U.S. News takes an unbiased approach to our recommendations. When you use our links to buy products, we may earn a commission but that in no way affects our editorial independence.

Travel Insurance for Europe: 4 Best Options for 2024

Allianz Travel Insurance »

Travelex Insurance Services »

Generali Global Assistance »

WorldTrips »

Why Trust Us

U.S. News evaluates ratings, data and scores of more than 50 travel insurance companies from comparison websites like TravelInsurance.com, Squaremouth and InsureMyTrip, plus renowned credit rating agency AM Best, in addition to reviews and recommendations from top travel industry sources and consumers to determine the Best Travel Insurance for Europe.

Table of Contents

- Allianz Travel Insurance

- Travelex Insurance Services

You almost certainly will want travel insurance for Europe, mostly because the high cost for international trips is worth protecting against travel delays and trip cancellations. Since your U.S. medical coverage will not apply overseas, you also need international health insurance that covers surprise medical expenses and medical evacuation.

If you're searching for the best Europe travel insurance that money can buy, consider the following plans and all they have to offer.

Frequently Asked Questions

Most people need travel health insurance at a bare minimum when traveling to European destinations like France, Italy or Switzerland, as well as additional countries inside and outside of the Schengen area. After all, U.S. health insurance plans do not provide coverage for medical emergencies overseas, and the same is true for government health plans like Medicare. Check out our article on whether your health insurance covers international travel .

Other benefits built into Europe travel insurance plans can also protect the money that's been spent on airfare, hotel stays, Europe cruises and tours. For example, travelers can benefit from having coverage for trip cancellation, trip delays, lost or delayed baggage, and more.

Every travel insurance policy is unique, so you'll want to read over individual travel insurance plans to see what they protect against. That said, the bulk of travel insurance plans for trips to Europe provide the following coverages:

- Trip cancellation

- Trip interruption

- Travel delays

- Lost luggage reimbursement

- Baggage delay coverage

- Medical expenses

- Emergency medical evacuation

- Rental car damage

Some travel insurance plans also offer additional or optional coverage for sports equipment or sports equipment delays, missed connections, accidental death and dismemberment (AD&D), adventure sports and more.

Some visitors to countries in the Schengen area are required to have a visa for short stays that can last for up to 90 days within a timeline of up to 180 days. However, this is not the case for American citizens, who can stay in Europe for up to 90 days at a time without meeting specific visa requirements.

The U.S. Department of State also notes that American citizens who want to stay in Europe for more than 90 days should reach out to the country they plan on visiting to inquire about their visa process.

If you live in a country that requires a Schengen visa, you are required to purchase Schengen visa insurance that pays for overseas medical expenses. This coverage must provide at least 30,000 euros in protection against medical expenses that result from hospitalization, emergency treatment and repatriation of remains in the case of accident or death.

- Allianz Travel Insurance: Best Overall

- Travelex Insurance Services: Best Cost

- Generali Global Assistance: Best for Medical Emergencies

- WorldTrips: Best for Groups

Optional cancel for any reason (CFAR) and preexisting medical conditions coverage available

Kids 17 and younger covered for free

Lower coverage amount for medical expenses than some providers

- $100,000 per traveler in coverage for trip cancellation

- $150,000 per traveler in coverage for trip interruptions

- $500 in coverage for eligible trip changes

- $50,000 in emergency medical coverage

- $500,000 for emergency medical transportation

- $1,000 toward baggage loss or damage

- $300 in coverage for baggage delays of 12 hours or more

- $800 in protection for travel delays (daily limit of $200 applies)

- $100 per insured person per day in SmartBenefits coverage for eligible delays

- 24-hour hotline assistance

- Concierge services

Optional CFAR and preexisting medical conditions coverages available

Kids 17 and younger are covered for free

Many coverages cost extra

- 100% of trip cost for trip cancellation (up to $50,000)

- 150% of trip cost for trip interruption (up to $75,000)

- $2,000 in coverage for trip delays of five hours or longer

- $750 in coverage for missed connections

- $50,000 in coverage for emergency medical expenses ($500 dental sublimit included)

- $500,000 in coverage for emergency medical evacuation and repatriation

- $1,000 in coverage for baggage and personal effects

- $200 for baggage delays of 12 hours or longer

- $200 for sporting equipment delays of 24 hours or longer

- $25,000 for accidental death and dismemberment coverage

- 24/7 travel assistance

- 100% of the insured trip cost for financial default of a travel provider (maximum of $50,000)

- Trip cancellation and interruption coverage for preexisting medical conditions (maximum of $50,000)

- Cancel for work reasons coverage

- CFAR insurance

- Car rental coverage worth up to $35,000

- $50,000 in additional emergency medical coverage

- $500,000 in additional coverage for emergency medical evacuation and repatriation

- Adventure sports exclusions waiver

- $200,000 in coverage for flight accidental death and dismemberment

CFAR and preexisting medical conditions coverages available

High coverage limits for medical expenses and evacuation

CFAR coverage only reimburses at 60%

- $1,000,000 coverage limit for emergency medical evacuation and transportation

- $250,000 coverage limit for medical expenses ($500 limit for dental emergencies)

- 100% of trip cost for trip cancellation

- 175% of trip cost for trip interruption

- $1,000 per person for travel delays ($300 per person daily limit applies)

- $2,000 per person in coverage for baggage and $500 for baggage delays

- $2,000 per person in coverage for sporting equipment and $500 for sporting equipment delays

- $1,000 per person in coverage for missed connections

- Air flight accident AD&D coverage worth $100,000 per person and $200,000 per plan

- Travel accident AD&D coverage worth $50,000 per person and $100,000 per plan

- $25,000 in coverage for rental cars

- 24-hour travel support

Discounts for groups of five or more

Potential for high coverage limits for medical expenses

No coverage for trip cancellation

Available coverage limits vary by age

- $5,000 for local burial or cremation

- Up to $25,000 in AD&D coverage

- $100,000 in coverage for emergency reunions

- $10,000 in coverage for trip interruption

- $1,000 for lost checked luggage

- $100 in coverage for lost or stolen passports or visas

- $100 in coverage per day for travel delays of at least 12 hours (two days of coverage maximum)

- Up to $25,000 in personal liability coverage

Why Trust U.S. News Travel

Holly Johnson is a travel writer who has created content about travel insurance, family travel, cruises, all-inclusive resorts and more for over a decade. She has visited more than 50 countries around the world and has an annual travel insurance plan of her own. Johnson also has experience navigating the claims process for travel insurance plans and has successfully filed several travel insurance claims for trip delays and trip cancellations over the years. Johnson works with her husband, Greg, who is licensed to sell travel insurance and owns the travel agency Travel Blue Book .

You might also be interested in:

9 Best Travel Insurance Companies of April 2024

Holly Johnson

Find the best travel insurance for you with these U.S. News ratings, which factor in expert and consumer recommendations.

8 Cheapest Travel Insurance Companies Worth the Cost

U.S. News rates the cheapest travel insurance options, considering pricing data, expert recommendations and consumer reviews.

The Best Travel Medical Insurance of 2024

Explore protection options for unexpected health issues abroad.

Expat Travel Insurance: The 5 Best Options for Globetrotters

Find the coverage and benefits you need for your adventures abroad.

- Best Travel Insurance 2024

- Cheapest Travel Insurance

- Trip Cancellation Insurance

- Cancel for Any Reason Insurance

- Seniors' Travel Insurance

- Annual Travel Insurance

- Cruise Insurance

- COVID-19 Travel Insurance

- Travel Medical Insurance

- Medical Evacuation Insurance

- Pregnancy Travel Insurance

- Pre-existing Conditions Insurance

- Mexico Travel Insurance

- Italy Travel Insurance

- France Travel Insurance

- Spain Travel Insurance

- Canada Travel Insurance

- UK Travel Insurance

- Germany Travel Insurance

- Bahamas Travel Insurance

- Costa Rica Travel Insurance

- Disney Travel Insurance

- Schengen Travel Insurance

- Is travel insurance worth it?

- Average cost of travel insurance

- Is airline flight insurance worth it?

