How do travel and tourism distribution channels work?

By Kevin Tjoe — 29 Nov 2021

tourism distribution channels

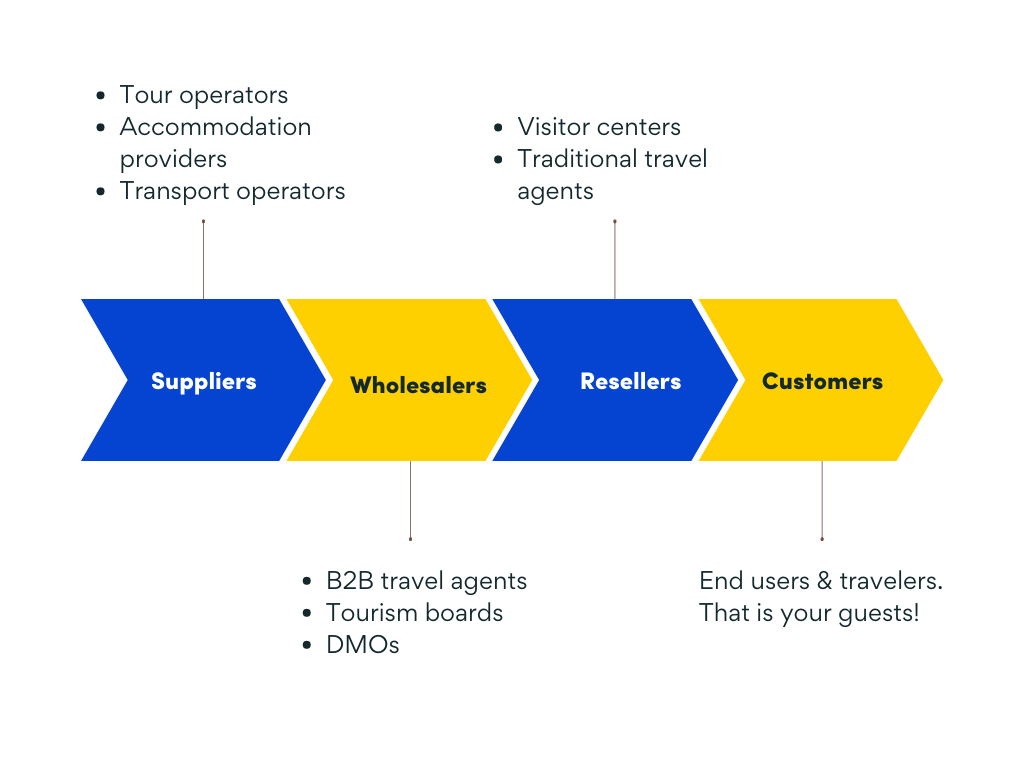

Updated January 2023 – A tourism distribution channel refers to the stakeholders and methods involved in taking a tourism product from the supplier to the consumer. Typically, the chain of distribution in tourism refers to the businesses and platforms involved in selling, distributing, and bundling tourism products. However, more components are involved across the entire distribution chain, including suppliers, wholesalers, resellers, and consumers.

By aligning your business with existing distribution channels, you connect with important stakeholders in the industry. This creates more efficiency in your marketing efforts and ultimately grows your tourism and activity business.

What is a distribution channel?

Tourism distribution channels are the avenues tourism products and services are made accessible to consumers. Typically, tourism products are sold directly by the primary provider or through a series of intermediaries. If brokers or travel wholesalers are involved, this is called indirect distribution. Consumers can access these products via various mediums, including traditional channels such as travel agents, government bodies such as information centers, and even other tour and activity operators .

How it works

While direct bookings may still account for a large part of business, branching out through additional distribution channels can help you to maximize your brand exposure, reduce risk and ultimately boost your bookings. Many distribution channels will have access to much larger marketing spend or broader customer bases. This can provide you with access to more exposure and quality bookings.

Typically speaking you’ll provide your availabilities to them, and they’ll, in turn, bring in bookings at a pre-agreed commission rate.

The chain of distribution

The chain of distribution in tourism refers to the businesses and platforms involved in selling, distributing, and bundling tourism products. This process begins with the primary tour and activity provider all the way to the end consumers experiencing it.

Generally, there are four steps to the distribution chain:

1. Suppliers/principals

2. Wholesales

3. Resellers

4. End consumers

The distribution chain for a particular product can go through all of the steps depending on its distribution channel. For example, direct distribution won’t require wholesalers or resellers, as suppliers sell their products directly to consumers, whereas indirect distribution requires intermediaries.

Suppliers or principals include the primary providers across accommodation, transportation and car hire companies, attractions, and experiences. Examples include hotels, Airbnb hosts, airlines, and the attractions such as the Empire State Building.

Wholesalers

Wholesalers develop packages of travel products for retailers to sell on, though in some cases they may actually sell directly to the consumer. These packages or itineraries might include tours, activities, accommodation, transport, and/or travel insurance.

Wholesalers can include:

- Destination Management Organisations (DMOs) or inbound tour operators, such as government tourism boards or tourism authorities

- Global Distribution Systems (GDSs), are used by retailers such as OTAs to easily see an inventory of availability from tourism operators.

Resellers purchase and bundle experiences to be sold directly to the consumer. A common example includes traditional travel agents, which create personalized travel packages. However, online travel agents (OTAs) such as Expedia and Tripadvisor are more commonly used these days. They provide accessibility to a range of tourism products such as airline tickets, hotel bookings, tours and activities, and more.

Consumers are the most critical component of the distribution chain. That is because they are the end user of the product. The choices and decisions consumers make have a huge impact on the rest of the distribution chain. Trends in consumer behavior, or individual decisions all influence how tourism products are marketed and sold.

Advantages of tourism distribution channels

Broadening your distribution channels involve heaps of advantages. Here are the top five:

Connectivity

By aligning your tour and activity business with the broader industry, you can connect with important stakeholders across every step of the tourism distribution chain. Forming strategic partnerships with resellers and tourism platforms enables you to access a broader customer base. This provides you with a greater opportunity to increase your sales.

Generating 100% of your revenue via direct marketing requires a great deal of investment in time and money. Existing distribution channels generally have larger marketing budgets that they can spend to attract more customers.

Typically, as the supplier, you’d only pay a fee when a booking has been made via their channel – making your marketing and sales costs predictable. This means you gain additional resources to expend on other areas of your business, such as improving your customer experience.

Flexibility

Given the wide array of potential partners, you have the freedom and flexibility to test and experiment with different methods of promoting your business. Plus, it’s more convenient for your customers to book your services through an array of trusted partners. This helps to increase customer loyalty and satisfaction.

Transparency

Utilizing existing distribution channels can make the entire booking process more transparent for both you and the end consumer. On the tour operator side, it provides you with a clearer understanding of your customer behavior and adjusts your marketing strategies for better outcomes. And on the customer side, information such as reviews displayed on your profile allows them to create informed decisions before choosing to book your services.

Accessibility

Promoting your tourism products via numerous distribution channels means that your customers can book your services where they like; when they like. Furthermore, your products and services will be found across multiple avenues – enabling a wider array of customers to book with you. In fact, operators are using an average of 14 distribution channels according to Arival’s Operator Insights 2021-2022 report.

What are the main types of tourism distribution channels?

There are many ways to get in front of customers, even more so since the rise of digital channels. From travel agents to mobile apps, tourism suppliers have never had more choices regarding promoting their products and services. There are four main distribution channel types. These include:

Traditional channels

Traditional distribution channels often refer to real-world marketing channels separate from online and mobile experiences. Indirect traditional distribution channels can include travel distribution services such as travel agents, tourism information centers, flyers and print/ digital brochures , promotional marketing services, and tour operators . Depending on your products and services, wholesalers can also make up part of your business’ traditional distribution channel.

