8 apps that will help track your travel expenses

Keeping track of travel expenses can be challenging. With paper receipts, email receipts and not being handed any receipt at times, it's important to be organized for both the business and leisure traveler.

Fortunately, for those who are not the best at having a good grasp on their expenses, there are many apps that can simplify your life. These apps help with expense reports, budgeting purposes, tax preparation and splitting expenses among friends.

For more TPG news delivered each morning to your inbox, sign up for our daily newsletter .

With something for everyone, here are the best apps to help you keep track of your expenses.

TrabeePocket

TrabeePocket is a straightforward app that allows you to keep track of your expenses for a given trip. Before you even start your trip you can add all prepaid expenses to the "preparing" tab. This allows you to account for your flights and any tours you might have booked in advance. Once your trip begins you can easily add all additional travel expenses. You can categorize your expenses into eight different categories, but with the paid version, you can add as many additional categories as you want if you have very specific expenses you want to track. The free version also only allows you to track one currency per trip, but the paid version allows you to track multiple currencies in one trip file.

Not only will TrabeePocket serve as a place to file your expenses, it also helps you on the budgeting front as well. You can set a monthly budget and have your expenses track against that overall number. If you are earning income during your travel, you can also enter income to a specific trip expense.

One neat feature of this app is that you can take pictures and tie it to a specific expense. This is great for the backpacker or family traveler who wants to remember exactly what the expense was used for, or to keep track of trip suggestions. Business travelers can also use this feature by taking a picture of a receipt if it is needed for a corporate expense report.

Cost: Free; Upgraded version is $1.99 and includes some additional options (i.e., multiple currencies, additional categories, view and export expense report)

Download: Google Play Store or iTunes App Store

Trail Wallet

Trail Wallet is very similar to TrabeePocket, but unfortunately is not available to Android users. With this app, you can add as many categories as you want to separate expenses and everything is color coded to make the app more visually appealing. (Unlike TrabeePocket, you do not need to pay for an upgraded version to add more categories).

When you enter your travel expenses, you'll tie it to both a trip and a date. This allows you to view your expenses at a Month View or Trip View. You can also spread expenses across multiple dates so you can see your daily expenses for a certain trip. This is handy if you are on a daily budget to ensure you're not exceeding the amount you can spend on a particular day.

One nice feature of this app is that you can add as many currencies as you'd like within a certain trip. This comes in handy if you are paying in multiple currencies — for example, flight and hotel costs in USD, but food expenses in euros.

This app caters more toward individual or family travel as you cannot invite friends to add expenses. You can, however, take pictures of receipts and tie them to a specific expense, and then export the images — perfect for keeping all receipts or for business travelers for expense purposes.

Cost: Free for the first 25 expense items added to a single trip; Upgraded version is $4.99 which allows you to enter an unlimited number of expenses per trip.

Download: iTunes App Store

Concur is one of the top expense programs for business travel. This app is definitely more involved then some of the others on the list, but it has all the bells and whistles for keeping your expenses fully organized. If you work for a large corporation, you might already find that this is the required app to use for your business expenses.

Expenses from corporate credit cards will automatically be uploaded and you can also manually add out-of-pocket expenses. For manually entered expenses, employees can take a picture of their receipt which will be included in their expense report. For the business traveler with many paper receipts during the week, this app helps ensure that all expenses are reimbursed properly.

If you run a small-business, this is a great platform for you and your employees to use as it allows you to manage expenses and prepare expense reports. When I worked for a large consulting company, I used this program on a weekly basis. Being able to keep track of my work expenses to ensure I was reimbursed with every amount paid out of pocket was huge. For solo and group travelers, this is not the app I suggest using as there is no need to pay the monthly fee as there are many other free apps available.

Cost: Fee depends on number of users and account type.

Related: 5 tips to turn business travel into family vacations

Tripcoin is a very simple app to use that will track all of your expenses against a particular trip. You can tie each expense to a specific category, enter a city location and a defined date and time. You can also include notes and a screen shot to keep better track of every purchase you make.

This app has an atheistically pleasing filter capability, where you can look at expenses between a given date, within a certain category, a type of payment method or within a particular country. There is also a real-time currency converter or you can set custom currency exchange rates if needed.

Best of all, you can automatically back up all of your data by enabling the Dropbox integration. With many of the other apps listed here, if you lose your phone or if your data gets wiped out, you will lose all of the expenses entered. If this does happen, with this specific app, all of your expenses are saved and can be re-imported.

Unfortunately, this app is only available for iPhone users.

SplitWise is one of my personal favorites and an app I've been using for years. If you are traveling in a group , this is the app for you. The best, and unique feature, is that you can have friends or family members join a group and everyone can enter all expenses incurred for the joint trip. The app will then itemize expenses and tell each individual how much they owe to make things equal. You can even designate which expenses should be split among certain individuals. Like most of the other apps, you can also take include a picture and notes for every expense entered.

I have used the app for friend and sibling trips, including bachelorette parties, group ski trips and even just day trips. Aside from travel expenses, you can even use it to split up expenses among roommates or just everyday purchases with friends.

Cost: Free; Upgraded version is $2.99/month ($29.99/year) which includes receipt scanning, currency conversion and more.

Tricount is a simple app, but a great choice for group travel . It works very similar to SplitWise where you can split expenses among multiple travelers in your group. Everyone can add their own expenses and designate the specific amount (or percentage) for each individual within the group. At the end of the trip, you'll then receive a breakdown of what everyone owes each other.

The app supports multiple currencies and allows you to take pictures of images or receipts to go along with every expense entered.

Cost: Free; Upgraded version is $0.99 and allows you to have an ad-free experience.

Related: 30 essential travel apps every traveler needs to know

If keeping track of receipts is high on your priority list, then the Foreceipt app will be perfect for your needs. You can attach a receipt with all expenses entered and all images will automatically be saved to your Google Drive account. Additionally, all email receipts can be tracked as well by forwarding them directly to Foreceipt email address and including your unique ID.

Other features include the capability to batch upload bank transactions and downloading excel reports for tax return purposes — perfect for those who need to write off travel expenses.

Within the app, Foreceipt allows you to enter your income, bills and travel expenses to track against your overall budget. You can also tie all travel expenses to one of many pre-populated categories.

With these more involved capabilities, business travelers and those who own small businesses will probably find this app more useful than solo or group travelers.

Cost: Free; Upgraded version is $3.99/month ($38.99/year) and includes more receipts scans per month, email receipts and expense reports.

Expensify caters toward both individual and group travelers traveling primarily for business. This app allows you to complete all the simple tasks such as documenting your expenses and taking a picture of your receipt, but goes one step further where you can submit your expenses to your manager or accountant (or really whomever you'd like).

For those who need to keep track of mileage driven, this app allows you to not only manually enter your information but also has a GPS calculator which you can turn on to track your distance. You can also enter your time worked, which helps those needing to track billable hours.

The app also features more than just a place to submit your expenses, as you can keep track of business operations and even set expense policies.

On the feel good front, Expensify will also donate $2 for every $1,000 in expenses to Expensify.org. These donations are given to a broad range of campaigns to help organizations around the world.

Cost: Free up to five scans a month; Upgraded version is $4.99/month per user giving you unlimited scans and additional automatic capabilities.

Bottom Line

With many apps to keep track of your expenses, it helps to find one that fits your needs. Whether you are traveling for business or pleasure, with a group or on your own, there are many apps out there that work well depending on your needs.

Everything You Need to Know About the Business Travel Tax Deduction

.jpeg)

Justin is an IRS Enrolled Agent, allowing him to represent taxpayers before the IRS. He loves helping freelancers and small business owners save on taxes. He is also an attorney and works part-time with the Keeper Tax team.

