- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

How Much Is Travel Insurance in 2024?

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

Average cost of travel insurance by trip cost

Factors that affect travel insurance cost, more example costs of travel insurance, types of travel insurance, how to buy travel insurance, credit cards with travel insurance, cost of travel insurance recapped.

According to NerdWallet analysis, the short answer to “How much does travel insurance cost?” is that it’s typically 7% of your overall trip cost. For example, travel insurance will cost you an additional $70 (roughly) for a $1,000 trip.

However, depending on your provider, travel insurance costs can range from 4%-16% of your trip cost. That means for that $1,000 trip, you might find coverage for as little as $40 or up $160 on the high end.

Costs vary across providers, level of coverage and factors like your age and destination. Let’s take a look at the different types of travel insurance, what influences its cost and the average cost of travel insurance.

The Nerds dove deep into over 50 real world coverage price points to get a clearer sense of typical travel insurance costs in 2024.

On average, travelers should expect to pay 6.87% of their total trip cost for travel insurance. The minimum you might expect to pay is 4.15%, but it can go as high as 15.8%.

How did we determine these ballpark travel insurance prices?

We broke it down by looking at four individual providers' cheapest basic plan and most expensive basic plan for two traveler age demographics: a 30 year old and a 60 year old.

The Texas-based travelers are taking a 10 day trip to Florida in the summer. Included providers in our analysis were:

Allianz Global Assistance .

Travel Guard by AIG .

USI Affinity Travel Insurance Services .

Travel Insured International .

World Nomads .

Berkshire Hathaway Travel Protection .

Travelex Insurance Services .

Seven Corners .

AXA Assistance USA .

TravelSafe .

HTH Insurance .

According to the U.S. Travel Insurance Association, a national association of insurance carriers, the amount you can expect to pay for travel insurance will vary between 4% to 8% of your overall trip. This falls in the general range of our analysis, too.

If your vacation was $5,000, you’d be looking at somewhere between $200 and $400 for insurance. NerdWallet findings corroborate this range, with the average travel insurance cost for a trip at this price point being about $350.

Of course, as we describe below, the type of coverage you choose can greatly affect the cost of your insurance.

» Learn more: What does travel insurance cover?

So, how much is travel insurance? Several factors will influence the cost, like:

Type and extent of coverage.

The length of your trip.

Your destination.

The age of the policyholder.

Total trip cost.

Let’s say that you chose to purchase an insurance policy to cover any health care expenses you incur while traveling. This will reimburse you in the event you need to see a doctor, require hospitalization or have a variety of needs related to health care.

However, let’s say that you also chose to insure some of your trip costs; this means that, if need be, the policy will reimburse you for nonrefundable trip costs in case of a covered event. This will drive up the price of your policy overall.

Another factor that will affect the cost of your travel insurance is the coverage limits of your policy. These limits dictate how much you’ll be reimbursed in the event you need to use your insurance; the higher the amount, the more expensive your insurance.

» Learn more: The best travel insurance companies

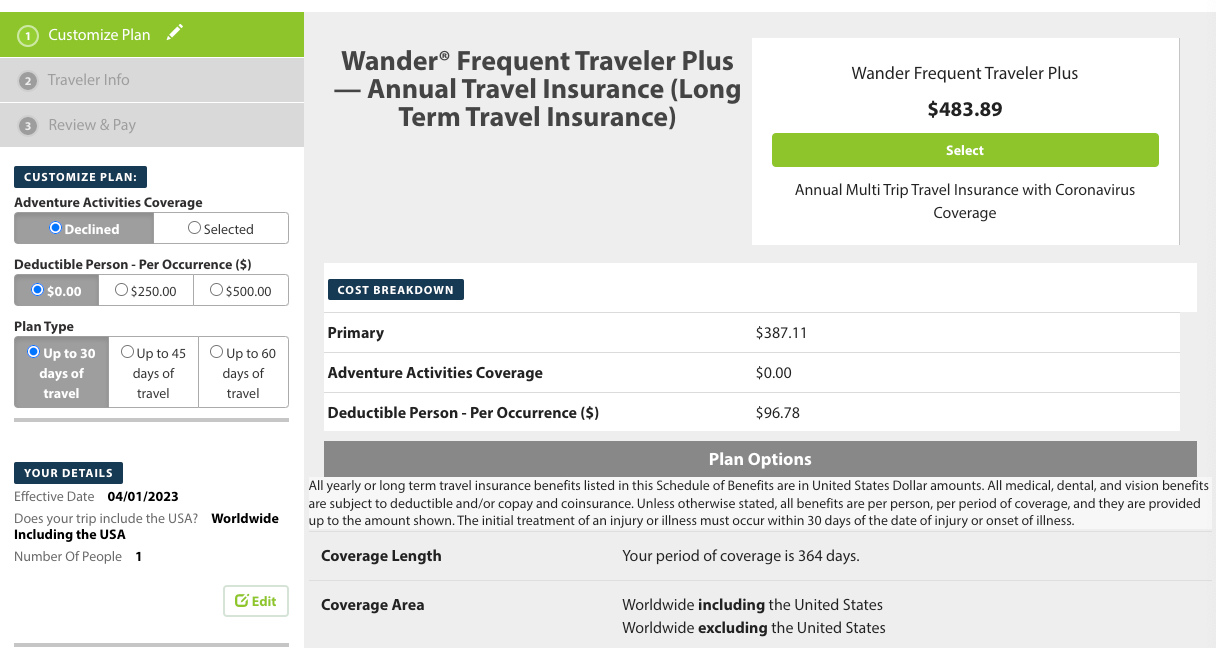

Here are some sample costs of travel insurance for a seven-day trip in the United States for two travelers ages 34 and 36. Full trip costs are estimated to be $2,000, and trip bookings have yet to be paid in full.

Policies include trip interruption coverage, travel delay coverage (up to $500) and emergency medical coverage.

In addition to the cost of travel insurance, we also need to talk about the different types of travel insurance. This is because the price you’ll pay will depend on the insurance you choose. Some policies — like those that allow you to cancel for any reason — can be more expensive than other, more limited, policies.

Common types of travel insurance include:

Lost luggage insurance .

Trip interruption insurance .

Trip cancellation insurance .

Rental car insurance .

Cancel For Any Reason insurance .

Health insurance .

Accidental death insurance .

Emergency evacuation insurance .

Different types of insurance will cover various things. Trip cancellation insurance, for example, will allow you to recoup a portion of nonrefundable costs when you’re forced to cancel your trip for a covered reason.

It’s simple to purchase travel insurance; you’ve probably seen dozens of ads for insurance whenever booking a flight or rental car.

However, it’s a better idea to get multiple quotes for policies. Insurance policy aggregators, such as Squaremouth, allow you to search a variety of different providers at once. You can then compare the coverage and price of each policy before choosing one that suits your needs.

» Learn more: What to know before buying travel insurance

If you’re looking into purchasing travel insurance, you may want to check which credit card you’re using to book your trip. Many of today’s popular travel credit cards offer complimentary travel insurance.

Cards such as the Chase Sapphire Preferred® Card offer primary rental car insurance; this means that the card will pay for any covered damage so that it doesn’t pass on to your personal insurance policy.

The types of insurance and total coverage vary according to the card, so you’ll want to check your individual policies.

Common coverage includes trip delay insurance, lost luggage insurance, rental car insurance and emergency medical insurance.

Popular cards that provide these types of coverage include:

Chase Sapphire Preferred® Card .

Chase Sapphire Reserve® .

Capital One Venture X Rewards Credit Card . (Benefits may change over time.)

The Platinum Card® from American Express . Terms apply.

United℠ Explorer Card .

In order to qualify for coverage, you’ll want to use your card to pay for any trip costs, including your airfare, lodging and rental cars.

The amount you’ll be reimbursed varies widely depending on which card you hold. For instance, the Chase Sapphire Preferred® Card provides coverage for up to $10,000 per person and $20,000 per trip for prepaid, nonrefundable travel expenses for covered trip cancellations.

Chase Sapphire Preferred® Card

These include airfare, accommodations and even tours.

The United℠ Explorer Card , meanwhile, offers far less coverage at just $1,500 per person and $6,000 per trip.

United℠ Explorer Card

$0 intro for the first year, then $95

Of course, your trip will need to fall under covered circumstances, including sickness and severe weather.

» Learn more: Does my Chase credit card have travel insurance?

It can make sense to purchase travel insurance, especially if you’re unsure about your vacation or worried about incurring expenses you can’t afford. Before buying a policy, you’ll first want to decide what type of insurance you’re looking to buy; some types of coverage cost much more than others.

You’ll also want to check to see if your credit card already provides complimentary travel insurance. Many popular travel cards offer this feature, though the limits may be lower than you might prefer.

Finally, do your homework before buying a policy. Gather quotes from multiple companies before making a decision, and remember the average price of trip insurance ranges from 4% to 8% of your total vacation costs.

For Capital One products listed on this page, some of the above benefits are provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

- Best Travel Insurance 2024

- Cheapest Travel Insurance

- Trip Cancellation Insurance

- Cancel for Any Reason Insurance

- Seniors' Travel Insurance

- Annual Travel Insurance

- Cruise Insurance

- COVID-19 Travel Insurance

- Travel Medical Insurance

- Medical Evacuation Insurance

- Pregnancy Travel Insurance

- Pre-existing Conditions Insurance

- Mexico Travel Insurance

- Italy Travel Insurance

- France Travel Insurance

- Spain Travel Insurance

- Canada Travel Insurance

- UK Travel Insurance

- Germany Travel Insurance

- Bahamas Travel Insurance

- Costa Rica Travel Insurance

- Disney Travel Insurance

- Schengen Travel Insurance

- Is travel insurance worth it?

- Average cost of travel insurance

- Is airline flight insurance worth it?

- Places to travel without a passport

- All travel insurance guides

- Best Pet Insurance 2024

- Cheap Pet Insurance

- Cat Insurance

- Pet Dental Insurance

- Pet Insurance That Pays Vets Directly

- Pet Insurance For Pre-Existing Conditions

- Pet Insurance with No Waiting Period

- Paw Protect Review

- Spot Pet Insurance Review

- Embrace Pet Insurance Review

- Healthy Paws Pet Insurance Review

- Pets Best Insurance Review

- Lemonade Pet Insurance Review

- Pumpkin Pet Insurance Review

- Fetch Pet Insurance Review

- Figo Pet Insurance Review

- CarePlus by Chewy Review

- MetLife Pet Insurance Review

- Average cost of pet insurance

- What does pet insurance cover?

- Is pet insurance worth it?

- How much do cat vaccinations cost?

- How much do dog vaccinations cost?

