- Start here!

- Travel Resources

- Blogging Resources

- Pre-Travel Checklist

- Books I’m Reading

- Start Your Own Blog

- What’s In My Backpack?

The Best Travel Cards And Bank Accounts For Kiwi Travellers

published by Bren

Last updated: May 23, 2023

QUICK SUMMARY

The best travel card for Kiwis right now is the Wise debit card.

To be frank, it's in a league of its own right now and there is nothing close to it.

It allows you to load NZD and exchange it to all other major currencies at a fair rate (better than any NZ bank rate).

It also allows you to get bank account numbers (!) in other currencies, so you can receive payments in those currencies.

Finally, it's all manageable within a very modern and easy-to-use app.

If you do not wish to sign up for a Wise card and want to just use your NZ bank, the best option right now is ASB.

Their fees for ATM withdrawals are the lowest, so you can get yourself cash in practically any country in the world without losing too much in fees.

This article is a part of my travel tips series for New Zealand travellers. If you're not from NZ, this post won't apply to you. You can see the rest of the Kiwi traveller guides by clicking here .

As a New Zealander, trying to find the best travel cards and banking options has been a frustrating affair. Why? There's just not that much to choose from.

Banks in larger countries are faced with higher competition and are forced to give their customers bundles of perks, while in NZ the banks enjoy a nice oligopoly which leaves us at the mercy of a few big players.

What that means is we never enjoy double and triple frequent flyer point deals, large signup bonuses, zero foreign transaction fees and ATM fee refunds. We don't have great travel credit cards or reward schemes. Very unlikely that you'll be getting free lounge passes or New Year bonus points.

However, there are still a few good options for us Kiwi travellers. And of course, it's still important that you don't lose money. With the wrong setup, you can end up paying hundreds in fees for currency conversions, overseas ATMs, interest, monthly and annual fees and more.

That's what I'm gonna help you with today.

In this post I'll break down the best travel cards, bank accounts, and some other lesser known options, and show you how over ten years of full time travel, I've managed to keep my bank fees down, gain several free flights on Airpoints, all while enjoying affordable and easy access to all my money, in various currencies, anywhere in the world.

Note: This is a long post with a lot of numbers. If you don't care for the analysis and just want to know what cards/accounts to get, you can skip straight to the bottom.

Part 1: Getting rid of ATM fees

The main way I access money while travelling is via ATM.

Not everyone knows this, but you can use ATM's overseas exactly the same way you use them in New Zealand. You get cash in the local currency, usually get a very good rate, and it comes straight out of your normal NZ bank account. It's very safe and easy.

In many countries, I never use a credit card or travel card at all. I just visit the ATM once or twice during my trip, and use cash for everything.

However! If you don't set up your bank accounts right, this can end up costing you a lot in fees.

Here's an example of when it doesn't work out so well for you:

I wanted to withdraw 10,000 Philippine pesos, which is around $265 NZD. At the time of this withdrawal, the interbank exchange rate (the 'real' rate that banks use) was around 38, and I was given 38.34.

So instead of paying $265, I paid $266.04.

That's a pretty good rate. At one of those currency exchanger booths, you'd lose 2-3% off that at least.

However, let's look at the fees here:

Offshore service margins: This is a fee they charge for withdrawing foreign currency, and will usually be between 1-2%. In my case, the fee is 1.1%, or $2.93 (that's actually low for a NZ bank).

Overseas ATM Fee: This is a fee charged for using an ATM outside your banking network. It usually ranges between $5-$10. In this case it's $7.50 (quite high).

Local ATM Fee: This is a fee the local bank will charge for using their ATM (everyone takes a cut!) As you can see, I wanted 10,000 pesos, but got charged 10,200. That extra 200 is the usage fee (around $5.50).

So for one $265 withdrawal I've been charged $3 in service margins, $7.50 by my NZ bank and $5.50 by the local bank whose ATM I'm using.

That's a total of $16 for one withdrawal. If I do that once a week it's going to add up to around $700 a year - not cool.

So, how do we avoid this?

Choose a bank with no foreign ATM fees

When I first wrote this article a few years ago, the only bank that offered free foreign ATM withdrawals was Westpac, through their membership with the Global ATM Alliance .

Things have changed since then.

In early 2018, ANZ announced they were waiving ATM fees both in NZ and overseas, and ASB followed suit later in the year and BNZ not long after that. Meaning most banks in New Zealand now waive all foreign ATM withdrawal fees.

However, if you really want to see who gives the best deal, we need to add up all the fees involved:

Overseas ATM fee summary (updated May 2020)

As you can see, ASB is easily the front runner here. But what we really care about are actual dollar amounts.

Here's what your fees will look like when making the following withdrawals at an overseas ATM:

This picture was a lot more complicated just one or two years ago, but now there's no contest when it comes to the best bank for NZ travellers: ASB .

The bank account I use is their Streamline account , which is managed entirely online, has a free EFTPOS card, and no fees.

How do you use a NZ EFTPOS card at an ATM overseas?

To use your NZ EFTPOS card at overseas ATMs, it works exactly the same as it does back home.

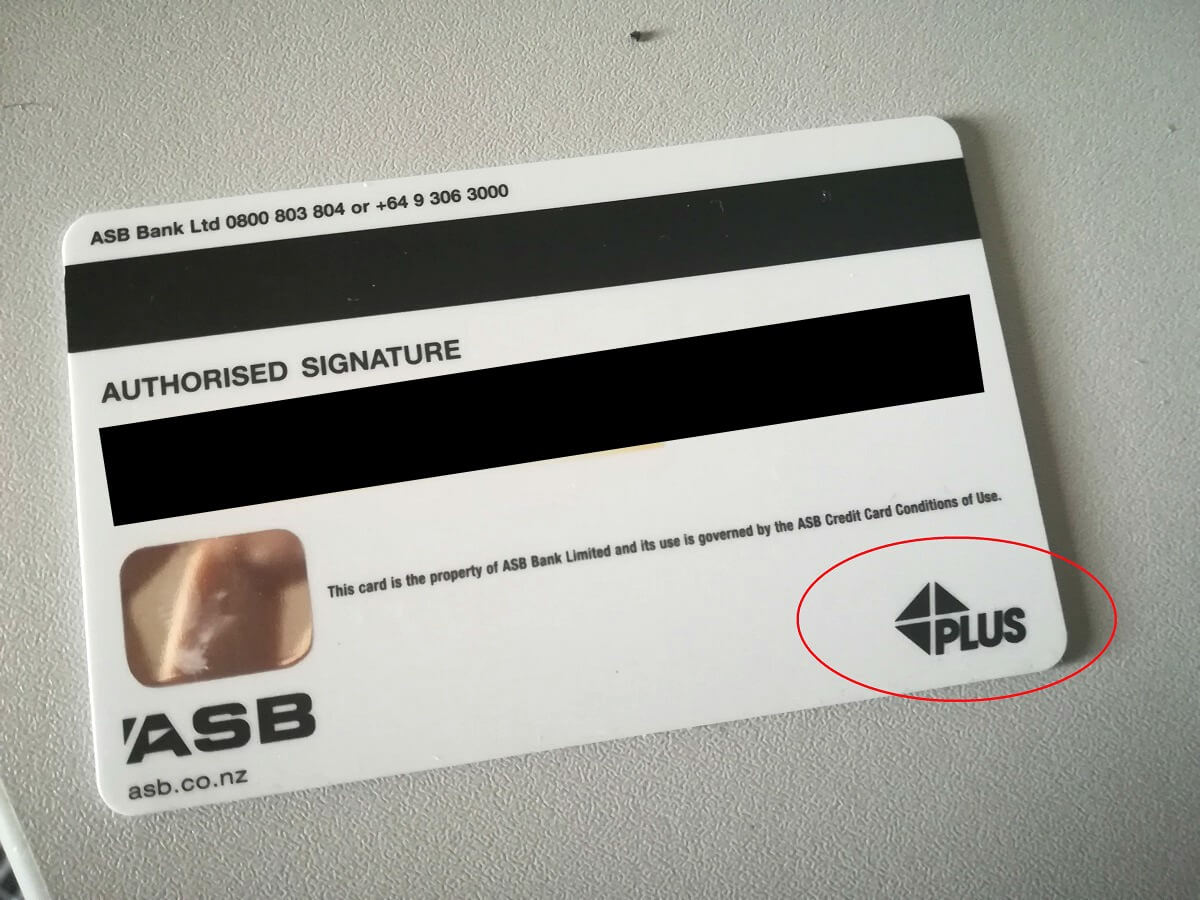

As long as your Eftpos card has a PLUS, Cirrus or Maestro symbol on the back, you can use it at almost any ATM in the world.

