kenyatta University; A Bachelor’s degree in Economics and Business from the University of Nairobi, Senior Management Course from Kenya School of Government and a member of the Kenya Association for Public Administration and Management (KAPAM).

He also possesses a Certificate in Leadership and Policy Implementation from ESAMI; Effective Audit and Oversight (Institute of Directors); Computer Application and Proficiency from African Institute of Research and Development Studies.

He has a wealth of hands-on experience in Corporate Governance; Leadership and Policy implementation; In addition, he has worked in the Public Sector spanning over twenty-five years in various Departments and agencies.

Currently, Mr. Sitieney works at the Inspectorate of State Corporations-Office of the Prime Cabinet Secretary (PCS)-Executive Office of the President.

Alex is a result driven and a strategic business marketing leader with a proven track record of achieving substantial revenue, market share and profitability growth. Demonstrated expertise in developing and executing business excellence, strategic management, brand positioning, innovation and customer insights to position companies as industry leaders and achieve mission critical objectives.

Alex is the founder and managing Director of Trillion consulting Services (TCS) and he possesses over 20 years’ experience in agri-business value chains, finance, sales, marketing and commercial management. His accomplishments include successfully establishing multinational companies such as Sealadair, Diversey and Black Ivy in Africa. in addition, founded Trillion consultancy Services (TCS), a specialized business advisory service provider offering tailored services to meet the unique needs of clients in agri-business sector.

Alex holds master’s management of Agribusiness from Strathmore University of Kenya, Bachelor of science in business administration from Auburn University, Alabama, USA and Associate’s degree in finance from Atlanta metropolitan college, Atlanta Georgia, USA.

He is an associate member of world economic forum Africa, Member of American Chamber of Commerce – Kanya, Member of Lagos state corporate Assembly – Nigeria, National speakers association (USA), Director, Finance committee, for Nairobi Babtist Church and Chairman HGF, Karen/Dagoreti.

Josephine Wambui Kinyuti is an experienced Communication/Public Relations Practitioner with a proven track record of over 10 years. She holds a Bachelors Degree in Communications/PR from Daystar University and currently undertaking a Course in Women Emerging Leaders.

She is skilled in developing and executing impactful publicity strategies and campaigns, polished in coordinating creation of visual communications and digital assets and demonstrating expertise in design and project management. She possesses a deep understanding of branding communication trends and audience engagement techniques.

She has vast experience in conceptualizing and implementing comprehensive publicity strategies that align with organizational goals effectively reaching target audiences. She is proficient in writing and producing a wide range of content, including audio and visual presentations, press releases, and social media posts.

She is highly rated in showcasing the ability to tailor messaging for different platforms and audiences. She has successfully executed numerous publicity campaigns, combining creative thinking with strategic planning that maximizes campaigns impact and reach. Previously, Josephine worked for different media houses as a radio presenter.

Alex is a multi-skilled professional with over 15 years’ experience in starting and leading a successful logistics company. Expertise spans in areas including but not limited to transportation, warehousing, importation and exportation as well as custom procedures and processes.

He is the Chief Executive Officer for superior cargo conveyors company Ltd. His greatest achievements have been proven ability to develop and strengthen business units and structures that maximize business profitability and efficiency. Alex vied as a member of National assembly for Lugari constituency in the just concluded 2022 National elections.

He holds a master of science in Governance & Leadership from Jomo Kenyatta University of science and Technology (JKUAT), Bachelors in Management & Leadership, Management university of Africa (MUA), Advanced Diploma in Business management, the Association of business executives UK, Diploma in Business management, the Association of business executives UK and Diploma in clearing & forwarding, City Institute of professional studies.

He is an associate member of the association of business executives, UK.

Eric Kiniti is currently the Group Corporate Relations Director at East African Breweries Limited a subsidiary of Diageo PLC a position he has held since 2016. He has over 19 years of experience in Environment, Social and governance (ESG), public policy, and communications. Before joining EABL in 2011, he worked at British American Tobacco from 2004.

He is a board member at Uganda Breweries Limited (UBL), the Tourism Regulatory Authority (TRA), and a member of the Public Relations Society of Kenya (PRSK).

He holds a Bachelor of Arts Degree in Economics from Kenyatta University. He has completed several leadership development programs among them the Leadership Development Programme (LDP), at Gordon Institute of Business (GIBS) in South Africa, the Advanced Management Programme (AMP) at the Strathmore Business School, the Fast Forward Leadership Development Programme at Sunwords Kenya, the Effective Director programme at Strathmore Business School and the Oxford Leading Sustainable Corporations Programme, at the University of Oxford.

