We all know "it" happens - have a guardian by your side

Explore Comprehensive Travel Insurance Plans in Across Canada

Welcome to Travel Guardian Insurance, your trusted partner for comprehensive travel insurance in Ontario and throughout Canada. We take pride in offering high-quality coverage at reasonable prices, even for individuals with pre-existing conditions. Planning a trip? Get peace of mind with our customizable travel insurance plans.

Get Your Free Quote Now ! Travel with Confidence.

Affordable Travel Insurance Across Canada

Discover budget-friendly travel insurance solutions tailored to meet your needs in Ontario, Alberta, BC, Québec and across Canada. Our policies ensure you’re covered for unexpected events, providing financial security throughout your journey.

Quick and Easy Travel Insurance Quotes

Obtain a fast and accurate travel insurance quote with our user-friendly online tool. We understand the importance of transparency, and our quotes reflect our commitment to offering value-driven coverage.

Coverage for Pre-Existing Conditions

At Travel Guardian Insurance, we specialize in providing coverage for individuals with pre-existing conditions. Our inclusive plans ensure that everyone can enjoy their travels worry-free.

Local Coverage – Barrie, Abbotsford, Edmonton, Amherstburg and Québec City

Whether you’re near our offices in Barrie, Abbotsford, Edmonton, Amherstburg, or located anywhere else in Canada, we’ve got you covered. Explore our regional coverage options designed to address specific needs in your area.

Need another reason to choose Travel Guardian? Check out our Google Reviews pages for Barrie , Québec City , Abbotsford , Edmonton and Amherstburg . We pride ourselves on our dedicated customer service and accommodating team.

- Privacy Overview

- Strictly Necessary Cookies

- 3rd Party Cookies

This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

You can adjust all of your cookie settings by navigating the tabs on the left hand side.

You can read more by reviewing our privacy policy .

Strictly Necessary Cookie should be enabled at all times so that we can save your preferences for cookie settings.

If you disable this cookie, we will not be able to save your preferences. This means that every time you visit this website you will need to enable or disable cookies again.

This website uses Google Analytics and Facebook Pixel to collect anonymous information such as the number of visitors to the site, and the most popular pages.

Keeping this cookie enabled helps us to improve our website.

Please enable Strictly Necessary Cookies first so that we can save your preferences!

HelloSafe » Travel Insurance » Travel Guardian

Is Travel Guardian insurance the best in 2024?

verified information

Information verified by Alexandre Desoutter

Our articles are written by experts in their fields (finance, trading, insurance etc.) whose signatures you will see at the beginning and at the end of each article. They are also systematically reviewed and corrected before each publication, and updated regularly.

In a world where unexpected events can disrupt our travel plans, having the right insurance coverage is crucial. One such option to consider in 2024 is Travel Guardian insurance in Canada.

But what are its travel plans? How much does it cost? What are its pros and cons and why should you chose it over another company?

This article answers all your questions and more!

5 key takeaways on Travel Guardian insurance

- Travel Guardian insurance stands out for its array of plans designed to meet the needs of diverse travellers.

- Travel Guardian's insurance is comprehensive and includes medical expenses, trip cancellations, and much more.

- On average, the cost of travel insurance with Travel Guardian insurance is around 5-7% of your total trip cost.

- Travel Guardian does have some exclusions to be aware of, such as losses caused by war, terrorism or hazardous activities.

- We recommend comparing Travel Guardian to its competitors to get the best price/value travel coverage.

Our review of Travel Guardian insurance

Travel Guardian insurance is a Canadian insurance company that specializes in travel insurance. They offer a variety of plans to fit the needs of different travellers, including:

- International travel insurance: This plan covers medical expenses, lost baggage, travel delays and other travel-related incidents while you are travelling outside of Canada.

- Snowbird insurance: This plan is designed for Canadians who spend at least 6 months of the year in another country. It covers medical expenses, emergency evacuation and other travel-related incidents while you are snowbirding.

- Domestic travel insurance: This plan covers medical expenses, lost baggage and travel delays while you are travelling within Canada.

Here are some of the pros and cons of Travel Guard insurance:

Pros of Travel Guardian insurance:

- Wide range of coverage options

- Competitive prices

- Easy to use the website and file a claim.

- Good customer service

Cons of Travel Guardian insurance:

- Can be expensive if you purchase a plan with a lot of coverage

- Some restrictions on its policies, such as pre-existing conditions and certain activities

- The claims process can be slow

The cost of travel insurance from Travel Guardian insurance Ltd. varies depending on the type of plan you choose, the length of your trip and your age and health. The average cost of travel insurance in Canada is $25.35 per trip for a single traveller , making it a great option for travellers.

Before you chose Travel Guardian insurance, do compare its plans to those of other travel companies:

Compare the best travel insurance plans on the market!

What is Travel Guardian insurance's coverage in Canada?

What is covered by travel guardian.

Travel Guardian insurance offers a variety of optional coverages, such as:

- Medical expenses: If you become ill or injured while travelling, Travel Guardian insurance can help pay for your medical expenses, including doctor's visits, hospital stays and prescription drugs.

- Lost or stolen baggage: If your baggage is lost or stolen while travelling, Travel Guardian insurance can help pay for the cost of replacing your belongings.

- Trip cancellation or interruption: If your trip is cancelled or interrupted due to a covered event, such as a medical emergency, natural disaster or terrorist attack, Travel Guardian insurance can help pay for your non-refundable travel expenses.

- Emergency medical transportation: If you become seriously ill or injured while travelling and need to be medically evacuated, Travel Guardian insurance can help pay for the cost of the evacuation.

- Pre-existing medical conditions: If you have a pre-existing medical condition, Travel Guardian insurance can help pay for your medical expenses if you need treatment while travelling.

- Baggage delay: If your baggage is delayed for more than 24 hours, Travel Guardian insurance can help pay for the cost of essential items, such as toiletries and clothing.

- Trip delay: If your trip is delayed due to a covered event, such as a flight cancellation or a natural disaster, Travel Guardian insurance can help pay for the cost of your meals and lodging while you wait for your trip to resume.

- Travel assistance: Travel Guardian insurance also offers a variety of travel assistance services, such as 24/7 emergency assistance, medical referrals and lost passport assistance.

What is not covered by Travel Guardian

Travel Guardian insurance has a number of exclusions, which means that there are certain events or circumstances that are not covered by the policy. Some of the most common exclusions include:

- War and terrorism: Travel Guardian insurance does not cover losses that are caused by war or terrorism.

- Pre-existing medical conditions: If you have a pre-existing medical condition, Travel Guardian insurance may not cover your medical expenses if you need treatment while travelling.

- Hazardous activities: Travel Guardian insurance does not cover losses that are caused by participating in hazardous activities, such as skydiving, bungee jumping or whitewater rafting.

- Deliberate acts: Travel Guardian insurance does not cover losses that are caused by your own deliberate acts, such as drunk driving or drug use.

Also, there are a number of other events or circumstances that may not be covered by Travel Guardian insurance based on the plan or policy you choose.

What are Travel Guardian's insurance plans for visitors?

The specific coverages and exclusions will vary depending on the type of plan you choose and the level of coverage you select. For Canadian residents, travel guardian offers international travel insurance, snowbird insurance, domestic travel insurance and expatriate insurance as we discussed earlier.

But that’s not all, Travel Guardian also offers travel insurance for those travelling to Canada:

How much doest Travel Guardian insurance cost?

The cost of Travel Guardian insurance varies depending on a number of factors, including:

- the type of plan and coverage you choose,

- your chosen destination,

- the length of your trip,

- your age and health ( travel insurance for senior citizens with a pre-existing medical will be more expensive).