You don’t have to fly first class and stay at a fancy hotel to claim travel expense tax deductions. Conferences, worksite visits, and even a change of scenery can (sometimes) qualify as business travel.

What counts as business travel?

The IRS does have a few simple guidelines for determining what counts as business travel. Your trip has to be:

- Mostly business

- An “ordinary and necessary” expense

- Someplace far away from your “tax home”

What counts as "mostly business"?

The IRS will measure your time away in days. If you spend more days doing business activities than not, your trip is considered "mostly business". Your travel days are counted as work days.

Special rules for traveling abroad

If you are traveling abroad for business purposes, you trip counts as " entirely for business " as long as you spend less than 25% of your time on personal activities (like vacationing). Your travel days count as work days.

So say you you head off to Zurich for nine days. You've got a seven-day run of conference talks, client meetings, and the travel it takes to get you there. You then tack on two days skiing on the nearby slopes.

Good news: Your trip still counts as "entirely for business." That's because two out of nine days is less than 25%.

What is an “ordinary and necessary” expense?

“Ordinary and necessary” means that the trip:

- Makes sense given your industry, and

- Was taken for the purpose of carrying out business activities

If you have a choice between two conferences — one in your hometown, and one in London — the British one wouldn’t be an ordinary and necessary expense.

What is your tax home?

A taxpayer can deduct travel expenses anytime you are traveling away from home but depending on where you work the IRS definition of “home” can get complicated.

Your tax home is often — but not always — where you live with your family (what the IRS calls your "family home"). When it comes to defining it, there are two factors to consider:

- What's your main place of business, and

- How large is your tax home

What's your main place of business?

If your main place of business is somewhere other than your family home, your tax home will be the former — where you work, not where your family lives.

For example, say you:

- Live with your family in Chicago, but

- Work in Milwaukee during the week (where you stay in hotels and eat in restaurants)

Then your tax home is Milwaukee. That's your main place of business, even if you travel back to your family home every weekend.

How large is your tax home?

In most cases, your tax home is the entire city or general area where your main place of business is located.

The “entire city” is easy to define but “general area” gets a bit tricker. For example, if you live in a rural area, then your general area may span several counties during a regular work week.

Rules for business travel

Want to check if your trip is tax-deductible? Make sure it follows these rules set by the IRS.

1. Your trip should take you away from your home base

A good rule of thumb is 100 miles. That’s about a two hour drive, or any kind of plane ride. To be able to claim all the possible travel deductions, your trip should require you to sleep somewhere that isn’t your home.

2. You should be working regular hours

In general, that means eight hours a day of work-related activity.

It’s fine to take personal time in the evenings, and you can still take weekends off. But you can’t take a half-hour call from Disneyland and call it a business trip.

Here's an example. Let’s say you’re a real estate agent living in Chicago. You travel to an industry conference in Las Vegas. You go to the conference during the day, go out in the evenings, and then stay the weekend. That’s a business trip!

3. The trip should last less than a year

Once you’ve been somewhere for over a year, you’re essentially living there. However, traveling for six months at a time is fine!

For example, say you’re a freelancer on Upwork, living in Seattle. You go down to stay with your sister in San Diego for the winter to expand your client network, and you work regular hours while you’re there. That counts as business travel.

What about digital nomads?

With the rise of remote-first workplaces, many freelancers choose to take their work with them as they travel the globe. There are a couple of requirements these expats have to meet if they want to write off travel costs.

Requirement #1: A tax home

Digital nomads have to be able to claim a particular foreign city as a tax home if they want to write off any travel expenses. You don't have to be there all the time — but it should be your professional home base when you're abroad.

For example, say you've rent a room or a studio apartment in Prague for the year. You regularly call clients and finish projects from there. You still travel a lot, for both work and play. But Prague is your tax home, so you can write off travel expenses.

Requirement #2: Some work-related reason for traveling

As long as you've got a tax home and some work-related reason for traveling, these excursion count as business trips. Plausible reasons include meeting with local clients, or attending a local conference and then extending your stay.

However, if you’re a freelance software developer working from Thailand because you like the weather, that unfortunately doesn't count as business travel.

The travel expenses you can write off

As a rule of thumb, all travel-related expenses on a business trip are tax-deductible. You can also claim meals while traveling, but be careful with entertainment expenses (like going out for drinks!).

Here are some common travel-related write-offs you can take.

🛫 All transportation

Any transportation costs are a travel tax deduction. This includes traveling by airplane, train, bus, or car. Baggage fees are deductible, and so are Uber rides to and from the airport.

Just remember: if a client is comping your airfare, or if you booked your ticket with frequent flier miles, then it isn't deductible since your cost was $0.

If you rent a car to go on a business trip, that rental is tax-deductible. If you drive your own vehicle, you can either take actual costs or use the standard mileage deduction. There's more info on that in our guide to deducting car expenses .

Hotels, motels, Airbnb stays, sublets on Craigslist, even reimbursing a friend for crashing on their couch: all of these are tax-deductible lodging expenses.

🥡 Meals while traveling

If your trip has you staying overnight — or even crashing somewhere for a few hours before you can head back — you can write off food expenses. Grabbing a burger alone or a coffee at your airport terminal counts! Even groceries and takeout are tax-deductible.

One important thing to keep in mind: You can usually deduct 50% of your meal costs. For 2021 and 2022, meals you get at restaurants are 100% tax-deductible. Go to the grocery store, though, and you’re limited to the usual 50%.

{upsell_block}

🌐 Wi-Fi and communications

Wi-Fi — on a plane or at your hotel — is completely deductible when you’re traveling for work. This also goes for other communication expenses, like hotspots and international calls.

If you need to ship things as part of your trip — think conference booth materials or extra clothes — those expenses are also tax-deductible.

👔 Dry cleaning

Need to look your best on the trip? You can write off related expenses, like laundry charges.

{write_off_block}

Travel expenses you can't deduct

Some travel costs may seem like no-brainers, but they're not actually tax-deductible. Here are a couple of common ones to watch our for.

The cost of bringing your child or spouse

If you bring your child or spouse on a business trip, your travel expense deductions get a little trickier. In general, the cost of bring other people on a business trip is considered personal expense — which means it's not deductible.

You can only deduct travel expenses if your child or spouse:

- Is an employee,

- Has a bona fide business purpose for traveling with you, and

- Would otherwise be allowed to deduct the travel expense on their own

Some hotel bill charges

Staying in a hotel may be required for travel purposes. That's why the room charge and taxes are deductible.

Some additional charges, though, won't qualify. Here are some examples of fees that aren't tax-deductible:

- Gym or fitness center fees

- Movie rental fees

- Game rental fees

{email_capture}

Where to claim travel expenses when filing your taxes

If you are self-employed, you will claim all your income tax deduction on the Schedule C. This is part of the Form 1040 that self-employed people complete ever year.

What happens if your business deductions are disallowed?

If the IRS challenges your business deduction and they are disallowed, there are potential penalties. This can happen if:

- The deduction was not legitimate and shouldn't have been claimed in the first place, or

- The deduction was legitimate, but you don't have the documentation to support it

When does the penalty come into play?

The 20% penalty is not automatic. It only applies if it allowed you to pay substantially less taxes than you normally would. In most cases, the IRS considers “substantially less” to mean you paid at least 10% less.

In practice, you would only reach this 10% threshold if the IRS disqualified a significant number of your travel deductions.

How much is the penalty?

The penalty is normally 20% of the difference between what you should have paid and what you actually paid. You also have to make up the original difference.

In total, this means you will be paying 120% of your original tax obligation: your original obligation, plus 20% penalty.

.jpeg)

Justin W. Jones, EA, JD

Over 1M freelancers trust Keeper with their taxes

Keeper is the top-rated all-in-one business expense tracker, tax filing service, and personal accountant.

