Before you buy

Please take care to answer all the questions accurately and completely, especially those relating to who can have this policy and any questions about health. If these are not answered correctly, this could affect whether claims are paid in full or paid at all.

What type of travel insurance do you need?

Further information

Single trip A policy for a single trip that starts and ends in the UK. Cover available for trips lasting up to 120 days.

Annual multi trip A 12-month policy that allows you to travel on more than one trip, this includes cover within the United Kingdom where you have at least two nights accommodation booked. Cover provided is for up to 31 days per trip, or upgrade to 45 days or 60 days.

Single trip

Please check the Foreign, Commonwealth & Development (FCDO) Travel Advice website for information about your destination(s). You will have no cover under this policy if you travel to an area or country where the FCDO have advised against travelling to. If you travel to an area or country that the FCDO have advised against all but essential travel, you will have no cover for claims related to the advice they have given.

Annual multi trip

Further Information

Europe All European countries as shown and including the UK: Albania, Andorra, Armenia, Austria, Azores, Belarus, Belgium, Bosnia-Herzegovina, Bulgaria, Cape Verde, Corsica, Croatia, Czech Republic, Denmark, Estonia, Finland, Macedonia, France, Germany, Gibraltar, Greece, Hungary, Iceland, Ireland, Italy, Kosovo, Latvia, Lichtenstein, Lithuania, Luxembourg, Madeira, Malta, Monaco, Moldova, Montenegro, Netherlands, Norway, Poland, Portugal, Romania, Russia, San Marino, Sardinia, Serbia, Slovakia, Slovenia, Spain (including Balearic Islands and Canary Islands), Sweden, Switzerland, Tunisia, Ukraine, Vatican City.

Worldwide EXCLUDING USA, Canada, Bermuda, Greenland, the Caribbean and Mexico All of the following destinations would be excluded : Alaska, American Samoa, Anguilla, Antigua and Barbuda, Aruba, Bahamas, Barbados, Belize, Bermuda, Bonaire (Antilles), British Virgin Isles, Canada, Cayman Islands, Cocos (Keeling) Islands, Costa Rica, Cuba, Curacao, Dominica, Dominican Republic, El Salvador, Greenland, Grenada, Guadeloupe, Guatemala, Haiti, Hawaii, Honduras, Jamaica, Leeward Islands, Martinique, Mexico, Midway Island, Montserrat, Nevis Island, Nicaragua, Panama, Puerto Rico, Saint Barthelemy, Saint Kitts & Nevis, Saint Lucia, Saint Martin, Saint Vincent and The Grenadines, Saint Martin, Trinidad & Tobago, Turks & Caicos Isles, United States Minor Outlying Islands, United States of America, Virgin Isles (UK), Virgin Isles (US), Wake Island.

Worldwide INCLUDING USA, Canada, Bermuda, Greenland, the Caribbean and Mexico All countries of the world.

Important: For Annual Multi-Trip policies, cancellation cover is provided from the selected policy start date. If you require cancellation cover to begin immediately, please select today as the policy start date.

Who's travelling?

Individual - One person who is 18 years of age or over.

Couple - You and your spouse, including a civil partner or co-habite

Family - You, your spouse (including civil partner or co-habite) and up to 4 of your children aged 17 years and under(age at time of purchase). Cover is provided for single parent families and up to 4 of your children aged 17 years and under. In this description, 'children' includes children, step-children, adopted children, foster children and grandchildren.

Group - A group of individuals travelling together, who may not be related. A group can be up to 8 people.

Do any travellers have any medical conditions?

If the answer to any of the questions below is yes for any travellers, please select "Yes":

If the answer is yes to any of these questions, these medical conditions will need to be declared for cover to apply. Questions about the medical conditions will be asked as part of the declaration. If you would prefer to speak to someone regarding medical conditions, you can contact us on 0333 333 9637 .

- Have you been prescribed medication in the last 12 months whether you are taking it or not? This includes tablets (including Morphine based pain killers), inhalers or injections?

- Do you currently routinely visit a GP, hospital or clinic for check-ups/consultations or treatments? This includes annual reviews or reviews once every 2 years of a condition?

- Are you visited by a doctor or nurse, or carer for check-ups or treatment (including dressings being changed)?

- Have you been admitted into hospital or undergone surgery in the last 12 months?

- Have you received treatment for heart, stroke, or respiratory related illness in the last 5 years?

- Are you currently waiting for any results of tests/investigations or awaiting any consultations or referrals or on any waiting lists?

If selecting "Yes", you will be asked to declare medical conditions on the next step.

Can all travellers have this policy?

To be covered by this policy, travellers must be able to agree to all of these statements:

- I am a UK resident and registered with a GP (Doctor) in the UK. A UK resident is a person whose main home is in the UK.

- I am not a resident of Channel Islands or the Isle of Man.

- I have not already started a trip.

- I am travelling from, and returning to, the UK.

- I am not aware of any reason why I may need to claim against this policy.

- I have not been diagnosed with a terminal illness.

- I am not undergoing/awaiting tests or consultations about an undiagnosed condition.

- I am not travelling intending to receive medical treatment.

- I am not travelling against advice of a medical practitioner or would be travelling against advice if I asked for it.

Please take a moment to check the details above and then click the ‘Next’ button to proceed.

Please take a moment to check the details above and then click the ‘Add Medical’ button where you will declare the medical conditions.

Important information

- Single Trip and Annual Multi Trip Policy Wording

- Single Trip and Annual Multi Trip Insurance Product Information Document (IPID)

- Silver Single Trip and Annual Multi Trip Insurance Product Information Document (IPID)

- Gold Single Trip and Annual Multi Trip Insurance Product Information Document (IPID)

- Platinum Single Trip and Annual Multi Trip Insurance Product Information Document (IPID)

- Terms of Business

We are sorry but we are unable to provide you with a quote. If you were unable to agree to any of the statements due to a medical condition you can access a directory that has been set up by MoneyHelper on behalf of the Financial Conduct Authority. The directory provides easy access to companies that specialise in providing cover for pre-existing medical conditions. The directory can be accessed at www.moneyhelper.org.uk/en/everyday-money/insurance/travel-insurance-directory or by calling 0800 138 7777 .

Covid cover features in new travel insurance for easyJet passengers

- Share on WhatsApp

- Share by email

Dedicated Covid-19 cover for domestic travel is included in new insurance being provided to easyJet passengers.

The new options will be offered via a renewed partnership between the budget carrier and insurance and assistance provider Collinson running until at least April 2024.

The enhanced offering, available to include during the booking process, means people diagnosed with Covid-19 ahead of a trip are covered for any necessary refunds or rearrangements, as well as for any required medical care if diagnosed with the virus while abroad.

If passengers are unable to return home due to being diagnosed with Covid, the policy will also cover them for additional accommodation as well as the cost of returning them home.

The cost of the cover was not disclosed.

EasyJet UK chief commercial officer Sophie Dekkers said: “The need for travel insurance is greater than ever before, so we know it will help bolster consumer confidence to book and travel, giving holidaymakers a much-needed reassurance for future bookings and possible Covid-19 related disruptions.

“We have also launched our enhanced Protection Promise meaning our customers can book with greater confidence knowing that if they are unable to travel, or their plans change, so can their flights.

“As we are looking forward to ramping up our flying programme as soon as it is safe to do so, we can now give our customers added peace of mind that they can book their much-needed holidays knowing they are fully protected should they test positive before they travel, while on holiday or if they have to cancel their trip altogether.”

Collinson head of travel insurance Greg Lawson said: “We know Brits are chomping at the bit to get out and see the world again when they can.

“However, some passengers are understandably wary of what will happen to them or their bookings if they catch Covid just before or during their trip.

“We want to give people peace of mind to encourage them to plan those holidays they’ve been dreaming of for over a year now.

“When the government gives the green light to travel again, choosing to fly with an airline – like easyJet – that provides extra Covid-19 insurance is a great option.”