Check the back of your card and you should see one of those symbols, most NZ cards are either PLUS or Cirrus.

For example, here's the back of my ASB card with the PLUS symbol:

Then when you visit an ATM, you'll see a sticker that shows what cards they accept, it will look like this:

Since those symbols are displayed there, it means your EFTPOS card will work just fine.

Just put it in, enter your PIN and away you go.

It's also really important to remember not to choose "credit" when you make your withdrawal. Choose check or savings or whichever your bank account is connected to.

If you choose credit, it will not be an EFTPOS withdrawal but a cash advance on your credit card. That incurs interest, a worse fx rate and maybe some other fees as well.

Part 2: Prepaid debit cards/travel cards

These types of cards the best travel cards available today when it comes to fees/usability.

They allow you to pre load different currencies (around 9 different ones) onto a prepaid Visa or Mastercard, meaning you can make purchases/ATM withdrawals in those currencies without paying the foreign exchange fees.

Some also offer free ATM withdrawals.

The 3 main ones available to New Zealanders are the Air NZ Onesmart, The Travelex Cash Passport, The Wise Debit Card and the Loaded for Travel card.

First off, Loaded For Travel has been phased out. You might still see people using them, but they're no longer being issued as of 2020. So that one is out.

Let's compare the other three. We'll look at the foreign exchange rate, the fees, and the overall ease of use for each card.

As a benchmark, right now the NZD/USD rate is 0.6185, so we'll base our analysis below on this:

The Air NZ Onesmart card is a Mastercard debit card by Air New Zealand. It is managed via your Airpoints account and is pretty easy to use.

When looking at the rate, here's what you'll get when loading $1,000 NZD into USD.

$1,000 NZD gives us $595 USD.

That's not very good.

With an interbank rate of 0.6185, that means they're taking a cut of 3.7% (that's a lot).

There is also a load fee of 1.5%, a currency conversion fee when you use the card of 2.5%, and a $1 monthly fee.

However the Onesmart does give you other perks, such as earning Air NZ Airpoints on your purchases and 3 free ATM withdrawals a month.

Getting the card is free.

Travelex Cash Passport

The Cash Passport is a travel debit card available from Travelex. You may have seen their currency exchange booths and ATMs in the airports.

Here's their current rate when loading $1,000 NZD to USD:

$1,000 NZD gives us $605 USD.

That's better than the Onesmart (which gave us $595).

The rate is 0.6055, compared to the interbank rate of 0.6185, so they're taking a cut of 2.1%. Not extravagant, but not great either.

Travelex also has a bunch of other fees:

- $10 initial load fee

- 1% subsequent load fee

- $4 monthly inactivity fee

- $10 closure fee).

Looking at that you're already guaranteed $20 in fees to simply open and close an account. ATM withdrawals are free.

Could still be better than a Onesmart, depending how often you plan on using it.

Wise Debit Card

Wise is a European money transfer service, but started offering debit cards and "borderless" bank accounts a few years later.

Their debit card came out around 2018 for Kiwis.

I've been using it and it's been pretty great.

Here's what rate you get for loading $1,000 NZD to USD.

At a rate of 0.6186, that almost exactly matches the interbank rate to four decimal places (actually slightly better).

So the currency exchange fee they are taking is zero. That's amazing.

Of course they also have a fee like the previous cards, which here works out to $7.83, or 0.7%. That's really low!

Ordering a card is not free; it costs $14 NZD.

After that there are no monthly fees, and you get free ATM withdrawals of $350 per month (2% thereafter).

There are also many other perks to owning a Wise card - you can open bank accounts in various currencies, get an IBAN number, and receive money in foreign currencies too.

So which prepaid travel card is the best?

Let's put all that info together and see if we can get a winner:

First, the Onesmart exchange rate is so crap that I would disregard it altogether - there is no way you would save money with it when you're losing 3.7% every time you load money.

That leaves Travelex and Wise.

Because the exchange rate is also rather terrible for Travelex (and literally perfect for Wise), that would be enough for me to recommend Wise outright.

Add in the fact that Wise has no closure fee, no inactivity fee, no monthly fee, and the cheapest load fee by far, and it's a no brainer.

The $14 set up fee is the one downside, but it is a one-off, and over the long run is easily worth it. In fact, you will make that back in savings the first time you load money.

Travelex also ran into financial problems in early 2020 , and it seems risky to have money stored on one of their travel cards right now. Them disappearing is not impossible.

So easy decision here: Best prepaid travel card for Kiwis is the Wise Debit Card.

You can sign up for yours here .

Part 3: The best travel credit card for Kiwis

Let's move onto travel credit cards.

The trick with credit cards is to minimise your fees, never pay interest, and try and earn some reward points along the way.

We'll start with fees. What are some of the fees you typically pay with credit cards?

Here's an example:

For this particular transaction, I purchased a $111 USD air ticket on Cambodia Angkor Air.

On that date the interbank rate was 0.875, and they gave me 0.873. That's good.

But you'll also see I got charged fees of $3.18; around 2.5%.

I personally do not want to add 2.5% to everything I buy, just because I'm using plastic.

Unfortunately there is currently no bank in New Zealand that offers a credit card without foreign transaction fees , so this is unavoidable.

However, having a credit card is very handy during your travels, so I think it's a good idea to always have one on you, even if our options aren't great in NZ.

Since there are literally hundreds of different cards available in New Zealand, I'm not going to compare them all. What I will do is compare a few "free" credit cards to see which gives us the best deal.

The following credits cards all have no annual fee and are reasonably easy to get approved for:

All are pretty similar across the board.

The main differentiator is the ASB Visa Light has no cash advance fee, meaning any ATM withdrawals are free. They should be free anyway on your EFTPOS account, but have this as a safety net is great as well.

The other thing is the AMEX Airpoints card is free and gives you a chance to earn Airpoints, plus you get a $50 signup bonus - that's also important and I'll address that more later.

Let's take a look out how these fees actually translate into numbers. These are the fees you would pay if you made the corresponding purchases or ATM withdrawals:

The ASB credit card is best if you'll need to make ATM withdrawals.

The Kiwibank card is best if you'll want to make actual purchases.

This is under the assumption you pay the bill on time and don't incur any interest.

Either way, credit cards should be a backup only , and you should use your ASB EFTPOS for ATM withdrawals and Wise debit card for purchases on the road wherever possible.

Don't forget about Airpoints!

This is more a tip for while you're in New Zealand, but make sure you're taking advantage of Airpoints!!

If the average New Zealander uses an Airpoints credit card in their day-to-day life, they should easily get a free air ticket to Aussie or Bali each year.

If you're after a good, cheap, fast-earning Airpoints card to use, the American Express Airpoints card is the easy winner.

It's the only zero-fee Airpoints card there is , plus the Airpoints earn rate is even better than some of the more expensive cards from the NZ banks. I'd highly, highly recommend applying for it today while it's around. Often they also have a $50 signup bonus, which makes it an absolute no brainer. Check here if the bonus is on offer and to get your free card .

For a more thorough breakdown of Airpoints cards in New Zealand - I've got an entire guide which analyses every single Airpoints card available in New Zealand. You can check it out here.

Another credit card tip: Paying in NZD (if it's a good deal!)

Sometimes shops and websites will ask if you want to pay in NZD instead of local currency.

This can be a good idea sometimes.

Whenever the shopkeeper asks if you'd like to pay in NZD, always ask what the amount will be. Then pull out your phone and do a quick conversion (I use the Oanda app) and check if it's a fair amount.

Nine times out of ten they will be taking a big commission on the exchange rate. That means even though you'll avoid FX fees on your credit card, you'll end up paying more to the shop and it will probably end up costing you more overall.

There are good opportunities to do this though. Take a look at this example.

This is a hotel booking form from one of my favourite booking sites, Agoda . It's for a hotel in Bangkok:

Their prices are USD listed ($88.55), however they also give me the option to pay in NZD ($102.25).

If I choose to pay in NZD, I'll be getting a conversion rate of 0.866, compared to the current interbank rate of 0.867.

That's very good, and much better than what AMEX will give me if I pay in USD and let them convert it (it was around 2.5%, remember?)

Therefore I often make online bookings in NZD (assuming the rate is good), which eliminates foreign transaction fees, and also lets me earn some Airpoints along the way.

In the case that it's better to pay with USD, just use your Wise debit card.

Summary for the best travel credit card:

There is no 'good' travel credit card in NZ (that I know of).

However, it's always good to have one anyway. My recommendations are:

- An ASB VISA Light as a backup.

- An AMEX Airpoints card to earn the $50 signup bonus, and earn Airpoints on all NZD purchases.

- For everything else, use the Wise Debit Card .

So which travel cards/bank accounts do I use?