Online channels

In recent years, online travel agencies (OTAs) have dominated the tourism industry. These online experiences allow users to plan, book, and pay for personalized travel plans through an easy-to-use centralized platform. Often flights, hotel bookings, car hire , and local experiences can be bundled and purchased through a single site, making the process convenient and intuitive. These platforms can also be cheaper due to the relatively low cost of maintaining a website over a brick-and-mortar travel agency.

Mobile channels

Like online channels, mobile distribution channels rely on digital platforms, such as apps, to promote and sell tourism products. Many popular mobile apps which centralize the tourism buying experience have cropped up in recent years. In addition, airlines, hotels, and other major suppliers have begun developing apps to improve customer loyalty and engagement. Other forms of mobile marketing can include SMS marketing, mobile advertising, and cold calling.

Direct channels

Direct marketing and sales channels include anything your business has direct control over and does not involve an intermediary. This type of marketing can occur through traditional, online, and mobile mediums. For example, direct online channels can include your website, direct bookings via a booking system, online chat assistance, and your social media accounts.

While direct marketing efforts via mobile can consist of sending promotional text messages to previous customers, cold calling potential customers, and sending personalized email marketing messages . More traditional measures may include brochures and flyers, a storefront, and salespeople.

Choosing the right tourism distribution channels

As a tour company, it’s essential to understand which distribution channels will achieve the most significant results for your business. While trial and error can bring results over the long run, understanding what makes a channel right for your business can accelerate your path to success.

Identify target market

To understand whether online or offline marketing, direct or indirect distribution, or mobile versus online platforms are best for your business, you need to understand your customers.

Demographics such as age, country of origin, the number of travelers in a party, and the number of children arriving can greatly impact how you communicate and effectively sell your services. For example, an older demographic may be more likely to use traditional channels such as a travel agent, while a young family might be found via online and social media . First, check over your previous customers and try to pull out any obvious trends amongst your clientele, then research which channels best suit your audience.

Research channels

It’s important to research which channels are available to promote your services. But also, it’s essential to understand the reputation of your potential strategic partners. When engaging in indirect marketing, you are aligning your brand with your distributors, so choosing platforms and businesses which align with your values is important. It’s also essential to understand the costs and benefits of each channel and make informed decisions based on what will work for your business.

Evaluate costs and benefits

Each platform and distribution channel will have different pricing models. Some may charge a flat fee for promotional services, others may purchase and resell your services, while others may charge a fee when you receive a booking. It’s essential to understand what level of return you can expect. If you are starting out, finding performance-based pricing options will allow you to pay as you go. Alternatively, flat fee services can sometimes provide a higher return as your budget can go directly to marketing spend.

Track performance

Once you choose one or more channels to distribute your services, ensure you track the performance versus how much it costs to attain them. By understanding the performance of your partnership, it enables you to eliminate ineffective channels and double down on your marketing efforts, thus, cutting you costs.

How can you manage all distribution channels easily?

It can take a lot of time to form and manage strategic partnerships with multiple resellers. Luckily, technology is here to help. A channel manager such as Rezdy Channel Manager can be accessed regardless of your booking system or size of business, and makes it simple to negotiate agreements, manage inventory, rates and manage commissions with a vast range of resellers, from local visitor centers to the big-name OTAs. Live availability of your tours, activities or attractions are visible from one dashboard, dropping the risk of pesky double bookings as well.

You can access the broadest reach of resellers in the industry, connect with desired resellers and easily distribute rates and availability in real-time. Rezdy is integrated with a number of alternative reservation systems and is continuously adding more, providing suppliers access to channel management tools, directly from their existing system. Suppliers with a custom built booking system can connect with Rezdy Channel Manager as well. For Rezdy booking software customers, channel management is included.

Find out more about how Rezdy’s channel management platform can support your business .

Ready to join the thousands of Rezdy customers that managed to grow their bookings by over 25% in 2022? Book a free channel manager demo with a product specialist to see how our products can fit the needs of your tour business. If you are interested in Rezdy’s booking software that includes channel management, you can start a free 21-day trail trial.

If you enjoyed this article, be sure to sign up to receive the Rezdy newsletter , a valuable resource for those who want to stay up-to-date on the latest industry happenings.

Want to know more about reseller commission rates? Read our guide to industry standard commission rates

Broaden your distribution channels with Rezdy

Enjoy 21 days to take a look around and see if we are a good fit for your business.

No obligations, no catches, no limits, nada

Distribution

eBook: Guide to growing your tourism business through distribution & channel management tools

How to navigate API connections with resellers

Case Study: Wendella Tours & Cruises

See how Cvent can solve your biggest event challenges. Watch a 30-minute demo.

The Complete Guide to Hotel Distribution Channels

Your hotel has a number of options when it comes to distribution. You can receive direct bookings through your website or the phone, advertise on online travel agency (OTA) booking sites, and utilize a plethora of other channels to grow your business. But to maximize your hotel’s revenue , it’s of vital importance to use a mixture of channels that meet the needs of your target market(s).

Below, we cover a handful of the most popular hotel distribution channels, as well as strategies and examples for taking advantage of those channels.

What is a hotel distribution channel?

At its highest level, a hotel distribution channel is anywhere — online or offline — that properties can sell rooms to potential customers. Examples of hotel distribution channels include hotel websites , online travel agencies (OTAs), global distribution systems (GDS), metasearch sites, direct phone bookings, and more.

How to build a hotel distribution channel strategy:

Your hotel's distribution strategy is a plan for booking rooms at a profit using a variety of channels. The right strategy for you will take into account your pricing, target audience, location, marketing resources , and more.

To create the right strategy for your hotel, you should consider a few key things:

- Determine your business objectives. The goal of most hotel distribution strategies is to increase visibility with your ideal guests, thereby increasing bookings. Make sure that your distribution strategy aligns with your sales objectives and target metrics.

- Find your target audience. Your brand is likely to appeal to certain demographics and types of customers and be less appealing to others. Your distribution strategy should take your audience into consideration so that your visibility is greatest for your target market. Some channels, like phone reservations, will appeal primarily to an older audience, for example, while channels like direct social media bookings may be more appealing for a younger audience.

- Compare key metrics across channels. After you determine which metrics are important to your hotel based on your goals and objectives, you’ll want to compare those across your distribution channels. Some channels will offer more visibility than others, but may also have higher costs or slimmer margins. The right strategy will find a mix of visibility, profitability, and optimized brand messaging.

- Test and optimize over time. Your disitribution strategy should not be static. You should continuously test new channels, optimize existing ones, and make sure that your core channels are delivering profitable results.

Popular types of hotel distribution channels:

1. direct website bookings.

If you’re like most hotels, your website is probably the primary source for direct bookings. Direct bookings are often more profitable, more likely to result in repeat visits, and better optimized for upselling. Because of this, most hotels consider their website as the No. 1 distribution channel in their distribution strategy.

Your website offers many opportunities to highlight your unique amenities, show off your property with high-quality imagery , and boost engagement with videos, interactive content, and testimonials.

In order to increase hotel direct bookings , make sure that the mobile version of your website is optimized for simple and speedy bookings. Many guests are now researching and booking hotels on mobile devices without ever opening a desktop browser, so you definitely don't want to miss out on that business.

You’ll also want to make sure that your website is optimized for search engines and includes location-specific terms to increase discoverability. Clear navigation, responsive design, and a seamless booking experience will all increase the chances that guests choose this valuable hotel distribution channel.

Target more qualified business today

2. Direct phone bookings

Some target audience demographics, such as older adults, travel agents, and event planners, may find direct phone bookings to be the most useful way to get in touch with your hotel. This is especially true if the potential customers have specific questions related to their stay, or if their booking is complicated in some way.

Your call center, reservation line, and front desk are all channels that offer an opportunity for human connection and tailored customer service. Make sure that your staff are trained to take a booking, even if the guest calls the front desk.

