- Reward types, points & expiry

- What card do I use for…

- Current Credit Card Sign Up Bonuses

- Credit Card Lounge Benefits

- Credit Card Airport Limo Benefits

- Credit Card Reviews

- Points Transfer Partners

- Singapore Airlines First & Business Class Seat Guide

- Singapore Airlines Book The Cook Wiki

- Singapore Airlines Wi-Fi guide

- The Milelion’s KrisFlyer Guide

- What is the value of a mile?

- Best Rate Guarantees (BRGs) for beginners

- Singapore Staycation Guide

- Trip Report Index

- Credit Cards

- For Great Justice

- General Travel

- Other Loyalty Programs

- Trip Reports

Review: New Singapore Airlines x Allianz travel insurance policy

Singapore Airlines' travel insurance is now provided by Allianz, and it's every bit an improvement over the previous AIG policy.

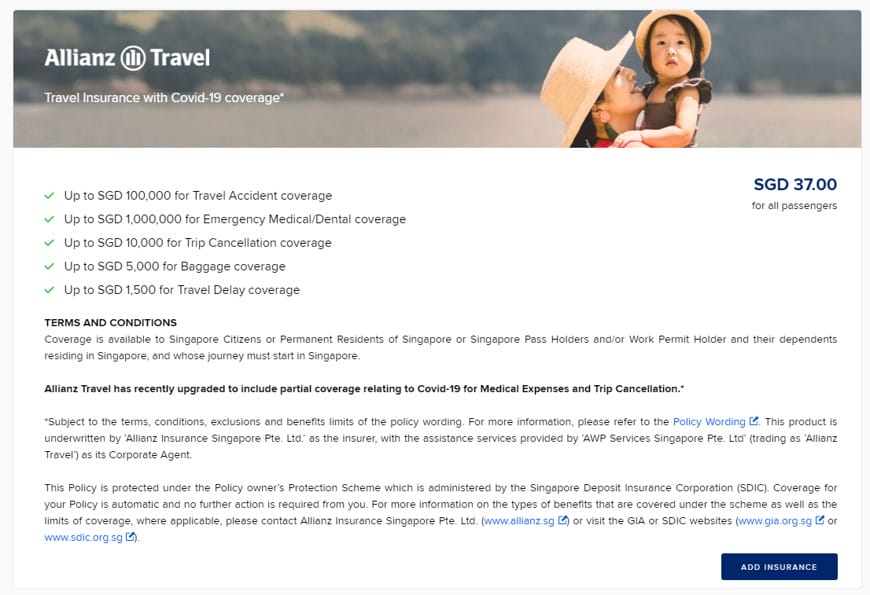

Singapore Airlines passengers have the option to purchase an exclusive travel insurance policy that provides coverage for overseas medical expenses (including COVID-19), accidents and travel inconveniences.

This was previously called Travel Insurance by Travel Guard (underwritten by AIG). Singapore Airlines has now replaced this with a new policy called Travel Protect by Singapore Airlines (underwritten by Allianz).

Coverage is available to Singapore Airlines passengers who are Singapore Citizens or Permanent Residents of Singapore, or Singapore Pass Holders and/or Work Permit Holders and their dependents residing in Singapore. Journeys must commence in Singapore.

I’ve gone through the new Allianz policy, and the good news is it’s a significant improvement from the previous AIG one- not only does it offer more coverage, it’s also cheaper to boot.

Allianz Travel Coverage

Travel Protect by Singapore Airlines (which for convenience I’ll just refer to as the “Allianz policy” from hereon) provides up to S$1 million of overseas medical coverage and S$500,000 of emergency medical evacuation coverage (both including COVID-19).

The policy is available regardless of whether you bought your ticket with cash or redeemed miles. Coverage can be added either at the time of booking your itinerary, or subsequently via the Manage Booking function.

If you don’t see the option to add insurance, you’ll need to contact customer service at [email protected] or call +65 6245 4059 (Mon-Fri 0930 to 1730 SGT).

Under the Allianz policy wording , you’ll notice two columns: Comprehensive , and KrisFlyer Comprehensive.

Simply put, if you’re a KrisFlyer member (of any tier) during the period of insurance, you’ll enjoy KrisFlyer Comprehensive coverage. This provides additional coverage for medical expenses, rental car excess, loss of personal documents and more, and there’s no reason why you shouldn’t qualify for this.

Comparison: Allianz vs AIG

Here’s a summary of how the new Allianz policy measures up to the previous AIG policy. Do note the following:

- I’ve used Allianz KrisFlyer Comprehensive as the basis of comparison since it costs nothing to join KrisFlyer

- AIG’s values have a range because coverage depends on where you’re travelling to. AIG splits the world into three zones: ASEAN, Asia and International. ASEAN has the lowest coverage, while International has the highest

- AIG also has some supplementary coverage for KrisFlyer members, so I’ve included it where relevant

There’s a lot of information in the table above, but what should immediately jump out is that Allianz not only offers more coverage in most areas, it’s also cheaper than AIG (unfortunately I don’t have historical AIG quotes for travel within Asia/ASEAN, so I can’t make that comparison).

Let’s look at some of the finer details below.

COVID-19 medical expenses & emergency medical evacuation

AIG’s policy covers up to S$350,000 of COVID-19 medical expenses, but Allianz covers up to S$1 million.

More importantly, under the AIG policy both COVID-19 medical expenses and emergency medical evacuation share the same cap (i.e. the maximum you can claim for COVID-19 medical expenses and emergency medical evacuation is S$350,000).

With Allianz, there is a separate cap for COVID-19 emergency medical evacuation of S$500,000.

Chances are, if your situation is bad enough to warrant medical evacuation to Singapore, you’ve already racked up a sizeable overseas medical bill. You’ll want to ensure there’s enough left over to cover the repatriation.

Quarantine allowance

If you’re diagnosed with COVID-19 overseas and are asymptomatic or mildly symptomatic, most countries won’t admit you to hospital. Instead, you’ll be issued with a quarantine order, which you’ll serve out in a hotel.

AIG provides a quarantine allowance that varies depending on country (max. 14 consecutive days):

- ASEAN: S$50 per day

- Asia: S$100 per day

- International: S$200 per day

Allianz doesn’t mention a quarantine allowance, but you can make a claim under the trip interruption section for:

Such coverage applies when :

tl;dr: if you get a quarantine order due to COVID-19, you can claim up to S$150 per day for 14 days.

AIG would be more generous for travel outside of Asia and ASEAN, but otherwise Allianz is the superior option.

One-way trips

Given award space constraints, it’s not uncommon for miles collectors to book separate one-way tickets, even if their intention is to fly a round-trip.

While both policies cover one-way trips, AIG was much stricter in its wording. Cover for a one-way trip was limited to certain sections of the policy, commenced 3 hours before leaving Singapore, and ceased at the earlier of:

- the expiry of the period specified in the insurance; or

- your arrival at your first overseas destination

That made it highly impractical on its own. Most customers ended up having to write in to AIG and present 2x one-way tickets, in order to get quoted insurance on a round-trip basis.

Allianz is much kinder with its treatment of one-way trips.

If your policy was purchased with a one-way booking, your coverage end date will be the scheduled return date for your trip, as shown on your travel documents (not exceeding 30 days from the departure date shown on your travel documents). Additionally, your policy will end on the earliest of:

1. At 23:59 on the day you cancel your policy; or 2. At 23:59 on the day you file a trip cancellation claim with us; 3. At 23:59 on the day you end your trip, if you end your trip early; 4. At 23:59 on the day you arrive at a medical facility for further care if you end your trip due to a medical reason; or 5. At 23:59 on the 180th day of the trip

Trip cancellation

In terms of trip cancellation, AIG covers a pre-departure COVID-19 diagnosis, plus the usual reasons like death or serious sickness, witness summons, and natural disasters affecting your destination.

However, Allianz provides a much wider range of covered reasons (16 in total), including a COVID-19 diagnosis, a traffic accident on departure date, getting laid off from work, securing a new job, or having your travel documents stolen.

However, note that neither policy covers trip cancellation resulting from border closures or additional quarantine requirements (so they wouldn’t cover the current situation with Italy , for example).

Coverage of airline miles

Speaking of trip cancellation, AIG’s policy explicitly states that it will not cover the loss of air miles used to pay for the trip.

On the other hand, Allianz’s policy is silent about this subject; the only line I can find that refers to air miles is this:

I take it to mean they will cover such claims, insofar as they relate to the redeposit of airline miles.

Here’s the thing though. There are only two scenarios where you could lose your KrisFlyer miles due to a cancelled trip:

- You booked a Spontaneous Escapes award , which is strictly non-refundable

- Your airline miles have already expired at the time of refund (remember: miles validity is different from ticket validity; if this concept confuses you, read this article )

(1) isn’t an issue right now, because Singapore Airlines has suspended Spontaneous Escapes. With regards to (2), Singapore Airlines has granted extensions to all KrisFlyer miles so the earliest any will expire is April 2022.

