U.S. News takes an unbiased approach to our recommendations. When you use our links to buy products, we may earn a commission but that in no way affects our editorial independence.

6 Best Cancel for Any Reason Travel Insurance Options

Allianz Travel Insurance »

Travelex Insurance Services »

Seven Corners »

AXA Assistance USA »

IMG Travel Insurance »

Squaremouth »

Why Trust Us

U.S. News evaluates ratings, data and scores of more than 50 travel insurance companies from comparison websites like TravelInsurance.com, Squaremouth and InsureMyTrip, plus renowned credit rating agency AM Best, in addition to reviews and recommendations from top travel industry sources and consumers to determine the Best Cancel for Any Reason Travel Insurance Options.

Table of Contents

- Rating Details

Allianz Travel Insurance

Travelex insurance services.

Even the best travel insurance policies don't cover every "what if." "If you buy travel insurance, there are covered reasons for cancellation or interruption. If your situation doesn't fit those covered reasons, there's no coverage," explains Angela Borden, product strategist with Seven Corners .

That's why cancel for any reason coverage, or CFAR, can be a valuable add-on. With this type of policy, you can cancel your trip for any reason at all and still get a percentage of your prepaid travel expenses back (typically around 50% to 80% of what you’ve already paid; percentages vary by provider).

Read on to see the best cancel for any reason travel insurance options and the main policy details you should know about, as well as answers to common questions around this type of coverage.

Seven Corners

Axa assistance usa, img travel insurance, squaremouth, best cfar insurance options in detail.

Reimburses up to 80% of prepaid travel arrangements

Allows you to cancel trip as late as day of departure

"Cancel Anytime" coverage may not be available in every state

Can cancel trip up to 48 hours before departure

Emergency medical coverage is only $50,000

CFAR add-on offers up to 75% reimbursement for prepaid travel costs

CFAR coverage can be purchased up to 20 days after initial trip payment

Benefit not available in all states

Get up to 75% of prepaid travel expenses back when you cancel for any reason

10-day money back guarantee if dissatisfied (prior to your trip)

Must purchase CFAR coverage within 14 days of initial trip deposit

Get back up to 75% of the full cost of nonrefundable travel expenses

CFAR coverage can be purchased within up to 20 days of the initial trip deposit

CFAR coverage does not apply if the travel supplier goes out of business or refuses to provide services

Compare multiple plans with CFAR coverage in one place

Comparison tool makes it easy to price shop

CFAR coverage reimbursements and fine print vary by company

Frequently Asked Questions

Cancel for any reason insurance (also called CFAR coverage) is a type of trip cancellation insurance that lets you cancel your trip for a reason not listed as a covered reason in your plan. For example, you may decide not to travel due to an illness in your extended family or a specific financial issue you're dealing with. In either case, this time-sensitive coverage can help you get reimbursement for prepaid trip payments you have made toward airfare, hotel stays, tours and more.

CFAR coverage typically needs to be purchased within a sensitive period of time after making a trip deposit (usually ranging from 14 to 20 days after). Travelers only get back between 50% and 80% of prepaid travel expenses, depending on your policy, so this coverage won't lead to a full refund.

If you're worried how COVID-19 might affect your travel plans, you can purchase travel insurance that includes COVID-19 coverage . That said, CFAR protection can also be a good investment, particularly if you want the option to cancel based on last-minute disinclination to travel due to the coronavirus pandemic.

Why Trust U.S. News Travel

Holly Johnson is an award-winning content creator who has been writing about travel insurance and travel for more than a decade. She has researched travel insurance options for her own vacations and family trips to more than 50 countries around the world, and she has experience navigating the claims and reimbursement process. In fact, she has successfully filed several travel insurance claims for trip delays and trip cancellations over the years. Johnson also works alongside her husband, Greg – who has been licensed to sell travel insurance in 50 states – in their family media business.

You might also be interested in:

Is Travel Insurance Worth It? Yes, in These 3 Scenarios

Holly Johnson

These are the scenarios when travel insurance makes most sense.

Flight Insurance: The 5 Best Options for 2023

Protect your flight (and peace of mind) with the top coverage plans.

Bereavement Fares: 5 Airlines That Still Offer Discounts

Several airlines offer help in times of loss.

Where to Travel During Hurricane Season

Amanda Norcross

Some destinations pose less of a risk than others.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

The Guide to Cancel For Any Reason (CFAR) Travel Insurance

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

What is Cancel For Any Reason travel insurance?

Can i really cancel for any reason what does a cfar policy cover, the limitations of cfar, how does cfar travel insurance compare with regular travel insurance, cancel for any reason travel insurance cost, best cfar travel insurance, tips before you buy, is cancel for any reason travel insurance worth it, cancel for any reason recapped.

CFAR coverage is sold as an optional add-on to a comprehensive travel insurance policy.

Expect to pay another 3% of your trip cost to get this coverage.

CFAR typically covers up to 75% of nonrefundable expenses. You will not get all of your money back.

CFAR only covers eligible expenses; check your terms to determine which down payments count.

Travel insurance can help you get your money back if you have to cancel a trip — but only if you cancel for certain reasons. If you want more flexibility, you may need “Cancel For Any Reason,” or CFAR, coverage.

Cancel For Any Reason travel insurance means exactly that: You can change your mind — regardless of why — and get a partial refund of what you paid without having to worry about meeting insurance coverage requirements.

The main details to know about Cancel For Any Reason travel insurance are:

CFAR is supplemental coverage that offers partial reimbursement when you cancel a nonrefundable trip for any reason that isn't covered by your travel insurance policy.

You cannot buy CFAR on its own; it’s an optional upgrade added when you buy primary travel insurance.

Not every trip insurer offers it, and not every plan is eligible for the add-on.

It is the only type of coverage that will offer reimbursement if you cancel a trip for any reason.

Yes — for any reason, including fear of travel. When you buy CFAR coverage, you can cancel your trip for any reason without worrying that you’ll lose your entire prepaid, nonrefundable vacation deposit.

The reason doesn't matter as long as you cancel within the allowable time frame (usually two days in advance) and you’ve insured the entire nonrefundable cost of your trip.

What doesn’t qualify for a claim?

Refundable expenses don’t qualify. For example, if you book a flight, cancel your trip and receive a refund or a travel voucher, you can’t claim it afterward. If you redeemed airline rewards and got the miles redeposited, that also doesn’t qualify for a reimbursement.

Additionally, if you accept a voucher or credit from a hotel or airline for a canceled trip, your claim may be ineligible for CFAR insurance reimbursement. However, if you’re provided with only a partial voucher/credit for the trip or have leftover unreimbursed expenses, you can claim the remaining amount.

Let’s say you received a voucher for a canceled flight to Amsterdam but your hotel reservation wasn’t refundable and you couldn’t use your prepaid ticket to the Van Gogh Museum. In that case, you can still claim the nonrefundable expenses, minus the flight.

CFAR has a few limitations:

It doesn't offer full reimbursement.

Different policies have varying reimbursement percentages ranging from 50% to 75%.

A trip cannot be canceled at the last minute. You will need to cancel usually two days in advance to get reimbursed.

You are required to insure 100% of your nonrefundable trip costs; you can’t pick and choose which parts you want to insure.

You have a limited number of days (10 to 21 days depending on the policy) after buying a nonrefundable trip to add the CFAR option.

Regular travel insurance restricts when you can get reimbursed for canceled travel. For example, you might get a full refund if you, a family member or a traveling companion gets sick before your trip and you have a doctor’s note to validate your claim. Other valid reasons under some trip insurance policies include circumstances like:

Terrorist attacks.

Natural disasters.

Bankruptcy of the carrier.

Travel insurance typically won’t help if you want to cancel because you’re afraid of getting sick. Many people found that out as the coronavirus was starting to spread in 2020. Buying CFAR coverage is usually the only way to get a partial refund of your prepaid, nonrefundable trip.

Also, travel insurance policies usually exclude pandemics from coverage. Once the World Health Organization officially declared COVID-19 a pandemic on March 11, 2020, policies with pandemic exclusions wouldn’t cover illness or losses related to COVID-19.