This distribution channel is often low-cost because it is a direct line of communication with your guests . You can also get valuable feedback from this channel, since you’ll be able to hear why a guest made a booking (or why they chose not to book).

3. Online travel agencies (OTAs)

There is no getting around it: Online travel agencies are a ubiquitous and integral part of the hotel booking process. Sites like Priceline, Expedia, Booking.com, and Orbitz have huge audiences and are a great way to reach guests that you might not otherwise have reached.

You don’t have complete control over the messaging about your hotel on an OTA, but you can optimize your listing with photos, highlight certain amenities, and offer attractive pricing for OTA audiences. You should focus on OTAs that your target audience uses and understands in order to keep your costs down.

Learn more about how to increase hotel direct bookings

4. Global distribution systems

Global distribution systems (GDS) are an important distribution channel for connecting with travel agents. Travel agents use this system to browse hotels, view rates, and check availability. Well-known global distribution systems include Amadeus , Worldspan , Sabre , and Travelport .

Global distribution systems are helpful for keeping your information up-to-date with travel agent systems all around the world, as well as providing real-time pricing and availability information. To take full advantage of this channel, set your pricing at levels that will remain competitive against similar properties but high enough that you can overcome the GDS fees.

5. Metasearch sites

One level above an OTA is the metasearch engine. These sites, such as Tripadvisor , Trivago , and Google Hotels , charge hotels and OTAs on either a pay-per-click or commission basis for bookings.

The user experience on metasearch sites is usually particularly good, with a simple booking process and easily-searchable information about your hotel.

Here are a few ways you can maximize your bookings from metasearch:

- Make sure that your pricing in search engines matches the price listed on your website.

- Test your cost-per-click (CPC) to balance your costs and your competitiveness with OTAs.

- Adjust your strategy for the metasearch site that you’re targeting. Some sites will attract visitors with less booking intent, and should therefore have lower CPCs in order to be an efficient distribution channel.

6. Wholesalers

Wholesalers serve as an important link between travel agents and travel suppliers. Although profit margins may be thin for this channel, it's a helpful way to fill last-minute space at your hotel or book large blocks of rooms. Although this channel is important to increase occupancy , it should not be one of your primary distribution channels.

Technology you can use to manage your hotel's channels:

1. channel management tools.

A channel manager is a tool that helps you manage your distribution strategy, keeping track of all of your channels and providing useful performance insights. These tools are very helpful for keeping everything in one place and making sure all of your information is up-to-date.

2. Reputation management tools

Reputation management tools help you monitor online channels for mentions of your hotel and respond to guest feedback in a timely manner. This may not seem related to distribution, but if guests are leaving negative feedback on your most popular channel, you’ll want to respond to it right away to make sure that channel stays strong for your business.

3. Revenue management tools

Your revenue management system helps you to plan and forecast demand for your rooms through peak periods, slow periods, and everything in between. It’s also a great tool for determining the right price bands on each of your hotel distribution channels. By analyzing your pricing, expenses, and profit across multiple channels, you’ll have a better idea of which channels are driving the most profitable outcomes for your hotel.

Put this hotel distribution channel guide to use today!

Up next, check out nine proven strategies to help increase hotel occupancy .

Laura Fredericks

Laura brings a decade of insight to improving marketing, as she has worked in technology since 2010. She has experience starting and scaling a business, driving customer marketing, and speaking at live events, including WeDC Fest 2018. She founded Describli and Paradigm Labs, and currently works with companies to improve their customer relationship management and content strategy.

LinkedIn | Website

More Reading

The discovery of a lifetime – atlantis bahamas, how to market to corporate event planners, what is a hotel business plan, and why you need one.

Subscribe to our newsletter

- Hospitality Industry

The future of hotel distribution channels: Seizing opportunity in channel disruption

April 03, 2024 •

10 min reading

The hotel distribution channel landscape is undergoing a seismic shift. Online travel agencies (OTAs) that once leveled the playing field for independent properties now dominate, their economic muscle squeezing hotel margins. Metasearch engines commoditize the search experience, making standalone properties indistinguishable. Meanwhile, the growth in alternative lodging threatens hotels' grip on the accommodations sector.

Yet within this disruption lies opportunity for savvy hoteliers. Emergent technologies now enable hotels to tailor the guest experience as never before. Strategic partnerships build localized affinity. Targeted social media expands reach. As we'll explore here, taking an imaginative, omni-channel approach to distribution can transform a threat into an opportunity to acquire customers at a fair cost .

We'll look at:

- The forces disrupting hotel distribution

- Key technologies shaping guest acquisition

- Lower-cost booking channels

- Strategies for localized marketing

- Social media distribution opportunities

- The role of personalized pricing

- Streamlining the booking process

- Optimizing channel management

- Building a distribution technology stack

The tsunami hitting hotel distribution creates openings for hotels willing to ride the wave. By adopting an integrated, imaginative channel approach, hoteliers can thrive amid industry turbulence.

The evolving hotel distribution landscape

Firstly, for those who are not familiar with the term, hotel distribution strategy refers to a plan of action for selling rooms profitably through a variety of channels. Get the full hotel distribution strategy definition here .

Hotel distribution resembles a game of musical chairs, with global mega brands and major OTAs claiming seats of power while smaller properties scramble for leverage. Three interconnected forces—the ascent of OTAs, meta search domination, and alternative lodging—have upended traditional distribution:

The OTA oligarchy

The early promise of OTAs to democratize discovery has given way to an oligarchy controlling guest access. Online travel agencies now account for over 35% of hotel bookings globally. Giant OTAs like Booking.com and Expedia have raised the table stakes so high that boutique hotels struggle to compete:

- Booking.com lists over 28 million listings across hotels, homes, and other properties.

- The Expedia Group owns 400+ booking sites spanning 75 countries.

- Airbnb offers over 6 million alternative lodging options worldwide.

Wielding unmatched reach and budgets, mega OTAs influence every stage of trip planning and booking. Flight aggregators like Kayak funnel airline shoppers to integrated hotel booking options. Sites like Tripadvisor siphon organic search traffic while earning commissions through hotel referrals.

The cost of distribution via OTAs keeps rising. OTA commissions that once ranged from 15-20% now reach 30% or higher. Recent finds hotels paying up to 40% commission when accounting for volume discounts.

With commissions devouring hotel margins, direct bookings emerge as an urgent priority. Tools like integrated loyalty programs can shift bookings from OTA channels while lowering guest acquisition costs.

The Commoditization of Search and Discovery Meta search engines like Tripadvisor, Trivago and Google Hotel Ads have conditioned guests to filter primarily by quantitative metrics like star rating, guest rating, and nightly price during hotel evaluation. By reducing differentiation to sortable criteria, the meta-search boom commoditizes hotel discovery and accelerates price transparency.

While vital for visibility, meta-search marketing costs keep rising even as click-through rates decline. Research by Kalibri Labs finds meta-search producing over 30% of site traffic for some hotels but driving under 20% of bookings.

With high volumes of low-intent traffic, meta-search efficiency suffers. Still, with over 40% of online bookings touching a meta site at some point, hotels can hardly abandon the channel. Creating differentiated meta landing pages through unique descriptions and imagery becomes critical for rising above rate comparisons.

Here are more hospitality industry statistics and trends to help you recalibrate .

Competition from alternative lodging

The spectacular rise of Airbnb has inspired a Cambrian explosion of alternative lodging platforms. Airbnb now claims listings in nearly every country worldwide, its 6+ million global listings far exceeding major hotel chains. Vrbo, a key Expedia holding, manages another 2 million vacation rental listings. Other alternative stay platforms serve rapidly expanding niches:

- Outsite - Coliving rentals for remote workers

- Zeus Living - Furnished corporate rentals

- Hipcamp - Campground and glamping sites

While extended stay rentals compete most directly with urban hotels, unique alternative properties also threaten to siphon leisure and business demand. As the chart below shows, Airbnb has gained significant market share across global cities.