In all other situations, you can pay a penalty fee to recover the miles used for your booking, as shown below.

Even if you miss your flight (i.e. no show), the miles are still recoverable. For example, if you made a Business Saver reservation and missed your flight, you’d pay a US$300 no show fee, plus a US$75 fee to change your dates.

Therefore it might not be all that important for travel insurance to cover miles at this juncture, since there’s no Spontaneous Escapes nor expiry.

Unless I’m missing something, Singapore Airlines’ new Allianz travel insurance policy looks to be every bit an improvement over the previous AIG one. Travellers enjoy more generous coverage for a lower fee, and this will more than satisfy the requirements for countries with mandatory COVID-19 travel insurance requirements (e.g. South Korea, Thailand).

Anything else you spotted in the policies worth flagging?

- singapore airlines

Similar Articles

Pelago offering 30% discount for krisflyer miles redemptions, krisflyer spontaneous escapes for may 2024 announced, 26 comments.

The definition of quarantine in this Allianz policy is so much more reasonable than some other insurers like Chubb. Allianz covers hotel. Chubb covers only government-appointed facilities which is useless in most of the destinations.

This Allianz insurance is new, so its actuarial computations are updated with the most recent data and environment (including where to quarantine). Others were launched earlier using older sets of assumptions and data. They can’t just change coverage anyhow. It’s unfortunate but there is a certain due process.

Hopefully they can change soon. I really liked using Chubb before the pandemic.

Hi Freddy, Chubb had previously shared that their TravellerShield Plus policy will provide cover for quarantine in hotels (under the Overseas Quarantine Benefit due to Covid-19), if all the conditions below are fulfilled: 1. The traveller is diagnosed with Covid-19 2. The overseas destination has no designated quarantine facility for Covid-19 patients 3. The authorities of the overseas destination requires the traveller to be quarantined in a hotel

Hi Aaron. Thanks for following up on this! Do you know where I can find this in Chubb’s website or somewhere? I can’t find it in the policy wording, at least for the one with DBS. If I buy their insurance and make the claim, I can’t say “Aaron Wong from Milelion told me this”…=)

It’s an official reply from a DBS spokesperson quoting a Chubb spokesperson. but yeah I understand the problem, I will ask if they can put it in black and white on the website.

Possible to overcome the IT constraint of Thailand Pass for this insurance?

Thanks Aaron. Good news for travellers!

So I guess the SIA complimentary travel insurance for PPS members has also been shifted from AIG to Allianz and will their policy conditions for this complimentary insurance be the same as mentioned above?

There is complimentary travel insurance for PPS? Oddly enough Google doesn’t seem to know that

I was initially not aware either, until SIA Netherlands informed me of that fact. I broke my wrist in 2019 while overseas. AIG complimentary travel insurance which is only applicable to PPS members if you fly on SIA covered all expenses incl quite a generous sum after my return to Singapore.

Hi Gaby, are you able to provide any link/reference to this policy which covers PPS members for any trips done on SIA flights?

It’s on the SIA PPS portal. It mentions coverage for Overseas Medical and Travel accident insurance. ” provided by AIG. You are covered for accidents and medical emergencies that happen whenever you are in another country”. Then it mentions worldwide emergency assistance underwritten by AXA assistance. Unfortunately can’t attach screenshots.

I just found out that this complimentary AIG travel insurance is only extended to Solitaire members and it is still underwritten by AIG.

The other noteworthy difference is Allianz treats all Epidemics and Pandemics the same (not just covid 19) so whether you are infected with Covid, Ebola or a new Epidemic you receive the same coverage. Most insurers have only extended specific to Covid

I’m personally glad that SQ ditched AIG. Previously I had two one-way trips, called up AIG, they said I had to call SQ to “link” the two bookings first, then call AIG back to get their policy because it has to be tagged to only ONE booking reference. I said no, AIG should have a process to cater to two one-ways and not trouble the passenger to make multiple calls between AIG and SQ. Only then they said they can raise internally for an “exception approval” process. Plus their premium was 3X higher than the other insurer I eventually went … Read more »

One think to point out is SIA-Allianz quarantine allowance (under Trip Interruption) terms are more favourable to the traveler as it provides $150 allowance per day up to 14 days. Whereas the public highest tier platinum policy only provides $500 per day up to 5 days. This is a downer for anyone purchasing the public policy, unless you are certain you can be discharged within 5 days; but there is supposedly the 14 day ICA health declaration issue to contend with (but that’s another matter altogether). Allianz public policy wording Additional accommodation and transportation expenses if the interruption causes you … Read more »

hey thanks bent, this is useful info! I did not know I could claim the remaining 9 days accomodation under Travel Delay of $1500,SJ albeit very low coverage under the public Allianz policy.

I wonder if Allianz covers Flights in between the journey that are purchased separately (eg. Domestic flights / intra schengen flights). AIG does not cover that and it makes it difficult to justify if we arrange a big trip and it is impossible to combine the flight itinerary with SIA / * Alliance.

In today’s context, this does not seem to cover accommodation for a case where you cannot return to SG due to testing positive, and where the foreign country does not require you to go into isolation/quarantine.

https://www.magroup-online.com/SAS/SG/EN/Policy_Wording.pdf it should cover under either of the following scenarios: Covered reasons: 1. You or a travelling companion becomes ill or injured, or develops a medical condition disabling enough to make you interrupt your trip (including being diagnosed with an epidemic or pandemic disease such as COVID-19). The following conditions apply: a. A doctor must either examine or consult with you or the travelling companion before you make a decision to interrupt the trip. b. You must not have travelled against your home country’s government advice or against local authority advice at your trip destination. 13. A travel carrier denies … Read more »

Hi Aaron, I spoke to Allianz CSO and found a slight error regarding the article’s paragraph on Allianz’s coverage for one way ticket coverage. The policy will only cover 30 days from the departure date (of the first ticket), not up to 180 days. So for example, if my one way ticket to USA is on 1 March, the coverage ends on 1 April. This applies even if my holiday is longer than 30 days or if my hospitalization or quarantine stay is beyond 1 April. This is a significant risk that travellers must be aware of when purchasing via … Read more »

Here’s what the policy says: If your policy was purchased with a one-way booking, your coverage end date will be the scheduled return date for your trip, as shown on your travel documents (not exceeding 30 days from the departure date shown on your travel documents). Additionally, your policy will end on the earliest of: 1. At 23:59 on the day you cancel your policy; or 2. At 23:59 on the day you file a trip cancellation claim with us; 3. At 23:59 on the day you end your trip, if you end your trip early; 4. At 23:59 on … Read more »

Thank you Aaron for adding the whole excerpt!

From the way I interpret it, the 30 days limit is an additional limitation for one way ticket trips on top of point 1 to 5. So for my earlier example of 1st March, if I have another one way ticket back to Singapore on 15 April, my trip portion for April 2nd onward would not be covered by the allianz policy bought via sq booking website.

I read elsewhere that Bali does not require mandatory travel insurance – can you clarify or correct that please?

CREDIT CARD SIGN UP BONUSES

Featured Deals

© Copyright 2024 The Milelion All Rights Reserved | Web Design by Enchant.sg

Quick Quote

- Airline Travel Insurance Review

- Country Travel Health Insurance

- Country Traveler Information

- Cruise Company Insurance Review

- Insurance Carrier Review

- Travel Company Insurance Review

- City Guides

Singapore Airlines Travel Insurance - 2024 Review

Singapore airlines travel insurance.

- Well-Respected Travel Insurance Provider

- Available At Checkout

- Low Coverage

Sharing is caring!

Singapore Airlines is the flag carrier airline of Singapore with its hub located at Singapore Changi Airport. Singapore Airlines’ the ‘Singapore Girl’ is their brand figure.

We are a huge fan of Singapore Airlines at TripInsure101. Its aircraft are always the most modern, the interiors are beautiful, and the staff go out of their way to be helpful. The on-board experience is second to none. Singapore Airlines continues to be the benchmark that the rest of the aviation world aspires to.

Travel insurance is available at checkout, so let’s book a sample trip, review the insurance offered, then see if we can get a better option in the open marketplace.