Every policy is different, and you’ll need to review the fine print to see what is and isn’t covered.

How much does CFAR travel insurance cost?

Cancel For Any Reason coverage will likely add about 50% to your total travel insurance bill. According to the U.S. Travel Insurance Association, a complete travel insurance policy will usually cost about 4% to 8% of the trip's cost.

Based on these numbers, if you buy CFAR coverage along with travel insurance, your total out-of-pocket cost will be 6% to 12% of your trip.

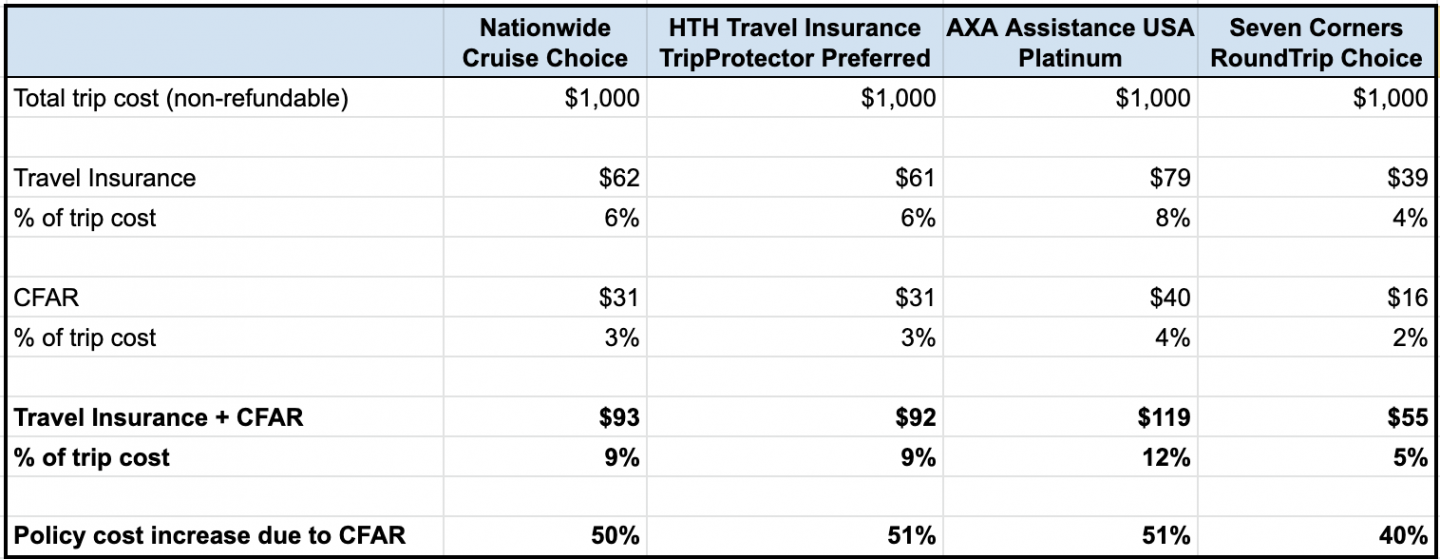

A sample of CFAR coverage cost

To test these numbers, we searched for travel insurance policies that offer a CFAR upgrade on Squaremouth , a travel insurance comparison site. In the chart below, we’ve included four providers that offer Cancel For Any Reason coverage. The figures are based on a nonrefundable $1,000 one-week trip to Mexico in April taken by a 30-year-old U.S. citizen.

For each of the policies listed, travel insurance was from 4% to 8% of the total trip cost. CFAR coverage increased the cost of travel insurance by roughly 40%-50%. The cost of travel insurance inclusive of CFAR represented 5% to 12% of the total trip cost.

As you can see, CFAR is a pricey upgrade. Though these numbers may not look excessive, they are based on a one-week $1,000 trip. If you want to protect a two-week $5,000 trip (or a bigger one), the cost of CFAR increases considerably.

» Learn more: How to find the best travel insurance

Will CFAR give me a full refund of my trip?

No. Typically, CFAR coverage includes a 75% reimbursement of prepaid nonrefundable trip plans. That is the appeal of the pricey CFAR add-on.

Let’s consider the example above. CFAR coverage under those policies reimburses 75% of the total trip cost. If you buy travel insurance for this trip (without CFAR) and need to cancel for a noncovered reason, you will lose the $1,000 you paid.

However, if you buy the CFAR option and cancel your trip, you will be reimbursed $750 and lose $250. You’re essentially paying an extra $16-$40 to safeguard $750 of your trip, no matter the reason for your cancellation.

If you’re having second thoughts about a trip you’re planning and suspect you may need to cancel it, CFAR could provide peace of mind.

1. Seven Corners

Seven Corners

- Annual, medical-only and backpacker plans are available.

- Cancel For Any Reason upgrade is available for the cheapest plan.

- Cheapest plan also features a much less costly Interruption for Any Reason add-on.

- Offers only one annual policy option.

With Seven Corners , you must insure your trip within 20 days of the first deposit to be covered for 75% of the trip cost.

The cancellation must not occur within two days of the scheduled departure. This benefit isn’t available in all states.

Tin Leg provides the option to cancel for any reason on some of its policies and reimburses up to 75% of nonrefundable expenses for a covered trip.

You must buy coverage within 14 days after paying a deposit, cover the full cost of all nonrefundable costs and cancel the trip no fewer than two days before departure.

Allianz Global Assistance provides AAA’s travel insurance policies. Some AAA travel insurance plans offer a Cancel For Any Reason add-on. You can’t buy such coverage online and must talk to an agent first.

4. Travel Guard by AIG

Travel Guard by AIG

- Offers last-minute coverage.

- Pre-Existing Medical Conditions Exclusion Waiver available at all plan levels.

- Plan available for business travelers.

- Cancel For Any reason coverage only available for higher-level plans, and only reimburses up to 50% of the trip cost.

- Trip interruption coverage doesn't apply to trips paid for with points and miles.

Travel Guard offers the CFAR option as an upgrade to select comprehensive plans.

To qualify for a partial refund, you must buy the CFAR upgrade within 15 days of the initial trip deposit, cancel the trip more than 48 hours before departure and insure all prepaid, nonrefundable costs when buying the policy.

5. Trawick International

- Many different plan options.

- CFAR available as an add on.

- Specialty coverage for adventure sports (SafeTreker Basic).

- Reports of long resolution processes.

- Low customer service rating on SquareMouth.

Cancel For Any Reason insurance is available as an add-on to the following protection plans by Trawick International : Safe Travels First Class and Safe Travels Voyager.

You must buy the coverage within 14 to 21 days of making your first trip payment (depending on the plan) and cancel the trip no fewer than two days before departure.

Most trip insurance providers limit the time during which you can buy CFAR coverage. We reviewed 16 travel insurance policies that offer CFAR as an optional upgrade and found that this add-on must be bought within 10 to 21 days of making your initial trip payment (depending on the company).

In the case of cruise-specific policies, you must buy CFAR coverage before the final payment date of your cruise. You cannot buy a CFAR supplement if your trip has begun.

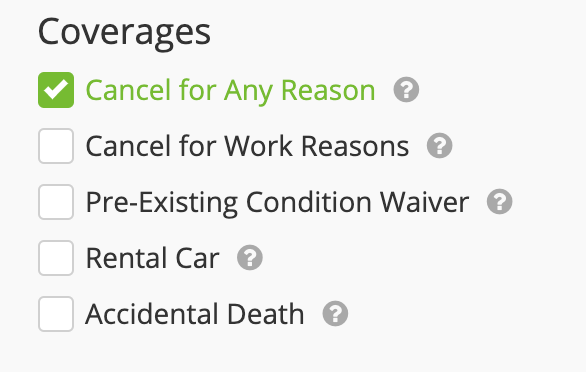

If you buy travel insurance from a comparison site like Squaremouth, you can filter by policies that offer a CFAR upgrade. When choosing a policy, make sure to select the Cancel For Any Reason add-on (remember, it is optional).