Norbert Talam is the Director General, Tourism Regulatory Authority. He is a Finance Executive with over twenty (20) years’ impressive track record in implementing high impact growth strategies, robust internal controls, and efficient reporting system.

Norbert is an Expert in leveraging logical and critical thinking behind the numbers that drive organization strategy, bolster efficiency, and propel achievements of strategic financial goals.

He has Proven success in leadership, operational excellence and organizational development with keen understanding of managing multiple grants, operational efficiency and overall technical assistance.

Prior joining TRA, Norbert served as Chief Executive Officer, Company Secretary and Head of Finance at the First Community Bank in Kenya for over 10 years. He also served in finance departments at K-Rep Bank (Sidian Bank), Kenya Airways (KQ) and Safari for Less Ltd.

Norbert is a Member of Institute of Public Accountants of Kenya (ICPAK), Institute of Public Secretaries of Kenya (ICPSK) and Institute of Directors (IOD).

He Holds a Master of Business Administration from the University of Nairobi, and a Bachelors of Commerce (Accounting Option) from the Catholic University (C.U.E.A). He is a Certified Public Secretaries (CPS – K) and a Certified Public Accountant-K (CPA-K)

Norbert has achieved among others, to introduce an accreditation scheme in the Tourism and hospitality sector that ensures conformity with quality standards in the Tourism sector in Kenya, Initiated the second phase of classification and grading of accommodation and catering facilities, he has managed to also Automate Tourism services within the Authority for ease of doing business, Reviewed various policies to transform the Tourism sector and is working closely with sector players and stakeholders in co-regulation of the Tourism sector in Kenya.

Joseph is a highly motivated professional with over 25 years’ experience in Finance, Economics and Investments. He has demonstrated expertise in financial management, and Corporate Governance.

He has vast experience in both private and public sectors having served in the banking sector and currently serving as an economist at the National Treasury. He is experienced in Economic Development, Policy Formulation & Analysis and Budgeting in the public sector.

He holds MBA (Finance), from Korea Advanced Institute of Science & Technology (KAIST) in South Korea, MA Economics, Finance & Banking (Financial Sector Policy) from Moi University and Bachelor of Arts in Mathematics & Economics from the University of Nairobi.

During his working profession, he has acquired extensive training in Advanced Trainers Skills Development for Senior Trainers (from Kigali Rwanda), Audit Committee Training, Compensation Committee Training and training on Making Boards More Effective (from Harvard Business School), Project appraisal and Risk Management (from Duke University), Senior Management Course (KSG), Corporate Governance Course for Directors(from Center for Corporate Governance), and Oil & Gas Commercialization Transactions Training (from Simmons & Simmons).

He is a certified Investment and Financial Analyst (ICIFA),

Halima Yussuf Mucheke

Board Chairperson

Hon. Halima Yussuf Mucheke is the Chairperson of the Board of Tourism Regulatory Authority. She has a Bachelor’s Degree in Psychology from the University of Nairobi, a Diploma in Business Administration and currently pursuing a Master’s Degree in Business Administration.

She previously worked as nominated member of Parliament with vast experience in the Public Service, having served as a Sub-county Administrator and a District Officer.

Divi Creative Agency

Bringing your vision to life, illustration, copywriting, discover the power of strategy.

We are a team of skilled creatives dedicated to help businesses like yours unleash their full potential with innovative solutions .

See Us In Action

Watch how we can help you stand out of the crowd.

How We Work

Transforming your business through creative process, user & market reserach, understanding your audience, results & analytics, innovative solutions for modern business, get started, start a new project today, public participation for the draft tourism regulatory authority (tourism enterprises) regulations, 2024..

Public participation for the draft Tourism Regulatory Authority (Tourism Enterprises) Regulations, 2024TRA Assessment and AccreditationAssessment and Accreditation in North and South Rift, Western and Nyanza Region.29 to May 31, 2023Safari In the ParkTRA Safari Park...

Subscribe for Sales and Updates

1235 Divi Avenue #1000, San Francisco, CA 49623

(255) 352-6258

Home care services, personal care.

Vestibulum ante ipsum primis in faucibus orci luctus et ultrices.

