SafetyWing's Nomad Insurance: Is It a Good Travel Insurance?

As I was enjoying a plate of khao soi in Koh Lanta with a group of digital nomads I had just met, one of them shared a story from the night before. A friend of theirs had gotten severe food poisoning, and with no hospital equipped for all emergency procedures on the island and no travel insurance to lean on, his only option was the small local clinic (fingers crossed for the best).

Listening to this, I couldn't help but eye my khao soi with a mix of suspicion and defiance. My next thought? Well, if it turns out to be a disaster, thank goodness I didn’t skip on travel insurance .

Yes, I’m the “better be safe than sorry” type of digital nomad, but it’s in these unpredictable situations that I like to remind the risk-takers that having a safety net is not just smart—it’s essential.

So today, we’ll be reviewing one of the most popular travel insurance options among digital nomads , SafetyWing . We picked this company because it offers insurance packages tailor-made to the needs of remote workers and digital nomads.

From what’s included to what isn’t, from their claims processes to comparing it to other travel insurance companies, let’s go ahead and dive into what SafetyWing's travel insurance offers (so you won’t have to keep your fingers crossed and hope for the best).

Who is SafetyWing?

Safetywing is not just another name in the vast sea of nomad travel insurance providers . They stand out because they were born from a real need: the desire to untangle the complexities of travel insurance for us digital nomads. And yes, they deliver.

At its core, SafetyWing gets the pulse of the nomadic lifestyle . They focus on the essentials that matter to us—the unexpected illness in a foreign land, the lost luggage in transit, the sudden need to return home—they've crafted their policies to ensure we're covered, no matter where our laptops are.

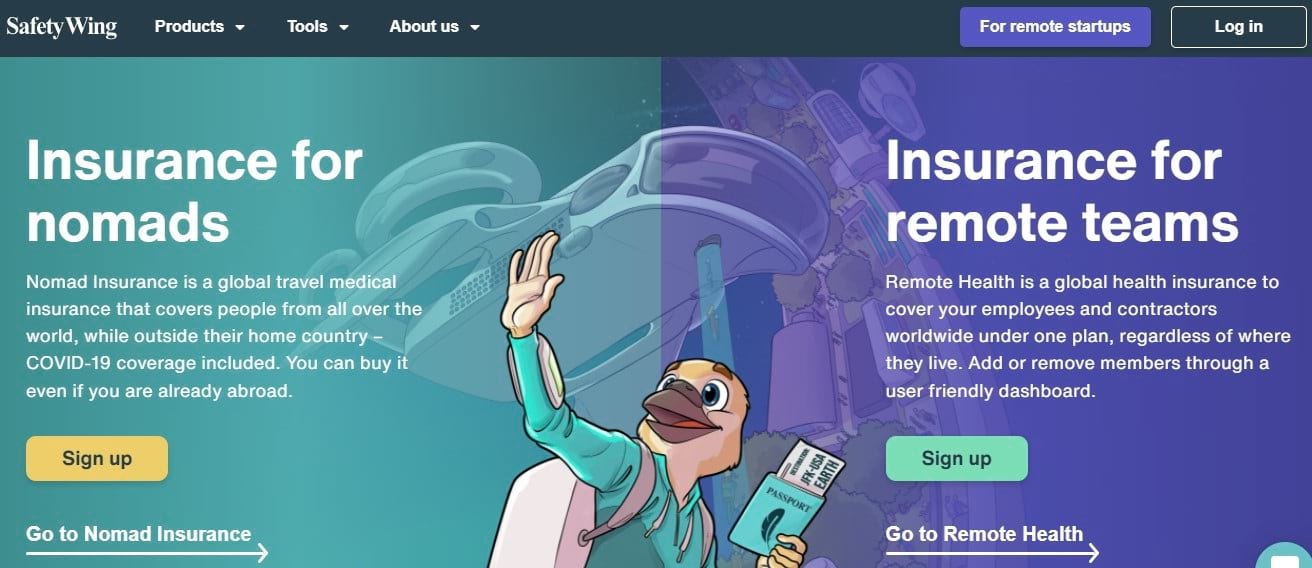

You can pick from two main policies: Nomad Insurance and Nomad Health (and if you’re a remote startup, they even have a policy called Remote Health that covers global health insurance for remote companies).

Nomad Insurance is more than just travel insurance —it's a lifeline for when things go sideways. Think of it as your safety net for medical emergencies, unexpected detours, and even those frustrating moments when your luggage decides to take a different plane than you.

Then there’s Nomad Health , which is their signature global health insurance (175+ countries covered!) tailored to those digital nomads who need more comprehensive and long-term coverage .

In this review, we’ll be focusing specifically on their Nomad Insurance , which is among the most popular travel policy for digital nomads out there.

How Does SafetyWing Travel Insurance Work?

How SafetyWing's travel insurance works is a testament to their deep understanding of the nature of the digital nomad lifestyle . They operate on a subscription model that bills you every 28 days , which means you can start, pause, or stop your coverage based on your current plans , whether you're mid-journey or planning the next trip from a beachside café.

But wait for it: most digital nomad insurance providers only allow you to purchase policies before your trip begins, but not SafetyWing . You're not locked out if your trip has already begun. Did you forget to get insurance before leaving, or suddenly decided to extend your trip? SafetyWing allows you to activate coverage while you're already abroad (something that could've been handy for that poor guy in Koh Lanta).

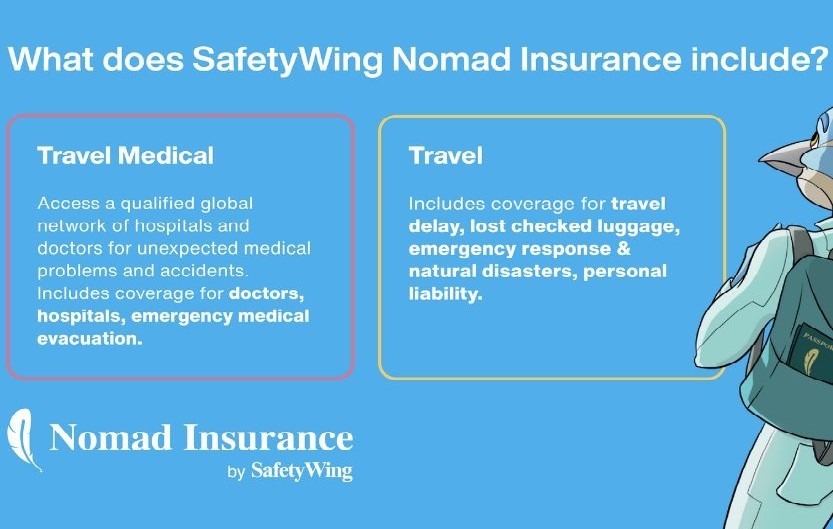

What Does SafetyWing Cover?

Remember that friend from Koh Lanta who was poisoned by food? Well, with SafetyWing on their side, that nasty surprise wouldn't mean choosing between a questionable local clinic or a budget-busting flight home. Coverage for unexpected medical emergencies means peace of mind (and, hopefully, a happier tummy!).

SafetyWings has really thought of this kind of emergency and just about everything that could go wrong during your extended travels. These are just a few of the many things that are covered by their Nomad Insurance :

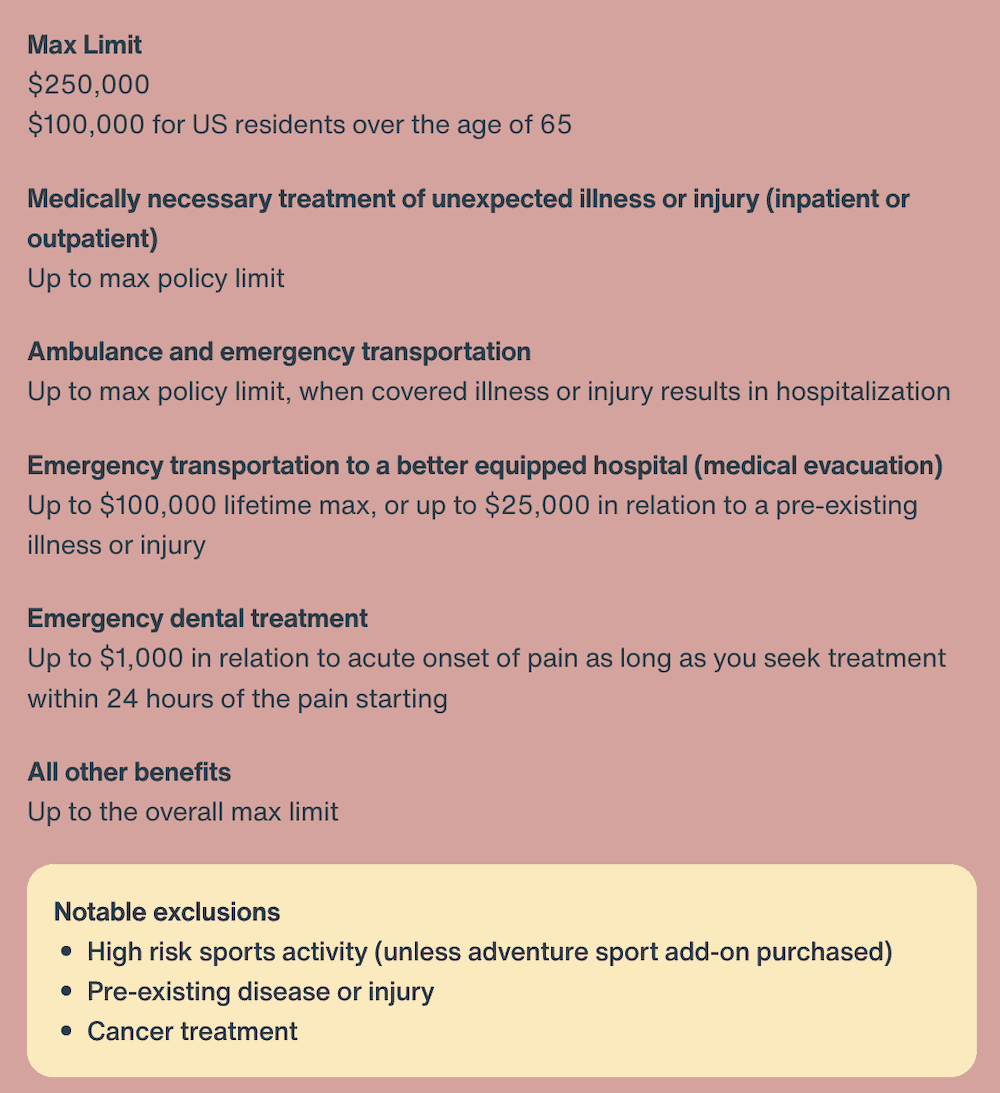

- Emergency medical treatment and hospital stays

- Ambulance and emergency transportation

- Emergency transportation to a better equipped hospital (medical evacuation)

- Emergency dental treatment

- Prescription drugs

- An unexpected event in your home country for which you to need to go home (trip interruption)

- Political Evacuation

- Trip interruption due to death of a family member

- Accidental death and dismemberment

- If you die Arrangement for your body (burial or repatriation of remains)

- Cash payout to your beneficiary (accidental death)

- Accommodation in a different place if a natural disaster causes evacuation

- Stolen passport or travel visa

- Lost checked luggage

- Unplanned overnight stay

- $0 deductible option

What's Not Covered in SafetyWing's Travel Insurance?