Share article

View comments, eastern airways replaces loganair on teesside-aberdeen route, visit florida aims to surpass pre-pandemic uk numbers in 2024, norwegian air summer ramp-up hit by air traffic control strikes, qantas resolves app privacy breach, jacobs media is honoured to be the recipient of the 2020 queen's award for enterprise..

The highest official awards for UK businesses since being established by royal warrant in 1965. Read more .

- Airport & Travel Enhancement

- Priority Pass

- LoungeKey Pass

- Lounge Pass

- Airport Dimensions

- Loyalty & Customer Engagement

- Salesforce Loyalty Management

- Data and Analytics

- Loyalty Platforms

- Valuedynamx

- Merchant Partners

- Reward Programmes

- Rewards Earning

- Rewards Redemption

- Insurance & Protection

- Travel Insurance

- International & Dental Healthcare

- Specialty & Ancillary Personal Lines

- Case Studies

- Our Leadership

- Our Offices

- Corporate Responsibility

- Contact us Contact us

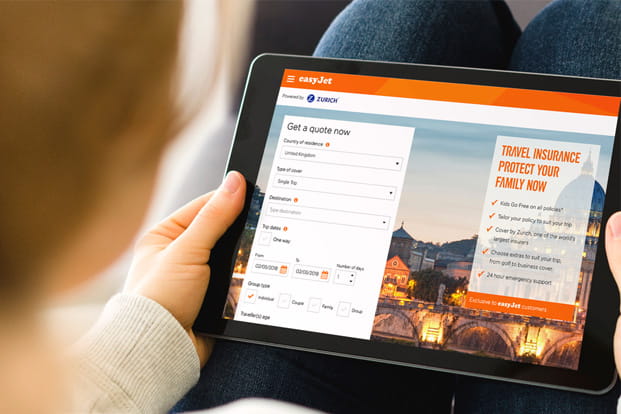

easyJet launches new tailored travel insurance partnership with Collinson and Zurich

easyJet, Europe’s leading airline, now offers customers dynamic travel insurance solutions in partnership with Collinson, a global leader in shaping and influencing customer behaviour, and underwritten by Zurich Insurance. easyJet is looking to significantly change the way travel insurance is sold to customers. The partnership sees Collinson supporting easyJet sales as well as customer servicing, claims and assistance in *13 European markets, with products and pricing tailored to a number of traveller profiles. The pricing engine uses variables such as the traveller’s destination, time of year, group size and flight add-ons to highlight a product that’s likely to resonate best with that customer. The opportunity for airlines to focus on optimising conversion rates within the flight booking journey is huge. This, coupled with the introduction of the new Insurance Distribution Directive (IDD) in February 2018, helps to place easyJet ahead of the curve in offering travel insurance that is competitive, compliant and tailored to its customers’ needs. Alongside familiar options such as cancellation, domestic and comprehensive insurance, customers will be presented with persona-based products if their booking matches the profile for winter sports, business travel, or sports such as cycling and golf. Depending on the persona purchasing the flights, bespoke add-ons will also be offered such as enhanced gadget cover for families. In addition to purchases with flight bookings, easyJet customers can buy travel insurance separately through an easyJet-branded website which was custom-built by Collinson and supports thirteen languages. In the months ahead, easyJet marketing activity will drive customers to the site at various points before travel to raise awareness of the best-matched insurance product. easyJet’s Ancillary Revenue Director, Andrew Middleton, commented: “We are pleased to be partnering with Collinson to sell Travel Insurance across Europe. Collinson stands out from mainstream insurers with a unique proposition and an ability to deliver e-commerce, marketing and big data solutions. Collinson’s partnership with Zurich combines these attributes with a customer-centric process to support claims and medical assistance.” Greg Lawson, Head of Travel Insurance at Collinson, added: “We’re delighted to be working with easyJet, Europe’s leading airline as Collinson expands into the global airline sector. We believe there is significant opportunity to introduce more tailored products at the point of sale, in addition to products that add greater customer engagement. We will continue to work with easyJet to create market differentiators to drive customer satisfaction and support their brand values.

“In addition, the partnership between Collinson and Zurich, a highly respected global brand, highlights the combined strengths in terms of customer understanding, innovative technology, dynamic insurance products, claims services and impactful marketing.”

Conor Brennan, Head of UK General Insurance Retail, said: “We really believe the future of insurance in key areas like travel is based on the quality of partnerships we commit to. Partnering with a well-known and respected brand like easyJet creates a great opportunity to provide their extensive customer base with insurance that’s closely tailored to their individual needs.”

Related Insights SEE ALL

Collinson’s Priority Pass Named “Official Airport Lounge Partner” for Hong Kong, China Delegation to the Paris 2024 Olympic Games

Opportunities abound for brands as travel rebounds in Asia Pacific

Collinson Forms Strategic Joint Venture with Joyful Journey Group in Mainland China

You are using an outdated browser. Please upgrade your browser to improve your experience.

REDEFINING THE END-TO-END PASSENGER EXPERIENCE AND BUSINESS PERFORMANCE

easyJet adds COVID-19 travel insurance cover in partnership with Collinson

Initiatives // May 2021

Share on LinkedIn LinkedIn Share on Twitter Twitter Share on Facebook Facebook Share on Reddit Reddit Share on Flipboard Flipboard Share on Tumblr Tumblr Share via Email Gmail Share on WhatsApp WhatsApp

easyJet has launched a partnership with Collinson to offer a new insurance which includes COVID-19 cover.

The new travel insurance will cover customers who are diagnosed with COVID-19 ahead of a trip, providing the necessary rearrangements or refunds, as well as cover to customers for any required medical care if diagnosed with COVID-19 during their trip.

Additionally, customers who are unable to return home due to being diagnosed with the virus are also covered for additional accommodation, necessary medical assistance, and the cost of returning home safely.

By including COVID-19 cover as standard, easyJet and Collinson have stated that they want to give customers confidence to travel, knowing they will be supported should they test positive and experience COVID-19 related disruption, either before or during their trip. Customers can purchase the new travel insurance during the booking process on easyjet.com. There is also a new online claims process, giving customers more flexibility and choice if they need to claim.

easyJet’s Chief Commercial Officer Sophie Dekkers, who will be joining the Women in Aviation Leadership Summit at FTE APEX Virtual Expo on 25-26 May, commented: “We are pleased to partner with Collinson Insurance and develop a new travel insurance product for customers which offers COVID-19 travel insurance as standard.

“The need for travel insurance is greater than ever before, so we know it will help bolster consumer confidence to book and travel, giving holidaymakers a much-needed reassurance for future bookings and possible COVID-19 related disruptions. We have also launched our enhanced Protection Promise meaning our customers can book with greater confidence knowing that if they are unable to travel, or their plans change, so can their flights.

“As we are looking forward to ramping up our flying programme as soon as it is safe to do so, we can now give our customers added peace of mind that they can book their much-needed holidays knowing they are fully protected should they test positive before they travel, while on holiday or if they have to cancel their trip altogether.”

Greg Lawson, Head of Travel Insurance at Collinson, added: “As many of us look forward to travelling again, whether for holiday or to visit friends and family, there may be some concerns and questions needing answers. Collinson is excited to partner with easyJet and help guide their customers through the travel restart and this new insurance is designed to give peace of mind, whilst also delivering great value and simplicity.

“We recognise that, even with progress in lowering infection rates and the rollout of the vaccine programme, we still need to include COVID-19 cover to support customers dealing with new challenges, both before and during their trip. We will continue to work with easyJet on enhancing the insurance product further, listening to customers and helping rebuild travel confidence in the months ahead.”

In addition, easyJet has also partnered with Randox to offer discounted COVID-19 tests.

Future Travel Experience Ancillary

11-13 June 2024, Dublin

Empowering the airline sector to profit from collaborative digital retailing opportunities at every step of the journey

Future Travel Experience EMEA

A gathering of air transport’s digital and innovation leaders, creative designers and progressive minds who will inspire one another and reimagine travel together.

