- Best Extended Auto Warranty

- Best Used Car Warranty

- Best Car Warranty Companies

- CarShield Reviews

- Best Auto Loan Rates

- Average Auto Loan Interest Rates

- Best Auto Refinance Rates

- Bad Credit Auto Loans

- Best Auto Shipping Companies

- How To Ship a Car

- Car Shipping Cost Calculator

- Montway Auto Transport Reviews

- Best Car Buying Apps

- Best Websites To Sell Your Car Online

- CarMax Review

- Carvana Reviews

- Best LLC Service

- Best Registered Agent Service

- Best Trademark Service

- Best Online Legal Services

- Best CRMs for Small Business

- Best CRM Software

- Best CRM for Real Estate

- Best Marketing CRM

- Best CRM for Sales

- Best Free Time Tracking Apps

- Best HR Software

- Best Payroll Services

- Best HR Outsourcing Services

- Best HRIS Software

- Best Project Management Software

- Best Construction Project Management Software

- Best Personal Loans

- Best Fast Personal Loans

- Best Debt Consolidation Loans

- Best Loans for Bad Credit

- Best Personal Loans for Fair Credit

- HOME EQUITY

- Best Home Equity Loan Rates

- Best Home Equity Loans

- Best Checking Accounts

- Best Free Checking Accounts

- Best Online Checking Accounts

- Best Online Banks

- Bank Account Bonuses

- Best High-Yield Savings Accounts

- Best Savings Accounts

- Average Savings Account Interest Rate

- Money Market Accounts

- Best CD Rates

- Best 3-Month CD Rates

- Best 6-Month CD Rates

- Best 1-Year CD Rates

- Best 5-Year CD Rates

- Best Jumbo CD Rates of April 2024

- Best Hearing Aids

- Best OTC Hearing Aids

- Most Affordable Hearing Aids

- Eargo Hearing Aids Review

- Best Medical Alert Systems

- Best Medical Alert Watches

- Best Medical Alert Necklaces

- Are Medical Alert Systems Covered by Insurance?

- Best Online Therapy

- Best Online Therapy Platforms That Take Insurance

- Best Online Psychiatrist Platforms

- BetterHelp Review

- Best Mattress

- Best Mattress for Side Sleepers

- Best Mattress for Back Pain

- Best Adjustable Beds

- Best Home Warranty Companies

- American Home Shield Review

- First American Home Warranty Review

- Best Home Appliance Insurance

- Best Moving Companies

- Best Interstate Moving Companies

- Best Long-Distance Moving Companies

- Cheap Moving Companies

- Best Window Replacement Companies

- Best Gutter Guards

- Gutter Installation Costs

- Best Window Brands

- Best Solar Companies

- Best Solar Panels

- How Much Do Solar Panels Cost?

- Solar Calculator

- Best Car Insurance Companies

- Cheapest Car Insurance Companies

- Best Car Insurance for New Drivers

- Same-day Car Insurance

- Best Pet Insurance

- Pet Insurance Cost

- Cheapest Pet Insurance

- Pet Wellness Plans

- Best Life Insurance

- Best Term Life Insurance

- Best Whole Life Insurance

- Term vs. Whole Life Insurance

- Best Travel Insurance Companies

- Best Homeowners Insurance Companies

- Best Renters Insurance Companies

- Best Motorcycle Insurance

Partner content: This content was created by a business partner of Dow Jones, independent of the MarketWatch newsroom. Links in this article may result in us earning a commission. Learn More

Best Medical Insurance for Visitors to the U.S. (2024)

U.S. visitors can get travel medical insurance for as low as $89 per trip.

from Seven Corners via Squaremouth.

Alex is a MarketWatch Guides team writer that covers automotive and personal finance topics. She’s worked as a content writer for over a dozen car dealerships across the U.S. and as a contributor to several major auto news websites.

Tori Addison is an editor who has worked in the digital marketing industry for over five years. Her experience includes communications and marketing work in the nonprofit, governmental and academic sectors. A journalist by trade, she started her career covering politics and news in New York’s Hudson Valley. Her work included coverage of local and state budgets, federal financial regulations and health care legislation.

Seven Corners, WorldTrips, IMG and Trawick offer the best health insurance plans for visitors to the U.S.

In this guide, we’ll provide you with details on travel health insurance plans from these providers, including example quotes, information on how to use your visitor health insurance and more.

Do Visitors Need U.S. Health Insurance?

While health insurance is not always mandatory when traveling to the U.S., regulations may vary depending on the circumstances around your visit and your visa needs. In addition, health plans from different countries are generally not accepted in the U.S., which means you could pay thousands of dollars out-of-pocket for treatment in an emergency without a valid plan.

Note that many foreign visitors traveling to the U.S. do not need a visa to enter the country for less than 90 days. However, some visa requirements for long-term visitors require health insurance coverage for the duration of their stay. Regardless of the requirements for your travels, it’s worth considering a travel medical insurance plan based on the high cost of U.S. healthcare. According to GoodRx, an emergency room visit can cost upwards of $2,400 to $2,600 without insurance in the U.S.

Health Insurance Requirements for People Visiting the U.S.

While tourists do not technically need a travel medical insurance plan to obtain a visa, other types of visitors do. For instance, if you’re a student planning to study abroad in a U.S.-based college or university using an F-1 or J-1 visa, you’ll likely need some sort of health insurance or a comparable equivalent. Many universities that accept students on visas require medical coverage that complies with the school’s outlined health insurance requirements.

Note that health insurance requirements for visitors to the U.S. largely depend on the type of visa you need to enter the country. Regardless of whether it’s required, we recommend medical insurance based on the high costs of U.S. healthcare services.

Best Travel Health Insurance for Visitors to the U.S.

Our team has spent extensive time researching the best travel medical insurance plans for visitors to the U.S., considering factors such as availability, coverage, customer support and provider reputation.

- Seven Corners Travel Medical Basic : Our pick for group travelers

- WorldTrips Atlas America : Our pick for high coverage limits

- IMG Patriot Lite : Our pick for budget coverage

- IMG Patriot America Plus : Our pick for continuous coverage

- Trawick Safe Travels USA Comprehensive : Our pick for wellness coverage

Seven Corners

Why We Picked It

Seven Corners’ Travel Medical Basic plan is our pick for group travelers. This plan is specifically designed for groups of up to 10 non-U.S. residents and non-U.S. citizens aged 14 days or older, making it ideal for families traveling together . However, it is also available for solo travelers. You can extend coverage for up to a year, with protection both in the U.S. and worldwide.

Pros and Cons

Medical coverage details.

The Travel Medical Basic plan offers extensive coverage with benefit maximums of up to $1 million and various deductible options, making it easy to customize a plan to suit your needs. Medical coverage offered through this plan includes the following:

- General medical

- Emergency dental

- Emergency services and assistance

- Accidental death and dismemberment (AD&D)

- Optional adventure activity coverage

Learn more : Seven Corners Travel Insurance Review

WorldTrips’ Atlas America plan is our pick for high coverage limits. This plan is designed for U.S. tourists, temporary workers, business visitors and international students studying abroad , providing accessible health coverage to a variety of travelers. It provides overall coverage maximums of up to $2 million, with up to $1 million for emergency medical evacuation coverage.

The Atlas America plan offers up to $2 million in overall coverage and seven different deductible options, providing sound medical coverage along with supplemental travel benefits. Medical coverages include services that fall under the following categories:

- Emergency dental and vision

Learn more: WorldTrips Travel Insurance Review

We chose IMG’s Patriot Lite plan as our pick for budget coverage — the company quoted us less for this plan than its competitors on our list. You can buy this plan as an individual or group, making it ideal for family members traveling to the U.S. together. Like other insurance companies in this review, IMG is partnered with UnitedHealthcare, meaning policyholders have access to a domestic network of over 1.4 million physicians for medical care.

