The Best Working Holiday Travel Insurance for Australians

Matt graham.

- 9 March 2024

- Preparing to Move Overseas

When applying for a working holiday visa , most countries require you to have adequate travel insurance covering your entire stay. In fact, your visa application may be rejected if you don’t have a suitable insurance policy.

Even if it’s not mandatory for your working holiday visa, getting the right travel insurance is still extremely important! That’s because it will protect you if something goes wrong during your trip. It doesn’t just cover medical costs, but many other unexpected events that can happen when you’re travelling as well.

There are lots of companies that sell travel insurance to Australians. But it can be difficult to find one that meets both your own needs and the visa requirements for a working holiday.

If you’re travelling to Europe, your travel insurance may also need to include minimum coverage for certain things like repatriation costs.

This comprehensive guide explains everything you need to know about long-term travel insurance for Australian backpackers. This includes policies that meet the special requirements for European working holiday visa applications.

Just want the TL;DR version?

You’ll find a list of travel insurance options suitable for Australians on a working holiday towards the end of this article .

But if you have the time, we’d recommend reading this guide in full as there are lots of important things to consider before buying travel insurance!

Single-trip policies don’t let you visit home during your working holiday year

Most policies have a maximum validity of 12 months, annual multi-trip policies aren’t suitable for long-term trips or living overseas, some insurance won’t cover you while working overseas, insurance requirements may differ between countries, southern cross travel insurance, axa schengen travel insurance, insureandgo backpackers insurance (not currently available), just want a cheap option, list of other travel insurance options, other resources to help you plan your working holiday, frequently asked questions (faqs), things backpackers should consider when choosing travel insurance.

Of course, your travel insurance policy doesn’t just need to meet the visa requirements. It also needs to work for you!

Make sure you read the Product Disclosure Statement (PDS) carefully to ensure your policy covers all of the places you’ll be visiting and the types of activities you’ll be doing. For example, if you’ll be doing lots of skiing, make sure you choose a policy that covers snow sports. Some insurers only offer coverage for snow sports if you purchase this as an add-on.

If you have any pre-existing medical conditions, you should also check whether your insurer covers these.

Tip: PDS documents can be long and confusing to read! When looking for specific information in a travel insurance PDS, search for keywords such as “repatriation”, “COVID” or “sport” to easily find the section that you’re looking for.

Complimentary credit card travel insurance is not generally considered acceptable for working holiday visa applications.

If you’re not sure whether your visa application will be successful, keep in mind that some insurance policies have a “cooling-off” period of between 2-4 weeks. This lets you cancel your policy for a full refund if you change your mind within the cooling-off period. This is only possible if you haven’t yet started your trip.

Here are some other common problems that backpackers may encounter when purchasing a long-term travel insurance policy…

Most single-trip travel insurance policies cover a single return journey from Australia.

The coverage usually ends the moment you return home to Australia, even if there are still many months left to run on your policy. This could cause problems if you plan to return to Australia for a short, temporary visit during your gap year .

There is generally an exception if the reason you need to return home mid-trip is the sudden illness or death of a relative. In this case, many policies will allow you to resume your trip and continue to cover you while outside Australia. The insurance may even pay for your trip back to Australia. But this doesn’t include planned holidays or family visits.

Workaround: If this affects you, consider purchasing a backpacker insurance policy that specifically allows you to return to Australia for one or more short visits. Fast Cover also lets you return to Australia mid-trip without automatically ending your insurance coverage.

Most travel insurers only offer coverage for a maximum single-trip length of 12 months. A small number of insurers, such as Travel Insurance Direct, won’t even let you choose a policy end date more than a year after the date of purchase. This could be a problem if you plan to be away for more than a year.

Workaround: Freely lets you buy travel insurance for trips lasting up to 18 months, and Southern Cross Travel Insurance lets you buy a two-year policy if you have a working holiday visa for Canada, USA or UK.

Several other insurers will also let you extend your initial policy for up to an additional year for an extra fee.

If you plan to travel a bit more after your working holiday ends, but before returning to Australia, you may also consider purchasing a separate one-way travel insurance policy that commences outside of Australia. This would cover the period from when your working holiday finishes until your arrival back into Australia.

As an alternative to a single-trip policy, most travel insurers offer annual multi-trip insurance. This covers multiple return trips from Australia, but only up to a certain trip length. They’ll also only cover you for a maximum total amount of time spent outside Australia during a given year.

Beware: For this reason, annual multi-trip policies are generally unsuitable for working holidays.

Most travel insurance offers some level of coverage in case something happens while you are working overseas, such as during a working holiday. But there are exceptions as standard single and multi-trip travel insurance policies are generally designed for people going overseas for a holiday or short business trip.

Insurers that do cover overseas work may have exclusions for certain types of jobs that involve manual labour or are considered high-risk. These include occupations such as firefighting or working with animals. If this applies to you, check the PDS before purchasing your insurance.

Workaround: Some travel insurers offer specialist backpacker or “working overseas” policies that cover overseas work, including Southern Cross Travel Insurance.

If your Australian travel insurance doesn’t cover this, you may also consider getting local health insurance in the country where you are working. (In some countries such as Germany or the Netherlands, this may even be legally required.)

Extra travel insurance requirements for Europe

If you’re applying for a working holiday visa in a Schengen country such as Germany , Greece or Poland , there may also be specific requirements about what your travel insurance must cover.

Most Schengen Area countries have similar minimum travel insurance requirements for Type-D Schengen visa applicants. This includes working holiday visa and Work & Holiday visa applicants.

When applying for a working holiday visa in Europe , your travel insurance would typically need to provide at least €30,000 worth of coverage for all of the following:

- Emergency medical/hospitalisation expenses

- Medical evacuation costs (i.e. the cost of flying you back to Australia for hospital treatment)

- Repatriation costs (i.e. the cost of transporting your mortal remains back to Australia if you die)

At the current exchange rate, €30,000 is roughly equivalent to AUD50,000. This amount varies as the EUR/AUD exchange rate fluctuates.

Many travel insurance policies offer cover for the repatriation of mortal remains, but for less than the required amount. So, pay extra attention to this!

Your insurance must be valid in all Schengen member states and be valid for the entire length of your trip . This means that if you apply for a 12-month visa but your travel insurance is only valid for 9 months, your working holiday visa may only be approved for 9 months.

Some countries, such as Germany, will also check that your health insurance covers pandemics such as COVID-19.

As part of your working holiday visa application, you may need to provide evidence that you hold travel insurance that meets this minimum criteria. That may include providing your certificate of insurance, and showing excerpts from the Product Disclosure Statement (PDS) which clearly state the level of coverage for the items listed above.

If your insurance doesn’t meet the minimum standards required by the country you’re travelling to, your visa application could be rejected . So, it’s really important to check the rules and your travel insurance policy carefully!

Visa conditions may differ between European countries. So, you should always confirm the requirements set by the specific country where you’re applying for your working holiday visa.

Countries that have reciprocal health care agreements with Australia , such as Belgium, Sweden and Norway, may have more lenient travel insurance requirements for Australian working holiday visa applicants. But this isn’t necessarily the case for all countries with a reciprocal Medicare agreement. You may still need to get travel insurance in order to get your visa.

Recommended travel insurance for backpackers

As you can see, selecting a suitable backpacker travel insurance policy can be a bit of a minefield!

