Editorial note: We may not cover every product in this category. For more information, see our Editorial guidelines .

The 5 best travel money cards for bali in 2024.

Bali is a well frequented destination for many Australians and is high on the list when daydreaming of a beach holiday. With its sunny weather, long beaches, warm smiles and welcome hospitality it is no wonder Australians return year after year.

In Bali you are likely to pay for accommodation, food and entertainment as well as withdraw cash from ATMs with your card. So which is the best travel card to take with you?

It's easy, to save you lots of time, we have compared a large number of the best travel cards to take to Bali for Australians in 2024 and have summarised their best points.

Best 5 Travel Money Cards for Bali in 2024:

- Wise Travel Card for the best exchange rates

- Revolut Travel Card for low fees

- Travelex as the best all rounder

- ING One Low Rate Platinum Credit Card for no international transaction fee

- HSBC Everyday Global for best debit card for ATM cash withdrawals

Wise Travel Card - Best Exchange Rates

- 40+ currencies available

- Best exchange rates globally

- One of the lowest conversion fee on the market

- No international transaction fees

- No annual or monthly fees

- Extremely low costs to send money overseas

Wise Travel Card

- Cross currency conversion fees are between 0.24–3.69%. AUD to USD, EUR or GBP was 0.42%, which is one of the lowest on the market

- Free cash withdrawals up to $350 every 30 days. However after that, Wise Card charge a fixed fee of $1.50 per transaction + 1.75%

- Daily ATM withdrawal is $2,700

- Issue up to 3 virtual cards for temporary usage

- It takes between 7 to 14 business days to receive your card

- Can be used wherever MasterCard is accepted

For Australians traveling to Bali, the Wise Travel Card presents a range of features that are particularly beneficial. Firstly, the card offers access to over 40 currencies at the intermarket exchange rate, which is renowned for being the most cost-effective globally. This is especially advantageous for Australians in Bali, as it allows them to convert Australian Dollars (AUD) to Indonesian Rupiah (IDR) at highly competitive rates. Given the exchange rate fluctuations, having access to the intermarket rate can lead to significant savings during their stay. However if you use ATMs frequently this is not the card to use due to the fees. Finally Wise Travel Card lets you transfer money to an overseas bank account with extremely low fees and the best exchange rate.

Revolut - Low Fees

- 30+ currencies available

- One of the best exchange rates globally

- No annual or monthly fees for standard membership

- No initial card fee

- Instant access to a range of cryptocurrencies

Read our Revolut Card Review

Revolut Travel Card

- No fee ATM withdrawals up to A$350, or 5 ATM withdrawals, whichever comes first, per rolling 30 day period and 2% of withdrawal amount (minimum charge of A$1.50) after that

- Exchanging currency on the weekend can incur a 1% mark-up fee

- Fees on international money transfers were introduced in April 2021.

- Can be used wherever Visa is accepted

The Revolut Travel Card is a decent option for those who travel a lot as it offers over 30 currencies at a great exchange rate, which is the cheapest rate globally. However if you exchange currency on the weekend you can incur a one-percent mark-up fee. In addition they have introduced fees for international transfers. Finally if you use ATMs frequently this is not the card to use due to the fees.

Travelex Money Card - Best All Rounder

Best features.

- Unlimited free ATM withdrawals

- 24/7 Emergency Assistance

- Initial and replacement card are free

- Lock in up to 10 currencies

Read our Travelex Travel Card Review

Travelex Money Card

- Minimum load of $100 and maximum load of $100,000

- Can be used wherever Mastercard is accepted

- Fees include a $10 closure fee, $5 for an additional card and $4 inactivity monthly fee.

- While Travelex don't charge ATM fees, some ATM operators may charge their own fees.

- Currencies that can be loaded are AU$, US$, EU€, GB£, NZ$, TH฿, CA$, HK$, JP¥, SG$

- If your card is lost or stolen you can access cash in your account through Moneygram or Western Union agents, with no charge

- Boingo hotspots offer free wifi and you can look at their number of free hotspots per country on this map

The Travelex Card is a good all rounder.

You can use it to take money out of the ATM, for merchant purchases like restaurants and even for online shopping in foreign currency. While the exchange rates aren't as good as the Wise or Revolut Card abroad , the support network if the card is lost or stolen is very good.

ING One Low Rate Credit Card

- No annual fee

- No international transaction fees on purchases

- Up to 45 days interest free on purchases

- Lowest cash advance interest rate of 11.99%

- Use instalment plans to pay off your purchases over time at a lower interest rate

- 11.99% interest rate on purchases

- $6,000 minimum credit card

- Make payments from your mobile with pay with Apple Pay and Google Pay

- International ATM fee and Foreign currency conversion fee are waived when you deposit $1,000 into your Orange Everyday each month, and make 5+ card purchases that are settled. Otherwise they are the higher of 3% or at least $3

- Put repayments on auto payment each month to pay the minimum balance or full amount

The ING One Low Rate credit card for travel is a great option to take to Bali for your next overseas trip as it has one of the lowest interest rates with no international transaction fee on purchases. These two features alone will save you lots of money abroad.

In addition, it has no annual fee, offers 45 days interest free on purchases and it offers the one of the lowest interest rates for cash advances. Finally, it's super versatile. You can make payments from your mobile with Apple Pay and Google Pay.

HSBC Everyday Global Debit Card

- No international ATM fees

- No initial card or closure fees

- No monthly or account fees

- No cross currency conversion fees

- Lock in very competitive exchange rates before travel

- No maximum balance

- Earn 2% cashback

- 10 Currencies can be loaded are AUD, USD, GBP, EUR, HKD, CAD , JPY, NZD, SGD, CNY (currency restrictions apply to CNY)

- Very competitive exchange rates on all currencies when you have currencies already loaded on your card

- ATMs within Australia need to be HSBC and overseas they need to display a VISA or VISA Plus logo, not be be charged fees

- Earn 2% cash back when you tap and pay with payWave, Apple Pay or Google Pay for purchases under $100. With a maximum of $50 cash back per month. In addition you need to deposit $2,000 or more into your Everyday Global Account each calendar month.

- Daily maximum ATM withdrawal is $2,000

- Fraud protection covered by Visa Zero Liability

HSBC is very prominent in Asia and Bali so this is the best debit card for ATM cash withdrawals , as the ATMs only need to display a VISA or VISA Plus logo for free cash withdrawals.

In addition the HSBC Everyday Global Travel Card has no international transaction fees and monthly fees. You can use this card as well in Europe, the UK, the US and New Zealand as well. Finally it offers a 2% cash back incentive when you tap and pay under $100.

Learn more about the best credit, debit and prepaid cards for travel

Credit Card

International Prepaid Cards

The best debit card for Bali charges no international transaction fees and offers intermarket exchange rates on currency conversion, this is the Wise Multi Currency card . It has no set up costs, no ongoing costs or fees for inactivity.

Yes, it is better to have a little bit of Indonesian Rupiah before you arrive. You need cash to pay for your visa when you arrive, cash to pay for transport and tipping in accommodation. The Indonesian exchange rate can be found at the Bank Indonesia page or our home page.

It’s not advisable to carry too much money into Bali, while there is no limit on the amount of foreign currency you bring into Bali, it's better to only bring enough for 2 days. You can work out how much money you need for a week in Bali in our useful guide.

You should take both cash and a card to Bali. A travel money card is better than cash for security reasons and that in most places in Bali you can pay with a card. No one can access your cash unless they have your 4 digit pin. If you lose your travel money card you can quickly report it lost or stolen to stop unauthorised transactions. Cash is better for tipping, on transport and in markets.

Yes Bali does take debit cards especially those linked to Mastercard or Visa, less so with American Express. Most debit cards issued in Australia will work in Bali and it's best to advise your bank that you are travelling to Bali before you leave so they don't cancel your card while you are away. Debit cards work in a similar way to in Australia, tap and pay or punch in your digits and pay. Always accept the local currency when the DCC screen appears to save money.

The currency in Bali is the Indonesian rupiah. They have 6 banknotes called rupiah and 5 coins called sen. The most common notes you’ll probably be dealing with are the blue Rp. 50,000 banknotes or the reddish-pink Rp. 100,000.

More Travel Card Guides

Learn more about the best travel money cards for your holiday destination.

