6.04% APY: Personal Premier Money Market Open Now!

- Open a Personal Checking Account Online

- Open a Personal Premier Money Market

- Open a Personal Savings Account Online

- Open a CD Account Online

- Apply for Credit Card

- Apply for Mortgage Loans

- Business Premier Money Market Account

- Personal Premier Money Market Account

- Learn More about Rewards

- CDARS and ICS

- FDIC-EDIE The Estimator

- Financial Calculators

- Reorder Checks

- Lending Team

- Personal Loans

- Mortgage Loans

- Business Loans

- Small Business Administration (SBA) Loans

- Farm Service Agency (FSA) Loans

- Agricultural Loans

- Loan Calculators

- About First Service Bank

- #firstservicestrong Blog

- First Service Travelers

- Superior Service Award Nomination

- American Flag Procedures & Etiquette

- #firstservicestrong

- ORWB 2024 Gala with First Service Bank as Presenting Sponsor

501-679-8000 Toll Free 1-800-669-2517

- Find additional ATMs in our Nationwide Network

- Mobile Banking App:

‘Wonderful’ trips planned in 2024

Monday, november 27, 2023.

With 2023 chocked full of fun trips to interesting places, the First Service Bank Travel Club has announced another “wonderful’ slate of excursions scheduled in 2024.

The exciting destinations range from Hawaii and the Wild West to Charleston and the Biltmore Estate at Christmas, according to First Service banker Ina Standridge, who has served as the director of the travel club since 2018.

“The trips in 2023 have been wonderful,” said Ina, noting that the scenery particularly in the Canadian Rockies – was breath-taking. “I’ve never seen anything more beautiful.” She added that the travelers were also humbled on the “great” Washington, D.C., trip which included time spent at Arlington National Cemetery.

“I think the trips planned in 2024 are going to be wonderful, too,” she said.

In addition to the travel club’s multi-day trips, one-day excursions will be announced soon.

Ina said travel club members don’t have to worry about the planning or logistics associated with a trip. “You don’t have to worry about where to stay, where to eat, where to park or transportation, which you would if you were on your own,” she said. “They just sit back and relax while forming new, lifetime friendships with others on the trip. I find it a great privilege to be the one taking care of them.”

There is a lot of interest in next year’s trips and spots are filling up. To learn more about these exciting trips and to make a reservation, contact Ina Standridge at 501-514-2340.

“They are filling up fast. If anyone is interested in going, they should call me as quickly as possible.”

Charleston, SC.

The Travel Club will kick off its 2024 trips with Charleston, SC, planned April 21-27.

The trip features motorcoach transportation with six nights lodging, including four consecutive nights in the Charleston area. The package also includes ten meals, six breakfasts and four dinners.

Travelers will enjoy a guided tour of the city, visit the historic Charleston City Market and take part in a relaxing harbor cruise. There will also be a visit to the famous and historic Middleton Place and a tour of a historic Charleston home. A guided tour of a historic Charleston plantation is also planned.

The price is $1,050 per person, double occupancy.

Pioneer Woman/U.S. Marshals Museum

Travel club members will enjoy a two-day trip titled "Journey to Pioneer Woman and United States Marshals Museum" June 3-4.

Ree Drummond, also known as The Pioneer Woman, is an American blogger, author, food writer and television personality. She stars in her own television program, also titled “The Pioneer Woman,” on The Food Network which began in 2011. In 2015, Drummond launched a "homey lifestyle" product line of cookware, cutlery, appliances, clothing and outdoor living items. She lives at the Drummond Ranch in Pawhuska, OK.

“Join us and embark on an unforgettable journey through America's heartland with our exclusive two-day tour,” said Ina. “This immersive experience promises to captivate your senses and take you on a remarkable adventure filled with history, scenic beauty and delectable cuisine.”

Trip highlights include motorcoach transportation and entrance to the U.S. Marshal Museum in Fort Smith. Travelers will enjoy a scenic drive to Pawhuska, OK., where they will explore the downtown for unique shopping opportunities.

Club members will embark on the Roaming the Osage Tour of Pawhuska, which includes Osage Hills, Tallgrass Prairie, the Drummond Ranch, and more,” said Ina. “We will discover the natural beauty and history of the area.”

The price is $550 per person, double occupancy, and includes a one-night stay in Downtown Tulsa. Two meals are included – a delectable brunch experience is planned at The Pioneer Woman Mercantile and a heartwarming homestyle dinner at Calico County in Fort Smith.

Yellowstone and the Wild West

The First Service Bank Travel Club will venture to the Wild West – which includes Yellowstone National Park – on a trip planned July 12-18.

“Step into the heart of the American Wild West in this enthralling seven-day tour that offers a mix of natural splendors, rich history and thrilling adventures,” said. Ina. “From the mesmerizing geothermal wonders of Yellowstone National Park to the rustic charm of Jackson, WY., this journey will immerse you in the diverse beauty and culture of the American West.”

The journey begins in Salt Lake City, the historic “City of Saints,” where travelers will enjoy a delectable welcome dinner and explore the city’s key highlights before heading north to settle in the quaint town of West Yellowstone.

Trip participants will dive deep into the wild terrains of Yellowstone and Grand Teton national parks, and experience the iconic Old Faithful Geyser. They will enjoy a Yellowstone Wildlife Safari and learn about the region's fauna at the Grizzly & Wolf Discovery Center. Club members will drift along the tranquil waters of the Snake River and soak in the beauty of the Tetons.

The trip includes a stop at Park City, where travelers will relive the 2002 Winter Olympics and stroll down the city’s historic streets.

The price is $3,875 per person, double occupancy, which includes airfare, three-star accommodations, meals and expert-guided tours.

“Join us in this unforgettable expedition and discover the American Wild West's untamed beauty and vibrant history,” Ina said.

First Service travelers will embrace the “Aloha” spirit on a leisure tour of three Hawaiian Islands October 6-15. Club members will enjoy three nights each in Oahu, the Big Island (Kona) and Maui.

Trip highlights include a visit to the USS Arizona Memorial on Oahu and Hawaii Volcanoes National Park on the Big Island along with a tour of a coffee farm in Kona to learn about the coffee bean’s journey from tree to cup.

“Our club members will uncover the beauty, culture and traditions of all three islands on this fabulous trip,” said Ina Standridge.

The 10-day trip includes 13 meals, nine breakfasts and four dinners. The price - $5,999 per person double occupancy - includes roundtrip airfare from the Little Rock airport, inter-flights from Honolulu International Airport, air taxes and fees/surcharges and hotel transfers.

Biltmore Estate/North Carolina

The First Service Bank Travelers Club will head east to North Carolina on a trip planned November 3-8.

“Join our Travelers Club and embark on a captivating journey to experience the magic of Christmas at the Biltmore Estate and the picturesque city of Asheville, NC,” said Ina. “Immerse yourself in the allure of the city and the splendor of the Biltmore Estate Mansion on our exclusive Asheville tour!”

During the motorcoach excursion to Asheville, the group will explore the opulent Biltmore Estate, renowned as America's largest privately owned residence. This vacation package also grants access to Biltmore's brand-new Antler Village, a delightful destination for shopping, dining, historical exhibitions and much more.

Additionally, the club will enjoy a guided tour of Asheville, celebrated for its Art Deco architecture, and behold the grandeur of the St. Lawrence Basilica, a cherished historic gem on the National Register of Historic Places. There will also be a guided drive along the Blue Ridge Parkway and visits to the famous Folk Art Center and Blue Ridge Parkway Visitor Center.

The cost is $915 per person, double occupancy, and includes five nights of lodging, including three consecutive nights in the Asheville area. Eight meals are included as well as a guided tour of Asheville and a full-day visit to the Biltmore.

News Categories

- Community Strong

- community Strong

- Customer Experience

- Customer Solutions

- Kids Corner

- Marketing News

- Press Releases

- Travel Tips

- Travelers Club

- Travelers Club Destinations

- Travelers Club Newsletter

Online Banking

Having Problems? Let Us Help

Bank from Anywhere

Personal Checking, Rewards Checking, Personal Savings and more...

Open your account today!

Real Banking. Real People.

7 am— 9 pm, 501-679-8000, toll free 1‐800‐669‐2517, if you have experienced a remarkable customer service experience, please tell us about it, how can we help you today, join our team at first service bank.

Copyright ©2024 First Service Bank. All Rights Reserved.

- Consumer Loans

- Agricultural Loans

- Commercial Loans

- Real Estate Loans

- Home Equity Line of Credit

- Partnership Student Loan

- FHLB HOMESTART PROGRAM

- Checking Accounts

- Savings Accounts

- Additional Services

- Mobile Banking

- All Aboard Kids Club

Welcome Aboard Travel Club

- Debit Cards

- ID TheftSmart

- Ways to Bank

- Credit Card Application

- President's Message

- History & Philosophy

- Meet Our Staff

- Locations & Hours

- Employment Application

- Insurance Services

- Community Links

- Calculators

- Protect Yourself

- Legislative Advocacy

- Student Loans

We "bank" on having a good time!

Each year, the Welcome Aboard Club takes fun trips around Iowa, the Midwest and even overseas! The ability to travel with the club at great prices is a benefit for our valued bank customers. Traveling as a group can be economical, relaxing and the fun way to go! Check back often to see what we're cooking up next!

Upcoming Trips

In the fall of 1999, the Bank Board approached me about organizing a travel club. Guess they knew that I had a love for travel and of course I said yes! Since that day 22 years ago, we ‘ve been to Europe, Asia, Australia, and Africa, some several times, not to mention many of the United States and local day trips. The best part is that you don't have to travel alone, we’ve made so many new friends, great memories, and travel is so exciting and educational.

Information About Past Trips:

2021 Croatia Trip

2020 Egypt Trip

2019 Greece Trip

For more information on the Welcome Aboard Club or any of our upcoming trips, please contact:

Renae Lane at 515-351-2096 or through the bank if you need reservations or have any questions regarding any of our trips.

Contact Renae Lane

E-mail is not on a secure server and confidential information such as account numbers, balances and personal identification should not be included in an e-mail.

Toll Free: 800.871.8171

Gowrie Office Charter Office

1015 Market Street, PO Box 189 Gowrie, IA 50543

Phone: 515.352.3333 Fax: 515.352.3224

The email link above is not a secure form of communication. Please do not include personal information, such as your social security number or any account numbers.