If you get SafetyWing's Nomad Insurance, you have to understand that you're not purchasing primary health insurance but a travel insurance plan for unexpected medical emergencies and travel-related costs . That means that not everything will be covered by this policy. Below is what you won't find in when purchasing their travel insurance plan:

- Pre-existing conditions

- Routine check-ups and preventive care

- Cancer treatment

- Injuries from high-risk adventure sports (unless you purchased the adventure sport add-on)

- Travel to Iran, North Korea, and Cuba

- Any treatment that is not medically necessary

- Mental health disorders

- Limited coverage of stolen or lost personal items (only if you purchased the electronics theft add-on)

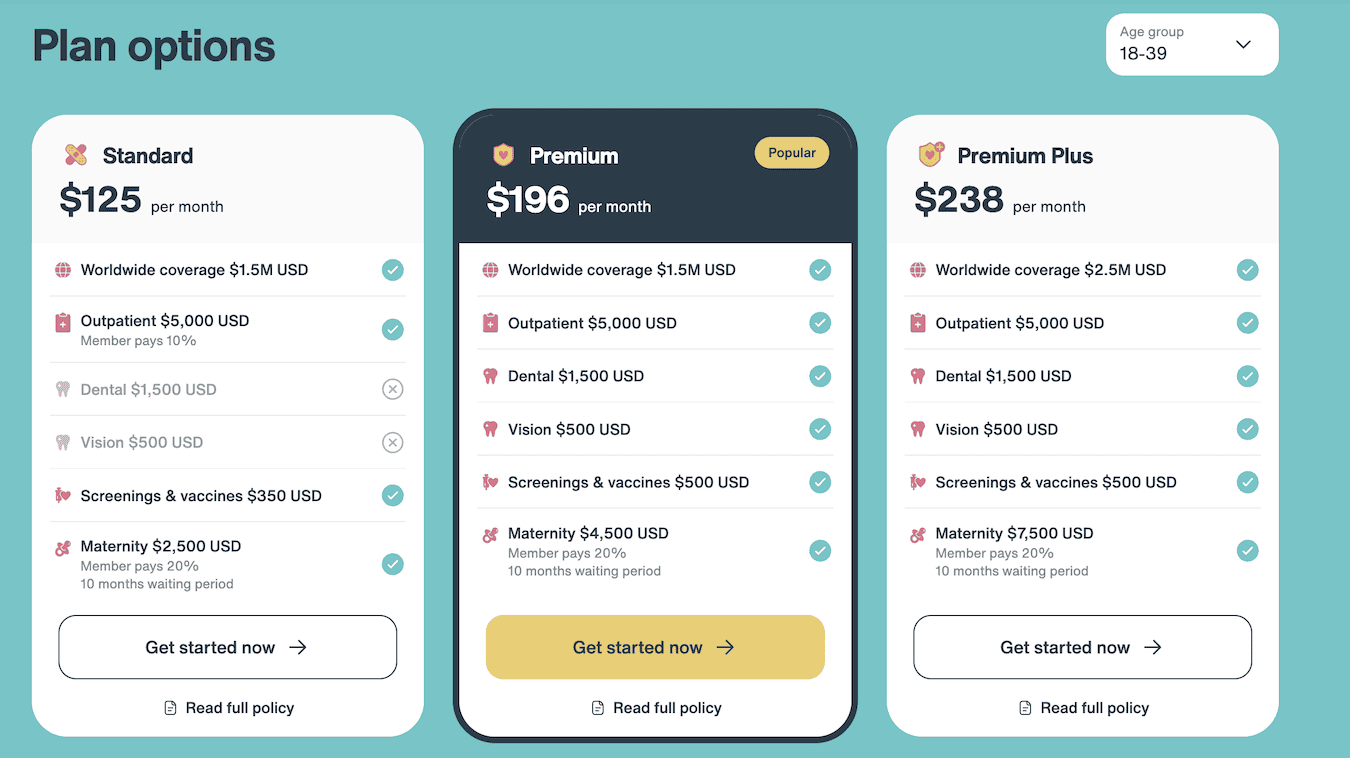

SafetyWing Travel Insurance Pricing

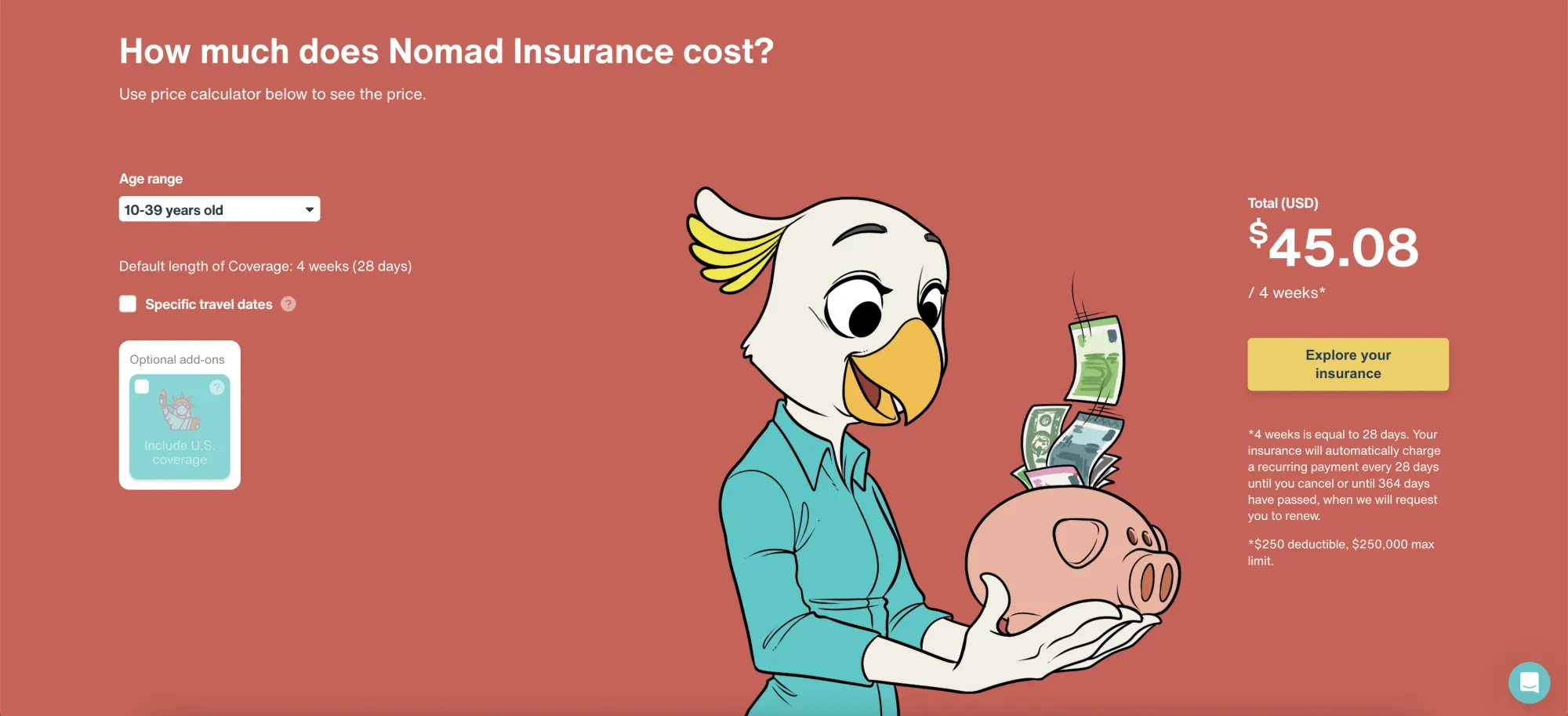

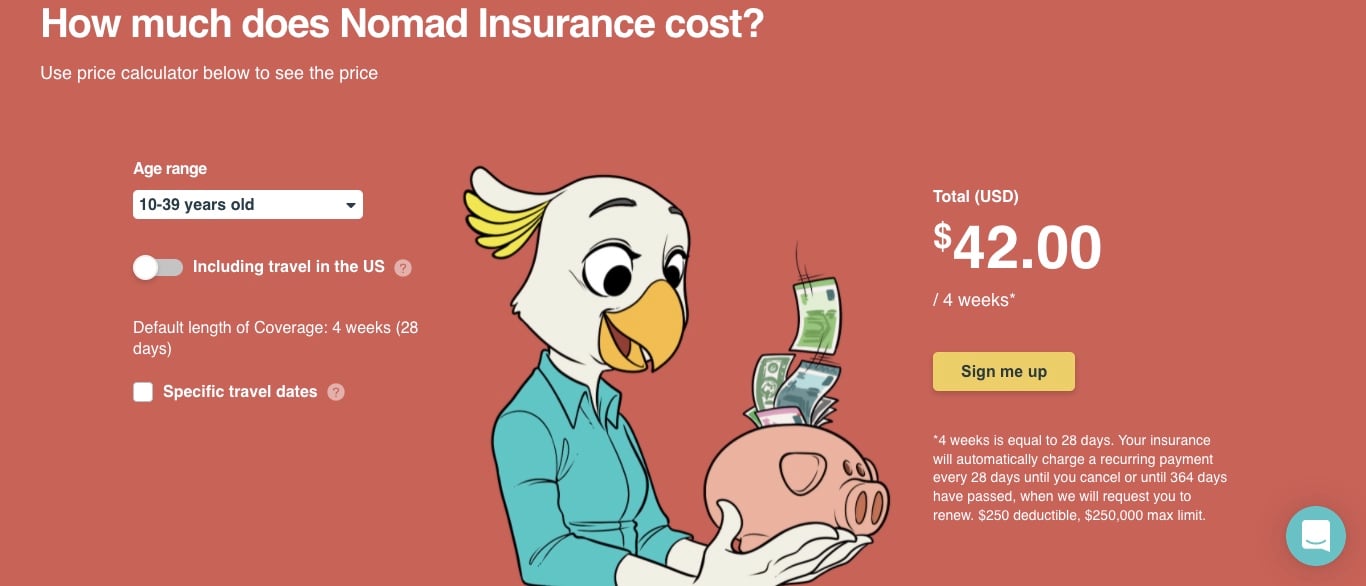

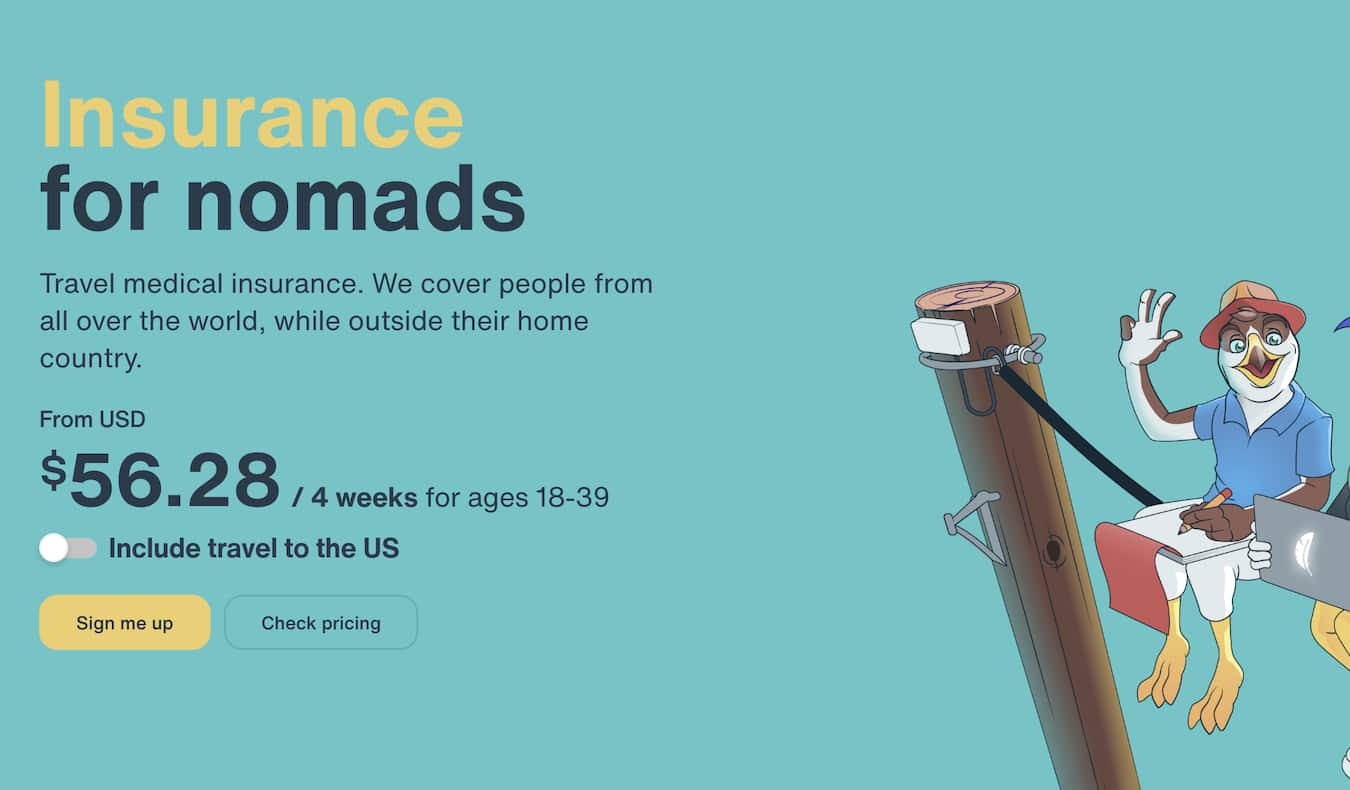

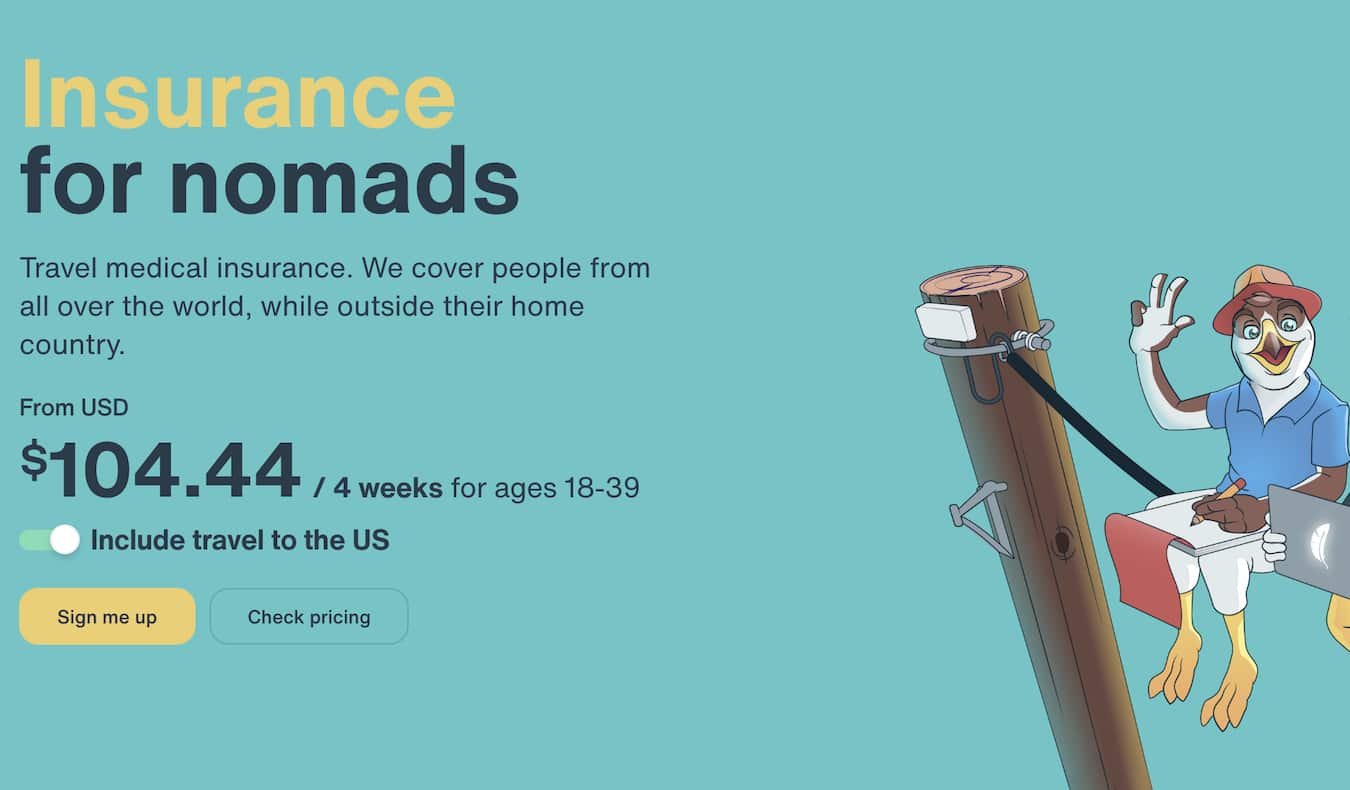

Now, let's talk about money, shall we? SafetyWing's pricing isn't one-size-fits-all. Their rates vary based on the policy you pick, how old you are , and if your travels include coverage in the United States .

If you want to beef up your coverage, SafetyWing offers a few extra options (for digital nomads living outside the US). You can choose to add protection for trips to the US, cover for injuries related to adventure sports , and even insure against electronics theft.

SafetyWing also balanced the $0 deductible awesomeness with a slight tweak in their pricing . Here's the updated breakdown to help you budget:

Nomad Insurance Pricing Excluding the US :

- Age 10-39 : $56.28 per 4 weeks

- Age 40-49 : $92.40 per 4 weeks

- Age 50-59 : $145.04 per 4 weeks

- Age 60-69 : $196.84 per 4 weeks

Nomad Insurance Pricing Including the US:

- Age 10-39 : $104.44 per 4 weeks

- Age 40-49 : $171.92 per 4 weeks

- Age 50-59 : $282.80 per 4 weeks

- Age 60-69 : $386.12 per 4 weeks

What Makes SafetyWing Stand Out From The Other Travel Insurance Plans?

From what we've seen, SafetyWing really stands out from other nomad travel insurance providers , and we’d even go as far as to say it's one of the best digital nomad insurance out there . Here’s why we’re big fans:

- Flexibility to buy insurance anywhere: If you've ever kicked off your travels only to realize you forgot to get insurance (it happens to the best of us), or maybe you just weren’t ready to head home yet and decided to extend your stay, don't sweat it. SafetyWing gets it. They let you sign up or extend your coverage from anywhere in the world, even if your trip has already begun.

- Pay-as-you-go subscription: With SafetyWing, you’re not tied down. Their 28-day billing cycle gives you the freedom to adapt your insurance to your life, not the other way around. It’s perfect for open-ended trips or for when your travel plans are as flexible as a morning yoga session.

- Travel without a return ticket: For those of us with wanderlust in our souls and no set end date in mind, SafetyWing is a dream come true. They don’t need a return date or ticket to start your coverage.

- Coverage in your home country (US residents only): For US residents who need to pop back to the US, SafetyWing covers incidental visits home. For every 90 days, you're covered for up to 30 days in your home country for unforeseen eligible medical conditions.