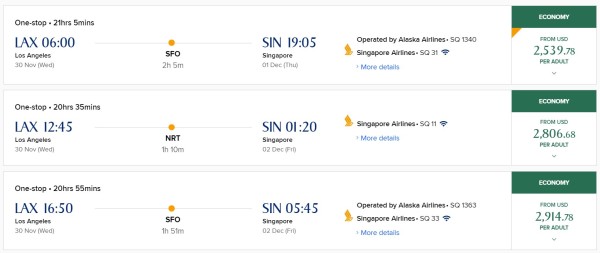

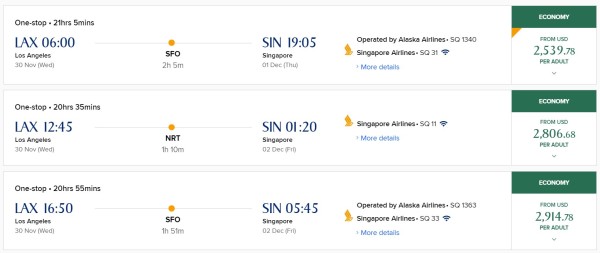

Singapore Airlines – Our Sample Trip

For our sample flight, our two travelers are flying from Los Angeles to Singapore on November 30 – December 16. Flights can be sorted by duration, price, arrival time or departure time. Looking at flights for our trip, the least expensive departure is $2539.78, which is the total for both travelers together.

Clicking on the fare, opens the details about that fare including penalty fees for cancellation, changes, and no-shows:

Comparing the two economy selections – Economy Standard and Economy Flex, for an extra $735, we can save $100 on cancellations, $50 for changes if we choose Economy Flex over Economy standard. Remember, this is the same seat. Same food. The exact same entertainment system. The difference is that if a traveler pays an extra $735 then they will pay less penalties. We will show later why it rarely, if ever, makes sense to buy anything other than a non-refundable seat.

After choosing our return flights, we can choose our seats for each leg.

Standard seats are free while extra legroom seats are $120. Final cost of our trip after selecting standard seating is: $5,359.36.

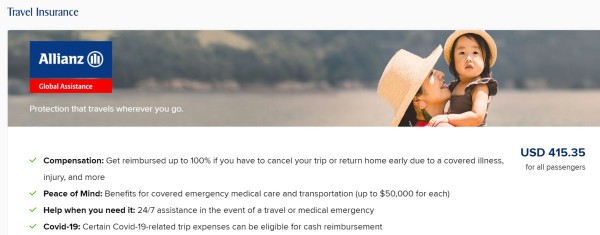

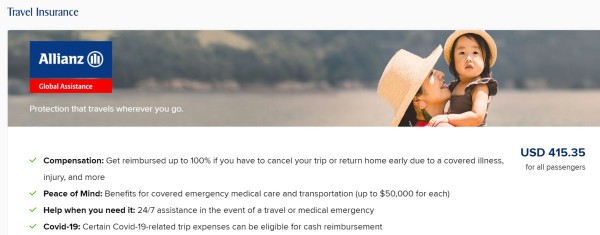

Finally, prior to payment, we’re asked if we’d like to insure our trip:

Singapore Airlines’ insurance is provided by Allianz, a well-respected travel insurer. Total cost for the insurance is $415.35.

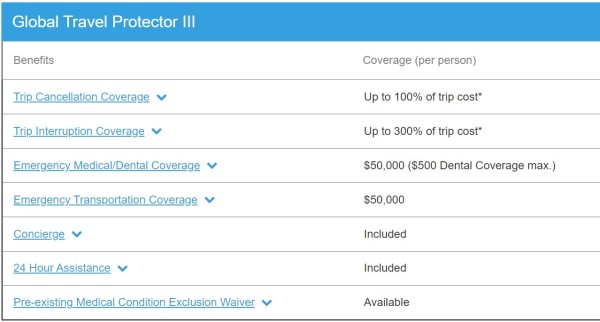

Unfortunately, the only way to preview the policy is to accept adding it to the trip cost, which then allows us to view the policy details. The policy is called the ‘Global Travel Protector III” and the standard benefits are summarized below:

The policy will pay up to 100% of the trip cost if the traveler cancels for a reason listed in the policy such as illness or injury. Trip Interruption will pay the remaining pro-rated portion of the trip up to 100% (depending on how far into the trip before the interruption occurred), and the additional 200% would be to cover additional accommodation fees, reasonable transportation expenses to either continue the trip or return home and additional accommodate expenses if you must stay at your destination for longer than originally planned up to $250/day for a maximum of 5 days.

However, the Allianz policy only provides $50,000 of medical expense coverage and $50,000 of medical evacuation coverage. These amounts are far too low for overseas travel to Southeast Asia. Medical evacuation back to the US can run $25,000 per flight hour or more. With this policy, it would only cover two hours of flight time and the traveler would be responsible for the remaining bill! Not a pleasant thought!

Since the coverage is too low for travel to Singapore, let’s see if we can find a better option in the open marketplace through TripInsure101 .

TripInsure101 – The Travel Insurance Marketplace

TripInsure101 is a travel insurance marketplace. We work with some of the best travel insurers in the industry. Inputting our trip details into the quoting system at TripInsure101, we’re presented with 27 options to choose from.

With so many options, what would be the best policy to choose?

TripInsure101 recommends having a minimum of $100,000 of medical coverage and $500,000 of medical evacuation coverage for travel to Asia and points beyond.

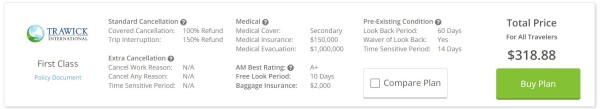

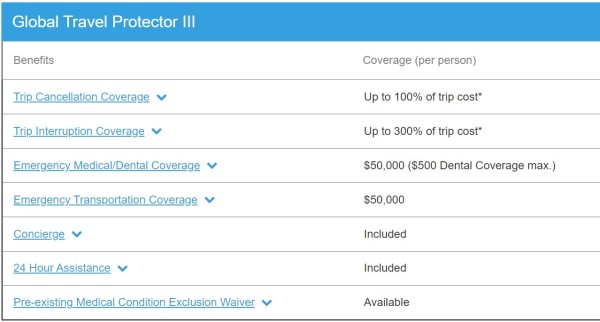

The least expensive plan with adequate medical coverage is the Trawick First Class .

The policy provides $150,000 of medical coverage and $1 million of medical evacuation coverage as well as trip cancellation, trip interruption, and baggage coverage. If we need to cancel prior to departure for a reason listed in the policy, such as illness or injury, we will receive a 100% refund of our trip costs. Best of all, the premium is $318.88, which is $96.47 LESS than the Allianz policy and provides three times the medical coverage and twenty times the medical evacuation coverage!

But what if we want maximum flexibility to cancel for ANY reason and not just for a listed reason? Do we have any options?

The answer is YES! A Cancel For Any Reason (CFAR) policy. Let’s take a look.

Cancel For Any Reason (CFAR) Policies

For maximum cancellation flexibility, a Cancel for Any Reason (CFAR) policy is a great option.

This is a super-powerful benefit that does exactly what it says. A traveler needs to have no reason at all to cancel and still receive a significant refund. The policies that we have can provide either a 50% or a 75% refund depending on the policy chosen.

Looking at our quote from TripInsure101, the least expensive CFAR policy with adequate coverage is the Trawick First Class (CFAR 75%). This policy provides the same benefits we saw above and adds the Cancel For Any Reason benefit if we purchase the policy within 10 days of the initial trip payment or deposit date. Total cost for both travelers combined is $542.10.

If we had to cancel for a listed reason in the policy such as an illness, we’d receive 100% of the non-refundable trip cost. However, if we cancel for a reason NOT listed in the policy, such as simply deciding we don’t want to go, the policy will refund us 75% of the trip cost. While $126.75 more than the Allianz policy, we get maximum cancellation flexibility as well as three times the medical coverage and twenty times the medical evacuation coverage.

Buying a non-refundable ticket and purchasing a Cancel For Any Reason policy has been called the TripInsure101 Flight Hack .

You will get nearly the same flexibility as a refundable ticket, plus a comprehensive insurance plan, and save hundreds of dollars on your flights. Refundable benefits, with non-refundable tickets!

Aardy – One Site – Many Carriers

Think of us at TripInsure101 as Amazon for travel insurance. At TripInsure101 we make comparing travel insurance easy. You do not need to go to every carrier. At TripInsure101 we provide binding quotes from our carries and present them in an easy-to-read format. The beauty of insurance comparison is you get to see all the best prices in the market.

Does TripInsure101 Charge More?

You won’t find the same trip insurance plans available at a better price – price certainty is guaranteed because of anti-discriminatory insurance law in the US. This is really powerful consumer protection.

A travel insurance marketplace like TripInsure101 will offer a multitude of different plans from some of the most respected travel insurance carriers in the country. You will only need a few minutes to check value for money, coverage, and insurance carrier ratings.

Enjoy your next trip on Singapore Airlines and remember to pack your travel insurance.

Safe travels!

This article has been written for review purposes only and does not suggest sponsorship or endorsement of AARDY by the trademark owner.

Recent AARDY Travel Insurance Customer Reviews

R Frachtman

Excellent agents

I have worked with Christianna on more than one occasion. She is consistently pleasant, knowledgeable, efficient, and patient. All of your agents I have dealt with have been excellent.