Policyholders can choose coverage with a maximum of up to $1 million with the Patriot Lite plan, with deductibles ranging from $0 to $2,500. Coverages with the Patriot Lite plan include the following:

Learn more : IMG Travel Insurance Review

IMG’s Patriot America Plus plan also made our list for providing short-term insurance for business and leisurely travelers. We named it our pick for continuous coverage, as it provides up to 24 months of renewable, consecutive coverage. Other benefits include access to multilingual customer service representatives and a maximum limit of up to $1 million. Unlike IMG’s Patriot Lite plan, Patriot America Plus covers COVID-19 treatments.

As with IMG’s Patriot Lite plan, coverage with a maximum of up to $1 million is available, with your choice of deductible from $0 to $2,500. Coverages with the Patriot America Plus plan include the following:

Trawick International

We named Trawick’s Safe Travels USA Comprehensive plan our pick for wellness coverage, as it affords policyholders a general wellness visit with a U.S. doctor during their travels for up to $125. As is standard across most plans in our review, Trawick’s Safe Travels plan offers up to $1 million in medical expense coverage. It also offers up to $2 million in emergency medical evacuation coverage and eight deductible options up to $5,000.</p

The Safe Travels USA Comprehensive plan covers up to $1 million in medical benefits after you pay your deductible. Benefits provided with each plan include:

- Optional sports activity coverage (excludes extreme sports)

Read more : Trawick International Travel Insurance Review

Compare Travel Medical Insurance Plans for U.S. Tourists

See the table below for a direct comparison of costs, deductibles and more between travel medical insurance plans for U.S. visitors.

We based plan costs on quotes we obtained for a 30-year-old Australian citizen traveling to the U.S. for 30 days. Each plan includes a medical maximum of $500,000 with a $250 deductible. Note that your actual cost will depend on factors such as your age, number of travelers, chosen deductible and more.

Types of Health Insurance for U.S. Visitors

Travelers have options when it comes to health insurance for U.S. visitors. For one, you could choose an international travel medical insurance plan, which provides coverage for emergency medical expenses or evacuation abroad. A U.S. short-term health insurance plan is also an option. Some health insurance companies, such as UnitedHealthcare, work with providers to allow policyholders to use the company’s preferred provider organization (PPO) network.

If you’re wondering whether your domestic health insurance policy will cover you in the U.S., we encourage you to contact your insurance provider for more details. You may need to purchase valid coverage specifically for your U.S. trip if you’re concerned about or foresee needing medical care abroad.

Fixed Medical Insurance

Fixed medical insurance or fixed indemnity insurance pays a predetermined amount of money for specific medical procedures and services. This type of medical insurance plan is limited — no matter what your total bill amounts to, it will not cover more than the agreed-upon amount. Fixed medical insurance plans are usually cheaper than comprehensive policies, which we cover in the next section.

Comprehensive Medical Insurance

Comprehensive medical insurance covers doctor’s visits, hospital care, prescription drugs and more without setting limits on certain services. Note that these plans typically have coverage maximums, deductibles and copays, so you will have to pay a certain amount before your policy covers any medical expenses.

Comprehensive coverage does not have benefit limits based on the type of medical service like fixed medical does, but it will cost you more overall. However, because health care in the U.S. is expensive, you may find comprehensive plans more beneficial in the long run despite being pricier than a fixed plan.

Short-Term vs. Long-Term Health Insurance

Short-term and long-term health insurance plans provide coverage that lasts for a specific period. You can consider travel medical insurance plans short-term policies for U.S. visitors, as they can cover medical expenses incurred during a period lasting less than a year.

If you plan on staying in the U.S. for longer than a year, you may be eligible to purchase a health insurance plan through a domestic provider, depending on your visa. For example, if you have a J-1 or F-1 visa, you may be eligible for a university-sponsored or private health insurance plan. We encourage you to check with the U.S. Department of State when you receive your visa for more on what long-term health insurance options are available to you.

What Does Travel Insurance in the U.S. Cover?

Travel insurance in the U.S. provides a variety of coverages for unexpected events that can affect your travel plans both before and during your trip. Specifics will vary depending on your choice of policy but will likely include some or all of the following coverages:

airplane Created with Sketch Beta. Trip cancellation: If you must cancel your trip for a covered reason, travel insurance can help you recover non-refundable costs such as hotel reservations, airline tickets and more.

airplane Created with Sketch Beta. Trip interruption: If you need to cut your vacation short for a covered reason, travel insurance plans can compensate you for expenses you didn’t use during your trip.

airplane Created with Sketch Beta. Trip and baggage delays: A travel insurance policy can help cover costs you incur if your trip or baggage gets delayed for a covered reason. Most coverage also includes lost or stolen baggage.

airplane Created with Sketch Beta. Emergency medical: Emergency medical coverage can reimburse the cost of necessary treatments if you experience a medical emergency abroad up to a maximum amount.

airplane Created with Sketch Beta. Emergency evacuation and transport: If you need transportation to a medical facility in the U.S. during a medical emergency, this coverage will provide an expense limit for the services. This benefit can also cover emergency evacuations if a natural disaster or political conflict occurs and affects your travels.

How Much Does Travel Health Insurance for U.S. Visitors Cost?

Our research found that the cost of travel insurance for U.S. visitors can range from $96 to $115 . This range is based on quotes gathered for a 30-year-old Australian citizen traveling to the U.S. for 30 days. Each plan we obtained a quote for included a medical maximum of $500,000 with a $250 deductible.

For cost data specific to your travel needs, we encourage you to gather quotes from the providers in this review. The quotes you receive will depend on factors such as your age, plan limits, chosen deductible, number of travelers and more.

How To Use Visitor Health Insurance

If you’ve purchased a visitor medical insurance plan for your stay in the U.S., it’s important you understand how to use it. Healthcare facilities in the U.S., such as doctor’s offices, urgent care locations and emergency rooms, often require you to bring an insurance card with you. This card includes essential information associated with your policy that helps the facility file a claim with your insurance provider. If you have one through your visitor health insurance plan, it is best to have it on hand when receiving medical treatment.

Your health insurance plan may require pre-approval before you receive treatment in non-emergent cases. Your insurance company may request to verify a procedure or medicine is necessary before agreeing to cover it. Be sure to check your policy to find out what the restrictions are.

Many visitor health insurance plans also cover prescription medications. If you’ve been prescribed medicine through a U.S. doctor during a medical visit, a pharmacy may choose to verify your prescription before filling it. This means the pharmacy will contact your healthcare provider with any questions about the prescription being correct. Verification could delay when you receive your medication, but likely won’t take longer than three to10 business days.

Finding Doctors and Hospitals as a Visitor

Most insurers provide online tools that help you find in-network healthcare providers and facilities covered by your insurance policy. Note that you may pay more if you choose to receive care through a doctor or facility that is not considered in-network. Out-of-network providers do not contract with your health insurance plan to provide agreed-upon rates. Unless you have a plan that lets you pick any provider you’d like, you will need to find a provider or facility working with your insurance.

If you want to verify the benefits offered by your insurance plan, contact your insurance provider directly or consult any documentation provided at the time of purchase. Healthcare providers may also take steps to verify your coverage, as it ensures the facility receives payment and lessens the chance of a denied insurance claim.

The cost of medical treatment depends entirely on the type of insurance plan you have. If you’ve purchased a travel medical insurance plan, your provider will cover emergency medical expenses up to a maximum amount. Once you’ve hit that limit, you will have to pay the rest of your bill. If you have a plan with a deductible or co-pay, you must pay that amount before your insurer will cover your expenses.

