U.S. News takes an unbiased approach to our recommendations. When you use our links to buy products, we may earn a commission but that in no way affects our editorial independence.

9 Best Travel Insurance Companies of April 2024

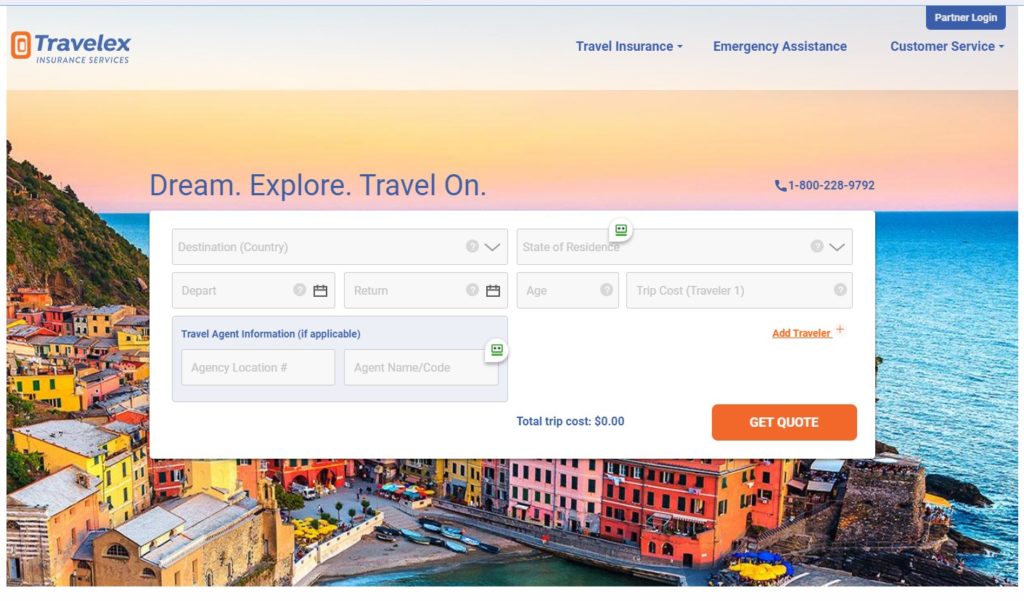

According to our analysis of more than 50 travel insurance companies and hundreds of different travel insurance plans, the best travel insurance company is Travelex Insurance Services. In our best travel insurance ratings, we take into account traveler reviews, credit ratings and industry awards. The best travel insurance companies offer robust coverage and excellent customer service, and many offer customizable add-ons.

Travelex Insurance Services »

Allianz Travel Insurance »

HTH Travel Insurance »

Tin Leg »

AIG Travel Guard »

Nationwide Insurance »

Seven Corners »

Generali Global Assistance »

Berkshire hathaway travel protection ».

Why Trust Us

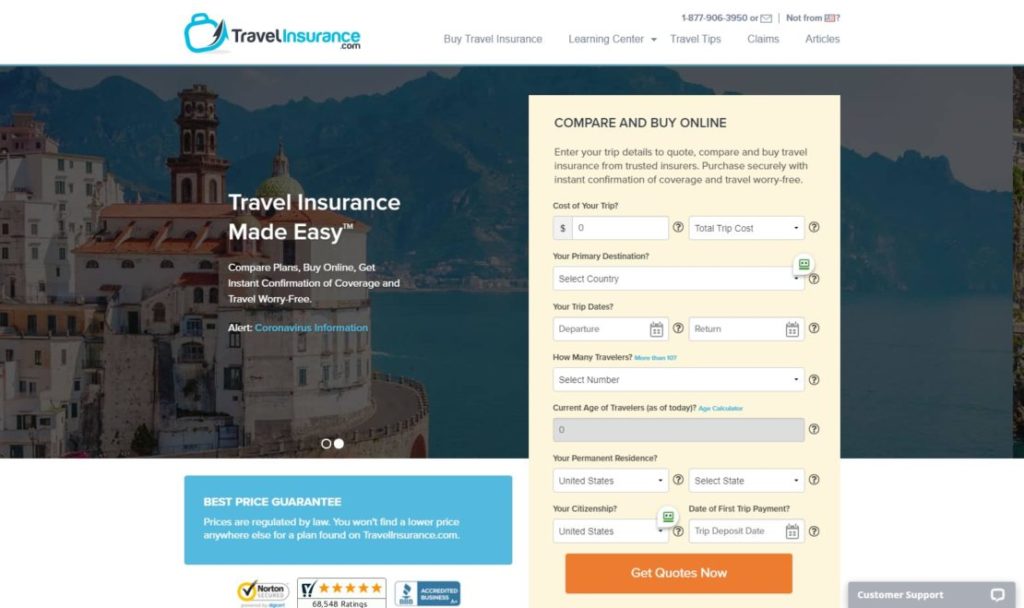

U.S. News evaluates ratings, data and scores of more than 50 travel insurance companies from comparison websites like TravelInsurance.com, Squaremouth and InsureMyTrip, plus renowned credit rating agency AM Best, in addition to reviews and recommendations from top travel industry sources and consumers to determine the Best Travel Insurance Companies.

Table of Contents

- Travelex Insurance Services

- Allianz Travel Insurance

Travel insurance can help you protect the financial investment you made in your vacation when unexpected issues arise. Find the best travel insurance for the type of trip(s) you're taking and the coverages that matter most to you – from interruptions and misplaced belongings to illness and injury.

- Travelex Insurance Services: Best Overall

- Allianz Travel Insurance: Best for Trip Interruptions

- HTH Travel Insurance: Best for Groups

- Tin Leg: Best Cost

- AIG Travel Guard: Best for Families

- Nationwide Insurance: Best for Last-Minute Travel Insurance

- Seven Corners: Best for 24/7 Support When Traveling

- Generali Global Assistance: Best for Medical Emergencies

- Berkshire Hathaway Travel Protection: Best for Specialized Coverage

Customizable upgrades are available, including car rental coverage, additional medical insurance and adventure sports coverage

Medical and trip cancellation maximum are not as high as some other companies

- 100% of the insured trip cost for trip cancellation; 150% for trip interruption

- Up to $1,000 in coverage for lost, damaged or stolen bags and personal items; $200 for luggage delays

- $750 in missed connection coverage

- $50,000 in emergency medical and dental coverage

- Up to $500,000 in emergency medical evacuation and repatriation coverage

SEE FULL REVIEW »

Annual and multitrip policies are available

Distinguishing between the company's 10 travel insurance plans can be challenging

- Up to $200,000 in trip cancellation coverage; $300,000 in trip interruption coverage

- $2,000 for lost, damaged or stolen luggage and personal effects; $600 for bag delays

- Up to $1,600 for travel delays

- Emergency medical coverage of up to $75,000

- Epidemic coverage

Generous coverage at the mid- and high-tier levels, and great group discounts

Preexisting conditions coverage is only available at mid- and high-tier plans

- 100% trip cancellation coverage (up to $50,000); 200% trip interruption coverage

- Up to $2,000 in coverage for baggage and personal effects; $400 in baggage delay coverage

- Up to $2,000 in coverage for trip delays; $1,000 for missed connections

- $500,000 in coverage per person for sickness and accidents

Variety of plans to choose from, including two budget-friendly policies and several more premium options

More limited coverage for baggage issues than other companies

- 100% trip cancellation protection; 150% trip interruption

- $500 per person for lost, stolen or damaged baggage and personal items

- Up to $2,000 per person in travel delay coverage ($150 per day); $100 per person for missed connections

- $100,000 per person in emergency medical coverage, including issues related to COVID-19

Travel insurance policy coverage is tailored to your specific trip

Information about policy coverage inclusions is not readily available without first obtaining a quote

- Trip cancellation coverage for up to 100% of your trip's cost; trip interruption coverage for up to 150% of the trip cost

- Up to $2,500 in coverage for lost, stolen or damaged baggage; $500 related to luggage delays

- Up to $1,000 in missed connection and trip delay coverage

- $100,000 in emergency medical coverage

Variety of plans to choose from and coverage available up to a day before you leave on your trip

Limited trip cancellation coverage even at the highest tier

- Trip cancellation coverage up to $30,000; trip interruption coverage worth up to 200% of the trip cost (maximum of $60,000)

- $2,000 for lost, damaged or stolen baggage; $600 for baggage delays

- Up to $2,000 for trip delays; missed connection and itinerary change coverage of $500 each

- $150,000 for emergency medical and dental issues

Customer service available 24/7 via text, Whatsapp, email and phone

Cancel for any reason coverage costs extra

- 100% trip cancellation coverage (up to between $30,000 and $100,000 depending on your state of residence); interruption coverage for up to 150% of the trip cost

- Lost, stolen or damaged baggage coverage up to $2,500; up to $600 for luggage delays

- Trip delay and missed connection coverage worth up to $1,500

- Emergency medical coverage worth up to between $250,000 and $500,000 (depending on where you live)

Generous emergency medical and emergency evacuation coverage

Coverage for those with preexisting conditions is only available on the Premium plan

- 100% reimbursement for trip cancellation; 175% reimbursement for trip interruption

- $2,000 in coverage for loss of baggage per person

- $1,000 per person in travel delay and missed connection coverage

- $250,000 in medical and dental coverage per person

In addition to single-trip plans, company offers specific road trip, adventure travel, flight and cruise insurance coverage

Coverage for missed connections or accidental death and dismemberment is not part of the most basic plan

- Trip cancellation coverage worth up to 100% of the trip cost; interruption coverage worth up to 150% of the trip cost

- $500 in coverage for lost, stolen or damaged bags and personal items; bag delay coverage worth $200

- Trip delay coverage worth up to $1,000; missed connection coverage worth up to $100

- Medical coverage worth up to $50,000

To help you better understand the costs associated with travel insurance, we requested quotes for a weeklong June 2024 trip to Spain for a solo traveler, a couple and a family. These rates should help you get a rough estimate for about how much you can expect to spend on travel insurance. For additional details on specific coverage from each travel insurance plan and to input your trip information for a quote, see our comparison table below.

Travel Insurance Types: Which One Is Right for You?

There are several types of travel insurance you'll want to evaluate before choosing the policy that's right for you. A few of the most popular types of travel insurance include:

COVID travel insurance Select insurance plans offer some or a combination of the following COVID-19-related protections: coverage for rapid or PCR testing; accommodations if you're required to quarantine during your trip if you test positive for coronavirus; health care; and trip cancellations due to you or a family member testing positive for COVID-19. Read more about the best COVID-19 travel insurance options .

Cancel for any reason insurance Cancel for any reason travel insurance works exactly how it sounds. This type of travel insurance lets you cancel your trip for any reason you want – even if your reason is that you simply decide you no longer want to go. Cancel for any reason travel insurance is typically an add-on you can purchase to go along with other types of travel insurance. For that reason, you will pay more to have this kind of coverage added to your policy.

Also note that this type of coverage typically only reimburses 50% to 80% of your nonrefundable prepaid travel expenses. You'll want to make sure you know exactly how much reimbursement you could qualify for before you invest in this type of policy. Compare the best cancel for any reason travel insurance options here .

International travel insurance Travel insurance is especially useful when traveling internationally, as it can provide medical coverage for emergencies (in some cases for COVID-19) when you're far from home. Depending which international travel insurance plan you choose, this type of travel insurance can also cover lost or delayed luggage, rental cars, travel interruptions or cancellations, and more.

Cheap travel insurance If you want travel insurance but don't want to spend a lot of money, there are plenty of cheap travel insurance options that will offer at least some protections (and peace of mind). These are typically called a company's basic or standard plan; many travel insurance companies even allow you to customize your coverage, spending as little or as much as you want. Explore your options for the cheapest travel insurance here .

Trip cancellation, interruption and delay insurance Trip cancellation coverage can help you get reimbursement for prepaid travel expenses, such as your airfare and cruise fare, if your trip is ultimately canceled for a covered reason. Trip interruption insurance, on the other hand, kicks in to reimburse you if your trip is derailed after it starts. For instance, if you arrived at your destination and became gravely ill, it would cover the cost if you had to cut your trip short.

Trip delay insurance can help you qualify for reimbursement of any unexpected expenses you incur (think: lodging, transportation and food) in the event your trip is delayed for reasons beyond your control, such as your flight being canceled and rebooked for the next day. You will want to save your receipts to substantiate your claim if you have this coverage.

Lost, damaged, delayed or stolen bags or personal belongings Coverage for lost or stolen bags can come in handy if your checked luggage is lost by your airline or your luggage is delayed so long that you have to buy clothing and toiletries for your trip. This type of coverage can kick in to cover the cost to replace lost or stolen items you brought on your trip. It can also provide coverage for the baggage itself. It's even possible that your travel insurance policy will pay for your flight home if damages are caused to your residence and your belongings while you're away, forcing you to return home immediately.

