A Comprehensive Guide to Opening a UK Bank Account (Even For Non-Residents Online)

François Briod

Co-Founder of Monito and money transfer expert, François has been helping Monito’s users navigate the jungle of money transfer fees, bad exchange rates and tricks for the last ten years.

Byron Mühlberg

.jpg?auto=compress,format&rect=0,0,1629,1629&w=120&h=120)

Monito's Managing Editor, Byron has spent several years writing extensively about financial- and migration-related topics.

Links on this page, including products and brands featured on ‘Sponsored’ content, may earn us an affiliate commission. This does not affect the opinions and recommendations of our editors.

With its high standard of living and easy-going way of life, the UK is one of the world's most popular countries for living and working.

Whether you've just arrived in the country or are planning to move there soon (or whether you're there for university, work, or anything else), one of the things you'll need to get in order is a local bank account. This comprehensive guide delves into the nitty-gritty of how to open a bank account in the UK for non-residents in particular . If you're already a UK resident, no problem; you'll find that much of our information still applies to you too.

Fortunately, depending on your needs, the process should be doable, and you'll likely be able to open a bank account online in the UK without much hassle. (And, if you've heard the horror stories about opening a bank account in the UK, don't worry too much!)

Are you in a rush? Here are our recommendations if you're...

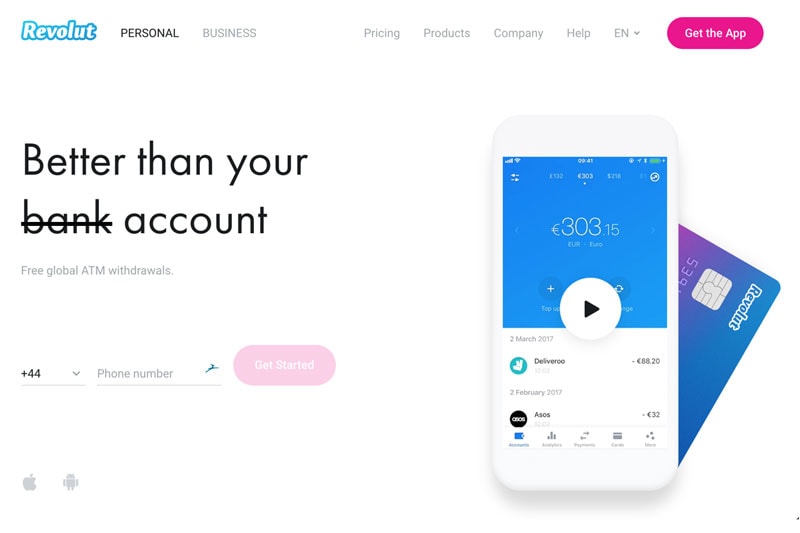

- from the EEA with no UK residence: Revolut gives you a UK account number, sort code, SWIFT code, and a debit card to spend in over 30 currencies, including pounds.

- not from the EEA with no UK residence: A Wise Account gives you multi-currency bank details in nine countries, including in the UK.

- in possession of a UK residence: Starling Bank offers a fully-fledged online current account that costs next to nothing every month.

Because it's needed to open most bank accounts, proof of address is usually where newcomers and non-residents in the UK hit a brick wall. It's also challenging if you've landed in the UK to live with relatives, where you won't have any bills or rental contracts in your name.

Can I Open a UK Bank Account as a Non-Resident?

All told, there are three main paths to open a bank account online in the UK, and not all of them are suitable for all types of non-residents. As a result, the best UK bank account will depend heavily on your needs and preferences. These paths are as follows:

- High-street banks: This path requires proof of UK residence and is only open to non-residents who make significant investments or who will soon be relocating to the UK. It's best for those who want extensive banking services and don't mind the fees.

- Online banks: Although the application is significantly more straightforward than at high-street banks, this path still requires proof of UK residence. It's best for those who want low-cost, digital banking services and don't mind slightly less banking coverage.

- Multi-currency accounts: This path provides a UK bank account without proof of address and is ideal for those wanting to open a UK bank account online from abroad.

Without further ado, let's explore each of these paths in detail below:

- 01. Path 1: Use a high-street bank (UK residents only) scroll down

- 02. Path 2: Use an online bank (UK residents only) scroll down

- 03. Path 3: Use a multi-currency account (no UK residence required) scroll down

- 04. How to get proof of address in the UK scroll down

- 05. How to transfer your money to the UK scroll down

- 06. Recapping how to open a UK bank account for non-residents online scroll down

- 07. FAQ about non-resident banking in the UK scroll down

Key Facts About Banking in the UK

Path 1: high-street uk banks.

The biggest high-street banks in the UK are HSBC, Lloyds, Barclays, NatWest, and Standard Chartered¹. Other big names include RBS, Nationwide, Santander, and Metro Bank. By "high-street", we mean traditional big banks with physical branches across the country (versus online banks, which don't have any branches).

High-street banks will generally only accept your application if you can provide proof of UK residence in your name. The only exceptions are for wealthy foreign investments (which we won't discuss in this article) and for opening an account before moving to the UK. In the latter case, some banks such as Barclays and Lloyds allow account opening from abroad within three months of moving to the UK. Still, they also require a higher barrier to entry, i.e. upwards of £50,000 in gross annual income or £25,000 saved or invested with the bank².

All deposits in UK high-street accounts are protected up to £85,000 in the case of bankruptcy by the Financial Services Compensation Scheme (FSCS)³, making them safe from a customer perspective.

Types of Bank Accounts in the UK

There are numerous types of accounts in the UK, but here are the two that most people mean when they talk about a "bank account":

- Current account: Called a 'checking account' in the US, this is what most people are looking for basic everyday use, such as paying bills and receiving a salary. They generally come with a debit card and overdraft facilities. Chequebooks are no longer automatically issued to new customers, but you can opt for one if you wish.

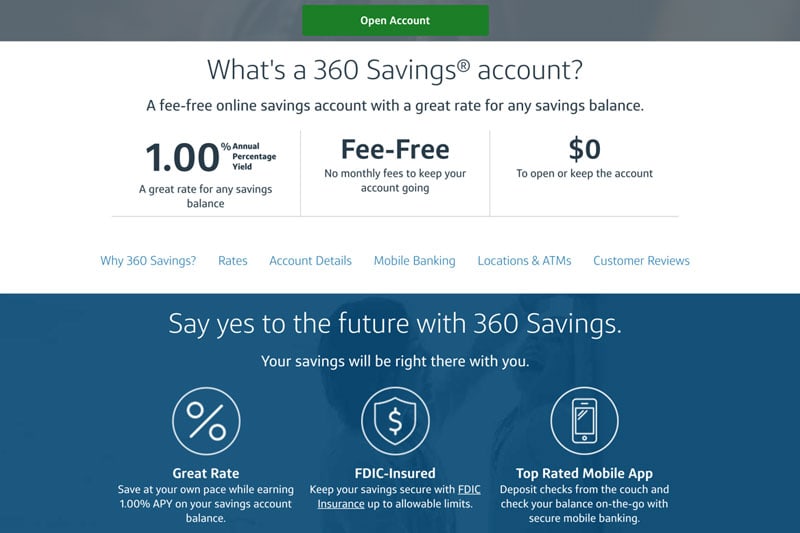

- Savings account: These accounts traditionally yield a higher interest rate and are meant for what their name implies — saving money. Some savings accounts require you to not touch the funds for a set number of months or years. However, some current accounts also pay interest on balances up to a set amount.

- Basic account: Major high-street banks in the UK are mandated by law to provide basic bank accounts to legal residents and citizens. Basic accounts are fee-free and offer only the most standard deposit and withdrawal operations, including failed payments to prevent overdrafts.

- Joint account: Joint accounts are legally shared between family members. They are generally used for married couples to combine their finances together, or for parents to manage expenses with their children.

- Student account: Banks usually offer accounts with added features and low fees for university students. The fees raise to their standard levels once you graduate or reach a certain age limit.

- Digital mobile account: With both high-street banks and UK online banks, you should be able to access your account balances by desktop or mobile app. User experience and service quality certainly varies from bank to bank, with UK online banks specialising in digital-only accounts.

- International non-resident account: International accounts are ideal for non-UK residents who want access to current accounts and everyday services in the UK. In addition to the resources found in this guide below, learn more with our guide about the 8 best international bank accounts for expats .

- Offshore account: UK banks with an international presence (such as HSBC or Barclays), and banks in your home country with a presence in the UK (like Santander or Citibank), may offer offshore accounts. These accounts have high minimum balance requirements and monthly fees, but they usually come with an account manager and balances held in multiple currencies . Offshore accounts are often used for real estate management, investment management, trusts, or holding deposits.