Sign up for Tax University

Get the tax info they should have taught us in school

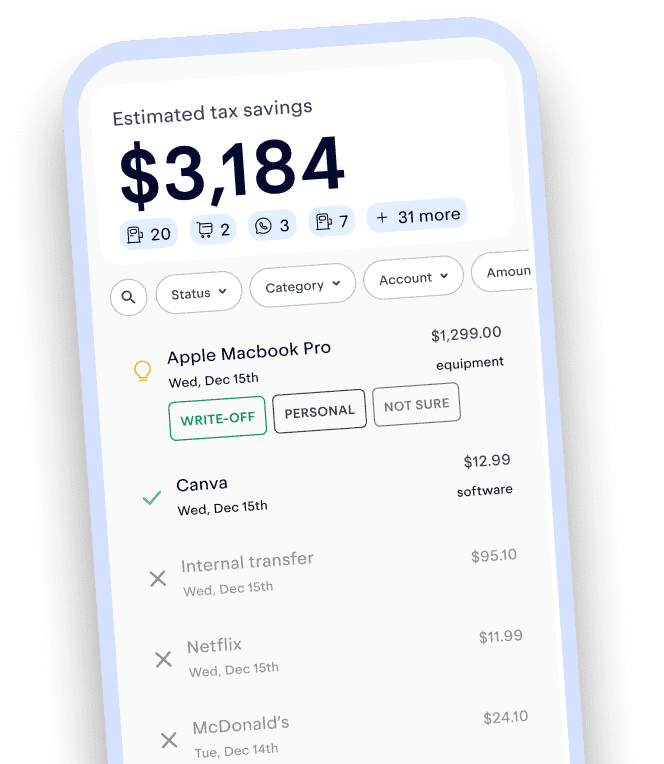

Expense tracking has never been easier

What tax write-offs can I claim?

At Keeper, we’re on a mission to help people overcome the complexity of taxes. We’ve provided this information for educational purposes, and it does not constitute tax, legal, or accounting advice. If you would like a tax expert to clarify it for you, feel free to sign up for Keeper. You may also email [email protected] with your questions.

Voted best tax app for freelancers

More Articles to Read

Free Tax Tools

1099 Tax Calculator

- Quarterly Tax Calculator

How Much Should I Set Aside for 1099 Taxes?

Keeper users have found write-offs worth

- Affiliate program

- Partnership program

- Tax bill calculator

- Tax rate calculator

- Tax deduction finder

- Quarterly tax calculator

- Ask an accountant

- Terms of Service

- Privacy Policy

- Affiliate Program

- Partnership Program

- Tax Bill Calculator

- Tax Rate Calculator

- Tax Deduction Finder

- Ask an Accountant

- Credits and deductions

- Business expenses

Can I deduct travel expenses?

If you’re self-employed or own a business , you can deduct work-related travel expenses, including vehicles, airfare, lodging, and meals. The expenses must be ordinary and necessary.

For vehicle expenses, you can choose between the standard mileage rate or the actual cost method where you track what you paid for gas and maintenance.

You can generally only claim 50% of the cost of your meals while on business-related travel away from your tax home, provided your trip requires an overnight stay. You can also deduct 50% of the cost of meals for entertaining clients (regardless of location), but due to the Tax Cuts and Jobs Act of 2017 (TCJA), you can no longer deduct entertainment expenses in tax years 2018 through 2025. In 2021 and 2022, the law allows a deduction for 100% of your cost of food and beverages that are provided by a restaurant, instead of the usual 50% deduction.

On the other hand, employees can no longer deduct out-of-pocket travel costs in tax years 2018 through 2025 per the TCJA (this does not apply to Armed Forces reservists, qualified performing artists, fee-basis state or local government officials, and employees with impairment-related work expenses). Prior to the tax rule change, employees could claim 50% of the cost of unreimbursed meals while on business-related travel away from their tax home if the trip required an overnight stay, as well as other unreimbursed job-related travel costs. These expenses were handled as a 2% miscellaneous itemized deduction.

Related Information:

- Can I deduct medical mileage and travel?

- Can I deduct my moving expenses?

- Can I deduct rent?

- Can I deduct mileage?

- Can employees deduct commuting expenses like gas, mileage, fares, and tolls?

Was this helpful?

Found what you need?

Already have an account? Sign In

- Search Search Please fill out this field.

What Are Travel Expenses?

Understanding travel expenses, the bottom line.

- Deductions & Credits

- Tax Deductions

Travel Expenses Definition and Tax Deductible Categories

Michelle P. Scott is a New York attorney with extensive experience in tax, corporate, financial, and nonprofit law, and public policy. As General Counsel, private practitioner, and Congressional counsel, she has advised financial institutions, businesses, charities, individuals, and public officials, and written and lectured extensively.

:max_bytes(150000):strip_icc():format(webp)/MichellePScott-9-30-2020.resized-ef960b87116444b7b3cdf25267a4b230.jpg)

For tax purposes, travel expenses are costs associated with traveling to conduct business-related activities. Reasonable travel expenses can generally be deducted from taxable income by a company when its employees incur costs while traveling away from home specifically for business. That business can include conferences or meetings.

Key Takeaways

- Travel expenses are tax-deductible only if they were incurred to conduct business-related activities.

- Only ordinary and necessary travel expenses are deductible; expenses that are deemed unreasonable, lavish, or extravagant are not deductible.

- The IRS considers employees to be traveling if their business obligations require them to be away from their "tax home” substantially longer than an ordinary day's work.

- Examples of deductible travel expenses include airfare, lodging, transportation services, meals and tips, and the use of communications devices.

Travel expenses incurred while on an indefinite work assignment that lasts more than one year are not deductible for tax purposes.

The Internal Revenue Service (IRS) considers employees to be traveling if their business obligations require them to be away from their "tax home" (the area where their main place of business is located) for substantially longer than an ordinary workday, and they need to get sleep or rest to meet the demands of their work while away.

Well-organized records—such as receipts, canceled checks, and other documents that support a deduction—can help you get reimbursed by your employer and can help your employer prepare tax returns. Examples of travel expenses can include:

- Airfare and lodging for the express purpose of conducting business away from home

- Transportation services such as taxis, buses, or trains to the airport or to and around the travel destination

- The cost of meals and tips, dry cleaning service for clothes, and the cost of business calls during business travel

- The cost of computer rental and other communications devices while on the business trip

Travel expenses do not include regular commuting costs.

Individual wage earners can no longer deduct unreimbursed business expenses. That deduction was one of many eliminated by the Tax Cuts and Jobs Act of 2017.

While many travel expenses can be deducted by businesses, those that are deemed unreasonable, lavish, or extravagant, or expenditures for personal purposes, may be excluded.

Types of Travel Expenses

Types of travel expenses can include:

- Personal vehicle expenses

- Taxi or rideshare expenses

- Airfare, train fare, or ferry fees

- Laundry and dry cleaning

- Business meals

- Business calls

- Shipment costs for work-related materials

- Some equipment rentals, such as computers or trailers

The use of a personal vehicle in conjunction with a business trip, including actual mileage, tolls, and parking fees, can be included as a travel expense. The cost of using rental vehicles can also be counted as a travel expense, though only for the business-use portion of the trip. For instance, if in the course of a business trip, you visited a family member or acquaintance, the cost of driving from the hotel to visit them would not qualify for travel expense deductions .

The IRS allows other types of ordinary and necessary expenses to be treated as related to business travel for deduction purposes. Such expenses can include transport to and from a business meal, the hiring of a public stenographer, payment for computer rental fees related to the trip, and the shipment of luggage and display materials used for business presentations.

Travel expenses can also include operating and maintaining a house trailer as part of the business trip.

Can I Deduct My Business Travel Expenses?

Business travel expenses can no longer be deducted by individuals.

If you are self-employed or operate your own business, you can deduct those "ordinary and necessary" business expenses from your return.

