- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

The Guide to American Express Travel Insurance

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

American Express travel insurance vs. coverage provided by AmEx cards

Complimentary travel insurance provided by amex cards.

Trip cancellation and interruption insurance

Trip delay insurance

Car rental loss and damage insurance

Baggage insurance

Premium global assist.

Global Assist Hotline

Standalone American Express travel insurance plans

Should you use the complimentary benefits or purchase a policy, amex travel insurance recapped.

You can get AmEx travel insurance via your card or as a standalone policy.

AmEx cards typically include coverage for trip delays, interruptions, cancellations, baggage and car rentals.

Coverage tends to be secondary.

Policies vary by card.

American Express has two different types of travel insurance offerings: standalone travel insurance plans that customers can purchase and travel insurance that is included as a complimentary benefit on certain cards.

So if you’re thinking about getting travel insurance before a trip, get familiar with American Express travel insurance benefits that are included on your credit cards. Knowing what protections you already have will prevent you from spending money on a separate policy with benefits that overlap.

A standalone travel insurance policy from American Express may offer more robust coverage, but depending on your needs, the travel insurance perks provided by your AmEx card may be sufficient.

If you primarily want specific coverage for cancellations, delays or rental cars and baggage, it’s likely your card will be enough.

If, however, you’re mainly concerned with emergency health coverage while traveling , you’re better off with a separate medical insurance policy because the benefits provided by credit cards are limited in those areas. You can purchase this from American Express directly or shop around other travel insurance companies .

» Learn more: How to find the best travel insurance

There are six travel insurance benefits offered on many American Express cards:

Trip cancellation and interruption insurance .

Trip delay insurance .

Car rental loss and damage insurance .

Baggage insurance plans .

Premium Global Assist Hotline .

Global Assist Hotline .

Here's a closer look at each.

Trip cancellation will protect you if you need to cancel your trip for a covered reason (more below), and you will be reimbursed for any nonrefundable amounts paid to a travel supplier with your AmEx card. Bookings made with Membership Reward Points are also eligible for reimbursement. Travel suppliers are generally defined as airlines, tour operators, cruise companies or other common carriers.

Trip interruption coverage applies if you experience a covered loss on your way to the point of departure or after departure. AmEx will reimburse you if you miss your flight or incur additional transportation expenses due to the interruption. American Express considers the following to be covered reasons:

Accidental injuries.

Illness (must have proof from doctor).

Inclement weather.

Change in military orders.

Terrorist acts.

Non-postponable jury duty or subpoena by a court.

An event occurring that makes the traveler’s home uninhabitable.

Quarantine imposed by a doctor for medical reasons.

There are many reasons that are specifically called out as not covered (e.g., preexisting conditions, war, self-harm, fraud and more), so we recommend checking the terms of your coverage carefully.

If you want a higher level of coverage for trip cancellation, consider purchasing Cancel For Any Reason (CFAR) travel insurance . CFAR is an optional upgrade available on some standalone travel insurance plans. This supplementary benefit allows you to cancel a trip for any reason and get a partial refund of your nonrefundable deposit.

Alternately, if you want what essentially amounts to CFAR insurance on your flights specifically, purchase your fares through the AmEx Travel portal and tack on Trip Cancel Guard for an extra fee. Trip Cancel Guard guarantees you an up to 75% refund on nonrefundable airfare costs when you cancel at least two days before departure, regardless of why. This isn't as comprehensive as other CFAR policies, but it can add some peace of mind for people who want the cash back (as opposed to a travel credit) for flights they may not take.

AmEx cards with trip cancellation, interruption coverage

The following American Express credit cards offer trip cancellation and trip interruption coverage:

on American Express' website

Additional AmEx cards that offer trip cancellation and interruption coverage include:

The Business Platinum Card® from American Express .

Centurion® Card from American Express.

Business Centurion® Card from American Express.

The Corporate Centurion® Card from American Express.

The Platinum Card® from American Express for Ameriprise Financial.

The American Express Platinum Card® for Schwab.

The Platinum Card® from American Express for Goldman Sachs.

The Platinum Card® from American Express for Morgan Stanley.

Corporate Platinum Card®.

Delta SkyMiles® Reserve Business American Express Card .

Terms apply.

Covered amount

The maximum benefit amount for Trip Cancellation and Interruption Insurance is $10,000 per Covered Trip and $20,000 per Eligible Card per 12 consecutive month period. Coverage is secondary and applies after your primary policy provides reimbursement. Claims must be filed within 60 days. To start a claim, call 844-933-0648.

This benefit will reimburse you for reasonable, additional expenses incurred if a trip is delayed by a certain number of hours. Examples of eligible expenses include meals, lodging, toiletries, medication and other charges that are deemed appropriate by American Express. It makes sense to use your judgment in terms of what will get approved based on your policy's fine print.

Acceptable delays include those that are caused by weather, terrorist actions, carrier equipment failure, or lost/stolen passports or travel documents. There are also plenty of exclusions, such as intentional acts by the traveler.

AmEx cards with trip delay insurance

The reimbursable amount depends on which card you hold.

Up to $500 per Covered Trip that is delayed for more than 6 hours; and 2 claims per Eligible Card per 12 consecutive month period.

Up to $300 per Covered Trip that is delayed for more than 12 hours; and 2 claims per Eligible Card per 12 consecutive month period.

As expected, the more premium travel credit cards offer higher compensation for shorter delays. Trip delay insurance is offered on the following American Express credit cards:

When you decline the collision damage waiver offered by the car rental agency, you will be covered if the car is damaged or stolen through your AmEx Travel Insurance. Depending on the card you have, the coverage is $50,000 or $75,000.

» Learn more: How AmEx car rental insurance works

In addition, the cards offering car rental damage and theft insurance up to of $75,000 also provide secondary benefits:

Accidental death or dismemberment coverage.

Accidental injury coverage.

Car rental personal property coverage.

To qualify, you must decline the personal accident coverage and personal effects insurance provided by your car rental company.

The entire rental must be charged on the American Express credit card to receive coverage for car rental loss and damage. And keep in mind that you do still need liability insurance when making your rental car reservation (you may have this through your personal auto insurance policy), as these credit card-provided coverage options don't include personal liability.

AmEx cards with car rental coverage

American Express lists over 50 different cards on its site that come with one of the two forms of car rental insurance. Cards that link to the Tier 1 policies are the $50,000-coverage cards, and Tier 2 policies are the $75,000 cards.

Car Rental Loss and Damage Insurance can provide coverage up to $75,000 for theft of or damage to most rental vehicles when you use your eligible Card to reserve and pay for the entire eligible vehicle rental and decline the collision damage waiver or similar option offered by the Commercial Car Rental Company. This product provides secondary coverage and does not include liability coverage. Not all vehicle types or rentals are covered. Geographic restrictions apply.

Car Rental Loss and Damage Insurance can provide coverage up to $50,000 for theft of or damage to most rental vehicles when you use your eligible Card to reserve and pay for the entire eligible vehicle rental and decline the collision damage waiver or similar option offered by the Commercial Car Rental Company. This product provides secondary coverage and does not include liability coverage. Not all vehicle types or rentals are covered. Geographic restrictions apply.

The amount reimbursed is calculated as whichever is lowest:

The cost to repair the rental car.

The wholesale book value (minus salvage and depreciation).

The invoice purchase price (minus salvage and depreciation).

Here are some key exclusions to be aware of with this coverage:

These policies don't cover theft or damage that was caused by a driver’s illegal operation of the car, operation under the influence of drugs/alcohol or damage caused by any acts of war.

Policies don't cover drivers not named as "authorized drivers" on your rental agreement.

The benefit only covers car rentals up to 30 consecutive days.

Not all cars are included in the policy. Certain trucks, vans, limousines, motorcycles and campers are excluded from coverage.

Insurance protection doesn't apply in Australia, Italy, New Zealand and any country subject to U.S. sanctions .