- All pet insurance guides

- Best Business Insurance 2024

- Business Owner Policy (BOP)

- General Liability Insurance

- E&O Professional Liability Insurance

- Workers' Compensation Insurance

- Commercial Property Insurance

- Cyber Liability Insurance

- Inland Marine Insurance

- Commercial Auto Insurance

- Product Liability Insurance

- Commercial Umbrella Insurance

- Fidelity Bond Insurance

- Business Personal Property Insurance

- Medical Malpractice insurance

- California Workers' Compensation Insurance

- Contractor's Insurance

- Home-Based Business Insurance

- Sole Proprietor's Insurance

- Handyman's Insurance

- Photographer's Insurance

- Esthetician's Insurance

- Salon Insurance

- Personal Trainer's Insurance

- Electrician's Insurance

- E-commerce Business Insurance

- Landscaper's Insurance

- Best Credit Cards of 2024

- Best Credit Card Sign-Up Bonuses

- Best Instant Approval Credit Cards

- Best Cash Back Credit Cards

- Best Rewards Credit Cards

- Best Credit Cards for Bad Credit

- Best Balance Transfer Credit Cards

- Best College Student Credit Cards

- Best 0% APR Credit Cards

- Best First Credit Cards

- Best No Annual Fee Cards

- Best Travel Credit Cards

- Best Hotel Credit Cards

- Best American Express Cards

- Best Amex Delta SkyMiles Cards

- Best American Express Business Cards

- Best Capital One Cards

- Best Capital One Business Cards

- Best Chase Cards

- Best Chase Business Cards

- Best Citi Credit Cards

- Best U.S. Bank Cards

- Best Discover Cards

- Amex Platinum Card Review

- Amex Gold Card Review

- Amex Blue Cash Preferred Review

- Amex Blue Cash Everyday Review

- Capital One Venture Card Review

- Capital One Venture X Card Review

- Capital One SavorOne Card Review

- Capital One Quicksilver Card Review

- Chase Sapphire Reserve Review

- Chase Sapphire Preferred Review

- United Explorer Review

- United Club Infinite Review

- Amex Gold vs. Platinum

- Amex Platinum vs. Chase Sapphire Reserve

- Capital One Venture vs. Venture X

- Capital One Venture X vs. Chase Sapphire Reserve

- Capital One SavorOne vs. Quicksilver

- Chase Sapphire Preferred vs. Capital One Venture

- Chase Sapphire Preferred vs. Amex Gold

- Delta Reserve vs. Amex Platinum

- Chase Sapphire Preferred vs. Reserve

- How to Get Amex Pre-Approval

- Amex Travel Insurance Explained

- Chase Sapphire Travel Insurance Guide

- Chase Pay Yourself Back

- CLEAR vs. TSA PreCheck

- Global Entry vs. TSA Precheck

- Costco Payment Methods

- All Credit Card Guides

- Citibank Savings Account Interest Rate

- Capital One Savings Account Interest Rate

- American Express Savings Account Interest Rate

- Western Alliance Savings Account Interest Rate

- Barclays Savings Account Interest Rate

- Discover Savings Account Interest Rate

- Chase Savings Account Interest Rate

- U.S. Bank Savings Account Interest Rate

- Marcus Savings Account Interest Rate

- Synchrony Bank Savings Account Interest Rate

- Ally Savings Account Interest Rate

- Bank of America Savings Account Interest Rate

- Wells Fargo Savings Account Interest Rates

- SoFi Savings Account Interest Rate

- Best Savings Accounts & Interest Rates

- Best High Yield Savings Accounts

- Best 7% Interest Savings Accounts

- Best 5% Interest Savings Accounts

- Savings Interest Calculator

- Emergency Fund Calculator

- Pros and Cons of High-Yield Savings Accounts

- Types of Savings Accounts

- Checking vs Savings Accounts

- Average Savings by Age

- How Much Should I Have in Savings?

- How to Make Money

- How to Save Money

- Compare Best Checking Accounts

- Compare Online Checking Accounts

- Best Business Checking Accounts

- Compare Best Teen Checking Accounts

- Best Student Checking Accounts

- Best Joint Checking Accounts

- Best Second Chance Checking Accounts

- Chase Checking Account Review

- Bluevine Business Checking Review

- Amex Rewards Checking Account Review

- E&O Professional Liability Insurance

- Best Savings Accounts & Interest Rates

- All Insurance Guides

- How Much is Travel Insurance?

On This Page

- Key takeaways

What’s the average cost of travel insurance in 2024?

Factors that impact the cost of travel insurance, examples of cost fluctuations based on trip details, how much should i spend on travel insurance, faq: cost of travel insurance.

- Recommended articles

Related topics

How much is travel insurance | average cost in 2024.

- The average cost of travel insurance for US travelers is $307 per trip – based on travel insurance sales data for the past 12 months (Jan 2023 – Jan 2024).

- Data from Squaremouth shows that between April 2022 and January 2024, the average cost of travel insurance for US travelers was 4.60% of their total trip cost – below the industry standard of 5% - 6%.

- From 2022 to 2024, US travelers had an average trip cost of $6,343 as prices rise due to inflation.

- The final cost of travel insurance for your trip will depend on specific factors such as the total trip cost, destination , type of plan, and more.

- Aim to spend 6% of your total trip cost or less when buying travel insurance to ensure you are getting a fair deal. Anything less than this is considered a great deal.

- Using a travel insurance comparison tool is the best way to find the lowest prices on travel insurance policies.

Understanding the average cost of travel insurance is key for identifying how much travel insurance could cost you.

To help you choose the best travel insurance for you needs, we analyzed policies from 31 different providers, including companies like AXA Assistance USA, IMG, John Hancock Insurance Agency, and Seven Corners, to discover the average amount people spent on travel insurance polices over the last year.

As of 2024, travel insurance plans typically cost about 5% to 6% of the total cost of your trip. This has always been a known figure in the travel industry, and our review of travel insurance quotes from top providers in the industry corroborates this figure for 2024.

The data shows that, for trips costing between $1k - $50k, travel insurance premiums can range from as low as $60 to $2,756 , respectively.

Ultimately, how much you end up paying for travel insurance depends on the specific details if your trip, and many of the factors that determine the cost of travel insurance are within your control.

For example, the following are all influencing factors that can be adjusted to help reduce the cost of your travel insurance:

- the trip destination

- the length of your trip

- the total trip cost

- the types of coverage you choose

In this guide, we’ll show you how much travel insurance costs and how to get a free insurance cost estimate for your trip using our website. To start, here is an in-depth look at the average cost of travel insurance and how the price has fluctuated over the past year.

The average cost of travel insurance for US travelers is around $307. This is based on a study of insurance sales data from 31 travel insurance providers over 12 months (January 2023 - January 2024).

There has been a progressive increase in travel spending over the last year, and the average cost of trips for US travelers increased roughly 21% from $5,988 in January 2023 to $7,427 in January 2024.

On average, travel insurance is around 5%-6% of the total trip cost, and the average trip cost for US travelers from April 2022- January 2024 was around $6,343.

As prices in increase globally thanks to inflation, this has driven up the overall price of insurance policies – as it means the plan must cover a more expensive trip.

Below is a graph showing the changes in the average cost of travel insurance over the last year as well as the average price US travelers paid for their trips.

Average Cost of Travel Insurance by Month (2022 - 2024)

As seen in the chart above, the average travel insurance price has also gone up over the last year and a half – rising from $236 per trip in April 2022 to $303 per trip in January 2024.

That said, the cost of travel insurance varies between travel insurance providers. Therefore, it pays to compare plans from multiple providers before opting for a specific plan. The tool (below) is a good place to start.

Our top picks for travel insurance

Seven corners, generali global assistance.

As we’ve seen above, prices fluctuate depending on your trip details and how much coverage you want.

Travel insurance typically reimburses you for the total cost of your trip. As a result, this is one of the main factors that decide how much travel insurance costs. The reality is, more expensive trips require travel insurance premiums on the higher end, whereas budget-friendly vacations are typically much less expensive to insure. As an added example, some travel insurance plans like trip cancellation and trip interruption insurance can reimburse you for anywhere from 100% to 150% of your total trip costs. In these cases, it only makes sense that the cost of the insurance plan is higher.

Trip length

The length of your trip impacts travel insurance costs since you need coverage for more days. Also, the longer the trip the higher the possibility of something going wrong. This means that the insurance company must assume a greater risk. You’ll typically pay a lot more for a trip in Spai n that lasts two weeks, for example versus just one week. Likewise, you’ll typically pay higher premiums for multi-trip or annual travel insurance plans versus one-off plans.

Age of traveler

The age of the traveler is an important factor in determining travel insurance costs. Senior travelers have an increased probability of falling ill or injuring themselves which means more medical expenses, which makes purchasing senior travel insurance crucial. In light of this, some travel insurance companies have an age limit to their policies.

Amount of travelers

Insuring a family or a large group inevitably costs more than insuring a solo trip. After all, more travelers in your group means there are more opportunities for things to go wrong which can lead to a higher payout from the insurance company. Despite this, some travel insurance providers, such as Travelex , offer free coverage for children ages 17 and under who are on the same plan as their parents or grandparents.

Type of plan

The type of travel insurance plan you buy can also affect the overall cost. For example, opting for a comprehensive travel insurance plan is more expensive than opting for medical coverage only or a cruise travel insurance plan specifically designed to cover potential risks on a cruise. You typically won’t get perks like baggage insurance, coverage for travel delays, or trip cancellation insurance when you forgo a comprehensive plan, but it can reduce the overall cost of your travel insurance policy. Therefore it’s important to consider what types of coverage you deem essential for your trip.

Coverage limits

Every travel insurance policy comes with a limit to how much the company will pay when you make a claim. The lower the limit, the less the plan will cost. A good example of this is travel medical insurance and medical evacuation insurance which usually make up the bulk of your travel insurance cost. These types of coverage typically have higher payout limits than other categories such as baggage insurance. Opting for less coverage will lower your overall cost, but that doesn’t mean it’s a good idea. When opting for cheap travel insurance we always recommend maintaining robust coverage limits.

Pre-existing conditions

Pre-existing conditions aren’t usually covered by travel insurance plans, but if they are, the policy tends to cost more than a standard policy. If you want coverage for pre-existing conditions you typically have to purchase a waiver for an extra fee ‘X’ days after making your initial trip deposit. (The amount of days depends on the company.) In the eyes of insurance companies, those with pre-existing conditions are more likely to need medical assistance while abroad. Therefore, plans that cover pre-existing conditions are usually more expensive.

Deductible amount

A deductible is the amount of money you must pay toward a claim before the insurance will start to pay out. Some travel insurance plans have a deductible, but this is always the case. Opting for a higher deductible can lead to a lower overall cost , whereas choosing a lower deductible or no deductible means paying more. Always read the fine print to ensure there are no surprise charges.

Add-ons & additional coverage

Travel insurance policies offer all kinds of add-ons that can cause the cost of coverage to skyrocket. Some of the most popular add-on coverages include cancel for any reason travel insurance (CFAR), interruption for any reason (IFAR) coverage, rental car coverage, insurance for sports equipment, and coverage for pre-existing medical conditions. Just one of these could increase your travel insurance policy by around 50%, so beware of add-ons if you are trying to keep costs down.

To help you understand these concepts better, we worked through some real-world examples and compared a range of travel insurance quotes for various trips, ages, and types of plans.

Then, we found the average cost of travel insurance based on the following variables:

- Total trip cost

- Age of the travelers

- Type of coverage

1. Average cost of travel insurance by trip cost

Using the LA Times Compare tool, we got quotes for a seven-night trip with costs ranging from $1,000 to $50,000.

The chart below shows how much the average trip cost for one person (age 35) impacted premiums in 2023:

We received travel insurance quotes for all the top providers to prepare this analysis, and we weren’t surprised to find that more expensive trips required higher travel insurance costs overall.

As you can see from the chart above, the cost of a vacation will greatly impact the premiums each insurance company charges. Still, we found that average travel insurance costs for all trips worked out to approximately 5% to 6% of the trip cost, on average.

2. Average cost of travel insurance by age

To give you an idea of the average cost of travel insurance as it pertains to age, we compared plans for a seven-night trip costing $2,500 for one traveler.

We got quotes using the LA Times Compare tool for the same trip parameters, only altering the age of the traveler from 20, 30, 40, 50, 60, 65, and 75.

The chart below provides an overview of the average cost of travel insurance by the age of the traveler:

As you can see from the study above, the travel insurance premium for a $2,500 trip ranges from 4% of the trip cost for travelers ages 20 to 30 up to 8% of the trip cost for a 65-year-old and 12% of the total trip cost for a 75-year-old. Therefore, it’s safe to say that age matters to travel insurance providers, although this is more true for people 60 years old or older.

Travel insurance companies price premiums based on the level of risk they’re taking for each covered trip, and it’s not surprising that it’s riskier to insure older travelers who are more likely to experience a medical event.

3. Average cost of travel insurance by type of coverage

While it’s difficult to answer how much is travel insurance, across different providers with different coverage options and limits, we got quotes for different plans from several top providers to give you an idea.

The chart below shows how much you would pay for travel insurance that covers a seven-night vacation for a total cost of $3,000 if you went with a budget plan, mid-tier coverage, or premium travel insurance:

Based on this study, it’s clear to see that the type of insurance policy you choose impacts the total cost, whether you opt for budget travel insurance, a middle-tier plan, or comprehensive coverage with exceptional limits.

4. Average cost of travel insurance with add-ons

As we mentioned earlier, add-ons can significantly increase the cost of travel insurance policies.