- Places to travel without a passport

- All travel insurance guides

- Best Pet Insurance 2024

- Cheap Pet Insurance

- Cat Insurance

- Pet Dental Insurance

- Pet Insurance That Pays Vets Directly

- Pet Insurance For Pre-Existing Conditions

- Pet Insurance with No Waiting Period

- Paw Protect Review

- Spot Pet Insurance Review

- Embrace Pet Insurance Review

- Healthy Paws Pet Insurance Review

- Pets Best Insurance Review

- Lemonade Pet Insurance Review

- Pumpkin Pet Insurance Review

- Fetch Pet Insurance Review

- Figo Pet Insurance Review

- CarePlus by Chewy Review

- MetLife Pet Insurance Review

- Average cost of pet insurance

- What does pet insurance cover?

- Is pet insurance worth it?

- How much do cat vaccinations cost?

- How much do dog vaccinations cost?

- All pet insurance guides

- Best Business Insurance 2024

- Business Owner Policy (BOP)

- General Liability Insurance

- E&O Professional Liability Insurance

- Workers' Compensation Insurance

- Commercial Property Insurance

- Cyber Liability Insurance

- Inland Marine Insurance

- Commercial Auto Insurance

- Product Liability Insurance

- Commercial Umbrella Insurance

- Fidelity Bond Insurance

- Business Personal Property Insurance

- Medical Malpractice insurance

- California Workers' Compensation Insurance

- Contractor's Insurance

- Home-Based Business Insurance

- Sole Proprietor's Insurance

- Handyman's Insurance

- Photographer's Insurance

- Esthetician's Insurance

- Salon Insurance

- Personal Trainer's Insurance

- Electrician's Insurance

- E-commerce Business Insurance

- Landscaper's Insurance

- Best Credit Cards of 2024

- Best Credit Card Sign-Up Bonuses

- Best Instant Approval Credit Cards

- Best Cash Back Credit Cards

- Best Rewards Credit Cards

- Best Credit Cards for Bad Credit

- Best Balance Transfer Credit Cards

- Best College Student Credit Cards

- Best 0% APR Credit Cards

- Best First Credit Cards

- Best No Annual Fee Cards

- Best Travel Credit Cards

- Best Hotel Credit Cards

- Best American Express Cards

- Best Amex Delta SkyMiles Cards

- Best American Express Business Cards

- Best Capital One Cards

- Best Capital One Business Cards

- Best Chase Cards

- Best Chase Business Cards

- Best Citi Credit Cards

- Best U.S. Bank Cards

- Best Discover Cards

- Amex Platinum Card Review

- Amex Gold Card Review

- Amex Blue Cash Preferred Review

- Amex Blue Cash Everyday Review

- Capital One Venture Card Review

- Capital One Venture X Card Review

- Capital One SavorOne Card Review

- Capital One Quicksilver Card Review

- Chase Sapphire Reserve Review

- Chase Sapphire Preferred Review

- United Explorer Review

- United Club Infinite Review

- Amex Gold vs. Platinum

- Amex Platinum vs. Chase Sapphire Reserve

- Capital One Venture vs. Venture X

- Capital One Venture X vs. Chase Sapphire Reserve

- Capital One SavorOne vs. Quicksilver

- Chase Sapphire Preferred vs. Capital One Venture

- Chase Sapphire Preferred vs. Amex Gold

- Delta Reserve vs. Amex Platinum

- Chase Sapphire Preferred vs. Reserve

- How to Get Amex Pre-Approval

- Amex Travel Insurance Explained

- Chase Sapphire Travel Insurance Guide

- Chase Pay Yourself Back

- CLEAR vs. TSA PreCheck

- Global Entry vs. TSA Precheck

- Costco Payment Methods

- All Credit Card Guides

- Citibank Savings Account Interest Rate

- Capital One Savings Account Interest Rate

- American Express Savings Account Interest Rate

- Western Alliance Savings Account Interest Rate

- Barclays Savings Account Interest Rate

- Discover Savings Account Interest Rate

- Chase Savings Account Interest Rate

- U.S. Bank Savings Account Interest Rate

- Marcus Savings Account Interest Rate

- Synchrony Bank Savings Account Interest Rate

- Ally Savings Account Interest Rate

- Bank of America Savings Account Interest Rate

- Wells Fargo Savings Account Interest Rates

- SoFi Savings Account Interest Rate

- Best Savings Accounts & Interest Rates

- Best High Yield Savings Accounts

- Best 7% Interest Savings Accounts

- Best 5% Interest Savings Accounts

- Savings Interest Calculator

- Emergency Fund Calculator

- Pros and Cons of High-Yield Savings Accounts

- Types of Savings Accounts

- Checking vs Savings Accounts

- Average Savings by Age

- How Much Should I Have in Savings?

- How to Make Money

- How to Save Money

- Compare Best Checking Accounts

- Compare Online Checking Accounts

- Best Business Checking Accounts

- Compare Best Teen Checking Accounts

- Best Student Checking Accounts

- Best Joint Checking Accounts

- Best Second Chance Checking Accounts

- Chase Checking Account Review

- Bluevine Business Checking Review

- Amex Rewards Checking Account Review

- E&O Professional Liability Insurance

- Best Savings Accounts & Interest Rates

- All Insurance Guides

- Europe Travel Insurance

On This Page

- Key takeaways

Do I need travel insurance to visit Europe?

What does travel insurance for europe cover, what isn’t covered by european travel insurance, how much does travel insurance for europe cost, how to get the best travel insurance for europe, europe travel information & requirements, europe travel insurance faqs, related topics.

Europe Travel Insurance: Your Essential Coverage Guide

- Based on our research, our top picks for travel insurance for Europe come from Tin Leg , Generali , and Seven Corners .

- If you have an emergency while traveling overseas, a European travel insurance plan can reimburse you for some of your losses.

- American medical insurance doesn’t cover the cost of receiving health care in Europe , so it’s especially important to get medical and medevac insurance when traveling in Europe.

- Street crime, risks of terrorism, and political unrest are some of the reasons trip interruption, cancellation, and medical coverage should be considered when visiting Europe.

- In addition to medical costs, a comprehensive travel insurance plan for Europe can also help cover costs associated with cancellations, delays, lost baggage, and more.

- While cheap insurance with basic coverage can cost as little as $1 per day, you can expect to pay around $8 to $11 per day for more extensive travel insurance.

- To compare plans and find the right policy to suit your needs, we recommend using an online comparison tool .

Our top picks for the best europe travel insurance

- Tin Leg: Best Rated Travel Insurance

- Seven Corners: Best Value for a Robust Coverage

- Generali Global Assistance: Best Value Travel Insurance

Our top picks for Europe travel insurance

Seven Corners

Generali global assistance.

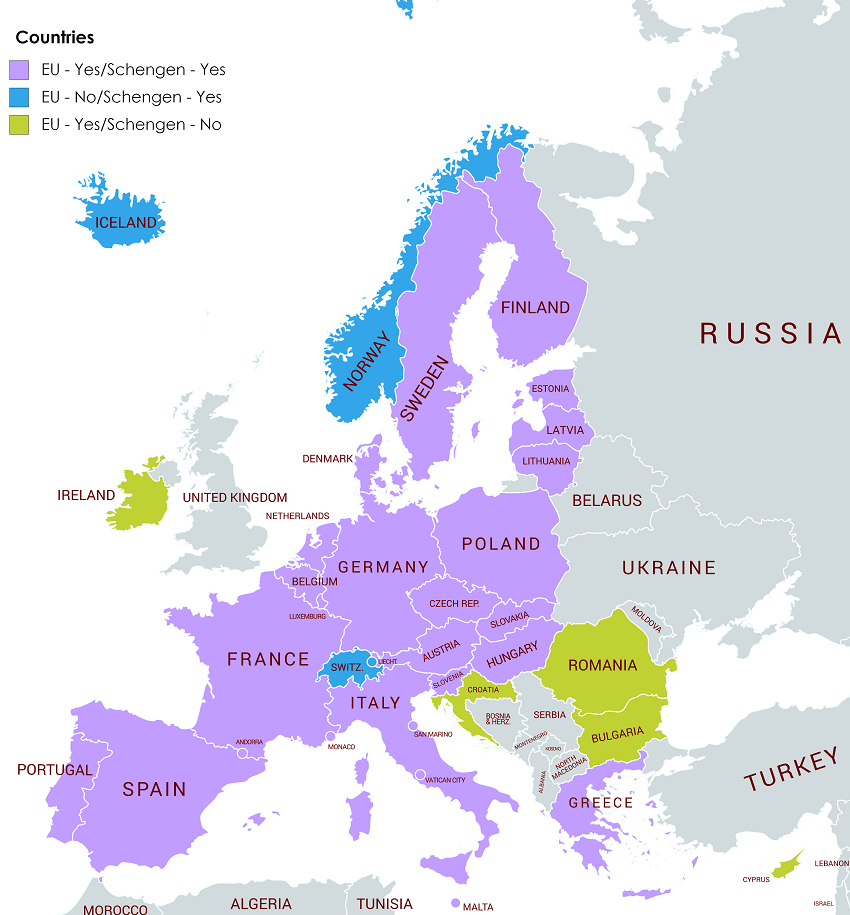

Standard European travel insurance usually covers every country in the European Union (now excluding the UK ) and the Schengen Zone . If you plan to travel to either country, make sure your insurance plan will cover you. If you plan to travel to a non-Schengen, non-EU country, ask your agent to write a custom policy that includes every destination on your itinerary. Alternatively, you can purchase an annual insurance plan that covers you for multiple trips and destinations.