In general, Travel Guardian insurance costs about 5-7% of the total cost of your trip.

For example

If your trip costs $1,000, you can expect to pay about $50-70 for travel insurance.

However, here are some tips for getting the best deal on Travel Guardian insurance:

- Shop around and compare different policies: Get quotes from different insurance companies to see which one offers the best coverage and price for your needs.

- Buy early: The earlier you buy your travel insurance, the cheaper it will be.

- Consider a multi-trip policy: If you travel frequently, you may want to consider a multi-trip policy. This type of policy will cover you for multiple trips within a certain period of time, which can save you money.

- Add optional coverages: If you are concerned about certain risks, you may want to add optional coverages to your policy. For example, you can add coverage for trip cancellation or interruption, lost luggage or medical evacuation.

- Consider a travel credit card : Some travel credit cards offer travel insurance as a benefit. This can be a great way to save money on travel insurance, especially if you already have a travel credit card.

Compate Travel Guardian's policy to that of other travel insurers on the market using our free comparison tool below:

Prepare for your trip Compare. Choose. Save.

How to contact Travel Guardian insurance?

Travel Guardian has a presence in many Canadian provinces, including Alberta, BC, and Ontario. You can visit these offices and explore the travel plans in person with an agent. Alternatively:

- You can get a Travel Guardian quote online

- Call the follow Travel Guardian phone number: 1-888-831-9338.

- Or email the company at [email protected] .

Save up to 25% on your travel insurance with our partner soNomad

Get a quote

1-888-550-8302

Sunny has over six years of experience curating engaging content spanning across industries. Specifically in finance, his expertise is insurance reviews and lending and investment topics.

This message is a response to . Cancel

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

AIG Travel Guard Insurance Review: What to Know

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

Coronavirus considerations

Travel insurance plans offered by aig travel guard, how to buy a travel guard policy, additional travel insurance options and add-ons, what’s not covered by a travel guard plan, who should get a travel guard insurance policy, travel guard, recapped.

Travel Guard by AIG

- Offers last-minute coverage.

- Pre-Existing Medical Conditions Exclusion Waiver available at all plan levels.

- Plan available for business travelers.

- Cancel For Any reason coverage only available for higher-level plans, and only reimburses up to 50% of the trip cost.

- Trip interruption coverage doesn't apply to trips paid for with points and miles.

As one of the world’s largest insurance companies and with a 100-year history, it makes sense that AIG would offer travel insurance. AIG’s travel insurance program, called Travel Guard, provides a number of coverage options to offer peace of mind on your trips.

Travel insurance helps you get some money back if anything goes wrong on your trip. If you’re thinking about buying coverage for an upcoming trip, first look into the coverage you may get from your travel credit cards . Many basic protections are offered on cards that you may already have.

If you’re looking for additional coverage, AIG travel insurance is a solid choice. Consumers Advocate rated AIG’s plans at 4.4 stars out of 5 stars.

» Learn more: The majority of Americans plan to travel in 2022

Importantly, if you catch COVID-19 before or during your trip, you will be covered under Travel Guard’s trip cancellation benefit. If you become sick with COVID-19 during the trip, the medical expenses and trip interruption benefits will kick in. However, Travel Guard considers COVID-19 a foreseen event and as a result, certain other coronavirus-related losses may not be covered. Given the constantly evolving travel environment, review the Travel Guard’s coronavirus coverage policies so that you’re award of what is and isn’t covered.

Here’s what you need to know about AIG's Travel Guard insurance plans.

AIG travel insurance’s Travel Guard plans cover you if you need to cancel (or interrupt) your trip due to illness, injury or death of a family member. Inclement weather that causes a trip delay or cancellation is covered by all Travel Guard policies as well.

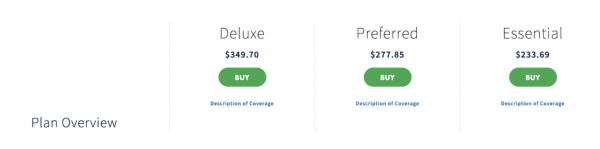

Travel Guard offers three main AIG travel insurance plans, plus a host of add-on options. Here are the most essential benefits:

Travel Guard Essential - The most basic level of coverage

Covers 100% of the cost of your trip if it gets canceled or interrupted due to illness.

Includes a $100 per day reimbursement for any delays in your trip (max $500 total).

Covers up to $15,000 in medical expenses ($500 dental), plus a $150,000 maximum for emergency medical evacuation.

Covers up to $750 in compensation for stolen luggage and a maximum of $200 if your bags get delayed by more than 24 hours.

Travel Guard Preferred - This midlevel plan gives many of the same basic coverages as the Essential, but at higher levels.

Trip cancellation pays out at 100%. If your trip gets interrupted, you’ll get 150% of the cost of the trip.

Trips delayed by more than five hours will get you up to $800 ($200/day).

You’ll be covered up to $50,000 for medical expenses ($500 dental) and up to $500,000 for emergency evacuation.

This plan offers $1,000 for lost or stolen bags and $300 for baggage delays longer than 12 hours.

Travel Guard Deluxe - The biggest benefits can be found in this highest level plan.

Like the Preferred, you’ll get 100% coverage for trip cancellation and 150% of the cost of your insured trip in the event of a trip interruption.

Up to $1,000 ($200/day) for a trip delay of five hours or more.

Up to $100,000 for medical expenses ($500 dental), $1,000,000 for emergency evacuation and $100,000 in coverage for a flight accident.

Coverage for lost or stolen bags jumps up to $2,500 and $500 for baggage delay of more than 12 hours.

A long list of "Travel Inconvenience Benefits" are also included (such as runway delays, closed attractions, diversions, etc.)

This plan also offers roadside assistance coverage for the duration of your trip, which isn't included in the other two plans.

» Learn more: How to find the best travel insurance

Travel Guard’s website is simple to navigate and provides instant quotes that clearly spell out what's covered. You’ll need to enter basic information about the trip you want coverage for, including:

Destination.

How you’re getting there (airplane, cruise or other).

Travel dates.

Your home state.

Date of birth.

How much you paid for the trip.

The date when you paid for the trip.

Once you answer the questions, you’ll instantly get price quotes for different options of insurance for your trip. Each column clearly shows what’s covered for all options in a long list, so you can quickly compare.

This example shows options based on a two-week $5,000 trip to Spain for someone who is 40 years old. In this case, the mid-tier plan costs about 6% of the total trip cost.

It’s also important to know that plan offerings change based on what state you live in; not all states are covered.

If you purchase a Travel Guard plan and need to file a claim, you can do it on their website or by calling (866) 478-8222. You can also track the status of the payment of your claim on the site.

If you’re planning multiple trips that you would like covered, look at Travel Guard’s Annual Travel Insurance Plan. This 12-month option covers multiple trips and could save you money over insuring each trip separately.

Another option is the "Pack and Go" plan, which is a good choice if you’re going on a last-minute getaway and don’t need trip cancellation protection.

There are also options to add rental vehicle damage coverage, Cancel For Any Reason coverage, and medical and security bundles to the plans. You’ll be able to select these add-ons when you’re purchasing a policy.

» Learn more: Cancel For Any Reason (CFAR) travel insurance explained

While the Essential, Preferred and Deluxe plans all offer varying degrees of coverage for your trip, there are some things that won’t be covered by any of the plans. Here are a few highlights of things that aren't included; you’ll find full lists on each policy:

Coverage for trips paid for with frequent flyer miles or loyalty rewards programs: Travel Guard will only protect the trips you pay for with cash. If you’re redeeming your points for that bucket list trip, unfortunately, you won’t qualify for coverage. However, the cost of redepositing miles back into your account is covered.