Paying Medical Bills Without Insurance

If you opt out of medical coverage when visiting the U.S. and end up needing medical care, you will have to cover the entire bill out of pocket. However, you have several options regarding payment. You can contact the debt collector in charge of your bill and work to negotiate the cost of your bill down . You can also set up a payment plan that works with your income and what you can afford.

While these payment options can be helpful, they do not negate the high U.S. healthcare costs, and can still leave you with a substantial bill after a medical crisis.

According to a study by the Peterson-KFF Health System Tracker , health expenditures per person in the U.S. in 2022 were over $4,000 more than any other high-income nation. For this reason, we recommend some form of medical coverage to help cover potential emergency expenses when visiting the U.S.

Filing a Claim with Visitor Health Insurance

Filing a claim through a visitor insurance plan or travel medical insurance policy will vary based on your provider. Note that providing proper documentation will help the claims process go smoothly, so it is important to keep track of hospital invoices and other billing forms.

If you have a domestic health insurance policy, the healthcare facility that provided your treatment will file your claim. You’ll receive a bill once your insurance provider processes the claim. On the other hand, travel medical insurance may require you to submit documents proving your claims for emergency medical treatment. Once your claim has been approved, your travel insurance company will reimburse your medical bills.

Where Can You Buy Visitors Insurance?

You can buy visitors’ insurance directly from travel insurance companies, international health insurance companies, university-approved providers and domestic providers, depending on the type of visa required during your stay. If you’re on a tourist visa, you can purchase travel medical insurance covering emergency medical services and transport, if needed, to a healthcare facility. Most travel insurance providers also offer travel healthcare plans that can last up to a year if you are planning multiple trips.

If you’re on a J-1 or F-1 visa and enrolling in a schooling program, contact your university to see if you’re eligible for a sponsored or private health insurance plan. If you need clarification on the available coverage or plan to stay in the U.S. for longer than a year, contact the U.S. Department of State for more information.

Do U.S. Visitors Need Health Care Coverage?

Healthcare in the U.S. is expensive. While medical insurance isn’t required for some visitors — such as tourists on a B-2 visa — it’s still worth considering if you’re concerned about an unexpected medical emergency abroad. We encourage you to extensively research your visa type and the coverage available to you before settling on a plan. Understanding the benefits and exclusions of a healthcare coverage plan will ensure there are no surprises if you need medical care during your U.S. trip.

Frequently Asked Questions About Visitor Health Insurance

How much is visitor health insurance in the u.s..

Visitor health insurance costs in the U.S. depend on factors unique to your travel needs. After gathering quotes from the providers in our review, we found that visitor health insurance can range from $89 to $115 . This range is based on a 30-year-old Australian citizen traveling to the U.S. for 30 days, opting for a plan with a medical maximum of $500,000 and a $250 deductible. Your actual costs will vary.

How much does travel insurance cost for trips to the U.S

Our research team found the average cost of travel insurance ranges from $35 to $400, with the average being $221 for a standard policy. Your costs will vary depending on your chosen plan, provider, length of travels, number of travelers and more.

Can foreign visitors get insurance while in the U.S.?

Yes, foreigners can get insurance while in the U.S. Various insurance options are available to travelers depending on their length of stay and visa type. It’s best to research what’s available to you based on your visa requirements before purchasing a plan.

Is it hard to get travel insurance for U.S.-based trips?

No, it’s not hard to get travel insurance for travel to the U.S. Providers such as Seven Corners, WorldTrips, IMG, Trawick and more provide plans for non-U.S. citizens seeking trip and medical coverage while abroad.

Methodology: Our System for Rating Travel Insurance Companies

- A 30-year-old couple taking a $5,000 vacation to Mexico.

- A family of four taking an $8,000 vacation to Mexico.

- A 65-year-old couple taking a $7,000 vacation to the United Kingdom.

- A 30-year-old couple taking a $7,000 trip to the United Kingdom.

- A 19-year-old taking a $2,000 trip to France.

- A 27-year-old couple taking a $1,200 trip to Greece.

- A 51-year-old couple taking a $2,000 trip to Spain.

- Plan availability (10%): We look for insurers with a variety of travel insurance plans and the ability to customize a policy with coverage upgrades.

- Coverage details (29%): We review the baseline coverage each company offers in its cheapest comprehensive plan. A provider with robust coverage earns full points, including baggage delay and loss, COVID-19 coverage, emergency evacuation and medical coverage, trip delay and cancellation coverage, and more. Companies also receive points for offering a variety of policy add-ons like accidental death and dismemberment, extreme sports, valuable items, cancel for any reason coverage and more.

- Coverage times and amounts (34%): We compare each company’s waiting periods and maximum reimbursement amounts for baggage, travel and weather delays. Companies that offer customers reimbursement after fewer than 12 hours of delays earn full points in this category. We also reward travel insurance providers that cover more than 100% of trip costs in the event of cancellations or interruptions.

- Company service and reviews (17%): We look for indicators that a company is well-prepared to respond to customer needs. Companies with an established global resource network, 24/7 emergency hotline, mobile app, multiple ways to file a claim and concierge services score higher in this category. We assess reputation by evaluating consumer reviews, third-party financial strength and customer experience ratings, specifically from AM Best and the Better Business Bureau (BBB).

For more information, read our full travel insurance methodology.

A.M. Best Disclaimer

More Travel Insurance Guides

- Best covid travel insurance companies

- Best cruise insurance plans

- Best travel insurance companies

- Cheapest travel insurance

- Best group travel insurance companies

- Best senior travel insurance

- Best travel insurance for families

- Best student travel insurance plans

- Travel insurance for parents visiting USA

- Best travel medical insurance plans

- How much does travel insurance cost?

If you have questions about this page, please reach out to our editors at [email protected] .

Related Articles

Search When autocomplete results are available use up and down arrows to review and enter to select.

Choose the plan that meets your needs and spend more time enjoying your international experience not worrying about your insurance coverage.

- Customer Stories

- Resume Quote / Application

What type of coverage do you need?

- Vacation / Holiday

- Visitor / Immigrant

- Student / Scholar

- Employer / Business Traveler

- Expat / Global Citizen

- Mission / Social Good

- Marine Captain / Crew

- Flights / Airfare

- Cruises / Excursions

Travel Medical Insurance

Temporary coverage for accidents, sicknesses, & emergency evacuations when visiting or traveling outside of your home country.

Popular Plans

International health insurance.

Annually renewable international private medical insurance coverage for expats and global citizens living or working internationally.

Travel Insurance

Coverage designed to protect you from financial losses should your trip be delayed, interrupted, or cancelled.

Enterprise Services

Meet your duty of care obligations with confidence, knowing your travelers are safe, healthy, and connected wherever they may be in the world.

What type of organization do you represent?

- Corporations

- Insurance Companies

- Educational Institutions

- Mission Organizations

- Maritime Industries

- Government Agencies

- Non-Profit Organizations

Medical & Travel Assistance

Your travelers can access 24/7 global support should they need medical attention, travel assistance, or medical transport services.

Global Workers' Compensation Case Management

Rest assured knowing you have an experienced team who is committed to reducing your costs, moving your files forward, and serving as an international resource for all your work injury claims.

Security Assistance Services

Keep your travelers safe, no matter where they are, with real-time alerts and intelligence on safety, health, political, and other global risks.

Insurance Administrative Services

You’ll have experts to guide you through all things related to your health care plan needs, from enrollment to claim reimbursement.