Documents Needed To Open a UK Bank Account

To open a UK bank account, you generally need the following:

- Proof of identity: Passports, driving licences, and national identity cards are accepted. In general, if you're a foreign national, your best bet is to use your passport — EU ID cards are usually accepted, but if you're from Australia, your home driving licence may not be.

- Proof of UK address: Generally, a recent utility bill, rental contract, or council tax bill will suffice. Mobile phone bills are generally not accepted.

There are no banks that don't need ID to open an account. Banks are required by law to collect this information for Know Your Customer (KYC) and anti-money laundering (AML) reasons⁴.

Which UK High-Street Banks Offer Accounts For Non-Residents?

Below, you'll find the account offerings among major high-street UK banks that we found the most useful for newcomers to the UK. As we saw above, there are also premium accounts and specialised accounts for students and youth too, but we selected the basic current accounts for the sake of illustration:

HSBC is the UK's largest bank by market value and total assets.

- Account: HSBC Bank Account

- Monthly fee: £0

- Int'l transfer cost: 1.5% - 8% (depending on the currency)

- Int'l card payment cost: 2.75% with limits

- Proof of UK residence required: Yes

National Westminster Bank, known colloquially as 'NatWest', is a large British bank that's based in Edinburgh, Scotland.

- Account: Select account

- Int'l transfer cost: 5% - 10% (depending on the currency)

- Int'l card payment cost: 2.75%

3. Barclays

Barclays is a UK banking giant offering retail, business, and investment banking worldwide.

- Account: Barclays Bank Account

- Int'l transfer cost: 4% - 10% (depending on the currency)

- Int'l card payment cost: 2.99%

Famous for its black horse logo, Lloyds is a popular banking choice among UK residents, with millions of customers nationwide.

- Account: Classic Account

- Int'l transfer cost: 3.5% - 8% (depending on the currency)

Opening an Account Before You Move to the UK

If you plan to relocate to the UK soon, you can sometimes still open a British bank account without proof of residence.

At Barclays, for example, you can open a UK bank account online from your home country within 90 days of relocating there. You'll then be required to complete the application process at a Barclays bank branch after you arrive in the country. You'll be eligible to open the following two types of accounts this way: (1) the £0-per-month Barclays Bank Account mentioned earlier, or (2) the Premier Current Account , which has a high barrier to entry (£75,000 gross annual income or £100,000 saved or invested with Barclays) and comes with a lucrative rewards program.

Similarly, Lloyds offers customers the International Current Account in GBP before they move in from abroad. To open an account from your home country, you can apply online, though you must have a £50,000 gross annual income or £25,000 saved or invested with Lloyds (which is a lower barrier to entry than Barclays).

Learn more with our guide about the 8 best international bank accounts for expats .

Hire a Third Party to Sort Out the Paperwork

If you want a high-street bank account but merely thinking about all the options makes you lose your marbles, we recommend visiting Sable International , which has relationships with several traditional banks, including Lloyds, Barclays, HSBC, and Metro Bank.

Sable facilitates an introduction to the banks, enabling you to open a UK bank account without the usual proof of residency documents, such as a utility bill. It offers several options:

- Bank account: If you want to open a UK bank account, you can get one without proof of address. You have to provide a valid passport, proof of permission to live and work in the UK, a residential address to receive post (this can be a friend or relative you're staying with, you don't need a utility bill), and be able to attend an appointment in London with one of their banking affiliates.

- Relocation: If you'd like a UK bank account plus various bells and whistles, this option assists with setting up a UK bank account and obtaining a National Insurance (NI) number and offers one free international money transfer, a pay-as-you-go UK SIM card, and a guidebook covering life in the UK.

- Tier 5 Visa: If you want all of the above (including a bank account) and help to apply for a Tier 5 Youth Mobility Scheme visa, then this option allows people between the ages of 18 and 30 to live and work in the UK for up to two years. However, it's only available to citizens of certain countries (including Australia, New Zealand, and Canada).

Path 2: Online Banks

UK online banks (sometimes called "challenger banks" or "neobanks") can be either registered banks or non-bank fintechs. They're characterised by not operating out of branches, with all banking services handled online instead. These banks generally offer a more limited range of services than the high-street banks we explored above, but at a fraction of the price and over a user-friendly web or mobile app interface.

If you want to open a UK bank account without proof of UK address, then the only online banks that may accept your application will be Monese and Revolut (although these will still require proof of residency in the EU/EEA or another country). On the other hand, Monzo and Starling Bank will require proof of address in the UK. Note that even if you don't submit proof of address, you might still need to supply a UK address to deliver your debit card.

Take a look at the UK's top three challenger banks according to our rankings, though we've summarised these rankings below too:

Starling Bank: Best UK Online Bank

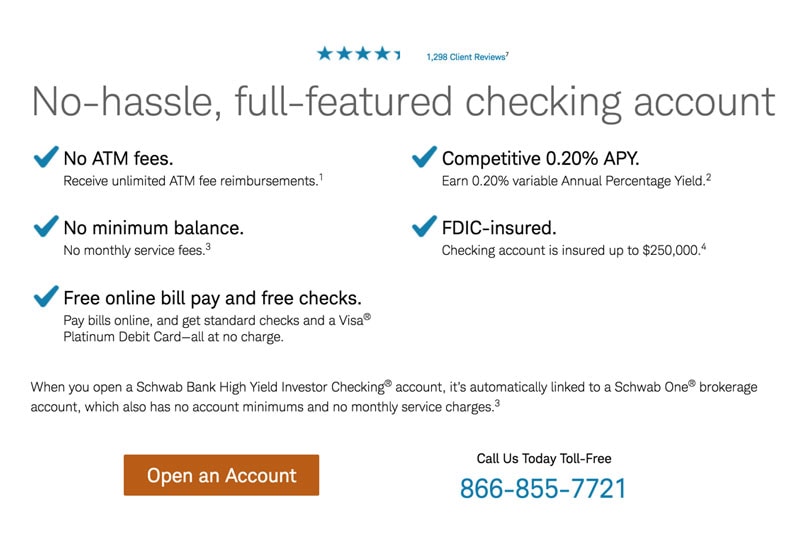

Starling Bank is a fully-authorised bank in the UK that's well known for its fee-free current account .

- Trust & Credibility 9.3

- Service & Quality 8.5

- Fees & Exchange Rates 10

- Customer Satisfaction 9.3

Because this account is entirely free and gives you access to an impressively complete range of financial services (including the Starling bank card , overdraft facilities, loans, joint accounts, youth cards, pensions, a euro account, interest rates, etc.), we think Starling offers the best free bank account in the UK — one we think makes an excellent replacement for a bank account at a high-street bank.

- Account name: Personal Account

- Int'l transfer cost: 0.5% - 3% (depending on the currency)

- Int'l card payment cost: 0%

- Proof of UK residence required: Yes

- More info: See our full Starling Bank review .

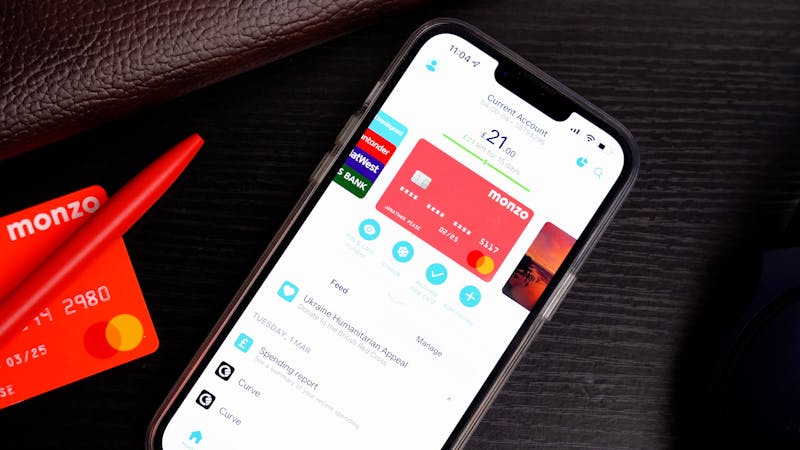

Monzo: Best Bank for Savers

Monzo is a regulated UK bank and probably the country's most famous mobile-only bank account.

- Trust & Credibility 8.3

- Service & Quality 8.4

- Fees & Exchange Rates 9.8

An excellent choice if you're looking to avoid fees, Monzo (like Starling) charges no fees for day-to-day card use in the UK and abroad. Moreover, because it offers one of the most advanced and comprehensive savings systems we've seen from any challenger bank (allowing lots of flexibility over your time horizon and savings goals), we think Monzo is especially well-suited for managing and growing wealth , regardless of your individual goals.

