- Publications

- Key Findings

- Interactive Data and Economy Profiles

- Full report

Travel & Tourism Development Index 2021: Rebuilding for a Sustainable and Resilient Future

1.1 Benchmarking the enablers of Travel and Tourism development

The index provides a strategic benchmarking tool for business, governments, international organizations and others to develop the T&T sector. By allowing cross-country comparison and by benchmarking countries’ progress on the drivers of T&T development, it informs policies and investment decisions related to the development of T&T businesses and the sector as a whole. The index provides unique insights into the strengths and areas for development of each country to support their efforts to enhance the long-term growth of their T&T sector in a sustainable and resilient manner. Furthermore, it provides a valuable platform for multistakeholder dialogue to formulate appropriate policies and actions at local, national, regional and global levels.

The index is comprised of five subindexes, 17 pillars and 112 individual indicators, distributed among the different pillars. However, the five subindexes are not factored into the calculation of the index and are used only for presentation and categorization purposes. The Non-Leisure Resources, Socioeconomic Resilience and Conditions, and T&T Demand Pressure and Impact pillars are all new when comparing earlier TTCI editions with the new TTDI.

Figure 1: The Travel & Tourism Development Index framework

Business Environment (9 indicators) : This pillar captures the extent to which a country’s policy environment is conducive to companies doing business. Research has found significant links between economic growth and aspects such as how well property rights are protected and the efficiency of the legal framework. Policy stability and levels of regulatory burdens and corruption also play a critical role in determining economic development, productivity and overall investment decisions. These factors are important for all sectors, including T&T. In addition, we consider access to financing for small and medium-sized enterprises (SMEs), which is a particularly relevant issue for T&T development as the majority of operators are SMEs.

Safety and Security (6 indicators) : Safety and security are critical factors in determining the success of a country’s T&T sector. This pillar measures the extent to which a country exposes locals, tourists and businesses to security risks. In addition to creating barriers to T&T investment, countries with a high incidence of crime or violence are likely to deter visitors, making it less attractive to develop the T&T sector in those places. Here, the costliness and occurrence of common crime and violence, police reliability, and terrorism and armed conflict are considered.

Health and Hygiene (6 indicators): This pillar measures healthcare infrastructure, accessibility and health security. COVID-19 has highlighted the potential impact of communicable diseases on the T&T sector. In particular, the pandemic has demonstrated how important a country’s healthcare system is when it comes to mitigating the impact of pandemics and ensuring safe travel conditions, and workforce availability and resilience. In general, if tourists or sector employees do become ill, the country’s health sector must be able to ensure that they are properly cared for, as measured by the availability of and access to physicians, hospital beds and general healthcare services. Moreover, access to safe drinking water and sanitation is important for the comfort and health of travellers and locals alike. Please note that due to evolving COVID-19 conditions, this pillar does not track the pandemic itself.

Human Resources and Labour Market (9 indicators): This pillar measures the availability of quality employees and the dynamism, efficiency and productivity of the labour market. High-quality human resources in an economy ensure that the sector has access to the collaborators it needs. Regarding a quality workforce, this means that years of schooling, formal educational attainment rates, the education system’s ability to meet economic needs and private-sector involvement in upgrading human resources are measured. Regarding the labour market, the flexibility, efficiency and openness of labour markets, as well as labour productivity in the hospitality, restaurant and transport sectors, are tracked.

ICT Readiness (8 indicators): This pillar measures the development and use of ICT infrastructure and digital services. Online services and digital platforms continue to grow in importance for T&T business operations. Such services and platforms are being used for everything from planning itineraries to booking travel and accommodation. Moreover, ICT has become crucial for businesses to access and advertise to new markets, improve efficiency and gain insights into consumer needs. The components of this pillar measure not only the existence of modern physical infrastructure (e.g. mobile network coverage and electricity supply), but also the degree to which digital platforms are used for T&T and related services and gain insights into consumer needs. The components of this pillar measure not only the existence of modern physical infrastructure (e.g. mobile network coverage and electricity supply), but also the degree to which digital platforms are used for T&T and related services.

Prioritization of Travel and Tourism (5 indicators): This pillar measures the extent to which the government and investors actively promote and invest in the development of the T&T sector. The extent to which the government prioritizes the T&T sector has an important impact on T&T development. By making clear that the sector is of primary concern, the government can channel funds to essential development projects and coordinate the actors and resources necessary to develop the sector. The government can also play an important role in directly attracting tourists through national marketing campaigns. This pillar includes measures of government spending, country branding and the completeness and timeliness of providing T&T data to international organizations, as these indicate the importance that a country assigns to its T&T sector. Moreover, overall capital investment in T&T is accounted for as it measures the degree to which public and private stakeholders are willing to invest resources in T&T relative to other parts of the economy.

International Openness (4 indicators): This pillar measures how open a country is to visitors and providing travel services. Developing a T&T sector internationally requires a certain degree of openness and travel facilitation. Restrictive policies such as cumbersome visa requirements diminish tourists’ willingness to visit a country. Components measured in this pillar include: the number of bilateral air service agreements that the government has entered into, which affects the availability of air connections to the country; and the number of regional trade agreements in force, which indicates the extent to which it is possible to provide world-class tourism services. Financial openness is also measured as the free flow of capital is important for cross-border trade and investment in T&T services.

Price Competitiveness (5 indicators): This pillar measures how costly it is to travel or invest in a country. Lower costs related to travel in a country increase its attractiveness for many travellers as well as making its T&T sector more appealing to investors. Among the aspects of price competitiveness taken into account in this pillar are: airfare ticket taxes and airport charges, which can make flight tickets much more expensive; the relative cost of hotel and short-term rental accommodation; the cost of living, represented by purchasing power parity; and fuel price costs, which directly influence the cost of travel.

Air Transport Infrastructure (4 indicators ): Air connectivity is essential for travellers’ ease of access to and from countries, as well as movement within many countries. In this pillar we measure international and domestic air route capacity and quality, using indicators such as available seat kilometres, the number of operating airlines and the efficiency of air transport services. The extent to which a country’s airports are integrated into the global air transport network is also measured.

Ground and Port Infrastructure (7 indicators): This pillar measures the availability of efficient and accessible ground and port transportation to important business centres and tourist attractions. Sufficiently extensive road and railway networks, indicated by road and railway densities, as well as road, railway and port infrastructure that meets international standards of comfort, security and modal efficiency are vital to enabling a T&T economy. This pillar also accounts for the efficiency of and access to public transport services such as underground rail systems and taxis as these are regularly used by visitors and T&T employees, especially in urban locations.

Tourist Service Infrastructure (5 indicators): This pillar measures the availability and competitive provision of key tourism services such as accommodation and car rentals. The availability of sufficient accommodation, resort and leisure facilities can represent a significant advantage for a country. We measure the level of tourism service infrastructure through the number of hotel rooms and short-term rental units, complemented by the extent of access to services such as car rentals and ATMs. Competition among tourism services is also accounted for because it plays a role in the pricing and quality of services.

Natural Resources (5 indicators): This pillar measures the available natural capital as well as the development of outdoor tourism activities. Natural capital is defined in terms of the landscape, natural parks and richness of fauna. Countries with natural assets may be better positioned to attract tourists. In this pillar, we include several attractiveness measures, including the number of United Nations Educational, Cultural and Scientific Organization (UNESCO) natural World Heritage Sites, the richness of fauna and biodiversity in the country and the scope of protected areas, which indicates the extent of national parks and nature reserves. Digital Demand [i] for nature and relevant activities is also measured as an illustration of how well known and effectively marketed a country’s natural assets are.

Cultural Resources (6 indicators): This pillar measures the availability of cultural resources such as archaeological sites and entertainment facilities. To an extent, this pillar captures how cultural resources are protected, developed and promoted. Included here are the number of UNESCO cultural World Heritage Sites, the number of large stadiums that can host significant sport or entertainment events, and a measure of Digital Demand for a country’s cultural sites and entertainment. Also included are the number of UNESCO Creative Cities, representing efforts to protect and develop cultural and creative activities and industries in urban centres.

Non-Leisure Resources (4 indicators): This pillar measures the extent and attractiveness of factors that drive business and other non-leisure travel, which account for a significant share of T&T revenue and profit. We have included the presence of major multinational corporations and cities that are highly integrated into the global economy as proxies for business travel. Meanwhile, the number and quality of a country’s universities play an important role in attracting academic travel. Lastly, online searches related to business, academic and medical travel are also measured to imply global interest in a country’s non-leisure resources.

Environmental Sustainability (15 indicators): This pillar measures the general sustainability of an economy’s natural environment, protection of its natural resources, and vulnerability to and readiness for climate change. The importance of the natural environment in providing an attractive location for tourism cannot be overstated, so policies and factors enhancing environmental sustainability are an important aspect of ensuring a country’s future attractiveness as a destination. Water stress, marine and air pollution, loss of forest cover and the degree of extinction risk for species provide an insight into the status of a country’s environment. Additionally, public- and private-sector protection of the environment and national parks and the ratification of international environmental treaties indicate the degree to which the government and the private sector are preserving the natural assets that generate nature-based T&T. Lastly, metrics related to greenhouse gas emissions (GHGs), the use of renewable energy, investment in green infrastructure and exposure to weather-related events are important in understanding how exposed, ready and willing a country is to address climate change, which in itself is one of the greatest long-term threats the T&T sector faces.

Socioeconomic Resilience and Conditions (7 indicators): This pillar captures the socio-economic well-being and resilience of an economy. Gender equality, inclusion of a diverse workforce, greater workers’ rights and reducing the number of young adults not in education, employment or training are all important for improving employee productivity and creating a larger and higher-quality labour pool. This is particularly important for the T&T sector as it often employs an above-average number of women, members of minorities and youths. Investment in and greater coverage of social protection services such as child and maternity support, unemployment and disability benefits are also key to making the labour market more resilient in the face of economic downturns and other shocks. Furthermore, combined with access to basic resources, as measured by poverty rates, all of the factors above play a role in broader social and economic stability, which affects investment in T&T.

Travel and Tourism Demand Pressure and Impact (7 indicators): This pillar measures factors that may indicate the existence of, or risk related to, overcrowding and demand volatility, as well as the quality and impact of T&T. The T&T sector does not operate in a vacuum. Unmanaged tourism development can lead to destinations operating beyond their capacity, leading to overcrowding, damaged natural and cultural resources, strained infrastructure, increased housing prices and overall reduced liveability for local residents. If left unaddressed, such issues can lead to a backlash by residents towards tourism, reduced visitor satisfaction and lower overall destination attractiveness, all of which negatively affect T&T development. Aspects measured include length of visitor stays, tourism seasonality, proxies for the dispersion of tourism, and the distribution of T&T economic benefits to local communities. Such factors can all help mitigate these issues by lowering the strain on destination capacity, creating resident buy-in, promoting more travel options and markets, and enriching travellers’ experiences.

By Bastian Herre, Veronika Samborska and Max Roser

Tourism has massively increased in recent decades. Aviation has opened up travel from domestic to international. Before the COVID-19 pandemic, the number of international visits had more than doubled since 2000.

Tourism can be important for both the travelers and the people in the countries they visit.

For visitors, traveling can increase their understanding of and appreciation for people in other countries and their cultures.

And in many countries, many people rely on tourism for their income. In some, it is one of the largest industries.

But tourism also has externalities: it contributes to global carbon emissions and can encroach on local environments and cultures.

On this page, you can find data and visualizations on the history and current state of tourism across the world.

Interactive Charts on Tourism

Cite this work.

Our articles and data visualizations rely on work from many different people and organizations. When citing this topic page, please also cite the underlying data sources. This topic page can be cited as:

BibTeX citation

Reuse this work freely

All visualizations, data, and code produced by Our World in Data are completely open access under the Creative Commons BY license . You have the permission to use, distribute, and reproduce these in any medium, provided the source and authors are credited.

The data produced by third parties and made available by Our World in Data is subject to the license terms from the original third-party authors. We will always indicate the original source of the data in our documentation, so you should always check the license of any such third-party data before use and redistribution.

All of our charts can be embedded in any site.

Our World in Data is free and accessible for everyone.

Help us do this work by making a donation.

- English (CA)

- Deutsch (DE)

- Deutsch (CH)

30+ Sustainable travel statistics & trends you need to know

Editor’s picks: the stats you need to know.

- Searches for “sustainable travel” have increased by 191% from 2020 to 2023.

- Traveling in business class has a bigger carbon footprint, since first-class seats consume four times as much as economy.

- The sustainable travel market in the business travel & tourism sector is expected to grow by $335.93 billion during 2023 - 2027.

- Globally, flights produced over 600 million tonnes of CO2 in 2022. Sources: Google Trends , Greenbiz, Research and Markets , Statista Research

What is sustainable travel and tourism?

- reducing greenhouse gas emissions by choosing more sustainable transport options

- offsetting pollution and harm to biodiversity

- reducing the negative impact on cultural heritage

- positively impacting the local economy at your destination

30 travel statistics and trends that tell you everything about sustainable traveling

- In 2022, the sustainable international tourism industry worldwide was estimated at $172.4 billion and expected to grow to $374.2 billion by 2028.

- A global survey in 2020 showed that Gen Z (56%) and millennial (51%) travelers are the most concerned with sustainable travel. Gen X (49%) and Baby Boomers (46%) are the least concerned about it.

- 77% of travelers aged between 18-29 say that sustainability impacts their travel decisions, compared to 48% of travelers aged 51 and above.

- 76% of travelers surveyed in 2023 say they want to travel more sustainably over the next 12 months.

How and why do travelers approach sustainable traveling?

- 43% of travelers surveyed in Booking.com ’s 2023 Sustainable Travel Report say they would be willing to pay more for more sustainable travel options.

- 69% of travelers want the money they spend when traveling to go back into the local economy.

- 59% of travelers will pay to offset their carbon emissions when they travel.

- 50% of travelers generally choose sustainable travel options because they care about the impact of their travels. Another 26% say sustainable travel options give them a better travel experience.

- 46% are concerned about excess waste.

- 38% worry about threats to local wildlife and natural habitats.

- 30% care about overtourism.

- 29% want to reduce CO2 emissions.

What about sustainable accommodation?

- Hotel and other rental accommodation guests are willing to pay up to 75% more for an eco-friendly option.

- 73% of travelers are more likely to choose accommodation providers that advertise their sustainability practices.

- 65% of travelers would feel better about staying in a particular hotel or accommodation if they knew it had a sustainable certification or met certain sustainability requirements.

- 27% of travelers say they would like the choice to opt out of daily room cleaning in order to reduce water usage.

- 48% of travelers said the hardest part of traveling sustainably was choosing a sustainable accommodation option.

- 59% of travelers would like a filter option to make the decision of staying in sustainable accommodation easier.

- Research has found that the hotel industry would need to reduce its carbon emissions by 66% per room by 2030, and by 90% per room by 2050, to make sure that the growth forecasted for the industry does not cause an increase in its carbon emissions.

Who should be accountable for sustainable travel?

- Employees agree that corporations need to take responsibility for making corporate travel more sustainable.

- 51% of travelers feel there aren’t enough sustainable travel options available.

- 48% of travelers say it’s important to them to choose travel companies that have strong sustainability policies.

What stops travelers from traveling sustainably?

- “There aren’t enough sustainable travel options available.” (51%)

- “I want economic incentives to choose more sustainable options.” (49%)

- “I don’t know where to find such options.” (44%)

- “I don’t trust that the options I find are truly sustainable.” (39%)

- In addition, 53% of travelers said that sustainable travel options are too expensive.

How do business travelers care about sustainability?

- 36% increased their environmentally friendly commitments

- 20% didn’t have reduction targets but have now start considering them

- 15% kept the same commitments they had

- 15% didn’t have targets, and don’t expect to implement new ones

- 12% are unsure of their companies’ targets

- 2% decreased the commitments they had

- At corporations with sustainability programs, 92% of executives report that sustainability investment is already increasing.

- 44% of corporate travel managers in North America said that travel sustainability was an increased priority for them in 2023 and beyond.

- Business travelers are thinking sustainably as well. In a 2022 survey, 53% of business travelers said they made a conscious effort to adopt more sustainable travel habits during their trips.

- According to a 2023 survey, 19% of corporate organizations had changed travel policies to reduce carbon emissions goals, and 35% of companies were reducing future business travel for sustainability reasons.

Final thoughts on sustainable travel

?)

Small steps. Big impact. Start offsetting your business travel today.

?)

Make business travel simpler. Forever.

- See our platform in action . Trusted by thousands of companies worldwide, TravelPerk makes business travel simpler to manage with more flexibility, full control of spending with easy reporting, and options to offset your carbon footprint.

- Find hundreds of resources on all things business travel, from tips on traveling more sustainably, to advice on setting up a business travel policy, and managing your expenses. Our latest e-books and blog posts have you covered.

- Never miss another update. Stay in touch with us on social for the latest product releases, upcoming events, and articles fresh off the press.

?)

The 5 best carbon footprint tracker apps

?)

60+ Business sustainability statistics (relevant in 2024)

?)

Why sustainability (and flexibility) matters for business in 2024

- Business Travel Management

- Offset Carbon Footprint

- Flexible travel

- Travelperk Sustainability Policy

- Corporate Travel Resources

- Corporate Travel Glossary

- For Travel Managers

- For Finance Teams

- For Travelers

- Thoughts from TravelPerk

- Careers Hiring

- User Reviews

- Integrations

- Privacy Center

- Help Center

- Privacy Policy

- Cookies Policy

- Modern Slavery Act | Statement

- Supplier Code of Conduct

- Hospitality Industry

Sustainable travel statistics: 6 facts to open your mind

March 01, 2021 •

7 min reading

What do industry professionals need to know about the 'new norm' in tourism? In this article we take a deeper look at 6 sustainable travel statistics. While COVID has upended the $8 trillion global travel industry, the pandemic has also paved the way for tourism and hospitality professionals to reflect, rethink and reshape the sector, making it better - and ultimately more sustainable - for people and places around the world.

As UNWTO Secretary-General Zurab Pololikashvili said:

Sustainability must no longer be a niche part of tourism but the new norm for every part of our sector. That means an opportunity to build back better and create and industry that is more resilient and aligned with the UN’s Sustainable Development Goals.

Which key findings and statistics will help inform hospitality and tourism professionals as they recover from the impact of the pandemic and prepare for a more resilient and sustainable future?

1. sustainability is in growing demand:, over 53% of people want to travel more sustainably in the future..

While the term "sustainable tourism" is tossed around with increasing frequency, many professionals have only a vague understanding of what sustainability really means. Essentially, sustainable travel refers to tourism that supports the natural and cultural heritage - as well as the economic viability - of destinations. Not only is sustainability essential for our collective future, but tourists are demanding it. According to the digital travel platform Booking.com, over half (53%) of global travelers want to travel more sustainably in the future , and the company expects to see a more eco-conscious mindset in 2021 and beyond, as coronavirus has amped people’s awareness of their impact on the environment and local communities. In fact, over two-thirds (69%) of respondents anticipate that the travel industry will offer more sustainable travel options .

2. Beyond sustainable:

Regenerative travel is trending with dozens of companies committing to supporting the future of tourism’s 13 principles of a more ethical and planet-friendly industry..

While sustainability refers to harm reduction, a new concept has recently cropped up among tourism professionals: "regenerative travel". Built on the sustainability concept, regenerative tourism, which is even more ambitious, refers to leaving a place even better than you found it. Six nonprofit organizations - including the Center for Responsible Travel and Sustainable Travel International - have established the Future of Tourism coalition , which aims to “build a better tomorrow". Dozens of hotel groups, destination marketers and travel organizations have signed on to the coalition’s 13 guiding principles, including “demand fair income distribution” and “choose quality over quantity. ”

3. Generating economic opportunity:

Following tremendous losses, according to the wttc, the industry could regain 111 million travel and tourism jobs in 2021..

In 2020, the world economy shrank by 4.3 per cent, over two and half times more than during the 2009 global crisis. The economies of tourism-dependent regions have been hit particularly hard. Women, young people and workers with low education, who make up the bulk of hospitality employees, have been most severely affected. In fact, job and income losses have pushed millions of people in tourism-dependent places like Latin America and the Caribbean into poverty, wiping out all economic progress made over the past 15 years. At the peak of the pandemic, nearly nine in ten hotels had to lay off or furlough workers, and the hospitality and leisure industry lost 7.5M jobs. On a somewhat encouraging note, however, the World Travel and Tourism Council’s latest economic forecast predicts that as many as 111 million global travel and tourism jobs could be regained in 2021. That will depend, of course on restoring traveler confidence through vaccine distribution, mandatory mask-wearing and comprehensive COVID testing. And key to all economic recovery is investment. As UN Secretary-General Antonio Guterres urged, "Let's invest in an inclusive and sustainable future driven by smart policies, impactful investments, and a strong and effective multilateral system that places people at the heart of all socio-economic efforts."

4. Travelers want to help:

Not only has the pandemic increased traveler commitment to sustainability and the environment, two-thirds of travelers want their choices to support the destination’s recovery efforts, and more than half want to see how their money is going back into the local community..

Travel companies are facilitating that desire to help. New businesses – such as the booking agency Regenerative Travel - features sustainable destinations and resorts and committed to a sustainable future. The interest in giving back to destination communities is even evident among armchair travelers. Global Child "Travel with Purpose" , a popular series available on Amazon Prime, is now in its third season. According to the series’ creator, "We wanted to inspire travelers to remember that everyone is part of one global family, it's time to leave the divisive behind and embrace the future together. Doing good in each place we visit, not only is a great blessing for each place we visit, but it actually does wonders for our own soul.”

5. Climate change:

The hotel sector accounts for around 1% of global carbon emissions, and this is set to increase..

Along with a global focus on the pandemic, concern over climate change has reached new levels this past year, with an increasing determination by businesses and individuals everywhere to do their part to mitigate carbon emissions. In fact, one of the silver linings of the pandemic has been the decrease in travel-related carbon emissions. Hotels can do their part to help further reduce emissions through sustainable building design, the efficient use of energy, by addressing issues in their supply chains and reducing single-use plastics. They can also reduce purchase carbon offsets with companies such as Cool Effect to offset their emissions. One important way that hotels and restaurants can contribute to reducing emissions - and address consumer concerns - is by serving sustainable foods. A recent survey from EU consumer organization BEUC, which focused on consumers’ attitudes toward sustainable food , found that more than half of consumers say that sustainability has some or a lot of influence on their eating habits. That means, for example, reducing red meat, which has a huge carbon footprint, and serving more plant-based and foods from local farms.

6. Sustainable design & stewardship sells:

53% of global travelers are willing to pay more for products that demonstrate environmental responsibility - 13% more than a year ago..

Even during the pandemic, concerns about the future of our planet are top of mind and driving decisions. As revealed by the Deloitte Global Millennial Survey 2020 - which explores the views of more than 27.5K millennials and Gen Zs, both before and after the start of the COVID-19 pandemic - “despite the individual challenges and personal sources of anxiety that millennials and Gen Zs are facing, they have remained focused on larger societal issues, both before and after the onset of the pandemic. If anything, the pandemic has reinforced their desire to help drive positive change in their communities and around the world.”

The world’s top hoteliers and industry professionals are heeding the call. Just as 9/11 increased their focus on security, the pandemic has raised hoteliers’ awareness of health and wellness - concerns that are closely linked to sustainability. Along with contactless and touchless check-in and room controls, new hotels are being designed with a focus on nature and wellness.

One of the leading sustainability trends in hotel design is modular construction, which is efficient, reduces waste, energy-use and carbon emissions. CitizenM, opened its first modular hotel in Amsterdam in 2008, and currently eight of the company’s hotels are made with modular units, with more underway in Los Angeles and Seattle. Marriott International currently has 50 projects in the works. Sustainability is a focus of the high-end market as well, not only because it leads to greater efficiency but because it appeals to consumer concerns.

Consultant at EHL Advisory Services

Keep reading

Luxury hotels and a ‘sense of place’: Brand identity and experiences

Apr 24, 2024

Luxury hotels and a ‘sense of place’: The branding imperative

Apr 17, 2024

Navigating challenges of AI and maximizing value in the service sector

Apr 16, 2024

This is a title

This is a text

- Bachelor Degree in Hospitality

- Pre-University Courses

- Master’s Degrees & MBA Programs

- Executive Education

- Online Courses

- Swiss Professional Diplomas

- Culinary Certificates & Courses

- Fees & Scholarships

- Bachelor in Hospitality Admissions

- EHL Campus Lausanne

- EHL Campus (Singapore)

- EHL Campus Passugg

- Host an Event at EHL

- Contact our program advisors

- Join our Open Days

- Meet EHL Representatives Worldwide

- Chat with our students

- Why Study Hospitality?

- Careers in Hospitality

- Awards & Rankings

- EHL Network of Excellence

- Career Development Resources

- EHL Hospitality Business School

- Route de Berne 301 1000 Lausanne 25 Switzerland

- Accreditations & Memberships

- Privacy Policy

- Legal Terms

© 2024 EHL Holding SA, Switzerland. All rights reserved.

The future of tourism: Bridging the labor gap, enhancing customer experience

As travel resumes and builds momentum, it’s becoming clear that tourism is resilient—there is an enduring desire to travel. Against all odds, international tourism rebounded in 2022: visitor numbers to Europe and the Middle East climbed to around 80 percent of 2019 levels, and the Americas recovered about 65 percent of prepandemic visitors 1 “Tourism set to return to pre-pandemic levels in some regions in 2023,” United Nations World Tourism Organization (UNWTO), January 17, 2023. —a number made more significant because it was reached without travelers from China, which had the world’s largest outbound travel market before the pandemic. 2 “ Outlook for China tourism 2023: Light at the end of the tunnel ,” McKinsey, May 9, 2023.

Recovery and growth are likely to continue. According to estimates from the World Tourism Organization (UNWTO) for 2023, international tourist arrivals could reach 80 to 95 percent of prepandemic levels depending on the extent of the economic slowdown, travel recovery in Asia–Pacific, and geopolitical tensions, among other factors. 3 “Tourism set to return to pre-pandemic levels in some regions in 2023,” United Nations World Tourism Organization (UNWTO), January 17, 2023. Similarly, the World Travel & Tourism Council (WTTC) forecasts that by the end of 2023, nearly half of the 185 countries in which the organization conducts research will have either recovered to prepandemic levels or be within 95 percent of full recovery. 4 “Global travel and tourism catapults into 2023 says WTTC,” World Travel & Tourism Council (WTTC), April 26, 2023.

Longer-term forecasts also point to optimism for the decade ahead. Travel and tourism GDP is predicted to grow, on average, at 5.8 percent a year between 2022 and 2032, outpacing the growth of the overall economy at an expected 2.7 percent a year. 5 Travel & Tourism economic impact 2022 , WTTC, August 2022.

So, is it all systems go for travel and tourism? Not really. The industry continues to face a prolonged and widespread labor shortage. After losing 62 million travel and tourism jobs in 2020, labor supply and demand remain out of balance. 6 “WTTC research reveals Travel & Tourism’s slow recovery is hitting jobs and growth worldwide,” World Travel & Tourism Council, October 6, 2021. Today, in the European Union, 11 percent of tourism jobs are likely to go unfilled; in the United States, that figure is 7 percent. 7 Travel & Tourism economic impact 2022 : Staff shortages, WTTC, August 2022.

There has been an exodus of tourism staff, particularly from customer-facing roles, to other sectors, and there is no sign that the industry will be able to bring all these people back. 8 Travel & Tourism economic impact 2022 : Staff shortages, WTTC, August 2022. Hotels, restaurants, cruises, airports, and airlines face staff shortages that can translate into operational, reputational, and financial difficulties. If unaddressed, these shortages may constrain the industry’s growth trajectory.

The current labor shortage may have its roots in factors related to the nature of work in the industry. Chronic workplace challenges, coupled with the effects of COVID-19, have culminated in an industry struggling to rebuild its workforce. Generally, tourism-related jobs are largely informal, partly due to high seasonality and weak regulation. And conditions such as excessively long working hours, low wages, a high turnover rate, and a lack of social protection tend to be most pronounced in an informal economy. Additionally, shift work, night work, and temporary or part-time employment are common in tourism.

The industry may need to revisit some fundamentals to build a far more sustainable future: either make the industry more attractive to talent (and put conditions in place to retain staff for longer periods) or improve products, services, and processes so that they complement existing staffing needs or solve existing pain points.

One solution could be to build a workforce with the mix of digital and interpersonal skills needed to keep up with travelers’ fast-changing requirements. The industry could make the most of available technology to provide customers with a digitally enhanced experience, resolve staff shortages, and improve working conditions.

Would you like to learn more about our Travel, Logistics & Infrastructure Practice ?

Complementing concierges with chatbots.

The pace of technological change has redefined customer expectations. Technology-driven services are often at customers’ fingertips, with no queues or waiting times. By contrast, the airport and airline disruption widely reported in the press over the summer of 2022 points to customers not receiving this same level of digital innovation when traveling.

Imagine the following travel experience: it’s 2035 and you start your long-awaited honeymoon to a tropical island. A virtual tour operator and a destination travel specialist booked your trip for you; you connected via videoconference to make your plans. Your itinerary was chosen with the support of generative AI , which analyzed your preferences, recommended personalized travel packages, and made real-time adjustments based on your feedback.

Before leaving home, you check in online and QR code your luggage. You travel to the airport by self-driving cab. After dropping off your luggage at the self-service counter, you pass through security and the biometric check. You access the premier lounge with the QR code on the airline’s loyalty card and help yourself to a glass of wine and a sandwich. After your flight, a prebooked, self-driving cab takes you to the resort. No need to check in—that was completed online ahead of time (including picking your room and making sure that the hotel’s virtual concierge arranged for red roses and a bottle of champagne to be delivered).

While your luggage is brought to the room by a baggage robot, your personal digital concierge presents the honeymoon itinerary with all the requested bookings. For the romantic dinner on the first night, you order your food via the restaurant app on the table and settle the bill likewise. So far, you’ve had very little human interaction. But at dinner, the sommelier chats with you in person about the wine. The next day, your sightseeing is made easier by the hotel app and digital guide—and you don’t get lost! With the aid of holographic technology, the virtual tour guide brings historical figures to life and takes your sightseeing experience to a whole new level. Then, as arranged, a local citizen meets you and takes you to their home to enjoy a local family dinner. The trip is seamless, there are no holdups or snags.

This scenario features less human interaction than a traditional trip—but it flows smoothly due to the underlying technology. The human interactions that do take place are authentic, meaningful, and add a special touch to the experience. This may be a far-fetched example, but the essence of the scenario is clear: use technology to ease typical travel pain points such as queues, misunderstandings, or misinformation, and elevate the quality of human interaction.

Travel with less human interaction may be considered a disruptive idea, as many travelers rely on and enjoy the human connection, the “service with a smile.” This will always be the case, but perhaps the time is right to think about bringing a digital experience into the mix. The industry may not need to depend exclusively on human beings to serve its customers. Perhaps the future of travel is physical, but digitally enhanced (and with a smile!).

Digital solutions are on the rise and can help bridge the labor gap

Digital innovation is improving customer experience across multiple industries. Car-sharing apps have overcome service-counter waiting times and endless paperwork that travelers traditionally had to cope with when renting a car. The same applies to time-consuming hotel check-in, check-out, and payment processes that can annoy weary customers. These pain points can be removed. For instance, in China, the Huazhu Hotels Group installed self-check-in kiosks that enable guests to check in or out in under 30 seconds. 9 “Huazhu Group targets lifestyle market opportunities,” ChinaTravelNews, May 27, 2021.

Technology meets hospitality

In 2019, Alibaba opened its FlyZoo Hotel in Huangzhou, described as a “290-room ultra-modern boutique, where technology meets hospitality.” 1 “Chinese e-commerce giant Alibaba has a hotel run almost entirely by robots that can serve food and fetch toiletries—take a look inside,” Business Insider, October 21, 2019; “FlyZoo Hotel: The hotel of the future or just more technology hype?,” Hotel Technology News, March 2019. The hotel was the first of its kind that instead of relying on traditional check-in and key card processes, allowed guests to manage reservations and make payments entirely from a mobile app, to check-in using self-service kiosks, and enter their rooms using facial-recognition technology.

The hotel is run almost entirely by robots that serve food and fetch toiletries and other sundries as needed. Each guest room has a voice-activated smart assistant to help guests with a variety of tasks, from adjusting the temperature, lights, curtains, and the TV to playing music and answering simple questions about the hotel and surroundings.

The hotel was developed by the company’s online travel platform, Fliggy, in tandem with Alibaba’s AI Labs and Alibaba Cloud technology with the goal of “leveraging cutting-edge tech to help transform the hospitality industry, one that keeps the sector current with the digital era we’re living in,” according to the company.

Adoption of some digitally enhanced services was accelerated during the pandemic in the quest for safer, contactless solutions. During the Winter Olympics in Beijing, a restaurant designed to keep physical contact to a minimum used a track system on the ceiling to deliver meals directly from the kitchen to the table. 10 “This Beijing Winter Games restaurant uses ceiling-based tracks,” Trendhunter, January 26, 2022. Customers around the world have become familiar with restaurants using apps to display menus, take orders, and accept payment, as well as hotels using robots to deliver luggage and room service (see sidebar “Technology meets hospitality”). Similarly, theme parks, cinemas, stadiums, and concert halls are deploying digital solutions such as facial recognition to optimize entrance control. Shanghai Disneyland, for example, offers annual pass holders the option to choose facial recognition to facilitate park entry. 11 “Facial recognition park entry,” Shanghai Disney Resort website.

Automation and digitization can also free up staff from attending to repetitive functions that could be handled more efficiently via an app and instead reserve the human touch for roles where staff can add the most value. For instance, technology can help customer-facing staff to provide a more personalized service. By accessing data analytics, frontline staff can have guests’ details and preferences at their fingertips. A trainee can become an experienced concierge in a short time, with the help of technology.

Apps and in-room tech: Unused market potential

According to Skift Research calculations, total revenue generated by guest apps and in-room technology in 2019 was approximately $293 million, including proprietary apps by hotel brands as well as third-party vendors. 1 “Hotel tech benchmark: Guest-facing technology 2022,” Skift Research, November 2022. The relatively low market penetration rate of this kind of tech points to around $2.4 billion in untapped revenue potential (exhibit).

Even though guest-facing technology is available—the kind that can facilitate contactless interactions and offer travelers convenience and personalized service—the industry is only beginning to explore its potential. A report by Skift Research shows that the hotel industry, in particular, has not tapped into tech’s potential. Only 11 percent of hotels and 25 percent of hotel rooms worldwide are supported by a hotel app or use in-room technology, and only 3 percent of hotels offer keyless entry. 12 “Hotel tech benchmark: Guest-facing technology 2022,” Skift Research, November 2022. Of the five types of technology examined (guest apps and in-room tech; virtual concierge; guest messaging and chatbots; digital check-in and kiosks; and keyless entry), all have relatively low market-penetration rates (see sidebar “Apps and in-room tech: Unused market potential”).

While apps, digitization, and new technology may be the answer to offering better customer experience, there is also the possibility that tourism may face competition from technological advances, particularly virtual experiences. Museums, attractions, and historical sites can be made interactive and, in some cases, more lifelike, through AR/VR technology that can enhance the physical travel experience by reconstructing historical places or events.

Up until now, tourism, arguably, was one of a few sectors that could not easily be replaced by tech. It was not possible to replicate the physical experience of traveling to another place. With the emerging metaverse , this might change. Travelers could potentially enjoy an event or experience from their sofa without any logistical snags, and without the commitment to traveling to another country for any length of time. For example, Google offers virtual tours of the Pyramids of Meroë in Sudan via an immersive online experience available in a range of languages. 13 Mariam Khaled Dabboussi, “Step into the Meroë pyramids with Google,” Google, May 17, 2022. And a crypto banking group, The BCB Group, has created a metaverse city that includes representations of some of the most visited destinations in the world, such as the Great Wall of China and the Statue of Liberty. According to BCB, the total cost of flights, transfers, and entry for all these landmarks would come to $7,600—while a virtual trip would cost just over $2. 14 “What impact can the Metaverse have on the travel industry?,” Middle East Economy, July 29, 2022.

The metaverse holds potential for business travel, too—the meeting, incentives, conferences, and exhibitions (MICE) sector in particular. Participants could take part in activities in the same immersive space while connecting from anywhere, dramatically reducing travel, venue, catering, and other costs. 15 “ Tourism in the metaverse: Can travel go virtual? ,” McKinsey, May 4, 2023.

The allure and convenience of such digital experiences make offering seamless, customer-centric travel and tourism in the real world all the more pressing.

Three innovations to solve hotel staffing shortages

Is the future contactless.

Given the advances in technology, and the many digital innovations and applications that already exist, there is potential for businesses across the travel and tourism spectrum to cope with labor shortages while improving customer experience. Process automation and digitization can also add to process efficiency. Taken together, a combination of outsourcing, remote work, and digital solutions can help to retain existing staff and reduce dependency on roles that employers are struggling to fill (exhibit).

Depending on the customer service approach and direct contact need, we estimate that the travel and tourism industry would be able to cope with a structural labor shortage of around 10 to 15 percent in the long run by operating more flexibly and increasing digital and automated efficiency—while offering the remaining staff an improved total work package.

Outsourcing and remote work could also help resolve the labor shortage

While COVID-19 pushed organizations in a wide variety of sectors to embrace remote work, there are many hospitality roles that rely on direct physical services that cannot be performed remotely, such as laundry, cleaning, maintenance, and facility management. If faced with staff shortages, these roles could be outsourced to third-party professional service providers, and existing staff could be reskilled to take up new positions.

In McKinsey’s experience, the total service cost of this type of work in a typical hotel can make up 10 percent of total operating costs. Most often, these roles are not guest facing. A professional and digital-based solution might become an integrated part of a third-party service for hotels looking to outsource this type of work.

One of the lessons learned in the aftermath of COVID-19 is that many tourism employees moved to similar positions in other sectors because they were disillusioned by working conditions in the industry . Specialist multisector companies have been able to shuffle their staff away from tourism to other sectors that offer steady employment or more regular working hours compared with the long hours and seasonal nature of work in tourism.

The remaining travel and tourism staff may be looking for more flexibility or the option to work from home. This can be an effective solution for retaining employees. For example, a travel agent with specific destination expertise could work from home or be consulted on an needs basis.

In instances where remote work or outsourcing is not viable, there are other solutions that the hospitality industry can explore to improve operational effectiveness as well as employee satisfaction. A more agile staffing model can better match available labor with peaks and troughs in daily, or even hourly, demand. This could involve combining similar roles or cross-training staff so that they can switch roles. Redesigned roles could potentially improve employee satisfaction by empowering staff to explore new career paths within the hotel’s operations. Combined roles build skills across disciplines—for example, supporting a housekeeper to train and become proficient in other maintenance areas, or a front-desk associate to build managerial skills.

Where management or ownership is shared across properties, roles could be staffed to cover a network of sites, rather than individual hotels. By applying a combination of these approaches, hotels could reduce the number of staff hours needed to keep operations running at the same standard. 16 “ Three innovations to solve hotel staffing shortages ,” McKinsey, April 3, 2023.

Taken together, operational adjustments combined with greater use of technology could provide the tourism industry with a way of overcoming staffing challenges and giving customers the seamless digitally enhanced experiences they expect in other aspects of daily life.

In an industry facing a labor shortage, there are opportunities for tech innovations that can help travel and tourism businesses do more with less, while ensuring that remaining staff are engaged and motivated to stay in the industry. For travelers, this could mean fewer friendly faces, but more meaningful experiences and interactions.

Urs Binggeli is a senior expert in McKinsey’s Zurich office, Zi Chen is a capabilities and insights specialist in the Shanghai office, Steffen Köpke is a capabilities and insights expert in the Düsseldorf office, and Jackey Yu is a partner in the Hong Kong office.

Explore a career with us

- Regular article

- Open access

- Published: 18 July 2022

Measuring sustainable tourism with online platform data

- Felix J. Hoffmann 1 ,

- Fabian Braesemann ORCID: orcid.org/0000-0002-7671-1920 2 , 3 &

- Timm Teubner ORCID: orcid.org/0000-0002-5927-3770 1

EPJ Data Science volume 11 , Article number: 41 ( 2022 ) Cite this article

6045 Accesses

9 Citations

9 Altmetric

Metrics details

Sustainability in tourism is a topic of global relevance, finding multiple mentions in the United Nations Sustainable Development Goals. The complex task of balancing tourism’s economic, environmental, and social effects requires detailed and up-to-date data. This paper investigates whether online platform data can be employed as an alternative data source in sustainable tourism statistics. Using a web-scraped dataset from a large online tourism platform, a sustainability label for accommodations can be predicted reasonably well with machine learning techniques. The algorithmic prediction of accommodations’ sustainability using online data can provide a cost-effective and accurate measure that allows to track developments of tourism sustainability across the globe with high spatial and temporal granularity.

1 Introduction

The tourism industry is of tremendous economic relevance, accounting for an estimated 10% of global GDP in the years before the Covid-19 pandemic [ 1 ]. Though strongly affected by restrictions and other uncertainties in international travel, the sector is expected to resume growth and fully recover throughout the coming years [ 2 ]. Tourism is also of high importance for economic development, which is underlined by its inclusion in the United Nations’ Sustainable Development Goals (SDGs), where it is directly mentioned in three of the 17 goals [ 3 ]. Between 2008 and 2018, the relative importance of tourism for the respective country’s GDP increased in 43 out of 70 countries that report to the UN [ 4 ]. At the same time, it has been criticized to have adverse environmental and social effects [ 5 ], causing 8% of the global carbon emissions in 2013 [ 6 ]. To balance the economic, environmental, and social impacts of tourism, the relevance of sustainable tourism becomes evident [ 7 ]. In order to monitor and manage tourism in view of sustainability, granular and accurate spatio-temporal data is needed. There is a growing number of indicator frameworks for the tourism sector that aim to measure sustainability, with the majority of successfully implemented projects focusing on the European market. Current data collection methods, however, are often costly and yield piecemeal results. Ideally, improvements would allow for a cost-efficient implementation in both high income and developing countries, where tourism is growing faster than in more mature markets [ 8 ]. In the past, data collection could often be improved by means of tapping into alternative data sources. Examples include the assessment of the digital gender gap based on social network data or the assessment of poverty using mobile phone records [ 9 , 10 ]. Besides lowering the cost of data collection, such approaches allow for the calculation of indicators in near real-time, rather than relying on year-long cycles.

The present paper expands on such approaches by exploring the feasibility of using online platform data to assess the sustainability of tourism throughout Europe. Specifically, we pose the following research question:

Research Question : Can statistical learning techniques using data from an online tourism platform predict tourist accommodations as sustainable, as indicated by a sustainability label?

We use a machine learning approach on online platform data alone to answer the research question. Thus, our study is different from others that discuss rule-based classification systems used by traditional sustainability labels. These labels require detailed information about waste, water use, and other factors to determine an accommodations’ level of sustainability. While highly accurate and true to the causal relationships of sustainability, the corresponding data collection procedures are expensive and not feasible quickly at scale. The classifiers introduced below rely on correlated but not necessarily causal factors. They can hence not fully replace the physical measurement of factors determining sustainability. Instead, the models’ wide applicability and low cost of calculation can serve to complement existing labels, allow for nowcasting of sustainability indicators, and increase the geographical coverage of such indicators.

The analysis is based on a unique dataset of TripAdvisor.com accommodations and the platform’s GreenLeader award. We contribute to the literature in two ways. First, we identify and outline systematic differences between award-holding and non-holding accommodations using public platform data. Secondly, making use of supervised machine learning techniques, we identify sustainable accommodations with reasonable accuracy also in regions that have not implemented the platform’s GreenLeader award. In doing so, we show that large-scale monitoring of sustainable tourism using online platform data in near real-time is feasible. The approach presented here provides a cost-effective and accurate measure with high spatial and temporal granularity, which could be rolled out to track sustainable tourism across the globe.

The remainder of the paper is structured as follows. Section 2 provides an overview of related work and past projects making use of alternative data sources for development statistics in general, and for the assessment of sustainable tourism in particular. Following this, Sect. 3 introduces our methodology, the data set, as well as criteria for model evaluation. Next, Sect. 4 presents our results. In Sect. 5 , we then discuss our findings in view of practical and theoretical implications and conclude the paper with limitations and suggestions for further research.

2 Background and related work

2.1 measuring sustainability in tourism.

The majority of current sustainability practices in tourism result from regulation and economic incentives rather than intrinsic motivation [ 11 ]. Accordingly, policy makers need to define and monitor sustainability in tourism to achieve change. A number of frameworks aim to supply this information by means of indicators (which represent a core element of development research and a central pillar of the SDGs). Next to the UN’s SDGs, tourism-specific indicators were devised by, among others, the World Tourism Organization (UNWTO), Footnote 1 the Global Sustainable Tourism Council (GSTC), Footnote 2 the European Commission, Footnote 3 and the European Environmental Agency (EEA). Footnote 4 Tourism finds direct mention in Goal 8 (‘Decent work and economic growth’), Goal 12 (‘Responsible consumption and production’), and Goal 14 (‘Life below water’) [ 3 ]. Note that the use of indicators for the measurement of sustainability in tourism dates back almost three decades, when the World Tourism Organization began to promote their use for policy-making and destination management [ 12 ]. Today, the Global Sustainable Tourism Council sets a widely used and accepted standard for sustainability of private companies in tourism based on performance indicators [ 13 ]. Moreover, the European Commission first published its ‘European Tourism Indicator System’ (ETIS) in 2013 (with several revisions in the subsequent years). Building on 27 core and 40 optional indicators, ETIS provides the most detailed approach to measure sustainable tourism [ 14 ]. At the same time, the EEA has developed a ‘Tourism and Environment Reporting Mechanism’ (TOUERM), monitoring the environmental impact of tourism similar to other industries. Note that the nine TOUERM indicators are similar/overlapping with those of the ETIS framework.

2.2 Sustainability labels

While the aforementioned indicators are mostly geared towards policy making, sustainability labels also serve as a source of information for consumers. Naturally, these labels can also be used to gather information about the state of sustainability in a region or country. Sustainability labels are deemed a suitable means to facilitate ecological progress, especially with regard to clean water and energy, sustainable consumption, and climate protection [ 11 ]. Consequently, such labels are considered both by the ETIS and TOUERM frameworks. ETIS indicator A.2.1 can thus be used to gather information relevant for policymakers while relying on third parties’ assessments. It is important to note that there is great variety of sustainability labels, oftentimes leaving consumers left to wonder about their exact meaning, the applied standards, as well as their credibility in view of control mechanisms and enforcement [ 15 ].

Beyond institutional labels such as the EU Ecolabel (introduced by the European Commission to highlight low waste, energy efficiency and other sustainability factors [ 16 ], online platforms have introduced indicative labels as well. TripAdvisor’s GreenLeader award, for instance, was introduced in the US in 2013 and has been consistently expanded to other countries. Touristic accommodations interested in the award can apply through a questionnaire and must fulfil several standards to become a ‘GreenLeader’. These standards include, among others, towel re-use, recycling, and green roofing [ 17 ]. While institutional labels inherit credibility from the sponsoring institution, it is worth taking a closer look at the GreenLeader scheme: The award was devised in cooperation with the UN Environment Programme and has been critically acclaimed. The German Consumer Association highlights its high standards, independence, and transparency. The potential for widespread application stemming from TripAdvisor’s global presence makes the label a useful point of reference. Award-holding listings are decorated with a visual label on TripAdvisor, incentivising accommodations to apply [ 18 ].

2.3 Problems of sustainable tourism indicators

The compilation of indicators for sustainable tourism comes with several difficulties, as outlined in the European Tourism Indicator System (ETIS). While some of the data used in the ETIS is readily available from national statistics offices, it is complemented by additional data from surveys and other sources. Rasoolimanesh et al. (2020), for example, reviewed and assessed 97 academic studies on sustainable tourism in terms of relevance for the SDGs, related governance, stakeholders, and the subjectivity of the indicators [ 7 ]. Governance-related indicators were found in less than a quarter of all studies, stressing the importance of strong institutions to push evidence-based decision making. Another identified problem is access to and accuracy of data, which play an important role for implementing robust and evidence-based indicators. The European Commission is aware of the time and cost intensity of this approach and suggests not to collect annual data for all indicators, but rather to rely on three-year cycles [ 14 ].

Moreover, data reliability is an issue. Modica et al. (2018) asses the initial implementation of the ETIS in the Sardinian region of Cagliari and found that up to 52% of indicator data was missing [ 19 ]. Such issues and questions regarding definitions and measurability have, for example, led to the abandonment of indicator 8.9.2 (‘Proportion of jobs in sustainable tourism out of total tourism jobs’) from the Sustainable Development Goals framework [ 20 ]. These issues in data collection exist despite high-quality census data and experienced institutions and researchers in the OECD countries. Moreover, there are only few studies on sustainable tourism indicators outside Europe and North America [ 7 ]. This means that the data gap on sustainable tourism is increasing, as tourism industries in the Middle East, North Africa, South Asia, and South-East Asia are growing faster than those in Europe and North America [ 2 ]. Scholars in development studies suggest yearly or even quarterly reporting of data instead of relying on multiple-year resolution [ 21 ]. With traditional methods of data collection, however, this goal seems unattainable.

2.4 Sustainable tourism indicators and online data

To overcome such limitations, online data, which is often created as a byproduct of digital business operations, may complement existing data sources. For example, search engines’ primary function is not the accumulation of popular search terms and their development over time, but this byproduct offers valuable insights for areas such as disease control [ 22 , 23 ], unemployment statistics [ 24 , 25 ], or sales forecasting [ 26 ].

Through utilizing the above-mentioned strengths and under careful consideration of the associated risks, the use of big data from online sources can increase the quality of existing development evaluations and allow for assessing previously unmeasured outcomes [ 27 ]. To better understand how different research approaches aim to achieve this goal, an overview of research facilitating methods of online data collection and analysis in tourism research and related phenomena is presented in Table 1 .

For example, GPS trackers and mobile phone applications can be employed to identify patterns of tourist movements in great detail. In combination with app data, Buning and Lulla (2020) were able to differentiate rental bike use between local users and tourists [ 28 ]. Furthermore, segments of tourists that are likely to use specific trails and visit at peak times could be identified via matching app-generated location and demographic survey data [ 29 ]. Big data can also help for improved touristic capacity management. For instance, tourist flights, overnight stays, and sightseeing crowds can be analyzed and forecasted using big data. This also holds for air passenger demand based on flight price search/comparison websites [ 30 ], as well as for the nights spent at certain destinations by tourists with high spatial resolution [ 31 ]. Using booking and travel platform data, the density of touristic stays could be estimated for the area of the European Union and Great Britain [ 32 ]. Similarly, the number of Airbnb offers per tract in the United States could be calculated [ 33 ]. At the level of single touristic sights, visitor flows to World Heritage sites were successfully estimated using Instagram posts [ 34 ]. Focusing on the quality of businesses, geographic clusters of similarly rated restaurants and bars were determined using Yelp review data [ 35 ].

Furthermore, text sources such as online customer reviews offer the possibility to analyze tourists’ concerns and preferences in real-time. For example, attributes that are important to environmentally aware tourists have been identified using text mining techniques on Airbnb comments [ 36 ]. The presence and depth of environmental discourses can be assessed based on booking and travel platform data [ 37 ]. TripAdvisor comments, in particular, have been used to understand sustainable practices introduced by accommodations [ 38 ]. Twitter data has been used to assess the attractiveness of popular touristic sites [ 39 ]. Advanced analytics can also be applied to traditional data sources, for instance, to assess a destination’s potential for ecotourism using artificial neural networks [ 40 ].

In addition, online data has found application in the measurement and nowcasting of several other phenomena. For example, Twitter data has been used to assess damages after earthquakes [ 41 ]. The estimated size of Facebook ad audiences was used to calculate a wealth index at high spatial granularity [ 42 ]. Professional social network data was used to estimate gender gaps within industries and seniority levels [ 43 ]. Lastly, the effect of the Covid-19 pandemic on the property sector was estimated using property listing website data [ 44 ].

3 Methodology

Having reviewed the literature on approaches to measure sustainable tourism, we now introduce the methodology used for the algorithmic identification of GreenLeader accommodations based on publicly displayed data from TripAdvisor.

After establishing the methodological steps of the analysis in the following paragraphs, we investigate the research question whether statistical learning algorithms are able to reveal systematic differences between online profiles of sustainable and non-sustainable accommodations that allow for predicting the existence of a sustainability label.

3.1 Data collection

Data collection took place in November and December of 2020 via web-scraping. For each of the countries included in the analysis, links to all cities with TripAdvisor listings were extracted from the starting page. To obtain direct links to all listings, the algorithm looped through the city URLs and searched for hotel listings in each city. Using this approach, we collected a total of 260,348 individual accommodation listings from 37 European countries. These include all 27 EU member states as well as England, Northern Ireland, Scotland, Wales, Iceland, Liechtenstein, Monaco, Norway, San Marino, and Switzerland.

TripAdvisor provides a broad range of information about accommodations. There are three main sources of data: Page owners (i. e., the accommodation’s operators), consumers, and other/external websites. Next to basic information such as an accommodation’s name and location, page owners can detail their hotel’s size and class, provide contact information, and publish room features and property amenities. Consumers can rate the accommodation on several quality metrics and give an overall rating. They can further provide written reviews, comments, questions, tips, or upload photos. TripAdvisor supplements this information in two ways. First, the website incorporates information from other webpages (e. g., average prices from other websites such as Booking.com and Opodo ). The platform further calculates a score for the accommodation’s location in the city and counts the number of close-by restaurants and attractions using geographic data from Google. Secondly, TripAdvisor accumulates and publishes background data of commentators such as their chosen language as well as trip times and durations. In addition, the website uses customer feedback to create an accommodation ranking within each city.

From the individual listings’ web pages, we collected a total of 102 features, covering five categories of data: the hotel description, its class and ratings (a), prices and information about the size (b), scores calculated by TripAdvisor about the hotel and its location (c), measures of customer interaction (d), and hotel amenities (e).

These features comprise all readily available numeric variables of a listing as well as its binary and ordinal labels. Of the collected information, 15 features relate to hotel description and ratings (a), six variables inform about price segment and hotel size (b), three features relate to location (c). In addition, customer interaction (d) is included through 16 variables for text and image interactions (reviews, uploaded photos). Please note that these variables refer to the amount of user interaction (i. e. number of photos uploaded, number of reviews). The content of photos or reviews is not analyzed. Finally, 62 features inform about the availability of specific amenities and hotel features (e). A detailed summary and description of all variables is provided in Additional file 1 sections I and II.

After splitting the dataset into observations stemming from countries using the TripAdvisor GreenLeader award and those without, 215,806 labelled listings remain available for classifier training. Of these observations, almost 30% have complete information about all variables of interest; 70% have at least one missing value. The variables with most missing values are hotel class (49% missing), TripAdvisor-generated location scores (34% missing) and the number of available rooms (26% missing). The amount of missing data for these variables is critically large – imputation of missing data is not possible here. To make sure not to introduce any bias due to imputation, we therefore exclude all observations with missing values. This leaves 65,515 complete and labelled observations for model training. Comparisons between the full data set (including missing values) and the final data set are provided in Additional file 1 section III. Furthermore, we excluded four observations that contained erroneous records on the number of rooms available (for details, see Additional file 1 section IV).

3.2 Data processing

We undertook several steps of data pre-processing before further analysis. Some variables had to be transformed to deal with skewness. This allowed for the selection and final application of transformations offering the greatest improvement in classifier performance. As dependent variable, we focus on the TripAdvisor GreenLeader Award as a (binary) proxy for an accommodation’s sustainability. A detailed account of all variables’ distributions is provided in Additional file 1 section V.

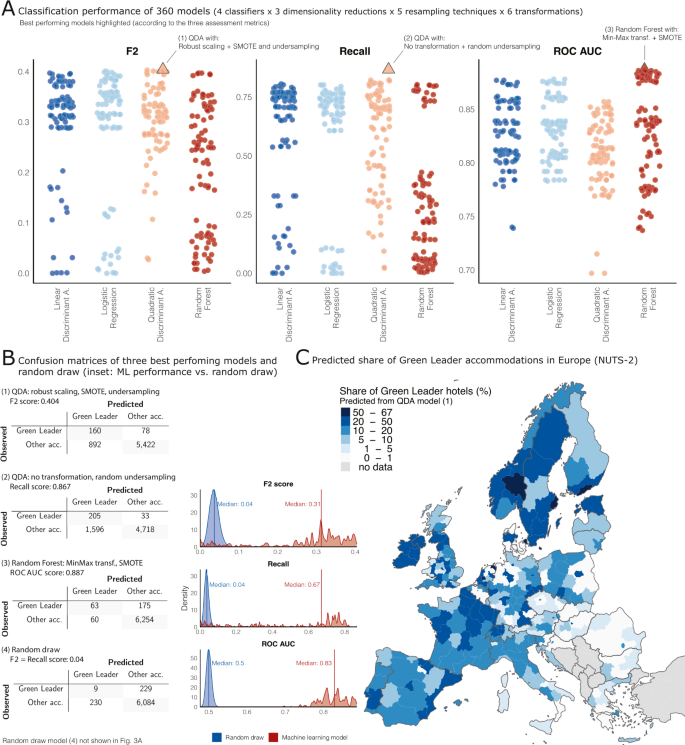

3.3 Classification

As the next step, we set out to distinguish sustainable and non-sustainable accommodations. To do so, we employ a grid search of preparatory methods and algorithms to find the models with best predictive performance. In total, we ran 360 models based on 3 dimensionality reduction techniques × 5 resampling approaches × 6 data transformations × 4 classifiers. The models are evaluated using three metrics suitable for imbalanced classification tasks. In the following, the components of the analyzed modelling processes and the applied classification metrics are listed. This allows for an understanding of the grid of methods used. A more detailed overview of the pre-processing techniques used in the grid search is provided in Additional file 1 section VI.

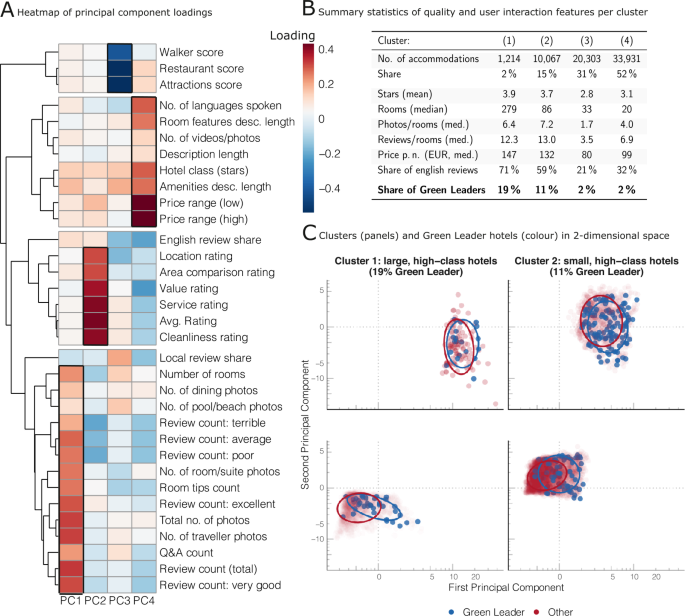

Dimensionality reduction (i. e. principal component analysis) of the input data enables the chosen classifiers to work more efficiently and avoids issues of excess dimensionality. Three options are compared in the grid search: Use of the full dataset, use of the first four, and use of the first eight principal components created from all variables.

Moreover, resampling alleviates issues related to imbalanced data by altering the training dataset to have a more equal distribution of labels. The grid search compares modelling processes without resampling with processes using one of four resampling strategies. These are random oversampling, random undersampling, and S ynthetic M inority O versampling TE chnique ( SMOTE ), as well as the combination of SMOTE and undersampling.

Additionally, the grid search considered six types of data transformation to adjust the distribution of the input data. The use of the original data is compared to three straightforward (normalization, standardization and robust scaling) and two distribution-dependent transformations (Yeo-Johnson and Box-Cox).

Finally, four classifiers are compared across the grid: Logistic Regression, Linear Discriminant Analysis, Quadratic Discriminant Analysis, and the Random Forest. More details on the classifiers are provided in Additional file 1 section VII.

The metrics used to compare the modelling processes pay special attention to the imbalanced distribution of class labels. In particular, standard accuracy is not a viable metric in this case since a useless model predicting the majority class label for all observations would score highly (with accuracy equalling the proportion of majority class observations in the data, in our case 96%). Thus, the final metrics chosen for comparison are recall, the F2-measure, and the R eceiver O perating C haracteristic A rea U nder C urve ( ROC AUC ). This choice of metrics reflects the importance of recognizing sustainable accommodations despite the comparatively few available cases in the dataset. All metrics are calculated using tenfold cross-validation.

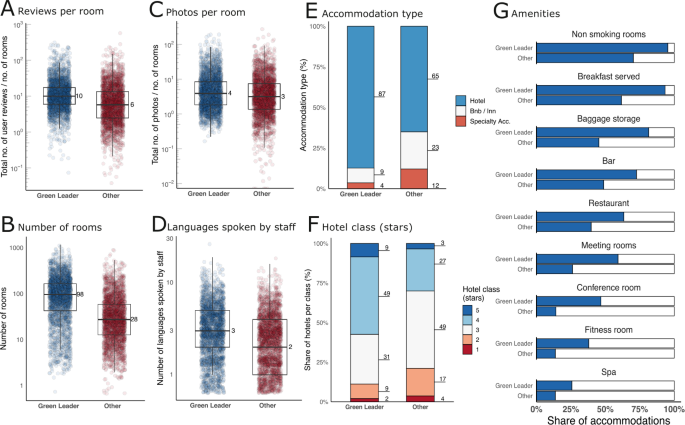

The TripAdvisor GreenLeader label is awarded to accommodations that fulfil requirements regarding specific sustainability practices. These accommodations make up 4% of all listings in the sample. Clear standards and thorough checks of the accommodations’ claims make the award a reliable source of information. As a first step of our analysis, we compare the relevant variables conditional on the accommodations’ award status (Additional file 1 section VIII). In the following, we highlight several key findings of this analysis.

4.1 Descriptive statistics