Visitor Insurance Plans

Visitor & immigrant health insurance options.

V isitor Insurance most commonly refers to international travel medical insurance plans designed for international travelers visiting the United States of America. These plans are perfect for non-U.S. citizens who have domestic health insurance, but aren’t covered outside of their home country.

Specifically, in the United States, healthcare costs are much higher than the rest of the world, and an unexpected illness could result in you owing thousands of dollars. IMG’s visitor insurance plans provide coverage for new medical expenses, multilingual customer service experts, hands-on healthcare coordinators available 24/7 and online resources to make traveling internationally less stressful.

Visitor Insurance plans are excellent for visiting family members or friends, vacationing, taking a short business trip, or any reason that you may find yourself in the U.S. To compare IMG's visitor insurance plans, check out our article, How to Choose the Best Visitor Insurance Plan for You .

Popular Plans For Visitors & Immigrants

Patriot America Plus

Temporary health insurance for non-U.S. residents traveling to the USA

- COVID-19 coverage for travelers to the U.S.

- Coverage for inside the U.S.

- Short-term travel medical coverage

- Made for individuals, groups, and their dependents

- Coverage for Acute Onset of Pre-Existing Conditions*

- Freedom to seek treatment with hospital or doctor of your choice

Summary of Benefits

Visitors Protect Insurance

Temporary health insurance for individuals, families

- Coverage for Pre-Existing Conditions

- Coverages for inside the U.S., Canada and Mexico

- Coverage for individuals, and their dependents

- Subject to deductible and coinsurance

- Limit: $300 (Unexpected pain or treatment due to an accident)

- Treatment at a hospital due to an

- Additional treatment for the same injury rendered by a dental provider will be paid at 100%

Patriot Platinum Travel Medical Insurance

Temporary first-class health insurance for individuals, families, and groups

- Coverages for inside and outside the U.S. ( Patriot America Platinum / Patriot International Platinum )

- Coverage for individuals, groups, and their dependents

- Higher Limits & More Coverage than Patriot Lite Travel or Patriot Plus

Additional Plans For Visitors & Immigrants

Patriot Lite Travel Medical Insurance

Temporary health insurance for individuals, families, and groups when traveling outside of your home country.

Visitors Care

Temporary fixed coverage health insurance for non-U.S. residents when traveling outside of your home country.

Global Medical Insurance

A long-term (1+ year), annually renewable, worldwide medical insurance program for individuals and families.

Patriot Multi-Trip Travel Medical Insurance

Annual multi-trip travel medical insurance for individuals, families and groups.

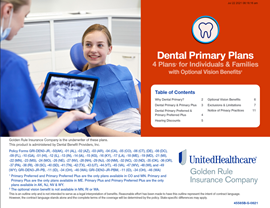

UnitedHealthcare Dental Plans

Dental insurance options with coverage for routine preventive dental care for individuals and families visiting the U.S. Underwritten by Golden Rule Insurance Company.

UnitedHealthcare Vision Plans

Vision insurance with coverage for routine preventive vision care for individuals and families visiting the U.S. Underwritten by Golden Rule Insurance Company.

Give us a call

Have any questions we’re here to help you, 866-263-0669, is visitor insurance required in the u.s..

V isitor insurance is not required to travel to the U.S. on a B-2 visa. However, healthcare costs in the U.S. are often higher than those in other countries, so not having the proper coverage could leave you to pay thousands of dollars for any necessary medical care.

Purchasing visitor insurance is also a very simple process as no medical exam or medical history review is necessary to get coverage. These plans are designed to protect you from unexpected illnesses or injuries that occur while you are traveling, thus your past health history is not needed.

For answers to any other visitor insurance questions, check out our Visitor Insurance FAQs .

How Much Does Visitors Insurance Cost? Coverage starts at a few dollars per day and increases depending on age and coverage options

IMG’s most popular visitor insurance plan, Patriot America Plus , offers excellent coverage at a competitive price. There are also other product tiers that vary in price depending on your budget and level of benefits. Patriot Platinum Insurance provides the highest level of coverage, while Visitors Care provides a lower priced option with limited benefits. Or you can choose your own visitor insurance plan.

Factors that Determine Cost The cost of a visitor health insurance plan varies based on many factors, including:

Age of traveler.

Old and young visitors alike can find a visitor insurance plan that fits their needs. While premiums become more expensive for older travelers due to increasing risks of health problems, there are still many varying price levels available to fit in your budget.

Area of Coverage

Visiting the United States will result in a higher premium than if traveling to another part of the world due to the high costs of medical care in the country.

View the breakdown of daily and monthly rates in the Patriot America Plus brochure to get a better idea of how much you can expect to spend for coverage during your trip. For any trip longer than a year, you may also want to explore our international health insurance options .

Coverage Level

Higher maximum limits and lower deductibles will increase your plan costs. Consider how much you could afford in addition to your deductible if something unexpected were to happen while you’re away when choosing the right options for you.

What Does Visitor Health Insurance Cover? Depending on the visitor insurance plan purchased, some of the key benefits provided can include:

Emergency evacuation.

In the event of an emergency medical evacuation, coverage provides evacuation to the nearest qualified medical facility and expenses for reasonable transportation resulting from the evacuation.

Medical Expenses

Coverage for medically necessary expenses resulting from new or unexpected injuries or illnesses including local ambulance, intensive care, emergency room, and more, if needed.

Return of Mortal Remains

Should a covered illness or injury unfortunately result in death, this benefit provides coverage for repatriation of bodily remains or ashes to your home country; or for the preparation, local burial or cremation of your mortal remains, at the place of death.

Pre-Existing Condition Coverage (Varies by Plan)

Visitors Protect provides pre-existing condition coverage for gradually developing conditions or those becoming worse over time. Patriot America Plus and Patriot America Platinum provide coverage for acute onset of pre-existing conditions in the event of a sudden and unexpected outbreak or recurrence of a pre-existing condition.

Recent Blog Articles

Where can you travel internationally right now.

There are many international destinations that you can currently visit, but here are eight popular spots to consider for your next leisure getaway.

Frequently Asked Questions

Our Visitors Protect plan offers coverage for pre-existing conditions that gradually develop or worsen over time (such as diabetes or high blood pressure). This plan is designed specifically for individuals and families traveling from their home country to the United States, Canada, and Mexico. For more information, view the full Visitors Protect benefits table .

Other IMG international travel medical plans may cover “Acute Onset of Pre-Existing Conditions.” This is different than a more traditional definition of “Pre-Existing Conditions.” Patriot America Plus, Patriot America Platinum, Patriot International, and Visitors Care plans cover acute onset of pre-existing conditions, but they are only covered prior to age 70 and are subject to the language in the insurance plan. Here is our definition of what would be considered an acute onset of a pre-existing condition (according to a sample insurance plan from October 2022):

A sudden and Unexpected outbreak or reoccurrence that is of short duration, is rapidly progressive, and requires urgent medical care. A Pre-existing Condition that is chronic or congenital, or that gradually becomes worse over time is not an Acute Onset of Pre-existing Condition. An Acute Onset of Pre-existing Condition does not include any condition for which, as of the Effective date, the Insured Person (i) knew or reasonably foresaw he/she would receive, (ii) knew or reasonably foresaw he/she should receive, (iii) had scheduled, or (iv) were told that he/she must or should receive, any medical care, drugs or Treatment.

Yes, the insured does not have to be the one that fills out the application. You can purchase a travel medical plan for your parents, friends, or relatives as long as you have the necessary information.

It is best to check all of your existing coverages or insurance policies before traveling abroad so that you're aware of how you're covered and where you have gaps in your existing coverage.