- Account name: Monzo

- Monthly fees:

- Int'l transfer cost: 0.2% - 2.5%

- More info: See our full Monzo review .

Suits Me: Best For New Arrivals

Suits Me is a reliable banking alternative for new arrivals in the UK.

- Trust & Credibility 7.3

- Service & Quality 7.0

- Fees & Exchange Rates 6.1

- Customer Satisfaction 8.6

It offers an easy and fast account opening process without requiring credit checks or proof of address. Additionally, Suits Me gives you a prepaid debit Mastercard, online banking services, and the ability to receive payments from employers and other sources (e.g. Faster Payments, BACS, and CHAPS, although not international SWIFT transfers).

- Account names: Essential, Premium, Premium Plus

- Int'l transfer cost: Not available

- Int'l card payment cost: £1.00 + 2%

- Proof of UK residence required: No

- More info: Go to the website .

Path 3: Multi-Currency Accounts

Online multi-currency accounts aren't full banks in the UK but rather fintech companies (known formally as Electronic Money Institutions or EMIs) that often compete to offer the cheapest ways to transfer money globally. However, in addition to money transfers and currency exchange, multi-currency wallets normally come complete with a debit card, multi-currency account balances, and even foreign bank details.

Below, we go over three of the most prominent multi-currency fintechs: Revolut, Wise, and Monese.

Revolut: Best UK Account for EEA Residents

Probably the UK's most famous fintech, there's a good chance you've heard of Revolut .

- Trust & Credibility 8.9

- Service & Quality 7.9

- Fees & Exchange Rates 8.3

- Customer Satisfaction 9.4

Using its innovative personal finance platform, you'll not only have access to a broad range of financial services unique among free online accounts, but you'll also be able to take advantage of these services at a comparatively low price. However, because it's not yet a bank in the UK, we think Revolut is best used as a powerful spending tool next to a main bank account, as opposed to in place of it (even if that bank account is in your home country).

Sadly, although Revolut is also available in the US, Australia, Singapore, Switzerland, and Japan, its British pound account details are only available to EU/EEA and UK customers who get both an EU IBAN account (in Lithuania) and a British current account number, sort code, and SWIFT code.

- Account names: Standard, Plus, Premium, Metal

- Monthly fee:

- Int'l transfer cost: 0.5% - 1.5%

- Proof of UK residence required: Not necessarily

- More info: See our full Revolut review or visit the website .

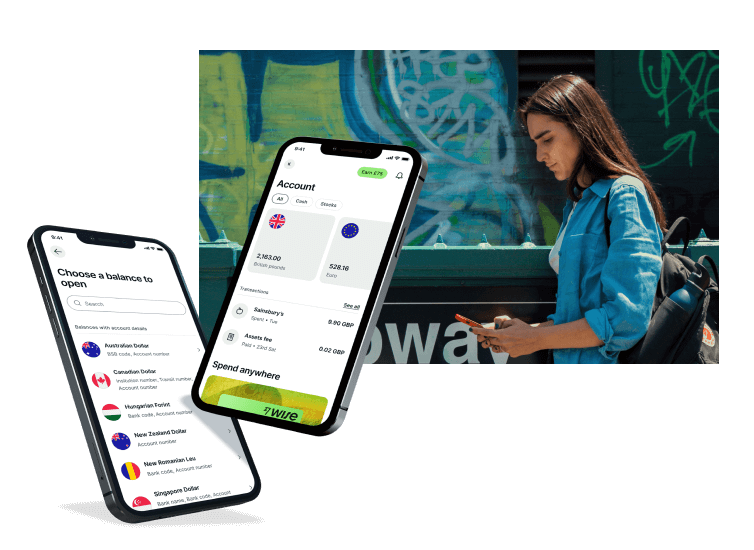

Wise: Best UK Account for Non-EEA Residents

The Wise Account is the best way to open a UK bank account from abroad (especially if you're not from the EU/EEA and don't have access to Revolut).

- Service & Quality 8.9

- Fees & Exchange Rates 7.6

- Customer Satisfaction 9.6

Wise will work for you no matter whether you want to hold money in pounds, spend money on holidays abroad, shop online, or receive earnings from the UK. Fortunately, after opening your account online, you'll only be required to verify your identity; you won't need to show proof of residence in the UK to sign up and obtain the VISA debit card (although you will need to show proof of residence in the EU/EEA, US, Singapore, Japan, Australia, or New Zealand).

Here's what Wise has to say about opening an account without proof of residence in the UK⁵:

"You can then choose to either supply proof of address from a standard list of documents, or to send in a selfie, in which you're holding your proof of ID. This can be a great alternative if you're still waiting to move to the UK or haven't yet got bills and other paperwork registered in your name."

Wise's Top Features

Your Wise Pound account will be held by Barclays Bank and come with the following details unique to you:

- A sort code;

- An account number;

- A British IBAN (starting with "GB").

This means you'll be able to spend and be paid just like a local in the UK and convert your GBP balance into your home currency without the exorbitant bank fees. Here's an overview of the other features you'll get:

- Local bank details, not just in the UK, but also in the US, EU, Australia, New Zealand, Singapore, Romania, Canada, and Hungary.

- Hold, exchange, and top-up up to 56 currencies.

- A multi-currency VISA debit card that's handy for paying in foreign currencies without hidden fees.

- Access to Wise 's powerful international money transfer service right from your account balance.

An Example of How Wise is Useful

To get a sense of how helpful Wise can be for expats and non-residents in the UK, let's say that you've just moved from Paris to London and need an active online account to receive and spend pound sterling. With a Wise, you'll be able to...

- send euros from your bank to your Wise euro account,

- convert all or part of your euro balance into sterling at a low fee of around €6.94 to add £1,000,

- pay with your Wise debit card, make or receive SEPA and SWIFT payments, and set up direct debits .

You'll also have UK bank details to share with an employer. Note that this account does not offer overdraft facilities, and you also won't earn interest on any in-credit balances.

Monese: Another Option for EEA Residents

Monese is a mobile-only challenger bank that offers fully-fledged checking accounts to more than two million customers in the UK and across much of Europe.

- Trust & Credibility 7.6

- Service & Quality 9.0

- Fees & Exchange Rates 6.6

- Customer Satisfaction 8.7

Because Monese doesn't require you to prove your residence to meet the minimum creditworthiness standards to open an account in the UK, we think Monese is especially well-suited for new arrivals to the UK from the EEA. Although we don't find Monese quite as feature-rich as Revolut, we do think it has an advantage over Wise if you plan to split your life between the UK and a country in Europe.

Although you only get a Euro IBAN (starting with 'BE') if you're an EU/EEA resident, you will be able to use this to receive British pounds too. It's currently illegal to discriminate based on the origin of an IBAN in the UK and EU.

Here's an overview of Monese's offering:

- Account name: Starter, Classic, Premium

- Int'l transfer cost: 0.5% - 1.5%

- Int'l card payment cost: 0% (0.4% - 0.8% for cash withdrawals)

- Proof of UK residence required: Not necessarily

- More info: See our full Monese review .

How To Get Proof of Address in the UK

Regardless of which bank account you choose, if you're planning to move to the UK for a more extended period, getting your proof of address in order will be a necessary step in the long run.

Following modern anti-money laundering (AML) regulations, banks and other financial institutions are required to ask for appropriate evidence of identity whenever certain financial transactions occur. Checking that identity and proof of address match minimizes the chance that the account is opened under a false identity⁶.

What Document Count as Proof of Identity?

Banks and other financial institutions will require proof of identity in the form of a valid, government-issued passport, original birth certificate, EU/EEA member state ID card, current UK or EU/EEA driving licence, registration card for self-employed individuals, Resident Permit issued by the Home office to EEA nationals, National Identity card, or a Firearms certificate.

Provisional driving licenses and biometric residence permit (BRP) cards are often not accepted as proof of ID by UK banks.

What Document Count as Proof of Address?

In addition to a proof of identity, you'll also be required to provide one (even two) original documents to prove that you live where you claim to live (i.e. your residential address) in the UK. The following documents are practically always accepted:

- Utility bills, such as for electricity, gas, satellite, TV, or landline that are at most three months old. (Note that a mobile phone bill will not be accepted).

- A local authority council tax bill for the current council tax year.

- A valid UK driving licence.

- Bank or building society statement or passbook less than three months old (bank statements won't be accepted if they're from Monzo).

- Mortgage statement (issued for the last full year).

- Solicitors letter within the last three months confirming the property purchase (or the land registry confirmation of address).

- A council or housing association rent card or tenancy agreement for the current year.

- HMRC self-assessment letters or tax demand dated within the current financial year.

- Electoral Register entry.

- NHS medical card or letter of confirmation from GP's practise of registration for surgery.