To give you a concrete example of this, we chose to study the cost of travel insurance plans with cancel for any reason insurance (CFAR) added to the policy.

Cancel for any reason travel insurance that lets you cancel a trip and be reimbursed for 50% to 80% of your prepaid trip expenses. This coverage can be used for any reason at all, even if you simply change your mind and decide to stay home.

The chart below shows how much two adult travelers would pay for some travel insurance plans for a seven-night trip with a total cost of $5,000.

While having CFAR coverage can be beneficial for travelers who are not entirely sure of their trip plans, this optional add-on can cause travel insurance premiums to increase by anywhere from 38% to 65%. Ultimately, we found that the average cost of adding CFAR to a policy equals approximately 48.6% of the premium.

You should aim to spend 6% or less of the total cost of your trip when searching for travel insurance. Anything less than 5% is considered a great price.

As an example, this means that travel insurance for a $5,000 vacation should cost between $250 and $300 – approximately.

If we follow this same rule, the cost of travel insurance for a $2,500 trip should be between $125 and $150, and premiums for a $15,000 trip should cost you between $750 and $900.

While these numbers are based on industry standards and internal research, our research did find some exceptions to this rule.

For example, travel insurance premiums tend to increase for:

- Older travelers

- Plans with higher coverage limits

- Plans that cover more than one traveler

People over the age of 60 can expect to pay the most. Plans that cover more than one traveler also cost more in general, as do travel insurance plans with higher coverage limits.

If you are hoping to get the best deal on travel insurance, you should take the time to compare at least three or four travel insurance plans side-by-side. Not only should you compare plans based on the types of coverage offered and the policy limits, but you’ll want to look at your out-of-pocket expenses, too.

From there, you’ll want to make sure your plan covers every conceivable issue you may run into, from missed connections to the contraction of COVID-19. With some research and planning, you can purchase coverage that puts travel-related issues aside so you can enjoy a worry-free trip.

You can get a free quote using our tool below. Simply enter your dates and destination to get a customized quote.

What is the approximate cost of travel insurance?

Travel insurance costs approximately 5% to 6% of the total cost of your trip. Based on travel insurance sales data from 31 different providers over the past year (from April 9, 2022 – April 9, 2023), the average cost of travel insurance for US travelers is $283 per trip . The average trip lasted 16 days and cost around $6,003.

Is it worth paying for travel insurance?

Travel insurance is worth it if you don’t have other types of insurance in place to cover the cost of incidents while traveling. The added expense of buying travel insurance can be well worth it if you run into a costly issue during your vacation. A lot of times, US health insurance does not work abroad. As an example, a conservative estimate for the cost of medical evacuation while traveling is around $25,000. However, this cost increases exponentially if you are overseas and need to be sent home, or are traveling in remote locations. Without travel insurance, you would be forced to pay for this cost out-of-pocket.

Who should get travel insurance?

Seniors, families, pregnant travelers , and those with pre-existing health conditions are prime examples of people who should buy travel insurance. However, there are some situations where travel insurance is essential for everyone. If you’re traveling overseas where your traditional health insurance coverage will not apply, even across the border in Canada , for example, travel insurance is the only way to ensure your medical expenses are covered.

Not only that, but trip insurance can reimburse you for non-refundable trip costs relating to hotels and flights you booked, missed connections, and medical expenses you rack up overseas. These costs can easily exceed the cost of travel insurance premiums, sometimes by tens of thousands of dollars. Keep in mind that flight insurance booked through an airline may not cover extra expenses such as medical complications.

Does travel insurance cover COVID-19 related issues?

Since COVID-19 has become commonplace, most travel insurance companies cover it the same as any other illness. This typically includes treatment or hospitalization from getting sick. Some travel insurance companies even cover doctor-ordered quarantine if you come down with COVID-19 during a covered trip and will cover the costs of extending your stay if you are forced to quarantine.

All travel insurance policies highlighted on our site include additionally COVID-19 travel insurance . If you are shopping elsewhere, make sure to read over the fine print before you select a plan as not all travel insurance policies offer this coverage.

Is travel insurance a one-time fee?

Some companies may offer options for paying in installments, but typically, travel insurance is a one-time fee that you pay upfront before going on your trip. Multi-trip travel insurance or annual travel insurance plans can cover more than one trip per year and may offer installment payments. However, most people buy a single travel insurance policy before each trip and a one-time fee.

What percentage of trip cost is travel insurance?

According to our research, travel insurance costs between 5% to 6% of the total trip cost for most travelers. All things considered, this is a small price to pay for peace of mind and being able to enjoy a worry-free trip.

Holly D. Johnson is an award-winning personal finance writer who covers topics like insurance, investing, credit and family finance. As a leading voice in the travel and loyalty space, Johnson has traveled with her family to more than 50 countries over the last decade.

The author has also written extensively on the power of household budgeting, and she even co-authored a book on the topic. Zero Down Your Debt: Reclaim Your Income and Build a Life You’ll Love was originally published in 2017, and it teaches families how to use zero-sum budgeting to reach their financial goals. She is also the co-owner and founder of the family finance and travel website, ClubThrifty.com.

Johnson’s 10+ years of writing have focused on helping families make important financial decisions at each stage of their lives. The author also applies the financial principles she teaches to her own life, and she is currently on track to retire in her late 40’s with her partner. She currently lives in Central Indiana with her husband and children, and she is a regular contributor for Bankrate, CNN, Forbes, U.S. News and World Report Travel and many other notable publications.

Explore related articles by topic

- All Travel Insurance Articles

- Learn the Basics

- Health & Medical

- Insurance Provider Reviews

- Insurance by Destination

- Trip Planning & Ideas

Best Travel Insurance Companies & Plans in 2024

Best Medical Evacuation Insurance Plans 2024

Best Travel Insurance for Seniors

Best Cruise Insurance Plans for 2024

Best COVID-19 Travel Insurance Plans for 2024

Best Cheap Travel Insurance Companies - Top Plans 2024

Best Cancel for Any Reason (CFAR) Travel Insurance

Best Annual Travel Insurance: Multi-Trip Coverage

Best Travel Medical Insurance - Top Plans & Providers 2024

- Is Travel Insurance Worth It?

Is Flight Insurance Worth It? | Airlines' Limited Coverage Explained

Guide to Traveling While Pregnant: Pregnancy Travel Insurance

10 Romantic Anniversary Getaway Ideas for 2023

Best Travel Insurance for Pre-Existing Medical Conditions April 2024

22 Places to Travel Without a Passport in 2024

Costa Rica Travel Insurance: Requirements, Tips & Safety Info

Best Spain Travel Insurance: Top Plans & Cost

Best Italy Travel Insurance: Plans, Cost, & Tips

Best Travel Insurance for your Vacation to Disney World

Chase Sapphire Travel Insurance Coverage: What To Know & How It Works

2024 Complete Guide to American Express Travel Insurance

Schengen Travel Insurance: Coverage for your Schengen Visa Application

Mexico Travel Insurance: Top Plans in 2024

Best Places to Spend Christmas in Mexico this December

Travel Insurance to Canada: Tips & Quotes for US Visitors

Best Travel Insurance for France Vacations in 2024

Travel Insurance for Germany: Tourist Information & Tips

Best UK Travel Insurance: Coverage Tips & Plans April 2024

Travel Insurance for Trips to the Bahamas: Tips & Safety Info

Europe Travel Insurance: Your Essential Coverage Guide

Best Trip Cancellation Insurance Plans for 2024

What Countries Require Travel Insurance for Entry?

Philippines Travel Insurance: Coverage Requirements & Costs

Travel Insurance for the Dominican Republic: Requirements & Tips

Travel Insurance for Trips Cuba: Tips & Safety Info

AXA Travel Insurance Review April 2024

Travel Insurance for Thailand: US Visitor Requirements & Tips

Travel Insurance for a Trip to Ireland: Compare Plans & Prices

Travel Insurance for a Japan Vacation: Tips & Safety Info

Faye Travel Insurance Review April 2024

Travel Insurance for Brazil: Visitor Tips & Safety Info

Travel Insurance for Bali: US Visitor Requirements & Quotes

Travel Insurance for Turkey: U.S. Visitor Quotes & Requirements

Travel Insurance for India: U.S. Visitor Requirements & Quotes

Australia Travel Insurance: Trip Info & Quotes for U.S. Visitors

Generali Travel Insurance Review April 2024

Travelex Travel Insurance Review for 2024

Tin Leg Insurance Review for April 2024

Travel Insured International Review for 2024

Seven Corners Travel Insurance Review April 2024

HTH WorldWide Travel Insurance Review 2024: Is It Worth It?

Medjet Travel Insurance Review 2024: What You Need To Know

Antarctica Travel Insurance: Tips & Requirements for US Visitors

Travel Insurance for Kenya: Recommendations & Requirements

Travel Insurance for Botswana: Compare Your Coverage Options

Travel Insurance for Tanzania: Compare Your Coverage Options

Travel Insurance for an African Safari: Coverage Options & Costs

Nationwide Cruise Insurance Review 2024: Is It Worth It?

- Travel Insurance

- Travel Insurance for Seniors

- Cheap Travel Insurance

- Cancel for Any Reason Travel Insurance

- Travel Health Insurance

- Is Flight Insurance Worth It?

- Anniversary Trip Ideas

- Travel Insurance for Pre-Existing Conditions

- Places to Travel Without a Passport

- Christmas In Mexico

- Europe Travel Insurance

- Compulsory Insurance Destinations

- Philippines Travel Insurance

- Dominican Republic Travel Insurance

- Cuba Travel Insurance

- AXA Travel Insurance Review

- Travel Insurance for Thailand

- Ireland Travel Insurance

- Japan Travel Insurance

- Faye Travel Insurance Review

- Brazil Travel Insurance

- Travel Insurance Bali

- Travel Insurance Turkey

- India Travel Insurance

- Australia Travel Insurance

- Generali Travel Insurance Review

- Travelex Travel Insurance Review

- Tin Leg Travel Insurance Review

- Travel Insured International Travel Insurance Review

- Seven Corners Travel Insurance Review

- HTH WorldWide Travel Insurance Review

- Medjet Travel Insurance Review

- Antarctica Travel Insurance

- Kenya Travel Insurance

- Botswana Travel Insurance

- Tanzania Travel Insurance

- Safari Travel Insurance

- Nationwide Cruise Insurance Review

Policy Details

LA Times Compare is committed to helping you compare products and services in a safe and helpful manner. It’s our goal to help you make sound financial decisions and choose financial products with confidence. Although we don’t feature all of the products and services available on the market, we are confident in our ability to sound advice and guidance.

We work to ensure that the information and advice we offer on our website is objective, unbiased, verifiable, easy to understand for all audiences, and free of charge to our users.

We are able to offer this and our services thanks to partners that compensate us. This may affect which products we write about as well as where and how product offers appear on our website – such as the order in which they appear. This does not affect our ability to offer unbiased reviews and information about these products and all partner offers are clearly marked. Given our collaboration with top providers, it’s important to note that our partners are not involved in deciding the order in which brands and products appear. We leave this to our editorial team who reviews and rates each product independently.

At LA Times Compare, our mission is to help our readers reach their financial goals by making smarter choices. As such, we follow stringent editorial guidelines to ensure we offer accurate, fact-checked and unbiased information that aligns with the needs of the Los Angeles Times audience. Learn how we are compensated by our partners.