IMG’s international travel medical products are not a substitute for minimum essential coverage that you may need to have under PPACA. If you are a U.S. citizen, national or legal resident alien in the U.S., you will need to maintain minimum essential coverage unless you are exempt. Exemptions include:

- Individuals not residing in the U.S.

- Non-U.S. citizens who are “non-resident aliens” (for U.S. income tax purposes). See Am I a Resident or Non-Resident Alien?

- Individuals with a coverage gap of less than 3 months

- Individuals who cannot afford coverage (i.e. required contribution exceeds 8% of household income)

- Individuals with a religious conscience exemption (applies only to certain faiths)

- Members of a health care sharing ministry

- Incarcerated individuals

- Individuals with income below the tax filing threshold; and

- Members of Indian tribes

You will not need PPACA coverage for short-term travel to the U.S., unless you are considered an “alien lawfully present” in the U.S. See I am a Non-U.S. citizen covered under a Global Medical Insurance Plan .

In general, PPACA does not govern short-term limited duration insurance, like IMG’s short-term travel medical insurance programs .

However please understand that under PPACA, as of January 1, 2014, extensions of short-term coverage will be limited to less than 12 months to meet the definition of a short-term limited duration plan.

The "Patient Protection and Affordable Care Act," commonly known as PPACA, was first introduced as a measure to deal with rising healthcare costs and numbers of uninsured.

The heart of PPACA consists of three provisions: guaranteed issue (insurers must offer coverage regardless of the applicant's health status or pre-existing conditions), community rating (insurers must offer policies within a given territory at the same price regardless of health status, age, gender, or other factors), and an individual mandate. The individual mandate assures that everyone has a minimum amount of coverage: those above a certain annual income are required to purchase coverage or incur a tax penalty; those who cannot afford it will have their coverage paid for by the government.

As PPACA continues to be implemented and challenged throughout the country, understanding the issues and implications for the international insurance industry and your business becomes all the more important.

Insurance prices are regulated by the government - you won't find a better price on IMG insurance plans anywhere else.

Visitors should plan to get insurance after they plan their trip and receive their visa, but before they arrive in the U.S. The effective dates for coverage should match their visa.

If you were to suffer an injury or get sick while visiting the United States, you might be surprised by the cost of medical care. You may also be surprised by the limited assistance your domestic insurance provider can provide while you're visiting. Visitor insurance coverage in the U.S. helps to ensure that you don't incur any unforeseen expenses, receive excellent care, and get home quickly and safely if anything were to happen during your visit.

If you are applying for coverage under the Patriot series of plans, IMG will process your application and send your ID card and other documents within one business day. If you are applying for coverage under the Global or Group series, IMG will process your application within three to four business days following the receipt of all required information, and your materials will be forwarded the same day coverage is approved. Every attempt will be made to process your application timely. The specific time frame depends largely on the type of coverage for which you are applying.

This is not an offer to enter into an insurance contract. This is only a summary and shall not bind the company or require the company to offer or write any insurance at any particular rate or to any particular group or individual. The information on this page does and will not affect, modify or supersede in any way the policy, certificate of insurance and governing policy documents (together the "Insurance Contract"). The actual rates and benefits are governed by the Insurance Contract and nothing else. Benefits are subject to exclusions and limitations.

Need extra protection and coverage? Explore our travel insurance options.

Global Resources. Local Care.

Languages spoken in-house, countries where members are served, insurance plans to fit your needs, employees & growing, doctors & hospitals in our global database, request information, to request more information, please fill out the form below. after you submit the form, we will have an img representative contact you., contact information, company information, how can we help.

Thank you for your submission! A representative will be with you shortly.

Select your language, headquarters, send a message.

If you need to send personal information such as medical records, payment information, etc., please use our Secure Message Center .

Thank you for your message! We'll be in touch shortly.

- United States

- United Kingdom

600 visa health insurance

Compare ovhc policies that meet the visitor visa 600 health insurance requirements..

In this guide

Visitor visa 600 health insurance: An overview

How to provide evidence of your health insurance arrangements, am i covered by medicare on a 600 visa.

Health insurance guides

Types of health insurance

Hospital cover

Extras cover

Health insurance and tax

Health funds

What you need to know

- You are liable for all your healthcare costs while travelling in Australia – unless you are covered by a reciprocal healthcare agreement. The right insurance can help limit your financial liability.

- The Australian 600 visa is a temporary visa that allows visitors to enter Australia for tourism or business purposes. The visa is valid for up to 12 months and allows the holder to travel in and out of Australia multiple times during that period.

- To be eligible for the 600 visa, individuals must meet certain health, character, and financial requirements, and must have a valid passport from a country that is eligible for the visa.

Pricing is based on a single person living in the State of New South Wales on a visa and is not from a country that Australia has a Reciprocal Health Care Agreement (RHCA) with and is not eligible for cover under Medicare. Prices are accurate for 2020 but are subject to change.

Key facts: Visitor visa 600

Health insurance is recommended by the Australian government for all visitors to Australia regardless of the type of visa. Doctor's visits and hospital stays can really add up and you're responsible for the full cost of treatment, emergency or otherwise.

For some visitors on a 600 visa, health insurance may be mandatory . If your visa is subject to condition 8501 , you must have adequate health insurance for the whole of your stay in Australia.

Condition 8501 might be attached to the following Visitor (subclass 600) visas:

- Tourist (In Australia)

- Tourist (Outside Australia)

Condition 8501 doesn't apply to the following Visitor (subclass 600) visas:

- Business Visitor

- Sponsored Family

- Approved Destination Status

- Frequent Traveller.

What treatments does OVHC cover?

Overseas Visitors Health Cover (OVHC) is a type of private health insurance tailored to visa holders coming to work, live and visit Australia, like those on the 600 visa. It can cover you for the following:

Important note : Not all OVHC policies meet the visa health insurance requirements for condition 8501. If you have this condition on your visa, you'll need to make sure you choose the right insurance cover.

Levels of cover

Just like with any insurance, Visitor visa 600 health insurance providers offer various levels of policies to choose from.

- Budget . This will be your most affordable option and will likely cover emergency ambulance and in-hospital expenses.

- Standard . You can expect the addition of some out-of-hospital cover. This may include doctor visits, specialists' fees and prescription medicines.

- Premium . More comprehensive coverage that will also include some extras cover including dental, optical and physio treatments.

"If applicants are required to provide evidence of their health insurance arrangements, any the following may be considered acceptable, unless a particular visa subclass instruction requires other specific information:

- a copy of the insurance policy;

- a written letter or cover note from an acceptable insurance provider, certifying that the primary visa applicant and any accompanying family members immediately upon visa grant or their arrival in Australia, are, or will be, covered by insurance that is at least as comprehensive as the prescribed adequate level of cover;

- evidence that the visa applicant has lawfully enrolled with Medicare via Reciprocal Health Care Agreements (RCHA);

- evidence that the primary visa applicant and any accompanying family members immediately upon visa grant or their arrival in Australia, are, or will be, covered by health insurance that is at least as comprehensive as the adequate level of cover required under policy, with the understanding that the applicants will either enrol with Medicare under a RHCA or enrol in a private insurance arrangement after arrival; or

- for citizens from the Republic of Ireland that may access RCHA, evidence that they hold an Irish passport.

Family members applying separately from the primary visa applicant or visa holder must produce evidence as per above, which clearly indicates that they, as dependant applicants, will be covered upon arrival in Australia by a policy with an adequate level of cover."

Finder survey: How many claims have people of different ages made on their Overseas Visitor Health Cover?

Australia's public healthcare system, Medicare, generally only covers Australian citizens and permanent residents.