COMMUNITY LINKS

+ Lehigh Valley Cooperative Telephone Association

+ Webster-Calhoun Cooperative Telephone Association

+ Stratford Mutual Telephone Company

+ Gowrie Development Commission

+ Southeast Valley Schools

544-3307 (local) or 800-957-7447

LOCATIONS & HOURS

- Commercial Lending

- Community Banking

- Compliance and Risk

- Cybersecurity

- Human Resources

- Mutual Funds

- Retail and Marketing

- Tax and Accounting

- Wealth Management

- Magazine Archive

- Newsletter Archive

- Sponsored Archive

- Podcast Archive

Travel Clubs Take the Customer Journey Literally

As winter drags on, you may find your mind wandering from financial topics to thoughts of warm climates, gorgeous scenery, fascinating cultures—or just relaxing while someone takes you on a tour of a place you’ve never seen before. Chances are, your customers feel the same way. If only there were some way to piggyback your bank’s messaging onto the human urge to explore the world.

Of course, banks have been doing just that for decades in the form of “travel club” programs.

Generally speaking, bank travel clubs are affinity programs aimed at engaging wealthier (often retirement-age) customers. The concept has been around so long, in fact, that some industry watchers have declared it moribund. By all accounts, maintaining a travel club is a lot of work. And in the wake of evolving bank marketing strategies and abundant M&A activity, many programs have disappeared. The editors at Leisure Group Travel magazine, however, argue that the jury is still out on the future of bank travel clubs. Even as many banks have shuttered their travel clubs, others gather steam—and some banks are looking into what it takes to start a program.

A recent discussion among bank marketers—some who are new to the space and others who’ve been at it for years—uncovered the central concerns and the biggest opportunities in bank travel clubs.

Why travel? Why now?

As banks rethink their strategy, brand and methods of customer engagement, they have to ask themselves: Is it not enough to be a great bank? Why get involved in an extraneous activity like travel?

These are big questions with many possible answers. It’s worth noting that like banking, the travel industry has gone through radical changes in recent years. Gone are the days of the neighborhood travel agent who took responsibility for designing, managing and following through on customers’ vacation plans. Making travel arrangements has become an overwhelmingly digital, self-service chore. Consumers looking for the social, logistical and safety benefits of group travel may have to rely on faceless tour operators found online—an option that comes with its own set of risks .

Meanwhile, banks seek out sticky relationships with consumers who have disposable income and a well-defined set of financial needs—along with the opportunity to engage these customers in a more relaxed context.

Travel clubs may serve both sets of needs.

Jeff MacDonald, VP at Chicago-based Marquette Bank , reports that Marquette positions its travel offering as part of “an exclusive banking club with travel, social and financial seminar events.” Educational opportunities cover topics like investments, estate planning, ID theft, senior driving, Medicare and how to use the bank’s technology. To participate, members must be 55 or older and maintain a minimum balance in the bank’s premier checking account. How is that working out for the bank? “We have almost 10,000 members,” MacDonald says, with about 300-500 of them actively taking part in the travel opportunities.

Most banks are also looking for ways to differentiate. MacDonald notes that Marquette has one of the last remaining travel clubs in an area where every bank once had a club. “We still accept club refugees from other banks who are exiting this space,” he says.

Beth Weldon, VP at First Financial Bank in El Dorado, Ark., reports a similar effect at her bank. “No other bank in our county offers group travel opportunities,” she says. With more than 20 years of practice, the First Financial travel club has topped 1500 members. “Since we require an account with us to participate, we gain some deposits from those whose primary banking relationship is elsewhere but want the benefit of group travel options.”

Attracting a new generation of travelers…if that’s what you really want.

Just because the trips are offered by a bank doesn’t mean they have to be stodgy. Several banks reported offering winery tours, and international trips have taken club members on far-flung adventures to places like the Mediterranean, New Zealand and Australia. The travel club at Texas-based Prosperity Bank has an upcoming trip to Cuba, and anyone over the age of 21 can join Missouri-based Bank of Sullivan on its trip to Iceland.

Still, many clubs restrict membership to older people—aged 50 or 55 and up. Weldon points out that retirees comprise the demographic most likely to take advantage of group travel. “Most 50-60 year olds are still able to travel on their own,” she says, “although some do participate in the group trips.” If your bank’s objective is to provide a loyalty program for customers who are more affluent and mature, the age minimum makes sense.

No matter what age you’re targeting, the club name should have the word “travel” in it for SEO purposes—as should any club-dedicated pages on the bank’s website. That way, when people in your area are looking for travel clubs, they can find you.

Is the club a product or a marketing tool?

While some marketers said that their travel clubs have generated some income, more reported that break-even was the goal, and occasional losses were not out of the question. So why do it at all?

Weldon says that the travel club has attracted new accounts to her bank. But she’s quick to add that “the indirect benefit is increased customer loyalty and satisfaction from a demographic that historically has the highest balances on our books.” A club can also serve as incentive for customers to maintain minimum balances or upgrade to a premier account, as it does at Marquette Bank. Participation can also generate valuable data points for targeted marketing efforts. And then of course, there’s the halo-effect that the club casts over the bank: pleasant experiences lead to positive impressions of the bank.

Changing the conversation.

Travel makes for compelling content for newsletters, blogs and social posts. And sharing memorable experiences is a great starting point for building a sense of community. “From a marketing perspective,” MacDonald says, his travel club “does reinforce our neighborhood-bank positioning and gives us something different to talk about.”

It’s important, however, not to forget about the potential for personal interaction with customers. Because banks typically partner with travel agencies to run the trips, bank employees don’t necessary have to accompany the group on its journey. From a time- and cost-management perspective, outsourcing the travel duties to non-bank employees might make the most sense for some banks.

However, banks that have sent employees on club travel can point to the benefits of bank representation. Christy Goza, SVP at Tennessee-based Bank of Cleveland , took numerous trips with her bank’s club before it was phased out. And she occasionally found herself taking club members to the hospital, making emergency trips to the pharmacy and mollifying friction among travelers. “We established a lot of goodwill over the years,” she says.

Lorenda Smith, VP at First National Bank of Decatur County in Georgia, agrees that the employee representing the bank during club travel is key. For her, it comes down to trust. “Many people that would never think of walking in your bank,” she says, “will travel with people they know and trust.”

Kate Young is the senior editor of ABABankMarketing.com . Email: [email protected].

A benefit to individual membership in the ABA Bank Marketing Network is the ability to converse through the ABA Bank Marketing Network Groupsite–a members-only discussion group. The thoughts expressed in this article reflect the collective wisdom of Groupsite responses to the question, “Does your bank have a Travel Club?” Join in the discussion today.

Related Posts

Marketing Money Podcast: Navigating the value of loyalty programs

From hotel upgrades to cashback bonuses, dissecting the nuances of rewards systems.

Benefiting from advisory boards

Start by sizing up what they are. And are not.

Is it time to kill the paper check?

Checks aren’t dying on their own. Meanwhile check fraud is up exponentially while bankers await a killer app for payments.

Climate risk: Threading the needle

The value of focusing on preemptive strategies

ABA supports FTC proposal to combat impersonation of banks

ABA and four financial and healthcare trade associations expressed support for the FTC’s proposal to make it unlawful to provide...

Unlocking the potential of marketing automation

Email, analytics, social media, lead generation and customer personalization among leading uses.

Podcast: Maximizing business, client value from SBA loan programs

Crafting board committees to drive optimal risk governance, sponsored content.

Sealing The Deal: Learn About Electronic Notarization in This Comprehensive Webinar Series

Digital Account Opening Best Practices That Will Boost Your Deposit Game

Why It May Be Time for Your Bank to Expand into Dealer Commercial Lending

Legal notice, podcast: is it time to kill the paper check, podcast: how a georgia community bank engaged employees at 3x the national rate, podcast: tackling big goals for financial literacy month, podcast: the ceo view from main street, podcast: the points guy on why credit card rewards matter.

American Bankers Association 1333 New Hampshire Ave NW Washington, DC 20036 1-800-BANKERS (800-226-5377) www.aba.com About ABA Privacy Policy Contact ABA

© 2024 American Bankers Association. All rights reserved.

- Privacy Policy

- Disclosures

- Do Not Sell My Information

Guide on How To Use United’s TravelBank

by The Frugal Tourist | Jan 6, 2024 | American Express , Travel , United | 22 comments

ADVERTISER DISCLOSURE: The Frugal Tourist is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as MileValue.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Additionally, the content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired. All information about the Hilton Honors American Express Aspire Card has been collected independently by The Frugal Tourist. The card details on this page have not been reviewed or provided by the card issuer.

In this blog post, I will walk you through the steps on how to fund and use United’s TravelBank.

Since some credit cards provide travel credits that expire within a year, depositing money in United’s TravelBank is a viable option to utilize those credits so they won’t go to waste.

Funds diverted into United’s TravelBank have a 5-year lifespan, offering some level of longevity and a lot of flexibility, especially since travel is not expected to pick up again anytime soon.

Whether you have plans this year or in the near future, funding your United TravelBank with free cash from your credit cards is a wallet-friendly strategy that can potentially save you a few hundred dollars when the time comes that you need to book your next flight.

United TravelBank

According to United, your TravelBank funds can either be used alone or in combination with select forms of payment only when booking United or United Express flights .

Therefore, we are unable to use United TravelBank to purchase flight itineraries that include segments on partner airlines such as Air Canada, Lufthansa, etc.

I was also unsuccessful in tapping my TravelBank reserves to pay for taxes when booking an award ticket or paying additional fees to cover the airfare difference when redeeming a voucher or rebooking a travel credit.

However, I did not encounter any roadblocks when I booked paid United tickets, even if the airfare was Basic Economy .

Terms and Conditions

The information below was taken from United.com

- Passengers can select from six purchase amount options, and once purchased, the value remains valid for five years from the date it is deposited in your TravelBank account.

- Purchases are not refundable and are limited to $5,000 per day per MileagePlus account.

- This purchase is also subject to all of the TravelBank terms and conditions .

- United has the right to terminate this promotion or to change the promotion’s terms and conditions, rules, regulations, policies and procedures, benefits, and/or conditions of participation, in whole or in part, at any time, with or without notice.