If you work for a company and are reimbursed for the costs of your business travel , your employer will deduct those costs at tax time.

Do I Need Receipts for Travel Expenses?

Yes. Whether you're an employee claiming reimbursement from an employer or a business owner claiming a tax deduction, you need to prepare to prove your expenditures. Keep a running log of your expenses and file away the receipts as backup.

What Are Reasonable Travel Expenses?

Reasonable travel expenses, from the viewpoint of an employer or the IRS, would include transportation to and from the business destination, accommodation costs, and meal costs. Certainly, business supplies and equipment necessary to do the job away from home are reasonable. Taxis or Ubers taken during the business trip are reasonable.

Unreasonable is a judgment call. The boss or the IRS might well frown upon a bill for a hotel suite instead of a room, or a sports car rental instead of a sedan.

Individual taxpayers need no longer fret over recordkeeping for unreimbursed travel expenses. They're no longer tax deductible by individuals, at least until 2025 when the provisions in the latest tax reform package are due to expire or be extended.

If you are self-employed or own your own business, you should keep records of your business travel expenses so that you can deduct them properly.

Internal Revenue Service. " Topic No. 511, Business Travel Expenses ."

Internal Revenue Service. " Publication 463, Travel, Gift, and Car Expenses ," Page 13.

Internal Revenue Service. " Publication 5307, Tax Reform Basics for Individuals and Families ," Page 7.

Internal Revenue Service. " Publication 463, Travel, Gift, and Car Expenses ," Pages 6-7, 13-14.

Internal Revenue Service. " Publication 463, Travel, Gift, and Car Expenses ," Page 4.

Internal Revenue Service. " Publication 5307, Tax Reform Basics for Individuals and Families ," Pages 5, 7.

:max_bytes(150000):strip_icc():format(webp)/TaxHome-3b9f1ac36f6c4e28889c34943d991fc9.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

Travel Expenses Deductible: A Clear Guide for Smart Savers

- Banking & Finance

- Bookkeeping

- Business Operations

- Starting a Business

Navigating the world of tax deductions can be tricky, especially when it comes to understanding which travel expenses are deductible. Business owners and employees alike can benefit from being knowledgeable about the rules around deducting travel expenses for tax purposes. This article aims to guide you through the ins and outs of travel expense deductions, focusing on the various aspects that might impact your ability to claim these deductions.

To begin, it is important to differentiate between personal and business travel expenses. While personal travel expenses are generally not deductible, business travel expenses may be claimed as tax deductions when certain conditions are met. These may include expenses related to transportation, lodging, meals, and entertainment, among other specific costs incurred during a business trip.

Key Takeaways

- A clear understanding of deductible travel expenses can benefit both business owners and employees

- Eligible deductions may include transportation, lodging, meals, and entertainment expenses incurred during a business trip

- Proper documentation and recordkeeping are crucial when claiming travel expense deductions.

Understanding Travel Expenses Deductions

Definition of travel expenses.

Travel expenses refer to the costs associated with conducting business-related activities away from an individual’s tax home. These expenses are deductible if they are considered reasonable and necessary for the purpose of conducting business. Deductible travel expenses include:

- Travel by airplane, train, bus, or car between your home and your business destination.

- Fares for taxis or other types of transportation between an airport or train station and a hotel, or from a hotel to a work location.

Ordinary and Necessary Expenses Explained

In order for travel expenses to be tax-deductible, they must be both ordinary and necessary . Here is a brief description of these two requirements:

- Ordinary expenses are those that are commonly accepted in your trade or business. This means that the expense is typical and standard within your industry.

- Necessary expenses are those that are helpful and appropriate for your business. It does not mean that the expense is required, but rather that it has a legitimate purpose in the course of conducting your business.

To ensure that deductions are made correctly, it is vital to keep accurate records of your travel expenses, such as receipts and mileage logs, as well as a clear description of how the expenses relate to your business activities. To calculate deductible travel expenses, you can subtract the non-deductible portion (such as personal expenses) from your total expenses. For example, you would calculate the deductible part of a round-trip airfare by subtracting the non-business portion (7/18 of the total expenses) from the total cost of the trip.

In summary, understanding travel expenses deductions is essential for business owners, as it can help to minimize tax obligations while ensuring compliance with tax laws. Be sure to keep clear and accurate records of your travel expenses and always consider whether any given expense is both ordinary and necessary for conducting your business.

Lodging and Accommodations

Hotel deductions.

When traveling for business, lodging costs such as hotel stays are generally tax-deductible. However, these deductions require that the trip be considered primarily for business purposes. To qualify, the taxpayer must be traveling away from their tax home and the overnight stay must be necessary for the business purpose to be achieved.

Some deductible expenses related to hotels include:

- Room charges

- Taxes on the hotel stay

- Tips for hotel staff

- Room service if it is part of the daily meal expenses

Remember that while lodging expenses are deductible, luxury or extravagant accommodations may draw scrutiny from the IRS. It is important to keep detailed records and receipts for all business-related lodging expenses.

Temporary Stays and Tax Home

A taxpayer’s tax home is the general area or vicinity of their primary place of work, regardless of their actual home location. When on a temporary work assignment away from the tax home, certain travel expenses become deductible. A temporary work assignment is defined as one that lasts no longer than one year.

Below is a table summarizing the key factors to consider for tax deductions related to temporary stays:

In conclusion, when dealing with lodging and accommodations for business travel, it is essential to understand the requirements and guidelines for tax deductions. Ensuring that your hotel stays and temporary work assignments meet these criteria can result in significant tax savings.

Meals and Entertainment

Deducting meal costs.

When it comes to deducting meal costs, taxpayers can generally deduct 50% of the unreimbursed cost of their meals while traveling or conducting business. However, the deduction rate may vary depending on the circumstances. For instance, you may be able to deduct 100% of your meal expenses if the meal is from a restaurant and was purchased between December 31, 2020, and January 1, 2023.

Here are some examples of what to keep in mind when deducting meal costs:

- Meals that are directly related to the active conduct of your trade or business

- Meals that are associated with the active conduct of your trade or business and are preceded or followed by a substantial business discussion

- Meals provided to employees on your business premises for your convenience

Remember to keep accurate records of your meal expenses, including receipts, the date, time, place, amount, and business purpose of the expense.

Entertainment Expenses

In contrast to meal expenses, entertainment expenses are no longer deductible under the current tax code. This rule change was implemented through the Tax Cuts and Jobs Act of 2017, and it applies to expenses incurred for activities such as:

- Attending a sporting event, concert, or theater

- Yacht rentals or golf outings

- Nightclubs, social clubs, or other recreational activities

To help you understand the costs associated with business travel, here’s a summary table:

By being aware of these rules and keeping accurate records of your expenses, you can ensure you’re making the most of the deductions available for your travel, meals, and entertainment costs.

Transportation and Mileage

Deducting transportation costs.

When it comes to tax deductions for business-related travel, transportation costs play a significant role. These expenses include travel by airplane, train, bus, or car between your home and the business destination, as well as fares for taxis or other types of transportation between an airport or train station and a hotel or work location 1 .

It’s important to note that these deductible expenses only apply to temporary work assignments away from home 2 . Travel expenses for indefinite work assignments, defined as those lasting over one year, are not deductible.

When deducting transportation costs, factors such as car rentals and taxi fares must be considered. Keep track of these expenses diligently to ensure accurate reporting and maximize your deductions.

Mileage and Standard Rates

For those who use their personal vehicle for business purposes, the standard mileage rate is another aspect of transportation expenses to pay attention to. The standard mileage rate for 2023 is 65.5 cents per mile, which increases to 67 cents per mile for 2024 3 .