Baggage loss for eyeglasses, contact lenses, hearing aids or false teeth: These items should be kept with you in your carry-on as a general rule, since a Travel Guard policy won’t cover them.

Known events: If you knowingly book a trip with some inherent risks, it won’t be covered. For example, once the National Weather Service issues a warning for a hurricane, it becomes a known event. Once COVID-19 became a pandemic, it was categorized as a foreseeable event and was no longer covered. You can cancel the policy you purchase up to 15 days prior to your trip to receive a refund for the premium paid.

» Learn more: Does travel insurance cover award flights?

Many trips may be sufficiently covered by your credit card benefits, but you should do research to see which cards provide the best options (and remember to use that card to book the trip).

However, if you’re planning major international travel or embarking on a big cruise trip, Travel Guard's Preferred and Deluxe plans may offer better coverage than your credit card. Overall, Travel Guard plans offer a variety of coverage options with an easy-to-navigate website that could be a good fit for your next trip.

If you’re not finding what you’re looking for with a Travel Guard plan, check out an insurance comparison site like Squaremouth, where you will have a lot of different plan options to choose from.

» Learn more: Is travel insurance worth it?

Travel Guard offers several trip insurance plans with varying degrees of coverage. Some plans also allow you to purchase optional upgrades such as CFAR and auto rental coverage. Plan availability differs by state, so make sure you input your trip details to see what plans are available to you.

If you have a premium travel credit card, you may already have some elements of travel insurance coverage included for free. Before you decide to purchase a comprehensive policy, check what coverage you may already have from your credit card.

Travel Guard’s insurance plans offer trip cancellation, trip interruption, emergency medical coverage and evacuation, baggage delay, baggage loss, and more. Some policies may also allow you to add on benefits like Cancel For Any Reason and car rental damage coverage.

If you need to cancel your trip for a covered reason (e.g., unforeseen sickness or injury of you or your family member, required work, victim of a crime, inclement weather, financial default of travel supplier, etc.) you will be covered. To see the whole list of covered reasons, refer to the terms and conditions of your policy.

To get a refund, you will need to file a claim by either calling (866) 478-8222 or submitting it online at its claims page . You may be required to provide verifying documentation to substantiate your claims so keep any receipts that you intend to submit. You can also check the status of your claim at any time on Travel Guard’s website .

The Cancel For Any Reason optional upgrade is available on certain Travel Guard plans. Travel Guard’s CFAR add-on allows you to cancel a trip for any reason whatsoever and get 50%-75% of your nonrefundable deposit back as long as the trip is canceled at least two days prior to the scheduled departure date.

To get a refund, you will need to file a claim by either calling (866) 478-8222 or submitting it online

at its claims page

. You may be required to provide verifying documentation to substantiate your claims so keep any receipts that you intend to submit. You can also check the status of your claim at any time

on Travel Guard’s website

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

- Credit Cards

- All Credit Cards

- Find the Credit Card for You

- Best Credit Cards

- Best Rewards Credit Cards

- Best Travel Credit Cards

- Best 0% APR Credit Cards

- Best Balance Transfer Credit Cards

- Best Cash Back Credit Cards

- Best Credit Card Sign-Up Bonuses

- Best Credit Cards to Build Credit

- Best Credit Cards for Online Shopping

- Find the Best Personal Loan for You

- Best Personal Loans

- Best Debt Consolidation Loans

- Best Loans to Refinance Credit Card Debt

- Best Loans with Fast Funding

- Best Small Personal Loans

- Best Large Personal Loans

- Best Personal Loans to Apply Online

- Best Student Loan Refinance

- Best Car Loans

- All Banking

- Find the Savings Account for You

- Best High Yield Savings Accounts

- Best Big Bank Savings Accounts

- Best Big Bank Checking Accounts

- Best No Fee Checking Accounts

- No Overdraft Fee Checking Accounts

- Best Checking Account Bonuses

- Best Money Market Accounts

- Best Credit Unions

- All Mortgages

- Best Mortgages

- Best Mortgages for Small Down Payment

- Best Mortgages for No Down Payment

- Best Mortgages for Average Credit Score

- Best Mortgages No Origination Fee

- Adjustable Rate Mortgages

- Affording a Mortgage

- All Insurance

- Best Life Insurance

- Best Life Insurance for Seniors

- Best Homeowners Insurance

- Best Renters Insurance

- Best Car Insurance

- Best Pet Insurance

- Best Boat Insurance

- Best Motorcycle Insurance

- Travel Insurance

- Event Ticket Insurance

- Small Business

- All Small Business

- Best Small Business Savings Accounts

- Best Small Business Checking Accounts

- Best Credit Cards for Small Business

- Best Small Business Loans

- Best Tax Software for Small Business

- Personal Finance

- All Personal Finance

- Best Budgeting Apps

- Best Expense Tracker Apps

- Best Money Transfer Apps

- Best Resale Apps and Sites

- Buy Now Pay Later (BNPL) Apps

- Best Debt Relief

- Credit Monitoring

- All Credit Monitoring

- Best Credit Monitoring Services

- Best Identity Theft Protection

- How to Boost Your Credit Score

- Best Credit Repair Companies

- Filing For Free

- Best Tax Software

- Best Tax Software for Small Businesses

- Tax Refunds

- Tax Brackets

- Taxes By State

- Tax Payment Plans

- Help for Low Credit Scores

- All Help for Low Credit Scores

- Best Credit Cards for Bad Credit

- Best Personal Loans for Bad Credit

- Best Debt Consolidation Loans for Bad Credit

- Personal Loans if You Don't Have Credit

- Best Credit Cards for Building Credit

- Personal Loans for 580 Credit Score Lower

- Personal Loans for 670 Credit Score or Lower

- Best Mortgages for Bad Credit

- Best Hardship Loans

- All Investing

- Best IRA Accounts

- Best Roth IRA Accounts

- Best Investing Apps

- Best Free Stock Trading Platforms

- Best Robo-Advisors

- Index Funds

- Mutual Funds

- Home & Kitchen

- Gift Guides

- Deals & Sales

- Sign up for the CNBC Select Newsletter

- Subscribe to CNBC PRO

- Privacy Policy

- Your Privacy Choices

- Terms Of Service

- CNBC Sitemap

Follow Select

Our top picks of timely offers from our partners

AIG Travel Guard insurance review: What you need to know

Whether you need an annual plan or a policy for a last-minute trip, travel guard can deliver..

Travel Guard is one of CNBC Select 's picks for best travel insurance , thanks to its wide range of customizable policies. But are any of them right for you? Below, we review the provider and its offers and how they compare to the competition to help you choose the right travel insurance for your next trip.

Travel Guard review

Other insurance offered, how it compares, bottom line, travel guard® travel insurance.

The best way to estimate your costs is to request a quote

Policy highlights

Travel Guard offers a variety of plans to suit travel ranging from road trips to long cruises. For air travelers, Travel Guard can help assist with tracking baggage or covering lost or delayed baggage.

24/7 assistance available

- A variety of plans are available to help cover different types of trips

- Not all products are available for purchase online

Travel Guard® is a global travel insurance provider specializing in plans for leisure and business travelers. Its online travel insurance packages include five options, from basic and last-minute trip coverage to more comprehensive plans. This allows travelers to pick a plan that best matches their situation.

For example, budget-minded travelers might go for the Essential Plan which offers basic protections, such as trip cancellation, interruption and delay insurance, coverage for lost, damaged and delayed baggage, and medical, evacuation and death coverage.

On the other hand, the Deluxe Plan — the most comprehensive option — adds such extras as missed connection coverage, security evacuation, travel inconvenience benefits and more. It also boosts high limits for essential coverages.