Here's the summary of what I use currently to keep my fees as low as possible and money as easily accessible on the road.

The main card I use while travelling is my Wise Card . Nothing else is anywhere near as good.

However, as backups:

- I have an ASB Streamline Account (no fees), which I use to withdraw larger amounts of money from ATMs. I have never visited a country where I could not do this.

- I have an Airpoints American Express (no annual fee), which also has no fees and earns me Airpoints. I barely use this while travelling, but I use it for pretty much everything I buy while in New Zealand . If you're not already, I'd highly recommend signing up for one today and start stacking Airpoints! I also recommend you read my guide on travel hacking for Kiwis .

- Lastly, I carry a small amount of USD in cash for emergencies.

Between these options I manage to keep my bank fees almost non existent - in fact you might have noticed every single card has no annual fee.

I also get to earn a few frequent flyer points along the way. Pretty good, no?

What should you use?

If you're on a shorter trip (say 2 weeks - 1 month), it becomes much less important what card you will use.

If you're just going to Australia, you can simply use your NZ Eftpos card to get money from ATMs. You can even use your ANZ and Westpac cards and their equivalent ATM in Australia.

If you're going on a longer trip, or travelling around the world, you absolutely need a Wise card . That option can hold you down in almost every country. Keep an ASB Eftpos card handy, and possibly one other bank account too as a backup.

Best of luck in your travels and as always, if you have any questions, drop them in the comments below.

Loved this? Spread the word

You might also like:

Running port vila: ten days in vanuatu’s capital, a night at the gallery, i wrote a book, where to stay in auckland: an insider’s guide, share your thoughts.

Your email address will not be published.

Another great usuful post Bren! I have done some researched on it myself and thought that the best option for me is ANZ (i have been a custumer for a long time anyway) and a Loaded for travel, which I manage to use a lot as an EFTPOS card to avoid withdrawn fees, also the exchange rate was much better than cash passaport everytime time I looked and I really like the fact that the maximum load fee is NZ$ 10, depending on how much you want to load that can really make a difference. I avoid inactitve fees using my card now and then in NZ and plan on using it for the 2 years the card is valid for so wont pay to cancel it. I heard, but have not verified, that if you put money into your normal credit card, as in paying it more that you owe, you dont pay international transaction fees, It would be pretty good if it is true but I am still very jealous of canadians and americans with their awsome deals and rewards!!!

I also heard that you don’t pay fees if you credit card is loaded with cash, but I double checked this with ASB and they said it doesn’t work like that. Otherwise I would definitely be doing that. I haven’t checked with the other banks though. Doesn’t Loaded for Travel cost $6 per ATM withdrawal? At least that’s what their website says.

I feel like I remember reading in your elance post that you worked in finance or something before.. not surprising looking at all these graphs and charts lol!

Yes, I can obsess about dollars and cents sometimes… 🙂

Great post – thanks for doing all that research and sharing it with everyone. I’m on ASB and whenever I travelled I would just withdraw and didn’t give those fees much thought but next time I travel I’ll think about getting a Westpac card. Although bank fees are a pain – a better way to think of it is at least we have banks and don’t have to carry suitcases of cash everywhere we go! So you can look at those fees as payment for their services such as keeping our money safe 🙂

That’ true, and I don’t mind paying bank fees at all, however, $13 just to get my own money out of an ATM – that’s a bit much for me. I know it doesn’t cost the bank that much, because if ANZ and Westpac can let you do it for free and still stay in business, I’m sure the other banks too 🙂 I’m also with ASB, however I’ll be winding down my accounts with them soon and shifting to ANZ (and I’m already with Westpac). Glad you found this helpful, and happy travels 🙂

Yes, they do charge $6, I didn’t express myself very well. What I meant is that I tried to pay with my card as much as I can instead of getting cash from an ATM. For the amount of money I loaded for my Italy trip I would have to withdraw cash many times for Loaded for travel to be more expensive than Cash passport because of the loading fee and exchange rate difference. So I guess it depends on the trip, I had a spreadsheet with all the fess and some scenario testing to help me chose 🙂

Ahh I get you, yes the exchange was quite a bit better on the LFT card. All depends on how you plan on using it I guess.

Thanks for that info Bren. I emailed you through a question in regards to the money situation about a month ago and wanted to thank you for your reply. My partner and I decided to go with the westpac credit card and the Air NZ Onesmart card as we already had both of these. Thanks for all the other informative blogs. Off to Indonesia next week to start our backpacking adventure around asia!

Hi Alan, you’re welcome, enjoy Indonesia and all the rest Asia has to offer!

Hey Bren – this post couldn’t have come at a better time for me, so thank you! I’m an ANZ customer and will be travelling through Asia. I was going to go with a Loaded for Travel card (so at least I could have baht for Thailand and USD for Cambodia) but the $6 ATM withdrawal fee is ludicrous! I’m looking into just taking my debit card and sticking to ANZ ATMs, as per your suggestion – do you know if they still charge the currency conversion fees?

Yes I believe they do, I know Westpac does anyway. I don’t think any bank in NZ lets you off those, but the rate can differ (ASB is only 1.1%, compared to Westpac’s 2.5%

Hey, thanks so much for this post! With the Global Alliance/Westpac account – do you know if there are fees if you use the eftpos card like an eftpos card overseas, or would it just be the offshore service margin charged? And the same question in regards to the prepaid credit cards – if you used them like an eftpos/credit card, are there any fees? I presume there is not offshore service charge because the money has already been changed to the local currency…

As far as I know the Westpac card can only be used for ATM withdrawals. As for the prepaid cards, there will be no fees if you have money loaded in the correct currency. Hope that helps!

Hi Bren – I’m off to the States for a month and was planning on using my Westpac eftpos card at bank of America ATMs (global alliance bank) to withdraw cash, and then was tossing up between using my Westpac debit plus card or a Onesmart card for any credit card transactions. What would you recommend? Would hotels, car rentals etc accept the Onesmart card? Also, do you know (from your experience) whether the States is a cash friendly place to visit or do merchants prefer credit cards? Thanks!

Yes I was also using my Westpac card in the States, there are no ATM withdrawal fees but they do charge a currency conversion fee when you make a withdrawal which was quite hefty at 2.5%. Sometimes it was cheaper to use my ASB card if withdrawing a large amount, which charges $7.50 + 1.1%.

If you’re only going for a month it will probably be cheaper to use your debit plus instead of activating a Onesmart. The Onesmart doesn’t give as good exchange rates, and plus, it’s biggest advantages are the free ATM withdrawals which you can get on your Westpac anyway.

To answer your other questions, the Onesmart should be accepted anywhere that accepts Mastercard. Most of the states should be card friendly – depends on the city I guess. It’s a big place!

Hope that helps, Bren

Have you done any research on opening up accounts with international banks? I know a lot of my American friends use Charles Schwab. They offer great interest rates and no fees for overseas ATM withdrawals.

I’ve been meaning to check into it for some time now but haven’t gotten around to it.

I haven’t looked into it but I think you need a US residency to open a Charles Schwab. Most American travellers I know use them also, they’re very good.

Hey Bren! Thanks for sharing this 🙂 We are also from NZ and last years atm fees in Vietnam were such a bum for 5 months! so now were more prepared 🙂 keep sharing, good stuff!

Hey Kate, no worries! I think there’s an ANZ in Vietnam if you’re heading back. As a side note I’m moving to Cash Passport over Onesmart because the exchange rate is better, in case you’re going that route.

This post was exactly what I have been looking for. Joining ANZ however does not seem very helpful as to get to the ATM locations would cost me more than the fees required normally, the ATMS are too far and few. Thanks for this post however very helpful and informative.

I am planning on using the westpac card in most of my journey through Europe and USA but I will be doing a bit of travel in Asia first so I have just done a bit of research, and looking at Westpac, BNZ, ANZ and Kiwibank they all charge 2.5% plus the ATM withdrawal fee Which varies from $5.00 to $7.50. In this case would the AirNZ onesmart card not be the best option as they charge minimal fees and includes 3 free withdrawals per month potentially saving you $22.50 a month. As stated above I would not really be willing to go with the ANZ card as it seems to be a bit awkward to get to the ATM locations.

Are there other hidden transaction costs that I am not seeing here with the onesmart card? Would like to know your thought.

Regards, Stevo

Gday Stevo, the thing with the Onesmart is it doesn’t give a very good exchange rate, so this adds up over time. On a big withdrawal the difference can be up to $20 or $30. Last I checked ASB only charges 1.1% plus $7.50 – in USA and Europe, where you can make quite big withdrawals, this can work out better than Westpac’s 2.5% even after the $8 fee is waived for alliance ATM’s. I have an ASB, a Westpac and a Onesmart and I cycle them, depending on the situation. Annoying, I know.