Companionship Care

Respite care, dementia care, transitional care, post stroke care, high quality care, vestibulum ante ipsum primis., orci luctus et ultrices posuere., donec velit neque., auctor sit amet aliquam vel., nulla quis lorem ut libero., mauris blandit aliquet elit., divi home care.

Pellentesque in ipsum id orci porta dapibus. Quisque velit nisi, pretium ut lacinia in, elementum.

- Tourism Fund Building , Bishop Road Nairobi

- +254 204400601

- [email protected]

- Staff Portal

Tourism Promotion Fund

Our mission, application for funding.

3.Disbursement / Request for payment

5.Utilization and absorption of funds

2. Funding process

1. Requirement for Funding

4. Monitoring & Evaluation

Key services, funding development in tourism sector, funding promotion in tourism sector, fund branding in tourism sector, latest news.

Funding the Mitigation/afforestation and environmental rehabilitation

Funding the Revamping And Revitalization Of Nairobi National Park

Funding a New Vision for Kenya’s Tourism sector

How To Pay Tourism Catering Levy in Kenya

This is a simple guide on how to pay the Tourism catering levy in Kenya. This is a charge at the rate of 2% on the gross sales derived from the sale of accommodation, food, drinks and all other services offered in scheduled establishments. This Levy is payable to the Tourism Fund by the 10 th day of the following subsequent month of sale.

Who Qualifies to pay the Catering Levy in Kenya?

1.Hotels: Charging a minimum of Ksh. 250 per person / per night, including the provision of breakfast meal or any other services.

2.Restaurants Making minimum gross sales of Ksh. 3 Million per annum or an average of Ksh. 250,000 for the first three (3) trading months, in case of new establishments.

You can visit any Tourism Fund to be guided in the registration process. Registration is free of charge.

How the 2% tourism catering levy is calculated.

As said earlier, the levy is payable by the 10 th day of the following subsequent month of sale. The levy can be paid to the following Tourism Fund accounts.

LATE PAYMENTS

- Levy payments received after the 10 th day of the following month are subject to an instant penalty of Kshs. 5,000.00.

- An additional penalty of 3% of the amount of the levy due of each month or part thereof during which the amount due remains unpaid.

NON COMPLIANCE

- Failure to pay the levy is a criminal offence punishable in a court of law and liable to a fine not exceeding Kshs 20,000 or imprisonment for a period not exceeding 6 months or both.

- Any due amount not paid by the 10th day following month is a civil debt recoverable by the Trustee through courts or appointed agents.

The levy collected is used :

- To finance the development of tourism products and services

- To finance the marketing of Kenya as a tourist destination through the Tourism Board

- To finance the activities of the Protection Service

- To finance the tourism research, tourism intelligence and the national tourism information management system

- To finance the activities of the Tourism Sector Safety, Communication and Crisis Management Centre

- To finance training and capacity development activities of the College and of such other tourism hospitality training institutions as may be established under this Act

- To mobilize resources to support tourism-related activities

Tourism Fund Branches in Kenya

Victor Matara

I help you to save time and live more with the most up-to-date lists, guides, reviews, and advice.

Related Posts

MTRH College of Health Sciences Courses and Fees Structure

Kenya Forest Service Rangers Recruitment Requirements

Best Places To Shop For Children Clothes In Nairobi

List Of Best Public Primary Schools In Samburu County

Top 5 Radio Stations in Kenya That Pay Good Salaries

Benefits Of NHIF Supa Cover

Over 35,000 Kenyan Airbnb's yet to comply with Tourism levy

This comes after the Tourism Fund and other regulatory agencies launched a new registration of Airbnb’s in an effort to bring them under the tax bracket.

The regulatory authorities have expressed concerns about the amount of revenue being lost as more Kenyans are now opting for luxurious Airbnb’s than traditional hotels for accommodation

According to the Tourism Fund, it is scanning the Kenyan online booking landscape to weed out those who are not remitting the two percent tourism levy as required by law, given that Airbnb operations fall under the umbrella of tourism promotion.

Speaking at a stakeholder meeting of the North Rift Economic Bloc (Noreb) officials, Tourism Fund Chief Executive Officer David Mwangi stated that discussions are underway with the Airbnb Africa office to have everyone running the business be registered and remit to the tourism fund.

“We urge all hosts to know that they offer accommodation and as a result are required by law to register and remit the 2 percent levy.”

Registered businesses in the tourism sector are supposed to remit a 2% tourism levy to fund various tourism-related initiatives, infrastructure development, and promotional activities.