To help you out, here are a few travel insurance options that may be suitable for Australians on different types of working holidays…

Freely offers affordable and flexible long-term travel insurance to Australians heading overseas for up to 18 months. That’s six months longer than the maximum period most other Australian insurers will cover! This makes Freely travel insurance ideal if you’re planning a full-year working holiday with a bit of extra travel between leaving and returning to Australia.

Although Freely normally provides up to $20,000 of cover if you die while overseas, there is an exception for people holding a valid Schengen Visa such as a working holiday visa in a Schengen member country. This makes it a suitable travel insurance option for working holidays in Europe.

This is the exact wording from the Freely PDS regarding cover for repatriation costs:

We will pay reasonable overseas funeral or cremation expenses or the cost of returning your remains to Australia if: a) you die during the period of insurance . In either event the maximum amount we will pay in total will not exceed $20,000; or b) you hold a valid Schengen Visa and you die in a Schengen Member state during the period of insurance . In either event the maximum amount we will pay in total will not exceed 30,000EUR for expenses incurred in that Schengen Member state.

Freely also lets you extend your trip by changing your return date in the App. And you can pay for Daily Boosts to do things like skiing or motorcycling – you pay-per-day, as needed.

Plus, there’s a 21-day cooling-off period. You can get a full refund if you change your mind within 3 weeks of buying the policy and haven’t yet started your trip or made a claim.

Here are some key facts about Freely travel insurance:

- Underwriter: Zurich

- Cover for emergency medical expenses including evacuation: Unlimited

- Cover for repatriation of mortal remains: $20,000 or €30,000 with a valid Schengen visa

- Maximum policy length: 18 months

- Coverage ends as soon as you return to Australia? Yes

Fast Cover is currently one of the only travel insurers in Australia that will let you return home to Australia for any reason while you’re still insured for your trip, and won’t automatically terminate the rest of your cover.

This is what the Fast Cover PDS says in the “Period of Insurance” section. The following excerpt applies to all Fast Cover travel insurance policies:

If you return home early for any reason, cover from your policy will be suspended from the time you return to your home until the time you leave your home to continue your trip. You must have 14 days remaining of the period of insurance as noted on your Certificate of Insurance. Following the resumption of your trip your policy will remain valid until the end date shown on your Certificate of Insurance or your permanent return home, whichever comes first. We will not pay any costs in relation to your return to Australia unless the costs are covered by this policy.

Although the maximum policy length you can purchase is for one year, Fast Cover provides the option to extend your insurance up to a travel period of 2 years.

Unfortunately, all of Fast Cover’s international travel insurance policies have a sub-limit of $20,000 for “bringing your remains back to your home in Australia”. This does not meet the Schengen visa requirements.

Fast Cover also offers a 25-day money-back guarantee.

Here are some key facts about Fast Cover travel insurance:

- Underwriter: Lloyd’s

- Cover for repatriation of mortal remains: $20,000

- Maximum policy length: 12 months (can extend for a total trip length of up to 24 months)

- Coverage ends as soon as you return to Australia? Not necessarily

Southern Cross Travel Insurance (SCTI) offers a dedicated “Working Overseas” travel insurance policy designed for Australian expats and backpackers on working holidays. As such, it also covers some types of work that you might do overseas and a range of medical services you might need while living overseas, including physiotherapy and dental care.

Going on a working holiday in Canada, the USA or the UK? You can get up to 24 months of cover on a single certificate with SCTI! Although Southern Cross only sells policies for trips up to 12 months online, you can buy a longer policy by calling them . This could be particularly useful if you’re participating in International Experience Canada and staying for the full two years available.

The trade-off is that the Southern Cross Working Overseas policy is among the most expensive travel insurance available to young Australians.

Here are some key facts about Southern Cross travel insurance:

- Underwriter: Southern Cross (SCTI underwrites its own policies)

- Cover for repatriation of mortal remains: $50,000

- Maximum policy length: 12 months (Australians getting a working holiday visa in Canada, USA or UK can get a 24-month policy over the phone)

- Coverage ends as soon as you return to Australia? Yes, unless your early return to Australia is due to an unexpected event (such as the unexpected death or serious illness of a relative under 85 years old)

Most Australian travel insurance options require you to start and finish your journey in Australia. Some will still offer you a policy if you’re already overseas, but with extra limitations – and you still need to return to Australia at the end of your trip.

If you’re not starting or ending your trip in Australia, and you just want up to six months of cheap travel insurance that meets the requirements for visas in Schengen countries, AXA’s Schengen travel insurance could be suitable. AXA is not an Australian company, but you can purchase AXA Schengen insurance as an Australian resident.

Here are some key facts about AXA Schengen insurance:

- Underwriter: AXA Insurance

- Cover for emergency medical expenses including evacuation: €30,000 (with Schengen Low Cost policy) or €100,000 (with Schengen Europe Travel policy)

- Cover for repatriation of mortal remains: €30,000

- Maximum policy length: 6 months

- Coverage ends as soon as you return to Australia? No. In fact, it doesn’t matter whether you start, end or visit in Australia – this just covers your medical and other basic expenses while in Europe.

Before the COVID-19 pandemic, InsureandGo offered special backpackers insurance with a maximum trip length of 540 days (almost 18 months). This insurance also came with the option to return to Australia mid-holiday for visits of up to 14 days, without voiding the insurance. Although it didn’t meet the Schengen visa requirements, this was a fairly good option for working holidays in other countries.

Unfortunately, InsureandGo has temporarily suspended sales of this type of insurance.

We compared the cost of travel insurance for a 25-year-old Australian travelling to Europe for one year with each of the providers listed in the table below . The cheapest insurance options appeared to be with Travel Insurance Saver, Australia Post and Tick Travel Insurance.

Tip: Save 10% on Australia Post Travel Insurance using the promo code TRAVEL10.

If you’d like more options, we’ve included some key information about the cover available to Aussies from a range of insurers in the table below:

The list above is not necessarily exhaustive, but contains some of the most useful options for Australians who need travel insurance for a working holiday.

If you’re travelling to Europe, please note that Tick and Southern Cross Travel Insurance provide AUD50,000 coverage for the repatriation of mortal remains. This would generally meet the EUR30,000 requirement, but this depends on the current exchange rate.

As of March 2024, AUD50,000 is equivalent to around EUR30,300 so should meet the Schengen visa criteria. But a few months earlier, this would not have been the case.

Planning a working holiday overseas? Working Holidays for Aussies has lots of other resources that can help you prepare for this exciting time in your life!

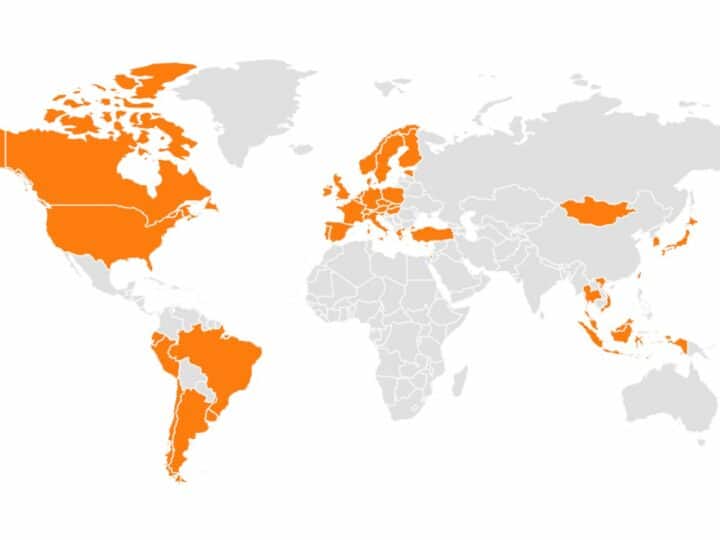

We have working holiday visa guides for all of the 40+ countries that offer these visas to Australian citizens:

These 45 Countries Offer Working Holiday Visas to Australians

See the full list These 45 Countries Offer Working Holiday Visas to Australians

These articles might also help you on your journey…

How to Survive the First Weeks After Moving Overseas

Read the article How to Survive the First Weeks After Moving Overseas

How to Find Work Overseas

Read the article How to Find Work Overseas

The Cheapest, Fastest Ways to Transfer Money Overseas

Read the article The Cheapest, Fastest Ways to Transfer Money Overseas

How to Send Your Bags to Another Country Affordably

Read the article How to Send Your Bags to Another Country Affordably

Enrich Your Gap Year with a Contiki Tour

Read the article Enrich Your Gap Year with a Contiki Tour

Each country sets its own travel insurance requirements for backpackers. When applying for a working holiday visa in Europe, you’ll need to show proof of travel insurance that provides at least EUR30,000 of cover for emergency medical, evacuation and repatriation costs.

The complimentary travel insurance that comes with some credit cards may not meet the required standards for a working holiday visa and may not be accepted. Depending on the country you’re travelling to, you may need to purchase a separate travel insurance policy that meets the visa requirements.

Yes, travel insurance is extremely important as it will protect you if something goes wrong during your travels. It is also a mandatory requirement when applying for many working holiday visas.

Most Australian international travel insurance policies provide some level of cover for events relating to COVID-19, including if you or your travel companion contract COVID-19 and need medical treatment or need to alter your trip. However, things like border closures are not generally covered. Check the PDS for details about what your insurance policy may or may not cover.

A one-way travel insurance policy is designed only to cover you while you are in transit to an overseas destination. The cover will generally end within 24 hours of your arrival at your intended destination.

In general, you need to purchase travel insurance before you start your trip and you need to plan to return to Australia (or your home country) at the end of your trip. However, if you’ve already left the country, some insurers do offer travel insurance to cover the remainder of your trip until you get back to Australia. These policies typically do not provide any cover during the first few days after you purchase the policy and may have a higher excess.

When applying for a Schengen visa, your travel insurance must include at least EUR30,000 of coverage for emergency medical, evacuation and repatriation costs, including for the repatriation of mortal remains back to your home country.

Please note that the information on this page is general in nature only and does not consider your personal circumstances. Please consider your own personal circumstances and if in doubt, seek independent advice, before purchasing a financial product such as an insurance policy.

This page may contain affiliate links. Working Holidays for Aussies may receive a commission if you make a purchase using a link provided on this page.

While best efforts are made to keep this information updated, we do not guarantee its accuracy. If you spot an error, would like to suggest new information to be added or simply have a question, please let us know in the comments .

Share This Article

Related Articles

Europe Working Holiday Visas for Australian Citizens

2 thoughts on “ the best working holiday travel insurance for australians ”.

Hi, I’m just trying to get insurance that meets the requirements for a German Working Holiday Visa. I’m just struggling to find one that covers for pandemics, which is a requirement. I was just wondering if you had any advice on finding an appropriate insurance policy or knew any which provide cover for pandemics? Thank you

You are correct that most travel insurance policies have a general exclusion for pandemics. However, many policies will cover certain costs relating to COVID-19, specifically.

Perhaps you could clarify with the German Consulate General whether you just need insurance that covers COVID-19, or whether it needs to be all pandemics – and if so, do they have a policy they suggest that meets this criteria?

If it just needs to cover medical, repatriation, hospitalisation and coronavirus travel costs relating to pandemics (but not necessarily other general expenses relating to pandemics), NIB and Travel Insurance Saver may work. (See https://api.nibtravelinsurance.com/products/v1/nibau/regulatoryWordingDocuments/INT-COM/HTML?Partnergroupid=9 and search for the word “pandemic” to see the relevant section in the PDS.)

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Notify me via e-mail if anyone answers my comment.

Best Australia Travel Insurance for Backpacker [Working Holiday]

Daniel Kovacs Australia , Planning Insurance 0

In order to do a Working Holiday in Australia, you need a special International Health and Travel insurance. The health insurance is one of the most important steps for your trip to Australia. Because depending on your country of residance the majority of health insurance companies don't cover the stay in Australia.

Going overseas with a Working Holiday Visa you need proper long-term travel health insurance that covers you in Australia. The ability to travel and work for 1 to 2 years abroad should be included. Many health and travel Insurance only cover 6 weeks holiday per year.

I have done the research for you and in this article I summarize everything you need to know about the International Health and Travel Insurance for Australia.

Important : The international health & travel Insurance must be valid for the entire duration of your stay in Australia as a Working Holiday Maker, otherwise you may be denied entry to Australia.

So, which is the best health insurance for Working Holiday in Australia?

The short answer: The best international health & travel insurance for Working Holiday in Australia is available from World Nomads* . They offer special insurance for working holiday makers, au-pairs, students and long-term travelers.

World Nomads is a travel insurance company based in Australia. It was founded in 2002 by Simon Monk, a traveler who wanted to address the three key concerns: freedom, safety, and connection.

World Nomads is the perfect insurance company for backpackers and travelers. It’s meant for people who are always on the move, and it covers all the essentials you want in travel insurance.

▷ World Nomads Travel Insurance*

Basics: What you should know in advance.

I started travelling with the working holiday visa in 2015. I stayed in Canada, New Zealand, Australia and South East Asia. In the last 5 years I gained alot of experience with many different Travel and Health Insurance companies.

International Health Insurance is a complex topic. Which health insurance really fits you and your needs can depend on your personal situation. Do you have dental problems? Or any sickness? If yes, you should spent time with this topic more intense and also get in contact with the different Health Insurance Companies to get the Health Insurance that fits your uniqe situation.

,,For 2022 we recommend Travel Credit Card from Revolut . No Annual Fee, withdrawling cash abroad is free"

Find out more in the article: Best Travel Credit Card for Working Holiday!

Do I need international health insurance for Australia?

The simple answer: YES ! As part of the Working Holiday Maker Program for Australia, all Travelers entering Australia with the Working Holiday Visa need a valid health Insurance that covers the duration of the stay in Australia.

The complex answer: Australia has a special agreement with some countries, so that travellers from these countries are also covered by the Australian health system “Medicare”. More details about the countries in the next chapter.

Moreover, many health insurance companies do not even cover a trip to Australia or they don't include work abroad.

Tip : If you are not from an english speaking Country have the policy of your international health insurance either translated directly by the insurance company or do it online via LingoKing*! (At Lingoking you can easily have all kinds of documents translated.)

Tip no. 2 : Even if you do not want to stay a year in Australia, I always advise to take the health insurance for at least 1 year. You can reclaim the remaining amount after your return and it will be paid back to you. But if you want to stay longer in Australia and you were not granted a complete year due to the duration of the insurance, you cannot change this afterwards. Furthermore, you risk being completely rejected even on arrival.

The health care system in Australia and the Medicare Card

Australia has a special agreement with some countries! This means that travellers from the United Kingdom, Ireland, New Zealand, Sweden, Netherlands, Finland, Belgium, Norway, Slovenia, Malta and Italy are also insured through the Australian health care system and can receive the so-called Medicare card and do not need to take out extra insurance.