Credit card statements or provisional driving licenses will not be accepted as proof of address. According to the Financial Conduct Authority (FCA) , if you're unable to provide the documents listed above, you can request to see if the bank will accept any of the following documents:

- A letter from a care home manager or warden of sheltered accommodation or a refuge.

- A letter from the warden of a homeless shelter.

- A letter from a probation officer or a hostel manager.

- A letter from a prison governor.

- If you are a traveller, a letter from the local authority that verifies your address.

- If you are an international student, a passport or European Economic Area National Identity Card and letter of acceptance or introduction from a body on the Department for Education list.

- If you're an asylum seeker, an application registration card.

What If My Application to Open a UK Bank Account is Refused?

There are 9 major high-street banks in the UK that are required to offer basic bank accounts to legal residents and citizens in the UK. These banks are: Barclays UK, the Co-operative Bank, HSBC UK, Lloyds Banking Group (including Halifax and Bank of Scotland brands), Nationwide Building Society, NatWest Group (including Royal Bank of Scotland and Ulster Bank brands), Santander UK, TSB, and Virgin Money.

However, banks in the UK can still refuse to open bank accounts if you fail to provide proper documentation, such as a proof of ID or proof of UK address. Know Your Customer (KYC) laws require banks to obtain identity information about their customers to help prevent money laundering and terrorist financing.

Banks are not required to give their reasons for refusing an account. However, you can issue a complaint to the Financial Ombudsman Service if you think you have faced discrimination. Typically, it takes 8 to 12 weeks to address such disputes. In the event that you are dissatisfied with the Ombudsman's final decision, you may consider pursuing legal action, though you will generally be responsible for covering your own legal expenses.

How To Send Money to a UK Bank Account

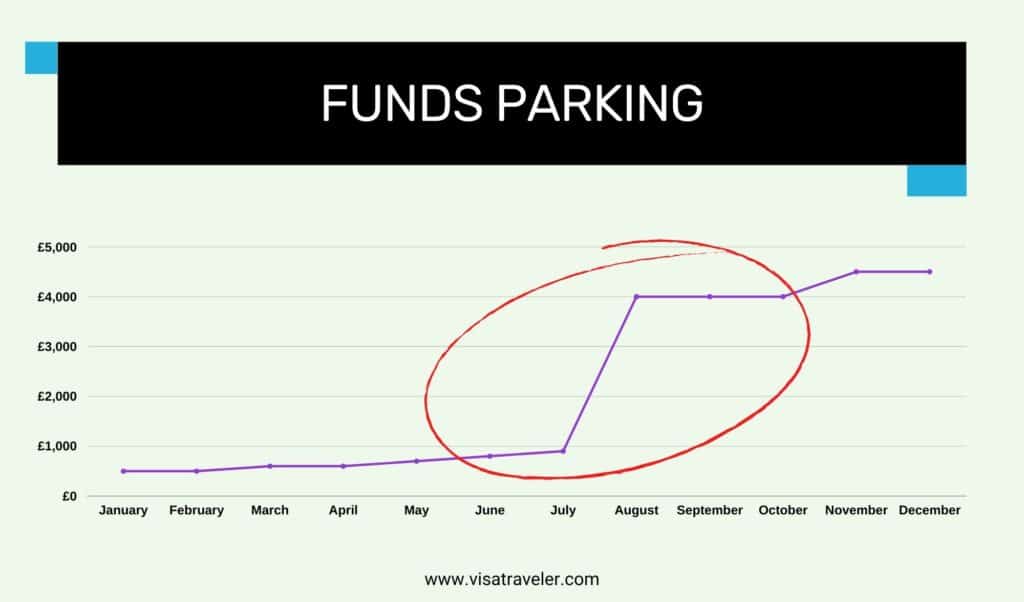

Once you've opened a bank account in the UK, you'll need to consider how to move your funds across , a process that can be exceptionally costly if you're depositing money from a currency other than pounds. To deposit money into your new pound sterling account from your home currency before you move, you'll need to go to your online banking and choose between one of two options:

- Sending a wire transfer through your bank directly;

- Sending a bank transfer via a money transfer specialist.

We don't recommend using your bank to transfer money internationally, as the fees can be exorbitant, and the waiting times can be lengthy. This is mainly because banks wire funds over the SWIFT network , which adds many timely and expensive steps to the money transfer process.

Instead, if the amount you'd like to send to the UK is in the order of several hundred or thousand Pounds or equivalent, then we recommend you use a money transfer specialist service ( Wise is one among many.) To compare which services are cheapest for your transfer amount and your home country to the UK, run a search on Monito's real-time comparison engine here .

On the other hand, if you're moving large amounts of money from your home currency to your new bank account in the UK (i.e. anything upwards of £30,000 or equivalent), services such as Wise may not be your cheapest bet. Instead, we recommend exploring your options among the foreign exchange brokers that support transfers from your country to the UK. These services specialise in negotiating favourable exchange rates on your behalf. They are the most cost-effective option for transferring large sums of money (such as life savings or liquid investments) across borders.

To find out which service will offer you the best deal in real-time, run a search on our comparison engine below:

Find the best deal when sending money to the United Kingdom:

Recap: what are the best online bank accounts in the uk.

To conclude, let's recap the main recommendations we explored in this non-resident banking guide:

- Revolut : Best GBP non-resident account for EU/EEA residents.

- Wise : Best GBP non-resident account for non-EU/EEA residents.

- Starling Bank : Best low-cost online bank for UK residents.

- Monzo : Best online savings account for UK residents.

- HSBC : Best traditional banking experience for UK residents.

- Monito : Best way to compare money transfers to the UK.

See our guide on the best online-only banks in the UK for more.

FAQ About Opening a Bank Account Online in the UK For Non-Residents

Few solutions offer a bank account in the UK when you don't have proof of address in the UK. With Monzo or Monese, you can open a UK bank account with just a few clicks, although you'll need to show proof of residence. Generally, we consider the Wise Account the best UK bank account for non-residents. See all the details about opening a bank account in the UK without proof of address in our in-depth guide.

Expats moving to the UK might find it difficult to open a traditional bank account. To open a bank account, you need proof of address, which might be hard to get if you are a non-resident. The good news is that companies like Monzo or Monese offer a UK bank account without proof of address. You can have a UK bank account with just a few clicks. You will find more info about UK bank accounts for non-residents in our blog post .

Yes, it is possible to have a Euro bank account in the UK, and some UK banks offer bank accounts in Euros. However, the fees for such accounts are quite high. For low-fee (or even free) solutions, take a look at our guide to the best Euro bank accounts in the UK .

To open a bank account in the UK, you'll generally need two things:

- Proof of your identity: E.g. Passport, drivers license, or national identity card. In general, if you are a foreign national, your best bet is to use your passport.

- Proof of the address in the UK: E.g. a recent utility bill, rental contract, council tax bill. Mobile phone bills are generally not accepted. If you don't have proof of address, then we recommend opening a Wise Account to take care of your finances until you sort one out.

UK banks ask customers to prove who they are and where they live in the UK before they open a bank account. Proof of address ensures that a bank account is not opened under a false identity. Each bank accepts different documents, but in general, you will be asked to show two official documents, for example:

- Utility bills

- Local authority council tax bill for the current council tax year

- Current UK driving license

- Bank, Building Society or Credit Union statement

- Mortgage statement

- A council or housing association rent card or tenancy agreement for the current year

- Solicitors letter within the last three months confirming the property purchase (or the land registry confirmation of address)

- HMRC self-assessment letters

- Electoral Register entry

- NHS Medical card

Foreigners can open a traditional bank account in the UK as long as they have proof of the address, which sometimes it's hard to get. The good news is that there are companies like Monzo or Monese which offer UK bank accounts even without proof of the address. All the information about opening a bank account in the UK you will find in our blog post .

A non-resident cannot open a bank account in the UK in a strict sense, as proof of address is always required by British banks for new customers. However, to open an account ahead of a move to the UK, you can opt to open a British pound foreign currency account at your local bank in your home country, or, you can open a savvy only multi-currency account in pounds (and dozens of other currencies) via Wise that gives you a full set of official UK banking details, including an IBAN, account number, and sort code.

- Current account: Called a 'checking account' in the US, this is what most people are looking for basic everyday use, such as paying bills and receiving a salary. They generally come with a debit card and overdraft. Chequebooks are no longer automatically issued to new customers, but you may be able to opt for one if you wish.

- Savings account: These accounts have traditionally yielded a higher interest rate and are meant for what their name implies — saving money. However, a number of current accounts also pay interest on balances up to a set amount.

There are also basic accounts (which are generally on offer for people with a poor credit history), as well as premium current accounts (which cost a monthly fee and come loaded with features), as well as current accounts aimed at youth and students.