Although you don’t have to officially buy travel insurance unless you plan to apply for a visa, it’s wise to buy coverage even if it’s not required. Travel insurance protects against losses associated with medical emergencies, travel delays, lost or stolen luggage, and a wide range of other travel-related problems as we can see below.

Best Rated Travel Insurance

Why we like it.

- Coverage for pre-existing conditions

- Cancelation & interruption coverage

- Offers hurricane and weather coverage

- Cancel for any reason not included standard

Best Value for a Robust Coverage

- Offers coverage for pre-existing conditions

- Money-back guarantee

- Cancellation & Interruption coverage standard

- Covers action sports & equipment

- Must meet waiver for pre-existing conditions to be covered

Best Value Travel Insurance

- Lowest cost of all Generali Global Assistance plans

- 24/7 emergency travel assistance included

- Telemedicine included

- Lower coverage than other Generali plans

- Pre-existing conditions are not covered by the Standard plan

- No coverage for accidental death and dismemberment during on-land travel

Here are some of the reasons Americans should get travel insurance for visiting Europe

Risk of falling victim to street crime

Instances of pickpocketing, general theft, financial scams, and street muggings are not uncommon throughout Europe , as highlighted by the European Crime Prevention Network . Such acts of opportunist theft often happen throughout major European cities such as London, Paris, Berlin, and Rome, places where there are a high number of visiting tourists with their guard down. Therefore, it’s important that you keep your valuables out of sight and secure, especially when visiting popular tourist sites and traveling on public transport.

Purchasing travel insurance to Europe that covers you for loss of items can go a long way to relieving any stress you receive from falling victim to pickpockets and thieves during your vacation to Europe.

Risk of terrorism

Much like the rest of the Western world, E urope remains on high alert for the risk of terrorist attacks , especially in recent years, especially from Islamic and political extremists - as seen in the official Europol data . Although Europol and local law enforcement strive to keep the risk of attack relatively low, it is not without basis that attacks can happen.

Therefore, it’s important for US citizens to take out travel insurance that covers them for emergency medical coverage and emergency evacuation coverage , should the worst happen while they are on

Political unrest

Political demonstrations, industrial strikes, and even riots are not uncommon across many European nations , especially in the nation’s capitals. As seen in the recent Paris riots in 2023 , these demonstrations can spill out across the city and cause chaos to both tourists and locals alike.

Having an insurance plan that covers you for any trip interruptions, cancellations, and medical coverage for any unforeseen accidents you may face is ideal when traveling across Europe .

Outdoor activities

Visitors to Europe can enjoy a huge range of outdoor activities. Whether this is hiking through the foothills of the Alps, scaling the numerous mountains scattered across the continent, swimming and boating along its endless shores, or an exciting mix of all - this all comes with its own particular risks.

If you plan to enjoy the endless opportunities of the great outdoors while on vacation, you must have travel health insurance in Europe that covers you for sporting and adventure pursuits.

Risk of a driving accident

Generally speaking, driving in Europe is a safe affair. However, it is important to remember that each country has its own unique driving conditions and rules, as can be seen on the official website of the EU . It’s important to familiarize yourself with the rules and driving customs of any European country you are visiting.

If you are planning to hire a vehicle while vacating in Europe, you should consider taking out rental care travel insurance that covers accidents, theft, and vandalism . Also, considering the general risks while driving on unfamiliar roads, emergency medical coverage is a must.

European travel insurance usually bundles several types of coverage into a single policy. Here are some of the most common types of travel insurance available:

Travel medical insurance in Europe

The best travel insurance for Europe should, at the most basic level, include coverage for medical emergencies and emergency evacuation coverage. Your American health insurance won’t pick up the tab if you need medical care while you’re in Europe. Therefore, it’s important to buy travel medical insurance . Health insurance for travel to Europe covers lab tests, X-rays, and other medical expenses. This type of insurance also covers the cost of repatriation, which is when you leave Europe and return to the United States.\

Medical travel insurance can be purchased as part of a comprehensive travel insurance plan or as an independent policy on its own. In addition to medical travel insurance, consider broadening your policy to include coverage for travel delays, cancellations, and interruptions.

Medical evacuation insurance

In addition to your travel medical insurance in Europe, you should have medical evacuation insurance , better known as medevac coverage. It would be convenient to get sick less than 1 mile away from a hospital, but many emergency situations occur in remote areas without immediate access to medical care.

This type of travel insurance pays to transport you to the closest suitable medical facility. For example, if you sustain serious injuries while skiing or hiking, your insurer will cover the cost of having a helicopter transport you to a trauma center.

Trip cancellation insurance

If you have to cancel your trip for no fault of your own, trip cancellation insurance reimburses you for all prepaid, nonrefundable travel expenses up to the limit outlined in your policy. For example, this type of travel insurance may cover the cost of flights, prepaid hotels, and prepaid excursions. Some policies will also offer cancel for any reason (CFAR) coverage . This allows you to cancel your trip for any reason and claim back between 50% and 70% of your total prepaid travel expenses.

Trip delay insurance

These days, flight delays are common. It’s also possible for a cruise ship, ferry, or bus to depart later than scheduled, causing you to miss your connection. If this happens while you’re traveling in Europe, trip delay insurance will cover meals, lodging, and other expenses incurred due to the delay. To use this type of travel insurance, you must be using a common carrier, which is a company that provides transportation services to the public.

Trip interruption insurance

It’s no fun ending a trip early, but it’s even less fun if you lose money on prepaid lodging, meals, and other expenses. Trip interruption insurance takes the sting out of this situation by reimbursing you for the unused portion of your trip.

Insurance for personal items

Comprehensive travel insurance usually covers baggage loss, baggage theft, and damage to the personal items in your luggage. For example, if your duffel bag gets stuck in a machine at the airport, your travel insurance may cover the cost of replacing some of your damaged belongings.

Rental car coverage

If you plan to travel around town in a rented vehicle, consider getting rental car coverage for extra peace of mind. This type of insurance covers accidents, theft, and vandalism.

Standard travel insurance covers many things, but it usually excludes the following:

- Intentional acts: If you damage a rental car on purpose, your travel insurance won’t pay a dime.

- Pre-existing conditions: Travel health insurance doesn’t cover pre-existing conditions, which are health problems that you have before you travel to Europe. For example, if you’ve had hypertension for 10 years, your travel insurance won’t pay any medical expenses associated with a hypertensive crisis. If you are aware of any ongoing illnesses, it is advisable to purchase insurance for pre-existing conditions .

- Reasonably foreseeable events: An emergency is a serious, unexpected event, so you don’t know when it’s going to occur. With a reasonably foreseeable event, there is some indication that an emergency might happen. If you choose to travel anyway, your travel insurance won’t cover any costs associated with trip cancellations, trip delays or trip interruptions.

- Injuries caused by risky activities: SCUBA diving, skydiving, and mountain climbing are risky. Standard travel insurance doesn’t cover medical expenses associated with these activities, so you’ll need to buy a policy that includes coverage for adventure sports.

- Government travel restrictions: Your insurance company has no control over how a government conducts its business. Therefore, if one of the countries you’re visiting decides to implement new travel restrictions during your trip, travel insurance won’t cover any of the associated costs.

Travel insurance for a trip to Europe can be as cheap as around $1 per day for very basic coverage. For a comprehensive policy, you can typically expect to pay $8 to $11 per day.

To give you a better idea of how much travel insurance for Europe costs we got price quotes for a trip to Ireland from three different insurance providers.