If you are not a member of one of the above countries you should check if your national insurance plans cover international travel – sometimes it also depends on the length of your stay. If not, it is highly recommended to get a travel insurance.

As a member of the United Kingdom , you are eligible for Medicare. However, you aren’t covered at work for example, or when you need repatriation back to the UK if necessary. That’s why you need to consider getting a travel insurance.

What does the Working Holiday Australia Health Insurance cost?

The prices of the different plans for the health insurance can vary from company to company. It also plays a role whether the health insurance covers work in Australia. Or do you want to continue travel after Australia?

Especially North America (Canada & U.S.) are very expensive. This is why insurances companies differ between the whole world including U.S. and Canada and for the whole world without U.S. and Canada.

For Working Holiday in Australia, you can find health insurance starting at around 40 – 100 Euros per month. You can use the widget below to get a quote from World Nomads:

Apply for your health insurance before departure!

You must apply for your international health and travel insurance before you leave your Country! The most health insurance companies do not accept, when you apply after you already left. You will lose your insurance cover if you did not apply before your trip started!

Can I buy a travel insurance policy if I'm already overseas?

YES! 🙂 You can be travelling anywhere in the world and still buy a policy with World Nomads! This is another reason why this Insurance is the BEST! You don't have to be at home or within your country of residence to buy this travel insurance.

How do I apply for the health insurance for Australia?

You can apply easy from home. Simply apply for your health insurance online and fill out the form. You will receive the healt insurance policy via email! After print it out and put it to your travel documents.

Tip : Create copies of all important documents before you arrive in Australia (print them out and save them in a cloud -> e.g. DropBox* or via email)

Tip No. 2 : If you are not from an english speaking Country have the policy of your international health insurance either translated directly by the insurance company or do it online via LingoKing. This will simplify the process at the border in Australia. (You can also have the translation done online with LingoKing* )

▷ For more Information about World Nomads Health and Travel Insurance* visit their Website.

My conclusion – International Health & Travel Insurance for Australia

International health insurance for your Working Holiday year in Australia is mandatory and also protects you from unpleasant financial surprises! Not only because you run the risk of being denied on entry to Australia without a valid health insurance (must be valid for the entire stay). But also because accidents or illness can happen faster than we like.

Based on the experiences of my last 5 years of Travel I recommend the health insurance and special travel insurance from World Nomads* .

World Nomads was founded by backpackers so they know exactly what the budget traveler needs in their plan. If it sounds like the company for you, you can use the widget below to get a quote:

I wish you much fun in Australia!

- Ultimate Backpackers Packing List! [Free PDF]

- The ultimate document checklist for Australia [with PDF]

- The most useful travel apps for your journey through Australia

- 15 Easy Tips to ALWAYS finding the Cheap Flights

- 10 Tips How To Pick A Good Hostel

- MELBOURNE: 11 Places To Visit Before You Die

Ciao Daniel 🙂

Follow Me on YouTube , Facebook , and Instagram .

If you find this helpful: Share It with your friends!

Related Posts

Australia , Planning

First days in Australia

Australia travel preparation

Australia , Job & Work , Planning

RSA Certificate in Australia

Leave a reply cancel reply.

Your email address will not be published. Required fields are marked *

- United States

- United Kingdom

Working holiday travel insurance

Find travel insurance for casual, full-time or volunteer work if you're heading overseas..

In this guide

Comparison of travel insurance brands that cover working overseas

What does working holiday travel insurance cover, working holiday travel insurance general exclusions, compare travel insurance for your next working holiday, faqs about non-australian residents and travel insurance.

Destinations

What you need to know

- Lots of Australian insurers will cover you for up to a year or longer if you are heading overseas to work.

- Travel insurance will not cover manual or hazardous work.

- Travel insurance will not cover you for personal liability while working.

Note: This information was last updated August 2022

While it will depend on your insurer, you can find cover for:

- Non-manual work. This can be paid or unpaid includes professions such as clerical duties, teaching and childcare.

- Manual work. Some policies offer cover for paid or volunteer work in industries such as maintenance, general farm work, retail and hospitality. If your profession is going to require you working at heights, make sure that it is included in the policy.

- Guide work. This include work as guide or instructor for activities such as skiing or surfing. Make sure that the activity is covered by the policy.

List of work that is generally covered by travel insurance

- Administration

- Hospitality

- Working on a cruise ship

- General farm work

- Working on a yacht

- Gym instructor

- Yoga teacher

- Swimming instructor

What don't working holiday travel insurance policies cover?

Just like what you are covered for, what you aren't covered for will vary from insurer to insurer. However, conditions that you should be aware of may include:

- Personal liability. While you will have cover for personal liability when travelling as part of most travel insurance policies, this benefit does not cover you while you’re working.

- Working at heights. Generally working heights of five metres or higher above ground is prohibited.

- Offshore. Most travel insurance policies will exclude cover if your overseas work will be offshore.

- Working underground. Generally there is no cover for working underground in mines or caves.

Finder survey: What types of holidays have Australians taken?

The general exclusions, or circumstances in which cover will not apply, are the same for working holiday travel insurance as for normal travel insurance policies. These include:

- Theft of unattended luggage. If you are deemed to have been negligent in the supervision of your belongings.

- Irresponsible behaviour. Reckless behaviour or acts committed under the influence of drugs or alcohol.

- Non-disclosure. Claims arising from circumstances of which you had prior knowledge and failed to disclose to the insurer.

- Illegal behaviour. Breaking of government prohibitions or regulations, including visa requirements.

- Actions by a government authority. Claims resulting from foreign government confiscation, detention or destruction.

- Self-harm. This includes suicide or attempted suicide.

- Pre-existing medical conditions. If you claim is related to a medical condition that was already affecting you prior to your departing on your trip.

- Adventure activities. Pastimes such as such as skiing, rock climbing, skydiving or hang gliding, unless included in the policy.

- Scuba diving. Underwater diving, unless you hold a current licence or are with a licensed instructor.

- Flying. Any form of air travel not in a licensed passenger aircraft.

Use a comma or space to separate ages. Add kids under the age of 1 by typing a “0” 0 traveller(s)

Include travel deals and helpful personal finance content from Finder

By submitting this form, you agree to our Privacy & Cookies Policy and Terms of Service

Why you can trust Finder's travel insurance experts

We're experts

We're independent

We're here to help

Am i covered by a reciprocal health care agreement (rhca).

The Reciprocal Health Care Agreement (RHCA) is an agreement with Australia that allows you to receive basic health care under that country's version of Medicare. Participating countries include Belgium, Finland, Ireland, Italy, Malta, Netherlands, New Zealand, Norway, Slovenia, Sweden and the UK.

An RHCA allows you to access free or subsidised medical treatment and prescription medicines. It's not a substitute for travel insurance.

Can I get travel insurance on a work visa?

Yes. You can get travel insurance on a work visa. However, make sure it satisfies your visa requirements. It's possible that you will need to take out form of health insurance from the country you are travelling to.

Do I need travel insurance for a working holiday in Australia?

Working holiday visa holders in Australia need Overseas Visitor Health Cover to meet their visa requirements, unless they are from an RHCA country . OVHC is not the same as travel insurance.

What kind of insurance do I need for Working Holiday Visa?

If you're travelling to Australia, you will need Overseas Visitor Health Cover , unless you are from an RHCA country .

Australians travelling overseas will need to check the requirements of the country they are going to.