You can file a claim online or call toll-free in the U.S. at 800-338-1670. From overseas, call collect 216-617-2500. Your claim must be filed within 30 days of the loss. Additionally, some benefits vary by state, so check the policy for your specific card.

» Learn more: The guide to AmEx Platinum’s rental car insurance

As an American Express cardholder, you are eligible to receive compensation if your luggage is lost or stolen. This benefit is in addition to what you may receive from the carrier. However, the AmEx policy is secondary, which means that it kicks in after the carrier provides any compensation for losses.

AmEx provides this insurance to "covered persons," who are defined as:

The cardmember.

Their spouse or domestic partner.

Their dependent children who are under 23 years old (there are age exceptions for handicap children).

Some business travelers (Tier 2 coverage only).

To qualify, all covered individuals need to be traveling on the same reservation and must be residents of the U.S., Puerto Rico or the U.S. Virgin Islands.

AmEx cards with baggage insurance

Naturally, the higher-end cards offer more protection — but even the basic cards have decent coverage. The compensation limits per person are as follows (note that the maximum payout per covered person for lost luggage is $3,000 on all of these cards).

Below are the limits for cardholders of the The Platinum Card® from American Express , The Business Platinum Card® from American Express , The American Express Platinum Card® for Schwab, The Platinum Card® from American Express for Goldman Sachs, The Platinum Card® from American Express for Morgan Stanley, Hilton Honors American Express Aspire Card , Marriott Bonvoy Brilliant™ American Express® Card, Centurion® Card from American Express and Business Centurion® Card from American Express:

Baggage in-transit to/from common carrier: $3,000.

Carry-on baggage: $3,000.

Checked luggage: $2,000.

Combined maximum: $3,000.

High-end items: $1,000.

Disclosure: Baggage Insurance Plan coverage can be in effect for Covered Persons for eligible lost, damaged, or stolen Baggage during their travel on a Common Carrier Vehicle (e.g. plane, train, ship, or bus) when the Entire Fare for a ticket for the trip (one-way or round-trip) is charged to an Eligible Card. Coverage can be provided for up to $2,000 for checked Baggage and up to a combined maximum of $3,000 for checked and carry on Baggage, in excess of coverage provided by the Common Carrier. The coverage is also subject to a $3,000 aggregate limit per Covered Trip. For New York State residents, there is a $2,000 per bag/suitcase limit for each Covered Person with a $10,000 aggregate maximum for all Covered Persons per Covered Trip.

And here are the coverage limits for cardholders of the American Express® Gold Card , American Express® Business Gold Card , American Express® Green Card , Business Green Rewards Card from American Express , Hilton Honors American Express Surpass® Card , Marriott Bonvoy™ American Express® Card, Marriott Bonvoy Business® American Express® Card , Delta SkyMiles® Reserve American Express Card , Delta SkyMiles® Reserve Business American Express Card , Delta SkyMiles® Platinum American Express Card , Delta SkyMiles® Platinum Business American Express Card , Delta SkyMiles® Gold American Express Card and Delta SkyMiles® Gold Business American Express Card , The Hilton Honors American Express Business Card :

Baggage in-transit to/from common carrier: $1,250.

Carry-on baggage: $1,250.

Checked luggage: $500.

High-end items: $250.

Disclosure: Baggage Insurance Plan coverage can be in effect for Eligible Persons for eligible lost, damaged, or stolen Baggage during their travel on a Common Carrier (e.g. plane, train, ship, or bus) when the entire fare for a Common Carrier Vehicle ticket for the trip (one-way or round-trip) is charged to an eligible Account. Coverage can be provided for up to $1,250 for carry-on Baggage and up to $500 for checked Baggage, in excess of coverage provided by the Common Carrier (e.g. plane, train, ship, or bus). For New York State residents, there is a $10,000 aggregate maximum limit for all Covered Persons per Covered Trip.

AmEx also offers limited reimbursement for high-end items (coverage varies by card), such as:

Sports equipment.

Photography or electronic equipment.

Computers and audiovisual equipment.

Wearable technology.

Furs (including items made mostly of fur and those trimmed/lined with fur).

Items made fully or partially of gold, silver or platinum.

Claims must be filed within 30 days of your baggage loss. To file a claim, call 800-645-9700 from the U.S. or collect to 303-273-6498 if overseas. You can also file a claim online.

» Learn more: Compare travel insurance options: airline or credit card?

This benefit helps with events like replacing a lost passport, missing luggage assistance, emergency legal and medical referrals, and in some instances, emergency medical transportation assistance.

The service can also help you figure out important travel-related details like customs information, currency information, travel warnings, tourist office locations, foreign exchange rates, vaccine recommendations for the country you’re visiting, passport/visa requirements and weather forecasts.

AmEx cards with Premium Global Assist

Premium Global Assistance is offered on the following American Express credit cards:

The Platinum Card® from American Express .

Delta SkyMiles® Reserve American Express Card .

Hilton Honors American Express Aspire Card .

Marriott Bonvoy Brilliant™ American Express® Card.

Services provided by Premium Global Assist Hotline

You can rely on Global Assist Hotline 24 hours a day / 7 days a week for medical, legal, financial or other select emergency coordination and assistance services while traveling more than 100 miles away from your home. Plus, the Premium Global Assist Hotline may provide emergency medical transportation assistance and related services. Third-party service costs may be your responsibility.

The hotline isn’t so much a concierge as a service that provides logistical assistance, which can include the following:

General travel advice

Emergency translation if you need an interpreter to help with legal or medical documents (cost isn't covered).

Lost item search if your belongings are lost while traveling.

Missing luggage assistance if an airline loses your luggage. The hotline will contact your airline on a daily basis on your behalf to help locate your bags.

Passport/credit card assistance if your credit card or passport is lost or stolen.

Urgent message relay if you need to contact a family member and/or friend in the event of an emergency.

Medical assistance

Emergency medical transportation assistance if the cardmember or another covered family member traveling on the same itinerary gets sick or injured and needs medical treatment (there are many conditions for this coverage; review your policy’s fine print).

Physician referral if you need a doctor or dentist (cardmember is responsible for costs).

Repatriation of remains in the event of death.

Financial assistance

Emergency wire service to get help obtaining cash (fees will be reimbursed).

Emergency hotel check in/out if your card has been lost or stolen.

Legal assistance

Bail bond assistance if you need access to an agency that accepts AmEx (cardmember is responsible for paying bail bond fees).

Embassy and consulate referral if you need help finding or accessing local embassies.

English-speaking lawyer referral if you’re traveling and need a list of available attorneys (cardmember is responsible for any legal fees).

To use this benefit, call the Premium Global Assist Hotline toll-free at 800-345-AMEX (2639). You can also call collect at 715-343-7979.

The main difference between the Global Assist Hotline and the Premium version is that some of the services that are fully covered by Premium Global Assist aren't covered in the more basic version (cited examples include emergency medical transportation assistance and repatriation of mortal remains).

You can rely on Global Assist Hotline 24 hours a day / 7 days a week for medical, legal, financial or other select emergency coordination and assistance services while traveling more than 100 miles away from your home. Third-party service costs may be your responsibility.

AmEx cards with Global Assist Hotline access

The Global Assist Hotline is available to holders of the following cards:

American Express® Gold Card .

American Express® Business Gold Card .

American Express® Green Card .

Business Green Rewards Card from American Express .

Delta SkyMiles® Platinum American Express Card .

Delta SkyMiles® Platinum Business American Express Card .

Delta SkyMiles® Gold American Express Card .

Delta SkyMiles® Gold Business American Express Card .

Delta SkyMiles® Blue American Express Card .

Hilton Honors American Express Surpass® Card .

Hilton Honors American Express Card .

The Hilton Honors American Express Business Card .

Marriott Bonvoy™ American Express® Card.

Marriott Bonvoy Business® American Express® Card .

The Amex EveryDay® Preferred Credit Card from American Express .