To decide whether to use the standard mileage or actual expenses method, carefully evaluate your specific situation. Factors to take into account include the cost of operating your vehicle for business use and whether your driving primarily benefits the company, such as in the case of Uber drivers 3 .

Using the standard mileage rate simplifies the process for calculating deductions, but keep in mind that certain types of employees and individuals traveling for volunteer work or medical appointments may have different eligibility and requirements for claiming mileage 4 .

Travel Documenting and Recordkeeping

Receipts and documentation.

When it comes to business travel expenses, thorough documenting and recordkeeping are crucial. Receipts play a key role in this process, as they provide concrete evidence of your expenses. It is essential to keep a record of all receipts for travel-related expenditures, such as transportation (airplane, train, bus, or car), accommodations, meals, and any other necessary business expenses.

Organizing your receipts and documentation is equally important. Some helpful tips for maintaining proper records include:

- Categorizing receipts by expense type

- Keeping a log of all your business trips, including dates, locations, and purposes

- Ensuring all digital receipts and records are stored in a secure and easily accessible location, such as cloud storage systems or encrypted folders

IRS Reporting Requirements

The Internal Revenue Service (IRS) has specific requirements for reporting travel expenses on your tax returns. Business travel expenses are generally deductible, but they must be reported appropriately to qualify for deductions.

- Form 1040 or Form 1040-SR : If you are a sole proprietor, partner, or an owner of a single-member LLC, you’ll need to report your deductible travel expenses on Schedule C of either Form 1040 or Form 1040-SR.

- Form 2106 : Employees who incur unreimbursed business travel expenses may use Form 2106 to report these costs. However, this is applicable only to specific categories of employees, such as Armed Forces reservists, qualified performing artists, fee-basis government officials, and employees with impairment-related work expenses.

Remember to maintain accurate records and receipts to support your claimed deductions, as the IRS might request this information during audits or reviews.

By following these documentation and recordkeeping practices, along with adhering to IRS reporting requirements, you can ensure your business travel expenses are accurately recorded and eligible for deductions.

Deductible Incidental Expenses

When it comes to deducting travel expenses for business purposes, it’s essential to understand which incidental expenses are tax deductible. In this section, we’ll discuss laundry and cleaning costs, as well as tips and gratuities related to business travel.

Laundry and Cleaning

During a business trip, laundry and dry cleaning expenses are considered deductible incidental expenses. This includes the costs related to washing, ironing, or dry cleaning of clothing . Keep in mind that only expenses incurred while away from home and specifically for your business trip are deductible. Proper documentation, such as receipts and dates, should be maintained to support the claim for these deductions.

Tips and Gratuities

While traveling for business, it’s common to encounter expenses like tips and gratuities. These expenses are also considered deductible incidental expenses. Some examples include:

- Tolls and Parking Fees : Business-related tolls and parking fees are deductible. This applies to both personal and rental vehicles used for business purposes. Keep track of your receipts to substantiate your claim.

- Tips for Service Providers : Tips given to service providers like hotel staff, drivers, and restaurant waitstaff can be included as deductible incidental expenses. It’s important to remember that only reasonable, non-lavish tips are allowed for deductions.

In conclusion, laundry, dry cleaning, tips, and gratuities, along with tolls and parking fees, can be considered deductible incidental expenses while traveling for business purposes. It’s crucial to maintain accurate records and receipts to support your deductions and ensure compliance with tax regulations.

Special Circumstances for Deductions

Self-employed and businesses.

For self-employed individuals and businesses , there are special circumstances surrounding the deductions for travel expenses. To qualify for business travel deductions , the trip must be primarily for business-related purposes, and the expenses must be ordinary and necessary . This means that the costs should be reasonable, directly related to conducting business, and helpful for your work.

Here are some examples of deductible travel expenses:

- Airfare, train, bus, and car transportation

- Lodging expenses

- Meals (subject to a 50% limit)

- Taxis and ride-sharing services

- Tips associated with eligible business expenses

- Public stenographer fees

- Telephone, fax, and internet expenses

For a quick reference on whether or not an expense can be deducted, refer to Table 1-1 in the Publication 463 provided by the Internal Revenue Service (IRS).

Conventions and Training

Another key aspect of travel deductions revolves around conventions, seminars, and training sessions . To make these expenses deductible, a self-employed individual or business must establish a direct connection between the event and their trade, profession, or job. Attending such events should enhance the professional’s skills or provide valuable insights related to their business.

- Conferences : Deductible expenses for conferences may include registration fees, transportation, accommodation, and meals (subject to a 50% limit). However, any expenses related to recreational or social activities during the conference would not be deductible.

- Seminars and Training : If the purpose of attending a seminar or training program is to maintain or improve skills required in your business, the related travel expenses may be deductible. This may include transportation, accommodation, and meal expenses. Remember that costs associated with non-business activities during the trip would not be deductible.

When claiming deductions for business travel expenses, it’s crucial to keep accurate and well-organized records, such as receipts and canceled checks, to support the deductions on your tax return.

Advanced Considerations

Tax cuts and jobs act effects.

After the implementation of the Tax Cuts and Jobs Act of 2017 , some important changes were made in the way business travel expenses are deductible. Firstly, the unreimbursed employee travel expenses are no longer deductible, as they were in previous years. However, this change does not affect self-employed individuals, who can still claim travel expenses as deductions.

Additionally, the deduction rate for mileage reimbursement has been adjusted. The Internal Revenue Service (IRS) announces the updated rates each year. It’s crucial for taxpayers to keep track of these changes to ensure they are claiming accurate deductions.

Here’s a quick summary of some deductible travel expenses:

- Travel by airplane, train, bus or car between your home and your business destination

- Fares for taxis or other transportation between an airport or train station and a hotel, or from a hotel to a work location

- Meals (subject to limitations)

Consulting Tax Professionals

Although the IRS provides guidelines on deductible travel expenses, the rules can be complex, and some aspects may be open to interpretation. It is therefore highly recommended to consult a tax professional or a tax expert in order to maximize the deductions you can claim legally while minimizing the risk of mistakes.

Tax professionals will help you fully understand the implications of the Tax Cuts and Jobs Act on your travel expenses deductions and ensure you are complying with IRS rules. They can also guide you through special circumstances, such as conventions held outside the North American area, where specific regulations apply.

Remember that relying on a tax professional will not only save you time but also reduce the possibility of conflicts with the IRS due to errors or misunderstandings. This investment in expert advice can potentially save you from financial setbacks and help you optimize your deductions in the long run.

Frequently Asked Questions

What constitutes a deductible business travel expense.

A deductible business travel expense is an ordinary and necessary expense incurred while traveling away from home for business purposes. This typically includes costs such as transportation, lodging, meals, and other related expenses. It’s essential to note that lavish or extravagant expenses or those for personal purposes cannot be deducted.

How do the IRS travel reimbursement guidelines affect deductible travel expenses?

The IRS travel reimbursement guidelines help clarify which travel expenses can be claimed as deductions, as well as providing information on allowable rates, such as the standard mileage rate or per diem rates for meals and lodging. Taxpayers need to adhere to these guidelines when claiming travel expense deductions to ensure they are claiming appropriately and avoiding potential issues with the IRS.

Are self-employed individuals able to deduct travel expenses, and if so, to what extent?

Yes, self-employed individuals can deduct travel expenses related to their business activities. These deductions may include transportation, lodging, and meals, as well as other necessary expenses like parking fees or tolls. However, self-employed individuals must ensure these expenses are indeed for business purposes and that proper records are maintained to substantiate the claims.

Which portion of meal expenses are deductible when traveling for business in 2023?

In 2023, taxpayers can generally deduct 50% of their meal expenses incurred while traveling for business. This percentage applies to both domestic and international travel. Keeping detailed records, such as receipts and a log of business trip meal expenses, will help ensure compliance with the IRS guidelines.

Can employees claim deductions for work-related hotel stays?

