- Mobile Forms

- INTEGRATIONS

- See 100+ integrations

- FEATURED INTEGRATIONS

- See more Integrations

- See more CRM Integrations

- See more Storage Integrations

- See more Payment Integrations

- See more Email Integrations

- Jotform Teams

- Enterprise Mobile

- Prefill Forms

- HIPAA Forms

- Secure Forms

- Assign Forms

- Online Payments

- See more features

- Multiple Users

- Admin Console

- White Labeling

- See more Enterprise Features

- Contact Sales

- Contact Support

- Help Center

- Jotform Books

- Jotform Academy

Get a dedicated support team with Jotform Enterprise.

Apply to Jotform Enterprise for a dedicated support team.

- Sign Up for Free

Travel Expense Reimbursement Form

A travel expense reimbursement form is used by organizations to reimburse employees for travel-related expenses. Whether your employees are on a business trip or working from home, your company can help them keep track of out-of-office expenses with our free Travel Expense Reimbursement Form. Simply customize the form to suit your business and embed it on your website or share it via email, link, or QR code. Employees can then get reimbursed for meals and transportation costs, regardless of whether they’re claiming per diem amounts or filing receipts. It’s also ideal for travel agents who help their clients book their conferences, seminars, or vacation packages. Get reimbursed for travel-related deals quickly and easily, and streamline the booking process.

With our free online Travel Expense Reimbursement Form template, employees can track expenses simply by adding receipts to the form as images with our mobile app. They can then send completed forms to your travel or expense manager for approval — or download PDFs of expenses for your accountant. Streamline your business travel with a free online Travel Expense Reimbursement Form template.

More templates like this

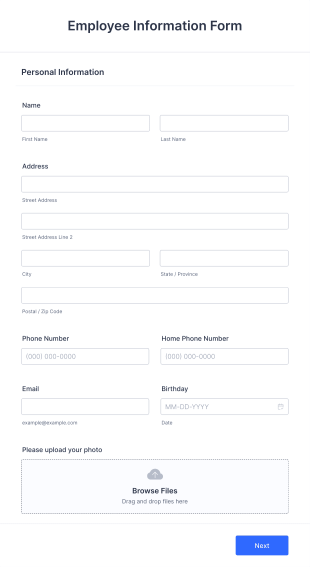

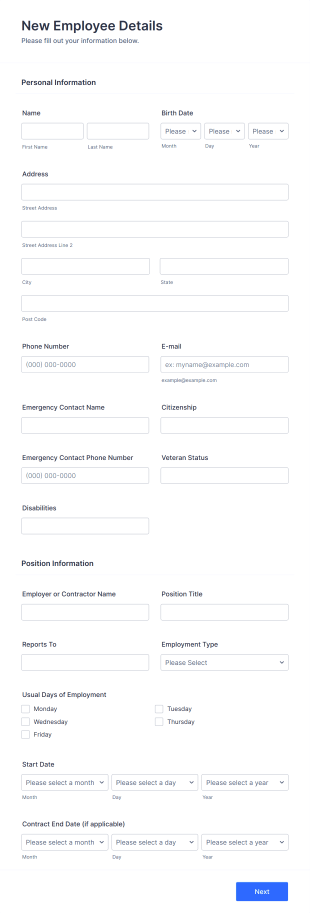

Employee Information Form

The employee Information form is being used by many companies to record and catalog their employees' information and help to collect the details needed for their database. The Template contains different sections where employee contact and personal information, all necessary information related to their job and position, emergency contact information can be collected. With many more customizable tools and widgets, build your own form using this one as your basis.If you’re looking to get more out of your employee info, add your logo or add a background image to brand the form. Or, edit the field layout, add form widgets, and add statistics to each description to track your company’s progress. And if you’ve got a lot of employees, use Jotform’s bulk editor to update fields, save time, and avoid mistakes. Collect all the employee data you need with a free employee information form.

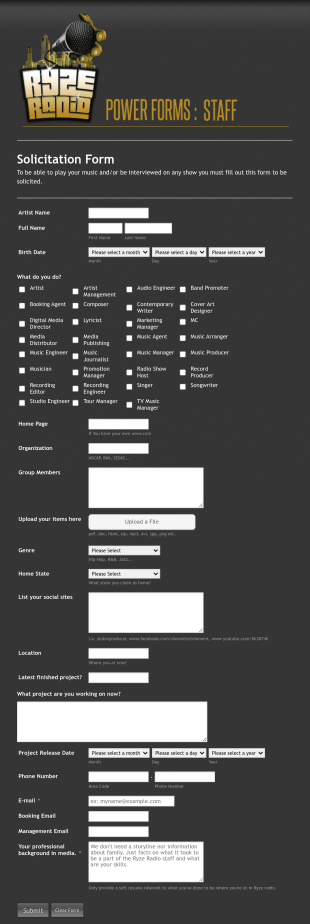

Artist Information Registration Form

Want that artistic gig? Screen the next participant that will put their talent out there with our form!Allows for modification to fit band members.Perfect for recruiters.PayPal integrated payment for donations.

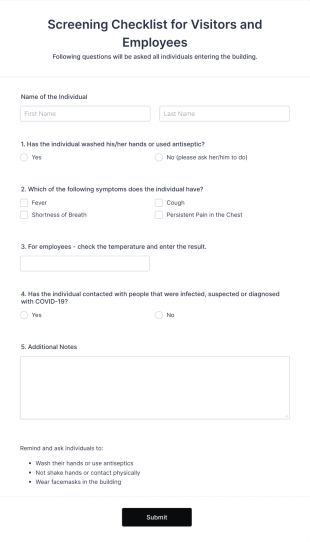

Screening Checklist For Visitors And Employees

A screening checklist for visitors and employees is used to track the contact details and symptoms of every visitor or employee who has entered an establishment during the coronavirus crisis. Whether you work for a hospital, doctor’s office, or other essential organization that needs to stay open, reduce the spread of COVID-19 by running checks on visitors and employees using our free online Screening Checklist for Visitors and Employees — easy to fill in on any device. By keeping track of the symptoms of everyone who enters your building, you can take steps to prevent the coronavirus from spreading.This online form already has fields for names, symptoms, and temperature checks, but use our drag-and-drop Form Builder to add other fields that are essential for your needs. Add your company logo, rearrange the layout, or include an e-signature field to let people officially sign off on their coronavirus checks. If you need to transfer the information to your other accounts — such as Salesforce (also available on Salesforce AppExchange), HubSpot, Zoho, Airtable, Trello, Slack, and more — use our free form integrations to do it automatically. And you can even protect submissions with sensitive health information using Jotform’s HIPAA compliance option. Keep everyone safe and reduce the spread of the coronavirus with a free Screening Checklist for Visitors and Employees.

Travel Expense Reimbursement Form FAQs

1) why is a travel expense reimbursement form used.

A travel expense reimbursement form is used to record the expenses an employee incurs during business trips or other work-related travel. The employee then submits the form in order to be reimbursed.

2) What should be included in a travel expense reimbursement form?

A travel expense reimbursement form should include fields to record the details of any travel-related expenses, such as transportation costs, accommodation fees, and meal expenses. It should also include fields for the employee’s name and contact information and any supporting documentation, such as receipts or invoices.

3) When should you use a travel expense reimbursement form?

A travel expense reimbursement form should be used whenever an employee incurs travel-related expenses that they need to be reimbursed for by their organization. For instance, employees can be reimbursed for expenses incurred for business trips, client meetings, conferences, or other work-related travel.

4) Who can use a travel expense reimbursement form?

Any organization that has employees who incur travel-related expenses can use a travel expense reimbursement form. This can include businesses, nonprofit organizations, government agencies, and more.

5) How do I create a travel expense reimbursement form with Jotform?

To create a travel expense reimbursement form with Jotform, simply sign up for a Jotform account for free and use this template to get started. Use the drag-and-drop form builder to customize the form to suit your organization’s needs. Add fields for the necessary information, such as expense details, employee information, and any required supporting documentation. Once you’re done, you can embed the form on your website or share it with employees via email, link, or QR code.

6) What are the benefits of using a travel expense reimbursement form template?

Using a travel expense reimbursement form template offers several benefits. It simplifies the process of tracking and reimbursing travel expenses, saving time and reducing administrative burden. It also provides a standardized format for expense reporting, ensuring consistency and accuracy. Additionally, Jotform offers features like electronic signatures, integrations with 100-plus third-party apps, and extensive customization options, making the reimbursement process even more efficient and convenient.

- Form Templates /

- Human Resources Forms /

- Employee Information Forms /

Employee Information Forms

An Employee Information Form is a form template designed to help companies record and catalog essential employee details for their database

Want that artistic gig? Screen the next participant that will put their talent out there with our form! Allows for modification to fit band members.Perfect for recruiters. PayPal integrated payment for donations.

Prevent the spread of COVID-19 with a free Screening Checklist for Visitors and Employees. Ideal for hospitals or other organizations staying open during the crisis.

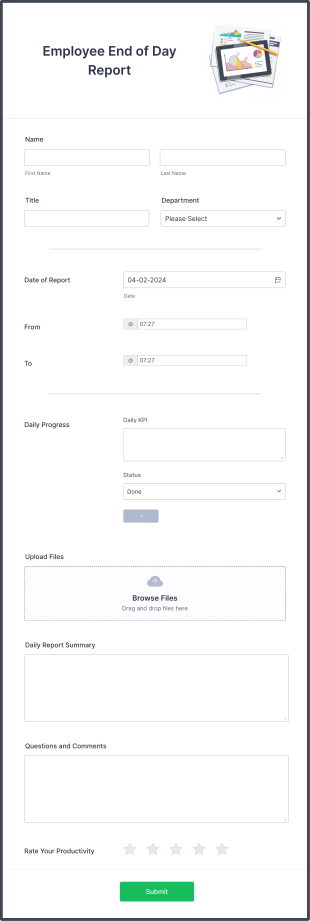

Employee End Of Day Report

An Employee End of Day Report is a form template designed to track employee progress and keep a record of daily accomplishments

New Employee Details Form

Accelerate and improve your new recruiting process with the new employee details form that provides all the necessary information. No code required!

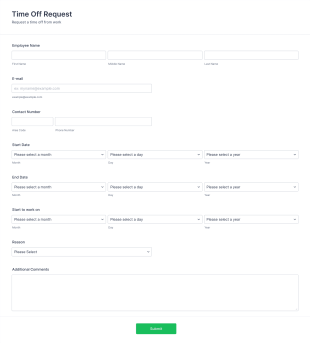

Time Off Request Form

The Time Off Request Form allows to track employee time off requests on a daily basis, where employees enter their contact information, start and end date of their leave, time interval information and further comments if any.

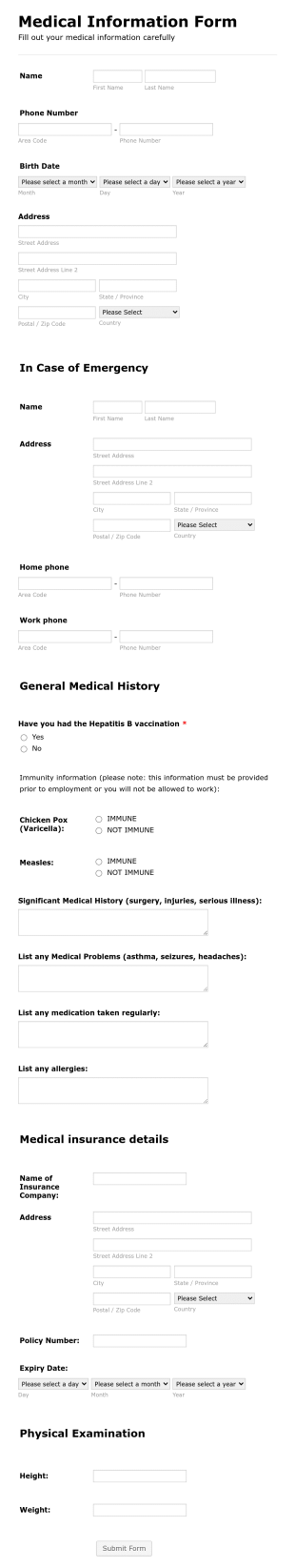

Medical Employment Information Form

Here is an Employee Medical History Form that can be used to create an employee medical information database which provides employee contact information along with emergency contact information and medical insurance details.

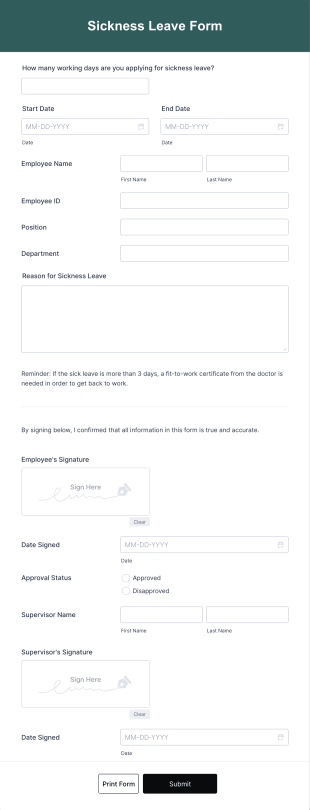

Sickness Leave Form

Apply for a sickness leave to your employer by using this Sickness Leave Form. This form should be approved by your supervisor so that the payroll will use your remaining leave credits.

Feature Artist Registration Form

Want to know the artist info? These templates are for Music and media industry. fill out this template in order to know them better and let them registered on entry for the Invitation.

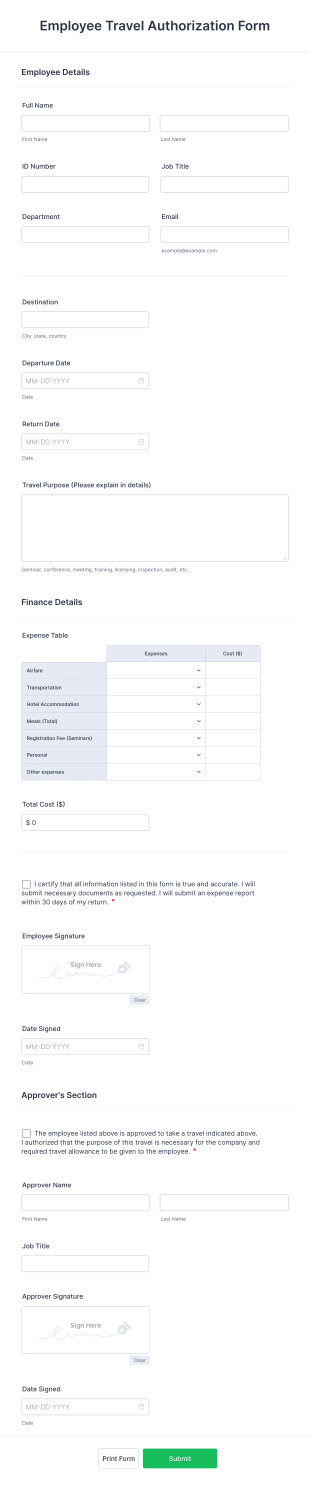

Employee Travel Authorization Form

Get authorization from your company to travel and attend a conference, seminar, auditing, or inspection by using this Employee Travel Authorization Form. This form can be embedded on ay webpage using the embed code.

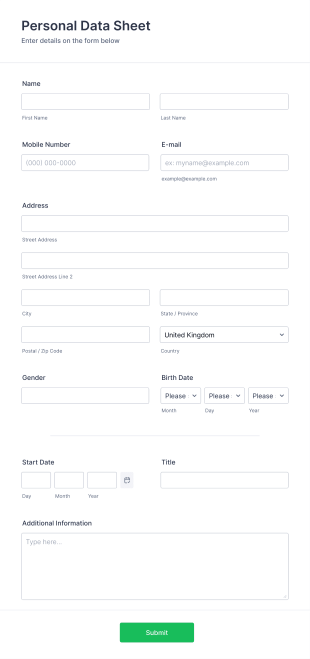

Personal Data Sheet

A Personal Data Sheet is a form template designed to collect details about a person from an organization.

Employee Availability Form

An Employee Availability Form is a form template designed to log and collect information about an employee's availability

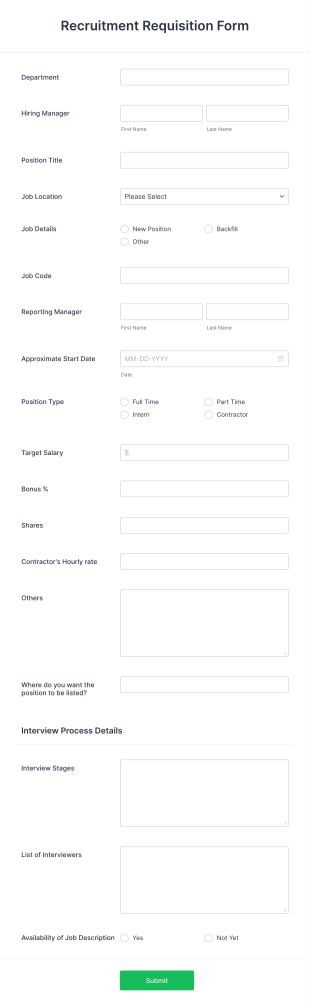

Recruitment Requisition Form

A Recruitment Requisition Form is a document used to create a record of the desired requisition for open job positions in an organization, business, or private sector.

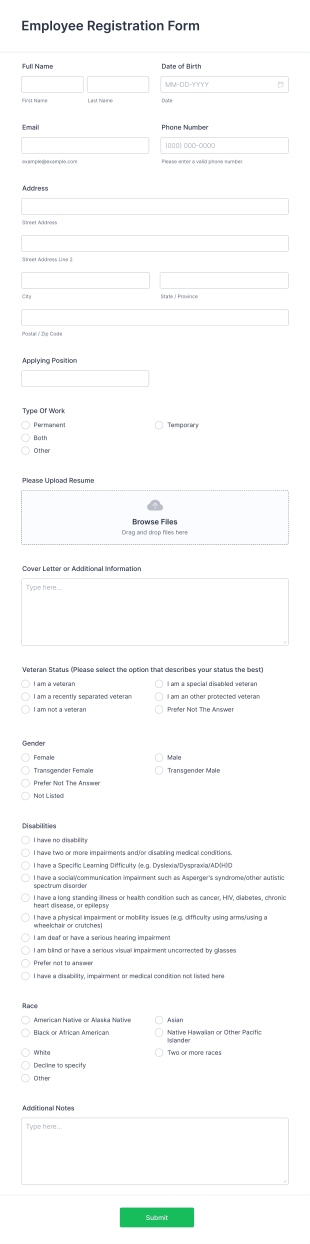

Employee Registration Form

An employee registration form is used by companies to recruit new employees. Inspire the next generation of talent with your company by recruiting with a free Employee Registration Form.