For each quote, we applied the following travel details:

- Age: 35 years old

- Destination: Ireland

- Trip Length: 7 days

- Trip cost: $2,000

- Date: August 2024

This table displays three quotes for basic travel insurance plans where plans don’t reimburse the full trip costs:

If you want to purchase more comprehensive travel insurance that covers trip cancellations and interruptions, your premium will be more expensive:

It’s important to understand that many factors influence the cost of travel insurance.

- Age: Older people have a higher risk of developing serious injuries. Travel insurance providers account for this risk with higher prices. However, there is also the opportunity to purchase specific travel insurance for seniors - these policies are designed with elderly travelers in mind.

- Trip length: The longer your trip is, the more money you’re likely to spend. Insurers charge more for long trips to account for the increased cost of reimbursing you for delays, cancellations, and other problems.

- Destination: Some destinations are a bit riskier than others. Insurance companies charge higher premiums to avoid losing money on claims.

How much travel insurance do I need for Europe?

Knowing what level of travel insurance you need for Europe depends on the trip you plan to take. It’s vital to factor in your choice of destination, the activities you plan to do, and the likelihood of you needing to cancel your trip. All of these can determine what type of coverage you will need and by how much. Generally speaking, a standard comprehensive insurance plan will cost you between 5 and 10% of your total trip costs

To get the best travel insurance for Europe, follow these tips:

Plan your itinerary carefully

The cost of travel insurance depends on your destination and the type of transportation you plan to use.

Purchase extra coverage if you plan to participate in adventure activities

Most travel insurance plans don’t cover adventure activities, so be sure to purchase additional protection if you plan to take part in such plans

Think about how much flexibility you want

If there’s a good chance you’ll experience an unexpected hiccup, consider purchasing comprehensive health insurance for European travel rather than a basic policy

Consult the table below for a quick overview of the requirements for traveling from the United States to Europe

Tips for visiting Europe

Are there covid-19 restrictions for entering europe.

As of September 2023, most countries have eliminated their COVID-19 screening requirements. However, the situation may change at any time, as SARS-CoV-2 mutates regularly. It is there for advisable that you take out a travel insurance policy that offers COVID-19 coverage .

Do I need a visa to travel to Europe?

In most European countries, including the 27 countries in the Schengen Zone , you don’t need a visa for trips lasting 90 days or less. You do need a visa if you plan to travel to Turkey or the Russian Federation, regardless of how long you plan to stay.

If you plan to stay in the country for more than 90 days, you may need a Schengen visa or a country-specific visa. The Schengen visa allows you to travel between countries in the Schengen Area without going through a check at every border crossing.

As of mid-2025, the European Travel Information and Authorisation System (ETIAS) will go into effect. This system will require any US citizen traveling to Europe to complete an ETIAS application for any European nation that is a co-signer of the Schengen Agreement. The application will cost $8, although some travelers are exempt from paying this fee.

The table below shows the tourist visa requirements for European countries.

Does American insurance work in Europe?

Most U.S. health insurance plans will not cover medical care and treatment outside the United States . Although there are some small exceptions, having comprehensive EU travel insurance will protect you against huge medical bills, travel delays, and much more

Does Medicare cover you in Europe?

In most situations, US-based insurance policies such as Medicare will not provide coverage outside the US. Therefore, it is best to purchase a medical travel insurance plan. This will protect you from huge bills when you require health care or medical supplies you get outside the U.S.

Do I need travel insurance for Europe?

In most cases, travel insurance isn’t required, but you should get it anyway. This type of insurance gives you extra peace of mind in the event you experience a delay, cancellation, or other problem outside of your control.

Is travel insurance for Europe worth it?

Absolutely, travel insurance is worth it . You never know when you’ll come down with a serious illness or experience some other type of emergency. It’s good to have travel insurance to reimburse you for your losses.

How much does travel insurance for a trip to Europe cost?

It depends on your age, destination, and trip cost. For the most basic coverage, you can purchase a policy for as little as $1 per day. A more extensive travel insurance policy for Europe will generally cost between $8 and $11 per day.

Can I use my U.S. health insurance in Europe?

No. Your U.S. health insurance won’t cover any medical expenses incurred in Europe

Leigh Morgan is a seasoned personal finance contributor with over 15 years of experience writing on a diverse range of professional legal and financial topics. She specializes in subjects like navigating the complexities of insurance, savings, zero-based budgeting and emergency fund development.

In the last five years, she’s authored over 300 articles for credit unions, digital banks, and financial professionals. Morgan is also the author of “77 Tips for Preventing Elder Financial Abuse,” a book focused on helping caregivers protect the elderly from financial scams.

In addition to her writing skills, she brings real-world financial acumen thanks to her previous experience managing rental properties as part of a $34 million real estate portfolio.

Explore related articles by topic

- All Travel Insurance Articles

- Learn the Basics

- Health & Medical

- Insurance Provider Reviews

- Insurance by Destination

- Trip Planning & Ideas

Best Travel Insurance Companies & Plans in 2024

Best Medical Evacuation Insurance Plans 2024

Best Travel Insurance for Seniors

Best Cruise Insurance Plans for 2024

Best COVID-19 Travel Insurance Plans for 2024

Best Cheap Travel Insurance Companies - Top Plans 2024

Best Cancel for Any Reason (CFAR) Travel Insurance

Best Annual Travel Insurance: Multi-Trip Coverage

Best Travel Medical Insurance - Top Plans & Providers 2024

- Is Travel Insurance Worth It?

Is Flight Insurance Worth It? | Airlines' Limited Coverage Explained

Guide to Traveling While Pregnant: Pregnancy Travel Insurance

10 Romantic Anniversary Getaway Ideas for 2023

Best Travel Insurance for Pre-Existing Medical Conditions April 2024

22 Places to Travel Without a Passport in 2024

Costa Rica Travel Insurance: Requirements, Tips & Safety Info

Best Spain Travel Insurance: Top Plans & Cost

Best Italy Travel Insurance: Plans, Cost, & Tips

Best Travel Insurance for your Vacation to Disney World

Chase Sapphire Travel Insurance Coverage: What To Know & How It Works

2024 Complete Guide to American Express Travel Insurance

Schengen Travel Insurance: Coverage for your Schengen Visa Application

Mexico Travel Insurance: Top Plans in 2024

Best Places to Spend Christmas in Mexico this December

Travel Insurance to Canada: Tips & Quotes for US Visitors

Best Travel Insurance for France Vacations in 2024

Travel Insurance for Germany: Top Plans 2024

Best UK Travel Insurance: Coverage Tips & Plans April 2024

Travel Insurance for Trips to the Bahamas: Tips & Safety Info

Best Trip Cancellation Insurance Plans for 2024

What Countries Require Travel Insurance for Entry?

Philippines Travel Insurance: Coverage Requirements & Costs

Travel Insurance for the Dominican Republic: Requirements & Tips

Travel Insurance for Trips Cuba: Tips & Safety Info

AXA Travel Insurance Review April 2024

Best Travel Insurance for Thailand in 2024

Travel Insurance for a Trip to Ireland: Compare Plans & Prices

Travel Insurance for a Japan Vacation: Tips & Safety Info

Faye Travel Insurance Review April 2024

Travel Insurance for Brazil: Visitor Tips & Safety Info

Travel Insurance for Bali: US Visitor Requirements & Quotes

Travel Insurance for Turkey: U.S. Visitor Quotes & Requirements

Travel Insurance for India: U.S. Visitor Requirements & Quotes

Australia Travel Insurance: Trip Info & Quotes for U.S. Visitors

Generali Travel Insurance Review April 2024

Travelex Travel Insurance Review for 2024

Tin Leg Insurance Review for April 2024

Travel Insured International Review for 2024

Seven Corners Travel Insurance Review April 2024

HTH WorldWide Travel Insurance Review 2024: Is It Worth It?

Medjet Travel Insurance Review 2024: What You Need To Know

Antarctica Travel Insurance: Tips & Requirements for US Visitors

Travel Insurance for Kenya: Recommendations & Requirements

Travel Insurance for Botswana: Compare Your Coverage Options

Travel Insurance for Tanzania: Compare Your Coverage Options

Travel Insurance for an African Safari: Coverage Options & Costs

Nationwide Cruise Insurance Review 2024: Is It Worth It?

- Travel Insurance

- Travel Insurance for Seniors

- Cheap Travel Insurance

- Cancel for Any Reason Travel Insurance

- Travel Health Insurance

- How Much is Travel Insurance?

- Is Flight Insurance Worth It?