Future Travel Experience Global

28-30 oCT 2024, California

Where the world's most progressive travel facilitators define tomorrow’s end-to-end passenger experience

Future Travel Experience APEX Asia EXPO

19-20 November 2024, Singapore

Connecting vendors with airline and airport executives to transform tomorrow’s end-to-end passenger journey across Asia-Pacific

Get Future Travel Experience news & updates sent to your inbox

Dont remind me again X Close

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

11 Best Travel Insurance Companies in May 2024

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

If the past few years have shown us anything, it’s that travelers need to be prepared for the unexpected — from a pandemic to flight troubles to the crowded airport terminals so many of us have encountered.

Whether you’re looking for an international travel insurance plan, emergency medical care or a policy that includes extreme sports, these are the best travel insurance providers to get you covered.

How we found the best travel insurance

We looked at quotes from various companies for a 10-day trip to Mexico in September 2024. The traveler was a 55-year-old woman from Florida who spent $3,000 total on the trip, including airfare.

On average, the price of each company’s most basic coverage plan was $126.53. The costs displayed below do not include optional add-ons, such as Cancel For Any Reason coverage or pre-existing medical condition coverage.

Read our full analysis about the average cost of travel insurance so you can budget better for your next trip.

However, depending on the plan, you may be able to customize at an added cost.

As we continue to evaluate more travel insurance companies and receive fresh market data, this collection of best travel insurance companies is likely to change. See our full methodology for more details.

Best insurance companies

Types of travel insurance

What does travel insurance cover, what’s not covered, how much does it cost, do i need travel insurance, how to choose the best travel insurance policy, what are the top travel destinations in 2024, more resources for travel insurance shoppers, top credit cards with travel insurance, methodology, best travel insurance overall: berkshire hathaway travel protection.

Berkshire Hathaway Travel Protection

- ExactCare Value (basic) plan is among the least expensive we surveyed.

- Speciality plans available for road trips, luxury travel, adventure activities, flights and cruises.

- Company may reimburse claimants faster than average, including possible same-day compensation.

- Multiple "Trip Delay" coverage types might make claims confusing.

- Cheapest plan only includes fixed amounts for its coverage.

Under the direction of chair and CEO Warren Buffett, Berkshire Hathaway Travel Protection has been around since 2014. Its plans provide numerous opportunities for travelers to customize coverage to their needs.

At $135 for our sample trip, the ExactCare Value (basic) plan from Berkshire Hathaway Travel Protection offers protection roughly $10 above the average price.

Want something cheaper? Air travelers looking for inexpensive, less comprehensive protections might opt for a basic AirCare plan that includes fixed amounts for its coverage .

Read our full review of Berkshire Hathaway .

What else makes Berkshire Hathaway Travel Protection great:

Pre-existing medical condition exclusion waivers available at nearly all plan levels.

Plans available for travelers going on a cruise, participating in extreme sports or taking a luxury trip.

ExactCare Value (basic) plan was among the least expensive we surveyed.

Best for emergency medical coverage: Allianz Global Assistance

Annual or single-trip policies are available.

- Multiple types of insurance available.

- All plans include access to a 24/7 assistance hotline.

- More expensive than average.

- CFAR upgrades are not available.

- Rental car protection is only available by adding the One Trip Rental Car protector to your plan or by purchasing a standalone rental car plan.

Allianz Global Assistance is a reputable travel insurance company offering plans for over 25 years. Customers can choose from a variety of single and annual policies to fit their needs. On top of comprehensive coverage, some travelers might opt for the more affordable OneTrip Cancellation Plus, which is geared toward domestic travelers looking for trip protections but don’t need post-departure benefits like emergency medical or baggage lost.

For our test trip, Allianz Global Assistance’s basic coverage cost $149, about $22 above average.

What else makes Allianz Global Assistance great:

Annual and single-trip plans.

Plans are available for international and domestic trips.

Stand-alone and add-on rental car damage product available.

Read our full review of Allianz Global Assistance .

Best for travelers with pre-existing medical conditions: Travel Guard by AIG

Travel Guard by AIG

- Offers last-minute coverage.

- Pre-Existing Medical Conditions Exclusion Waiver available at all plan levels.

- Plan available for business travelers.

- Cancel For Any reason coverage only available for higher-level plans, and only reimburses up to 50% of the trip cost.

- Trip interruption coverage doesn't apply to trips paid for with points and miles.

Travel Guard by AIG offers a variety of plans and coverages to fit travelers’ needs. On top of more standard trip protections like trip cancellation, interruption, baggage and medical coverage, the Cancel For Any Reason upgrade is available on certain Travel Guard plans, which allows you to cancel a trip for any reason and get 50% of your nonrefundable deposit back as long as the trip is canceled at least two days before the scheduled departure date.

At $107 for our sample trip, the Essential plan was below average, saving roughly $20.

What else makes Travel Guard by AIG great:

Three comprehensive plans and a Pack N' Go plan for last-minute travelers who don't need cancellation benefits.

Flight protection, car rental, and medical evacuation coverage, as well as annual plans available.

Pre-existing medical conditions exclusion waiver available on all plan levels, as long as it's purchased within 15 days.

Read our full review of Travel Guard by AIG .

Best for those who pack expensive equipment: Travel Insured International

Travel Insured International

- Higher-level plan include optional add-ons for event tickets and for electronic equipment

- Rental car protection add-on for just $8 per day, even on lower-level plan.

- Many of the customizations are only available on the higher-tier plan.

- Coverage cost comes in above average in our latest analysis.

Travel Insured International offers several customization options. For instance, those going to see a show may want to add on event ticket registration fee protection. Traveling with expensive gear?Consider adding on coverage for electronic equipment for up to $2,000 in coverage.

Be sure to check which policies are available in your state. You will need to input your destination, residence, trip dates and the number of travelers to get a quote and see coverages.

What else makes Travel Insured International great:

Comprehensive plans include medical expense reimbursement accidents, sickness, evacuation and pre-existing conditions, depending on the plan.

Flight plans include coverage for missed and canceled flights and lost or stolen baggage.

Read our full review of Travel Insured International .

Best for adventurous travelers: World Nomads

World Nomads

- Travelers can extend coverage mid-trip.

- The standard plan covers up to $300,000 in emergency evacuation costs.

- Plans automatically cover 200+ adventurous activities.

- No Cancel For Any Reason upgrades are available.

- No pre-existing medical condition waivers are available.

Many travel insurance plans contain exclusions for adventure sports activities. If you plan to ski, bungee jump, windsurf or parasail, this might be a plan to consider.

Note that the Standard plan ($72 for our sample trip), while the most affordable, provides less coverage than other plans. But it can be a good choice for travelers who are satisfied with trip cancellation and interruption coverage of $2,500 or less, do not need rental car damage protection, find the limits to be sufficient and do not need coverage for certain more adventurous activities.

What else makes World Nomads great:

Comprehensive international travel insurance plans.

Coverage available for adventure activities, such as trekking, mountain biking and scuba diving.

Read our full review of World Nomads .

Best for medical coverage: Travelex Insurance Services

Travelex Insurance Services

- Top-tier plan doesn’t break the bank and provides more customization opportunities.

- Offers a plan specifically for domestic travel.

- Sells a post-departure medical coverage plan.

- Fewer customization opportunities on the Basic plan.

- Though perhaps a plus for domestic travelers, keep in mind the Travel America plan only covers domestic trips.

For starters, basic coverage from Travelex Insurance Services came in at $125, almost exactly average for our sample trip.

Travelex’s plans focus heavily on providing protections that are personalized to your travel style and trip type.

While the company does offer comprehensive plans that include medical benefits, you can also choose between cheaper plans that don’t provide cancellation coverage but do offer protections during your travels.

Read our full review of Travelex Insurance Services .

What else makes Travelex Insurance Services great:

Three comprehensive plans available, two of which cover international trips.