- Auto Insurance Best Car Insurance Cheapest Car Insurance Compare Car Insurance Quotes Best Car Insurance For Young Drivers Best Auto & Home Bundles Cheapest Cars To Insure

- Home Insurance Best Home Insurance Best Renters Insurance Cheapest Homeowners Insurance Types Of Homeowners Insurance

- Life Insurance Best Life Insurance Best Term Life Insurance Best Senior Life Insurance Best Whole Life Insurance Best No Exam Life Insurance

- Pet Insurance Best Pet Insurance Cheap Pet Insurance Pet Insurance Costs Compare Pet Insurance Quotes

- Travel Insurance Best Travel Insurance Cancel For Any Reason Travel Insurance Best Cruise Travel Insurance Best Senior Travel Insurance

- Health Insurance Best Health Insurance Plans Best Affordable Health Insurance Best Dental Insurance Best Vision Insurance Best Disability Insurance

- Credit Cards Best Credit Cards 2024 Best Balance Transfer Credit Cards Best Rewards Credit Cards Best Cash Back Credit Cards Best Travel Rewards Credit Cards Best 0% APR Credit Cards Best Business Credit Cards Best Credit Cards for Startups Best Credit Cards For Bad Credit Best Cards for Students without Credit

- Credit Card Reviews Chase Sapphire Preferred Wells Fargo Active Cash® Chase Sapphire Reserve Citi Double Cash Citi Diamond Preferred Chase Ink Business Unlimited American Express Blue Business Plus

- Credit Card by Issuer Best Chase Credit Cards Best American Express Credit Cards Best Bank of America Credit Cards Best Visa Credit Cards

- Credit Score Best Credit Monitoring Services Best Identity Theft Protection

- CDs Best CD Rates Best No Penalty CDs Best Jumbo CD Rates Best 3 Month CD Rates Best 6 Month CD Rates Best 9 Month CD Rates Best 1 Year CD Rates Best 2 Year CD Rates Best 5 Year CD Rates

- Checking Best High-Yield Checking Accounts Best Checking Accounts Best No Fee Checking Accounts Best Teen Checking Accounts Best Student Checking Accounts Best Joint Checking Accounts Best Business Checking Accounts Best Free Checking Accounts

- Savings Best High-Yield Savings Accounts Best Free No-Fee Savings Accounts Simple Savings Calculator Monthly Budget Calculator: 50/30/20

- Mortgages Best Mortgage Lenders Best Online Mortgage Lenders Current Mortgage Rates Best HELOC Rates Best Mortgage Refinance Lenders Best Home Equity Loan Lenders Best VA Mortgage Lenders Mortgage Refinance Rates Mortgage Interest Rate Forecast

- Personal Loans Best Personal Loans Best Debt Consolidation Loans Best Emergency Loans Best Home Improvement Loans Best Bad Credit Loans Best Installment Loans For Bad Credit Best Personal Loans For Fair Credit Best Low Interest Personal Loans

- Student Loans Best Student Loans Best Student Loan Refinance Best Student Loans for Bad or No Credit Best Low-Interest Student Loans

- Business Loans Best Business Loans Best Business Lines of Credit Apply For A Business Loan Business Loan vs. Business Line Of Credit What Is An SBA Loan?

- Investing Best Online Brokers Top 10 Cryptocurrencies Best Low-Risk Investments Best Cheap Stocks To Buy Now Best S&P 500 Index Funds Best Stocks For Beginners How To Make Money From Investing In Stocks

- Retirement Best Gold IRAs Best Investments for a Roth IRA Best Bitcoin IRAs Protecting Your 401(k) In a Recession Types of IRAs Roth vs Traditional IRA How To Open A Roth IRA

- Business Formation Best LLC Services Best Registered Agent Services How To Start An LLC How To Start A Business

- Web Design & Hosting Best Website Builders Best E-commerce Platforms Best Domain Registrar

- HR & Payroll Best Payroll Software Best HR Software Best HRIS Systems Best Recruiting Software Best Applicant Tracking Systems

- Payment Processing Best Credit Card Processing Companies Best POS Systems Best Merchant Services Best Credit Card Readers How To Accept Credit Cards

- More Business Solutions Best VPNs Best VoIP Services Best Project Management Software Best CRM Software Best Accounting Software

- Manage Topics

- Investigations

- Visual Explainers

- Newsletters

- Abortion news

- Coronavirus

- Climate Change

- Vertical Storytelling

- Corrections Policy

- College Football

- High School Sports

- H.S. Sports Awards

- Sports Betting

- College Basketball (M)

- College Basketball (W)

- For The Win

- Sports Pulse

- Weekly Pulse

- Buy Tickets

- Sports Seriously

- Sports+ States

- Celebrities

- Entertainment This!

- Celebrity Deaths

- American Influencer Awards

- Women of the Century

- Problem Solved

- Personal Finance

- Small Business

- Consumer Recalls

- Video Games

- Product Reviews

- Destinations

- Airline News

- Experience America

- Today's Debate

- Suzette Hackney

- Policing the USA

- Meet the Editorial Board

- How to Submit Content

- Hidden Common Ground

- Race in America

Personal Loans

Best Personal Loans

Auto Insurance

Best Auto Insurance

Best High-Yields Savings Accounts

CREDIT CARDS

Best Credit Cards

Advertiser Disclosure

Blueprint is an independent, advertising-supported comparison service focused on helping readers make smarter decisions. We receive compensation from the companies that advertise on Blueprint which may impact how and where products appear on this site. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Blueprint. Blueprint does not include all companies, products or offers that may be available to you within the market. A list of selected affiliate partners is available here .

Travel Insurance

Average cost of travel insurance in 2024

Heidi Gollub

Megan Horner

“Verified by an expert” means that this article has been thoroughly reviewed and evaluated for accuracy.

Updated 2:48 p.m. UTC April 24, 2024

- path]:fill-[#49619B]" alt="Facebook" width="18" height="18" viewBox="0 0 18 18" fill="none" xmlns="http://www.w3.org/2000/svg">

- path]:fill-[#202020]" alt="Email" width="19" height="14" viewBox="0 0 19 14" fill="none" xmlns="http://www.w3.org/2000/svg">

Editorial Note: Blueprint may earn a commission from affiliate partner links featured here on our site. This commission does not influence our editors' opinions or evaluations. Please view our full advertiser disclosure policy .

Getty Images

- Travel insurance costs an average of 5% to 6% of the cost of your trip.

- Your travel destination and your age impact the cost of travel insurance.

- Senior travelers need to budget extra for travel insurance as they pay a higher percentage of their trip cost — an average of 18% for 80-year-olds.

There are several factors that influence how much you’ll pay for travel insurance, from your age and travel destination to the cost of your trip and the coverages you choose. Our insurance experts analyzed rates from the best travel insurance companies, and we’ve used that data to break down the average cost of travel insurance for you.

Compare travel insurance costs personalized for your trip

Travel insured.

Via TravelInsurance.com’s website

Top-scoring plan

Worldwide Trip Protector

Covers COVID?

Medical & evacuation limits per person

$100,000/$1 million

Atlas Journey Preferred

Seven Corners

RoundTrip Basic

$500,000/$1 million

How much is travel insurance?

The average cost of travel insurance is 5% to 6% of your nonrefundable trip expenses. To insure a $1,000 trip, for instance, costs an average of $61 (6%).

Average cost of travel insurance by trip cost

Average cost of travel insurance is based on quotes for a 30-year-old female traveling from California to Mexico for a 14-day trip. Source: Squaremouth.

Traveling on a budget? Check out these cheap travel insurance plans .

Average cost of travel insurance by age

While the cost of your trip is a key factor in how much you’ll pay for travel insurance, your age can also impact your rate. This is particularly true for travelers over 60. The average cost of travel insurance for a 70-year-old increases to 11% of total trip cost, and 80-year-old travelers pay an average of 18% for a senior travel insurance policy.

Average cost of travel insurance by number of travelers in your group

If you’re traveling with others, it’s typically cheaper to insure everyone in your group with a single travel insurance policy. Some plans even cover kids younger than 17 for free, as long as they’re traveling with their parents on the same itinerary.

In our analysis of travel insurance rates, we found that a family of four taking a 14-day trip from California to Mexico valued at $5,000 only pays about $29 more than a solo traveler buying travel insurance for the same trip. A couple, both age 40, will pay an average of $17 more than a single traveler of the same age.

What determines travel insurance costs?

One of the biggest factors to influence the cost of travel insurance is the travel insurance plan you select. The best travel insurance plans bundle several types of insurance, including coverage for trip cancellation, trip delay, trip interruption, travel medical, emergency medical evacuation and baggage loss and delay. The more comprehensive the plan, the more you’ll pay for travel insurance.

The coverage limits of your policy will also affect its cost. The limits dictate how much you’ll be reimbursed if you use your insurance. All of the 5-star plans in our best travel insurance rating offer medical reimbursement limits of $1 million. The higher the reimbursement limit, the more expensive your coverage will be.

Sample rates for different travel insurance plans

Average cost of travel insurance is based on quotes for a 30-year-old female traveling from California to Mexico for a 14-day trip. Different levels of benefits can account for price differences. These rates do not include a “cancel for any reason” upgrade. Source: Squaremouth.

Average travel insurance cost for “cancel for any reason”coverage

Based on our analysis of 16 travel insurance policies, adding CFAR coverage to a travel insurance policy will increase your cost by about 50%.

If you want to be able to cancel your trip for any reason — not just those listed in your policy — consider buying a travel insurance plan that offers “cancel for any reason” (CFAR) coverage .

“In 2023, the travel industry has faced a number of challenges including a rise in inclement weather, staffing shortages and strikes,” said Rajeev Shrivastava, CEO of VisitorsCoverage. “Consequently, we’re seeing an increase of canceled trips, disrupted flights and stranded travelers.”

“To prepare for these uncertainties,” said Shrivastava, “travelers should consider choosing flexible insurance coverage options like ‘cancel for any reason’ and ‘interruption for any reason,’ which protect trip investments in case of cancellations or disruptions.”

“Interruption for any reason” (IFAR) coverage isn’t as readily available as an upgrade, but it typically adds only 3% to 10% to the cost of your travel insurance.

Travel insurance costs for your vacation

What travel insurance covers.

“Travel insurance provides coverage for prepaid, nonrefundable trip expenses — up to the limits of the policy — should a trip be canceled or interrupted for a covered reason,” said Daniel Durazo, director of external communications at Allianz Partners USA.

The trip cancellation insurance part of your travel insurance can reimburse up to 100% for lost trip deposits, such as airline tickets, hotel rooms, rental cars, tours and cruises, if you cancel your trip for a reason listed in your policy.

“Examples of acceptable reasons to cancel a trip include illness or injury for the traveler, a close family member or a traveling companion,” said Durazo. “Other reasons may include your travel supplier stops offering services for 24 hours due to a natural disaster, severe weather or a strike, your home or destination becomes uninhabitable, or you or a travel companion are laid off after you purchase your policy.”

Once you start your trip, travel insurance continues to offer financial protection, said Durazo. “Post-departure benefits can help cover expenses like lost bags and travel delays and most importantly, can include emergency medical coverage and emergency medical transportation.”

If you do become ill or injured while traveling, travel insurance can cover your medical costs including doctors’ fees and hospital costs that may not be covered by your health insurance. “Domestic health care plans are usually not accepted outside the U.S.,” Durazo said. “So it’s especially important to get travel insurance with medical coverage and emergency medical transportation when traveling internationally.”

Even if you’re not traveling out of the country, travel insurance with medical coverage can be a good idea, Durazo said. “As many Americans now have high deductible health insurance plans, trips to urgent care or the ER can be expensive but could be covered by travel insurance while traveling.”

Methodology

Using data from Squaremouth, a travel insurance comparison website, our insurance experts analyzed rates for 23 travel insurance plans. The average rates were determined by comparing quotes for trips with a variety of costs, traveler ages, traveler groups and travel plan benefits.

Travel insurance costs FAQs

The average cost of travel insurance is between 5% and 6% of the cost of the trip. How much you pay for travel insurance will depend on the travel insurance company and plan you select, the total cost and destination of your trip, the age of travelers and the number of travelers you’re insuring.

You may wonder: Is travel insurance worth it?

A comprehensive travel insurance plan will include coverage for trip cancellation, trip interruption, trip delay, medical expense, emergency medical evacuation and baggage delay and loss.

Read your travel insurance policy carefully to understand what is covered and what is excluded. You can sometimes purchase add ons such as “cancel for any reason” (CFAR) coverage.

Do you need trip insurance? What travel insurance covers

Yes, travel insurance is typically more expensive for older travelers. While the average cost of travel insurance for a 20-year-old traveler is $224, the average cost increases at age 60 to $420 and to $907 for an 80-year-old.

Find the best coverage: Best senior travel insurance companies

Blueprint is an independent publisher and comparison service, not an investment advisor. The information provided is for educational purposes only and we encourage you to seek personalized advice from qualified professionals regarding specific financial decisions. Past performance is not indicative of future results.