- Motorbike or scooter coverage: Zooming around on a motorbike or scooter? SafetyWing’s coverage of accidents on two wheels is a rare find and a major plus for adventurers.

- What you see is what you get pricing: No need to decode complicated rate charts. SafetyWing keeps it clear with straightforward pricing based on your age and whether your travels include the US.

What are SafetyWing's Nomad Insurance Disadvantages and Limitations?

Of course, it's not all sunshine and rainbows (and we wouldn't expect it to be, either). While SafetyWing really brings it home with its insurance tailored for digital nomads, like anything, it's got its quirks and limits. Here’s the real talk on what it doesn't do:

- Lack of coverage for pre-existing conditions: If you’ve got ongoing health battles or chronic conditions, SafetyWing’s going to step back on this one. They won’t cover treatments tied to those long-term health issues.

- Routine health checks off the list: For those of us living the nomad life long-term, staying on top of health through regular check-ups or preventive care is key. But with SafetyWing, you’ll need to cover these costs on your own since they're not part of the deal.

- Lack of coverage for some adventure sports: For those adrenaline junkies, just a heads up—even if you purchase the adventure sports add-on, SafetyWing draws a line on covering injuries from certain thrill-seeking activities. While most of the adventure sports are covered with the add-on, it's best to double check if yours is included before you purchase it.

- Limited coverage for stolen or lost personal items: If you're traveling with gadgets or gear that cost a pretty penny (who isn't?), absolutely purchase the electronics theft add-on. If you don't and your stuff gets stolen, it won't be covered. But still, even if you purchase the add-on, keep a close eye on your tech because, in case of theft, SafetyWing will only be covering up to $1000 per stolen item with a yearly limit of $3000 per policy.

- Lack of coverage in certain countries: If you're dreaming of adventures in Iran, North Korea, or Cuba, you'll need to look beyond SafetyWing for coverage—these destinations are off their coverage map.

- Deductible: Every time you claim, there’s a $250 deductible. That means for anything under $250, the bill’s on you. And even for bigger claims, you're covering the first $250.

What Nomads Think of SafetyWing Travel Insurance?

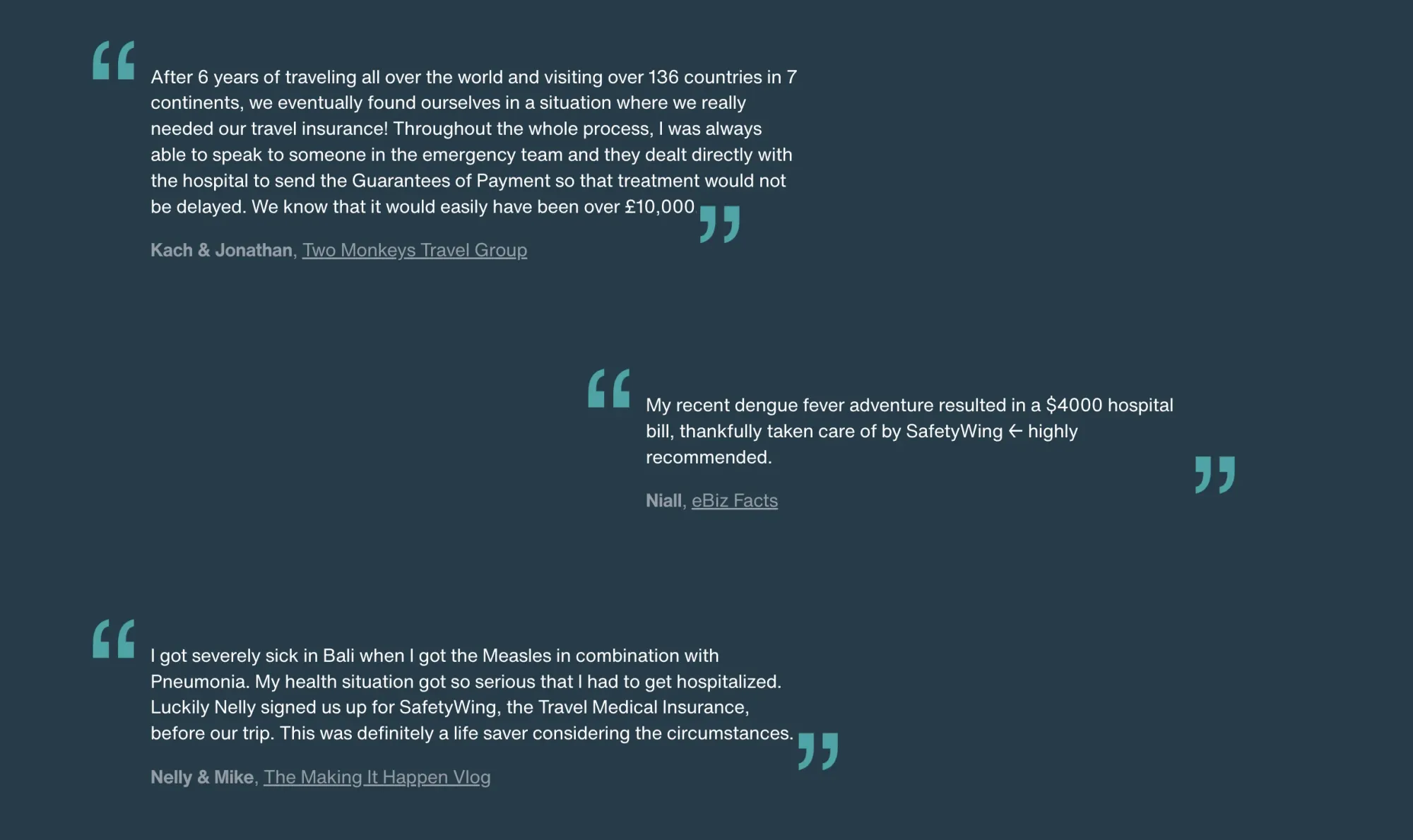

For something as important as travel insurance, we didn’t just want to rely on our own impressions for this review. So, we took a deep dive into what others are saying about SafetyWing on Trustpilot and ProductHunt . Here’s the scoop from the wider digital nomad community:

SafetyWing Travel Insurance Reviews on Trustpilot

Over on Trustpilot , SafetyWing's scoring a solid "Great" with a 3.9 out of 5 , and that's from a batch of 966 reviews (at the time of writing). A lot of users are giving thumbs up for the excellent customer service , highlighting how supportive and quick-to-respond the team is. They say signing up's a breeze, and the pricing is easy on the wallet.