Last-minute travelers can opt for the Pack N' Go Plan which only includes certain post-departure coverages. Or, if you travel often, the Annual Plan can cover your trips throughout the year.

Finally, Travel Guard offers "offline" travel insurance packages, meaning you'll have to call if you're looking for a specialty plan.

Coverage types

Depending on the plan, here are the types of protection Travel Guard can include in your package:

- Trip cancellations

- Trip interruption

- Baggage coverage

- Baggage delay

- Travel medical expenses

- Travel inconvenience benefits (reimbursement for such situations as runway delays, cruise diversion and other unforeseen situations)

- Medical evacuation

- Trip Saver (reimbursement for meals, hotels and transportation if you need to begin your trip sooner due to weather or airline changes)

- Trip exchange (reimbursement in case you have to cancel your trip and book a new one due to covered unforeseen circumstances)

- Security evacuation (due to a riot or civil disorder)

- Flight guard (coverage for accidental death or dismemberment that occurs when traveling by plane)

- Pre-existing medical conditions exclusion waiver

You can also customize your plan with add-ons, such as car rental insurance and "cancel for any reason" coverage .

Travel Guard landed on our list of the best travel insurance companies thanks to its variety of coverage. With plenty of options to choose from, both online and offline, it's easy to build a policy that meets your needs.

Travel Guard also features 24-hour concierge services that you can use to book a new flight in case of an emergency or delay.

The provider's website also offers informational resources — here, you can check travel news, read safety tips and find general travel advice. Additionally, the website lets you modify your plan, file a claim and check its status, or apply for a voucher or refund.

As of writing, Travel Guard doesn't offer any discounts. That's common for travel insurance — you're more likely to find deals when shopping for other types of insurance, such as home and auto insurance .

Travel Guard is a portfolio of travel insurance and travel-related services offered by AIG Travel, a member of American International Group (AIG). AIG also offers life insurance and a variety of business insurance products.

Travel Guard makes it easy to get a travel insurance policy customized to your needs. But before you purchase coverage, it's always a good idea to shop around.

For example, if you're going on a cruise, you might want to look at Nationwide Travel Insurance . The provider advertises cruise-specific insurance with three plan options available. This type of coverage is designed with issues unique to cruises in mind — from ship-based breakdowns to missed pre-pard excursions.

If you're planning a more active trip filled with rock climbing or sky diving, Berkshire Hathaway offers the AdrenalineCare® plan which features coverage for unforeseen costs that result from participating in extreme sports on your trip, as well as reimbursement for sporting equipment delay. Pre-existing conditions are covered under this plan (if you meet qualifying conditions).

Berkshire Hathaway Travel Protection

Berkshire Hathaway Travel Protection has multiple plans to cover vacations from luxury travel to adventure travel. The brand's LuxuryCare offers the highest limits of travel insurance coverage offered by the company. Quotes and policies are available online.

As you can see, offerings vary by provider. It can be helpful to compare multiple companies and the plans they offer to find what works best for you. It's even better if you gather several quotes to ensure you're getting a good price for your policy.

Money matters — so make the most of it. Get expert tips, strategies, news and everything else you need to maximize your money, right to your inbox. Sign up here .

Travel Guard offers plenty of ways to customize your policy, making it a solid choice for travel insurance. You can also access additional options by giving Travel Guard a call. However, make sure to check out other travel insurance companies too — comparison shopping is essential when picking any type of financial product.

Why trust CNBC Select?

At CNBC Select, our mission is to provide our readers with high-quality service journalism and comprehensive consumer advice so they can make informed decisions with their money. Every insurance review is based on rigorous reporting by our team of expert writers and editors with extensive knowledge of insurance products . While CNBC Select earns a commission from affiliate partners on many offers and links, we create all our content without input from our commercial team or any outside third parties, and we pride ourselves on our journalistic standards and ethics.

Catch up on CNBC Select's in-depth coverage of credit cards , banking and money , and follow us on TikTok , Facebook , Instagram and Twitter to stay up to date.

- How Quicken Simplifi can help you get a grip on your spending Elizabeth Gravier

- IRA vs CD — what's the difference and which one should you pick? Andreina Rodriguez

- 3 best Chase balance transfer credit cards of 2024 Jason Stauffer

JavaScript has been disabled on this browser. For a seamless experience, please enable the option to run JavaScript on this device

Log in to pay bills, manage policies, view documents, company news, materials & more.

Individuals

Private client group.

Policyholders in the U.S. can make online payments.

Workers’ Compensation (AIG Go WC)

Access workers’ compensation claims information, including FAQs, payments, prescription data, doctor information, and more.

Report a Claim

Report Aerospace, Commercial Auto, General Liability, Property, and Workers’ Compensation claims.

Dental, Group Life, and AD&D Claims

Employers and employees can access claim forms, claim reports, and information on claim status.

IntelliRisk Advanced

Clients and brokers can file claims, manage risks, and access claims data from 100+ countries.

myAIG Client Portal for Multinational

Track the status of controlled master programs, view policy details, download policy documents, access invoices, and more.

AIG Multinational Insurance Fundamentals

Receive free, accredited online training in multinational risk assessment and program design.

Brokers & Agents

Myaig portal for north america.

Generate loss runs, download policy documents, access applications and tools, and more.

myAIG Portal for Multinational

U.s. producer appointment and licensing.

Submit requests to become an AIG appointed brokerage/agent, expand or terminate your current AIG appointment.

Risk Managers

Log in to pay bills, manage policies, view documents, company news, materials & more.

- INDIVIDUALS

- BROKERS & AGENTS

- RISK MANAGERS

AIG Travel Guard

Get a quote in less than two minutes and travel with more peace of mind.

Travel Guard Plans

Compare coverage levels and pricing on our most popular plans with our product comparison tool—and find a Travel Guard plan that’s right for you.

Deluxe Plan

Our top-of-the-line, comprehensive travel coverage that sets the standard.

Preferred Plan

A comprehensive travel plan with superb coverage and service from start to finish.

Essential Plan

Savvy coverage for the budget-minded traveler.

Pack N' Go Plan

Immediate coverage for unplanned trips and adventures

Annual Travel Insurance Plan

Year-round coverage for your travel investments.

Millions of travelers each year trust AIG's Travel Guard to cover their vacations

Travel insurance plans provide coverage for certain costs and losses associated with traveling. Travel Guard ® helps you navigate canceled flights, lost bags, sudden health emergencies, and much more—almost anywhere in the world. Whether you’re planning a two-day getaway, a cruise, an adventure vacation, or a month-long international holiday, our plans help cover travelers and their trip inverstments.

Education Center

Sort through common questions about travel insurance

Traveler Resources

Safety information and travel tips for travelers

Preparing travelers wherever their journey takes them

AIG Travel CEO Jeff Rutledge shares how the underlying risks of travel have changed and what AIG is doing to help companies and individuals manage risks.

Coverage available to residents of U.S. states and the District of Columbia only. These plans provide insurance coverage that only applies during the covered trip. You may have coverage from other sources that provides you with similar benefits but may be subject to different restrictions depending upon your other coverages. You may wish to compare the terms of each policy with your existing life, health, home, and automobile insurance policies, as well as any other coverage which you may already have or is available to you, including through other insurers, as a member of an organization, or through your credit card program(s). If you have any questions about your current coverage, call your insurer or insurance agent or broker. Coverage is offered by Travel Guard Group, Inc .(Travel Guard). California lic. no. 0B93606, 3300 Business Park Drive, Stevens Point, WI 54482, www.travelguard.com. CA DOI toll free number: 800-927-HELP.