Blueprint has an advertiser disclosure policy . The opinions, analyses, reviews or recommendations expressed in this article are those of the Blueprint editorial staff alone. Blueprint adheres to strict editorial integrity standards. The information is accurate as of the publish date, but always check the provider’s website for the most current information.

Heidi Gollub is the USA TODAY Blueprint managing editor of insurance. She was previously lead editor of insurance at Forbes Advisor and led the insurance team at U.S. News & World Report as assistant managing editor of 360 Reviews. Heidi has an MBA from Emporia State University and is a licensed property and casualty insurance expert.

Megan Horner is editorial director at USA TODAY Blueprint. She has over 10 years of experience in online publishing, mostly focused on credit cards and banking. Previously, she was the head of publishing at Finder.com where she led the team to publish personal finance content on credit cards, banking, loans, mortgages and more. Prior to that, she was an editor at Credit Karma. Megan has been featured in CreditCards.com, American Banker, Lifehacker and news broadcasts across the country. She has a bachelor’s degree in English and editing.

10 worst US airports for flight cancellations this week

Travel Insurance Heidi Gollub

10 worst US airports for flight cancellations last week

AXA Assistance USA travel insurance review 2024

Travel Insurance Jennifer Simonson

Cheapest travel insurance of April 2024

Travel Insurance Mandy Sleight

Average flight costs: Travel, airfare and flight statistics 2024

Travel Insurance Timothy Moore

John Hancock travel insurance review 2024

HTH Worldwide travel insurance review 2024

Airfare at major airports is up 29% since 2021

USI Affinity travel insurance review 2024

Trawick International travel insurance review 2024

Travel insurance for Canada

Travelex travel insurance review 2024

Best travel insurance companies of April 2024

Travel Insurance Amy Fontinelle

Best travel insurance for a Disney World vacation in 2024

World Nomads travel insurance review 2024

The best travel insurance policies and providers

It's easy to dismiss the value of travel insurance until you need it.

Many travelers have strong opinions about whether you should buy travel insurance . However, the purpose of this post isn't to determine whether it's worth investing in. Instead, it compares some of the top travel insurance providers and policies so you can determine which travel insurance option is best for you.

Of course, as the coronavirus remains an ongoing concern, it's important to understand whether travel insurance covers pandemics. Some policies will cover you if you're diagnosed with COVID-19 and have proof of illness from a doctor. Others will take coverage a step further, covering additional types of pandemic-related expenses and cancellations.

Know, though, that every policy will have exclusions and restrictions that may limit coverage. For example, fear of travel is generally not a covered reason for invoking trip cancellation or interruption coverage, while specific stipulations may apply to elevated travel warnings from the Centers for Disease Control and Prevention.

Interested in travel insurance? Visit InsureMyTrip.com to shop for plans that may fit your travel needs.

So, before buying a specific policy, you must understand the full terms and any special notices the insurer has about COVID-19. You may even want to buy the optional cancel for any reason add-on that's available for some comprehensive policies. While you'll pay more for that protection, it allows you to cancel your trip for any reason and still get some of your costs back. Note that this benefit is time-sensitive and has other eligibility requirements, so not all travelers will qualify.

In this guide, we'll review several policies from top travel insurance providers so you have a better understanding of your options before picking the policy and provider that best address your wants and needs.

The best travel insurance providers

To put together this list of the best travel insurance providers, a number of details were considered: favorable ratings from TPG Lounge members, the availability of details about policies and the claims process online, positive online ratings and the ability to purchase policies in most U.S. states. You can also search for options from these (and other) providers through an insurance comparison site like InsureMyTrip .

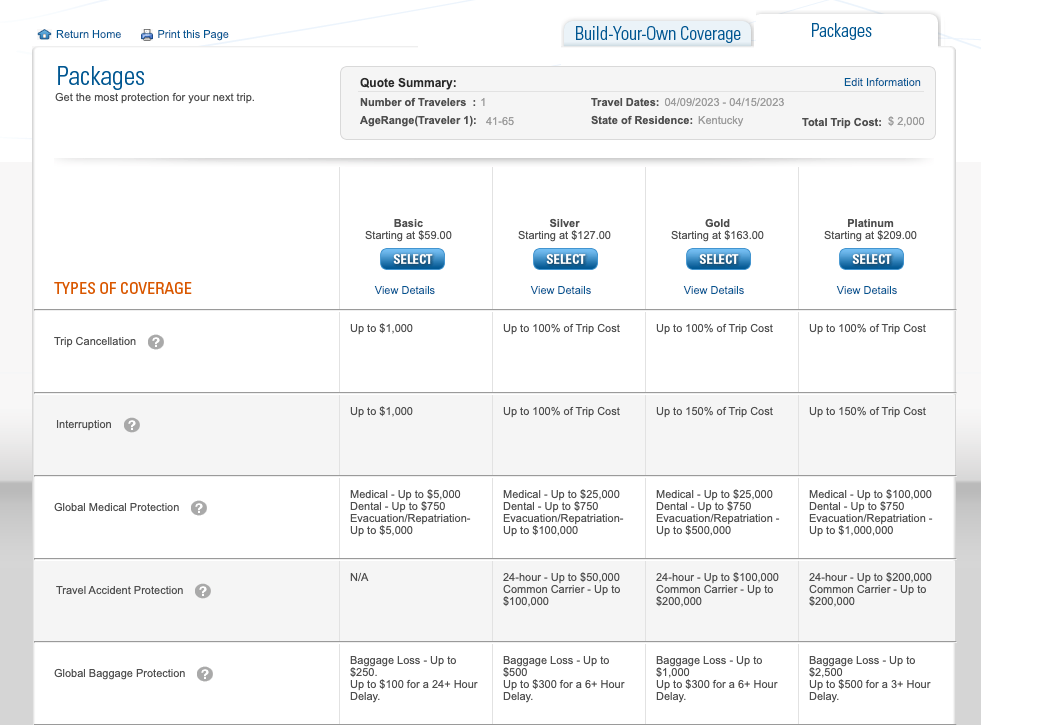

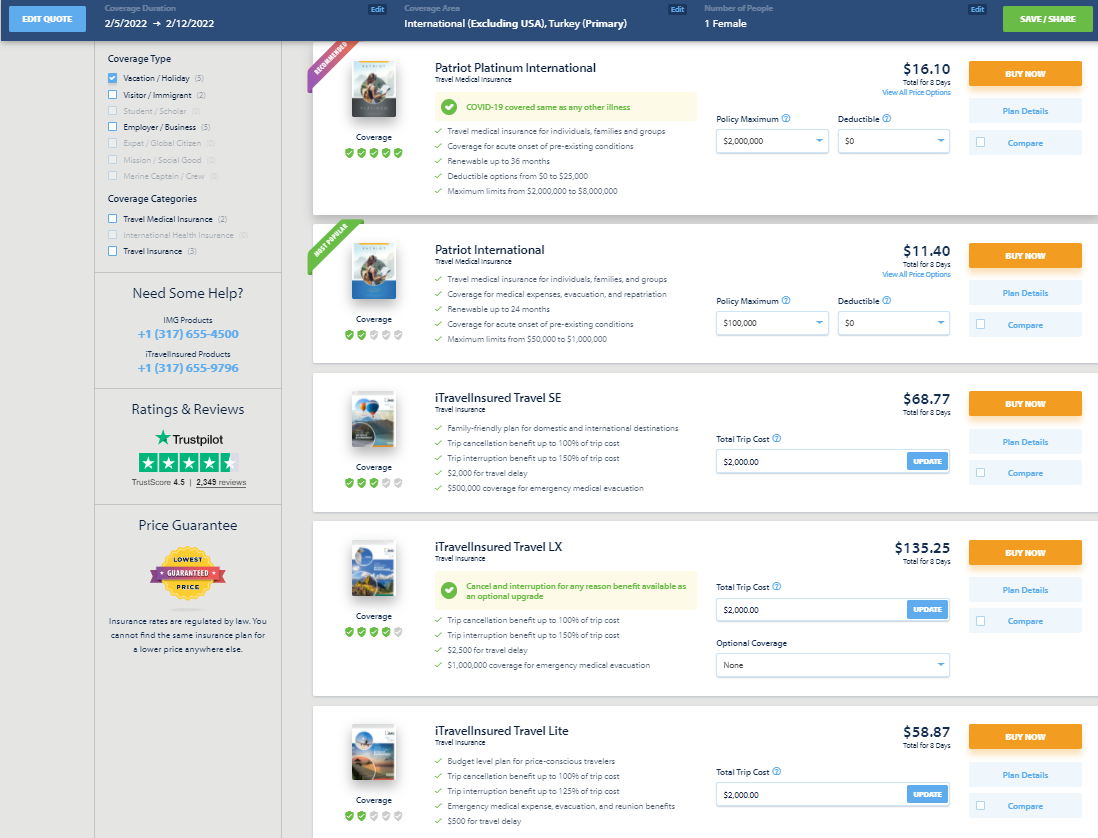

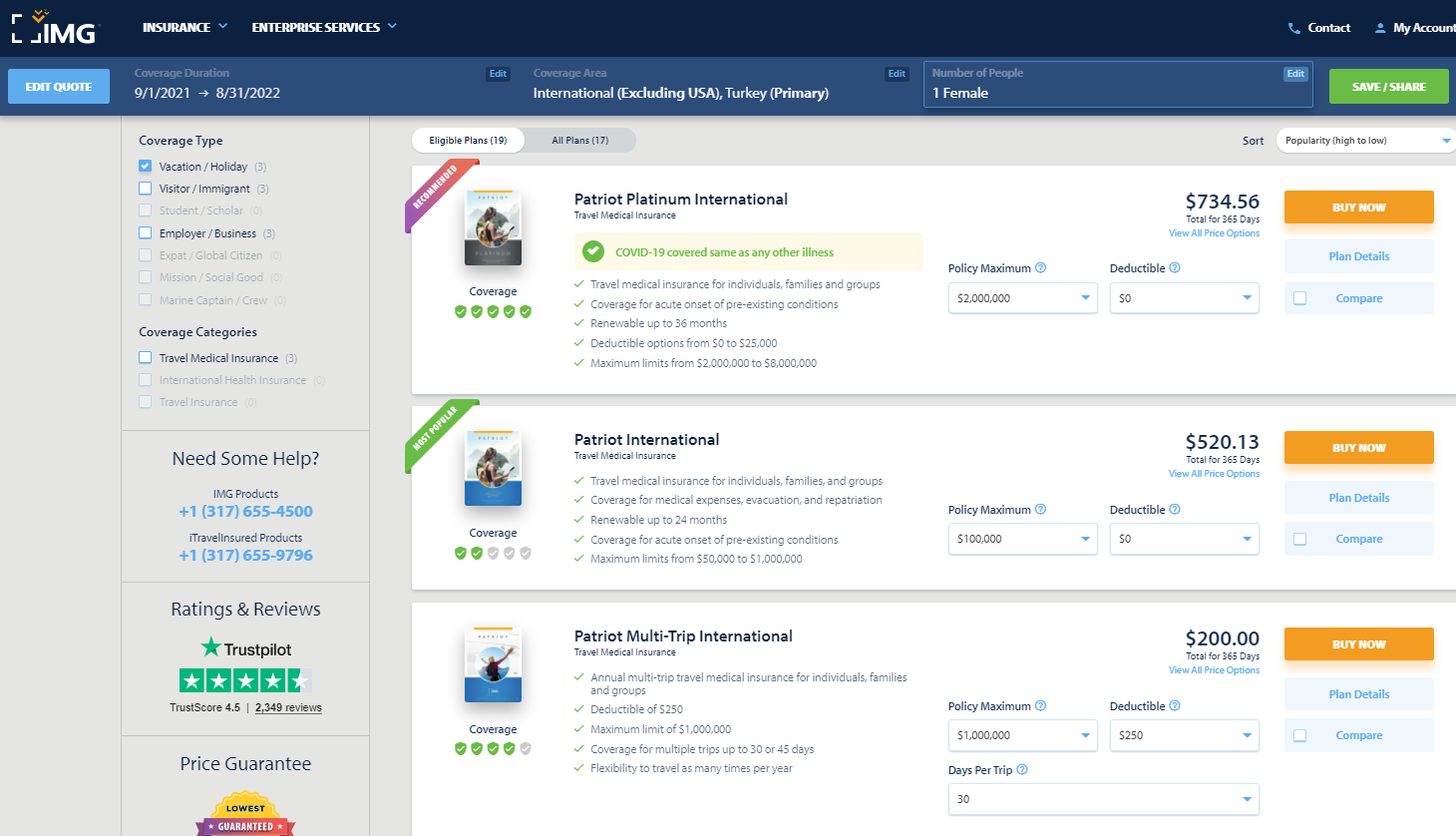

When comparing insurance providers, I priced out a single-trip policy for each provider for a $2,000, one-week vacation to Istanbul . I used my actual age and state of residence when obtaining quotes. As a result, you may see a different price — or even additional policies due to regulations for travel insurance varying from state to state — when getting a quote.