Travel medical insurance If you find yourself sick or injured while you are on vacation, emergency medical coverage can pay for your medical expenses. With that in mind, however, you will need to find out whether the travel medical insurance you buy is primary or secondary. Where a primary policy can be used right away to cover medical bills incurred while you travel, secondary coverage only provides reimbursement after you have exhausted other medical policies you have.

You will also need to know how the travel medical coverage you purchase deals with any preexisting conditions you have, including whether you will have any coverage for preexisting conditions at all. Read more about the best travel medical insurance plans .

Evacuation insurance Imagine you break your leg while on the side of a mountain in some far-flung land without quality health care. Not only would you need travel medical insurance coverage in that case, but you would also need coverage for the exorbitant expense involved in getting you off the side of a mountain and flying you home where you can receive appropriate medical care.

Evacuation coverage can come in handy if you need it, but you will want to make sure any coverage you buy comes with incredibly high limits. According to Squaremouth, an emergency evacuation can easily cost $25,000 in North America and up to $50,000 in Europe, so the site typically suggests customers buy policies with $50,000 to $100,000 in emergency evacuation coverage.

Cruise insurance Travel delays; missed connections, tours or excursions; and cruise ship disablement (when a ship encounters a mechanical issue and is unable to continue on in the journey) are just a few examples why cruise insurance can be a useful protection if you've booked a cruise vacation. Learn more about the top cruise insurance plans here .

Credit card travel insurance It is not uncommon to find credit cards that include trip cancellation and interruption coverage , trip delay insurance, lost or delayed baggage coverage, travel accident insurance, and more. Cards that offer this coverage include popular options like the Chase Sapphire Reserve credit card , the Chase Sapphire Preferred credit card and The Platinum Card from American Express .

Note that owning a credit card with travel insurance protection is not enough for your coverage to count: To take advantage of credit card travel insurance, you must pay for prepaid travel expenses like your airfare, hotel stay or cruise with that specific credit card. Also, note that credit cards with travel insurance have their own list of exclusions to watch out for. Many also require cardholders to pay an annual fee.

Frequently Asked Questions

The best time to buy travel insurance is normally within a few weeks of booking your trip since you may qualify for lower pricing if you book early. Keep in mind, some travel insurance providers allow you to purchase plans until the day before you depart.

Many times, you are given the option to purchase travel insurance when you book your airfare, accommodations or vacation package. Travel insurance and travel protection are frequently offered as add-ons for your trip, meaning you can pay for your vacation and some level of travel insurance at the same time.

However, many people choose to wait to buy travel insurance until after their entire vacation is booked and paid for. This helps travelers tally up all the underlying costs associated with a trip, and then choose their travel insurance provider and the level of coverage they want.

Figuring out where to buy travel insurance may be confusing but you can easily research and purchase travel insurance online these days. Some consumers prefer to shop around with a specific provider, such as Allianz or Travelex, but you can also shop and compare policies with a travel insurance platform. Popular options include:

- TravelInsurance.com: TravelInsurance.com offers travel insurance options from more than a dozen vetted insurance providers. Users can read reviews on the various travel insurance providers to find out more about previous travelers' experiences with them. Squaremouth: With Squaremouth, you can enter your trip details and compare more than 90 travel insurance plans from 20-plus providers.

- InsureMyTrip: InsureMyTrip works similarly, letting you shop around and compare plans from more than 20 travel insurance providers in one place. InsureMyTrip also offers several guarantees, including a Best Price Guarantee, a Best Plan Guarantee and a Money-Back Guarantee that promises a full refund if you decide you no longer need the plan you purchased.

Protect your trip: Search, compare and buy the best travel insurance plans for the lowest price. Get a quote .

When you need to file a travel insurance claim, you should plan on explaining to your provider what happened to your trip and why you think your policy applies. If you planned to go on a Caribbean cruise, but your husband fell gravely ill the night before you were set to depart, you would need to explain that situation to your travel insurance company. Information you should share with your provider includes the details of why you're making a claim, who was involved and the exact circumstances of your loss.

Documentation is important, and your travel insurance provider will ask for proof of what happened. Required documentation for travel insurance typically includes any proof of a delay, receipts, copies of medical bills and more.

Most travel insurance companies let you file a claim using an online form, but some also allow you to file a claim by phone or via fax. Some travel insurance providers, such as Allianz and Travel Insured International, offer their own mobile apps you can use to buy policies and upload information or documents that substantiate your claim. In any case, you will need to provide the company with proof of your claim and the circumstances that caused it.

If your claim is initially denied, you may also need to answer some questions or submit some additional information that can highlight why you do, in fact, qualify.

Whatever you do, be honest and forthcoming with all the information in your claim. Also, be willing to provide more information or answer any questions when asked.

Travel insurance claims typically take four to six weeks to process once you file with your insurance company. However, with various flight delays and cancellations due to things like extreme weather and pilot shortages, more travelers have begun purchasing travel insurance, encountering trip issues and having to submit claims. The higher volume of claims submitted has resulted in slower turnaround times at some insurance companies.

The longer you take to file your travel insurance claim after a loss, the longer you will be waiting for reimbursement. Also note that, with many travel insurance providers, there is a time limit on how long you can submit claims after a trip. For example, with Allianz Travel Insurance and Travelex Insurance Services, you have 90 days from the date of your loss to file a claim.

You may be able to expedite the claim if you provide all the required information upfront, whereas the process could drag on longer than it needs to if you delay filing a claim or the company has to follow up with you to get more information.

Travel insurance is never required, and only you can decide whether or not it's right for you. Check out Is Travel Insurance Worth It? to see some common situations where it does (and doesn't) make sense.

Why Trust U.S. News Travel

Holly Johnson is an award-winning content creator who has been writing about travel insurance and travel for more than a decade. She has researched travel insurance options for her own vacations and family trips to more than 50 countries around the world, and has experience navigating the claims and reimbursement process. In fact, she has successfully filed several travel insurance claims for trip delays and trip cancellations over the years. Johnson also works alongside her husband, Greg, who has been licensed to sell travel insurance in 50 states, in their family media business.

You might also be interested in:

Carry-on Luggage and Personal Item Size Limits (2024)

Amanda Norcross

Just like checked bags, carry-on luggage size restrictions can vary by airline.

Bereavement Fares: 5 Airlines That Still Offer Discounts

Several airlines offer help in times of loss.

The Best Way to Renew a Passport in 2024

The proposed online passport renewal system is behind schedule.

The Best Carry-on Luggage of 2024

Erin Evans and Rachael Hood and Catriona Kendall and Amanda Norcross and Leilani Osmundson

Discover the best carry-on luggage for your unique travel style and needs.

The best travel insurance policies and providers

It's easy to dismiss the value of travel insurance until you need it.

Many travelers have strong opinions about whether you should buy travel insurance . However, the purpose of this post isn't to determine whether it's worth investing in. Instead, it compares some of the top travel insurance providers and policies so you can determine which travel insurance option is best for you.

Of course, as the coronavirus remains an ongoing concern, it's important to understand whether travel insurance covers pandemics. Some policies will cover you if you're diagnosed with COVID-19 and have proof of illness from a doctor. Others will take coverage a step further, covering additional types of pandemic-related expenses and cancellations.

Know, though, that every policy will have exclusions and restrictions that may limit coverage. For example, fear of travel is generally not a covered reason for invoking trip cancellation or interruption coverage, while specific stipulations may apply to elevated travel warnings from the Centers for Disease Control and Prevention.

Interested in travel insurance? Visit InsureMyTrip.com to shop for plans that may fit your travel needs.

So, before buying a specific policy, you must understand the full terms and any special notices the insurer has about COVID-19. You may even want to buy the optional cancel for any reason add-on that's available for some comprehensive policies. While you'll pay more for that protection, it allows you to cancel your trip for any reason and still get some of your costs back. Note that this benefit is time-sensitive and has other eligibility requirements, so not all travelers will qualify.

In this guide, we'll review several policies from top travel insurance providers so you have a better understanding of your options before picking the policy and provider that best address your wants and needs.

The best travel insurance providers

To put together this list of the best travel insurance providers, a number of details were considered: favorable ratings from TPG Lounge members, the availability of details about policies and the claims process online, positive online ratings and the ability to purchase policies in most U.S. states. You can also search for options from these (and other) providers through an insurance comparison site like InsureMyTrip .

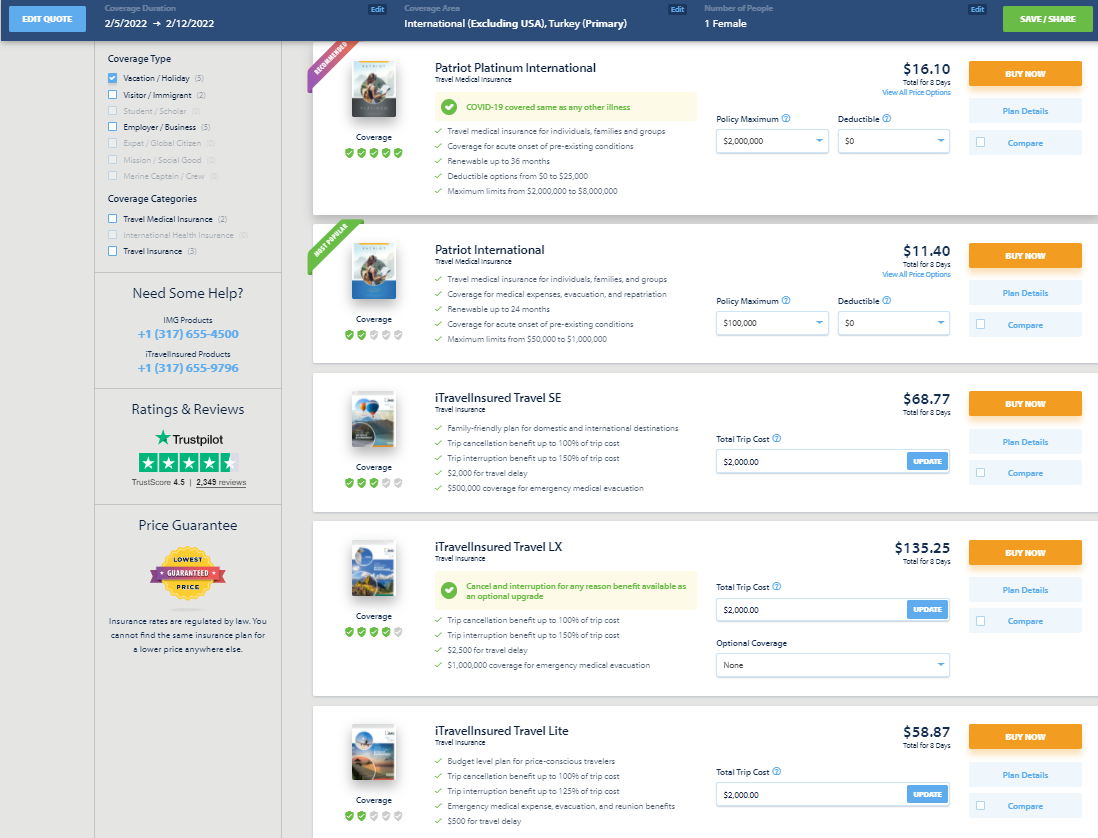

When comparing insurance providers, I priced out a single-trip policy for each provider for a $2,000, one-week vacation to Istanbul . I used my actual age and state of residence when obtaining quotes. As a result, you may see a different price — or even additional policies due to regulations for travel insurance varying from state to state — when getting a quote.