Amex EveryDay® Credit Card .

Blue Cash Preferred® Card from American Express .

The American Express Blue Business Cash™ Card .

The Blue Business® Plus Credit Card from American Express .

You can call the Global Assist Hotline toll-free at 800-333-AMEX (2639), or collect at 715-343-7977.

If you don’t have any of the credit cards above and are thinking about purchasing a policy from American Express or just simply want to price compare to see if you get better perks by purchasing a policy, you can go to the AmEx travel insurance website and input your trip plans to build a quote. You’ll need to provide your departure and return date, state of residence, age of traveler, number of travelers covered by the policy and the trip cost per traveler. Then, you can select the option of choosing a package or building your own.

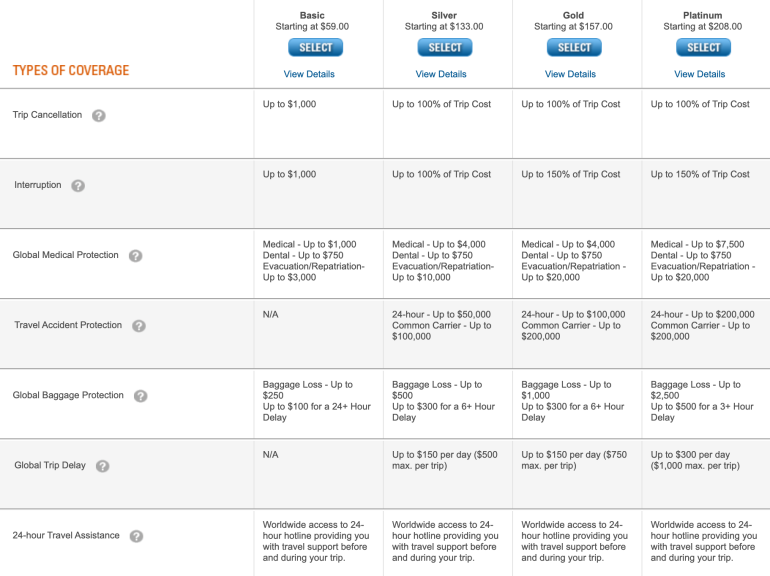

To see which plans are available, we input a sample $3,000, one-week trip by a 35-year-old from South Dakota. Our search result yielded four different plans ranging from $59 for a Basic plan to $208 for a Platinum plan.

Global medical protection (not included on AmEx cards)

Medical protection includes coverage for emergency healthcare and dental costs as well as medical evacuation and repatriation of remains . The limits increase as the plans become more expensive. Although AmEx cards offer an array of travel insurance benefits, medical coverage isn't included. So if medical protection benefits are important to you, a standalone travel insurance policy is what you’ll want to look for.

Travel accident protection (not included on AmEx cards)

Another benefit not included with AmEx cards is travel accident protection. This benefit provides coverage in case of death or dismemberment while traveling . Although this is a topic no one wants to think about, it's good to be familiar with this coverage. While travel accident protection isn’t offered on the Basic plan, all of the higher plans offer it.

Standalone policy benefits that are also included on AmEx cards

These elements of coverage are offered on the AmEx cards mentioned, although in some, the limits may be higher or lower.

Trip cancellation

The Basic plan only covers a trip up to $1,000, however, all the other plans cover 100% of the trip cost. To compare this with the perks included as a benefit on the cards, all AmEx cards that include trip cancellation coverage provide up to $10,000 per covered trip.

Keep in mind that, all the cards included have annual fees and the card with the lowest fee is the Hilton Honors American Express Aspire Card , with a $550 annual fee.

Trip interruption

Trip interruption coverage ranges from $1,000 on a Basic plan to 150% of trip cost on the Gold and Platinum plans. The trip interruption benefit offered by the AmEx cards is included on all the same cards that offer trip cancellation insurance, with the trip interruption limit capped at $10,000 per covered trip.

Global baggage protection

If your luggage is lost or stolen this benefit will provide monetary compensation to reimburse you for your lost items. AmEx cards offer baggage coverage as a complimentary benefit, with the higher-end cards naturally providing higher limits. Interestingly, the cards with the lower annual fees (i.e. Hilton Honors American Express Surpass® Card , annual fee $150 ) have a high limit as well, offering a total combined limit for lost luggage of $3,000, which is higher than the coverage offered by the standalone Platinum plan.

Global trip delay

If your trip is delayed, you’re eligible for reimbursement of any necessary expenses incurred up to a specific limit. The Basic plan doesn’t offer this benefit, but all the other plans do, with the Platinum plan providing up to $300 per day (maximum of $1,000 per trip). This coverage is also included on the higher-end AmEx cards.

AmEx cards offer key travel insurance benefits: trip cancellation and interruption insurance, trip delay insurance, car rental loss and damage insurance, baggage insurance, Premium Global Assist Hotline (or Global Assist Hotline). However, they don't offer any sort of emergency medical coverage. This is pretty typical of travel credit cards, as the travel insurance perks they offer don't provide coverage for emergency health care costs.

If you’re looking for emergency medical coverage, you’ll need to purchase a separate policy, such as the standalone one offered by American Express. The other limits provided in the American Express travel insurance policy are comparable to what you get on the AmEx cards, so it makes sense to shop around to make sure that the benefits you’re paying for are sufficient for your needs.

» Learn more: What to know about American Express Platinum travel insurance

Yes, if you have one of the cards listed above. If you have a credit card that isn’t listed in this guide or the card is no longer available by American Express, call the number on the back of your card for more information. Generally, AmEx offers a number of travel insurance benefits on its credit cards that shouldn't be overlooked.

Yes, but it depends on which card you have. To qualify for reimbursement, the trip cancellation must be for a covered reason. Refer to the section "Trip Cancellation and Interruption Insurance" for a list of cards and explanations of covered reasons.

American Express offers a solid range of travel insurance protection across its credit cards, with the premium cards providing the most coverage. However, if you need insurance benefits with higher limits, we recommend purchasing a separate travel insurance policy . If you only need emergency medical coverage , there are policies that provide that as well.

Call the number on the back of your card to ask for guidance. Some benefits may require authorization from American Express before coverage kicks in, so make sure you follow all the correct steps for reimbursement.

Refer to the AmEx credit card policy for the specific benefit because it will include instructions for submitting a claim. If you cannot find the policy, you should call the customer service number on the back of your American Express card for more assistance.

Yes. American Express offers travel insurance as a benefit of some of its cards, but it also sells standalone coverage that you can purchase out-of-pocket. The latter tends to be more comprehensive and customizable to your needs.

No, you do not get automatic travel insurance with American Express. It is available as a benefit on certain cards. Refer to your terms and conditions to learn if you are covered.

American Express cards do not include medical coverage; instead, you will want to purchase a standalone travel insurance policy with medical protections, such as repatriation of remains or medical evacuation coverage .

American Express offers a solid range of travel insurance protection across its credit cards, with the premium cards providing the most coverage. However, if you need insurance benefits with higher limits, we recommend purchasing a

separate travel insurance policy

. If you only need

emergency medical coverage

, there are policies that provide that as well.

American Express cards do not include medical coverage; instead, you will want to purchase a standalone travel insurance policy with medical protections, such as

repatriation of remains or medical evacuation coverage

American Express travel insurance offers a wide array of benefits, especially on its premium cards. Knowing what benefits are available to you is important in the event of unforeseen circumstances. Determine whether an individual policy is a better fit for your risk tolerance than coverage that is included on an eligible card, then go from there.

Eligibility and Benefit level varies by Card. Terms, Conditions and Limitations Apply.

Please visit americanexpress.com/benefitsguide for more details.

Underwritten by New Hampshire Insurance Company, an AIG Company.

Underwritten by AMEX Assurance Company.

Baggage insurance plans

Please visit americanexpress.com/benefit sguide for more details.