The Tourism Tund is a government corporation that was established under the Tourism Act of 2011 and it’s mandated to support tourism growth in the country.

Want to send us a story? SMS to 25170 or WhatsApp 0743570000 or Submit on Citizen Digital or email [email protected]

Leave a Comment

No comments yet.

latest stories

- About ECOLEX

- User Agreement

- Acknowledgments

- Take a tour

Tourism Act (Cap. 383).

This Act concerns the development, management, marketing and regulation of a sustainable tourist industry in Kenya. It provides for the control of tourist activities through licensing and registration. It requires the Minister to formulate and publish in the Gazette a national tourism strategy at least once every five years and provides for the establishment of various institutions including: the Tourism Regulatory Authority, the Tourism Protection Service, the Kenya Tourism Board, Tourism Research Institute, the Tourism Fund, the Tourism Finance Corporation and the Tourism Tribunal.

References - Legislation

Kenya tourist development corporation act (cap. 382)..

Keyword: Tourism, Institution, Special fund

Source: FAO, FAOLEX

Tourism Regulatory Authority Regulations (L.N. No. 128 of 2014).

Keyword: Land-use planning, EIA, Tourism, Institution, Authorization/permit, Classification/declassification, Sustainable development

Statute Law (Miscellaneous Amendments) Act, 2014 (No. 18 of 2014).

Keyword: Governance, Institution, Animal health, Harbour, Tourism

Delete record "Tourism Act (Cap. 383)."

Kenya Tourism Board (KTB) is a State Corporation established under the Tourism Act whose mandate is to market Kenya as a tourist destination locally, regionally, and internationally. KTB’s marketing strategy includes inspiring the world through a powerful brand Kenya by digital marketing programs that takes advantage of the latest technology and research-based strategies.

The Kenyatta International Convention Centre (KICC) is a State Corporation established under the Tourism Act 2011 whose objective and purpose is to promote the business of Meetings, Incentive Travel, Conferences and Exhibitions also known as MICE. The facility boasts a conference room with a capacity of over 4000 delegates.

Bomas of Kenya offers Kenya in miniature! It is a must visit to all visitors. Situated 10km from Nairobi city center, and about 1 km past main entrance of the game-filled Nairobi National Park, Bomas of Kenya lets you see the wonderful diversity of cultures that make up this fascinating country.

Kenya Safari Lodges and Hotels Limited (KSLH) being a government parastatal mandated with the provision of premium hotel and lodge accommodation, current conference and business meeting venues, customized beach and safari experiences as well as high value niche products, has geared its core activities towards achieving Vision 2030.

Tourism Fund is a body corporate established under the Tourism Act, 2011 which came into operation on 1st September, 2012 vide special issue Kenya Gazette Supplement No. 93 of 24th August, 2012.The Fund is the legal successor to Catering and Tourism Development Levy Trustees. Catering and Tourism Development Levy Trustees has been in existence since.

Wildlife Clubs of Kenya (WCK) is a charitable, nonprofit organization formed in 1968 by Kenyan students. It was the first conservation education programme of its kind on the continent of Africa. Through Africa wide workshops, WCK has stimulated a continental wildlife clubs’ movement. It has also helped spawn clubs in Asia, Latin America and elsewhere in the third world.

Tourism Act (Cap. 383).

- SUBSCRIBE NOW

- Diaspora News

- East Africa News

- National News

KRA Faces Potential Loss of Ksh1.7 Trillion in Uncollected Taxes- Auditor General

Mediheal Hospitals Face Auction Over Unpaid Rent

Govt Starts Firing Doctors After Deadlock

Dangers of Driving Small Cars in Flood Water & Tips to Avoid Accidents

Inside Bunge Towers: High End Kitchen, Gym Among Facilities MPs Will Enjoy

Why KNEC Will Not Deploy Police Officers to Man National Exams

Gachagua Praises Africa’s Youngest Minister, Challenges Kenyan Youth

Sweeping Changes Proposed on Qualifications of Chebukati’s Successor & IEBC Employees

KUCCPS Advises Students Who Missed University Slots as Deadline Nears

Trending tags.