Hotel rates prove highly elastic in markets with low barriers to entry for short-term rentals. A 2022 study by STR and AirDNA analyzed over 8 million Airbnb listings across 10 key markets, finding:

- New York: 10K+ new entire-home Airbnb listings resulted in a -4% change in hotel occupancy and -7% fall in ADR

- Los Angeles: 6K+ new entire-home listings led to -11% occupancy drop and -12% ADR decline

These impacts underscore the need for integrated hotel distribution covering both transient and group/extended booking channels.

Seeds of opportunity in channel disruption

Yet for all the challenges in distribution, immense possibility exists for hotels that take an imaginative omnichannel approach. While OTAs will remain a significant channel at least in the near term, technologies that optimize conversion across the guest journey enable hotels to gradually shift share. After years of steadily rising customer acquisition costs, lower cost, and higher intent booking avenues emerge.

We group these opportune channels into four key categories:

- Emergent booking technologies streamlining hotel websites and powering personalized engagement

- Strategic partnerships forging localized bonds

Targeted social media marketing connecting with relevant audiences

- Optimized channel management dynamically driving demand across platforms

Now let's explore key strategies and technologies hotels can deploy within each avenue to sustain growth amid industry disruption.

Future-proofing hotel distribution: Key technologies and strategies

1. streamline conversion with emergent booking technologies.

Travelers visit 38 websites on average before making a hotel booking. With guests demanding seamless booking, website conversion optimization becomes mission-critical.

Integrating key technologies creates frictionless purchase pathways while enabling personalized guest interactions. Mobile responsiveness also proves vital—55% of hotel website visitors now access from mobile devices.

Here we'll look at five technologies delivering outsized ROI through higher online conversion:

CMS personalization

A/b & multivariate testing.

- Mobile Optimization

Merchandising analytics

Drag-and-drop CMS platforms like WordPress and Webflow incorporate built-in personalization based on factors like:

- Geolocation - surface location-relevant offers

- Referrer data - tailor messaging for OTA traffic

- Search terms - respond with relevant landing pages

- Returning visitor status - create loyalty incentives

A/B testing compares different versions of web pages to determine which option better converts site visitors. Multivariate testing builds on this by changing multiple page elements at once.

For example, testing could pit a 15% off offer against a discounted extra night. Or feature hero images showcasing different hotel amenities. Testing across devices also proves critical—calls-to-action that pop on desktop may fail on mobile.

AI-powered chatbots enable 24/7 assistance via instant messaging apps, SMS, smart speakers, and websites. Guests value immediacy - 73% expect a response within 5 minutes of reaching out online. Chatbots deliver sub-minute answers at all hours using Natural Language Processing (NLP), reducing reliance on call centers.

Integrations with property management systems equip bots to handle common inquiries without human assistance:

- Questions on reservations, rates, inventory

- Requests for amenity delivery, maintenance issues

- Recommendations for local attractions, dining

Mobile optimization

With over half of hotel website traffic now mobile, ensuring flawless mobile conversion becomes imperative. Core elements include:

- Responsive web design (RWD) enabling dynamic resizing across devices

- Accelerated load speeds through size reduction

- One-click calls-to-action removing friction from bookings

- Native app integration bridging mobile commerce

Travel metasearch firm Trivago reported bookings made within 24 hours of searching rising 6X higher via mobile apps compared to desktop. Ensuring mobile seamlessness earns the direct bookings that determine hotel profitability.

Merchandising analytics guide online promotional strategy using reams of hotel data. Key insights uncovered relate to:

- Booking lead times - set early bird offers aligned with behavior

- Length of stay - promote add-on nights to match patterns

- Pages viewed prior to booking - feature these amenities prominently

- Which images drive more bookings

- Seasonal demand trends

With intense competition across booking channels, ensuring seamless, personalized conversion on hotel websites gives operators their best opportunity to secure direct bookings. Mastering the above technologies builds tremendous advantage.

2. Strategic partnerships

While cost efficiencies drive hotel distribution strategy, forging genuine bonds with local partners also expands market reach. As chains encroach on independent properties, cultivating community affinity becomes vital for building brand love.

We'll look at two potent approaches here—industry collaborations and experiential partnerships:

Strategic industry collaborations

Partnering with proximate organizations expands visibility dramatically when co-marketing opportunities. Researchers find mere proximity creates perception of affinity among brands. Events also drive powerful exposure.

For example, a hotel adjoining a major university can collaborate on lodging promotions tied to family weekend, graduation, or homecoming. These build awareness while establishing the property as part of campus life.

The Montage hotel in Beverly Hills, California partners with nearby luxury retailers like Gucci to co-host experience-driven shopping weekends. These encourage extended guest stays while associating the Montage brand with exclusive luxury goods.

Proven examples highlight the power of location-based collaborations to elevate smaller brands. Savvy independent owners actively seek such opportunities.

Experiential partnerships

Immersive travel gains ground, with travelers increasingly seeking transformation. Hotels catering to this market by partnering with practitioners of emerging modalities create deep guest connections.

Examples include:

- Hosting rotating resident artists from local galleries

- Featuring teachers of adjacent yoga or spin studios

- Promoting neighboring surf schools or SUP clubs

These informal affiliations bring elevated visibility and prestige to niche hotels while capturing business from another brand's existing customer base.

Location-based partnerships enable smaller hotels to punch above their weight in competitive markets. Identifying win-win promotional opportunities with local organizations earns the authenticity and prestige chain hotels struggle to manufacture.

Discover more on how building industry partnerships is a win-win situation .

3. Targeted social media marketing

Hotel social marketing historically relied on shotgun-style campaigns broadcasting to the ether. Today precision targeting distributed across emerging platforms enables truly personalized guest connections.

We'll break down current best practices into three areas:

Community building on NextGen networks

Success on recently launched networks like Reddit, TikTok and Snap depends on community integration. Reddit in particular proves hospitable for travel brands attracting valuable long-form commentary. Hotels organically build affinity by:

- Being helpful first rather than promotional

- Commenting knowledgably on local threads

- Creating Reddit AMAs allowing candid brand Q&A

- Sponsoring geo-targeted posts to niche groups

This community caretaking earns credibility driving significant website referrals. Hotel marketers actively nurture subreddits aligned with positioning like family travel or pet-friendly properties.

On TikTok, Snapchat and Instagram Reels, viral travel moments resonate. User-generated hotel highlight reels outperform corporate accounts. Hashtags expanding reach include #hotelsoftheworld and #luxuryhotel.

Pay-Per-Stay ads on Facebook

Sponsored travel posts on Facebook, Instagram and Messenger enable pay-per-booking hotel promotions. Dynamic ads adjust display based on past user actions, serving highly targeted offers:

- Viewed a specific hotel page - display a special offer

- Searched rival property - cross-sell better experience

Location parameters also trigger contextual messages on travelers' arrival to a hotel's metro area. Facebook's expert planner tool designs the optimal sequential ads for moving guests along the booking funnel.

Given Facebook's unrivaled targeting capabilities, pay-per-stay emerges as the lower-cost performance marketing option, now extended to Instagram Stories and Messenger.

YouTube masthead ads

YouTube video ads enable lavish storytelling unconfined by character limits. YouTube also offers the Masthead and Video Discovery ad series across devices:

- Masthead = Top video banner ad earning 30 billion+ impressions annually

- Video Discovery - Skippable YouTube sidebar units

Travel publishers generate billions of YouTube views annually. Conversion rates are favorable across many industries, for hospitality brands investing in YouTube it might be particularly rewarding as the content lends itself so well to video format.

Sponsored videos allow elaboration beyond soundbites to share full property stories. With YouTube charging only when viewers opt-in past skippable ads, hotels gain affordable access to the world's second-largest search platform.