AIG Travel Guard

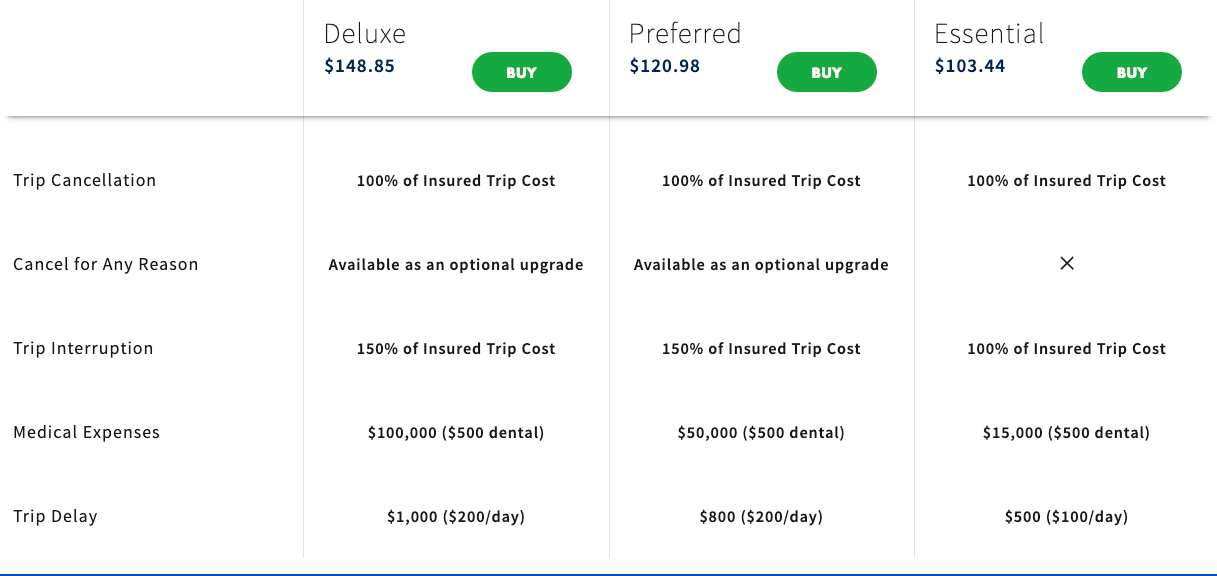

AIG Travel Guard receives many positive reviews from readers in the TPG Lounge who have filed claims with the company. AIG offers three plans online, which you can compare side by side, and the ability to examine sample policies. Here are three plans for my sample trip to Turkey.

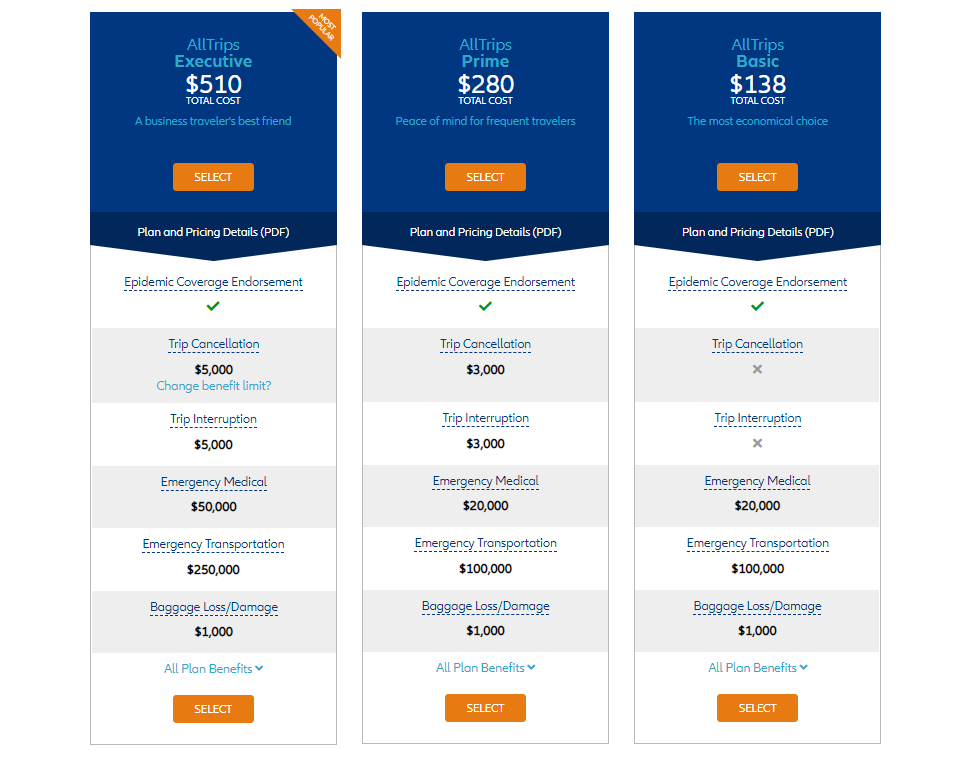

AIG Travel Guard also offers an annual travel plan. This plan is priced at $259 per year for one Florida resident.

Additionally, AIG Travel Guard offers several other policies, including a single-trip policy without trip cancellation protection . See AIG Travel Guard's COVID-19 notification and COVID-19 advisory for current details regarding COVID-19 coverage.

Preexisting conditions

Typically, AIG Travel Guard wouldn't cover you for any loss or expense due to a preexisting medical condition that existed within 180 days of the coverage effective date. However, AIG Travel Guard may waive the preexisting medical condition exclusion on some plans if you meet the following conditions:

- You purchase the plan within 15 days of your initial trip payment.

- The amount of coverage you purchase equals all trip costs at the time of purchase. You must update your coverage to insure the costs of any subsequent arrangements that you add to your trip within 15 days of paying the travel supplier for these additional arrangements.

- You must be medically able to travel when you purchase your plan.

Standout features

- The Deluxe and Preferred plans allow you to purchase an upgrade that lets you cancel your trip for any reason. However, reimbursement under this coverage will not exceed 50% or 75% of your covered trip cost.

- You can include one child (age 17 and younger) with each paying adult for no additional cost on most single-trip plans.

- Other optional upgrades, including an adventure sports bundle, a baggage bundle, an inconvenience bundle, a pet bundle, a security bundle and a wedding bundle, are available on some policies. So, an AIG Travel Guard plan may be a good choice if you know you want extra coverage in specific areas.

Purchase your policy here: AIG Travel Guard .

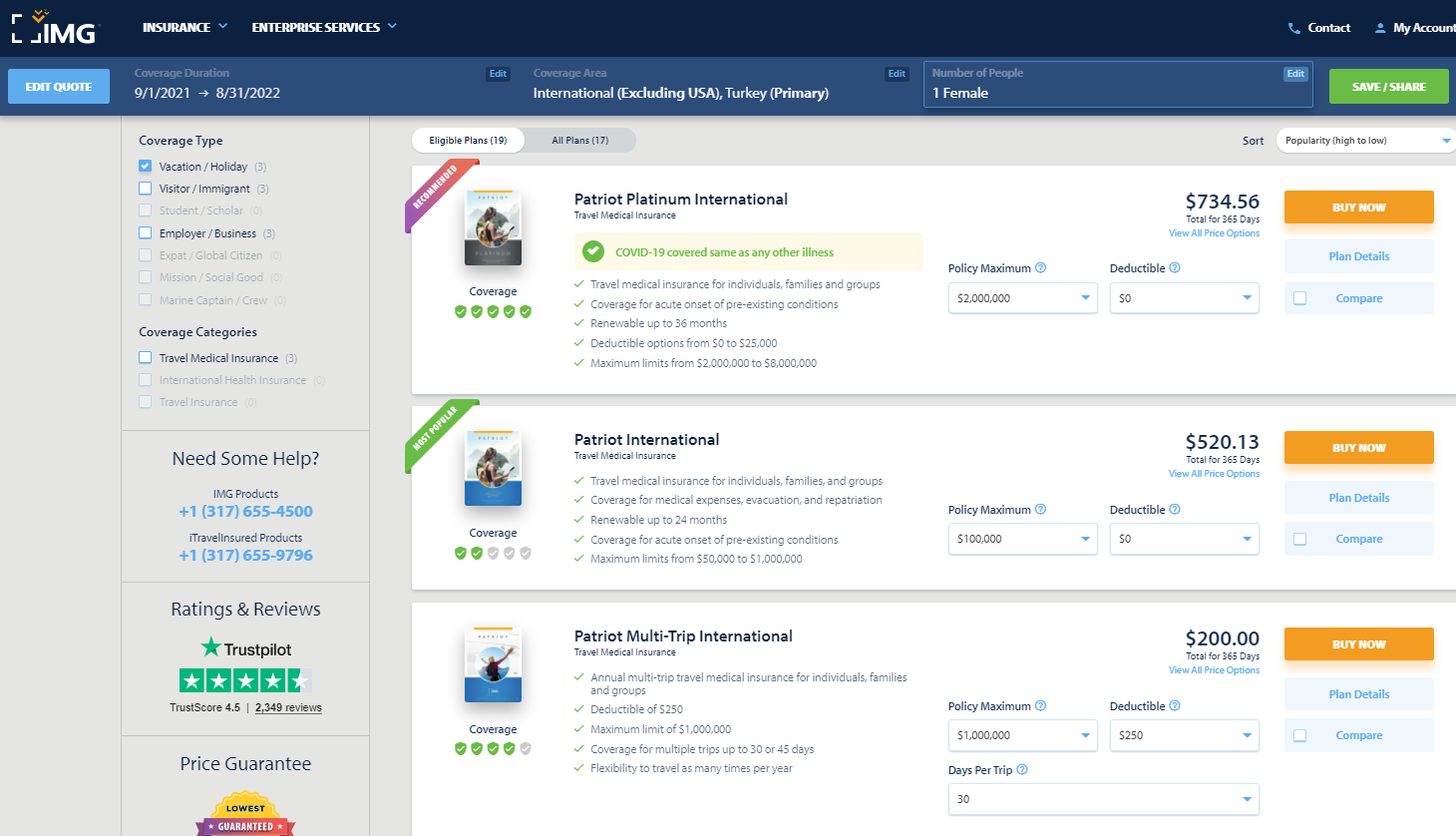

Allianz Travel Insurance

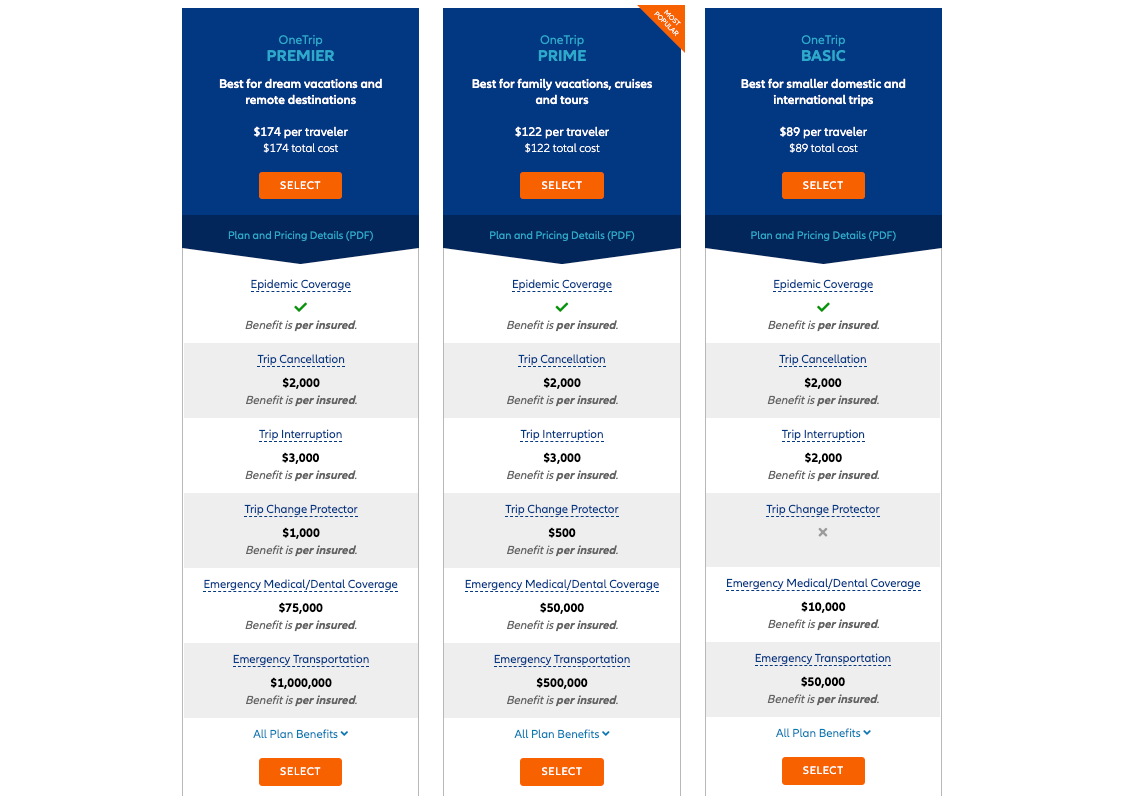

Allianz is one of the most highly regarded providers in the TPG Lounge, and many readers found the claim process reasonable. Allianz offers many plans, including the following single-trip plans for my sample trip to Turkey.

If you travel frequently, it may make sense to purchase an annual multi-trip policy. For this plan, all of the maximum coverage amounts in the table below are per trip (except for the trip cancellation and trip interruption amounts, which are an aggregate limit per policy). Trips typically must last no more than 45 days, although some plans may cover trips of up to 90 days.

See Allianz's coverage alert for current information on COVID-19 coverage.