Not every insurance company offers CFAR, so if you’re buying directly from a provider, check to see whether CFAR is available before you buy. Cancel For Any Reason coverage may not be available in every state, and policies may have changed because of the coronavirus pandemic.

» Learn more: Is there travel insurance that covers COVID quarantine?

If you’re interested in adding this type of coverage to your travel insurance policy, these providers are a good place to start your search.

If you have any inclination that you may cancel your trip — be it for personal, professional, health, family or other reasons — paying the upcharge for this optional add-on will be worth it.

Rather than being out all of your prepaid, nonrefundable expenses, you'll lose 25%-50% of those costs.

If you booked your trip with a credit card that offers travel insurance , like the Chase Sapphire Preferred® Card , paying out of pocket for CFAR coverage may not be a smart money move.

Cross-check your card's insurance benefits and coverage limits with the CFAR policy in question so you can make the right decision for you.

Look closely at transit and lodging cancellation and refund policies because having CFAR coverage may not be necessary for your specific trip plans. If the airline will credit your account with the full value of the ticket, you might be comfortable forgoing getting that money back in your personal bank account (rather than tied up in your loyalty account).

Similarly, some hotels offer generous refund policies for certain bookings, and vacation rentals vary in timelines for eligible refunds.

Trip cancellation provisions under travel insurance policies have a lot of exclusions. Wanting to cancel because you’re scared to catch the coronavirus isn't an allowable reason under these policies. The only way to protect a nonrefundable trip is to buy CFAR coverage. If you do cancel, make sure you do so in the allowable time frame (two days for many providers).

Similar to the trip cancellation coverage provided by travel insurance policies, credit card trip cancellation coverage has a long list of exclusions. Acceptable reasons for trip cancellation coverage can include bankruptcy, terrorist attacks and extreme weather that prevents a trip from starting. Changes in plans are generally not covered. The only way to protect your nonrefundable trip is to buy travel insurance and get a CFAR optional upgrade.

If it has been more than 10 to 21 days (based on the policy) since you made your initial trip payment, it’s probably too late to buy CFAR coverage. If you’re planning a cruise, CFAR must be bought before your final payment, in most cases.

No, you must add a Cancel For Any Reason insurance upgrade to an existing policy. Not all travel insurance policies offer the option to add the CFAR portion, so make sure you read the terms carefully before buying a plan. You can call the insurance provider if you can’t find the information online.

Trip cancellation clauses cover a list of events, such as natural disaster, an airline strike, a hurricane or jury duty, which are typically spelled out in a policy. If a reason isn’t listed, it’s not covered. A CFAR policy, by definition, covers events not specified in the policy, such as border closures or fear of travel, meaning you can cancel without disclosing the reason for cancellation. A standard trip cancellation policy still applies because you buy the two benefit components together. This means that if you have to cancel for a covered reason, you might be eligible for 100% reimbursement instead of the partial refund that a CFAR plan provides.

Because you have to claim 100% of your nonrefundable trip expenses on a CFAR policy, you should be able to identify them. Typically, these expenses are anything you’ve paid for and likely won’t be refunded if you cancel. Examples include: flights that can’t be refunded, a deposit for a Danube cruise, a monthlong Airbnb in Spain, airport transfers in Cancun, amusement park tickets bought for specific dates, a cooking class in Bali, you name it. If you can’t get a refund, it qualifies.

The coronavirus has had a significant impact on travel. Many people have had to cancel trips, and some are still hesitant to plan vacations. Though standard travel insurance can protect you when unforeseen circumstances affect you before or during your trip, the coverage comes with a lot of limitations and exclusions.

The best way to protect a nonrefundable trip is to buy a Cancel For Any Reason optional upgrade because it will allow you to cancel for any reason and still receive a sizable reimbursement.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $1,125 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's over $900 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

Everything you need to know about cancel for any reason trip protection

In January 2020, my husband and I decided to splurge and book a suite aboard a Celebrity Cruises springtime voyage on the line's Apex ship . The cruise fare wasn't insignificant, so we bought travel insurance — as we usually do for any big trip. We printed out policies from five different companies and carefully reviewed the differences.

We thought about all the things that could go wrong that might stop us from going on this cruise — the death of an elderly relative, a work conflict or a broken leg. At the time, "pandemic" did not make our shortlist. We ultimately purchased a trip insurance package without the pricey "cancel for any reason" add-on (sometimes called CFAR). We thought we'd be just fine.

Of course, the sudden emergence of COVID-19 changed things and, boy, do we wish we'd sprung for the additional CFAR protection.

Interested in travel insurance? Visit InsureMyTrip.com to shop for plans that may fit your travel needs — including cancel-for-any reason coverage.

More destinations are reopened to American travelers, and people are booking trips once again. But the coronavirus pandemic isn't over, and there is still some uncertainty about what the rest of this year and 2022 holds. Cancel-for-any-reason trip protection can save you hundreds or even thousands of dollars in a time when flexibility is paramount when booking travel.

If you're not sure what cancel-for-any-reason travel protection is and when you should purchase it, here's everything you need to know.

Visit TPG's coronavirus hub for the latest news and advice.

For more TPG news delivered each morning to your inbox, sign up for our daily newsletter .

What you need to know about travel insurance

Cancel for any reason, also known as CFAR, is a time-sensitive, optional benefit that can be added to some comprehensive travel insurance policies for qualifying travelers. Before we delve into the details, it's useful to understand trip insurance in general. Here are some resources that explain everything you need to know about travel insurance and its benefits, from trip cancellation and interruption coverage to emergency medical to baggage delay. And, we've included some resources that specifically talk about coronavirus as it relates to insurance policies:

- The best travel insurance policies and providers

- When to buy travel insurance versus when to rely on credit card protections

- Will independent travel insurance cover coronavirus? Here's what you should know

- Best credit cards with travel insurance

- What you should know about the trip cancellation and interruption protection offered by select credit cards

- Be careful: Avoiding outbreaks isn't covered by most travel insurance

What is cancel-for-any-reason protection?

While travel insurance policies can offer a range of inclusions (think: medical evacuation, trip cancellation due to foreign or domestic terrorism or damage to your rental car), not every eventuality is included in all insurance policies. For example, some trip insurance plans may offer coverage in the event of employment layoffs, while others do not. Some policies may have robust emergency medical coverage, while competitors don't. That's why it's so important for you to select a plan that meets your specific needs for each trip.

A commonality among insurance policies is their long list of exclusions. For example, my homeowners' insurance clearly states I'm not covered for damage caused by an alien invasion. Yes. Seriously.

When it comes to travel insurance, it's common to see these sorts of incidents excluded from coverage: normal pregnancy, the illness of a pet, suicide (yours or a traveling companion) or any self-inflicted injury, psychological disorders, mountain climbing, bungee-jumping, skydiving, declared (or undeclared) war as well as epidemics and pandemics.

So, under normal circumstances, a travel insurance policy would likely not cover a trip you cancel because you're worried about contracting coronavirus .

That's where a cancel-for-any-reason policy comes into play. This is a time-sensitive add-on you can purchase from some providers when buying specific comprehensive travel insurance plans — as long as you meet certain eligibility requirements. By paying extra for this coverage, you can cancel for any reason under the sun as long as you follow the policies' purchase and cancel stipulations.

When am I eligible to add CFAR protection?

In general, you're only eligible to add CFAR protection to a comprehensive travel insurance policy at the time of purchase — you typically can't purchase the policy and then decide (at a later date) to commit to the CFAR add on. In addition, you'll need to commit to the policy and CFAR protection fairly soon after making your initial trip payment. According to InsureMyTrip.com , typically "a policy must be purchased within 10-21 days of making the initial trip payment to be eligible for CFAR benefits."

Many providers will also require you to insure the entire value of your trip, and additional requirements may apply. As always, it's critical to read through all of the terms before committing to purchasing any travel insurance policy — including CFAR coverage.

How much does cancel-for-any-reason coverage cost?

CFAR coverage is sounding pretty good as a way to hedge bets against the continued uncertainty of the coronavirus pandemic. But, how much are you going to have to dig into your wallet to pay for it? The fee for this add-on is typically calculated as a percentage of the price of the standard insurance policy you select.