Offers a post-departure plan geared exclusively toward disruptions after you leave home.

Two flight insurance plans available.

Best if you have travel credit card coverage: Seven Corners

Seven Corners

- Annual, medical-only and backpacker plans are available.

- Cancel For Any Reason upgrade is available for the cheapest plan.

- Cheapest plan also features a much less costly Interruption for Any Reason add-on.

- Offers only one annual policy option.

Each Seven Corners plan offers several optional add-ons. Among the more unique is a Trip Interruption for Any Reason, which allows you to interrupt a trip 48 hours after the scheduled departure date (for any reason) and receive a refund of up to 75% of your unused nonrefundable deposits.

The basic coverage plan for our trip to Mexico costs $124 — right around the average.

What else makes Seven Corners great:

Comprehensive plans for U.S. residents and foreigners, including travelers visiting the U.S.

Cheap add-ons for rental car damage, sporting equipment rental or trip interruption for any reason.

Read our full review of Seven Corners .

Best for long-term travelers: IMG

- Coverage available for adventure travelers.

- Special medical insurance for ship captains and crew members, international students and missionaries.

- Claim approval can be lengthy.

While some travel insurance companies offer just a handful of plans, with IMG, you’ll really have your pick. Though this requires a bit more research, it allows you to search for coverage that fits your travel needs.

However, travelers will want to be aware that IMG’s iTravelInsured Travel Lite is expensive. Coming in at $149.85, it’s the costliest plan on our list.

Read our full review of IMG .

What else makes IMG great:

More affordable than average.

Many plans to choose from to fit your needs.

Best for travelers with unpredictable work demands: Tin Leg

- In addition Cancel For Any Reason, some plans offer cancel for work reason coverage.

- Adventure sports-specific coverage is available.

- Plans have overlap that can be hard to distinguish.

- Only one plan includes Rental Car Damage coverage available as an add-on.

Tin Leg’s Basic plan came in at $134 for our sample trip, adding about $8 onto the average basic policy cost. Note that you’ll pay a lot more if you shop for the most comprehensive coverage, and there are eight plans to choose from for trips abroad.

The multitude of plans can help you find coverage that fits your needs, but with so many to choose from, deciding can be daunting.

The only real way to figure out your ideal plan is to compare them all, look at the plan details and decide which features and coverage suit you and your travel style best.

Read our full Tin Leg review .

Best for booking travel with points and miles: TravelSafe

- Covers up to $300 redepositing points and miles on eligible canceled award flights.

- Optional add-on protection for business equipment or sports rentals.

- Multi-trip or year-long plans aren’t available.

Selecting your travel insurance plan with TravelSafe is a fairly straightforward process. The company’s website also makes it easy to visualize how optional add-on elements influence the total cost, displaying the final price as soon as you click the coverage.

However, at $136, the Basic plan was among the more expensive for our trip to Mexico.

What else makes TravelSafe great:

Rental car damage coverage add-on is available on both plans.

Cancel For Any Reason coverage available on the TravelSafe Classic plan.

Read our full TravelSafe review .

Best for group travel insurance: HTH Insurance

HTH Travel Insurance

- Covers travelers up to 95 years old.

- Includes direct pay option so members can avoid having to pay up front for services.

- A 24-hour delay is required for baggage delay coverage on the TripProtector Economy plan.

- No waivers for pre-existing conditions on the lower-level plan.

HTH offers single-trip and multitrip medical insurance coverage as well as trip protection plans.

At around $125, the Trip Protector Economy policy is at the average mark for plans we reviewed.

You can choose to insure group trips for educators, crew, religious missionaries and corporate travelers.

What else makes HTH Insurance great:

Medical-only coverage and trip protection coverage.

Lots of options for group travelers.

Read our full review of HTH Insurance .

As you shop for travel insurance, you’ll find many of the same coverage categories across numerous plans.

Trip cancellation

This covers the prepaid costs you make for your trip in cases when you need to cancel for a covered reason. This coverage helps you recoup upfront costs paid for flights and nonrefundable hotel reservations.

Trip interruption

Trip interruption benefits generally involve disruptions after you depart. It helps reimburse costs incurred for flight delays, cancellations and plenty of other covered disruptions you might encounter during your travels.

This coverage can cover the costs for you to return home or reimburse unexpected expenses like an extra hotel stay, meals and ground transportation.

Trip delay coverage helps cover unexpected costs when your trip is delayed. This is another coverage that helps offset the costs of flight trouble or other travel disruptions.

Note that many policies have a total amount a traveler can claim, with caps on per diem benefits, too.

Cancel For Any Reason

Cancel For Any Reason coverage allows you to recoup some of the upfront costs you paid for a trip even if you’re canceling for a reason not otherwise covered by your standard travel insurance policy.

Typically, adding this protection to your plan costs extra.

Baggage delay

This coverage helps cover the costs of essential items you might need when your luggage is delayed. Think toiletries, clothing and other immediate items you might need if your luggage didn’t make it on your flight.

Many travel insurance plans with baggage delay protection will specify how long (six, 12, 24 hours, etc.) your luggage must be delayed before you can make a claim.

Lost baggage

Used for travelers whose luggage is lost or stolen, this helps recoup the lost value of the items in your bag.

You’ll want to make sure you closely follow the correct procedures for your plan. Many plans include a maximum total amount you can claim under this coverage and a per-item cap.

Travel medical insurance

This covers out-of-pocket medical costs when travelers run into an emergency.

Because many travelers’ health insurance plans don’t cover medical care overseas, travel medical insurance can help offset out-of-pocket health care costs.

In addition to emergency medical coverage, many plans have medical evacuation or repatriation coverage for costs incurred when you must be taken to a hospital or return to your home country because of a medical situation.

Most travel insurance plans cover many trip protections that can help you be prepared for unexpected travel disruptions and expenses.

These coverages are generally aimed at protecting the money you put into your trip, expenses you incur because of travel trouble and costs incurred if you have a medical emergency overseas.

On top of core coverages like trip cancellation and interruption and travel medical coverage, some plans offer add-on options like waivers for pre-existing conditions, rental car collision damage waivers or adventure sports riders. These usually cost extra or must be added within a specified timeframe.

Typical travel insurance policies offer coverage for many unforeseen events, but as you research to select a plan, consider your needs. Though every plan differs, there are some commonly excluded coverages.

For instance, you typically can’t get coverage for a named storm if you bought the coverage after the storm was named. In other words, if you have a trip to the Caribbean booked for Sept. 25 and on Sept. 20 a hurricane develops and is named, you generally won’t be able to buy a travel insurance plan Sept. 21 in hopes of getting your money back.

Many plans also don’t cover activities performed under the influence of drugs or alcohol or any extreme sports. If the latter applies to you, you might want to consider a plan with specific coverages for adventure-seekers.

For numerous plans, a few other situations don’t qualify as an acceptable reason to cancel and make a claim, such as fear of travel, medical tourism or pregnancies (unless you booked a trip and bought insurance before you became pregnant or there are complications with the pregnancy). This is where a Cancel For Any Reason add-on to your coverage can be helpful.

You can also run into trouble if you give up on a trip too soon: a minor (or even multihour) flight delay likely isn’t sufficient to cancel your entire trip and get reimbursed through your plan. Be sure to review what requirements your specific plan has when it comes to canceling a trip, claiming trip interruption, etc.

Travel insurance costs vary widely. The final price of your plan will fluctuate based on your age, length of trip and destination.

It will also depend on how much coverage you need, whether you add on specialized policies (like Cancel For Any Reason or pre-existing conditions coverage), whether you plan to participate in extreme sports and other factors.

In our examples above, for instance, the 35-year-old traveler taking a $2,000 trip to Italy would have spent an average $76 for a basic plan to get coverage for things like trip cancellation and interruption, baggage protection, etc. That’s a little less than 4% of the total trip cost — lower than average.