In an echo chamber marketplace, social platforms finally enable genuine traveler connections, their broadcasting reach now matched by targeting precision. Hotels marrying data intelligence to creative content development can nurture meaningful guest relationships across channels.

4. Optimized channel management

With hotels paying over 30% commission for OTAs bookings, direct reservations produce 10-20% higher revenue. Still OTAs deliver over one third of hotel website traffic, which often leads to over-dependancy on them to fill rooms but with a hefty price tag.

This leaves savvy hoteliers asking—how to tap OTAs' vast reach while maximizing profit. A data-led distribution strategy provides the path. We examine two key prongs:

Dynamic rate variation

Varying room rates across booking channels maximizes revenue and optimizes channel cost. Dynamic pricing platforms like Integrated Channel Management enable rate variability by responding to factors like:

- Channel cost differential - higher margins for direct bookings

- Competitive conditions - parity for brand presence

- Period demand - higher OTA rates during peak seasons

- Length of Stay - add-on incentive for longer stays

Machine learning drives nightly rate optimization channel-by-channel. Brand consistency stays protected by limiting lower-bound differentials. The outcome? Expanded booking channels without margin erosion.

Channel attribution analytics

As visitors visit more booking sites, quantifying actual conversion sources grows impossible without analytics. Multi-touch attribution (MTA) modeling attributes bookings algorithmically based on weighted visitor interactions.

For example, analysis may find 60% of bookings originate from paid search, yet final lead sources are:

- 15% Google Hotel Ads

- 35% TripAdvisor clicks

- 20% metasearch referral sites

- 30% direct and other channels

This nuanced understanding ensures precise media budget allocation to highest ROI channels. Top hotel marketers use attribution intel to optimize annual channel spend.

An intelligent ratio of OTA bookings to direct reservations optimizes distribution at the highest possible margins. Weighing dynamic pricing precision against real-time channel analytics unlocks this advantage.

The future of hotel distribution

Rather than retreat amid the rising OTA oligarchy, hotels now counter by getting smarter and faster. As audiences fracture further, forging community bonds builds loyalty. Cloud platforms unlock the potential for personalization at scale. Blockchain-verified customer data enables flawless service anticipation.

While the face of hospitality distribution changes almost daily, the imperatives for hotels remain constant - curate unique experiences to develop devoted guests. Commitment to authenticity still proves the surest path to prosperity.

The opportunities illuminated here only hint at possibilities, now it's over to you to leverage the hotel distribution channels that make sense for your hotel and hotel chain.

Consultant at EHL Advisory Services

Founder of Creative Supply & Visiting Lecturer at EHL

Keep reading

The future of luxury experiences: Where luxury meets hospitality

Apr 09, 2024

The potential of green financing for hotel real estate in Asia

Apr 04, 2024

Apr 03, 2024

This is a title

This is a text

More on Hotel Strategies

- Bachelor Degree in Hospitality

- Pre-University Courses

- Master’s Degrees & MBA Programs

- Executive Education

- Online Courses

- Swiss Professional Diplomas

- Culinary Certificates & Courses

- Fees & Scholarships

- Bachelor in Hospitality Admissions

- EHL Campus Lausanne

- EHL Campus (Singapore)

- EHL Campus Passugg

- Host an Event at EHL

- Contact our program advisors

- Join our Open Days

- Meet EHL Representatives Worldwide

- Chat with our students

- Why Study Hospitality?

- Careers in Hospitality

- Awards & Rankings

- EHL Network of Excellence

- Career Development Resources

- EHL Hospitality Business School

- Route de Berne 301 1000 Lausanne 25 Switzerland

- Accreditations & Memberships

- Privacy Policy

- Legal Terms

© 2024 EHL Holding SA, Switzerland. All rights reserved.

NEXT-LEVEL INSIGHTS

Deepen your knowledge of profitability management and empower your team.

- Press & Events

- Total Guide

- Distribution

- August 22, 2023

Strategies for Managing Distribution Channels in the Hospitality Industry

How to optimize your distribution channels and maximize revenu, optimizing online presence, in the fast-paced world of the hospitality industry, managing distribution channels has become a paramount concern for businesses seeking to expand their reach and maximize revenue. with a multitude of platforms available, from online travel agencies (otas) to direct bookings, a strategic approach is crucial. in this article, we delve into two essential aspects of effective distribution channel management: the optimization of online presence through diverse channels and the integration of data-driven insights to refine distribution strategies..

The hospitality industry thrives on the seamless flow of services and experiences to its customers. One critical aspect of ensuring this smooth operation is the effective management of distribution channels. Distribution channels play a pivotal role in connecting hospitality businesses with their target audiences, making them a key determinant of success in the industry. In this blog post, we’ll explore essential strategies for managing distribution channels in the hospitality sector.

Embrace a Multi-Channel Approach

Gone are the days when hotels and resorts relied solely on a single distribution channel. To reach a diverse customer base, it’s crucial to embrace a multi-channel approach. Utilize online travel agencies (OTAs), direct bookings through your website, global distribution systems (GDS), and even social media platforms to extend your reach. By diversifying your distribution channels, you reduce the risk of relying heavily on one channel and increase your visibility in various markets.

Implement a Channel Management System

Channel management systems are powerful tools that allow you to control room rates, inventory, and availability across multiple distribution channels from a single platform. These systems streamline the process of updating information in real-time, ensuring consistency and accuracy across all channels. This prevents overbooking, reduces manual errors, and provides a more seamless experience for both guests and staff.

Focus on Direct Bookings

While third-party distribution channels are beneficial, direct bookings should still be a priority. Encourage customers to book directly through your website by offering exclusive perks such as room upgrades, discounts, or loyalty program benefits. Direct bookings not only save on commission fees but also strengthen your brand-customer relationship, enabling you to gather valuable guest data for personalized marketing strategies.

Leverage Data Analytics

In today’s digital age, data is a goldmine of insights. Utilize data analytics to understand customer preferences, booking patterns, and channel performance. Analyzing this data helps you identify which distribution channels yield the highest returns and which require optimization. With these insights, you can allocate resources more effectively and tailor your marketing efforts to specific customer segments.

Maintain Price Parity

Price consistency across all distribution channels is crucial to building trust with customers and partners. If a potential guest finds a lower rate on an OTA compared to your hotel’s website, it can damage your reputation and customer relationships. Employ a dynamic pricing strategy that adjusts rates based on market demand, but always ensure price parity to avoid confusion and maintain credibility.

Build Strong Partnerships

Collaboration with distribution partners is key to achieving mutual success. Develop strong relationships with OTAs, travel agents, and other intermediaries. Regular communication and collaboration can lead to more favorable terms, better exposure, and increased business. By working together, you can create win-win scenarios that benefit both your property and your distribution partners.

Invest in Technology and Integration

Modern technology plays a pivotal role in managing distribution channels efficiently. Ensure that your property management system (PMS) integrates seamlessly with various distribution platforms. This integration minimizes manual data entry, reduces errors, and allows for real-time updates. Investing in user-friendly and efficient technology empowers your staff to manage distribution channels more effectively.

Stay Agile and Adaptable

The hospitality industry is dynamic, influenced by changing market trends, seasons, and global events. To successfully manage distribution channels, you must remain agile and adaptable. Regularly assess your distribution strategy’s performance and make necessary adjustments based on market shifts and guest preferences. Being responsive to changes ensures your distribution channels remain aligned with your business goals.

Train Your Staff

Behind every successful distribution strategy is a well-trained team. Ensure your staff understands the importance of distribution channels, how they work, and how to navigate various platforms. This knowledge empowers them to assist guests with booking inquiries, resolve issues promptly, and maintain consistency in customer experiences.