Hi Bren, thanks for your post!! I’ve been searching online for days trying to find info about NZ travel/credit cards. My eyes hurt. Real bad! My problem is that I’m travelling to South America, where the currencies aren’t an option on any of the travel cards … and if I had NZD on the Travel Cards, the huge 5.75% conversion will likely wipe out any benefit of no ATM fees in the long run.

After my own research comparing foreign curency conversion rates, atm withdrawl fees and card fees, I’m leaning towards opening a westpac debit account, simply to avoid the ATM fees. My question to you, is whether you have travelled SA and whether you had any trouble finding the global banks aligned with Westpac to avoid fees???

I will also keep my ASB cards as the give a marginally better conversation rate than westpac. (2.1% so I’m interested how you get 1.1%!!)

Thanks in advance. Megan 🙂

I’ve been to SA a few times but the global alliance doesn’t have great reach throughout the continent. I’d say it’s best to use a cash passport or an ASB. As for the service margin – this is from ASB Fastnet – ** The Offshore Service Margin is 1.10% for a FastCash overseas withdrawal and 2.10% for a Visa Debit overseas transaction.

In other words, withdraw from your ASB checking account rather than your credit account.

Hi Bren, heres a scenario… i am in Spain and log onto Google NZ and book accommodation with my NZ credit/or debit card buying in NZD (obviously) and paying no foriegn currency changes. (Because the bank see’s a NZ transaction being processed in NZ even though i am in Spain)…. hows that sound? And is it possible?

Cheers Graham

Hi Graham. Usually the website is very clear on which currency you’re being charged in. It’s possible to book accommodation in NZD on international sites and I do it often (e.g. hotels.com, agoda). And yes, that will avoid the foreign currency rates. The only thing to look out for is to make sure you’re getting a fair exchange rate. Cross check the price you’re given with current rates and see if it’s a reasonable conversion.

Hi Bren, Just been reading your useful article. Regarding credit cards. I have a Warehouse Credit card and overseas transaction fees are only 1% ! This is easily the cheapest. Check it out! Cheers Paul

PS I am in the process of contacting Charles Swarb bank USA re opening a no fees chequeing ac in USA for a Kiwi resident. I will post on their reply.

Hi Paul. Nice find. I probably won’t be using my credit card too much overseas until they bring one out with 0% foreign transaction fees + Airpoints. Until then I pay with most things in cash. Do let me know what Charles Schwab say!

Hi Bren, Just had an online chat session with Charles Schwab. It is possible to open an account with them for free chequeing and them also providing a Visa card ! (don’t know limit though) BUT the catch is to open an International account the minimum deposit is US$10000!

Hey I’ve been booking in NZ dollars on the accommodation sites and I still get charged the 2.5%(WPac) charge every time. It has after all been converted from a currency that is not mine at some stage!! Westpac credit cards WERE free if your card was in credit but they axed that about 6-7 years ago!!

If the site charges you in NZD it shouldn’t incur a charge. I don’t have a Wpac credit card so can’t say if what is happening to you is normal, but on my Kiwibank and ASB I’m getting charged in NZD with no currency conversion.

Hi and thank you! I am going to Cambodia and so got myself a ANZ account for free ATM cash withdrawals but will have to pay 2.5% conversion. My Kiwibank Air NZ mastercard only charges 1.85% conversion but $6 for ATM use abroad PLUS it says possible extra charge from the overseas bank you withdraw from. Any experience of this double ATM charge in Cambodia please? Difficult to work out which option will cost less.

I’ve been using my Kiwibank Mastercard more and more just because the fee is relatively low and it’s convenient. I don’t remember if the local ATM charged fees in Cambodia. ANZ banks are there but I only saw one or two. They use USD there too. If you’re only there a short time take some USD and you may only need to make one withdrawal, so the cost should be negligible.

Awesome article. I didn’t know about the Westpac online account – this is really helpful, thank you!

Great article. We are getting slammed in Central and South America using our ANZ australia account, so have switched back to kiwibank (unfortunately not much cash on that side of the ditch). ANZ Australia and Westpac Australia both charge a 3% (!!!) foreign currency conversion fee for ATM withdrawals and CC purchases, plus the spread on the conversion (usually quite low) plus the ATM fees (not for CC obviously).

Kiwibank charges 1.7% which is pretty decent. I have an ASB account but left the card at home unfortunately, didn’t realise their rate was 1.1%.

To answer the global alliance questions, the only countries in Central and South America that are included are Mexico (apparently difficult to find but I never tried), Peru and Chile. We are only in Ecuador so can’t comment on the latter two but will hopefully chase them down when we are there.

We’ve found the best way to avoid getting screwed over was actually the cash we withdrew (AUD) and got changed to USD before leaving NZ at a little Chinese currency conversion place in Newmarket (spread was about 1.5% I think). Many places accept USD here and if you look, you can find good conversion rates in some countries and at most borders (be careful, a tired me got done at the Colombia/Ecuador border because I wasn’t paying attention, but the rate WOULD have been good!). Nicaragua for example was the best, they basically converted at the mid-market rate everywhere.

Also, had a look at the Charles Schwab thing. You can sign up as a non-US resident, but I believe you need a minimum $25k USD and also looks like there’s a tonne of paperwork, so not for us at current, but maybe kiwis planning on travelling can look into this if they have time. Our US friends are always rubbing it in our faces…

Thanks again JC

Yes, Ecuador is great because they use the USD. Westpac is only okay because you don’t get charged the $8 ATM fee, but they still charge currency conversion at 2.5%. ASB is still the best I know of for that region. Just try and take your money out in big chunks to keep the number of withdrawals as low as possible.

Hi Bren I live in the USA and I have a ASB card that I use! What is the best option for me to cut down on offshore fees?

If you live there you should open a US bank account!! They are far superior to anything we have.

Hi Bren, thank you for the article. Appreciate the work you have put in explaining these financial issues to a lay person like me. Can I ask if you know of the best travel card for Thai Baht? I will be heading to Thailand, Cambodia, Vietnam and Laos but most of my time will be in Thailand. I bank with ASB and have a Visa Debit Card. Thanks,

Hi Colm, Thailand is not great for Kiwis when it comes to currency. I would suggest just taking one big lump sum out on your ASB cheque account, it will cost you $7.50 + 1.1%. Alternatively you could do it in Cambodia, because the ATMs there give USD, then you can change that to local currency in the other countries.

Hi Bren, Great information here about the charges on the cards and the best ones to use overseas, but the other side to this is the customer service backup when things go wrong. I am currently in Spain and have a Loadedfortravel card (for the second year running) and it’s has been great and cheap however it has been skimmed and all money gone. I have contacted Kiwibank many times over the last 10 days and they have been so unresponsive and I cannot believe the lack of response to this serious situation. There systems and customer support are obviously not sophisticated enough to deal with problems when things go wrong. People really need to check the support they will get before deciding on which card to use. They should definitely use one of the bigger banks and not Kiwibank and Loadedfortravel.

Hi Louise, thanks for the tip. I’ve never used that card so I’m not sure what your recourse could be. However, if you don’t have any luck with Kiwibank maybe your travel insurance will help you out.

Really good information thanks! Just wanted to let people know if they travel to Singapore and Malaysia, moneychangers are very heavily regulated by the respective governments. Rates only vary by a small amount OUTSIDE THE AIRPORT and are much better than anything you’ll get with a credit card, there are also no fees. But NEVER ever change your cash at the airport, the rates are terrible and nobody local would ever do that! There are moneychangers in most medium to large shopping centres/malls. In Singapore for example, just take the MRT train 10 minutes (at a cost of no more than $1.60) to Expo Station and use the moneychanger in the shopping centre next to the station entrance… You could also pick up some inexpensive but great local food in the food court at the same time!

This is so helpful, thank you so much! Unfortunately, I’m living long term in Indonesia but unable to open a local bank account. THere’s no option for any pre-loaded travel cards in Indonesian rupiah. I get charged about a total of $10NZD for every withdrawal (which I try and minimise but it is difficult). I don’t suppose you have come across any extra information about money saving tips for this region? I’m with ASB and generally use my ASB visa for all withdrawals etc. Love this blog post!

Try open an ANZ account. I believe they have branches in Indonesia.

Hi guys, I leave for Singapore coming Saturday and then 12 hours later leave for South Africa, Just wanted to know with about $3500 spending money, should I exchange some cash here in New Zealand and load some on a card? Which is best please? I would also lie to know whether I should just use a card in Singapore since I don’t plan to spend much there?