Premium Global Assist Hotline

If approved and coordinated by Premium Global Assist Hotline, emergency medical transportation assistance may be provided at no cost. In any other circumstance, Card Members may be responsible for the costs charged by third-party service providers.

Card Members are responsible for the costs charged by third-party service providers.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

Amex Blue Cash Preferred card review: Generous bonus categories and a solid welcome offer

Editor's Note

Blue cash preferred® card from american express overview.

The Blue Cash Preferred® Card from American Express is a lucrative cash-back card for several spending categories. If cash back is up your alley — and select U.S. streaming, U.S. supermarkets, transit and U.S. gas station categories align with your spending habits — then you can't go wrong with the Blue Cash Preferred. Card Rating*: ⭐⭐⭐⭐

*Card Rating is based on the opinion of TPG's editors and is not influenced by the card issuer.

There are pros and cons to picking a cash-back card over a travel rewards card . However, the Blue Cash Preferred could be great for infrequent travelers and those looking to spend their rewards in other ways.

The unique and high-value bonus categories set this card apart from a simpler option, such as the Citi Double Cash® Card (see rates and fees ), though it's worth noting that reward redemption options are fewer with the Blue Cash Preferred. The Blue Cash Preferred is for discerning customers looking for a rewards credit card to maximize their returns in specific bonus categories on a card with a $0 introductory annual fee (then $95; see rates and fees ).

To successfully apply for this card, you should have a credit score of at least 670 — and preferably above 700.

Let's look at this card's ins and outs to help you decide if it's right for you.

Amex Blue Cash Preferred welcome bonus

Cash-back credit cards rarely offer solid bonuses as travel rewards cards do, but the Blue Cash Preferred has a quality welcome offer right now: $250 cash back (as a statement credit) after you spend $3,000 on purchases in the first six months of card membership. That's an ~8% return on spending.

Additionally, new applicants can take advantage of a 0% introductory annual percentage rate (APR) on purchases and balance transfers for the first 12 months of card membership. After that, a variable APR of 19.24%-29.99% will apply.

Amex Blue Cash Preferred benefits

As a low-annual-fee card, you won't find luxury perks on the Blue Cash Preferred; however, it has quality features worth mentioning.

You can receive $7 back each month (up to $84 back annually) after spending $12.99 or more on an eligible subscription to The Disney Bundle — which includes Disney+, Hulu, and ESPN+ — using your card. Another monthly credit provides up to $10 (for up to $120 annually) back when you use your Blue Cash Preferred Card to pay for Equinox+ at equinoxplus.com . Note that enrollment is required in advance for some benefits.

You'll also enjoy several travel and shopping protections with the Blue Cash Preferred. You can enjoy secondary rental car insurance when paying for the rental with your card — up to $50,000 of protection against theft or damage.*

The Global Assist Hotline provides medical, legal, financial and other emergency services coordination 24 hours a day, 7 days a week when traveling more than 100 miles from home. This service provides coordination only, however; you'll be responsible for the costs of any third-party services you use.**

For purchases made with your card, you can enjoy an extra year on top of manufacturers' warranties of five years or less, thanks to extended warranty protection. This coverage is limited to the amount paid for with your card — up to $10,000 and an annual limit of $50,000.^

You also can enjoy return protection, which covers items purchased in the last 90 days for which the merchant won't accept a return. You can be refunded for the full purchase price (excluding shipping and handling costs) — up to $300 per item and up to $1,000 per year. This applies only to purchases in the U.S. or U.S. territories, however.

Purchase protection is another card benefit, which covers items purchased with your card in the last 90 days but that are damaged, stolen or lost. You can be covered for up to $1,000 per claim and up to $50,000 per year.^

*Eligibility and benefit level varies by card. Not all vehicle types or rentals are covered, and geographic restrictions apply. Terms, conditions and limitations apply. Visit americanexpress.com/benefitsguide for details. Policies are underwritten by AMEX Assurance Company. Coverage is offered through American Express Travel Related Services Company, Inc. **Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Visit americanexpress.com/benefitsguide for details. Cardmembers are responsible for the costs charged by third-party service providers. # Eligibility and benefit levels vary by card. Terms, conditions and limitations apply. Visit americanexpress.com/benefitsguide for details.

^Eligibility and benefit levels vary by card. Terms, conditions and limitations apply. Visit americanexpress.com/benefitsguide for details. Policies are underwritten by AMEX Assurance Company.

Other cardmember benefits include " Plan It ," which allows you to select purchases of $100 or more to split up into monthly payments with a fixed fee, and access to valuable Amex Offers .

Related: Your complete guide to shopping protections on American Express cards

Earning cash back on the Amex Blue Cash Preferred

The standout feature of the Blue Cash Preferred is its various cash-back bonus categories:

- 6% back on select U.S. streaming subscriptions

- 6% back at U.S. supermarkets (up to $6,000 per calendar year, then 1% thereafter)

- 3% back on transit (parking, tolls, ride-hailing apps, subway, etc.)

- 3% back at U.S. gas stations

- 1% back everywhere else

Cash back is received as Reward Dollars that can be redeemed for statement credits.

While the Blue Cash Preferred is not the first card to offer bonus earnings on streaming subscriptions , its rate of 6% cash back is the industry leader. The Blue Cash Preferred is also a rewarding card at the supermarket and gas pump, earning 6% cash back and 3% cash back, respectively.

Aside from the U.S. supermarkets category, the other earning categories don't have annual caps on how much you can earn. These are strong earning rates for anyone with regular spending in these categories.

Redeeming cash back on the Amex Blue Cash Preferred

While cash-back cards won't unlock the doors to $10,000 first-class airplane suites , there's also no pressure to save up for a specific reward. Plus, the Blue Cash Preferred has no minimum redemption amount.

You have three redemption options:

- Receive a statement credit

- Redeem for gift cards

- Shop with your rewards

While multiple options exist, receiving a statement credit is likely your best option. That's because you can buy gift cards at most supermarkets. Rather than using your points for these purchases, you could pay for them with your Blue Cash Preferred and earn even more cash back.

Related: What credit cards should you use to purchase gift cards?

Which cards compete with the Amex Blue Cash Preferred?

The main alternatives to this card are other cash back cards that earn bonus points on groceries and gas, with no or a low annual fee.

- If you want similar benefits with no annual fee: The Blue Cash Everyday® Card from American Express has no annual fee (see rates and fees ) and earns 3% back at U.S. supermarkets, U.S. online retail purchases and U.S. gas stations — though there's a limit of $6,000 in purchases per category. After that, you'll earn 1% back. The card also provides the same Disney Bundle benefit as the Blue Cash Preferred card. (Enrollment required). For more information, read our full review of the Blue Cash Everyday.

- If you want Amex points instead of cash back: The Amex EveryDay® Preferred Credit Card has an annual fee of $95 (see rates and fees ) and earns Membership Rewards points instead of cash back. TPG values these points at 2 cents each, and you'll earn 3 points per dollar at U.S. supermarkets (up to $6,000 of purchases per year, then 1 point per dollar), 2 points per dollar at U.S. gas stations and 1 point per dollar on other purchases. However, if you make 30 or more transactions in a billing cycle, you'll get a 50% boost on your earnings. For more information, read our full review of the EveryDay Preferred .

- If you want rewards with more uses: The Citi Double Cash® Card earns 2 Citi ThankYou points per dollar — 1 point when you buy and another 1 point when you pay your bill — on all purchases. In addition to redeeming your earnings for cash back (at a 1 cent per point), you can transfer your points to several travel programs to unlock higher-value redemptions. For more information, read our full review of the Double Cash.

- If you want higher earning rates on gas: If you're looking for cash back, low fees and a higher earning rate at the pump, consider the Costco Anywhere Visa® Card by Citi (see rates and fees ). You'll earn 4% back on gas — anywhere, not just Costco gas stations — on your first $7,000 in fuel purchases per year, then 1% thereafter. This card has no annual fee, but you need a paid Costco membership (which starts at $60 per year). For more information, read our full review of the Costco Anywhere Visa.