Most Allianz travel insurance plans may cover preexisting medical conditions if you meet particular requirements. For the OneTrip Premier, Prime and Basic plans, the requirements are as follows:

- You purchased the policy within 14 days of the date of the first trip payment or deposit.

- You were a U.S. resident when you purchased the policy.

- You were medically able to travel when you purchased the policy.

- On the policy purchase date, you insured the total, nonrefundable cost of your trip (including arrangements that will become nonrefundable or subject to cancellation penalties before your departure date). If you incur additional nonrefundable trip expenses after purchasing this policy, you must insure them within 14 days of their purchase.

- Allianz offers reasonably priced annual policies for independent travelers and families who take multiple trips lasting up to 45 days (or 90 days for select plans) per year.

- Some Allianz plans provide the option of receiving a flat reimbursement amount without receipts for trip delay and baggage delay claims. Of course, you can also submit receipts to get up to the maximum refund.

- For emergency transportation coverage, you or someone on your behalf must contact Allianz, and Allianz must then make all transportation arrangements in advance. However, most Allianz policies provide an option if you cannot contact the company: Allianz will pay up to what it would have paid if it had made the arrangements.

Purchase your policy here: Allianz Travel Insurance .

American Express Travel Insurance

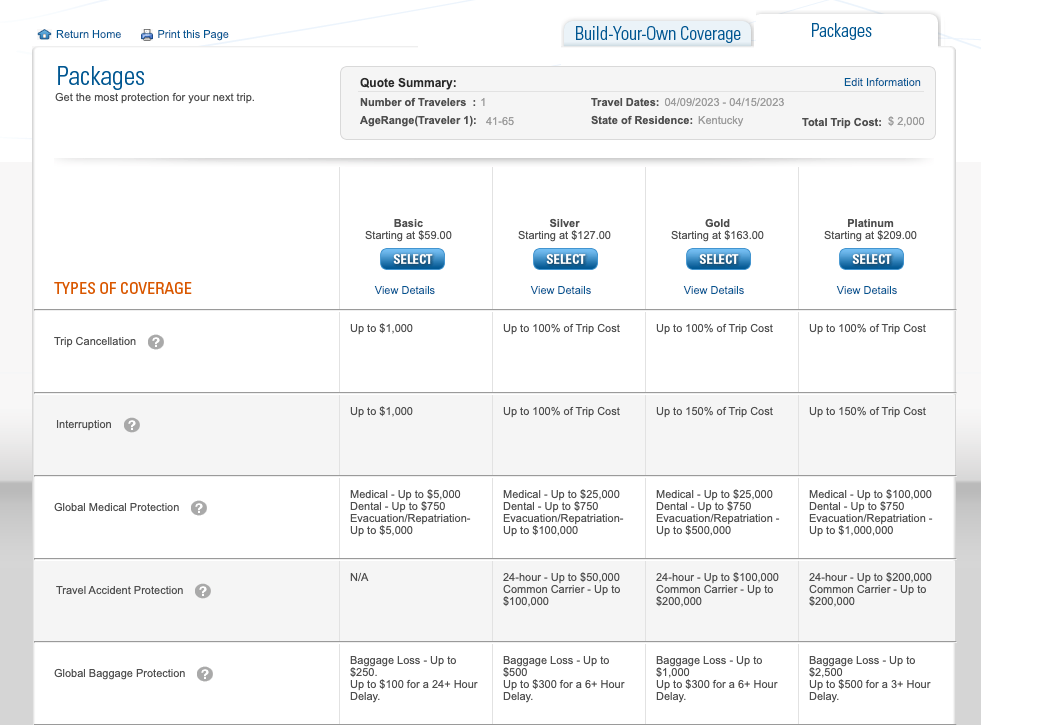

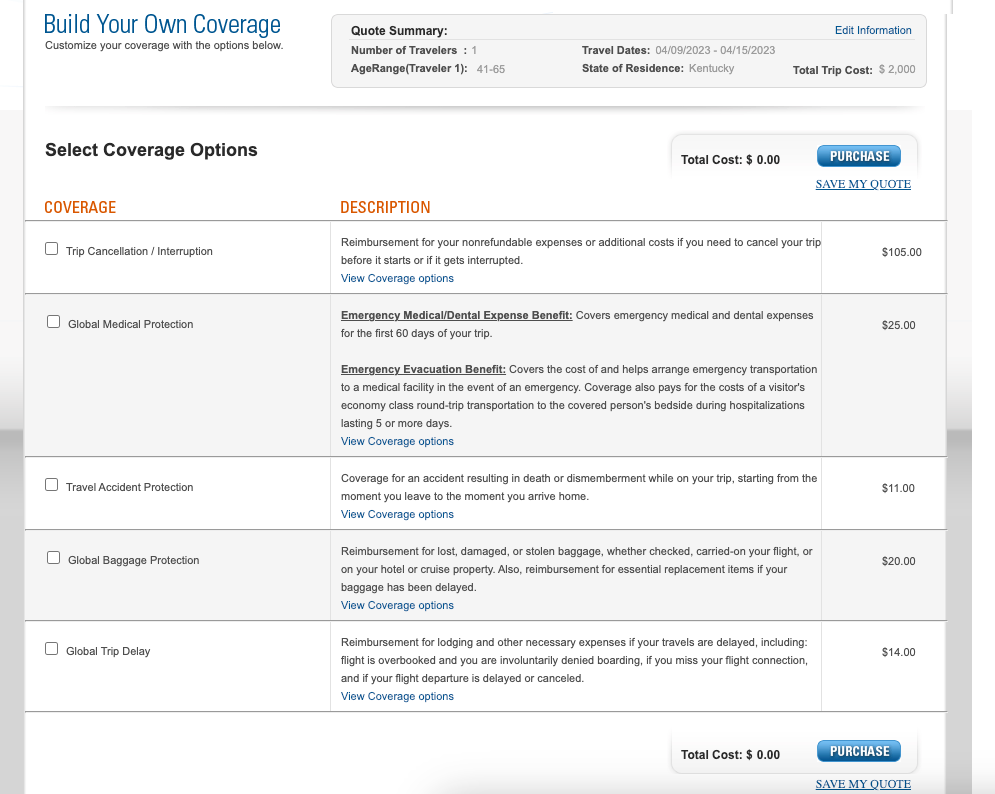

American Express Travel Insurance offers four different package plans and a build-your-own coverage option. You don't have to be an American Express cardholder to purchase this insurance. Here are the four package options for my sample weeklong trip to Turkey. Unlike some other providers, Amex won't ask for your travel destination on the initial quote (but will when you purchase the plan).

Amex's build-your-own coverage plan is unique because you can purchase just the coverage you need. For most types of protection, you can even select the coverage amount that works best for you.

The prices for the packages and the build-your-own plan don't increase for longer trips — as long as the trip cost remains constant. However, the emergency medical and dental benefit is only available for your first 60 days of travel.

Typically, Amex won't cover any loss you incur because of a preexisting medical condition that existed within 90 days of the coverage effective date. However, Amex may waive its preexisting-condition exclusion if you meet both of the following requirements:

- You must be medically able to travel at the time you pay the policy premium.

- You pay the policy premium within 14 days of making the first covered trip deposit.

- Amex's build-your-own coverage option allows you to only purchase — and pay for — the coverage you need.

- Coverage on long trips doesn't cost more than coverage for short trips, making this policy ideal for extended getaways. However, the emergency medical and dental benefit only covers your first 60 days of travel.

- American Express Travel Insurance can protect travel expenses you purchase with Amex Membership Rewards points in the Pay with Points program (as well as travel expenses bought with cash, debit or credit). However, travel expenses bought with other types of points and miles aren't covered.

Purchase your policy here: American Express Travel Insurance .

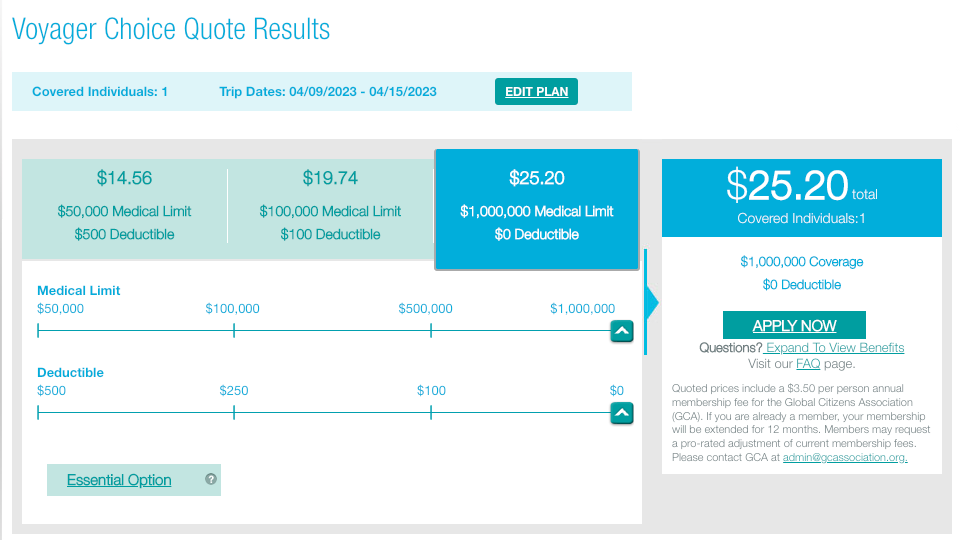

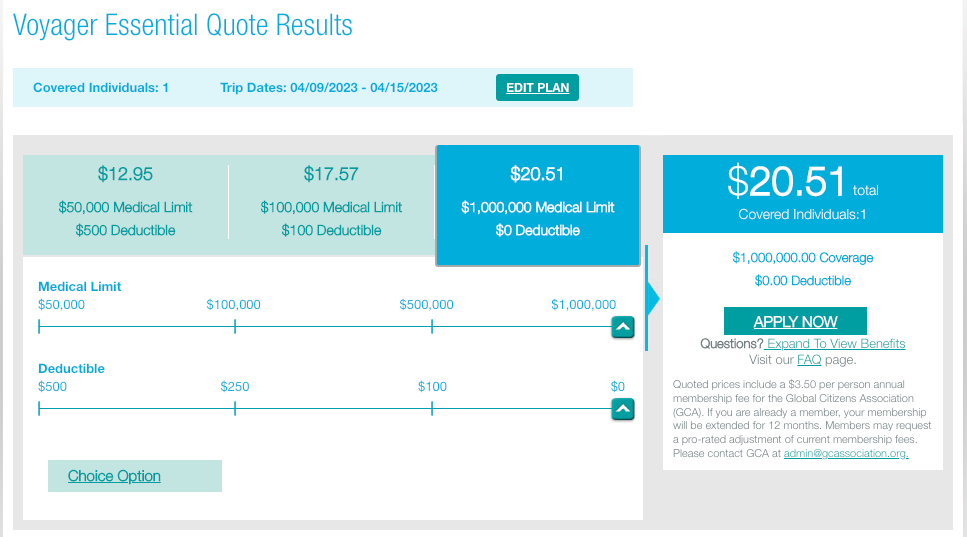

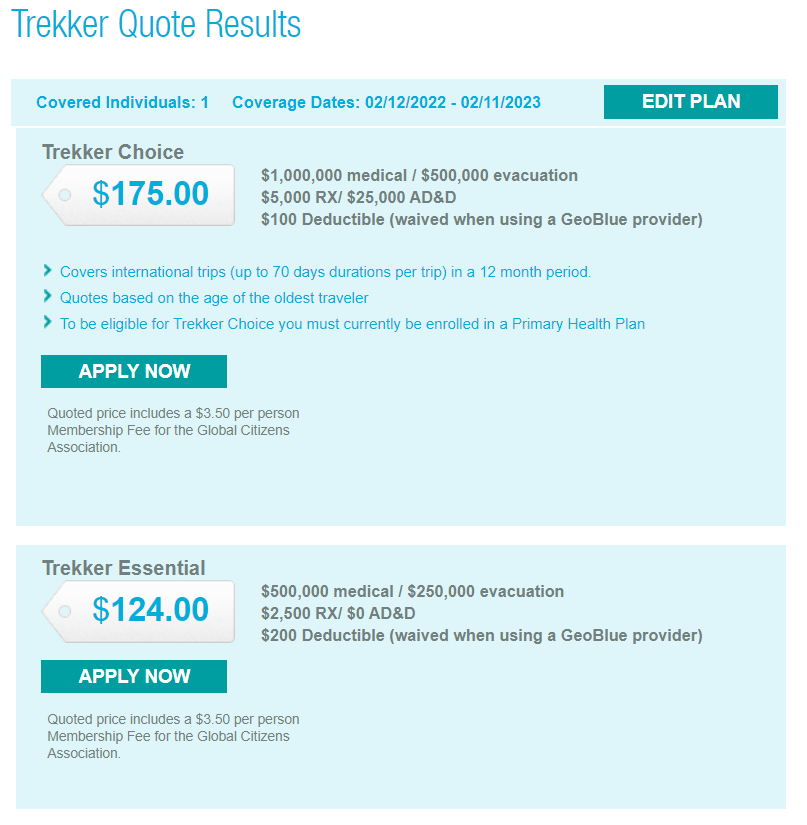

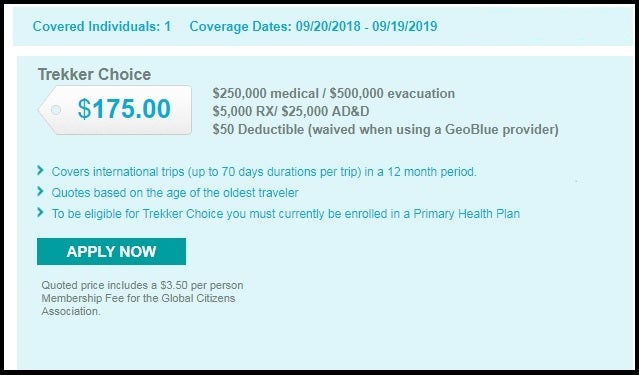

GeoBlue is different from most other providers described in this piece because it only provides medical coverage while you're traveling internationally and does not offer benefits to protect the cost of your trip. There are many different policies. Some require you to have primary health insurance in the U.S. (although it doesn't need to be provided by Blue Cross Blue Shield), but all of them only offer coverage while traveling outside the U.S.