If it were me, I would just withdraw everything from ATMs in South Africa. You can either just use your eftpos card or if you prefer you can get a travel card. However, if you’re planning on spending all that money in SA and you prefer to use plastic, then you could get a travel card and load it all as South African Rand. Loaded for Travel is probably the best card for that amount of money as there is no load fee. If you’re only in Singapore for 12 hours you probably won’t even leave the airport, and you can use any major currency in the airport. If you do leave you could just change a little currency in the city, won’t be a big deal if it’s just a small amount. Have fun!

Hi Bren Wow what a lot of info, it’s all very overwhelming, but like you, I hate banks getting anymore money than necessary. We are off to the UK, Europe and Dubai and am just debating how much cash to carry vs loading my Onesmart. We can get an exemption of fees at the airport for buying currency but are the exchange rates worse than at the local branches, wondering if it’s worth our while? We also bank with ASB and hadn’t even considered just using an ATM card. Decisions decisions, any hot tips for Europe would be much appreciated. Regards

It really depends on so many things – Euro UK and Dubai probably means you can use plastic a lot and if you’re planning on loading a lot of money the Loaded For Travel card can work well because there is no load fee. There are Global Alliance ATMs in UK and Europe so you can use Westpac for free ATM withdrawals but they charge 2% conversion fee anyway which can add up to quite a lot. But try and figure out which one will work best based on your budget. ASB is fine too – they charge 1.1% but charge a flat $7.50 per withdrawal, so it can still work out cheaper than Westpac depending on how big your withdrawals are. Onesmart is probably not a good idea as the rates are usually really bad on that.

Great tips Bren My ASB Visa Platinum reward card has a 2.1% foreign currency fee but then that is offset by the accumulation of 1% true reward benefit so I’m thinking that using that card extensively where ever it is accepted is a better option at 1.1% net, than paying cash by using a Westpac Card at Alliance ATMs which has a 2.5% foreign currency fee. This assumes that the retailer/supplier has not applied an additional local credit card fee in the credit card transaction. What am I missing?

This is true as long as you account for your True Reward Fee and your Platinum card account fee and if the country you’re visiting accepts cards everywhere. The reason I like using cash is because a lot of the places I go to are cash only (markets, street food, cabs etc) and I don’t need to carry my card everywhere. Plus I often use my ASB cash card over my Westpac at ATMs these days, as the fee usually works out lower. Crunch some numbers and if it works out cheaper for you to go Visa then go for it!

The Gem onecard Visa now has a currency conversion fee of 1.9% and foreign ATM and cash advance fee of only $1.50! This means you have to get over $750NZD from an ATM before the ASB EFTPOS card wins. By simply prepaying your credit card you avoid the interest on the cash advance. It costs $65/yr but free for the first 12 months. I’m planning on travelling to Nepal with this card and then cancel it at a later date in preference to using my Air New Zealand American Express Card for Airpoints 🙂 What are your thoughts on that plan?

Sounds good! Also if you don’t mind micro-managing your cards (opening and cancelling constantly) you could keep this up for quite a while, as most credit cards in NZ have “special” signups where they’ll waive the annual fee for a year and give you all sorts of other bonuses (Airpoints etc). Just gotta keep an eye out!

Also the Warehouse Purple Card has similar rates but has no annual fee – check that one out too 😉

Slightly different thread but the lounge benefits of the Amex card rocks! Recently had a 7 hour stop in Sydney and the lounge pass was worth it’s weight in gold. The free food and grog was spectacular,we were like kids in a candy store. Nearly worth flying to Sydney for lunch!

Which Amex card have you got?

Thanks for great info Bren. Used Westpac alliance to withdraw cash on last trip mainly in France and Italy. This time it is Croatia and Greece – seems no global alliance ATM options there and no ANZ branches. Any tips?

I usually just use an ASB eftpos card and will take the max withdrawal out of the ATM. Because Greece uses the euro it’s not a big deal if you have some leftover – you can just keep it for another trip or it’s easy enough to change back if you need to. Croatia uses the kuna so a little more tricky – depends on how long you’re staying there. If it’s just a few days, exchange a little euro at a currency exchange with a decent rate. Not perfect but will get the job done.

Hi Bren. What a can of worms this is. You’ve done a great job here of letting people communicate ideas and ask questions. I’m heading away shortly to Britain, Europe and the States for a total of 4 months. Fortunate to have a son in England who will get me Euros and Pounds, which has the disadvantage of carrying a lot of cash, but which avoids a lot of fees. I can load up my ASB Visa so that it is in credit and any overseas ATM withdrawals come out at Fastcash rates of 1.1% which is comparatively pretty good I think. I’m still trying to work out if ASB is the best option as credit card. Because we’re away for such a long time I’ll still be making a lot of CC purchases. I’ll get True Rewards points but I’d love to pick your brains to find out if you’re aware of a better solution. Thanks heaps

I had a friend who used the Loaded for Travel debit card. Because she was buying everything with plastic it worked out best for her – it has a low loading fee and she never did ATM withdrawals. Also look into the Warehouse purple cards – they’re pretty good!

Thanks so much for all your advice Bren on this site, it has really helped me a lot on my travels. Can I ask for your thoughts here…im going to North Cyprus for 8-10weeks. They use Turkish lira, but also evidently Euro and English Pounds are accepted. I have an ANZ debit card and a Onesmsrt Card. I’m in Finland at the moment. What should I do money wise.. I leave next week. I am not making money so am always using NZ dollars as my main source.

For that period of time I would probably avoid using your Onesmart. The exchange rate will catch up with you a lot. I you’re comfortable carrying around a large amount of cash, I would just take a big withdrawal in Finland and try and use cash. Although in Cyprus you could probably just use your card to pay for most things – I’m not sure though as I’ve never been there.

Thanks for the reply. Wish I had known about your site sooner! I am planning to try and be away for at least 12 months. Unfortunately I didn’t realize Onesmart had such high fees. Sorry to ask another two questions…so am I actually better off using my ANZ eftpos visa debit card in atm machines rather than converting NZ dollars to euros on my Onesmart card and then using that to withdraw money. Also is it worth it now or is it even possible to change to another travel wallet now or perhaps i shouldn’t bother. Thanks Been in advance for your suggestions..working out the money side of things when travelling is not my strong point! I’m hoping to do volunteer work through work away to keep me going

I actually haven’t checked the Onesmart exchange rate since a few years back so it might have improved. Maybe you can go and compare the rate you’re getting from Onesmart with the rate ANZ gives you. But with the data I have it looks like your ANZ card would be better for actually paying for things with your card. If you’re doing ATM withdrawals, you could probably use either card without much difference. ANZ would give you a better rate but Onesmart ATM withdrawals are free, so it will probably even out. Again it really depends on how much you withdraw and how often.

Thanks heaps for your article. I am travelling to Switzerland for 6 weeks shortly and I am wanting to know the best way to get money and pay for things while over there. Since swiss francs isn’t a currency used on travel cards, is it best just to use an eftpos card? I am wondering if it is better just to use my Westpac eftpos card at shops since doing this or using an ATM will have the 2.5% fee but if i use an ATM I will get charged an additional $3 per transaction?

Thanks for your help. Ben

You can’t use an EFTPOS card to buy things there, only to withdraw from an ATM. The best card to use at an ATM would be an ASB EFTPOS card. Westpac is expensive to use at ATMs. If you want to pay with plastic I’d get a Kiwibank Mastercard Zero. Otherwise it might even be worth getting Swiss Francs from the bank in New Zealand and taking them with you. You’ll need to check what rate you get though and see if it’s fair.

Thanks for your help Bren

Just finished my 3 year trip and boy this kinda info woulda been usefull. Had to make do with ANZ Eftpos (very useful in Asia overall most places for compatibility) ASB Debit visa (unfortunately has 2.1% fx, will be changing to mastercard which has lower), BNZ Credit classic (only for online), and the AIRNZ Onesmart, which I didn’t find that useful except in the key countries it had currencies for, I found it hard to find many atms which were compatible with this card compared to my other cards, but with the recent provider change for AIRNZ maybe that has changed. It is now a Platinum Mastercard if you notice, and has the Mastercard Platinum Benefits also like inclusive travel insurance etc. Though wondering when it’s $150 standard platinum card fee a year will kick in.

ASB EFTPOS is still the best I know of for standard ATM withdrawals. $7.50 + 1.1%. Minimise that standard $7.50 with big withdrawals, so especially in Europe just take out 1,000+ EUR at a time and the fee isn’t too bad. Warehouse Money Card also offers pretty cheap cash advances now – I’ve just got one of those.

Gah correction been looking at this and Travel insurance only for Platinum Visa, though there are some standard fraud benefits as standard http://www.mastercard.com/sam/en/guide_to_benefits/

Thanks for the article. For a 2 week trip in Aussie, would a Kiwibank Zero MasterCard, some cash and/or Cash Passport be necessary? I feel my ASB visa debit card and extra cash would be more than enough.