- Anniversary Trip Ideas

- Travel Insurance for Pre-Existing Conditions

- Places to Travel Without a Passport

- Christmas In Mexico

- Compulsory Insurance Destinations

- Philippines Travel Insurance

- Dominican Republic Travel Insurance

- Cuba Travel Insurance

- AXA Travel Insurance Review

- Travel Insurance for Thailand

- Ireland Travel Insurance

- Japan Travel Insurance

- Faye Travel Insurance Review

- Brazil Travel Insurance

- Travel Insurance Bali

- Travel Insurance Turkey

- India Travel Insurance

- Australia Travel Insurance

- Generali Travel Insurance Review

- Travelex Travel Insurance Review

- Tin Leg Travel Insurance Review

- Travel Insured International Travel Insurance Review

- Seven Corners Travel Insurance Review

- HTH WorldWide Travel Insurance Review

- Medjet Travel Insurance Review

- Antarctica Travel Insurance

- Kenya Travel Insurance

- Botswana Travel Insurance

- Tanzania Travel Insurance

- Safari Travel Insurance

- Nationwide Cruise Insurance Review

Policy Details

LA Times Compare is committed to helping you compare products and services in a safe and helpful manner. It’s our goal to help you make sound financial decisions and choose financial products with confidence. Although we don’t feature all of the products and services available on the market, we are confident in our ability to sound advice and guidance.

We work to ensure that the information and advice we offer on our website is objective, unbiased, verifiable, easy to understand for all audiences, and free of charge to our users.

We are able to offer this and our services thanks to partners that compensate us. This may affect which products we write about as well as where and how product offers appear on our website – such as the order in which they appear. This does not affect our ability to offer unbiased reviews and information about these products and all partner offers are clearly marked. Given our collaboration with top providers, it’s important to note that our partners are not involved in deciding the order in which brands and products appear. We leave this to our editorial team who reviews and rates each product independently.

At LA Times Compare, our mission is to help our readers reach their financial goals by making smarter choices. As such, we follow stringent editorial guidelines to ensure we offer accurate, fact-checked and unbiased information that aligns with the needs of the Los Angeles Times audience. Learn how we are compensated by our partners.

- Auto Insurance Best Car Insurance Cheapest Car Insurance Compare Car Insurance Quotes Best Car Insurance For Young Drivers Best Auto & Home Bundles Cheapest Cars To Insure

- Home Insurance Best Home Insurance Best Renters Insurance Cheapest Homeowners Insurance Types Of Homeowners Insurance

- Life Insurance Best Life Insurance Best Term Life Insurance Best Senior Life Insurance Best Whole Life Insurance Best No Exam Life Insurance

- Pet Insurance Best Pet Insurance Cheap Pet Insurance Pet Insurance Costs Compare Pet Insurance Quotes

- Travel Insurance Best Travel Insurance Cancel For Any Reason Travel Insurance Best Cruise Travel Insurance Best Senior Travel Insurance

- Health Insurance Best Health Insurance Plans Best Affordable Health Insurance Best Dental Insurance Best Vision Insurance Best Disability Insurance

- Credit Cards Best Credit Cards 2024 Best Balance Transfer Credit Cards Best Rewards Credit Cards Best Cash Back Credit Cards Best Travel Rewards Credit Cards Best 0% APR Credit Cards Best Business Credit Cards Best Credit Cards for Startups Best Credit Cards For Bad Credit Best Cards for Students without Credit

- Credit Card Reviews Chase Sapphire Preferred Wells Fargo Active Cash® Chase Sapphire Reserve Citi Double Cash Citi Diamond Preferred Chase Ink Business Unlimited American Express Blue Business Plus

- Credit Card by Issuer Best Chase Credit Cards Best American Express Credit Cards Best Bank of America Credit Cards Best Visa Credit Cards

- Credit Score Best Credit Monitoring Services Best Identity Theft Protection

- CDs Best CD Rates Best No Penalty CDs Best Jumbo CD Rates Best 3 Month CD Rates Best 6 Month CD Rates Best 9 Month CD Rates Best 1 Year CD Rates Best 2 Year CD Rates Best 5 Year CD Rates

- Checking Best High-Yield Checking Accounts Best Checking Accounts Best No Fee Checking Accounts Best Teen Checking Accounts Best Student Checking Accounts Best Joint Checking Accounts Best Business Checking Accounts Best Free Checking Accounts

- Savings Best High-Yield Savings Accounts Best Free No-Fee Savings Accounts Simple Savings Calculator Monthly Budget Calculator: 50/30/20

- Mortgages Best Mortgage Lenders Best Online Mortgage Lenders Current Mortgage Rates Best HELOC Rates Best Mortgage Refinance Lenders Best Home Equity Loan Lenders Best VA Mortgage Lenders Mortgage Refinance Rates Mortgage Interest Rate Forecast

- Personal Loans Best Personal Loans Best Debt Consolidation Loans Best Emergency Loans Best Home Improvement Loans Best Bad Credit Loans Best Installment Loans For Bad Credit Best Personal Loans For Fair Credit Best Low Interest Personal Loans

- Student Loans Best Student Loans Best Student Loan Refinance Best Student Loans for Bad or No Credit Best Low-Interest Student Loans

- Business Loans Best Business Loans Best Business Lines of Credit Apply For A Business Loan Business Loan vs. Business Line Of Credit What Is An SBA Loan?

- Investing Best Online Brokers Top 10 Cryptocurrencies Best Low-Risk Investments Best Cheap Stocks To Buy Now Best S&P 500 Index Funds Best Stocks For Beginners How To Make Money From Investing In Stocks

- Retirement Best Gold IRAs Best Investments for a Roth IRA Best Bitcoin IRAs Protecting Your 401(k) In a Recession Types of IRAs Roth vs Traditional IRA How To Open A Roth IRA

- Business Formation Best LLC Services Best Registered Agent Services How To Start An LLC How To Start A Business

- Web Design & Hosting Best Website Builders Best E-commerce Platforms Best Domain Registrar

- HR & Payroll Best Payroll Software Best HR Software Best HRIS Systems Best Recruiting Software Best Applicant Tracking Systems

- Payment Processing Best Credit Card Processing Companies Best POS Systems Best Merchant Services Best Credit Card Readers How To Accept Credit Cards

- More Business Solutions Best VPNs Best VoIP Services Best Project Management Software Best CRM Software Best Accounting Software

- Manage Topics

- Investigations

- Visual Explainers

- Newsletters

- Abortion news

- Coronavirus

- Climate Change

- Vertical Storytelling

- Corrections Policy

- College Football

- High School Sports

- H.S. Sports Awards

- Sports Betting

- College Basketball (M)

- College Basketball (W)

- For The Win

- Sports Pulse

- Weekly Pulse

- Buy Tickets

- Sports Seriously

- Sports+ States

- Celebrities

- Entertainment This!

- Celebrity Deaths

- American Influencer Awards

- Women of the Century

- Problem Solved

- Personal Finance

- Small Business

- Consumer Recalls

- Video Games

- Product Reviews

- Destinations

- Airline News

- Experience America

- Today's Debate

- Suzette Hackney

- Policing the USA

- Meet the Editorial Board

- How to Submit Content

- Hidden Common Ground

- Race in America

Personal Loans

Best Personal Loans

Auto Insurance

Best Auto Insurance

Best High-Yields Savings Accounts

CREDIT CARDS

Best Credit Cards

Advertiser Disclosure

Blueprint is an independent, advertising-supported comparison service focused on helping readers make smarter decisions. We receive compensation from the companies that advertise on Blueprint which may impact how and where products appear on this site. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Blueprint. Blueprint does not include all companies, products or offers that may be available to you within the market. A list of selected affiliate partners is available here .

Travel Insurance

Travel insurance for Europe: Coverage and policies for 2024

Erica Lamberg

Heidi Gollub

“Verified by an expert” means that this article has been thoroughly reviewed and evaluated for accuracy.

Updated 9:30 a.m. UTC Nov. 27, 2023

- path]:fill-[#49619B]" alt="Facebook" width="18" height="18" viewBox="0 0 18 18" fill="none" xmlns="http://www.w3.org/2000/svg">

- path]:fill-[#202020]" alt="Email" width="19" height="14" viewBox="0 0 19 14" fill="none" xmlns="http://www.w3.org/2000/svg">

Editorial Note: Blueprint may earn a commission from affiliate partner links featured here on our site. This commission does not influence our editors' opinions or evaluations. Please view our full advertiser disclosure policy .