For additional options, please check out our full list of cards that earn bonus points at supermarkets and gas stations .

Read more: Complete guide to credit card annual fees

The information for the Amex EveryDay Preferred Card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Bottom line

If you aren't a frequent traveler and want flexibility in how to spend your rewards, the Blue Cash Preferred might be a good fit for you . This is especially true if you want to earn cash back on groceries, streaming services, transit and gas purchases. An extra sweetener is the Disney statement credits.

With the enticing bonus categories and a solid welcome offer, many who prefer cash-back cards will have no problem justifying the annual fee after the first year on the Blue Cash Preferred. This card is best for those who spend on groceries, streaming services, transit and gas. Disney fans also can find value in this card due to monthly credits for Disney bundle subscriptions.

Apply here: Earn $250 back (in the form of a statement credit) after you spend $3,000 in purchases within the first six months of card membership with the Blue Cash Preferred

Additional reporting by Ryan Wilcox, Chris Dong and Ryan Smith.

For rates and fees of the Blue Cash Preferred card, click here . For rates and fees of the Blue Cash Everyday card, click here . For rates and fees of the EveryDay Preferred card, click here .

Introduction to American Express Travel Protection

Types of travel protection offered, american express travel protection: a guide to your benefits.

Affiliate links for the products on this page are from partners that compensate us and terms apply to offers listed (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate credit cards to write unbiased product reviews .

The information for the following product(s) has been collected independently by Business Insider: Hilton Honors American Express Aspire Card, Amex EveryDay® Preferred Credit Card, American Express® Green Card, The Plum Card® from American Express. The details for these products have not been reviewed or provided by the issuer.

- Some American Express cards offer trip cancellation and interruption benefits .

- You'll find these perks on cards like The Platinum Card® from American Express.

- If you're eager to sign up for a travel credit card with perks, compare each card's offerings.

Overview of Travel Protection Benefits

While credit card insurance and travel protection coverage are usually considered secondary to rewards programs and other cardholder perks, these benefits can be equally important if you travel.

When you pay for a trip with a credit card that offers trip cancellation and interruption insurance, for example, you can get reimbursed for some of your travel expenses in the event your vacation is halted for reasons beyond your control. Meanwhile, trip delay insurance lets you apply for some reimbursement when a delay of your trip results in surprise expenses, such as an unplanned hotel stay near the airport when your flight is on hold.

Importance of Travel Insurance

Chase credit cards like the Chase Sapphire Reserve® and Chase Sapphire Preferred® Card have really stood out for years in terms of the protections they offer, and with some of the highest limits out there. Still, American Express is still coming around — it recently added trip cancellation and interruption insurance, along with trip delay coverage, to many of its top rewards credit cards.

If you're in the market for an American Express card and you're hoping to take advantage of important travel benefits, consider the cards below and their expanded travel protections.

Trip Cancellation and Interruption Insurance

New trip cancellation and interruption insurance from American Express credit cards will provide you with up to $10,000 in coverage (and up to $20,000 per account per year) you can use for reimbursement of prepaid travel expenses like airfare and hotels. This coverage can come in handy if your trip is canceled for a covered reason beyond your control, or you're stuck in your destination and require an extended stay and additional costs before you can return home.

Note that this coverage is good for round-trip travel booked with your credit card, meaning you have to pay for travel expenses with a common carrier with your American Express credit card in order to be eligible.

American Express cards that qualify for this coverage include:

- The Platinum Card® from American Express

- Delta SkyMiles® Reserve American Express Card

- Hilton Honors American Express Aspire Card

- Marriott Bonvoy Brilliant® American Express® Card

- The Business Platinum Card® from American Express

- Delta SkyMiles® Reserve Business American Express Card

Other versions of the Amex Platinum card — including the Goldman Sachs, Morgan Stanley, and corporate flavors — also offer this coverage, as do all versions of the Amex Centurion (black) card , which is invite-only.

Baggage Insurance Plan

Quite a few American Express credit cards also offer a baggage insurance plan, although this isn't a new or upgraded benefit from the card issuer. This coverage can come in handy if your luggage is lost or stolen during a covered trip. To be eligible for this coverage, you have to pay for travel with a common carrier (airfare, cruise fare, etc.) with your American Express credit card.

The amount of coverage you'll receive depends on the card you have. For example, baggage insurance from the The Platinum Card® from American Express offers up to $3,000 in coverage per person for carry-on luggage and up to $2,000 per person in coverage for some types of checked baggage.

With baggage insurance from the Amex EveryDay® Preferred Credit Card , on the other hand, you'll only qualify for up to $1,250 in coverage per person for carry-on luggage and up to $500 for covered checked baggage, although an extra benefit of $250 is offered for qualified "high risk items" like jewelry or sporting equipment.

American Express cards that come with baggage insurance include:

- The Platinum Card® from American Express (including various versions)

- American Express® Gold Card (including various versions)

- American Express® Green Card (including various versions)

- Delta SkyMiles® Gold American Express Card

- Delta SkyMiles® Platinum American Express Card

- Hilton Honors American Express Surpass® Card

- Amex EveryDay® Preferred Credit Card

- The Plum Card® from American Express

American Express business cards with baggage insurance include:

- American Express® Business Gold Card

- The Blue Business® Plus Credit Card from American Express

- Delta SkyMiles® Gold Business American Express Card

- Delta SkyMiles® Platinum Business American Express Card

- Marriott Bonvoy Business® American Express® Card

- The Hilton Honors American Express Business Card

- Lowe's Business Rewards Card from American Express

- Amazon Business Prime American Express Card

- Amazon Business American Express Card

Various versions of the Amex Centurion card and several Amex corporate cards also offer baggage insurance.

Travel Accident Insurance

Some American Express cards also offer secondary auto rental coverage, which means this coverage kicks in after other policies you have are exhausted, as opposed to primary car rental coverage.

While this benefit applies to many Amex cards, note that coverage limits can vary. With the Amex Gold card, for example, coverage is limited to $50,000 per rental agreement for damage or theft, yet the Amex Platinum card offers up to $75,000 in coverage. The insurance doesn't cover personal liability, either.

Also note that this coverage comes with a certain amount of Accidental Death or Dismemberment Coverage that varies by card. With , for example, you'll receive up to $200,000 in coverage per person and up to $300,000 in coverage per car accident for accidental death and dismemberment. Make sure to read your credit card's terms and conditions so you know exactly how much coverage you have.

American Express cards that come with secondary auto rental coverage include:

- The Platinum Card® from American Express (including various versions)

- Delta SkyMiles® Blue American Express Card

- Hilton Honors American Express Card

- Marriott Bonvoy American Express® Card (no longer available to new applicants)

- Blue Cash Everyday® Card from American Express

- Blue Cash Preferred® Card from American Express

- Amex Everyday® Credit Card from American Express

And business cards from Amex that offer secondary car rental insurance include:

While American Express did offer travel accident insurance on some of its cards, this coverage was effectively dropped as of January 1, 2020. The same is true for the American Express Roadside Assistance Hotline, which is no longer available.

Trip Delay Insurance

In January of 2020, American Express also rolled out an upgraded trip delay insurance benefit for many of its top rewards credit cards. While this perk may seem like an unusual one, there are so many scenarios where trip delay coverage could help you save money and avoid surprise expenses when travel is delayed beyond your control.

With trip delay coverage from Amex, you can be reimbursed for up to $500 per trip for hotel stays, meals, and other miscellaneous required expenses when your flight or other trip plans are delayed by more than six hours. If you're sitting at the airport and your flight is suddenly delayed until the next morning, for example, you could use this coverage to get reimbursed for a nearby airport hotel and your dinner, then for an Uber or Lyft ride back to the airport.

To qualify for American Express trip delay coverage, you need to pay for your round-trip travel expenses with a common carrier with your credit card.