Easy and fast to purchase travel…

Easy and fast to purchase travel insurance.

Miranda was very helpful going over…

Miranda was very helpful going over policy coverage and answering the questions I had! She helped put me at ease about my choice.

- Vacation Rentals

- Restaurants

- Things to do

- Things to Do

- Travel Stories

- Rental Cars

- Add a Place

- Travel Forum

- Travelers' Choice

- Help Center

Singapore Airlines travel insurance purchased post-booking - Air Travel Forum

- Tripadvisor Forums

- Air Travel Forums

Singapore Airlines travel insurance purchased post-booking

- United States Forums

- Europe Forums

- Canada Forums

- Asia Forums

- Central America Forums

- Africa Forums

- Caribbean Forums

- Mexico Forums

- South Pacific Forums

- South America Forums

- Middle East Forums

- Honeymoons and Romance

- Business Travel

- Train Travel

- Traveling With Disabilities

- Tripadvisor Support

- Solo Travel

- Bargain Travel

- Timeshares / Vacation Rentals

- Air Travel forum

I've spoken to SQ and the insurance provider, neither will help and each just refers me to the other. This is the best cover I have seen, it doesn't contain an exclusion based on our current travel advisory, and will cover for travel of several months duration (also often an exclusion). Really keen to even get an approximate sense of what the cost will be. Thanks!

Your location shows as Wellington so if it’s the insurance referred to here you may not be eligible

As suggested on the Singapore airlines website, you might try contacting the AIG Customer Service Hotline

If you shift the website location to NZ, you will see there is a specific insurance option for NZ citizens.

Tripadvisor staff removed this post at the original author's request.

I use SQ to fly as much as possible. I have never taken their travel insurance on any ticket because it has always been better for me to get that insurance elsewhere.

Either their cover is available cheaper elsewhere or as is the case these days now Im older, I get competitive travel insurance with wider cover including what SQ offer and normally for not much more cost but wider coverage.

I think that Myrm is right that you'll get a better deal looking for your own insurance product.

If you believe that this is the best product for you, then you will have to just persist with the carrier and AG. But I don't see how that can be the case if you don't know the price compared with other policies.

I have done a lot of research on the range of insurance products available, hence the question.

NZ has a level 4 travel advisory "Do not travel" to everywhere in the world except Australia and the Cook Islands. Every other insurance policy I've researched has a standard exclusion for the entire policy around travelling to countries where your country of origin has a government advisory at this level and/or no Covid cover (required for Singapore and other places I'm travelling to) and/or is limited to travellers under 59, and/or is limited trip length to 60 days or less and/or is not available to travellers from NZ

Very few NZ insurers are offering travel insurance at all, and international companies I would usually consider (I've looked at 20+ options) are not offering insurance to NZers. Even my insurance broker couldn't come up with a policy as good as the SQ one, and agreed at this time, it has the best range of features. If there are recommendations on insurance companies that cover the range of feature outlined above, I'd be overjoyed to receive them.

I'm not going to argue about this being the best policy for you, as you have researched and taken professional advice.

It's a dilemma that in my view will require more patience and persistence with SQ. I'd tell them that it's their site that is the issue, because it's their site that you (rightly) want to book on but you can't do what you want to do.

Thanks, I escalated this with SQ and then received a very terse response that they were not able to provide any assistance. They sell it as a add on but you cannot get any information about the cost of the insurance until you have paid for your ticket.

Just circling back on this, for travellers from NZ the SQ pricing and coverage is an excellent option - around $NZ900 for 4 months travel with good Covid cover, and no general exclusion for the NZ L4 travel advisory.

AIG will now give a general indication of cost for the duration of your travel if you ring them. I know from my research there are very limited and expensive travel insurance options available from local NZ companies so hopefully this will be helpful.

$900 for four months cover sounds really expensive to me. Our annual UK trip insurance is around £150 annually for two of us and each trip is allowed to be up to 90 days as many times per year.

Have you looked at World Nomads? Well known for offering flexible options.

- Travelling with slightly damaged passport 1:05 pm

- Boeing 787-9 layout 2-3-2 premium economy 12:52 pm

- Researching flights from London or Manchester to Buenos Aire 12:52 pm

- Halal Catering on British Airways short haul 12:50 pm

- Applying for a China Tourist Visa in London as a USA tourist 12:24 pm

- Hopper App - is it trustworthy??! 12:19 pm

- Kiwi.com 12:14 pm

- Lodging reimbursement question 12:02 pm

- Singapore Airlines v Qantas 11:33 am

- Connecting flight in Madrid 11:25 am

- A flight change still in the 24hr cancellation window 11:13 am

- EasyJet 2025 flights 11:06 am

- Very nervous to fly due to painful ears on past trips 10:33 am

- Delta Premium Select vs LH Premium Eco 10:31 am

- ++++ ESTA (USA) and eTA (Canada) requirements for visa-exempt foreign nationals ++++

- ++++ TIPS - PLANNING YOUR FLIGHTS +++++++

- Buy now or later? What's with these screwy ticket prices?

- Around-the-world (RTW) tickets

- All you need to know about OPEN JAW tickets

- Beware of cheap business class tickets (sold by 3rd parties)

- ++++ TIPS - PREPARING TO FLY +++++++++

- TIPS - How to prepare for Long Haul Flights

- TIPS - Being Prepared for Cancellations and Long Delays

- TIPS - How to survive being stuck at an airport

- Flights delays and cancellations resources

- How do I effectively communicate with an airline?

- Airline, Airport, and Travel Abbreviations

- Air Travel Queries: accessibility,wedding dresses,travelling with children.

- Connecting Flights at London Heathrow Airport

- TUI Airways (formerly Thomson) Dreamliner - Movies and Seating Information

- ++++ COVID-19 CORONAVIRUS INFORMATION ++++

- Covid-19 Coronavirus Information for Air Travel

Singapore Travel Insurance

Travel insurance for singapore.

Known for its mouthwatering hawker fare, dazzling skyline, and the ever-so-iconic Marina Bay Sands, Singapore is a combination of cultural delights and modern wonders. As you plan your exciting journey to the Lion City, it's essential to consider the unexpected twists and turns that can arise during your travels. In this guide, we'll unravel everything you need to know about travel insurance for your Singaporean adventure.

- What should your Travel insurance cover for a trip to Singapore?

How does Travel Insurance work in Singapore?

- Do I need Travel Insurance for Singapore?

- How much does Travel Insurance cost for Singapore?

- Our Suggested AXA Travel Protection Plan

- What types of medical coverage does AXA Travel Protection plans offer?

- Are There Any COVID-19 restrictions for Travelers to Singapore?

Traveling with pre-existing Medical Conditions?

What should your travel insurance cover for a trip to singapore.

At a minimum, your travel insurance to Singapore should cover trip cancellation, trip interruption and emergency medical expenses. When it comes to international travel, the US Department of State outlines key components that should be included in your travel insurance coverage. AXA Travel Protection plans are designed with these minimum recommended coverages in mind.

- Medical Coverage – The top priority is making sure your health is in order. With AXA Travel Protection, you can have access to quality healthcare during your trip overseas in the event of unexpected medical emergencies.

- Trip Cancellation & Interruptions – Assistance against unexpected trip disruptions can dampen the mood, AXA Travel Protection offers coverage against unforeseen events.

- Emergency Evacuations and Repatriation – In situations where transportation is dire, AXA Travel Protection offers provisions for emergency evacuation and repatriation.

- Coverage for Personal Belongings – AXA offers coverage for your belongings with assistance against lost or delayed baggage.

- Optional Cancel for Any Reason – For added flexibility, AXA offers optional Cancel for Any Reason coverage, allowing you to cancel your trip for non-traditional reasons. Exclusive to Platinum Plan holders.

In just a few seconds, you can get a free quote and purchase the best travel insurance for Singapore.

Imagine you're all set for your vacation to Singapore. You've got your itinerary planned, bags packed, and excitement levels through the roof. However, your flight encounters unexpected delays due to severe weather conditions. Here's where AXA Travel Protection’s "Trip Delay" coverage comes to assist. While waiting for the skies to clear and your flight to take off, you find comfort in knowing that your policy offers coverage for additional expenses incurred during the delay. Whether it's the cost of a meal at the airport or an unplanned overnight stay in a hotel, your travel insurance has got you covered. In times of escalating challenges, AXA is here to assist you in devising a strategic course of action. Here’s the full list of benefits AXA Travel Protection Plans have to offer:

Medical Benefits:

- Emergency Medical Expenses: Should you fall ill or have an accident during your trip, your policy may offer coverage for medical expenses, including hospital stays and doctor's fees.

- Emergency Evacuation & Repatriation: In case of a serious medical emergency, your policy may include provisions for evacuation to the nearest appropriate medical facility or repatriation.