Standard comprehensive plans can cost about 4-10% of the total cost of the insured trip, and CFAR can be an additional 40-60% on top of the standard plan (not the cost of the trip).

Consider the following illustrative example for a $5,000 trip with two 50-year-old travelers to Aruba:

- A standard, comprehensive plan might cost around $250 — which is 5% of the total trip cost.

- A comprehensive plan with the CFAR upgrade included might cost around $375 — which is the price of the standard plan ($250) plus an additional 50% ($125).

However, please note that all plan costs can differ based on individual quote details.

Will you get all your money back if you purchase CFAR coverage?

No. Generally speaking, CFAR can reimburse up to 75% of your total insured, prepaid, nonrefundable trip cost. In addition, CFAR typically requires you to cancel your trip no less than two days prior to departure to be eligible for reimbursement.

Check the insurance policy terms carefully to find out how much your refund would be if you invoked the CFAR terms and canceled your insured trip — and be sure to know the deadline for doing so.

Should you buy CFAR coverage?

Whether to travel and what level of insurance to purchase — or not — is always a personal decision. But, TPG has consistently received a lot of reader questions over the past year about what they should do if they have a trip booked or were about to book a trip and now don't know what to do because of the uncertainty of the coronavirus.

"One of the top questions travelers ask is about when to splurge for the CFAR upgrade," says Meghan Walch, a travel insurance expert for InsureMyTrip . "It's important to note that a standard comprehensive policy does not cover fear of travel. That's why we strongly recommend all travelers consider CFAR, if eligible. There is so much uncertainty with the pandemic, travelers are leaning towards maximum flexibility to cancel their trip to receive a percentage of their trip cost back."

If your total trip cost is low, you may decide to forego insurance — or the additional CFAR coverage — and self-insure (i.e., eat the nonrefundable trip costs if you cancel). But, if your vacation is expensive, the additional fee for CFAR may feel like a bargain instead of potentially losing thousands of dollars if you have to cancel nonrefundable reservations.

A few more words of advice

Coronavirus is adding a layer of complexity to decisions travelers must make about going on planned trips and booking future vacations. Here are a few specific scenarios to consider:

What to do if you're about to book a trip but are hesitant because of coronavirus

If you're afraid to commit a large amount of money to a future trip, purchasing a comprehensive travel insurance policy and adding the cancel-for-any-reason coverage option might be the best bet.

"Cancel-for-any-reason is the only way to protect the majority of your trip cost if you would like the flexibility to cancel your trip due to fear of the coronavirus pandemic and variants that are currently spiking," says Walch.

This could also be a great option for immunocompromised travelers. Even a doctor attesting to your inability to travel may not be enough to qualify for reimbursement under a standard, comprehensive plan — but CFAR coverage could help recoup some of your forfeited costs.

If you're shopping for CFAR, you can use a site like InsureMyTrip.com , and then check the applicable box under the search results:

Doing so will only return policy results that include that type of coverage.

What to do if you booked a trip and have insurance — but your policy doesn't include CFAR clause

If you purchased a comprehensive travel insurance plan for an upcoming trip but didn't add CFAR coverage, just be aware that your options for coronavirus-related cancellations are more limited. While CFAR is the only cancellation option to cover fear of travel due to the coronavirus pandemic, some comprehensive policies still offer coverage for other COVID-19-related concerns. This may include:

- Coverage for common concerns like cancellation due to diagnosed illness before traveling

- Emergency medical care from a doctor or hospital if you become ill while traveling

- Accommodation coverage if quarantined at your destination

Always be sure to review your policy carefully to understand the exclusions — but note that, without CFAR coverage, canceling a trip simply because you're afraid of contracting COVID-19 will likely not result in a successful claim under standard, comprehensive travel insurance plans.

What to do if you booked a trip and have no travel insurance

First, look at when you actually booked the trip. If it was within the last three weeks, you may still be eligible for a comprehensive travel insurance plan with the cancel-for-any-reason add-on. And if not, there may still be more limited policies that provide some coronavirus-related protection — including emergency medical evacuation.

In short, it's critical to begin investigating your travel insurance options as soon as you book (and make an initial payment on) a trip, as this will maximize the number of applicable plans. This is particularly important when it comes to time-sensitive benefits — like CFAR protection.

To explore these options, you can enter your trip details to compare available plans on a site like InsureMyTrip.com .

Bottom line

Having the peace of mind of travel insurance is more important than ever as countries reopen to vaccinated U.S. citizens and people start booking trips once again. With the delta variant now the dominant strain in the U.S., there is still uncertainty ahead for travelers hoping to take trips this year and into next.

In the past, you may have shrugged at the idea of trip insurance, especially the more expensive policies that offer a CFAR add-on. If you don't want the coronavirus pandemic to derail your travel plans but want to be covered if an expensive trip must be postponed or canceled, CFAR may be a great option to consider.

Disclaimer : This information is provided by IMT Services, LLC ( InsureMyTrip.com ), a licensed insurance producer (NPN: 5119217) and a member of the Tokio Marine HCC group of companies. IMT's services are only available in states where it is licensed to do business and the products provided through InsureMyTrip.com may not be available in all states. All insurance products are governed by the terms in the applicable insurance policy, and all related decisions (such as approval for coverage, premiums, commissions and fees) and policy obligations are the sole responsibility of the underwriting insurer. The information on this site does not create or modify any insurance policy terms in any way. For more information, please visit www.insuremytrip.com .

- Today's news

- Reviews and deals

- Climate change

- 2024 election

- Fall allergies

- Health news

- Mental health

- Sexual health

- Family health

- So mini ways

- Unapologetically

- Buying guides

Entertainment

- How to Watch

- My watchlist

- Stock market

- Biden economy

- Personal finance

- Stocks: most active

- Stocks: gainers

- Stocks: losers

- Trending tickers

- World indices

- US Treasury bonds

- Top mutual funds

- Highest open interest

- Highest implied volatility

- Currency converter

- Basic materials

- Communication services

- Consumer cyclical

- Consumer defensive

- Financial services

- Industrials

- Real estate

- Mutual funds

- Credit cards

- Balance transfer cards

- Cash back cards

- Rewards cards

- Travel cards

- Online checking

- High-yield savings

- Money market

- Home equity loan

- Personal loans

- Student loans

- Options pit

- Fantasy football

- Pro Pick 'Em

- College Pick 'Em

- Fantasy baseball

- Fantasy hockey

- Fantasy basketball

- Download the app

- Daily fantasy

- Scores and schedules

- GameChannel

- World Baseball Classic

- Premier League

- CONCACAF League

- Champions League

- Motorsports

- Horse racing

- Newsletters

New on Yahoo

- Privacy Dashboard

Cancel For Any Reason Travel Insurance: What You Need to Know

As travelers frantically try to cancel upcoming vacations and reschedule trips for later this year, they may find that even though they had purchased travel insurance, the policy doesn't cover the cost of their vacation. That is probably because an event like the coronavirus pandemic was not a reason for cancellation specified in their plan.

"Most policies cover a limited amount of peril, so there can be exclusions, such as CDC warnings and travel advisories," according to Erin Gavin, insurance product specialist at InsureMyTrip.com, an insurance aggregator. That's why you should read the fine print. While many plans cover cancellation at 100% of the trip costs due to a natural disaster or a terrorist attack at the destination, these plans generally do not include a pandemic.

The only way that you can guarantee coverage for an event not specified in a traditional comprehensive travel plan, such as the coronavirus, is to purchase an upgrade for the cancel for any reason (also known as CFAR) benefit.

What Is Cancel for Any Reason Travel Insurance?

The cancel for any reason benefit is an optional upgrade (available for an additional fee) with select travel insurance plans. It is time-sensitive and must be purchased once the trip is booked and an initial deposit on the trip is made. Several other eligibility requirements must be met, including canceling the trip within a specified time. If all criteria are met, CFAR allows travelers the flexibility to cancel their trip for any reason and recover part of the cost.