If there were multiple members in a traveling party or if they were going on, say, a rock-climbing or bungee-jumping excursion, the costs would go up.

On average, travel insurance comes to about 5% to 10% of the trip cost. However, considering many of the plans reimburse up to 100% of the trip cost (or more) for disruptions like trip cancellation or interruption, it can be a worthwhile expense if something goes wrong.

It depends. Consider the following factors that might affect your decision: You’re young and healthy, all your bookings are refundable or cancelable without a penalty, your flights are nonstop, you’re not checking bags and a credit card you carry offers some travel protections . In that case, travel insurance might not be necessary.

On the other hand, if you prepaid a large chunk of money for a nonrefundable African safari, you’re going on a Caribbean cruise in the middle of a hurricane season or you’re going somewhere where the cost of health care is high, it’s not a bad idea to buy a travel insurance plan. Here’s how to find the best travel insurance coverage for you.

If you’re thinking of booking a trip and not planning to buy travel insurance, you may want to consider at least booking refundable airfare and not prepaying for hotel, rental car and activity reservations. That way, if something goes wrong, you can cancel without losing any money.

Selecting the best travel insurance policy comes down to your needs, concerns, preferences and budget.

As you book, take a few minutes to consider what most concerns you. Is it getting stranded because of flight trouble? Having the ability to cancel for any reason you see fit without losing money? Getting sick or injured right before departure and needing to postpone the trip? Injuring yourself or falling ill while overseas?

Ultimately, you want a plan that protects you, your money and the large investment in your trip — but doesn’t cost too much, either.

Medical coverage. If your priority is having adequate medical coverage abroad, you might want to look for plans with high limits for medical emergencies and medical evacuation.

Complex travel itinerary. If your itinerary has lots of flight connections, prepaid hotels and deposits for activities you can’t get back, prioritizing a plan with the best coverage for trip cancellations or interruptions may land at the top of your list.

Travel uncertainty. If you’re on the fence about a trip and have nonrefundable reservations, you may want to select a plan with a Cancel For Any Reason coverage option, which can help you recoup about 50% to 75% of the costs. This helps provide peace of mind, placing the decision on whether to travel entirely in your hands.

Car rentals. If you’re renting a car, a collision damage waiver is often worth looking into.

The following destinations are the top insured destinations in 2024, according to Squaremouth (a NerdWallet partner).

The Bahamas.

Costa Rica.

Antarctica.

In 2022, travelers spent about 25.53% more on trips than they did before the pandemic.

As of December, NerdWallet analysis determined travel prices are 10% higher than pre-pandemic. Each statistic makes a strong case for protecting your travel investment as you plan your next trip.

Bookmark these resources to help you make smart money moves as you shop for travel insurance.

What is travel insurance?

CFAR explained.

Is travel insurance worth getting?

10 credit cards that provide travel insurance.

Here is the list of travel cards offered by Chase that include various forms of travel insurance.

Having one of these in your wallet is a good start to protecting your travel investments and preventing expensive accidents; however, savvy travelers check card terms closely and sometimes supplement with a third-party policy, like from one of the companies above, to better protect themselves.

on Chase's website

• Trip delay: Up to $500 per ticket for delays more than 12 hours.

• Trip cancellation: Up to $10,000 per person and $20,000 per trip. Maximum benefit of $40,000 per 12-month period.

• Trip interruption: Up to $10,000 per person and $20,000 per trip. Maximum benefit of $40,000 per 12-month period.

• Baggage delay: Up to $100 per day for five days.

• Lost luggage: Up to $3,000 per passenger.

• Trip delay: Up to $500 per ticket for delays more than 6 hours.

• Trip delay: Up to $500 per trip for delays more than 12 hours.

• Car rentals: Theft and collision damage for most cars in the U.S. and abroad.

• Trip cancellation: Up to $1,500 per person and $6,000 per trip.

• Trip interruption: Up to $1,500 per person and $6,000 per trip.

• Baggage delay: Up to $100 per day for three days.

We used the following factors to choose insurance providers to highlight:

Breadth of coverage: We looked at how many plans each company offered plus the range of their standard plans.

Depth of coverage: We considered two data points to get a sense of how much each company pays out for common travel issues — the maximum caps for trip cancellation and trip interruption claims.

Cost: By looking at the costs for basic coverage across multiple companies, we determined an average cost for shoppers to benchmark plan prices against.

Customizability: While standard plans can cover a lot of ground, sometimes you need something a little more personal.

Customer satisfaction. Using data from Squaremouth when available, and Google Reviews as a backup, we can give kudos to companies with better track records from their clients.

No, it doesn’t necessarily get more expensive the longer you wait to purchase. However, as you put off buying insurance, you may lose access to potential plans and coverage options.

In general, buying travel insurance within a few days to two weeks of prepaying or making an initial deposit for your trip is your best bet. Assuming you’re not booking last-minute, this will provide you with access to the widest possible range of coverage options. It also helps prevent any medical conditions or storms that pop up between booking and buying a plan from ending up as excluded situations, which won’t be covered by your plan.

But, generally, many plans do allow you to buy coverage quite close to your departure date.

To get the most out of your travel insurance plan, buy it soon after making your initial prepayment or deposit to ensure you have access to the biggest menu of plans possible.

Select a plan that’s comprehensive enough to cover the travel scenarios you’re most concerned about or likely to encounter but not too expensive or laden with protections you’d never likely need.

Whatever your coverage, thoroughly review the plan so you understand what’s covered and what’s not, plus how to adhere to the plan’s rules for making a claim.

Travelers frequently use phrases like “trip insurance” and “travel insurance,” as well as “trip protection,” interchangeably, but they do mean different things, according to Stan Sandberg, founder of insurance comparison site TravelInsurance.com.

Trip insurance, or trip protection, generally refers to predeparture (or preevent) coverage if you need to cancel. You may see these plans sold by airlines, online travel agencies or even ticketed event sellers.

“You could refer to it as the portion that protects the investment in the trip,” Sandberg says.

A travel insurance plan typically includes that — plus more comprehensive benefits to protect you during your trip, from medical coverage to trip delay and lost baggage protections, and many more elements, depending on the plan.

Though travel insurance is typically not required for international trips, your personal circumstances will play a key role in whether it’s a good investment.

For instance, young, healthy travelers with few prepaid trip expenses embarking on a relatively risk-free trip may not see a need to buy a plan.

Older travelers with complicated itineraries who are visiting destinations where they could potentially fall ill or get injured — or who could encounter bad weather or some other disrupting factor along the way — may want to buy coverage.

Consider a few key questions:

How well would your health insurance plan cover you if you needed to visit a hospital overseas?

How much did you prepay for a hotel or rental car?

How much money would you be out if weather or some other flight issue derailed your itinerary?

Could you afford an unexpected night in a city where you have a connecting flight?

Do you already have a credit card that provides some travel protections?

Your answers to these questions can help you decide whether you need travel insurance for your international trip.

In general, buying travel insurance

within a few days to two weeks of prepaying or making an initial deposit

for your trip is your best bet. Assuming you’re not booking last-minute, this will provide you with access to the widest possible range of coverage options. It also helps prevent any medical conditions or storms that pop up between booking and buying a plan from ending up as excluded situations, which won’t be covered by your plan.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

On a similar note...

Partnership between Collinson and easyJet provides Covid insurance

Collinson has renewed its partnership with easyjet until at least april 2024, providing travellers with a range of relevant and dynamic insurance options, including dedicated covid-19 cover for all domestic travel.

The product, available to include during easyJet’s booking process, will mean customers diagnosed with Covid-19 ahead of a trip are covered for any necessary refunds or rearrangements, as well as being covered for any required medical care if diagnosed with the virus whilst abroad. In the event customers are unable to return home due to being diagnosed with Covid, the policy will also cover them for additional accommodation, as well as the cost of returning them home safely.