Employees who are reimbursed by their employer for work-related hotel stays cannot claim the deduction as it is considered a tax-free benefit from the employer. However, employees who are not reimbursed by their employer can claim deductions for work-related hotel stays as long as they are considered ordinary and necessary expenses for their job, and proper records are maintained to substantiate the claim.

What are the limits on the amount one can claim for travel expenses on taxes?

There are no specific limits on the overall amount one can claim for deductible travel expenses. However, the expenses must be reasonable, and taxpayers must substantiate any claims with proper records and documentation. Additionally, certain expenses, such as meals, have specific deduction limits (e.g., 50% of meal expenses) that must be adhered to when claiming deductions. It is advisable to consult a tax professional for guidance on individual circumstances and potential limitations.

- 1-800-711-3307

- Expense management

- Corporate card

- Tax returns & preparation

- Payment processing

- Tax compliance

- Vision & clarity

- Accounting mobile app

- Reduce your accounting expenses

- What does a bookkeeper do

- Why outsource

- Cash vs. Accrual Accounting

- Guides & ebooks

- How Finally works

- Privacy policy

- Terms of service

*Finally is not a CPA firm © 2024 Finally, Backoffice.co , Inc. All rights reserved.

Here’s How Much You Should Actually Be Spending on Your Travels

Experts in finance and travel weigh in on how to create a stress-free travel budget you can afford..

- Copy Link copied

There’s the dreaming phase of travel, and then there’s the planning and budgeting phases. All are equally important.

Photo by Annie Spratt/Unsplash

There’s a lot to consider when planning the perfect getaway. For most people, the number one consideration in trip planning is cost. But if we stress about expenses during vacation, that defeats the whole purpose of travel as an escape from our daily rituals, a chance to reset, rest, and relax. Fortunately, with a little bit of planning and some good tips and tricks for creating a solid budget, you can take the spending anxiety out of the equation and be well on your way to a stress-free (and affordable) vacation.

How much of your budget should you devote to travel?

When saving for a trip, or multiple trips, the financial formula may slightly differ person to person. There’s no standard percentage of income that should be set aside for travel. The amount depends on what you want to prioritize and what works for your income.

“There is not necessarily a set amount or percentage that you should use for travel. After all of your bills are paid for the month, you will have a leftover portion for discretionary spending,” said Christopher Miller, a financial adviser with Krueger Financial Group . “You will then have to make a decision on what to use this for—what is most important to you. It may be buying the newest electronics, going out to eat, traveling, or saving up for a big purchase such as a home improvement.”

Miller recommends using the 70/20/10 breakdown. This means 70 percent of your income should go toward household expenses, including debt. Twenty percent should be put into savings, including retirement. That leaves 10 percent of your income for wants, including travel, or for additional savings.

The first step to deciding how much to devote to travel is pinpointing the cost of your ideal trip. Price out hotels, airfare, activities, and food and get a rough estimate for what the entire trip will run. Once you know how much to save, you can figure out how long it will take you to do so.

“We recommend keeping track of all monthly income and expenses, monitoring what is coming in and going out. By doing this, you will have a good idea of how much travel you can afford,” said Miller. “For any large purchase [like travel], saving a little each month to reach your goal is very helpful. If the trip total will be $2,400, saving $200 a month will meet your goal in 12 months.”

Having a guilt-free vacation means knowing you won’t go into debt because of it. Saving before a trip is the best way to ensure that. There is nothing wrong with putting trip expenses on a credit card, provided you have the money to pay it off immediately or without accruing interest.

Do you prefer to splurge on a hotel or to opt for a more affordable boutique property like Coco Hotel in Copenhagen so that you can spend more elsewhere?

Courtesy of Coco Hotel

What are the travel expenses to consider?

After you have a rough idea of the trip’s total cost, you can break it down into itemized travel expenses. Here is where you can get a little creative and start to think about your dream itinerary.

The first and most important factors to consider are airfare and accommodations, as these typically are the two biggest ticket items of your overall travel budget. Will you splurge on accommodations, or do you consider them solely a place to sleep? Do you have credit card points to redeem for hotel upgrades or discounted airline tickets? If you’re new to points and miles, we will briefly touch on that soon.

Once the flight and accommodations are out of the way, you can see what you have left over for food and entertainment, based on what makes the most sense for you.

Everyone’s travel priorities are different. Foodies, for example, are going to want a bigger budget for dining out, while others may prefer to cook to save money for activities, shopping, or spa treatments (in which case, you may opt for a vacation rental or residential-style hotel that has guest rooms outfitted with kitchens).

“My typical travel expenses include accommodation, flights, activities, and food,” said Caroline Lupini, who has been a full-time traveler for the past decade and is the managing editor for Forbes Advisor’s credit cards and rewards travel verticals. In the past 10 years, she has visited more than 100 countries while living on the road full-time.

“I especially love food, so I budget extra money so I can go on food tours, visit nice restaurants, and otherwise explore the food culture of a country more deeply. This year, my partner and I are traveling through West Africa for a large part of the year, so we also had to include a pretty significant budget for visas. Depending on exactly where we end up visiting, we could end up spending around $1,000 each on visas. To date in 2024, I’ve spent $350 on visas alone.”

How to establish a daily budget while traveling

Lupini said, “I have my normal budget for accommodation, flights, food (restaurants and groceries), drinks, activities, and other miscellaneous charges that come up. I log all of my expenses into an app called TravelSpend , which makes it easy to keep track of spending in multiple currencies, and every month I log my totals into a spreadsheet.”

If she comes in under budget, she says she puts half of the leftover money into investments and half into what she has deemed her “special trip fund,” a fund for special activities she wants to do that are beyond what she considers affordable.

“It’s my guilt-free travel-spending money,” she said. “I think this is a strategy anyone can apply to their own finances to save money for travel.”

How to stretch a trip with points and miles

Using credit card points and airline miles is a great way to make your travel budget work harder and to get some cool perks along the way, like free breakfast, and room or airplane seat upgrades. But if you feel overwhelmed by the complexities and nuances of the individual points and miles program, know you are not alone—it’s a lot of information to digest. Even loosely understanding some ins and outs can stretch your trip budget. And because travel often includes higher price-point purchases such as airfares and hotels, it’s an opportunity to earn points and miles for future trips—in other words, using your current trip to help pay for your next adventure.

“I love points and miles. I got into learning about that space when I was in college and wanted to travel more but had very little cash to work with. Now I often use my points and miles to upgrade my travel experience—think business class on long-haul flights and the occasional cushy hotel room instead of booking an Airbnb or a more affordable hotel,” said Lupini.

You can use points and miles to upgrade to United’s Polaris business class seats.

Courtesy of United Airlines

There are many resources for getting into the points game. She recommends reading forums and blogs and following influencers on Instagram and TikTok to get their tips and tricks.

“My biggest recommendation,” she said, “is to look for someone, or multiple people, who has a similar travel style to what you’re going for and follow them to get started. I also recommend starting with one flexible points currency, like Chase Ultimate Rewards . You’ll have a lot more options with the flexible point currencies than with a specific type of airline mile, and there are easier redemption options available if you decide you don’t want to dig into the individual frequent flier programs too deeply.”

Set aside some funds for emergency or surprise expenses

No one intends for things to go wrong on a vacation, but sometimes the unexpected comes up: a canceled or delayed flight , a lost hotel reservation, a medical emergency, lost luggage , etc. Surprise expenses are a part of life, and they certainly can be a part of a vacation, as much as we hope they aren’t. Having a backup plan or an emergency fund can help lessen the financial blow that these surprises may cause.

“The unexpected always happens, but not going over budget will help account for the emergency expense,” said Miller. “Keeping an emergency savings account that is not factored into your travel expenses will help cover these as well. A person should always have an emergency account whether traveling or not.”