"The CFAR option enables the insured to cancel their trip for any reason up to 48 to 72 hours prior to their scheduled departure date and receive a partial reimbursement of their insured trip costs, depending on the plan and provider. If you cancel within that 48 to 72 hours, only the standard trip cancellation reasons will apply," says Stan Sandberg, co-founder of TravelInsurance.com, another insurance aggregator.

Another requirement to qualify for the CFAR benefit is that you need to insure 100% of your nonrefundable, prepaid trip costs, Sandberg adds. That amount must include any trip costs subject to a cancellation penalty, fee or other restriction, according to Sandberg.

"If someone buys a CFAR policy and then purchases additional travel arrangements, they are also required to insure those subsequent travel arrangements in order to meet the 100% requirement. They must purchase the additional insurance within the same timeframe as the original purchase, 24 hours to 21 days, depending on the plan," he says.

[Read: The Best Travel Insurance Credit Cards .]

Additionally, when evaluating plans with CFAR, you should know there are major differences in reimbursement rates, especially when there are more deposits and prepaid costs involved with longer and more expensive trips. There are also per-person coverage limits. Travelers need to keep in mind that regulations and rates vary by the insured's state of residence as well.

When Do You Have to Buy Cancel for Any Reason Travel Insurance?

Travelers must purchase cancel for any reason insurance typically within 21 days of booking the trip or paying a deposit toward the vacation.

"All CFAR plans require that you purchase the plan and the optional upgrade within a strict timeframe from when the insured made their initial trip deposit or payment. The window ranges from 24 hours to 21 days. Once a customer is outside of the 21 days of their initial trip payment date, then CFAR is no longer available for their trip," Sandberg says.

After that time, the only policy available for purchase would be a standard travel insurance plan.

Some companies also have tighter windows of just 10, 14 or 15 days from when you booked or put a deposit down on a trip to be able to purchase the CFAR upgrade, so you need to compare policies carefully. Also, if you are planning a last-minute trip, be sure to purchase the insurance with the CFAR benefit more than 24 hours prior to your time of departure. You cannot buy this upgrade the day of travel and have valid coverage.

What Does Cancel for Any Reason Travel Insurance Cover?

As long as you meet all the eligibility requirements and restrictions on timeframes as outlined above, and can purchase the CFAR upgrade, it will cover canceling your trip for any reason. If you are uncomfortable traveling, whether it's because you've had a change of heart or due to coronavirus concerns or anything in between, you don't need to explain. Just be sure that you have documentation for the exact amount of your prepaid and nonrefundable expenses that were insured to submit for your claim.

What Doesn't Cancel for Any Reason Travel Insurance Cover?

The only time CFAR would not cover a claim is if the eligibility requirements are not met. These would include items mentioned above, such as purchasing the benefit within less than 24 hours of the departure time, not canceling the trip at least 48 to 72 hours before the departure date (as specified in the plan), or not correctly insuring the exact dates and amount of the trip.

"The insured amount must cover you from the moment you leave home to the moment you return home. You cannot cover part of a trip," Gavin adds.

[Read: What Travel Credit Card Insurance Doesn't Cover .]

Also, the amount you insure must be specific. For example, if the total prepaid and nonrefundable cost of the trip is $2,893.28, then use that figure to calculate the price of the policy, don't round up.

How Much Is Cancel for Any Reason Travel Insurance?

If you want to add the CFAR benefit to your travel policy, how much more will it cost than a regular comprehensive travel insurance plan? According to Sandberg, standard trip cancellation coverage without CFAR typically costs between 4% and 10% of the insured trip. With CFAR, travelers can expect to pay another 50% to 60% of the standard policy cost.

Here is an example of how much travel insurance with the cancel for any reason benefit costs. (Prices were accurate at the time of publication.) The following rates are for a 40-year-old Florida resident traveling within the U.S. for one week in June, with a total trip expense of $3,000. The costs were calculated on TravelInsurance.com.

There were 24 plans available for a standard travel insurance policy. Rates ranged from a Silver Plan with one company (AXA) for as low as $77 and went as high as $231 for a Platinum Plan with another company (AIG - Travel Guard). Of course, the policy benefits varied depending on the price and the company.

Of the 24 options, only seven companies offered the cancel for any reason upgrade. AXA was one of them, but to apply for the CFAR option, the policy had to be upgraded to a Platinum Plan at $125. The additional upgrade charge for CFAR was $63 for a total of $188. One of the most expensive plans, from AIG -- Travel Guard, totaled $320.60 for the standard travel insurance policy plus the CFAR benefit.

How Much Can I Get Back with CFAR Coverage?

The typical reimbursement benefit is between 50% and 75% of the total insured costs. The rate of reimbursement will depend on several factors, including the length and value of the trip. It's best to compare all the plans available to determine the best benefits for the price and what will be the best travel insurance plan with cancel for any reason coverage for you.

You also need to follow the specific requirements to ensure that you are eligible for the reimbursement. Gavin reiterates that if you ever had to file a claim and say, the documentation surrounding the amount of the trip you insured wasn't precise, it could result in a denial of the claim.

"While there are advocates that can help and mitigate the situation to where they may make an exception, you don't want to be in that position," she says.

Cancel For Any Reason Travel Insurance Providers

Not every travel insurance company offers the cancel for any reason benefit, and the types of plans each insurance company provides vary by state.

Here are a few popular companies that currently offer the CFAR benefit:

-- AIG -- Travel Guard

-- AXA -- Assistance USA

-- CF -- Travel Insured International

-- John Hancock Travel Insurance

-- Nationwide

-- Seven Corners

-- TravelSafe

"Selling travel insurance has never been more important but has also never been so difficult. With an inundation of claims and differing state regulations, many companies are changing terms of new policies," says Jack Ezon, founder and managing partner of Embark Beyond, a premier luxury travel company based in New York. He explains further: "For example, Travelex just removed the ability to buy cancel for any reason on any policy."

[Read: Can You Cancel Your Flight Because of the Coronavirus? ]

As an example of how things in the insurance world can evolve, for the past 10 years New York state residents could not purchase CFAR coverage due to state regulations. This policy changed when Gov. Andrew Cuomo announced in early March that insurance companies in the state would be able to offer the cancel for any reason option. Six international and national companies have agreed to provide the benefit. However, it is not available yet through many of the online insurers. According to a spokesperson for InsureMyTrip.com, they have not received the CFAR product for New York as of yet. She said it will take several weeks to get these policies to market.

The Bottom Line

With so much uncertainty about how long this pandemic will last and how severe it will be, travel insurance with the added cancel for any reason benefit may be worth the investment to many travelers. While it is more expensive and it doesn't cover 100% of the cost of the trip, it will give travelers peace of mind knowing they can cancel if it's necessary.

As Ezon mentioned, if you're going to book a trip and want to insure it, know that the rules and state regulations are changing fast. It's very tempting to plan future travel with airfare, cruise and travel deals too good to pass up, but keep in mind it may be more difficult going forward to insure trips with the CFAR benefit.

More From US News & World Report

What Will Happen to My Elite Status and Points Because of the Coronavirus?

14 Things to Do When Your Flight Is Canceled or Delayed

Coronavirus Travel: What You Must Know

Recommended Stories

Former mlb infielder, little league world series star sean burroughs dies at 43.

The seven-year major leaguer collapsed while coaching his son's Little League game on Thursday.

The best RBs for 2024 fantasy football, according to our experts

The Yahoo Fantasy football analysts reveal their first running back rankings for the 2024 NFL season.

Juan Soto’s unapologetic intensity and showmanship are captivating the Bronx and rubbing off on teammates: ‘Literally every pitch is theater’

The 2024 Yankees have rediscovered their bravado and hold the second-best record in the AL, thanks in large part to the superstar outfielder.

The FDIC change that leaves wealthy bank depositors with less protection

Affluent Americans may want to double-check how much of their bank deposits are protected by government-backed insurance. The rules governing trust accounts just changed.

How rich homebuyers are avoiding high mortgage rates

Homebuyers with means are turning to an old strategy to get around a new crop of high mortgage rates: all-cash deals.