Gary Ross Hunter

Gary Ross Hunter is an editor at Finder, specialising in insurance. He’s been writing about life, travel, home, car, pet and health insurance for over 6 years and regularly appears as an insurance expert in publications including The Sydney Morning Herald, The Guardian and news.com.au. Gary holds a Kaplan Tier 2 General Advice General Insurance certification which meets the requirements of ASIC Regulatory Guide 146 (RG146).

More guides on Finder

Ready to get moving? See quotes and compare travel insurance policies for Bali from 13 brands

If you’re planning to travel to a country that has high travel risks, learn how cover is and is not provided.

Ready to get moving? See quotes and compare travel insurance policies for Netherlands from 13 brands

Ready to get moving? See quotes and compare travel insurance policies for Spain from 13 brands

Ready to get moving? See quotes and compare travel insurance policies for Canada from 13 brands

Ready to get moving? See quotes and compare travel insurance policies for Japan from 13 brands

Long term travel insurance is designed to meet the specific needs of travellers planning extended trips away, including backpackers and business travellers.

Keep yourself and your belongings safe on your European escape by comparing insurance polices today.

How likely would you be to recommend finder to a friend or colleague?

Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve.

Important information about this website

Advertiser disclosure.

finder.com.au is one of Australia's leading comparison websites. We are committed to our readers and stands by our editorial principles

We try to take an open and transparent approach and provide a broad-based comparison service. However, you should be aware that while we are an independently owned service, our comparison service does not include all providers or all products available in the market.

Some product issuers may provide products or offer services through multiple brands, associated companies or different labeling arrangements. This can make it difficult for consumers to compare alternatives or identify the companies behind the products. However, we aim to provide information to enable consumers to understand these issues.

How we make money

We make money by featuring products on our site. Compensation received from the providers featured on our site can influence which products we write about as well as where and how products appear on our page, but the order or placement of these products does not influence our assessment or opinions of them, nor is it an endorsement or recommendation for them.

Products marked as 'Top Pick', 'Promoted' or 'Advertisement' are prominently displayed either as a result of a commercial advertising arrangement or to highlight a particular product, provider or feature. Finder may receive remuneration from the Provider if you click on the related link, purchase or enquire about the product. Finder's decision to show a 'promoted' product is neither a recommendation that the product is appropriate for you nor an indication that the product is the best in its category. We encourage you to use the tools and information we provide to compare your options.

Where our site links to particular products or displays 'Go to site' buttons, we may receive a commission, referral fee or payment when you click on those buttons or apply for a product. You can learn more about how we make money .

Sorting and Ranking Products

When products are grouped in a table or list, the order in which they are initially sorted may be influenced by a range of factors including price, fees and discounts; commercial partnerships; product features; and brand popularity. We provide tools so you can sort and filter these lists to highlight features that matter to you.

Terms of Service and Privacy Policy

Please read our website terms of use and privacy policy for more information about our services and our approach to privacy.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

Visiting Australia? Consider Travel Insurance

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

Different types of travel insurance

Do you need travel insurance for australia, which credit cards offer australia travel insurance, other ways to get travel insurance, if you want to get travel insurance for australia.

Now open to tourists after two years of pandemic-related closures, Australia is back on many travelers’ wish lists, and for good reason. Whether you’re interested in surfing on the Gold Coast, taking a road trip through the Outback or diving along the Great Barrier Reef, there are a lot of options to consider. But with so many adventurous — and potentially dangerous — activities, you may also want to think about purchasing travel insurance.

Let’s take a look at the different types of travel insurance for Australia, which credit cards provide complimentary coverage and other ways you can acquire insurance for added peace of mind.

A must-have for many, travel insurance can help cover unexpected costs related to travel mishaps, medical incidents or evacuations. However, not all travel insurance is created equal. There are a variety of types available for every kind of situation, and you’ll need to do some research to understand what’s worth purchasing and what might not be necessary.

Here are some common types of travel insurance:

Trip cancellation insurance . Used to recoup costs when you cancel a trip due to something unanticipated, like a medical issue.

Trip interruption insurance . Reimburses you for travel costs when you need to cut a trip short and return home unexpectedly.

Baggage loss insurance . Provides reimbursement when your baggage is lost, damaged or stolen.

Emergency evacuation insurance . Covers costs related to evacuating you to a different location, either for medical or safety reasons.

Travel medical insurance . Used to cover medical costs while traveling, either as a primary or secondary insurer, depending on the type of coverage you purchase.

Cancel for Any Reason insurance . A supplemental insurance that provides partial reimbursement of nonrefundable travel costs when you cancel a trip for any reason.

Rental car insurance . Covers costs related to damage or repair of a rental vehicle. This can be especially useful when renting a car in another country.

Accidental death insurance. Similar to life insurance, this coverage provides payment to a person of your choosing in case of death while you’re traveling.

You may also want to consider finding insurance that covers COVID quarantine costs. Not all policies include this coverage, so you’ll want to be sure it’s included if it’s important to you.

» Learn more: The best travel insurance companies, according to Nerds

While it’s not required for entry, it may be a good idea. Travel insurance can come in useful just about anywhere, especially because it’s difficult to anticipate things like travel delays and accidents.

If you’re fairly confident about your travel plans, you may be comfortable with the insurance provided by your credit cards, though be aware that they may have lower limits than you’d like.

Otherwise, purchasing a travel insurance policy is always an option. Keep in mind that rates will vary according to your travel destination, dates of travel, ages and total trip cost.

» Learn more: What you need to know before shopping for travel insurance

Even if you’ve decided not to buy travel insurance, you may already have some coverage. Plenty of travel cards include some form of complimentary travel insurance, though the types — and limits — you receive will vary depending on which card you hold.

Many Chase credit cards offer primary rental car insurance, which will cover you in the event of an accident without needing to involve your personal auto insurance company. You’ll need to decline the rental car company’s coverage and pay with your eligible Chase card .

You can find trip delay insurance, emergency medical evacuation, lost baggage coverage and more among the different protections offered by these cards. Here are some of the more common travel cards that provide complimentary travel insurance.

Chase Sapphire Preferred® Card .

Chase Sapphire Reserve® .

The Platinum Card® from American Express . Terms apply.

Capital One Venture X Rewards Credit Card . (Benefits may change over time.)

United℠ Explorer Card .

You’ll want to read each card’s benefits guide very carefully before deciding which card to use. For example, both the The Platinum Card® from American Express and the Chase Sapphire Reserve® offer lost luggage insurance. Terms apply.

However, insurance from the The Platinum Card® from American Express only applies in the event that you’ve either paid for the full fare with your AmEx card or have redeemed your AmEx points for the flight. Using your card to pay the taxes and fees on an award flight you’ve booked elsewhere — such as redeeming Delta SkyMiles for your flight — does not mean that you’ll receive insurance coverage benefits. Terms apply.

This is in contrast to the Chase Sapphire Reserve® , whose lost luggage benefit is much more generous. In the event that your luggage is lost, you need only have paid the remainder of the charges for the flight after redeeming reward miles, points, coupons or other certificates. This means that charging just the taxes and fees on your card renders you eligible for benefits.

Aside from American Express and Chase cards, you may also want to consider the Capital One Venture X Rewards Credit Card .

Capital One’s offering includes a plethora of travel insurance benefits, including primary rental car insurance, travel accident insurance, trip cancellation and interruption insurance, lost luggage reimbursement, trip delay reimbursement, travel and emergency assistive services and more. Of course, in order to qualify for these benefits, you’ll need to have charged the trip to your card. Benefits may change over time.