AIG Travel Guard

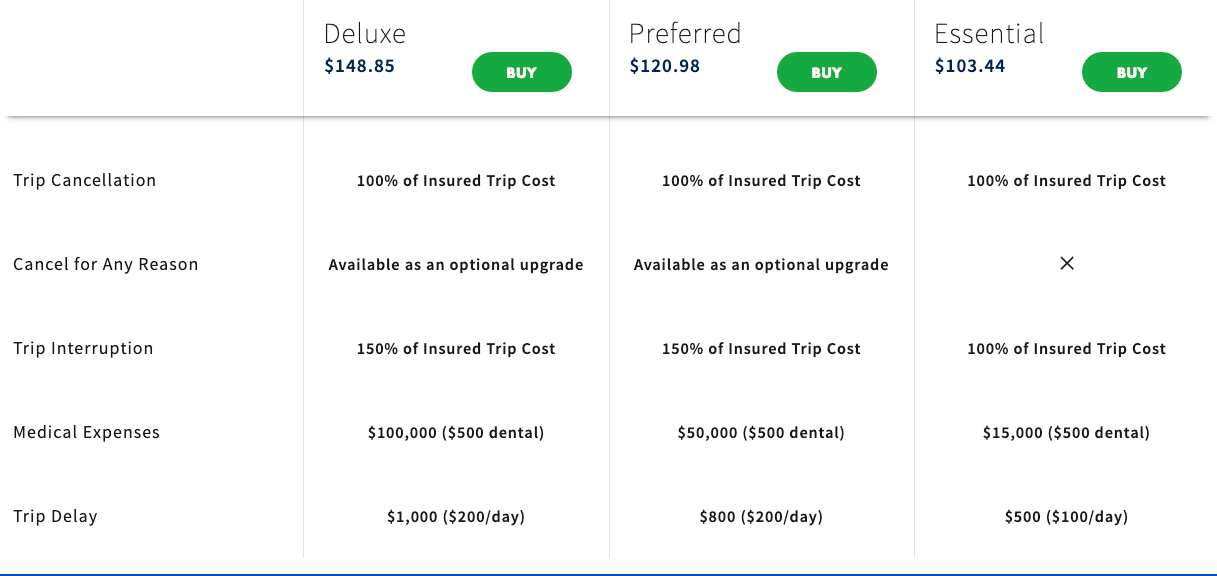

AIG Travel Guard receives many positive reviews from readers in the TPG Lounge who have filed claims with the company. AIG offers three plans online, which you can compare side by side, and the ability to examine sample policies. Here are three plans for my sample trip to Turkey.

AIG Travel Guard also offers an annual travel plan. This plan is priced at $259 per year for one Florida resident.

Additionally, AIG Travel Guard offers several other policies, including a single-trip policy without trip cancellation protection . See AIG Travel Guard's COVID-19 notification and COVID-19 advisory for current details regarding COVID-19 coverage.

Preexisting conditions

Typically, AIG Travel Guard wouldn't cover you for any loss or expense due to a preexisting medical condition that existed within 180 days of the coverage effective date. However, AIG Travel Guard may waive the preexisting medical condition exclusion on some plans if you meet the following conditions:

- You purchase the plan within 15 days of your initial trip payment.

- The amount of coverage you purchase equals all trip costs at the time of purchase. You must update your coverage to insure the costs of any subsequent arrangements that you add to your trip within 15 days of paying the travel supplier for these additional arrangements.

- You must be medically able to travel when you purchase your plan.

Standout features

- The Deluxe and Preferred plans allow you to purchase an upgrade that lets you cancel your trip for any reason. However, reimbursement under this coverage will not exceed 50% or 75% of your covered trip cost.

- You can include one child (age 17 and younger) with each paying adult for no additional cost on most single-trip plans.

- Other optional upgrades, including an adventure sports bundle, a baggage bundle, an inconvenience bundle, a pet bundle, a security bundle and a wedding bundle, are available on some policies. So, an AIG Travel Guard plan may be a good choice if you know you want extra coverage in specific areas.

Purchase your policy here: AIG Travel Guard .

Allianz Travel Insurance

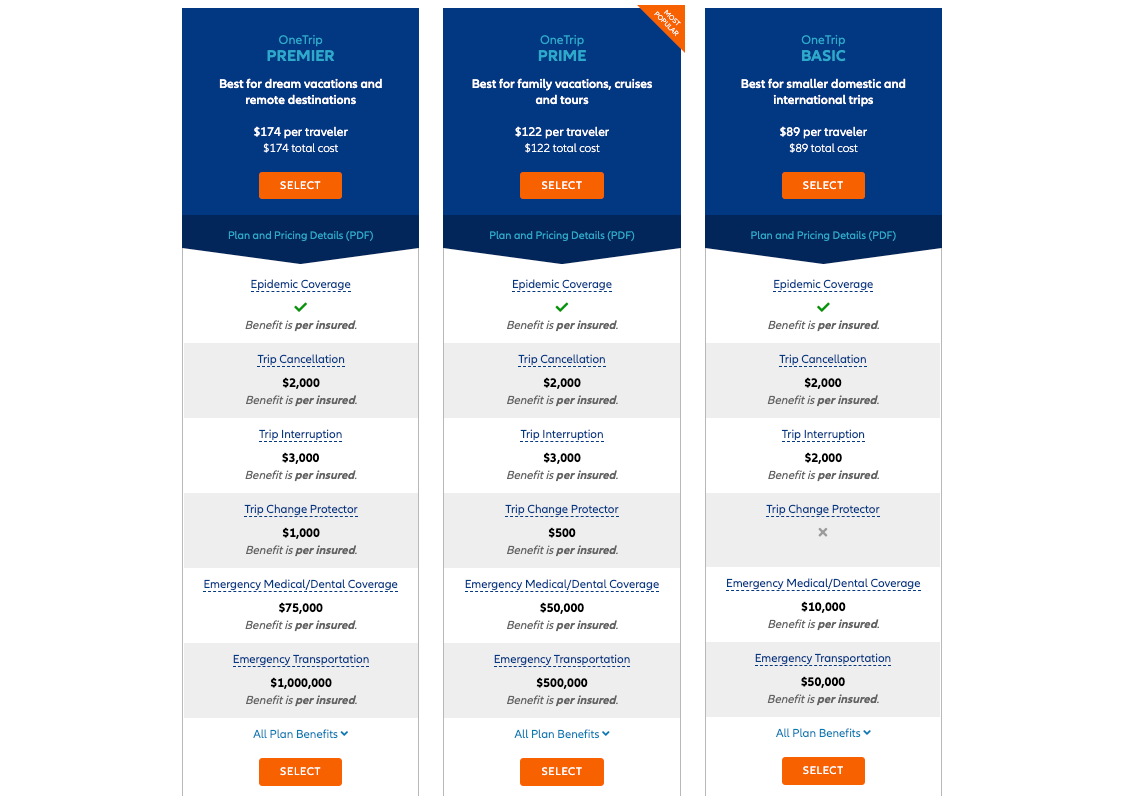

Allianz is one of the most highly regarded providers in the TPG Lounge, and many readers found the claim process reasonable. Allianz offers many plans, including the following single-trip plans for my sample trip to Turkey.

If you travel frequently, it may make sense to purchase an annual multi-trip policy. For this plan, all of the maximum coverage amounts in the table below are per trip (except for the trip cancellation and trip interruption amounts, which are an aggregate limit per policy). Trips typically must last no more than 45 days, although some plans may cover trips of up to 90 days.

See Allianz's coverage alert for current information on COVID-19 coverage.

Most Allianz travel insurance plans may cover preexisting medical conditions if you meet particular requirements. For the OneTrip Premier, Prime and Basic plans, the requirements are as follows:

- You purchased the policy within 14 days of the date of the first trip payment or deposit.

- You were a U.S. resident when you purchased the policy.

- You were medically able to travel when you purchased the policy.

- On the policy purchase date, you insured the total, nonrefundable cost of your trip (including arrangements that will become nonrefundable or subject to cancellation penalties before your departure date). If you incur additional nonrefundable trip expenses after purchasing this policy, you must insure them within 14 days of their purchase.

- Allianz offers reasonably priced annual policies for independent travelers and families who take multiple trips lasting up to 45 days (or 90 days for select plans) per year.

- Some Allianz plans provide the option of receiving a flat reimbursement amount without receipts for trip delay and baggage delay claims. Of course, you can also submit receipts to get up to the maximum refund.

- For emergency transportation coverage, you or someone on your behalf must contact Allianz, and Allianz must then make all transportation arrangements in advance. However, most Allianz policies provide an option if you cannot contact the company: Allianz will pay up to what it would have paid if it had made the arrangements.

Purchase your policy here: Allianz Travel Insurance .