- Non-Emergency Evacuation & Repatriation : In non-medical crises (e.g., political unrest), your policy may cover evacuation or repatriation, subject to policy terms.

Pre-Departure Travel Benefits:

- Trip Cancellation: You may be eligible for reimbursement if you cancel your trip due to a sudden illness or injury.

- COVID-19 Travel Insurance: Coverage is available for trip cancellation and medical expenses related to COVID-19, subject to policy terms and conditions.

- Trip Delay: If your flight faces delays due to unforeseen circumstances, you may have coverage for additional expenses such as meals and accommodations.

Post-Departure Travel Benefits:

- Trip Interruption: In case of an unexpected event, you could be eligible for reimbursement for the unused portion of your trip.

- Missed Connection: If you miss a connecting flight due to delays or cancellations, this coverage may help with expenses like rebooking fees and accommodations.

Baggage Benefits:

- Luggage Delay: If the airline delays your checked baggage, your policy might offer reimbursement for essential items like clothing and toiletries.

- Lost or Stolen Luggage: In the unfortunate event of permanent loss or theft of your luggage, your policy may offer reimbursement for its value, assisting you in replacing your belongings.

Additional Optional Travel Benefits:

- Rental Car (Collision Damage Waiver): Exclusive to Gold & Platinum plan policy holders, this optional benefit gives travelers extra coverage on their rental car against damage and theft.

- Cancel for Any Reason: Exclusive to Platinum plan policy holders; this optional benefit gives travelers more flexibility to cancel their trip for any reason outside of their standard policy.

- Loss Skier Days: Exclusive to Platinum plan policy holders, this optional benefit offers reimbursement to mitigate some costs associated with pre-paid ski tickets that you or your traveling companion cannot use due to specified slope closures.

- Loss Golf Days: Exclusive to Platinum plan policy holders, this optional benefit offers reimbursement to mitigate the expenses linked to prepaid golf arrangements that you or your travel companion are unable to utilize due to specified golf closures.

Do I need Travel Insurance for Singapore?

Starting February 13, 2023, visitors to Singapore are no longer mandated to have travel insurance. However, it's highly advised for all travelers to consider obtaining a thorough travel insurance policy that includes coverage for medical emergencies, trip cancellations, and delays. Why? There are several reasons:

Singapore, known for its top-notch healthcare, might surprise you with unexpected medical costs. With coverage for emergency medical expenses, you're offered coverage and assistance for any unforeseen life events.

Lost Baggage: Airlines sometimes mishandle baggage, and the last thing you want is to be without your essentials in an unfamiliar place. Travel insurance offers to cover the cost of replacing necessary items, allowing you to continue.

Despite Singapore's efficient travel network, unexpected delays can happen. The "Trip Delay" benefit comes in handy, covering extra expenses like meals and accommodation so your travel hiccups do not turn into headaches.

How much does Travel Insurance cost for Singapore?

In general, travel insurance costs about 3 – 10% of your total prepaid and non-refundable trip expenses. The cost of travel insurance depends on two factors for AXA Travel Protection plans:

- Total Trip cost: The total non-prepaid and non-refundable costs you have already paid for your upcoming trip. This includes prepaid excursions, plane tickets, cruise costs, etc.

- Age: Like any other insurance type, the correlation is rooted in increased health risks associated with older individuals. It's important to note that this doesn't make travel insurance unattainable for older individuals.

With AXA Travel Protection, travelers to Singapore will be offered three tiers of insurance: Silver, Gold and Platinum . Each provides varying levels of coverage to cater to individual's preferences and travel needs.

Our Suggested AXA Travel Protection Plan

AXA presents travelers with three travel plans – the Silver Plan , Gold Plan , and Platinum Plan , each offering different levels of coverage to suit individual needs. Given that Singapore hospitals often do not accept U.S. health insurance or Medicare, we genuinely recommend travelers to consider purchasing any of these plans, particularly for the crucial coverage they offer for emergency accident and sickness medical expenses. The Platinum Plan is your go-to choice if you're looking for extra coverage for Singapore’s experience. " Cancel for Any Reason " offers greater flexibility for those unexpected twists in your travel plans and the "Rental Car (Collision Damage Waiver)" offers assistance when you're out exploring Singapore's stunning landscapes in a rental car. For avid golfers planning a swing through Singapore’s world-class golf courses, the "Loss Golf Days" benefit is exclusive to Platinum plan policyholders. This optional benefit steps in to offer reimbursement for pre-paid golf arrangements that you might be unable to utilize due to specified golf closures.

What types of medical coverage do AXA Travel Protection plans offer?

AXA covers three types of medical expenses:

- Emergency medical expenses

- Emergency evacuation & repatriation

- Non-medical emergency evacuation & repatriation

Emergency Medical: Offers coverage when unexpected health issues happen, like broken bones, burns, sudden illnesses, or allergic reactions.

Emergency Evacuation and Repatriation: Can cover your immediate transportation home in the event of an accidental injury or illness.

Non-Medical Emergency Evacuation and Repatriation: Comes into play when you urgently need to leave a place for reasons not related to health. This coverage may assist with evacuation in non-medical situations, such as natural disasters or civil unrest.

Are there any COVID-19 restrictions for travelers to Singapore?

Entry into Singapore for all travelers is permitted without the need for entry approvals, pre-departure tests, on-arrival tests, quarantine, or mandatory COVID-19 travel insurance.

Traveling with preexisting medical conditions can complicate your plans, but with AXA Travel Protection, we're here to support you during your trip.

Traveling with pre-existing medical conditions can complicate your plans, but with AXA Travel Protection, we're here to support you during your trip. Our Gold and Platinum plans offer coverage for pre-existing medical conditions. The Platinum plan, in particular, is our highest-offered choice for travelers who want our highest coverage limits and optional add-ons,

What does this mean for you? If you've got a medical condition that's been hanging around, you can qualify for coverage under our Gold and Platinum plans with a pre-existing medical condition , so long as it’s within 14 days of placing your initial trip deposit and in our 60-day look-back period. We're here to ensure you travel easily, no matter your health situation.

1. Can you buy travel insurance after booking a flight?

You can buy travel insurance even after your flight is booked.

2. When should I buy Travel Insurance to Singapore?

Purchasing travel insurance for your trip is advisable as soon as you have made your initial trip deposit (prepaid and non-refundable trip costs.) AXA Travel Protection offers coverage as soon as you purchase your protection plan. We can give coverage against unforeseen events before you leave for your trip. Additionally, our policies offer coverage for preexisting medical conditions and Cancel for Any Reason if you purchase your protection within 14 days of making your initial trip deposit.

3. Do Americans need travel insurance in Singapore?

From February 2023, Singapore no longer requires travel insurance for visitors, but it's still advised. Given Singapore's reputation for outdoor activities like kayaking and hiking, having travel insurance is essential for emergencies.

4. What is needed to visit Singapore from the USA?

Documents required for entering Singapore include a passport valid for a minimum of six months, an SG Arrival Card (which you can obtain via the ICA website), bank statements demonstrating adequate funds for your stay in Singapore, and a confirmed onward or return flight ticket.

5. What happens if a tourist gets sick in Singapore?

If you become sick in Singapore, travelers with AXA Travel protection can contact the AXA Assistance hotline at 855-327-1442 . Contact information is typically provided within the insurance documentation. Please ensure to read through your policy details and information.

Disclaimer: It is important to note that Destination articles are for editorial purposes only and are not intended to replace the advice of a qualified professional. Specifics of travel coverage for your destination will depend on the plan selected, the date of purchase, and the state of residency. Customers are advised to carefully review the terms and conditions of their policy. Contact AXA Travel Insurance if you have any questions. AXA Assistance USA, Inc.© 2023 All Rights Reserved.

AXA already looks after millions of people around the world

With our travel insurance we can take great care of you too

Get AXA Travel Insurance and travel worry free!

Travel Assistance Wherever, Whenever

Speak with one of our licensed representatives or our 24/7 multilingual insurance advisors to find the coverage you need for your next trip.

We’re on the road right now – join in on the fun and follow @thebrokebackpacker on IG!

- Meet the Team

- Work with Us

- Czech Republic

- Netherlands

- Switzerland

- Scandinavia

- Philippines

- South Korea

- New Zealand

- South Africa

- Budget Travel

- Work & Travel

- The Broke Backpacker Manifesto

- Travel Resources

- How to Travel on $10/day

Home » Southeast Asia » Singapore » INSIDER Guide To Singapore Travel Insurance – Must Read!

INSIDER Guide To Singapore Travel Insurance – Must Read!

Singapore is a jewel of a city that straddles modern and traditional sentiments. On the one hand, you have cutting-edge skyscrapers, vibrant light shows, and futuristic trees. On the other, you have a melting point of ancient and contemporary cultures. In the space of a few hours, you can explore one of the most thriving Chinatowns on the planet, sip chai in Little India, and listen to the call to prayer on Arab Street. Then after that you can hit the neon-lit bars and toast a Singapore Sling with hip young Singaporeans!