Two single-trip plans are available if you're traveling for six months or less. The Voyager Choice policy provides coverage (including medical services and medical evacuation for a sudden recurrence of a preexisting condition) for trips outside the U.S. to travelers who are 95 or younger and already have a U.S. health insurance policy.

The Voyager Essential policy provides coverage (including medical evacuation for a sudden recurrence of a preexisting condition) for trips outside the U.S. to travelers who are 95 or younger, regardless of whether they have primary health insurance.

In addition to these options, two multi-trip plans cover trips of up to 70 days each for one year. Both policies provide coverage (including medical services and medical evacuation for preexisting conditions) to travelers with primary health insurance.

Be sure to check out GeoBlue's COVID-19 notices before buying a plan.

Most GeoBlue policies explicitly cover sudden recurrences of preexisting conditions for medical services and medical evacuation.

- GeoBlue can be an excellent option if you're mainly concerned about the medical side of travel insurance.

- GeoBlue provides single-trip, multi-trip and long-term medical travel insurance policies for many different types of travel.

Purchase your policy here: GeoBlue .

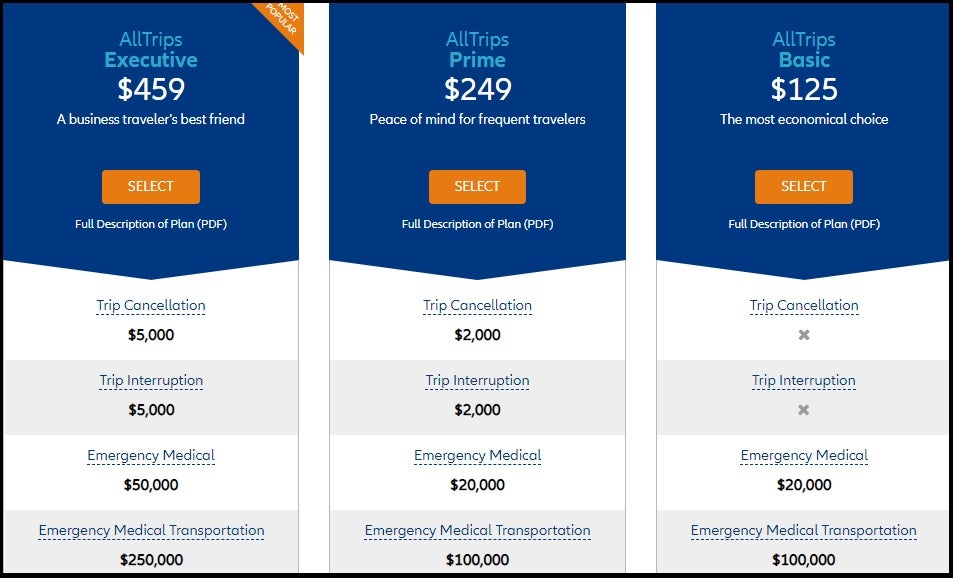

IMG offers various travel medical insurance policies for travelers, as well as comprehensive travel insurance policies. For a single trip of 90 days or less, there are five policy types available for vacation or holiday travelers. Although you must enter your gender, males and females received the same quote for my one-week search.

You can purchase an annual multi-trip travel medical insurance plan. Some only cover trips lasting up to 30 or 45 days, but others provide coverage for longer trips.

See IMG's page on COVID-19 for additional policy information as it relates to coronavirus-related claims.

Most plans may cover preexisting conditions under set parameters or up to specific amounts. For example, the iTravelInsured Travel LX travel insurance plan shown above may cover preexisting conditions if you purchase the insurance within 24 hours of making the final payment for your trip.

For the travel medical insurance plans shown above, preexisting conditions are covered for travelers younger than 70. However, coverage is capped based on your age and whether you have a primary health insurance policy.

- Some annual multi-trip plans are modestly priced.

- iTravelInsured Travel LX may offer optional cancel for any reason and interruption for any reason coverage, if eligible.

Purchase your policy here: IMG .

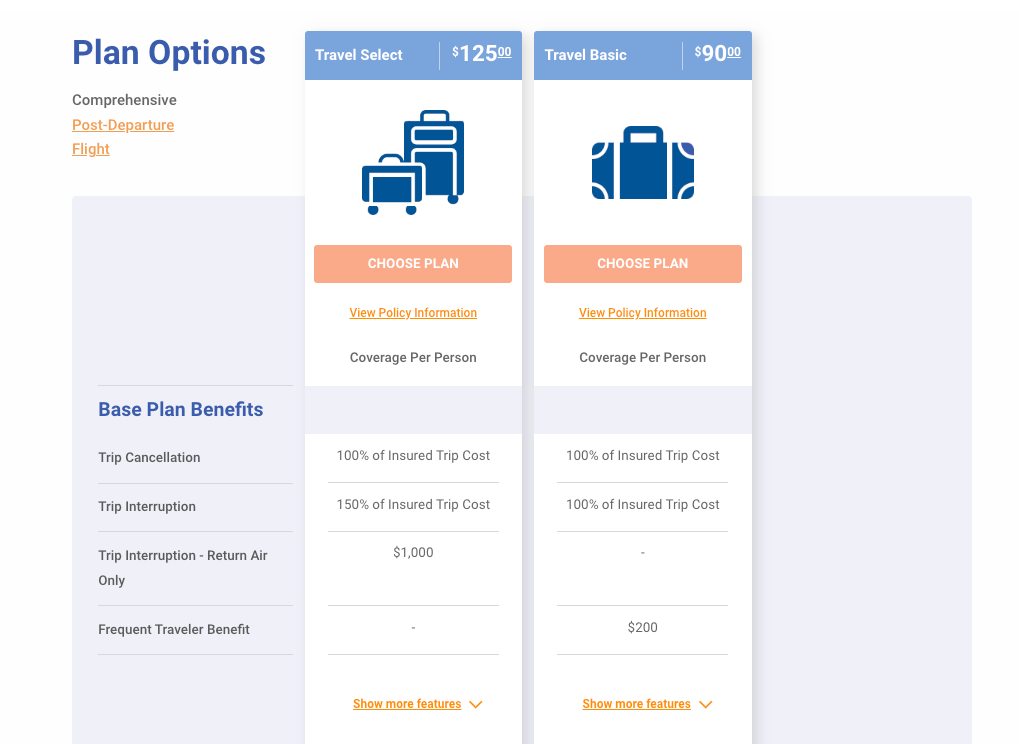

Travelex Insurance

Travelex offers three single-trip plans: Travel Basic, Travel Select and Travel America. However, only the Travel Basic and Travel Select plans would be applicable for my trip to Turkey.

See Travelex's COVID-19 coverage statement for coronavirus-specific information.

Typically, Travelex won't cover losses incurred because of a preexisting medical condition that existed within 60 days of the coverage effective date. However, the Travel Select plan may offer a preexisting condition exclusion waiver. To be eligible for this waiver, the insured traveler must meet all the following conditions:

- You purchase the plan within 15 days of the initial trip payment.

- The amount of coverage purchased equals all prepaid, nonrefundable payments or deposits applicable to the trip at the time of purchase. Additionally, you must insure the costs of any subsequent arrangements added to the same trip within 15 days of payment or deposit.

- All insured individuals are medically able to travel when they pay the plan cost.

- The trip cost does not exceed the maximum trip cost limit under trip cancellation as shown in the schedule per person (only applicable to trip cancellation, interruption and delay).

- Travelex's Travel Select policy can cover trips lasting up to 364 days, which is longer than many single-trip policies.

- Neither Travelex policy requires receipts for trip and baggage delay expenses less than $25.

- For emergency evacuation coverage, you or someone on your behalf must contact Travelex and have Travelex make all transportation arrangements in advance. However, both Travelex policies provide an option if you cannot contact Travelex: Travelex will pay up to what it would have paid if it had made the arrangements.

Purchase your policy here: Travelex Insurance .