American Express Travel Insurance

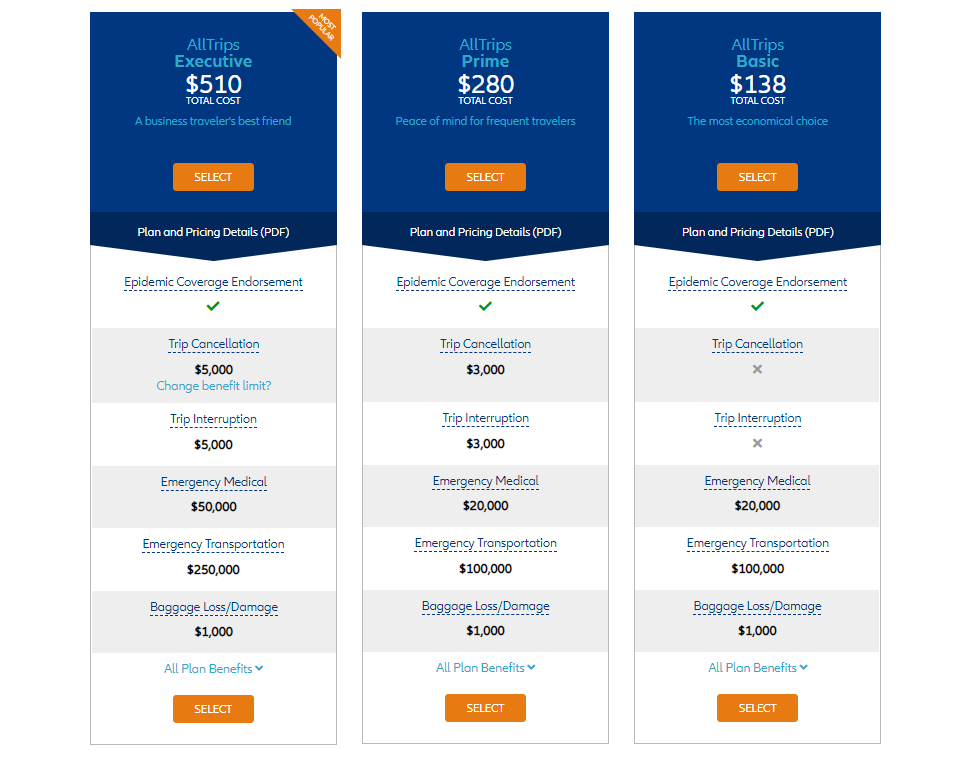

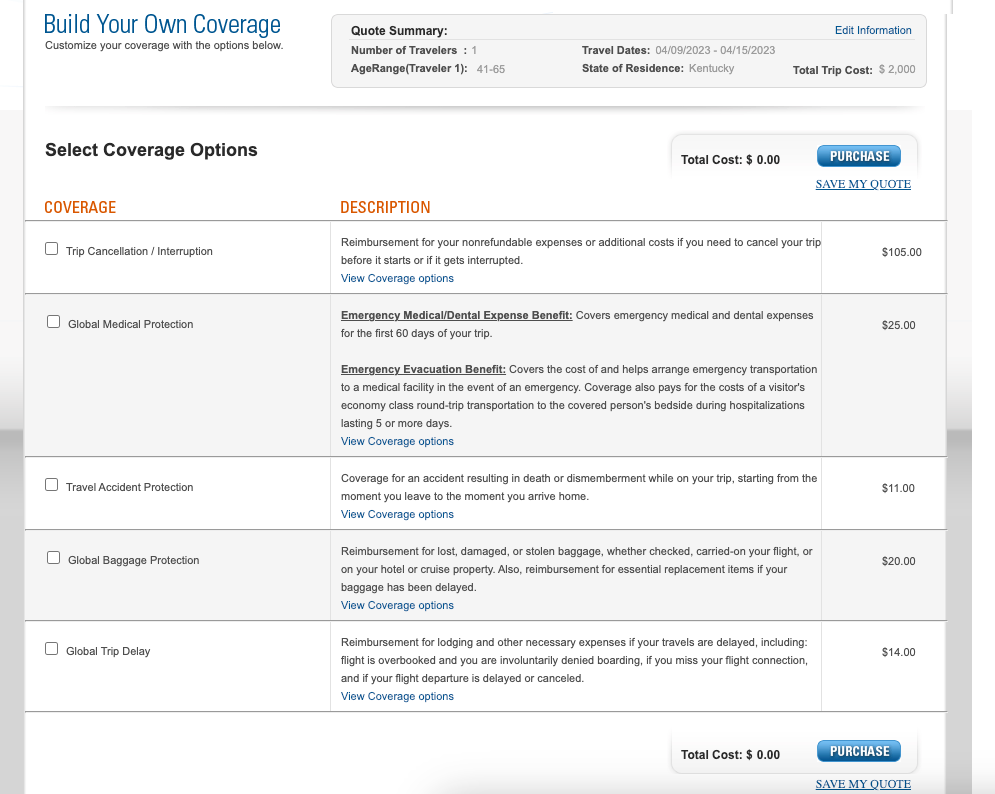

American Express Travel Insurance offers four different package plans and a build-your-own coverage option. You don't have to be an American Express cardholder to purchase this insurance. Here are the four package options for my sample weeklong trip to Turkey. Unlike some other providers, Amex won't ask for your travel destination on the initial quote (but will when you purchase the plan).

Amex's build-your-own coverage plan is unique because you can purchase just the coverage you need. For most types of protection, you can even select the coverage amount that works best for you.

The prices for the packages and the build-your-own plan don't increase for longer trips — as long as the trip cost remains constant. However, the emergency medical and dental benefit is only available for your first 60 days of travel.

Typically, Amex won't cover any loss you incur because of a preexisting medical condition that existed within 90 days of the coverage effective date. However, Amex may waive its preexisting-condition exclusion if you meet both of the following requirements:

- You must be medically able to travel at the time you pay the policy premium.

- You pay the policy premium within 14 days of making the first covered trip deposit.

- Amex's build-your-own coverage option allows you to only purchase — and pay for — the coverage you need.

- Coverage on long trips doesn't cost more than coverage for short trips, making this policy ideal for extended getaways. However, the emergency medical and dental benefit only covers your first 60 days of travel.

- American Express Travel Insurance can protect travel expenses you purchase with Amex Membership Rewards points in the Pay with Points program (as well as travel expenses bought with cash, debit or credit). However, travel expenses bought with other types of points and miles aren't covered.

Purchase your policy here: American Express Travel Insurance .

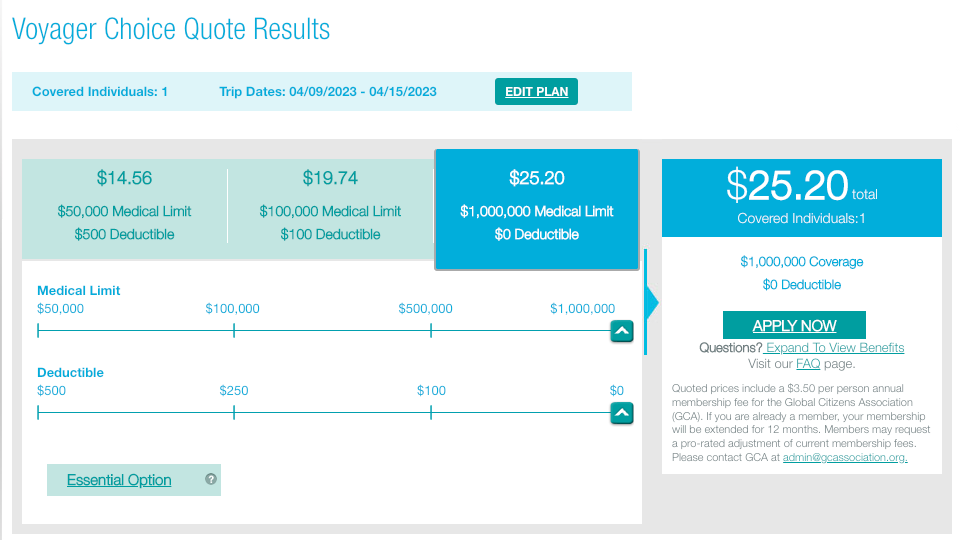

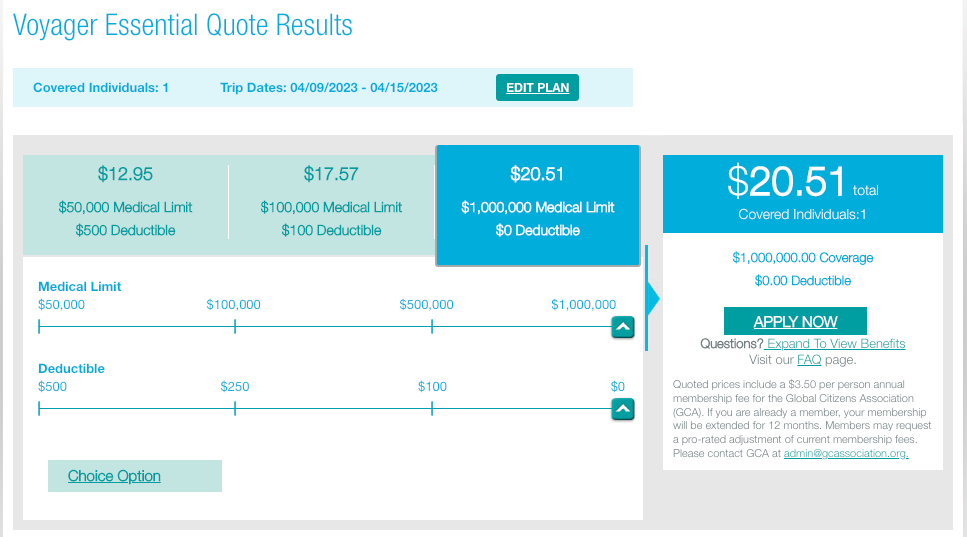

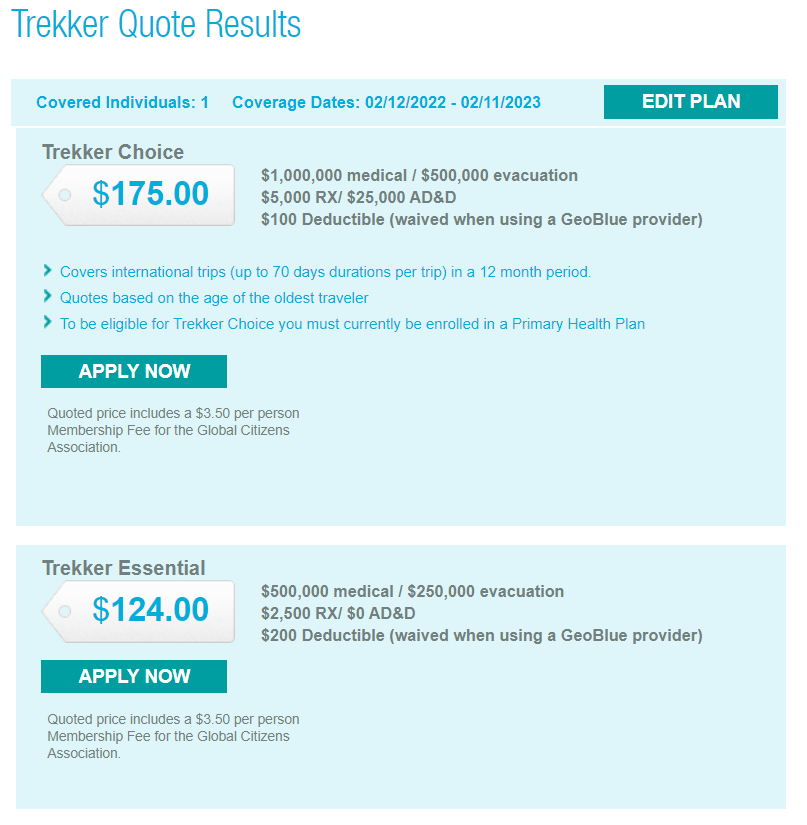

GeoBlue is different from most other providers described in this piece because it only provides medical coverage while you're traveling internationally and does not offer benefits to protect the cost of your trip. There are many different policies. Some require you to have primary health insurance in the U.S. (although it doesn't need to be provided by Blue Cross Blue Shield), but all of them only offer coverage while traveling outside the U.S.

Two single-trip plans are available if you're traveling for six months or less. The Voyager Choice policy provides coverage (including medical services and medical evacuation for a sudden recurrence of a preexisting condition) for trips outside the U.S. to travelers who are 95 or younger and already have a U.S. health insurance policy.

The Voyager Essential policy provides coverage (including medical evacuation for a sudden recurrence of a preexisting condition) for trips outside the U.S. to travelers who are 95 or younger, regardless of whether they have primary health insurance.

In addition to these options, two multi-trip plans cover trips of up to 70 days each for one year. Both policies provide coverage (including medical services and medical evacuation for preexisting conditions) to travelers with primary health insurance.

Be sure to check out GeoBlue's COVID-19 notices before buying a plan.

Most GeoBlue policies explicitly cover sudden recurrences of preexisting conditions for medical services and medical evacuation.

- GeoBlue can be an excellent option if you're mainly concerned about the medical side of travel insurance.

- GeoBlue provides single-trip, multi-trip and long-term medical travel insurance policies for many different types of travel.

Purchase your policy here: GeoBlue .

IMG offers various travel medical insurance policies for travelers, as well as comprehensive travel insurance policies. For a single trip of 90 days or less, there are five policy types available for vacation or holiday travelers. Although you must enter your gender, males and females received the same quote for my one-week search.

You can purchase an annual multi-trip travel medical insurance plan. Some only cover trips lasting up to 30 or 45 days, but others provide coverage for longer trips.

See IMG's page on COVID-19 for additional policy information as it relates to coronavirus-related claims.

Most plans may cover preexisting conditions under set parameters or up to specific amounts. For example, the iTravelInsured Travel LX travel insurance plan shown above may cover preexisting conditions if you purchase the insurance within 24 hours of making the final payment for your trip.

For the travel medical insurance plans shown above, preexisting conditions are covered for travelers younger than 70. However, coverage is capped based on your age and whether you have a primary health insurance policy.

- Some annual multi-trip plans are modestly priced.

- iTravelInsured Travel LX may offer optional cancel for any reason and interruption for any reason coverage, if eligible.

Purchase your policy here: IMG .