This is only a brief description of the coverage(s) available. The policy will contain reductions, limitations, exclusions and termination provisions. Insurance underwritten by National Union Fire Insurance Company of Pittsburgh, Pa., a Pennsylvania insurance company, with its principal place of business at 1271 Ave of the Americas, Floor 41, New York, NY, 10020-1304. It is currently authorized to transact business in all states and the District of Columbia. NAIC No. 19445. Coverage may not be available in all states.

Related Content

COVID-19 Updates

Corporate Accident & Health Insurance

Insurance for Individuals and Families

DO NOT SELL OR SHARE MY PERSONAL INFORMATION

The California Consumer privacy Act gives California residents the right to opt-out of the sale or sharing of their personal information. A "sale" is the exchange of personal information for payment or other valuable consideration and includes certain advertising and anatytics practices. "Sharing" means the disclosure of personal information for behavioral advertising purposes, where the informatirm used to serve ads is collected across different online services.

Opt-out from the sale or sharing of your personal information.

Your request to opt out will be specific to the browser from which you submit your request, and you will need to submit another request from any other browser you use to accessour website. Additionally, if you clear cookies from your browser after submitting an opt-out request, you will clear the cookie that we used to honor your request. For this reason, you will have to submit a new opt-out request.

For information about our privacy practices, please review our Privacy Notice .

Thank you. We have received your request to opt out of the sale/sharing of personal information.

More information about our privacy practices.

- Travel Insurance

- Travel Guard Travel Insurance Review

The Forbes Advisor editorial team is independent and objective. To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive payment from the companies that advertise on the Forbes Advisor site. This comes from two main sources.

First , we provide paid placements to advertisers to present their offers. The payments we receive for those placements affects how and where advertisers’ offers appear on the site. This site does not include all companies or products available within the market.

Second , we also include links to advertisers’ offers in some of our articles. These “affiliate links” may generate income for our site when you click on them. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Forbes Advisor.

While we work hard to provide accurate and up to date information that we think you will find relevant, Forbes Advisor does not and cannot guarantee that any information provided is complete and makes no representations or warranties in connection thereto, nor to the accuracy or applicability thereof.

Travel Guard Travel Insurance Review 2024

Updated: Feb 28, 2024, 7:42am

Travel Guard travel insurance offers unlimited emergency medical coverage for travellers under age 54, and a still-generous $10 million for those 55 and up. There’s also a number of add-ons for certain plans if you’re a business traveller, taking a golf or ski vacation, or flying to a destination wedding. And if you’re worried about having to cancel, the Cancel For Any Reason upgrade gives peace of mind. But there are downsides. The mail-in claims process is clunky, and the upgrades aren’t available for all plans. Plus Travel Guard travel insurance isn’t currently offered in Quebec. Still, Travel Guard offers comprehensive coverage for a competitive price.

- Unlimited medical coverage under age 54

- Several benefit add-ons

- Pre-existing medical condition exclusion waiver

- CFAR coverage option

- Not available for Quebec residents

- Medical questionnaire required at age 56

- Clunky claims process

- Maximum age is 85

Table of Contents

About travel guard travel insurance, what travel insurance does travel guard offer, travel guard travel insurance plans, summary: plan comparison, travel guard travel insurance cost, comparing travel guard travel insurance with other insurers, optional add-ons for travel guard travel insurance, does travel guard travel insurance offer any discounts, does travel guard offer annual multi-trip plans, travel guard 24/7 travel assistance, does travel guard travel insurance have cancel for any reason (cfar), does travel guard travel insurance have interruption for any reason (ifar), travel guard travel insurance and pre-existing medical conditions, travel guard travel insurance exclusions, travel guard travel insurance eligibility, how to file a claim with travel guard travel insurance.

AIG Travel, Inc., a member of American International Group, Inc., is a worldwide leader in travel insurance and global assistance. Travel Guard is the marketing name for AIG’s portfolio of travel insurance and related services for both leisure and business travellers. Medical and security services are provided through a network of wholly-owned assistance centres located in Asia, Europe and the Americas.

Travel Guard Travel Insurance is underwritten by Toronto-based AIG Insurance Company of Canada.

Travel Guard Travel Insurance is currently not available for Quebec residents.

Here are the key types of travel insurance coverage offered in Travel Guard Travel Insurance plans:

- Emergency medical insurance: If you get ill or are injured on your trip, travel medical insurance can pay for emergency medical expenses, up to the coverage limits in your plan. These expenses can include doctor and hospital bills, medication and lab work, as well as medical evacuations, repatriation and arranging for a bedside companion if you are hospitalized.

- Trip cancellation insurance: If you cancel a trip for a reason listed in your travel policy, such as you or your travelling companion becoming ill, weather conditions cause a massive delay or you lose your job, trip cancellation insurance can reimburse you for prepaid, non-refundable costs.

- Travel interruption or delay insurance: Trip interruption insurance can pay for a last-minute flight home in an emergency and reimburse money that you lose by cutting a trip short due to a covered reason, including non-refundable activities and hotel stays. If your flight is delayed , your insurance can cover the cost of incidentals, such as meals or accommodations, after a specified period of time, such as six, 10 or 12 hours.

- Baggage insurance: Baggage travel insurance can compensate you up to your policy limits if your luggage is lost or stolen. It will reimburse the depreciated value of your suitcases and what you packed. If your bags are delayed, it can reimburse you for the cost of the necessities you’ll have to buy to tide you over. It also extends to your personal belongings, if they are lost, damaged or stolen.

- Travel accident insurance: This coverage offers compensation in the event of accidental death or catastrophic injury from an accident during your trip. Flight Accident Insurance covers injury while you’re on a commercial plane, during a connection or in an airport. Travel Accident Insurance covers death or dismemberment, including the loss of limbs or eyesight, while in transit during your trip.

Travel Guard Travel Insurance offers four plans for travelling outside of Canada.

Platinum All Inclusive Package: This is the most comprehensive plan offered by Travel Guard with unlimited emergency medical insurance for travellers under age 59, and $10 million in coverage for travellers 60 and up. It includes coverage for unforeseen medical emergencies, trip cancellation and interruption, flight and travel accident coverage, and baggage loss, damage and delay insurance.

Eligible emergency medical expenses include:

- Care received from a physician in or out of hospital

- A hospital room

- Rental or purchase of a hospital bed

- Medical appliances including a wheelchair, brace or crutches

- Diagnostic tests

- Prescription medication

- Private duty nursing

- One follow-up visit for your emergency

- Ground ambulance transportation

- Emergency evacuation and repatriation

- Dental treatment due to a blow to the face, up to $1,500

- Dental treatment due to other causes, up to $600

- Paramedical services, such as treatment from a physiotherapist, chiropractor, chiropodist, podiatrist or osteopath, up to $300 per profession

Medical benefits also include coverage to bring someone to your bedside, expenses for meals, hotel accommodations and associated expenses if you are hospitalized and/or if a medical delay prevents you from returning home, repatriation expenses and return of your remains if you die.

The Platinum All Inclusive Package offers two optional add-ons: Cancel For Any Reason (CFAR) and Cruise and Tour Protector coverage.

The Platinum All Inclusive Package is for travellers age 74 and younger.

Gold Emergency Medical Plan: If you’re only worried about medical emergencies while travelling, this benefit offers all of the medical coverage listed above. The Gold Emergency Medical Plan offers unlimited medical coverage for travellers aged 54 and under, and $10 million in coverage for travellers 55 and older.

Silver Deluxe Trip Cancellation & Interruption Package: This coverage option reimburses you for insured non-refundable travel expenses (such as hotels or prepaid excursions) if you have to cancel, interrupt, or delay your trip due to a covered reason. This benefit also includes baggage loss, damage and delay coverage, flight and travel accident coverage, and provides a specific benefit for a missed connection.