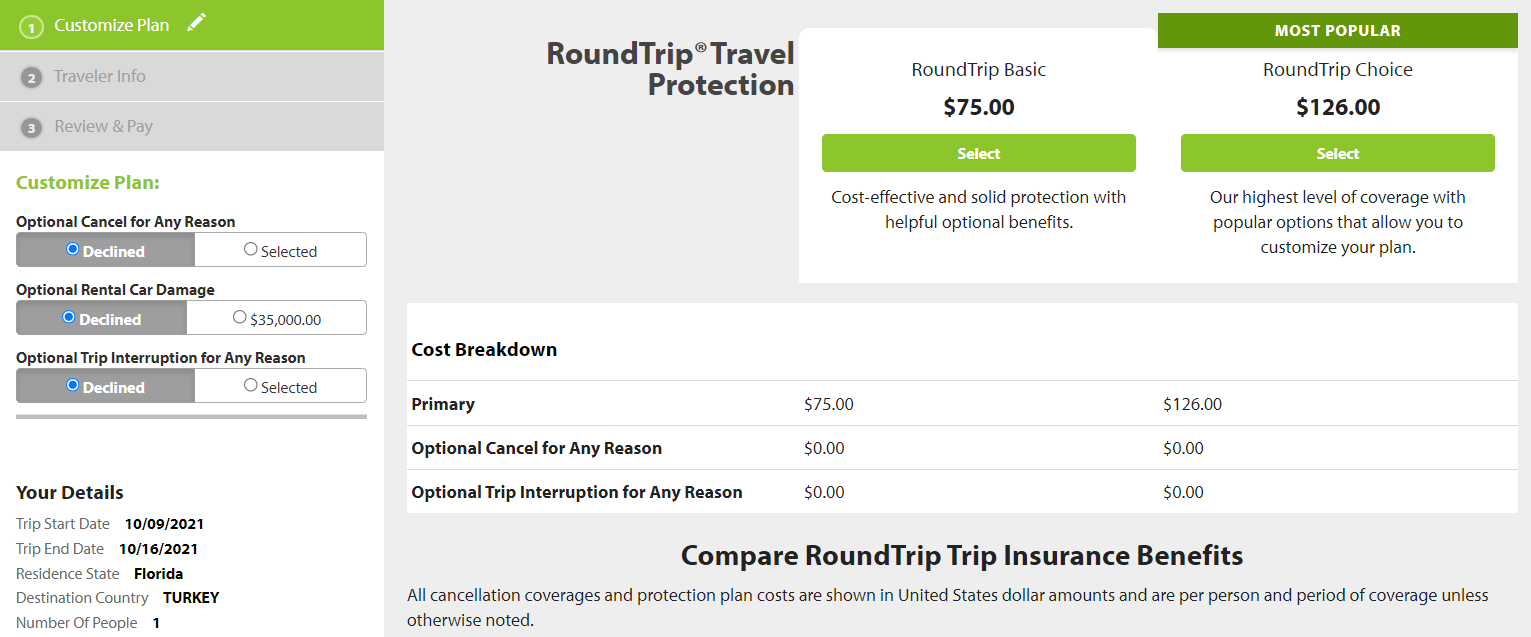

Seven Corners

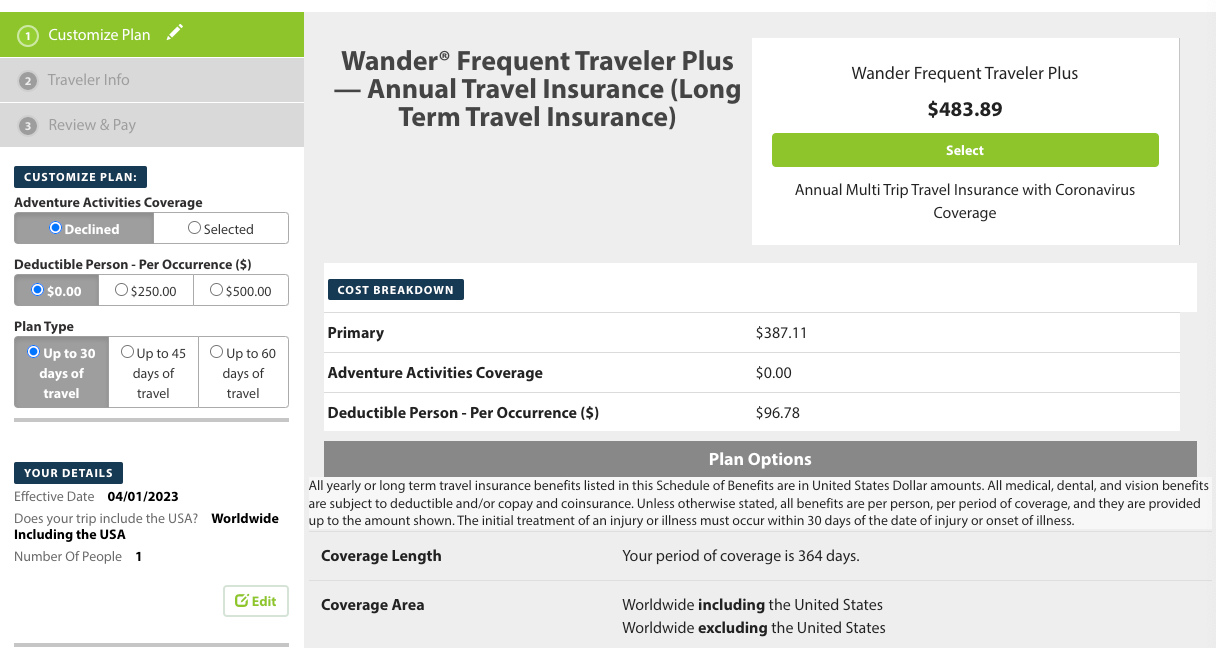

Seven Corners offers a wide variety of policies. Here are the policies that are most applicable to travelers on a single international trip.

Seven Corners also offers many other types of travel insurance, including an annual multi-trip plan. You can choose coverage for trips of up to 30, 45 or 60 days when purchasing an annual multi-trip plan.

See Seven Corner's page on COVID-19 for additional policy information as it relates to coronavirus-related claims.

Typically, Seven Corners won't cover losses incurred because of a preexisting medical condition. However, the RoundTrip Choice plan offers a preexisting condition exclusion waiver. To be eligible for this waiver, you must meet all of the following conditions:

- You buy this plan within 20 days of making your initial trip payment or deposit.

- You or your travel companion are medically able and not disabled from travel when you pay for this plan or upgrade your plan.

- You update the coverage to include the additional cost of subsequent travel arrangements within 15 days of paying your travel supplier for them.

- Seven Corners offers the ability to purchase optional sports and golf equipment coverage. If purchased, this extra insurance will reimburse you for the cost of renting sports or golf equipment if yours is lost, stolen, damaged or delayed by a common carrier for six or more hours. However, Seven Corners must authorize the expenses in advance.

- You can add cancel for any reason coverage or trip interruption for any reason coverage to RoundTrip plans. Although some other providers offer cancel for any reason coverage, trip interruption for any reason coverage is less common.

- Seven Corners' RoundTrip Choice policy offers a political or security evacuation benefit that will transport you to the nearest safe place or your residence under specific conditions. You can also add optional event ticket registration fee protection to the RoundTrip Choice policy.

Purchase your policy here: Seven Corners .

World Nomads

World Nomads is popular with younger, active travelers because of its flexibility and adventure-activities coverage on the Explorer plan. Unlike many policies offered by other providers, you don't need to estimate prepaid costs when purchasing the insurance to have access to trip interruption and cancellation insurance.

World Nomads offers two single-trip plans.

World Nomads has a page dedicated to coronavirus coverage , so be sure to view it before buying a policy.

World Nomads won't cover losses incurred because of a preexisting medical condition (except emergency evacuation and repatriation of remains) that existed within 90 days of the coverage effective date. Unlike many other providers, World Nomads doesn't offer a waiver.

- World Nomads' policies cover more adventure sports than most providers, so activities such as bungee jumping are included. The Explorer policy covers almost any adventure sport, including skydiving, stunt flying and caving. So, if you partake in adventure sports while traveling, the Explorer policy may be a good fit.

- World Nomads' policies provide nonmedical evacuation coverage for transportation expenses if there is civil or political unrest in the country you are visiting. The coverage may also transport you home if there is an eligible natural disaster or a government expels you.

Purchase your policy here: World Nomads .

Other options for buying travel insurance

This guide details the policies of eight providers with the information available at the time of publication. There are many options when it comes to travel insurance, though. To compare different policies quickly, you can use a travel insurance aggregator like InsureMyTrip to search. Just note that these search engines won't show every policy and every provider, and you should still research the provided policies to ensure the coverage fits your trip and needs.

You can also purchase a plan through various membership associations, such as USAA, AAA or Costco. Typically, these organizations partner with a specific provider, so if you are a member of any of these associations, you may want to compare the policies offered through the organization with other policies to get the best coverage for your trip.

Related: Should you get travel insurance if you have credit card protection?

Is travel insurance worth getting?

Whether you should purchase travel insurance is a personal decision. Suppose you use a credit card that provides travel insurance for most of your expenses and have medical insurance that provides adequate coverage abroad. In that case, you may be covered enough on most trips to forgo purchasing travel insurance.

However, suppose your medical insurance won't cover you at your destination and you can't comfortably cover a sizable medical evacuation bill or last-minute flight home . In that case, you should consider purchasing travel insurance. If you travel frequently, buying an annual multi-trip policy may be worth it.

What is the best COVID-19 travel insurance?

There are various aspects to keep in mind in the age of COVID-19. Consider booking travel plans that are fully refundable or have modest change or cancellation fees so you don't need to worry about whether your policy will cover trip cancellation. This is important since many standard comprehensive insurance policies won't reimburse your insured expenses in the event of cancellation if it's related to the fear of traveling due to COVID-19.

However, if you book a nonrefundable trip and want to maintain the ability to get reimbursed (up to 75% of your insured costs) if you choose to cancel, you should consider buying a comprehensive travel insurance policy and then adding optional cancel for any reason protection. Just note that this benefit is time-sensitive and has eligibility requirements, so not all travelers will qualify.

Providers will often require CFAR purchasers insure the entire dollar amount of their travels to receive the coverage. Also, many CFAR policies mandate that you must cancel your plans and notify all travel suppliers at least 48 hours before your scheduled departure.

Likewise, if your primary health insurance won't cover you while on your trip, it's essential to consider whether medical expenses related to COVID-19 treatment are covered. You may also want to consider a MedJet medical transport membership if your trip is to a covered destination for coronavirus-related evacuation.

Ultimately, the best pandemic travel insurance policy will depend on your trip details, travel concerns and your willingness to self-insure. Just be sure to thoroughly read and understand any terms or exclusions before purchasing.

What are the different types of travel insurance?

Whether you purchase a comprehensive travel insurance policy or rely on the protections offered by select credit cards, you may have access to the following types of coverage:

- Baggage delay protection may reimburse for essential items and clothing when a common carrier (such as an airline) fails to deliver your checked bag within a set time of your arrival at a destination. Typically, you may be reimbursed up to a particular amount per incident or per day.

- Lost/damaged baggage protection may provide reimbursement to replace lost or damaged luggage and items inside that luggage. However, valuables and electronics usually have a relatively low maximum benefit.

- Trip delay reimbursement may provide reimbursement for necessary items, food, lodging and sometimes transportation when you're delayed for a substantial time while traveling on a common carrier such as an airline. This insurance may be beneficial if weather issues (or other covered reasons for which the airline usually won't provide compensation) delay you.

- Trip cancellation and interruption protection may provide reimbursement if you need to cancel or interrupt your trip for a covered reason, such as a death in your family or jury duty.

- Medical evacuation insurance can arrange and pay for medical evacuation if deemed necessary by the insurance provider and a medical professional. This coverage can be particularly valuable if you're traveling to a region with subpar medical facilities.

- Travel accident insurance may provide a payment to you or your beneficiary in the case of your death or dismemberment.

- Emergency medical insurance may provide payment or reimburse you if you must seek medical care while traveling. Some plans only cover emergency medical care, but some also cover other types of medical care. You may need to pay a deductible or copay.

- Rental car coverage may provide a collision damage waiver when renting a car. This waiver may reimburse for collision damage or theft up to a set amount. Some policies also cover loss-of-use charges assessed by the rental company and towing charges to take the vehicle to the nearest qualified repair facility. You generally need to decline the rental company's collision damage waiver or similar provision to be covered.

Should I buy travel health insurance?

If you purchase travel with credit cards that provide various trip protections, you may not see much need for additional travel insurance. However, you may still wonder whether you should buy travel medical insurance.

If your primary health insurance covers you on your trip, you may not need travel health insurance. Your domestic policy may not cover you outside the U.S., though, so it's worth calling the number on your health insurance card if you have coverage questions. If your primary health insurance wouldn't cover you, it's likely worth purchasing travel medical insurance. After all, as you can see above, travel medical insurance is often very modestly priced.

How much does travel insurance cost?

Travel insurance costs depend on various factors, including the provider, the type of coverage, your trip cost, your destination, your age, your residency and how many travelers you want to insure. That said, a standard travel insurance plan will generally set you back somewhere between 4% and 10% of your total trip cost. However, this can get lower for more basic protections or become even higher if you include add-ons like cancel for any reason protection.

The best way to determine how much travel insurance will cost is to price out your trip with a few providers discussed in the guide. Or, visit an insurance aggregator like InsureMyTrip to quickly compare options across multiple providers.

When and how to get travel insurance

For the most robust selection of available travel insurance benefits — including time-sensitive add-ons like CFAR protection and waivers of preexisting conditions for eligible travelers — you should ideally purchase travel insurance on the same day you make your first payment toward your trip.

However, many plans may still offer a preexisting conditions waiver for those who qualify if you buy your travel insurance within 14 to 21 days of your first trip expense or deposit (this time frame may vary by provider). If you don't need a preexisting conditions waiver or aren't interested in CFAR coverage, you can purchase travel insurance once your departure date nears.

You must purchase coverage before it's needed. Some travel medical plans are available for purchase after you have departed, but comprehensive plans that include medical coverage must be purchased before departing.

Additionally, you can't buy any medical coverage once you require medical attention. The same applies to all travel insurance coverage. Once you recognize the need, it's too late to protect your trip.

Once you've shopped around and decided upon the best travel insurance plan for your trip, you should be able to complete your purchase online. You'll usually be able to download your insurance card and the complete policy shortly after the transaction is complete.

Related: 7 times your credit card's travel insurance might not cover you

Bottom line

Not all travel insurance policies and providers are equal. Before buying a plan, read and understand the policy documents. By doing so, you can choose a plan that's appropriate for you and your trip — including the features that matter most to you.

For example, if you plan to go skiing or rock climbing, make sure the policy you buy doesn't contain exclusions for these activities. Likewise, if you're making two back-to-back trips during which you'll be returning home for a short time in between, be sure the plan doesn't terminate coverage at the end of your first trip.

If you're looking to cover a sudden recurrence of a preexisting condition, select a policy with a preexisting condition waiver and fulfill the requirements for the waiver. After all, buying insurance won't help if your policy doesn't cover your losses.

Disclaimer : This information is provided by IMT Services, LLC ( InsureMyTrip.com ), a licensed insurance producer (NPN: 5119217) and a member of the Tokio Marine HCC group of companies. IMT's services are only available in states where it is licensed to do business and the products provided through InsureMyTrip.com may not be available in all states. All insurance products are governed by the terms in the applicable insurance policy, and all related decisions (such as approval for coverage, premiums, commissions and fees) and policy obligations are the sole responsibility of the underwriting insurer. The information on this site does not create or modify any insurance policy terms in any way. For more information, please visit www.insuremytrip.com .

