Japanese Yen card

Travelling from the UK to Japan? Spend effortlessly (JPY) with a multi-currency card.

40+ million worldwide customers use Revolut

Revolut offers so much more than a travel card. Exchange currencies, send money abroad, and hold 36 local currencies in-app. These are just some reasons why our customers rely on us for their travel spending.

How does a Japanese Yen card work?

How to get your JPY card

Get your Japanese Yen card in 3 steps

Get revolut.

Join 40+ million people worldwide saving when they spend abroad with Revolut.

Order your card

Order your free Japanese Yen card. Top up your balance in GBP or 36 other currencies.

Spend like a local

Start spending .

Currency exchange fees subject to fair-usage limits and weekend markups. Currency exchange shown is only an indicative example.

Why should I get a Japanese Yen card?

Where is the Japanese Yen card available?

Spend confidently with a Japanese Yen card

How to save money when spending

Tips for saving money in Japan

Don't exchange at airports or at home.

No need to exchange cash before you travel — use your travel money card to spend or withdraw money from an ATM.

Choose JPY as the local currency

Choose the local currency when spending with your card in shops and restaurants.

Save with a travel money card

Spend in Japanese Yen like a local with Revolut.

How to avoid unwanted ATM fees

Need to make JPY withdrawals in Japan?

Fee-free Japanese Yen ATM withdrawals

Fee-free atm withdrawals up to £200, fee-free atm withdrawals up to £400, fee-free atm withdrawals up to £800.

ATM withdrawals are subject to fair-usage fees depending on plan. Currency exchange fees may apply.

What are you waiting for?

Save when you travel with a JPY travel card

Rating as of 24 Apr 2024

702K Reviews

2.8M Reviews

Need a little more help?

Japanese Yen currency card FAQs

Is it better to use a travel money card rather than cash in japan.

There is no 'best' way to spend , but here are some tips to help you save money:

- Don’t exchange cash at the airport. It’s much cheaper to withdraw money from an ATM with your Japanese Yen card.

- Don't carry more cash than you need. When you return home to the UK, you’ll have to re-convert this cash back to GBP.

- Always choose JPY as the local currency when spending with your card in shops and restaurants.

- Download the Revolut app, then sign up to get instant notifications on what you spend and manage your balance.

Are travel money cards safe and secure?

Where can i use my jpy travel money card, how much can i pay using my japanese yen card.

There is no limit to the amount that you can spend using your Japanese Yen card. Just top up in-app with however much you want and enjoy your travels.

How can I avoid unwanted ATM fees in Japan?

There are tonnes of benefits to a Japanese Yen card. Let’s look at a few:

- Send and spend and 150+ other currencies.

- No need to exchange or carry cash. Pay with your Japanese Yen card, either contactless or with chip and PIN.

- No need to wait for your physical card to arrive. Instantly add your card to Google Pay or Apple Pay.

- Create single-use virtual cards for safe online shopping or travel bookings.

- Enjoy fee-free ATM withdrawals between £200 and £2,000 monthly, depending on your plan.

- Get instant payment notifications to keep track of how much you spend.

- Stay in control of your card’s security, with card freezing and spending limit controls.

- Easily manage your spending around the world with the free Revolut app.

How do I get a Japanese Yen travel money card?

To order your Revolut debit card and start spending , simply:

- Download the Revolut app on your Android or iPhone and sign up for free.

- Order your free Japanese Yen card. Top up your balance in GBP or 150+ other currencies.

- Get your card in the post or add it to Google Pay or Apple Pay to use it immediately.

- Start spending like a local .

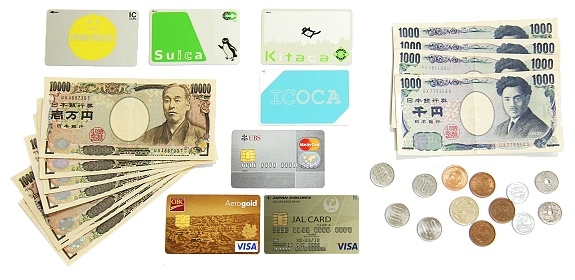

Spend over $4,000 on Travelex Money Card and enter code TMC120 at the checkout to get $120 OFF - T&C apply

A Travel Card for Japan

Experience stress-free travels in Japan with Travelex’s award-winning Travel Money Card. Use the card everywhere throughout Japan where Mastercard is accepted.

The Travelex Travel Money Card can also be used to withdraw JPY cash from thousands of ATMs in Japan wihout paying any international ATM fees 1 .

Easily top-up on the go via the App or online .

Travel Money Card for Japan

The Travelex Money Card allows you to buy, store, and move money in multiple currencies so that you can safely make purchases during your travels overseas. There’s usually no need to pay international ATM fees, an initial card fee, or a cash advance fee when withdrawing cash with the Travelex Travel Money Card.

Gone are the days of the cash society and exchanging currency in advance; the Travelex Travel Money Card makes storing and transferring money to make purchases in foreign currencies quick and easy. With Travelex Travel Money Card, you can also check currencies in real-time and enjoy a prevailing exchange rate when purchasing currencies.

More on Japan from our Travelex Hub Blog

Features and benefits.

UNLIMITED FREE overseas ATM withdrawals 1

Highly competitive exchange rates

NO fees when you buy online $0 Currency conversion fee ^

24/7 Global Assistance

Convenient Mobile App Download it here

Shop at millions of outlets wherever Mastercard is accepted and on international websites with the local currency

Buy online, collect in-store or get it delivered to your home (allow up to 7 days from when payment is received)

5 ☆ outstanding value award winning travel money card

Exclusive offers with Mastercard Priceless TM Cities

No account or membership required

How our Travel Card Works

Order your travel card.

Order your Travelex Money Card online or in-store (passport or driver's license required)

Get your travel card

Collect from a Travelex store or delivered FREE to your home (allow up to 7 days from when payment is received)

Download the App

Download the app from the Google Play and Apple App stores

Register for My Account

Simply activate your card by registering your account via the app or online

Manage and check your balance online and on your mobile

Exchange leftover currency

After your trip, exchange leftover money for another currency, transfer into your bank account or withdraw in-store or at an ATM.

Download the Travelex Travel Money App

Convenience on the go

- Top up your Travelex Money Card

- Check your balance

- Quick touch log in

The app requires Android 5.0 and up or iOS 10.0 or later. Compatible with iPhone, iPad and iPod touch.

Fees and Limits

NO fees online $0 Currency conversion fee ^

Withdraw daily up to AU$3,000 (or currency equivalent)

Maximum Card limit of AU$50,000

Free initial and replacement card

The following fees and limits apply. Fees and limits are subject to variation in accordance with the Terms and Conditions. Unless otherwise specified, all fees will be debited in AU$ Currency

If there are insufficient funds in AU$ Currency to pay such fees, then we will automatically deduct funds from other Currencies in the following order of priority: AU$, US$, EU€, GB£, NZ$, THB, CA$, HK$, JP¥, SG$.

• Online: FREE via travelex.com.au or the Travelex Money App • In-Store: FREE for loads of foreign currency (loads of Australian dollars (AUD) incur a fee of 1.1% of the amount or $15 whichever is greater).

• Online: FREE via travelex.com.au or the Travelex Money App • In-Store: FREE for top-ups of foreign currency (top-ups of AUD incur a fee of 1.1% of the amount or $15 whichever is greater). • BPAY: Top-ups not made via travelex.com.au or the Travelex Money App incur a fee of 1% of the amount. - MasterCard Biller Code: 184416 - Reference No: your 16 digit Travelex Money Card number - Funds will be allocated to your default currency. To check your default currency login to your account.

FREE (note: Some ATM operators may charge their own fees or set their own limits)

- Charged at the start of each month if you have not made any transactions on the card in the previous 12 months

- Unless your card is used again, or reloaded, this fee applies each month until the card is closed or the remaining card balance is less than the inactivity fee.

AU$4.00 per month

- Charged when you close your card or withdraw from your Card Fund. This fee is set and charged by Mastercard Prepaid.

- This is applied when you move your funds from one currency to another currency.

At the then applicable retail foreign exchange rate determined by us. We will notify you of the rate that will apply at the time you allocate your funds from one currency to another.

- Applied when a purchase or ATM withdrawal is conducted in a currency either not loaded or sufficient to complete the transaction and the cost is allocated against the currency/ies used to fund the transaction.

FREE* *The Spend Rate will apply to foreign exchange transactions in accordance with the Terms and Conditions.

AU$350 or currency equivalent AU$100 or currency equivalent

AU$50 or currency equivalent

The maximum amount you can load on the card at the time of the initial online purchase is AU$5,000 equivalent.

to a maximum of $10,050 per single top-up; and to a maximum of $10,050 top-up value over 24hrs; and to a maximum of $20,000 top-up value over 21 days.

AU$3,000 or currency equivalent

AU$15,000 or currency equivalent

Other Important Information

Please read the following information about your Travelex Money Card carefully:

- Your Travelex Money Card does not generate any interest or any other similar return. You do not earn interest on the amount standing to the credit of the Travelex Money Card Fund accessed by the card.

- Although the issuer of the card is an authorised deposit-taking institution in Australia, the Card is not a deposit account with the Issuer.

Important Information about Fees & Limits for loads/top ups made online:

- If you are making a purchase or topping up the Card online via www.travelex.com.au (i) the initial load and top up fee may differ to (but not be greater than) those contained in the “Fees and Limits Table” of this Product Disclosure Statement; and (ii) the limits may differ to those contained in the “Fees and Limits Table” of this Product Disclosure Statement. Travelex may also charge a card surcharge if you pay with a credit or debit card. Please refer to the relevant online terms and conditions available at www.travelex.com.au for details of the applicable fees and limits.

- AU$ cannot be loaded or topped up onto a card online via www.travelex.com.au

Terms & Conditions

Travelex travel card currency information, travel card faq links.

Getting Started

Using the Card

Topping up the Card

Travelex Money Card FAQ

You can only hold one card in your name at any one time.

An Additional Emergency card is a replacement card as a back-up only which you must only use if your primary card is damaged, lost, misused or stolen. An Additional Emergency card can only be purchased at the time of purchasing the Travelex Money Card. It cannot be added to your account at a later date.

Top-up via the Travelex website

Note that you must use your unique reference number when paying or the transfer may be delayed.

Top-up via the Travelex Money App

Move currencies on your card, instantly.

If you have AUD (or any other currency) already loaded on the card, you can move your funds to another currency within the Travelex Money App. Instant top-up!

Top-up in a Travelex store

Direct top-up via bpay:.

Top-ups not made via travelex.com.au or the Travelex Money App incur a fee of 1% of the amount. You must make payment using your own account.

MasterCard Biller Code: 184416 Reference No: your 16 digit Travelex Money Card number

Funds will be allocated to your default currency. To check your default currency login to your account. Top ups will generally take two business days to be processed however may take longer if the payment is not made before 2pm on a business day Australian Eastern Standard Time.

- Locking in fixed foreign currency exchange rates and avoiding foreign transaction fees before you travel

- The ability to load multiple currencies onto one card, similar to a travel debit card

- The ability to spend money conveniently and comfortably overseas

- No overseas ATM withdrawal fees

- No fees when making online purchases

- Travel money cards can be ordered online and collected in store next day.

- Just walk in store. Cards purchased and loaded in-store are active and ready-to-use on the spot. We will automatically transfer funds between currencies complete your card transactions.

- Home delivery within 5-7 business days.

Most common questions

An Additional Emergency card is a replacement card as back-up only which you must only use if your primary card is damaged, lost, misused or stolen. An Additional Emergency card can only be purchased at the time of purchasing the Travelex Money Card. It cannot be added to your account at a later date.

If you’re visiting Japan, a travel money card can be a convenient and affordable way to access your money. The best travel money card for Japan should help you save money with favourable exchange rates and no hidden fees. For example, a Travelex Money Card has unlimited free overseas ATM withdrawals, so you can make purchases in Japanese yen for less.

Yes, travel money cards come with a host of advantages that can save you money when travelling. These include the ability to load multiple currencies at a fixed and competitive exchange rate, and the capability to make purchases in-store, online, and at ATMs worldwide with no overseas ATM or withdrawal fees.

The best travel money card for Australians is the one that caters to the currencies available at your destination, removes ATM withdrawal and foreign purchase fees, and has the best exchange rate.

A travel money card is a global currency card that allows you to load several foreign currencies into a personal account at a prevailing exchange rate . Like debit and credit cards, a travel money card can be used to make purchases in stores, online, and to withdraw cash at ATMs while travelling. You can buy currencies and add or reload them into your travel money card account via a mobile app whilst abroad.

One of the best ways to use the Travelex Money Card is with the Travelex Money App. The Travelex Money App makes ordering, transferring, and checking currencies quick and simple on your travel card. You can also use the Travelex travel exchange rate tracker to check currencies in real time.

You can order a travel money card online or purchase one directly from a Travelex store. Find a store near you.

Some of the benefits of a travel card include:

Money travel cards can be ordered online and topped up via a convenient mobile app.

The Travelex Money Card is a Mastercard travel card, meaning it is free to make international withdrawals at ATMs displaying the Mastercard acceptance mark. It is also free to obtain cash over the counter and to make online purchases with a travel money card. However, some ATM operators may charge their own withdrawal ATM fees. Be sure to check with the ATM in question prior to making cash withdrawals.

Similar to any bank account, you can withdraw money from your travel money card at ATMs worldwide. When withdrawing cash, select the “credit” option on the ATM machine screen to access funds. You will not be charged credit card fees by selecting this option. If the “credit” option does not work, try selecting “debit” or “savings”. The maximum withdrawal amount is 3,000 Australian dollars each 24 hour period. Bear in mind that some ATMs may also have their own ATM fee, adding a cost to your withdrawal.

The Travelex Money Card is a prepaid travel card and has been awarded the best prepaid travel card by Mozo two years in a row.

The Travelex Money Card is a multi currency card that can be used in most countries around the world. Widely considered the best travel money card for overseas travel, the Travelex Money Card can be used in the US, Europe, Japan, Canada, Hong Kong, Singapore, Japan, New Zealand, and many more countries.

Mastercard Prepaid Management Services Australia Pty Ltd (ABN 47 145 452 044, AFSL 386 837) arranges for the issue of the Travelex Money Card in conjunction with the issuer, EML Payment Solutions Limited (‘EML’)(ABN 30 131 436 532, AFSL 404131). You should consider the Product Disclosure Statement for the relevant Travelex Money Card and Target Market Determination available at www.travelex.com.au , before deciding to acquire the product. Any advice does not take into account your personal needs, financial circumstances or objectives and you should consider if it is appropriate for you. Mastercard and the circles design are registered trademarks of Mastercard International Incorporated.

* Transacting via some online merchants may incur a surcharge.

- Find a Store

- Join our Mailing List

- Price Promise

- About Travelex

- Best Ways to Buy Foreign Currency

- Travel Money Card

- Travelex Money App

- Currencies Available to Buy

- Currency Converter

- Rate Tracker

- Sell Your Currency

- Travelex Travel Hub

- Australia Post

- Become an Affiliate

- Other Services

- International SIM Cards

- Travel Insurance

Travelex Info

- Business Services

- Product Disclosure Documents and Terms & Conditions

- Website Terms of Use

- Privacy Policy

- Fraud & Scams

Join the conversation

Customer support.

Online Order Queries:

- Tel.: 1800 440 039

- Email: [email protected]

- Map: Suite 45.01, Level 45, 25 Martin Place, Sydney NSW 2000

- Argentina

- Australia

- Deutschland

- Magyarország

- New Zealand

- Österreich

- Singapore

- United Kingdom

- United States

- 繁體中文 (香港)

The 6 Best Travel Money Cards for Japan

When visiting Japan, using a travel money card specifically designed for yen transactions can make spending and withdrawing yen cheaper and more convenient. There are various options available, such as travel debit cards, prepaid travel cards, and travel credit cards, each tailored to different customer requirements. The right one for you will depend on your personal preference and how you like to manage your money.

Keep reading to explore the different types of travel money cards, look at some great options to consider, and the sorts of fees you need to think about when you choose.

Wise - travel debit card for Japan

Before we get into details about different travel money card options, let’s start with the Wise card as a good all round option for a travel money debit card you can use to hold and spend JPY and a good selection of other currencies too.

Wise accounts can hold and exchange 50+ currencies , and you can get a linked Wise card for a one time delivery fee. Top up your account in pounds and switch to JPY before you travel, so you know your travel money budget in advance. All currency conversion uses the mid-market exchange rate, with low fees from 0.41%.

Here are some of the pros and cons of the Wise travel money debit card , to help you decide if it’s right for you:

Hold and exchange 50+ currencies alongside JPY

No fee to spend any currency you hold , low conversion fees from 0.41%

Mid market rate on all currency conversion

Some fee free ATM withdrawals every month

No ongoing fees and no interest to pay

7 GBP delivery fee

No option to earn points or rewards

Click here to read a full Wise review

What is a travel money card?

Similar to a regular bank card, a travel money card can be used for online and in-store payments, as well as cash withdrawals. However, with a travel money card you’ll find the features and fees have been optimised for international use. That might mean you get a better exchange rate compared to using your normal card overseas, or that you run into fewer fees. Some travel cards also have options to earn cashback and rewards when you use your card internationally.

6 travel money cards for Japan compared

We’ll look at each of these card options in a little more detail in just a moment, but let’s start with an overview of how 6 top travel money cards for Japan line up side by side:

As you can see, the features of different travel money cards can vary pretty widely. Travel debit cards are typically a convenient and affordable option, whereas travel credit cards may offer attractive rewards such as cashback. However, using a travel credit card could potentially lead to interest charges and late payment fees, depending on how you choose to clear your bills.

One important consideration when heading to Japan is how much it’ll cost you to make cash withdrawals while you’re there. Japan is still a very cash dominated country, so while carrying a large sum of cash isn’t a smart idea for security reasons, having a card which has low or no ATM fees is.

Ultimately which card is best for you will come down to how you like to manage your money - we’ll dive into a few more details about each card type, next.

What are different types of travel cards?

Broadly speaking, UK customers are able to select a travel money card from either a regular bank or a specialist provider, which may be a travel debit card, travel prepaid card or a travel credit card. We’ll walk through what each travel money card type is, and pick out a couple of good card options, so you can compare and choose.

1. Travel debit cards

2. Travel prepaid cards

3. Travel credit cards

1. Travel Debit Cards

Specialist providers often offer travel debit cards that come with linked digital accounts to manage your currency balance. Although different cards may have their own features, they are typically easy to top up online or through a mobile app, with the added convenience of receiving transaction notifications and tracking your balance via your phone. That makes it easier to keep on top of your money, no matter where in the world you are.

Travel debit card Option 1: Wise

Wise is our best value travel money debit card for Japan. There’s no fee to open a Wise account, and just a small delivery fee for your Wise card, with no minimum balance and no monthly charge. You just pay low Wise fees from 0.41% when you convert currencies, and transparent transaction fees when you exhaust the monthly free transactions available with your account.

No fee to open a Wise account , no minimum balance requirement

7 GBP one time fee to get your Wise card

2 withdrawals, to 200 GBP value per month for free, then 0.5 GBP + 1.75%

Hold JPY and 50+ other currencies, convert between them with the mid-market rate

Get local account details to receive 10 currencies including GBP for free

Travel debit card option 2: Revolut

Revolut has a selection of different account tiers, so you can simply pick the account you prefer - from free Standard plans to the 12.99 GBP/month Metal plan. All Revolut accounts have linked cards, although exactly what type of card you get depends on your account tier. You can hold around 25 currencies including JPY, and convert currencies with the mid-market rate to your plan’s allowance.

No fee to open a Standard Revolut account, or upgrade for up to 12.99 GBP/month

Card delivery fees may apply depending on your account tier

All accounts have some fee free currency conversion with 0.5% fair usage fees after that

Standard plan holders can withdraw 200 GBP (up to 5 withdrawals in total) per month for free

Hold JPY and around 25 other currencies

Pros and cons of using debit travel cards in Japan

No interest costs or late payment fees

Hold and convert currencies in advance or at the time of spending

Accounts can be topped up, viewed and managed digitally

Safe to use, as accounts aren’t linked to your main UK bank account

Travel debit cards are issued on popular global payment networks

Transaction and currency conversion fees may apply

Cash back and rewards may not be available

Click here to read a full Revolut review

How to choose the best travel debit card for Japan?

The best travel debit card for Japan really depends on your personal preferences and how you like to manage your money. If you’ll be travelling widely it makes sense to look for an account with mid-market currency exchange and a large selection of supported currencies as well as JPY, like Wise. Other providers like Revolut can also be a good pick, particularly if you’ll use your account very frequently and would prefer to pay a monthly fee to unlock lots of fee free transactions and extra perks.

Is there a spending limit with a travel debit card in Japan?

Different providers set their own limits for card use. Limits may apply daily, weekly or monthly, and can apply to different types of transaction. Daily limits may apply to the number of ATM withdrawals or the amount of contactless payments you can make, among other things. These limits are set for security and can sometimes be managed and changed in the provider’s app.

2. Prepaid Travel Cards

With a prepaid travel card you’ll need to order a card and add funds in the supported currency of your choice. Once you have a balance you may then be able to switch to the currency you need, to pay merchants and make cash withdrawals. While prepaid travel cards are usually issued on large global networks - and can therefore be used pretty widely - not all cards support all currencies, so you may find you pay a foreign transaction fee if you pick a card which doesn’t support all the currencies you use.

Prepaid travel card option 1: Post Office

You can pick up a Post Office prepaid travel money card in a Post Office branch or order one online. You’ll then be able to top up in pounds or one of the 22 supported currencies, which includes JPY. If you hold JPY in your account there’s no fee to spend when you’re in Japan, but if you don’t have a JPY balance - or if your JPY balance isn’t high enough for the transaction, you’ll pay a 3% foreign transaction fee.

Hold and exchange 22 currencies including JPY

No fee to spend a balance in a supported currency

3% foreign transaction fee when spending a currency you don’t hold on the card

Variable ATM withdrawal fees - 200 JPY for use in Japan

No interest to pay

Click here to read a full Post Office review

Prepaid travel card option 2: Monese

Monese accounts can be opened by UK residents to hold GBP, EUR and RON. There are several different types of accounts, from the Simple account which has no monthly fees, to fee paying account tiers which have more features. It’s free to spend a balance you hold - but as JPY isn’t a supported currency, you may find you pay a foreign transaction fee of 2% when you’re spending in Japan. Foreign transaction fees may be waived for higher tier account holders.

Hold a balance in GBP, EUR or RON

Choose a free Simple account, or upgrade to an account with monthly fees

Foreign transaction fees of 2% may apply depending on your account tier

ATM withdrawal fees may apply, depending on the value of withdrawals and the account tier you hold

Track and spend Avios reward points within your account

Pros and cons of using prepaid travel cards in Japan

Manage your account online or with an app, to add more money or convert funds

No monthly fees for some account options

Multiple supported currencies, with no fees for spending a currency you hold

Global ATM withdrawals offered

Some accounts have extras like options to earn reward points

Typically not a huge range of currencies supported

Transaction fees apply to most accounts

How to choose the best travel prepaid card for Japan?

There’s no single best travel prepaid card for Japan - it’ll come down to your personal preference. If you hold a Monese Classic or Premium account already it’s good to know that the 2% foreign transaction fee is waived, which means you get the card network rate when you spend in Japan. This may be cheaper than using your regular bank card. The Post Office card can also be a strong pick as you can hold a JPY balance, which you can spend for free, plus you can get a card instantly by walking into a Post Office branch.

Is there a spending limit with a prepaid card in Japan?

Different prepaid travel cards set their own limits for spending and withdrawals, which can vary between currencies. You’ll need to check your card’s terms and conditions carefully to make sure you pick a provider which suits your needs.

3. Travel Credit Cards

Travel credit cards come with added international features such as low or no foreign transaction fees and rewards for international spending. Although they are safe and convenient, they can be more expensive compared to using a debit card. Before you select the right card for you it’s important to check the fees, rates, eligibility rules and interest rates which apply, so you can make sure it’s a good fit for you.

Travel credit card option 1: Barclaycard Rewards Visa

The Barclaycard Rewards Visa card has no foreign transaction fees and no international ATM fees. Instead, your overseas spending is simply converted to pounds using the Visa exchange rate, before being added to your monthly bill. You’ll need to repay your bill in full every month to avoid fees and interest, but can earn cashback on your day to day spending.

No foreign transaction or foreign ATM fee

Earn cashback at 0.25% on spending

Protection on purchases over 100 GBP

International spending uses the Visa exchange rate

Variable interest rates which apply if you don’t pay off your bill in full

Travel credit card option 2: Halifax Clarity Mastercard

The Halifax Clarity Mastercard has a variable interest rate which you can see when you check your eligibility for the card. There’s no foreign transaction or foreign ATM fee to pay, and all currency conversion uses the Mastercard exchange rate.

Variable interest rates

Check your eligibility and order a card online easily

No foreign transaction fee

No ATM fee - but interest will accrue instantly when you make a withdrawal

Mastercard exchange rates apply

Pros and cons of using credit cards in Japan

Spending from 100 GBP has extra consumer protection

Spread the cost of your travel over several months

Check eligibility for a card online with no impact on your credit score

You may pay no foreign transaction fee and no ATM fee

Network exchange rates usually apply, which are usually pretty fair

Interest charged if you don’t repay in full every month

Eligibility rules apply

How to choose the best travel credit card for Japan?

The best travel credit card for Japan will depend on your personal preferences. If you’re interested in earning rewards and cash back on your overseas spending, the Barclaycard Rewards Visa might be a good pick, as it has no foreign transaction fee and offers cashback on all spending. Whichever card you’re considering you’ll want to weigh up the potential fees you’ll need to pay against the rewards you can earn to make sure it’s worthwhile.

If you’re off on a trip to Japan you might want to get yourself a travel money card for convenient spending in JPY. Travel money cards have different features, and can be picked up via regular banks, online specialists and even the Post Office.

You could opt for a low cost travel debit card which comes with a linked account to hold a selection of currencies - like the Wise account. Or you might prefer a prepaid travel money card like the Monese card which can be linked to either a fee free account or an account which has monthly fees in exchange for lower transaction charges. Finally, another option is to get a travel credit card either to earn cashback and rewards, or to avoid foreign transaction fees.

You'll be pleased to know that there are plenty of options available in the UK for travel money cards. Use this guide as a starting point to research and find the best option that fits your specific needs.

FAQ - Best travel cards for Japan

You can usually make cash withdrawals with a credit card in Japan at any ATM that supports your card network. Occasionally ATMs in Japan can’t accept foreign issued credit cards, although this is becoming less common over time. You’ll often find that a fee applies, and you may start to accumulate interest on the withdrawn amount immediately. Travel money debit cards from providers like Wise and Revolut can be a lower cost option for cash withdrawals in JPY.

You can use your debit card anywhere you see the card network’s logo displayed. However, it’s worth being aware that card acceptance in Japan isn’t as high as in the UK, so you’ll also need to carry cash just in case. Visa and Mastercard networks are very well supported globally, including in Japan, making these good options to look out for when you pick your travel debit card for Japan.

Prepaid cards from reputable providers are safe to use at home and abroad. They aren’t linked to your main bank account which can offer extra peace of mind, and may also make it easier to manage your travel budget. However, you’ll need to check the card features and fees carefully to make sure you're getting the best match for your needs.

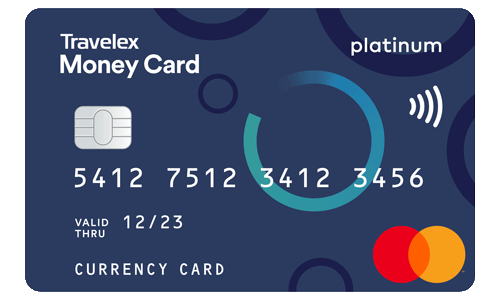

The Japanese currency is the yen (�~, en). One yen corresponds to 100 sen; however, sen are not used in everyday life anymore, except in stock market prices. Bills come in 1,000 yen, 2,000 yen (very rare), 5,000 yen and 10,000 yen denominations. Coins come in 1 yen, 5 yen, 10 yen, 50 yen, 100 yen and 500 yen denominations. Foreign currencies are not accepted for payments in Japan, except perhaps at major international airports .

Payment methods in Japan

Japan has a reputation of being a cash-based society, but trends have been changing, and there has been a significant increase in the acceptance of other payment methods. Below are the modes of payment that you might use when visiting Japan:

Cash is still a very popular payment method, especially for small amounts. Big bills are readily used and accepted in Japan; you are unlikely to be frowned upon for using a 10,000 yen bill to pay even for low-cost items, although smaller denominations are appreciated for payments made in taxis , smaller shops, temples and shrines . The likelihood that credit cards are accepted decreases in small cities and towns, and thus it is advisable to keep cash at hand when visiting rural areas.

Cash is often the only way to pay for small entrance fees at tourist sights, smaller restaurants and small shops. Many lockers also require coins. Most buses and trams accept payment by IC cards these days; if you pay by cash, note that bills above 1,000 yen may not be accepted and that drivers may not carry enough change. Vending machines typically accept 10, 50, 100 and 500 yen coins and 1,000 yen bills. Newer machines typically also accept 5,000 and 10,000 yen bills.

Credit and debit cards are now widely accepted, especially in big cities. Most hotels accept payment by credit cards, as do most department stores , mid to high end restaurants , outlet malls and large retail shops. In addition, many train stations, convenience stores , supermarkets , chain restaurants and boutiques also accept them.

IC cards , such as Suica and Icoca, are stored-value cards which can be recharged. Primarily a tool for convenient payment of train and bus fares, IC cards now double as a means of payment at large numbers of shops and restaurants, most convenience stores , many chain restaurants , numerous vending machines and coin lockers .

The last few years have seen a big increase in other mobile payment options available besides the IC cards mentioned above. Most come in form of mobile phone apps that allow for payments at selected stores by tapping an NFC reader or scanning a QR code.

Among them are a large number of domestic services, such as Edy, Rakuten Pay, Paypay and Line Pay, which target residents of Japan and tend to be difficult or impossible to use by foreign tourists.

Apart from the domestic services, Alipay, WeChat Pay and Apple Pay are some of the services enjoying increasing acceptance; but note that at many stores Apple Pay will only work if you have an iphone 8 or later and a Suica card registered with it. Google Pay won't work on most phones sold outside of Japan because they don't support the global FeliCa standard needed for making payments at most stores.

How to get your yen

Cash is handy because it is accepted under all situations, but credit cards can be a convenient alternative at appropriate locations. Theft and robberies are very rare in Japan, so with regards to keeping large amounts of cash with you, security is less of a concern than your propensity to lose money by accident. Here are ways to get your yen:

In Japan, currency exchange is usually handled by banks , post offices , some larger hotels and a handful of licensed money changers found especially at international airports .

Whether or not it is better to change for yen before coming into Japan depends on the currency that you hold. For example, the US dollar is a highly traded foreign currency in Japan, and partly for this reason you might get a favorable rate if you change US dollars into yen in Japan. On the other hand, in some Southeast Asian countries, the foreign exchange market is very competitive and money changers take a smaller cut, therefore it might be better to do the exchange there before coming into Japan.

A considerable number of ATMs in Japan do not accept cards that are issued outside of Japan. At those that do, exchange rates tend to be competitive, but service fees vary widely depending on the card. Inquire with your card issuer in advance. Note that many ATMs in Japan are out of service during the night, and some are unavailable on weekends.

Money-related tourist attractions

Below are a few money related sites in Japan that may be of interest to tourists:

Currency Museum

Tokyo Stock Exchange

Osaka Mint Bureau

Otaru Bank of Japan Museum

Questions? Ask in our forum .

Links and Resources

Bank of japan currency museum, bank of japan otaru museum.

- Investing & super

- Institutional

- CommBank Yello

- NetBank log on

- CommBiz log on

- CommSec log on

Help & support

Popular searches

Travel insurance

Foreign exchange calculator

Discharge/ Refinance authority form

Activate a CommBank card

Cardless cash

Interest rates & fees

Travel / Travel Money Card

Travel Money Card

Lock in exchange rates and load up to 13 currencies on one account to easily access your money while you’re travelling.

Features & benefits

$0 card issue fee.

Order a Travel Money Card for free in branch or online (search 'Travel Money Card' in the CommBank app or log into NetBank ).

Lock in exchange rates

Load up to 13 currencies on one card before your trip, so you know how much you have to spend, no matter how the Australian Dollar moves.

Spend anywhere in the world

Shop online, in-store, or over the phone wherever Visa is accepted, plus get access to Visa ® travel offers .

Easily manage your travel budget

Manage your holiday money and track your spending via the CommBank app or NetBank.

Your purchases, covered

Lost or stolen personal belongings? We may be able to cover the cost to repair or replace them up to 90 days after purchase. 2

Extra card security

Lost, misplaced or stolen card? Lock it and report it in the CommBank app or NetBank.

- Currency converter

Exchange rates

Load up to 13 currencies on one account

Lock in exchange rates and load up to 13 currencies easily on one account – wherever you are in the world – through NetBank or the CommBank app:

- United States Dollars (USD)

- Euros (EUR)

- Great British pounds (GBP)

- Australian Dollars (AUD)

- Japanese Yen (JPY)

- New Zealand Dollars (NZD)

- Hong Kong Dollars (HKD)

- Canadian Dollars (CAD)

- Singapore Dollars (SGD)

- Thai Baht (THB)

- Vietnamese Dong (VND)

- Chinese Renminbi (CNY)

- Emirati Dirham (AED)

No load or reload fees

You can load up to 13 currencies on your Travel Money Card with no load or reload fees. The exchange rate is the CommBank Retail Foreign Exchange Rate at the time of the conversion.

When you’re ready to pay for something, we will always try to complete the transaction for the country you are in. Make sure you have enough of the correct currency for the country you’re in on your card to avoid additional fees. If you don’t have enough of the local currency, we’ll use the next available currency instead, so long as there’s enough of it loaded on your card.

If you load multiple currencies on your Travel Money Card, you can change the order (the next available currency) anytime online.

Rates & fees

See all fees and charges

Who can apply

To get your Travel Money Card, you’ll need to:

- Be at least 14 years old;

- Be registered to use NetBank, or register online New to CommBank? Sign up to NetBank at your nearest branch ;

- Provide a valid email address; and

- Have an Australian residential address

How to apply

Before your trip.

- Order a Travel Money Card in the CommBank app (search 'Travel Money Card'), NetBank , or at your nearest branch .

- Load at least AUD 50 or the foreign currency equivalent to get started

- Once you’ve got your card, activate and set your PIN online in NetBank, or under Cards in the CommBank app

- Lock-in the exchange rate by loading currency on your card in NetBank or the CommBank app

How it works

During your trip.

- The local currency will be automatically applied when you pay for something, as long as it’s loaded on your card and you have sufficient funds

- Reload in real time , fee-free if your balance gets low

- Stick to daily transaction limits

- The maximum value of purchases per day is unlimited, however no more than your available balance

- The maximum amount you can withdraw from ATMs per day is AUD 2,500 or the foreign currency equivalent. Keep in mind most ATM operators have a limit on how much you can withdraw from an ATM per transaction

- The maximum amount for over-the-counter withdrawals per day is AUD 2,500 or the foreign currency equivalent.

When you’re home

- Got leftover currency? Exchange it for another currency or back into your CommBank account from NetBank or the CommBank app

- Top up your Travel Money Card (it’s valid for 4 years) in preparation for your next trip

- Donate your foreign (and local) currency to any CommBank or Bankwest branch and every cent will go to UNICEF

- How to manage your Travel Money Card

You’ve got your new card – here’s how to get the most out of it.

Find detailed info on getting started, loading and reloading currencies, setting a currency order, checking your balance and tracking your spend. Plus, info on Purchase Security Insurance Cover and access to Visa ® travel offers .

Manage your Travel Money Card

Need foreign cash? Have it ready before you travel

If you’re a CommBank customer, you can buy or sell up to 9 foreign currencies at selected CommBank branches in exchange for Australian Dollars.

You can also order foreign cash in over 30 currencies online – even if you’re not a CommBank customer.

Discover Foreign Cash

Planning an overseas trip?

Discover travel tips to help make the most of your European summer holiday.

See travel tips

Emergency support & tools

What to do if you’ve lost your card or it’s stolen.

If you’ve lost your Travel Money Card, or you think it might’ve been stolen, we can have an emergency replacement card sent to you anywhere in the world.

You may also be eligible for an Emergency Cash Advance, giving you access to cash within 24-48 hours (often on the same day).

Call us in an emergency on:

- 1300 660 700 within Australia

- +61 2 9999 3283 from overseas (reverse charges accepted).

When calling from overseas using your mobile, standard roaming charges may apply. To avoid roaming charges, call the international operator in the country you’re in from a landline and give them our reverse charges number +61 2 9999 3283.

Tools & calculators

- Saving calculator

- Budget planner

- Managing multiple currencies on your Travel Money Card

- Travelling overseas: 10-step money checklist

- Beginners guide to exchange rates

- Online banking while overseas

- Planning an overseas holiday

We can help

Your questions answered

Get in touch

Visit your nearest branch

Things you should know

1 The cash withdrawal fee will not apply to cash withdrawals made in Australia.

2 For more information relating to the complimentary Purchase Security Insurance refer to Travel Money Card Complimentary Insurance Information Booklet (PDF) .

As this advice has been prepared without considering your objectives, financial situation or needs, you should before acting on this advice, consider its appropriateness to your circumstances. The Product Disclosure Statement and Conditions of Use (PDF) issued by Commonwealth Bank of Australia ABN 48 123 123 124 for Travel Money Card should be considered before making any decision about this product. View our Financial Services Guide (PDF) .

To raise a dispute related to your Travel Money Card please complete this form for transactions (PDF) or this form for ATM disputes (PDF) .

Any withdrawal or balance enquiry fee will come from the currency for which you are using your card. If this currency is not loaded on your card, the fee will be taken from the first (or sole) currency loaded on your card. Any SMS balance alert fee will come from the first (or sole) currency loaded on your card.

The target market for this product will be found within the product’s Target Market Determination, available here .

Editorial note: We may not cover every product in this category. For more information, see our Editorial guidelines .

The 5 best travel money cards for japan in 2024.

Japan is one of Australia’s favourite destinations and with all its culture, food and nature it's not hard to see why thousands of Australians visit each year.

While Japan relies heavily on cash, you are likely to pay for accommodation and restaurants with a card. So which is the best travel card to take with you?

It's easy, to save you lots of time, we have compared a large number of the best travel money cards in Australia to take to Japan for in 2024 and have summarised their best points.

Best 5 Travel Money Cards for Japan in 2024:

- Wise Travel Card for the best exchange rates

- Revolut Travel Card for low fees

- Travelex Card - Best all rounder

- HSBC Global Everyday Debit Card for best debit card

- Bankwest Breeze Platinum Credit Card for lowest interest rate

Revolut Card Offer

Sign up and get a $15 top-up . For new customers only, T&Cs apply .

Wise Travel Card - Best Exchange Rates

- 40+ currencies available

- Best exchange rates globally

- One of the lowest conversion fee on the market

- No international transaction fees

- No annual or monthly fees

- Extremely low costs to send money overseas

Wise Travel Card

- Cross currency conversion fees are between 0.24–3.69%. AUD to USD, EUR or GBP was 0.42%, which is one of the lowest on the market

- Free cash withdrawals up to $350 every 30 days. However after that, Wise Card charge a fixed fee of $1.50 per transaction + 1.75%

- Daily ATM withdrawal is $2,700

- Issue up to 3 virtual cards for temporary usage

- It takes between 7 to 14 business days to receive your card

- Can be used wherever MasterCard is accepted

The Wise Travel Card is an excellent choice for those traveling to Japan, tailored to meet the unique needs of international visitors. A standout feature of the card is its offering of over 40 currencies at the interbank exchange rate, known for being the most economical rate globally. This is particularly beneficial for travelers to Japan, enabling them to convert their home currency into Japanese Yen (JPY) at highly competitive rates. However if you use ATMs frequently this is not the card to use due to the fees. Finally Wise Travel Card lets you transfer money to an overseas bank account with extremely low fees and the best exchange rate.

Revolut - Low Fees

- 30+ currencies available

- One of the best exchange rates globally

- No annual or monthly fees for standard membership

- No initial card fee

- Instant access to a range of cryptocurrencies

Read our Revolut Card Review

Revolut Travel Card

- No fee ATM withdrawals up to A$350, or 5 ATM withdrawals, whichever comes first, per rolling 30 day period and 2% of withdrawal amount (minimum charge of A$1.50) after that

- Exchanging currency on the weekend can incur a 1% mark-up fee

- Fees on international money transfers were introduced in April 2021.

- Can be used wherever Visa is accepted

The Revolut Travel Card is a decent option for those who travel a lot as it offers over 30 currencies at a great exchange rate, which is the cheapest rate globally. However if you exchange currency on the weekend you can incur a one-percent mark-up fee. In addition they have introduced fees for international transfers. Finally if you use ATMs frequently this is not the card to use due to the fees.

Travelex Money Card - Best Support

Best features.

- Unlimited free ATM withdrawals

- 24/7 Emergency Assistance

- Initial and replacement card are free

- Lock in up to 10 currencies

Multi Currency Travelex Travel Card Review

Travelex Money Card

- Minimum load of $100 and maximum load of $100,000

- Can be used wherever Mastercard is accepted

- Fees include a $10 closure fee, $5 for an additional card and $4 inactivity monthly fee.

- While Travelex don't charge ATM fees, some ATM operators may charge their own fees.

- Currencies that can be loaded are AU$, US$, EU€, GB£, NZ$, TH฿, CA$, HK$, JP¥, SG$

- If your card is lost or stolen you can access cash in your account through Moneygram or Western Union agents, with no charge

- Boingo hotspots offer free wifi and you can look at their number of free hotspots per country on this map

The Travelex Money Card is a good all-rounder no matter if you are heading to the bustling streets of Tokyo or experiencing the tranquility of Kyoto.

You can use it to take money out of the ATM, for merchant purchases like restaurants and even for online shopping in foreign currency. While the exchange rates aren't as good as the Wise or Revolut cards , the support network if the card is lost or stolen is very good. This attribute can be quite practical when immersing yourself in the rich culture of Japan.

HSBC Everyday Global Travel Card - Best Debit Card

- Great exchange rate offered for Japanese yen (JPY)

- No fees at ATMs in Japan to withdraw cash

- No initial card, closure, account keeping or monthly fees

- No cross currency conversion fees

HSBC Everyday Global Travel Card

- 10 Currencies can be loaded are JPY, USD, AUD, EUR, GBP, CAD, NZD, SGD, INR and CNY (currency restrictions on CNY)

- No maximum balance for any currency

- Very competitive exchange rates on all currencies when you have currencies already loaded on your card

- ATMs within Australia need to be HSBC and overseas they need to display a VISA or VISA Plus logo, not be be charged fees

- Earn 2% cash back when you tap and pay with payWave, Apple Pay or Google Pay for purchases under $100.

- Daily maximum ATM withdrawal is $2,000

- Fraud protection covered by Visa Zero Liability

The HSBC Everyday Global Travel Card is a good option to take to Japan and to spend money in Australia with no international transaction fees, international ATM fees and monthly fees.

Its worth noting that to withdraw Japanese yen from an ATM you will need to go to a 7-11 or a post office as most other ATMs in Japan will not accept a card issued outside of Japan.

Finally there is no maximum balance on currencies held and a 2% cash back incentive when you tap and pay under $100.

Bankwest Breeze Platinum Credit Card - Lowest Interest Rate

- Lowest interest rate at 9.90%

- No international transaction fees on purchases

- Up to 55 days interest free on purchases

- Low annual fee

- Complimentary international travel insurance

Bankwest Breeze Platinum Credit Card

- Free annual fee first year, then $69 annual fee

- Free international travel insurance that includes the basics but does not cover cancellation costs, pre existing conditions and travellers over 80

- $6,000 minimum credit card

- 0% p.a. on purchases and balance transfers for the first 15 months, then reverts to 9.90%

- 21.99% interest rate on purchases and cash advances

- Cash advance fee of the higher of $4 or 2% of cash advance

The Bankwest Breeze Platinum is a great no frills credit card that offers ‘no foreign transaction fees’ and the lowest interest rate on the market, at 9.90%. These two factors alone will save you hundreds of dollars when travelling throughout Japan.

In addition it has a low annual fee and complimentary international travel insurance. Finally for its price point it is a great value credit card that will be accepted most places in Japan.

Westpac Worldwide Wallet - Best Card from Big Banks

- No foreign transaction fees

- No fees on initial card, load, unload or inactivity fees

- Competitive exchange rates for Japanese yen (JPY)

- Free additional card

- Flight delay pass

Westpac Worldwide Wallet Global Card

- 11 Currencies can be loaded are JPY, AUD, USD, EUR, GBP, NZD, CAD, HKD, SGD, THB & ZAR

- Lock in exchange rates before you leave

- No cross currency transactions fees

- No ATM fee at 50,000 Global Alliance ATMs worldwide

- $2,000 maximum limit on ATM withdrawals overseas within 24 hours

- $50,000 maximum limit on currencies loaded on to travel card

- $3 roughly for ATMs that are not within the Non Westpac Global Alliance

- If you run out of one currency on the card, you can pay with other currencies without the expensive cross currency transaction fee

- No foreign transaction fees, initial card, load, unload or inactivity fees

- According to the Westpac it can take up to 8 business days to receive the travel card

- Secure from fraudulent transactions with Mastercard Zero Liability protection

- 2 cards per account for free

The Westpac Travel Card is a no frills handy travel card with very low fees, no foreign transaction fees, access to some free ATMs worldwide and competitive exchange rates, especially on JPY, USD, EUR, GBP and CAD.

In addition it has the South African Rand (ZAR) which is not common in visa prepaid travel cards . Finally it has access to a flight delay pass in case your flights are delayed and you need to access airport lounges.

Learn more about the best credit, debit and prepaid cards for travel

Travel Credit Card Australia

Best Prepaid Travel Cards

The best travel cards to use in Japan are the Wise Multi Currency card, which offers the best exchange rate for Japanese yen, a HSBC Global , Citibank Plus or Westpac Wallet card for ATM withdrawals and the BankWest Platinum Breeze cards for credit purchases. All of these cards do not charge an international transaction fee of 3%.

You should bring both card and cash to Japan . Japan relies heavily on cash and cards are needed to pay for big items like accommodation. We advise you to buy Japanese yen before you leave and take a prepaid card like Wise , a card to withdraw money from ATMs like HSBC or Citibank and a credit card as a back up like Bankwest Breeze Platinum .

Travel money cards for Japan should be free of charge. All the travel cards in the top 14 travel cards guide are free. On some prepaid travel cards you might have to pay for load, unload and inactivity fees, however if you choose a HSBC Global or Citibank Everyday card you will not have to pay these fees. You will also not have to pay an international transaction fee.

A travel money card is better than cash because it is more secure. With a travel money card you have to punch in your 4 digit code for transactions over $100. Therefore if you lose your card or if it is stolen, then you won't lose your money as you can cancel your card online.

Mastercard, Visa and JCB are the three most common cards accepted in Japan. This includes Mastercard debit, Mastercard credit, Visa debit and Visa credit cards. American Express and Diners cards are rarely accepted because the cost is too high for the merchant.

HSBC, Citibank and Westpac offer the best bank travel cards for Japan. They all have very good currency exchange rates, no international transaction fees, no initial card fee, no load, unload fee and no inactivity fees. They all offer access to other currencies including USD, EUR, GBP, NZD, HKD, SGD and CAD. HSBC offers 2% cash back, Citibank offers free bottles of wine and Westpac offers complimentary travel insurance.

Yes you can withdraw cash from a travel card in Japan. However, depending on the travel card you can pay an overseas ATM withdrawal fee and international transaction fees when using a debit card overseas . It is more expensive if your travel card is a credit card because you will also pay higher interest on cash advances. Save $15 on a $300 cash withdrawal and choose the correct debit travel card or prepaid card for travel.

More Travel Card Guides

Learn more about the best travel money cards for your holiday destination.

ASIC regulated

Like all reputable money exchanges, we are registered with AUSTRAC and regulated by the Australian Securities and Investment Commission (ASIC).

S Money complies with the relevant laws pertaining to privacy, anti-money laundering and counter-terrorism finance. This means you are required to provide I.D. when you place an order. It also means the order must be paid for by the same person ordering the currency and you must show your identification again when receiving your order.

- Argentina

- Australia

- Brasil

- Canada

- Deutschland

- España

- France

- India

- Italia

- Magyarország

- Malaysia

- New Zealand

- Polska

- Portugal

- România

- Singapore

- United Kingdom

- United States

- 繁體中文 (香港)

4 Best Ways to Take Travel Money to Japan in 2024

Japan is a big tourist draw for many Australians - whether you want to experience the frenetic rush of the cities, immerse yourself in the culture, or hit the slopes, there’s something for you there. However, life in Japan isn’t cheap - so you’ll need to plan your travel spending in advance so you don’t blow your budget.

This guide covers 4 popular ways to take money to Japan, so you can spend without needing to worry too much about high or unexpected fees.

Best ways to take money to Japan

In this guide we’ll walk through 4 of the most practical and popular ways to take money to Japan, including our top picks for providers to look at, pros and cons. Here are the common ways to pay overseas that we’ll investigate:

Prepaid Travel Card

Travel Debit Card

Travel credit card

Prepaid travel cards to use in Japan

Ideal for: adding money conveniently in AUD, for spending and withdrawal in JPY on arrival

You can order a prepaid travel money card online from specialist services, or pick one up at a branch of Travelex or the Post Office. Top up your card in dollars using your AUD card or a bank transfer, and switch to JPY in advance so you can lock in the exchange rate and see your travel budget easily. In some cases, you can also choose to leave your money in dollars and the card will convert your payment using the live exchange rate whenever you buy something or make a withdrawal.

Double check the exchange rate used by the card you pick. Some providers add a markup on the mid-market rate - an extra fee. This isn’t unusual at all but it does mean it’s harder to work out exactly what your foreign exchange is costing you. Picking a card that offers the mid-market rate or as close as possible to it makes it easier to see what you’re spending and keeps the costs down overall.

It’s also worth looking out for a card with no inactivity fee and no ongoing charges, so you can just top up and use it again on your next trip.

Learn more about our picks for the 6 best prepaid cards - there’s more on our top choice, Wise, next.

Wise - our pick for prepaid travel card

With this card:

- Hold and exchange 40+ currencies in your linked Wise account

- No annual or monthly fees to pay, and no minimum balance requirement

- Currency exchange uses the mid-market rate with no markup

- Some free ATM withdrawals available every month

- Virtual and physical cards available

Pros and cons of taking money to Japan with a prepaid travel card

- Japanese yen are supported for spending and withdrawal with most cards

- Many cards support multiple currencies so you can use them again on your next trip

- Safe to use, as your prepaid card isn’t linked to your main everyday account

- Cards are available with no minimum balance or ongoing fees to pay

- Currency exchange may have better rates than a bank will offer

- Exchange rates may include a markup on the mid-market rate

- ATM fees may apply, depending on the card you pick

- Some cards have inactivity fees which apply if you don’t use them regularly

Travel debit cards to use in Japan

Ideal for: convenient spending and withdrawals in Japan with travel friendly perk and no interest to pay.

Travel debit cards can be a good pick as they often offer travel perks and benefits, like insurance or airport lounge access, plus low or no foreign transaction fees. You can order a travel debit card from a specialist service, or in some cases get one from your bank. The features you get are often quite different depending on whether you choose a specialist provider or a bank service, so it’s worth weighing up both options before you decide.

Travel debit cards from specialist providers usually come with a multi-currency digital account which can hold and exchange dozens of currencies. Plus, your card isn’t linked to your main AUD account, so even if you’re unlucky enough to have your travel card lost or stolen you can simply freeze the card without worrying about anyone accessing your primary AUD funds.

We’ll go into more detail about our top pick for a travel debit card - Revolut - next, and you can also read more about the best travel debit cards in Australia here.

Revolut - our pick for travel debit card for Japan

- Hold and exchange 25+ currencies

- Choose the account plan that suits your needs and spending, including some with no monthly fees

- Some no- fee ATM withdrawals and currency exchange with the mid-market rate, based on the account tier you choose

- Extra perks like accounts for under 18s, plus cash back on card spending for top tier account holders

- Travel benefits offered for some account plans

Pros and cons of taking money to Japan with a travel debit card

- Top up in AUD and spend in JPY

- Access travel perks like free airport lounge access or insurance

- Spend and make ATM withdrawals with no interest, cash advance or penalty fees

- Many cards from specialist services are linked to multi-currency accounts you can use on future trips too

- Not connected to your main AUD account, adding a layer of security when you’re overseas

- Some transaction fees usually apply

- You may pay a fee when converting from one currency to another, which may be split out transparently, but which is often just rolled up in the exchange rate you get

- Some cards have monthly fees to pay to get full feature access

Taking cash in Japan

Ideal for: spending where cards aren’t accepted - you’ll find many smaller businesses prefer cash to cards.

While things are changing slowly in favour of card usage, cash is still heavily used in Japan. Large stores and hotels will usually take cards, but smaller merchants normally require cash payments, so carrying cash in yen is essential.

It’s also worth noting that not all ATMs in Japan can offer services to foreign card holders. Look out for an ATM marked as ‘international’. You can usually use machines branded as Seven Bank, Japan Post and E-net, which are found in 7-Eleven stores, train stations and malls. If you’re outside of city areas it’s worth carrying a bit more cash than you think you’ll need just in case you can’t get to an international ATM conveniently.

The best strategy for your JPY cash depends on where you’re heading. You can get your JPY before you travel through a service like Travelex, or you could choose to take some AUD to convert when you’re there if you’ll be in tourist areas. If you’re sticking to cities, making ATM withdrawals in Japan should be fine, but off the beaten track this may be trickier.

Generally having a few different payment options at any one time is a good plan. Carry some JPY cash (either converted in advance or by making an ATM withdrawal at the airport on arrival), make ATM withdrawals when you can, and have some AUD cash to convert too, and you should be covered for all eventualities.

Do I need cash in Japan?

Yes. Having cash in JPY is essential, as you’ll find cash is the only accepted payment method in many smaller stores and restaurants. Generally having more than one payment option with you is a smart plan, so taking some cash in JPY and AUD, plus one or more cards should mean you’re prepared for anything.

Learn more about travel money in Japan here .

How to buy Japanese yen on arrival in Japan?

If you carry Australian dollars in cash when you travel to Japan, you can exchange them with currency exchange stores in cities and popular tourist areas. Bear in mind that the exchange rate you’ll get in the airport or your hotel is not likely to be the best available - using an exchange service in the city centre where there’s more competition will usually get you the best overall deal.

How to buy Japanese yen in Australia?

You can also exchange AUD to Japanese yen in cash in Australia before you travel. Options like Travelex often let you order JPY online and collect your cash later in a branch. Fees and exchange rate markups may apply.

Best place to get Japanese yen from

There’s no single best place to get your travel cash. Using a combination of carrying some JPY and AUD in cash, and making some cash withdrawals when you’re in the city and can find an international ATM is a good way to balance security and convenience when travelling in Japan.

Travel credit cards to use in Japan

Ideal for: easy spending where cards are accepted - often with extra rewards when you spend in JPY

Travel credit cards work the same as any other credit card, but will usually come with perks like low or no foreign transaction fees or extra reward points, cashback or miles when you spend in foreign currencies. Credit cards are handy if you want to spread the costs of your trip to Japan across several months - but don’t forget that interest - and potentially penalty fees - will apply if you don’t clear your bill regularly.

As we’ve already explored, relying on a card when you’re in Japan isn’t really possible. You’ll also need cash in some situations. If you’re intent on getting your yen in cash from ATMs when you arrive, bear in mind that using a credit card at an ATM is a very expensive option, with cash advance fees and interest mounting up quickly.

Learn about the best travel credit cards in Australia here, and read on for more on our top pick.

28 Degrees - our pick for travel credit card

- Order online and start spending with your virtual card instantly if approved

- No annual or monthly fees

- No foreign transaction or currency conversion fees

- Make ATM withdrawals overseas - fees apply for this service

- Unlock perks like discounts on travel bookings and internet roaming packages

Pros and cons of travel credit cards to Japan

- Cards issued on major networks are usually accepted anywhere international card payments are supported

- Earn rewards and discounts, or get travel perks - depending on the card you pick

- Some cards have low or no foreign transaction fees

- Credit cards are useful as a payment guarantee in some situations

- Interest and fees usually apply if you don’t pay back your bill immediately

- Using your card at an ATM is expensive - and you’ll definitely need some cash while in Japan

- Eligibility rules apply

Travel requirements from Australia to Japan

Generally if you’re heading to Japan with an Australian passport you can enter for tourist or business reasons under the visa exemption scheme, for up to 90 days. Bear in mind that entry requirements can change rapidly, so checking before you travel is always advised.

Check the government’s Smart Traveller website to learn more.

Does Japan accept Australian dollars?

No. You won’t be able to spend AUD anywhere in Japan. If you’re carrying dollars with you you'll need to exchange them for Japanese yen when you arrive.

Best currency to take to Japan

You’ll only be able to spend in Japanese yen in Japan, so you can choose to either carry AUD in cash with you and convert on arrival, or to order your travel cash in Japanese yen before you leave. Bear in mind that exchange offices will be hard to find in more remote areas.

How much money do I need per day in Japan?

Exactly what you’ll need to pay for your visit will depend a lot on what you like to do, and where in Japan you’ll stay. You’ll find prices in major cities far higher than in the countryside, but there’s a pretty good choice of accommodation price points wherever you go. That means you can design your trip to suit your budget.

To put this in context, a 3 course lunch for 2 will set you back a little over 50 AUD on average, a cheap lunch for one will be around 10 dollars - and a domestic beer about 4 dollars. Public transport can be around 2 dollars for a single journey, making this an attractive option for getting around while in Japan.

Do some detailed research to see how much things are likely to cost based on your plans and where you’re headed, so you can set your budget. Get more detailed cost information by city, from Numbeo.com .

How much does it cost to fly from Australia to Japan?

Flight costs vary widely depending on where in Australia you’ll leave from and the time of year you’ll visit Japan. At the time of writing (September 2023), you can find flight deals from under 500 AUD return from Sydney to Tokyo’s Narita airport, for example.

Top travel money tips to Japan

Here are a few final tips to help your money go further while you’re away:

- Cash is king in Japan - make sure you have some cash on your at all times, to avoid unnecessary problems

- Have several different payment methods in case one isn't accepted wherever you are

- Get a travel money card before you leave to make it easier and cheaper to spend and withdraw in Japan

Avoid common travel money traps in Japan with this handy guide.

There’s no single best way to take money to Japan. You’ll meet situations where you definitely need cash - but carrying all your travel money in cash isn’t a smart move for safety. That means that for most people, having a variety of ways to pay including some cash and one or more cards makes sense.

Consider getting a travel card - such as a prepaid travel card from Wise or a travel debit card from Revolut - to use alongside your regular debit or credit card, and make ATM withdrawals where you see international ATMs available during your trip. Using your specialist travel card can mean you get a good exchange rate, plus many have some free ATM withdrawals overseas. They’re also a safe option as they’re not linked to your home bank account, so even if you’re unlucky and have your card stolen the thieves can’t get to your everyday account.

Use this guide to decide which option to take money to Japan will work best for you, based on your own preferences and needs.

FAQ - Best ways to take money to Japan

Should I exchange money before I travel to Japan?

You’ll need to have some cash in Japan, so you can exchange in advance or make an ATM withdrawal on arrival at the airport. Using an ATM can also be cheaper than advance exchange, particularly if you have a travel card from a provider like Wise or Revolut.

Can I withdraw Japanese yen from a local ATM?

You can’t withdraw Japanese yen at an ATM in Australia, but you can use a travel card to make an ATM withdrawal on arrival in Japan. Bear in mind that not all ATMs in Japan can support international cards - look out for specific international ATMs at branches of 7-Eleven and Japan Post.

Are prepaid travel cards a good way to take money to Japan?

Travel prepaid cards from services like Wise are a safe way to spend when abroad. With Wise you’ll also get mid-market exchange rates and low, transparent fees which can bring down the costs of your trip.

Can I use cash in Japan?

Yes. Cash is the only payment method accepted by many smaller merchants, so having some cash to use alongside your cards is pretty much essential when you’re in Japan.

- United States

- United Kingdom

Travel Money Guide: Japan

Credit, debit or cash avoid unnecessary fees and find the best way to use your money in japan..

In this guide

Compare your travel money options for Japan

What is the best travel money card to take to japan, how the different travel money products work in japan, japanese yen: exchange rate history, a guide to the japanese yen, how much ¥en do i need to bring.

Travel Money Cards

Compare your travel money options, read our guide on Japanese yen and figure out how much you'll need to budget for those ramen lunches and karaoke nights.

Our top tip? Most ATMs in Japan don't accept international cards so you'll need to keep an eye out for ATMs inside Japanese Post Bank and Seven Bank.

Cash is still king in Japan, especially due to the difficulty of ATM access for visitors form overseas. You've also got the choice of prepaid travel cards and debit or credit cards for larger purchases.

- Prepaid Travel Money Cards

- Travel Credit Cards

- Travel Debit Cards

Best is a subjective term — it means something different for everyone. At the very least, a travel product should have one of these features:

- No currency conversion fee

- Either no international or local ATM operator fee

- Travel extras: insurance, airport lounges, worldwide concierge service, etc

Next, you need to have an idea about how you plan on transacting in Japan. While Japan is very much a cash society, there are times when you'll need to use your card. Hotel and travel bookings as well as big ticket items should be purchased on your credit card if possible to make the most of your card's interest-free days feature.

But, if you plan on indulging in Japanese culture — think tea ceremonies, guided tours in Sakura season, entry the Emperor's Palace and small cafeterias and eateries — you'll need cash. The cost of withdrawing from an ATM should be a factor in your comparison of travel money products.

A product which doesn't charge for currency conversion or to use the ATM is ideal. Some ATMs in Japan (mainly in 7/11 stores and post offices) don't charge a local ATM operator fee. Pick the right product and it could be cheaper to withdraw your money in Japan than it is at home.

A quick summary of travel money options for Japan

Japan is a cash society; however, credit and debit cards are accepted in most places in Japanese cities. Establishments such local restaurants, markets and rural inns (ryokans) are cash only. In the places where you can use your card, you may have issues if you're using a travel card at the point of sale. Some merchants may reject this card because it doesn't have your name on the front.

Using a prepaid travel card

A travel card like Wise lets you load Australian Dollars and convert the funds to Yen (along with a number of other currencies). The main advantage to these cards are they allow you to spend without paying extra for currency conversion. Other benefits for travellers include:

- A dual card account. You get a backup in case your first card is lost or stolen.

- Security. Travel cards are CHIP and PIN protected.

- Prepaid accounts. Stick to your budget and top up your travel card when you need more money.