Getty Images

- A trip to Europe often requires hefty prepaid and nonrefundable deposits to secure flights, hotels and tours. Travel insurance protects these outlays if you cancel your trip for a covered reason.

- Many U.S. health insurance plans don’t provide coverage in foreign countries, making a travel insurance plan with medical expense benefits important for trips to Europe.

- The best travel insurance for Europe will package together different types of coverage, including trip cancellation, trip delay, trip interruption, travel medical, emergency medical evacuation and baggage insurance.

Planning a trip to Europe is exciting, but can also be expensive. Your itinerary may include visits to several European countries, and you can quickly rack up prepaid and nonrefundable expenses for flights, hotels, excursions, tours and experiences.

Travel insurance can give you peace of mind that you’ll be financially protected if things go wrong before or during your trip. But plans differ, so it’s important to pay attention to included coverages, limits and exclusions when choosing your insurance for travel to Europe.

Do I need travel insurance for Europe?

Travel insurance is not required for entering Europe. “But it is a very important consideration for a number of reasons,” said Scott Adamski, spokesperson for AIG Travel.

In addition to protecting your trip deposits if you need to cancel, Adamski said an important reason to secure a travel insurance policy relates to health care coverage for U.S.-based travelers headed to Europe.

“In a surprise to many, their U.S.-based health insurance policy may not provide coverage, or may provide limited coverage, when they’re traveling out of the country,” said Adamski.

“Medicare also may not provide coverage outside the U.S. (for older Americans) and there may be restrictions/limitations on medical benefits when traveling abroad,” he said. “In short, it’s vital to review your existing health care coverage before traveling.”

To make sure you’re covered financially if things go awry before or during your European vacation, look for a travel insurance plan that includes travel medical benefits as well as coverage for trip cancellation, trip delay, trip interruption, emergency medical evacuation and baggage delay or loss.

Featured Travel Insurance Offers

Travel insured.

Via Squaremouth’s website

Top-scoring plan

Worldwide Trip Protector

Covers COVID?

Medical & evacuation limits per person

$100,000/$1 million

Atlas Journey Preferred

Seven Corners

Via Squaremouth’s Website

RoundTrip Basic

Average cost for plan with CFAR

CFAR coverage

75% of trip cost

Trip cancellation insurance for travel to Europe

If you’ve booked a trip to Europe, you’re probably thinking, why would I cancel my dream vacation?

“No one plans to cancel a trip, but sometimes there are circumstances beyond our control — you suffer an injury before your trip, circumstances at your job change or your flight is canceled due to severe weather at your destination,” said Shannon Lofdahl, spokesperson for Travelex Insurance Services. “Trip cancellation and interruption coverage reimburses you if your trip is canceled or interrupted for a covered reason,” she said.

In general, covered reasons for trip cancellation insurance benefits include:

- Death of an immediate family member or a travel companion.

- A serious illness or injury to you, a close relative or a travel companion.

- A sudden and serious family emergency.

- An unexpected job loss or layoff.

- Unplanned jury duty.

- Severe weather.

- Your travel supplier is going out of business.

- A national transportation strike.

So, if three days before your trip to Vienna, Austria, your husband has a heart attack, you can cancel your trip and receive 100% of any prepaid and nonrefundable trip outlays.

It’s important to note that not all reasons to cancel will be covered by your travel insurance policy. For example, if you see a rainy weather forecast in Barcelona or get nervous to travel to Paris because you learn about a rise in petty crimes there, these are not covered reasons.

If you want the highest level of flexibility to change your travel plans, consider adding “ cancel for any reason ” (CFAR) coverage.

CFAR is an upgrade to a basic travel insurance plan that may boost the price of your policy by about 50%, but will give you the latitude to cancel your trip for any reason as long as you cancel at least 48 hours before your scheduled departure. If you meet all the requirements of your plan, you can expect to be reimbursed for 75% — or 50%, depending on the plan — of your prepaid, nonrefundable trip costs.

Trip delay insurance

Delays are an expected part of traveling these days, especially while traveling abroad, and that fact has emphasized the importance of trip delay coverage, said Lofdahl. “A short delay probably won’t cause you too much stress, but longer delays can mean missing connecting flights.”

Trip delay coverage can reimburse you for costs you incur as a result of a travel delay, as long as the delay was caused by a reason in your policy documents. Severe weather, airline maintenance issues or a security breach at an airport, for instance, are typical reasons covered by trip delay insurance.

Most policies have a waiting period before your trip delay benefits begin, such as six or 12 hours. If you meet the criteria outlined in your travel insurance policy, you can expect to be reimbursed for a meal, hotel room, taxi fare and a few personal care items to tide you over for the delay, up to the limits in your plan.

Be sure to hold onto your receipts as you will be asked to submit this documentation when you file a trip delay claim.

DOT rules : What you’re owed when your flight is canceled or delayed may be less than you think

Trip interruption in Europe

No one wants to end their trip early, especially when it’s a long-awaited European vacation, but unexpected issues can arise, said James Clark, spokesperson for Squaremouth, a travel insurance comparison site.

If there is an emergency back home that is covered by your travel insurance plan, such as a critically ill parent, or if you suffer an injury while traveling in Europe and need to cut your trip short, your policy’s trip interruption insurance can provide financial assistance.

You can file a trip interruption claim to recover any prepaid, unused and nonrefundable trip costs you lose because of your unexpected early departure. Your benefits will also typically cover a last-minute one-way economy flight home, and transportation to the airport.

Keep in mind, however, not all reasons to end a trip early will be covered. For example, if you miss your new kitten or have a fight with your partner while in Budapest, and want to go home, these are not covered reasons. You will have to pay your own way home and can’t file a claim for losses.

Americans will have to get travel authorization to enter Europe

Currently, Americans don’t have to worry about getting a visa to travel around Europe. However, that will change in mid-2025. That’s when the European Travel Information and Authorisation System (ETIAS) goes into effect, requiring people traveling from visa-exempt countries like the United States to get authorization for travel to 30 European countries.

Once applications open up, you will be able to apply on the official ETIAS website or mobile app. You’ll need your passport information to apply, and it will cost 7 euros to process the application. For those who don’t get immediate approval, the decision process could take up to 30 days.

Once approved, your ETIAS travel authorization will be attached to your passport. It will be valid for three years or until your passport expires, whichever happens first.

A standard travel insurance policy won’t cover you if you don’t get your ETIAS travel authorization in time for your trip, or your ETIAS application is rejected. It will be important to apply for ETIAS early, in case there’s a delay or you need to appeal if you’re denied a visa.

If you have “cancel for any reason” (CFAR) coverage you could cancel your trip if your visa doesn’t get approved in time, but you’d need to cancel at least 48 hours before your trip to file a CFAR claim for reimbursement.

Travel medical insurance for Europe

Don’t assume your health insurance applies outside the United States. “Many [domestic health insurance] plans won’t cover you if you become ill or injured traveling in Europe or any other country outside the U.S., and, without travel protection, you would be responsible for all the medical expenses,” said Lofdahl with Travelex.

For instance, if you twist your ankle while touring in Rome, your travel insurance can cover the cost of seeing a doctor, getting X-rays, buying prescription medication and staying in the hospital if deemed necessary. Without this coverage, you are responsible for any medical expenses.

The average cost of travel insurance is between 5% and 10% of the total price of your trip. This can be worth it for the medical benefits alone when traveling in Europe.

Travel insurance plans also typically include travel assistance, which can help if you get sick or injured in Europe. “This benefit offers a range of 24/7 services while you’re traveling — from assistance finding a covered health care provider to helping with replacing lost or stolen passports,” said Lofdahl. These services can also assist with translation services.

Emergency medical evacuation

Depending on where in Europe you’ll be visiting, you might be far from a medical facility adequately equipped to treat severe illnesses and injuries.

“For this reason, travelers with underlying medical conditions might wish to consider additional medical evacuation coverage for certain costs associated with transportation, to either the nearest recommended medical facility or back home,” said Adamski with AIG Travel.

Also, he explains, many countries in Europe — particularly in the mountainous regions — offer adventure sports for visitors. “In the warmer months, the outdoorsy types who aren’t biking might pursue mountain climbing, available through a wide range of treks and climbs for beginners and advanced climbers alike. In the winter, of course, ski enthusiasts from around the world visit a number of European countries for their access to great snow, luxurious accommodations and challenging runs,” Adamski said.

Unfortunately, accidents can happen when mountaineering, regardless of the time of year. Having a travel insurance plan can provide financial protection in the event of medical or evacuation losses, he said.