- Credit Cards

- All Credit Cards

- Find the Credit Card for You

- Best Credit Cards

- Best Rewards Credit Cards

- Best Travel Credit Cards

- Best 0% APR Credit Cards

- Best Balance Transfer Credit Cards

- Best Cash Back Credit Cards

- Best Credit Card Sign-Up Bonuses

- Best Credit Cards to Build Credit

- Best Credit Cards for Online Shopping

- Find the Best Personal Loan for You

- Best Personal Loans

- Best Debt Consolidation Loans

- Best Loans to Refinance Credit Card Debt

- Best Loans with Fast Funding

- Best Small Personal Loans

- Best Large Personal Loans

- Best Personal Loans to Apply Online

- Best Student Loan Refinance

- Best Car Loans

- All Banking

- Find the Savings Account for You

- Best High Yield Savings Accounts

- Best Big Bank Savings Accounts

- Best Big Bank Checking Accounts

- Best No Fee Checking Accounts

- No Overdraft Fee Checking Accounts

- Best Checking Account Bonuses

- Best Money Market Accounts

- Best Credit Unions

- All Mortgages

- Best Mortgages

- Best Mortgages for Small Down Payment

- Best Mortgages for No Down Payment

- Best Mortgages for Average Credit Score

- Best Mortgages No Origination Fee

- Adjustable Rate Mortgages

- Affording a Mortgage

- All Insurance

- Best Life Insurance

- Best Life Insurance for Seniors

- Best Homeowners Insurance

- Best Renters Insurance

- Best Car Insurance

- Best Pet Insurance

- Best Boat Insurance

- Best Motorcycle Insurance

- Travel Insurance

- Event Ticket Insurance

- Small Business

- All Small Business

- Best Small Business Savings Accounts

- Best Small Business Checking Accounts

- Best Credit Cards for Small Business

- Best Small Business Loans

- Best Tax Software for Small Business

- Personal Finance

- All Personal Finance

- Best Budgeting Apps

- Best Expense Tracker Apps

- Best Money Transfer Apps

- Best Resale Apps and Sites

- Buy Now Pay Later (BNPL) Apps

- Best Debt Relief

- Credit Monitoring

- All Credit Monitoring

- Best Credit Monitoring Services

- Best Identity Theft Protection

- How to Boost Your Credit Score

- Best Credit Repair Companies

- Filing For Free

- Best Tax Software

- Best Tax Software for Small Businesses

- Tax Refunds

- Tax Brackets

- Taxes By State

- Tax Payment Plans

- Help for Low Credit Scores

- All Help for Low Credit Scores

- Best Credit Cards for Bad Credit

- Best Personal Loans for Bad Credit

- Best Debt Consolidation Loans for Bad Credit

- Personal Loans if You Don't Have Credit

- Best Credit Cards for Building Credit

- Personal Loans for 580 Credit Score Lower

- Personal Loans for 670 Credit Score or Lower

- Best Mortgages for Bad Credit

- Best Hardship Loans

- All Investing

- Best IRA Accounts

- Best Roth IRA Accounts

- Best Investing Apps

- Best Free Stock Trading Platforms

- Best Robo-Advisors

- Index Funds

- Mutual Funds

- Home & Kitchen

- Gift Guides

- Deals & Sales

- Best of Wellness Awards 2024

- Sign up for the CNBC Select Newsletter

- Subscribe to CNBC PRO

- Privacy Policy

- Your Privacy Choices

- Terms Of Service

- CNBC Sitemap

Follow Select

Our top picks of timely offers from our partners

The best travel insurance companies to make sure your next trip is covered

Travel insurance can protect you against a range of unforeseen events, from lost bags to medical emergencies..

Whether you're taking a family vacation to Disney World or a romantic cruise through the Mediterranean, travel insurance could help protect your trip from the unexpected. From trip cancellations and flight delays to medical emergencies, travel insurance could protect you financially and give you peace of mind.

There are several different types of travel insurance plans to choose from when shopping for a policy. Here are a few of the common coverage types:

- Trip cancellation coverage : Helps you recoup travel expenses if you can't travel, though generally limited to specific reasons.

- Travel delay coverage: Helps you cover expenses if your travel is delayed due to a covered reason.

- Trip interruption coverage: Helps if you need to cut your trip short. Covered reasons may include an injury or illness on the trip, or a family emergency at home.

- Medical expenses and emergency evacuation coverage: This covers unforeseen medical expenses when traveling outside of the U.S. where your health insurance may not work. Emergency evacuation could help get you home if medically needed while overseas.

- Baggage loss: Covers baggage that is lost, damaged or stolen during your trip.

You'll also want to consider the prospective insurer's epidemic-related coverage. Each insurance company covers epidemic-related issues, such as Covid-19, differently, so it's worth checking the fine print on a policy you're considering.

CNBC Select analyzed dozens of different U.S. travel insurance products and narrowed down the top six for all sorts of travelers. (Read more about our methodology below.)

Best travel insurance companies

- Best for lost baggage and personal belongings: AXA Assistance USA travel insurance

- Best for customization: Travel Guard travel insurance

- Best for cancellation coverage: Allianz travel insurance

- Best for travel medical plans: USI Affinity travel insurance

- Best for cruise insurance: Nationwide travel insurance

- Best for luxury travel: Berkshire Hathaway Travel Protection

Best for lost baggage and personal belongings

Axa assistance usa travel insurance.

The best way to estimate your costs is to request a quote

Policy highlights

AXA Assistance USA offers several travel insurance policies that include travel interruption, trip cancellation, and the option of cancel for any reason (CFAR) coverage.

24/7 assistance available

- Three tiers of plans available

- Highly rated for financial strength

- Cancel for any reason only available on highest-tier coverage

AXA Assistance USA ’s travel insurance offers three different plans for travelers to choose from, with the most basic plans including trip interruption and cancellation and baggage and personal effects coverage. The platinum plan offers coverage for lost ski days and golf rounds, ideal for trips centering around those activities.

Best for customization

Travel guard® travel insurance.

Travel Guard offers a variety of plans to suit travel ranging from road trips to long cruises. For air travelers, Travel Guard can help assist with tracking baggage or covering lost or delayed baggage.

- A variety of plans are available to help cover different types of trips

- Not all products are available for purchase online

For those wanting to cover an upcoming trip, Travel Guard is a strong option because of its variety of coverage types. With three base packages available online and more options available through a representative, there are a variety of ways to customize your policy. The deluxe, preferred and essential plans include coverage for one related child age 17 or younger.

Best for trip cancellation coverage

Allianz travel insurance.

10 travel insurance plans make it possible to customize your coverage. For families, Allianz's OneTrip Prime package covers children age 17 and younger when traveling with a parent or grandparent.

- Trip cancellation benefits can reimburse your prepaid, nonrefundable trip payments if you have to cancel your trip for one of the covered reasons stated in your plan documents.

- Limited coverage for risky sports

Travelers who want the ability to cancel their trips will find 10 different travel insurance policies through Allianz . You can either purchase coverage for a specific trip or purchase an annual plan that covers an entire year's worth of trips. Instead of basic cancel for any reason coverage, Allianz offers a Cancel Anytime policy that can reimburse up to 80% of prepaid, non-refundable trip costs, while many other companies we reviewed cap "cancel for any reason" (CFAR) coverage at 75%.

Best for travel medical plans

Usi affinity travel insurance.

USI Affinity has travel medical policies in addition to trip cancellation policies. Travel medical plans include an option for frequent travelers to cover multiple trips. Trip cancellation options include coverage for road trips and group travel.

- Wide variety of plans for both trip cancellation coverage and travel medical insurance

- CFAR only covers up to 70% of non-refundable trip costs

People who are traveling out of the country can find medical plans from USI Affinity to cover them during their travels. Frequent travelers can get an annual medical plan that covers them on multiple trips of 30 days or less. This company also has trip cancellation insurance policies in addition to global travel medical plans.

Best for cruise insurance

Nationwide travel insurance.

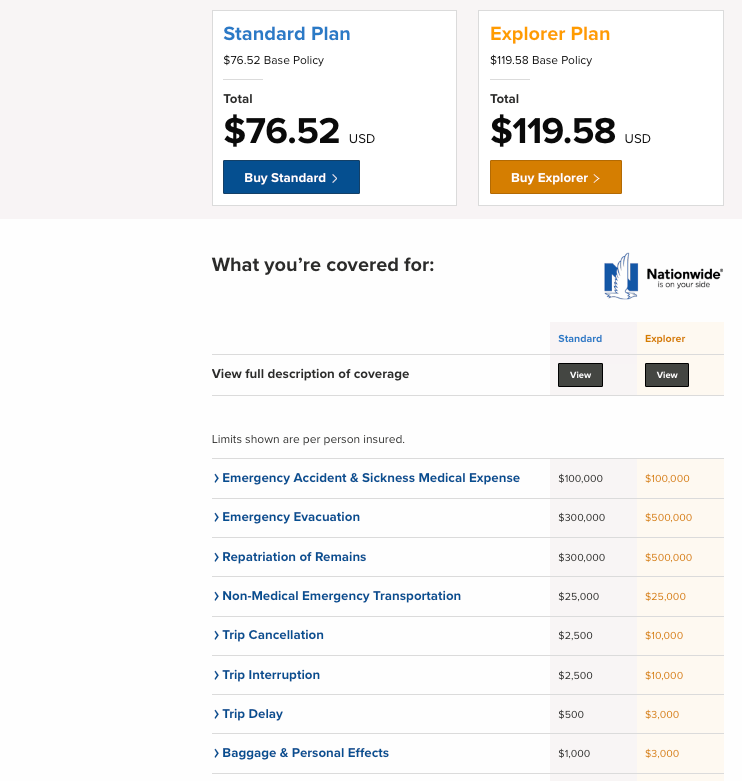

Nationwide's wide coverage for travel insurance allows many different types of travelers to find coverage that fits their needs. Three levels of cruise insurance coverage gives extra options to cruise passengers.

- 10-day review period on cruise insurance policies to make sure the plan meets your needs (not available in NY or WA)

- Most basic cruise plan doesn't offer CFAR coverage

Those planning a cruise in the future might find cruise-specific travel insurance helpful. Nationwide offers cruise-specific insurance that can cover things like emergency accidents, sicknesses, itinerary changes and trip interruption to start. Nationwide offers three tiers of cruise insurance (universal, choice and luxury) to get the right level of coverage for every type of trip. Nationwide offers a 10-day review period on its cruise policies (though unavailable in NY or WA), giving you extra time to look over the policy and ensure it’s a good fit.

Best for luxury travel

Berkshire hathaway travel protection.

Berkshire Hathaway Travel Protection has multiple plans to cover vacations from luxury travel to adventure travel. The brand's LuxuryCare offers the highest limits of travel insurance coverage offered by the company. Quotes and policies are available online.

- Wide variety of policies available

- Strong financial strength rating by AM Best

- Cancel for any reason only provides reimbursement for up to 50% of non-refundable trip payments

Since a luxury vacation is a large investment, insuring it could make sure that cost is covered if you have to cancel or have your trip interrupted. Berkshire Hathaway ’s LuxuryCare travel insurance has high limits of coverage for trip interruption coverage, medical expenses, and coverage for things like sporting equipment. Berkshire Hathaway also covers cruises and adventure travel with other separate plans.

Travel insurance FAQs

How do i choose the best travel insurance .

The best travel insurance is one that will meet your needs, cover the type of travel you’re doing (and the experiences you’re planning) and will give you the peace of mind you need.

Shopping around for travel insurance can help you make sure that you get the best deal possible. Since policies and coverage can vary by company, it could be helpful to get several quotes and compare the coverage limits and types available from several companies to find the best deal for your specific needs and trip.

To simplify the shopping process, a travel insurance comparison site like InsureMyTrip or Squaremouth could help you get an idea of how much you’ll spend and what types of insurance coverage are available for your trip.

Is travel insurance worth it?

Whether or not travel insurance is worth it could depend on the types of coverage you already have, including whether or not an existing travel credit card you hold could provide similar coverage, and whether that would cover your concerns.

Some travel credit cards offer car rental insurance , baggage insurance, trip delay insurance, and trip cancellation and interruption insurance. In addition, others offer more coverage like travel accident insurance.

The Chase Sapphire Reserve® card, for example, offers travel accident insurance, emergency evacuation insurance, and coverage for baggage delays and lost luggage reimbursement. Several of CNBC Select’s top travel credit cards also offer some credit card travel insurance that could cover potential travel issues.

How much does travel insurance cost?

The average travel insurance costs between 4% and 10% of your prepaid, non-refundable trip costs, according to travel insurance marketplace InsureMyTrip .

However, travel insurance costs vary based on the cost of the travel you’re insuring, as well as the age of the travelers and any extra coverage that’s added to the policy.

Bottom line

Travel insurance can cover a variety of unexpected events on your trip, from lost baggage to emergency medical expenses. While costs vary based on age, type of coverage and trip costs, it can be useful if you need to cancel or cut your trip short.