Which pickup trucks get the best fuel economy? Here are the tops for gas mileage (or diesel)

Trucks aren't known for being fuel efficient, though times are changing. These are the trucks with the best gas mileage in various segments.

Dolphins owner Stephen Ross reportedly declined $10 billion for team, stadium and F1 race

The value of the Dolphins and Formula One racing is enormous.

Timberwolves coach Chris Finch calls Jamal Murray's heat-pack toss on court 'inexcusable and dangerous'

Murray made a bad night on the court worse during a moment of frustration on the bench.

Tight end rankings for fantasy football 2024

The Yahoo Fantasy football analysts reveal their first tight end rankings for the 2024 NFL season.

Golf’s moment of truth is here, and the sport is badly flailing

Nonexistent negotiations and missed opportunities for reconciliation between the PGA Tour and LIV Golf have the sport stuck in place.

Former House Speaker Paul Ryan says he’s not voting for Trump : 'Character is too important'

Ryan says he would be writing in a Republican candidate instead of voting for Donald Trump.

Bud Light sales still falling as Modelo, Coors fight to keep their gains

The competition among beer giants is still brewing.

2024 Fantasy Football Mock Draft, 1.0

The Yahoo Fantasy football crew got together for their very first mock draft of 2024. Andy Behrens recaps the results.

The best budgeting apps for 2024

Budgeting apps can help you keep track of your finances, stick to a spending plan and reach your money goals. These are the best budget-tracking apps available right now.

Is Pacers coach Rick Carlisle right to be upset about officiating in Knicks series and a big-market bias?

Indiana's head coach refused to blame the officiating following Game 1, then looked at the high road two days later and went a step away from nuclear.

Yahoo Fantasy staff's Mock Draft 1.0: Shocking picks are plentiful

Teams have made their big splashes in free agency and made their draft picks, it's time for you to do the same. It's fantasy football mock draft time. Some call this time of year best ball season, others know it's an opportunity to get a leg up on your competition for when you have to draft in August. The staff at Yahoo Fantasy did their first mock draft of the 2024 season to help you with the latter. Matt Harmon and Andy Behrens are here to break it all down by each round and crush some staff members in the process.

Blockbuster May trade by Padres, MVP Ohtani has arrived, Willie Mays’ 93rd birthday & weekend recap

Jake Mintz & Jordan Shusterman discuss the Padres-Marlins trade that sent Luis Arraez to San Diego, as well as recap all the action from this weekend in baseball and send birthday wishes to hall-of-famer Willie Mays.

Please save 'Inside the NBA'

Appreciate 'Inside the NBA' while it's still here, because if this goes away, there may never be anything as good again.

Mortgage rates drop for the first time in five weeks with experts adjusting their forecasts

The average 30-year fixed mortgage rate edged back toward 7% this week but remains elevated, prompting housing experts to revise their forecasts for the rest of 2024.

Post-draft NFL fantasy power rankings: Offenses we love, like and want to stay away from

With free agency and the draft behind us, what 32 teams look like today will likely be what they look like Week 1 and beyond for the 2024 season. Matt Harmon and Scott Pianowski reveal the post-draft fantasy power rankings. The duo break down the rankings in six tiers: Elite offensive ecosystems, teams on the cusp of being complete mixed bag ecosystems, offensive ecosystems with something to prove, offenses that could go either way, and offenses that are best to stay away from in fantasy.

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

When Is Cancel for Any Reason (CFAR) Travel Insurance Worth It?

Jessica Merritt

Editor & Content Contributor

88 Published Articles 493 Edited Articles

Countries Visited: 4 U.S. States Visited: 23

Michael Y. Park

17 Published Articles 166 Edited Articles

Countries Visited: 60+ U.S. States Visited: 50

Keri Stooksbury

Editor-in-Chief

34 Published Articles 3189 Edited Articles

Countries Visited: 47 U.S. States Visited: 28

Table of Contents

What is cfar, when cfar makes sense, questions to ask about cfar, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

If you’ve booked the trip of a lifetime, you might think that nothing can keep you from getting on the plane and experiencing the vacation you’ve dreamed of. Unfortunately, reality doesn’t always play out that way, and you may need to cancel your trip. That’s where Cancel for Any Reason, or CFAR, travel insurance can help.

Standard travel insurance policies generally cover major trip cancellations for most reasons, such as serious illness, a death in your family, or natural disasters. But you might need cancellation coverage for situations not covered by your standard policy , such as job loss, fear of travel, or issues with traveling companions.

CFAR travel insurance can be clutch where standard travel insurance policies fall short, but it costs more and doesn’t offer 100% reimbursement. So, when does it make sense to get a CFAR policy?

Read on to see what you can expect from CFAR coverage, and find out what questions you should ask if you’re considering adding CFAR to your travel insurance policy.

CFAR insurance is optional travel insurance coverage that enhances your trip cancellation coverage. With CFAR, you can cancel your trip for any reason and receive back a percentage of your nonrefundable trip costs — usually 50% to 75%.

You can add it to most comprehensive travel insurance policies, though it will increase your costs.

Though you pay more to add CFAR to standard travel insurance, you also get more flexibility. Travel insurance policies without CFAR coverage generally limit the circumstances in which trip cancellation coverage applies, such as illness or natural disasters. With standard trip insurance, you must meet specific requirements to get reimbursed for your lost expenses. Not so with CFAR coverage.

What CFAR Offers

The main benefit of CFAR is its exceptional flexibility with trip cancellations. You can cancel your trip for practically any reason, whether you want to postpone your trip, have a fear of traveling, experience a breakup, or just don’t feel like going anymore.

The ability to cancel your trip for any reason is huge. Maybe your passport didn’t come in time. Maybe recent reviews suggest the resort you booked has bedbugs. Maybe your travel companion suddenly can’t go, or you want to start a new job but can’t get time off. Any of these reasons would be covered under CFAR but not under a standard travel insurance policy.

CFAR also gives you the freedom to cancel if you’re thinking twice about a trip because of concerns that a trip cancellation policy won’t cover , such as a rise in COVID-19 cases at your destination or reports of unsafe conditions.

The best CFAR policies offer up to 75% of your nonrefundable trip cost back as long as you cancel within the cancellation window, which is usually up to 2 days before your planned departure.

CFAR covers reimbursement for travel expenses, which can include these prepaid, nonrefundable items:

- Airline tickets

- Attraction tickets

- Boat charters or rentals

- Cruise deposits and payments

- Hotel reservations

- Rental cars

- Spa bookings

How Much CFAR Costs

CFAR typically costs about 10% to 50% more than a comprehensive travel insurance policy with standard trip cancellation coverage . For example, you should expect to pay $20 to $100 more when you add CFAR to a standard travel insurance policy that costs $200 otherwise.

Also, keep in mind that CFAR is not a standalone policy. CFAR is an optional benefit that you add to a travel insurance policy. You first need to buy a standard travel insurance policy and then add CFAR to it, so you’re paying for the travel insurance policy plus the CFAR upgrade.

When you purchase a CFAR policy, you must get a policy that will cover the full amount of nonrefundable travel expenses for the trip. You can’t insure only some parts of your trip, nor can you add more expenses later if you make additional bookings.

Is CFAR Better Than Other Travel Insurance?

You pay more to get CFAR coverage, but you also have greater flexibility when it comes to getting refunded for a canceled trip. Just because it’s more expensive doesn’t mean it’s better, and you won’t get all of your money back if you have to cancel. But it can offer better coverage if you need it.

For example, comprehensive travel insurance with trip cancellation coverage may offer up to 100% reimbursement for your nonrefundable costs if you need to cancel for a covered reason. That’s better than the 75% you might get with a CFAR policy.

You might be surprised what a standard travel insurance policy already considers a legitimate reason to cancel your trip. Illness, accidents, weather shutdowns, births, deaths, natural disasters, and even divorce may be covered under your trip cancellation benefits without needing CFAR coverage.

Still, CFAR coverage can be superior to standard travel insurance policies that already come with trip cancellation coverage because you can cancel for any reason, not just the reasons allowed under the standard policy .