Two weeks in Aussie shouldn’t be complicated – I would just use my ASB card. I believe if you have a Westpac or ANZ card you can use those ATM’s for free (I think).

Hey Bren, What an extremely useful blog – thanks for sharing! My partner and I are about to start about 9-12 months backpacking through SEA/India so this been really helpful to figure out what to do with our money. We’re both ASB customers so have the eftpos & ASB Visa Light to work with. Will also look to open an ANZ account in case we find those ATMs for eftpos. In terms of credit cards, I think we are only really interested in ones that will earn Airpoints as we’ll stick to cash. Can I ask whats the benefit of having a Kiwibank and AMEX that earn Airpoints? Why not stick to one, e.g. the AMEX which has no fees? Thanks heaps!!

A lot of people don’t accept AMEX overseas, that’s the main reason. Plus it’s prudent to have a backup.

Hi Bren, Thanks so much for this post – so, so helpful! I’m planning to travel to America (and Mexico and Cuba), Southeast Asia and Europe/UK for around 8 months. I assume I’ll mostly be withdrawing cash but will probably want something to use as an EFTPOS. I’m currently planning to use the Cash Passport for the US because the exchange rate iand it’d be good to have something to use as an eftpos. I’m now thinking I’ll use either the ASB or the Westpac for withdrawals in Asia and Europe – I’m not sure how much I’ll withdraw each time at the moment which is where I’m a bit stuck. Would you recommend getting a Westpac for the smaller withdrawals (which I already have an account with) and an ASB Streamline account for the larger withdrawals? I was also wondering if you have any idea how often the ATM’s overseas have their own additional fee for use?

If you plan on doing lots of small withdrawals definitely take a Westpac card with you. The ATM fee really just depends, kind of 50-50. More often in some countries than others. For example Thailand always has it. Europe less common.

Heading over to Europe for a couple of months, and thinking I’ll get a Westpac card for the ATM withdrawals. Just wondering if you know what the usual limit at European ATM’s is? When I went around Asia, I remember only being able to get $200-$300 max from the ATM at a time.

The most I ever tried to take out was 1,000 euros and it worked fine.

If you’re planning on doing big withdrawals like that though, use an ASB card, it’s cheaper as you’ll see from my tables above.

Hi Bren, thanks for tips and the graphs above:) Any tips or advice when travelling to South Africa for 4 months in terms of which bank/bank card to use etc. ? Thank you.

Either a Westpac card at ABSA ATMs for small withdrawals, or ASB eftpos card for large withdrawals.

Hey Bren, great article! I’m trying to find a good travel money debit card for the inlaws but this seems to be impossible in NZ! I can’t believe how good we have it here in Aus. When I compared the Air NZ card (which won Canstar 5 star rating…. goes to show how bias they are) with the Mastercard spot rate, the spread was more than 4%!! Is there any debit visa/mastercard at the moment which is your personal go to?

For multiple currency cards, NZ really has nothing good. I just use my regular banking card.

Just got a Westpac Account. Had a lot of interesting questions. One being “Am i a US citizen” Enquired to bank employee about this. She states the US has a right to request access to your bank account details if it deems it necessary to. This is an agreement 3 years ago many countries have signed up to just to allow the US (no other country mind you) to allow snooping on your bank account details if they want. Doens’t sound right to me.

Should only apply to US citizens.

Hi Bren, This was a great read. I’m heading to Spain soon on a working holiday visa. I’ll be travelling Europe and the UK, so predominantly Euros and Pounds will be my currency over the next year. After reading your article I’ll be switching from Kiwibank to ASB to get an eftpos card just for large ATM withdrawals. I’m concerned whether I should get a travel money card (I’m thinking Loaded for Travel) or a debit card (through ASB) when I’ll be paying by card over there or paying online for flights, accommodation etc.. What would you suggest? I’m new to the nomad life so your advice would be appreciated. Cheers Dominic

Hi Dominic. Since you’re actually going to be living in Spain, I’d recommend getting an N26 account if you’re after a debit/credit card. It’s an online bank based in Germany. You can sign up on your NZ passport, like I’ve done. That way you can pay everything in Euros on your N26 Mastercard, plus you’ll have an IBAN to get paid. You do need a European address to sign up, so you’ll need to wait until you get to Spain, but your ASB should hold you down while you wait. Getting my card was really quick (just a few days). It’ll be perfect for travelling Europe too!

Hi there, great post. From Monday 26 March, ANZ removed the $5 fee for using ATMs overseas. This would make an ANZ eftpos card the best for use worldwide when withdrawing amounts < $500. Cheers.

Thanks! That’s great news. I’ll update this post.

Great resource. Thanks. Not much choice in NZ but you have made it easier for me. to make my decision on travel cards and ATM withdrawals. Luckily have an ANZ no fee eftpos card and a no fee credit card. Learned a lot about the so called “hidden fees”. Thanks.

Great blogg for kiwis, Really good work on here, thank you.

The AMX air points card you use in NZ only, Would i still be able to use this overseas for retail purchases and online purchases(air tickets etc) and gain air points or do you only get points when buying in nz?

You can definitely use it overseas and get Airpoints on it, it’s just you will also pay foreign exchange fees on everything.

Hi Bren, I am about to go to Oz for an extremely short trip so was trying to find out how to get cash out using my eftpos card. Looked on a number of sites before stumbling on to your blog. This is the most helpful article i have found! Wish I had found it earlier! thank you Bren.

You’re welcome!

Firstly, you’re an absolute legend for putting all this info together – super helpful!

I’m about to head off to Europe on a four month trip, will be spending most of the time in Italy, Hungary, Croatia and the UK.

It looks like an ANZ/ASB account will be best for ATM withdrawals. However, I’m still working out whether to use an Amex, Mastercard Zero or Loaded for Travel card for purchases.

Taking into account the airpoints it would seem that the Amex would be the best option (e.g. 2.5% fee offset by 1airpoint/$100).

This is compared to: – Mastercard Zero (1.85%); and – Loaded for Travel (LFT rate for UK/Italy (supported countries) and 2.5% for Hungary/Croatia (unsupported countries)).

Just wondering whether you can see any reason why, when factoring in airpoints earned, the Amex wouldn’t be the preferable option for purchases?

Only thing I can think of is that the AMEX might not be accepted everywhere. So it would be good to have the Mastercard on hand just in case. But definitely get the Amex anyway since it’s free. If you have access to a European address, I’d highly recommend getting a N26 account . That will give you a Mastercard in Euros you can use on European soil.

Great, will do. Thanks mate!

When I use my kiwibank platinum MasterCard on international transactions, I get charged a 1.0% currency conversion fee plus a 0.85% foreign currency txn fee…… how do you get 2.5%?

I’m going to Europe in 3 weeks for about 4 weeks, was going to try and spend as much as possible using the credit card (1.85% doesn’t seem too bad plus accumulate an airpoints dollar for every $75 spent (1.3% payback). Airpoints accumulation only applies to transactions not cash withdrawals though. Was also planning to load it up with credit and do $6 + 1.85% atm withdrawals for when they don’t accept credit card etc. Am I missing something? It seemed like the way to go but after reading this post I’m not entirely sure….. any tips would be greatly appreciated as I’ve got 3 weeks to get an alternate plan sorted!

Cheers Antony

Hey Antony. The Kiwibank 2.5% is when you use your Kiwibank EFTPOS card to make an ATM withdrawal. For Kiwibank credit cards it’s 1.85% (you can see credit card fees summarised in Part 3 of the guide). If you’re only going for four weeks, your plan should be fine. I’d use an ANZ EFTPOS card or a Warehouse Visa for ATM withdrawals, or an ASB Eftpos card if you plan on making a big withdrawal ($1,000+).

how come you use transfer wise over the normal ASB international transfer option. It looks more expensive (ASB has a flat $15 transfer fee)

Am i missing some key points?

Cheers in advance

Hey Joel, I use TW because last time I sent money using the ASB service they took a huge chunk off the other end. Not sure if it was the Aussie bank or ASB but it was around another $30-$40 chopped of when it arrived in my Aussie account. Also, Transferwise fees are much lower if you use the bank deposit option over the credit card option, and faster. Definitely will be less than $15. Just much better overall!

Totally confused! going to New Zealand, Australia and Figi. What is my best option?

Probably use an ANZ Eftpost card.

Thank you for all your hard work!