But it's not all smooth sailing. Some travelers have hit a bit of turbulence when it comes to making claims , pointing out that things can move at a snail's pace, and getting reimbursed feels like a bit of a maze. There's also a bit of chatter about how the company's communication could be improved , especially in wanting more check-ins from the company just to feel in the loop about where their claims stand.

SafetyWing Travel Insurance Reviews on ProductHunt

On ProductHunt , SafetyWing's getting similar feedback to what's on Trustpilot. With a 3.5 out of 5 from 224 reviews (at the time of writing), lots of users appreciate the ease of use and affordability . They're fans of the flexible subscription model and how simple it is to start coverage. Some users even found the claims process straightforward.

But, just like on Trustpilot, it's not all perfect. There are users on ProductHunt sharing frustrations with slow claim responses and challenges in getting compensated . Issues with policy renewal have also come up, notably that ongoing treatments get labeled as "pre-existing conditions" in a new policy period.

SafetyWing Travel Insurance: Pros and Cons

Drawing from our experience as digital nomads and pooling insights from other travelers, we’ve put together a candid look at the ups and downs of SafetyWing's Nomad Insurance for you to make a more informed decision yourself:

SafetyWing Nomad Insurance Pros and cons:

How does safetywing compare to other travel insurance providers.

And if you were wondering what's out there and how SafetyWing compares to the other digital nomad insurance providers, we also got you covered. Here's an overview of what we know:

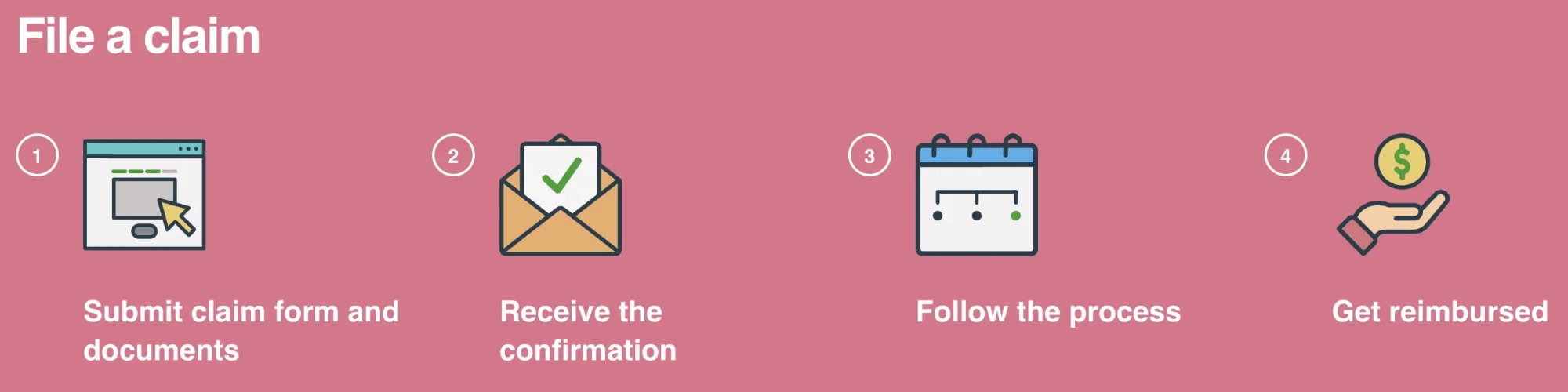

How to Make a Claim With SafetyWing Travel Insurance

If you'll ever need to file a claim, the good news is that the claims process with SafetyWing has improved a lot .

In the last year or so, they made major improvements to make it more user-friendly , and they've also streamlined their claim process for quicker resolution .

Here's how you can now file a claim with SafetyWing:

Step 1: Start your claim

Begin by filling out the claim form available on SafetyWing's website . If you prefer, you can also download the form and submit it via email or traditional mail.

Step 2: Gather your documentation

Collect all original itemized bills, receipts, and proof of payment for the expenses you're claiming. These documents are crucial in demonstrating the validity of your claim. If you're making a medical claim, don’t forget to include a medical statement from the treating physician or facility, as this provides a comprehensive overview of the services rendered. A mere receipt may not do the trick , as the claims team may need detailed information that only a medical statement can provide.

Step 3: Include essential information

Ensure your claim form includes your policy number and accurate contact details . This information is vital for SafetyWing to process your claim efficiently and to get in touch with you for any further information or clarifications needed.

Step 4: Get your submission on time

It's important to submit your claim within 60 days from the date of service . Prompt submission is key to a smooth claims process, allowing SafetyWing to address your needs as quickly as possible.

Step 5: Get confirmation and follow-up

After submitting your claim, you'll receive a confirmation email, acknowledging that your claim is being processed. For any queries or to check the status of your claim, SafetyWing makes it easy with options to contact their claims team via chat , phone ( +1 415 802 0299 ), or email ( [email protected] ).

How To Check Your SafetyWing Claim Progress

After you've dotted the i's and crossed the t's on your DocuSign submission, which is a part of getting your claim filed with SafetyWing, a bit of patience is in order.

The steps from submission to conclusion for your claim can take from 30 to 45 business days .

Now, about keeping tabs on your claim's status — you won't get updates in your inbox. Instead, you'll need to log into the Member Portal .

Once you're there, the following button will guide you to the "Claims and Appeals" tab:

It's here, at the very bottom of the page, where you can catch the latest on your claim's status.

If you're seeing " No claims started " or " Open ", it means the claim is still being processed , so you will have to wait up to 30-45 days before getting any updates.

So, What's Our Verdict on SafetyWing Travel Insurance?

There's no denying it, SafetyWing brings something special to the table for us digital nomads . It’s not without its quirks, but its standout features do make it an attractive pick, especially for anyone chasing a budget-friendly and no-fuss insurance option .

That said, the variety of feedback out there really underlines the need to get cozy with the policy specifics and manage your expectations when it comes to filing claims.

Like with anything important, it's smart to browse around and weigh your options when it comes to travel insurance . Go ahead and compare different travel insurance plans to find the one that meshes just right with what you need. We've rounded up some of the top picks for you to check out in the article below:

SafetyWing Travel Insurance: FAQs

Can i purchase safetywing insurance while already abroad.

Yes, SafetyWing allows you to start a policy while you are already abroad.

Does SafetyWing cover COVID-19?

Yes, SafetyWing covers COVID-19 like any other illness, provided it wasn't contracted before your policy start date.

Does SafetyWing cover pre-existing conditions?

No, SafetyWing does not cover pre-existing conditions.

How does SafetyWing handle claims?

SafetyWing has a "make a claim" section under your profile that guides you through the process. The claims form can be filled out digitally and uploaded with receipts and necessary documents.

What is the average time to get reimbursed?

Based on user reviews, the reimbursement time can vary. Some users have reported getting reimbursed in a reasonable timeframe, while others have mentioned delays and the need to follow up on their claims.

What is the deductible for SafetyWing's Nomad Insurance?

SafetyWing's Nomad Insurance has a $250 deductible. This means you'll need to pay the first $250 of your covered expenses before the insurance starts to pay.

Ready To Get Coverage for Your Next Travel Adventure?

If you want more digital nomad guides like these, sign up for our free newsletter and get upcoming articles straight to your inbox!

Sign up for our Newsletter

Receive nomad stories, tips, news, and resources every week!

100% free. No spam. Unsubscribe anytime.

You can also follow us on Instagram and join our Facebook Group if you want to get in touch with other members of our growing digital nomad community!

We'll see you there, Freaking Nomads!

Disclosure: Hey, just a heads up that some of the links in this article are affiliate links. This means that, if you buy through our links, we may earn a small commission that helps us create helpful content for the community. We only recommend products if we think they will add value, so thanks for supporting us!

How to Beat Your Post-Travel Depression: Your Guide to Feeling Better

How to create a healthy work-life balance while working remotely, wise travel debit card review: fees, exchange rates, limits and how to use it.

- Meet the Team

- Work with Us

- Czech Republic

- Netherlands

- Switzerland

- Scandinavia

- Philippines

- South Korea

- New Zealand

- South Africa

- Budget Travel

- Work & Travel

- The Broke Backpacker Manifesto

- Travel Resources

- How to Travel on $10/day

Home » Budget Travel » Is SafetyWing The Best Travel Insurance For Long Term Travellers? Updated For 2024

Is SafetyWing The Best Travel Insurance For Long Term Travellers? Updated For 2024

“The worst can happen and does happen…so you had better make sure you’re Insured” – Fargo Season 1.

Usually, whenever I buy something I like to get my money’s worth and use it as much as possible. Take for example those Levi jeans that I wore everyday for a year until the knees wore out. Or take my trusty MacBook Pro which I use to beat out at least 10,000 words a day.

Travel Insurance on the other hand, is one of those rare things in life whereby you pay for it, and yet you hope that you never ever need to use it. But whenever you hit the road and head out on an adventure, it’s very important to get travel insurance. Whether you’re headed to Prague for a boozy weekend, or to Southeast Asia to spend 6 months finding yourself, disaster could be waiting for you at any point.

So here we run down what SafetyWing insurance offers and how they stack up against the competition. So with that, here’s our SafetyWing insurance review!

Do SafetyWing Cover COVID?

Safetywing review, do you need travel insurance, breakdown of safetywing travel insurance, what travel insurance plans does safetywing offer, what’s covered by safetywing travel insurance, what’s not covered by safetywing, who is safetywing travel insurance suitable for.

- Who isn’t SafetyWing Travel Insurance Suitable For?

How Much Does SafetyWing Travel Insurance Cost?

Other travel insurance providers, when should you buy travel insurance, staying safe on your adventure, frequently asked questions about safetywing travel insurance, final thoughts on safetywing travel insurance.

When COVID-19 first rocked the world in 2020, most travel insurers were quick to invoke their cancellation clauses and pull all cover relating to either illness, cancellation or disruption caused by the pesky pandemic.

These days, most insurance providers are offering some form of COVID coverage included within their policies, but some are more useful than others. Whilst many now cover hospitalisation caused by COVID infections, fewer are offering any kind of cover for disruption or cancellation such as being refused boarding on a flight for displaying symptoms, or having to cancel your trip because of a positive test.

Whilst the pandemic has largely subsided , COVID is still able to severely disrupt travel plans. Therefore do consider paying close attention to the finer details of any insurers COVID-19 cover.

SafetyWing can offer COVID-19 coverage in their policies and may be able to cover you for illness, evacuation cancellation and interruption.

These days there are countless travel insurance providers out there and choosing between them can be overwhelming. Furthermore, some of these providers have better reputations than others and there are some very unfortunate instances of insurers not paying out on claims. Finally, deciphering between policies and reading their fine print can be exhausting. But we’re here to help.

In this SafetyWing Review, we’ll take a good, detailed look at SafetyWing and its travel insurance policy. We’ll run through the various types of cover they offer, look at what is and is not included in their policy, and we’ll assess their value for money. We’ll also have a quick look at some of their best competitors (including World Nomads insurance).

Need help deciding between Safety Wing or Hey Mondo ? Check out our helpful guide.

Do you really even need travel insurance ? It’s a fair question. After all, the vast majority of trips end happily and safely without incident.