» Learn more: The best credit cards with travel insurance

Even if your card provides complimentary travel insurance, you may also want to consider acquiring an additional policy — especially if you’re planning on some of the more adventurous activities you’ll find within Australia, such as camping in the Outback.

Health insurance benefits provided by credit cards such as the Chase Sapphire Reserve® max out at relatively low levels, which may mean you end up paying out of pocket in the event of an emergency.

If you’re looking for a supplemental policy, you’ll want to check quotes from a variety of providers. You can do this manually, but websites such as Squaremouth will compare multiple policies at once, making it much easier to peruse offerings. You can also filter your search according to the type of coverage you’d like.

» Learn more: Is travel insurance worth it?

Travel insurance can provide peace of mind to the wary traveler. Whether or not you’re interested in purchasing travel insurance, a variety of credit cards offer complimentary coverage for incidents such as trip delays, emergency medical care, rental car collisions and lost luggage.

Otherwise, you may want to consider buying an additional policy to ensure that you’re covered. If this is what you’re looking to do, make sure to acquire quotes from a variety of providers in order to find the best deal possible.

For Capital One products listed on this page, some of the above benefits are provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

U.S. News takes an unbiased approach to our recommendations. When you use our links to buy products, we may earn a commission but that in no way affects our editorial independence.

The Best Travel Insurance for Australia in 2024

Travelex Insurance Services »

Allianz Travel Insurance »

Generali Global Assistance »

World Nomads Travel Insurance »

GeoBlue »

Why Trust Us

U.S. News evaluates ratings, data and scores of more than 50 travel insurance companies from comparison websites like TravelInsurance.com, Squaremouth and InsureMyTrip, plus renowned credit rating agency AM Best, in addition to reviews and recommendations from top travel industry sources and consumers to determine the Best Travel Insurance for Australia.

Table of Contents

- Travelex Insurance Services

- Allianz Travel Insurance

Most travelers heading "Down Under" need to make quite the trek, and that's especially true for those planning a trip to Australia from the United States. Flying from Los Angeles to Sydney takes around 15 hours, and even more travel time is required to get to Melbourne and other destinations that require a layover on the way.

Plenty can go wrong en route to Australia as well as once you get there, and the potential for financial losses can be great if you're not careful. Not only can traveling long distances increase the risk of travel delays, but you also face the risk of flight cancellations, baggage delays, lost baggage and missed connections.

These are just some of the reasons why it makes sense to have a robust travel insurance plan in place before you fly overseas for a vacation in Australia. While any reputable travel insurance provider can provide you with protection for emergency medical expenses, your bags, travel delays and other various travel mishaps, we curated this list of top travel insurance plans for a trip to Australia specifically.

Frequently Asked Questions

Travel to Australia requires a huge commitment in terms of travel time and cost, which is why you'll want to make sure you have coverage that can reimburse you if something goes wrong. If your flight is delayed or canceled , your bags are lost in transit, or a missed connection leaves you stuck in another country for several days, having travel insurance means you can get reimbursement for unexpected hotel stays, meals you have to pay for and various incidental expenses.

Having travel insurance for Australia that includes medical coverage is also crucial since coverage provided in U.S. health plans will not apply.

Some travel credit cards offer coverage for trip cancellations or interruptions, travel delays, and lost or delayed baggage. However, credit cards are a poor source for coverage that protects against emergency medical expenses. Most credit cards do not offer coverage for emergency medical expenses or emergency medical evacuation at all, and those that do (such as the Chase Sapphire Reserve ) have insufficient coverage limits.

- Travelex Insurance Services: Best for Families

- Allianz Travel Insurance: Best for Flexible Cancellations

- Generali Global Assistance: Best for Medical Emergencies

- World Nomads Travel Insurance: Best for Adventure Travel

- GeoBlue: Best for Travel Health Insurance

Kids ages 17 and younger are covered automatically with Travel Select plan

Primary coverage with no deductibles

Lower limits for medical expenses than some providers

- 100% trip cancellation coverage worth up to $50,000

- 150% trip interruption coverage worth up to $75,000

- Trip delay coverage worth up to $2,000 for delays of five hours or longer ($200 daily limit applies)

- Missed connection coverage worth up to $750 for delays of three hours or longer

- Up to $50,000 in protection for emergency medical expenses (dental sublimit of $500)

- Up to $500,000 in coverage for emergency medical evacuation and repatriation of remains

- Up to $1,000 in coverage for baggage and personal effects

- Up to $200 in coverage for baggage delays of 12 hours or longer

- Up to $200 in coverage for sporting equipment delays of 24 hours or longer

- $25,000 in coverage for accidental death and dismemberment (AD&D)

Optional CFAR coverage reimburses at 80%

Numerous plans to choose from

Lower coverage limits for medical expenses than some providers

- Up to $100,000 per traveler in coverage for trip cancellations

- Up to $150,000 per traveler in coverage for trip interruptions

- Up to $500 per traveler in Trip Change Protector coverage

- Up to $50,000 in emergency medical coverage per traveler

- Up to $500,000 for emergency medical transportation per traveler

- Up to $1,000 toward baggage loss or damage per traveler

- Up to $300 per traveler in coverage for baggage delays of 12 hours or more

- Up to $800 in protection for travel delays per traveler (daily limit of $200 applies)

- $100 per insured person per day in SmartBenefits coverage for eligible delays

- 24-hour hotline assistance

- Concierge services

Tailor medical coverage to your needs

Generous limits for emergency medical and medical evacuation coverage

Coverage for preexisting conditions only available with Premium plan

Optional CFAR coverage with Premium plan only reimburses at 60%

- Trip cancellation coverage up to 100% of the trip cost

- Trip interruption coverage up to 175% of the trip cost

- Travel delay coverage up to $1,000 per traveler ($300 daily limit)

- Up to $2,000 per person in baggage protection; $500 for delays

- Up to $2,000 per person in coverage for sporting equipment; $500 for delays

- Up to $1,000 per person in missed connection coverage

- Up to $250,000 per person in coverage for emergency medical and dental procedures

- Up to $1 million in coverage for emergency assistance and transportation ($10,000 limit for companion hospitality expenses)

- Up to $25,000 per person in rental car coverage

- Accidental death and dismemberment coverage

Coverage for more than 200 sports and activities

24-hour travel assistance services included

Low coverage limits within standard plans

No coverage for most preexisting conditions

- Up to $10,000 in coverage for trip cancellations

- Up to $100,000 in coverage for emergency medical expenses

- Up to $500,000 in protection for emergency medical evacuation

- Up to $3,000 in protection for damage or theft to your bags or gear

Offers travel health insurance for lengthy trips abroad

Deductibles can apply

Some plans require a primary U.S. health insurance plan

- Up to $1,000,000 medical maximum per insured person

- Up to $500,000 in coverage for emergency medical evacuation per trip

- Up to $50,000 in coverage for accidental death and dismemberment

- Up to $2,500 in coverage for emergency family travel arrangements

- Up to $25,000 in medical coverage for hazardous activities like skiing and diving

- Up to $500 per trip in lost baggage and personal effects coverage ($100 limit per bag)

- Up to $1,000 per trip period in post-departure trip interruption transportation

- Up to $50 per day in post-departure trip interruption quarantine coverage (in the case of COVID-19)

- Up to $25,000 in protection for repatriation of remains

Why Trust U.S. News Travel

Holly Johnson is an award-winning writer who has been covering topics like family travel, cruises, all-inclusive resorts and travel insurance for well over a decade. Johnson has researched and purchased travel insurance plans for her own trips, and she has successfully filed claims and received reimbursement more than once over the years. Currently, Johnson uses an annual travel insurance policy from Allianz to cover her family's many trips overseas each year. Johnson also works alongside her husband, Greg – who sells travel insurance for trips all over the world – in their family media business. Johnson also co-owns the travel agency Travel Blue Book .