In conclusion, effective distribution channel management is a cornerstone of success in the hospitality industry. By embracing a multi-channel approach, utilizing technology, leveraging data analytics, and building strong partnerships, you can optimize your distribution strategy for maximum reach and profitability. Remember that agility, adaptability, and a customer-centric focus are essential to staying ahead in an ever-evolving industry. Through these strategies, you’ll be well-equipped to navigate the complexities of distribution channels and offer exceptional experiences to your guests.

Unlock your potential

Speak with one of our dedicated hotel experts and get started on your journey to sustainable profitability.

BEONx will only use your personal information to manage your account and provide the products and services you requested from us. Occasionally, we would like to contact you regarding our products and services, as well as other content that may be of interest to you. If you agree to receive communication from us for this purpose, please check the box below to indicate how you would like us to communicate with you:

You can unsubscribe from these communications at any time. For more information, please review our Privacy Policy.

“Beonprice has not only helped us in a technological way, but also in a human way. The support and understanding of the people who make up Beonprice, especially during the difficult times we have gone through in recent years, has been exceptional. The team is remarkable.” –

Pedro Pavón, Revenue

Management Director at Casual Hoteles.

Other Articles

© 2024. BEONx. All rights reserved

- Privacy Policy

- Cookies Policy

- Terms & Conditions

Exp.: 08/22/SA/0012 . Línea 2022 Expansión internacional de Pymes. Expansión internacional de las PYMES de la Comunidad de Castilla y León Objetivo: “Conseguir un tejido empresarial más competitivo” Actuación subvencionada: Participación en la feria FITUR (Madrid, Enero 2023)

Exp.: 03/18/SA/0022 Línea: Fomento de la innovación en Pymes Proyectos de innovación en en ámbito tecnológico de las Pymes Descripción del proyecto: Diagnóstico de ciberseguridad y seguridad IT de la plataforma SAAS de Beonx

Exp.: 07/18/SA/0015. Línea: Desarrollo de la Industria TIC Proyectos de desarrollo de las TIC en Pymes Descripción del proyecto: Smart Hotel Distribution for General Purpose: Nueva solución de Revenue Management System para la optimización de la distribución en la venta de habitaciones de hotel.

What are the main types of tourism distribution channels?

The travel and tourism chain of distribution

Variations in the chain of distribution, what is a tourism distribution channel.

For the owners and employees of travel businesses, it’s important to have a good understanding of the distribution channels available to you. The digital revolution means there is a wide choice of online channels today. But do not forget your strategic partnerships and offline channels too. To avoid spending unnecessary time and money, you need to know which channels do the best job of getting your travel products in front of your target audience.

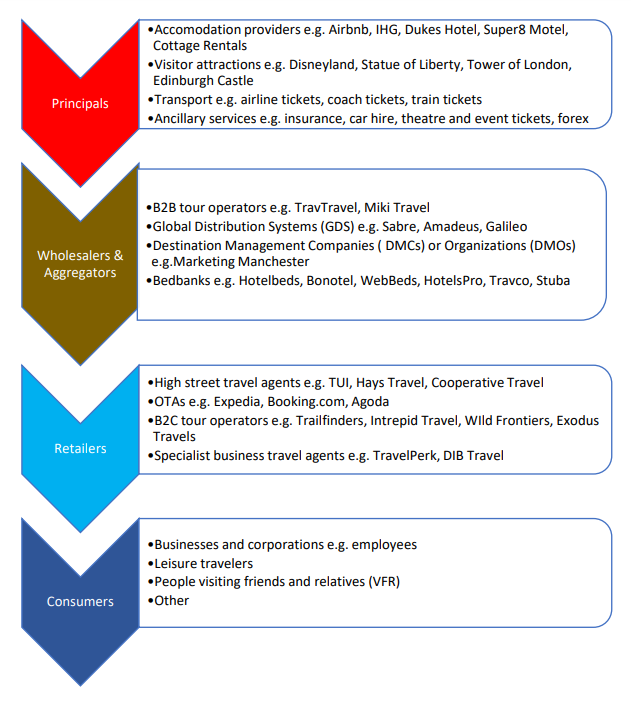

But before we look at the various sales and marketing avenues at your disposal, we need to focus on the chain of distribution first. In order to maximize opportunities and efficiencies, it’s essential to understand the chain of distribution and where your company is positioned within the chain.

Generally speaking, there are four key stages within the chain of distribution . These are: principals, wholesalers & aggregators, retailers, and consumers (see chart 1).

Chart 1: The Travel and Tourism Chain of Distribution

The principals are the separate components of a travel product. For example, a leisure traveler buys a three-night stay in Paris that includes flights, accommodation, entrance to the Louvre and the Eiffel Tower, with other ancillary services such as travel insurance and foreign exchange thrown in too. In this case, each of the principals could have been sold separately. Instead, they were bundled together by a travel business and sold as a mini-break promotion.

Wholesalers & aggregators

Tour operators take various components of the travel experience and create a travel product which is then traditionally sold by a travel agent.

At the wholesaler stage in the distribution chain, the tour operator is providing a business-to-business (B2B) service by selling the product to a travel agent who then sells it to the consumer (a B2C service). They have their tour operator business plan which they follow to provide the best options to other travel-related businesses.

A global distribution system (GDS) is a computer system that holds records of availability from airlines, hotels, and car hire. Retailers such as OTAs and B2C travel agents are able to directly access this inventory.

As the oldest type of distributor in the travel industry, GDS are predominantly involved in the sale of air tickets rather than accommodation.

Destination Management Companies (DMCs) or Destination Management Organizations (DMOs) often contract travel products and sell on packages and itineraries relevant to their destination to a tour operator.

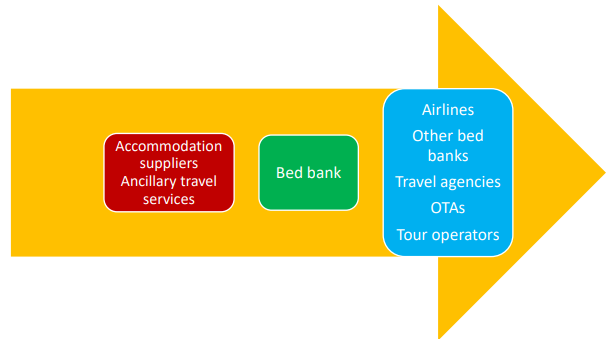

A bed bank is a B2B company that buys rooms from hotel groups and other accommodation providers in bulk at discounted and fixed prices for specific dates.

Some bed banks might also sell ancillary services such as tickets to visitor attractions or car hire.

Bed banks are middlemen, or intermediaries, between hotel companies and retailers. They might sell on their discounted bulk accommodation products to airlines, other bed banks, travel agents, OTAs or tour operators (see Chart 2). Chart 2: Bed Bank Distribution Chain

Retailers and consumers

Retailers are the organizations that sell the travel products directly to the consumer. These include traditional travel agents with a physical store in the high street such as TUI, Hays, and Cooperative Travel in the UK, for example. Other travel retailers are found online and include OTAs, B2C tour operators, and travel agents that specialize in business travel. Consumers are the end-users who buy the travel products or services. The main types of consumers are business travelers, leisure tourists (either domestic or international) and people who are visiting friends or relatives.

Chart 1 identifies the four key stages in the chain of distribution, although this process can vary and be more direct or indirect. For instance, a leisure traveler booking accommodation directly from a hotel website means there is only one stage in the chain. A bed bank that sells to another bed bank, results in five stages in the chain.

The wholesaler and retailer stages may be carried out by the same company . This is known as vertical integration , which happens when two or more organizations at different stages in the supply chain merge.

It is fairly common for tour operators and travel agents to buy each other. After all, the role of tour operators in sustainable tourism is quite significant. When mergers occur at the same level in the distribution chain, this is called horizontal integration . The original brand names are often retained, so consumers may not be aware that booking.com, KAYAK, Agoda and priceline, for instance, are all owned by one company: Booking Holdings. Digitalization and corporate mergers have resulted in plenty of crossover and consolidation in the travel and tourism distribution system.