Yes, in some cases, it's possible to open a Spanish bank account from the UK, although you'll need to prove a legitimate interest in Spain and obtain a certificate of non-residency (and the associated NIE number) in order to do so. Take a look at our guide to opening a non-resident bank account in Spain to learn more.

If you don't yet have a UK ID and are planning to move to the country, you can opt to open a British pound foreign currency account at your local bank in your home country, or, alternatively, you can open a savvy only multi-currency account in pounds (and dozens of other currencies) via Wise that gives you a full set of official UK banking details, including an IBAN, account number, and sort code.

Yes, it's possible to open a bank account online at most UK banks, although many high-street banks will require you to come in for an appointment too. To get an overview of which banks are completely online in the UK, take a look at Monito's guide to the best UK challenger banks .

- Statista: Largest banks in the United Kingdom (UK)

- Lloyds Bank: International Current Account

- FSCS: What we cover

- GOV.UK: Your responsibilities under money laundering supervision

- Wise: How to get a proof of address in the UK

- GOV.UK: Proof of identity checklist

Compare Top Online Banks in the UK

Filter your results.

- Languages open English (8) Polish (5) German (4) French (4) Italian (4) See all

- Country availability 1 open United Kingdom (8) Italy (14) Germany (13) Poland (11) United States (11) See all

- Services open Multi-currency account (3) Travel card (3) Full bank account (2) All-in-one finance app (2)

- Monthly fee open Very low (6) Low (1) Moderate (1)

- Card delivery time open Fast (5) Mid (3)

- Best for open Spending while abroad (4) Easy registration (2) Everyday banking (2) Spending online (1) Saving money (1)

- Bank details open Euro IBAN (5) UK account no. & sort code (5) Romanian account no. (2) Australian account & BSB no. (1) Canadian account, transit, institution no. (1) See all

- Supported currencies open Pound sterling (8) Euro (6) US dollar (5) Australian dollar (4) Canadian dollar (4) See all

- Overdraft open No (5) Yes (3)

- Annual interest rate open Very low (6) High (1) Low (1)

- Supports cash deposits open Yes (5) No (3)

- International transfers open Yes (8)

- Overall Monito Score

- Trust & Credibility

- Service & Quality

- Fees & Exchange Rates

- Customer Satisfaction

- Service & Quality 7.8

- United Kingdom

- Full bank account

- Everyday banking

- UK account no. & sort code

- Pound sterling

- Overdraft Yes

- Supports cash deposits Yes

- International transfers Yes

- Saving money

- Czech Republic

- Liechtenstein

- Netherlands

- Switzerland

- United States

- New Zealand

- Multi-currency account

- Spending while abroad

- Hungarian account no.

- US account & routing no.

- Australian account & BSB no.

- New Zealand account no.

- Canadian account

- institution no.

- Romanian account no.

- Singaporean account no. & bank code

- Turkish IBAN

- Australian dollar

- Bulgarian lev

- Canadian dollar

- Swiss franc

- Czech koruna

- Danish krone

- Croatian kuna

- Japanese yen

- Malaysian ringgit

- Norwegian krone

- New Zealand dollar

- Polish zloty

- Romanian leu

- Swedish krona

- Singapore dollar

- Turkish lira

- United Arab Emirates dirham

- Chilean peso

- Moroccan dirham

- Pakistani rupee

- Tanzanian shilling

- Uruguayan peso

- Argentine peso

- Botswana pula

- Chinese yuan

- Egyptian pound

- Ghanaian cedi

- Indian rupee

- Kenyan shilling

- Mexican peso

- Ukrainian hryvnia

- Vietnamese Dong

- Costa Rican colon

- Israeli new shekel

- South Korean won

- Ugandan shilling

- Bangladeshi taka

- Sri Lankan rupee

- Nigerian naira

- Philippine peso

- Russian ruble

- Overdraft No

- Supports cash deposits No

- All-in-one finance app

- Spending online

- Hong Kong dollar

- Qatari riyal

- Saudi riyal

- Trust & Credibility 8.6

- Service & Quality 8.6

- Fees & Exchange Rates 7.3

- Customer Satisfaction 9.9

- Travel card

- Easy registration

- Fees & Exchange Rates 7.8

- Customer Satisfaction 6.2

- Service & Quality 5.4

- Fees & Exchange Rates 6.0

- Customer Satisfaction 7.9

- No account details (balance only)

Non-Resident Bank Accounts in the UK vs Other Countries

Many countries allow non-residents to open a bank account within their legal jurisdictions, but exactly what kind of requirements non-residents face can differ drastically from country to country and even bank to bank. See the list below to get a better idea of this:

Last updated: 18/2/2022

Other Banking Guides in the UK

Why Trust Monito?

You’re probably all too familiar with the often outrageous cost of sending money abroad. After facing this frustration themselves back in 2013, co-founders François, Laurent, and Pascal launched a real-time comparison engine to compare the best money transfer services across the globe. Today, Monito’s award-winning comparisons, reviews, and guides are trusted by around 8 million people each year and our recommendations are backed by millions of pricing data points and dozens of expert tests — all allowing you to make the savviest decisions with confidence.

Monito is trusted by 15+ million users across the globe.

Monito's experts spend hours researching and testing services so that you don't have to.

Our recommendations are always unbiased and independent.

How To Open A UK Bank Account For Non-British Citizens

Ross Irvine

Finance Director

Have you just arrived to the UK, or planning to move soon? If you’re moving for work or international studies and want to be ready for settling here, you might be eligible for a UK bank account as a non-British citizen. But is opening a UK bank account essential if you are planning to stay here? And can you open a bank account online even without proof of residence in the UK? Can you have a UK bank account if you live abroad?

To answer these questions, we take a look at some of the best bank accounts for non-British citizens in the UK, from expat accounts to app-based online banking. Read below to find out everything about expat banking.

In this article

- UK bank account for non-residents: why do you need one?

- Types of banks and bank accounts in the UK

- How can you open a UK bank account without proof of address?

- How do you choose a bank account?

- What is the easiest UK bank account to open?

- What else do you need to consider about banking and sending money abroad as a non-British citizen?

UK bank account for non-British citizens: why do you need one?

When thinking of moving to the UK, it’s important to make sure you understand how to manage your money. The good news is that there are a lot of reliable banks in the UK, so if you are moving for work, study, or retiring, there will be plenty of options for you.

Whilst y ou can get a bank account in the UK as a foreigner – you should be aware that banks and building societies require proof of address in the UK. This can make things a little difficult when you first arrive as an expat.

We explore all of the options below, from high street banks to expat accounts to app-based banking and more.

Do you have to open a bank account as a non-citizen in the UK?

Whilst you don’t legally have to open a bank account when you move to the UK, you may find it makes your life a lot easier if you do! It is not required by law to have a bank account to live in the UK (and not all British residents have one) but you may find that very few employers pay into foreign accounts or pay by cash.

Also, you may see higher transaction charges for using a foreign account in shops and cash machines in the UK. Moreover, you will certainly need a bank account to pay your utility bills and get a mortgage.

If you don’t want to go down the route of opening a traditional bank account in the UK, there are alternative money management options such as:

- Building societies

- Credit unions

- National Savings and Investment accounts (formerly Post Office Savings accounts)

Why is it more difficult to open a bank account in the UK as a new resident?

The proof of address detail is where people moving to the UK from abroad often hit a wall. It’s also tough if you’ve landed in the UK and live with relatives and don’t have any bills in your name or a rental contract.

Here are our recommendations in short:

If you want to open a bank-like UK account without proof of address, Revolut, Monese and Monzo are a few online services that will set up a UK account without residency. All offer UK account numbers and sort codes, and debits cards you can use in retailers or pay for items online. Each service has different rules, so read the detail section for each provider to make sure you find the best service for your needs. In the case of Revolut, you might have to get in touch with the customer support team to open an account without the address in the UK.

What can you do to prepare for opening a bank account in the UK as a non-British citizen?

Before you open a UK bank account as a non-British citizen, you can still manage your money from your overseas account. However, to make your move to the UK as smooth as possible, you might want to:

- check with your home bank if your debit or credit cards can be used abroad

- make sure that you know the exact costs of transaction fees and currency exchange fees

- double check if your home bank is able to help you open a bank account in the UK if it has a correspondent banking relationship with a UK bank

Alternatively, some UK banks have international accounts for non-citizens that can be opened up from abroad (especially in the EU), so you could open an account in advance of your move. Some banks charge monthly fees for these accounts, though, so check first and don’t open an account months in advance of moving if it will mean hefty charges.

Why is it worth opening a bank account in the UK as a non-citizen?