- Cryptocurrency

- Money Markets

- Real Estate

CBK Publishes List of Licensed Microfinance Banks

Stanbic Bank Shareholders: How to Apply for Dividend After Record Performance

Absa Threatens to Hand Over Billions of Shareholders’ Cash to Govt

Over 13 Million Kenyans Hit as Opera Stops Free Data Offers

Profile of Kenyan CEO Earning Ksh1.2M Per Day

Motorists Explain Why Matatu Owners are Not Making Profit

Kenyan Tycoons Who Own Multi-Billion Businesses

- Health & Science

- Mens Health

- Mental Health

- Womens Health

Alarm Raised Over Increased Use of Banned Roofing Materials

How a Baby Was Saved from Womb of Dead Mother

Governor’s Call for Review of Doctors’ & Govt Deal

Govt Releases New List of 9,600 Approved Pharmacies; How to Check

Kenyans Warned Against Buying Popular Cough Syrup

Kindiki Declares Doctors Strike Illegal, Gives Fresh Directive to Police

Doctors Respond to Ruto’s Offer in Ending Ongoing Strike

Hospital Cleaners Strike Over Unpaid Salaries

- Cyber Crime

- Missing Persons

Man Arrested with DJ Joe Mfalme Over Death of Cop Charged with Murder

Politician in Court for Conning Jobless Kenyans

Lawyers Danstan Omari, Ombeta Pull Out of Echesa’s Extortion Case

How Ex-National Museum Boss Paid Ksh 490M to Ghost Workers

Kenya Has Tightened Its Laws to Stop Money Laundering: Why Banks Are the Focus

Ugandan Teen Sentenced in Kenya After Confessing to Killing Her Son

NTSA Crackdown: 5 Reasons Why Passengers and Motorists are being Arrested

How to File a Petition Against a Judge in Kenya

Notorious Thug Among 3 Suspects Gunned Down by Police

Omanyala Suffers Defeat as Mary Moraa Shines; Kip Keino Classic Winners [LIST]

Kenyan Athletes Who Deliberately Let Chinese Runner Win Race Punished

Why Liverpool Coaches Jetted in Kenya for 3-Day Event

Kenyan Athlete Explains Why He Let Chinese Runner Win Beijing Race

Everton Files Appeal Against Two-Point Deduction

Investigation Launched After Two Kenyan Athletes Allegedly Let Chinese Runner Win Marathon

Kipchoge Speaks on Retirement Plans Ahead of Paris Olympics

Win for Athletes as World Athletics Approves Ksh129 Million Prize in Olympics

Kenyan Star Nominated for Premier League Award After Top Performance

Davido: Why I Took Action Against JKIA Arrest Prank

Renowned Kenyan Musician Changes Stage Name; Here’s Why

Famous TikToker Kapinto Lands New Job at Top Radio station

Kenyans Excited as Christina Shusho is Set to Release New Song ‘Zakayo’

Easy Tricks Kenyans Can Use to Make Money on TikTok

Popular Musician Exits Sol Generation After 5 Years, Unveils New Team

- Disabilities Matters

- Ethics & Religion

- Human Interest

- Immigration

- Personal Finance

Karni Mata Temple: Where Humans Live and Eat with Rats

Pastor Dorcas Rigathi Explains Why Family Unit is Dying

Eid-ul-Fitr: What to Know About the Muslim Holiday After Ramadan

Hidden Gems of Kenya: Discover 5 Rooftop Swimming Pools in Nairobi

Why Jehovah’s Witnesses & SDA Do Not Celebrate Easter

How Eggs Become Part of Easter Holiday Traditions

- Bruce Schneier

- Contributors

- Eyal Mayroz

- John Mukum Mbaku

- Letters to Editor

- Makau Mutua

- Marie Durrieu

- Peter Ongera

- William Hatungimana

- Wycliffe Njororai Simiyu

Doors a Foreign Language Will Open in Your Life

Kenya’s Shilling Is Gaining Value, but Don’t Expect It to Last – Expert

Unseen Economy: Unpaid Care Work and Its Impact on Kenyan Women

European Union to Ban Export of Mitumba to Africa

Exploring the Roots of Stupidity: Psychology of What Lies Behind Irrational Opinions

Kenyans Use Humor to Counter Unpopular State Policies – Memes Are the Latest Tool

Breaking Barriers for a Data-Driven Future by Empowering Women in STEM

Order to Run All State Adverts on KBC is Unfair to Consumers

- Cyber Security

Govt Makes Final Submissions on TikTok Ban Debate

Apple Axes Over 600 Employees Involved in Secret Projects

Google to Delete Browsing Records After Being Dragged to Court

3 Simple Steps to Cancel Unwanted Safaricom Subscriptions from Your Phone

TikTok Faces Ban in US Amid Free Speech Debate

Why More Women Need Digital Skills: Bridging Gender Gap

Govt Issues Tax Directive to Serviced Apartment Owners

Cabinet Secretary Ministry of Tourism Wildlife, Dr Alfred Mutua. PHOTO/ Courtesy

Tourism Fund, a state corporation under the Ministry of Tourism and Wildlife, has issued a directive to serviced apartment owners, homestays, and villa operators, to comply with the Tourism Levy.