As a B2C travel agent or tour operator, distribution channels represent the various ways to sell or market your product. You need to have a multi-channel presence to maximize your sales opportunities and brand presence, and to reduce your risk. There is specialized tour operator software that can help you manage this workload more efficiently. At the same time, depending on the size of your business and the resources you have available, it could be an error to spread yourself too thinly over too many channels.

Choosing the best distribution channels for your business needs to be done with care and attention.

Generally speaking, we can divide distribution into three main categories: online channels, strategic partnerships and offline channels (see Chart 3).

Chart 3 Travel & Tourism Distribution Channels

Online channels

As a tour operator or travel agent, the overriding benefit of optimizing your own website is that you pay no commission on direct bookings and have full control over how consumers interact with your brand.

Being listed on Google My Business is essential today. Google is the default destination for most consumers to gather information of any kind. Your listing will come up in Google searches and on Google Maps and registering is free.

Online travel marketplaces like Bookmundi and Viator have large audiences. Most are free to join but take a significant amount of sales commission, so monitor performance carefully.

Select one or two and keep your profile and listings current. The same goes for review sites such as Tripadvisor and TrustPilot . Only concentrating your energies on one or two review sites is a sensible strategy.

Channel managers, such as HRS , provide a service that sources hotel accommodation for corporate clients from a wide variety of OTAs instead of the client having to go directly to each separate OTA.

Similarly, instead of having individual accounts with OTAs, many hotel companies – big and small – will use channel management technology.

Omnibees , for example, allows hoteliers to sell to end-users and intermediaries through a single platform connected to the hotel’s property management system. Such solutions can automate sales and reduce the amount of commission paid by hotels.

Strategic partnerships

Working with other travel agents or tour operators is a great way to increase your sales. Working directly with Destination Marketing Organizations (DMO) will allow travelers to book with you directly when you advertise on the DMO website.

Building a relationship with travel bloggers will help get your name out there, as will close involvement with trade bodies associations.

To attract more bookings made directly on your website , a ffiliate digital marketing services are an option .

Offline channels

It would be a mistake to overlook offline distribution channels. The worldwide web may give you global reach, but cross-selling partnerships with local businesses such as stores, restaurants, cafes and hotels can turn out to be extremely valuable distribution channels.

Visitor information centers can be useful too because many tourists do not book tours and activities until they are in the destination.

Attending trade shows and industry events can be costly, especially for small businesses, but the resulting contacts and sales leads are often invaluable.

Subscribe to our newsletter

Yay you are now subscribed to our newsletter.

Cristóbal Reali, VP of Global Sales at Mize, with over 20 years of experience, has led high-performance teams in major companies in the tourism industry, as well as in the public sector. He has successfully undertaken ventures, including a DMO and technology transformation consulting. In his role at Mize, he stands out not only for his analytical and strategic ability but also for effective leadership. He speaks English, Spanish, Portuguese, and Italian. He holds a degree in Economics from UBA, complementing his professional training at Harvard Business School Online.

Mize is the leading hotel booking optimization solution in the world. With over 170 partners using our fintech products, Mize creates new extra profit for the hotel booking industry using its fully automated proprietary technology and has generated hundreds of millions of dollars in revenue across its suite of products for its partners. Mize was founded in 2016 with its headquarters in Tel Aviv and offices worldwide.

Related Posts

List of 32 travel agency management groups

6 min. Whether you are thinking of moving into the travel industry or you already own a business in this sector, the concept of travel agency management groups is a task worthy of analysis and study. Defining an effective business model for your retail travel agency is one of the key factors in optimizing sales […]

Ultimate Guide to Understanding the Benefits of a Travel Management Company

12 min. Managing and operating modern businesses often encompasses corporate travel. However, managing business travel is complex, especially with limited experience and resources. You must ensure that everything goes smoothly for the travelers while staying on top of the logistics and expenses. That’s why many organizations decide to outsource their travel management to a dependable […]

The Essentials About the Inventory System Used by Travel Agencies

11 min. While travel agencies have to overcome many challenges to remain competitive, there is one challenge in particular that all agencies need to overcome despite their size or target market. They need to excel as intermediaries between tour operators or travel product suppliers and consumers or travelers. The real question is, how do they […]

To read this content please select one of the options below:

Please note you do not have access to teaching notes, tourism distribution channels.

Knowledge Transfer to and within Tourism

ISBN : 978-1-78714-406-4 , eISBN : 978-1-78714-405-7

Publication date: 7 July 2017

This chapter presents a summary of the presentations and the discussions concerning electronic distribution channels in tourism and hospitality held at the 2015 t-Forum. Both academics and practitioners examined the present situation and elaborated on the problems and possible ways to overcome them. The main topics that emerged were distribution channels and their best use and optimization, interoperability between the many different technological systems, the need for a standardized representation of data and transactions, and the role of the Internet and Web as source of information useful for market analysis and product planning. Finally, the importance and the necessity of a more intense collaboration among all the stakeholders and between academic researchers and the industry was emphasized.

- Distribution channels

- Interoperability

- Collaboration and cooperation

Colombo, E. and Baggio, R. (2017), "Tourism Distribution Channels", Knowledge Transfer to and within Tourism ( Bridging Tourism Theory and Practice, Vol. 8 ), Emerald Publishing Limited, Leeds, pp. 289-301. https://doi.org/10.1108/S2042-144320170000008016

Emerald Publishing Limited

Copyright © 2017 Emerald Publishing Limited

We’re listening — tell us what you think

Something didn’t work….

Report bugs here

All feedback is valuable

Please share your general feedback

Join us on our journey

Platform update page.

Visit emeraldpublishing.com/platformupdate to discover the latest news and updates

Questions & More Information

Answers to the most commonly asked questions here

Distribution channel in hospitality and tourism

Purpose – The purpose of this paper is to reexamine several issues about disintermediation from the perspectives of tourism product/service suppliers (hotels) and traditional intermediaries (travel agencies), considering the move of the current distribution landscape toward disintermediation. Internet and mobile technologies offer various tools for consumers to search and purchase products/services from suppliers directly. Consequently, the necessity and role of traditional intermediaries in the industry become questionable. Design/methodology/approach – In all, six focus group interviews were conducted to collect primary data from ten managers of three traditional travel agencies and 11 managers from three business hotels in Hong Kong, which is a major travel destination in Asia with many world-class hotels and tourism facilities. Findings – Despite their different business backgrounds, the interviewees agreed on the increasing importance of Internet technology in the distribution of tourism products. The interviewees also posited that traditional travel agencies are still needed to serve certain customer groups, albeit their role may have little importance. Practical implications – Practitioners should adapt to technologically induced changes to remain competitive in the e-business era. Originality/value – This paper provides several original contributions. First, this paper supplements the extant literature by revealing how modern practitioners perceive disintermediation in the tourism and hospitality industry. Second, this paper is the first to investigate the disintermediation issue from the perspectives of tourism product/service suppliers and intermediaries. Finally, this paper provides a reference for industry practitioners to establish adequate strategies that take advantage of Internet technology.

- Related Documents

Mobile technologies and applications towards smart tourism – state of the art

Purpose The popularity of mobile technologies and applications is constantly growing and undoubtedly changing consumers’ and providers’ behavior. The purpose of this study is to provide a comprehensive systematic literature review of academic research related to mobile technologies and applications in smart tourism published between 2012 and June 2017. Design/methodology/approach Published peer-reviewed articles were gathered from the three largest and most popular online databases and search engines – EBSCO host, Science Direct and Google Scholar and ENTER conference proceedings. Based on a keyword-driven search and content analysis, 126 articles were determined to be relevant to this study. Findings Selected publications were analyzed in accordance with the proposed research questions and thematically classified into three main categories: consumer perspective, technological perspective and provider perspective. The findings contribute to a better overall understanding of recent research into mobile technologies and applications in smart tourism by presenting the main results, methods, trends and other insights of relevant publications. Research limitations/implications Although the researchers used two databases, one search engine and ENTER conference proceedings to collect articles, there is the possibility that some studies connected to the topic were not included. The study did not include books, other conference proceedings, literature reviews, theses, business reports and other possibly relevant publications. Originality/value This study provides a systematic review of the most recent published academic research (2012-June 2017; also including “Online First” articles) on mobile technologies and applications in smart tourism. The results of this study provide an agenda for future research in tourism and hospitality industry by identifying major trends and developments in smart tourism.