Amex cards that come with trip delay coverage include:

- American Express® Gold Card

- American Express® Green Card

Again, the various versions of the Amex Platinum and Amex Centurion cards also offer trip delay insurance.

Most travel protections are automatically activated when you use your American Express card to book your travel. However, specific activation steps, if any, depend on the benefit.

Covered reasons for trip cancellation or interruption typically include illness, severe weather, and other unforeseen events, reimbursing you for non-refundable travel expenses.

Yes, baggage insurance plans come with coverage limits, which vary depending on the card and the type of loss (e.g., lost, damaged, or stolen baggage).

The Global Assist Hotline offers medical, legal, and other emergency coordination and assistance services, but financial costs for services rendered are typically the cardholder's responsibility.

Eligibility for specific travel protections varies by card. Premium cards often offer more comprehensive protections compared to basic cards.

For rates and fees of The Platinum Card® from American Express, please click here.

Eligibility and Benefit level varies by Card. Terms, Conditions and Limitations Apply. Please visit americanexpress.com/benefitsguide for more details. Trip Delay Insurance, Trip Cancellation and Interruption Insurance, and Cell Phone Protection Underwritten by New Hampshire Insurance Company, an AIG Company. Global Assist Hotline Card Members are responsible for the costs charged by third-party service providers. If approved and coordinated by Premium Global Assist Hotline, emergency medical transportation assistance may be provided at no cost. In any other circumstance, Card Members may be responsible for the costs charged by third-party service providers. Extended Warranty, Purchase Protection, and Baggage Insurance Plan Underwritten by AMEX Assurance Company. Car Rental Loss & Damage Insurance Underwritten by AMEX Assurance Company. Car Rental Loss or Damage Coverage is offered through American Express Travel Related Services Company, Inc.

- Main content

The Amex Blue Cash Preferred is my go-to card—Here’s why anyone buys groceries should consider it

Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Unlike travel rewards credit cards, cash-back cards typically don’t offer a lot of ongoing perks. At the same time, many of the best cash-back credit cards don’t charge an annual fee, so you don’t have to worry about getting enough value in rewards and perks to justify a yearly cost.

The Blue Cash Preferred® Card from American Express is one exception, charging a $0 intro annual fee for the first year, then $95 after that. But while the card isn’t the right fit for everyone—no rewards credit card is—I’d argue it’s one of the best for everyday spending, particularly for couples and families.

After canceling the card several years ago in favor of travel rewards, here’s why I recently applied for it again.

Blue Cash Preferred® Card from American Express

See Rates and Fees

Intro Bonus

Reward rates.

- 6% Earn 6% cash back at U.S. supermarkets on up to $6,000 per year in purchases (then 1%)

- 6% Earn 6% cash back on select U.S. streaming subscriptions

- 3% Earn 3% cash back at U.S. gas stations and on transit (including taxis/rideshare, parking, tolls, trains, buses and more)

- 1% Earn 1% cash back on other eligible purchases

- Return protection, which is rare for a card at this level

- 0% introductory APR for the first 12 months from the date of account opening (after that, the variable APR will be 19.24%–29.99%)

- Strong rewards rate on groceries and gas

- 3% cash back only for the first $6,000 spent in each category per year

- Rewards can only be redeemed as a statement credit

- Charges foreign transaction fee

- The Blue Cash Preferred card comes with added car rental loss and damage insurance and a Disney+ bundle credit.

The card offers best-in-class rewards on groceries

The Blue Cash Preferred Card offers an impressive 6% cash back at U.S. supermarkets on up to $6,000 per year in purchases (then 1%). As a single dad with two kids, I spend more than the card’s annual limit on groceries. But even with a cap, the card is tough to beat.

Here’s how it compares to other top credit cards for groceries based on an average annual household supermarket bill of $4,935, according to the 2022 U.S. Bureau of Labor Statistics Consumer Expenditure Survey :

To view rates and fees of the Blue Cash Preferred® Card from American Express , see this page

To view rates and fees of the Blue Cash Everyday® Card from American Express , see this page

The card’s other bonus rewards are solid

The card offers 6% cash back on select U.S. streaming subscriptions, which you’ll be hard-pressed to beat anywhere else.

It also provides 3% cash back at U.S. gas stations and on transit (including taxis/rideshare, parking, tolls, trains, buses and more).

While you could get better gas station rewards from a different card, that’s still a solid rate, especially combined with the card’s supermarket rewards. As someone who works from home, I don’t drive much, so gas station rewards aren’t as important to me.

As a new cardholder, you’ll earn $250 statement credit after you spend $3,000 in purchases on your new card within the first 6 months. While that may be a steep spending requirement for some, American Express offers three more months to earn the welcome bonus than most credit card issuers.

Other card benefits help offset the cost of the annual fee

The Blue Cash Preferred comes with a handful of perks that can add more value to your everyday spending and even help mitigate the cost of the card’s annual fee:

- Introductory 0% APR promotion: New cardholders can also enjoy 0% introductory APR on purchases and balance transfers for the first 12 months from the date of account opening (after that, the variable APR will be 19.24%–29.99%). If you have one or more upcoming purchases you can’t afford to pay off immediately or want to pay down some high-interest debt from another card, this benefit could save you hundreds of dollars in interest charges.

- Disney Bundle credit: $7 statement credit each month (up to $84 back annually) after spending $9.99 or more each month on an eligible subscription to The Disney Bundle which includes DisneyPlus.com, Hulu.com, or Plus.espn.com using your Blue Cash Preferred® Card. Enrollment required (subject to auto-renewal).

- Equinox+ credit: When you use your card to pay for an auto-renewing subscription to the fitness app Equinox+, you’ll get $10 in monthly statement credits. Enrollment required.

Personally, I don’t think the $39.99 monthly fee for an Equinox+ membership is worth it, and I didn’t get the 0% APR promotion because I’ve had the card in the past—Amex welcome offers and introductory promotions are typically a one-time deal—but the Disney Bundle credit gives me $84 back per year, almost enough to cover the card’s annual fee.

To view rates and fees of the Blue Cash Preferred® Card from American Express , see this page

Some caveats to consider

Like any other credit card, the Blue Cash Preferred isn’t perfect. If you don’t spend a lot at the supermarket, you tend to shop for groceries with ineligible merchants, or you have other preferences, this card may not be for you. Here are some potential drawbacks to keep in mind.

Supermarket rewards are limited

The Blue Cash Preferred Card doesn’t offer supermarket bonus rewards when you buy at superstores like Walmart and Target or wholesale clubs like Costco and Sam’s Club. Since I do most of my grocery shopping at a locally-owned supermarkets, the Blue Cash Preferred is the perfect fit.

If you prefer to shop for groceries with those retailers, though, the U.S. Bank Shopper Cash Rewards® Visa Signature® Card may be a better fit. The card offers 6% cash back on up to $1,500 spent quarterly with two retailers of your choice (including Target and Walmart), 3% back on up to $1,500 spent quarterly in a category of your choice (including wholesale clubs), and 1.5% back on everything else. The card charges a $0 intro annual fee, then $95 after that.

The card’s base rewards rate is low

If you use the card for all of your spending, it’s likely that most of your purchases will net you the 1% base rewards rate. As a result, it’s recommended that you pair the card with another rewards card that offers a high, flat rewards rate on all of your purchases.

To maximize my rewards, I pair the Blue Cash Preferred with the Alliant Cashback Visa Signature® Credit Card , which gives me 2.5% cash back on up to $10,000 spent each month (though I have to meet certain criteria to earn that rate).

Redemption is inflexible

The other downside to the card’s rewards program is that there’s only one redemption option: statement credits.

I generally prefer the flexibility of depositing cash back into my checking account, so I can use it the way I want. I can still get some flexibility by redeeming Reward Dollars for a statement credit and then earmarking the same amount in my bank account for discretionary spending, but it’s not as exciting as getting paid directly.