A travel expense reimbursement form is used by organizations to reimburse employees for travel-related expenses.

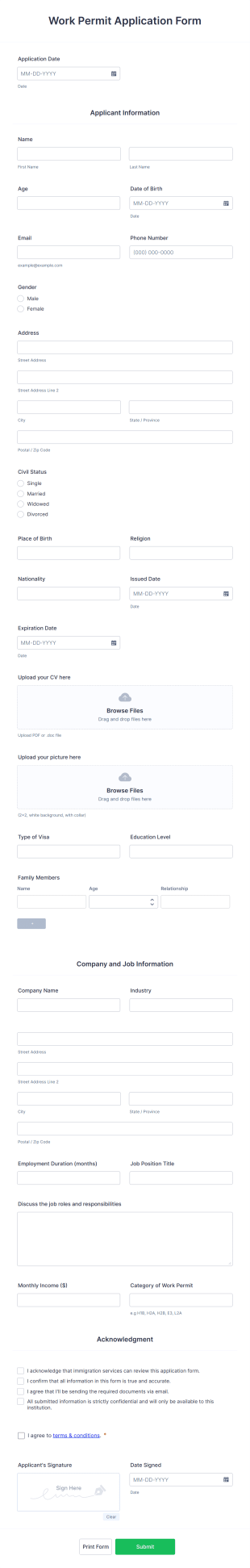

Work Permit Application Form

A Work Permit Application Form is a document that is used when applying for permission to work.

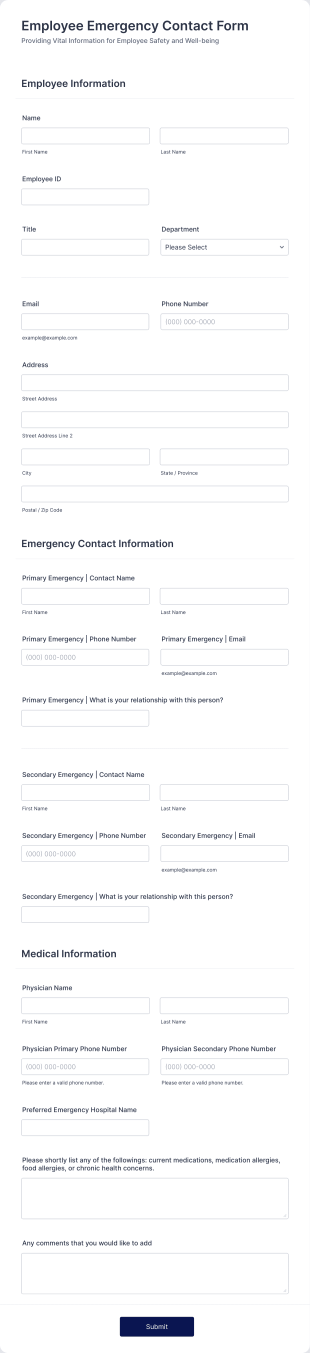

Employee Emergency Contact Form

Gather emergency contact information for employees. Free online form for HR. Easy to customize and embed. Integrate with 100+ apps. No coding.

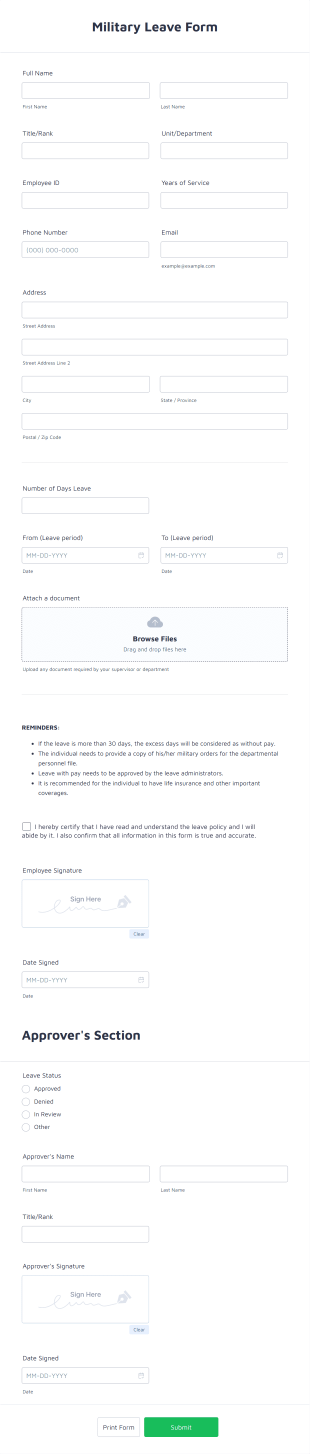

Military Leave Form

Make it easier for the employee to file and request for leave by using this Military Leave Form. It is important for this form to be completed properly in order to prevent delays and confusion.

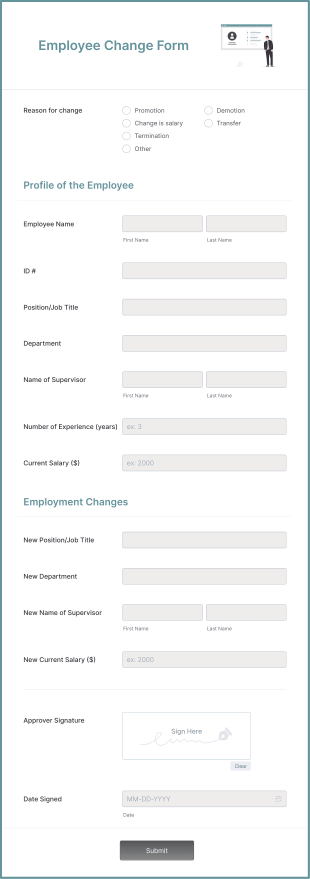

Employee Change Form

Change the employment status of an employee smoothly by using this Employee Change Form. This form template contains all necessary information when updating or changing the status of an employee.

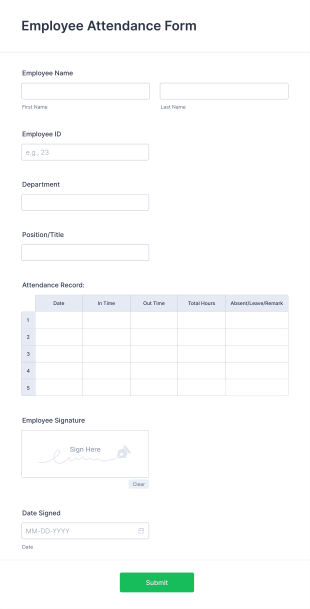

Employee Attendance Form

An Employee Attendance Form is a form template designed to streamline the process of monitoring attendance within organizations.

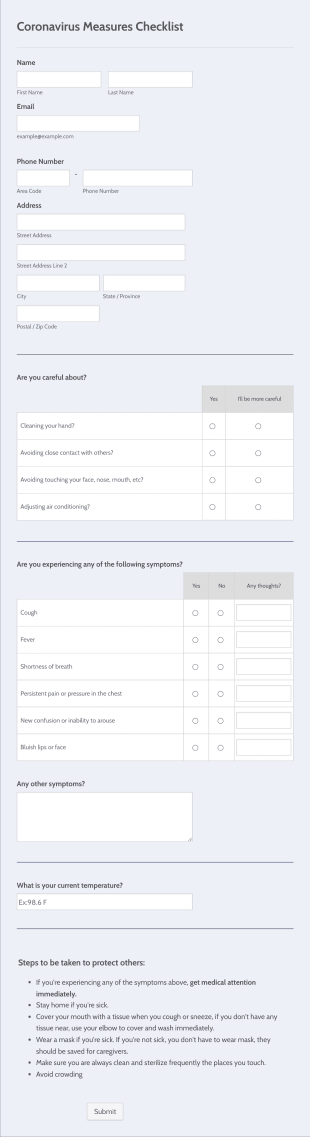

Coronavirus Measures Checklist

Check up on your employees with a free Coronavirus Measures Checklist. Collect responses online. View symptoms, temperatures, and more.

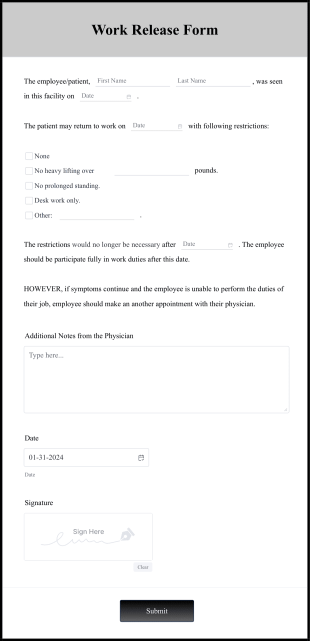

Work Release Form

Generate work release forms online. Gather e-signatures. Customize with no coding. Download, print, or share with employers as a PDF. Great for medical professionals.

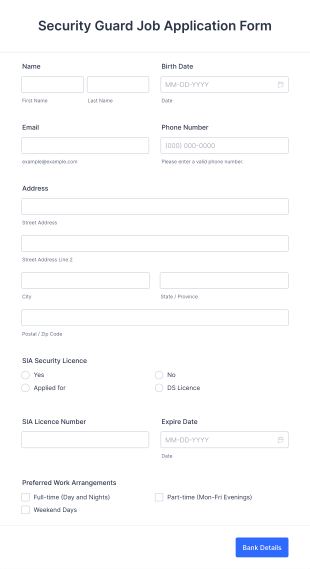

Security Guard Job Application Form

A security guard job application form is used by security agencies to collect details from applicants and review them before assigning them to a position. Easy to use. No coding.

Employee Payroll Change Form

An employee payroll change form is a document, often used by human resources personnel, which details a change made to an employee's pay rate. No coding!

About Employee Information Forms

Streamline your employee intake process and seamlessly onboard new employees with Jotform. Simply choose an Employee Information Form Template below to securely collect employee information like contact details, medical history, and emergency contact information. Our easy-to-use Form Builder lets you customize form fields, change fonts and colors, or add your company logo to make an employee information form that perfectly matches your business. Why not integrate with Google Sheets or Airtable to create detailed spreadsheets of all employee info? Say goodbye to messy paperwork — our Employee Information Form Templates automate your employee intake process, organizing your HR database in no time at all.

Your account is currently limited to {formLimit} forms.

Go to My Forms and delete an existing form or upgrade your account to increase your form limit.

An official website of the United States Government

- Kreyòl ayisyen

- Search Toggle search Search Include Historical Content - Any - No Include Historical Content - Any - No Search

- Menu Toggle menu

- INFORMATION FOR…

- Individuals

- Business & Self Employed

- Charities and Nonprofits

- International Taxpayers

- Federal State and Local Governments

- Indian Tribal Governments

- Tax Exempt Bonds

- FILING FOR INDIVIDUALS

- How to File

- When to File

- Where to File

- Update Your Information

- Get Your Tax Record

- Apply for an Employer ID Number (EIN)

- Check Your Amended Return Status

- Get an Identity Protection PIN (IP PIN)

- File Your Taxes for Free

- Bank Account (Direct Pay)

- Payment Plan (Installment Agreement)

- Electronic Federal Tax Payment System (EFTPS)

- Your Online Account

- Tax Withholding Estimator

- Estimated Taxes

- Where's My Refund

- What to Expect

- Direct Deposit

- Reduced Refunds

- Amend Return

Credits & Deductions

- INFORMATION FOR...

- Businesses & Self-Employed

- Earned Income Credit (EITC)

- Child Tax Credit

- Clean Energy and Vehicle Credits

- Standard Deduction

- Retirement Plans

Forms & Instructions

- POPULAR FORMS & INSTRUCTIONS

- Form 1040 Instructions

- Form 4506-T

- POPULAR FOR TAX PROS

- Form 1040-X

- Circular 230

Understanding business travel deductions

More in news.

- Topics in the News

- News Releases

- Multimedia Center

- Tax Relief in Disaster Situations

- Inflation Reduction Act

- Taxpayer First Act

- Tax Scams/Consumer Alerts

- The Tax Gap

- Fact Sheets

- IRS Tax Tips

- e-News Subscriptions

- IRS Guidance

- Media Contacts

- IRS Statements and Announcements

IRS Tax Tip 2023-15, February 7, 2023

Whether someone travels for work once a year or once a month, figuring out travel expense tax write-offs might seem confusing. The IRS has information to help all business travelers properly claim these valuable deductions.

Here are some tax details all business travelers should know

Business travel deductions are available when employees must travel away from their tax home or main place of work for business reasons. A taxpayer is traveling away from home if they are away for longer than an ordinary day's work and they need to sleep to meet the demands of their work while away.

Travel expenses must be ordinary and necessary. They can't be lavish, extravagant or for personal purposes.

Employers can deduct travel expenses paid or incurred during a temporary work assignment if the assignment length does not exceed one year.

Travel expenses for conventions are deductible if attendance benefits the business. There are special rules for conventions held outside North America .

Deductible travel expenses include:

- Travel by airplane, train, bus or car between your home and your business destination.

- Fares for taxis or other types of transportation between an airport or train station and a hotel, or from a hotel to a work location.

- Shipping of baggage and sample or display material between regular and temporary work locations.

- Using a personally owned car for business.

- Lodging and meals .

- Dry cleaning and laundry.

- Business calls and communication.

- Tips paid for services related to any of these expenses.

- Other similar ordinary and necessary expenses related to the business travel.

Self-employed individuals or farmers with travel deductions

- Those who are self-employed can deduct travel expenses on Schedule C (Form 1040), Profit or Loss From Business (Sole Proprietorship) .

- Farmers can use Schedule F (Form 1040), Profit or Loss From Farming .

Travel deductions for the National Guard or military reserves

National Guard or military reserve servicemembers can claim a deduction for unreimbursed travel expenses paid during the performance of their duty .

Recordkeeping

Well-organized records make it easier to prepare a tax return. Keep records such as receipts, canceled checks and other documents that support a deduction.

Subscribe to IRS Tax Tips

Free Expense Report Templates

By Andy Marker | November 28, 2016 (updated June 5, 2023)

- Share on Facebook

- Share on LinkedIn

Link copied

We’ve compiled the most useful collection of free expense report templates for businesses, individuals, nonprofits, contractors, consultants, construction employees, and fundraisers so they can better track and manage their expense reports.

Included on this page, you’ll find a monthly expense report template , a personal expense templat e, a printable business expense template , and more. We’ve also included a list of helpful tips for completing these expense report templates .

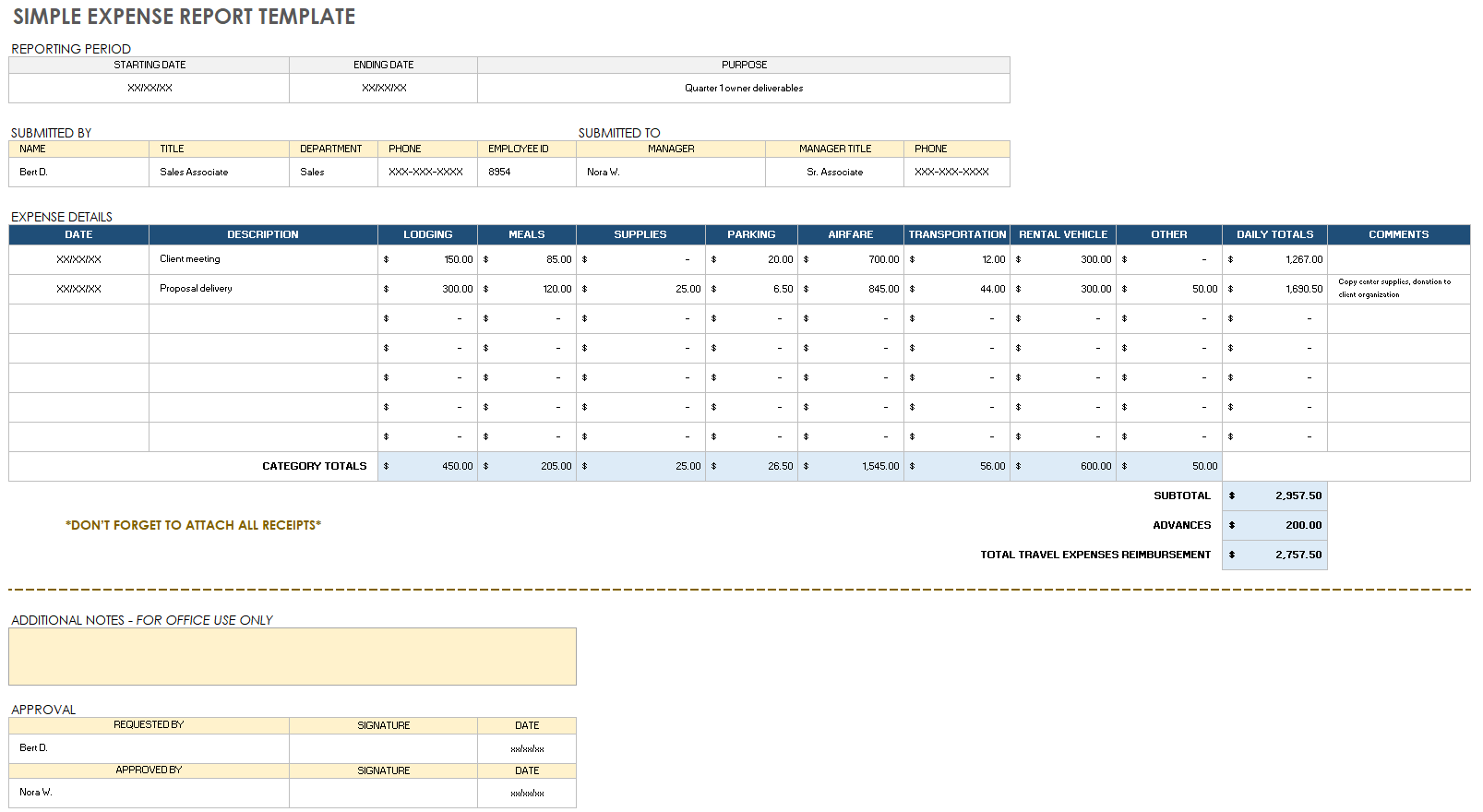

Simple Expense Report Template

Download a Simple Expense Report Template for

Excel | Google Sheets | Smartsheet

This expense report is a simple spreadsheet template for documenting the date, type, and total amount for each expense. You can customize the template by changing the column headings for categorizing expenses, or adding new columns if needed. Expenses are itemized, and the total reimbursement amount is calculated for you, minus any advance payments.