Guide on How to Fund United’s TravelBank

Access United TravelBank by clicking the button below. You will need to log in to your United Mileage Plus Account to purchase.

Do not have a United membership yet?

It is free and easy to register. Click the button below to enroll in United’s Mileage Plus Program.

After logging in, you will see your United Mileage Account, any United miles you have available for redemption, and your TravelBank Cash Balance.

Plus Points – a points system that passengers can utilize to upgrade their flights – will also show up, but we will not go over that in this post. You can read more about this program here.

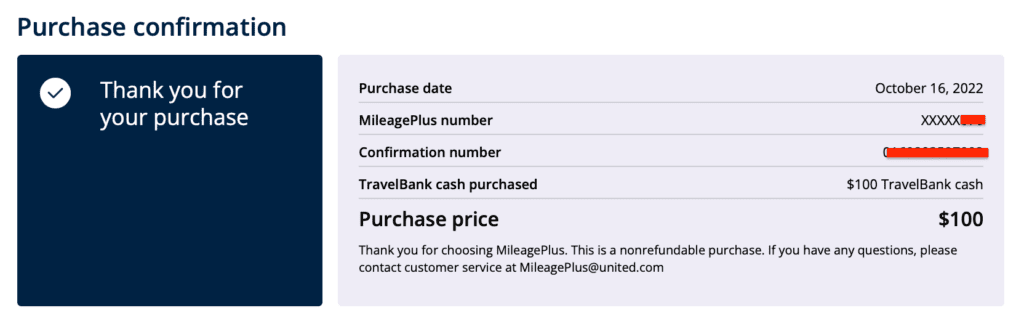

Select the amount of travel cash you want to purchase.

As previously stated, there are six possible amounts that you can elect to deposit to your TravelBank.

The next page will ask for you to type in your Payment Information.

In this case, you would want to use a credit card that provides an Airline Credit.

I will list these credit cards in one of the sections below.

You will then get confirmation that your purchase was successful. A receipt will be emailed immediately after as well.

In this example, I used my The Business Platinum Card® from American Express to buy $100 worth of travel cash in United’s TravelBank.

Guide on How to Use Your United Travel Bank Cash

Thankfully, we are generously given five years to spend our travel cash.

Once you are ready to book your flight, log back on to your United.com profile and enter your travel details.

United TravelBank purchased using certain IHG Credit Cards has a shorter lifespan. Please check the terms of your IHG Credit Cards for the most current UnitedTravel Bank policy.

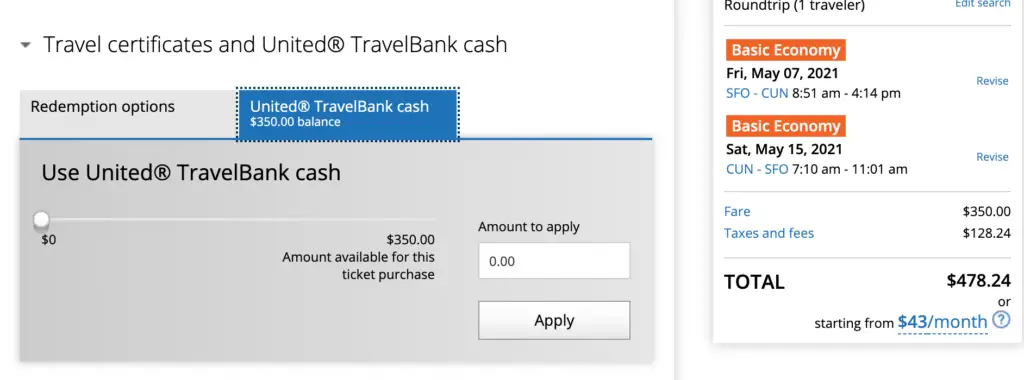

Select your particular flight, verify your personal information, and pick your seat.

Afterward, you will be directed to the Payment Page.

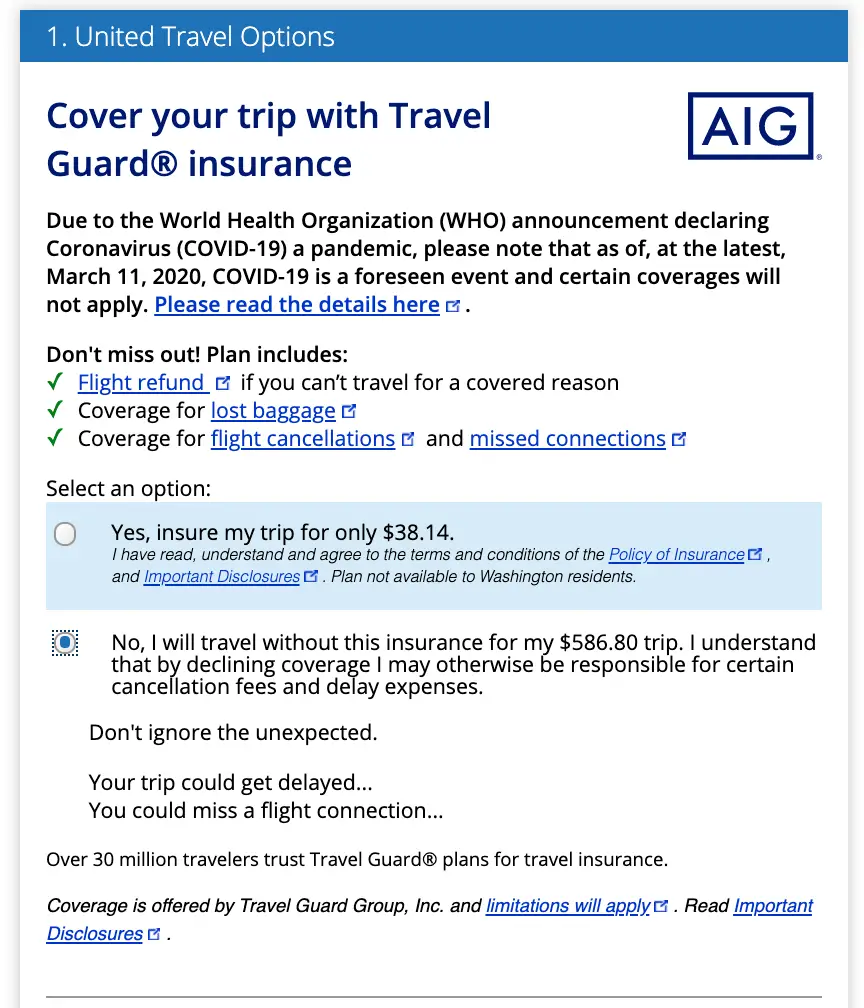

Next, United will offer you travel insurance (select yes/no), priority boarding, and miles for purchase.

Regardless of whether you decide or decline to purchase these additional bells and whistles, the payment section comes right after.

You have the following payment options:

- Pay In Full

- Pay Monthly

- Travel Certificates and United TravelBank Cash (if this option does not appear, then the ticket you’re buying is not a permitted purchase using travel cash.)

- Other Forms of Payments (PayPal, etc)

- Debit / Credit Card

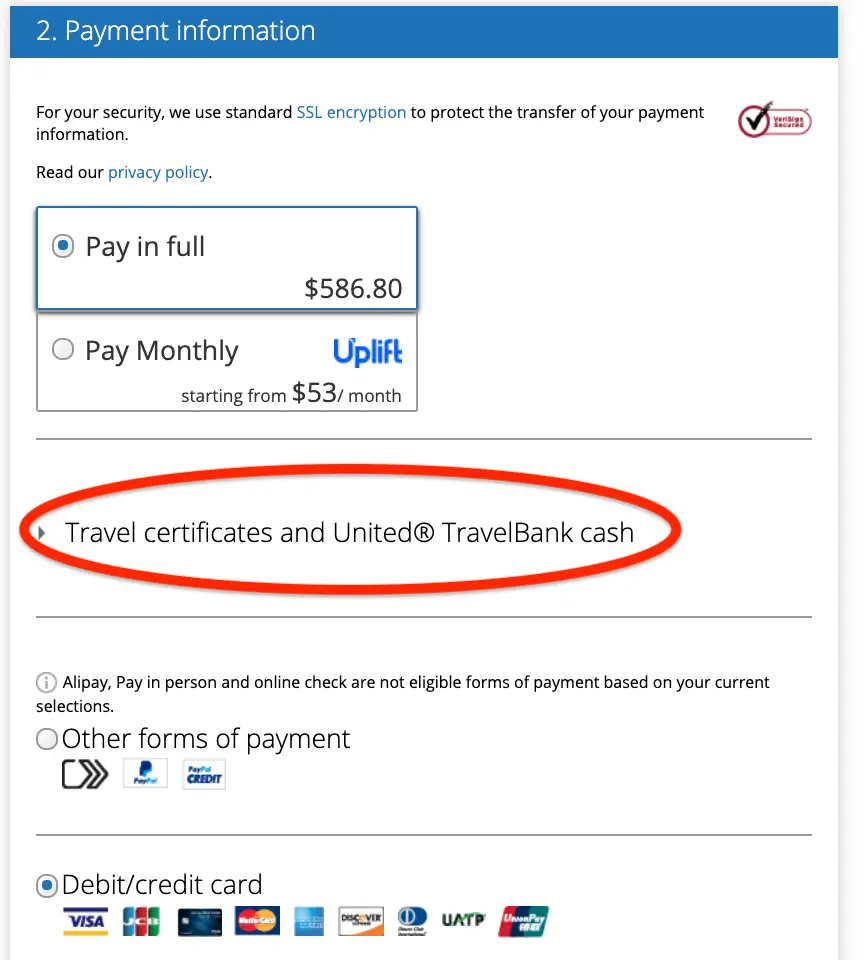

Select “Travel Certificates and United TravelBank Cash.”

As you can see, my $100 travel bank deposit is already reflected in my account.

Next, enter the amount you want to use for the flight you wish to book.

It is not necessary to spend your entire stash of United travel cash if you have other plans to spend it later.

Once you have a final amount in mind, click apply.