As an example, said Adamski, a policyholder might need to return to the U.S. after a skiing injury and may need accommodations such as a lay-flat seat or a row of seats to stretch out a broken leg.

“A travel insurance provider, with on-staff doctors and medical coordinators, are invaluable in assisting with medical needs in foreign countries and coordinating with airlines to get injured travelers back home. Such arrangements are remarkably expensive, ranging from $20,000 easily into the six figures,” he explained.

Medical evacuation coverage could help cover these costs, and, in AIG Travel’s travel protection plans, said Adamski, this is complemented by access to an entire medical team dedicated to consulting with the local medical providers, working with you or your family to confirm what’s in your best interests as a patient and making the necessary arrangements to get you where you need to be.

When budgeting for a trip, even the most thorough planners rarely consider a contingency that includes a five- or six-figure emergency medical evacuation, said Adamski. “To be suddenly faced with a bill like that could be devastating. Also, the expertise of the medical staff that would be helping to coordinate such an evacuation could (literally) be a lifesaver,” he said.

Clark with Squaremouth notes that travelers heading to Europe should look for policies with at least $100,000 in medical evacuation coverage. However, if a traveler is doing more remote activities, such as backpacking through the Swiss Alps or exploring the Scandinavian wilderness, “We recommend at least $250,000 in medical evacuation coverage,” he said.

Travel insurance coverage for baggage and belongings

Lofdahl with Travelex said that the return to travel has been wonderful, but the labor shortage has brought some challenges to the industry. “Delayed and lost baggage is one that most people heard about last year and into this year,” she said. “Every airline experienced increases in lost and delayed baggage, and some even had triple the number of lost and delayed bags as they did in the same period in 2021. I can tell you from experience that this can impact your trip.”

European travel generally can include connecting flights which can increase the likelihood that your luggage can be misdirected or lost.

If your luggage decides to vacation in Madrid instead of Athens, you can file a claim with your travel insurance company. Just be sure to get a report from your airline carrier first.

You may also be able to file a claim for delayed luggage. Depending on your plan, you can purchase a few items to tide you over until your bags arrive at your destination, like a swimsuit, some toiletries and a change of clothes. Just be sure to keep any applicable receipts.

Your travel insurance plan may also reimburse you for other personal effect losses while on your vacation. For example, if your camera gets stolen while touring Copenhagen, or if your leather jacket is swiped while in Milan, you can file a claim. But first, you’ll need to file an incident report with your tour leader, hotel manager or local law enforcement. You will be asked for this documentation during the claim process.

It’s very important to read your travel insurance documents carefully so you understand the scope of your benefits. There are often per-item limits and caps for coverage, rules about how depreciation will affect your reimbursement levels and exclusions which won’t be covered. For instance, lost or stolen cash isn’t reimbursable, and many high-ticket items like heirloom jewelry and designer watches are often excluded from coverage.

Baggage loss insurance is also typically secondary coverage, meaning it comes into play only after you’ve filed for reimbursement from your airline or homeowners insurance (in the event of theft).

Frequently asked questions (FAQs)

Buying a travel insurance policy for Europe isn’t required, but it is a smart way to financially protect your trip investment and to ensure you have medical coverage while traveling abroad.

“Just because it’s not required doesn’t mean it’s not a good idea. Unexpected medical bills can be costly, and an unforeseen emergency evacuation or repatriation back home to the U.S. or Canada can climb to tens of thousands of dollars,” said Terra Baykal, spokesperson with World Nomads.

Travel insurance also provides trip cancellation benefits, which can help you recoup the cost of trip deposits. “Travel insurance may reimburse you for your missed nonrefundable, prepaid travel arrangements like hotels, flights and tours, if you need to cancel for a covered reason, like the death of an immediate family member, or your last-minute illness or injury,” said Baykal.

It’s also important to find an insurer who will cover you for all the activities you plan to pursue in Europe. So if skydiving in Switzerland, paragliding in Greece or ziplining in Croatia is in the cards, make sure your insurer covers your more adventurous pursuits, said Baykal.

World Nomads automatically covers more than 150 adventure activities and sports for U.S. residents without the need for an additional adventure activities rider.

While not required to enter Europe, a travel insurance policy with emergency medical coverage is a good idea when traveling to Europe, said Baykal of World Nomads.

Many U.S.-based health insurance providers offer no coverage abroad, or very limited global benefits. If your domestic health insurance doesn’t provide adequate coverage outside of the U.S., buying travel medical insurance for Europe is recommended.

Whether your health coverage travels with you outside the U.S. depends on your Blue Cross Blue Shield plan. Check with your carrier to determine the scope of your travel medical insurance .

According to Blue Cross Blue Shield, travelers should refer to their Certificate of Coverage and riders and also call customer service to find out about limitations to travel coverage.

Blueprint is an independent publisher and comparison service, not an investment advisor. The information provided is for educational purposes only and we encourage you to seek personalized advice from qualified professionals regarding specific financial decisions. Past performance is not indicative of future results.

Blueprint has an advertiser disclosure policy . The opinions, analyses, reviews or recommendations expressed in this article are those of the Blueprint editorial staff alone. Blueprint adheres to strict editorial integrity standards. The information is accurate as of the publish date, but always check the provider’s website for the most current information.

Erica Lamberg is a regular contributor to Fox News, Fox Business, Real Simple, Forbes Advisor, AAA and USA TODAY. She writes about business, travel, personal finance, health, travel insurance and work/life balance. She is based in suburban Philadelphia.

Heidi Gollub is the USA TODAY Blueprint managing editor of insurance. She was previously lead editor of insurance at Forbes Advisor and led the insurance team at U.S. News & World Report as assistant managing editor of 360 Reviews. Heidi has an MBA from Emporia State University and is a licensed property and casualty insurance expert.

10 worst US airports for flight cancellations this week

Travel Insurance Heidi Gollub

10 worst US airports for flight cancellations last week

AXA Assistance USA travel insurance review 2024

Travel Insurance Jennifer Simonson

Cheapest travel insurance of April 2024

Travel Insurance Mandy Sleight

Average flight costs: Travel, airfare and flight statistics 2024

Travel Insurance Timothy Moore

John Hancock travel insurance review 2024

HTH Worldwide travel insurance review 2024

Airfare at major airports is up 29% since 2021

USI Affinity travel insurance review 2024

Trawick International travel insurance review 2024

Travel insurance for Canada

Travelex travel insurance review 2024

Best travel insurance companies of April 2024

Travel Insurance Amy Fontinelle

Best travel insurance for a Disney World vacation in 2024

World Nomads travel insurance review 2024

4 Best Travel Insurance for Europe in 2024

Home | Travel | Europe | 4 Best Travel Insurance for Europe in 2024

When traveling abroad, get a policy from one of the best travel insurance companies . Y ou can get a 5% discount on Heymondo , the only insurance that pays medical bills upfront for you, HERE!

Getting European travel insurance is one of the main requirements for obtaining a Schengen visa, whether for traveling, studying, or working overseas.

However, if you don’t need a Schengen Visa , you may ask yourself, Do I need travel insurance for Europe ? Well, it’s always a good idea. As I mentioned in my guide to the best international travel insurance companies , you should buy coverage if you want the peace of mind that comes with knowing you’re protected in any unforeseen circumstances.

4 Best travel insurance for Europe in 2024

Of course, not everyone needs the same kind of coverage, so in this article, I’m sharing the best travel insurance for Europe and Schengen travel insurance that meets all the visa requirements:

- Schengen visa travel insurance requirements

- Europe travel insurance cost & comparison

- Best travel insurance for Europe

What should European travel insurance cover?

Not to spoil the surprise, but Heymondo is the best option for Europe trip insurance and Schengen Area travel insurance . Heymondo offers comprehensive coverage at an affordable price, and it’s the only company that pays your medical expenses upfront , so you don’t have to worry about filing a reimbursement claim.

5% OFF your travel insurance

Another great option, if you’re traveling on a budget and don’t mind having a deductible, is SafetyWing . Just be aware that there is a $250 deductible per claim, and they don’t cover medical expenses upfront. You will need to pay out of your pocket and ask for reimbursement later, but it is the cheapest option by far.

I’ll give you a full review of other top travel insurance for Europe below .

Is travel insurance for Europe mandatory?

If you’re required to have a visa to enter the Schengen Area, you must have travel medical insurance for a Europe trip . Be aware that not all travelers need a Schengen visa, so check the requirements for different countries below.