The Silver Deluxe Trip Cancellation/Interruption Package includes six optional add-ons: Cruise and Tour Protector, Expanded Benefits Upgrade, Golf Protector Coverage, Ski Protector Coverage, Business Protector Coverage and Collision Damage Waiver Coverage.

Gold Deluxe Trip Cancellation & Interruption Package: This coverage option offers the same benefits as the Silver package but some have higher payouts.

The Gold Deluxe Trip Cancellation/Interruption Package includes one optional add-on: Cruise and Tour Protector. There is also a Change of Mind benefit that reimburses your cancellation penalties up to $400 if you cancel a trip because you changed your mind, provided your trip has been paid in full.

We’ve highlighted the key benefits of Travel Guard Travel Insurance for the four single trip plans to help you identify which coverage is the best fit for you.

The price of a Travel Guard Travel Insurance plan depends on factors such as the cost of your trip, your age, your answers to a medical questionnaire, if required, and the amount of coverage you choose.

Here are some examples of the cost for Travel Guard Travel Insurance single trip plans for healthy travellers based in Ontario:

TravelSafe Travel Insurance Review

Emergency medical: $1 million Cancel For Any Reason: Yes, 75% Baggage insurance (maximum): $2,000

Related: TravelSafe Travel Insurance Review

CAA Travel Insurance

Emergency medical: $5 million Cancel For Any Reason: Yes, 50% to 75% Baggage insurance (maximum): $1,500

Related: CAA Travel Insurance Review

TuGo Travel Insurance

Emergency medical: $10 million Cancel For Any Reason: Yes, 50% Baggage insurance (maximum): $500

Related: TuGo Travel Insurance Review

Travel Guard offers several optional add-ons for its travel insurance.

The following six add-ons are available with the Silver Deluxe Trip Cancellation & Interruption Package :

- Business Protector coverage

- Cruise and Tour Protector

- Expanded Benefits Upgrade

- Golf Protector coverage

- Ski Protector coverage

- Collision Damage Waiver coverage

Business Protector coverage: This upgrade offers the following added benefits if you are travelling for business and need to make a claim under these scenarios:

Cruise and Tour Protector: If your pre-booked cruise is cancelled or if the dates are changed by the cruise company or tour operator, you are eligible for the following benefits:

Expanded Benefits Upgrade: This upgrade offers the following increased benefits and added benefits under these scenarios:

- Wedding coverage: If the primary reason for your trip is to attend a wedding and the wedding is cancelled due to the death or hospitalization of the bride, groom and/or parents of the bride or groom

- Wedding, sporting event or conference arrival delay: If the primary reason for your trip is to attend a wedding, sporting event or conference and your arrival is delayed for a reason beyond your control.

- Entertainment benefit: If you are delayed beyond your scheduled return date, the entertainment benefit pays for a ticketed event, such as a movie, live production or sporting event.

- Same-class ticket benefit: If you travelled on business or first class and you are later eligible for a flight replacement under your trip cancellation. Interruption or delay coverage, this benefit upgrades your economy-class ticket to your same-class ticket.

- Meals & accommodation benefit increase: Your meals and accommodation benefits for trip interruption and trip delay are increased.

- Baggage delay benefit increase: Your baggage delay benefit is increased from $400 to $750.

- Hurricane coverage: Your trip cancellation, interruption and delay coverage will now cover hurricanes.

Golf Protector coverage: This upgrade offers the following added benefits if you are playing golf on your trip and need to make a claim under these scenarios:

Ski Protector coverage: This upgrade offers the following added benefits if you are skiing or snowboarding on your trip and need to make a claim under these scenarios:

Collision Damage Waiver coverage: The benefit offers $50,000 in coverage if you need to make a claim due to physical loss or damage to a rental car during your trip.

If you purchase the Platinum All Inclusive Package , you can purchase the following add-ons:

- Cancel For Any Reason coverage

- Cruise and Tour Protector coverage

If you purchase the Gold Deluxe Trip Cancellation & Interruption Package , you can purchase the following add-on:

There are no add-ons with the Gold Emergency Medical Plan .

Using the example of the couple travelling to Mexico, here is the cost of the optional add-ons when selecting the Silver Deluxe Trip Cancellation & Trip Interruption Package with a base premium of $134:

Yes. You can buy multi-trip annual insurance if you travel more than once a year for multiple individual trips. Travel Guard offers nine, 16, 30 and and 60-day annual plans for emergency medical coverage.

Here’s how the cost compares for a single-trip emergency medical plan and the four multi-trip annual plans:

Worldwide emergency travel assistance is available 24/7 by calling the LiveTravel hotline.

When you have a travel medical emergency, the following support may be available:

- Health care facility location

- Assistance finding a doctor who speaks your preferred language

- Translation assistance

- Prescription refill assistance

- Coordinating medically necessary return travel arrangements

- Emergency medical evacuation

- Medical monitoring

- Medical equipment rental/replacement

Depending on your coverage, worldwide travel assistance services include:

- Lost baggage search and stolen luggage replacement assistance

- Lost passport and travel documents assistance

- ATM locator

- Emergency cash transfer

- Travel information, including visa and passport requirements

- Emergency telephone interpretation services

- Urgent message relay to family, friends or business associates

- Up-to-the-minute travel delay reports

- Assistance with obtaining long-distance calling cards for worldwide telephoning

- Inoculation information

- Embassy or consulate information

- Currency conversion or purchase assistance

- Up-to-the-minute information on local medical advisories, epidemics, required immunizations and available preventive measures

- Up-to-the-minute travel supplier strike information

- Legal referrals/bail bond assistance

- Worldwide public holiday information

- Flight rebooking assistance

- Hotel rebooking assistance

- Rental vehicle booking assistance

- Coordinate emergency return travel arrangements

- Roadside assistance

- Rental vehicle return assistance

- Guaranteed hotel check in

- Missed connection coordination

Personal security assistance includes:

- Arrange emergency and security evacuations

- Coordinate consultants to extract client to safety

- 24/7 access to security and safety advisories, global risk analysis and consultation specialists

- Immediate security intelligence on events occurring throughout the world

- Collaboration with law enforcement

The Gold and Silver Deluxe Trip Cancellation & Interruption Packages also offers the following Concierge Services:

- Assistance with restaurant reservations

- Ground transportation arrangements

- Event ticketing arrangements

- Tee times and course referrals

- Floral services

- Local activity recommendations

You must contact the Assistance Centre before receiving medical treatment or you may have to pay 30% of the eligible medical expenses. If you are unable to call, you must get someone to call on your behalf.

Yes. Travel Guard offers Cancel For Any Reason coverage as an optional add-on with the Platinum All Inclusive Package. If you are prevented from taking your trip for any reason not otherwise covered by the trip plan, Travel Guard will reimburse you for up to 75% of your prepaid, forfeited and non-refundable payments or deposits.

This add-on must be purchased at the same time the base plan is purchased, and within 15 days of the initial trip payment. Any additional payments must also be insured under this coverage within 15 days. To be eligible for coverage, you need to cancel your trip 48 hours or more prior to your departure date.

In general, a pre-existing condition is defined as any sickness, injury or medical condition that existed before the start of your coverage, whether or not diagnosed by a physician, that you showed signs or symptoms of or received medical attention for.