You might also be interested in:

Travel Insurance for Europe: 4 Best Options for 2024

Holly Johnson

Learn about a range of coverage options for traveling abroad.

The Best Travel Insurance for Mexico in 2024

Find coverage options for medical emergencies, travel delays, lost baggage and more.

Expat Travel Insurance: The 5 Best Options for Globetrotters

Find the coverage and benefits you need for your adventures abroad.

Is Travel Insurance Worth It? Yes, in These 3 Scenarios

These are the scenarios when travel insurance makes most sense.

Quick Links

- Cancel Policy

- Make a claim

Working Overseas

Working overseas travel insurance, living and working abroad.

Working overseas can be one of the most enriching experiences of your life. It’s a great way to understand different cultures, learn new skills and discover all the world has to offer. But when it comes to travelling, there’s always room for the unexpected to happen, so it’s important to protect yourself with comprehensive travel insurance.

Our Working Overseas travel insurance policy is designed to provide the comprehensive benefits of a standard travel insurance policy, whilst also covering while living and working abroad.

Get a Working Overseas quote now

What is travel insurance for working holidays?

Whether you’re planning a big OE to Canada or the UK, a working holiday travel insurance policy can be a great option for you. It provides comprehensive coverage for a range of travel-related issues, including medical expenses, emergency medical evacuation, trip cancellation, trip interruption, lost or stolen baggage, and more.

As a working holiday traveller, it's important to have adequate coverage to protect yourself financially and ensure you receive the necessary medical treatment if something goes wrong as you may not be eligible for healthcare at your chosen destination.

What our Working Overseas travel insurance policy covers

We want you to relax and enjoy your time spent working overseas. Our Working Overseas travel insurance is specifically designed for you to remove the worry and anxiety should something not go quite to plan.

$2,500 Options to increase up to Unlimited

This table is a summary of the Working Overseas policy benefits and shows the maximum cover under each benefit for each person (unless otherwise stated). The excess you select applies per unexpected event (unless otherwise stated).

Why choose a Working Overseas policy?

We know that living overseas is different from going on a holiday or visiting family and friends overseas, and our Working Overseas policy reflects that. When you’re working overseas, you require a policy that suits what you’re going to be doing and will give you peace of mind while you’re enjoying your overseas experience.

Below are some of the features of our Working Overseas policy:

- We offer cover for office-based work, educational work, healthcare and manual work, including retail hospitality.

- We offer Comprehensive Cover with three excess options ($0, $100 & $250), so you can tailor the plan to work best for you.

- Under Section D.1 of our Product Disclosure Statement (Medical and Evacuation), we offer cover for a range of services that you may require while overseas including dental treatment, optical treatment, maternity care, ancillary services (chiropractor, physiotherapist), rehabilitation and occupational therapy, and mental health.

- Under Section D.3 of our Product Disclosure Statement (Changes to Your Journey once you have left), we offer cover for resuming your journey, so you can get back on track if you have to return to Australia as a result of an unexpected event.

- We provide cover for COVID-19 under section D.1 Medical and evacuation for medical expenses and evacuation if you’re diagnosed with COVID-19 while on your journey. All of our policies come with worldwide emergency assistance, giving you access to one of the world's largest networks of emergency medical resources, 24 hours a day, 7 days a week.

What we’re unable to cover

We do not cover professional sports or hazardous work. We consider hazardous work to be any work or occupation (paid, unpaid or voluntary), where you are exposed to an increased risk of physical danger, harm or any adverse health effects as a result of your duties or the location of your work.

All work, occupations, business or professions are excluded under Section D.7, Personal Liability.

Here are some examples of occupations we consider to be hazardous:

- Aircraft crew member

- Armed forces

- Cement and concrete manufacturing

- Commercial fishing

- Construction work

- Deep sea drilling

- Fire fighting

- Power line repair

- Search and rescue

- Slaughterhouse work

- Structural and steel work

- Tornado chasing

- Work with wild animals

- Working in any type of mine or oil or gas field

If you are still unsure whether your role would be considered 'Hazardous work', please feel free to give us a call on 1800 196 484 or send us an email at [email protected] . Please click here to see the Product Disclosure Statement in full.

Is the Working Overseas policy right for me?

We've designed this policy to cover people who are temporarily living overseas and working, or on a working holiday.

If you are only travelling overseas to attend a work or business conference, there may be cover under our International Comprehensive travel insurance policy and we recommend that you check whether this policy is suitable for you.

Our Working Overseas policy is available to you whether you have a return or one-way ticket. You can buy cover from one month to 12 months, and don’t have to be working while you’re overseas to purchase this policy.

For full details, please refer to the Product Disclosure Statement , and if you’re unsure about the type of work you’re planning to do overseas, we would be happy to answer any questions you might have.

What destinations should I choose?

When you’re living and working overseas, we know that you may want to holiday in other countries as well. The good news is that there is cover under our Working Overseas policy for leisure trips to other destinations, as well as the country you’re spending most of your time in.

However, it is important that we know of all destinations that you’re planning to visit.

For example, if you’ll be working in the United Kingdom but you plan to visit France, you must let us know that you require cover in France, either when you’re buying your policy or before you leave for your trip to France. Depending on the country you plan to visit, there may be an additional premium that you need to pay.

When considering which destinations to choose, please check the travel advisory risk rating published on Australian Department of Foreign Affairs and Trade website . Destinations with a travel advisory risk rating of ‘do not travel’ or ‘reconsider your need to travel’ are not covered for unexpected events relating to the reason why travel advisory was issued for a destination or region by the Australian Department of Foreign Affairs and Trade. For more information please visit our website here .

What if things change?

One day you’re living in New Caledonia, the next you could be in New York! If your situation changes and you need to make a change to your Working Overseas travel insurance policy, get in touch with us, and we can make the necessary changes for you. You will need to make sure that your policy is kept up-to-date, ensuring that the destinations you travel to are covered. If you need to contact us from overseas, you can either email us at [email protected] or call us on +61 1800 196 484.

Frequently asked questions

Get in touch.

Got a question? We have lots of quick answers here.

Get in touch with the team and we'll be happy to help.

Call us Monday to Friday 8.30am to 5.00pm (AEDT).

- 1300 409 322 Australian Based Call Centre

Working Holiday Insurance

Travel insurance for travellers on a working holiday

The following information applies to policies purchased from 30th October 2023 onwards. For policies purchased prior to 30th October 2023: you can find the PDS relevant to you in your policy confirmation email, by logging into MyPolicy , or you can contact us for assistance.

Travelling internationally means leaving behind Australian Medicare benefits, so it's essential to take out working holiday travel insurance before you head off overseas.

Whether you're headed to Canada on the IEC program to work the snow season, teaching English in Southeast Asia, volunteering in Africa, or working at a summer camp in the United States , a working holiday is a fantastic way of sustaining your travels or topping up your bank account for your next overseas adventure.

Fast Cover’s working holiday travel insurance provides cover from one day up to one year initially, with the option of extending your policy up to two years if you're having too much fun overseas or want to keep working and travelling!

What are the benefits of working holiday travel insurance?