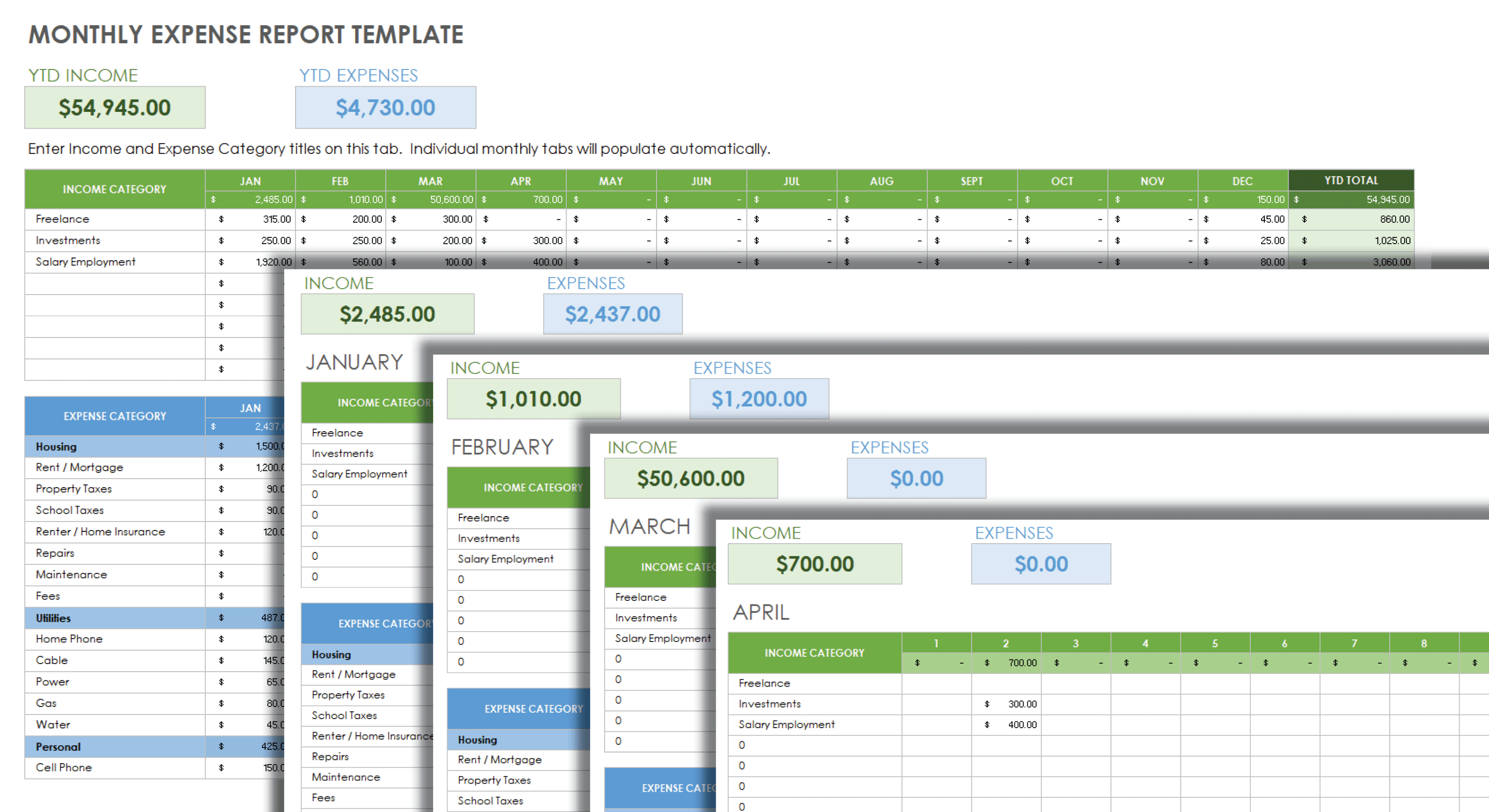

Monthly Expense Report Template

Download a Monthly Expense Report Template for Excel | Google Sheets

Keep your expenses organized and under control with this versatile monthly expense report template. The template features month-over-month records, with each month listed on a separate sheet, as well as a year-to-date total. This printable template is perfect for individuals, small businesses, fundraisers, project managers, contractors, construction workers, consultancies, and event managers who need to track expenses. Use it to stay on top of your finances and make better budgeting decisions.

Try one of these free business budget templates for your organization’s budgeting needs.

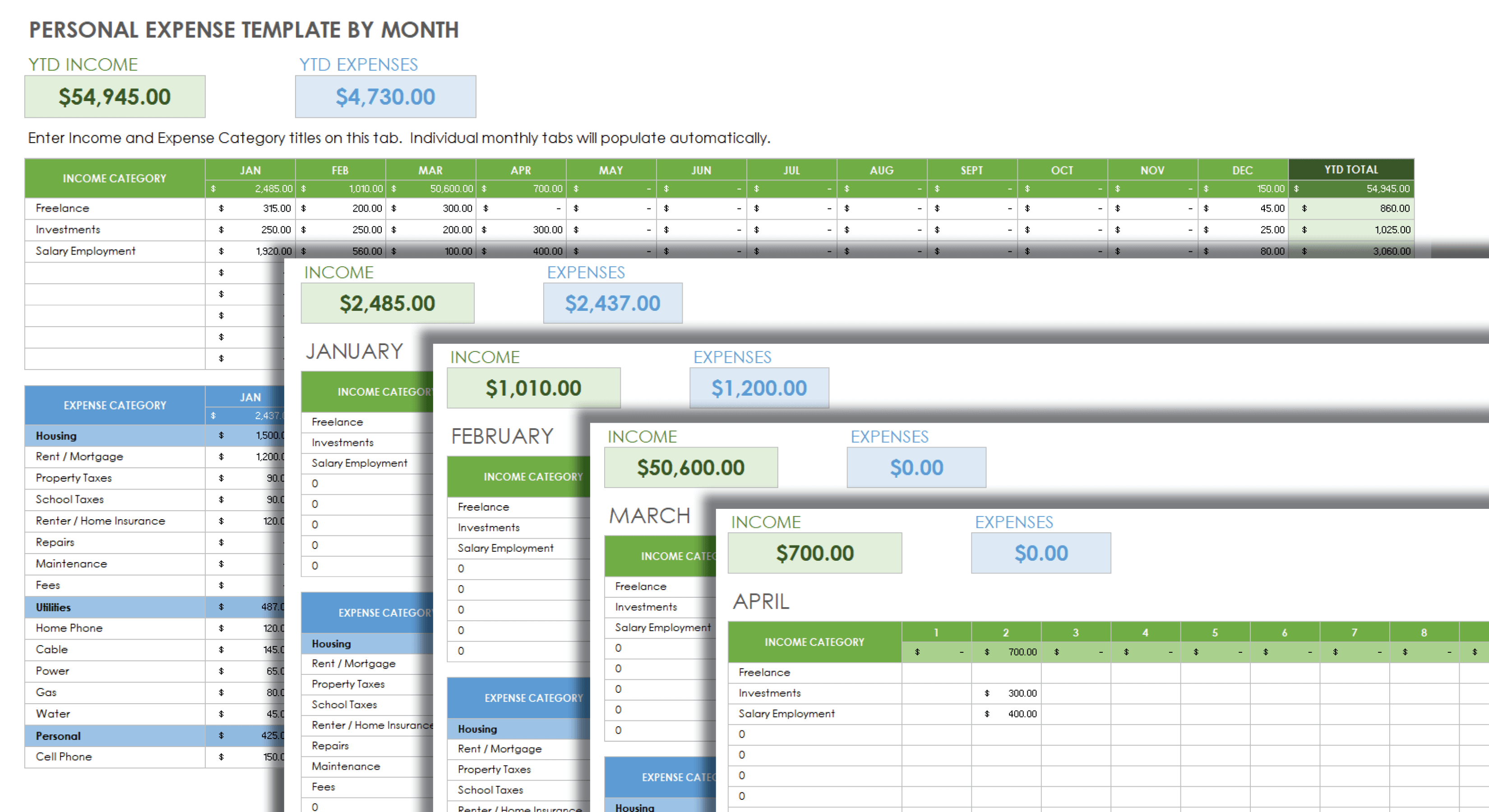

Personal Expense Template by Month

Download a Personal Expense Template by Month for Excel | Google Sheets

Consider using this personal expense template to effectively track your personal expenses on a monthly basis. With its user-friendly spreadsheet format, this printable expense template automatically calculates totals for you. You can customize the template to include only the expenses you want to monitor. Each month has its own dedicated sheet, making it convenient to track both monthly and annual expenses.

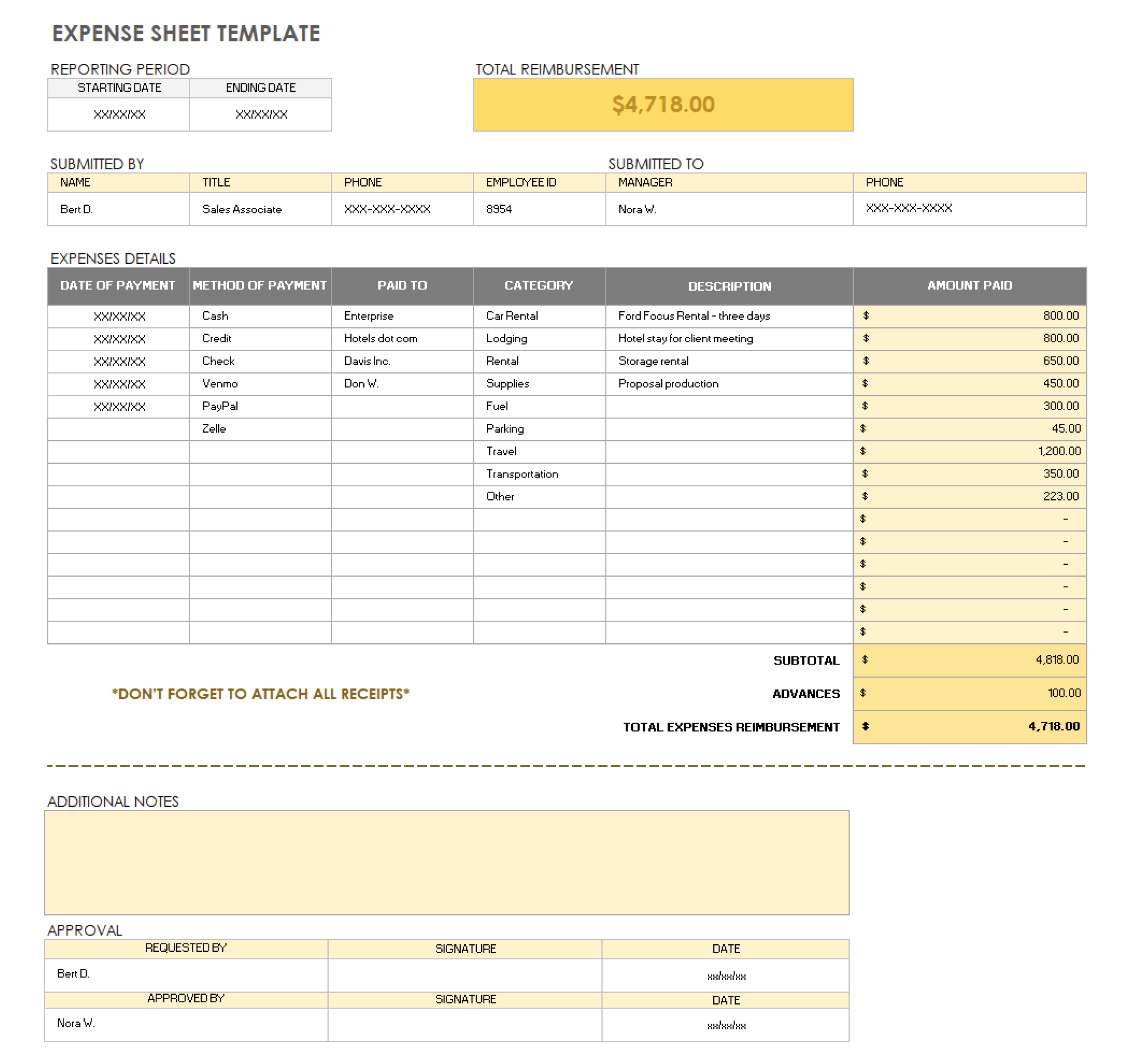

Expense Sheet Template

Download an Expense Sheet Template for Excel | Google Sheets | Smartsheet

This basic, printable expense spreadsheet template is designed for tracking expenses, whether personal or business related. Keep track of purchases and other expenses by recording the payment method, type of transaction, amount of payment, and other details. You can refer to this expense sheet as an easy reference tool, create a monthly expense report, and quickly add up expenses over any time period.

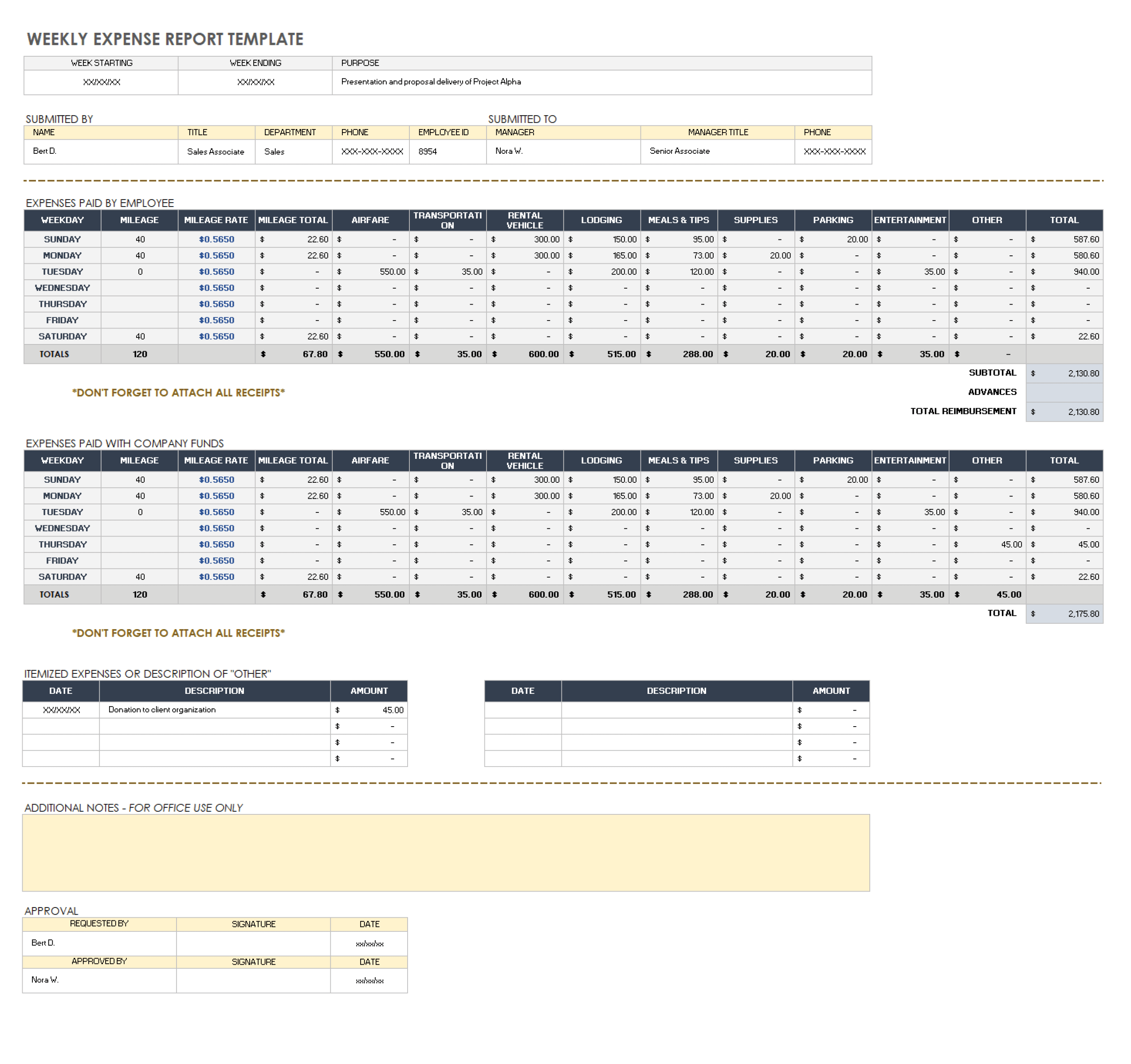

Weekly Expense Report Template

Download a Weekly Expense Report Template for Excel | Google Sheets | Smartsheet

Some businesses require employees to submit a weekly expense report so that expenses are tracked and reimbursed at consistent intervals. This printable template provides a detailed record of expenses for each day of the week. You can edit the expense categories to match your needs, whether it’s travel costs, shipping charges, business meals, or other expenses. There is room for describing the business purpose, the payment type, and subtotals.