You may be partially covered by Medicare, however, if you're visiting Australia from a country that has a Reciprocal Health Care Agreement (RHCA) in place.

Cover varies based on the country you’re visiting from but generally includes:

- Free or reduced-cost treatment in a public hospital

- Subsidised prescription medicines

- Medicare benefits for out-of-hospital medical treatment and doctor’s visits.

If you're a visitor, you aren't generally eligible for Medicare unless you are from a country that has a Reciprocal Health Care Agreement in place with Australia. You may be partially covered by Medicare if you're from one of the following countries that Australia has an RHCA with:

- The United Kingdom

- The Republic of Ireland

- New Zealand

- The Netherlands

How much does health insurance cost?

- Basic: $116

- Bronze: $143

- Silver: $168

Why you can trust Finder's overseas health cover experts

We're experts

We're independent

We're here to help

Frequently asked questions, what is ovhc and why do i need it.

OVHC stands for Overseas Visitor Health Cover, which is a type of health insurance for visitors to Australia on a temporary visa. This insurance covers the cost of medical treatment and hospital care for the duration of your stay in Australia. It is required for individuals who hold a 600 visa and is necessary in order to meet the visa's health requirement.

What types of OVHC policies are available?

There are several types of OVHC policies available to visitors to Australia on a 600 visa. These include basic policies that cover the cost of treatment for certain conditions, as well as more comprehensive policies that cover a wider range of medical services. Some policies also offer additional benefits such as ambulance cover and private room accommodation.

What companies offer OVHC to 600 visa holders?

There are several companies that offer OVHC to visitors to Australia on a 600 visa. Some examples of these companies include Allianz Care Australia , Bupa and nib . It is important to compare the policies and prices offered by different companies to find the one that best meets your needs and budget. You should also make sure that the policy you choose meets the requirements of the 600 visa, as not all policies may be accepted.

Does OVHC include out-of-hospital services?

Neither Medicare nor OVHC usually includes out-of-hospital services like dental, physiotherapy and optical. However, lots of policies allow you to add extras cover onto your OVHC policy for as little as $3 per week.

Are there waiting periods before I will be covered?

Yes, a waiting period is the time you need to serve before you can submit a claim. The Australian government sets the waiting periods for hospital treatments , so they are the same no matter which health insurer you choose.

- 12 months for pre-existing conditions (excluding psychiatric, rehabilitation and palliative care).

- 12 months for pregnancy and maternity services.

- 2 months for all other hospital treatments and services.

Is the 600 or 651 the best tourist visa to visit Australia?

It depends on your personal circumstances. The 651 visa is for eligible passport holders from a select group of countries for stays up to 3 months at a time. The 600 visa is for people who don't hold an eligible passport or for stays longer than 3 months and up to 12 months.

Gary Ross Hunter

Gary Ross Hunter is an editor at Finder, specialising in insurance. He’s been writing about life, travel, home, car, pet and health insurance for over 6 years and regularly appears as an insurance expert in publications including The Sydney Morning Herald, The Guardian and news.com.au. Gary holds a Kaplan Tier 2 General Advice General Insurance certification which meets the requirements of ASIC Regulatory Guide 146 (RG146).

More guides on Finder

With inflation still high and the annual indexation looming, should you make some extra repayments to your debt?

Are runes and ordinals about to be the next big thing in crypto?

Save $1,297 by investing some of your savings in an exchange-traded fund.

Find all the weekly tips from our Dollar Saver newsletter and see how you could save.

Drive a banger that needs some TLC?

More Australians are resorting to theft as they struggle with the rising cost of living, according to new research by Finder.

No one wants to spend years and years paying off what ends up being mostly interest. Here are several tips on how to pay off your home loan faster.

SPONSORED: We take a look at how term deposits can help you save more cash and build wealth.

Australian pet owners would fork out an eye-watering amount before considering putting their pet down, according to new research by Finder.

The fourth Bitcoin halving is here - what to expect next from Bitcoin.

How likely would you be to recommend finder to a friend or colleague?

Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve.

Important information about this website

Advertiser disclosure.

finder.com.au is one of Australia's leading comparison websites. We are committed to our readers and stands by our editorial principles

We try to take an open and transparent approach and provide a broad-based comparison service. However, you should be aware that while we are an independently owned service, our comparison service does not include all providers or all products available in the market.

Some product issuers may provide products or offer services through multiple brands, associated companies or different labeling arrangements. This can make it difficult for consumers to compare alternatives or identify the companies behind the products. However, we aim to provide information to enable consumers to understand these issues.

How we make money

We make money by featuring products on our site. Compensation received from the providers featured on our site can influence which products we write about as well as where and how products appear on our page, but the order or placement of these products does not influence our assessment or opinions of them, nor is it an endorsement or recommendation for them.

Products marked as 'Top Pick', 'Promoted' or 'Advertisement' are prominently displayed either as a result of a commercial advertising arrangement or to highlight a particular product, provider or feature. Finder may receive remuneration from the Provider if you click on the related link, purchase or enquire about the product. Finder's decision to show a 'promoted' product is neither a recommendation that the product is appropriate for you nor an indication that the product is the best in its category. We encourage you to use the tools and information we provide to compare your options.

Where our site links to particular products or displays 'Go to site' buttons, we may receive a commission, referral fee or payment when you click on those buttons or apply for a product. You can learn more about how we make money .

Sorting and Ranking Products

When products are grouped in a table or list, the order in which they are initially sorted may be influenced by a range of factors including price, fees and discounts; commercial partnerships; product features; and brand popularity. We provide tools so you can sort and filter these lists to highlight features that matter to you.

Terms of Service and Privacy Policy

Please read our website terms of use and privacy policy for more information about our services and our approach to privacy.

Loading form...

- Get a price

- Compare OSHC

- OSHC Extras

- How to claim - OSHC

- Compare OVHC

- How to claim - OVHC

- Allianz MyHealth app

- Getting medical help

- Waiting periods

- MyHealth member portal FAQ

- Under-16 information

- COVID Information for OVHC Members

- COVID Information for OSHC Members

- Physical Health

- Mental Health

- Work & Study

- Accessing Health Care in Australia

- Apps & Tools

- Living in Australia

- Hatch Maternity Package

- Hospital in the Home

- Cancer Treatment at Home

- The Fracture Clinic

- St John Urgent Care

- Urgent Care

Overseas Visitor Health Cover

Visitor visa 600 health insurance, are you travelling to australia on a 600 visitor visa.

Whether you are a tourist on a holiday, coming for a short business trip or staying with family, we offer Overseas Visitor Health Cover (OVHC) for international visitors on 600 Visitor Visas.

Our OVHC is Australia-wide and lets you access medical and health cover if something happens during your stay. The Department of Home Affairs recommends that 600 Visa holders take out health insurance each time you travel to Australia – so you are covered during your stay.

Our visitor cover options

Budget visitors cover.

From $135.15 AUD /mth with $500 hospital excess.

Our most affordable in-hospital cover to meet visa requirements.

Standard Visitors Cover

From $402.20 AUD /mth with $500 hospital excess

In-hospital and out of hospital cover including local doctors, specialists and prescription medicines.

About 600 Visitor Visa

Visitor visas are issued by the Australian Government Department of Home Affairs for tourists, business visitors or to visit family. You must be a genuine visitor and have enough money to support your stay and leave.

For more information about how to apply, visit the Department of Home Affairs .

What does this visa let you do?

The 600 Visitor visa lets you visit Australia for up to 3, 6 or 12 months and has 6 streams:

- Tourist stream (apply in Australia)

- Tourist stream (apply outside Australia)

- Sponsored family stream

- Business visitor stream

- Approved Destination Status stream

- Frequent Traveller Stream

For more information about the streams, visit the Department of Home Affairs website.