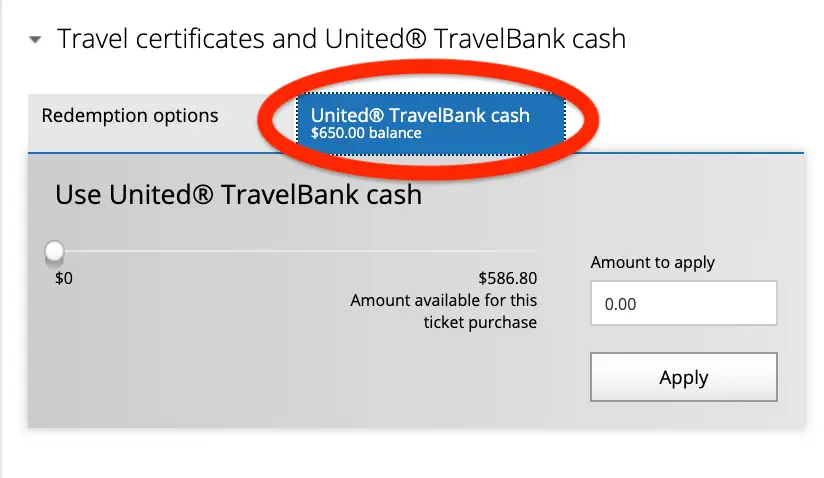

In this example, I decided to spend $75 of the $100 currently in my United TravelBank.

After your travel cash is deducted, the total amount you still owe will automatically be calculated.

Continue with your purchase by selecting the mode of payment you want to use for the remaining balance.

I highly recommend paying a portion of the flight with a credit card that offers travel protections, such as the Chase Sapphire Preferred® Card or the Chase Sapphire Reserve®.

Alternatively, you can purchase travel insurance to cover your entire trip.

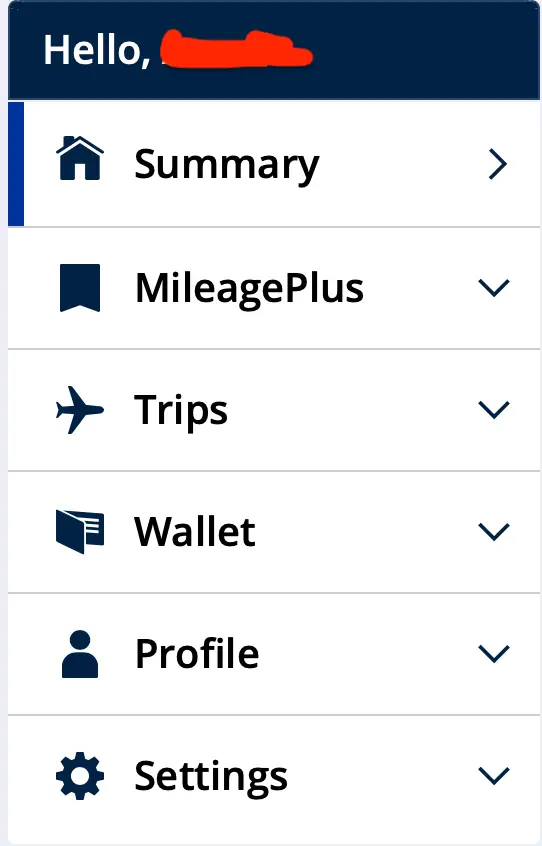

Where Do I Find My TravelBank Account?

United has recently updated its website. You can find your United TravelBank account information and balance by navigating to your United Wallet on the app and the computer.

Troubleshooting Potential Issues

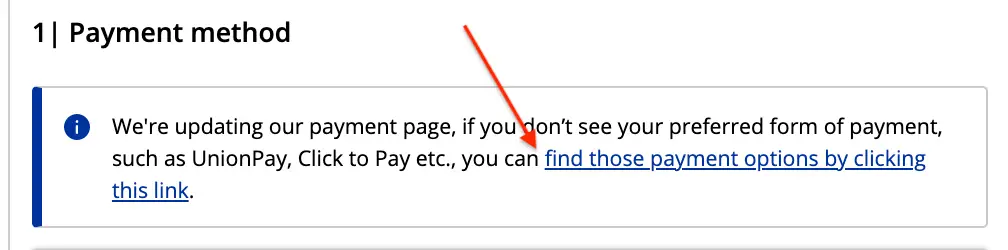

Issue 1: united travelbank does not show up.

A few readers have expressed that they are having difficulty locating the TravelBank option on United’s website.

It appears that United’s site is currently updating its payment page. When you see the notice below under “Payment Method, ” click the “find those payment options…” link.

This link will direct you to the “United Travel Options” section, where you can add travel insurance to your purchase. Make your selection.

Afterward, you will be directed to “Payment Information,” where the TravelBank option appears.

Click “Travel Certificates and United TravelBank Cash” and select Travel Cash as your mode of payment.

Type the amount you would like to spend.

As suggested, charge a small portion of your airfare on a credit card that provides travel insurance, like the Chase Sapphire Preferred® Card or the Chase Sapphire Reserve®.

You may also elect to purchase travel insurance for additional coverage.

Issue 2: United TravelBank Keeps On Freezing

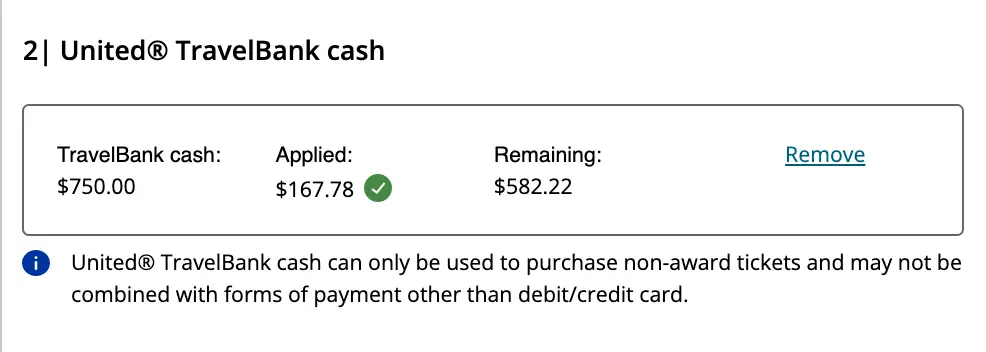

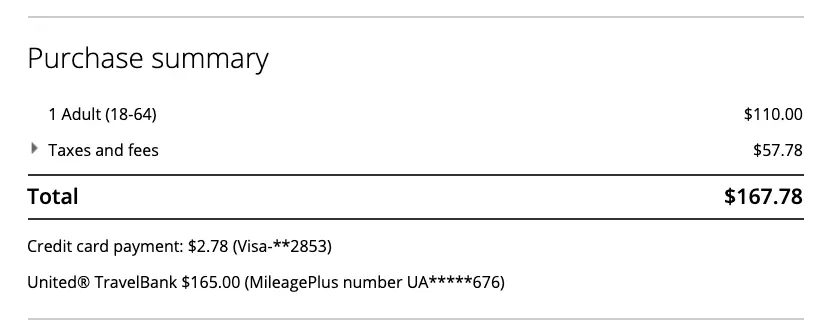

While booking a plane ticket to Cabo costing $167.78 recently, I found the United website struggling to process my TravelBank payment, ultimately freezing the payment page.

After attempting various troubleshooting strategies, I eventually made it work by typing a whole number into the TravelBank box.

In this case, I redeemed $165 of my TravelBank credits towards the purchase of this ticket and used a credit card that gives travel protections ( Chase Sapphire Reserve® ) to cover the remaining amount ($2.78).

Issue 3: TravelBank is Unable to Add a New Credit Card (Payment Error)

United.com can only save a certain number of credit cards on your profile.

If the website is not allowing you to add another credit card to your United TravelBank account, you will need to log in to your main United.com account, go to “Wallet,” remove the credit cards that you no longer use, and then add the ones you would like saved.

Once your new credit card is linked, note the last four digits of your card and its expiration date so you can easily find it on your list of saved cards when you try to purchase United TravelBank funds again.

Issue 4: Unable to Purchase

As mentioned above, your United TravelBank funds can either be used alone or in combination with select forms of payment when booking United or United Express flights only.

When Do United TravelBank Funds Expire?

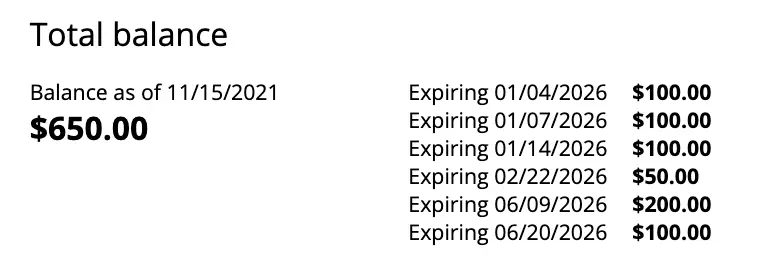

As of this update, TravelBank funds appear to expire after five years.

The screenshot below, captured from my TravelBank account, supports this assertion.

While the money deposited in our United TravelBank accounts has a 5-year validity, it can be forfeited if no activity is recorded in our TravelBank accounts for 18 consecutive months.

Therefore, ensure that you either add money to your TravelBank or use your TravelBank funds to purchase tickets at least once every 18 months.

Heads Up: United also stipulated that any re-deposited funds originating from canceled tickets purchased with TravelBank money do not qualify as an eligible activity. In short, any re-deposited funds will NOT reset the expiration date.

United may also change the expiration date of subsequent deposits or discontinue the program altogether. Only time will tell.

For now, this option to convert our credit card airline credits to some form of flexible currency is available, so certainly consider this method if you are running out of ways to redeem your expiring credits.

Which Credit Cards to Use?

You should only purchase TravelBank funds when you anticipate no other eligible travel-related purchases for the remainder of the year.

Chase Credit Cards

Chase sapphire reserve® (csr).

The Chase Sapphire Reserve (CSR) comes with a $300 travel credit that resets every year on the card member’s anniversary date and does not roll over onto the following year; therefore, you either use it or lose it.

I do not recommend using your CSR travel credits to purchase funds on United’s TravelBank, given that Chase provides an extensive array of valuable avenues to redeem this credit.

In addition to the traditional airfare purchase, you can also trigger the travel credit when paying for public transit, ride-sharing services, parking, hotels, campgrounds, cruises, etc.

Citi Credit Cards

Citi prestige® credit card.

This card is no longer available to new applicants.