Travel insurance is one of the best ways to protect yourself in the event of emergencies or surprises. Often, travel insurance includes emergency medical insurance as well as an amount for canceled or delayed trips, lost luggage, and more.

The key things to remember when budgeting for travel is not to overspend, to make sure you’re protected, and to have enough money saved so that you can relax and have fun. A vacation is a time to treat yourself—within your means.

Miller added, “Not overextending yourself with the amount you spend on travel is important. Paying for a vacation for the next 12 months [after the trip] can hurt you in the long run.”

- Host Agencies

- Accelerator Course

- Travel Jobs

- Travel Agent Chatter

- Etiquette & Rules

- Privacy Policy

A List of Business Travel Expenses You Can Write Off In 2023 [+Travel Expense Calculator & Tax Organizer]

Figuring out which business travel expenses you can write off probably registers on the fun-o-meter at the same level as root canals or bathing feral cats.

Travel agents are plagued with tricky questions when it comes to travel expense write-offs. If you have a few business meetings during a family vacation, how much of the trip can be a travel expense write-off? If you specialize in Europe does that mean any and all trips to Europe are tax write-offs?

Don’t worry. Stick with us and we’ll clear up what you can and can’t write off as a travel expense. I learned a thing or two when I chatted with Jay Elstad, a CPA (Certified Public Accountant) with Riley Martin Ltd , and Stephanie Cannon, a former accountant turned Founder of SC Travel Design . Our Friday 15 Episode with Stephanie Cannon in late 2022 is pretty much a movie trailer for this article!

It turns out that figuring out travel expenses is a lot less intimidating when you talk to professionals. So I’m here to share their wisdom with you. Starting with HAR's beauteous tax organizer! Download it now and keep it handy while you go through the article!

Here's how HAR's Tax Organizer looks in action:

To make it your very own, just click on the upper right-hand arrow on the document to download it for yourself! (If you have any issues or you don't have a Gmail account, we won't leave you out! Just drop us a line at [email protected] and we'll send it via email).

This article and the HAR tax organizer will ensure you’re tracking and logging expenses thoroughly and efficiently. Will it make tracking travel expenses fun? Um, no. Sorry. I’m not that good. But I will give you the tools to help you feel more confident when it comes to travel expenses.

⭐️ HAR ARTICLE HIGHLIGHTS: ⭐️

- PDF: A list of travel expenses you can (and can't) write off

- Business Travel Expenses You Can Write Off

- Business Travel Expenses You Can't Write Off

- Hobbyists (or Travel Dabblers)

- Cruises & Travel Expenses

- The Elephant in the Room: Is a Vacation a Travel Expense?

- Travel Expense Scenarios for Travel Professionals

- Tips on Tracking & Documenting Your Business Travel Expenses

- Travel Expense Tracking Tools

A PDF Summary of Business Travel Expenses You Can (and Can't) Write Off

Our infographic details which business travel expenses you can (and can't) write off at a glance. If you're looking for crib notes, this PDF is it. But I highly recommend reading the rest of the article because business travel expense write-offs are all about nuance and the nitty-gritty.

A List Travel Expenses You Can Write Off

You can write off any travel expenses that are necessary, reasonable, and ordinary to your business operations. Below are examples of travel expenses you can (and cannot write off). Let's start with which write-offs are a green light.

1: Transportation

- By airplane, train, bus, or car between your home and your business destination.

- Fares for taxis or other types of transportation between the airport or train station and your hotel, or the hotel and the work location of your customers or clients, your business meeting place, or your temporary work location.

- Personal car usage or car rental: You can deduct actual expenses or the standard mileage rate (¢65.5 for 2023 travel), as well as business-related tolls and parking fees. If you rent a car, you can deduct only the business-use portion for the expenses.

2. Baggage or Shipping

Checking in your luggage? You can deduct that. Shipping display materials for the trade show? Go ahead and write that off too (so long as it’s between your regular and temporary work location).

You can deduct any of your business-related lodgings as an expense so long as it’s reasonable and necessary to your business (e.g. hotel/resort stay during a travel conference).

If you bring your sweetie/friend/kid you can only deduct lodging expenses that are reasonable for one person, for the nights/days that you worked.

4. Dry cleaning and laundry

If you have laundry or dry cleaning bills during your business travel, keep those receipts for your travel expenses. (I'm told that traveling to your basement to do laundry does not fall under this category.)

5. Communication Expenses (Beyond your work cell phone)

(beyond your cell phone): Your cell phone will already be deducted in a different category. But if you have any peripheral communications like leasing a satellite phone in Antarctica (sweet!) for emergency business calls, you can deduct that.

Tips include any gratuity to pay for the services noted on this list (porter fees, room service/cleaning, cab rides, etc.).

Note on cash: If you take out cash for tips (or other incidentals) from an ATM, the ATM receipt is not enough documentation. You should write down on your ATM receipt the date, location/service, and amount, for which you tipped if you want to take it as a deduction.

This one is super vague, but here it is in IRS speak, "Other similar ordinary and necessary expenses related to your business travel." (e.g. use of a hotel business center, hiring an interpreter, transportation to and from hotel to business event, etc.)

I saved meals for last because it's a little complicated. But here's what you need to know about meals. The IRS recommends using a standard meal allowance rather than engaging in the administrative gymnastic of saving every receipt form every meal. Here's the lowdown.

- You can (generally) deduct 50% of the unreimbursed meal cost. (Meals in 2022 can be deducted at 100% due to IRS' temporary rule, Notice 21-25 )

- Meals must be non-entertainment-related. In 2018, the tax law changed, rendering entertainment expenses 100% nondeductible . So if you go to a dinner theater show with a client and the meal portion is not itemized on your theater ticket, you cannot deduct it.

- There are two ways you can track/deduct meal expenses. You can either use a per diem or track your actual expenses. We’ll explore this soon , so stay tuned

A List of Travel Expenses You Can't Write Off

Now for the less fun part: Here are examples of travel expenses you CAN NOT deduct.

1. Entertainment

Entertainment is not an allowable expense. Going golfing at the resort with a potential client or a BDM (business development manager) while you’re at a business conference? Too bad . . . you’re going to have to do it on your own dime.

2. Family/friends/dependents traveling with you

If you’re traveling with a friend, family member, and/or dependent you cannot deduct any of their travel expenses.

If you feel like you fall under an exception to this rule—e.g. you compensate your family member/friend/dependent to fulfill necessary business activities during the trip and have the 1099 or W-2 to prove they work for you—talk to your CPA.

3. Lavish and extravagant

Lavish and extravagant expenses are not allowed by the IRS. However, they’re a little foggy on what defines lavish or extravagant saying only, “an expense isn’t considered lavish or extravagant if it’s reasonable based on facts or circumstances.”

If you think this may be a concern for you, talk to your CPA.

4. Travel that is compensated

This may seem obvious, but if your travel is comped, you cannot deduct it as an expense. For example, if you’re presenting at a conference and the event planner comps your entire hotel stay, you cannot deduct lodging.

The same also goes for using points on loyalty programs toward flight/lodging etc.

5. Personal vacations

You cannot deduct personal travel. When it comes to mixing business with leisure (I mean, do travel agents ever really stop working?), we get into a serious gray area. It’s such a doozie that it gets its own section. So read on.

Travel Expenses for Travel Advisor Hobbyists (or Travel Dabblers)

I’m not going to spend too much time talking about hobbyists. Just know that if you sell travel as a hobby, then none of your travel expenses are allowable in the eyes of the IRS.

How do you know if you’re a hobbyist? The IRS has a long list , including items like whether or not “you depend on the income for your livelihood” and other fun determining factors.

The IRS understands it can take a while to become profitable. Typically, you’re approaching hobbyist territory in the eyes of the IRS if you report a loss of three out of five years of business operations. (A loss means you’re claiming business expenses beyond your income.)