The takeaway

When I canceled the Blue Cash Preferred Card several years ago to focus on travel rewards, I opted to replace it with the American Express® Gold Card , which offers outstanding rewards on groceries and dining out.

But as my preferences switched back to the straightforward and flexible nature of cash back, the Blue Cash Preferred was one of the first cards I applied for. While it’s not the right fit for everyone, and there are some downsides to consider, the card can be an excellent fit for families and others who spend a lot on groceries, like the card’s other rewards and benefits, and don’t mind a modest annual fee.

To view rates and fees of the American Express® Gold Card , see this page

Please note that card details are accurate as of the publish date, but are subject to change at any time at the discretion of the issuer. Please contact the card issuer to verify rates, fees, and benefits before applying.

Eligibility and Benefit level varies by Card. Terms, Conditions, and Limitations Apply. Please visit americanexpress.com/benefits guide for more details. Underwritten by Amex Assurance Company.

EDITORIAL DISCLOSURE : The advice, opinions, or rankings contained in this article are solely those of the Fortune Recommends ™ editorial team. This content has not been reviewed or endorsed by any of our affiliate partners or other third parties.

Guide to cash back credit cards

Best cash back credit cards of april 2024, how cash back credit cards work and some tips on how to choose the best one for you, if you use a cash back credit card, here are a few smart ways to use your rewards, how to make the most of your 5% cash-back credit cards, don't pass up free money: get a cash back credit card, can i get cash back with a credit card yes, and here's how to make sure it's worth it, credit card points, miles, and cash back—how to choose the best rewards program for your needs, why i switched from travel rewards to cash back credit cards—how to know if you should, too, chase freedom rise credit card review: build good credit and earn cash back, the amex blue cash preferred is my go-to card—here's why anyone buys groceries should consider it.

- Best Travel Insurance 2024

- Cheapest Travel Insurance

- Trip Cancellation Insurance

- Cancel for Any Reason Insurance

- Seniors' Travel Insurance

- Annual Travel Insurance

- Cruise Insurance

- COVID-19 Travel Insurance

- Travel Medical Insurance

- Medical Evacuation Insurance

- Pregnancy Travel Insurance

- Pre-existing Conditions Insurance

- Mexico Travel Insurance

- Italy Travel Insurance

- France Travel Insurance

- Spain Travel Insurance

- Canada Travel Insurance

- UK Travel Insurance

- Germany Travel Insurance

- Bahamas Travel Insurance

- Costa Rica Travel Insurance

- Disney Travel Insurance

- Schengen Travel Insurance

- Is travel insurance worth it?

- Average cost of travel insurance

- Is airline flight insurance worth it?

- Places to travel without a passport

- All travel insurance guides

- Best Pet Insurance 2024

- Cheap Pet Insurance

- Cat Insurance

- Pet Dental Insurance

- Pet Insurance That Pays Vets Directly

- Pet Insurance For Pre-Existing Conditions

- Pet Insurance with No Waiting Period

- Paw Protect Review

- Spot Pet Insurance Review

- Embrace Pet Insurance Review

- Healthy Paws Pet Insurance Review

- Pets Best Insurance Review

- Lemonade Pet Insurance Review

- Pumpkin Pet Insurance Review

- Fetch Pet Insurance Review

- Figo Pet Insurance Review

- CarePlus by Chewy Review

- MetLife Pet Insurance Review

- Average cost of pet insurance

- What does pet insurance cover?

- Is pet insurance worth it?

- How much do cat vaccinations cost?

- How much do dog vaccinations cost?

- All pet insurance guides

- Best Business Insurance 2024

- Business Owner Policy (BOP)

- General Liability Insurance

- E&O Professional Liability Insurance

- Workers' Compensation Insurance

- Commercial Property Insurance

- Cyber Liability Insurance

- Inland Marine Insurance

- Commercial Auto Insurance

- Product Liability Insurance

- Commercial Umbrella Insurance

- Fidelity Bond Insurance

- Business Personal Property Insurance

- Medical Malpractice insurance

- California Workers' Compensation Insurance

- Contractor's Insurance

- Home-Based Business Insurance

- Sole Proprietor's Insurance

- Handyman's Insurance

- Photographer's Insurance

- Esthetician's Insurance

- Salon Insurance

- Personal Trainer's Insurance

- Electrician's Insurance

- E-commerce Business Insurance

- Landscaper's Insurance

- Best Credit Cards 2024

- Best Sign-Up Bonuses

- Instant Approval Cards

- Best Cash Back Credit Cards

- Best Rewards Credit Cards

- Credit Cards for Bad Credit

- Balance Transfer Credit Cards

- Student Credit Cards

- 0% Interest Credit Cards

- Credit Cards for No Credit History

- Credit Cards with No Annual Fee

- Best Travel Credit Cards

- Best Airline Credit Cards

- Best Hotel Credit Cards

- Best Gas Credit Cards

- Best Business Credit Cards

- Best Secured Credit Cards

- Best American Express Cards

- American Express Delta Cards

- American Express Business Cards

- Best Capital One Cards

- Capital One Business Cards

- Best Chase Cards

- Chase Business Cards

- Best Citi Credit Cards

- Best U.S. Bank Cards

- Best Discover Cards

- Amex Platinum Card Review

- Amex Gold Card Review

- Amex Blue Cash Preferred Review

- Amex Blue Cash Everyday Review

- Capital One Venture Card Review

- Capital One Venture X Card Review

- Capital One SavorOne Card Review

- Capital One Quicksilver Card Review

- Chase Sapphire Reserve Review

- Chase Sapphire Preferred Review

- United Explorer Review

- United Club Infinite Review

- Milestone Mastercard Review

- Destiny Mastercard Review

- OpenSky Credit Card Review

- Self Credit Builder Review

- Chime Credit Builder Review

- Aspire Card Review

- Amex Gold vs Platinum

- Amex Platinum vs Chase Sapphire Reserve

- Capital One Venture vs Venture X

- Capital One SavorOne vs Quicksilver

- How to get Amex pre-approval

- Amex travel insurance explained

- Chase Sapphire travel insurance guide

- Chase Pay Yourself Back

- CLEAR vs. TSA PreCheck

- All credit card guides

- Citibank Savings Account Interest Rate

- Capital One Savings Account Interest Rate

- American Express Savings Account Interest Rate

- Western Alliance Savings Account Interest Rate

- Barclays Savings Account Interest Rate

- Discover Savings Account Interest Rate

- Chase Savings Account Interest Rate

- U.S. Bank Savings Account Interest Rate

- Marcus Savings Account Interest Rate

- Synchrony Bank Savings Account Interest Rate

- Ally Savings Account Interest Rate

- Bank of America Savings Account Interest Rate

- Wells Fargo Savings Account Interest Rates

- SoFi Savings Account Interest Rate

- Best Savings Accounts & Interest Rates

- Best High Yield Savings Accounts

- Best 7% Interest Savings Accounts

- Best 5% Interest Savings Accounts

- Savings Interest Calculator

- Emergency Fund Calculator

- Pros and Cons of High-Yield Savings Accounts

- Types of Savings Accounts

- Checking vs Savings Accounts

- Average Savings by Age

- How Much Should I Have in Savings?

- How to Make Money

- How to Save Money

- Compare Best Checking Accounts

- Compare Online Checking Accounts

- Best Business Checking Accounts

- Compare Best Teen Checking Accounts

- Best Student Checking Accounts

- Best Joint Checking Accounts

- Best Second Chance Checking Accounts

- Chase Checking Account Review

- Bluevine Business Checking Review

- Amex Rewards Checking Account Review

- E&O Professional Liability Insurance

- Best Savings Accounts & Interest Rates

- Best Credit Cards

- American Express Credit Cards

- American Express Blue Business Cash Card Review

On This Page

- Key takeaways

Is the American Express Blue Business Cash card worth it?