In a notice dated February 27th, the Ministry announced that, in accordance with Sections 66 and 105 of the Tourism Act, The Ninth (9th) Schedule of the Tourism Act, Tourism Fund Regulations 2015, and Tourism Levy Order 15, all Serviced Apartments are required to adhere specifically to Order 2 of the Tourism Levy Order.

As per the order, owners of the establishments categorized as Class A & B enterprises under the Ninth Schedule of the Tourism Act are required to pay a 2% levy on their gross monthly receipts from their sales.

“There shall be paid by the owner of Tourism Activities and Services Specified in class A & B enterprises, a levy at the rate of Two per centum (2%) of gross receipts from the monthly sale of food, drinks, accommodation and all other services,” reads part of the notice.

Also Read: Airbnb Announces New Charges for Cross-Currency Booking

Both Serviced Apartments, Homestays, and Villas are categorized as Class A and B enterprises in the Ninth Schedule.

The Tourism Fund was established under section 66 of the Tourism Act 2011 (Cap 383) Laws of Kenya.

This levy is crucial for the Tourism Fund to fulfill its core mandate of mobilizing resources for tourism industry development projects, marketing initiatives, and community-based tourism initiatives.

This is achieved through the Tourism levy as stipulated in Section 105(1) of the Tourism Act.

Tourism Fund Warnings on Penalties

The directive however emphasized that failing to pay the levy constitutes an offense and can lead to penalties as outlined in the Tourism Fund Regulations and the Tourism Levy Order.

“Take notice that any person who fails to pay any amount payable by him as the levy on or before the prescribed date commits an offense and is liable to penalties in Regulation 3(2) of Tourism Fund Regulations in addition to such other general penalties imposed under Regulation 17 of Tourism Fund Regulations as read together with the provisions of the Act,” read part of the notice.

Also Read: Court Orders Former Nairobi Boss to Surrender Ksh 114M Apartments to Govt

Additionally, non-compliance within 30 days of the notice will trigger enforcement proceedings against the establishment.

“Take further notice that failure to comply within 30 DAYS from the date of this Notice shall result in enforcement proceedings against you under the provisions of the Tourism Act, Tourism Fund Regulations, and Tourism Levy Order,” the body said in a notice.

Service apartments owners are urged to contact Tourism Fund by email on [email protected] or call +254 020 2714901/+254 728 337 499 to inquire any information about the levy.

Get real time update about this post categories directly on your device, subscribe now.

Annah Nanjala Wekesa

Annah Nanjala Wekesa is a seasoned journalist at The Kenya Times, with a passion for crafting news-worthy stories that leave a lasting impact. She holds a Bachelor of Arts in Communication and Media from Kisii University. She has honed her skills in the art of storytelling and journalism. Her passion lies in the art of storytelling that resonates with audiences, driving a commitment to delivering news-worthy stories through the lens of integrity and precision. She started her career at Kenya News Agency where most of her news stories have been published. She can be reached at [email protected]

Pastor Ezekiel Gifts Benny Hinn Ksh 14M to Clear Crusade Bills

RECENT NEWS

THE MOST IMPORTANT NATIONAL AND GLOBAL NEWS OF THE DAY

Subscribe to our mailing list to receives daily updates direct to your inbox!

© 2024 The Kenya Times | Contact Us | Privacy Policy | Standards & Policies | House Rules

Welcome Back!

Login to your account below

Remember Me

Create New Account!

Fill the forms below to register

Retrieve your password

Please enter your username or email address to reset your password.

Your Privacy and Cookies

Privacy overview, add new playlist.

- Select Visibility - Public Private

- Financial Fraud

- Anjana Susarla

© 2024 The Kenya Times | Our Privacy Policy | Standards and Policies | House Rules

Are you sure want to unlock this post?

Are you sure want to cancel subscription.