Hi Bren, thanks for your posts. Found this one great and the shengen visa one too. We are travelling to Spain in sept to spent the next year cruising the Med on a boat, then sailing to the Carribean, thru the Panama Canal, and back down to NZ through French Polynesia. It sounds like our ASB eftpos card will be fine for atm withdrawals, and our Kiwibank Mastercard for credit card, but I’m also I nterested in the N26 card you mention. You say we need a “European address” to get this. How strict is this? Like, can I use the address of a marina we will be at for a week or so? Or maybe my cousins address in Spain? Will they need proof that I live there or anything? Thanks in advance for any help. Cheers!

Your cousins address will probably be fine, as long as you have access to the mail there. Just give it a try, if you can’t get it you can’t get it – no harm in trying!

Hi Bren. Do you have to give proof of address when signing up for an N26 card? Or can I just use a friends address or address of a place I am staying at? Cheers.

You need to give an address where you can receive mail, but I don’t think I had to submit a document as proof of address.

Hi Bren, I’m planning on a trip in South America. I’ve already got an ASB card and am tossing up between another Westpac or ANZ bank card. My understanding of the new ANZ fee update is that they’ve waived their oversea withdrawal fees BUT that doesn’t mean that I won’t be charged the local ATM fees. However, with a Westpac global alliance banks, the Westpac overseas + local ATM fees are both waved. So potentially this can be a better deal (although less coverage) compared with the ANZ card. I’m wondering what has been your experience in regards to the local ATM fees around South America region. Thanks for your blog, it has been very informative

Hey Michael,

Just get them both. Both banks have free accounts, and you can easily move money between them with internet banking.

Hi Bren, we are off to India for three weeks. Very hard to find information on the best way to access money while there. Any recommendations would be greatly appreciated.

Take some USD with you, take an ANZ eftpos card to use at ATMs and a standard Mastercard or Visa as a backup. India is a very well travelled country, you should be fine 🙂

Hi Bren We are travelling to Europe in March and plan to be away for a minimum of 2 years motorcycling around so won’t have a permanent address over there as such Our plan was to transfer funds from our NZ bank account to a travel card on a monthly basis to use as we need to as we don’t intend to maintain a NZ based credit card at all Interested in your thoughts/suggestions

Did you check out my post on N26? https://brenontheroad.com/n26-review-the-ultimate-bank-for-travellers/

Apply for it as soon as you arrive in Europe (or if you have a friend/family address you can use there, use that and apply now). For two years on the road, it is hands down the best option and will save you tons of money.

Hi Bren, I just opened an account at TransferWise, using my NZ address, so now I am wondering if I can still open an N26 account using an address in Sweden I have access to. We are going to be in Europe for a couple of months next year so would love to have that N26 card…but given how closely they work together, have I shot myself in the foot? Thanks very much

I did it, and it worked fine. They’re not the same company, so legally they’re not allowed to share your details with each other.

Hi Bren, as others have said – great post thanks!

I just wanted to double check with you what you think the best approach for us will be. We are taking our four kids to Europe and the UK to travel in a motorhome for 8 months and will travel as cheap as poss but it will add up. Currently we are Westpac and Kiwibank customers. It sounds like the best approach for us would be to withdraw large amounts of cash on an asb eftpos card as we travel so as to minimise fees. Is this still the case you think? And what credit card would you recommend for Europe and the UK? We currently only hold Westpac platinum I think. Thanks again, Kev

For that period of time, I HIGHLY recommend signing up for N26 when you arrive (you’ll need a mailing address). I have a full guide on that here: https://brenontheroad.com/n26-review-the-ultimate-bank-for-travellers/

Having a N26 account will make banking a complete non-issue while you’re there, you’ll have a Mastercard that works in all of the EU (and actually the world) with no fees. I use that card exclusively now on all my travels worldwide.

As for your backups, I would take an ASB Eftpos, and then just any credit card, Westpac would be fine.

Just came across this a week before flying out – too late to get the Warehouse Visa unfortunately, but will be in the UK in a few months so a reminder to sign up for an N26 account in now in my calendar! Thanks for all the time put in to writing these posts, they are really helpful.

No problem!

This is a great post, thanks. Yes, NZ is really behind the curve on this one. I am only 21 and live in Beijing at the moment, but have been in Europe for a few months for research purposes. I am with Westpac and I have to say… I’ve paid HUNDREDS in fees, largely foreign currency conversion fees. Not good. Not that great a bank to be with if one plans on leaving NZ long term/frequently, as I do. As I enter adulthood, I’ll be sure to make the switch. I shiver to think of the costs… 21 y/olds do not have hundreds to just blow on fees, in my experience.

Definitely get N26 next time you’re there! Or if you have access to an address there you could apply for one now.

Hi Bren, thanks so much for all your great articles, it’s a real help having some NZ specific stuff out there. FWIW I found out that ASB has just removed their $7.50 overseas withdrawal fee on all their cards, so when doing ATM withdrawal with a Fastcash card you just pay 1.1% offshore service margin plus whatever the ATM provider’s fee is.

Yes I always read something about that, but couldn’t find it officially on ASB’s website at the time. I’ll update!

Hey Brendon, thanks for the great tips. Just wondering is it possible to start up a foreign currency account and transfer money into it (using transferwise) then use a card issued for that currency? Do any big international banks like HSBC offer cards for their foreign currency accounts?

The closest to this is going to be the N26 card that I mentioned in the post. It’s what I use. I transfer NZD into it using Transferwise and now I use my N26 card for literally everything while travelling (and even in NZ sometimes).

Thanks for a great post! I am living in NZ but going traveling around Europe soon and I want to get a n26 card. In the opening account process it asks what country you live in, and if you put NZ it doesn’t let you set up an account. There doesn’t seem to be a space for a shipping address in Europe. Is it possible to put that I “live” in a European country (the country that I have the shipping address in)? Do they ask for proof of address? I know it’s possible to get a n26 card as a NZer but I can’t seem to get past the initial stage!

Yep, list that as your living address. The proof of address will be they send the card to that address and you receive it 🙂

Hey, just wanted to say a big thank you for your very informative post. Travelling through Asia soon and you have definitely helped clarify some things and provided some great advice. Don’t normally comment on things, but you deserve it here for all the hard work you’ve put in to this guide. Cheers

This is such a good post. I used to work in FX and one thing I would add is if you want cash; ask if places will price beat the banks/ other local stores.This can save you $100s and I’ve seen people get the margin down to like under 1% by shopping around. (If you want to buy foreign, you want the HIGHEST rate; if you want to swap foreign for nzd, you want the LOWEST rate.)

Ask which places?

Great article! seems now that Onesmart has surpassed Cash passport for exchange rates though!

Cash passport 1NZD = 0.5658Euro Onesmart . 1NZD = 0.5715Euro

After this i assume Onesmarts would tend to be the preferable option in this case? would you agree? obviously losing out on every withdrawal after 3 free per month.

Would like your thoughts on this.

I’m not a fan of either card to be honest but yes I’d take whichever one gave the best rate.

Hi Bren, Great article very informative! Just wanting to check again have you found out whether ASB has definitely waived the $7.50 overseas ATM fees. I looked really hard on their website I couldn’t find anything relating to the $7.50 fee only the 1.1% FX fees. Just wanting to know do you if you have any further information re: ASB. Thanks again.

Yes it’s been phased out.

Bren, the Transferwise card coming to NZ has got banks acting…BNZ’s fee is now $0 and many others have been cut recently. Check out https://www.moneyhub.co.nz/best-credit-card-overseas-fees.html

Nice. I’ve already ordered my TWise card!

Given that a non-card holder can’t contact Wise, I’m hoping that, as a result of your inquiries, you might be able to answer one query about the Wise card that I have:

Are the limits for transactions cumulative e.g. monthly limit for chip and pin N$17500, ATM $5250, PayWave/Contactless $7K? This would allow a total spend of NZ$29750.

The reason why I ask is that my wife and I will be going on our last overseas trip (we are retired), which will be to Europe, and we want to take a travel card/debit card loaded with Euros, and for the first month, we will need approx. NZ$20K. If the limits are cumulative, we should be OK so long as we can control when we use PayWave/contactless – the monthly contactless limit is miserly.

We are concerned that the only support is via online, which wouldn’t be great when you’re overseas and need help, especially if urgent – but we realise that this is just the way it would have to be if we were to opt for the WISE card. We need to make a decision. We note the many bad reviews of Travelex and Westpac, including as to support and difficulty with top ups, and if we were to use my ANZ VISA credit card, we would be hit by poor fx rates and fees for every transaction.

To be honest I’m not sure, I believe the daily spend limit is 2k (so 60k per month) and for Europe you can pay by card pretty much everywhere. If you’re concerned I would just apply for 2 accounts (you and your wife apply for one each) and then you have a backup too, and it’s easy to transfer funds between Wise accounts. In my experience Wise support is very good, much better than any NZ bank, especially when you’re overseas. Enjoy your trip!!!