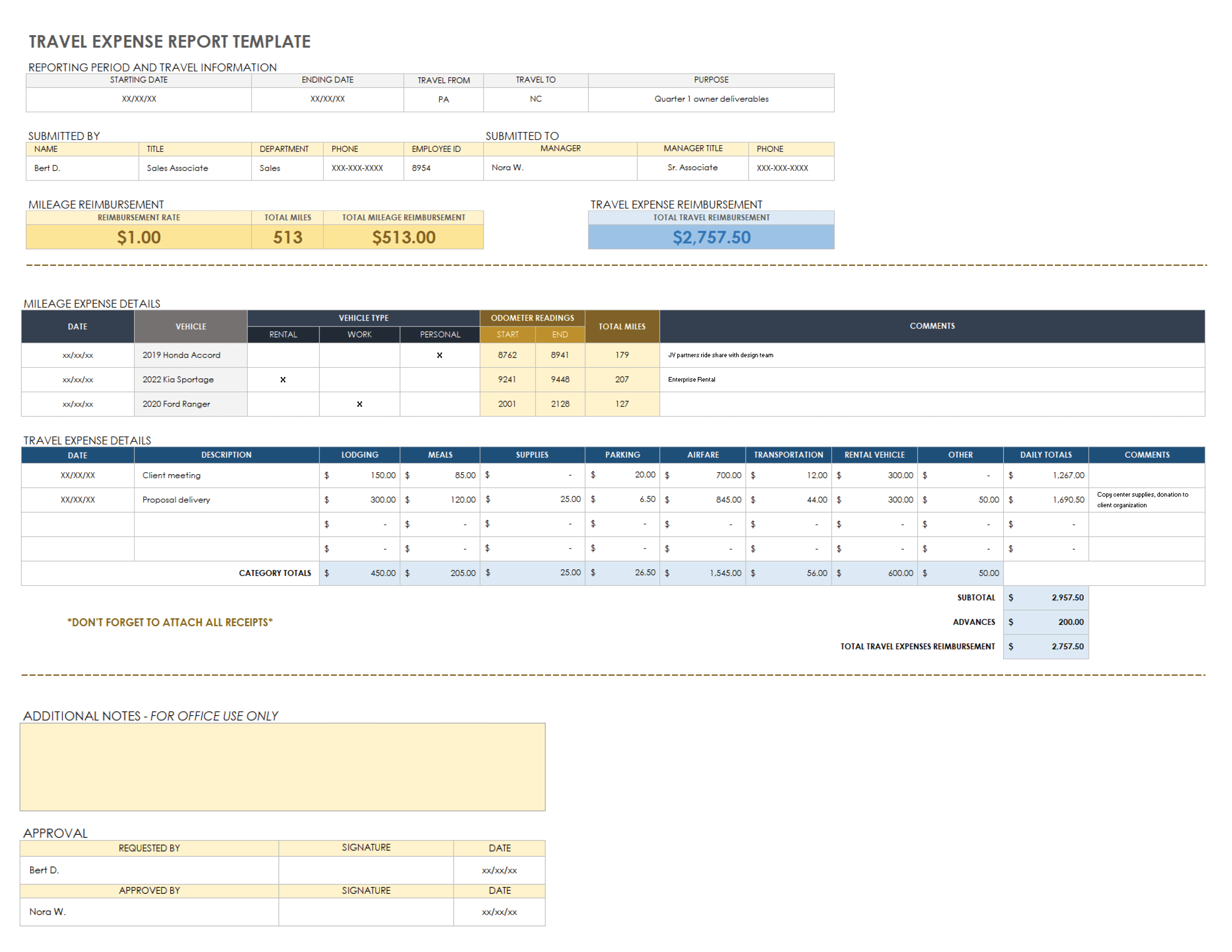

Travel Expense Report Template

Download a Travel Expense Report Template for Excel | Google Sheets

Use this detailed , printable travel expense report template to keep track of business trip expenditures. The template includes mileage tracking, other transportation costs, lodging, meals, and more. There is also space to list miscellaneous expenses that may not fit in the other categories. You can include contact information for employer and employee, as well as info on the travel destination and purpose for the trip.

Expense Report With Mileage Tracking Template

Download an Expense Report With Mileage Tracking Template for Excel | Google Sheets

Many businesses and organizations reimburse employees for mileage costs. This printable mileage expense sheet can be used to record and calculate any miles accrued for business purposes. Enter the rate per mile and number of miles to calculate the total reimbursement amount. You can include odometer readings and any pertinent notes about the travel purpose or outcome.

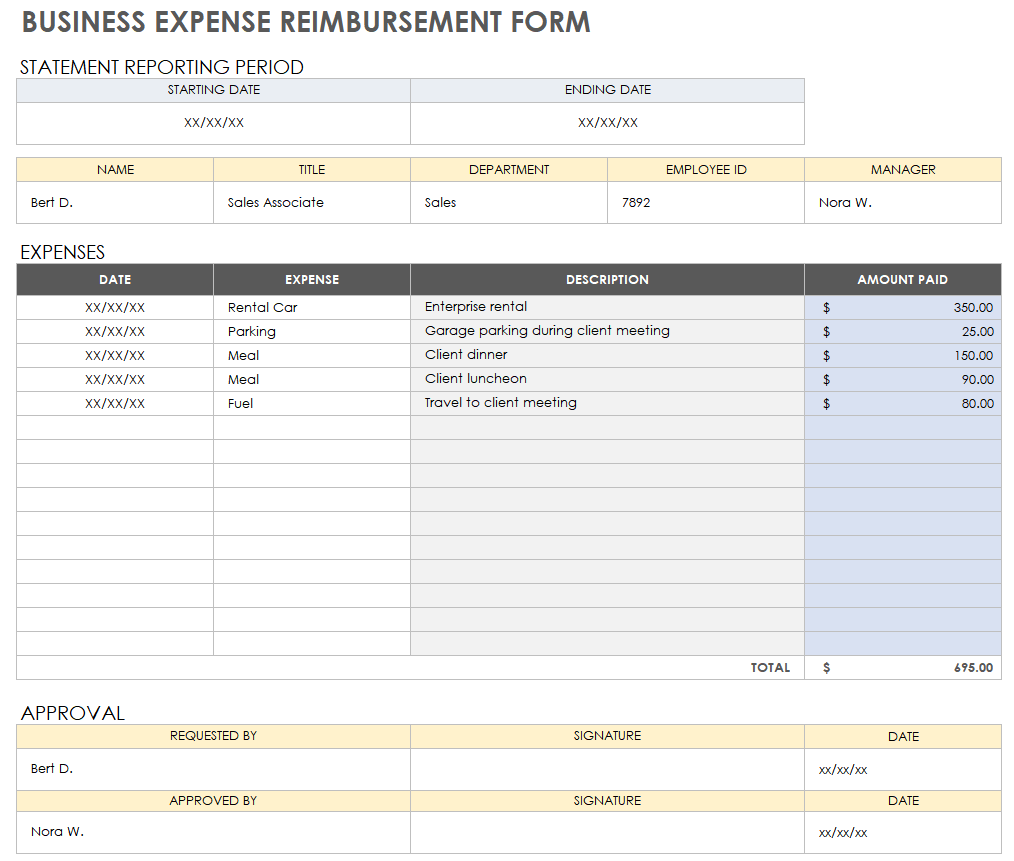

Business Expense Reimbursement Form

Download a Business Expense Reimbursement Form for

Excel | Google Sheets

Employees can use this expenses template to request reimbursement for business costs, and employers can use it to document that remuneration has been paid. This is a basic, printable expense report template for describing costs, listing amounts, and recording the dates of each transaction. It can also easily be modified to include more columns or additional information.

Explore these small business budget templates to find effective tools for managing the financial health of your company.

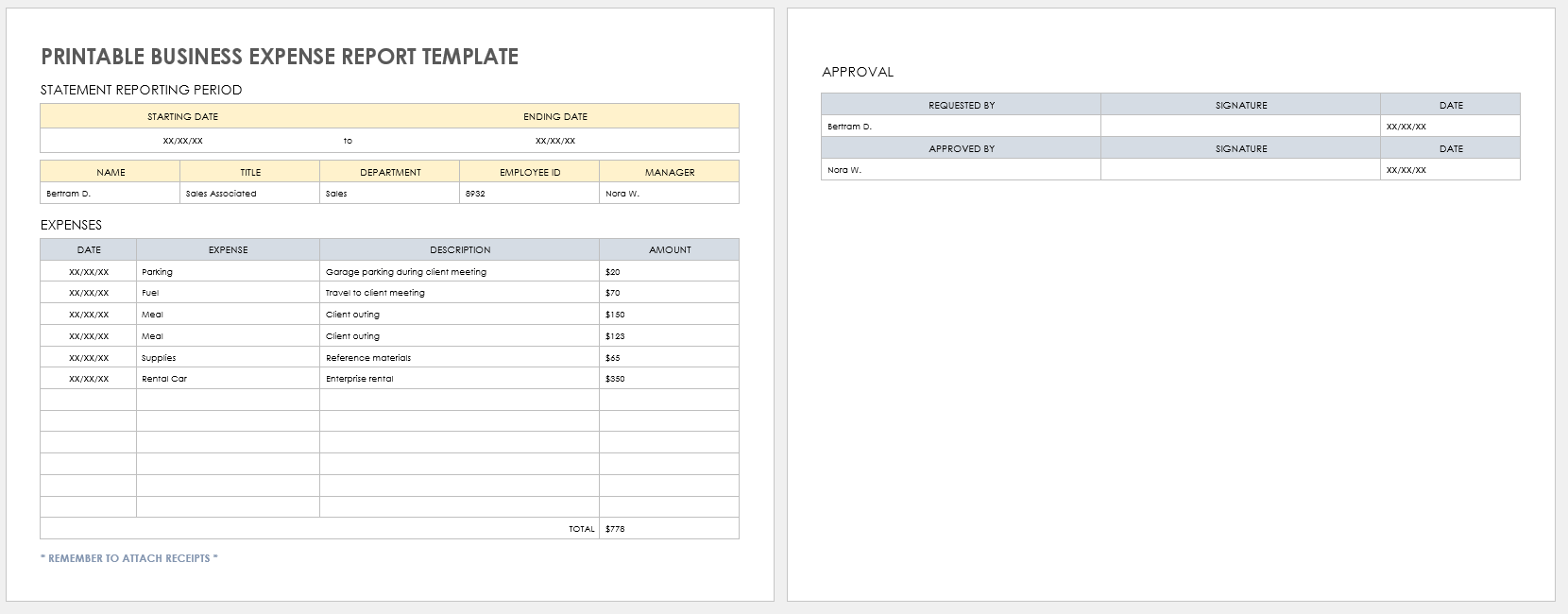

Printable Template to Fill Out Manually for Business Expenses

Download a Printable Template for Business Expenses Microsoft Word | Adobe PDF | Google Docs

If you need a printable business expenses template, this template provides an itemized outline in table format and is perfect for manually filling in your expenses. Use this easy-to-fill template to document various expenses, the dates they were accrued, total costs, and employee information. This is a simple form that can be modified to suit your business.

Download one of these free small business expense report templates to help ensure your small business’ expenditures and reimbursements are accurate.

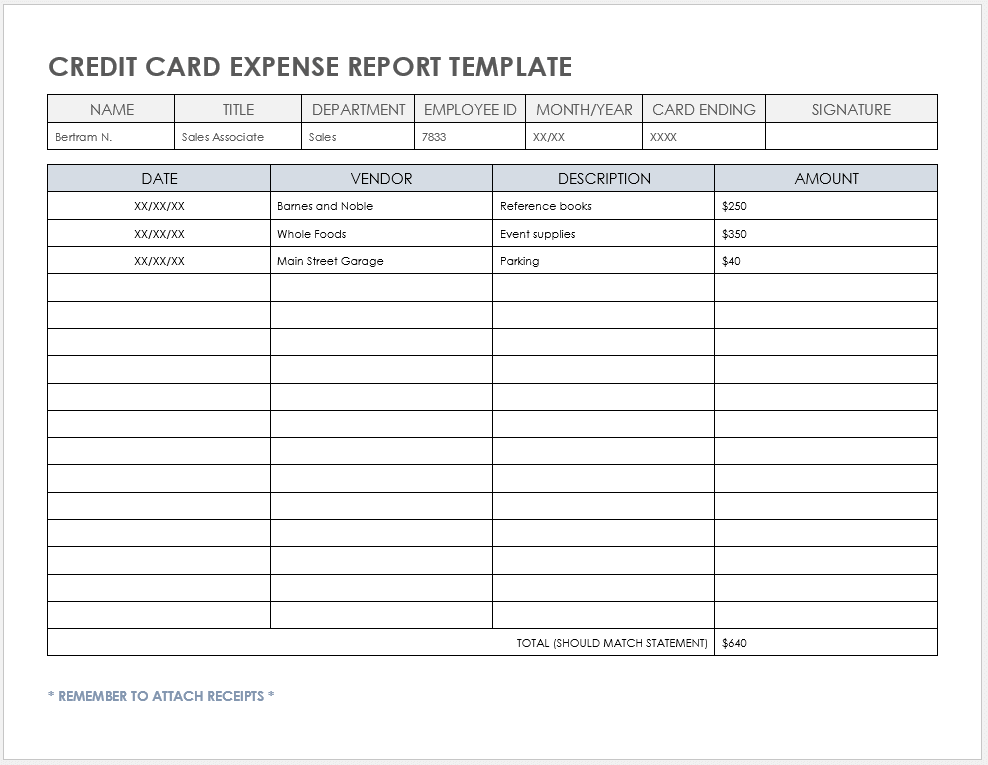

Credit Card Expense Report Template

Download a Credit Card Expense Report Template for Microsoft Word | Adobe PDF | Google Docs

This template summarizes credit card expenses to track business purpose and amount spent. This printable expense report should be accompanied by receipts for each transaction listed. This can be used for tracking monthly credit card expenses and to support accounting practices.

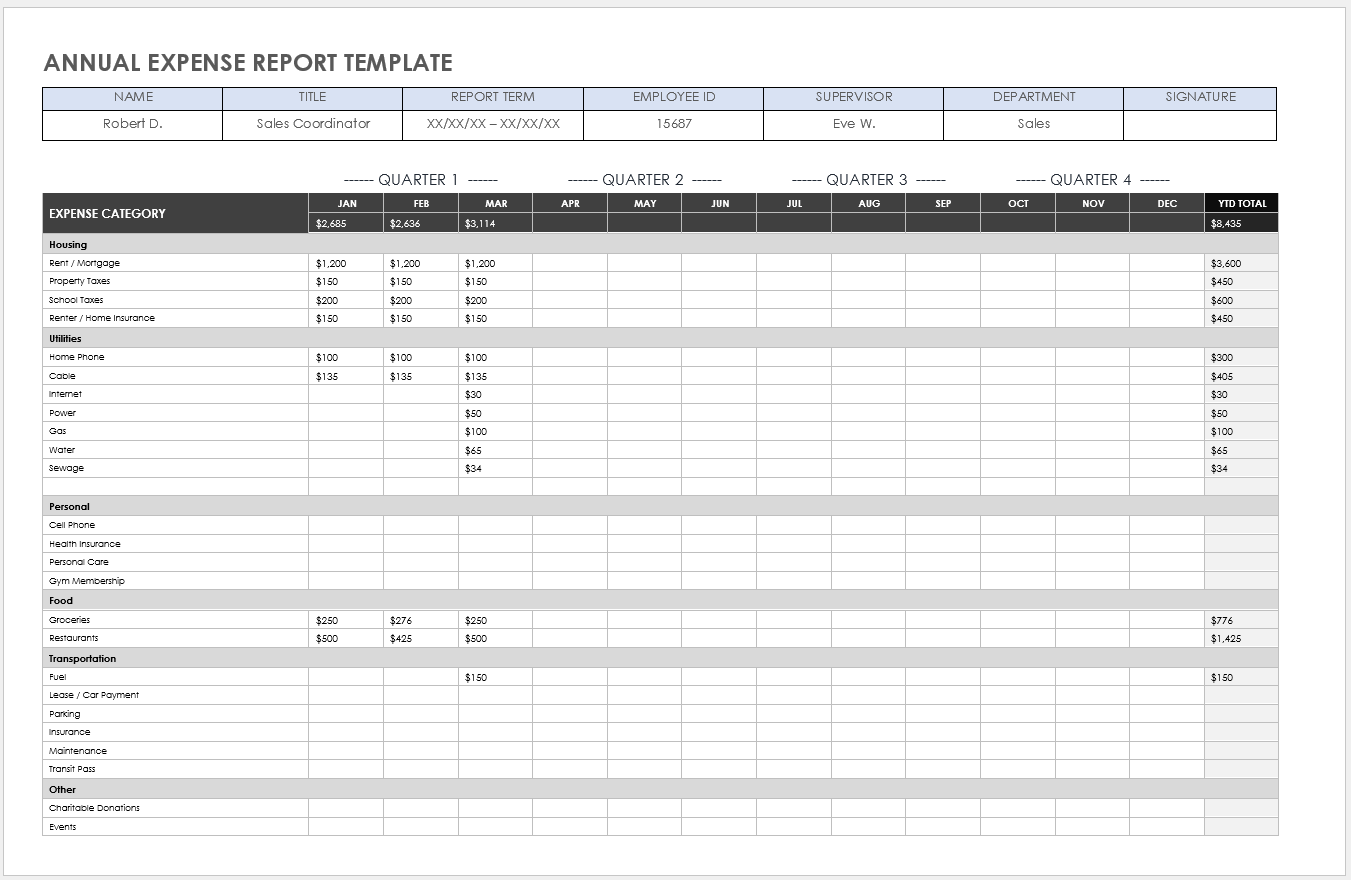

Annual Expense Report Template

Download an Annual Expense Report Template for Microsoft Word | Adobe PDF | Google Docs

Use this annual expense report to itemize monthly, quarterly, and yearly totals. This printable form provides a quick breakdown of costs for different business categories and creates a brief report. There is also room for notes if additional information needs to be included.