This credit card comes with a $250 travel credit, which can now be conveniently spent on groceries, restaurants, and take-out.

Like the Chase Sapphire Reserve, this credit resets every calendar year and likewise does not roll over.

I do not suggest using your Citi Prestige travel credits to purchase United TravelBank funds because of other beneficial spending options you have at your disposal.

American Express Credit Cards

American express® credit cards with airline fee credits.

- The Platinum Card® from American Express ($200 Annual Airline Credit)

- The Business Platinum Card® from American Express ($200 Annual Airline Credit)

- Hilton Honors American Express Aspire Card ($50 Quarterly Airline Credit)

American Express’s airline fee credit is challenging to redeem compared to Chase’s and Citi’s more flexible identical offerings.

In the past several years, consumers consistently find themselves jumping through hoops in search of effective methods to capitalize on these generous offers.

First and foremost, Chase and Citi do not require activation – their credits apply to all airlines and other forms of travel.

Whereas Amex’s airline fee credit will not work unless you activate it.

Plus, it can only be used on one airline you pre-select, ideally at the beginning of the year.

Even though there are data points (DP) that Amex has been lenient in allowing the preferred airline to be changed via chat as of late, there is no way to predict until when they will allow this.

AMEX Airline Fee Credit Restrictions

AMEX has strict restrictions on what fees qualify under this credit.

Technically, only incidental purchases, such as seat assignments, baggage fees, change fees, lounge access fees, and food/beverage inflight purchases, are eligible.

As such, traditional expenses such as award fees, plane tickets, upgrades, and gift cards do not qualify.

But occasionally, we see additional methods that temporarily open up that trigger this airline fee credit – and for now, United TravelBank is one of them.

While no language explicitly states this particular purchase will not qualify, I have to underscore that Amex can undoubtedly claw back this credit at any moment if they deem that TravelBank is not eligible. So, just be aware of that possibility.

Hence, please utilize this tactic only if you do not anticipate using your airline fee credit throughout the rest of the year.

Steps in Selecting Your Airline With Amex

Before you go ahead with your purchase, follow the steps below on selecting your preferred airline, as AMEX does not make it simple to locate where to activate this benefit.

To optimize this TravelBank strategy, make sure that the airline you selected is United.

Go to AmericanExpress.com, then log in to your account.

Select the particular AMEX credit card that currently offers an airline fee credit.

- The Platinum Card® from American Express

- The Business Platinum Card® from American Express

- Hilton Honors American Express Aspire Card

On the main page, click “More, ” then select “ Benefits .”

On the Benefits page, scroll down to locate “ Airline Fee Credit. ”

This is where you can also change your selected airline for the year.

It bears repeating that you’re technically not allowed to change your preferred airline mid-year, so choose wisely.

With that said, there are data points from people reporting that they have successfully modified their airline choice by contacting AMEX through chat, but this is YMMV (your mileage might vary).

As of this writing, you can use your airline fee credit with the following U.S. carriers:

While on the Benefits page, enroll in all the offers available to you even if you are not sure you will use them.

It is practically money you had already paid for when you paid your annual fee, so you might as well take advantage of it.

At any rate, maximizing this airline fee credit is a fantastic way to offset the steep annual fees Amex charges on their ultra-premium cards.

Add funds to your travel credit using your AMEX card.

If you are unsure how much airline credit you have left, AMEX generates a tracker under this benefit to display your remaining funds.

Periodically check your Amex credit card to see if the airline fee credit was successfully triggered.

If not, Amex has likely terminated this redemption method.

Final Thoughts

Indeed, United’s TravelBank is a wonderful addition to the dwindling menu of possible purchases that can activate Amex’s elusive airline credit.

Being fully aware that this method is temporary, I try to take advantage of it while it’s still possible, especially when I am on the verge of running out of redemption alternatives for my Amex airline fee credit.

I hope that Amex follows Chase’s and Citi’s lead and relaxes this benefit, making it much easier to redeem in the future.

Until then, we will have to adjust to American Express’ policies.

Ultimately, I am glad that United’s TravelBank provides us with another fantastic alternative for using our travel credits.

Not only does it prolong the shelf-life of our funds, but it also affords us the flexibility we genuinely need.

EDITORIAL DISCLOSURE – Opinions expressed here are the author’s alone, not those of any bank, credit card issuer, hotel, airline, or other entity. The content has not been reviewed, approved, or otherwise endorsed by any of the entities included within the post.

Related posts:

22 comments.

Bank of America Premium card also include benefits of $100 incidental travel credits, can I use it to purchase United Travel Bank fund too?

Hi Angie, I am not familiar with Bank of America rules but upon checking what qualifies under “incidental”, I got the following info: Get up to $100 in Airline Incidental Statement Credits annually for qualifying purchases such as seat upgrades, baggage fees, in-flight services, and airline lounge fees – automatically applied to your card statement.

It seems to me that this is similar to Amex. I would suggest purchasing the lowest allowed denomination of $50 to see if it would trigger it but if you have anticipated travel in the near future, I suggest redeeming the credits there instead.

Hi, I booked the ticket and when I entered the payment page, there is no Travel Bank part, I got 200+ dollars in travel bank and cannot seem to use it. Why is this? I can only see “Travel certificates” instead of “Travel certificates and United Travel Bank Cash”. What should i do?

Hi Tristan, thanks for asking. Sorry about that. Not all purchases in United.com are eligible. I wonder if the ticket you are purchasing includes a partner airline. From the Terms and Conditions: “TravelBank Cash is valid for air travel purchases on United and United Express® flights and as otherwise permitted by United. After a TravelBank Award is issued, a service charge may be imposed for each change or cancellation requested by the Member.”

I have encountered this exact problem and I am definitely booking a United airline airfare (from LAX – EWR): any more update on this?

HI Cindy, I had updated the post with hopefully a potential solution to your problem. Jump to the section “What to do? United Travel Bank Does Not Show Up”. I tried your route (LAX-EWR) and the steps I outlined worked in making Travel bank re-appear! Good luck and please let me know if it worked for you too!

Thank you for this post and the very detailed instructions!!! Really helpful as I’ll be using this as long as we can get that $200 credit from Amex Plat!

Thank you Tony for the kind feedback. I am glad you found it useful. Please feel free to ask questions anytime.

Great information, thank you!

Thank you so much!

Its unfortunate you can’t use your Travel Bank just to upgrade your seat. Or pay for the bundles upon checkout

I am sorry! Sadly, it is just not as flexible 🙁 But United might make some changes in the future that will allow us to use it for incidentals.

Newbie to United Travel Funds.

Is it possible to use it for booking a ticket for anyone else, any restrictions?

You can book it for anyone else. When they cancel though, the travel credits will be under their account.

This article saved me 30mins! I was typing a non-whole number to use my United Travel Bank and it would NOT take it. Apparently, it needs to be a WHOLE NUMBER. Thanks for the tip!

Glad you found it useful!

Can you combine miles and a travel bank balance? I have 33k miles I need to use and $600 in travel bank credits.

Unfortunately, you can not mix miles and travel bank balance. I’d use the travel bank first if you find cheap tickets as those expire. United miles do not expire.

Hi, how long does the Amex Airline Credit usually take? It’s been a week now and my credits have not shown up yet.

HI Kunal. It’s been about 10 days, on average, for me.

I wanted to add that you Travel Bank does not come up as an option to pay if your flight involves a leg operated by a partner airline (eg. Swiss Air).

I called United to see if they could book the ticket but it errored out for the representative and he gave me that as the reason.

This might be helpful to incorporate in your article.

HI Stephanie, thank you for sharing. That’s correct. Apologies that it was not clear in the article. Yes, it is sadly for United and United Express flights only. I highlighted that part of the article and added additional language under Troubleshooting so it’s much clearer. Thanks so much again for the feedback and Safe travels!

Submit a Comment Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

JOIN OUR FREE FACEBOOK TRAVEL MILES AND POINTS COMMUNITY!

TRAVEL MILES AND POINTS

- $15 Discount On $300+ Mastercard Gift Cards At Office Max / Depot

- Earn 5X Chase Points Per Dollar: Staples Fee-Free Visa Gift Cards

- Earn 5X Travel Points: Staples Fee-Free Mastercard Gift Cards

- $15 Discount On $300+ Visa Gift Cards At Office Max / Depot

- Top Things to Do in Porto on a Rainy Day

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

United TravelBank Card: Closed to Applications, Replaced by United Gateway

The card was suited to those who didn't travel much, but who flew United when they did travel. But it did not offer flexibility or traditional airline-card perks.

- High rewards rate

No annual fee

- No foreign transaction fee

15.99%-22.99% Variable APR

Rewards rate

Bonus offer

$150 in United TravelBank cash after you spend $1,000 on purchases in the first 3 months from account opening.

Ongoing APR

APR: 15.99%-22.99% Variable APR

Cash Advance APR: 24.99%, Variable

Balance transfer fee

Either $5 or 5% of the amount of each transfer, whichever is greater.

Foreign transaction fee

- Earn 2% in TravelBank cash per $1 spent on tickets purchased from United.

- Earn 1.5% in TravelBank cash per $1 spent on all other purchases

- No foreign transaction fees

- Enjoy 25% back as a statement credit on purchases of food, beverages and Wi-Fi onboard United®-operated flights when you pay with your United TravelBank Card.

- TravelBank cash is easy to use. $1 in TravelBank cash = $1 when used toward the purchase of a United ticket.

- Your TravelBank cash accumulates in your United TravelBank account on United.com.

- $0 Annual fee

Compare to Other Cards

Detailed review: United℠ TravelBank Card

» this card is no longer available..

The United℠ TravelBank Card is no longer accepting applications. United Airlines and Chase have introduced a new credit card with no annual fee, the United Gateway℠ Card , which effectively takes the place of the TravelBank Card. Read our review of the United Gateway℠ Card , or explore other United Airlines credit card options . Below is our review of the United℠ TravelBank Card from when the card was still on the market.

If you fly United Airlines, the United℠ TravelBank Card might be tempting because of its annual fee of $0 . But it ultimately might not be worthwhile for most United flyers because of all that it lacks as an airline card.

The card has its own rewards currency that you can use to book free United flights. And its rewards rate is decent for both United spending and all other spending. It’s kind of like a cash-back card, where you can spend the cash only at United.