Are you eligible for a Visa 600?

- as a visitor or tourist

- for business visitor activities

- to visit family

- on a tour with a registered travel agent from the People’s Republic of China.

For full details about eligibility and more information, visit the Department of Home Affairs website.

Accessed: Department of Home Affairs, March 2023.

601 Electronic Travel Authority

651 evisitor visa, who can be covered, single policy, dual family policy, multi-family policy.

Looking for a different visa?

870 Sponsored Parent Visa Health Insurance

Bridging Visa Health Insurance (010, 020, 030)

408 Temporary Activity Visa Health Insurance

Why choose Allianz Care Australia

Access to health care

24/7 Emergency Phone

Receive certificate of insurance online

Join australia's leading international health experts.

Overseas Visitors Health Cover

For visa subclass 600, 601, 651 and more.

Enjoy your trip to Australia knowing your health insurance will help pay for the essential medical treatment you’re most likely to need.

Common visas:

600 , 601 , 651

Why choose Medibank's Overseas Health Cover?

Trusted health partner

Medibank is a leading private health insurer in Australia with over 3.7 million health insurance members.

Accident cover boost

Medibank members with hospital cover get the benefits of Gold level cover no matter what level of hospital cover you have, thanks to our Accident Injury Benefit. 1

Protect against the unexpected

No matter which Medibank Overseas Visitors Cover you choose, your cover includes unlimited emergency ambulance Australia-wide. 2

24/7 Medibank Nurse & Mental Health Service

Need advice? You can call 1800 644 325 and speak to a Medibank Nurse or Mental Health professional to discuss any health questions or concerns and get professional advice on what to do next.

Health insurance for visitors to Australia that includes the basics

Pays towards unlimited emergency ambulance services Australia-wide ^ , plus benefits if you have an Accident+, providing certainty during the uncertainty of travel.

Overseas Visitors Starter Hospital and Medical

A mid level cover option for younger visitors to Australia who don’t require health cover for visa purposes (condition 8501), but want the peace of mind of having cover for more than the essentials (incl. Heart and vascular system services) during their time in Australia.

This cover may only be purchased by policy holders who are aged 49 or under.

Pays benefits towards accommodation and medical costs for included medical procedures in hospital. This includes charges for treatment you receive from doctors, specialists, surgeons and anaesthetists.

- Includes 26 common clinical categories of hospital treatment (incl. Heart and vascular system)

- Accidental Injury Benefit+

- Choice of $250 or $750 excess

Pays benefits towards included medical services in and out of hospital.

- Pays 100% of the MBS fee

- Inpatient medical services across 26 clinical categories

- General Practitioner (GP) consultations

- Other common out-of-hospital medical services (blood tests & x-rays)

- Most Allied Health services billed with an MBS item number~

Overseas Visitors Everyday Hospital and Medical

A cover option suitable for those visiting Australia who are fit and healthy, don't require health cover for visa purposes (condition 8501) and only want cover for the essentials and accidents 'just in case' the unexpected occurs.

- Includes 24 common clinical categories of hospital treatment

- Choice of $250 or $500 excess

Pays benefits towards medical services in and out of hospital.

- Inpatient medical services across 24 clinical categories

Things you should know

^For ambulance attendance and transportation to a hospital where immediate professional attention is required and your medical condition is such that you couldn't be transported any other way.

+Any Excluded service will be treated as an Included service where you require hospital treatment as a result of injuries sustained in an Accident after joining this cover and within 12 months of the date the Accident occurred. The Accident must have occured in Australia while the cover was not suspended. Treatment must be sought within 7 days of the Accident. Excludes claims covered by third parties such as WorkCover.

~Services not provided by a doctor but are billed with an MBS item number. For example, eye checks and services related to chronic disease management plans. Excludes mental health services.

Here are two popular visas that Medibank’s Overseas Visitors Health Covers are generally suitable for:

Visa subclass 600.

The Visitor visa (subclass 600) allows you to stay in Australia as a visitor or a visitor for business purposes for 3, 6 or 12 months. This might be an appropriate visa if you’re taking a holiday, visiting family or friends or on a tour with a registered travel agent from China.

Visa subclass 651

The eVisitor (subclass 651) lets you visit Australia for up to 3 months at a time within a 12-month period. You can stay as a visitor or a visitor for business purposes.

Not sure what you're looking for?

Speak to one of our friendly staff about your cover options. Call 1300 981 380 or request a call .

Please note that if your visa is subject to Condition 8501 Overseas Visitors Health Cover may not be suitable. This information above is sourced from the Department of Home Affairs' website and is accurate as of April 2019.

Learn more about Australia's healthcare system

If you need medical attention while you’re in Australia and you don’t have health cover it can be very expensive, whether you’re treated in the public or the private healthcare system. Find out more about the differences between the private and public healthcare system.

Need some help?

We’re here to help you choose the health cover that matches your needs while you’re in Australia. Contact Medibank how it suits you; messaging, WeChat, in-store or by phone.

Overseas students (OSHC)

Message one of our friendly staff about your cover options.

Visitor, working and working holiday (OVHC)

Speak to one of our friendly staff for sales and policy enquiries.

Medibank 微信公众号

扫描二维码或搜索Medibank_AU,获取新会员优惠、促销资讯以及健康信息和中文服务。

1 For Accidents that occur in Australia after your cover starts. Must seek medical treatment within 7 days, and receive hospital treatment within 12 months, of the Accident occurring. Excludes claims covered by third parties and our Private Room Promise. Out of pockets may apply.

2 For ambulance attendance and transportation to a hospital where immediate professional attention is required and your medical condition is such that you couldn't be transported any other way.

Request a call back

Leave your details and a Medibank expert will be in touch to take you through your options. In providing your telephone number, you consent to Medibank contacting you about health insurance.

We'll have someone call you soon to help with any questions you have.

COVID-19 Health Assist - Expression of interest

Complete this form to express your interest in one of our programs. If you're eligible, a member of our team will call you within 2-3 business days.

What program are you interested in?

Sorry, only members with current Hospital cover are eligible to participate in these programs

Eligible Medibank members with Extras cover are able to access a range of telehealth services included on their cover - you can find out more here . Alternatively, if you would like to talk to one of our team about your cover, we're here on 132 331 .

Your membership details

Please provide your details so we can know how to contact you.

Your contact details

By clicking Submit, I understand that Medibank or its subsidiaries may contact me to discuss my eligibility for the Covid-19 Heath Assist program(s), and will disclose my personal information within the Medibank Group of companies and to third party service providers. Please see Medibank’s privacy policy for further information about how Medibank will handle my personal information, and how to contact Medibank: https://www.medibank.com.au/privacy/

Thank you for expressing your interest in one of our COVID-19 Health Assist programs.

If you are eligible, one of our health professionals will call you in 2-3 business days to discuss your situation and help to enrol you in the relevant program.

There is no cost to participate, however some referred services may incur an out of pocket cost.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

Best Travel Insurance for Visiting the U.S.

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

Travel insurance basics

Best visitors insurance policies, for the lowest price: trawick international, for customizing options: worldtrips, for pre-existing conditions: worldtrips, for highest medical coverage limit: img, other options to consider, the bottom line.

Since health care can be expensive in the U.S., it’s important that visitors have insurance coverage, aka visitors insurance or travel medical insurance, in case something happens that requires medical attention mid-trip.

Whether you have coverage for travel in the U.S. depends on your health care plan in your home country. But if you don't, you'll need to buy a policy from a third-party insurance provider. Several companies sell this kind of visitor insurance, and each company and policy is a bit different. Let’s look at which is best for you.