The sovereign city-state has attracted an influx of ex-pats to further shake up the population. What was once a nation that terrified broke backpackers with its eye-watering prices is now an integral part of any South East Asia trip. This ‘Garden City’ is a total breath of fresh air, and unlike any city you’ll visit anywhere else in the world.

Have we convinced you to book that flight? Awesome. Now, settle in and cast your eye over this special blog post we’ve created. Today we’re going to guide you through the riveting topic of Singapore travel insurance!

Month to month payments, no lock-in contracts, and no itineraries required: that’s the exact kind of insurance digital nomads and long-term traveller types need. Cover yo’ pretty little self while you live the DREAM!

Do I Need Travel Insurance For Singapore?

What should travel insurance in singapore cover, what is the best singapore travel insurance, how to choose the right singapore travel insurance for you.

Unlike some countries, Singapore does not impose mandatory travel insurance upon its guests. And in such a safe city, you might be wondering if you really need it. Singapore truly is a safe country to visit -it’s actually the safest city in South East Asia. Particularly if you’re only visiting for a weekend or on a layover visit, you might feel like you’re off the hook with travel insurance.

But think again…

However, while the crime rate is low, it isn’t non-existent and valuables do get taken. Also bear in mind Airlines can cancel flights without any notice, so you may need emergency Singapore accommodation. Natural disasters in Singapore are rare but not impossible. Above all, if at any point you require emergency medical attention in Singapore, the price will sting more than a jellyfish.

At the end of the day, travel insurance for visitors to Singapore (or anywhere else) is definitely something to ponder.

Need more convincing? Check out these other reasons why you should have travel insurance!

Unlock Our GREATEST Travel Secrets!

Sign up for our newsletter and get the best travel tips delivered right to your inbox.

Healthcare in Singapore

What you’ve heard is true: healthcare in Singapore is phenomenal! It shouldn’t come as a surprise that the city has the best healthcare in Asia. It’s sitting very pretty in #6 place for the best healthcare in the world, with clean, modern facilities and top-quality doctors. Singaporeans are blessed with having an average life expectancy of a ripe old 85.2 years. This is down to their wondrous healthcare system, as well as the fact the country focuses on preventative care.

Singapore’s health system presents a mixture of public and private healthcare. Those hospitalized in Singapore have five treatment tiers available: A, B1, B2+, B2 and C. ‘A’ gives you a private, en-suite room and your choice of doctor. At the bottom of the scale, ‘C’ puts you in an open ward with up to eight other patients. Selecting ‘A’ means the patient coughs up the full amount, whereas ‘C’ is funded by the government up to 80%. All Singaporean workers are obligated to put their monthly earnings into a pot for savings and health needs.

Tourists, however, are required to cover the cost of their own treatment. Although guidelines exist, private hospitals and clinics in Singapore set their own fees . The average cost of a short doctor’s consultation is S$51 ($36 USD). Emergency clinics that operate around the clock charge from around S$80 ($56 USD) for a consultation, or upwards of S$90 ($63 USD) after midnight.

Smaller than London, Singapore is an island city-state. The whole country is urban, with hospitals well distributed. So if you do need to visit a doctor, the good news is that you won’t have to travel far. But without Singapore travel insurance, that spell in the doctor’s office could bite.

Crime in Singapore

The crime rate in Singapore is remarkably low. The city has a crime index of 31.56 and a safety index of 68.44. Data shows that violent crimes are extremely rare in Singapore. In 2019, the overall crime rate spread concern by being shown to be on the increase. But that wasn’t down to theft, violet crimes or robberies – they’re all on the decrease. However, scams had risen by an alarming 54.2%. These were mainly targeting victims online and via loans. As a tourist, exercise caution when surfing the net in Singapore. Use a VPN when logged into public wi-fi, and look closely at your Singapore travel insurance to see how it protects you.

Unlike the majority of other cities around the world, even pick-pockets rarely operate in this safe haven. In fact, Singaporeans frequently find themselves the victim of petty crime when they travel! That’s because they’re simply not used to having to protect themselves against thieves . But, as always, all travellers should have their wits about them. As safe as Singapore’s streets are – even at night – it’s best to be cautious.

Issues Facing Travellers in Singapore

With this low crime rate, fabulous healthcare system, and lack of danger, what could possibly go wrong in Singapore? And why should you waste your hard-earned cash on Singapore travel insurance? There are a few issues facing travellers backpacking around Singapore . One thing Singapore hasn’t escaped is the dreaded mosquito. Dengue fever is on the rise, with over 14,600 reported dengue cases in 2019. This tropical disease doesn’t always require hospital treatment, but it’s wise to be covered.

Another issue that plagues tourists is fines. Singapore is, literally, a fine city. Well, yes – it is fine, but it also has a reputation for fines. Although it isn’t actually illegal to chew gum in the city, it is illegal to sell or import it. Don’t smuggle in a family pack of Wrigley’s and try flogging it in your hostel in order to buy the best insurance for Singapore.

Playing a musical instrument in an ‘annoying’ manner will get you a fine of up to $1,000 USD. Using another’s wi-fi counts as hacking (farewell, $10,000 USD). If you forget to flush the toilet, that’ll cost you $150 USD. In some cases of drug use, you could be sentenced to death. Your travel insurance in Singapore won’t be able to help you much with fines, sadly.

Common Activities in Singapore

No matter where you stay in Singapore , your trip is going to be a love affair with incredible food, fascinating museums, and mind-boggling architecture, not forgetting some truly supertrees. If you need a dose of adventure, spice up your stay in Singapore with one of these activities.

City tours – by foot, by bicycle, by scooter or segway! If you don’t fancy traipsing around the city on your feet all day, do as the cool kids do and join a tour on wheels. This is one of the most popular things to do in Singapore. It’s a relatively safe affair, but you might want to cover your ankles and elbows on your Singapore travel insurance before letting loose.

Scuba diving – not for those travelling on a shoestring budget! But if you’re a PADI pro, you might want to add one of Singapore’s dive spots to your portfolio. As an island, Singapore has a number of sites available, including Pulau Jong, Pulau Hantu, and Kesu Island. If you do dive, be super cautious about the restrictions on flying after your excursion. If you don’t obey the minimum surface interval before you take to the sky, you’ll have more than an earache.

Sentosa Island – this awesome day trip gives you a slice of tropical paradise. Visit Universal Studios, go sailing or kayaking, or chill on the beach. If you’re brave, you can do a bungee jump here too!

Things go wrong on the road ALL THE TIME. Be prepared for what life throws at you.

Buy an AMK Travel Medical Kit before you head out on your next adventure – don’t be daft!

More often than not, the majority of Singapore travel insurance policies will include the following;

Emergency Accident & Sickness Medical Expenses

Luggage and personal property, emergency evacuation and repatriation, non-medical emergency evacuation, trip cancellation, trip interruption.

These are some key terms to look out for when you are comparing different travel insurance policies . Now, let’s take a closer look at each one of these to see what they actually mean!

Emergency Medical costs cover, is the most important aspects of most travel insurance policies. If you are involved in an accident or get very sick with a mystery illness, you want to rest easy knowing that any medical costs and hospital bills will be taken care of.

Many of you will have never seen a medical bill. Good. But let me tell you, they can get very expensive very easily. A friend of mine was once billed $10,000 in Costa Rica. Even 2 days in a Thai hospital cost him nearly $2,000.00, and Singapore is way more expensive than Thailand.

Pre-existing medical and health conditions may not be covered or may be covered for an additional premium.

Ideally, Emergency Accident & Sickness Medical insurance should offer at least $100,000.00 of coverage. Some run into the millions.

Luggage and Personal Stuff coverage covers the value of your personal property. It’s most common application is for lost luggage and However, many policies also extend this to cover “on the ground” theft which comes in useful if you are robbed once you reach your destination.

The limits on this vary between policies. However, the maximum value rarely exceeds $1000 with a maximum item value between – $250 – $500.

This is ok for many travellers. However if you travel with a lot of electrical gear (laptop & camera), or are packing skiing gear, you may also wish to think about taking out a separate gadget cover.

We’ve tested countless backpacks over the years, but there’s one that has always been the best and remains the best buy for adventurers: the broke backpacker-approved Osprey Aether and Ariel series.

Want more deetz on why these packs are so damn perfect? Then read our comprehensive review for the inside scoop!

Emergency evacuation covers the cost of sending you back to your home country in a sickbed. Let’s say that the above mentioned illness is a nasty one, and the decision is taken to send you home for further treatment; this will take care of the high costs of flying you home with tubes stuck into your arms.