But you won't get free checked bags or early boarding like you do with many airline cards. And you won’t earn United MileagePlus miles, the airline’s frequent-flyer miles that have a chance at returning huge value.

If you want a card like this one, just get a true cash-back card . Then, you can spend your cash rewards on anything, not just United flights. Otherwise, ante up for a United card with an annual fee that comes with useful airline perks. There’s a good option in the United℠ Explorer Card .

» MORE: How to choose an airline credit card

United℠ TravelBank Card : Basics

Card type: Airline .

Annual fee: $0 .

2% in TravelBank cash per $1 spent on tickets purchased from United.

1.5% in TravelBank cash per $1 spent on all other purchases.

Sign-up bonus: $150 in United TravelBank cash after you spend $1,000 on purchases in the first 3 months from account opening.

Foreign transaction fee: None.

Interest rate: The ongoing APR is 15.99%-22.99% Variable APR .

Noteworthy perks:

25% back as a statement credit on purchases of food, beverages and Wi-Fi onboard United-operated flights when you pay with your card.

No foreign transaction fees.

Trip cancellation/interruption insurance.

Rental car insurance.

Purchase protection.

» MORE: Benefits of United Airlines credit cards

Benefits and perks

Simple rewards earning.

With a typical airline card, you earn frequent flyer miles or points with every purchase. You then redeem those rewards for free flights or seat upgrades. But frequent flyer programs can be exceedingly complicated. The number of miles you’ll need for a particular flight depends on an array of factors. On top of that, the flight you want might not have award seats available. And your preferred travel dates might be “blacked out” — that is, reserved for paying customers.

The United℠ TravelBank Card eliminates the whole idea of miles. Instead, you earn “TravelBank cash,” which is redeemable for travel with United on a simple dollar-for-dollar basis.

The card earns 2% back on United purchases and 1.5% back on everything else. A $500 United flight, for example, would earn $10 in TravelBank cash. A $500 purchase elsewhere would earn $7.50.

Simple rewards redemption

When booking a flight with United, you can pay some or all of the fare with your accumulated TravelBank cash rewards. Consider a ticket that costs $400. If you had at least $400 in TravelBank cash, you could use it to pay the entire fare. If you had only $50 in rewards accumulated, you could apply it to the fare and reduce the cost to $350.

Some travel credit cards have annual fees measured in hundreds of dollars, while the typical airline card often charges a fee of close to $100 per year. This card has an annual fee of $0 .

Sign-up bonus

For a simple credit card with an annual fee of $0 , it’s a pleasant surprise to have a sign-up bonus: $150 in United TravelBank cash after you spend $1,000 on purchases in the first 3 months from account opening.

» MORE: NerdWallet's best airline cards

The United℠ TravelBank Card is light on flash compared with most travel cards, but it comes with minor perks:

In-flight discount: 25% back as a statement credit on purchases of food, beverages and Wi-Fi onboard United-operated flights when you pay with the card.

No foreign transaction fees: Travel cards generally don’t charge a fee — 3% is common — for making purchases abroad. This United card doesn’t, either. And it uses the Visa network, which is widely accepted abroad.

Travel-related insurances: Trip cancellation/interruption insurance and secondary rental car insurance are nice-to-haves on an airline card.

Purchase protection: Covers new purchases made with the card for 120 days against damage or theft, up to $500 per claim and $50,000 per account.

How it compares with other United cards

The United℠ TravelBank Card is one of three co-branded consumer United Airlines credit cards. Its siblings pack more perks.

Here’s how they compare on key features:

Business owners, even those with side gigs, might consider the United℠ Business Card .

» MORE: Full review of the United℠ Business Card

Drawbacks and considerations

No checked bags or early boarding.

At $35 per bag each way when you don't prepay, fees for first checked bags add up in a hurry, especially when you’re traveling with others on your itinerary. That’s why typical airline cards are so valuable. But this card has no checked-bag-fee waivers, so you’ll have to pay. And you won’t get boosted toward the front of the boarding line, because the card lacks a priority boarding perk. That could hurt you when looking for overhead bin space.

» MORE: Airline credit cards that offer free checked bags

The logical solution is the United℠ Explorer Card . It offers:

2 MileagePlus miles per dollar spent on purchases from United.

2 miles per dollar spent on restaurant purchases and hotel stays.

1 mile per dollar spent on all other purchases.

First checked bag free for you and a companion on your reservation, if you use the card to purchase your ticket.

Two United Club one-time use passes per year.

Global Entry/TSA Precheck statement credit every four years.

25% off in-flight purchases.

Sign-up bonus: Earn 50,000 bonus miles after you spend $3,000 on purchases in the first 3 months your account is open.

It has an annual fee of $0 intro for the first year, then $95 .

» MORE: Full review of the United℠ Explorer Card

You won’t earn United MileagePlus miles with this card. That keeps things simple, but you also lose the potential to reap outsize value by scoring a great awards seat — like a business-class international fare worth thousands of dollars — for relatively little spending.

Fewer benefits

Some airline cards give you perks at the airport. They might reimburse you the application cost of Global Entry or TSA Precheck to get through security lines quicker, or get you free or discounted passes to an airport lounge.

This card offers none of those.

» MORE: Cards that offer airport lounge access

Limited reward redemptions

Redeeming rewards is relatively simple, but you’re still locked into United Airlines. That's limiting compared with general travel credit cards , which allow you to apply rewards to a wide range of travel-related expenses.

An option for those looking to avoid an annual fee is the Bank of America® Travel Rewards credit card .

1.5 points per dollar spent.

3 points per dollar spent on eligible travel booked through the Bank of America® Travel Center.

A value of 1 cent per point when redeemed for travel credit and a little over half a cent per point for cash.

A sign-up bonus.

The Bank of America® Travel Rewards credit card isn't tied to an airline or hotel chain. Book travel any way you want, with no restrictions and no blackout dates, and then use points to wipe out the cost on your statement. Bank of America® also has one of the broadest definitions of "travel" of any major issuers. You can use points to get credit for airfare, hotel stays, cruises, car rentals, campgrounds, art galleries, amusement parks, carnivals, circuses, aquariums and zoos.

» MORE: Full review of the Bank of America® Travel Rewards credit card

This card earns bonus rewards in multiple categories, including dining and travel. You can transfer points on a 1:1 basis to about a dozen hotel and airline programs, including United, or you can use them to book travel through Chase at 1.25 cents per point. However, you won't get any airline-specific perks. Annual fee: $95 .

How to decide if it's right for you

The United℠ TravelBank Card offers a simpler way to earn free flights on United Airlines for casual flyers committed to that airline. But honestly, you’re better off with a cash-back credit card .

If you spread your flying among a number of carriers or want more flexibility, consider a general travel credit card . United loyalists are likely to get more value from the United℠ Explorer Card .

Information related to the United℠ TravelBank Card has been collected by NerdWallet and has not been reviewed or provided by the issuer of this card.

- The best credit cards of 2024

- Best travel credit cards

- Best rewards credit cards

- Best cash back credit cards

Methodology

NerdWallet reviews credit cards with an eye toward both the quantitative and qualitative features of a card. Quantitative features are those that boil down to dollars and cents, such as fees, interest rates, rewards (including earning rates and redemption values) and the cash value of benefits and perks. Qualitative factors are those that affect how easy or difficult it is for a typical cardholder to get good value from the card. They include such things as the ease of application, simplicity of the rewards structure, the likelihood of using certain features, and whether a card is well-suited to everyday use or is best reserved for specific purchases. Our star ratings serve as a general gauge of how each card compares with others in its class, but star ratings are intended to be just one consideration when a consumer is choosing a credit card. Learn how NerdWallet rates credit cards.

About the author

Gregory Karp

Online Banking

News & articles paris and alaska are travel club’s major destinations for 2025.

- News & Articles

- PARIS AND ALASKA ARE TRAVEL CLUB’S MAJOR DESTINATIONS FOR 2025

The charming allure of Paris, France, and the natural grandeur that is Alaska will be the focal points of the major tours in 2025 for the Adventure First Travel Club of First Community Bank. During “Spotlight on Paris,” a nine-day tour starting on April 1, 2025, Travel Club members will enjoy the enchantment of Paris, its spectacular sights, history, architecture, art, and of course, its fine food and wine. They will savor dinner at the Eiffel Tower; explore the treasures of the Louvre Museum; visit Versailles, one of the world’s most opulent royal palaces; glide down the Seine on a romantic river cruise; retrace the history of World War II at Normandy; and so much more. Travelers on “Alaska Discovery,” scheduled for September 3-14, 2025, will experience the Pacific Coast by land and sea on a breathtaking journey through one of the most beautiful places on Earth. They will encounter Alaska’s diverse culture and rich history aboard a sternwheeler and luxury domed rail car, and complete the adventure on a seven-night Holland America cruise through the Inside Passage. Along the way, they will explore Denali National Park, Glacier Bay, Ketchikan, and relive Alaska’s Gold Rush days in historic Skagway. The public is invited to learn more about these unforgettable Travel Club tours by attending a preview presentation at 6 p.m. on Wednesday, May 15, in the George Rider Community Room at the First Community Main Bank at 1325 Harrison Street in Batesville. Space on all Travel Club tours is limited, so guests should come to this preview meeting prepared to secure their reservations by submitting tour deposits. Also, it may still be possible to join other monthly activities that remain on the Travel Club’s 2024 schedule of events, including: • “A Culinary Journey through New England,” June 15-21 – A culinary-related tour to include a lobster pulling cruise in Maine; Ben & Jerry’s ice cream and cheese-making in Vermont; oyster shucking in Rhode Island; and a colonial culinary program in Massachusetts. • “Come from Away,” August 3, at Robinson Center in Little Rock – A Broadway musical that tells the remarkable true story of 9/11, when all commercial airlines were grounded, and 7,000 passengers who were suddenly stranded in a small town in Newfoundland. • “Cooking, Culture & the Blues,” Sept. 11-13 – A hands-on class at the world famous Viking Cooking School in Greenwood, Mississippi, highlights this tour, which will also explore the cultural history and musical legacy of the Mississippi Delta. • “Iceland’s Magical Northern Lights,” Oct. 24 - Nov. 2 – Travelers will visit the “land of fire and ice” to chase the aurora borealis on a starlit cruise; see explosive geothermal fields; walk on a black volcanic sand beach; and see a glacial lagoon filled with floating icebergs. • “National Cold War Center,” Nov. 19 – This new museum under development at Blytheville, will relate the story of the “Cold War,” which saved the world during a time when everyone lived under the constant threat of nuclear annihilation. • “Christmas on the Danube,” Dec. 2-10 – Shop the charming Christmas markets of Austria and Germany during a wintertime cruise along the Danube River. Relax as you are transported to beloved riverside towns and experience local European holiday traditions. For additional information about the Travel Club and its tours, contact Chuck Jones, 870-612-3400, at First Community Bank, or email [email protected]. Membership in the Adventure First Travel Club requires a minimum of $10,000 in account relationships with First Community Bank, preferably in checking or savings “demand deposit” accounts.