We at the Broke Backpacker have probably spent a combined total of maybe 10 years on the road and have easily visited over 100 countries. During all of that travel, we’ve clocked up a fair few mishaps ranging from inflected legs that almost needed amputating, to the inevitable bike crashes, all the way to gun-point robberies. These incidents were all traumatic enough themselves leaving physical or mental scars.

But mercifully, we were all insured at the time meaning that were spared the further trauma of paying out $10,000 medical bills and emergency medical evacuation or having to find $700 for a new iPhone.

Basically, nobody ever thinks it will happen to them and yet, it has to happen to somebody. Besides that, the law of averages tells us that if you travel enough, something somewhere will eventually go wrong.

Furthermore, some countries do actually require you to obtain insurance before even letting your enter.

What Does Travel Insurance Cover?

In order for you to decide whether you really do need travel insurance, let’s look at some of the things it can help with, and where you would be without travel insurance coverage.

Lost Luggage

The aviation industry watchdog estimates that 5.73 items of luggage are lost for every 1000 passengers. This is not a bad statistic but it means that if you take 10 flights, there is a 5% chance of your luggage being lost forever. Also, note that some airlines and airports (the black hole of Charles De Gaulle anybody?) are a lot worse than others for this.

Lost luggage can easily mean your trip is ruined as you’re forced to walk around Ibiza for a week sweating your ass off in the same inappropriate jeans and jumper combo you left home in. Replacing everything you own though, can mean you then have to find $1000 to replenish your wardrobe, refill your toiletry shelf and get a new travel camera . Any good travel insurance policy, therefore, covers lost luggage, usually up to at least $1000.

We’ve tested countless backpacks over the years, but there’s one that has always been the best and remains the best buy for adventurers: the broke backpacker-approved Osprey Aether and Ariel series.

Want more deetz on why these packs are so damn perfect? Then read our comprehensive review for the inside scoop!

Medical Expenses

Medical expenses can be seriously expensive. For example a friend of mine was once hospitalised whilst volunteering in Costa Rica and ran up bills in excess of $10,000. He recently spent 1 night in a Thai hospital, was billed $1,000 and his passport was used as a ransom. Personally, I don’t have $10,000 to pay Costa Rican Doctors but I do have maybe $50 to get myself some comprehensive health insurance.

Coming from the UK where we (just about) have the NHS, the cost of medical care in some parts of the world is quite a revelation. If you are reading this in the US you already know all about health extortion but do remember that your domestic health insurance will not cover your medical expenses outside of the US.

Accidents happen without warning and ill health can strike at any time, anywhere. In fact, if you have experienced driving or hygiene standards in India, then you’ll probably agree that you’re actually at a much higher risk of coming to harm on the road than you are at home!

Travel Disruption

Travel disruption and trip interruption comes in all shapes and sizes but let’s take a classic, topical example. Every year a few airlines and travel agents go bust leaving passengers stranded. Booking flights home at short notice is expensive, but not getting home ASAP can mean getting fired from your job. Having to stay an extra few nights in a hotel can also put undue strain on an already tired travel budget.

Having travel insurance can therefore mean the difference between desperately raiding your overdraft to pay a hotel, or your travel insurance company covering a few extra nights at your destination free of charge! Trip interruption is upsetting enough without it costing a fortune!

Robbery

In many parts of the world, tourists are a target for thieves. I’ve had my phone stolen by knife-wielding bandits in Colombia and know people whose hotels have been raided leaving them without gold jewellery and laptops.

Getting jacked is scary, but having to find $700 for a new iPhone is seriously fucking depressing. Thankfully, many travel insurance companies cover it.

Stash your cash safely with this money belt. It will keep your valuables safely concealed, no matter where you go.

It looks exactly like a normal belt except for a SECRET interior pocket perfectly designed to hide a wad of cash, a passport photocopy or anything else you may wish to hide. Never get caught with your pants down again! (Unless you want to…)

Who Are SafetyWing?

If you have never heard of SafetyWing, it’s probably because they are still a new company. Launched in 2018, founded by Norwegians and based in the US, SafetyWing is one of the newest travel insurance providers in the space.

In case you are nervous about entrusting your wellbeing to a baby company, don’t be. SafetyWing’s Insurance partner is Tokio Marine, one of the biggest and most established insurance companies in Japan, and the Insurance is underwritten by Lloyds. Furthermore, Insurers are required to go through a shed load of vetting and have erm, insurance, in place before they are even allowed to trade.

SafetyWing identifies as long-term travellers and digital nomads describing their mission as “insurance for nomads by nomads”. In practice, this means that they focus on long term travellers and digital nomads who are not served by other providers and can often fall between the cracks of healthcare systems.

SafetyWing is pretty unique in that they offer a kind of hybrid between travel insurance and health insurance. Their package is nowhere near as comprehensive as standard travel insurance as they have ripped out some of the features which are less likely to apply to digital nomads and long term travellers. This is reflected in the pricing which makes them one of the most reasonable and competitive travel insurance companies.

Whereas most travel insurance companies offer multiple different plans, SafetyWing insurance keeps things straightforward and offers one simple plan.

One Simple SafetyWing Plan

The headline is that SafetyWing plan may be able to cover you up to a maximum value of $250,000 per cover period with direct billing. The excess is $250 meaning that you must pay the first $250 of any claim yourself. For example, if you end up in hospital for stitches and the bill comes to $197, then unfortunately the entire bill comes out of your pocket and you cannot claim. That is however pretty standard across insurance cover.

In case you are in a hurry, the key points are set out below.

- Medical emergencies may be covered up to $250,000. This also includes emergency dental treatment up to $1,000 which is perfect if you fancy a bit of 2am gutter boxing!

- Medical Evacuation may be covered up to $100,000. Note that emergency medical evacuation means been transferred to a hospital in your home country and does not mean been rescued from a mountain after breaking your leg whilst trekking.

- Emergency evacuation in case of civil unrest or something may be covered up to $10,000.00. So, if London erupts into riotous, murderous, anarchy following Brexit, you can get yourself a flight either all the home, or simply to safety in Paris!

- In the event of a natural disaster , cover may be $100 per day for 5 days for accommodation costs.

- Whilst trip cancellation is not included, trip interruption up to $5,000.00 is included. This means that if you are forced to cut your trip short, you may receive up to $5,000 to help you get home.

- Lost Luggage may be covered up to $3,000. However, note that the maximum value per item is $500. Therefore, if you plan on checking-in that diamond necklace, you may wish to obtain different cover.

Please remember that international travel insurance coverage changes from time to time. It is important for you to read the policy yourself and make sure you understand it. If you are uncertain of anything, it is a good idea to speak with the provider for clarification especially when it comes to things like trip interruption and specific medical coverage.

Remote Health

SafetyWing quite recently launched a second policy; Remote Health. Remote Health was initially designed to cover remote working teams and was a pioneering form of workplace health insurance for the age of the Digital Nomad.

However, SafetyWing has now evolved the concept and it is available for individuals. Remote Health differs from the standard policy in a number of ways offering a more robust cover. Crucially, it may be able to cover pandemics like the COVID-19 outbreak of 2020 and for this reason, appeals to a growing number of travellers. Not all insurance will cover Covid 19 so this is a great addition.

Remote Health is more expensive than the standard policy but may still be a good investment for those seeking stronger cover.

Emergency Accident & Sickness Medical Expenses

Got food poisoning in Delhi? Got hit by a moped in Bangkok? Or maybe you just slipped in the shower and broke your wrist at a hostel in Madrid ? These things can, and do happen and will all require emergency medical treatment. Being sick, infirm and unable to jerk yourself off is bad enough as it is, so the last thing you want is a hefty medical bill which you have to pay out of your own pocket.

Emergency accident, sickness and medical coverage is quite likely the most important aspect of any travel insurance plan – I certainly know it is for me. If you get ill, get hurt, or otherwise need medical attention, you may have medical coverage up to $250,000 and direct billing is available too.

If you need emergency dental care, you may be covered up to $1000.

Besides the above medical coverage, SafetyWing also offers a few additional benefits:

- Acute Onset of Pre-Existing Condition – If you have a pre-existing condition which suddenly, flares up, then you may be able to claim up to $250,000 of the maximum limit or $25,000 for medical emergency evacuation. If you do have a pre-existing conditions, please speak to the insurer about it to make sure you are covered.

- Outpatient Physical Therapy – You may be able to claim up to $50 per day if you ever need to see a physio or a chiropractor during your trip. This is very useful for when the dreaded, Digital Nomad bad-back strikes!

Emergency Evacuation and Repatriation

Medical Evacuation is when you need to be sent to your home country, or another country for further or continued medical treatment, and are too sick to travel home normally as a regular passenger. For example – when you are still stuck in a hospital bed with tubes coming stuck in you.

Repatriation means the cost of sending your dead body home. This is often overlooked by many travellers but it really is very important. The cost of flying bodies home is very expensive and I would hate for my family to ever be landed with this cost at such an awful time for them.

Accidental Death and Dismemberment

This applies in the very, very unlikely event that you have an accident and lose an arm or a foot. Or if you tragically arrive at your departing destination and then die.

This coverage is for the loss of life or limb as a result of an accidental injury occurring during the trip. The loss must occur within 365 days after the date of the accident causing the loss. Basically what this means is if you have an accident and are dying, if you die your family may be covered.

The same goes if you have something happen that results in your arm eventually being removed as a result of the accident.

We appreciate that this is pretty heavy going, grim stuff. But please persevere, these cover policies exist for a reason – the reason being that it is has happened to somebody before.

Things go wrong on the road ALL THE TIME. Be prepared for what life throws at you.

Buy an AMK Travel Medical Kit before you head out on your next adventure – don’t be daft!

Kidnapping is very rare but does happen so thankfully, SafetyWing’s Crisis Response coverage protects against this. If this happens, you may receive recompense for either your ransom or loss of personal belongings that occur during the kidnapping.

Note that crisis response does not apply in some “dangerous countries”. Examples are Iraq, Afghanistan, Pakistan, Nigeria, Somalia and Venezuela. Personally, I think it’s a bit harsh putting Pakistan on that list but there you go.

Incidentally, quite a few reputable travel insurance providers do not cover kidnapping at all.

Lost or Stolen Passport

Did you know that lost or stolen passport claims are amongst the most common ones made by travellers?! If your passport is lost or stolen, you may be able to claim up to $100 for a new one which I think, should cover it pretty much anywhere in the world.

Of course, in order to minimise the risk of this happening you should keep your passport securely locked in your hotel room or hostel locker. Even in countries that require foreigners to carry passports with them, a photo copy usually suffices.

When in transit, keep it near to you at all times and do not absent-mindedly put it down anywhere.

Personal Liability

Personal Liability indemnifies you in the event that your actions cause injury, harm or financial loss to another party. This includes vehicle accidents where you were found to be to blame.

Coverage also includes legal fees which can be harrowingly expensive.

Home Country Coverage

Somewhat unusually, SafetyWing even offers a level of coverage in your home country. This is because SafetyWing understands that long term travellers and Digital Nomads will go home once in a while, but that “the trip” is still not over. It’s great for popping home for Christmas or to attend your annoying cousin’s wedding.

The cover period is 30 days per every 90 day period (15 days in the US) .

We are not aware of any other travel insurance provider that offers anything like this.

To get the full measure of any travel insurance, it is important to look at what is not covered as well as what is covered.

In the case of SafetyWing, there are some very notable exclusions that you should carefully take into account before deciding whether it is the right cover for you.

Trip Cancellation

In case you get ill and have to cancel your trip, you cannot recover the costs of it. From what I can deduce, the rationale behind this is that for long term travellers and Digital Nomads, life is the trip! Therefore, you may be unlikely to ever even really need this.

Electronics

Expensive electronic equipment is not covered by the SafetyWing plan at all. At first, this may seem odd in a policy aimed at Digital Nomads . However, most Digital Nomads have separate, comprehensive gadget covers anyway. Most travel insurers who do cover gadgets only cover them up to $500 which is about one third the price of a MacBook.