Repatriation is the cost of sending your body home in the unlikely event that you die on your trip. The costs of this are usually very high. Repatriation costs are not a burden I would want to leave to my family. Whilst this is thankfully rare, I do sometimes come across Facebook or “Go Fund Me” campaigns for somebody’s body to be flown home.

Non-medical Emergency Evacuation is when you have to be evacuated from your destination because of some unexpected crisis. Examples can be outbreaks of war/civil unrest and earthquakes that decimate infrastructure such as the 2015 earthquake in Nepal.

Emergency evacuation insurance covers the costs of having to book a last-minute flight home ( which can be very expensive) and will also cover accommodation costs if you end up being flown to a random, “safe” country rather than going straight home.

Having to cancel a trip that you were psyched about is heartbreaking. However, then being left out of pocket just adds scurrilous insult to grievous injury. Trip Cancellation cover can help you recover the non-refundable costs of your trip such as flight and hotel costs.

Obviously, you can’t claim this simply because you changed your mind about the trip or broke up with your girlfriend. Legitimate cancellation reasons are things like sickness, family emergencies, bereavement, natural disaster and war – you get the gist.

Trip Interruption is when something goes wrong, or interrupts, your trip leaving you out of pocket. One example, when your pre-paid hotel burns down and you are forced to book another one. Another example is when your flight home is canceled and you need a few extra nights at your hotel.

Anything Else?

The above are what we consider to be the basic, bare-bones of travel insurance policies. However, some policies do offer a few more aspects to them. The very best Singapore travel insurance policies may also include the following;

Adventure Sports and Activities

Adventure sports and activities are not covered by all travel insurance policies. The definition of adventure sports and activities really does vary between providers but for example, can include;

- Martial Arts

- Bungee Jumping

- Scuba Diving

- Informal basketball games….

If you are even thinking about doing anything physical or outdoorsy on your trip, it is very wise to check that your insurance provider is in fact covering it. Snapped tendons tend to hurt plenty enough without having hefy medical bills attached to them.

Accidental Death and Dismemberment

This one is perhaps a bit macabre. It doesn’t cover any travel-related expenses as such but instead it basically provides you (or your next of kin) with monetary compensation in the event that something happens to you. If you die, your loved ones get a payout. Or, if you lose a toe or something, YOU get a payout.

It’s kind of like having a bit of life cover attached to your travel insurance.

“Well dear, I’m afraid there is good new and bad news. The bad news is that our beloved daughter little Jenny died on her trip to Singapore. The good news is that we get $10k! Singapore here WE come!”

Gear and Electronics Cover

Some insurance policies cover electronic gadgets but others do not. Those that do, sometimes charge an additional fee and they also usually limit the maximum item value. If you only travel with a phone or a tablet then your travel insurer may well cover it entirely. However, if like us if you are traveling with a decent laptop and camera, then you may wish to consider obtaining gadget cover.

I have personally had separate gadget cover on my MacBook Pro for years.

A new country, a new contract, a new piece of plastic – booooring. Instead, buy an eSIM!

An eSIM works just like an app: you buy it, you download it, and BOOM! You’re connected the minute you land. It’s that easy.

Is your phone eSIM ready? Read about how e-Sims work or click below to see one of the top eSIM providers on the market and ditch the plastic .

Whilst they may all seem the same, not all insurers are. Some travel insurers offer lower prices more suited to budget backpackers while others offer higher coverage amounts. Some are infamous for not paying claims whilst others are celebrated for being fair and helpful.

Travel insurers – always the same yet always different. It isn’t possible (or legal) for us to say that anyone of them is the best, or is “better” than the others. No. Insurance is a very complex product and any policy takes into account a whole lot of data and a wide set of variables.

Remember that the “best” travel insurance always depends on where you are going, when you are going there and ultimately upon you and your needs. The best travel insurer for one trip, may not be the best for a different trip.

Below, we will introduce a few of the many travel insurance providers on offer. These are all firms we have used ourselves over the years.

SafetyWing are a relatively new player in the travel insurance space but are already making big waves. They specialise in cover for digital nomads and they offer open ended cover on a monthly subscription basis. Because they primarily cover digital nomads, they don’t offer much in the way of trip cancellation or delay so do take that into consideration.

However, SafetyWing really excels on the health side of travel insurance, covering dental and some complimentary treatments. In fact they even allow young children to be covered for free.

If cancellation and delay is not a concern for you or if you will be spending some considerable time on your trip, then maybe SafetyWing is the insurance provider for you.

- Emergency Accident & Sickness Medical Expenses – $250,000

- Baggage and Personal Property – $3000

- Emergency Evacuation and Repatriation – $100,000

- Non-Medical Emergency Evacuation – $10,000

- Trip Cancellation -$0

- Trip Interruption – $5000

If you need more information or want to get a quote, then you can visit the website for yourself.

Talk about efficient and effective, Heymondo are up-to-date when it comes to combining travel insurance with technology in the digital world of 2024. What truly sets them apart is their assistance app offering a 24-hour medical chat, free emergency assistance calls and incident management. How reassuring is that?! They also have a convenient and complication-free way to make a claim straight from your phone.

Medical expenses are covered up to $10,000,000 USD so try not to damage yourself anything over that amount… If you’d like travel insurance that operates with that little extra swiftness and ease, give these guys a go. They offer multiple options – single trip, annual multi-trip and long stay. We’ve focused on single trip, but do check out the others and find what fits your next adventure.

- Emergency Accident & Sickness Medical/Dental Expenses –$10,000,000 USD

- Baggage and Personal Property – $2,500 USD

- Repatriation and Early Return – $500,000 USD

- Non-Medical Emergency Evacuation – $10,000 USD

- Trip Cancellation – $7,000 USD

- Trip Disruption – $1,500 USD

- Covid 19 coverage included in all plans

If you need more convincing, click our link below to get 5% off your Heymondo travel insurance plan!

Columbus Direct

Named after one of history’s greatest (and most divisive explorers), Columbus Direct also specialise in insuring adventure-hungry explorers like us. They have been providing award-winning insurance for 30 years. What we like about this plan is that it does cover small amounts of personal cash. However, Gadget Cover is not available.

Columbus Direct actually offers a number of different travel insurance plans. Below we have focused on 1 of these and have set out the coverage amounts for the Globetrotter plan.

- Emergency Accident & Sickness Medical Expenses – $1,000,000

- Baggage and Personal Property – $750

- Emergency Evacuation and Repatriation – $1,000,000

- Non-Medical Emergency Evacuation – $0

- Trip Cancellation -$1,000

- Trip Interruption (“Catastophe”) – $750

World Nomads

World Nomads have been insuring backpackers for years now. World Nomads specialise in backpacker travel insurance and their policies cover long way travel on one way tickets, trips to multiple countries and a whole lot of adventure activities. These guys are well used to dealing with backpackers like us, and they are regularly recommended by travel bloggers and industry insiders. We love World Nomads Insurance .

They offer 2 different policies depending on your needs. The Standard Plan is standard & the Explorer Plan covers a whole host of high risk, high fun activities. World Nomads are also one of the few travel insurers who will write you a policy after starting your trip. The one downside for us is that they don’t cover Pakistan.

Let’s look at the maximum coverage amounts with both the Standard & Explorer plan.

- Emergency Accident & Sickness Medical Expenses -$100,000/$100,000

- Baggage and Personal Property – $1000/$3000

- Emergency Evacuation and Repatriation – $300,000/$500,000

- Non-Medical Emergency Evacuation – $25,000/$25,000

- Trip Cancellation -$2500/$10,000

- Trip Interruption – $2500/$10,000

If you want more info or to get a quote then visit the World Nomads site for yourself and take a look.

Iati Seguros

Iati Seguros is a Spanish based travel insurance company who we have personally used and loved. You will notice that they provide competitive cover amounts for the key travel insurance areas, and are competitively priced. So far we have heard nothing but good things about them.

They also offer multiple ones, but we have focused on the Standard Plan although we wholly encourage checking out all plans for yourself to identify the best one for your needs.

Standard Plan

- Emergency Accident & Sickness Medical Expenses – $200,000

- Baggage and Personal Property – $1000

- Emergency Evacuation and Repatriation – 100% of cost

- Trip Cancellation -$1,500

- Trip Interruption – 100% of cost

Insure My Equipment

Insuremyequipment.com does precisely what the name suggests. They are an online insurer for expensive equipment (like camera gear & gold clubs). You can use them to get specific pieces of gear insured but please bear in mind this policy is only for your specified gear.

An Insure My Equipment policy works well in combination with other travel insurance. Insure My Equipment policies are an excellent choice for professionals and backpackers with more $0000’s worth of camera equipment, expensive laptops or fishing rods.

I also know a few travelling musicians and DJs who use these guys so you are in cool company.

Choosing the right travel insurance for your holiday vacation in Singapore is like choosing a pair of shoes. Only you can really say how well they fit, and how many miles you can manage in them.