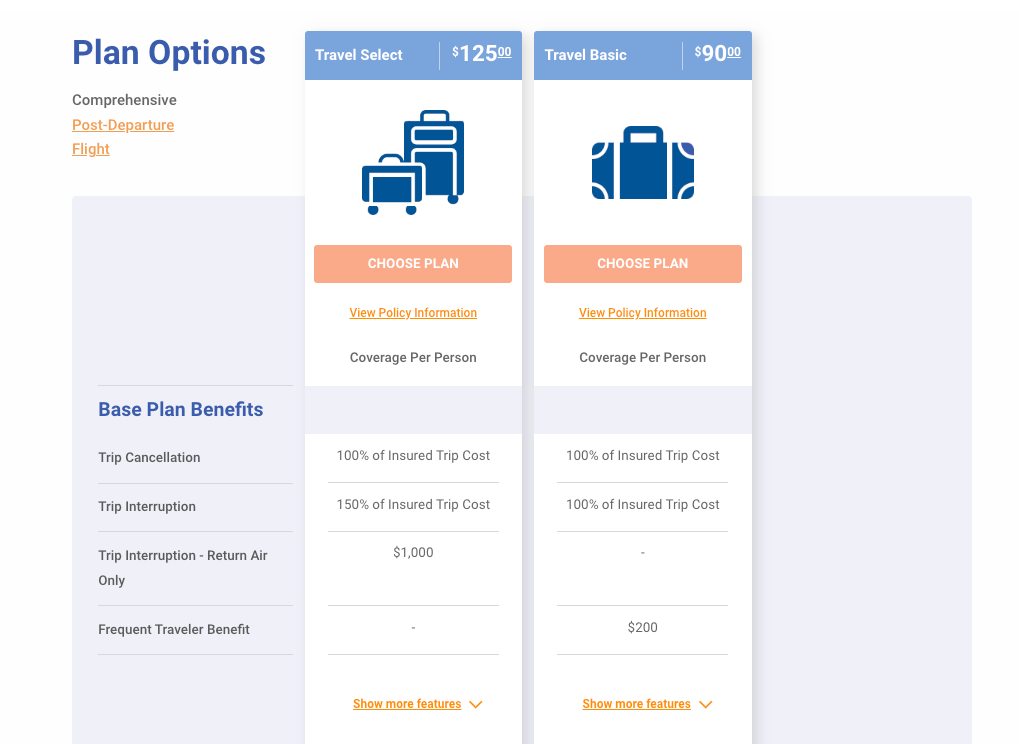

Travelex Insurance

Travelex offers three single-trip plans: Travel Basic, Travel Select and Travel America. However, only the Travel Basic and Travel Select plans would be applicable for my trip to Turkey.

See Travelex's COVID-19 coverage statement for coronavirus-specific information.

Typically, Travelex won't cover losses incurred because of a preexisting medical condition that existed within 60 days of the coverage effective date. However, the Travel Select plan may offer a preexisting condition exclusion waiver. To be eligible for this waiver, the insured traveler must meet all the following conditions:

- You purchase the plan within 15 days of the initial trip payment.

- The amount of coverage purchased equals all prepaid, nonrefundable payments or deposits applicable to the trip at the time of purchase. Additionally, you must insure the costs of any subsequent arrangements added to the same trip within 15 days of payment or deposit.

- All insured individuals are medically able to travel when they pay the plan cost.

- The trip cost does not exceed the maximum trip cost limit under trip cancellation as shown in the schedule per person (only applicable to trip cancellation, interruption and delay).

- Travelex's Travel Select policy can cover trips lasting up to 364 days, which is longer than many single-trip policies.

- Neither Travelex policy requires receipts for trip and baggage delay expenses less than $25.

- For emergency evacuation coverage, you or someone on your behalf must contact Travelex and have Travelex make all transportation arrangements in advance. However, both Travelex policies provide an option if you cannot contact Travelex: Travelex will pay up to what it would have paid if it had made the arrangements.

Purchase your policy here: Travelex Insurance .

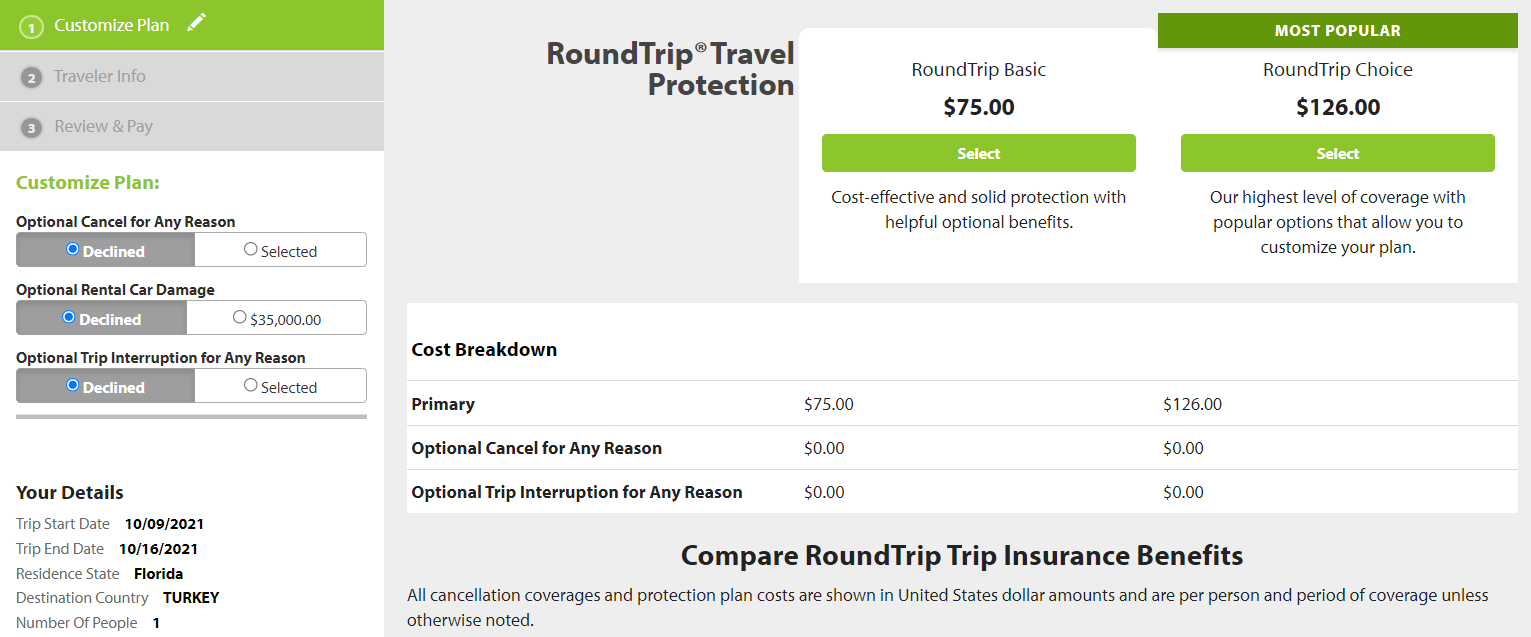

Seven Corners

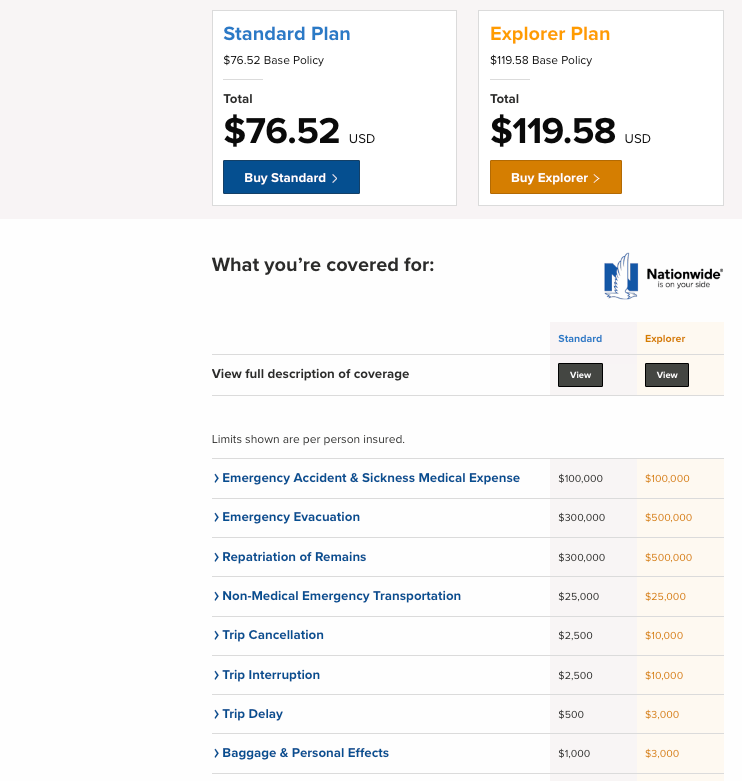

Seven Corners offers a wide variety of policies. Here are the policies that are most applicable to travelers on a single international trip.

Seven Corners also offers many other types of travel insurance, including an annual multi-trip plan. You can choose coverage for trips of up to 30, 45 or 60 days when purchasing an annual multi-trip plan.

See Seven Corner's page on COVID-19 for additional policy information as it relates to coronavirus-related claims.

Typically, Seven Corners won't cover losses incurred because of a preexisting medical condition. However, the RoundTrip Choice plan offers a preexisting condition exclusion waiver. To be eligible for this waiver, you must meet all of the following conditions:

- You buy this plan within 20 days of making your initial trip payment or deposit.

- You or your travel companion are medically able and not disabled from travel when you pay for this plan or upgrade your plan.

- You update the coverage to include the additional cost of subsequent travel arrangements within 15 days of paying your travel supplier for them.

- Seven Corners offers the ability to purchase optional sports and golf equipment coverage. If purchased, this extra insurance will reimburse you for the cost of renting sports or golf equipment if yours is lost, stolen, damaged or delayed by a common carrier for six or more hours. However, Seven Corners must authorize the expenses in advance.

- You can add cancel for any reason coverage or trip interruption for any reason coverage to RoundTrip plans. Although some other providers offer cancel for any reason coverage, trip interruption for any reason coverage is less common.

- Seven Corners' RoundTrip Choice policy offers a political or security evacuation benefit that will transport you to the nearest safe place or your residence under specific conditions. You can also add optional event ticket registration fee protection to the RoundTrip Choice policy.

Purchase your policy here: Seven Corners .

World Nomads

World Nomads is popular with younger, active travelers because of its flexibility and adventure-activities coverage on the Explorer plan. Unlike many policies offered by other providers, you don't need to estimate prepaid costs when purchasing the insurance to have access to trip interruption and cancellation insurance.

World Nomads offers two single-trip plans.

World Nomads has a page dedicated to coronavirus coverage , so be sure to view it before buying a policy.

World Nomads won't cover losses incurred because of a preexisting medical condition (except emergency evacuation and repatriation of remains) that existed within 90 days of the coverage effective date. Unlike many other providers, World Nomads doesn't offer a waiver.

- World Nomads' policies cover more adventure sports than most providers, so activities such as bungee jumping are included. The Explorer policy covers almost any adventure sport, including skydiving, stunt flying and caving. So, if you partake in adventure sports while traveling, the Explorer policy may be a good fit.

- World Nomads' policies provide nonmedical evacuation coverage for transportation expenses if there is civil or political unrest in the country you are visiting. The coverage may also transport you home if there is an eligible natural disaster or a government expels you.

Purchase your policy here: World Nomads .

Other options for buying travel insurance

This guide details the policies of eight providers with the information available at the time of publication. There are many options when it comes to travel insurance, though. To compare different policies quickly, you can use a travel insurance aggregator like InsureMyTrip to search. Just note that these search engines won't show every policy and every provider, and you should still research the provided policies to ensure the coverage fits your trip and needs.

You can also purchase a plan through various membership associations, such as USAA, AAA or Costco. Typically, these organizations partner with a specific provider, so if you are a member of any of these associations, you may want to compare the policies offered through the organization with other policies to get the best coverage for your trip.

Related: Should you get travel insurance if you have credit card protection?

Is travel insurance worth getting?