Now Available

Sign into your online account

- Forgot Password

Prosperity Bank's Travel Club Members are solely responsible for all travel and event expenses.

The ultimate guide to United Club access

Airport lounges can be an oasis from a busy, crowded or outdated terminal.

Some lounges belong to a membership network, like Priority Pass . Others are airline-specific, like the United Club.

If you're a loyal United flyer or frequent one of the carrier's largest hubs, here's what you need to know about accessing the United Club.

Same-day boarding pass requirement

The "Big Three" U.S. airlines — American, Delta and United — all require a same-day boarding pass to access their lounges. That means you can't use a United Club when you're flying with American.

Related: The best credit cards for flying United

For starters, you'll need a same-day boarding pass on United or a Star Alliance partner airline to gain entry to a United Club.

Credit cards

The United Club Infinite Card is the newest (and potentially most affordable) way to access United Clubs for frequent travelers. The card comes with a lounge membership that allows the primary cardholder and two adult companions (or one adult and any dependent children under the age of 21) access to United Clubs for as long as you hold the card.

The United Club Infinite Card carries a $525 annual fee, which is lower than a discounted lounge membership with Premier elite status (see below). The card currently offers a sign-up bonus of 80,000 bonus miles after you spend $5,000 on purchases in the first three months from account opening.

Business owners can open the United Club Business Card which offers the same United Club access as the United Club Infinite Card. However, this card has slightly different auxiliary benefits and a lower $450 annual fee.

The information for the United Club Business Card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

If you'd prefer to avoid the hefty annual fee, you can opt for the entry-level United Explorer Card , which includes two single-use United Club passes each year. Note that these day passes don't include guest access.

Paid membership

You can pay for a United Club membership with either cash or miles, though the price varies depending on your United Premier elite status , with rates as follows:

While top-tier elite members (Premier Platinum and Premier 1K) enjoy a discount, the prices are still quite high. TPG values United MileagePlus miles at 1.4 cents each, so your best bet is to pay the annual membership fee with cash, as opposed to miles. (Of course, opening the United Club Infinite Card is an even better deal.)

If you don't travel enough to commit to an annual membership, you can also purchase day passes for $59 at United Club locations or through the United mobile app. Just note that day passes don't guarantee entry during peak crowding periods.

Since Jan. 1, 2021, United's invite-only Global Services members can enjoy lounge access on all United-operated flights, including those operating exclusively within the United States. Note that this new perk only covers the Global Services member — you'll only be able to bring a guest into the lounge with a separate membership or when flying internationally.

Elite status

Select Premier members can use the United Club at any time during their travel journey.

United Premier Gold (and higher) members have access to the carrier's lounges when traveling internationally on any Star Alliance carrier, regardless of their class of service. They can also bring along one guest departing on a Star Alliance carrier from the same airport. Note that since May 3, 2021, the guest must be traveling on the same flight.

Star Alliance Gold members who hold status with another partner airline can use the United Club with any same-day Star Alliance boarding pass, including during domestic United travel. The same guest rules apply. Since May 3, 2021, the Star Alliance requires guests to be traveling on the same flight as the elite member.

(Note that Premier elites can't use the carrier's Polaris lounges , as those locations have separate entry requirements that we'll discuss in a moment.)

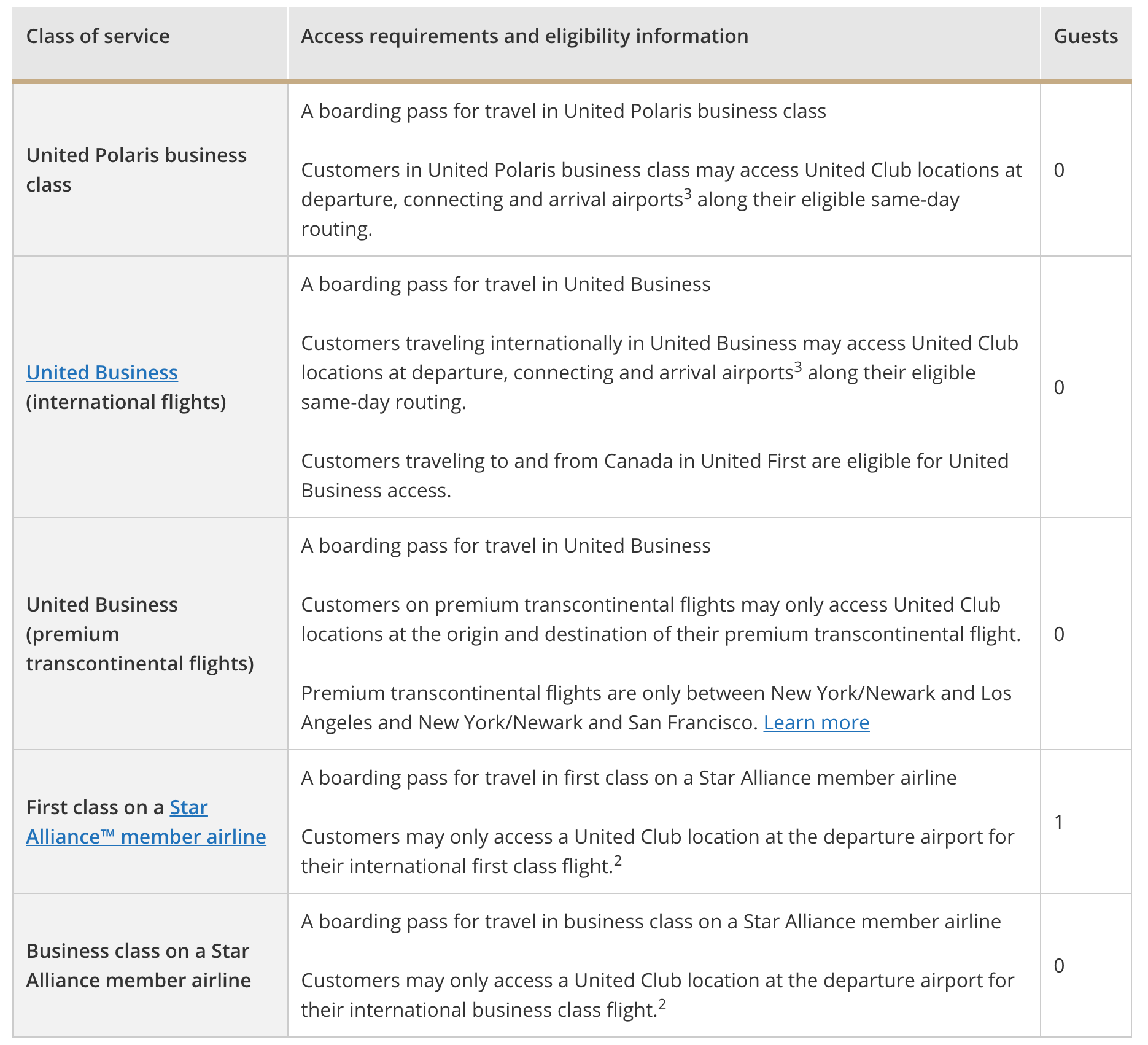

Ticket type

Premium-cabin Star Alliance travelers can also use United Clubs, though the exact terms and guest privileges vary by ticket type, as seen below.

Other United Club access

United's lounges are open to a few other travelers, including:

- Active U.S. military personnel. You'll need to travel with a valid military ID, a same-day United boarding pass and be dressed in uniform or bring your leave orders or rest and recuperation papers.

- If you're an Air Canada Maple Leaf Club member, you can access the United Club as before any same-day Star Alliance member flight.

- Maple Leaf Club North America members can use any domestic United Club location, while Maple Leaf Club Worldwide members can use all locations worldwide and bring a guest for each visit.

- Virgin Australia Velocity Gold, Platinum and VIP elite members may visit United Clubs by presenting a same-day boarding pass for an international United or Virgin Australia flight departing from the same airport. You can bring one guest if you're traveling with United.

United Polaris Lounge access

Of course, Star Alliance premium-cabin passengers also have access to United's Polaris lounges, which offer modern furnishings, private spa-like shower suites and elevated culinary experiences.

Three types of passengers are eligible for Polaris lounge access:

- Travelers in United Polaris business class: available at departure, connecting and/or arrival airports (no guests).

- Travelers in Star Alliance first class: only available at the departure airport for a long-haul first-class flight (one guest).

- Travelers in Star Alliance business class: only available at the departure airport for a long-haul business-class flight (no guests).

United Club Fly Access

In addition to United Clubs and Polaris Lounges, the carrier operates a new lounge concept called "Club Fly."

The first such space opened in Denver in November, based on a grab-and-go concept . Eligible travelers can enter Club Fly by scanning their boarding pass at the self-serve entry gate.

Once you get inside, you can raid the snack bar that's stocked with packaged and prepared foods, and you can also order a coffee from the barista.

Given Club Fly's focus on efficiency, the access policies are a bit different. All travelers eligible to enter a United Club or Polaris Lounge can visit Club Fly, but they cannot bring any guests. (This excludes active U.S. military personnel and Air Canada Maple Leaf Club members.)

You'll find a plethora of United Clubs in the carrier's main hubs, including:

- Chicago O'Hare (ORD) — Four locations: three in Terminal 1 (near gates B6, B18 and C10) plus another in Terminal 2 across from Gate F9.

- Denver (DEN) — Two locations: one near Gate B32 and the other near Gate B44. United Club Fly can be found near Gate B60, and there's a temporary pop-up club near Gate B59. Two new and renovated clubs are expected to open in Denver in 2023.