To decide who the right insurer for you is, you need to add up how much your trip is worth, how much equipment you plan to take with you and what activities you intend to engage in.

You also need to ask yourself how much you can afford. This means how much you can afford to pay for cover but also how much you can afford to be out of pocket in the unlikely event of an incident. Sometimes, the cheapest Singapore travel insurance will be enough and sometimes it will be worth spending a bit more.

Hopefully the information provided in this post will help you to decide. If not, then have a blast and break a leg! Actually, probably not… you don’t have insurance.

Final Thoughts on Singapore Travel Insurance

Well done for making it to the end! Now you know everything you could possibly need to know about travel insurance in Singapore. Use our guide to inform your decision and shop around. Even the cheapest Singapore travel insurance should cover you in case something unsafe does happen in one of the safest cities in the world.

Now that’s done and dusted, you can turn your attention to packing for Singapore because it’s time for an adventure! We’ve got plenty of content to help, including where to stay in Singapore, unique things to do, and delicious things to eat.

And for transparency’s sake, please know that some of the links in our content are affiliate links . That means that if you book your accommodation, buy your gear, or sort your insurance through our link, we earn a small commission (at no extra cost to you). That said, we only link to the gear we trust and never recommend services we don’t believe are up to scratch. Again, thank you!

Aiden Freeborn

Share or save this post

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Notify me of followup comments via e-mail.

- Best Extended Auto Warranty

- Best Used Car Warranty

- Best Car Warranty Companies

- CarShield Reviews

- Best Auto Loan Rates

- Average Auto Loan Interest Rates

- Best Auto Refinance Rates

- Bad Credit Auto Loans

- Best Auto Shipping Companies

- How To Ship a Car

- Car Shipping Cost Calculator

- Montway Auto Transport Reviews

- Best Car Buying Apps

- Best Websites To Sell Your Car Online

- CarMax Review

- Carvana Reviews

- Best LLC Service

- Best Registered Agent Service

- Best Trademark Service

- Best Online Legal Services

- Best CRMs for Small Business

- Best CRM Software

- Best CRM for Real Estate

- Best Marketing CRM

- Best CRM for Sales

- Best Free Time Tracking Apps

- Best HR Software

- Best Payroll Services

- Best HR Outsourcing Services

- Best HRIS Software

- Best Personal Loans

- Best Fast Personal Loans

- Best Debt Consolidation Loans

- Best Personal Loans for Bad Credit

- Best Home Equity Loan Rates

- Best Home Equity Loans

- What Is a HELOC?

- HELOC vs. Home Equity Loan

- Best Free Checking Accounts

- Best High-Yield Savings Accounts

- Bank Account Bonuses

- Checking Accounts

- Savings Accounts

- Money Market Accounts

- Best CD Rates

- Citibank CD Rates

- Synchrony Bank CD Rates

- Chase CD Rates

- Capital One CD Rates

- Best Hearing Aids

- Best OTC Hearing Aids

- Most Affordable Hearing Aids

- Eargo Hearing Aids Review

- Best Medical Alert Systems

- Best Medical Alert Watches

- Best Medical Alert Necklaces

- Are Medical Alert Systems Covered by Insurance?

- Best Online Therapy

- Best Online Therapy Platforms That Take Insurance

- Best Online Psychiatrist Platforms

- BetterHelp Review

- Best Mattress

- Best Mattress for Side Sleepers

- Best Mattress for Back Pain

- Best Adjustable Beds

- Best Home Warranty Companies

- American Home Shield Review

- First American Home Warranty Review

- Best Home Appliance Insurance

- Best Moving Companies

- Best Interstate Moving Companies

- Best Long-Distance Moving Companies

- Cheap Moving Companies

- Best Window Replacement Companies

- Best Gutter Guards

- Gutter Installation Costs

- Best Window Brands

- Best Solar Companies

- Best Solar Panels

- How Much Do Solar Panels Cost?

- Solar Calculator

- Best Car Insurance Companies

- Cheapest Car Insurance Companies

- Best Car Insurance for New Drivers

- Same-day Car Insurance

- Best Pet Insurance

- Pet Insurance Cost

- Cheapest Pet Insurance

- Pet Wellness Plans

- Best Life Insurance

- Best Term Life Insurance

- Best Whole Life Insurance

- Term vs. Whole Life Insurance

- Best Travel Insurance Companies

- Best Homeowners Insurance Companies

- Best Renters Insurance Companies

- Best Motorcycle Insurance

Partner content: This content was created by a business partner of Dow Jones, independent of the MarketWatch newsroom. Links in this article may result in us earning a commission. Learn More

Travel Insurance for a Trip to Singapore (2024)

Travel insurance is affordable and can reduce sunken costs if you can’t make it to Singapore as expected.

in under 2 minutes

Jessica Bergin is a Barcelona-based Australian writer who has worked in the travel industry for half a decade. Her passion for adventure, travel, culture and lifestyle has helped her navigate a successful career in the writing industry, including for World Words.

Tori Addison is an editor who has worked in the digital marketing industry for over five years. Her experience includes communications and marketing work in the nonprofit, governmental and academic sectors. A journalist by trade, she started her career covering politics and news in New York’s Hudson Valley. Her work included coverage of local and state budgets, federal financial regulations and health care legislation.

Whether you’re a seasoned traveler or it’s your first time abroad, having travel insurance for a Singapore vacation can be beneficial. From trip cancellation protection to medical expense coverage, travel insurance can help reimburse nonrefundable costs if your plans go astray.

We at the MarketWatch Guides Team have reviewed the best travel insurance companies and compiled what to know about travel insurance for Singapore, including advantages and costs.

Compare Singapore Travel Insurance Companies

Compare the best Singapore travel insurance companies with the table below:

Why Trust MarketWatch Guides

Our editorial team follows a comprehensive methodology for rating and reviewing travel insurance companies. Advertisers have no effect on our rankings.

Companies Reviewed

Quotes Collected

Rating Factors

Do I Need Travel Insurance for Singapore?

As of February 2023, Singapore has eased up on COVID-19-related travel insurance requirements. Visitors are no longer required to obtain travel insurance before entering the country, but the government still highly recommends it.

In case things go wrong, having travel insurance coverage can provide an added layer of security. A comprehensive travel insurance plan may cover emergency medical expenses and assistance, lost or delayed baggage, unexpected trip cancellations and flight delays.

Singapore is known for outdoor adventure activities like kayaking, scuba diving and hiking — and travel insurance can offer peace of mind when you’re exploring the great outdoors. Most plans include emergency medical coverage if you sustain injuries while traveling, and some policies offer protection for sporting gear.

But every traveler is unique and will require different coverage. Whether you’re an adventure aficionado or a business traveler, there’s an insurance plan that’s right for you. Here are the most common travel insurance coverages:

Cancel for Any Reason Coverage

Cancel for any reason coverage , also known as CFAR, allows you to claim reimbursement if you cancel your trip for reasons not listed in your insurance policy. CFAR coverage is advantageous for travelers who might need to cancel their trip for unconventional reasons.

When compared to standard travel insurance, CFAR coverage is more flexible. However, it can be more costly and doesn’t always cover you completely. There are a handful of rules to qualify for coverage, including:

- You may have to cancel at least 48 hours before your departure date.

- You need to buy CFAR coverage within a certain number of days after booking your trip.

Gear Theft Protection

Singapore has some of the highest safety rankings in the world . Nevertheless, backing yourself with gear theft protection can still be a wise choice, especially if you’re traveling with valuable personal belongings, travel documents and credit cards.

Travel insurance can help cover you in case your items are lost, damaged or stolen. Although travel insurance policies include predetermined cost limitations and exclusions, coverage is worth considering if you wish to bring the following:

- A laptop, tablet or smartphone

- Professional camera and equipment

- Sports equipment (like a kayak)

Note that, due to sub-limits on some policies, your policy may not cover the full value of your items. Review your policy documents, including the product disclosure statement, to ensure you are protected. If not, you may want to consider leaving some of your more valuable items at home.

Medical Emergency Insurance and Emergency Medical Evacuation

If you encounter health complications during your trip, having travel insurance with medical emergencies and evacuation coverage can make a big difference.

In Singapore, the smog and tropical heat may negatively affect some travelers . Be sure to declare any pre-existing medical conditions like high blood pressure, asthma or skin conditions when booking your trip insurance.

Travel insurance for medical emergencies can cover a variety of scenarios, from viral outbreaks to unforeseen medical treatments. Keep in mind that your U.S. health insurance card may not provide coverage abroad, even if you have a private plan. If things go awry, you’ll have peace of mind knowing you have medical protection with travel insurance.

For medical emergency coverage, a standard travel insurance policy may include:

- Hospital admission fees

- Operations and operating room fees

- Ambulance fees

- X-rays and lab tests

- Dental costs