Executive summary

The President of Kenya on 19 March 2024 assented into law the Affordable Housing Act, 2024 (the Act), which has immediate implications for employers. This follows the suspension by the High Court of Kenya of provisions providing for the deduction and remittance of affordable housing levy (the levy) as introduced through the Finance Act, 2023 .

An employer is required to remit in respect of each employee the employer's contribution at 1.5% of the employee's monthly gross salary and the employee's contribution at 1.5% of the employee's monthly gross salary.

The provision providing for the deduction and remittance of the levy became effective on the date of assent.

Employers are thus expected to account for the levy in March 2024 payroll and going forward.

Detailed discussion

Affordable housing units

The Act provides for four categories of housing units and defines them as follows:

- A social housing unit - means a house targeted to a person whose monthly income is below 20,000 Kenyan shillings (KES 20,000).

- An affordable housing unit - means a house targeted at a person whose monthly income is between KES 20,000 and KES 149,000.

- Affordable middle class housing unit - means middle- to high-income housing targeted at persons whose monthly income is over KES 149,000.

- Rural affordable housing unit - means a house targeted at a person living in any area that is not an urban area.

Imposition of Affordable Housing Levy

The levy is a mandatory contribution that will be contributed by both the employer and employee. The employer is required to remit in respect of each employee both:

- The employer's contribution at 1.5% of the employee's monthly gross salary

- The employee's contribution at 1.5% of the employee's monthly gross salary

It is the responsibility of the employer to remit the levy by the ninth day of the following month.

The Act also incorporates non-salaried persons, who were not previously covered by the provisions that the High Court suspended. Non-salaried persons will be expected to make contributions of 1.5% of their gross income.

The Kenya Revenue Authority had previously clarified that gross monthly salary constitutes basic salary and regular cash allowances. The regular allowances include housing, travel or commuter and car allowances, as well as any regular cash payments but exclude non-cash payments as well as income not paid regularly, such as leave allowance, bonus, gratuity, pension, severance pay, or any other terminal dues and benefits.

A 3% penalty on the unpaid amount shall be levied on persons who fail to remit the levy by the due date. Penalties shall accrue for each month or part thereof that the levy remains unpaid and shall be recovered as a civil debt for the person liable to remit the amount.

Affordable housing relief

Resident individuals who prove that they paid the affordable housing levy in a year of income shall be entitled to affordable housing relief for that year of income.

Effective 19 March 2024, the affordable housing relief shall be extended as per section 30A of the Income Tax Act. The amount of the relief shall be 15% of the employee's contribution but shall not exceed KES 108,000 per annum (KES 9,000 per month).

The Cabinet secretary, through a gazette notice, may exempt from the levy any income or class of income or any person or category of persons.

At present there are no exemptions extended to any persons or any income other than the ones clarified above (non-cash benefits and income not paid regularly).

The information contained herein is general in nature and is not intended, and should not be construed, as legal, accounting or tax advice or opinion provided by Ernst & Young LLP to the reader. The reader also is cautioned that this material may not be applicable to, or suitable for, the reader's specific circumstances or needs, and may require consideration of non-tax and other tax factors if any action is to be contemplated. The reader should contact his or her Ernst & Young LLP or other tax professional prior to taking any action based upon this information. Ernst & Young LLP assumes no obligation to inform the reader of any changes in tax laws or other factors that could affect the information contained herein.

Copyright © 1996 – 2024, Ernst & Young LLP

All rights reserved. No part of this document may be reproduced, retransmitted or otherwise redistributed in any form or by any means, electronic or mechanical, including by photocopying, facsimile transmission, recording, rekeying, or using any information storage and retrieval system, without written permission from Ernst & Young LLP.

EY US Tax News Update Master Agreement | EY Privacy Statement

IMAGES

COMMENTS

The Tourism Act, 2011 www.kenyalaw.org 2 22— Tenure and vacation of office. 23—Conduct of meetings of the Council. 24—Disclosure of interest. 25— The Principal. 26— Appointment of other staff. 27—Funds of the College. C. The Tourism Protection Service 28—Establishment of Tourism Protection Service. D. The Kenya Tourism Board

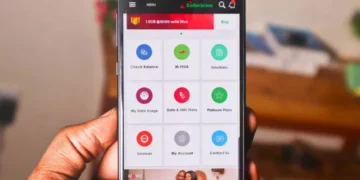

Tourism levy payment portal. Nairobi. 1. 0202714900/1. 2. 0717363411. 3. 0728337499. Mombasa. 1. 0412249829. 2. 0703287808

Tourism Regulatory Authority (TRA) is a corporate body established under section 4 of the Tourism Act No.28 of 2011 and is mandated to regulate the tourism sector in Kenya. This entails developing regulations, standards and guidelines that are necessary to ensure an all-round quality service delivery in the tourism sector.