Exploring customers’ attitudes to the adoption of robots in tourism and hospitality

Purpose This study aims to explore the factors affecting customers’ attitudes to the adoption of robots in hotels and travel agencies. Design/methodology/approach Structural equation modelling was used to test the extended technology acceptance model based on data collected from 570 customers of hotels and travel agencies. Findings The findings revealed that hotel customers have more positive attitudes to service robots than their peers in travel agencies. Originality/value This research contributes to the literature on robots in tourism and responds to the call to investigate customers’ attitudes to the adoption of robots in developing countries.

Examining effectiveness of online and offline channel integration

Purpose Channel conflicts between initial providers (IPs) and independent middlemen (IMM) can hinder the market penetration of IPs, especially for small- and medium-sized enterprises with low brand awareness. Design/methodology/approach A case study is used to describe the introduction of an agent-friendly graphic user interface (AFGUI) as a compromise for the basic needs of the IP and IMM, both for the successful market entry of IPs and to encourage the IMM to accept original brand manufacturing (OBM), which can maximize the benefits of IPs after a successful product/service launch. Findings This case study shows that the AFGUI significantly contributes to increasing the IMM’s OBM selection. Comparing the “before AFGUI introduction” group to the group of IMMs who have been SeaHerb’s – a manufacturer of brown seaweed extract – IMM for fewer than three years shows that the latter group’s OBM selection can positively affect the order amount. Originality/value The AFGUI can integrate traditional offline distribution channel systems into online distribution systems. Regarding the AFGUI’s functional effectiveness for preventing fake sellers and fake products, further research on its adoption by online platform providers (e.g. Amazon and eBay) is recommended.

Big data and analytics in tourism and hospitality: opportunities and risks

Purpose The purpose of this paper is to examine and provide insights into one of the most influential technologies impacting the tourism and hospitality industry over the next five years, i.e. big data and analytics. It reflects on both opportunities and risks that such technological advances create for both consumers and tourism organisations, highlighting the importance of data governance and processes for effective and ethical data management in both tourism and hospitality. Design/methodology/approach This paper is based on a review of academic and industry literature and access to trends data and information from a series of academic and industry databases and reports to examine how big data and analytics shape the future of the industry and the associated risks and opportunities. Findings This paper identifies and examines key opportunities and risks posed by the rising technological trend of big data and analytics in tourism and hospitality. While big data is generally regarded as beneficial to tourism and hospitality organisations, there are extensively held ethical, privacy and security concerns about it. Therefore, the paper is making the case for more research on data governance and data ethics in tourism and hospitality and posits that to successfully use data for competitive advantage, tourism and hospitality organisations need to solely expand compliance-based data governance frameworks to frameworks that include more effective privacy and ethics data solutions. Originality/value This paper provides useful insights into the use of big data and analytics for both researchers and practitioners and offers new perspectives on the debate on data governance and ethical data management in both tourism and hospitality. Because forecasts from the UNWTO indicate a significant increase in international tourist arrivals (1.8 billion tourist arrivals by 2030), the ways tourism and hospitality organisations manage customers’ data become important.

Co-creation of a food marketing offer by final purchasers in the context of their lifestyles

PurposeThis article is theoretical and empirical in nature. Its purpose is to determine whether a lifestyle resulting from a particular personality type is significant for elements of a food marketing offer, which final purchasers would like to co-create with offerors.Design/methodology/approachA cognitive-critical analysis of the world literature on the subject was used to prepare the theoretical section. The results of the analysis indicate a cognitive and research gap in analyzing the above aspects. In order to reduce the gap, empirical studies were conducted in which a questionnaire was used to gather primary data. The data were subjected to quantitative analysis using statistical analysis including exploratory factor analysis, Pearson chi-square independence test, V-Cramer coefficient analysis, Kruskal–Wallis test and cluster analysis.FindingsThe results of the statistical analysis allowed three research hypotheses to be verified. It was found that there is dependence between respondents' lifestyles and elements of a marketing offer which they would like to co-create with offerors. It was also found that a lifestyle is a feature differentiating both material and non-material elements of a marketing offer which respondents would like to co-create with offerors. Such dependence was identified for, respectively, a material product, service and brand, regardless of whether these considered a company or a product. Thus, research hypotheses were proved to be valid for respondents.Research limitations/implicationsThe results obtained from the research have a cognitive and applicability value. They contribute to the theory, including marketing and customer behavior. They can also facilitate the shaping of good mutual relationships between offerors and final purchasers as important partners cooperating in the process of creating marketing values.Originality/valueThe originality of the approach presented is confirmed by the fact that until now elements of a marketing offer which purchasers would like to co-create with offerors have not been analyzed in the context of a lifestyle either in theory or in practice.

Unraveling the fuzzy predictors of stress at work

Purpose This study aims to identify and rank the significant determinants of stress among tourism and hospitality employees. Design/methodology/approach A mixed-method approach is used to identify and rank workplace stressors. Particularly, the synthesis of relative literature and interview with the panel of experts resulted in the preliminary identification of workplace stressors. Underpinned by fuzzy theory, in addition, the fuzzy analytical hierarchy process is used to rank identified criteria and relative sub-criteria. Findings Results of three-wave investigation lead to an index comprising key components and weighted ranking of workplace stressors in the tourism and hospitality industry with job characteristics as the most important criteria and mental demand as the most salient sub-criteria influencing stress at work. Research limitations/implications The pattern of findings enhances the current knowledge regarding significant workplace stressors in the tourism and hospitality industry. Practical implications Compositional framework and the weight-based ranking of identified components may act as a source of strategic solution for managers to reduce and manage stress among employees. Originality/value Workplace stressors have attracted considerable research attention, however, no general consensus yet exists among scholars and practitioners conferring to the key composition and relative importance of workplace stressors.

Employees’ evaluative repertoires of tourism and hospitality jobs

Purpose This paper aims to examine employees’ evaluative repertoires of tourism and hospitality jobs and segments them based on a set of job attribute preferences. Understanding the social–cultural underpinnings of employees’ job preferences is vital if employers are to overcome the challenging task of finding and retaining talented employees in the tourism and hospitality industry. Design/methodology/approach A discrete-choice experiment with waiters, barkeepers, cooks and front-desk employees working in the Tyrolean tourism industry was conducted. Employees were categorized into distinct segments using a hierarchical Bayesian analysis and a cluster analysis. Findings Results show that flexible working hours and the ability to balance professional and private aspirations are the most important job attributes for employees. Overall, the evaluative repertoires of the “green” and “domestic (family)” conventions are most prevalent. Research limitations/implications This study contributes to literature on talent management by providing insights into employees’ evaluations of jobs and their evaluative repertoires embedded in the broader social–cultural context. Practical implications Industry representatives and employers can adapt their recruiting and retention strategies based on employees’ job preferences. Social implications Adapting job attributes according to employees’ evaluative repertoires helps to ensure the long-term sustainability of the industry workforce. Originality/value Applying the Economics of Convention (EC) perspective, combining organizational job attributes and socially embedded evaluative repertoires provides a new approach to analysing and understanding employees’ job preferences.

COVID-19: potential effects on Chinese citizens’ lifestyle and travel