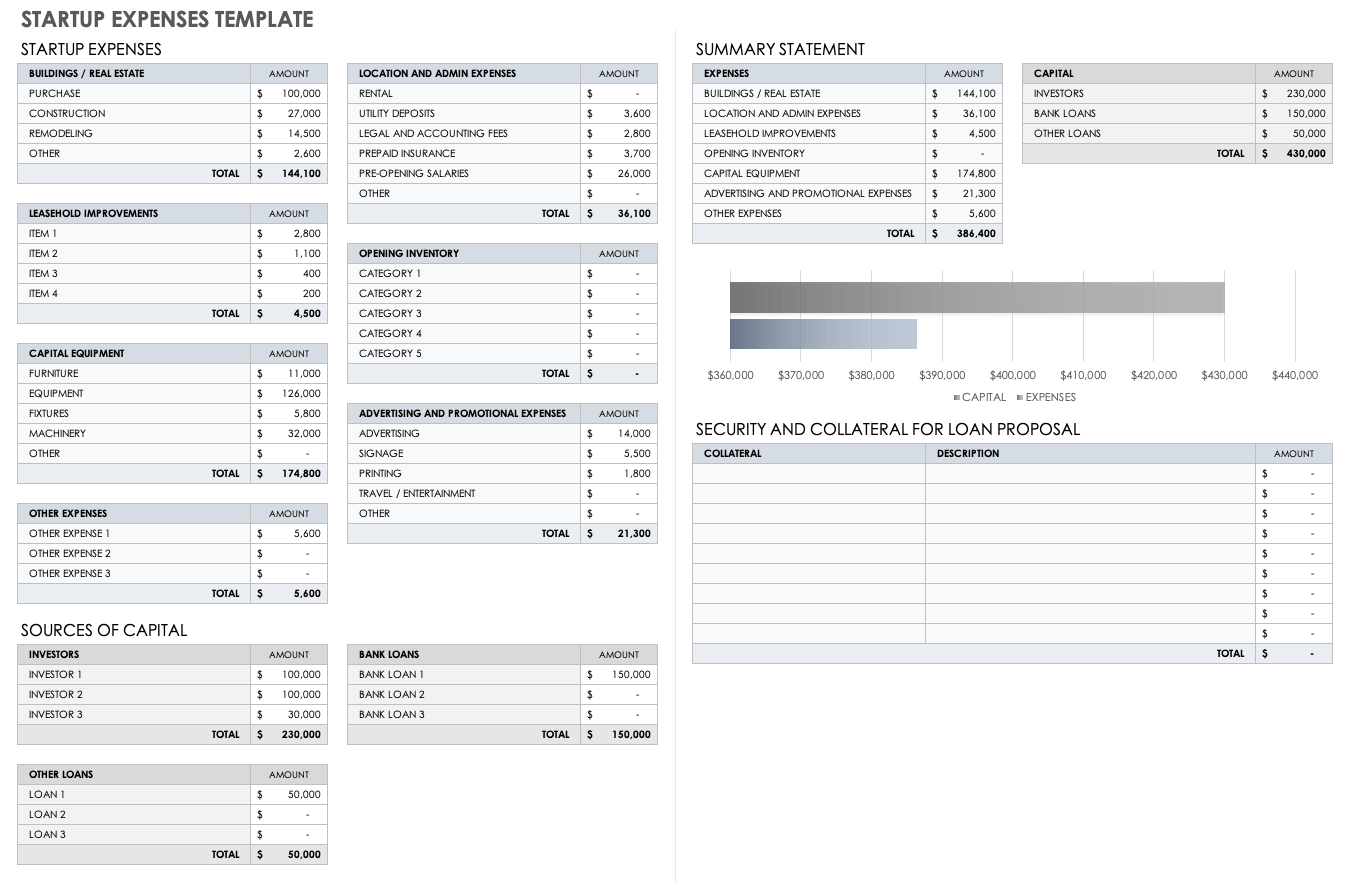

Startup Expenses Template

Download a Startup Expenses Template for Excel | Google Sheets

This comprehensive expenses-tracking template is designed for startups to monitor all the expenditures related to launching a new business. The printable template consists of pre-built sections for specific expense categories, such as building and real estate, leasehold improvements, location and administrative expenses, opening inventory, capital equipment, advertising and promotional expenses, and miscellaneous expenses. It offers a ready-made report that can be shared with key stakeholders and investors to review your startup's expenses.

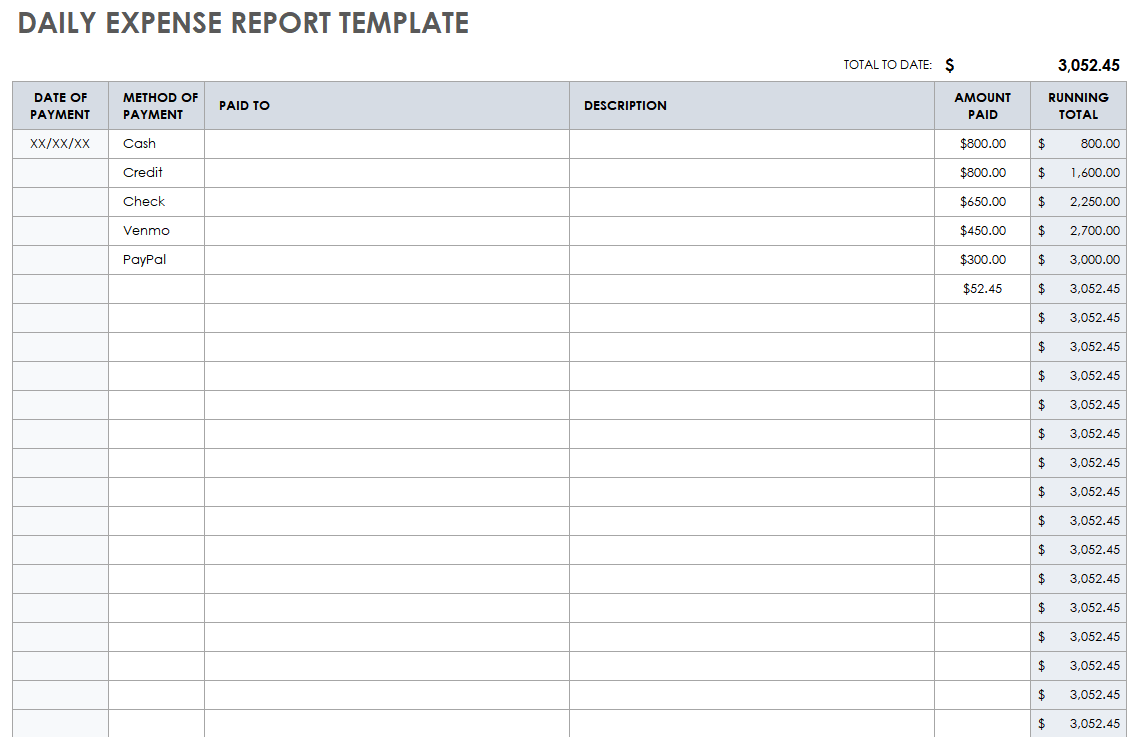

Daily Expense Report Template

Download a Daily Expense Report Template for Excel | Adobe PDF | Google Sheets

This printable daily expense report template is a versatile solution for various industries such as nonprofit, fundraising, construction, events, trucking, and more. It empowers you to track and monitor daily expenditures efficiently, ensuring timely and accurate reimbursements.

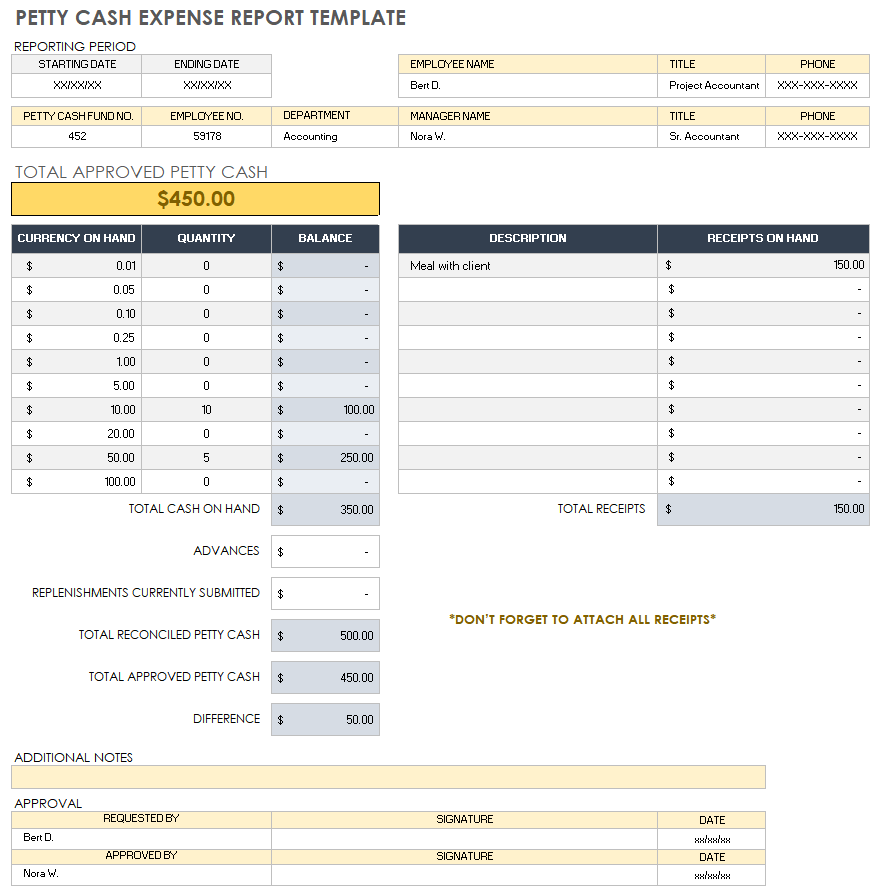

Petty Cash Expense Report Template

Download a Petty Cash Expense Report Template for Excel | Google Sheets

For organizations that keep petty cash on hand to pay for incidental expenses (e.g., paying for employees’ lunches, reimbursements, office supplies, etc.), this printable template is the perfect solution to track minor, one-off expenditures. The template provides Currency on Hand, Quantity, and Balance columns for each petty-cash expense. The template then allows you to reconcile these expenses with Total Reconciled Petty Cash and Total Approved Petty Cash cells, and the over-under difference between the two.

What Is an Expense Report?

An expense report is a document used to track business-related expenses, such as transportation, food, lodging, and conference fees. This report includes details about each expense and acts as an organized record for reimbursement or accounting purposes.

An expense report can be used in various scenarios, such as tracking mileage and gas expenses during work-related travel, documenting client meetings that involve meals or entertainment, or recording office supply purchases made by employees. Maintaining these reports is crucial for budgeting and tax purposes.

Requiring receipts for all listed expenses on a report is essential to minimize errors and facilitate tax filing and audits for businesses. Regularly collecting expense reports from employees, whether on a weekly or monthly basis, serves as a safeguard against budgeting inaccuracies and helps ensure responsible use of funds.

An expense report can vary in length and complexity depending on your business requirements. It can range from a simple form to a more detailed document. Typically, an expense report includes a comprehensive list of expenses, with each item accompanied by a corresponding description. Expenses are often categorized, such as mileage, meals, hotel costs, or employee training. In the case of a travel-specific report, additional details about the destination and purpose of travel may also be included.

When listing expenses for reimbursement, it is essential to include any advance payments, which should be deducted from the total reimbursement amount. Additionally, the expense report should feature a signature line for approval and provide contact information for the individual requesting reimbursement. To maintain accurate records, it is advisable to indicate the specific time period during which the expenses were incurred.

What Is an Expense Report Template?

An expense report template is a tool that allows businesses or individuals to track and manage their expenses. An expense report template helps you record and organize your expenses, making it easier to get reimbursed and keep accurate financial records.

Expense report templates are not only helpful for tracking business expenses but can also be useful in creating a personal budget. Whether you're managing your monthly income and household expenses, undertaking a remodeling project, or planning a special event like a wedding, a personal budget can help you keep track of your primary expenses. It enables you to identify areas where you can reduce costs and increase your savings.

While expense reports may vary, they typically include the following sections, which you can customize to suit your expense-tracking needs:

- Name: Enter the name of the individual to be reimbursed upon submission of the expense report.

- Department: Specify the department where the employee or individual works or the department responsible for reimbursement.

- Manager: Provide the name of the manager overseeing the individual who can authorize expense reimbursement.

- Date: Indicate the date(s) when the expenses were incurred.

- Description: Provide a brief description for each expense.

- Expense Category: Categorize expenses into specific categories such as transportation, lodging, food, or mileage.

- Subtotal: Calculate the total of all expenses.

- Advances: Record any advances given to the individual being reimbursed.

- Total Reimbursement: Calculate the final reimbursement amount by subtracting any advances from the subtotal.

- Authorized By: Enter the name of the person authorized to approve the expense reimbursement.

- Receipts: Attach all relevant receipts to the expense report for accurate and timely payment processing.

Discover a Better Way to Manage Expense Reporting and Finance Operations

Empower your people to go above and beyond with a flexible platform designed to match the needs of your team — and adapt as those needs change.

The Smartsheet platform makes it easy to plan, capture, manage, and report on work from anywhere, helping your team be more effective and get more done. Report on key metrics and get real-time visibility into work as it happens with roll-up reports, dashboards, and automated workflows built to keep your team connected and informed.

When teams have clarity into the work getting done, there’s no telling how much more they can accomplish in the same amount of time. Try Smartsheet for free, today.

Additional Resources

Budget & accounting

Free Excel Invoice Templates

Need to submit and track invoices? Here are 12 free invoice templates to get you started.

Mar 25, 2024 6 min read

Top Excel Financial Templates

Discover all the top financial templates that your business needs to succeed.

Sep 23, 2022

Discover why over 90% of Fortune 100 companies trust Smartsheet to get work done.

Free Excel Travel Expense Templates

Download free Excel Travel Expense templates that are compatible with Microsoft Excel. Customize the forms and templates according to your needs.