The Tourism Fund, gazetted in November last year, also requires homestays, hostels and supermarkets running restaurants to pay the levy. Kenya Association of Hotelkeepers and Caterers Coast executive officer Sam Ikwaye said the levy was an excellent regulation that would address unfair competition in the industry.

The Kenya Revenue Authority (KRA) is set to start collecting the two percent tourism levy from hotels and restaurants. This follows a push by the Tourism Ministry to transfer the function from the ...

Tourism Promotion Fund is a government National Public Fund established under section 24 (4) of the Public Finance Management Act, 2012, through the legal notice No. 24 of 2019, with the mandate to provide funds to support development, promotion and branding of the tourism sector in Kenya.

The levy set at two per cent is paid to Tourism Fund, which is formed since 2012. The Tourism Levy can be paid to any KCB/ CO-OP branch via: TOURISM FUND ACCOUNTS. PARLIAMENT ROAD BRANCH. ACC-NO-011-3600-133-1600. SWIFT CODE: KCOOKNS. TEL: 020 214878/020 221369. KICC BRANCH. ACC-NO-1102123803.

Functions of Kenya Tourism Fund. 1. It collects the tourism levy imposed under the Tourism Act of 2011. The levy is charged at the rate of 2% on the gross sales derived from the sale of accommodation, food, drinks, and all other services offered in scheduled establishments.e hotels and restaurants. 2.

Tourism Fund is a body corporate established under the Tourism Act, 2011 which came into operation on 1st September, 2012 vide special issue Kenya Gazette Supplement No. 93 of 24thAugust, 2012.The Fund is the legal successor to Catering and Tourism Development Levy Trustees. Catering and Tourism Development Levy Trustees has been in existence ...

You can visit any Tourism Fund to be guided in the registration process. Registration is free of charge. How the 2% tourism catering levy is calculated. As said earlier, the levy is payable by the 10 th day of the following subsequent month of sale. The levy can be paid to the following Tourism Fund accounts. LATE PAYMENTS.

Registered businesses in the tourism sector are supposed to remit a 2% tourism levy to fund various tourism-related initiatives, infrastructure development, and promotional activities. The Tourism Tund is a government corporation that was established under the Tourism Act of 2011 and it's mandated to support tourism growth in the country.

This Act concerns the development, management, marketing and regulation of a sustainable tourist industry in Kenya. It provides for the control of tourist activities through licensing and registration. It requires the Minister to formulate and publish in the Gazette a national tourism strategy at least once every five years and provides for the establishment of various institutions including ...

The Fund is the legal successor to Catering and Tourism Development Levy Trustees. Trustees had been in existence since 1972 and operated under the umbrella of the Hotels and Restaurant Act, Cap 494, Laws of Kenya. The Act was repealed when the Tourism Act came into effect. To be the ultimate source of funding for the sustainable

Tourism Fund is a body corporate established under the Tourism Act, 2011 which came into operation on 1st September, 2012 vide special issue Kenya Gazette Supplement No. 93 of 24th August, 2012.The Fund is the legal successor to Catering and Tourism Development Levy Trustees. Catering and Tourism Development Levy Trustees has been in existence ...

Abstract. This Act concerns the development, management, marketing and regulation of a sustainable tourist industry in Kenya. It provides for the control of tourist activities through licensing and registration. It requires the Minister to formulate and publish in the Gazette a national tourism strategy at least once every five years and ...

Both Serviced Apartments, Homestays, and Villas are categorized as Class A and B enterprises in the Ninth Schedule. The Tourism Fund was established under section 66 of the Tourism Act 2011 (Cap 383) Laws of Kenya.. This levy is crucial for the Tourism Fund to fulfill its core mandate of mobilizing resources for tourism industry development projects, marketing initiatives, and community-based ...

The President of Kenya on Tuesday, 19 March 2024 assented into law the Affordable Housing Levy Act, 2024. The Act pertains to individuals in both the formal and informal sector (i.e., employees and independent contractors) and requires employers to remit contributions on behalf of employees and account for the levy beginning in March 2024 payroll.