Every working traveller has different priorities, but some of the main benefits you might want to look for in a travel insurance policy for your working holiday include:

- 24 Hour Emergency Medical Assistance

- Overseas Emergency Medical and Hospital Expenses

- Emergency Evacuation and Repatriation Expenses

- Cover for Luggage and Personal Belongings

- Medical screening available for your medical conditions .

Remember that it's important to compare the different benefits and exclusions when shopping around for a travel insurance policy for your working holiday, not just the price.

Fast Cover offers several different levels of cover for you to choose from so you can cover all the things that are most important to you without blowing your travel budget:

- Standard Saver

- Comprehensive

- Snow Sports Plus

See the benefits tables below for more details about what each policy offers:

Please note: This is only a summary of benefits. Policy terms, conditions, limits, sub limits and exclusions apply to each cover type. Benefit limits shown are for Single and Duo (per person) policies. Pooled Benefits mean that Family policy benefit limits apply for the whole family and are double the corresponding benefit limit under a Single policy, except for certain benefits - please refer to the Product Disclosure Statement for full details. ^Cover under these Benefits are excluded while travelling within Australia.

Who should get working holiday travel insurance?

If you're a digital nomad or business traveller, working internationally is probably a regular part of your job. Otherwise, perhaps you just want to experience living and working in a different country, or add impressive skills to your resume by getting a job, internship, or volunteering overseas.

Travellers of any age who plan to go overseas for a week, month, or up to two years can get working holiday travel insurance with Fast Cover.

You can have cover regardless of the type of work you’ll be doing, including for office work, teaching, nursing, trades, hospitality, retail, conservation, farm work and also volunteering.

Cover is available for both the times that you’re working as well as your days off and any travel in between!

Fast Cover's working holiday travel insurance is ideal if you're:

- Working the snow season at a ski resort on the International Experience Canada program

- Working as a camp counselor or guide at an American summer camp

- Taking advantage of the Youth Mobility Scheme in the United Kingdom for up to two years

- A backpacker who plans to pick up odd jobs here and there while travelling

- Working remotely on your own business while travelling

- A student taking an internship or overseas work placement opportunity

- Going on a business trip or attending a conference overseas

- Taking advantage of an ancestry visa

- A dual passport holder visiting another country

- Volunteering overseas

No matter where you're headed or what kind of work you're doing, we've made buying travel insurance for your working holiday as fast and simple as possible.

Why do I need working holiday travel insurance?

There are a few steps involved in finding the travel insurance you need for your working holiday.

We've put together a list you can follow to understand how travel insurance will assist you on your trip:

1) Read the Consular Services Charter before you leave

The Consular Services Charter explains the way in which the Australian Government can assist you while you’re overseas, as well as the areas where their assistance is limited.

They recommend you travel with comprehensive travel insurance including emergency medical and hospital cover, as medical costs overseas can be extremely high.

2) Check whether you’re covered by your employer

If you’ve already organised employment overseas, check if your employer provides insurance and what this insurance covers. You may still require your own insurance for medical expenses, theft and damage to belongings and cancellations to travel plans.

You may also find that your employer's insurance only covers you while you're on the clock. They may not cover you if you get injured or something happens during your days off.

3) Know what activities you might do overseas

There are so many activities you can do overseas, but some of these may not be covered by travel insurance.

For example, if you’re injured in a motorcycle accident or fall and break a bone while horse riding, you must have these activities covered by your insurance to be able to make a claim. If they’re not covered, you’ll have to personally foot the bill for any medical costs which can be in the hundreds of thousands of dollars.

To make it fast and simple for you, Fast Cover covers a huge list of non-contact activities including bungee jumping, snorkelling, hiking and horse riding.

If you want to do more adventurous activities like quad biking, trekking above 3,000 metres and under 6000 metres or walking the Kokoda Trail, our Adventure Pack add-on will make sure that you don’t miss out.

Optional extras for travel insurance

Rental vehicle excess insurance.

If you’re planning on hiring a car or campervan so you’re more mobile while you’re overseas, you can choose Rental Vehicle Excess Insurance of $5,000 or $8,000.

This provides cover for the excess the rental company would charge you in the event of an accident or damage to the vehicle, up to the specified amount.

If you're hiring a car within Australia we've already included Rental Vehicle Excess up to $5,000.

Adventure Pack

We cover a huge list of non-contact sports and activities like horse riding, snorkelling, indoor rock climbing and safari. But if you plan on more adventurous activities such as abseiling, quad biking, skydiving, or trekking above 3,000 metres, make sure you add on o ur Adventure Pack s o you’ll be ready for action!

Motorcycle Pack

Riding a moped, scooter or motorcycle is a fantastic way to see the sights on your days off. Add the optional Motorcycle Pack to your policy, make sure you comply with the licensing requirements and you're ready to go!

Increased cover for High Value Items:

If you’re going to be working overseas for a long period of time, you're probably taking more valuable items than the average backpacker or holidaymaker. These may include things like laptop computers, tablets, GoPro cameras or video recording equipment.

Our policies provide generous limits on the things that you take on your travels.

If you've got a valuable item and want to make sure you have extra cover for it, you can specify it as a High Value Item on your insurance certificate by paying an additional amount when you purchase the policy.

Specifying High Value Items on your travel insurance policy also 'locks in' their current value, so there's no depreciation applied if you need to make a claim for a lost, stolen or damaged item.

Optional cover for skiing, snowboarding and snow sports:

If you’re going to be skiing, snowboarding, or working at a ski resort, choose our Snow Sports Plus policy.

It has all the top benefits of our Comprehensive policy, as well as cover for emergency medical evacuation and hospital expenses if you're injured on the slopes, plus cover for your snow gear and equipment and reimbursement for piste closure due to bad weather.

There's also cover for prepaid lift passes or the unused portion of your ski package if you get sick or injured and can't continue skiing.

Travelling together on a working holiday?

If you’re travelling with a partner, spouse, friend or relative, you can save by getting a working holiday travel insurance policy together.

Travellers on a Duo policy get a 5% discount and 50% off your excess reduction compared to if you each bought separate single policies.

Why choose Fast Cover travel insurance for your next working holiday?

Fast Cover’s working holiday travel insurance is designed to cover you in many of the different situations and emergencies you might experience while working overseas.

You can travel knowing that you can have cover if an emergency does occur, and also access to prompt and professional help from our 24 hour Emergency Assistance team.

They’re available 24 hours a day, 7 days a week, 365 days a year, anywhere in the world.

Compare our working holiday travel insurance and you’ll find that we may be able to provide you with a competitive price for great cover.

It’s affordable travel insurance made fast and simple!

^ Price as at 20/03/2024 compared to the price calculated today for this policy.

* See Product Disclosure Statement for full terms and conditions and exclusions and limits that apply.

† Fast Cover has a referral arrangement with this company.

The entity that referred you does not act for Fast Cover and may receive remuneration from us. You can ask them or us for more details. Make sure any information listed in any quote provided remains accurate and if not, please change it on our website.

- Best Travel Insurance 2024

- Cheapest Travel Insurance

- Trip Cancellation Insurance

- Cancel for Any Reason Insurance

- Seniors' Travel Insurance

- Annual Travel Insurance

- Cruise Insurance

- COVID-19 Travel Insurance

- Travel Medical Insurance

- Medical Evacuation Insurance

- Pregnancy Travel Insurance

- Pre-existing Conditions Insurance

- Mexico Travel Insurance

- Italy Travel Insurance

- France Travel Insurance

- Spain Travel Insurance

- Canada Travel Insurance

- UK Travel Insurance