As you compare CFAR coverage to standard travel insurance coverage, also compare CFAR to any credit card travel protections you may have. Though CFAR will give you far more cancellation options, credit card travel protection applies to travel you book using your credit card and will come at no additional cost.

Credit cards such as Chase Sapphire Preferred ® Card , Chase Sapphire Reserve ® , The Platinum Card ® from American Express , and Capital One Venture X Rewards Credit Card offer travel insurance coverage to cardholders. You can only cancel using credit card trip cancellation protection for certain reasons, but you might find the coverage adequate for your needs. Learn more in our guide to the best credit cards for travel insurance .

With a higher cost and lower payout, purchasing CFAR coverage on a policy that already offers trip cancellation doesn’t always make sense. However, it could save you money if you need to cancel your trip for a reason not covered by standard trip cancellation.

Ultimately, CFAR coverage can be worth it if you know you may need to cancel your trip for a reason not covered by a standard policy .

CFAR can be a good choice under these circumstances:

- Your plans aren’t set in stone. If you’re not sure you’ll keep your bookings or might need to postpone your trip, CFAR gives you the flexibility to cancel and start over.

- You’re taking a costly trip . CFAR can save the day if you have significant nonrefundable expenses you’d lose if you cancel your travel plans.

- Your travel companions might flake out. Booking a group trip? If your trip plans hinge on travel companions who might not make it, CFAR coverage can protect you if you don’t want to go on without them.

- You have unpredictable work commitments. Business or work commitments that could require you to stay home can interfere with travel plans and are a good reason to get CFAR coverage. For example, it might be a good idea to get CFAR coverage when you want to book a trip at a great rate that might not be available later but don’t have approved paid time off yet. If it turns out you can’t actually take the time off and need to cancel, you can get reimbursed for most of your expenses.

- You have unpredictable family commitments. If you might need to stay home to support a family member, or you’re unsure about getting a babysitter for kids or pets during your trip, CFAR can offer a backup plan.

- You’re especially cautious about public health. People who are immunocompromised or otherwise concerned about public health may want to cancel travel when viral caseloads or other public health issues become problematic. For example, COVID-19 spikes continue worldwide , but standard travel insurance coverage generally won’t reimburse you for canceling your trip just because you don’t want to contract the virus — only if you have to stay home because you’re already sick.

- You’re cautious about other situations, such as weather or political instability. As with health concerns, what you consider a good reason to cancel a trip (such as hurricanes or political conflicts) may differ from what your travel insurance considers a covered reason. For example, forecasters may indicate a good chance of a storm affecting your destination. Regular travel insurance generally won’t kick in until there’s a named storm, even if you want to cancel before it gets to that point.

- You or a family member have health concerns. Standard trip cancellation benefits usually cover serious illnesses for you, travel companions, and family members you must care for. However, there are limitations on preexisting conditions. Also, you may need a doctor’s note for your benefits to apply. CFAR can let you cancel if you’re not feeling well but don’t necessarily need a doctor’s visit. And while you might consider your pets to be family, standard travel insurance policies generally don’t, so you’d need to use CFAR coverage for reimbursement to cancel your trip to stay home for an ailing pet.

- You want to make last-minute decisions. Whatever the reason you cancel, CFAR can help you keep your options open and make new plans, usually up to 2 days before your scheduled departure date.

CFAR probably isn’t a good choice if these circumstances apply to you:

- Your travel plans are predictable. While travel plans can always go awry, CFAR coverage is less necessary if you’re unlikely to make major changes. You can probably get by with standard travel insurance coverage that offers trip cancellation benefits for covered cancellation reasons.

- You’re taking a cheap trip. CFAR coverage can be helpful if you stand to lose a lot over canceled plans, but if it won’t cost you much to cancel your trip, it’s probably not worth the added expense.

- Your travel costs are refundable. You only get coverage for nonrefundable prepaid expenses if you cancel your trip under CFAR coverage. If an airline, hotel, or other travel operator will give you your money back, CFAR travel insurance won’t help you.

- You’re buying coverage long after booking. Typically, CFAR coverage is only available within the first 2 weeks or so of booking travel. After that, your trip is not normally eligible for CFAR.

- You won’t get much back. CFAR policies vary, and some CFAR coverage only offers reimbursement of up to 50% of your trip cost. You might not find it worth paying for coverage if you’d only get half of your money back.

- You’re mostly traveling on rewards. While CFAR covers your fees and taxes on award travel, it doesn’t reimburse the value of any points or miles used to book travel. Using this coverage doesn’t make sense unless you have significant cash costs.

Whether CFAR travel insurance is worth it for your trip depends on your circumstances, and it may be beneficial for some trips but not for others. Ultimately, you need to decide whether the cost is worth the flexibility and if you’d likely see a benefit from it.

As you consider whether CFAR travel insurance is worth it for your trip, ask yourself these questions:

- How likely is it you’d need to cancel for health, work, weather, or other reasons?

- Are your expenses nonrefundable?

- What are the refund policies of the airline, hotel, tour operator, or other bookings you’ve made?

- Do you have other applicable coverage that’s good enough?

- Are you paying for your trip with cash or rewards?

- Are your travel costs significant?

- Do you need to be able to cancel beyond what’s covered by a standard travel insurance policy?

- Are you confident that your travel companions will keep to your plans?

It can make sense to get CFAR coverage in addition to standard travel insurance coverage if you have a lot of money on the line, your plans could change, and you need flexibility. Still, it’s an added cost that isn’t worth it for every trip, so carefully consider your circumstances before you purchase a CFAR travel insurance policy.

For the trip cancellation and interruption insurance benefit of The Platinum Card ® from American Express, eligibility and benefit level varies by card. Terms, conditions and limitations apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by New Hampshire Insurance Company, an AIG Company.

The information regarding the Capital One Venture X Rewards Credit Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer.

For rates and fees of The Platinum Card ® from American Express, click here .

Frequently Asked Questions

What does cancel for any reason mean on travel insurance.

Cancel for Any Reason means what it sounds like: You can cancel your trip for any reason and receive reimbursement. Standard travel insurance policies generally offer trip cancellation benefits, but only for specific reasons. With Cancel for Any Reason coverage, it doesn’t matter why you need to cancel, you can just do it.

Why is Cancel for Any Reason travel insurance not available in New York?

For years, Cancel for Any Reason travel insurance wasn’t available in New York because New York law required insurance to depend on a triggering event. As Cancel for Any Reason insurance doesn’t require any particular peril for benefits to apply, it technically wasn’t considered valid insurance under New York law. Updated guidance during the COVID-19 pandemic loosened policies to allow for Cancel for Any Reason travel benefits, though policies may still be limited for New York residents.

Does travel insurance cover trip cancellation for any reason?

Comprehensive travel insurance policies generally offer trip cancellation benefits, though your benefits only apply in specific circumstances. If you want to cancel for any reason, you need to purchase CFAR coverage as an add-on to your standard travel insurance policy.

What is the difference between trip cancellation and Cancel for Any Reason insurance?

Trip cancellation coverage usually reimburses you for up to 100% of nonrefundable travel costs, provided you cancel for a qualifying reason. CFAR coverage is an optional upgrade to standard travel insurance policies, allowing you to cancel for any reason — not just qualifying reasons — and get 50% to 75% of your nonrefundable costs back, depending on the policy.

Where can you buy Cancel for Any Reason travel insurance?

You can purchase CFAR travel insurance from most travel insurance companies. It’s typically available as an add-on to standard travel insurance policies.

When should you purchase CFAR insurance?

It’s best to purchase CFAR insurance shortly after you book your trip. Most CFAR policies have limits on how long you have to purchase CFAR after making a booking — usually about 2 weeks.

Getting CFAR insurance makes sense if you stand to lose significant nonrefundable costs because of trip cancellations and you’re concerned you may need to cancel for a reason not covered by your standard travel insurance policy.

Should you still get CFAR insurance if your credit card offers travel insurance?

Credit card travel protection can be helpful but is often limited. As with a standard travel insurance policy, you should expect your credit card trip cancellation benefit to have exclusions and only cover specific reasons for canceling. You need CFAR insurance if you think you might need to cancel for reasons not covered by your credit card’s trip cancellation benefit.