This is the latest initiative from Collinson, which has launched a long line of new products and propositions designed to get the world travelling safely again in the wake of the pandemic. By providing insurance that travellers know will cover them for Covid, as well as other illnesses abroad, the new product from Collinson and easyJet will help reignite consumer confidence in travel, giving much-needed reassurance that future bookings are protected from Covid when travelling.

“We know Brits are chomping at the bit to get out and see the world again when they can,” said Greg Lawson, Head of Travel Insurance at Collinson. “However, some passengers are understandably wary of what will happen to them or their bookings if they catch Covid just before or during their trip. We want to give people peace of mind to encourage them to plan those holidays they’ve been dreaming of for over a year now. When the Government gives the green light to travel again, choosing to fly with an airline – like easyJet – that provides extra Covid-19 insurance is a great option.”

Insurance products tailored to the customer

Within the partnership, Collinson will underwrite and service the full range of dynamic and tailored products. These products are filtered to be relevant to the booking profile with business travel routes, for instance, being offered a gadget insurance upgrade while a ski resort destination would be offered a Winter Sport upgrade.

“We are pleased to partner with Collinson Insurance and develop a new travel insurance product for customers which offers Covid-19 travel insurance as standard,” said Sophie Dekkers, easyJet’s UK Chief Commercial Officer. “The need for travel insurance is greater than ever before, so we know it will help bolster consumer confidence to book and travel, giving holidaymakers a much-needed reassurance for future bookings and possible Covid-19 related disruptions. We have also launched our enhanced Protection Promise meaning our customers can book with greater confidence knowing that if they are unable to travel, or their plans change, so can their flights.

“As we are looking forward to ramping up our flying programme as soon as it is safe to do so, we can now give our customers added peace of mind that they can book their much-needed holidays knowing they are fully protected should they test positive before they travel, while on holiday or if they have to cancel their trip altogether.”

EasyJet CEO Johan Lundgren has said that he believes this summer will be better than last year’s for the global travel industry.

- Travel Insurance

- Best Travel Insurance Companies

11 Best Travel Insurance Companies Of May 2024

Expert Reviewed

Updated: May 6, 2024, 12:22pm

We evaluated 39 policies and found that Travel Insured International, WorldTrips and Travel Safe are among the best travel insurance companies. We evaluated costs and a variety of coverage features to find the best options. See all our top picks.

Considering Travel Insurance?

Via Forbes Advisor's Website

- Best “Cancel For Any Reason” Travel Insurance

- Cheapest Travel Insurance Plans

- Best Cruise Insurance

Summary: Best Travel Insurance Companies

Best for travel medical coverage, best for medical evacuation coverage, best for travel delays, best for baggage delays, what does travel insurance cover, what’s not covered by travel insurance, how much does travel insurance cost, what affects travel insurance costs, how to get travel insurance, do i need travel insurance, top travel destinations in may 2024, list of may 2024 top travel destinations, methodology, other travel insurance policies we rated, best travel insurance companies frequently asked questions (faqs), compare travel insurance quotes, compare & buy travel insurance, how we chose the best travel insurance.

We assessed cost, travel medical and evacuation limits, baggage and trip delay benefits, the availability of cancellation and interruption upgrades, and more. Our editors are committed to bringing you unbiased ratings and information. Our editorial content is not influenced by advertisers. You can read more about our editorial guidelines and the methodology for the ratings below.

- 39 travel insurance policies evaluated

- 1,482 coverage details analyzed

- 102 years of insurance experience on the editorial team

Our Picks For The Best Travel Insurance Companies

Best for non-medical evacuation, travel insured international.

Top-scoring plan

Worldwide Trip Protector

Average price

Medical & evacuation limits per person

$100,000/$1 million

We recommend Travel Insured’s Worldwide Trip Protector policy because it offers robust benefits at the lowest average price among top-rated plans we analyzed. We also like its superior non-medical evacuation coverage.

- “Cancel for any reason” and “interruption for any reason” upgrades available.

- Top-notch non-medical evacuation benefits of $150,000 per person.

- Good travel delay and baggage delay benefits kick in after just a 3-hour delay.

More: Travel Insured International Travel Insurance Review

I have been working with Travel Insured for over 15 years, and have been using them almost exclusively. Typically, they have been quite responsive and pay their claims in a timely fashion. – Stephanie Goldberg-Glazer, chief experience officer of Live Well, Travel Often

- Medical coverage of $100,000 per person is on the low side compared to top competitors but might be enough for your needs.

- Missed connection benefits of $500 are low compared to top-rated competitors and for cruise and tours only.

Here’s a look at whether top coverage types are included in the Worldwide Trip Protector policy.

Also included:

- Pet kennel benefits of up to $500 are included if you return home three hours or more later than your planned return date.

Optional add-ons offered:

- Rental car damage and theft coverage of up to $50,000.

- Event ticket protection pays up to $1,000 if you can’t attend for a reason covered by the policy.

- Travel inconvenience coverage allows you to recoup money for unforeseen circumstances, such as closed beaches and attractions, rainy weather, tarmac delays and more.

- Bed rest benefits pay up to $4,000 if a doctor requires you to stay on bed rest for at least 48 hours during your trip.

GREAT FOR ADD-ON COVERAGE

Atlas Journey Premier

Average cost

$150,000/$1 million

We like the Atlas Journey Premier plan for its wide choice of add-ons. These add-ons provide extra coverage for pets traveling with you, adventure sports, destination weddings, hunting and fishing equipment and more. We also like that this plan has a low average cost compared to competitors.

- Very good travel delay benefits of $2,000 per person after only 5 hours.

- Very good missed connection coverage of $2,000 per person after 3 hours.

Another option is the Atlas Journey Preferred plan, but this policy doesn’t offer the “interruption for any reason” upgrade and has lower travel medical benefits of $100,000 per person. Still, it hits all the marks for great benefits at a low price. It also offers lots of choices for add-on coverage.

More: WorldTrips Travel Insurance Review

WorldTrips offers a streamlined process for purchasing insurance online and filing claims. A user-friendly interface and efficient claims handling contribute to a positive customer experience and increased satisfaction. – Joe Cronin , advisory board member

- Medical coverage limits of $150,000 aren’t as high compared to some top-rated competitors but you might find it’s sufficient.

- Baggage delay benefits have a 12-hour waiting period.

Here’s a look at whether top coverage types are included in the Atlas Journey Premier policy.

- Travel inconvenience benefits of $750 if your arrival home is delayed due to a transportation delay and you can’t work for at least two days, your flight lands at a different airport than scheduled, your passport is stolen and can’t be reissued, and more.

- “Cancel for any reason” and “interruption for any reason” coverage.

- Destination wedding coverage in case the wedding is canceled.

- Baggage insurance upgrade to $4,000 per person.

- Rental car theft and damage coverage of $50,000.

- Political or security evacuation benefits of $150,000 per person.

- Vacation rental accommodations coverage of $500 if unclean or overbooked.

- Adventure sports add-on to extend coverage to safaris, bungee jumping and more.

- Hunting and fishing coverage for equipment and cancellation due to government restrictions.

- School activities coverage if trip has to be canceled due a test, sporting event, etc.

BEST FOR MISSED CONNECTIONS

Classic Plus Plan

TravelSafe’s Classic Plus plan stood out in our analysis for its superior missed connection benefits of $2,500. We also like the Classic Plus plan’s top-notch medical evacuation coverage of $1 million.

- “Cancel for any reason” upgrade available.

- Superior baggage loss coverage limits of $2,500.

- Great travel delay limits of $2,000 per person after a 6-hour delay.

More: TravelSafe Travel Insurance Review

TravelSafe packs essential coverage into budget-friendly rates without skimping on key benefits, and its responsive claims handling preserves peace of mind. – Timon van Basten, tour guide and founder of Travel Spain 24

- $100,000 in medical benefits is on the low side compared to top competitors but might be sufficient for your needs.

- Baggage delay coverage is a little skimpy at $250 per person after a 12-hour delay.

Here’s a look at whether top coverage types are included in the Classic Plus policy.