I for one have a gadget cover that covers loss, theft, accidental damage and malfunction. After all, my livelihood depends on this little piece of overpriced silicon valley crap powering up each morning.

A new country, a new contract, a new piece of plastic – booooring. Instead, buy an eSIM!

An eSIM works just like an app: you buy it, you download it, and BOOM! You’re connected the minute you land. It’s that easy.

Is your phone eSIM ready? Read about how e-Sims work or click below to see one of the top eSIM providers on the market and ditch the plastic .

Theft or Loss

If you are robbed in Colombia, or you stupidly leave your Ombraz Armless sunglasses on an Indian bus, you are not covered. This is kind of unusual for travel insurance as both of these things do happen to travellers.

However, is this really such an issue? For example, in the case of your lost sunglasses, many insurers would try and wriggle out of paying that one anyway. Even if they did, you would have to pay the excess which could be anywhere between $50 – $250 (ie, more than the glasses are worth).

As for getting robbed, cash is generally not insured and any items are still subject to the excess. Therefore, the only thing you could realistically claim for is a stolen smartphone – see above re electronics.

Adrenaline Activities

SafetyWing does not certain adrenaline sports such as Quad Biking and Parachuting which is fair enough. However, somewhat surprisingly, football/soccer is not covered if you are playing as part of a regular team. Therefore, if you are a Digital Nomad thinking of joining the local 5 a side team in Budapest, think again! Trekking and mountaineering are covered up to an altitude of 4500 metres.

Sanctioned Countries

SafetyWing does not extend any coverage at all to Cuba, North Korea and Iran. This is presumably because the US’ draconian financial sanctions prevent them from doing so. Note that if you do wish to visit Iran, you will need travel insurance to enter so should find an alternate provider.

The kidnap or crisis coverage is not available in Iraq, Afghanistan, Pakistan, Nigeria, Somalia or Venezuela.

So what makes SafetyWing unique amongst other travel insurance providers, and who is there cover the perfect cover for?

SafetyWing understands that there is a lot more to travel than a 2-week trip. They appreciate that many of us set off with a one-way ticket, no itinerary, and have no idea when we will be coming back.

Therefore SafetyWing may be suitable for;

- Long Term Travellers – SafetyWing are pretty unique in that they offer open-ended travel insurance. You can bum around the world for years, and stay covered as long as you keep up your premiums.

- One Way Travellers – As I said, your trip doesn’t need to have a set end date in order for the cover to be valid!

- Digital Nomads – When you’re a digital nomad, you move from one destination to another working and hustling as you go. You can hustle around the world for years at a time with this policy. If you’re living as a digital nomad long term, there’s a pretty good chance that at some point you’re gonna need to see a Doctor about something.

- Travellers With Kids – This is another cool feature. The policy covers one young child per adult , up to 2 per family, age between 14 days and 10 years old. So, if both you and your partner take the cover, it’s 2 children for free as long as they are not over 10 years old! If your child is over the age of 10, you may wish to enquire about separate or additional cover for them.

Who isn’t SafetyWing Travel Insurance Suitable For?

SafetyWing specialises in travel insurance for long term backpackers and Digital Nomads. This is a sizeable and growing niche. However, this kind of cover isn’t necessarily right for everybody out there. SafetyWing is perhaps not the best travel insurance out therefor;

- Conventional Holidaymakers – If you are going on a classic, 2 weeks in the sun type holiday, then there will be plenty of travel insurance providers more suited to your needs, who can probably cover you cheaper than SafetyWing.

- Travellers Who Need Comprehensive Cover – Note that SafetyWing is a specialised cover but is not comprehensive. For example, trip cancellation cover is not included.

- Adrenaline Junkies – SafetyWing does not cover extreme sports such as white water rafting, running with the bulls or been fired from cannons. If you require this kind of cover, then perhaps consider another provider.

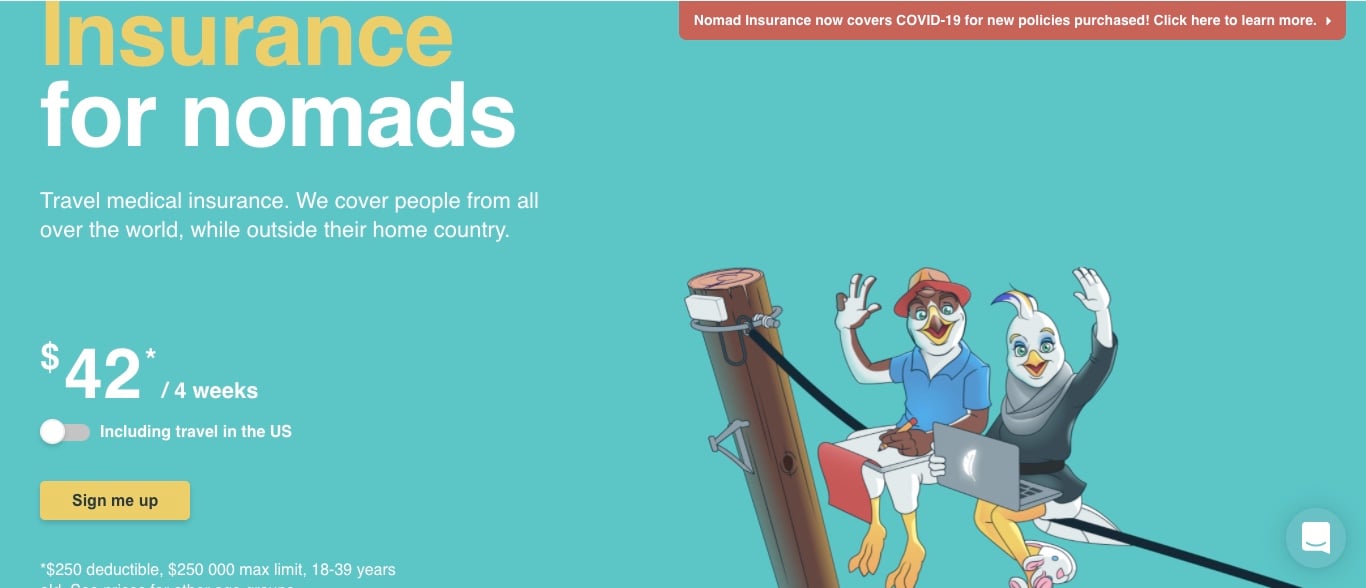

SafetyWing Travel Insurance can cost as little as $42 for 28 days. Compared to some private medical insurance policies, which can cost hundreds of dollars, this is great value. They also offer affordable monthly payment options.

SafetyWing’s monthly premium does vary depending on a number of factors, including the age of the applicant. A higher premium also applies if you intend to go backpacking in the USA (because of the expensive American healthcare system).

Not sure whether SafetyWing Travel Insurance is for you? Perhaps you feel you need a more comprehensive level of cover? Or maybe you are interested in SafetyWing but want to know what else is out there before you make a purchase?

There are loads of other travel insurance providers out there to choose from. In fact, there are possibly too many! In this section, we will take a quick look at some other leading, specialised travel insurance providers who we have also used and had positive experiences with.

World Nomads

World Nomads are by far, one of our favourite travel insurance providers. Like SafetyWing, they also offer backpacker insurance.

The cover levels for medical emergencies and evacuations are broadly speaking, very similar to SafetyWing. However, World Nomads do offer 2 separate plans depending on how much coverage you want and what exactly you intend to do. World Nomads do also include trip cancellation, electronic gadgets, rental car excess, and theft cover in the policies.

Word Nomads can cover over 100 countries. They can also cover a wide range of adventure sports which SafetyWing do not. However, they do not offer Home Country cover and do not offer open-ended cover.

ALWAYS sort out your backpacker insurance before your trip. There’s plenty to choose from in that department, but a good place to start is Safety Wing .

They offer month-to-month payments, no lock-in contracts, and require absolutely no itineraries: that’s the exact kind of insurance long-term travellers and digital nomads need.

SafetyWing is cheap, easy, and admin-free: just sign up lickety-split so you can get back to it!

Click the button below to learn more about SafetyWing’s setup or read our insider review for the full tasty scoop.

World Nomads’ cover appears a bit wider than SafetyWing but is also substantially more expensive. It is perhaps better suited to adventure travellers and more typical backpackers and less suited to Nomads.

For more information about World Nomads – check out our comprehensive World Nomads Review or just visit the site by hitting the button below.

Provided you’re still reading, I guess you have concluded that you do want travel insurance. Good decision. The next question is probably, when should you buy travel insurance?

Ideally, you should buy travel insurance before you start your trip and some providers may even insist on this. Note that if you do ever do make a claim on your travel insurance, they will probably ask for evidence of when your trip started in the form of an airline booking or flight ticket.

As a rule of thumb, I usually book my travel insurance the same day I book my flight. The only exception is if I have long term or annual cover in place at the time.

We hope you never have to claim on your travel insurance and wish you many long, happy, safe adventures. And in order to help you stay safe, we do have some top tips for you.

Firstly to make things far more difficult for potential thieves to take your money, pick yourself up a backpacker security belt to keep your cash safe & hidden on the road. Also, check out our Backpacker Safety 101 post for tips and tricks to stay safe whilst on your backpacking adventure.

For hiding bigger wads of cash, check out this post on ingenious ways to hide your money when travelling.

I strongly recommend travelling with a headlamp whilst backpacking anywhere in the world (every backpacker should have a good headtorch!) to prevent you from falling down a well on a dark night. In case you don’t have a head torch, check out this post for a breakdown of the best value headlamps to take backpacking.

These are some of the most commonly asked questions about SafetyWing that we received from you guys.

Do SafetyWing Insure Electronic Devices?

No. SafetyWing does not cover electronic devices. This is because most Digital Nomads usually have dedicated gadget insurance. If you have expensive electronic devices, I recommend getting decent cover for them.

What Countries Are Covered by SafetyWing?

SafetyWing can cover over 100 countries. They are not able to cover trips to North Korea, Iran or Cuba at all. The kidnap and crisis cover is not available in Iraq, Afghanistan, Somalia, Nigeria, Pakistan & Venezuela or any other country from where they are prohibited due to the US’ Financial Sanctions.

Is SafetyWing the Best Travel Insurance for Digital Nomads?

It is not possible to say which provider or cover is best. However, SafetyWing’s mission is to provide cover for nomads, by nomads. They certainly do provide dedicated, strong cover for Digital Nomads at a great price.

Is SafetyWing the Cheapest Travel Insurance on the Market?

SafetyWing is definitely amongst the cheapest travel insurance providers we have come across.

Whether you are planning to spend a month in Oz or to live in Southeast Asia as a freelancer, it really is a good idea to get yourself some insurance. Life is unpredictable and you never know when illness, accident or bad luck can strike. When it does, there is no worse feeling than being stuck with hefty expenses that could have easily been avoided.

I hope your future backpacking adventures fulfil all over your travel dreams and then some. Hopefully, the day will never ever come when you actually need to claim on your insurance.

But, if that dark day does arrive, SafetyWing travel insurance will help you out and you’ll be glad you made the investment.

A word on Travel Insurance. Please note that Insurance terms and conditions do vary and may change from time to time. The information provided here is for guidance purposes only. We recommend you check with your policy provider to ensure that you are fully covered before beginning your trip. Please read your policy terms and conditions very carefully.

And for transparency’s sake, please know that some of the links in our content are affiliate links . That means that if you book your accommodation, buy your gear, or sort your insurance through our link, we earn a small commission (at no extra cost to you). That said, we only link to the gear we trust and never recommend services we don’t believe are up to scratch. Again, thank you!

Aiden Freeborn

Share or save this post

Hi! We’re putting together a collection of reviews about Safetywing and would appreciate your input. We’re a high authority (Moz DA of 71, ahrefs DR of 62) website and can link back to you with a dofollow link below your review (can be just a few sentences long of unique content, but the more detail the better) if you submit one to us. We have a “submit review” page on our website otherwise you can email it to me. Let me know if you have any questions. Thank you!

We may well be able to provide an honest review of SafetyWing for you! I have contacted you by email.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Notify me of followup comments via e-mail.

Subscribe & get your free guide to going abroad!!