- If you’re planning to work in the UK, your future employer will be transferring your salary into a UK bank account

- It will be easier to rent a property if you can cover the costs from a UK account

- You’ll be charged currency conversion fees each time you use your debit card or withdraw cash in the UK. Currency exchange rates fluctuate, making it harder to keep to a budget

- You will need a local bank account for your bills, such as mobile phone contracts, gym membership and energy bills

- Last but not least, if you get locked out of your home bank account because you’ve forgotten your PIN code, it will be challenging to deal with it internationally as opposed to a local branch

Is it harder for expats to get mortgages in the UK?

What to look out for when applying for an expat mortgage, banking in the uk if you’re a non-british citizen: traditional vs online banks.

The UK is one of the global financial centres and its financial services sector consists of private UK banks, international banks, and publicly owned lending institutions such as building societies and credit unions.

The UK has the biggest banking sector in Europe , with 300 banks and 45 building societies. The banks available to the public are called ‘high street’ banks: the major ones include Barclays, HSBC, Lloyds, NatWest, and Royal Bank of Scotland. Santander is also a big name. The biggest building society is Nationwide. Most high street banks are available online as well as on the high street.

Types of UK bank accounts

- Current account – Usually referred to as a ‘checking account’ in the US. This is your day-to-day account, the one your main salary is paid into. Current accounts offer debit cards and, depending on your circumstances, will permit you to go overdrawn up to a set limit. Some of these accounts charge a fee, for which you get benefits in return, like cashback on your spending and/or interest on your balance when you’re in credit or roadside car insurance.

- Basic banking accounts – these are a type of current account, mainly aimed at people with a low income or with a poor credit rating. As the name suggests, they only offer the basics. You won’t get an overdraft, for example.

- Savings accounts – these come in different types, including regular savings accounts where current account customers get a preferential rate, and ISAs, where interest earned is protected from tax.

Several high street banks also provide international student bank accounts . These can offer incentives, such as cashback and gift cards, and international students may be able to apply for a small overdraft.

Some banks offer expat accounts especially designed for those living and working outside their home country. These usually have minimum income or deposit requirements.

Which documents will you need to open a UK bank account as a non-British citizen?

To open a UK bank account, you generally need the following two things:

- Proof of your identity : it can be a passport, driving licence, or national identity card. In general, if you are a foreigner, you most likely will use your passport.

- If you are an international student , you will need to show a valid study visa, a Student ID or a letter of acceptance from your university, and sometimes a bank statement from your home bank.

- Proof of address : This is generally a recent utility bill, rental contract, council tax bill. Mobile phone bills are generally not accepted.

What are the best hospitals in the UK?

We look at everything you need to know about healthcare in the uk, how do you open a uk bank account without proof of address.

The proof of address requirement is where foreigners and non-residents in the UK who have just arrived in the country experience difficulties. However, with the recent surge of digital app-based banks launching in the UK, there is more choice than before for you to open a bank account to make your life in the UK easier.

According to a recent study by the Finder.com, 14 million Britons have already opened accounts in digital banks, and 18% of Brits plan to switch to an online-only bank by 2027. Convenience, better terms of service and the ability to track spending in real time are the three main reasons that British users enjoy the ‘disrupters’ online banks.

Note that even though you don’t have to submit proof of address, you’ll still need to supply a UK address – this is also where your debit card will be delivered.

How do you get proof of residence in the UK as an expat?

Banks and financial institutions, according to the Money Laundering Regulations 2017, are required to ask for appropriate Identity Evidence when certain financial transactions take place. By checking your ID (name) and a proof of address at your name, this minimises the chance that the account is opened under a false identity.

Banks and other financial institutions will require proof of name in the form of a current signed passport, original birth certificate, EEA member state identity card, current UK or EEA driving licence, registration card for self-employed individuals, Resident Permit issued by the Home office to EEA nationals, National Identity card or Firearms certificate.

UK banks ask customers to prove who they are and where they live in the UK before they open a bank account. Proof of address ensures that a bank account is not opened under a false identity. Each bank accepts different documents, but in general, you will be asked to show two official documents, e.g.:

- Utility bills

- Local authority council tax bill for the current council tax year

- Current UK driving license

- Bank, Building Society or Credit Union statement

- Mortgage statement

- Council or housing association rent card or tenancy agreement for the current year

- Solicitors letter within the last three month confirming the property purchase (or the land registry confirmation of address)

- HMRC self-assessment letters

- Electoral Register entry

- NHS Medical card

How do you choose a UK bank account as a non-British citizen?

If you are looking to open a bank account in the UK as an expat, which bank you decide to go for will depend on your own personal circumstances and what you are looking for. There are various factors you might want to take into consideration, such as:

- Flexibility – as an expat, if you’re looking for ease of access and 24/7 banking, digital and mobile accounts are well worth considering.

- International scope – if you want an account that will be well-linked to accounts and services overseas, you’ll need to check international and multi-currency account options as well as services such as international money transfers.

- Potential costs – some banks may charge you for withdrawing money. You also might want to check the commission you pay for exchanging currency.

- Range of products and services – this can range from account-related services such as credit and borrowing options to other financial services including UK mortgages, insurance in the UK, and investments.

- Incentives – many banks will try to attract customers by offering incentives such as cash deposits or interest-free periods, so shop around to see what’s available.

How can expats survive the cost of living crisis?

We look at how best to manage your budget and help you stay in control of your spending, what is the easiest uk bank account to open for non-british citizens.

The high street banks will want to see proof of your UK address, often in the form of a Council Tax bill or utility bills in your name, before they will allow you to open an account. But expats who’ve just arrived won’t have these .

Because of this, some expats find applying for an account with an online-only bank or e-money institution (such as a FinTech app) quicker and easier than with a high street bank.

As an expat, you might also want one that offers multi-currency accounts, especially if you’re a digital nomad working in different countries . Plus, you’ll probably be looking to send money back to your home country as cheaply as possible. The latter might be cheaper if you open an account with the same bank as your one at home.

Account opening requirements vary, so be sure to check the terms and conditions, but some options include:

Please note: we are not promoting any of these accounts and you will need to make an informed decision before opening one. Subject to change. Please check their websites for full information.

Depending on your salary, it might also be worth looking at the expat accounts offered by the high street banks . These include:

- HSBC Expat Premier account – sterling, USD and euro multi-currency accounts and exclusive foreign exchange rates. But you need a salary of £100,000 or £50,000 in an HSBC bank account.

- HSBC Currency Account – an easy-to-manage currency holding account, with no monthly account fee. You can choose from 14 major currencies and open a separate account for each one to store, send and receive money.

- Lloyds International account – a choice of sterling, USD or euro and free international money transfers. You’ll need an annual income of £50,000.

- Barclays International account – offers services in 70 countries, however, you will need to deposit at least £100,000 (or currency equivalent) across your accounts with Barclays.

- NatWest International Select account – pay in a minimum salary of £40,000 and manage your money on the mobile app.

How much does medical treatment cost away from home?

Prices vary significantly, so find out before you make a move, what else do you need to consider about banking and sending money abroad in the uk as a non-citizen, can you have a uk bank account if you don’t live in the uk.

You can simply keep your current account open if you leave the UK to live and work overseas. This might be a smart move, especially if you’re not moving permanently.

There are also some accounts you can open ahead of time if you’re planning to move to the UK. It’s a good idea to check with your bank to see if they have links with UK banks, as it can make doing this easier.

Online banking in the UK: what does it look like?

Online or mobile banking is available through mobile banking apps in the UK which can be downloaded onto smartphones and tablets. Services and features vary slightly between banks. Many offer the possibility of mobile banking for a range of accounts including current accounts, savings accounts, and business accounts.

Mobile banking features include:

- Mobile payments, so that you can pay bills, go shopping, and make P2P payments to other mobile users

- Money management and budgeting tools, including keeping track of loans and investments

- 24/7 access to your account and instant bank mobile bank statements

- International money transfers to multi-currency accounts

- Online support including through social media channels such as Facebook and Twitter

- Enhanced security features

Not all banking services are available through apps at the moment, with mobile-only banks unlikely to offer the full range of services available through traditional banks such as loans, mortgage options, and insurance. Mobile banking in the UK is also reliant on good Wi-Fi coverage, which can be a problem in some rural and remote areas.

Can a tourist open a bank account in the UK?

No. You need a UK address to open a bank account in the UK. If you’re just passing through, a multi-currency account with one of the banking apps might be a good option.

What about sending money abroad?

There are a lot of options, so it’s important to shop around for the best rates. You might want to investigate what banking apps have to offer. A few examples include:

- Paysend – transfer money online to over 90 countries.

- Wise (formerly TransferWise) – rates based on the real exchange rate. Receive money for free.