- Itinerary change coverage of $250 per person if your travel supplier makes a change that forces you to lose non-refundable costs for missed activities.

- Reimburses $300 for fees if you have to redeposit frequent traveler awards for reasons covered by your trip cancellation insurance.

- Pet kennel coverage of $100 a day if your return home is delayed by 24 hours or more due to a reason covered in your policy.

- “Cancel for any reason” coverage of 75% of lost trip costs.

- Accidental death and dismemberment for flights, up to $500,000 per person.

- Rental car damage and theft up to $35,000.

- Business equipment and sports equipment coverage of $1,000 if lost, stolen or damaged.

BEST FOR POLICY PERKS

Cruise Luxury

Nationwide’s Cruise Luxury plan is one of our favorites because it has a treasure trove of benefits such as “interruption for any reason” and “cancel for work reasons” coverage. You can upgrade to “cancel for any reason” coverage. Some competitors offer none or one of those options. We also like its excellent missed connection benefit of $2,500 per person.

Note that you do not have to be going on a cruise to take advantage of this policy’s coverage.

- “Interruption for any reason” benefit of $1,000 per person is included.

- Includes $25,000 per person in non-medical evacuation benefits for problems such as a natural disaster or security or political problem.

- Good travel delay benefits of $1,000 per person.

More: Nationwide Travel Insurance Review

Count me in as a believer in Nationwide’s trusted track record in insurance. Their travel policies check all the boxes, especially for cruises. My only gripe is that some of their medical limits seem lower than other guys. But the rates are easy on the wallet. – Tim Schmidt, travel expert, entrepreneur, published travel author and founder of All World

- Medical coverage of $150,000 per person is lower than most other top-rated plans but might be sufficient for your needs.

- 24-hour delay required for hurricane and weather coverage, compared to some competitor policies with only a 12-hour delay requirement.

Here’s a look at whether top coverage types are included in the Cruise Luxury policy.

- Inconvenience benefit of $250 per person if your cruise ship’s arrival at the next port of call is delayed for two or more hours due to mechanical breakdown or fire.

- “Interruption for any reason” up to $1,000.

- Coverage for extension of the school year, terrorism in an itinerary city, work-related emergency issues.

- Coverage if the CDC issues a health warning at your destination.

Optional add-on offered:

- “Cancel for any reason” upgrade that provides 75% reimbursement of insured trip cost if you cancel two or more days prior to your departure for a reason not listed in the base policy.

BEST FOR CUSTOMIZATION

Travel Guard Deluxe

The Travel Guard Deluxe plan impressed us with its optional pet, wedding, security, baggage, medical, adventures sports and travel inconvenience upgrades. These add-ons allow you to customize the policy to your needs. We also like that the policy includes benefits if, under certain conditions, you must start your trip earlier than planned—a feature not found in all policies.

- Offers upgrades to meet the needs and budgets of many kinds of travelers.

- Includes $100,000 per person for security evacuation and superior medical evacuation coverage of $1 million per person.

- Provides up to $750 per person for “travel inconveniences” such as a flight delay to your return destination, runway delays and cruise diversions.

- Has good travel delay coverage of $1,000 per person, with a short waiting period of 5 hours.

More: AIG Travel Insurance Review

AIG’s TravelGuard offers an easy-to-use online platform for purchasing insurance and filing claims. A streamlined process minimizes hassle for customers, making it convenient to obtain coverage and receive reimbursement for eligible expenses. – Joe Cronin , advisory board member

- The Travel Guard Deluxe policy has robust coverage across the board but also a high average cost ($539) compared to other top-rated policies.

- Medical expense coverage of $100,000 per person is on the low side but might be adequate for your needs.

Here’s a look at whether top coverage types are included in the Travel Guard Deluxe policy.

- Travel inconvenience benefits of $750 total ($250 per problem) if you encounter issues such as closed attractions, cruise diversion, hotel infestation, hotel construction and more.

- Trip exchange benefits of 50% of your trip cost that pay the difference in price between your original reservation and the new one.

- Ancillary evacuation benefits up to $5,000 for expenses related to return of children, bedside visits, baggage return and more.

- Flight accidental death and dismemberment coverage of $100,000 per person.

- “Cancel for any reason” upgrade.

- Rental vehicle damage coverage.

- “Name Your Family” upgrade allows you to add a person to your policy who will qualify for family member-related unforeseen events that can apply to claims for trip cancellation and interruption.

- Adventure Sports Bundle for adventure and extreme activities.

- Pet Bundle for boarding and medical expenses for illness or injury of dog or cat while traveling. Includes trip cancellation or trip interruption if your pet is in critical condition or dies within seven days before your departure.

- Wedding Bundle to cover trip cancellation due to wedding cancellation. Sorry cold-feeters: Coverage does not apply if you are the bride or groom.

The Travel Guard Preferred plan also earned 4.3 stars in our analysis. We recommend this policy if you’re looking for a lower price and don’t need the higher coverage amounts provided by the Deluxe plan. The Preferred plan provides $50,000 for medical expenses and $500,000 for medical evacuation benefits per person.

GREAT FOR MEDICAL & EVACUATION COVERAGE

Seven corners.

Trip Protection Choice

$500,000/$1 million

We like Seven Corners’ Trip Protection Choice plan because it has superior travel medical expenses and evacuation benefits. It also provides great upgrade options and benefits across the board.

- “Cancel for any reason” and “interruption for any reason” upgrade available.

- Very good travel delay coverage of $2,000 per person.

- Includes $20,000 for non-medical evacuation

More: Seven Corners Travel Insurance Review

With over two decades of experience in the insurance industry, Seven Corners has built a reputation for reliability and customer service. Their track record of handling claims efficiently and providing support to customers in need adds to their credibility. Their Choice plan offers primary coverage, meaning they will pay all claims as if they are the primary insurer, so your claims will be processed faster. – Joe Cronin , advisory board member

- Hurricane and weather coverage has a 48-hour delay, compared to some competitors that require only 12-hour delays.

- Average cost ($527) is only so-so compared to other top-rated policies we evaluated.

Here’s a look at whether top coverage types are included in the Trip Protection Choice policy.

- Accidental death and dismemberment coverage of $40,000 per person for qualifying common carrier events

- Change fee compensation of $300 per person if you have to change your flight or original travel arrangements due to qualifying events.

- Pet kennel benefits of $500 if your return home is delayed by six hours or more due to qualifying missed connection, interruption or delay problems.

- Frequent traveler coverage of $500 to pay for the cost to redeposit awards due to a trip cancellation caused by a reason listed in your policy.

- “Cancel for any reason” coverage.

- “Interruption for any reason” coverage.

- Rental car damage coverage of $35,000.

- Sports & golf equipment rental coverage up to $5,000.

- Event ticket fee registration coverage of $15,000 if you can’t attend an event due to unforeseen reasons listed in trip cancellation and interruption coverage.

BEST FOR BAGGAGE

Axa assistance usa.

Platinum Plan

$250,000/$1 million

AXA’s Platinum plan is among our favorites because it hits all the high points for coverage that you’ll want if you’re looking for top-notch protection, including excellent baggage benefits of $3,000 per person. Excellent medical and non-medical evacuation benefits are another reason we like the Platinum plan.

- Generous medical and evacuation limits, plus $100,000 per person in non-medical evacuation—among the highest for plans we analyzed.

- Coverage for lost ski days, lost golf rounds and sports equipment rental.

More: AXA Assistance USA Travel Insurance Review

AXA Assistance USA impresses with its strong global reach and access to an extensive network of medical providers. This is particularly valuable in travel insurance, where emergencies can occur in any part of the world. Their attention to detail in crafting policies that include benefits for trip cancellations and interruptions adds a layer of security that reaffirms their strengths in protecting travelers against a wide array of potential issues. – John Crist, founder of Prestizia Insurance

- Travel delay and baggage coverage kicks in only after a 12-hour delay.