SafetyWing Review: Great Travel and Nomad Insurance for ~$1 A Day

I live for adventure and travel. Along the way I hope for the best, and plenty of luck, but let’s be honest – accidents happen. The best I can do is be prepared so that when something finally does go wrong, handling it is as quick and easy as possible. Maintaining travel insurance, with emergency medical coverage, evacuation coverage, and perks for my trips is the first line of defense against travel mishaps, and something I adamantly recommend. Now, thanks to SafetyWing travel insurance coverage for only ~$1 per day, any traveler can wander with a great safety net, regardless of how tight their budget is.

In this SafetyWing travel insurance review, you’ll discover why every traveler should stay covered while they wander and why SafetyWing is an excellent option I recommend…and use myself to stay safe while adventuring hard. Cheap, reliable, and convenient

Note: This article may contain affiliate links

SafetyWing Travel Insurance Review

- Claims Process

- Customer Support

- Global Availability

SafetyWing is an excellent, budget insurance options for travelers that, only ~$1 per day, offers emergency medical , trip insurances, and the coverages we need to adventure well without breaking the bank. A convenient, recurring subscription model, easy signup, and straight forward claims process makes this a great, affordable travel insurance option for backpackers, budget travelers, and digital nomads wandering the world.

Rating Breakdown:

- Price: 5/5 – Cheaper than most other travel insurance options

- Coverage: 5/5 – Adequate coverage limits for emergency medical, evacuation, baggage, adventures and more

- Claims Process: 3/5 – Easily done via email and processing filled out and scanned forms

- Customer Support: 3/5 – Available 24/7 via email or phone with processing being constantly improved (reputation over the long term is still being assessed)

- Global Availability: 5/5 – Covered issues can be treated at any hospital, with in-network hospitals available for direct payment

User Review

Safetywing travel insurance review: 4.4/5.

SafetyWing is an excellent, budget insurance options for travelers that, only ~$1 per day, offers emergency medical , trip insurances, and the coverages we need to adventure well without breaking the bank. A convenient, recurring subscription model with low monthly payments (~$40), easy signup, and straight forward claims process makes this a great, affordable travel insurance option for backpackers, budget travelers, and digital nomads wandering the world.

CONTENTS OF THIS SAFETYWING REVIEW

Quick safetywing insurance review.

- What is SafetyWing: Travel Insurance for ~$1 Per Day

- Why You Need Travel Insurance (From A Backpacker Who Always Avoided It…)

- What SafetyWing Covers…and What It Doesn’t

- Pros & Cons of SafetyWing

- Price for SafetyWing Travel Insurance

- Who Is SafetyWing Best For: Nomads, Backpackers, and Budget Travelers

- The Quick Bottom Line of this SafetyWing Review

Full Safetywing Review

- How to Signup for SafetyWing

- How to Use SafetyWing (Treatment & Claims)

- The Fine Print

- SafetyWing Reviews from Other Travelers: What Others Are Saying

- SafetyWing vs. World Nomads: Which Is Better for You?

- Other Great Travel Insurance Companies

- SafetyWing FAQ

Traveling adventurously (like everyone should) is inherently risky as it gets better. Whether you’re trekking through the Himalayas, diving through the Philippines, or eating street food in Bangkok, travel insurance is a must to make sure you’re covered during accidents without breaking the bank and disrupting your travels.

Unfortunately, most travel insurance is pricey, and some travelers skip the coverage when they really should get it – ultimately putting their adventure, budget, and life at risk. Until now. SafetyWing is a new travel insurance option that offers emergency medical coverage and a host of other benefits for just $1 a day. In this SafetyWing insurance review, I’ll explain why SafetyWing may (or may not) be great for you, and share some tips for getting the most from your coverage

In my years of traveling, I’ve seen all kinds of accidents, from trekkers getting helicoptered out of the Himilayas due to altitude sickness to a friend having rabies ridden bat fly right into his mouth, and countless stomach bugs requiring antibiotics and antiparasitics. Even worse (and more adventurous), more than 90% of my travelers friends that have been to Southeast Asia have crashed a motorbike.

As travelers and backpackers, regardless of how bulletproof we think we are, there is always the possibility of an accident or medical emergency that costs much more than we anticipated.

This doesn’t mean we should adventure less (we should always go further!) , this just means we should be prepared.

In this SafetyWing review, I’ll share why this budget-friendly travel insurance coverage might be the perfect emergency tool for travelers on tight budgets – protecting you from the inevitable without burning your hard-earned cash, and leaving more spare change for those beachside coconuts to come.

WHAT IS SAFETYWING: TRAVEL INSURANCE FOR NOMADS FOR ~$1 PER DAY

Safetywing is a new, popular option among travel insurance companies for emergency health insurance and travel insurance while wandering abroad.

The coverage is much cheaper than other options, at ~$1 per day, and works based on a subscription model, renewing your travel medical insurance every 30 days until you cancel.

In my experience, the signup process is quick, easy, and simple, all handled online via the SafetyWing website.

SAFETYWING TIPS UP FRONT

- Keep your SafetyWing ID card on you to present at the hospital for insurance verification – bearing your policy number and SafetyWing claims contact info

- Use the “In-Network” hospitals when possible (found in the menu logged in, in the upper right) to allow for direct payment – but know you can go to any hospital

- Beware of what is not covered, like pre existing conditions, or any injuries sustained while intoxicated, reckless, or engaging in an activity without proper protection (think lifeguards and helmets)

WHY YOU NEED TRAVEL INSURANCE: FOR THOSE UNEXPECTED MEDICAL EMERGENCIES

For the first year of traveling, I wandered pretty hard without international health insurance, nomad insurance, or comprehensive health insurance of any kind. Considering my adventures, that was a big risk. I motorbiked through Vietnam and Laos , trekked solo to Everest Base Camp , snorkeled with hammerhead sharks in the Galapagos Islands and ate things I couldn’t pronounce everywhere I went.

Delilah (my motorbike) and I crossing a large river in north Vietnam on one of the best adventures of my life, with travel insurance as my safety net.

My original plan, instead of purchasing coverage from a traveler focused emergency health insurance company, was to save the $100 to $200 per month I would have spent on sufficient coverage and set that aside to spend in the event of an accident. Though this tactic might hold reasonable for a small dog bite or scrape from surfing or a small motorbike spill, generally costing between $50 and a few hundred dollars, I soon learned that the accidents we should aim to cover can not only break the bank, but also put us in debt.

From experience, I observed a friendcrash a motorbike and immediately require $5000 worth of care in the first 24 hours – and that was in Indonesia, a low cost health location. Another friend suffered a liver infection that required a Life flight back to Europe, and the flight alone cost ~$25,000. Even closer to home, I observed a hiker on the Everest Base Camp trek getting an emergency airlift to lower elevation due to altitude sickness and brain swelling, and I later learned the price for that flight on the cheap side is $3,000, with $5,000 to $10,000 being much more possible and likely.

In my 4 years of travel I’ve observed countless close calls of my own – surfing and bouncing off reefs, barely dropping motorcycles down mountains, and near misses with infections and food poisoning. More convincing though is the high number of travelers I’ve seen with much worse situations, from being bitten by rabies ridden dogs, to getting toes and fingers amputated after accidents, to taking very intense spills motorbiking, hiking, and surfing, for which a hospital visit would drain the travel budget very quickly. That is why emergency health insurance is a must for travelers.

Luckily nothing ever went wrong medically for me – but more than 90% of traveler friends have all crashed a motorbike during their Asia travels. One of my friends had to be helicoptered off the Everest Base Camp Trek due to altitude sickness, while another picked up a staph infection on the trek that she was treating for months after the trek. Another friend spent $1000 getting tested to find out which type of parasite she picked up in Bali.

All of these incidents were unexpected and would have been very costly if they hadn’t been covered by one of the good travel insurance companies – which is exactly why you should have some form of emergency medical coverage when adventuring outside of your home country.

THE 4 MAIN REASONS YOU NEED TRAVEL INSURANCE WHENEVER YOU WANDER INTERNATIONALLY

- Your home country health insurance may not cover you while abroad

- Mishaps abroad can cost much more than expected

- Situations requiring life flights, evacuations, and cash payments can equate to life or death situations – having good travel insurance ensures the “life” outcome as much as possible

- Other perks: Delayed flight coverage, delayed and lost bags coverage

YOUR HOME COUNTRY HEALTH INSURANCE MAY NOT COVER YOU WHILE ABROAD

Confirm with your home country’s health insurance provider, but some locations outside of your home country won’t be covered. This can be double the case if higher-risk activities, like surfing or canyoning, aren’t covered but you still want to travel adventurously.

Even more difficult, certain coverages like life flights and evacuation might not be covered. A friend last year died in Bali after a freediving accident wherein he didn’t have the medical coverage to be transported to a country with a more developed healthcare system. If he’d had that insurance, covering emergency medical evacuation, he might be alive today.

If you do have insurance back in your home country confirm that it covers jaunts abroad and to the degree that you need it too, including the adventure sports you have planned and life flights/emergency evacuation. If your primary health insurance in your home country doesn’t explicitly cover your destination and activities, I highly recommend that you buy insurance with a legitimate travel insurance company that includes life flights and emergency evacuations with worldwide coverage for your upcoming adventures

MISHAPS ABROAD CAN COST MUCH MORE THAN EXPECTED

How much do you think a case of the upset stomach could cost you? If you’re most people, just a few dollars for a bottle of Pepto Bismol and a Netflix subscription for an easy night in. Right?

Not so much.

Try $1000 and counting.

A friend just a week ago came down with a case of “Bali Belly” that ran on for a week, requiring two visits to the emergency room and an expensive string of drugs to treat an infection. All of this came out of the blue and with a tab (so far) of over $1000, and that’s on Bali where medical care is a fraction of US and western costs.

Go back one more month and a friend ended up in a late-night motorbike crash in Southeast Asia that left him unconscious, waking up later in the hospital with a couple of “brain bleeds”. After 2 days in the hospital, a $2000 tab, and no travel insurance he had to check himself out with no way to pay additional bills. One week later, friends got word that he conditioned worsened he suffered a stroke because he wasn’t able to stay in the hospital, safely monitored by professionals.

Ultimately, mishaps during travel can happen to anyone (and eventually do) and they usually cost much more than we’d expect – eating through

SITUATIONS REQUIRING LIFE FLIGHTS, EVACUATIONS, AND CASH PAYMENTS CAN EQUATE TO LIFE OR DEATH SITUATIONS – HAVING GOOD TRAVEL INSURANCE ENSURES THE “LIFE” OUTCOME AS MUCH AS POSSIBLE

Whether you’re traveling somewhere that political unrest or violence might be a possibility or you need an emergency flight out of the country for life-saving medical treatment, evacuation is an essential and worthwhile part of any travel insurance policy.

OTHER TRAVEL INSURANCE PERKS: DELAYED FLIGHT COVERAGE, DELAYED AND LOST BAGS COVERAGE

Though I haven’t been broken or bruised to the point of needing medical attention during travel, I’ve had a lot of bad experiences with airlines.

Flying from Nepal to India to Ecuador and the Galapagos islands, my bags were lost for two weeks. A combination of having a good travel-ready and travel hacking friendly credit card and having the right travel insurance made buying the gear I needed to get me through my travels and getting reimbursed later much easier than it otherwise would have been

More recently, some of my surf gear randomly “came up missing” after flights to a country where that surf gear sold for 3x to 4x the price.

Any good travel insurance has coverage for your bags – lost, delayed, or stolen in transit – and this benefit can be quite the lifesaver and headache reliever.

Click here to see a full list of SafetyWing benefits

TRAVEL INSURANCE COVERAGES YOU SHOULD BE SURE TO HAVE

The most likely and costliest mishaps during travel are likely to fall into a few areas (some of which I’ve already mentioned). To ensure you’re getting enough of the right coverage for your trip, ensure your travel insurance policy has the following:

- Emergency medical coverage

- Medical emergency evacuation and life flights

- Evacuation due to civil or political unrest (if you feel its needed)

- Covers your choice of adventure sports

- Lasts for the entire duration of your travels (some are limited to 40 or 60 days)

- Covers motorbike crashes, dog/animal bites

- Applies in all of the countries & destinations on your itinerary (some exclude North Korea, Iran, and Cuba)

WHAT’S COVERED UNDER SAFETYWING TRAVEL INSURANCE

Straight from SafetyWing, “This means that if you get ill or injured, we [SafetyWing] will cover eligible medical expenses.”