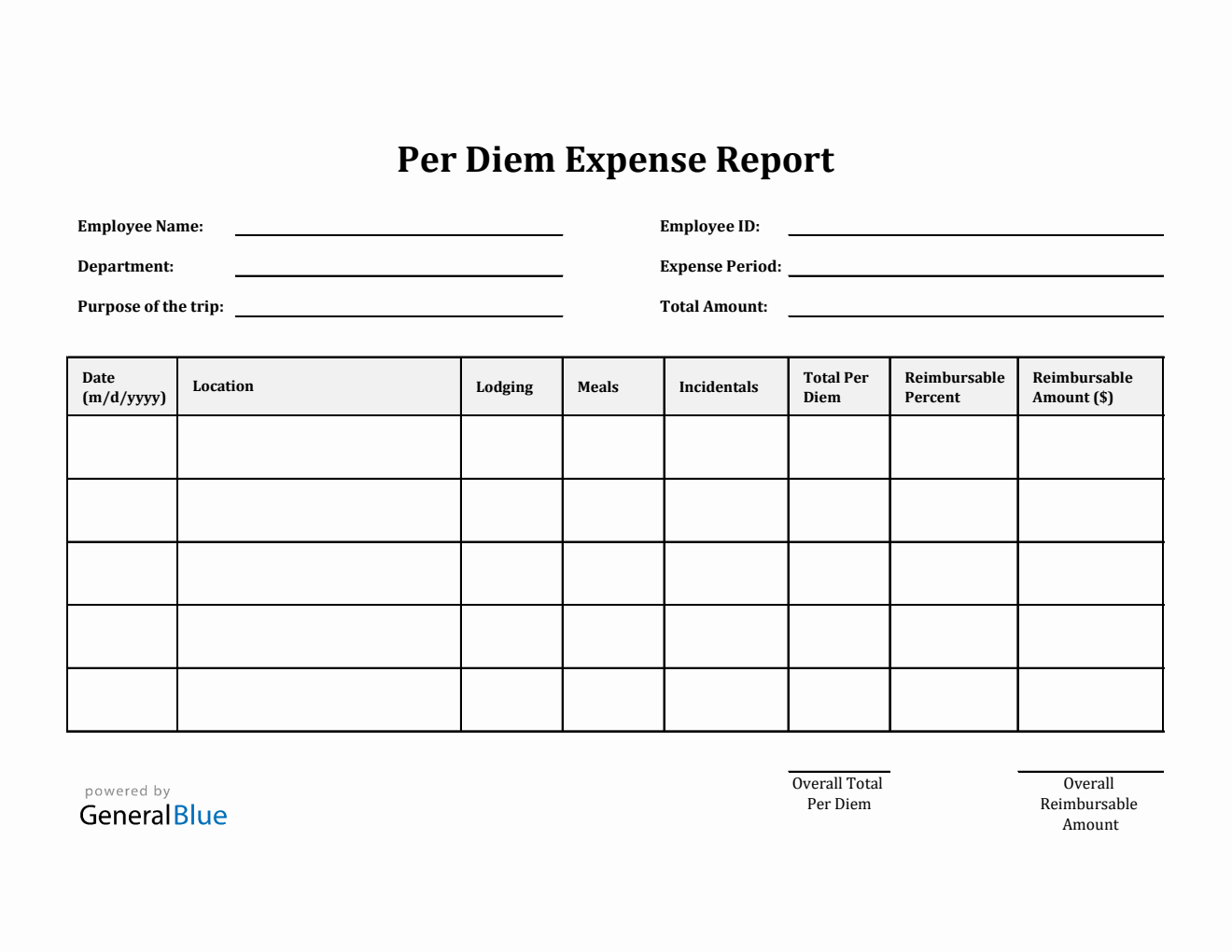

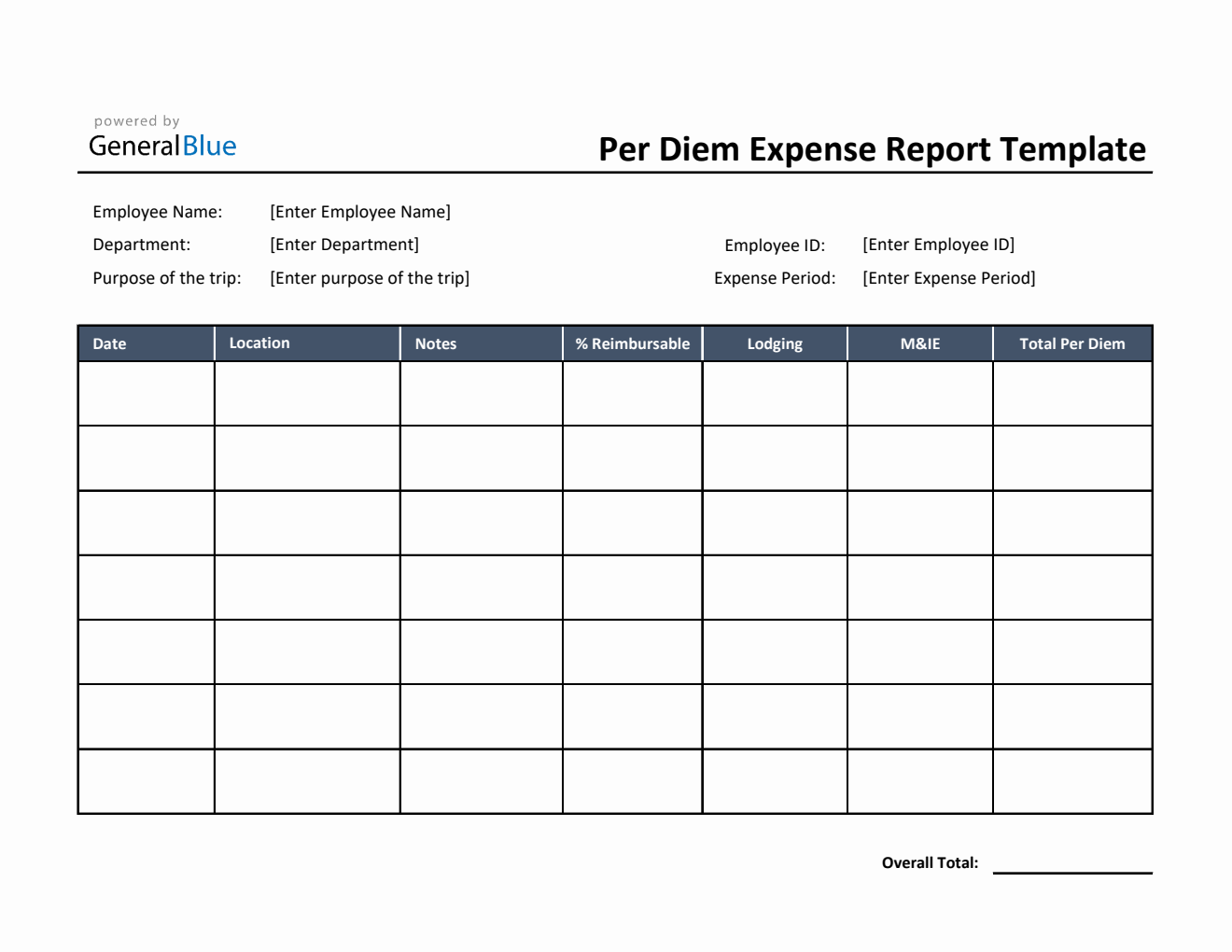

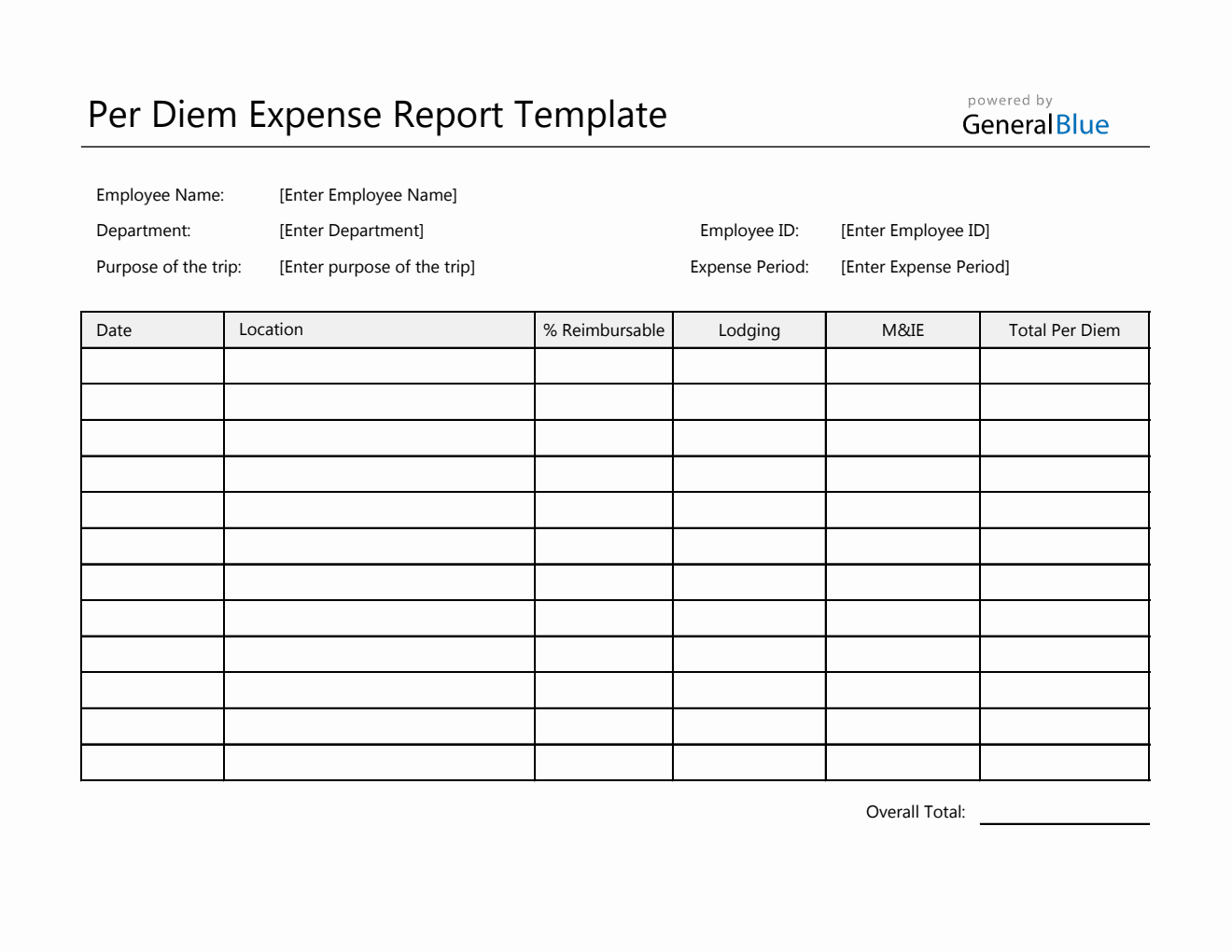

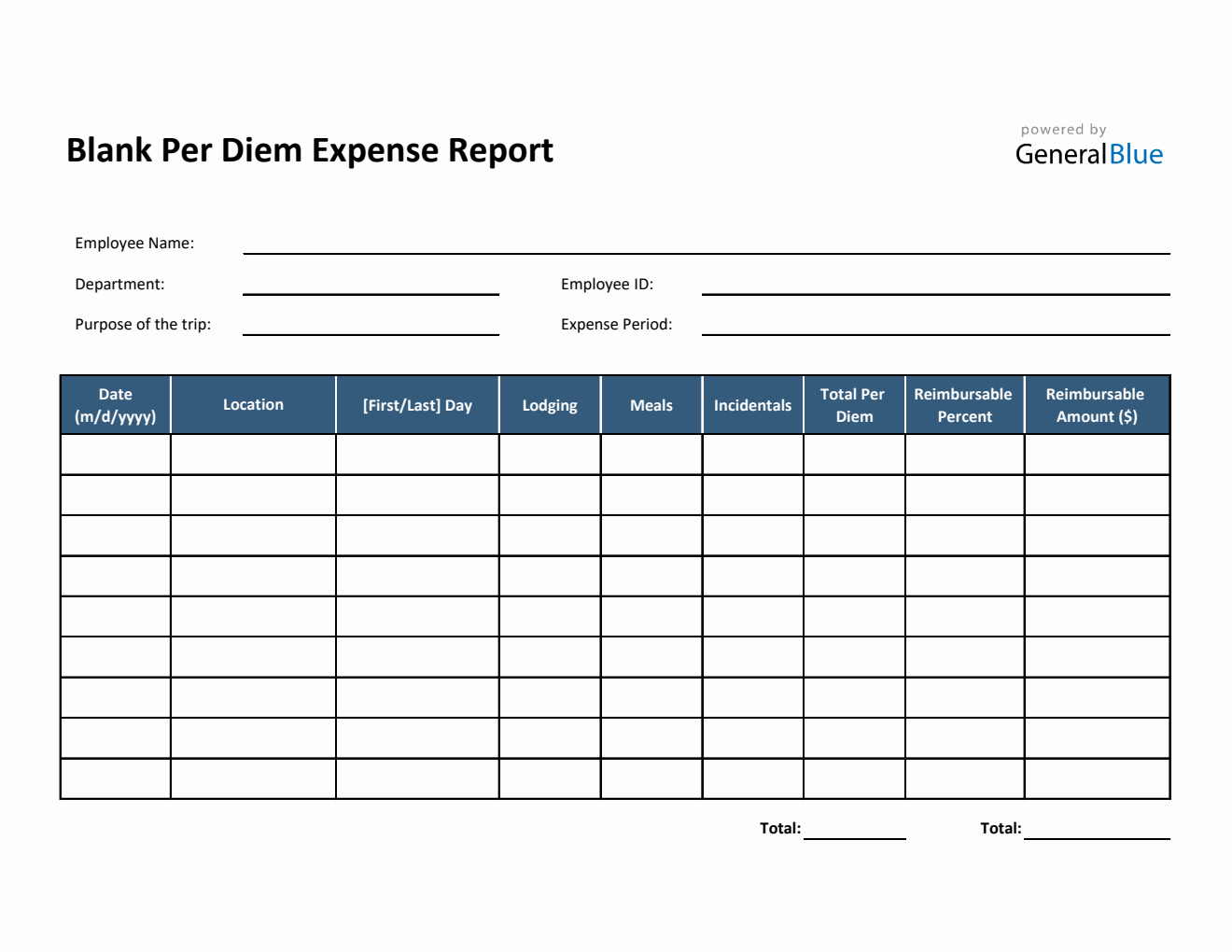

Blank Per Diem Expense Report Template in Excel (Plain)

Get this free Blank Per Diem Expense Report Template available in Excel to help track your employees’ business travel expenses on a daily basis.

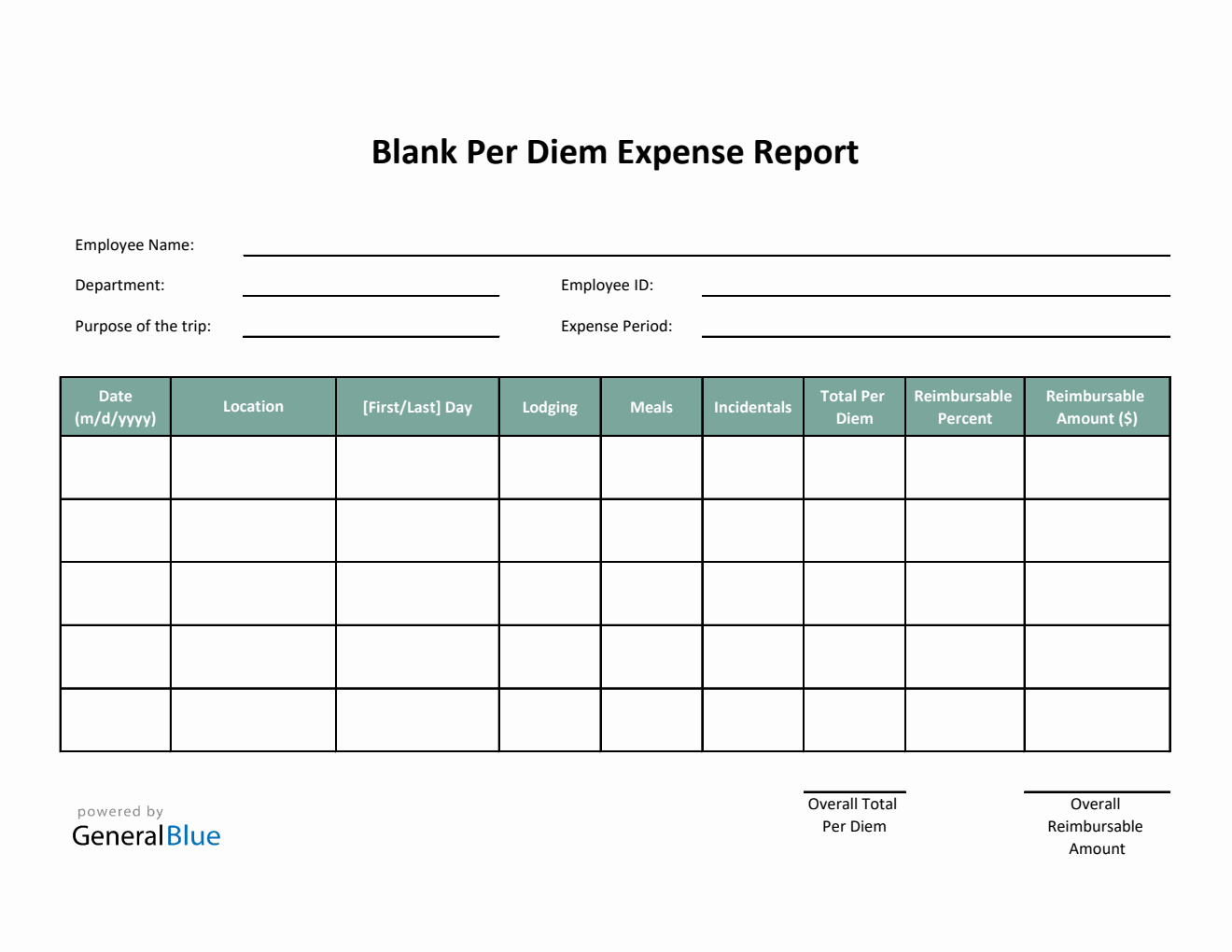

Blank Per Diem Expense Report Template in Excel (Green)

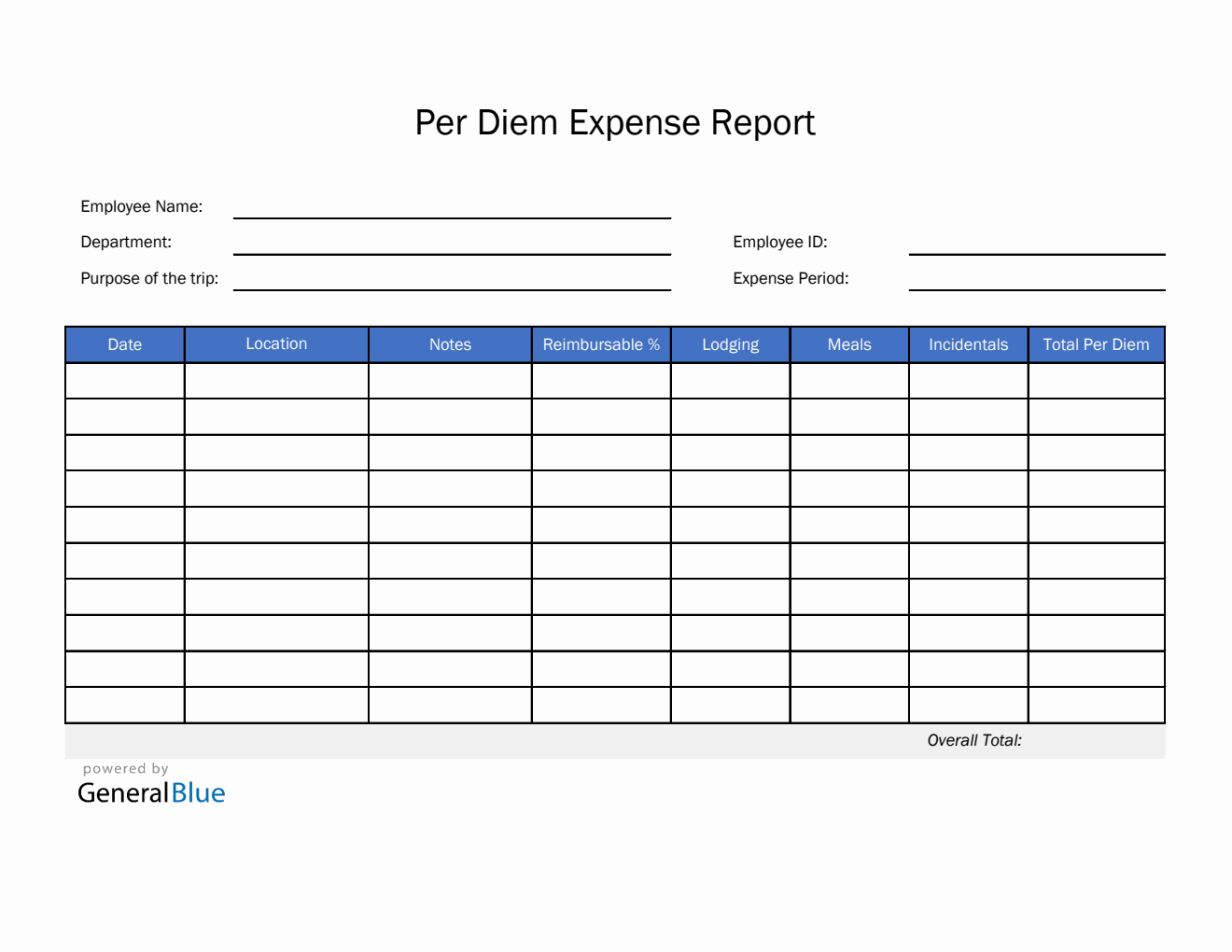

Per Diem Expense Report Template in Excel (Blue)

Get this free Per Diem Expense Report Template available in Excel to help track your employees’ business travel expenses on a daily basis.