First, a few basics about visitor insurance. Two kinds are available: travel medical insurance and trip insurance.

Travel medical insurance covers medical expenses that you may incur while traveling internationally, like a visit to the doctor, a trip to the hospital and medical evacuation and repatriation.

Trip insurance usually covers limited medical expenses like emergency care and can compensate you if your trip is delayed, you need to leave the trip early or you have to cancel the trip. It is designed to help you protect the investment you’re making as you prepare to travel.

Standard trip insurance might not cover a visit to the doctor unless it is an emergency.

It’s important to make sure any pre-existing conditions are covered if the visitor has any. Some policies exclude them.

» Learn more: How to find the best travel insurance

With so many kinds of visitors insurance policies, which is the best?

To make comparisons, we got quotes from several companies using Squaremouth , a website to search for different types of travel insurance in one place.

The parameters we set are for a 49-year-old citizen and resident of Spain traveling to the U.S. on May 1-31, 2024.

The quotes don't include cancellation coverage; these examples are for medical coverage only. To get a quote, the hypothetical deposit for the trip was paid on Feb. 15.

Since we’re looking for a policy that will cover medical care for visitors, there are several medical filters to select: emergency medical ($100,000 or more), medical evacuation ($100,000 or more) and coverage for pre-existing medical conditions.

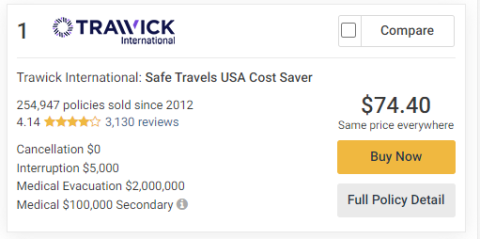

The search came up with nine results ranging in price from $74.40 to $179.18.

The policy with the lowest cost was the Trawick International 's Safe Travels USA Cost Saver at $74.40.

Trawick policies use the FirstHealth PPO network.

The policy as quoted has a $250 deductible and includes $100,000 in emergency medical, $2 million in medical evacuation and $5,000 in interruption coverage. It has limited coverage for pre-existing conditions.

It is possible to change the deductible to as little as $0 or raise it to $5,000.

The same company has another policy, the Trawick International Safe Travels USA Comprehensive policy, that is better at covering pre-existing conditions and costs a little more — $89.59.

The general coverage is the same as the less expensive policy, and the Safe Travels USA Comprehensive option adds coverage for acute onset of a pre-existing condition. it is possible to change the deductible amount to $0 or go up to $5,000.

» Learn more: The best travel credit cards right now

Some policies are sold as is, while others allow some flexibility depending on what is important to you.

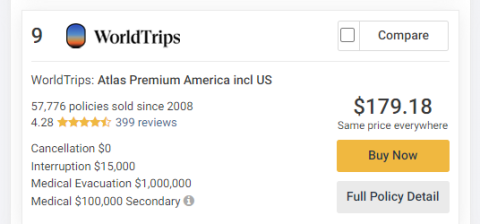

The WorldTrips Atlas Premium America policy for $179.18 allows a lot of customization.

It was also the most expensive of the nine policies Squaremouth suggested.

It’s possible to customize the emergency medical coverage and pre-existing condition coverage and medical deductible. The policy also includes $15,000 in trip interruption coverage, the highest of any of the nine policies available.

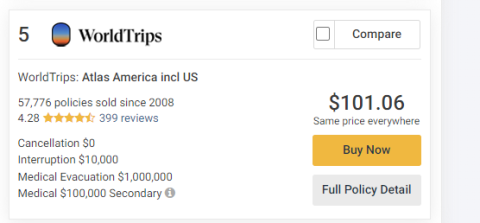

If the traveler has a pre-existing condition, policies from WorldTrips Atlas America are your best bet. The WorldTrips Atlas America policy in our comparison costs $101.06.

The policy as quoted covers $100,000 in emergency medical care and $25,000 in medical evacuation for an unexpected recurrence of a pre-existing condition.

The deductible is also available for customization from $0 to $5,000.

The PPO network for Atlas America Insurance is United Healthcare.

The WorldTrips Atlas Premium America policy mentioned above is also good for pre-existing condition coverage.

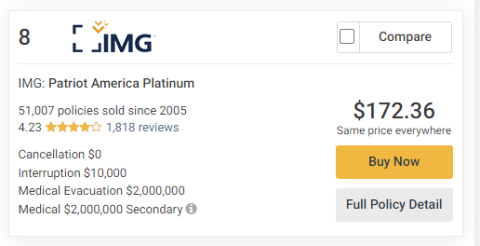

While eight of the nine policies had $100,000 in secondary medical coverage, one had a limit of $2 million.

The IMG Patriot America Platinum policy has a premium of $172.36 along with a high medical evacuation limit of $2 million and interruption coverage of $10,000.

If $2 million in medical coverage is not enough, it’s possible to increase that amount to an $8 million policy limit.

It’s not possible to change the level of coverage for preexisting conditions from the high $1 million limit in emergency medical care and $25,000 in medical evacuation for an unexpected recurrence.

It is possible to change the deductible from $0 all the way up to $25,000.

Our comparison also included policies from two additional companies, Seven Corners and Global Underwriters .

Seven Corners had two policies come up in the results, the Seven Corners Travel Medical Basic for $98.27 and the Seven Corners Travel Medical Choice policy for $136.71. Both of the Seven Corners policies include coverage for hurricane and weather, and the less expensive policy covers acts of terrorism.

Having insurance to cover unexpected medical expenses for anyone visiting the U.S. can be a smart money move.

An illness or accident could cause financial problems for visitors because of potentially having to pay for full health care costs. When planning your travel, be sure to check your current health insurance to find out if it will cover you in the U.S.

For a monthlong stay in the U.S., the lowest-priced visitors insurance policy was around $75 (Trawick International Safe Travels USA Cost Saver) and the highest was about $180 (WorldTrips Atlas Premium America). That’s about $2.42 or $5.81 a day, depending on the policy.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

Everything you need to know about visitor health insurance

Are you planning a trip to the USA and wondering what to do in case of a medical emergency? A trip overseas can be stressful, especially when you do not understand how to maneuver the other country’s medical system and the insurance you would need to purchase to cover the costs.

In this blog, you will learn everything you need to know about visitor health insurance when visiting the United States and how to find the best visitor health insurance in USA .

What Is VISITOR HEALTH INSURANCE?

Visitor health insurance Is a type of travel health insurance for international visitors and residents visiting the United States. A visitor health insurance will protect a policyholder’s medical and travel costs for the duration of their stay in the United States starting from the effective date of the policy.

Tourists and people traveling on a few other select visas will benefit from health insurance for visitors and access good quality healthcare and travel benefits for unexpected medical emergencies in the United States.

WHY DO I NEED VISITOR HEALTH INSURANCE?

Millions of tourists visit the US annually to see the vast scenic expanse and groundbreaking technological advances. With this comes a greater risk of falling sick or experiencing an injury. If you’re visiting the USA, health insurance for visitors is highly recommended by the CDC (Centers for Disease Control and Prevention). Here are some reasons we recommend visitor health insurance when you visit the USA.

Unexpected illness

Despite basic precautions, succumbing to an unexpected illness during your trip is possible. These are the times when visitor medical insurance can be beneficial. It will cover expenses incurred due to an unexpected illness or injury.

No coverage

Local medical insurance will cover medical expenses within your country but may not protect you during your overseas travel. Visitor medical insurance is made specifically for people visiting the United States or other countries.

Exorbitant Healthcare