Money matters — so make the most of it. Get expert tips, strategies, news and everything else you need to maximize your money, right to your inbox. Sign up here .

Why trust CNBC Select?

At CNBC Select, our mission is to provide our readers with high-quality service journalism and comprehensive consumer advice so they can make informed decisions with their money. Every travel insurance review is based on rigorous reporting by our team of expert writers and editors with extensive knowledge of travel insurance products . While CNBC Select earns a commission from affiliate partners on many offers and links, we create all our content without input from our commercial team or any outside third parties, and we pride ourselves on our journalistic standards and ethics. See our methodology for more information on how we choose the best travel insurance.

Our methodology

To determine the best travel insurance companies, CNBC Select analyzed dozens of U.S. travel insurance companies that come with a wide variety of policies and offer coverage for a number of situations.

When narrowing down the best travel insurance companies, we focused on the coverage available, including the number of plans available, 24/7 assistance availability and cancel for any reason (CFAR) coverage availability. We also considered financial strength ratings from AM Best and Better Business Bureau ratings for customer satisfaction.

From there, we sorted our recommendations by the best overall and runner-up, best for cancellation coverage, best for travel medical plans, best for cruise insurance and best for luxury travel.

Note that the premiums and policy structures advertised for travel insurance companies are subject to fluctuate in accordance with the company’s policies.

Catch up on CNBC Select’s in-depth coverage of credit cards , banking and money . And follow us on TikTok , Facebook , Instagram and Twitter to stay up to date.

- What to do if you can't make your mortgage payments Kelsey Neubauer

- Aura review: Protect your identity, finances and family Elizabeth Gravier

- 5 hidden insurance fees to avoid Liz Knueven

Find The Best Travel Insurance Policy For Your Needs & Avoid Costly Surprises!

Compare 2024's Best Travel Insurance Companies. Get Yourself Peace Of Mind.

Compare and Buy Travel Insurance

Standard single trip policies.

- The most popular and comprehensive travel insurance plan

- Covers cancellations, medical emergencies, delays, and luggage

- Protection from the time you purchase to the date you return

Annual / Multi Trip Policies

- Cost-effective option for travelers taking multiple trips a year

- Includes common medical, delay, and luggage benefits

- May require add-ons from trip cancellation or interruption

Cruise Insurance Policies

- Offers comprehensive trip protection on land and at sea

- Includes high travel medical insurance coverage limits

- Protects against hurricanes, inclement weather, and more

Adventure & Sports Policies

- Essential for travelers partaking in high-risk activities

- Provides protection for lost or delayed sports equipment

- Strong coverage for cancellations and medical emergencies

Compare and Save in Minutes

Whether you’re heading abroad or staying local, we make it easy to find the best travel insurance plan for your next adventure. No bias. No hidden fees. Just the best trip protection quotes from the country’s leading providers.

Tell us some basic information about your next trip. We’ll use these details to help narrow your search and show the plans that best fit your needs.

Easily see how plans from the best travel insurance providers compete on cost and coverage. Use filters and sort results to uncover the right plan for you.

Get peace of mind at the lowest possible price. We partner with leading providers to offer you the best policies at the best value, guaranteed.

Why Trust Squaremouth?

When selecting a travel insurance provider, it's crucial to compare options. Obtain quotes from three to five insurers to ensure the best coverage and value. While it may seem time-consuming, this process can result in significant savings.

That's why we're here – over the past two decades, our industry-leading comparison engine has helped millions of travelers find highly-rated insurance plans and protect their trip expenses.

Our industry-leading comparison platform , enriched by customer reviews, displays unbiased results based on your specific trip details. If you run into any trouble, our multi-award-winning customer service team is just a phone call away.

- Helped more than 3 million travelers

- 20+ years serving the travel community

- Intuitive & user-friendly comparison engine

- More plans and top-rated providers than the competition

- Prices are regulated by law; you won't find a lower price anywhere else

- Multi award-winning customer service team

- 140,000+ customer reviews

Save With Squaremouth

Squaremouth has helped more than 3 million travelers find the best policy for their trip.

Key Travel Insurance Benefits

Most trip insurance policies are comprehensive, including coverage for cancellations, medical emergencies, travel delays, and lost luggage, among other benefits.

What Coverage is the Most Important?

Squaremouth customer reviews.

More than 99% of customers would recommend Squaremouth to others. Read what a few of them had to say about their recent experience buying travel insurance.

Great Experience!

"The Squaremouth website is fantastic! It was very easy to select coverage and find and compare policies. Will recommend it to others."

Savannah from NC 03/26/2024

Great Coverage and Price

"Getting a travel insurance quote online was easy. We have used Squaremouth before and have been pleased each time. It's peace of mind for our travel needs."

Rhonda from IN 03/20/2024

Easy to Use!

"I always use Squaremouth simply because it is so easy to use and offers plans that are affordable to me."

Emily from AZ 03/08/2024

Very pleased!

"They give great service, and the website is so easy to navigate to find just the right insurance plan. I always appreciate working with them."

Don from UT 03/07/2024

The Squaremouth website is fantastic! It was very easy to select coverage and find and compare policies. Will recommend it to others.

Featured Articles

Our topic experts keep a constant pulse on the travel industry so we can provide the most current information and recommendations based on today's traveler needs.

What Type of Insurance Do I Need?

Plans can range in terms of cost and coverage, so it’s important to identify your specific needs before comparing options. Discover the different types of travel insurance policies you should consider for your upcoming trip.

How to Buy Travel Insurance on Squaremouth

If you’re new to Squaremouth, this quick guide can help you identify your needs, start your first quote, and compare your results. If you need additional help, our customer service team is just a phone call away.

Travel Insurance FAQs

Here are some of the most frequently asked questions from travelers like you.

Is Travel Insurance Mandatory for International Travel?

While rare, some countries or organized tours may require proof of travel insurance that lasts for the duration of your trip. Our Destination Center is a good starting point to learn about entry requirements and travel insurance recommendations.

While it is typically not mandatory, travelers should consider buying insurance if they want to protect themselves financially from unforeseen events that may impact their travel plans. Many Americans and U.S. residents purchase travel insurance when planning international or high cost trips. View our list of the top international travel insurance providers .

What Does Travel Insurance Cover?

Comprehensive travel insurance is designed to cover common disruptions that may impact a trip. Most policies will provide coverage for trip cancellations , medical emergencies , travel delays , missed connections , accidental death and dismemberment , and lost luggage . Travelers that experience financial loss as a result of a covered disruption may be eligible for reimbursement through their insurance policy.

How Much Does Travel Insurance Cost?

In general, a comprehensive policy with Trip Cancellation typically costs between 5% and 10% of the total trip cost. The cost of a policy depends on four primary factors: trip cost, traveler age, trip length, and coverage amounts. A policy without an insured trip cost will be significantly less expensive. We recommend comparing plans from multiple providers to find the best priced plan for your trip.

What Should I Look for When Comparing Travel Insurance?

There’s no one-size-fits-all policy when it comes to travel insurance. When comparing plans, you should consider the following:

- Benefits: Travel insurance benefits outline what situations are covered under each plan. Make sure each plan you’re considering includes coverage for what’s important to you.

- Coverage Limits: Plans will set limits to how much reimbursement you’re eligible for, and can vary significantly. Higher coverage limits can result in less out of pocket expenses in the event of a claim.

- Exclusions: Travel insurance companies will list specific activities, equipment, and scenarios that are not covered by their plans in the event of a claim.

- Premium: Higher priced insurance products do not always equate to better coverage. We recommend choosing the most affordable plan that offers the travel protection you need.

- Provider Reputation: All providers on Squaremouth have been carefully vetted and offer 24-Hour Assistance services. Customers are also encouraged to share honest reviews about their experience before, during, and after their trips.

Does Travel Medical Insurance Cover International Trips?

In many cases, primary health care plans, such as Medicare or a policy you have through your employer, are not accepted overseas. If you’re not covered, you may be responsible for unforeseen medical expenses if you get sick or injured while traveling.

To avoid out-of-pocket expenses if you need medical care in the event of an emergency, many travelers opt for travel medical insurance. These plans can cover the cost of treating unexpected medical conditions incurred during your international trip.

Are Pre-Existing Conditions Covered by Travel Insurance?

Coverage for pre-existing conditions varies among travel insurance policies. While many plans won’t offer coverage for existing injuries or illnesses, some plans may offer Pre-Existing Condition waivers if certain conditions are met, such as purchasing the policy within a specified time frame from booking the trip.

Will My Policy Cover Trip Cancellations?

Yes, many comprehensive travel insurance policies cover trip cancellations under specified circumstances, such as sudden illness, injury, or death of the insured or a family member, natural disasters, or unexpected work obligations. Most policies that include the Trip Cancellation benefit offer 100% reimbursement for all prepaid, non-refundable trip costs.

What’s the Difference Between Single-Trip and Annual Travel Insurance?

Single-trip travel insurance covers a specific journey for a set duration, offering protection for that trip only. This is the most popular type of travel insurance among Squaremouth users. In contrast, Annual Travel Insurance provides coverage for multiple trips within a year. Annual plans can be cost-effective for frequent travelers and less of a hassle than purchasing multiple single-trip plans.

What's the Process for Filing a Travel Insurance Claim?

To file a trip insurance claim, follow these steps:

- Contact your insurer: Notify them as soon as possible about the incident.

- Gather documentation: Collect relevant documents, such as police reports, medical records, or receipts for expenses incurred.

- Complete the claim form: Fill out the insurer's claim form with accurate details.

- Submit supporting documents: Attach all required documents to substantiate your claim.

- Keep records: Maintain copies of all submissions and correspondence for your records.

- Follow up: Stay in touch with the insurer for updates on your claim status.

- Be honest and thorough: Provide clear and truthful information to expedite the process.

Remember, the process may vary by insurer, so review your policy or contact your insurance provider for specific instructions. Learn more about what can be covered and how to file a travel insurance claim .

Where Can I Buy Travel Insurance?

Travelers can purchase travel insurance directly from providers, through a comparison site like Squaremouth, or directly through a travel supplier when booking. Credit cards and travel agents are other sources to consider. Travel insurance prices are regulated by law, meaning the price of one specific policy must be the same regardless of where it is sold, whether it’s purchased from Squaremouth or directly from the provider.

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

The Ultimate Guide to Buying the Best Travel Insurance [For You]

Christine Krzyszton

Senior Finance Contributor

306 Published Articles

Countries Visited: 98 U.S. States Visited: 45

Keri Stooksbury

Editor-in-Chief

30 Published Articles 3097 Edited Articles

Countries Visited: 45 U.S. States Visited: 28

Director of Operations & Compliance

1 Published Article 1170 Edited Articles

Countries Visited: 10 U.S. States Visited: 20

![best travel insurance site The Ultimate Guide to Buying the Best Travel Insurance [For You]](https://upgradedpoints.com/wp-content/uploads/2018/09/Travel-insurance-tag-on-luggage.jpg?auto=webp&disable=upscale&width=1200)

Situations Where Travel Insurance Can Help

Covering your major concerns, when to buy travel insurance, credit cards, employer-sponsored health insurance, club memberships, medicare supplements and advantage plans, travel insurance comparison tools/websites, world nomads — best for comprehensive coverage and adventure activities (recommended), travelex /berkshire hathaway travel insurance — family protection for children at no extra cost, geoblue — affordable annual medical travel insurance, usaa — travel insurance for military and families, allianz — affordable annual travel insurance, expedia — an impulse buy you can prepare for, other travel insurance companies, single trip policies, multiple trip or multi-destination policies, annual policies, travel insurance for seniors, special needs and travel insurance for those with disabilities, group travel insurance, pet travel insurance, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

Whether you’re traveling with family or solo, on an epic adventure or a weekend getaway , travel insurance can go a long way toward providing peace of mind during your trip. And if things should go wrong, you’ll find consolation in being financially covered.

With all that’s at stake, you’ve probably given serious thought to purchasing travel insurance just like I have. There have certainly been times when I’ve needed it, including severe flight delays, a parasailing accident in Mexico, and when my luggage took a trip of its own!

Unfortunately, it’s also easy to become overwhelmed with the vast selection of travel insurance options available. We’ve created this guide to help you sort through the confusion and demystify the process.

In this article, we’ll cover all the information you need to:

- Determine the type of coverage you need

- Find out if you currently have any travel coverage

- Narrow your options to just a few policies that fit

- Select a reputable travel insurance company

Let’s get started with helping you find the best travel insurance policy for your situation.

Why You Need Travel Insurance

If you travel frequently, you’ve probably experienced an event where travel insurance would have helped.

Whether it was a severely delayed flight, illness abroad, stolen possessions, or a canceled trip due to an unforeseen event — travel insurance could have made the situation better.