ASIC regulated

Like all reputable money exchanges, we are registered with AUSTRAC and regulated by the Australian Securities and Investment Commission (ASIC).

S Money complies with the relevant laws pertaining to privacy, anti-money laundering and counter-terrorism finance. This means you are required to provide I.D. when you place an order. It also means the order must be paid for by the same person ordering the currency and you must show your identification again when receiving your order.

- Argentina

- Australia

- Deutschland

- Magyarország

- New Zealand

- Singapore

- United Kingdom

- United States

- 繁體中文 (香港)

5 Best Travel Cards for Bali

Getting an international travel card before you travel to Bali can make it cheaper and more convenient when you spend in Indonesian Rupiah. You'll be able to easily top up your card in USD before you leave the US, to convert seamlessly to IDR for secure and flexible spending and withdrawals.

This guide walks through our picks of the best travel cards available for anyone from the US heading to Bali, like Wise or Revolut. We'll walk through a head to head comparison, and a detailed look at their features, benefits and drawbacks.

5 best travel money cards for Bali:

Let's kick off our roundup of the best travel cards for Bali with a head to head comparison on important features. Here's an overview of the providers we've picked to look at, for customers looking for ways to spend conveniently overseas when travelling from the US:

Each of the international travel cards we’ve picked out have their own features and fees, which may mean they suit different customer needs. Keep reading to learn more about the features, advantages and disadvantages of each - plus a look at how to order the travel card of your choice before you head off to Bali.

Wise travel card

Open a Wise account online or in the Wise app, to order a Wise travel card you can use for convenient spending and withdrawals in Bali. Wise accounts can hold 40+ currencies, so you can top up in USD easily from your bank or using your card. Whenever you travel, to Bali or beyond, you’ll have the option to convert to the currency you need in advance if it’s supported for holding a balance, or simply let the card do the conversion at the point of payment.

In either case you’ll get the mid-market exchange rate with low, transparent fees whenever you spend in IDR, plus some free ATM withdrawals every month - perfect if you’re looking for easy ways to arrange your travel cash.

Wise features

Wise travel card pros and cons.

- Hold and exchange 40+ currencies with the mid-market rate

- Spend seamlessly in IDR when you travel

- Some free ATM withdrawals every month, for those times only cash will do

- Ways to receive payments to your Wise account conveniently

- Manage your account and card from your phone

- 9 USD delivery fee for your first card

- ATM fees apply once you've exhausted your monthly free withdrawals

- Physical cards may take 14 - 21 days to arrive

How to apply for a Wise card

Here’s how to apply for a Wise account and order a Wise travel card in the US:

Open the Wise app or desktop site

Select Register and confirm you want to open a personal account

Register with your email, Facebook, Apple or Google ID

Upload your ID document to complete the verification step

Tap the Cards tab to order your card

Pay the one time 9 USD fee, confirm your mailing address, and your card will be on the way, and should arrive in 14 - 21 days

Revolut travel card

Choose a Revolut account, from the Standard plan which has no monthly fee, to higher tier options which have monthly charges but unlock extra features and benefits. All accounts come with a smart Revolut card you can use in Bali, with some no fee ATM withdrawals and currency conversion monthly, depending on the plan you pick. Use your Revolut account to hold and exchange 25+ currencies, and get extras like account options for under 18s, budgeting tools and more.

Revolut features

Revolut travel card pros and cons.

- Pick the Revolut account plan that suits your spending needs

- Hold and exchange 25+ currencies, and spend in 150 countries

- Accounts come with different card types, depending on which you select

- All accounts have some no fee currency exchange and some no fee ATM withdrawals monthly

- Some account tiers have travel perks like complimentary or discounted lounge access

- You need to upgrade to an account with a monthly fee to get all account features

- Delivery fees may apply for your travel card

- Fair usage limits apply once you exhaust your currency conversion and ATM no fee allowances

- Out of hours currency conversion has additional fees

How to apply for a Revolut card

Set up your Revolut account before you leave the US and order your travel card. Here’s how:

Download and open the Revolut app

Register by adding your personal and contact information

Follow the prompts to confirm your address and order your card

Pay any required delivery fee - costs depend on your account type

Chime travel card

Use your Chime account and card to spend in Bali with no foreign transaction fee. You’ll just need to load a balance in USD and then the money is converted to IDR instantly with the Visa rate whenever you spend or make a withdrawal. There’s a fee to make an ATM withdrawal out of network, which sits at 2.5 USD, but there are very few other costs to worry about. Plus you can get lots of extra services from Chime if you need them, such as ways to save.

Chime features

Chime travel card pros and cons.

- No Chime foreign transaction fees

- No ongoing charges for your account

- Lots of extra products and services if you need them

- Easy ways to manage your money online and in app

- Virtual cards available

- You'll need to inform Chime you're traveling to use your card abroad

- Low ATM limits

- Cards take 7 - 10 days to arrive by mail

How to apply for a Chime card

Here’s how to apply for a Chime account and order a travel card in the US:

Visit the Chime website or download the app

Click Get started and add your personal details

Add a balance

Your card will be delivered in the mail and you can use your virtual card instantly

Monzo travel card

Monzo cards can be ordered easily in the US and used for spending in Bali and globally. Monzo accounts are designed for holding USD only - but you can spend in IDR and pretty much any other currency easily, with no foreign transaction fee. Your funds are just converted using the network exchange rate whenever you pay or make a withdrawal.

Monzo doesn’t usually apply ATM fees, but it’s worth knowing that the operator of the specific ATM you pick may have their own costs you’ll need to check out.

Monzo features

Monzo travel card pros and cons.

- Good selection of services available

- No foreign transaction fee to pay

- No Monzo ATM fee to pay

- Manage your card from your phone conveniently

- Deposits are FDIC protected

- You can't hold a foreign currency balance

- ATM operators might apply their own fees

How to apply for a Monzo card

Here’s how to apply for a Monzo account and order a travel card in the US:

Visit the Monzo website or download the app

Click Get Sign up and add your personal details

Check and confirm your mailing address and your card will be delivered in the mail

Netspend travel card

Netspend has a selection of prepaid debit cards you can use for spending securely in Bali. While these cards don’t usually let you hold a balance in IDR, they’re popular with travelers as they’re not linked to your regular checking account. That increases security overseas - plus, Netspend offers virtual cards you can use to hide your physical card details from retailers if you want to.

The options with Netspend vary a lot depending on the card you pick. Usually you can top up digitally or in cash in USD and then spend overseas with a fixed foreign transaction fee applying every time you spend in a foreign currency. You’ll be able to view the terms and conditions of your specific card - including the fees - online, by entering the code you’ll find when your card is sent to you.

Netspend features

Netspend travel card pros and cons.

- Large selection of different card options depending on your needs

- Some cards have no overseas ATM fees

- Prepaid card which is secure to use overseas

- Manage your account in app

- Change from one card plan to another if you need to

- You may pay a monthly fee for your card

- Some cards have foreign transaction fees for all overseas use, which can be around 4%

- Selection of fees apply depending on the card you pick

How to apply for a Netspend card

Here’s how to apply for a Netspend account and order a travel card in the US:

Visit the Netspend website

Click Apply now

Complete the details, following the onscreen prompts

Get verified

Your card will arrive by mail - add a balance and activate it to get started

What is a travel money card?

A travel money card is a card you can use for secure and convenient payments and withdrawals overseas.

You can use a travel money card to tap and pay in stores and restaurants, with a wallet like Apple Pay, or to make ATM withdrawals so you'll always have a bit of cash in your pocket when you travel.

Although there are lots of different travel money cards on the market, all of which are unique, one similarity you'll spot is that the features and fees have always been optimised for international use. That might mean you get a better exchange rate compared to using your normal card overseas, or that you run into fewer fees for common international transactions like ATM withdrawals.

Travel money cards also offer distinct benefits when it comes to security. Your travel money card isn't linked to your United States Dollar everyday account, so even if you were unlucky and had your card stolen, your primary bank account remains secure.

Travel money vs prepaid card vs travel credit card

It's helpful to know that you'll be able to pick from several different types of travel cards, depending on your priorities and preferences. Travel cards commonly include:

- Travel debit cards

- Travel prepaid cards

- Travel credit cards

They all have distinct benefits when you head off to Bali or elsewhere in the world, but they do work a bit differently.

Travel debit and prepaid cards are usually linked to an online account, and may come from specialist digital providers - like the Wise card. These cards are usually flexible and cheap to use. You'll be able to manage your account and card through an app or on the web.

Travel credit cards are different and may suit different customer needs. As with any other credit card, you may need to pay an annual fee or interest and penalties depending on how you manage your account - but you could also earn extra rewards when spending in a foreign currency, or travel benefits like free insurance for example. Generally using a travel credit card can be more expensive compared to a debit or prepaid card - but it does let you spread out the costs of your travel across several months if you'd like to and don't mind paying interest to do so.

What is a prepaid travel money card best for?

Let's take a look at the advantages of using a prepaid travel money card for travellers going to Bali. While each travel card is a little different, you'll usually find some or all of the following benefits:

- Hold and exchange foreign currencies - allowing you to lock in exchange rates and set a travel budget before you leave

- Convenient for spending in person and through mobile wallets like Apple Pay, as well as for cash withdrawals

- You may find you get a better exchange rate compared to your bank - and you'll usually be able to avoid any foreign transaction fee, too

- Travel cards are secure as they're not linked to your everyday USD account - and because you can make ATM withdrawals when you need to, you can also avoid carrying too much cash at once

Overall, travel cards offer flexible and low cost ways to avoid bank foreign transaction and international ATM fees, while accessing decent exchange rates.

How to choose the best travel card for Bali

We've picked out 5 great travel cards available in the US - but there are also more options available, which can make choosing a daunting task. Some things to consider when picking a travel card for Bali include:

- What exchange rates does the card use? Choosing one with the mid-market rate or as close as possible to it is usually a smart plan

- What fees are unavoidable? For example, ATM charges or top up fees for your preferred top up methods

- Does the card support a good range of currencies? Getting a card which allows you to hold and spend in IDR can give you the most flexibility, but it's also a good idea to pick a card with lots of currency options, so you can use it again in future, too

- Are there any other charges? Check in particular for foreign transaction fees, local ATM withdrawal fees, inactivity fees and account close fees

Ultimately the right card for you will depend on your specific needs and preferences.

What makes a good travel card for Bali

The best travel debit card for Bali really depends on your personal preferences and how you like to manage your money.

Overall, it pays to look for a card which lets you minimise fees and access favourable exchange rates - ideally the mid-market rate. While currency exchange rates do change all the time, the mid-market rate is a good benchmark to use as it’s the one available to banks when trading on wholesale markets. Getting this rate, with transparent conversion fees, makes it easier to compare costs and see exactly what you’re paying when you spend in IDR.

Other features and benefits to look out for include low ATM withdrawal fees, complimentary travel insurance, airport lounge access or emergency cash if your card is stolen. It’s also important to look into the security features of any travel card you might pick for Bali. Look for a card which uses 2 factor authentication when accessing the account app, which allows you to set instant transaction notifications, and which has easy ways to freeze, unfreeze and cancel your card with your phone.

When you’re planning your trip to Bali, bear in mind that cash is still a primary payment method, and many merchants and public service providers won’t accept a card. You’ll want a travel card which allows low cost cash withdrawals so you’ve always got some IDR in your pocket - and you can also keep hold of your card as a convenient back up in case of emergency too. Choose a card with no ongoing fees and no inactivity costs, so you can use it for your next trip abroad to get the most possible use out of it.

Ways to pay in Bali

Cash and card payments - including contactless, mobile wallet, debit, credit and prepaid card payments - are the most popular ways to pay globally.

In Bali cash is a very popular payment method. While you may find cards are accepted in major hotels and chain stores or very busy tourist areas, many merchants prefer cash. Make sure you’ve always got some IDR in cash in your wallet by making ATM withdrawals with your travel card whenever you need to.

Which countries use IDR?

You’ll find that IDR can only be used in Bali. If you don’t travel to Bali frequently it’s worth thinking carefully about how much to exchange so you’re not left with extra foreign currency after your trip. Or pick a travel card from a provider like Wise or Revolut which lets you leave your money in USD and convert at the point of payment with no penalty.

What should you be aware of when travelling to Bali

You’re sure to have a great time in Bali - but whenever you’re travelling abroad it's worth putting in a little advance thought to make sure everything is organised and your trip goes smoothly. Here are a few things to think about:

1. Double check the latest entry requirements and visas - rules can change abruptly, so even if you’re been to Bali before it’s worth looking up the most recent entry requirements so you don’t have any hassle on the border

2. Cash is a widespread payment method - so you’ll need some IDR in your pocket when you travel to Bali. You can sort out your travel money by visiting an exchange office here in the US, or you can wait until you arrive and make an ATM withdrawal in IDR at the airport when you land. Bear in mind that currency exchange at exchange offices at the airport, either in the US or in Bali can be expensive - so if you’re carrying USD in cash and need to exchange it, head into a town centre to do so.

3. Get clued up on any health or safety concerns - get travel insurance before you leave the US so you have peace of mind. It’s also worth reading up on any common scams or issues experienced by tourists. These tend to change over time, but may include things like rip off taxis or tour agents which don’t offer fair prices or adequate services.

Conclusion - Best travel cards for Bali

Ultimately the best travel card for your trip to Bali will depend on how you like to manage your money. Use this guide to get some insights into the most popular options out there, and to decide which may suit your specific needs.

FAQ - best travel cards for Bali

When you use a travel money card you may find there’s an ATM withdrawal fee from your card issuer, and there may also be a cost applied by the ATM operator. Some of our travel cards - like the Wise and Revolut card options - have some no fee ATM withdrawals every month, which can help keep down costs.

Travel money cards may be debit, prepaid or credit cards. Which is best for you will depend on your personal preferences. Debit and prepaid cards are usually pretty cheap and secure to spend with, while credit cards may have higher fees but often come with extra perks like free travel insurance and extra reward points.

There’s no single best prepaid card for international use. Look out for one which supports a large range of currencies, with good exchange rates and low fees. This guide can help you compare some popular options, including Wise, Revolut and Monzo.

Yes, you can use your local debit card when you’re overseas. However, it’s common to find extra fees apply when spending in foreign currencies with a regular debit card. These can include foreign transaction fees and international ATM charges.

Usually having a selection of ways to pay - including a travel card, your credit or debit card, and some cash - is the best bet. That means that no matter what happens, you have an alternative payment method you can use conveniently.

Yes. Most travel debit cards have options to make ATM withdrawals. Check the fees that apply as card charges do vary a lot. Some cards have local and international fees on all withdrawals, while others like Wise and Revolut, let you make some no fee withdrawals monthly before a fee kicks in.

Both Visa and Mastercard are globally accepted. Look out for the logo on ATMs and payment terminals in Bali.

The cards you see on this page are ordered as follows:

For card providers that publish their exchange rates on their website, we used their USD / IDR rate to calculate how much Indonesian Rupiah you would receive when exchanging / spending $4,000 USD. The card provider offering the most IDR is displayed at the top, the next highest below that, and so on.

The rates were collected at 15:54:21 GMT on 19 February 2024.

Below this we display card providers for which we could not verify their exchange rates. These are displayed in alphabetical order.

Send international money transfer

More travel card guides.

- IndiHome Homepage

- Poin myIndiHome

- Add-On Packages

- Telkomsel One

- Telkomsel PraBayar

- Telkomsel Lite

- Telkomsel Halo

- Roaming & SLI

- Home Internet

- Telkomsel Poin

- Additional Services

- Support Page

- GraPARI Online

- Kuota Belajar

- Undi-Undi Hepi

- #CepetAntiRibet

Tourist Prepaid Card

- Starter Pack

- SIM Card Pick up Location

Unleash the beauty of Indonesia with Telkomsel

Experience the natural wonder of Indonesia and stay connected with Telkomsel prepaid card on the widest network. Wherever you go, Telkomsel will always be the best choice of provider.

Pre-Order Tourist Prepaid Card

Get 25GB data quota and 25-minute voice call for only Rp150,000. Unlock your phone to enjoy this special offer.

Pick up your SIM card when you arrive in Indonesia

Currently, SIM card pick-up points are only available in the Bali and Mandalika Lombok areas. Please check the pick-up location first before arriving in Indonesia.

Additional Information

It’s a special SIM card starter pack for tourists with special data plan/package that can be ordered online through Telkomsel website and pick up upon arrival in Indonesia.

Tourist prepaid card can be obtained for Rp150,000 with 25GB data quota on all networks and 25-minute voice call.

- Pre-order via Telkomsel website and pick up upon arrival in Indonesia.

- Direct purchase on selected Telkomsel store/booth/outlet (called GraPARI).

- Credit Card, requires 3D-secure with Visa, MasterCard or JCB logos.

- Cash on pick-up location (in Rupiah).

Currently, you can pick-up the SIM card at Telkomsel store/booth/outlet (called GraPARI) around Bali and Mandalika - Lombok. For detailed locations, please check the Pick-up Location page .

You should bring the confirmation email, passport, and IMEI.

No, it’s not refundable if the pre-order was made using a credit card.

You can use 1 passport for a maximum of 3 SIM cards.

Yes, the pick-up time limit is 14 days after pre-order.

No. Tourist Prepaid Card is only eligible for international tourists with passport and IMEI as data validation.

No, Tourist Prepaid Card data/voice plan is only valid for 1x purchase. However, you can buy other variants of Telkomsel package via:

- MyTelkomsel App

- Dial *363#

- Nearest Telkomsel outlet

- All data quota of Tourist Prepaid Card can be used nationally and can be consumed on all Telkomsel networks (3G/4G/5G).

- Tourist Prepaid Card is the latest Telkomsel package, special for international tourists.

- Tourist Prepaid Card is only available for 1x purchase.

- Tourist Prepaid Card is only available on Telkomsel.com and selected Telkomsel booth.

- Tourist Prepaid Card consists of 1 package variant only, with 30-day validity.

- Call Center: 188

- Twitter: @telkomsel

- Email: [email protected]

- Facebook: Telkomsel

- WhatsApp Telkomsel: 081111111111

- LINE: Telkomsel

- Argentina

- Australia

- Deutschland

- Magyarország

- New Zealand

- Singapore

- United Kingdom

- United States

- 繁體中文 (香港)

The 6 Best Travel Money Cards for Bali 2024

Bali has it all, from pristine beaches perfect for surfing, a wild party scene, spiritual sites and unique culture - plus places to get away from it all, practice yoga, wander rice terraces and eat fantastic food.

Getting to Bali from the UK isn’t the cheapest or easiest journey. Make sure you can get as much from your trip as possible with a travel debit, prepaid or credit card which can let you cut your overall costs, beat foreign transaction fees, or earn cash back and rewards. This guide walks through your travel money card options and touches on 6 of our favourites to kickstart your research.

Wise - our pick for travel debit card when travelling to Bali

Wise accounts can hold and exchange 40+ currencies, and you can get a linked Wise card for a one time delivery fee. Top up your account in GBP and switch to IDR before you travel. All currency conversion uses the mid-market exchange rate, with low fees from 0.41%. Here are some of the pros and cons of the Wise travel money debit card, to help you decide if it’s right for you.

Hold and exchange 40+ currencies , including GBP-IDR

No fee to spend any currency you hold, low conversion fees from 0.41%

Mid market exchange rate on all currency conversion

Some fee free ATM withdrawals every month

No ongoing fees and no interest to pay

7 GBP delivery fee

No option to earn points or rewards

Click here to read a full Wise review

What is a travel money card?

A travel money card can be used for contactless payments in stores, online shopping and cash withdrawals. Where it’s different to any other card you might hold is that your travel card will have been optimised for international spending, to make spending in a foreign currency cheaper and easier.

The UK is well served for travel money cards, and while individual cards all have their own features and benefits, you may find you can hold a balance in multiple currencies, avoid foreign transaction fees, or earn cash back or rewards overseas.

What are different types of travel cards?

Generally you can split the different types of travel cards available in the UK into the following categories. We’ll walk through the features and benefits of each in a moment:

Travel debit cards

Travel prepaid cards

Travel credit cards

Quick summary: Best travel cards for Bali

Bali is part of Indonesia - so while you’re there you’ll need to spend Indonesian rupiah (IDR). This review of travel cards offers 6 convenient cards to let you do just that. Here’s what we’ll be looking at:

Wise travel debit card : Hold 40+ currencies, including IDR, with no ongoing fees, and spend with the mid-market exchange rate with no foreign transaction fee and low conversion costs from 0.43%

Revolut travel debit card : Hold a balance in GBP or around 25+ other currencies, then spend in IDR with mid-market exchange rates to the plan limit. Pick from 4 different plan types, including some with no monthly fee, and some which come with ongoing costs but which unlock more benefits and no fee transactions

Post Office travel money card : Hold GBP and 21 other currencies, with a secure card you can pick up in person at a Post Office. A 3% fee applies when spending IDR

Monese travel money card : Hold a balance in GBP, then spend in IDR with no fees, up to your plan’s limit. Different plans on offer, including Simple which has no ongoing fees to pay

Barclays Rewards Visa travel credit card: Spend with the Visa exchange rate, and earn 0.25% cash back, with no foreign transaction fee and no cash advance fee. Interest and penalties can apply

Halifax Clarity Mastercard travel credit card: No foreign transaction fee, no annual fee, and no cash advance fee if you withdraw money at an ATM. Variable interest and penalties can apply

Travel money cards for Bali compared

Here’s a brief comparison of all the cards we’ve picked out - in a moment we’ll also look at each card in more detail.

Before you order a new travel money card, you’ll need to weigh up which type of card, and which specific provider might suit your needs. Travel debit cards from a service like Wise can let you hold an IDR balance which is handy if you want to see your travel budget for Bali in advance.

Monese cards come with some currency exchange with no fees, depending on the plan you pick. And while credit cards can be pretty costly they can also offer ways to earn rewards as you spend. This guide helps you compare different card types and providers so you can pick the right one for your needs.

Travel Debit Cards for Bali

Travel debit cards from a specialist provider come with a linked digital account you’ll manage from your phone. Depending on the specific travel debit card you select you may be able to add money in GBP and just convert to IDR at the point of payment automatically, or to hold a balance in IDR in your account so you can see exactly what you have to spend in advance. That can be handy if you spot a good exchange rate and want to lock it in, or if you’re working to a strict budget and want to see exactly how much you have to play with before you start spending.

Below we’ll walk through two popular travel debit card picks which each have their own specific features and fees, so you can compare.

Travel debit card option 1: Wise

There’s no fee to open a personal Wise account , but you’ll pay a one time card order fee of 7 GBP. After that there’s no minimum balance and no monthly charge. Wise accounts can support 40+ currencies for holding and exchange, with low fees from 0.43% when you convert currencies, and transparent ATM fees when you exhaust the monthly free transactions available with your account.

No fee to open a personal Wise account, no minimum balance requirement

7 GBP one time fee to get your Wise card

2 withdrawals, to 200 GBP value per month for free, then 0.5 GBP + 1.75%

Hold IDR and 40+ other currencies, convert between them with the mid-market rate

Get local account details to receive GBP, NZD, EUR, USD and a selection of other major currencies conveniently

Travel debit card option 2: Revolut

Revolut has a selection of different account tiers for personal customers in the UK, including Standard plans with no monthly fee, to the top end Ultra plan which has a 45 GBP/month fee and comes with loads of perks including a fancy platinum plated card.

You can hold around 25 currencies, although IDR isn't supported for holding and exchange. Instead you’ll add money in GBP and your card will convert automatically with the mid-market rate to your plan’s allowance, whenever you spend or make a cash withdrawal. The higher account tiers also come with extras like various different forms of complimentary insurance, discounts, cash back opportunities and travel benefits.

No monthly fee for a Standard Revolut account, or upgrade to one of 4 different account plans which have monthly fees running from 3.99 GBP/month to 45 GBP/month

All accounts have some no fee weekday currency conversion with fair usage fees after that which are 1% for Standard plan holders

Standard plan holders can withdraw 200 GBP overseas per month for free

Hold around 25 currencies

Pros and cons of using debit travel cards in Bali

How much does a travel debit card cost.

The costs of a travel debit card depend on the provider you pick and the way you transact.

For the cards we’ve looked at here, the Wise travel debit card has a one time fee to get your physical card, but there are no monthly charges or minimum balance requirements after that. You can add a balance in GBP and then switch over to IDR in advance with a small currency conversion cost which can be as low as 0.43%. Or you can leave your money in GBP and the card can convert for you with the same great rates and low fees.

Revolut works a little differently, with 4 different account plans available including a Standard account with no ongoing charges but relatively limited features, and 3 personal account plans which have a monthly fee but which offer more no-fee transactions. You can’t hold a balance in IDR so you’ll need to rely on the card to convert for you. There are no fees until you hit your plan conversion limit, but there are then fair usage fees of 0.5% - 1% for some account tiers after that.

How to choose the best travel debit card in Bali?

The best travel debit card for Bali will depend to an extent on your personal preference. If you’d prefer to see your travel budget in IDR ahead of time, you might consider Wise as you can add a balance and then convert to IDR for spending later.

As an alternative, you might choose Revolut which lets you add money in GBP and spend in IDR with no conversion fees up to your plan limit. To unlock more no-fee conversion you’ll need to pay monthly fees so it’s worth comparing your options based on how frequently you might use your card.

Is there a spending limit with a travel debit card in Bali?

You’ll probably find there’s a spending limit for your travel debit card. However, this limit can vary quite significantly, depending on the provider you pick. You can also usually adjust your spending limits for security in the provider’s app which means you can set the limit you’re comfortable with.

For the providers mentioned above, Revolut UK travel debit card holders have some spending caps based on merchant and transaction type. This applies to things like sending money to others, buying travellers cheques or money orders, and betting. Wise caps monthly card spending at 30,000 GBP but you can also move your limit lower if you’d like to, for security reasons.

ATM withdrawals

ATM withdrawals with a travel debit card are also likely to be subject to limits. Revolut applies a 3,000 GBP limit based on any given 24 hour period. Wise ATM withdrawal limits are 4,000 GBP per month. Both providers allow you to make some no fee ATM withdrawals monthly, but the exact amount you can withdraw will depend on your account type.

Prepaid Travel Cards for Bali

[Prepaid travel cards] ( https://exiap.co.uk/guides/best-prepaid-travel-cards ) are another common option for your trip to Bali. As with travel debit cards, you’ll have an extra layer of security because your card isn’t linked to your main UK bank account. But because prepaid cards don’t commonly support IDR for holding a balance, there could be a few extra transaction fees which push up the overall cost, depending on the specific card you select. Here are a couple of strong contenders for prepaid travel cards in the UK:

Prepaid travel card option 1: Post Office Travel Money Card

You can order a Post Office Travel Money Card online or pick one up in person at a branch as long as you have a valid ID on you. Cards allow you to top up and hold 22 currencies, although bear in mind a fee applies when you spend in IDR as it’s not a currency supported by the card. That means that when you spend in Bali, payments will be deducted from your GBP balance instead, with a 3% fee.

3% cross border fee when you spend in IDR

22 currencies are supported for holding and exchange

No fee to spend a currency you hold on your card

ATM withdrawal fee will be deducted from your GBP balance, and will be the equivalent of 1.5 GBP

Manage your account and card from the Post Office travel money app

Prepaid travel card option 2: Monese Travel Money Card

Monese offers several different account plans which come with linked cards you can use while overseas. Depending on the plan you pick you’ll get some free international spending and some free ATM withdrawals. Simple account plans have no monthly fees, but are more limited in terms of no-fee transactions compared to the other account tiers. While Monese does offer foreign currency account plans, these are not available in IDR.

Pick the account plan that suits your needs, including a Simple plan with no monthly costs and some plans which do have a fee to pay every month

Accounts offered in GBP, EUR and RON

Simple account plan holders can spend up to 2,000 GBP a month in foreign currencies with no fees - other account plans have unlimited overseas spending with no extra fees

All accounts have some fee free ATM withdrawals every month, with variable limits based on account plan

Virtual cards available

Pros and cons of using prepaid travel cards in Bali

How much does a prepaid card cost.

The costs of a prepaid travel card can vary quite a lot. The Post Office travel card has no initial fee, but as IDR isn’t supported for holding and exchange, you’ll pay a 3% cross border fee when you’re in Bali.

Monese has account plans which offer some currency conversion with no fees every month, so this can still be an attractive option based on cost, but you’ll need to weigh up any monthly fees that apply for your specific card plan.

How to choose the best travel prepaid card for Bali?

The best prepaid travel card for Bali really depends on your personal preferences. The Post Office card has the advantage that you can pop into a Post Office branch and get one in person if you’re in a hurry - but the downside that using it in Indonesia comes with a hefty 3% cross border fee. The Monese cards on offer include a Simple card which has no monthly fee but which only lets you spend up to 2,000 GBP internationally a month before extra costs apply. If you’re spending more, upgrading to a Monese account with a monthly fee may actually be better value - plus you can downgrade again any time you like.

Prepaid travel card spending limit

The Post Office travel card lets you top up to 5,000 GBP at a time, with the maximum balance at any given time set at 10,000 GBP, or 30,000 GBP annually. Monese accounts may have different limits based on the tier you pick - usually set at a maximum holding balance at any time of 40,000 GBP. You may be limited to spending up to 7,000 GBP a day, depending on your account type.

With the Post Office card, you can make up to 17,000 THB maximum daily withdrawals and each withdrawal costs 80 THB. Monese accounts may have a maximum ATM withdrawal of 300 GBP a day, depending on the specific account you pick, so it’s worth reading the fee schedule carefully to understand the details.

Travel credit cards for Bali

Travel credit cards don’t let you hold a balance in IDR, but instead when you spend your payment is converted from Indonesian rupiah to GBP using the network rate to be added to your bill. With travel credit cards you’ll often find that the foreign transaction fees which many credit cards use for foreign currency spending are waived, which can mean it’s around 3% cheaper to use a travel credit card abroad compared to using a normal credit card.

However, as with all credit cards, there are some fees you’re likely to run into with a travel credit card which can mean it’s a more expensive option than using a debit card.

Travel credit card option 1: Barclaycard Rewards Visa

The Barclaycard Rewards Visa credit card is a good, straightforward option for UK customers looking for a credit card which does not have foreign transaction fees, and which doesn’t have an annual fee. As with any credit card, some costs can apply including interest fees if you don’t clear your bill monthly, but you’ll be able to earn 0.25% cash back on all your card spending at home and abroad.

No annual fee, with 0.25% cash back on card spending

Currency exchange uses the network rate and no foreign transaction fee

No ATM withdrawal fee - but interest can still apply

28.9% representative APR, with penalty fees for late payments

Secure spending with extra protection on some purchases

Travel credit card option 2: Halifax Clarity Mastercard

The Halifax Clarity Mastercard has a variable interest rate which is based on your creditworthiness, but doesn’t use different rates for different transaction types as some cards do. There’s no foreign transaction fee when you spend or withdraw in foreign currencies, but bear in mind that an ATM operator might charge a fee, and interest accrues instantly for cash advance transactions.

No foreign transaction fee when spending or making a cash withdrawal overseas

Interest applies instantly when making cash withdrawals

Same interest rate applies on all purchase categories

Variable APR based on your credit score - you’ll need to check your eligibility online to see the APR you’d be offered

Spending is covered by the Consumer Credit act which means extra protections for purchases from 100 GBP to 30,000 GBP in value

Pros and cons of using credit cards for Bali

How much does a travel credit card cost.

Travel credit cards may have no annual charge and no foreign transaction fee to pay when spending overseas. However, variable interest, which is set based on your credit score, will still apply if you don’t pay your bill in full every month. It’s also important to note that although the cards we’ve featured above have no cash advance fee for making ATM withdrawals, interest usually accrues instantly. Overall that can mean credit card spending costs more in the end than using a debit or prepaid travel card.

How to choose the best travel credit card for Bali?

If you’re planning on spreading the costs of your spending over a few months it’s worth looking for the card which has the lowest available interest, particularly if it has no annual fee to worry about. If you’ll usually repay your bill in full monthly it may be more important to you to find a card which offers cash back or rewards. Weigh up a few different options while you decide, to make sure you get the right match for your specific needs.

Travel credit card spending limit

Your travel credit card spending limit will be set by the card provider, and will depend on your credit score. You’ll be shown details of your spending limit when you’re approved for a travel credit card.

The cards we’ve looked at earlier don’t charge a cash advance fee, but this is a common cost when using a credit card at an ATM, so worth looking out for when you select any credit card. It’s also worth noting that it’s very common for ATM withdrawals to start accruing interest instantly, so you’ll end up needing to repay some charges whenever you use your credit card in an ATM.

How much money do I need in Bali?

Bali doesn’t have to be an expensive destination. While you can opt for high end luxury, there are nice hotels at a reasonable price and food shouldn’t break the bank either. Here’s a quick look at some common costs in Bali:

Conclusion: Which travel money card is best for Bali?

Using a travel money card when you’re overseas is secure and convenient, and can help you cut costs and manage foreign transaction fees.

The right travel card for Bali will depend on what you prefer. Check out a few while you’re shopping around - the Wise travel debit card might suit if you want to convert to IDR either in advance or at the point of payment, with low fees and the mid-market exchange rate. A Monese travel prepaid card might be a good pick if you’ll only exchange money to the free currency conversion limit set in your specific plan. Or, a travel credit card like the Barclays Rewards Visa could work if you want a card for earning cash back and for using as a payment guarantee.

FAQ - Best travel cards for Bali

Can you withdraw cash with a credit card in bali.

Yes. You can use your credit card to make an ATM withdrawal at any ATM in Bali where your card network is accepted. However, bear in mind you’ll pay interest instantly when you use a credit card in an ATM. Choosing to withdraw with a low cost travel debit card from Wise or Revolut may bring down your overall fees.

Can I use a debit card in Bali?

Cards aren’t universally accepted in Bali. You should have no problems paying in larger and chain stores, hotels and restaurants in the cities, but bear in mind that you may not be able to pay with card in smaller merchants or at markets, so having both a prepaid or travel debit card and some Indonesian rupiah in cash is a smart plan.

Are prepaid cards safe?

Yes. Prepaid cards are not linked to your normal UK bank account which means that they’re safe to use. Even if you were unlucky and someone stole your card while you’re in Bali, they would not be able to access your main account - and you could freeze your prepaid card in the app easily if you needed to.

What is the best way to pay in Bali?

In some places, cash will be the only option for making payments in Bali. In general, making sure you always have some cash in Indonesian rupiah, and a travel card for spending or getting cash from an ATM, is a good choice so you have a back up plan if you ever need it.

Bali Holiday Secrets

Wise Debit Card: 7 Reasons Why it’s the Best Travel Card for Bali

updated April 1, 2022, 5:24 pm 24.5k Views 54 Comments

If you are looking for a sure-fire way to save money while travelling, the Wise Debit Card is a must-have. I’ve been using Wise (formerly Transferwise) to transfer money between bank accounts in different currencies for a couple of years, and I swear by it. But the addition of personal debit cards as well as their original business debit card makes this the best travel debit card by a country mile.

Why Wise Debit Card is cheaper than banks and credit cards.

The reason Wise can exchange currencies cheaper than your bank is that they process so much volume they acquire (formerly Transferwise) real-time foreign exchange rates without the markup your bank charges for the privilege of exchanging currencies.

Think of it this way – every moment there is a market between two commodities. The amount you are buying another currency (for example, the Indonesian Rupiah) and the rate someone else (your bank) is willing to sell that Rupiah. Your bank charges a fat margin – Transferwise has lower margins – therefore you get more Rupiah for your Dollar.

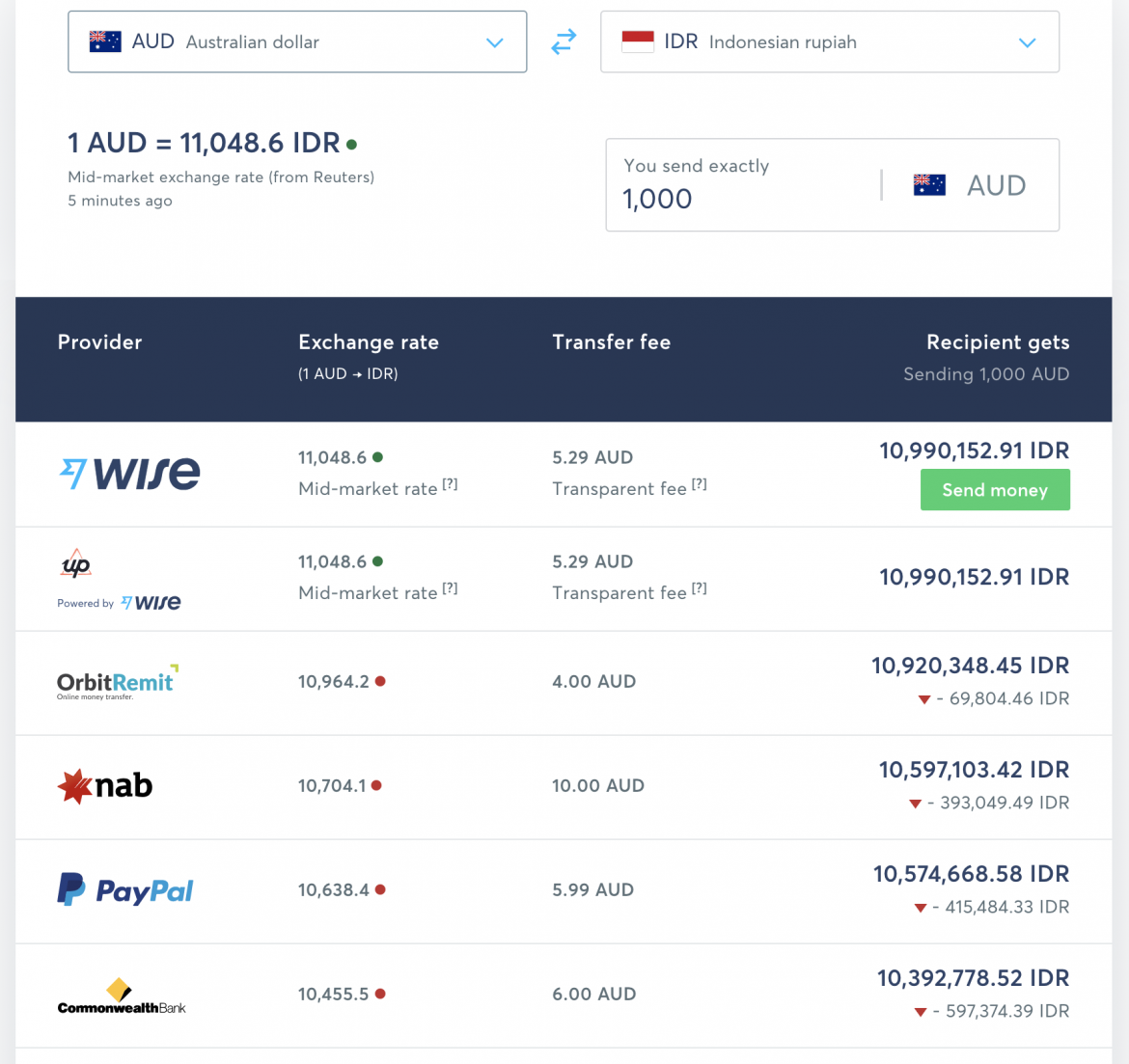

Check out the screenshot below showing the transfer of AUD$1,000 using Wise compared with NAB, PayPal and Commonwealth Bank.

The difference can be as much as IDR600,000, which is around AUD$60. The currency in Bali is the Indonesian Rupiah (IDR), and let me tell you, AUD$60 goes a long way in Bali.

Using Wise for sending money from Australia to Bali.

Many Australians have friends and family in Bali and need to send money from Australia to a Bali bank account.

Let’s use an example of sending AUD$100 from your Australian bank account to a friend’s bank account in Bali. Remember, the currency in Bali is the Indonesian Rupiah (IDR).

First, you register your own personal Wise account . Register on a desktop or laptop first, then download the smartphone apps for Android and Apple .

It’s very easy to confirm your identity (required by law, same as any Australian bank) using a passport or driver’s license, but the verification process is quite quick.

Next, you create a new Australian bank account complete with BSB Code and Account number. This account behaves exactly the same as any of your other Australian bank accounts. Now you have the new account number, it’s dead easy to transfer money from your current local bank account to your new Wise bank account .

So now you have an account within Wise in Australian Dollars. Next, you use the menu options to open an IDR balance . The difference between a balance and an account is that a balance is simply holding a foreign currency without a bank account attached to it — an account is a proper bank account with account numbers.

Now here is the fun bit — you can send IDR to your friend’s Indonesian bank account. All you need is the name on their account, the name of the bank and the account number. This makes it almost impossible to make a mistake and send it to the wrong person because the confirmation screen will display the name of the account holder, which you can check against the details they provided you.

Once confirming the transfer, you can track its progress online and also receive email notifications when it arrives in their account.

The difference when transferring from your bank directly to a foreign bank is huge.

- You get charged an “administrative fee”, usually around $20-50.

- The exchange rate they transfer your money is the retail rate , meaning they are making a significant margin off you.

- A “delivery” fee is often charged. The recipient’s bank is literally charging them for receiving the funds being transferred.

Wise cuts out the middle-man , in this case, your bank, and withdraws the money from your account (without fees), exchanges it for the destination currency (which is where you save the most) and deposits it in the recipient account for a tiny fraction of the fee that your bank would charge.

The Wise Travel Debit Card.

If you apply for a Wise Debit Card , you can use it to spend Indonesian Rupiah while in Bali without any transaction fees at all .

Think about this. You go to dinner in a restaurant in Seminyak and in a fit of generosity pay the bill for your four guests. Maybe drinks and dinner come to IDR 4,000,000.

Using the rates in the above example, you will be charged around AUD$360 if you pay with your Visa or Mastercard. The bank decides what exchange rate it will charge you in Australian Dollars, and let’s be frank – the rate isn’t great.

On top of that they may charge you an “overseas transaction fee” because, well, they can. That’s just another bank tax. Since the consumer commissions in several countries made “overseas transaction fees” against the law, most banks simply sneak it in with an even worse foreign currency conversion rate.

Either way, they get you, and you end up paying a lot more than the original IDR4,000,000 bill.

I cannot thank you enough for this tip

I cannot thank you enough for this tip. I have used Transferwise in BALI last week and it worked perfectly without the horrible australian banks fees. also, it’s so easy to withdraw money from the many ATM’s around and I must say that I am now using it in Australia if and when I need to transfer money abroad. Best tip ever.

With a Wise Debit Card , you pay… Rp 4,000,000 for dinner. No extra fees, no transaction charges. That’s because the money you are holding in your IDR currency is used to pay just like a local would using their Indonesian debit card.

And the best feature is that whenever you make a transaction you get an alert on your smartphone telling you where the transaction was made and how much. That means whenever I use it (and I make several transactions a day) I get an instant confirmation showing the local currency transaction.

Not only does this give me a great sense of security but I can also confirm how much is left in the local currency account where I’m travelling.

Withdraw Local Currency with your Transferwise Debit Card

Other than using the card for purchases without any transaction fees while you’re on holiday in Bali, you can also withdraw cash from ATMs in Bali as well.

That means you don’t need to bring cash to exchange at a money changer or get hit with exorbitant bank fees by using your existing Visa or Mastercard.

Not all ATMs will accept the Transferwise Debit Card but many do — I’ve found several around Bali that allow cash withdrawals, with my favourite being the yellow-coloured Maybank (there’s one outside Biku in Seminyak ).

No leftover foreign currency at the end of the holiday.

One of the biggest pains when travelling is using up the local currency before you leave. Or conversely, for me, it’s not having any when I land in a new country.

Using the Transferwise smartphone app I can move money between currencies at the most competitive rate on the market. Which means if I’m a bit short because of a big splurge with a few days to go, I can exchange money from one of my other currency wallets into the local currency.

And when leaving, or anytime after I leave, I can move the leftover money into the currency I’m going to use next. Because the rates are better than I can find anywhere else, the stress of getting a horrible exchange rate for small or large amounts is no longer a factor.

It’s just one less friction point when travelling, so I can focus on making my Indonesian Rupiah, Vietnamese Dong, Malaysian Ringgit or Euro go further.

Save money by spending local currency during airport transits.

One of the pains of travelling far and wide is the transit times while changing flights at foreign airports. There’s not enough time to get outside immigration, but enough time that you may want some food or drink (always a good idea), or check-out the local airport shopping (never a good idea).

The problem is you don’t have any local currency, and using the currency exchange booths means paying either a commission or a shockingly expensive exchange rate , especially for small amounts.

My solution is to figure out what I’m going to get (usually food or drink while waiting for my connecting flight) and transfer that amount using my Transferwise smartphone app and then paying for it using my Transferwise Debit Card.

That way I get the most competitive rate even with small amounts, and paying for it using my card means it’s being transacted in the local currency.

So buying a laksa at KLIA doesn’t mean paying my credit card issuing bank an “overseas transaction fee” along with a grossly uncompetitive exchange rate. The last time I tested the difference I paid 54% more than I would with my Transferwise Debit Card using local currency. An AUD$8.20 curry turned into a $12.67 charge on my credit card.

And if you doubt this, or have had a similar experience, please leave a comment below.

Saving for a holiday made easy.

We all know that saving for a holiday is hard work. And when you go to change your hard-earned cash into the local currency you are at the whim of the prevailing exchange rate.

What I do is transfer money from my home bank account into my Transferwise Debit Card account and regularly exchange those dollars into my destination currency.

For example, for a holiday to Vietnam, I transfer a few hundred dollars a month into my Transferwise account and then swap those dollars for Vietnamese Dong regularly. That way I’m averaging the exchange rate over a length of time – which means I won’t get the best rate or the worst rate – but an average rate over the time I’m saving for the trip.

So there it is. Put funds into your Transferwise account, change it into any currency you like, and spend like a local. You can try it out by getting a Transferwise account, connecting it with your own bank account, putting in a small amount to try it out (that’s what I did) and testing the exchange rate by using the same amount as a foreign exchange transaction using your own own Internet banking, or asking for an over-the-counter transaction at your local bank branch (like that’s somewhere we go any more).

While most anyone can open a Transferwise account, Debit Cards can only be issued to residents of certain countries.

Disclaimer: Using the links from this website means I get a very small commission from anyone who signs up for a Transferwise account and makes a currency conversion. I’ve been using Transferwise for over two years and I love it. Ask any questions in the comments section below.

© 2024 Bali Holiday Secrets. Hosted with Cloudways .

- Argentina

- Australia

- Brasil

- Canada

- Deutschland

- España

- France

- India

- Italia

- Magyarország

- Malaysia

- New Zealand

- Polska

- Portugal

- România

- Singapore

- United Kingdom

- United States

- 繁體中文 (香港)

8 Travel Traps to Avoid If You're Heading to Bali

Nothing can put a dampener on your escape to Bali like falling into a trap. A travel money trap!

We're sharing the most important travel moment traps we think you should avoid, and the travel money tips for Bali that can really help you save some money.

1. Not taking a prepaid card

Our first point is an important one. Using a prepaid card in Bali is a great way to avoid the fees and costly exchange rates that often come with ordinary debit and credit cards, not to mention the theft risk of carrying around large amounts of cash.

The Wise card is a good choice for a prepaid travel card. You get the market exchange rate, low fees and you'll only spend what you put on there.

Read the full review

2. Exchanging money at the Airport

Do not exchange currency at the airport. This goes for before you get on the plane in Australia and when you land in Bali. The rates are awful and the fees are high. You are much better off withdrawing cash from an ATM or going to a money exchange shop in a major city that you visit.

3. Not having different payment methods

Card is becoming more and more accepted in Bali. But having said this, there may be times when you will almost definitely need some cash. Having a combination of payment methods such as cash, debit card and credit card means you're covering all bases. As an extra tip, keep your money in different places. If the worst happens and you don't have access to some of your things it will put your mind at ease to know you still have money.

4. Paying in Australian dollars when using your card.

Sometimes when you make a purchase Internationally with your Australian debit or credit card, you will be asked if you want to make the payment in your currency, or the local currency. It is almost always better to pay in the local currency than it is to pay in AUD. The exchange rates are generally awful otherwise.

5. Forgetting to book luggage when you book your flight

Don't get caught out. If you're booking a flight, it can be tempting to save money by not booking any checked luggage. This can be a saving at the time, but it's much more expensive to buy luggage when you're checking in. Even if you're a light traveller, at least consider booking it for your flight home. This way you're covered in case you stock up on souvenirs and shopping.

6. Making too many ATM withdrawals

While it could be better to withdraw money from an ATM than it is to exchange money at the airport, or your hotel you still want to be careful. If you do decide to do this, just try to plan in advance. Because you will almost definitely need to make a withdrawal at some point during your stay in Bali, try and withdraw more money, less often. Fees will almost always be a set amount, so lessening the amount of times you're doing it can definitely help you save.

7. Not checking terms and conditions of travel cards

If you're worried about carrying cash, you may be tempted to buy a prepaid currency card. If you do this, just make yourself aware of all the fees and charges involved. Often they are advertised as free but can be expensive to reload and withdraw cash with. You can read more about the best cards to take to Bali here .

8. Keeping too much cash on you

Our final tip is to safe guard you and those you are travelling with. If you choose to travel with cash, try to split up where you're keeping it. If you're keeping millions of Rupiah in your wallet, you're opening yourself to being left in a sticky situation if you lose it or it gets stolen. By keeping some cash on you, and maybe some in your luggage or in the safe at your hotel you will have a back up if the worst happens. But like we said in tip 2, it's best to have a few payment methods on you when you're travelling.

Where to get Bali currency from?

Spending with your card when you’re away from home is usually the most convenient option - but not everywhere you visit in Bali will accept cards, so also having some rupiah in cash is a smart idea. There are plenty of different ways you can get your IDR either before you travel or on arrival - although some will net you better exchange rates and lower fees compared to others. Here are a few places you can get your Bali travel money from:

- Open a multi-currency account with an online provider like Wise or Revolut. With Wise for example, you can add money in AUD and exchange to IDR, and set your holiday budget in advance of travel

- Get a travel card from a provider like Wise or Revolut which will let you top up in AUD and convert to IDR at the point of purchase or withdrawal, often with great exchange rates

- Order your IDR in cash before you travel and collect it at the airport - or take along AUD in cash and switch in the airport on the spot as you pass through (this can be a quite costly way to go - watch out for markups in the exchange rate if you choose to use an airport exchange)

- Carry cash to Bali and exchange in tourist locations and larger towns there which have currency exchange shops

- Buy IDR from your bank in cash - if this service is supported

Before you decide where to get your Bali currency from, compare a few options looking at both fees and exchange rates. Using a travel card with a linked multi-currency account is often one of the best value options as you’ll be able to securely manage your money in AUD and IDR without needing to carry too much cash at any given time.

Read a comprehensive guide on currency in Bali .

What other travel money traps to avoid in Bali?

You want your money to go as far as possible when you’re on holiday - and you certainly don’t want to be the victim of scams or theft. Use these common sense tips to make sure you avoid common travel money traps, so you can focus on enjoying your trip.

1. Use a safety deposit box in your villa or hotel

You’ll be carrying your passport, electronics and valuables, as well as cash - and you don’t want to take any chances. In most cases hotels and villas will have a safety deposit box available for use, which can help protect all your important items and money while you’re away.

Worried about forgetting things in the safety deposit box? Leave something in there that you simply can’t forget - like a single shoe. You’ll notice it’s missing when you try to pack or leave, which can be a handy reminder to double check the safe!

2. Agree on a price before a service starts

Before you take a tour or trip, or hop in a taxi, make sure you’re very clear on the fees you’ll be charged in the end. It’s pretty common to find you’re asked for more than expected, either through simple miscommunication or if a seller or merchant deliberately inflates prices or forgets to mention all the fees involved in a service.

Get everything straightened out in advance - so if you’re taking a snorkelling trip and don’t have your own gear, check if there’s a hire fee, and make sure you know if food or entry tickets are included in any tour you take, for example.

3. Beware of pickpocketing

Tourists are easy prey for pickpockets because they’re not familiar with their surroundings and often won’t be paying much attention to their belongings. Don’t get caught out.

Situational awareness is usually all you need to avoid pickpockets - keep your valuables close by at all times, don’t put your wallet in a back pocket where it can easily be taken, and consider carrying your rucksack forward facing if you’re in a crowded area.

Bali prices

It’s rightly a very popular destination for Australians looking to spend time on the beach, surf, take part in yoga classes, visit retreats and spiritual or cultural sites. But what can you expect to pay for a trip to Bali? Let’s look.

How much does a trip to Bali cost from Australia?

You’ll inevitably need a flight which can be one of the biggest costs of any travel. The exact costs of a trip to Bali from Australia vary of course, depending on the airline you pick, the season and the airport you need to fly from. However, at the time of writing (July 2023), flights were available from Sydney for August 2023 starting from around 660 AUD return per person.

Accommodation

Bali hotel and villa pricing runs from great budget buys to top end all out luxury - and where on the island you want to be makes a huge difference too. The good news is that there’s something for you whatever your budget.

At the time of writing, if you wanted to stay in Ubud in August 2023 you could get a 4 star luxury hotel room for 2 including breakfast starting at about 250 AUD a night, while the very best villa (which tend to sleep far more people) came in at more like 500 AUD a night. Far cheaper options including hostels and homestays are also available.

Restaurant prices in Bali

If you’re looking for a low key meal, you’ll be able to get great food on Bali for just a few dollars. Or, go for a mid-range place for a 3 course meal for 2, and you’ll pay from about 33 AUD in total, according to cost of living calculator Numbeo.com.

For more information about Bali prices read this guide on how much things cost in Bali .

FAQ - travel money traps to avoid in Bali

What is the safest way to take money to Bali?

When you travel to Bali you probably want to have several different ways to pay including one or two cards, and some cash. However, carrying too much cash isn’t the safest option, and having your regular bank card with you can also expose you to extra fees when spending overseas. A great option is to get a travel money card from a service like Wise or Revolut, which lets you add AUD, and spend in IDR on your card. The account isn’t linked to your primary everyday account, making it secure, and easier to set your travel budget.

Should I exchange money before I travel to Bali?

Often the best way to get IDR cash for Bali is to have a multi-currency account with a payment card which lets you hold, spend and withdraw conveniently in rupiah. This can often mean you get a better exchange rate and lower overall costs compared to exchanging at the airport or your hotel - check out Wise and Revolut as strong options available in Australia.

Is it better to use cash or card in Bali?

Many places in Bali will accept card payments, which can be the most convenient way to pay. However, it’s not an option everywhere so having some cash is also a smart move. Get a travel money card to make ATM withdrawals locally on arrival in Bali, and so you don’t need to carry too much IDR cash at any one time.

Need to know more about travelling to Bali?

Passports, Visas and Vaccinations

How Much Things Cost in Bali

Currency in Bali

Banks, ATMs & Currency Exchange

The Best Cards to Use in Bali

7 Common Travel Money Traps to Avoid in Bali

- United States

- United Kingdom

Travel Money Guide: Indonesia

Get from the beach bar to surfie havens with the right access to your holiday money..

In this guide

Compare travel money options for Indonesia

Travel card, credit card, or debit cards, how much rupiah do i need to bring to the indonesia, exchange rate history (aud to idr), how the different travel money products work in indonesia, a guide to indonesian banknotes and coins, find cash and atms in indonesia, get travel insurance quotes for your holiday in indonesia.

Travel Money Cards

Whether it's Bali, Lombok or any of the 17,000 islands that make up Indonesia, you'll need to figure out the best way to access your money.

If you're sticking to a swanky resort in a built-up area like Bali, you'll be fine with a no-fee debit or credit card and access to some cash for any smaller purchases along the way, like souvenirs and quick meals. If you're doing it loval style in a villa or heading off the beaten track, then having more Indonesian Rupiah available in cash is a must.

- Travel Credit Cards

- Travel Debit Cards

- Prepaid Travel Money Cards

We update our data regularly, but information can change between updates. Confirm details with the provider you're interested in before making a decision.

Learn how we maintain accuracy on our site.

What's in this Indonesia travel money guide?

A quick summary of travel money options for indonesia.

- Stephanie’s trip to Bali

- A guide to Indonesia Rupiah: banknotes and coins

- Finding cash and ATMs in Indonesia

- Find travel insurance for Indonesia

Whether you're on a quick business trip or taking a holiday, it's good to have an at least a couple of ways to access your money. There are currently no travel cards which allow you to load Indonesian rupiah. Compare travel credit cards and debit cards to take to Indonesia instead.

Choose a mix that suits your needs: for example a debit card for regular spending with a credit card for emergencies, or Indonesian currency supplemented by a debit card. Whatever mix you decide on, you want to have enough Indonesian currency in your pockets when travelling through Indonesia — even if it's enough for the first couple of days.

You're going to need to pay for a visa when you arrive in Indonesia. In places such as Denpasar airport, you have to pay cash, so make sure you have sufficient funds.