- Western Union – a huge global network and your choice of sending cash to a bank account, Western Union agent, or (in some locations) direct to a mobile number.

Can a foreigner open a bank account in the UK?

Foreigners can open a traditional bank account in the UK as long as they have proof of the address, which sometimes it’s hard to get.

Good news is that there are companies like Monzo or Monese which offer UK bank accounts, even without proof of the address.

Is it possible to have a Euro bank account in the UK?

Some UK banks offer bank accounts in Euro. However, the fees for such accounts are quite high. But we have good news – there is a possibility to open a bank account in Euro for free.

Want more expat content? Subscribe to our fortnightly newsletter!

- Enter your email address

- Email This field is for validation purposes and should be left unchanged.

Wherever you move, we can help you safeguard your health

At William Russell, we have over 30 years’ experience helping expatriates move abroad and settle into their new lives overseas by providing world-class international health insurance . We produce lots of expert material to help you and your family adapt to life abroad.

Making the move to another country can be challenging. But no matter where you go, you can take one thing off your mind. William Russell offers global health insurance that can cover you for everything from minor injuries to long hospital stays, and we even offer medical evacuations to patients who require treatment in other countries. Speak to us today to find out more about how international health insurance could support you.

Looking for international health insurance?

Related articles.

- Relocation guides

Living In Pakistan: A Guide To Moving To Pakistan As An Expat

This practical guide will walk you through everything you need to know about living in Pakistan.

The 10 Best Countries For University Education In 2024

To help you decide where to move to as an international student, we’ve ranked the top universities to study abroad.

The Best And Worst Cities For Healthcare In 2024

If you’re thinking about moving abroad, make sure you choose a destination with great healthcare.

What Is An Embassy And What Does It Do For Expats?

If you’re living overseas and you remain a citizen of your home country, it’s important to know about your embassy.

More results…

How To Open A UK Bank Account For Non-Residents

Uk bank account for non-residents: why do you need one, do you have to open a bank account as a non-resident in the uk.

- Building societies

- Credit unions

- National Savings and Investment accounts (formerly Post Office Savings accounts)

Why is it more difficult to open a bank account in the UK as a new resident?

What can you do to prepare for opening a bank account in the uk as a non-resident.

- check with your home bank if your debit or credit cards can be used abroad

- make sure that you know the exact costs of transaction fees and currency exchange fees

- double check if your home bank is able to help open a bank account in the UK for you if it has a correspondent banking relationship with a UK bank

Why is it worth opening a bank account in the UK as a non-resident?

- If you’re planning to work in the UK, your future employer will be transferring your salary into a UK bank account.

- It will be easier to rent a property if you can cover the costs from a UK account.

- You’ll be charged currency conversion fees each time you use your debit card or withdraw cash in the UK. Currency exchange rates fluctuate, making it harder to keep to a budget.

- You will need a local bank account for your bills, such as mobile phone contracts, gym membership and energy bills.

- Last but not least, if you get locked out of your home bank account because you’ve forgotten your PIN code, it will be challenging to deal with it internationally as opposed to a local branch.

Banking in the UK if you’re a non-resident: traditional vs online banks

Types of uk bank accounts.

- Current account – Usually referred to as a ‘checking account’ in the US. This is your day-to-day account, the one your main salary is paid into. Current accounts offer debit cards and, depending on your circumstances, will permit you to go overdrawn up to a set limit. Some of these accounts charge a fee, for which you get benefits in return, like cashback on your spending and/or interest on your balance when you’re in credit or roadside car insurance.

- Basic banking accounts – these are a type of current account, mainly aimed at people with a low income or with a poor credit rating. As the name suggests, they only offer the basics. You won’t get an overdraft, for example.

- Savings accounts – these come in different types, including regular savings accounts where current account customers get a preferential rate, and ISAs, where interest earned is protected from tax.

Which documents will you need to open a UK bank account as a non-resident?

- Proof of your identity : it can be a passport, driving licence, or national identity card. In general, if you are a foreigner, you most likely will use your passport.

- If you are an international student , you will need to show a valid study visa, a Student ID or a letter of acceptance from your university, and sometimes a bank statement from your home bank.

- Proof of address: This is generally a recent utility bill, rental contract, council tax bill. Mobile phone bills are generally not accepted.

How do you open a UK bank account without proof of address?

How do you get proof of residence in the uk as an expat.

- Utility bills

- Local authority council tax bill for the current council tax year

- Current UK driving license

- Bank, Building Society or Credit Union statement

- Mortgage statement

- Council or housing association rent card or tenancy agreement for the current year

- Solicitors letter within the last three month confirming the property purchase (or the land registry confirmation of address)

- HMRC self-assessment letters

- Electoral Register entry

- NHS Medical card

How do you choose a UK bank account as a non-resident?

- Flexibility – as an expat, if you’re looking for ease of access and 24/7 banking, digital and mobile accounts are well worth considering.

- International scope – if you want an account that will be well-linked to accounts and services overseas, you’ll need to check international and multi-currency account options as well as services such as international money transfers.

- Potential costs – some banks may charge you for withdrawing money. You also might want to check the commission you pay for exchanging currency.

- Range of products and services – this can range from account-related services such as credit and borrowing options to other financial services including UK mortgages, insurance in the UK, and investments.

- Incentives – many banks will try to attract customers by offering incentives such as cash deposits or interest-free periods, so shop around to see what’s available

What is the easiest UK bank account to open for non-residents?

- HSBC Expat Premier account – sterling, USD and euro multi-currency accounts and exclusive foreign exchange rates. But you need a salary of £100,000 or £50,000 in an HSBC bank account.

- Lloyds International account – a choice of sterling, USD or euro and free international money transfers. You’ll need an annual income of £50,000.

- NatWest International Select account – pay in a minimum salary of £40,000 and manage your money on the mobile app.

What else do you need to consider about banking and sending money abroad in the UK as a non-resident?

Can you have a uk bank account if you don’t live in the uk, online banking in the uk: what does it look like.

- Mobile payments, so that you can pay bills, go shopping, and make P2P payments to other mobile users.

- Money management and budgeting tools, including keeping track of loans and investments.

- 24/7 access to your account and instant bank mobile bank statements.

- International money transfers to multi-currency accounts.

- Online support including through social media channels such as Facebook and Twitter

- Enhanced security features

Can a tourist open a bank account in the UK?

What about sending money abroad.

- Paysend – transfer money online to over 90 countries.

- Wise (formerly TransferWise) – rates based on the real exchange rate. Receive money for free.

- Western Union – a huge global network and your choice of sending cash to a bank account, Western Union agent, or (in some locations) direct to a mobile number.

Can a foreigner open a bank account in the UK?

Is it possible to have a euro bank account in the uk, thinking of moving abroad in 2022.

Our website doesn't support your browser so please upgrade .

Apply for an account when you're outside the UK

Need a uk account.

Do you live outside the UK but need a bank account to manage your finances in the UK? Or, are you planning a move to the UK and looking to open a UK bank account? Apply for an HSBC bank account from outside the UK and take full control of your finances.

Already in the UK? Search for and open a UK account

Banking in the UK

Who can apply for an hsbc uk bank account .

You can apply for an HSBC UK bank account if you:

- Are 18 or older

- Are happy for us to do a credit check against your name (if you live in the UK)

- Can provide ID and proof of address (other eligibility criteria may also apply)

How do I open an HSBC UK bank account?

The easiest way to open an HSBC UK bank account is to apply online. If you need support, you can also visit one of our branches in the UK and we’ll help you with your application.

If you have a smartphone or tablet, bring it with you if you're visiting a UK branch in person.

What do I need to open an HSBC UK bank account?

To open an account, you'll need:

- Your current employment, income, and tax details

- Proof of ID, such as your passport or driving license

- Proof of address, such as utility bill or bank statement

For more information, visit our page on what you need to open an HSBC UK bank account .

Can I set up an HSBC UK bank account from abroad?

You can set up an HSBC UK bank account from many locations abroad. Once you've chosen your preferred account, use the apply button to find out if you might be eligible.

Why open an HSBC UK bank account

Convenient ways to bank

24/7 access to your account using mobile, online, automated phone banking and a debit card.

No monthly account fee

We don't charge you a fee just for keeping your account with us.

Enjoy discounts and offers

HSBC debit card holders can access offers with a number of retailers with our home&Away offers programme.

Bank wherever you are

Manage all your HSBC accounts around the world from anywhere with our mobile app and online banking.

Choose the HSBC UK bank account that's right for you

HSBC Premier Account

HSBC’s premier banking service, recognised globally and created for your constantly changing world.

Plus, if you have HSBC accounts in other countries or regions, you can manage them all online and make fee-free transfers between them in minutes.