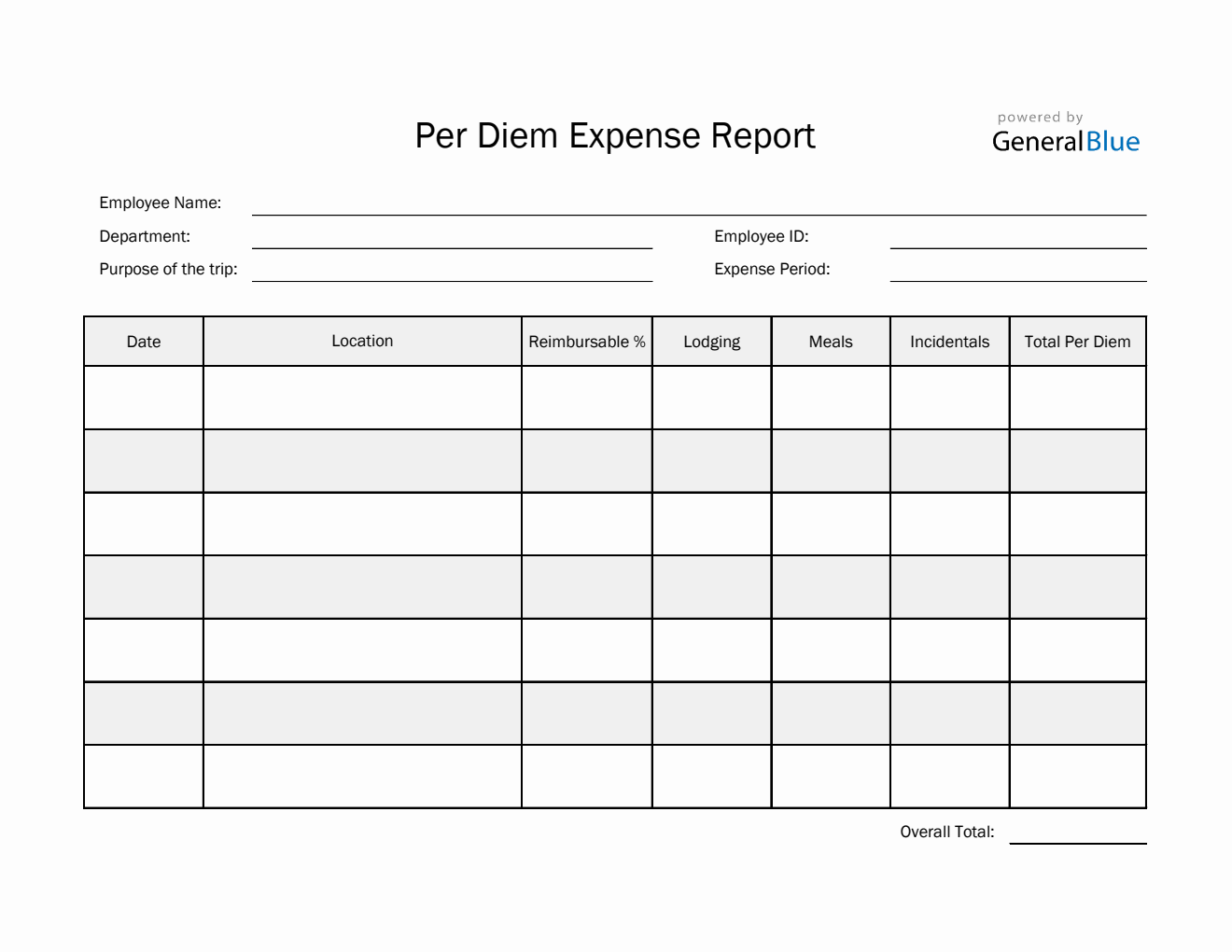

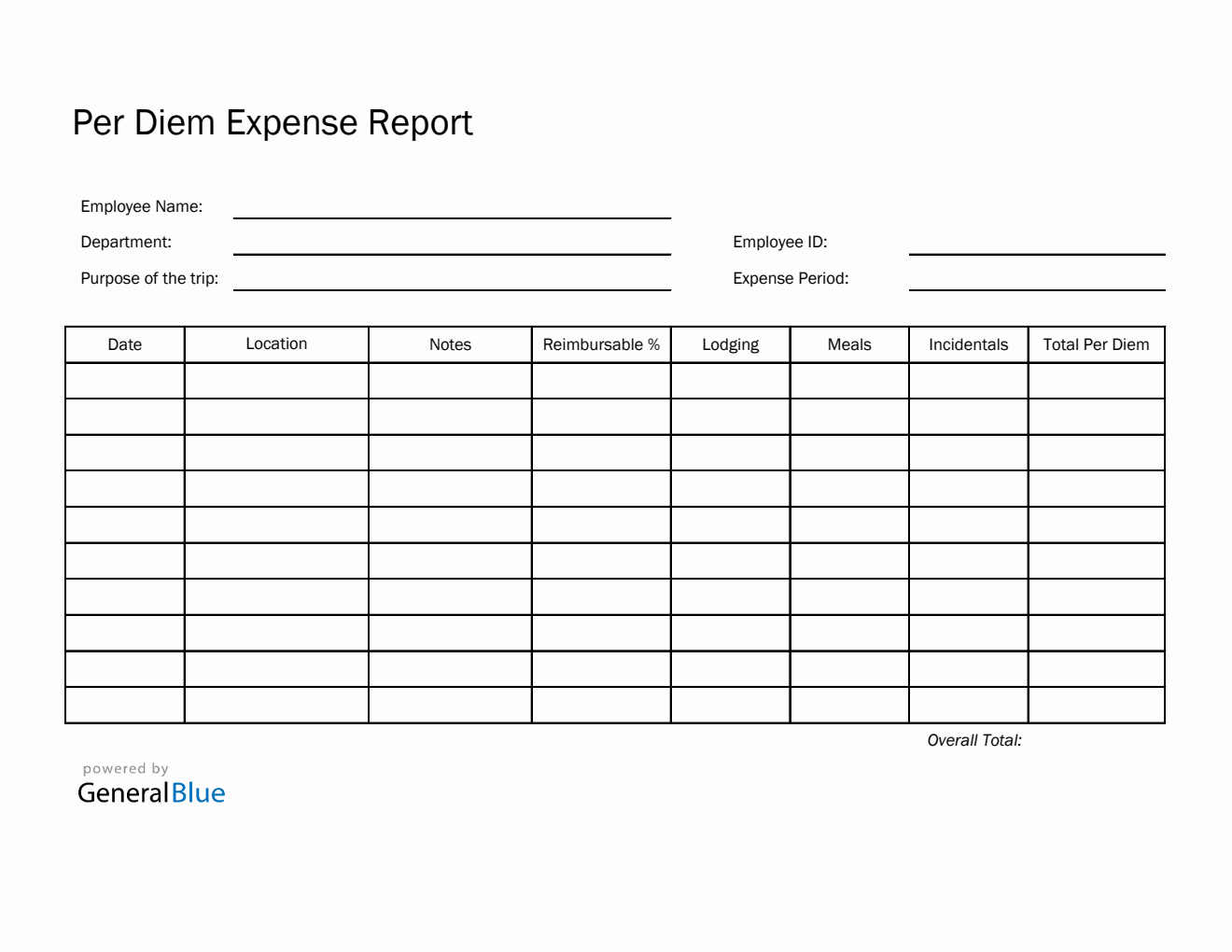

Simple Per Diem Expense Report in Excel

Per Diem Expense Report Template in Excel (Striped)

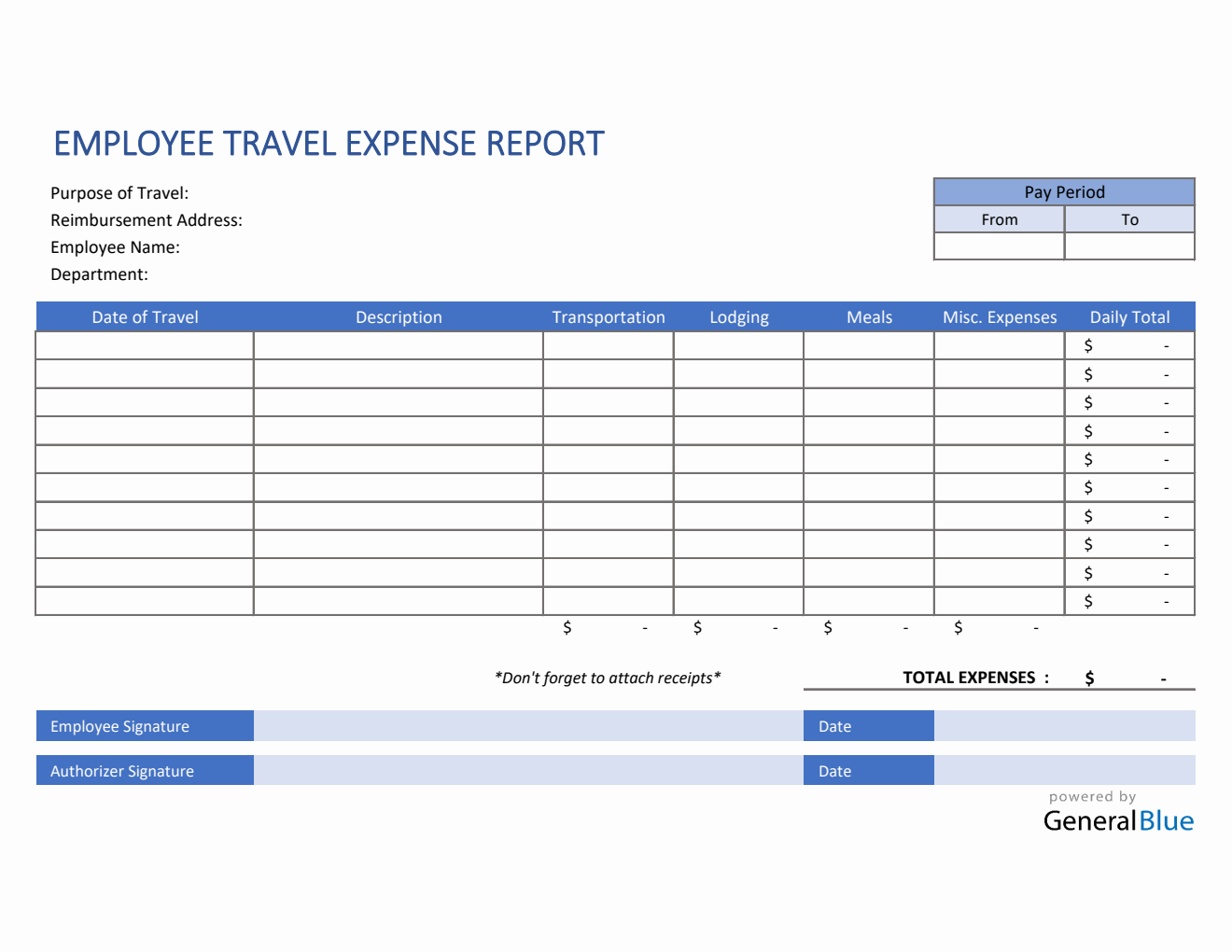

Employee Travel Expense Report Template in Excel

Use this Travel Expense Report in Excel to get reimbursements from all expenses spent during your trip. Receipts should be attached along with this form.

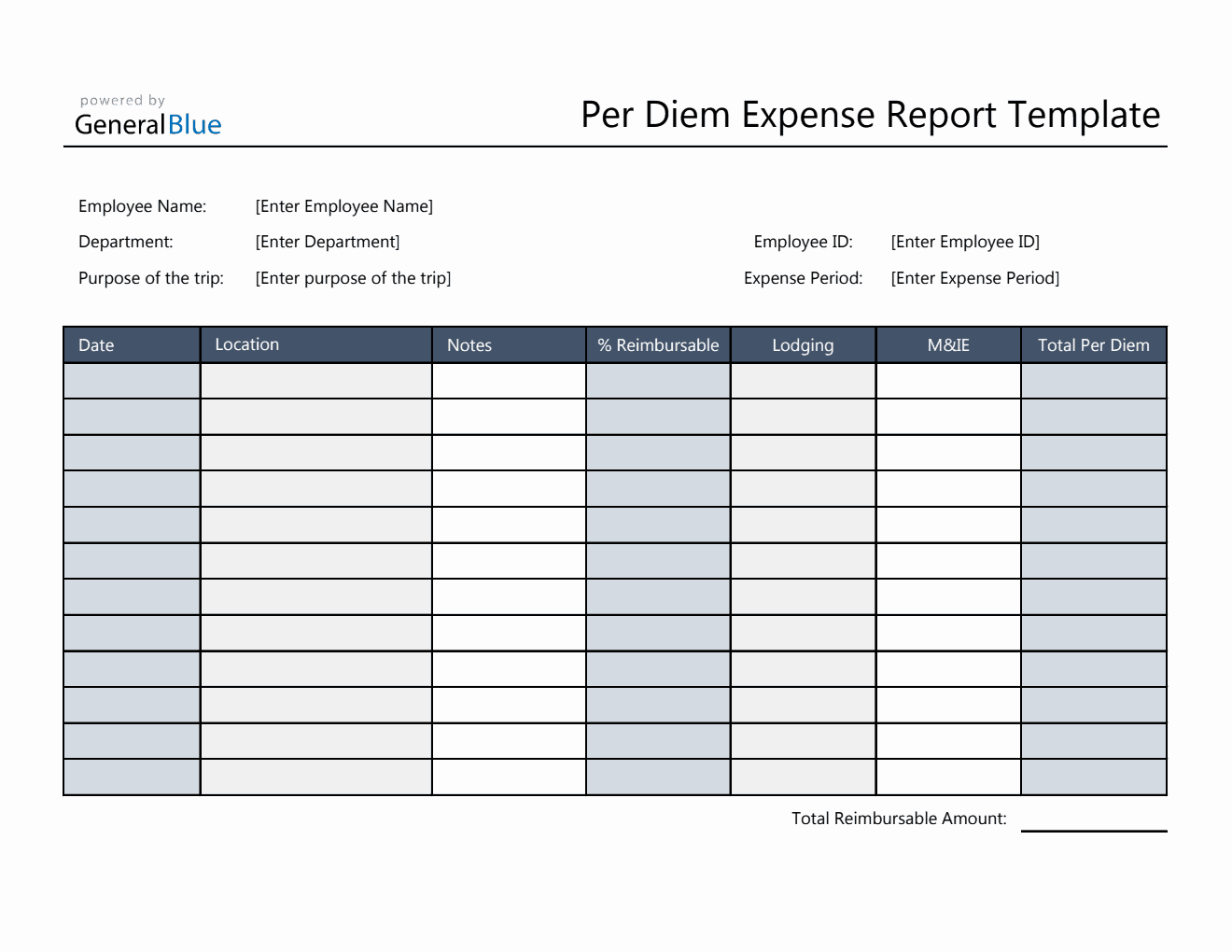

Editable Per Diem Expense Report in Excel

Printable Per Diem Expense Report in Excel

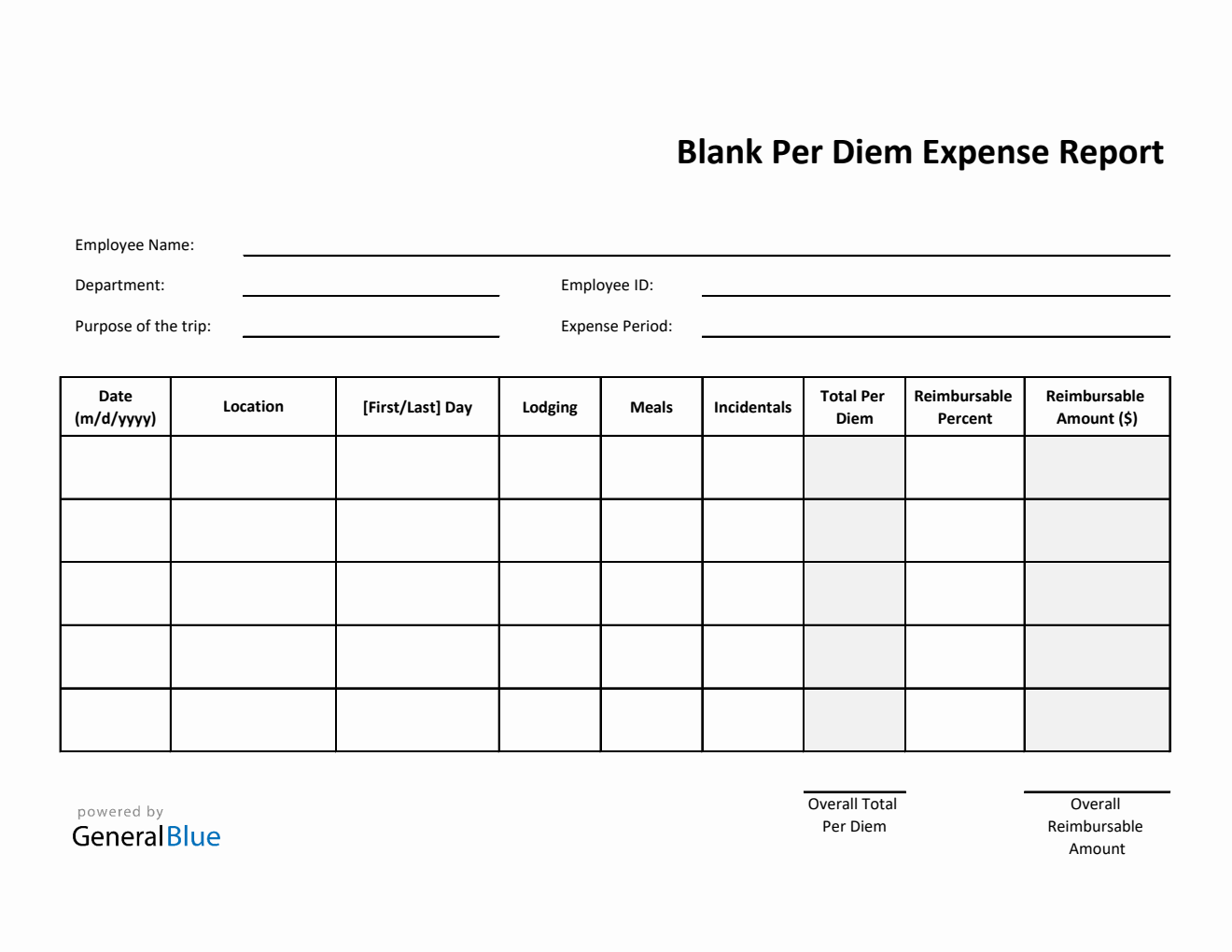

Blank Per Diem Expense Report Template in Excel (Simple)

Blank Per Diem Expense Report Template in Excel (Printable)

Per Diem Expense Report Template in Excel (Printable)

- Skip to primary navigation

- Skip to main content

- Skip to primary sidebar

- Skip to footer

Legal Templates

Home Business Employee Reimbursement

Employee Reimbursement Form

Report expenses paid on behalf of a company to receive reimbursement.

Published July 6, 2023 Reviewed by Brooke Davis

An employee reimbursement form is a valuable tool for tracking work-related expenses. Employees can use the form to keep track of their costs on a weekly, monthly, or annual basis. Employers benefit from having a standard format that lists expense details.