If you’re a citizen of a country in the Schengen Area, you don’t need travel insurance for Europe , but it’s wise to have coverage for your trip .

What countries need a Schengen Visa to visit Europe?

Travelers from the following countries must purchase European travel insurance to obtain a Schengen visa and visit the Schengen Area:

Schengen visa insurance requirements

To obtain a Schengen visa, you must have Schengen Area travel insurance . That is, insurance that covers the Schengen Area and meets these requirements:

- At least $30,000 in coverage for medical emergencies and accidents : Healthcare and medical expenses in Europe aren’t cheap, so emergency medical coverage is a requirement. No matter where you travel in the Schengen Area, your insurance will cover the medical fees if you get sick or injured.

- Repatriation coverage in case of medical incidents or death : If you fall gravely ill in a remote area or require further medical attention for a serious injury, you may need to be transported back to your home country. This is an expensive service, so your insurance should include repatriation coverage. This way, you won’t have to pay big bucks for transportation fees.

- Coverage in all 26 Schengen Area countries for the entire duration of your trip : Even if you’re not planning to visit all 26 countries (which would be incredibly ambitious!), your insurance policy must cover all of them. The best Schengen travel insurance policies allow you to select “Europe” as your coverage area, so you don’t have to worry. I always recommend reading the fine print to ensure you don’t encounter any problems when applying for your Schengen visa.

What countries are in the Schengen Area?

The 26 countries that make up the Schengen Area are:

- Czech Republic

- Liechtenstein

- Netherlands

- Switzerland

Of those countries, Iceland, Liechtenstein, Norway, and Switzerland are the only countries that don’t also belong to the European Union.

How much does European travel insurance cost?

Choosing the best travel health insurance for Europe is one of the most frequent doubts among tourists. We currently have a policy with Heymondo , and we’re very happy with it. The company has been super responsive and helpful whenever we’ve needed assistance. I love that they take care of medical payments for us upfront, so we don’t need to pay out of pocket and file a claim.

If you’re still unsure which European tourist insurance best suits you and your needs , look at the table below. I’ve compared the cost of European travel insurance from 4 different companies. To be as impartial as possible, I’ve simulated the prices for a 30-year-old American traveling to Spain for two weeks with a trip cost of $2,500.

*Price used for example

For this European travel insurance comparison , I chose the cheapest policies that cover the Schengen Area and meet all the requirements. While Heymondo isn’t the cheapest, it offers better coverage than the others, and it’s the only one that pays for medical expenses upfront.

Also, remember that these prices are just an example and can vary depending on your trip’s duration, your country of origin, destination, and other factors. However, no matter the cost, you want travel insurance, even for the cheapest places to visit in Europe .

Best Europe travel insurance

Again, each European travel insurance company has its advantages, so I’m sharing an overview of each option below to help you make the best choice.

1. Heymondo , the best travel insurance for Europe

Heymondo is the best holiday insurance for Europe , offering $200,000 in emergency medical coverage and no deductible. One of the main advantages of Heymondo insurance is the 24/7 customer support and medical chat . This way, you can quickly consult a doctor or get directions to the nearest hospital.

Another thing I like about Heymondo is that it takes care of everything, so you won’t have to pay a single bill out of pocket . No more filing claims and waiting for reimbursement! Just remember that for Heymondo to cover expenses upfront, you must contact them before going to the doctor. If you forget or don’t have time, don’t worry. Heymondo will refund your money after you send them the medical invoice.

Besides, it covers electronic equipment , something that most travel insurance doesn’t include. For us, that coverage is crucial since we always travel with two laptops and professional camera gear.

We’ve been using Heymondo’s annual travel insurance and have been delighted with the experience. We have had to use the customer support more than once, and the team has always been professional, efficient, and kind. If you choose this company for your European travel health insurance , you can save 5% with our Heymondo discount .

2. SafetyWing , a cheap European travel insurance

If you’re looking for a low-cost Schengen travel insurance policy, look into SafetyWing . It’s one of the cheapest travel insurance companies on the market, offering excellent coverage without a hefty price.

SafetyWing’s European travel health insurance includes extensive emergency medical coverage, evacuation and repatriation protection, and up to $5,000 in trip interruption benefits for added peace of mind.

However, while SafetyWing has some of the lowest prices on the market, remember that it’s more of a medical travel insurance , so its trip-related coverage is minimal.

Also, there is a $250 deductible, so you’ll have to pay $250 before the company covers your medical costs. If you don’t want to deal with a deductible and want the added benefit of having your expenses paid upfront, I recommend Heymondo .

3. Trawick International , the best Europe travel insurance for seniors

Trawick International is another option to consider, especially if you’re looking for a good travel insurance plan for seniors . Trawick is affordable and features great medical benefits, including coverage for pre-existing conditions. The company also offers decent protection for natural disasters and repatriation.

This company also has travel insurance with Cancel For Any Reason (CFAR) . So, if you add CFAR to your policy, you’ll get reimbursed for your flight and accommodation expenses if you call the trip off, regardless of the reason for your cancellation. However, there are specific terms and conditions, so I recommend reading the policy thoroughly.

It’s important to review the different Trawick policies since some pertain to European travel insurance while others are tailored to students or tourists coming to the USA. In our comparison, we looked at the Safe Travels Explorer plan, which includes decent trip cancellation and interruption coverage, but only a small amount of baggage loss protection.

Overall, you can get much more coverage for the same price or a bit more. For example, Heymondo offers $200,000 in emergency medical expenses compared to Trawick’s $50,000. Plus, Heymondo pays your medical expenses upfront.

4. Travelex , another good travel health insurance for Europe

Lastly, Travelex is dependable tourist insurance for Europe that meets all Schengen visa insurance requirements. Its Select plan is the more expensive option, but it includes extensive repatriation and evacuation coverage, as well as natural disaster protection.

You’ll also be covered for travel-related expenses like baggage loss/theft, trip cancellation/interruption, and trip delay. Travelex is also a travel insurance that covers pre-existing conditions , making it a good choice if you want your policy to cover treatments and medication abroad for chronic diseases like diabetes.

On the other hand, the Select plan is the most expensive option of the policies we looked at, and the emergency medical expense coverage is very low. In comparison, Heymondo offers much better coverage for a lower price.

What should travel insurance for Europe cover?

When shopping around for travel medical insurance for Europe , make sure you’re looking for the best coverage. Below, you can see what the best European travel insurance should include:

Emergency medical expenses

Emergency medical coverage is the most basic and essential requirement for any European holiday insurance . Even the cheapest policies include this type of coverage. With emergency medical expenses protection, you’ll be covered for any visits, tests, treatments, and hospitalizations during the trip due to illness or injury.

However, chronic illnesses or sicknesses that existed before the start of the trip are excluded from this coverage. For example, the insurance won’t cover treatment for cancer, as that’s a chronic disease that must be treated in your country of origin. On the other hand, an emergency operation for appendicitis would be covered.

Emergency medical expenses, something that’s covered with European travel insurance

As for injuries and accidents, most policies don’t cover incidents that occur while practicing extreme sports or risky activities. In the case of Heymondo , some adventure sports are included in the Premium plan. For other insurers, there is the option to add this type of coverage to your policy for an extra fee. So, if you’re a daredevil and plan on participating in some extreme sports during your trip, I recommend getting a policy with Heymondo.

Evacuation & repatriation

Evacuation and repatriation coverage are other must-haves when buying insurance for a European trip . If you have to return to your home country due to a medical emergency or death abroad, this coverage will take care of the associated expenses. Moreover, if a family member back home gets seriously sick or dies, or there is an accident at your home, the costs will fall under this category.

Unexpected delays can happen while traveling, be it a flight delay, weather problems, or an issue with the airline. This is why many European travel insurance companies include trip delay coverage. This covers expenses like meals and accommodation if your trip is delayed several hours or more.

Trip cancellation & interruption

As for trip cancellation , it’s often not included in European travel insurance . You usually must take out a trip cancellation policy or add this coverage to your plan.

With trip cancellation protection, you’ll be covered if you have to cancel your trip for health, legal, or work reasons. The amount varies depending on your policy, but you could recover up to 100% of the money you invested in the trip. Of course, you must provide documentation justifying the cancellation.

If you want the option of canceling your trip for any reason and getting reimbursed, look into Cancel For Any Reason (CFAR) insurance . Many companies offer this coverage as an add-on.