- Houston (IAH) — Five locations: one in Terminal A (across from Gate A9), one in Terminal B (south mezzanine), two in Terminal C (near Gate C1 and toward Gate C33) and one in Terminal E (between gates E11 and E12).

- Los Angeles (LAX) — one location adjacent to Gate 71A.

- Newark (EWR) — Three locations: one is a "pop-up" in Terminal C (near Gate C93), plus a full club in Terminal C (upper level, near Gate C123). Two new and renovated clubs are expected to open in Newark in 2023.

- San Francisco (SFO) — Three locations: two in Terminal 3 (near Gate E4 and Gate F11) and one in the international terminal (between gates G6 and G9).

- Washington Dulles (IAD) — Four locations in the Midfield Terminal (near gates C4, C7, C17 and D8).

Except for Denver, all of these airports ( Chicago O'Hare , Houston , Los Angeles , Newark , San Francisco and Washington, D.C. ) have Polaris lounges.

Most of the other clubs are scattered across the U.S., including in airports such as Dallas Fort Worth International Airport (DFW), Philadelphia International Airport (PHL) and Phoenix Sky Harbor International Airport (PHX), Hartsfield-Jackson Atlanta International Airport (ATL) and Minneapolis-St. Paul International Airport (MSP), among others.

For complete details on all of these locations, including hours of operation, you can visit this page .

Bottom line

United offers a variety of ways to access its United Clubs, both for premium-cabin frequent flyers and for those with a membership.

If you frequently travel with United, it's worth analyzing which options offer the best bang for your buck to unlock a relaxing lounge experience.

- © Roadtrippers

- © Mapbox

- © OpenStreetMap

- Improve this map

The Breakfast Club

501 S Main St, Moscow , Idaho 83843 USA

- Independent

- Credit Cards Accepted

- More in Moscow

Learn more about this business on Yelp .

“Breakfast & Lunch among friends”

The Breakfast Club has been a locally-owned Moscow breakfast staple for 12 years. The food is delicious, and the portions are appropriate (not gigantic). They have stuffed biscuits and gravy which is biscuits cut in half with eggs and bacon in the middle, covered in in-house made sausage gravy. If you are ever in Moscow in the wee hours of the morning, this is the place to stop!!!

Reviewed by Melanie B.

Phenomenal!!! We went to Moscow for a quick wkend trip and stumbled upon this spot! The wait was 45 mins (of which needed up being 20 / 30 mins! Nothing but positive things to say about The... Read more

Reviewed by Katherine J L.

Came here for breakfast for the first time the other day because we flew to Pullman, Washington for a graduation (Go Cougs!!) This place was 7 miles from where we are and we wanted to try food in... Read more

Reviewed by Katrina B.

Great food, Great environment Great prices. I'm not coffee drinker but the coffee bar and the latte they made me was really good. The biscuits and gravy weren't the best but I had assumed as... Read more

View 390 reviews on

- Sun - Sat: 7:00 am - 2:00 pm

Problem with this listing? Let us know .

Has RV parking changed? Let us know .

- Check Parking

- Unavailable Pets Allowed

- Unknown Restrooms

- Unavailable Wifi

- Unknown Wheelchair Accessible

- Check Credit Cards Accepted

- Check Lunch

- Check Brunch

- Unavailable Dinner

- Check Drinks

- Check Dine In

- Check Takeout

- Check Breakfast

- Check Waitstaff

Parking, Dining

Nearby Hotels

Related trip guides, the great northern is a 3,600 mile, cross-country odyssey, pacific coast highway: oregon - washington, the ultimate guide to north cascades national park, the top things to do on a u.s. route 20 road trip, keep exploring with the roadtrippers mobile apps..

Anything you plan or save automagically syncs with the apps, ready for you to hit the road!

Connect with us and hit up #roadtrippers

Tall tales, trip guides, & the world's weird & wonderful.

- Roadpass Digital

- Mobile Apps

Business Tools

- Partnerships

Get Inspired

- Road trip ideas by state

- National parks

- Famous routes

- Voices from the Road

Fresh Guides

- The ultimate guide to Mammoth Cave National Park

- The Ultimate Guide to Badlands National Park

- Route 66 Leg 2: St. Louis to Tulsa

- Route 66 Leg 1: Chicago to St. Louis

- Route 66 Leg 3: Tulsa to Amarillo

- Top 10 things to do in Ohio

- Offbeat Road Trip Guides

- Road Trip USA

- Scenic Routes America

- National Park Road Trips

- Terms and Conditions

IMAGES

COMMENTS

Monday, November 27, 2023. With 2023 chocked full of fun trips to interesting places, the First Service Bank Travel Club has announced another "wonderful' slate of excursions scheduled in 2024. The exciting destinations range from Hawaii and the Wild West to Charleston and the Biltmore Estate at Christmas, according to First Service banker ...

2021 Croatia Trip. 2020 Egypt Trip. 2019 Greece Trip. 2018 Mystery Trip. 2018 Africa Trip 2018 New England Trip. For more information on the Welcome Aboard Club or any of our upcoming trips, please contact: Renae Lane at 515-351-2096 or through the bank if you need reservations or have any questions regarding any of our trips.

The travel club at Texas-based Prosperity Bank has an upcoming trip to Cuba, and anyone over the age of 21 can join Missouri-based Bank of Sullivan on its trip to Iceland. Still, many clubs restrict membership to older people—aged 50 or 55 and up. Weldon points out that retirees comprise the demographic most likely to take advantage of group ...

Speed up the wire process by filling out the associated wire form prior to coming into the bank by using either of the printer friendly versions of our wire forms provided. Please call (800)924-4427x1373 for information regarding wiring money to First United Bank. *Must use Online Treasury Management services for online wire transfer.

Look into travel insurance. Trip delays, medical emergencies, and baggage mishaps happen. They don't have to ruin your trip or cost you a lot of money when you're covered by travel insurance. Start by investigating the travel insurance offered by your credit card, then decide if you want to add additional coverage.

Since some credit cards provide travel credits that expire within a year, depositing money in United's travel bank is a viable option to utilize those credits so they won't go to waste. Funds diverted in United's travel bank have a 5-year lifespan so it offers some level of longevity and a whole lot of flexibility, especially that travel is not expected to pick up again anytime soon.

The airline has offered this type of account at various times in the past. Now, it's incentivizing travelers to put money in by Sept. 23 by awarding five bonus United miles per dollar spent as a special offer. You are limited to $1,000 (5,000 bonus miles) per promotion, per MileagePlus account. For more TPG news and deals delivered each morning ...

United TravelBank makes it easy to manage your travel budget from your MileagePlus ® account. Simply add money to your account and then use TravelBank Cash as payment on united.com or the United mobile app. TravelBank Cash can be used alone or in combination with most other forms of payment. You can't combine TravelBank cash with travel ...

If you booked any trips before the end of your current membership, we'll credit any united.com Club benefits to your TravelBank after you've completed your trip. For more questions about the program, call us at 1-800-UNITED-1. Check your TravelBank balance. See full united.com Club terms and conditions.

Priority bag handling Be one of the first to receive your checked bag+ after the flight. * United Club access is only available for United Business on international flights, including premium transcontinental, and United First for Canada. + Standard size for a checked bag is 30 in x 20 in x 12 in (76 cm x 52 cm x 30 cm) and 50 lbs (23 km).

Say you want to deposit $150. Just purchase $50 in funds and then make another purchase of $100. The only limitation is that you can't exceed $5,000 per day per MileagePlus account, meaning that ...

The United Travel Bank has been around for many years. UA had a program where purchasing a ticket on united.com would receive a $5 Travel Bank bonus. This was called united.com Club and had an annual $25 subscription fee. This ended in early 2020. But funds are still accessible for 18 months after earning.

The Adventure First Travel Club of First Community Bank has released an ambitious calendar of monthly events through year-end 2022, highlighted by a European river cruise next spring, and an excursion next fall through the Colorado Rockies, including national parks, monuments and historic trains.

Here are the most common ways to book United First: Pay cash: United First tickets can be purchased when you book your flight. Naturally, First class fares typically cost quite more than economy ...

Card type: Airline. Annual fee: $0. Rewards: 2% in TravelBank cash per $1 spent on tickets purchased from United. 1.5% in TravelBank cash per $1 spent on all other purchases. Sign-up bonus: $150 ...

If you add $50 or $100 to your TravelBank, you'll get a 5% bonus deposit. If you add $250, $500, $750, or $1,000, to your TravelBank, you'll get a 10% bonus deposit. There are some restrictions to be aware of with this promotion, though: This promotion is valid through 11:59PM CT on Wednesday, December 9, 2020.

For additional information about the Travel Club and its tours, contact Chuck Jones, 870-612-3400, at First Community Bank, or email [email protected]. Membership in the Adventure First Travel Club requires a minimum of $10,000 in account relationships with First Community Bank, preferably in checking or savings "demand deposit ...

Houston. Phone: 713-255-1522 Email: [email protected]. Beverly Patton Travel Club Coordinator. Dallas/Fort Worth, East Texas/Oklahoma. Phone: 972-509-2020 Ext. 1167113 Email: [email protected]. Prosperity Bank's Travel Club Members are solely responsible for all travel and event expenses.

We have an extensive network of lounges around the world for you to visit. This includes more than 45 United Club locations, five United Polaris ® lounges and partner lounges. Make sure to check for any entry requirements before your trip. To see the full list of Star Alliance™-affiliated lounges, go to the Star Alliance website.

KYLE OLSEN/THE POINTS GUY. In addition to United Clubs and Polaris Lounges, the carrier operates a new lounge concept called "Club Fly." The first such space opened in Denver in November, based on a grab-and-go concept. Eligible travelers can enter Club Fly by scanning their boarding pass at the self-serve entry gate.

New United Club premium features. Take a look at our latest additions from our cutting-edge technology to indulging on-the-go or relaxing before your flight. Our enhanced features will elevate your experience and redefine how you enjoy airport lounges.

The Breakfast Club has been a locally-owned Moscow breakfast staple for 12 years. The food is delicious, and the portions are appropriate (not gigantic). They have stuffed biscuits and gravy which is biscuits cut in half with eggs and bacon in the middle, covered in in-house made sausage gravy. If you are ever in Moscow in the wee hours of the morning, this is the place to stop!!!