ATM withdrawal limit

GBP1,000 per day

Fee for using your card outside the UK

Eligibility

To be eligible, you’ll need to meet and maintain one of the following criteria :

- Be an existing HSBC Premier customer in another country

- Have savings or investments of at least GBP50,000 with HSBC UK (within 6 months of opening your account)

- Have an individual annual income of at least GBP75,000 and one of the following with HSBC UK: a mortgage, an investment, life insurance or a protection product (to be held within 6 months of account opening)

You may be required to provide ID and proof of address if needed.

You may not be eligible for some account features if you remain resident outside the UK.

HSBC Advance Account

Get everything you need from everyday banking and lots more.

GBP500 per day

2.75% plus a 2% fee (minimum GBP1.75, maximum GBP5) when withdrawing cash

HSBC Bank Account

Easily manage your everyday finances and activate your life in the UK.

HSBC customers with an HSBC debit card can access home&Away offers with a number of retailers.

GBP300 per day

Moving to the UK guides

Living in the UK

Moving to the UK Guide

How does banking work in the UK?

Customer support.

International Money Made Simple

Open a Bank Account in the UK

About Author: Hi, I’m Quinn Askeland. In 2014, I started Transumo after experiencing expensive, slow, and frustrating international money transfers and payments through banks. Once I discovered how to manage my own international currencies much better, I became driven to help others improve their transfers and payments. Fortunately, today, there are many excellent options. See My Full Bio .

Many years ago I struggled to open my own bank account in the UK. While it remains a solid task, in addition to traditional high street banks, you can also consider the convenience of opening a digital account with services like Wise or Revolut and others which can save time, money and frustration.

It can be frustrating opening a UK bank account – usually documents are needed to prove your residency in the UK.

Fortunately:

There are some banks who can make it easier and great online alternatives that can be opened without the need for documents which prove your address. We will show you the minimum requirements for many of traditional “high street” banks.

But there are pros and cons to both options.

First we will explain the difference between traditional high street bank accounts and digital (or neo) banking alternatives. Then we will discuss the documentation needed for the different options and finally the pros and cons of each option.

Let’s dive in.

Disclosure: This post contains affiliate links and savings on transfers if you use some of the links! For more information, see my disclosures here .

Traditional Vs Online Banking (Requirements)

Traditional banks have a wide range of bank accounts and offer lots of other services like loans, mortgages, insurance and wealth management services. Also UK banks have deposit protection through the (FSCA) Financial Services Compensation Scheme which means that even if the bank goes bust, your money is safe up to £85,000.

However these banks are subject to more regulation and as a result they also generally require proof of identity and proof of a UK address to open them. However there are some banks that offer slightly easier ways (we will show you in a moment).

This can be a problem if you are not yet in the UK or have just arrived.

Fortunately you can open a bank-like account without proof of a UK address.

These online accounts from companies like Wise, Revolut, Monzo, Starling, Monese and others have limitations but tend to be very user friendly with great apps , multi-currency accounts and international prepaid debit cards .

Most importantly they enable you to to get paid by your employer in British pounds, pay bills and pay others.

Skip down to 4 Best Online Banking of Alternatives Below .

3 Best High Street Bank Accounts (+ How to Open Them)

There are a few expat-friendly banks in the UK including HSBC, Barclays, and Lloyds Banking Group.

These banks offer both free and paid bank accounts and let you manage your account offline (at a branch) and online (website and mobile app). They also offer deposit protection up to £85,000 GBP.

Every bank has a different sign up process, and a handful of banks also let users open an account from overseas before moving to the UK – more on that in a moment.

1.3 How to get address proof in the UK as a non-resident/expat

UK banks accept the following alternatives as address proof for expats and non-residents:

- Salaried individuals: A letter from the employer confirming an applicant’s address

- International Student: Passport and a letter from the educational institution confirming the applicants acceptance and current address

- Frequent traveler/digital nomad: A letter from a local authority verifying the current address

- Asylum seekers: Application registration card

The preference may vary from bank to bank and it’s best to ask what you can submit to make the account opening process go smoothly.

1.4 UK bank options

1.4.1 hsbc overseas account (for existing customers).

Account type: Overseas Account

Who is it for? Existing HSBC One, Jade or Premier customer in 30 countries

Monthly fee: £0

International transfers? Yes

Proof of UK residence required? No (but must show probable cause to move to the UK)

If you are not an existing HSBC customer you may find that only Council tax bills are accepted for proof of address.

1.4.2 HSBC for international Students

Account type: UK Current Account for International Students

Who is it for? Students living in the live in the UK, Channel Islands or Isle of Man

Proof of UK residence required? Yes

1.4.3 Barclays International Bank Account

Account type: Global Bank Account (Savings and Current)

Who is it for? Non-residents living in 70 eligible countries

Monthly fee: NA – but must maintain £100,000 balance

Proof of UK residence required? No (but proof of residence in eligible country overseas required)

1.4.4 Barclays Current Account

Account type: Regular and Premier Current Account

Who is it for? Anyone with a UK biometric residence permit

Monthly fee: £4 monthly fee

1.4.5 Lloyd’s Classic or Basic Account

Account type: Current Account

1.5 International Alternatives

Although a bit of a long shot, over 250 foreign banks operate in the UK and it may be possible to set up a UK bank account if you have a corresponding account in your home country.

Some of these banks include:

- CitiBank (the US)

- Triodos (the Netherlands)

- Axis Bank (India)

- Emirates NBD Bank (Middle East)

1.6 How to Choose the Best Bank Account

With so many options, it can be hard to zero in on the best UK bank account for you as an expat. To make things easier, consider the following.

Ease of signup and covers basic needs: If your goal is simply to get established in the UK (get paid and pay others) an online bank-like alternative may be the best way to get started. After you are more established opening a high street bank will be easier and you can benefit by having both.

Specific products and services: Ask yourself how you plan to use the bank account – do you plan to use it only for receiving your salary or expenses? Do you need savings or investment options? Do you want to manage multiple currencies? What kind of debit or credit card do you need?

Costs: Most UK bank accounts are free, but some premium accounts may have monthly or annual fees. If the perks offset the features, sometimes having a paid account can be worthwhile.

User friendliness: Ultimately, the experience you have with the bank will help you can get out of your account. Dig deeper into customer service, flexibility of usage across mediums (offline and online), 24×7 banking, etc.

4 Best Digital Accounts (+ How to Open Them)

New age digital services (also known as challenger banks or neo banks) operate fully online and offer many helpful features that make managing your money easier.

Opening an account with them is a smooth and fast process and some do not even need a UK proof of address (you will need to provide a valid ID and proof of address from your home country though.

Most of them have free accounts , but the paid options do come with some cool features, expand the capacity of the account (ATM withdrawal limits, deposit limits, etc.), and help to save money in the long run.

Here are our tried and tested recommendations:

1. Wise – Best Multi-Currency Account (for frequent travellers and digital nomads)

Wise is not a bank but they offer many banking-like features with their multi-currency account (and they’re a regulated financial institution in the UK by the FCA ). If you’re a frequent traveler, expat or digital nomad, Wise can work really well.

For example, regardless of where you open your Wise account you can get paid like a local through unique UK account details. The Wise debit card (review) is also a winner, enabling you to then spend in British Pounds wherever Visa is accepted (everywhere). Once signed up their App pulls everything together.

The best thing about them is their radical transparency and low fees. Check out Wise Multi Currency Account here .

With Wise, you can hold, manage, and convert between 50+ currencies, use their debit card to withdraw money in the UK (and anywhere in the world), and even get a spending account in GBP which can make you instantly fee like a local.

Account Fees: Free to open and hold an account (other fees applicable)

Interest on savings: No

International transfers: Yes – at very affordable rates in 70+ currencies

Learn more about the Wise Multi-currency Account (review) here.

2. Revolut – Overall best online UK account for new Arrivals (no UK address proof to sign up)

Revolut (founded in 2015) has a EU banking license and offers fully digital checking and savings accounts. But Revolut is not a bank in the UK – yet anyway.

Users love their all-in-one money management features and the fact that they don’t need a UK ID address proof to sign up makes them a go-to option for new expats. (However you do need a mobile phone, which can be tricky in itself)

Click here to see the options and pricing available in your country (opens a new tab so you can keep reading).

Note: Revolut and other online banks are great as current accounts because they make day-to-day money management easier. We recommend opening a high street bank account for your savings for higher interest rates and deposit guarantee.

3. Monzo – Best Online Current Account in the UK

Monzo has a UK banking license and offers deposit protection up to £85,000 GBP.

This means you you’ll need a UK mobile phone and a valid ID. They accept:

- Driving licence (your provisional is fine)

- National ID card

- Biometric residency permit

They will also need a residential address in the UK where they can send your card .