With a Travel Guard travel insurance plan, any pre-existing conditions must be stable and controlled for 90 days before the start of your policy to be eligible for coverage. In additional, Travel Guard will not cover any losses if you:

- Have been required to use, take or been prescribed nitroglycerin in any form more than once during a seven-day period for a heart condition

- Require the use of home oxygen or had to take oral steroids, such as prednisone or prednisolone, for a lung condition

According to Travel Guard, a medical condition is considered stable and controlled when there has been:

- No new treatment, new medical management or newly-prescribed medication

- No change in treatment, change in medical management, or newly prescribed medication

- No new, more frequent or more severe symptom or finding

- No test results showing deterioration

- No investigations or future investigations initiated or recommended for symptoms whether or not your diagnosis has been determined

- No hospitalization or referral to a specialist (made or recommended)

Travel Guard offers a Pre-existing Medical Condition Exclusion Waiver whereby the company will waive any pre-existing medical condition exclusions if:

- The policy is purchased within 15 days of making the initial trip payment

- Any additional payments or deposits are insured within 15 days of purchase

- You (the insured) are medically able to travel when you pay your premium

In addition to pre-existing condition exclusions, there are a number of scenarios not covered by travel insurance and it’s critical to know what not to do before you make a claim. The following are general exclusions to coverages provided by Travel Guard travel insurance:

- Expenses from any sickness or injury present before you bought your policy that you would expect to need medical treatment or hospitalization during your trip

- Expenses incurred once the medical emergency ends

- Non-emergency or prescription medication, including vaccinations, medication for the maintenance of a medical condition, vitamins, physical exams or routine tests

- Organ or bone marrow transplants, or surgery for artificial joints or prosthetic devices or implants

- Expenses for acupuncture or holistic treatment

- Ionizing radiation or radioactive contamination

- Eligible expenses that were not pre-approved

- Any medical condition if if was determined you could return home but you chose not to travel

- Expenses for any services prohibited by your provincial or territorial health insurance plan

- Routine prenatal care, a child born during your trip, childbirth or associated complications, pregnancy or associated complications after 26 weeks or any time after the expected date of delivery

- Your mental or emotional disorders

- Suicide or attempted suicide or intentional self-inflicted injury

- Any alcohol-related sickness, injury or death, or the abuse of medication, drugs, alcohol or other toxic substance

- A trip taken against your physician’s orders not to travel

- Your commission of, or attempt to commit, a crime

- Your participation in rock or mountain climbing, hang-gliding, parachuting, bungee jumping, skydiving, ski jumping, ski flying, heli-skiing, ski acrobatics, ski stunting, freestyle skiing, ski racing, ski bob racing, on-piste and off-piste skiing in areas designated as unsafe

- Your participation as a professional athlete in a sporting event

- Your participation in a motorized race or motorized speed contest

- Operating or learning to operate any aircraft, performing employment duties on any aircraft or ship, performing duties in any regular armed force services

- Travel to any country where there is an active travel advisory not to travel before your departure date

- War, acts of foreign enemies or rebellion

- Expenses relating to travel in, to or through Cuba, Iran, Syria, Sudan, North Korea or the Crimea region

There may be additional exclusions specifically for medical, trip cancellation/interruption/delay and baggage coverage.

To be eligible for Travel Guard Travel Insurance you must:

- Be a Canadian resident

- Have purchased your policy prior to your departure date

- Have purchased your policy less than 18 months prior to your departure date

- Have purchased your policy for the full duration of your trip

- Have purchased your policy for the full value of your non-refundable, prepaid travel arrangements

- Be insured under your provincial or territorial insurance plan (or your emergency medical benefits will max out at $10,000)

- Be less than 75 years old

- Be travelling for less than 183 days if you are less than 60 years old

- Be travelling for less than 60 days if you are between 60 and 75 years old

In addition, the following makes you ineligible for Travel Guard Travel Insurance:

- A licensed physician has diagnosed you with a terminal condition.

- You have undergone a bone marrow transplant or an organ transplant (except for a corneal transplant) that requires the use of anti-rejection/immune suppression drugs.

- You require dialysis of any type for kidney disease.

- If you are under the age of 75 and in the last 12 months you have been prescribed or utilized home oxygen therapy at any time.

You can file a claim by contacting Travel Guard by telephone at the numbers listed on the website depending on the province or territory you are calling from.

The insurer will provide the forms for your claim within 15 days of you initiating the claim. However, if you haven’t received the required forms during that time, you can submit your proof of claim in the form of a written statement outlining the cause or nature of the accident, sickness or disability that caused the claim.

If you are making an emergency medical claim, you must provide original receipts for incurred expenses, including those for subsistence allowance expenses.

For a trip cancellation/trip interruption/trip delay claim, you may be asked to provide:

- Proof of all non-refundable, prepaid deposits or payments

- Completed documentation if a medical condition was the cause of the cancellation

- Complete unused transportation tickets and vouchers

- Original receipts for subsistence allowance expenses

- Original receipts for new tickets

- Reports from police or local authorities documenting the missed connection or travel delay

- Invoices and original receipts from travel service providers

If you are making a baggage insurance and personal effects claim, you may need to provide:

- A letter of coverage or denial from the transportation carrier

- A written report regarding the loss or damage

- Original receipts or sales slips for all lost and stolen items over $149.99 per item claimed and proof that you owned the articles

- Original receipts and sales slips for all items claimed under baggage and personal effects coverage

If you are making a Rental Car Collision Damage Protection Benefit claim, you may be asked to provide:

- Your car rental invoice

- Your rental agreement with the record of the damages that existed when you picked up the car

- The police report and rental car agency report including estimate of repair costs

You must file your claim with us within 30 days of the loss or damage in the case of a claim under Rental Car Protector Coverage.

Travel Guard Travel Insurance FAQs

Does travel guard travel insurance pay for medical costs upfront.

According to the company, benefits for emergency medical expenses, emergency evacuation and repatriation of remains services may be payable directly to the provider of the services, however the provider, “must comply with the statutory provision for direct payment and may not have been paid from any other sources.” The insurer adds it will “make every effort, though we cannot guarantee, to pay providers directly.”

Does Travel Guard Travel Insurance offer coverage extensions?

Yes. Your coverage is automatically extended for up to 72 hours if your return home is delayed due to a transportation issue. If you or your travelling companion are hospitalized, your coverage is extended for the period of hospitalization, plus up to 120 hours after discharge. If you or your travelling companion are too sick to travel on your return date but do not require hospitalization, your coverage is automatically extended for up to 120 hours after your planned return date.

If you want to stay longer on your trip, you can extend your coverage if you apply and pay the premium before your original return date as long as you have not made a claim and there is no reason to make a claim.

Does Travel Guard Travel Insurance require a medical questionnaire?

Yes. Travellers over age 55 are required to complete a medical questionnaire to determine your eligibility and rate category.

Does Travel Guard Travel Insurance have any age restrictions?

Yes. You must be a minimum of 15 days old and no more than 85 years old.

When does my coverage with Travel Guard Travel Insurance begin?

In general, if you purchase cancellation coverage, it begins the day you buy your policy and ends the day you make a claim or leave on your trip. Your medical and interruption coverage, if purchased, begins when you leave home. Your delay coverage begins once an insured risk prevents you from returning home as scheduled.

Does Travel Guard Travel Insurance offer a free look period?

Yes. Travel Guard offers a 10-day Right to Examine period during which you can review your policy and cancel if you’re not satisfied with it.

Can I get a refund with Travel Guard Travel Insurance?

You can request a refund for the all-inclusive plan up to the departure date as long as you have not made a claim against the policy. A refund will also be issued if your travel supplier cancels or changes your trip and all your insured trips costs are refunded without penalty.

With an emergency medical plan, you can request a refund if you have a minimum of four unused days of coverage.

No refund will be issued if you have initiated, reported or made a claim against your policy.