SafetyWing Insurance covers both medical and travel mishaps, both are destined to happen at some point during anyone’s travels

- Unexpected illness or injury, including eligible expenses for hospital, doctor or prescription drugs

- Emergency travel-related benefits such as emergency medical evacuation

- Travel delay and lost checked luggage

- Covers you everywhere in the world except Iran, North Korea, and Cuba

- Covers you at home for 30 days of every 90 (15 days of every 90 if you’re from the US)

- Covers most of the adventure sports you’ll want to take on

(Find more in Safetywing’s description of coverages in this SafetyWing Policy PDF )

WHAT ADVENTURE SPORTS DOES SAFETYWING COVER?

- Surfing: Yes

- SCUBA Diving: Yes (As long as you are PADI certified)

- Freediving and Snorkeling: Yes (check fine print at SafetyWing for exclusions)

- Trekking, Camping, and Mountaineering (Up to 4500 Meters): Yes

- Trekking, Camping, and Mountaineering (Above 4500 Meters): No

- Motorbiking (On Road): Yes (with proper safety equipment

- Dirtbiking: No

- Bungee Jumping: Yes

- Mountain Biking: Yes

- Canyoning: Yes

- Rock Climbing and Ice Climbing: Yes

- Running with Bulls: No (It was worth a shot to ask…)

Click here for a full list of covered sports

Note that SafetyWing will not cover you during train courses, like the PADI Open Water Diver course (for SCUBA), the SSI Level 1 Course (for Freediving), or rock climbing/mountaineering courses. However, for these, your instructor and school of choice should provide insurance that covers you during all training at their school. Email your school prior to the course to confirm that they do have the necessary insurance – and if they don’t opt for another school.

Also note that if done for competition or organized sport, these activities are not covered by SafetyWing – so keep that in mind. For more details on SafetyWing coverage, and confirmation that your adventure sport of choice is covered, I recommend contacting SafetyWing directly via chat , via email at [email protected] , or by phone at +1-(800) 605-2282.

Fine Print Notes on Adventure Sports Coverage Straight from SafetyWing:

“You are not covered if the activity is organized athletics involving regular or scheduled practice and/or games, or the activity is performed in a professional capacity or for any wage, reward, or profit.

You must ensure the activity is adequately supervised and that appropriate safety equipment (such as protective headwear, life jackets, etc.) are worn at all times .”

HIGHLIGHT OF SAFETYWING COVERAGES

(Some coverages may be subject to deductibles, all coverages subject to coverage limits)

- Overall Maximum Limit: $250,000

- Hospital Room and Board

- Intensive Care Unit: Up to maximum limit ($250,000)

- Emergency Room Services (subject to $100 deductible)

- Outpatient Physical Therapy: Up to $50 per day

- Emergency Dental: Up to $1000 (no deductible)

- Political Evacuation: $10,000

- Terrorism: $50,000 lifetime benefit

- Emergency Medical Evacuation: $100,000 lifetime maximum

- Trip Interruption: $5,000 (no deductible)

- Lost Luggage: $3,000

- Lost or Stolen Passport/Visa: $100

- Natural Disaster Coverage: $100 per day for 5 days

- Personal Liability: $25,000

Coverage applies everywhere except North Korea, Iran, and Cuba

Click here for a full PDF list of SafetyWing Policy Coverages or

Click here for a quick SafetyWing Travel Insurance Quote

OTHER GREAT BENEFITS OF SAFETYWING

- 24/7 support

- “In-Network” hospital finder, to find hospitals where payment is handled directly with SafetyWing

- Ability to go to any hospital

- Family coverage

BENEFITS OF SAFETYWING OVER OTHER TRAVEL INSURANCE OPTIONS

SafetyWing offers two very solid benefits over any other travel insurance I’ve tried, making it perfect for budget travelers and long term nomads:

- Great Price: Cheaper than most at ~$1

- Convenient Subscription model: Renews every month until canceled, skipping the process of searching and signing up for coverage every few months

GREAT PRICE: CHEAPER THAN MOST TRAVEL INSURANCE AT ~$1

World Nomads is a pretty great travel insurance provider, highly recommended by the travelers I know that have used them. However, World Nomads runs ~$100 per month on average. For the budget traveler, living off of $50 per day, that $100 per month can be a huge hit (literally costing two days per travel each month)

For roughly $1 per day (or ~$35 per month) we travelers can maintain all of the essential coverages (emergency medical, evacuation, baggage coverage during travel).

CONVENIENT SUBSCRIPTION MODEL: RENEWS EVERY MONTH UNTIL CANCELLED

Signing up for SafetyWing works on a convenient subscription basis. Though you can signup for a week or two, I find the auto-billed subscription to be the most convenient way to handle my travel insurance needs. I simply let SafetyWing travel insurance automatically renew each month with my card on file that I’m traveling, and place it on pause during the very brief periods I’m in the US.

Before I’d have to renew every few months for World Nomads, comparing quotes for 30, 60, and 90 day periods, and deciding between the standard vs. explorer option, and also dealing with the break-in coverage. With SafetyWing, I never have to worry about that lapse, those decisions, or the hassle of sitting down and signing up again. I just start my subscription when needed, pause it when I don’t, and restart it when I’m ready to wander again.

Click here to check SafetyWing Rates for Your Upcoming Trip

WHAT’S NOT COVERED UNDER SAFETYWING TRAVEL INSURANCE

- Routine Checkups

- Preexisting Conditions

- Organized athletics and professional sports, regular or scheduled practices, and games (read more here -)

- Find out more in Safetywing’s coverage description PDF

- Theft of electronics and valuables

Click here for More Details of What SafetyWIng Doesn’t Cover

PRICE OF SAFETYWING

SafteyWing covered can be provided for a set period of days or weeks, but can also be requested on a monthly basis for a set rate, billed monthly on a recurring basis until canceled.

MONTHLY COVERAGE

- 10-39 Years Old: $37/mo. | Including US coverage $68/mo.

- 40-49 Years Old: $60 /mo. | Including US coverage $112/mo.

- 50-59 Years Old: $94/mo. | Including US coverage $184/mo.

- 60-69 Years old: $128/mo. | Including US coverage $250 mo.

- Children (Under 9): $0

DAILY COVERAGE

- 10-39 Years Old: $1.25/day | Including US coverage $2.25/day

- 40-49 Years Old: $2 /day | Including US coverage $3.75/day

- 50-59 Years Old: $3.15/day | Including US coverage $6.15/day

- 60-69 Years old: $4.25/day | Including US coverage $8.35/ day

Click here to check SafetyWing Rates for Your Specific Trip

WHO IS SAFETYWING TRAVEL INSURANCE FOR?

Nomads, backpackers, and budget travelers.

If you’re traveling outside of your home country for more than 30 days and you’re budget conscious, SafetyWing is likely right for you.

If your Trip is Longer than 30 Days…

Many credit cards, like Revolut** or Chase Sapphire offer travel insurance benefits that provide all of the coverages we need, however, they usually top out if your trip is longer than 30 days. SafetyWing is good indefinitely

If You’re Not an “Expat”, Staying in One Place and in need of routine care

SafetyWing is great for travelers wandering, but if you’re an ex-pat living outside of your home country for over a year, consider “ex-pat insurance”. Expat insurance, like with IMG Global, covers emergencies and mishaps, but also provides routine medical coverage, for things like annual physicals, checkups, routine dental, and more. Just because we’re wandering doesn’t mean we can ignore the routine stuff, so if you’re abroad long term and need more than “emergency medical”, look into expat insurance

If You’re Adventuring Well but not too hard

SafetyWing offers some great coverage that will likely cover you 99% of the time, but there are some adventurous occasions wherein you might need a more robust policy, if you’re adventuring hard. For instance, high altitude trekking (above 4500 meters), like what you’d do for the Everest Base Camp hike (at 5,380 meters) or Kilimanjaro (at 5,895), would not be covered under SafetyWing.

If you’re adventuring especially hard, I’d instead recommend World Nomad’s Explorer plan for those periods. This is exactly what I did for my Everest Base Camp Trek to ensure I had coverage for a helicopter out in the event that altitude sickness hit.

If your adventures won’t be too heavy, then SafetyWing will provide sufficient coverage for your travels

If you’re budget conscious

Let’s be honest, most backpackers and digital nomads are trying to save as much money as they can, because more money saved equals more time on the road, doing what we love. Travel insurance is an odd expense in that we need it, but we feel like we never use it.

With SafetyWing being nearly 1/3 the cost of other big travel insurance providers while delivering the same coverage in the areas that matter, we balance being responsible with being budget-conscious.

HOW TO SIGNUP FOR SAFETYWING

- Head over to SafetyWing

- Click the “signup” button

- Follow the prompts to register, selecting (or unselecting) US coverage

That’s it. You’ll be covered within minutes

If you’re traveling for a few months, I highly recommend leaving the autopay on so that you’re automatically re-upped each month. I’ve had a couple of times (with World Nomads ) when my coverage lapse while I was away from wifi or too busy to get to a coffee shop and in places where I genuinely needed coverage. Signing up for the autopay and subscription feature helps you stay covered throughout your whole trip.

HOW TO FILE A CLAIM WITH SAFETYWINGS

The claims process and tips to keep things smooth.

- Step 1: Determine If its an emergency. If it is an emergency : Make sure you have your ID card on hand and go to the nearest, legally operating hospital

- Step 2: If it is not an emergency: Attempt to find an “In-Network” hospital – when logged into your account, click on the menu in the top left and click “My Profile >> Find a Hospital” to find an in-network hospital with direct payment

- Step 3: Prepare your insurance ID card: ID card has the policy number and phone number so that the hospital can contact SafetyWing directly to check that insurance is valid and arrange for direct payment at “in-network” hospitals

- Step 4: Ask the provider about payment: If direct billing is possible (between insurer and provider) opt for that

- Step 5: Collect Itemized Receipts: Keep copies of itemized receipts for all expenses, and snap pictures as backups (with your smartphone) as soon as you receive them – you’ll need them for the claims process later

- Step 6: Start Claims process: Email screenshots of original, itemized receipts and a filled out claimant statement ( https://safetywing.com/static/media/hccmis_claimants_statement_safety_wing.c2f4318d.pdf ) to [email protected] and contact via phone to start the claims process

Note that there are no Coverage restrictions, the hospital network suggested simply makes it so that you don’t have to pay upfront for treatment, but you are covered for treatment at any hospital

HOW TO CONTACT SAFETYWING SUPPORT BY PHONE OR EMAIL FOR QUESTIONS

- Email: [email protected]

- Phone Outside the USA: +1 317-262-2132

- Phone Inside the USA: (800) 605-2282

- Worlwide Phone Numbers List: Available in this PDF

Notes: The in-site chat is meant for asking technical questions and providing information before purchasing a policy and is not intended for emergencies or handling claims

Click here for More Details on the SafetyWing Claims Process

HIGHLIGHTS OF THE SAFETYWING FINE PRINT

For coverage to be active and cover the insured individual, sports activities must be adequately supervised and appropriate safety gear is used at all times.

Keep in mind that you’re covered in your home country for a maximum of 15 days of every 90, but consult your policy to confirm the exact number of days based on your home country

SAFETYWING REVIEWS FROM OTHER TRAVELERS

What others are saying about safetywing.

Though SafetyWing’s coverage and pricepoint is perfect for most travelers, and the coverages are great, not all of the SafetyWing reviews (at this point) are 100% positive…yet, simply because the customer service and claims relations process and SafetyWing’s communications (website copy mostly) are still having the bugs worked out.

Despite some negative SafetyWing reviews, I still believe SafetyWing is a great, budget friendly travel tool – as long as you remember to keep your itemized receipts and contact SafetyWing claims and support through the correct channels.