Tena Koe Bren

Love you analysis I have recently got a flight centre Mastercard as it has no international transaction fees. Could this be the first only New Zealand credit card with no international transaction fees?

We have travelled to Europe a few times in the last 10 years, and have always found your advice on how to deal with money and bankcards etc just so invaluable – thankyou! Clear, informative, and easy to follow….and I hate fees!!

We are leaving from NZ for France and Switzerland this year, and have a Wises card each now (new for us) and our ASB visa although don't use credit cards unless emergency. (Last trip in 2017, did ATM withdrawals though Westpac ATM in Europe because of their free ATM option at that time.) My question is with a credit card, you do not compare Westpac credit card as an option, is it right it has a 1.95% FX fee? (lower that asb visa?). Is ASB credit card still better in your opinion?

We will use our ASB cashflow card to withdraw at ATM's this trip, as the off-shore margin fee is lower at 1.1% and now doesn't have the other ATM fee anymore – is that correct? Also have Wises free for first two $350 ATM withdrawals in a month.

In summary, we will have some cash when we leave, will have cash loaded on Wises in Euro and Swiss francs (our 2 countries visiting), and will use ASB cashflow for ATM withdrawals for cash (with Wises as a backup). For emergencies ASB credit card (altho am interested in Westpac credit card comparison?). I guess my main question too is – is it better during everyday travelling to pay with cash withdrawn on ASB cashflow at ATM, or Wises card e.g.at a cafe for example.?

If you could answer these couple of questions, I would be most appreciative. Kind regards

I have Wise and ASB, if I do ATM withdrawals I usually use ASB, but for 90% of things in Europe I just use the Wise card.

My newsletter includes exclusive stories, updates, giveaways and more. 100% free.

Zero spam. Unsubscribe anytime.

Best Choices

The 10 Best Credit Card NZ

When it comes to managing our finances, few tools have revolutionized the way we handle money like credit cards. In the bustling financial landscape of New Zealand, finding the best credit card can make a significant difference in our daily lives. From earning rewarding perks to enjoying financial flexibility, the right credit card can open doors to a world of possibilities.

In this blog post, we’ll dive into the realm of credit cards in New Zealand to help you uncover the top choices tailored to your needs. Whether you’re a frequent traveler seeking travel rewards, a savvy shopper looking for cashback benefits, or a responsible spender aiming to build credit, we’ve got you covered. Join us as we explore the best credit card options in NZ, unravel the unique benefits they offer, and guide you towards a financially empowered future.

YOU MIGHT ALSO LIKE:

- Best Online Dating Sites in NZ

- How Can You Make Real Money Online NZ

Table of Contents

Best Balance Transfer Credit Card

1. co-operative bank’s credit card.

Co-operative Bank’s credit card presents an appealing long-term low interest rate with an annual fee of $20. The deal entails an enticing 0% interest rate for the initial 6 months, which later adjusts to 12.95%. The annual fee amounts to $20, paid in $10 increments every six months. There is no balance transfer fee, and the monthly payments must exceed the minimum requirement, which is either 3% of the outstanding balance or $10, whichever is higher.

To make use of this credit card, certain factors must be considered. Firstly, you cannot transfer a balance from another The Co-operative Bank card. Additionally, the credit limit must be at least $1,000, and the balance transfer amount cannot exceed 80% of the credit limit, with a minimum of $100 for balance transfers. After the 0% interest period ends, any remaining transferred debt will incur a 12.95% interest until it is fully paid off.

Furthermore, it is essential not to use the card for cash withdrawals or new purchases, as the interest rate for these transactions stands at 12.95%. While you can only perform one balance transfer from another card, it is possible to consolidate balances from multiple cards into a single transfer.

2. Westpac Fee Free Mastercard

Westpac Fee Free Mastercard presents a plethora of benefits without any burdensome charges. With no annual fees, no foreign transaction fees for overseas purchases, and a highly favorable low-interest rate of 12.90% per annum, it’s a compelling choice for financially savvy individuals.

Here’s a summary of the deal’s key features: Firstly, there are no annual fees, providing cardholders with the freedom to enjoy its perks without worrying about extra costs. Secondly, the absence of overseas foreign exchange fees ensures that travelers can make purchases abroad without incurring additional expenses. Thirdly, the credit card offers a competitive interest rate of 12.90% per year, which is considerably lower than many other options in the market.

Moreover, this card presents an attractive balance transfer offer, with a fixed rate of 5.95% for the entire duration of the balance. This enables users to consolidate their debts and manage them more effectively. However, it’s essential to note that monthly payments must exceed the minimum requirement, which is either 2% of the outstanding balance or a minimum of $5, whichever is higher. Responsible credit management will ensure that cardholders can fully benefit from this exceptional offering.

3. ASB Visa Light

ASB Visa Light is presenting a compelling 0% balance transfer opportunity, allowing you to clear your outstanding balance and enhance your financial practices. The deal offers an interest-free period lasting six months, during which you can diligently work towards paying off your debt without incurring any interest charges. However, it’s crucial to take timely action and initiate the balance transfer within the initial 30 days to secure this advantageous 0% interest period. It’s important to note that balance transfers from other ASB cards are not permitted.

The terms of this deal are quite attractive. For the first six months, the interest rate remains at a favorable 0% per annum, offering significant financial relief. Beyond this grace period, the interest charge will rise to 13.50% per annum, necessitating careful financial planning to avoid high interest costs. Additionally, there is no annual fee associated with this offer, which is another appealing aspect.

Moreover, ASB is providing a window of opportunity for interest-free purchases over $1,000 for six months. This means that if you need to make sizeable purchases, you can take advantage of this interest-free period to manage your expenses efficiently.

4. ANZ Low Rate Visa

ANZ Low Rate Visa presents an appealing offer for those seeking to manage short-term debt through a balance transfer, and the first-year annual fee is waived. To make the most of this opportunity, the balance must be settled within 24 months, or else a 9.95%* interest rate will apply to any remaining balance.

The deal entails an initial interest rate of 1.99% for a duration of 24 months, after which it reverts to 12.90%*. During the first year, there is no annual fee, but subsequently, an annual fee of $35 will be charged ($17.50 every six months).

When initiating the balance transfer, no additional fee is imposed. However, it is crucial to effectuate the transfer within the first 30 days to avail of the 0% interest period. Note that transferring a balance from another ANZ card is not permitted.

Once the 0% interest period concludes, any remaining transferred debt will be subjected to a 9.95% interest rate until it is completely paid off. It’s important to avoid using this card for cash withdrawals or purchases, as new purchases will also incur a 9.95% interest rate.

Best Travel Benefits Credit Card

5. american express airpoints platinum.

American Express Airpoints Platinum comes with a $195 annual fee but offers a plethora of valuable features. Cardholders can explore the detailed review of this credit card to learn more about its benefits. One of the significant advantages is the ability to use Airpoints Dollars for various purposes such as gifts, food and beverages, shopping at Mitre 10 and other hardware stores, flights, and numerous other options. Additionally, new applicants can enjoy a sign-up bonus of 300 Airpoints Dollars after being approved and spending $1,500 on the card within the first three months, effectively covering the membership fee for at least the initial year.

This credit card stands out with its high earning rate of Airpoints Dollars, approximately 1.70 for every NZ$100 spent, making it an attractive choice for those looking to grow their Airpoints balance each month. Moreover, cardholders benefit from a range of useful insurance perks, including coverage for rental cars and international travel, which could potentially save them hundreds of dollars. Notably, the American Express card is widely accepted across New Zealand, including all major supermarkets and retailers.

The card’s additional perks include mobile phone screen insurance for those who purchased their phone with the American Express card, as well as a notable discount on the Koru Club membership. In conclusion, the American Express Airpoints Platinum is deemed as one of the top credit card choices available, appealing to a wide range of households in New Zealand.

6. Kiwibank Air NZ Airpoints Platinum Visa

Kiwibank Air New Zealand Airpoints Platinum Visa card being discussed here is widely accepted and offers certain benefits, but it comes with a significant annual fee and a lower Airpoints earning rate compared to the AMEX Airpoints Platinum card. While the AMEX card earns 1 Airpoints Dollar for every $59 spent, this Visa card only earns 1 Airpoints Dollar for every $115 spent. This discrepancy makes it a high-fee platinum-level option, which might not be the best choice for those looking to maximize their Airpoints rewards.

The card’s deal includes an interest rate of 20.95% p.a. and an annual fee of $180. To maintain the account in good standing, monthly payments must exceed the greater of either 5% of the balance owing or $10. Additionally, using this credit card to pay for travel expenses provides complimentary overseas travel insurance, which can be beneficial for frequent travelers.