How To Reimburse Employees for Expenses

What should to include, how to write, frequently asked questions.

Depending on the type of business, an employee may seek reimbursement for various expenses, including meals, mileage, travel, and supplies. Successful expense reimbursement requires the employer and employee to understand their roles.

For Employers

Company documents such as an employment contract , consulting agreement , or work-from-home policy may outline your expense reimbursement policy. Reimburse your workers for employment-related expenses by taking the following steps:

- Provide a standard employee reimbursement form template.

- Create an expense policy that includes reimbursable expenses and payment terms.

- Delineate the time frame for expense form submissions.

- Review submitted expenses and receipts, if applicable.

- Include reimbursements in the employee’s paycheck, direct deposit , or separate payment, as outlined in your expense policy.

Keep copies of the completed reimbursement form and documentation for your company’s records in case a labor dispute arises.

For Employees

While your employer may have a contractual obligation to reimburse certain expenses related to your job, you, as the employee, must still provide proof of those expenses. Follow these steps to avoid confusion and receive the correct reimbursement:

- If your employer does not offer a specific form, use a well-organized employee reimbursement form

- Review your company’s reimbursement policies to understand which expenses are reimbursable

- Be conscious of spending limits imposed by your company’s reimbursement policy

- Retain copies of receipts, credit card bills, or invoices for your expenses

- Submit your expenses within the required time frame to ensure timely payment

- Review your expense documents to ensure their accuracy

- Submit your employee reimbursement form to your manager or supervisor for approval

Depending on your company’s processes, you may need to submit the approved employee reimbursement form to your payroll department. In some cases, your supervisor will do this for you.

An employee reimbursement form should include the following:

- The employee’s full name, job title, department, email address, and phone number

- The name of the employee’s supervisor

- Reimbursement details for each expense, including the amount, category, date, and reason for the expense

- Copies of any receipts or supporting documentation for expenses claimed

- A declaration that the form is correct

- Employee signature and date

- Supervisor approval, with their printed name, signature, and date

- Finance or payroll department approval, including the approved reimbursement amount, date reimbursed, and signature from the employee handling the payout

These details may differ depending on your company policy and procedures, so review your reimbursement policy with your supervisor or finance department before you submit your expenses. Incorrect submissions may prevent you from receiving reimbursement or lead to disciplinary action.

Avoid unnecessary delays and complications by filling out your employee reimbursement form as follows:

Step 1 – Enter Employee Information

Your company may handle reimbursement forms from multiple employees. Keep your reimbursement on track by providing your printed name, job title, department, work email, and phone number. You should also clearly print your supervisor’s name with your information for easy reference.

Step 2 – Enter Reimbursement Details

List the details of your reimbursable expenses. Include whether they are for accommodations, travel, meals, supplies, or other reimbursable costs. Provide a clear description and explanation of the reason for each expense. Indicate the amount for each reimbursement request and the date you incurred the expense.

Step 3 – Attach Receipts and Documentation

Receipts, bills, invoices, and credit card bills provide evidence of the amount and date of your expenditure. If you do not provide documented proof, your company may delay or deny payment.

Step 4 – Declare the Form’s Accuracy

Sign and date the declaration to indicate that the information you provided in your form is true and accurate to the best of your knowledge. This demonstrates that you incurred the listed expenses while performing your job duties. The declaration is also your acknowledgment that false or misleading expense reimbursement requests could result in disciplinary action.

Step 5 – Secure Supervisor Approval

Once you complete, sign, and date your employee reimbursement form, submit it to your supervisor for approval. They will review your form before signing, dating, and forwarding it to your finance or payroll department.

Step 6 – Submit to the Finance Department

The finance department will review your expense documentation for accuracy. After this final check, the finance department will submit your employee expense reimbursement for payment. You may receive payment separately or in your regular paycheck.

You can simplify employee expenses by using this employee reimbursement form sample:

What expenses can be reimbursed?

Here are everyday expenses that companies could reimburse:

- Travel expenses: Airfare, transportation, accommodation, parking fees, tolls.

- Meals and entertainment: Business meals, client entertainment.

- Office supplies: Stationery, printer ink, small equipment.

- Professional development: Conference fees, training sessions.

- Communication expenses: Mobile phone bills, internet charges.

- Client-related expenses: Hosting clients, gifts, and business-related events.

- Miscellaneous expenses: Shipping costs, professional membership fees, subscriptions.

Please note that specific reimbursement policies and guidelines may vary by company. Always refer to your company’s reimbursement policy for detailed information.

What supporting documents should I attach to the reimbursement form?

Typically, you will need to provide original or electronic copies of receipts, invoices, or any other relevant documents that support your expense claim. These documents serve as proof of payment and should include details such as the vendor’s name, date, the amount paid, and a description of the expense.

Are there any limitations on the reimbursement amount?

Some companies may have limitations or guidelines on the maximum reimbursement amount for specific expense categories. Review your company’s reimbursement policy or guidelines to ensure compliance with any limits or restrictions.

Related Documents

- Employee Complaint Form : File a complaint with HR.

- Employee Information Form : Keep track of important employee information

- Employee Onboarding Checklist : Keep track of each element of the onboarding process.

- Legal Resources

- Partner With Us

- Terms of Use

- Privacy Policy

- Do Not Sell My Personal Information

The document above is a sample. Please note that the language you see here may change depending on your answers to the document questionnaire.

Thank you for downloading!

How would you rate your free template?

Click on a star to rate

Warning notification: Warning

Unfortunately, you are using an outdated browser. Please, upgrade your browser to improve your experience with HSE. The list of supported browsers:

Travel expenses

Login to HR & Payroll Self Service

Claim travel expenses for your vehicle using self service.

To claim travel expenses for using your vehicle you must have a Travel Privileges record.

You can submit the documents to create your Travel Privileges record through My Travel Privileges

You will need to submit a certified copy of your:

- vehicle licence certificate

- letter of indemnity

- insurance policy

- signed employee declaration form for approval of travel and expenses (PDF, 131KB, 1 page)

Your declaration document must be updated annually.

Related documents

My travel privileges guide (PDF, 1MB, 7 pages)

Creating travel privileges tutorial (video)

Approving travel privileges tutorial (video)

My travel privileges faqs (PDF, 576KB, 3 pages)

Claiming travel expenses when not using a vehicle

You can claim travel expenses when not using a vehicle on My Travel Privileges

Select 'valid from' date and enter 'No Vehicle' in vehicle type and class.

Upload your completed employee declaration and submit.

Related document

My travel privileges - no vehicle (PDF, 826 KB, 3 pages)

Claiming other expenses

You can claim expenses incurred during your trip using My Travel and Expenses

Click on 'add expenses'

Complete the expense details and click save.

For queries about the rules and policies around travel and subsistence see:

NFR B-4 travel and subsistence guidelines (PDF, 1.4 MB, 39 pages)

My travel and expenses tutorial (PDF, 1.2MB, 9 pages)

Travel and expenses tutorial (video)

Travel and expenses faqs (PDF, 469KB, 4 pages)

Related topics

My Inbox- reminders and correct trip information

Travel allowances

Contact HR & Payroll Self Service helpdesk (NiSRP) using any of the following options:

Log your query on Health Shared Services Self Service Portal

Email [email protected]

When emailing the helpdesk include your name and personnel number (or your PPS number if you do not know your personnel number).

Phone: 0818 300 296 9am to 4.30pm Monday to Friday

For pay and payslip queries contact your local payroll department

Language selection

- Français fr

T2200 Declaration of Conditions of Employment

Download instructions for fillable pdfs.

You must download the accessible fillable PDF to your computer. Use Acrobat Reader 10 or later to open the file. Do not click the link to open it in your web browser.

- Download and save the PDF to your computer

- Open the downloaded PDF in Acrobat Reader 10 or later

The t2200 form must be completed by employers in order for their employees to deduct employment expenses from their income.

Ways to get the form

Download and fill out with acrobat reader.

You must download and open fillable PDFs in Acrobat Reader 10 or higher.

- Accessible Fillable PDF (t2200-fill-23e.pdf)

This form is also available for the years listed below:

- 2022 – Fillable PDF (t2200-fill-22e.pdf)

- 2021 – Fillable PDF (t2200-fill-21e.pdf)

- 2020 – Fillable PDF (t2200-fill-20e.pdf)

- 2019 – Fillable PDF (t2200-fill-19e.pdf)

- 2018 – Fillable PDF (t2200-fill-18e.pdf)

- 2015 – Fillable PDF (t2200-fill-15e.pdf)

- 2013 – Fillable PDF (t2200-fill-13e.pdf)

- 2012 – Fillable PDF (t2200-fill-12e.pdf)

- 2011 – Fillable PDF (t2200-fill-11e.pdf)

- 2010 – Fillable PDF (t2200-fill-10e.pdf)

- 2009 – Fillable PDF (t2200-fill-09e.pdf)

- 2008 – Fillable PDF (t2200-fill-08e.pdf)

- 2007 – Fillable PDF (t2200-fill-07e.pdf)

- 2006 – Fillable PDF (t2200-fill-06e.pdf)

- 2005 – Fillable PDF (t2200-fill-05e.pdf)

- 2004 – Fillable PDF (t2200-fill-04e.pdf)

- 2003 – Fillable PDF (t2200-fill-03e.pdf)

- 2002 – Fillable PDF (t2200-fill-02e.pdf)

- 2001 – Fillable PDF (t2200-fill-01e.pdf)

Print and fill out by hand

- Standard print PDF (t2200-23e.pdf)

- 2022 – Standard print PDF (t2200-22e.pdf)

- 2021 – Standard print PDF (t2200-21e.pdf)

- 2020 – Standard print PDF (t2200-20e.pdf)

- 2019 – Standard print PDF (t2200-19e.pdf)

- 2018 – Standard print PDF (t2200-18e.pdf)

- 2015 – Standard print PDF (t2200-15e.pdf)

- 2013 – Standard print PDF (t2200-13e.pdf)

- 2012 – Standard print PDF (t2200-12e.pdf)

- 2011 – Standard print PDF (t2200-11e.pdf)

- 2010 – Standard print PDF (t2200-10e.pdf)

- 2009 – Standard print PDF (t2200-09e.pdf)

- 2008 – Standard print PDF (t2200-08e.pdf)

- 2007 – Standard print PDF (t2200-07e.pdf)

- 2006 – Standard print PDF (t2200-06e.pdf)

- 2005 – Standard print PDF (t2200-05e.pdf)

- 2004 – Standard print PDF (t2200-04e.pdf)

- 2003 – Standard print PDF (t2200-03e.pdf)

- 2002 – Standard print PDF (t2200-02e.pdf)

- 2001 – Standard print PDF (t2200-01e.pdf)

Ask for an alternate format

You can order alternate formats such as digital audio, electronic text, braille, and large print.

- Order alternate formats for persons with disabilities

Page details

Declaration of Immigration Status by Non-US Citizens

Entertainment Worksheet

Entertainment Exception Worksheet (Auto-download; open with Adobe Acrobat )

Express Quick Ref Guide

Global Entry Reimbursement Form

Relocation Expense Form

Request for Stop Payment

Sponsorship Contribution Form (Auto-download; open with Adobe Acrobat )

T&E Card Application Form

Transient Occupancy Tax Exemption Certificate

Travel Expense Voucher

10920 Wilshire Blvd., 5th Floor Los Angeles, CA 90024-6541 Mail Code: 143348 Phone: (310) 206-2639 or (800) 235-UCLA (8252)

CST# 2046415-70

Travel Services Directory

© 2024 Regents of the University of California

- Accessibility

- Report Misconduct

- Privacy & Terms of Use

IMAGES

VIDEO

COMMENTS

Using a travel expense reimbursement form template offers several benefits. It simplifies the process of tracking and reimbursing travel expenses, saving time and reducing administrative burden. It also provides a standardized format for expense reporting, ensuring consistency and accuracy. Additionally, Jotform offers features like electronic ...

Summary: This form is to be used when claiming reimbursement for travel (i.e. private vehicle, public transport and/or taxi) expenses to attend: medical treatment for accident injuries; medical examinations arranged by the TAC; approved rehabilitation or disability services; or work, if you are participating in a formal Return to Work program.

Travel expenses defined. For tax purposes, travel expenses are the ordinary and necessary expenses of traveling away from home for your business, profession, or job. ... (Form 1040), you can deduct on line 5c state and local personal property taxes on motor vehicles. You can take this deduction even if you use the standard mileage rate or if ...

Travel expenses are the ordinary and necessary expenses of traveling away from home for your business, profession, or job. ... plus any parking fees, ferry fees, and tolls. Claim these expenses on Form 2106, Employee Business Expenses and report them on Form 1040, Form 1040-SR, or Form 1040-NR as an adjustment to income. Good records are essential.

Other similar ordinary and necessary expenses related to the business travel. Self-employed individuals or farmers with travel deductions. Those who are self-employed can deduct travel expenses on Schedule C (Form 1040), Profit or Loss From Business (Sole Proprietorship). Farmers can use Schedule F (Form 1040), Profit or Loss From Farming.

Account number. ABN 22 033 947 623. GPO Box 2751 Melbourne, VIC, 3001 DX 216079 Melbourne Telephone 1300 654 329 STD Toll free 1800 332 556 www.tac.vic.gov.au. Travel expense declaration. Date of travel. Travel from name and address. Travel to name and address. Taxi amount claimed. Public transport amount claimed.

An expense report can be used in various scenarios, such as tracking mileage and gas expenses during work-related travel, documenting client meetings that involve meals or entertainment, or recording office supply purchases made by employees. Maintaining these reports is crucial for budgeting and tax purposes.

Per Diem Expense Report Template in Excel (Printable) Get this free Per Diem Expense Report Template available in Excel to help track your employees' business travel expenses on a daily basis. Download free Excel Travel Expense templates that are compatible with Microsoft Excel. Customize the forms and templates according to your needs.

An employee reimbursement form should include the following: The employee's full name, job title, department, email address, and phone number. The name of the employee's supervisor. Reimbursement details for each expense, including the amount, category, date, and reason for the expense. Copies of any receipts or supporting documentation for ...

Mileage Reimbursement Rates. Expense FAQ. Bulletin 3.4 Employee Travel and Expense Policy. Bulletin 2.3 State Vehicle Policy. Collective Bargaining Agreements. VISION Procedure #9: Travel Cash Advance Management. Best Practice #10: Employee Travel and Expense Reimbursements. Month End Closing Instructions. Expense Module Security Overview.

Thank you.) STD-272 Firm Quoted Price Agreement (DOT) STD-277 Request for Approval of Moving Expenses (DOC) STD-334 Request for Reimbursement of Applicant's Travel Expenses (DOC) BCPO-3302 Declaration of Missing Receipt (PDF) BCPO-3302e Declaration of Missing Receipt (eSignature) (PDF) REV-1220 PA Exemption Certificate. REV-1220 Sample (PDF)

For more information about travelling expenses, read Archived Interpretation Bulletin IT-522R, Vehicle, Travel and Sales Expenses of Employees, and Archived Interpretation Bulletin IT-518R, Food, Beverages and Entertainment Expenses.. Completing your tax return. Include these expenses on the Food, beverages, and entertainment expenses line (8523) of Form T777, Statement of Employment Expenses ...

You can submit the documents to create your Travel Privileges record through My Travel Privileges. You will need to submit a certified copy of your: vehicle licence certificate; letter of indemnity; insurance policy; signed employee declaration form for approval of travel and expenses (PDF, 131KB, 1 page) Your declaration document must be ...

Travel expense form. Travel expenses for medical appointments for your workplace injury/illness must be pre-approved to avoid delays in payment. You should fill out this form based on the travel expenses approved in your claim. Please call the WSIB at 416-344-1000 or 1-800-387-0750 to find out what expenses you may claim.

Travel expense declaration formUse this form to claim reimbursement for travel.This can be private vehicle, public transport or taxi expenses to go to:medical treatment for accident injuries,medical examinations arranged by the TAC,approved rehabilitation or disability services,work, if you take part in a formal Return to Work program.

Ask for an alternate format. You can order alternate formats such as digital audio, electronic text, braille, and large print. Order alternate formats for persons with disabilities. Date modified: 2024-01-23. The t2200 form must be completed by employers in order for their employees to deduct employment expenses from their income.

Declaration of Immigration Status by Non-US Citizens Entertainment Worksheet ... Relocation Expense Form. Request for Stop Payment. Sponsorship ... T&E Card Application Form. Transient Occupancy Tax Exemption Certificate. Travel Expense Voucher. 10920 Wilshire Blvd., 5th Floor Los Angeles, CA 90024-6541 Mail Code: 143348 Phone: (310) 206-2639 ...

Form Adopted for Mandatory Use Judicial Council of California FL-150 [Rev. January 1, 2019] INCOME AND EXPENSE DECLARATION. Family Code, §§ 2030-2032, 2100-2113, 3552, 3620-3634, 4050-4076, 4300-4339 . www.courts.ca.gov. Page 1 of 4. Employer: SUPERIOR COURT OF CALIFORNIA, COUNTY OF. BRANCH NAME: CITY AND ZIP CODE: STREET ADDRESS ...

Declaration of Missing Receipt. In accordance with Section 7.4 of . Manual 230.1, Commonwealth Travel Procedures Manual, this form may be used for: 1. Vending machine subsistence, parking meter, or unmanned toll booth expenses, when a receipt is not provided. A complete explanation is required. 2.

This form is for submission of health care and work transition expenses. Travel expenses for medical and work transition appointments for your workplace injury/illness must be pre-approved to avoid delays in payment. You should fill out this form based on the travel expenses approved in your claim. Please call the WSIB at 416-344-1000 or 1-800 ...

Travel expenses incurred travelling to and from medical treatment and/or rehabilitation need to be completed on a Travel Expenses: Declaration form. If, because of your transport accident injuries, you are unable to travel to work in the way you did prior to your transport accident the TAC can reimburse reasonable expenses incurred travelling ...

This form must be completed and provided to the Victims of Crime Assistance Tribunal when the applicant is seeking reimbursement of travel expenses. The completed Travel Expenses Declaration Form and supporting documentation must be submitted to the venue of the Tribunal where the award of assistance was made. 1. Application details.