Was this page helpful?

About Jessica Merritt

A long-time points and miles student, Jessica is the former Personal Finance Managing Editor at U.S. News and World Report and is passionate about helping consumers fund their travels for as little cash as possible.

INSIDERS ONLY: UP PULSE ™

Get the latest travel tips, crucial news, flight & hotel deal alerts...

Plus — expert strategies to maximize your points & miles by joining our (free) newsletter.

We respect your privacy . This site is protected by reCAPTCHA. Google's privacy policy and terms of service apply.

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

- News 12 New York

- Download the News 12 App

- News 12 Deals

- Power & Politics

- The East End

- Environment

- New Jersey Events

- Food & Fun

- Numbers & Links

- State of Our Schools

- Transportation

- Noticias Univision 41

- Asian Pacific American Heritage Month

- Ask Governor Murphy

- Best Of New Jersey

- Garden Guide

- Hometown Heroes in New Jersey

- Jersey Buzz

- Jersey Proud

- LIVE BLOG: News 12 weather updates

- Made in New Jersey

- Main Street New Jersey

- New Jersey Birthday Smiles

- New Jersey Honor Roll

- New Jersey Weather Photos

- Mental Health Awareness Month

- Paws & Pals

- Photo Galleries

- Scholar Athlete

- Spotlight New Jersey

- What's Cooking

News 12 Originals

- Crime Files

- Kane in Your Corner

- On a Positive Note

- Road Trip: Close to Home

- Turn to Tara

Choose Your Region

- Connecticut

- Hudson Valley

- Long Island

- Westchester

Be the first to know

Topics you care about, straight to your inbox

Gov. Cuomo: New York travelers can purchase ‘cancel for any reason’ insurance policies

Gov. cuomo announced on friday that new yorkers will be able to purchase travel insurance policies that allow travelers to cancel for any reason..

News 12 Staff

Mar 7, 2020, 12:41 PM

Updated 1,526 days ago

More from News 12

Pro-Palestinian hunger strike at Princeton University marks 1 week

Rainy morning on Mother’s Day in New Jersey, tapers by evening

Authorities: 24-year-old man fatally shot in Jersey City

Montclair police: 2 people hurt in shooting near Mission Street and Bloomfield Avenue

North Arlington garden center 'blooms' with business ahead of Mother's Day

Authorities: Pennsylvania woman receives 2 consecutive life sentences for Ocean County murders

Police: Motorcyclist killed in Barnegat crash

Newark charter school students learn financial literacy at Mother's Day market

Light show: Severe solar storm produces spectacular auroras across the tri-state

Why do Black women have the highest death rate for most cancers? A massive study in underway

Prospect Park residents flock to North 16th Street for black bear sighting

Authorities identify person killed in crash on Route 27 in Franklin Township

Piscataway fire chief accused of throwing mud and rocks on business owner's rare sports car

Prosecutor: Rochelle Park man accused of sexually assaulting child multiple times

‘Little Heroes Prom’ brings pediatric cancer patients together for a night of fun

Jersey Proud: Quintuplets set to graduate from Montclair State University

Toms River School District works to finalize next year’s budget amid $26.5 million shortfall

Police: Man assaults owner of Maywood dry cleaner, steals $400

13 Kohl's in New Jersey to open Babies'R'Us locations. See list of stores

Prosecutor: 3 men accused in deadly 2023 shooting in Elizabeth

sign up and keep track of your travel insurance events

Cancel for Any Reason Travel Insurance: Is it Worth it?

- What is cancel for any reason trip insurance?

- Downsides of cancel for any reason coverage

- Is CFAR worth it?

When to get Trip Cancellation for Any Reason

Tip: You may see cancel for any reason coverage called CFAR travel insurance, and we call it Trip Cancellation For Any Reason.

Most travel insurance plans will not cover you if you cancel a trip just because you feel like it. There are set rules for what kind of trip-wrecking events are insured. However, there is one exception: travel insurance with cancel for any reason coverage.

Trip Cancellation For Any Reason coverage (CFAR) will let you cancel a trip for whatever reason you want and collect money on a claim, and you can get it as an add-on coverage with our Premium Plan .

That sounds exactly like what a lot of travelers are looking for… so why doesn’t everyone buy CFAR when they buy travel insurance?

It’s one of the most asked-about travel insurance coverages yet one of the least frequently purchased. Everyone wants cancel for any reason coverage, but few end up buying it.

Before we get into why that is, let’s talk a little about the basics of CFAR and how Trip Cancellation travel insurance coverage works when it doesn’t include cancel for any reason.

Trip Cancellation vs. Cancel for Any Reason

Any travel insurance plan that covers Trip Cancellation and Trip Interruption includes specific covered reasons, or similar limitations of the coverage. Those covered reasons usually fall into the following categories:

- Health, sickness, and death;

- Transportation failure;

- Weather and natural disasters ;

- Work reasons; and

- Military reasons.

However, cancel for any reason sweeps away all these categories in one fell swoop. If you want to cancel your trip for any reason – any reason, from a hangnail to a hurricane – you can.

That sounds amazing, right? Well, because it sounds amazing, there must be a catch.

Also read: How Travel Insurance Can Help with Trip Cancellation

Downsides to CFAR Travel Insurance

While it’s true that cancel for any reason coverage will pay your claim even if you cancel a trip because of a pretend hangnail, what you may not know is that CFAR will not pay you back all the money you’ve invested in your trip.

A few things bring cancel for any reason trip insurance back down to earth:

1) It’s expensive. Expect to pay a good deal more for travel insurance when adding on the Trip Cancellation For Any Reason coverage. Why so much? The expectation is that if you buy cancel for any reason coverage, you’re more likely to use it.

Also read: How Much Does Travel Insurance Cost?

2) It only pays a percentage of the penalty amount. With many plans, like Generali’s Premium Plan , where it is an add-on option, Trip Cancellation for Any Reason will reimburse travelers up to 60% of the penalty amount for their trip. With expensive trips, the combination of an about an extra 50% in premium and only 60% penalty amount reimbursement is often a deal-breaker.

See the difference? Traditional travel insurance has fewer covered reasons for canceling but can pay back all non-refundable insured trip costs; travel insurance with Trip Cancellation For Any Reason has an infinite number of covered reasons, but only pays back a percentage of the penalty amount.

3) Trip Cancellation for Any Reason coverage is not available to residents of New York.

There are also some eligibility requirements for cancel for any reason travel insurance coverage, which can only be added to our Premium plan:

- You have to buy it within 24 hours of making your initial trip deposit.

- You must cancel your trip 48 hours or more before you’re scheduled to leave.

- You must insure all of your nonrefundable trip costs.

- You were physically able to travel when you bought the coverage.

- All insured travelers under the coverage need to cancel in order to use the coverage.

- The Trip cost per person is no more than $10,000.

Is Cancel for Any Reason Travel Insurance Worth It?

Let’s do the math on all of that to see if travel insurance with Cancel For Any Reason coverage is really worth it.

Suppose your trip has a trip cost of $1,000, and you paid a $500 deposit when you bought the insurance. And let’s say the insurance plan costs $100, or 10% of your insured trip cost – a little low for a CFAR plan, but close enough for our calculations.

Remember, you only paid half of the trip cost, so you have $500 left to pay. If you cancel your trip before making your final payment, you’d only receive 60% of the $500 you paid initially – and you still might owe the final payment to your travel supplier.

In other words, you will have paid $100 plus $500 for the ability to get back about $300 for whatever reason – with the specter of paying another $500 down the road.

Even if you buy a CFAR plan because you’re afraid of getting COVID-19, spending $1,100 to get back roughly $300 doesn’t seem like the best way of addressing your fear. This is why many people ask about travel insurance with cancel for any reason, but only a handful actually buy the product.

See more surprising travel insurance features

Given that it costs a lot and doesn’t pay back all that much, when and why would you want to have travel insurance with cancel for any reason coverage? Several scenarios come to mind: