Here Are the Four Best Travel Money Cards in 2024

François Briod

Co-Founder of Monito and money transfer expert, François has been helping Monito’s users navigate the jungle of money transfer fees, bad exchange rates and tricks for the last ten years.

Jarrod Suda

A writer and editor at Monito, Jarrod is passionate about helping people apply today’s powerful finance technologies to their lives. He brings his background in international affairs and his experiences living in Japan to provide readers with comprehensive information that also acknowledges the local context.

Links on this page, including products and brands featured on ‘Sponsored’ content, may earn us an affiliate commission. This does not affect the opinions and recommendations of our editors.

From the multitude of bank fees and ATM charges to hidden currency conversion fees, there's no question that spending your money abroad while travelling can be costly — and that's saying nothing about the cost of the holiday itself!

As you prepare for your trip abroad, the golden rule is that you'll save the most money by using the local currency of your destination. This means withdrawing local cash at foreign ATMs and using a debit card to pay directly in the local currency. For example, if you're from the UK, using your bank's debit card that accesses your British pounds will likely lose you money to hidden fees at ATMs abroad and at local merchants.

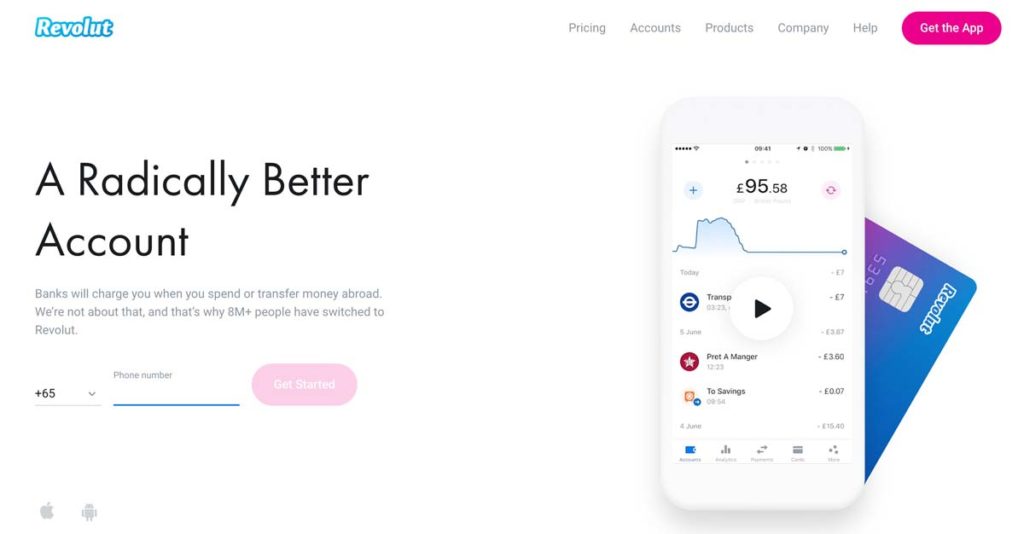

In general, we rate Revolut as the best travel card all around. Its versatile account and card can be used to spend like a local pretty much anywhere in the world. ✨ Get 3 months of free Revolut Premium as a Monito reader with our exclusive link .

If you're from the EU, UK, or US, here are a few more specific recommendations to explore:

- Best for travelling from the UK: Chase

- Best for travelling from the US: Chime ®

- Best for travelling from the Eurozone: N26

If it's not possible for you to spend in the local currency when travelling abroad, then spending in your home currency while using a card that doesn't charge any hidden exchange rate markups from your bank (e.g. only the VISA or Mastercard exchange rates to convert currency) is still a good bet for most people.

In this guide, we explore cards that waive or lower ATM fees and that hold multiple currencies. Spend on your holiday like a local and enjoy peace of mind after each tap and swipe!

Best Travel Cards (And More!) at a Glance

Best travel money cards.

- 01. What is the best best multi currency card? scroll down

- 02. Are prepaid currency cards really it? scroll down

- 03. Monito's best travel money card tips scroll down

- 04. FAQ about the best travel cards scroll down

Revolut: Best All-Rounder

Revolut is one of the most well-known fintechs in the world because it offers services across Europe, the Americas, Asia, and Oceania.

- Trust & Credibility 8.9

- Service & Quality 7.9

- Fees & Exchange Rates 8.3

- Customer Satisfaction 9.4

Revolut is available in many countries. You can double-check if it's available in yours below:

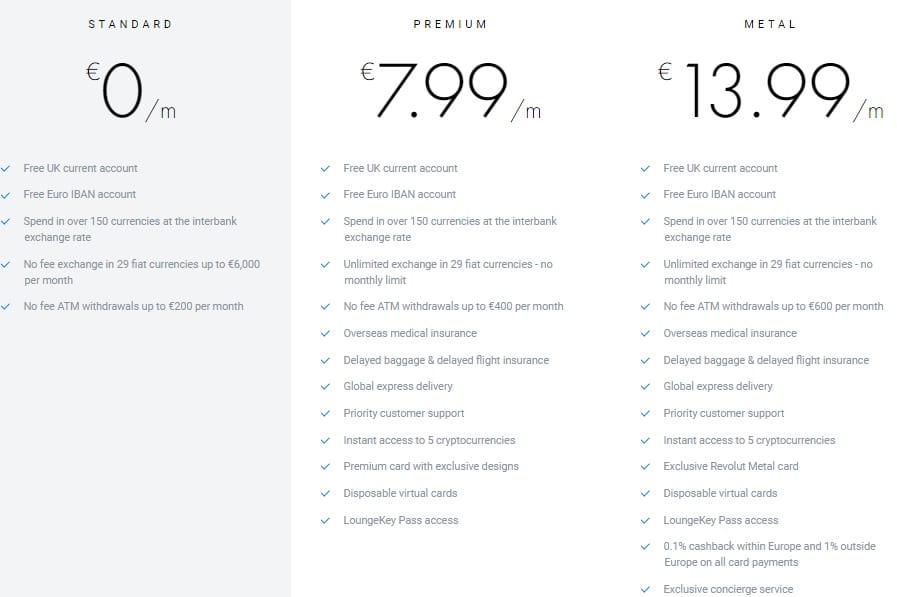

Here's an overview of Revolut's plans:

Revolut Ultra is currently only available in the UK and EU.

Like Wise, Revolut converts your currency to the local currency of your travel destination at an excellent exchange rate (called the 'Revolut Rate', which, on weekdays, is basically on par with the rate you see on Google), making it a good way to buy foreign currency before travelling abroad. As always though, bear in mind that Revolut's exchange rates might be subject to change.

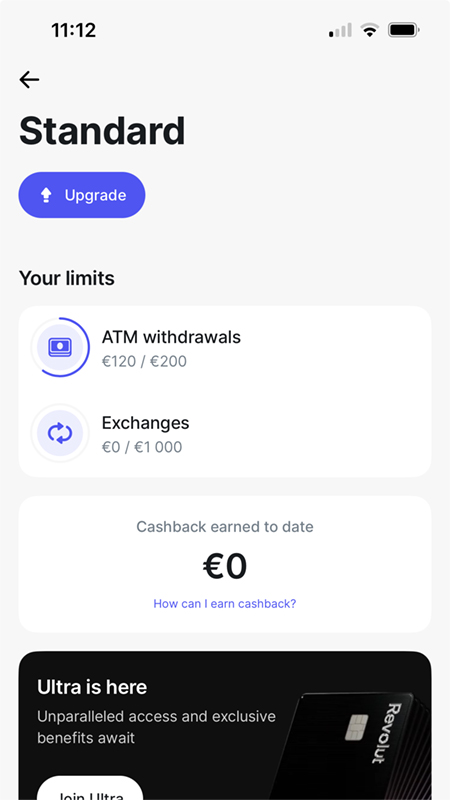

Revolut's Standard Plan only allows currency exchange at the base mid-market exchange rate for transfers worth £1,000 per month. ATM withdrawals are also free for the first €200 (although third-party providers may charge a withdrawal fee, and weekend surcharges may also apply). These allowances can be waived by upgrading memberships.

N26: Good Bank For EU Travellers

One of the most well-known neobanks in Europe, N26 and its debit card operate in euros only. However, N26 is a partner with Wise and has fully integrated Wise's technology so that you never have to pay foreign transaction fees on your purchases outside of the eurozone. While N26 does not have multi-currency functionality, N26 will apply the real exchange rate on all your foreign purchases and will never charge a commission fee — making N26's card a powerful card for EU/EEA residents who travel across the globe.

- Trust & Credibility 7.9

- Service & Quality 8.0

- Fees & Exchange Rates 9.3

- Customer Satisfaction 8.1

These are the countries in which you can register for an N26 account:

And here is an overview of the various plans and account:

This low-fee option for banking is also ideal for travellers who do not belong to a European bank but frequent the Eurozone. For example, N26 is available for residents and citizens of Switzerland, Norway, and other European Economic Area countries that do not run on the Euro.

These citizens, who are in close proximity to the Eurozone, will save each time they spend with an N26 card while in Europe. N26 provides three free ATM withdrawals per month in euros but does charge a 1.7% fee per ATM withdrawal outside of Europe.

Take a look at our guide to the best travel cards for Europe to learn more.

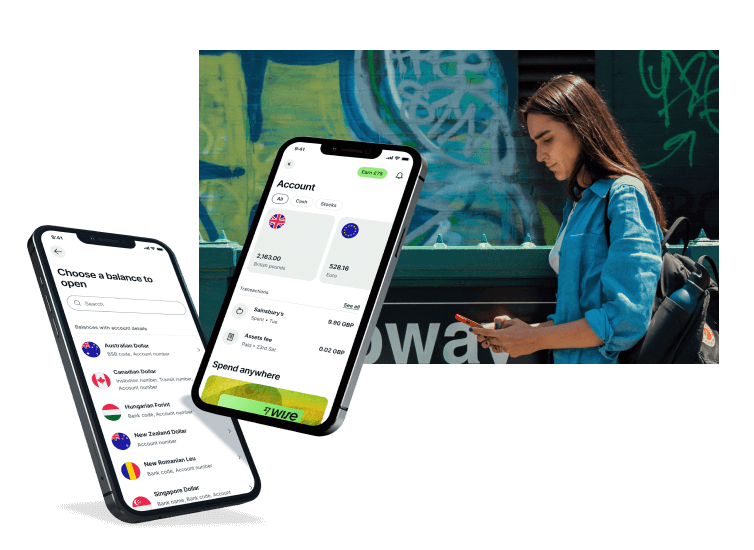

Wise: Best For Multi-Currency Balances

Load up to 54 currencies onto this card at the real exchange rate, giving you access to truly global travel.

- Trust & Credibility 9.3

- Service & Quality 8.9

- Fees & Exchange Rates 7.6

- Customer Satisfaction 9.6

These are the countries in which you can order a Wise debit card:

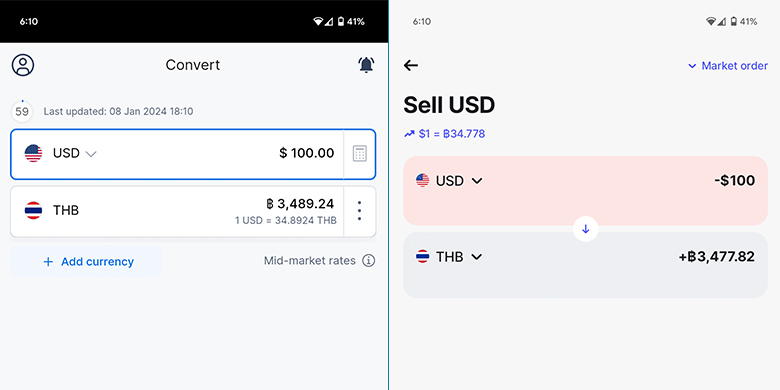

Unlike banks, credit unions, airport kiosks, and foreign ATMs, Wise is transparent about never charging a hidden exchange rate margin when you convert your home currency into up to 54 currencies. The live rate you see on Google or XE.com is the one you get with Wise.

An industry-low commission fee per transaction will range from 0.35% to 2.85%, depending on the currency.

Chase: Great UK Bank For Travel

A recent arrival from the USA, Chase is one of the UK’s newest digital challenger banks and comes with a rock-solid reputation and no monthly charges, no currency conversion charges, no withdrawal fees, and no other charges for everyday banking from Chase. It’s a simple, streamlined bank account with an excellent mobile banking app and a great cashback offer. However, it doesn’t yet offer more advanced features like international money transfers, joint accounts, business banking, overdrafts and loans, and teen or child accounts.

- Trust & Credibility 10

- Fees & Exchange Rates 10

- Customer Satisfaction 8.7

Chime: Great Account For US Travelers

Chime is a good debit card for international travel thanks to its no foreign transaction fees¹. Unlike multi-currency accounts like Revolut (which let you hold local currency), Chime uses the live exchange rate applied by VISA. This rate is close to the mid-market rate, and Chime does not add any extra markup to your purchases, although out-of-network ATM withdrawal and over-the-counter advance fees may still apply.

- Trust & Credibility 9.5

- Service & Quality 8.8

- Fees & Exchange Rates 9.8

While Chime waives ATM fees at all MoneyPass, AllPoint, and VISA Plus Alliance ATMs within the United States, this fee waiver does not extend to withdrawals made outside the country. For withdrawals abroad, Chime applies a $2.50 fee per transaction, with a daily withdrawal limit of $515 or its equivalent. This is in addition to any fees charged by the ATM owner. Therefore, we recommend Chime primarily for card purchases rather than relying on it for withdrawing cash while traveling internationally.

- No foreign transaction fees ¹;

- Uses VISA's exchange rate ( monitor here ):

- A $2.50 fee per ATM withdrawal made outside of the United States;

- More info: Read our Chime review or visit their website .

Best Travel Money Cards in 2024 Compared by Country

In the table below, see our comparison summary of the four best travel cards for 2024 by country:

Last updated: 8 January 2024

What's The Best Prepaid Card to Use Abroad?

Travel cards come in many varieties, such as standard credit cards or debit cards with no foreign transaction fees or cards that waive all foreign ATM withdrawal fees.

What is a Multi-Currency Card?

Multi-currency cards are a specific type of travel card that allows you to own all kinds of foreign currencies, which you can instantly access when you pay with your card abroad. By spending the local currency in the region of travel , you bypass poor foreign exchange rates. ATMs and cashless payment machines will treat your card like a local card.

We have already mentioned a few multi-currency cards in this review, but we will also introduce Travelex . Travelex's Money Card also allows you to top up several foreign currencies — albeit at exchange rates slightly poorer than the real mid-market rate .

Wise Account

Wise has one of the best multi-currency cards available on the market.

Read our full review for more details.

Revolut is impressive for its vast options in currencies and its additional services.

Our in-depth review explores Revolut's services in detail.

Travelex offers a prepaid travel money card that supports 10 currencies and waives all ATM withdrawal fees abroad.

- Trust & Credibility 9.0

- Service & Quality 5.8

- Fees & Exchange Rates 7.1

- Customer Satisfaction 9.3

Travelex charges fees, which fluctuate according to the exchange rates of the day, in order to convert your home currency into the currencies that it supports. But once the currency is on the card, you'll be able to spend like a local. Learn more with our full review .

Don’t Let Banks, Bureaux de Change, and ATMs Eat Your Lunch 🍕!

Are you withdrawing cash at an ATM in the streets of Paris? Exchanging currencies at Gatwick airport? Paying for a pizza with your card during a holiday in Milano? Every time you exchange currencies, you could lose between 2% to 20% of your money in hidden fees . Keep reading below to make sure you recognize and avoid them.

Currency Exchange Fees Eating My Lunch? What’s That?

You’re often charged a hidden fee in the form of an alarming exchange rate.

At any given time, there is a so-called “ mid-market exchange rate ” — this is the real exchange rate you can see on Google . However, the money transfer provider or bank you use to exchange currencies rarely offers this exchange rate. Instead, you will get a much worse exchange rate. They pocket this margin between the actual rate and the poor exchange rate they apply, allowing the bank or money transfer provider to profit from the currency exchange.

In other words, you or your recipient will receive less foreign currency for each unit of currency you exchange. All the while, the provider will claim that they charge zero commission or zero fees.

So the question now is… how can you avoid them? Thankfully, the best travel money cards will allow you to hold the local currency, which you can access instantly with a tap or swipe. Carrying the local currency avoids exchange rate margins on every purchase.

Top Travel Money Tips

- Avoid bureaux de change. They charge between 2.15% and 16.6% of the money exchanged.

- Always pay in the local currency and never accept the dynamic currency conversion .

- Don't use your ordinary debit or credit card unless it's specifically geared toward international use. Doing this will typically cost you between 1.75% and 4.25% per transaction. Instead, use one of the innovative travel money cards below.

By opting for a travel card without FX fees, you can freely swipe your card abroad without worrying about additional charges. However, saving money doesn't stop there. To make the most out of your travel budget, consider using Skyscanner , one of the most powerful flight search engines available that allows you to compare prices from various airlines and find the best deals.

With Skyscanner's user-friendly interface and comprehensive search options, you can discover cheap flights and enjoy your holidays with peace of mind and more money in your pocket.

Best Travel Money Card Tips

When you convert your home currency into a foreign currency, foreign exchange service providers will charge you two kinds of fees :

- Exchange Rate Margin: Providers apply an exchange rate that is poorer than the true "mid-market" exchange rate . They keep the difference, called an exchange rate margin .

- Commission Fee: This fee is usually a percentage of the amount converted, which is charged for the service provided.

With these facts in mind, let's see what practices are useful to avoid ATM fees, foreign transaction fees, and other charges you may encounter while on your travels.

Tip 1: While Traveling, Avoid Bureaux de Change At All Costs

Have you ever wondered how bureaux de change and currency exchange desks are able to secure prime real estate in tourist locations like the Champs-Élysées in Paris or Covent Carden in London while claiming to take no commission? It’s easy: they make (plenty of) money through hidden fees on the exchange rates they give you.

Our study shows that Bureaux de Change in Paris charges a margin ranging from 2.15% at CEN Change Dollar Boulevard de Strasbourg to 16.6% (!!) at Travelex Champs-Élysées when exchanging 500 US dollars into euros for example.

If you really want cash and can’t wait to withdraw it with a card at an ATM at your destination, ordering currencies online before your trip is usually cheaper than exchanging currencies at a bureau de change, but it’s still a very expensive way to get foreign currency which we, therefore, would not recommend.

Tip 2: Always Choose To Pay In the Local Currency

Don’t fall for the dynamic currency conversion trap! When using your card abroad to pay at a terminal or withdraw cash at an ATM, you’ve probably been asked whether you’d prefer to pay in your home currency instead of the local currency of the foreign country. This little trick is called dynamic currency conversion , and the right answer to this sneaky question will help you save big on currency exchange fees.

As a general rule, you always want to pay in the local currency (euros in Europe, sterling in the UK, kroner in Denmark, bahts in Thailand, etc.) when using your card abroad, instead of accepting the currency exchange and paying in your home currency.

This seems like a trick question - why not opt to pay in your home currency? On the plus side, you would know exactly what amount you would be paying in your home currency instead of accepting the unknown exchange rate determined by your card issuer a few days later.

What is a Dynamic Currency Conversion?

However, when choosing to pay in your home currency instead of the local one, you will carry out what’s called a “dynamic currency conversion”. This is just a complicated way of saying that you’re exchanging between the foreign currency and your home currency at the exact time you use your card to pay or withdraw cash in a foreign currency, and not a few days later. For this privilege, the local payment terminal or ATM will apply an exchange rate that is often significantly worse than even a traditional bank’s exchange rate (we’ve seen margins of up to 8%!), and of course, much worse than the exchange rate you would get by using an innovative multi-currency card (see tip #3).

In the vast majority of times, knowing with complete certainty what amount you will pay in your home currency is not worth the additional steep cost of the dynamic currency conversion, hence why we recommend always choosing to pay in the local currency.

Tip 3: Don't Use a Traditional Card To Pay in Foreign Currency/Withdraw Cash Abroad

As mentioned before, providers make money on foreign currency conversions by charging poor exchange rates — and pocketing the difference between that and the true mid-market rate. They also make money by charging commission fees, which can either come as flat fees or as a percentage of the transaction.

Have a look at traditional bank cards to see how much you can be charged in fees for spending or withdrawing $500 while on your holiday.

These fees can very quickly add up. For example, take a couple and a child travelling to the US on a two-week mid-range holiday. According to this study , the total cost of their holiday would amount to around $4200. If you withdraw $200 in cash four times and spend the rest with your card, you would pay $123 in hidden currency exchange and ATM withdrawal fees with HSBC or $110 with La Banque Postale. With this money, our travellers could pay for a nice dinner, the entrance fee to Yosemite Park, or many other priceless memories.

Thankfully, new innovative multi-currency cards will help you save a lot of money while travelling. Opening an N26 Classic account and using the N26 card during the same US holidays would only cost $13.60.

Need Foreign Cash Anyway?

In many countries, carrying a wad of banknotes is not only useful but necessary to pay your way since not every shop, market stall, or street vendor will accept card payments. In these cases you'll have two options to exchange foreign currency cheaply:

1. Withraw at an ATM

As we've explored in great depth in this article, withdrawing money from a foreign ATM will almost always come with fees — at the very least from the ATM itself, and so it's therefore the best strategy to use a travel debit card that doesn't charge in specific ATM withdraw fees on its own to add insult to injury. That said, if you need cash, we recommend making one large withdrawal rather than multiple smaller ones . This way, you'll be able to dodge the fees being incurred multiple times.

2. Buy Banknotes (at a Reasonable Rate!)

As we've also seen, buying foreign currency at the airport, at foreign bank branches, or in bureaux de change in tourist hotspots can be surprisingly expensive. Still, not all exchange offices are equally pricey . If you're looking for a well-priced way to exchange your cash into foreign currency banknotes before you travel, Change Group will let you order foreign currency online and pick them up at the airport, train station, or a Change Group branch just before you leave for your holiday. A few pick-up locations in the UK include:

- London centre (multiple locations),

- Glasgow centre,

- Oxford centre,

- Luton Airport,

- Gatwick Airport,

- St. Pancras Station.

(Note that Change Group also has locations in the USA, Australia, Germany, Spain, Sweden, Austria, and Finland!)

Although its exchange rates aren't quite as good as using a low-fee debit card like Revolut, Change Group's exchange rates between popular currencies tend to be between 2% to 3%, which is still a lot better than you'll get at the bank or at a touristy bureau de change in the middle or Paris or Prague!

FAQ About the Best Travel Money Cards

Having reviewed and compared several of the industry's leading neobanks, experts at Monito have found the Wise Account to offer the best multi-currency card in 2024.

In general, yes! You can get a much better deal with new innovative travel cards than traditional banks' debit/credit cards. However, not all cards are made equal, so make sure to compare the fees to withdraw cash abroad, the exchange rates and monthly fees to make sure you're getting the best deal possible.

- Sign up for a multi-currency account;

- Link your bank to the account and add your home currency;

- Convert amount to the local currency of holiday destination ( Wise and Revolut convert at the actual mid-market rate);

- Tap and swipe like a local when you pay at vendors.

Yes, the Wise Multi-Currency Card is uniquely worthwhile because it actually converts your home currency into foreign currency at the real mid-market exchange rate . Wise charges a transparent and industry-low commission fee for the service instead.

More traditional currency cards like the Travelex Money Card are good alternatives, but they will apply an exchange rate that is weaker than the mid-market rate.

The Wise Multi-Currency Card is the best money card for euros because unlike banks, credit unions, airport kiosks, and foreign ATMs, Wise is transparent about never charging a hidden exchange rate margin when you convert your local currency into euros with them.

The live rate you see on Google or XE.com is the one you get with Wise . An industry-low commission fee will range from 0.35% to 2.85%. USD to EUR transfers generally incur a 1.6% fee.

Learn more about how to buy euros in the United States before your trip.

There are usually three types of travel cards, prepaid travel cards, debit travel cards and credit travel cards. Each have pros and cons, here's a short summary:

- Prepaid travel cards: You usually need to load cards with your home currency via a bank wire or credit/debit card top-up. You're then able to manage the balance from an attached mobile app and can use it to pay in foreign currencies or withdraw cash at an ATM abroad tapping into your home currency prepaid balance. With prepaid travel cards, as the name indicates, you can't spend more than what you've loaded before hand. Some prepaid card providers will provide ways to "auto top-up" when your balance reaches a certain level that you can customize. On Revolut for example, you can decide to top-up £100/£200/£500 from your debit card each time your balance reaches below £50.

- Debit travel cards: Some innovative digital banks, like N26 or Monzo, offer travel debit cards that have the same advantages than a Prepaid Travel Cards, except that they're debit card directly tapping into your current account balance. Like a Prepaid travel card, you can't spend more than the balance you have in your current account with N26 or Monzo, but you can activate an overdraft (between €1,000 or €10,000 for N26 or £1,000 for Monzo) if you need it, for a fee though.

Note that even if they're Prepaid or Debit cards, you can use them for Internet payments like a normal credit card.

- Credit travel cards: You can find credit cards made for international payments offering good exchange rates and low fees to withdraw money abroad, but you'll need to pay interests in your international payment if you don't pay in FULL at the end of every month and interest on your ATM withdrawals each day until you pay them back.

Why You Can Trust Monito

Our recommendations are built on rock-solid experience.

- We've reviewed 70+ digital finance apps and online banks

- We've made 100's of card transactions

- Our writers have been testing providers since 2013

Other Monito Guides and Reviews on Top Multi Currency Cards

Why Trust Monito?

You’re probably all too familiar with the often outrageous cost of sending money abroad. After facing this frustration themselves back in 2013, co-founders François, Laurent, and Pascal launched a real-time comparison engine to compare the best money transfer services across the globe. Today, Monito’s award-winning comparisons, reviews, and guides are trusted by around 8 million people each year and our recommendations are backed by millions of pricing data points and dozens of expert tests — all allowing you to make the savviest decisions with confidence.

Monito is trusted by 15+ million users across the globe.

Monito's experts spend hours researching and testing services so that you don't have to.

Our recommendations are always unbiased and independent.

- Argentina

- Australia

- Brasil

- Canada

- Deutschland

- España

- France

- India

- Italia

- Magyarország

- Malaysia

- New Zealand

- Polska

- Portugal

- România

- Singapore

- United Kingdom

- United States

- 繁體中文 (香港)

Revolut travel card review: Rates, fees & limits [2024]

The Revolut travel card is a multi-currency card you can use for convenient spending and withdrawals in the US and when you’re abroad.

This guide walks through everything you need to know about how the Revolut travel card works, its key features and benefits, and the fees associated with using it. We’ll also touch on some alternatives to use abroad, such as the Wise travel card, as a comparison.

Revolut travel card: key features

Revolut offers 3 different account plans

- The Standard plan has no monthly fee to pay, while the Premium and Metal account plans have monthly costs, but also include more features and higher no-fee transaction limits.

- All accounts come with a travel card for spending and withdrawals, but the exact card type you get will depend on the account tier you choose. With the highest tier of account you get an exclusive solid steel Metal card, while all account types can also opt for a personalized card.

- Virtual cards are also available on all account plans, which can be used for mobile and online spending, and added to a walleye like Apple Pay.

We’ll walk through the Revolut travel card in detail throughout this guide, including how it works at home and abroad.

Go to Revolut Here are a few pros and cons of the Revolut travel card to kickstart our full review:

The Revolut travel card offers an easy and flexible way to hold, spend and exchange multiple currencies, with just your card and your phone. You’ll be able to choose the plan that suits your specific needs and transaction requirements, including some with no monthly costs associated. Once you’ve opened a verified account you can order your physical card in the Revolut app, and start spending right away online or using a mobile wallet, with your virtual card.

Who is the Revolut travel card for?

The Revolut travel card can suit frequent travelers as well as anyone living, studying or working abroad. You may want to get a Revolut travel card if:

- You’re a traveler spending in foreign currencies often

- You love to shop online at home and abroad

- You want a virtual card for security

- You’d prefer to manage your money using just your phone

Go to Revolut

What is a Revolut travel card?

The Revolut travel card is a payment card linked to a Revolut digital account. There are several different Revolut cards which are issued with different Revolut account plans – all are debit cards, and all can be used for global spending and cash withdrawals.

If you are looking for more information about Revolut: Revolut review

Is the Revolut Travel card a multi-currency card?

Yes. You can hold around 25 currencies in the Revolut account and spend conveniently in multiple currencies around the world.

Compare the Revolut travel money card to alternative options like the Wise travel money card , to see which suits you best. More on that, next.

Alternatives to Revolut travel card

Non-bank providers like Revolut can be a cost effective way to spend at home and abroad. They’ve often got fairly low fees, and tend to be innovative, offering some helpful and unusual account features to suit different customer needs.

Here’s a quick look at how Revolut lines up on features and fees against a couple of other non-bank services from Wise and Chime .

*Information correct at time of writing, 13th October 2023

Go to Revolut Go to Wise

Wise travel card

Hold 40+ currencies and spend in 150+ countries, with mid-market rate currency conversion, no minimum balance and no monthly fees. You can open your Wise account online and order a card for home delivery. Use your card to spend and make cash withdrawals globally, and get instant in-app notifications to keep on top of your finances.

Go to Wise

Learn more: Wise card review

Chime debit card

Chime accounts have no monthly fees and no minimum balance. In fact there are very few fees to worry about at all. You can only hold USD in your Chime account, but you’ll still be able to use your card around the world to spend in any currency. Your overseas spending will be converted back to USD using the network exchange rate with no foreign transaction fee.

Revolut travel card fees & spending limits

As with any travel card, there are some fees involved in using the Revolut travel card. There are also a few limits applied to keep customers and their accounts safe. Here’s a rundown of the limits for the Revolut travel card:

*Details correct at the time of research – 13th October 2023

Here are the Revolut travel card fees you’ll need to be familiar with:

Exchange rates

All Revolut accounts have some currency exchange every month which uses the mid-market exchange rate. Standard plan holders can convert up to 1,000 USD a month, Premium plan holders can get 10,000 USD a month and Metal plan holders have unlimited conversion with the mid-market rate.

It’s important to note that out of hours conversion fees apply, which means you pay 1% extra when exchanging currencies at the weekend or overnight. If your plan has a limited amount of mid-market rate conversion, you’ll be charged a 0.5% fair usage fee once this is exceeded.

How to get Revolut travel card

To order your Revolut travel card you’ll need to have an active Revolut account. Download the Revolut app, and you can get your new account in just a few taps, by entering your personal information and getting verified.

Once you’ve got your Revolut account set up all you need to do is open the Revolut app and go to the ‘Cards’ tab. Here you’ll see the option to get a physical or virtual card, and to create a card PIN.

What documents you’ll need

To verify your Revolut account you’ll need to upload a selfie and a photo of one of the following documents:

- Driving license

If you don’t have these documents available, you can reach out to Revolut to understand which other documents may be used in your specific situation.

What happens when the card expires?

Revolut will contact you 28 days before your card is due to expire, so you can order a new one in good time. Standard shipping has no fee when getting a new card to replace an expiring Revolut travel card.

How to use a Revolut travel card?

The Revolut travel card is a debit card issued on either the Visa or Mastercard network. That means you can use it to pay or make a withdrawal anywhere you see the logo of your card’s network being displayed, globally. You’ll also be able to add your card or your virtual card to your preferred mobile wallet for on the go payments.

How to withdraw cash with a Revolut travel card?

To make an ATM withdrawal with a Revolut travel card you’ll need to first find an ATM that supports your card network. You can then just insert the card into the ATM and enter your PIN, then the amount you want to withdraw. Easy.

Is the card safe?

Yes. The Revolut card in the US is issued by Community Federal Savings Bank, Member FDIC, pursuant to license by Visa.

How to use the Revolut travel card overseas?

You can spend with your Revolut travel card in about 150 countries , anywhere the card network is accepted. If you hold the currency you need in your account there’s no fee, but an exchange or fair usage fee may apply in some situations – if you’ve exhausted your monthly currency exchange limits, or if you’re exchanging out of hours for example.

If Revolut doesn’t support holding the currency you need, it’s worth checking out Wise which has a broader selection of 40+ currencies for holding and exchange.

Conclusion: is the Revolut travel card worth it?

The Revolut travel card is a flexible option for holding 25+ currencies and spending globally in 150+ countries. Depending on the account tier you select you may pay a monthly fee, and some transaction fees are also likely to apply. Compare the Revolut travel card against some alternatives like the Wise travel card and the Chime debit card to see which suits you best.

The Wise card may suit you if you’re looking for a powerful international account that can hold 40+ currencies, and receive payments in multiple currencies with local bank details. Chime may be a good pick for customers looking for a USD account with pretty much no fees to pay which you can use at home and abroad.

Revolut travel card review FAQ

How does the Revolut travel card work?

The Revolut travel card is linked to a digital account you can hold about 25 currencies in. Add money to your account in USD and then you can start spending and making withdrawals globally.

Is the Revolut travel card an international card?

Yes. The Revolut travel card supports spending in about 150 countries, and you can hold 25+ currencies in your account.

Are there any alternatives to a Revolut travel card?

Other non-bank providers like Wise and Chime also offer spending cards which have their own features and fees. It’s worth comparing these against the Revolut travel card to see which suits you best.

Dave's Travel Pages

Greek Island Hopping | Greece Travel Ideas | Bicycle Touring

Revolut Travel Card Review – The Best Travel Money Card?

My Revolut card review is based on a year of using it in 10 different countries. Here's what I like about the Revolut travel card, what can be improved, and why I think you should consider it as a travel money card.

Revolut Travel Card Review

Have you ever noticed, that when it comes to getting hold of travel money you get ripped off no matter what you seem to do?

Whether it's your bank charging a fee you hadn't heard of before, or a crazy exchange rate that bears no relation to reality, they seem to get you in the end. And don't get me started on airport currency exchange rates!

Surely, there must be some way to get an honest currency exchange rate?

Well, there is now, thanks to the Revolut cash card .

We've been using the Revolut cards for a little over a year, and they were our main cards to get hold of travel money during our 5-month-trip in SE Asia. Here's an explanation of how the Revolut card works, and our honest review.

What is the Revolut account?

There's two ways to look at what the Revolut account is.

One, is to think of the Revolut account as a current account that can be easily managed through your mobile phone. The big bonus here being that you can store money in different currencies. They also provide banking details for different currencies which is great for me, as I can use it as a way to receive payments into my online business.

The second, and perhaps simplest way to think of the Revolut card for most people, is that it is a pre-paid travel card. You can make transfers into the Revolut card from your bank account, and then convert it into any currency you like (well, within reason).

The truth is, it's both things, and offers a great deal of flexibility for anyone wanting to store different currencies, or who has travel plans.

The Revolut Card itself

The Revolut account comes with a card, either Visa or Mastercard, which you can use as a debit card for purchases, or for ATM withdrawals.

As we opened our accounts a year ago, I can't honestly remember if we had a choice between the two, or were given what came. However it was, I have a Visa Revolut Card, and Vanessa has a Revolut Mastercard.

The Revolut card acts as a debit card, and you can only withdraw or spend money that is available in the account. You can easily monitor the account in the Revolut app you'll need to download to a smartphone.

You can apply for a Revolut card here : Get Revolut Card

Opening a Revolut account is really straightforward and quick. You will need to provide your address and passport, and you will be sent your card in the post in a few days.

The Revolut App

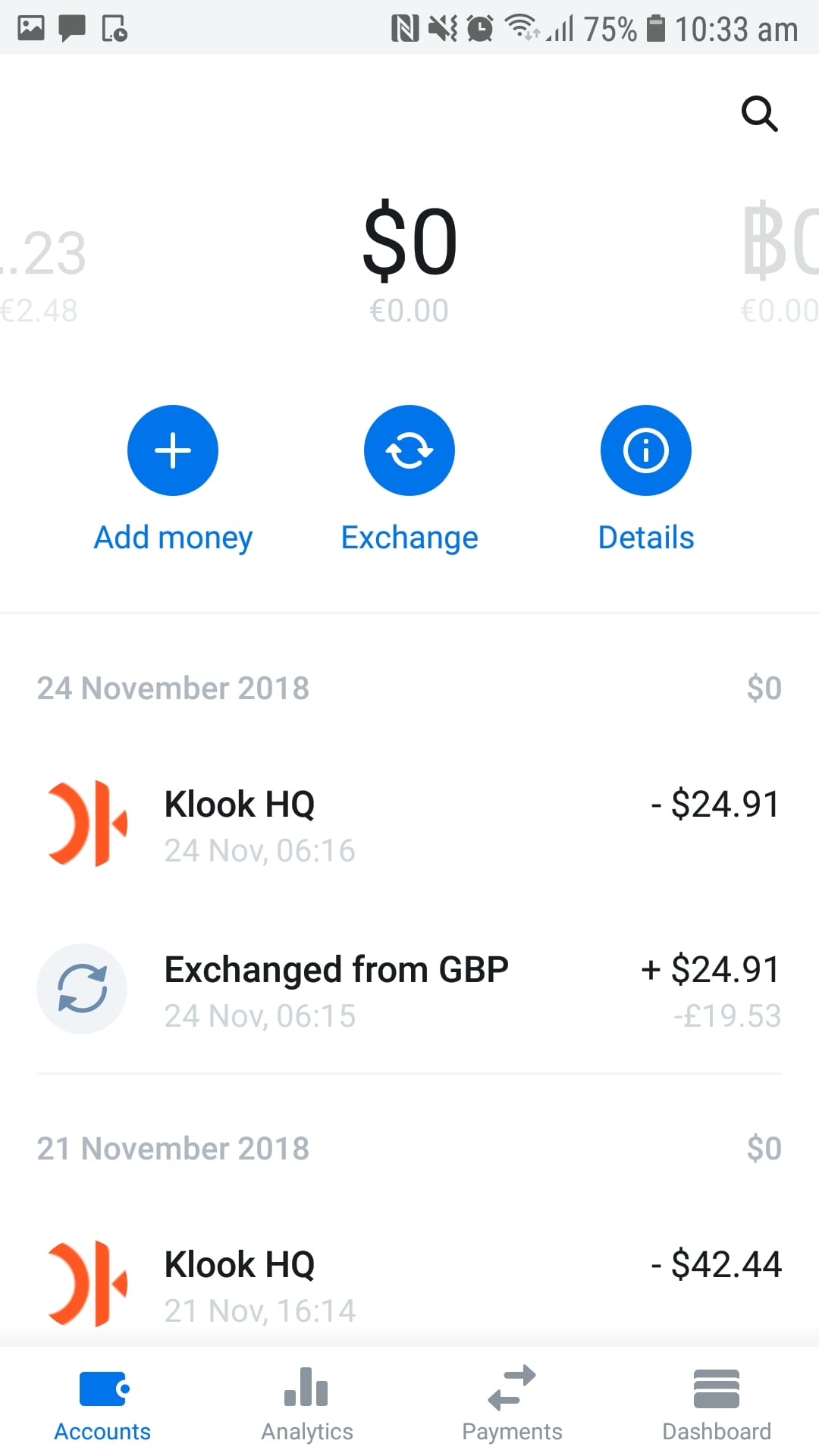

The app is where you can monitor the holdings in your Revolut account. After transferring money in, you can leave it in its original currency, or exchange it straight away.

The app is very simple to use, and if you have an internet connection, will even give you real time updates when you withdraw money or spend money on the card.

Why should I open a Revolut account?

People who travel a lot can really benefit from a Revolut account, as it offers a very easy way to spend money abroad. You can send money from your primary bank account to your Revolut account, and then use your Revolut card the same way you would use any other card.

The main difference when using a Revolut card vs a bank card, is that the rate offered is interbank exchange rate, i.e. a fair rate. Depending on your bank and the type of card you have with them, you will probably discover that a Revolut card gives you a much better exchange rate, and smaller handling fees.

Why a Revolut Card was best for Vanessa

In Vanessa’s case, every Greek bank has its own policy when withdrawing or spending money abroad. Revolut rates and handling fees were much better than any of the four Greek banks she asked, for debit as well as credit cards.

Additionally, most of the Greek banks clearly stated that, even when a customer informed them in advance that they would travel abroad for an extended period of time, they could still deactivate the card if they noticed “suspicious activity” and couldn’t get in touch with the customer via the registered phone number.

Therefore, Revolut was really the easiest way to spend money abroad.

Why a Revolut Account was almost the best for Dave

In my case, I have a Halifax Clarity card from the UK. This card gives a perfect exchange rate with no fees, in a similar fashion to Revolut. What makes the Clarity card a winner over Revolut for me, is I can withdraw an unlimited amount of cash without additional fees.

The downside to my Halifax card, is that I have to pay the amount off the same day using my online banking app in order to avoid interest charges. This is a pain, especially when travelling countries with poor connection!

So, I found the Revolut card to be a useful addition to my ‘travel toolkit', and of course it's always good to have multiple cards just in case when you travel!

How much does it cost to open a Revolut account?

We found it quite hard to believe, but opening a basic Revolut account is totally free of charge. This includes the card itself, which is perhaps what separates Revolut from other pre-paid travel cards.

OK, so what's the catch?

Well, nothing is ever entirely perfect, right?!

If you go for the basic (free) version of Revolut, you can withdraw up to 200 pounds or euro per month for free at ATMs, while for any excess there will be a fee of 2%.

However, you can still use the Revolut card as a debit card, and there are no Revolut card fees for amounts of up to 6,000 euro a month.

Revolut Card Fees

Apart from the free basic version, there are two types of upgrades that you can look into.

These are definitely worth it, especially for people travelling often for up to 40 continuous days.

If you choose any of the “premium” or “metal” upgrades, you will get a higher withdrawal limit (400 euro and 600 euro, respectively).

Many other perks, such as travel and medical insurance and a few others, are also included. In our case, travelling for five months, this wasn’t applicable, so we just went with the basic free version of Revolut which suited us just fine.

Why do you need a mobile phone to use the Revolut card?

Technically speaking, as soon as you apply to get your Revolut plastic card, you don’t really need to use a phone in order to spend your money. However, the phone is essential in order to monitor your transactions, and it’s also the only way to manually exchange money from one currency to another.

As an example, if you have GBP stored in your Revolut account and expect the GBP to drop vs the Euro, you can convert all your GBPs into Euros.

All transactions with your card are recorded instantly on the app, and you will always get an instant notification as soon as you make a payment, or whenever you are online next. We often received the notification before getting the paper receipt!

The phone is also necessary if you want to send money to a friend, transfer money to the Revolut account from another account, or vice versa.

Finally, if you need to freeze your card, it is easy to do it through the app. So if your card is stolen, lost or misplaced, you can quickly freeze it and request a new one.

Revolut and cryptocurrencies

People who are using cryptocurrencies will be pleased to know that Revolut can currently be used with Bitcoin, Bitcoin Cash, Litecoin, Ethereum and XRP.

However, I personally don't think this is worth it right now, as you can't transfer in crypto from outside wallets. The day that happens, Revolut will be truly revolutionary!

Our experience with the Revolut card

Quite honestly, we can’t recommend the Revolut card highly enough. We had both a Mastercard and a Visa during our trip, and we used both of them interchangeably.

In our five months of travelling to countries such as Myanmar , Vietnam , Thailand and Singapore , there were only 2 instances where our card was rejected when trying to pay by debit card.

As for ATMs, some of them didn’t accept a Mastercard, so we used the Visa instead – but that has nothing to do with Revolut itself.

At one point, we had to get in touch with customer service – this was all through the app, and it was quick and easy. It turned out that there was a glitch in the system at that time, and they promised to fix it soon, which they did. So, 5 stars for customer experience!

While it was a little frustrating to have to pay the 2% fee for ATM withdrawals of over 200 euro a month, it was still very little compared to any Greek ATM card. And the amount of times we did that was still cheaper than paying the monthly fee. And a LOT cheaper than using airport currency changers!

Overall, we totally suggest that you get a Revolut card, even if you don’t travel too often – it’s free, it’s generally accepted everywhere, and it’s hassle free.

Related posts on saving money when traveling:

- Money in Greece

- How much does it cost to cycle around the world

- How to book a Santorini hotel without breaking the bank

- Travel budget for a bike tour in Europe

3 thoughts on “Revolut Travel Card Review – The Best Travel Money Card?”

It’s a prepaid card Writing on the back Some car rental will not accept prepaid card

Beside that Great

Hello dave,

Obviously you are one of the lucky ones who did not have any problems during your travel.

Think of all the other customers of revolut bank who have their accounts locked during their travel. And have no access to their accounts.

And also think about the customers who have problems with transferring money that are missing or take too long to access their monies.

Think of the customers who are having problems accessing their live agents with poor customer services.

I can only write about my experiences, and so far they have all been positive. Like every bank, product or service there’s going to be people who have negative experiences, and it sounds like you are one of those. I hope whatever went wrong was resolved for you!

Leave a Comment Cancel reply

- Argentina

- Australia

- Deutschland

- Magyarország

- New Zealand

- Österreich

- Singapore

- United Kingdom

- United States

- 繁體中文 (香港)

The 6 Best Travel Money Cards for Europe

If you’re travelling to Europe, a travel money card can make spending and withdrawing cash when you’re away cheaper and more convenient. Different types of travel money cards, including travel debit cards, prepaid travel cards and travel credit cards, are available to support different customer needs. The right one for you will depend on your personal preference and how you like to manage your money.

Read on for all you need to know, including a closer look at travel money card types, some great options to consider, and the sorts of fees you need to think about when you choose.

Wise - our pick for travel money card for Europe

Before we get into details about different travel money card options, let’s start with the Wise card as a good all-round option that allows you to hold and spend euros, as well as a diverse range of other European and world currencies.

Wise accounts have the flexibility to hold and exchange more than 50 currencies, plus you can get a linked Wise card for a one-time delivery fee. You can either top up your account in pounds and switch to EUR, RON, HUF, NOK, DKK, SEK or any of the other supported European currencies before you travel.

Click here to read a full Wise review.

Here are some of the advantages and disadvantages of using the Wise travel money debit card, to help you decide if it's suitable for you.

Hold and exchange 50+ currencies including EUR and a selection of other European and world currencies

No fee to spend any currency you hold, low conversion fees from 0.41%

Mid market exchange rate on all currency conversion

Some fee free ATM withdrawals every month

No ongoing fees and no interest to pay

7 GBP delivery fee

No option to earn points or rewards

What is a travel money card?

Similar to your standard bank card, a travel money card is accepted for online and in-store transactions, as well as cash withdrawals - but the features and fees you’ll get are tailored for international usage. That can lead to benefits such as improved exchange rates and reduced fees compared to your regular card.

If you’re headed to Europe, you could find a travel money card which supports the currency or currencies in the destinations you’re visiting is a good idea. While much of Europe uses the euro, there are actually 29 different European currencies, so you’ll need to double check what’s needed wherever you’re headed.

6 travel money cards for Europe compared

Before we get into each card option in more depth, here’s a summary of how six of the best travel money cards for Europe compare to each other.

The features of various travel money cards can differ significantly. Typically, travel debit cards are cost-effective and convenient, while travel credit cards offer advantages such as cashback or rewards, but may result in interest and late payment fees, depending on how you choose to pay.

Travel debit cards usually allow you to easily add funds online or via a mobile app, which helps you stick to your budget and avoid overspending. Conversely, travel credit cards enable you to spend up to your credit limit, and you can pay off the balance over several months. The choice between the two will come down to how you like to manage your money - we’ll dive into a few more details about each card type, next.

What are different types of travel cards?

Generally, UK customers are able to select a travel money card from either a regular bank or a specialist provider, with card types available including travel debit cards, travel prepaid cards or travel credit cards. We’ll walk through what each travel money card type is, and pick out a couple of good card options, so you can compare and choose.

1. Travel debit cards

2. Travel prepaid cards

3. Travel credit cards

1. Travel Debit Cards

Travel debit cards from specialist providers have linked digital accounts you can use to hold and convert a currency balance. It’s common to find a good selection of major currencies supported, including euros, Norwegian or Danish kroner, Swedish kronor, Romanian lei and more. While different cards have their own features, travel debit cards can usually be topped up easily online and through an app, with the option to see your balance and get transaction notifications through your phone too. That makes it easier to keep on top of your money, even when you’re away from home.

Travel debit card Option 1: Wise

Wise is our best value travel money debit card for Europe. There’s no fee to open a Wise account, and just a small delivery fee for your Wise card, with no minimum balance and no monthly charge. You just pay low Wise fees from 0.41% when you convert currencies, and transparent transaction fees when you exhaust the monthly free transactions available with your account.

No fee to open a Wise account, no minimum balance requirement

7 GBP one time fee to get your Wise card

2 withdrawals, to 200 GBP value per month for free, then 0.5 GBP + 1.75%

Hold EUR and 50+ other currencies, convert between them with the mid-market rate

Get local account details to receive EUR, HUF, RON and 7 other currencies for free

Travel debit card Option 2: Revolut

Revolut has a selection of different account tiers, so you can simply pick the account you prefer - from free Standard plans to the 12.99 GBP/month Metal plan. All Revolut accounts have linked cards, although exactly what type of card you get depends on your account tier. You can hold around 25 currencies including EUR, PLN, DKK, SEK and a selection of other major European currencies, and convert between them with the mid-market rate to your plan’s allowance.

No fee to open a Standard Revolut account, or upgrade for up to 12.99 GBP/month

Card delivery fees may apply depending on your account tier

All accounts have some fee free currency conversion with 0.5% fair usage fees after that

Standard plan holders can withdraw 200 GBP (up to 5 withdrawals in total) per month for free

Hold EUR and around 25 other currencies

Click here to read a full Revolut review

Pros and cons of using debit travel cards in Europe

Avoid interest costs and late payment fees

Hold and exchange currencies in advance or at the time of spending

Accounts can be topped up, viewed and managed using just your phone

Safe to use, as accounts aren’t linked to your main UK bank account

Travel debit cards are issued on popular global payment networks

Transaction and currency conversion fees may apply

Cash back and rewards may not be available

How to choose the best travel debit card for Europe?

The best travel debit card for Europe really depends on your personal preferences and how you like to manage your money. If you’ll be travelling widely it makes sense to look for an account with mid-market currency exchange and a large selection of supported currencies as well as EUR, like Wise. Other providers like Revolut can also be a good pick, particularly if you’ll use your account very frequently and would prefer to pay a monthly fee to unlock lots of fee free transactions and extra perks.

Is there a spending limit with a travel debit card in Europe?

Card use limits are determined by individual providers and can vary depending on the transaction type. Limits may apply on a daily, weekly or monthly basis. For instance, there may be a cap on the number or value of ATM withdrawals allowed per day or a limit on the value of contactless payments you can make. These limits are set for security reasons and can often be adjusted using the provider's app.

2. Prepaid Travel Cards

With a prepaid travel card you’ll usually need to first order a card and then add funds in the supported currency of your choice. Once you have a balance you may then be able to switch to the currency you need, to pay merchants and make cash withdrawals. While prepaid travel cards are usually issued on large global networks - and can therefore be used pretty widely - not all cards support all currencies, so you may find you pay a foreign transaction fee if you pick a card which doesn’t support all the currencies you use.

Prepaid travel card option 1: Post Office

You can pick up a Post Office prepaid travel money card in a Post Office branch or order one online. You’ll then be able to top up in pounds or one of the 22 supported currencies, which includes EUR alongside other major European currencies like NOK, DKK and SEK. There’s no fee to spend a currency you hold in your account when you’re in Europe, but if you don’t have a balance in the currency required - or if your balance isn’t high enough for the transaction, you’ll pay a 3% foreign transaction fee.

Hold and exchange 22 currencies including EUR

No fee to spend a balance in a supported currency

3% foreign transaction fee when spending a currency you don’t hold on the card

Variable ATM withdrawal fees - 2 EUR for use in Eurozone countries, for example

No interest to pay

Prepaid travel card option 2: Monese

Monese accounts can be opened by UK residents to hold GBP, EUR and RON. There are several different types of accounts, from the Simple account which has no monthly fees, to fee paying account tiers which have more features. It’s free to spend a balance you hold, so getting a EUR or RON account makes sense if you’re headed to Romania or any of the Eurozone countries. If not, you may find you pay a foreign transaction fee of 2% when you’re spending in Europe. Foreign transaction fees may be waived for higher tier account holders.

Hold a balance in GBP, EUR or RON

Choose a free Simple account, or upgrade to an account with monthly fees

Foreign transaction fees of 2% may apply if you don’t hold a EUR/RON balance, depending on your account tier

ATM withdrawal fees may apply, depending on the value of withdrawals and the account tier you hold

Track and spend Avios reward points within your account

Pros and cons of using prepaid travel cards in Europe

Manage your account, add more money or convert funds online or with an app

Accounts with no monthly fees are available

Selection of supported currencies, with no fee to spend a currency you hold

ATM withdrawals supported globally

Some accounts have extras like options to earn reward points

Typically not a huge range of currencies supported

Transaction fees apply to most accounts

How to choose the best travel prepaid card for Europe?

There’s no single best travel prepaid card for Europe - it’ll come down to your personal preference. If you hold a Monese account that supports the currency wherever you’re headed, or a Monese Classic or Premium account which waives foreign transaction fees, you might find it’s cheaper to stick with Monese when in Europe compared to using your regular bank card. The Post Office card can also be a strong pick as you can hold a balance in euros and a large selection of other major European currencies, plus you can get a card instantly by walking into a Post Office branch.

Is there a spending limit with a prepaid card in Europe?

Different prepaid travel cards set their own limits for spending and withdrawals, which can vary between currencies. You’ll need to check your card’s terms and conditions carefully to make sure you pick a provider which suits your needs.

3. Travel Credit Cards

Travel credit cards typically offer some extra international features compared to regular credit cards, such as low or no foreign transaction fees or extra option to earn rewards when you’re abroad. In general, travel credit cards are safe and convenient but can be more expensive compared to using a debit card option. Before you select the right card for you it’s important to check the fees, rates, eligibility rules and interest rates which apply, so you can make sure it’s a good fit for you.

Travel credit card option 1: Barclaycard Rewards Visa

The Barclaycard Rewards Visa card doesn't charge foreign transaction fees or international ATM fees. Instead, your spending abroad is converted into pounds using the Visa exchange rate and added to your monthly bill. To avoid fees and interest charges, you must pay your bill in full every month. However, you can earn cashback on your everyday purchases.

No foreign transaction or foreign ATM fee

Earn cashback at 0.25% on spending

Protection on purchases over 100 GBP

International spending uses the Visa exchange rate

Variable interest rates which apply if you don’t pay off your bill in full

Travel credit card option 2: Halifax Clarity Mastercard

When you check your eligibility for the Halifax Clarity Mastercard, you'll be able to see the variable interest rate that’s available to you. No matter what rate’s offered, you won't have to pay any foreign transaction or foreign ATM fees, and all currency conversions are done using the Mastercard exchange rate.

Variable interest rates

Check your eligibility and order a card online easily

No foreign transaction fee

No ATM fee - but interest will accrue instantly when you make a withdrawal

Mastercard exchange rates apply

Pros and cons of using credit cards in Europe

Spending from 100 GBP has extra consumer protection

Spread the cost of your travel over several months

Check eligibility for a card online with no impact on your credit score

You may pay no foreign transaction fee and no ATM fee

Network exchange rates usually apply, which are usually pretty fair

Interest charged if you don’t repay in full every month

Eligibility rules apply

How to choose the best travel credit card for Europe?

Selecting the best travel credit card for Europe largely depends on individual preferences. If you aim to earn rewards and cashback on your foreign transactions, the Barclaycard Rewards Visa may be a suitable option as it does not have a foreign transaction fee and provides cashback on all purchases. Whichever card you’re considering you’ll want to weigh up the potential fees you’ll need to pay against the rewards you can earn to make sure it’s worthwhile.

If you regularly travel to Europe, getting a travel money card which supports the currencies you need frequently can help you save money. Travel money cards have different features, and can be picked up via regular banks, online specialists and even the Post Office.

You could opt for a low cost travel debit card which comes with a linked account to hold a selection of currencies - like the Wise account. Or you might prefer a prepaid travel money card like the Monese card which can be linked to either a fee free account or an account which has monthly fees in exchange for lower transaction charges. Finally, another option is to get a travel credit card either to earn cashback and rewards, or to avoid foreign transaction fees.

The good news is that the UK market is well served for all types of travel money cards - use this guide to start your research and pick the right option for your specific needs.

FAQ - Best travel cards for Europe

You can usually make cash withdrawals with a credit card in Europe at any ATM that supports your card network. You’ll often find that a fee applies, and you may start to accumulate interest on the withdrawn amount immediately. Travel money debit cards from providers like Wise and Revolut can be a lower cost option for cash withdrawals overseas.

You can use your debit card anywhere you see the card network’s logo displayed. Visa and Mastercard networks are very well supported globally, including in Europe, making these good options to look out for when you pick your travel debit card for Europe.

Prepaid cards from reputable providers are safe to use at home and abroad. They aren’t linked to your main bank account which can offer extra peace of mind, and may also make it easier to manage your travel budget. However, you’ll need to check the card features and fees carefully to make sure you're getting the best match for your needs.

My Honest Revolut Travel Card Review: Pros & Cons of Revolut

Posted on Last updated: March 21, 2024

I will gladly admit that 1/3 of my success in life is simply me being in the right place at the right time. I found Revolut at a Tech startup conference in London earlier this year and they told me about their money cloud program.

Basically, you save money while traveling because Revolut holds/exchanges the Great British Pound, the U.S. Dollar, and the Euro… all in one place. Backed by Master Card, the Revolut card can be used in any country (using any currency) as a normal domestic debit card AND you can send people money via apps like Facebook and WhatsApp.

In my line of work, I get paid in USD but I need to pay my bills in GBP and I’m constantly in Europe throwing Euros like Kanye (not really).

During my last two years abroad, I’ve been paying ridiculous fees just to access MY MONEY and The Universe has clearly brought Revolut into my life to rectify this issue.

So shut up and take my money.

Since the program is still in its developing stages, you have to be invited in order to join and the landing page doesn’t have all of the details… but I do. So let’s break it down further. So why is Revolut revolutionary for travelers like you and me?

What is the Revolut Travel Card?

Revolut has the vision of making sending and spending abroad as easy as it is at home, which is made of three parts:

1) Sending Money with Revolut

Revolut allows users to send money through SMS/WhatsApp/Email and via URL. The recipient can retrieve money by downloading the Revolut app or by entering their bank account details after following the link.

Revolut currently allows deposits and withdrawals in GBP, USD, and EUR as well as sending in 20 other currencies (AUS, CAD, CZK, DKK, HKD, HUF, ILS, JPY, MXN, NZD, NOK, PLN, RON, SGD, ZAR, SEK, CHF, THB, TRY, AED).

2) Exchanging Money with Revolut

Revolut provides the best possible exchange rate, the interbank rate. No hidden fees or spread! Revolut currently offers currency exchange between GBP, USD, and EUR however this will soon expand this list.

3) Spending Money with Your Revolut Card

With the multi-currency card, you can spend abroad without the horrendous fees.

Revolut’s multi-currency card currently supports GBP, USD, and EUR and can be used online as well as offline immediately after there topping up on the Revolut app.

Even if you spend abroad Revolut will automatically do the exchange so you get the most out of your money!

Fees and Charges

Plain and simply, 1% on exchanges with maximum fee charges of GBP120 per year.

Super low fees and capped charges ensure that whether you are sending, exchanging, or spending money, with Revolut, you avoid horrific fees so that your money can be spent on the things that really matter!

Security of the Revolut Travel Card

Revolut ensures that all money sent and stored on Revolut is secured by working with Optimal Payments, which is a registered and regulated e-money issuer by the FCA (reference FRN: 900015).

Optimal Payments manages ring-fenced Barclays accounts which means all money is secured against the possible distress of Revolut, Optimal Payments, and Barclays.

Additionally, Revolut only operates on mobile apps as these platforms provide better protection against hacking than web-based applications. Your money is also secured for up to 85,000 GBP. Awesome.

With ATM fees, transaction fees, and currency exchange fees piling up, I’ve been losing 75 USD A MONTH since I moved to London.

That could have bought me a round trip to Paris and so much more. Join the movement. It’s your money, do what you want with it.

Disclosures

The Revolut USA Prepaid Visa® and Prepaid Mastercard® are issued by Metropolitan Commercial Bank pursuant to a license from Visa U.S.A. Inc. for Visa cards, and Mastercard International for Mastercard cards, and may be used everywhere Visa or Mastercard are accepted.

Banking services are provided by Metropolitan Commercial Bank, Member FDIC, and are subject to the terms of a Cardholder Agreement. “Metropolitan Commercial Bank” and “Metropolitan” are registered trademarks of Metropolitan Commercial Bank © 2014.

A note from Metropolitan Commercial Bank: Funds in your Revolut Prepaid Card Account are held at an FDIC-insured institution. Your funds will be held at or transferred to Metropolitan Commercial Bank, an FDIC-insured institution.

While there, your funds are insured up to $250,000 by the FDIC in the event Metropolitan Commercial Bank fails if specific deposit insurance requirements are met and your card is registered. See fdic.gov/deposit/deposits/prepaid.html for details. FDIC insurance does not protect your funds in the event of Revolut’s failure or from the risk of theft or fraud.

Related Posts:

- Best Banks for Digital Nomads

- How I Made Thousands of Dollars Traveling the World as a Digital Nomad

- When Parents Say No to Traveling

- Why You Can’t Afford To Travel?

- The Challenges of Living Abroad

Thursday 3rd of December 2015

The promotion is not working anymore?

Marcus Bryant

Tuesday 8th of September 2015

It is a great idea - actually there are no transaction fees (they earn their money from the mastercard transaction fee when you use it). A Word of caution though - when attempting to credit my account via transfer the reference field got corrupted and it couldn't be processed. One week later they still haven't found my money and just keep apologizing - no offer of compensation and no solution so far. Their back office is extremely poor IF things do go wrong.

Jonas Hürbin

Thursday 4th of June 2015

Got to your post by searching the internet for a way to save money abroad. When I first read your post, revolut didn't support Android Phones, they now do, so I joined them as well. Great idea and great post. I will give it a try during my travels ;)

Sarah Elizabeth

Tuesday 14th of April 2015

Brilliant idea. Thanks for sharing. I'm lucky enough that my bank is kind to me about living abroad and withdrawing money, but there is definitely always money lost between transfers and exchange rates every now and then.

- Destinations

- Travel Tips

- Travel With Us

- Paid Travel Internship

- TTIFridays (Community Events)

- SG Travel Insider (Telegram Grp)

Revolut Review: The pros, the cons, what it does, and what it’s not

This Revolut Review has been updated here .

I’m a pretty old school traveller, the kind that usually brings loads of cash on a trip. I still remember carrying S$3,000 worth of cash for my three-month solo backpacking trip around South America because I wanted to avoid getting crappy debit/credit card exchange rates! Yet it’s a pain exchanging money before a trip. Other than physically heading to a store somewhere, there’s the struggle of figuring out which money changer has the best rates.

Read also : Which Multi-Currency Travel Card is best for me?

When Revolut reached out to us to review their product, I thought it was a good idea to travel around Germany without any cash (ok I had maybe €2.8 of coins).

We’re not finance people, but we tried our best to experience it as a normal traveller and see what worked and what didn’t. Hopefully you’ll find this Revolut review useful!

Disclosure : While the writer was provided with spending allowance to test the card, it’s in The Travel Intern’s interest to protect the editorial integrity of our website. We have taken every reasonable effort to ensure a realistic and honest review for our readers.

But first, what’s a Multi-Currency Travel Card?

The basic premise is that credit cards charge too much for currency exchange, and multi-currency travel cards try to level the playing field with better exchange rates (very close to the physical money changer). You can also typically hold multiple currencies in your account, allowing you to plan ahead and exchange money when the rates are more favourable.

Revolut Review: How it works

Compared to many other multi-currency debit cards, Revolut has plenty of interesting features. Here’s an overview of the important stuff.

Main Revolut Features & Pricing Plans

Revolut Multi-currency Debit Card & Wallet Your Revolut card works like a debit card, and you can use it in any place that accepts Visa . Simply top-up using your debit/credit card, and you’re free to exchange and store up to 28 currencies in your multi-currency wallet. When you make a purchase, the card will automatically deduct from the relevant currency. If there are insufficient funds in that currency, it will automatically convert any leftovers from your other currencies, starting from your base currency (SGD in our case). This ensures that payment is always seamless as long as you have money in your account.

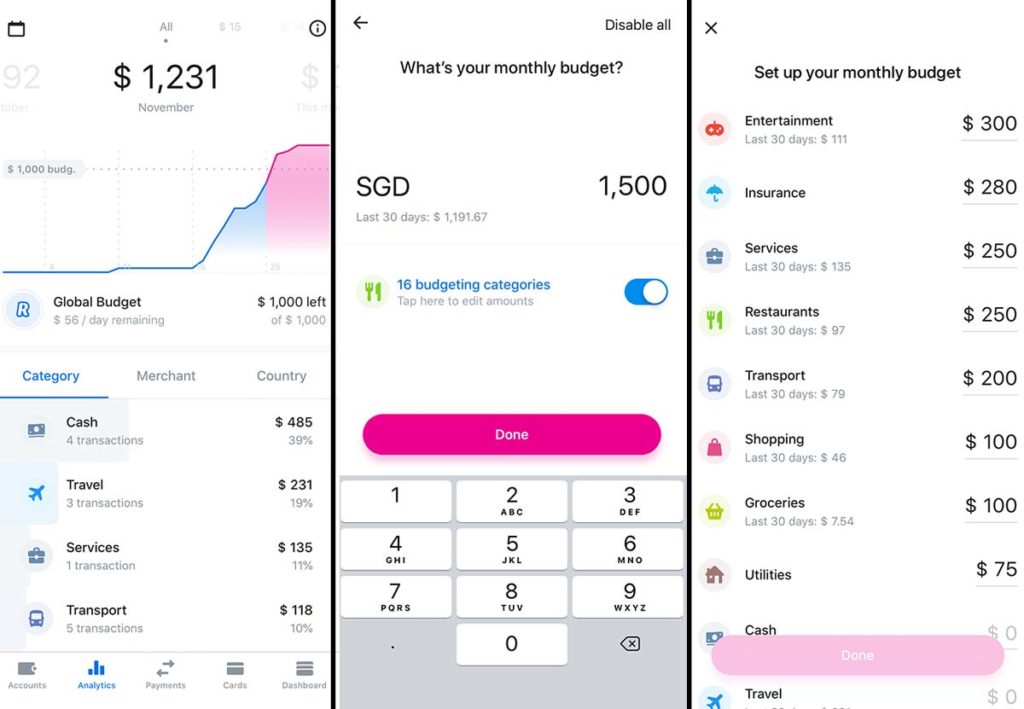

Revolut Budgeting Tools

Other than acting as a multi-currency wallet and overseas debit card, there are also budgeting and analytics tools on the App to make spending more organised. Revolut automatically categorises all your purchases instantly, making it easier to track and manage your expenses. You can even set monthly budgets by categories and easily tell when you overspend.

To make it more effortless in saving towards your goals, there is also a feature called Vault that can add your spare change into a savings vault. It does this by automatically rounding up your purchases to the nearest dollar and saving it in your account.

Revolut is free to use, but if you want even more features, there are three Revolut Visa cards with monthly subscription plans .

The paid Revolut Pricing Plans gives you a higher limit for ATM withdrawals, a lower currency exchange fee, priority customer support, nicer physical cards, and LoungeKey Pass access. The Metal Card also offers 1% cashback on overseas spending.

Interestingly, the paid Revolut cards also provide travel insurance coverage from Tokio Marine . They mainly cover: – Emergency Medical Treatment & Related Expenses with a maximum aggregate limit of S$10m per Policy – Emergency Dental Treatment up to S$2,000 – Delayed baggage cover up to S$200

Currency Exchange Rates & ATM Withdrawal

Currency Exchange Fees : 0-2.5% depending on membership and market hours Overseas ATM Withdrawal : Free up to S$350 (Standard), S$700 (Premium), S$1050 (Metal) every month, 2% Fair Usage Fee after

Currency Exchange Rates Revolut uses the real-time interbank mid-market rates to calculate currency exchange rates, which is really close to the rate you see on Google. The rate refreshes every few seconds, keeping it as close to the real-time rates.

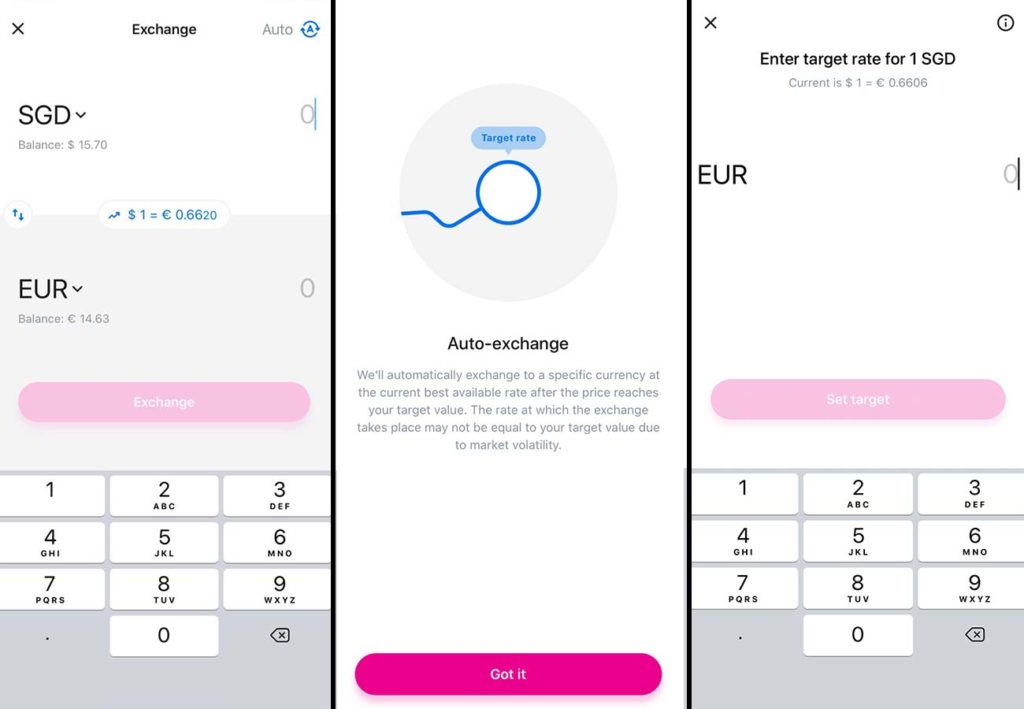

The good thing about using a multi-currency wallet is that you can lock in favourable exchange rates ahead of time before you need it. Revolut allows you to pre-set auto-exchange targets , so you don’t have to monitor them constantly. Simply set your target and let the App do the rest. Alternatively, you can set up Price Alerts if you want to do it manually.

Currency Exchange Fees A currency exchange fee is charged based on a few factors — your membership level (standard, premium or metal card), amount you exchange each month, and London’s market hours. With Revolut, you are split into either a “Regular” or “High Frequency Standard” customer.

*High Frequency Standard rates are charged to standard users (free membership) who have exchanged more than S$9,000 or equivalent in any rolling month.

Revolut also locks in the closing rate for the weekend (UTC) and charges more currency exchange fees to protect against market fluctuations when it’s closed. Here’s the breakdown:

Exchange Fees during market hours (UTC, Mon-Fri)

Exchange Fees after market hours (UTC, Sat-Sun, trading holidays)

Overseas ATM Withdrawals ATM withdrawal is free up to certain amounts depending on your membership level. Standard: S$350/month Premium: S$700/month Metal Card: S$1050

A 2% usage fee is charged for amounts exceeding your limit but that shouldn’t be an issue when travelling in places where card payment is widely accepted.

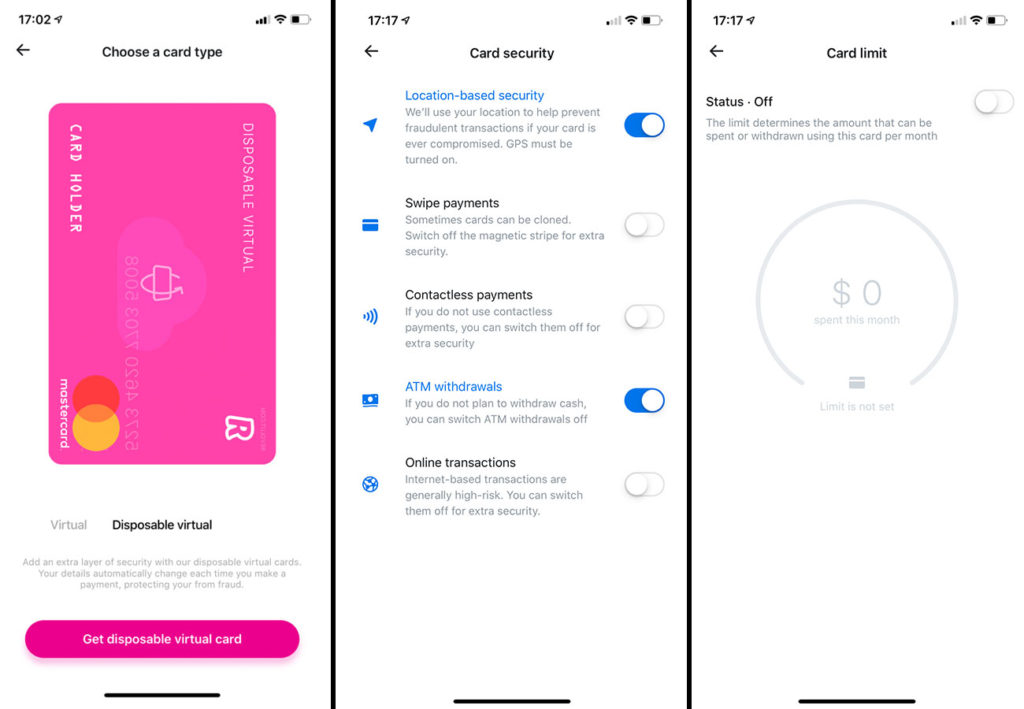

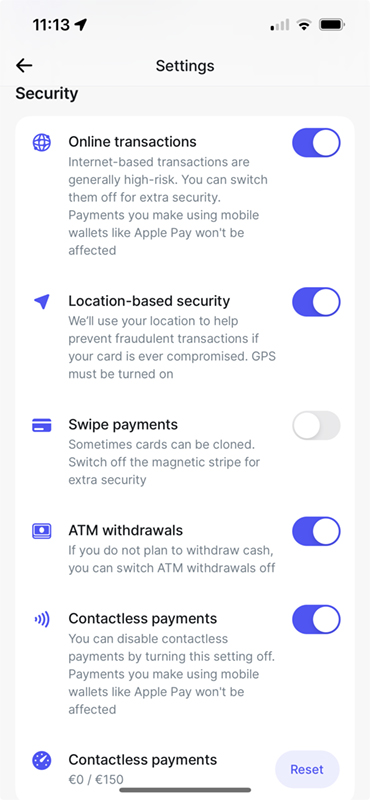

Revolut Security Features Review

Easy control over security features What I especially loved about Revolut is the control you have over all the security features. If you happen to lose your card, you can deactivate your card temporarily Through the Revolut App . This temporary feature is great because I’m sure many of us have been in situations where we think we’ve lost our credit card, only to find them a few days later after going through the trouble of calling the bank and having it deactivated permanently. You can also easily toggle security features like location-based security, use of contactless payments, ATM withdrawals, online payments, or magnetic stripe usage. This means even if you lose it without realising, the card cannot be misused since the features only work when you activate them.

Disposable Virtual Cards For Premium & Metal Card users, you create Disposable Virtual Cards — perfect for times when you need to make an online payment through a dodgy looking website.

According to Revolut, the Disposable Virtual Card will automatically be destroyed and a new one is generated each time an online payment is made. This reduces the risk of online credit card fraud since it can only be used once.

Card Limits You can also set your own spending limits in the App easily without going through the hassle of calling your bank and waiting forever for a customer service staff to answer your call.

User Experience

In general the App’s User Interface is clear and easy to use. Everything you need to do can be accessed within a few clicks from the Home Screen. Tutorials can also be easily accessed via the (i) icon at the top right of the App.

Revolut Review — Putting the Revolut Card to the Test

Having not exchanged any cash before the trip, reliability was a very important factor for me. Here are some common situations with the corresponding internet exchange rate to see how well Revolut fared. I used the Premium Card, which gave me some extra perks like being able to withdraw more money from the ATM at lower currency exchange fee.

(1) Using the Revolut Card for food, activities, and transport

I used Revolut everywhere. At restaurants, paying for museum tickets, and even on the subway. While I generally always made sure I had Euros in my account, there were occasions where I put the exchange rates to the test by letting the account automatically convert from my remaining SGD.

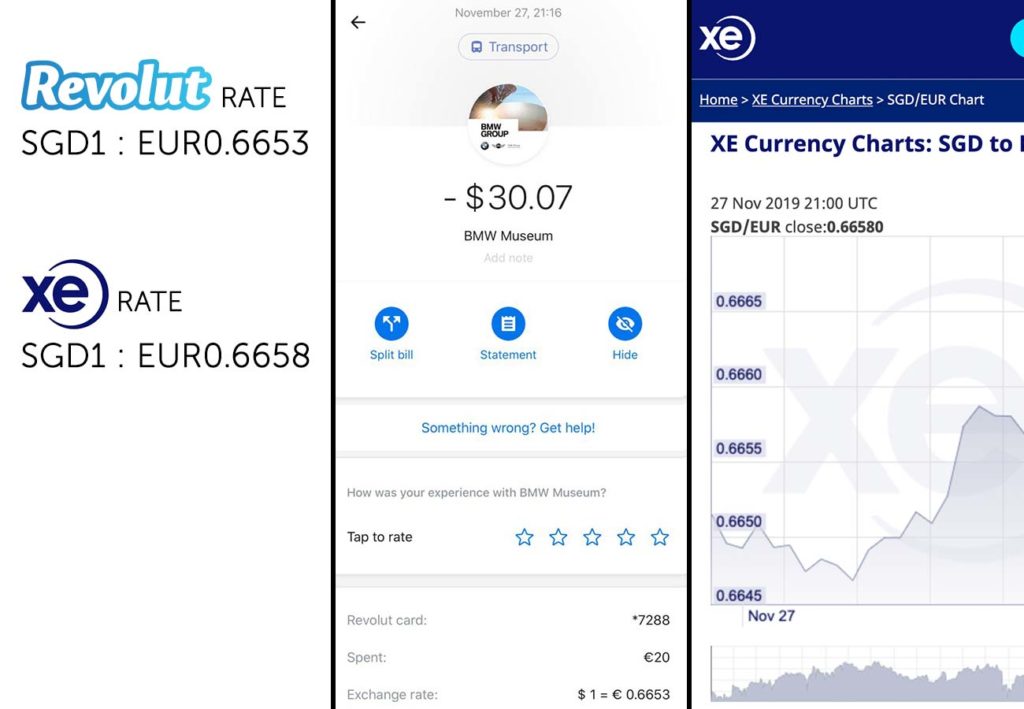

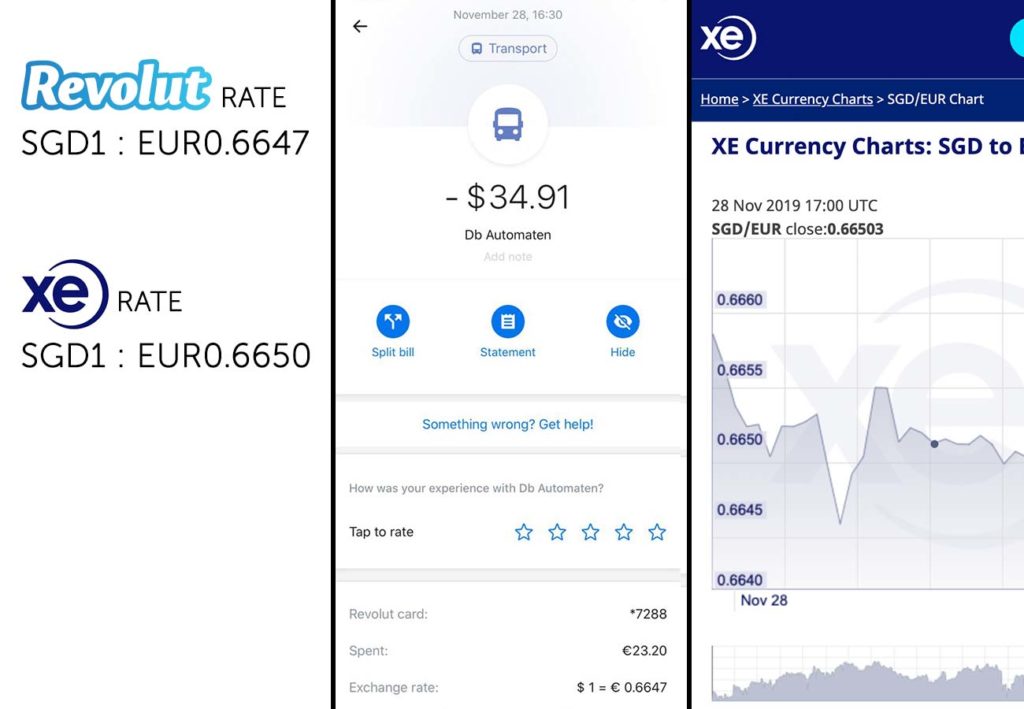

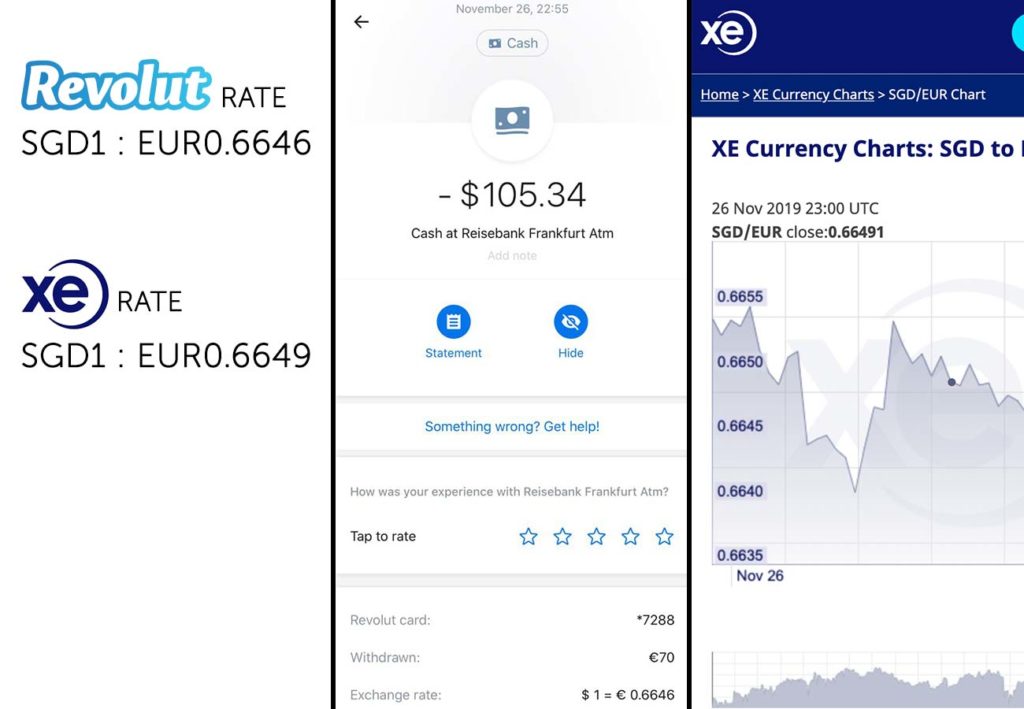

ATTRACTIONS: BMW Museum Entrance x2 (27 Nov 2019) Revolut Exchange Rate SGD1 : EUR0.6653 Internet Exchange Rate (xe.com) SGD1 : EUR0.6658 Difference = – EUR 0.0005

ATTRACTIONS: Airport Transport x2 (28 Nov 2019) Revolut Exchange Rate SGD1 : EUR0.6647 Internet Exchange Rate (xe.com) SGD1 : EUR0.6650 Difference = – EUR 0.0003

ATTRACTIONS: Overseas ATM Withdrawal (26 Nov 2019) Revolut Exchange Rate SGD1 : EUR0.6646 Internet Exchange Rate (xe.com) SGD1 : EUR0.6649 Difference = – EUR 0.0003

The rates were pretty good and there was hardly any difference between Revolut’s Rate and the Internet’s Rate.

(2) Withdrawing Money from the ATM

Unfortunately there were still places that required cash. For those situations, I was able to draw cash at ATMs that accepted VISA.

Since I had already pre-exchanged Euros and have not exceeded my limit of S$700 for the Premium Card, there were no additional charges or surprises on the exchange rate. Pro-tip : Avoid tourist ATMs that charge a processing fee. I only encountered one during our trip to Germany, so I’m pretty sure you can just look for another ATM that does not charge extra.

(3) Testing the security features

Just to make sure everything worked as described, I decided to test a couple of the security features. For the main test, I basically deactivated the card and tried using it at a restaurant. The card didn’t work and I had to quickly activate it so I didn’t hold up the queue! I also tried withdrawing money after toggling ATM Withdrawal off. As expected, the card wouldn’t work!

Revolut Review — Pros, Cons, and Final Thoughts

All in all, the Revolut card worked as described. Despite not changing any cash beforehand, travelling around Germany with the Revolut card turned out pretty seamless. It might not be a replacement for credit cards but for its preferential currency exchange rates, it’s a pretty convenient option for overseas spending.

Pros – Works as described with good currency exchange rates – Robust security controls – Intuitive UI

Cons – Weekday/weekend Exchange Rates can be more obvious – Requires an Internet Connection for card management or top-ups – No credit card benefits

Quick Tips for Maximising your Revolut Card

(1) Use Auto-Exchange or Price Alerts to lock in exchange rates Plan ahead and utilise the in-app Auto Exchange or Price Alert features. If you know that you’re heading to Europe, set a target for auto-exchange rate so to lock in favourable rates! (2) Exchange currency on weekdays There’s an additional 0.5-1% surcharge on weekends. Unless you absolutely need to, I’ll try to do the bulk of my currency exchange on weekdays. (3) Monitor currency exchange rates. It refreshes really often If you hover around the currency exchange screen on the Revolut App, you will notice that the currency exchange rates fluctuate every few seconds. Monitoring it for a bit can score you a slightly more favourable exchange rate. Those extra dollars saved can go towards your travel fund! (4) Always make sure you have spare SGD in your account Despite using a local sim card with data, there were instances where there wasn’t any internet connection. To avoid being in a situation where you don’t have enough money in your account, plan ahead and top up more.

During my trip, I only exchanged enough Euros for our needs, while maintaining some spare SGD in my account. I wanted to avoid situations where I ran out of Euros and didn’t have internet connection to top up my card on the Revolut App, especially in smaller towns and rural areas!

As Germany and the rest of the world become more cashless, I can see how multi-currency debit cards like Revolut becoming an essential for overseas spending. It was honestly a joy bringing only a small card holder around instead of a bulky wallet!