As with all things tax-related, there are exceptions as to what expenses are considered a loss, but that's above my pay grade. You’re a psychic now so you know what I’m about to say . . . talk to your accountant or CPA.

Cruises & Business Travel Expenses

Cruises are special snowflakes and are subject to their own rules when it comes to travel expenses. According to the IRS , “You can deduct up to $2,000 per year of your expenses of attending conventions, seminars, or similar meetings held on cruise ships. All ships that sail are considered cruise ships.”

This may not be the happiest news to cruise buffs who spend thousands per year on Seminars at Seas. But remember, I’m just the messenger (not the IRS).

If you want to write off your 2k in cruises, there are all sorts of stringent requirements you need to meet. Below, I am copying and pasting what the IRS has to say on the matter, verbatim (why reinvent the wheel):

You can deduct these [cruise] expenses only if all of the following requirements are met.

- The convention, seminar, or meeting is directly related to the active conduct of your trade or business.

- The cruise ship is a vessel registered in the United States.

- All of the cruise ship's ports of call are in the United States or in possession of the United States.

- You attach to your return a written statement signed by you that includes information about:

- The total days of the trip (not including the days of transportation to and from the cruise ship port),

- The number of hours each day that you devoted to scheduled business activities, and

- A program of the scheduled business activities of the meeting.

- You attach to your return a written statement signed by an officer of the organization or group sponsoring the meeting that includes:

- A schedule of the business activities of each day of the meeting, and

- The number of hours you attended the scheduled business activities.

Again, if you think your cruise trip/business model is an exception, or you have a bone to pick with these rules, don’t call me. [Enter refrain] Talk to your CPA.

The Elephant in the Room: Is Your Vacation a Travel Expense?

I know that CPAs and accountants everywhere are probably going to duck and cover at the merest whisper of deducting trips that have even a whiff of personal travel.

But as a travel agent, it’s confusing since you need to travel to run a successful and profitable business.

Sure, it’s easy enough to justify travel expenses for a conference or an escorted FAM (familiarization trip). But when it comes to deducting travel expenses for any trip that’s in any way attached to personal travel, you’re entering some serious gray area (I like to call this Grayland).

The IRS isn’t super helpful when it comes to navigating Grayland. Their verdict is this, “If your trip was conducted primarily for personal reasons, such as a vacation, the entire cost of the trip is a nondeductible personal expense. However, you can deduct any expenses you have while at your destination that are directly related to your business.”

Not exactly cut and dry. Sigh.

I can’t advise you on your taxes (trust me, everyone loses in this scenario). But here are a few guiding questions that help you determine if your trip is justifiable as a travel expense (and to what extent).

1. What is the primary purpose of your trip? You know in your heart of hearts whether your primary purpose is business or personal. If your primary purpose is to go to Mexico with your family, it’s going to be a tough sell to deduct your travel expenses. (Even if you do sell the resort or region you’re staying at.)

If the primary purpose of your trip is an Oaxaca FAM that’s sponsored by the Mexico tourism board, then that’s a different story. We’ll talk more about mixing business with pleasure later. But here’s the major takeaway: You can deduct only the expenses of your trip that are directly related to business. (Remember: reasonable, ordinary, necessary).

2. How much of your trip is spent on activities directly related to business activities? You can only write off the travel expenses directly related to business activity. So if you spend 10 days in Mexico with your family, but you spend 3 days ditching your family to go on-site inspections you scheduled weeks ago, you can reasonably write off a portion of your trip as a business expense.

Conversely, if you go on your family vacation and decide to pop into the nearest Sandals at the last minute for a self-administered “tour” in the name of business activity, that is a serious foul in the eyes of the IRS. (We’ll get into scenarios later).

3. Will your business derive income from the trip? You can have the most un-fun, jam-packed business trip in the world. But if you don’t make a good-faith effort to do any follow-up (ahem, earn moolah) with all your great meetings and research, then this could raise a red flag to the IRS.

4. Is the business activity necessary to your business/niche? If your niche is Italy, it’s going to be tough to write off a trip to Hawaii if you’ve never booked that destination (and don’t plan on doing it any time soon).

5. Is the trip necessary to the business operations you’re conducting? Working away from your tax home doesn’t automatically qualify as a travel expense. To deduct travel expenses, the business activity must necessitate the trip.

For example, if I go visit a friend in Paris and spend three full days working on this blog post about travel expenses, I may not deduct my trip as a business expense because I could easily conduct these business operations from home. Major bummer (because who isn't inspired to write about travel expenses when they see the Arc de Triomphe?)

The same goes for travel agents. If you’re on a family vacation but you’re still booking trips and supporting your clients from afar, your travel expenses are not deductible as travel expenses 1 because the trip wasn’t required for that particular business activity.

At the end of the day, you need to rely on your common sense (or, better yet, the common sense of your CPA or accountant). Remember the golden rule: travel expenses must be reasonable and necessary to your business.

How do you decide what’s reasonable? The following scenarios will help provide a little perspective.

Business Travel Expense Scenarios for Travel Agents

When it comes to deducting any business travel expenses that are (in any way) attached to personal travel, the CPA/accountants I chatted with agreed to proceed with caution.

If you’re mixing personal and business travel, be clear about what days you spend working and document your meetings and business activity during those days.

As an example, here are a few scenarios by way of example. Please remember that these scenarios are just crib notes. They’re intended to help give you a lay of the land, not to advise you in any way shape, or form:

Scenario 1 (The Conference)

You fly to the annual ASTA conference on Tues. and stay through Fri. The entire time is scheduled with conference activities except for breakfasts, which you purchase every morning at the resort cafe and charge to your room. On Thurs. night after the conference is over, you take an Uber to meet your long-distance college friend for dinner and drinks. You fly out early Friday morning.

Travel expenses are entirely deductible except for the Uber rides (to and from) and dinner and drinks with your friend.

Scenario 2 (The FAM)

You’re invited to an escorted FAM in Hawaii. The FAM is 3 days, but you decide to take your family with you and extend your trip, tacking on a 7-day family vacation after your FAM. You stay at the same resort with your family as you did during the FAM.

Since your business operations necessitated the trip to Hawaii, you can write off 100% of your flight and transportation to and from the airport (so long as it’s reasonable). Why? Because you’d have to fly to and from Hawaii and transfer to and from the airport to conduct your business anyway.

Additionally, you can also deduct other travel expenses incurred while you were working (such as meals and incidentals). If you rented a car, you can prorate your rental fees according to what percentage of the time you used it for work (e.g. 30% for 3 of ten days of total cost may be deductible).

Scenario 3 (working on vacation part I)

You’re on a family vacation to Disney World for 5 days. You take a last-minute lunch meeting to meet a new property manager at a resort you often book. The rest of the time, you enjoy with your family, posting about your time together on your travel agency's social media.

None of this trip is deductible except for your meal with the property manager. Sad face.

Scenario 4 (working on vacation part II)

A baseball fanatic, you decide to go to Japan for the Japan Series. While you’re there, you bring work with you and spend three hours per day booking trips and supporting your traveling clients. The rest of the time, you watch baseball and explore Japan.

None of your travel expenses are deductible because your trip to Japan wasn’t necessary for the business operations you were conducting while there.

These scenarios are merely examples. I know that real-life scenarios are much more complicated. If you’re mixing personal and business travel, be clear about what days you spend working and document your meetings and business activity during those days.

At the end of the day, it’s easiest to document your business activity and track expenses if you keep your personal and business travel separate. And let’s be honest, it’s best for your work-life balance too! Ultimately, you need to ensure you’re doing your due diligence to record and document your trips. Guess what?! We have a few tools to help you do just that.

Pro Tips on Tracking & Documenting Your Business Travel Expenses