American express blue business cash card rewards, american express blue business cash card benefits, american express blue business cash card fees, rates & limit , how the american express blue business cash card compares, is the amex blue business cash card right for me, how do i get the amex blue business cash card, faq: american express blue business cash card.

Amex Blue Business Cash Card Review April 2024

- The American Express Blue Business Cash™ Card offers 2% cash back on up to $50,000 in eligible business purchases per calendar year.

- This credit card has no annual fee ( see rates and fees ).

- Blue Business Cash cardholders have access to several card benefits, including extended warranty protection and purchase protection.

- With the Blue Business Cash card, it’s possible to give your employees their own cards.

- The Blue Business Cash card works with QuickBooks to automatically categorize your business expenses.

*Eligibility and Benefit level varies by Card. Terms, Conditions, and Limitations Apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by Amex Assurance Company.

Whether you just started your own company or you’ve been running a small business for years, using a rewards credit card is a great way to earn cash back on your purchases.

If you’re ready to earn rewards based on your spending habits, it’s important to find the right credit card.

We reviewed The American Express Blue Business Cash™ Card to determine if this business card is worth a slot in your wallet.

Stick with us as we explore:

- Why the Amex Blue Business Cash card is a great fit for start-ups and small businesses

- How you can earn rewards based on your business spending

- What benefits are available with this American Express card

- No annual fee

- High rewards rate

- Simple cash back structure

- Spending cap for 2% rewards

- Requires good to excellent credit

- Limited redemption options

The American Express Blue Business Cash™ Card is absolutely worth it if you’re a small-business owner who doesn’t have time to track multiple spending categories.

This credit card has no annual fee , making it an excellent fit for budget-conscious business owners. The Blue Business Cash card also comes with Expanded Buying Power, which allows you to spend beyond your credit limit as your company’s needs change.

Pros and cons of the Amex Blue Business Cash card

- Allows you to spend above your credit limit

- 2% cash back on up to $50,000 in eligible business purchases each year

- Built-in tools for expense management

- 2% cash back only applies to your first $50,000 in business purchases each year

- Limited features compared to other business credit cards

- 2.7% foreign transaction fee

- Limited redemption options (statement credits only)

Learn more about the Amex Blue Business Cash Card

Terms apply / Rates & fees

* Eligibility and Benefit level varies by Card. Terms, Conditions, and Limitations Apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by Amex Assurance Company.

The Amex Blue Business Cash card has a straightforward rewards structure, making it easy to earn cash back on your eligible purchases.

Welcome bonus

Amex Blue Business Cash members have two opportunities to earn a welcome bonus. If you spend $5,000 on your card within six months of opening it, you’ll receive a $250 statement credit.

If you spend an additional $10,000 or more within your first year of membership, you’ll earn another statement credit worth $250.

When all is said and done, you have the potential to earn $500 in welcome bonuses if you spend $15,000 or more within one year of opening your account.

Earn Blue Business Cash card rewards

The simple Amex Blue Business Cash rewards structure is one of the best features of this cash-back credit card . You get 2% back on up to $50,000 in eligible business purchases per calendar year and 1% back on everything else.

Note that cash back isn’t available for gift cards, person-to-person transactions or cash-equivalent purchases. For example, if you use your card to load funds on a prepaid debit card, you won’t earn cash back on the transaction.

Redeem Blue Business Cash card rewards

The main drawback of the Amex Blue Business Cash card is that you can’t redeem your cash back for miles, travel perks or anything other than statement credits. American Express automatically applies these credits to your account. Each statement credit reduces your balance, but it doesn’t eliminate your minimum monthly payment.

For example, if you have a balance of $5,000 with a $150 minimum monthly payment, a statement credit of $200 would reduce your balance to $4,800. However, you’d still have to make your $150 payment as scheduled.

The American Express Blue Business Cash Card offers several benefits for business owners. It also comes with some of the standard card benefits offered by American Express.

Business benefits

American Express offers several benefits designed to make things easier for business owners, including:

- Expanded buying power. The Amex Blue Business Cash card outperforms several other business credit cards because it gives you access to Expanded Buying Power. This feature lets you spend more than your limit, ensuring you can take advantage of new opportunities as they arise. Amex adds the overage to your minimum monthly payment, so you must pay it back by the end of your billing cycle.

- Employee cards. American Express allows you to issue Employee Blue Business Cash cards, making it easier to track expenses by department or role. Employees can use their cards to cover business dinners, conference fees and other expenses. As the account holder, you get summary reports and spending alerts to make expense management even easier.

- Account managers. With the Blue Business Cash card, it’s possible to add trusted individuals to your account. Each account manager can make payments, access summary reports and perform other activities if you’re on the road or busy handling other tasks.

- Vendor Pay by Bill.com. When you enroll your card in Vendor Pay, you can use it to pay your company’s bills. There’s no fee for the first user, making this an easy way to stop on top of your expenses.

- Connect to QuickBooks®. If you use QuickBooks to manage your bookkeeping, you can connect your Amex Blue Business Cash card to your QuickBooks account. Connecting the two accounts makes it possible to automatically tag your business charges with your QuickBooks categories.

Other benefits

Blue Business Cash cardholders also have access to some of the general credit card benefits offered by American Express.

- Extended warranty protection: American Express gives you extra peace of mind with extended warranty protection, which extends the original manufacturer’s warranty by one year. This feature is available for warranties of five years or less on eligible purchases made in the United States or one of its territories/possessions.

- Purchase protection: If you use your card to pay for a covered purchase, you’ll receive 90 days of purchase protection. This benefit reimburses you for up to $1,000 per occurrence if a covered item is stolen or accidentally damaged. Note that purchase protection has a coverage limit of $50,000 per year.

- Car rental loss and damage insurance: If you use your card to cover the cost of a rental vehicle, American Express provides car rental loss and damage insurance. You must rent the vehicle in a covered territory and use your Amex Blue Business Cash card to pay the full rental fee. This insurance coverage is secondary, which means it only applies after you’ve exhausted your personal auto insurance benefits.

- Global Assist Hotline: If you need help when you’re more than 100 miles from home, your Blue Business Cash card entitles you to use the Global Assist Hotline. Trained agents are available to help you with missing luggage, medical emergencies, lost passports and other problems. Agents can also refer you to medical and legal services as needed.

- American Express mobile app: The American Express mobile app makes it easy to manage your account on the go. You can use it to check your balance, make payments, review your account benefits and complete other account-related tasks.

Eligibility and Benefit level varies by Card. Terms, Conditions, and Limitations Apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by Amex Assurance Company.

Before you open an American Express Blue Business Cash account, note the rates, fees and credit limit associated with the card ( see rates and fees ).

Blue Business Cash card fees

The Blue Business Cash card comes with the following fees:

- Annual fee: $0

- Balance transfer fee: $5 or 3% of the transfer amount, whichever is greater

- Late payment: Up to $39

- Returned payment: $39

- Foreign transactions: 2.7% of the transaction amount after it’s converted to U.S. dollars

- Cash advances: N/A (Blue Business Cash doesn’t allow cash advances)

Amex Blue Business Cash card interest rates

American Express charges the following rates to Blue Business Cash cardholders:

- Regular APR: 18.49% to 26.49% variable

- Purchase intro APR: 0% interest for 12 months from the date of account opening

- Cash advance APR: N/A

- Balance transfer intro APR: N/A

American Express Blue Business card credit limit

The American Express Blue card limit depends on your income, debt load and other factors. If you have an excellent credit score, you may qualify for as much as $20,000. If you have a limited credit history , limits may start out as low as $1,000 or $2,000.

Note that American Express may occasionally offer credit limit increases based on your account usage. For example, if your credit score increases significantly within two years of opening your account, you may qualify for a higher limit.

The main advantage of getting the American Express Blue Business Cash card is that it has a simple rewards structure. You don’t have to keep track of ever-changing bonus categories or pull out a calculator every time you make a transaction.