- The average cost for the Platinum plan is only so-so compared to other top-rated plans, although you do get robust coverage for the money.

Here’s a look at whether top coverage types are included in the Platinum policy.

- “Cancel for any reason” coverage

- Rental car damage coverage of $50,000.

- Lost ski days

- Lost golf rounds

GREAT FOR PRE-EXISTING MEDICAL CONDITION COVERAGE

Generali global assistance.

Generali’s Premium policy stood out in our analysis for its generous window for pre-existing condition coverage. Travelers with pre-existing conditions can get coverage as long as you buy a Premium policy up to or within 24 hours of your final trip deposit. Competitors often have a deadline of 10 to 20 days after making your first trip deposit .

We also like the policy’s excellent trip interruption insurance and superior medical evacuation benefits of $1 million per person.

- Excellent trip interruption coverage of up to 175% of your trip costs.

- Very good baggage loss coverage at $2,000 per person.

More: Generali Global Assistance Travel Insurance Review

Generali Global Assistance excels in providing user-friendly services and efficient claims processing, which enhances customer experience significantly. Their policies are particularly valuable due to the inclusion of concierge services, which can be a lifesaver during unforeseen travel disruptions. – Pradeep Guragain, co-founder of Magical Nepal

- If you want “cancel for any reason” coverage you must buy it within 24 hours of making your initial trip deposit, compared to 10 to 20 days from top competitors.

- This plan’s “cancel for any reason” coverage will reimburse you for only 60% of lost trip costs; most competitors provide 75%.

- Baggage delay benefits kick in only after a 12-hour delay.

Here’s a look at whether top coverage types are included in the Premium policy.

- Rental car coverage for theft and damage of $25,000.

- Sporting equipment coverage of $2,000.

- Sporting equipment delay coverage of $500.

- “Cancel for any reason” upgrade that reimburses you 60% of your insured trip cost if you cancel at least 48 hours prior to your scheduled departure.

BEST FOR FAMILIES

Travelex insurance services.

Travel Select

$50,000/$500,000

We recommend Travelex’s Travel Select plan for families because it provides coverage for children at no extra cost (when accompanied by an adult covered by the policy). Its average price is also among the lowest among the companies we evaluated, making it an option to take a look at

- Very good travel delay coverage of $2,000 per person after a 5-hour delay.

More: Travelex Travel Insurance Review

Travelex is a go-to for many of our clients due to its straightforward coverage options and ease of use. The company excels in offering plans that are simple to understand, which is great for first-time buyers of travel insurance. However, their basic plans might lack the depth of coverage seen with more premium offerings. – Jim Campbell, independent travel agent and founder of Honeymoons.com

- Medical coverage of $50,000 per person is on the low side, but you can buy an upgrade to double it.

- Baggage delay coverage requires a 12-hour delay and has a low $200 per person limit.

- Missed connection benefits of $750 per person are lower than many other competitors.

Here’s a look at whether top coverage types are included in the Travel Select policy.

- Sporting and golf equipment delay benefits of $200 after 24 hours or more.

Optional add-ons & upgrades offered:

- Medical coverage upgrade to $100,000 per person.

- Medical evacuation upgrade to $1 million per person.

- “Cancel for any reason” coverage of 75% (up to max of $7,500).

- Accidental death and dismemberment coverage of $200,000 per person for flights.

- Financial default coverage if your travel supplier goes out of business that provides 100% reimbursement of your insured trip cost.

- Car rental collision coverage of $35,000.

- Adventure sports upgrade to cover activities that would otherwise be excluded.

BEST FOR TRIP INTERRUPTION

Hth worldwide.

TripProtector Preferred Plan

We were impressed by TripProtector Preferred’s superior trip interruption benefits—200% of the trip cost. Most competitors provide 150%. Luxury-level benefits are another reason we recommend the TripProtector Preferred plan.

- Top-notch coverage limits for medical expenses and evacuation.

- Coverage for adventure sports—such as zip-lining, snowmobiling, whitewater rafting, and more—are included.

- Very good travel delay coverage of $2,000 per person after a 6-hour delay.

More: HTH Worldwide Travel Insurance Review

My experience with HTH Worldwide Travel Insurance has been positive. While their policies may come at a slightly higher cost, the peace of mind and level of coverage they offer make it worth considering for travelers seeking comprehensive protection. HTH Worldwide stands out for its extensive coverage of medical emergencies, which is essential for international travel. Their policies are flexible, allowing travelers to customize coverage based on their specific requirements, and their worldwide assistance services ensure travelers have access to support wherever they are in the world. – Kevin Mercier, travel expert and founder of Kevmrc.com

- Higher average price ($602) compared to most companies we evaluated, but you’re buying robust benefits.

- Baggage delay coverage requires a 12-hour delay.

Here’s a look at whether top coverage types are included in the TripProtector Preferred policy.

- Pet medical expense coverage of $250 if your dog or cat traveling with you gets injured or sick during your trip.

- Rental car coverage of $35,000 for damage and theft.

- “Cancel for any reason” upgrade available that provides 75% reimbursement of trip costs if you cancel at least two days prior to your scheduled departure.

GREAT FOR CRUISE ITINERARY CHANGE/INCONVENIENCE

Cruise Choice

$100,000/$500,000

The Cruise Choice plan gets our attention for its compensation if you miss activities because your cruise ship changes its itinerary and for the inconvenience of delays to the next port of call. The Cruise Choice plan’s competitive price is another reason we recommend taking a look.

- Includes ”interruption for any reason” coverage of $500 if you buy policy within 14 days of trip deposit.

- Includes $25,000 per person in non-medical evacuation benefits.

- Provides benefits if your cruise ship has a fire or mechanical breakdown that delays arrival at the next port of call for two or more hours.

Nationwide stands out primarily for its versatility in coverage options catering to diverse travel needs—a vital advantage often overlooked by travelers until they face a mishap. They have built a robust system for handling claims efficiently, which I find crucial for travel insurance, where timely support can dramatically impact the customer experience. – John Crist, founder of Prestizia Insurance

- Medical coverage of $100,000 per person is lower than most other top-rated plans but might be sufficient for your needs.

- 24-hour delay required for hurricane and weather coverage, compared to many competitors with shorter required times.

- “Cancel for any reason” coverage not available.

Here’s a look at whether top coverage types are included in the Cruise Choice policy.

- Shipboard service disruption of $200 per person if your cruise ship has a fire or mechanical breakdown that delays the next port of call for 2 or more hours or changes the scheduled itinerary.

- Coverage for an extended school year, terrorism in an itinerary city and work-related emergency issues.

These policies offer the highest level of medical coverage among the plans that we judged to be the best.

These policies offer the highest level of emergency medical coverage among the plans in our top picks.

These policies offer the highest maximum coverage limits for travel delays among the plans that we judged to be the best.

Nationwide’s Cruise Luxury policy offers the highest maximum coverage for delayed baggage among the plans that were our top picks.

Comprehensive travel insurance policies package together a number of valuable benefits. You can also buy policies that cover only trip cancellation or only medical expenses. With the wide variety of travel insurance plans available, you can find coverage levels that will fit your budget and trip needs.

Problems not covered by travel insurance tend to be similar among policies. We recommend that you read a policy’s exclusions so you’re not caught by surprise later if you try to make a claim. Typical exclusions include:

- Injuries from high-risk activities such as scuba diving.

- Problems that happen because you were drunk or using drugs.

- Medical tourism such as going abroad for a face lift or other elective procedure.

- Lost or stolen cash.

The average cost of travel insurance is 6% of your trip cost , based on our analysis. The cost of travel insurance is usually mainly based on the age of travelers and the trip cost being insured.

Unlike many other types of insurance, there are usually only a few factors that go into travel insurance pricing.

You can buy travel insurance from a travel agent, website or a travel supplier like an airline or cruise company. We’ve bought travel insurance online and it’s relatively easy. In our experience you can purchase a policy online within a few minutes.