Fiona Campbell is a Staff Writer for Forbes Advisor Canada. She started her career on Bay Street, but followed her love for research, writing and a good story into journalism. She is the former editor of Bankrate Canada, and has over 20 years of experience writing for various publications, including the Globe and Mail, Financial Post Business, Advisor’s Edge, Mydoh.ca and more.

- Goose Travel Insurance Review

- CAA Travel Insurance Review 2023

- TuGo Travel Insurance Review

- Blue Cross Travel Insurance

- Manulife Financial CoverMe Travel Insurance

- World Nomads Travel Insurance Review

- Medipac Travel Insurance Review

- RBC Insurance Travel Insurance

- TD Insurance Travel Insurance Review

- Johnson MEDOC Travel Insurance

- Allianz Global Assistance Travel Insurance

- TD Bank Travel Insurance

- CUMIS Travel Insurance Review

- AMA Travel Insurance

- GMS Travel Insurance Review

- CIBC Travel Insurance Review

- BMO Travel Insurance Review

- Desjardins Travel Insurance Review

- Travelance Travel Insurance

- Scotia Travel Insurance Review

- How To Get Pre-Existing Conditions Covered By Travel Insurance

- Should You Buy Travel Insurance And Is It Worth It?

- Why Travel Medical Insurance Is Essential

Do I Need Travel Insurance When Travelling Within Canada?

- Trip Cancellation Travel Insurance

- How To Get Reimbursement For A Travel Insurance Claim

- Do Canadian Travellers Need Schengen Visa Insurance?

- How Travel Insurance Works For Baggage

- How To Travel To The U.S. From Canada

- Do You Need Annual Multi-Trip Travel Insurance?

- Travel Insurance For Trips To Europe

- What Travel Insurance Does Not Cover

- Top 10 Travel Insurance Tips For 2023

- Travel Insurance For A Mexico Vacation

- How To Read The Fine Print Of Your Travel Insurance Policy

- 5 Top Tips For Handling Flight Cancellations Like A Pro

- What Does Travel Delay Insurance Cover?

- Advantages Of Buying Travel Insurance Early

- Travel Insurance For U.K. Trips

- Travel Insurance For Trips To Italy

More from

$10 etias travel pass for europe visits pushed to 2025, what’s the purpose of an etias travel authorization, bcaa travel insurance review 2024, pacific blue cross travel insurance review 2024, cumis travel insurance review 2024.

Travel Tech Industry’s Most Advanced Platform & API. 📞 888-885-5550 ✉ [email protected]

Travel Guardian +

One of the Broadest Coverages in the Entire Global Travel Insurance Industry

Do you want to offer the Travel Guardian + benefit? We have it!

When you offer travel protection with Cancel For Any Reason benefits, that gives your customers the assurance they need to book their trip with confidence.

- Protection for hurricanes, natural disasters, death in the family, sickness, injury, medical coverage and much, much more.

- Protection against things that might not be included in standard travel protection policies: divorce, personal finances have changed, kid’s sports event gets cancelled, or it’s simply going to rain all week during your golf trip.

- One of the broadest coverages in the entire global travel insurance industry.

- greatly simplifies the travel protection purchase process,

- supports more coverage option offers,

- reduces administrative burden, and

- integrated booking path offers increase penetration “take-up” rates on all reservations.

- traveler/guest (protects their vacation investment)

- homeowner/property manager (protects booking commissions earned).

- Fosters guest satisfaction and positive reviews

- Protects booking revenue against last-minute guest cancellations

- Multiple underwriters (Nationwide® and US Fire) give clients the ability to fulfill more travel insurance requests vs. a single underwriter solution.

- Custom co-branded Microsites automate direct purchase and second-chance purchase opportunities.

- eliminates snail-mail document delivery,

- maintains all parties in compliance, and

- reassures travelers by delivering their policy ID and claims contact information.

- US resident travelers (all US states except New York)

- Canada resident travelers (all CA provinces except Quebec)

- Retail cost: 10.8% x Trip Cost

- Authorized property managers offering travel protection earn related compensation.

- Travel Guardian + travel protection programs are offered by authorized travel insurance retailers of InsureStays, dba of Sandhills Insurance Group LLC, NPN 16269113, a licensed agency headquartered in Pawleys Island, South Carolina, and holding resident and non-resident insurance agency licenses throughout the United States. Visit www.insurestays.com for more information. Terms and conditions apply.

Are You Ready To Learn More?

Click here and fill out your contact information and additional details.

Is It Safe in Moscow?

:max_bytes(150000):strip_icc():format(webp)/RussianKerry2-56a39e8d5f9b58b7d0d2ca8c.jpg)

Stanislav Solntsev / Getty Images

When you visit Moscow , Russia, you’re seeing one of the world’s largest, and most expensive, capital cities . While there is a history of violent crime against foreign journalists and aid personnel in Russia, a trip to Moscow is usually safe for mainstream travelers. Most tourists in Moscow only face potential issues with petty crime, though terrorism is also a concern. Visitors should stick to the principal tourist areas and abide by the local security advice.

Travel Advisories

- The U.S. Department of State urges travelers to avoid travel to Russia because of COVID-19 and to "exercise increased caution due to terrorism, harassment, and the arbitrary enforcement of local laws."

- Anyone exploring more of Russia should avoid "The North Caucasus, including Chechnya and Mount Elbrus, due to terrorism, kidnapping, and risk of civil unrest." Also, travelers should stay away from "Crimea due to Russia’s occupation of the Ukrainian territory and abuses by its occupying authorities."

- Canada states travelers should use a high degree of caution in Russia due to the threat of terrorism and crime.

Is Moscow Dangerous?

The Moscow city center is typically safe. In general, the closer you are to the Kremlin , the better. Travelers mainly need to be aware of their surroundings and look out for petty crime. Be especially careful in tourist areas such as Arbat Street and crowded places like the Moscow Metro transit system. The suburbs are also generally fine, though it is advised to stay away from Maryino and Perovo districts.

Terrorism has occurred in the Moscow area, leading authorities to increase security measures. Be more careful at tourist and transportation hubs, places of worship, government buildings, schools, airports, crowds, open markets, and additional tourist sites.

Pickpockets and purse snatching happen often in Russia, perpetrated by groups of children and teenagers who distract tourists to get their wallets and credit cards. Beware of people asking you for help, who then trick you into their scheme. Don’t expect a backpack to be a safe bag bet; instead, invest in something that you can clutch close to your body or purchase a money belt . Always diversify, storing some money in a separate location so that if you are pickpocketed, you'll have cash elsewhere. Keep an eye out for thieves in public transportation, underground walkways, tourist spots, restaurants, hotel rooms and homes, restaurants, and markets.

Is Moscow Safe for Solo Travelers?

Large cities like Moscow in Russia are overall fairly safe if you are traveling alone, and the Moscow Metro public transit is a secure and easy way to get around. But it is still a good idea to follow basic precautions as in any destination. Avoid exploring alone at night, especially in bad areas. You may want to learn some basic Russian phrases or bring a dictionary, as many locals don't speak English. However, in case you need any help, there are tourist police that speak English. Also, exploring with other trusted travelers and locals or on professional tours is often a good way to feel safe.

Is Moscow Safe for Female Travelers?

Catcalling and street harassment are infrequent in Moscow and the rest of Russia and females traveling alone don't usually have problems. There are plenty of police officers on the streets as well. Still, it serves to stick to Moscow's well-lit, public areas, avoid solo night walks, and use your instincts. Women frequenting bars may take receive some friendly attention. Females can wear whatever they want, but those entering Orthodox churches will be required to cover up. Though women in Russia are independent, domestic violence and other inequality issues take place regularly.

Safety Tips for LGBTQ+ Travelers

Russia is not known as a gay-friendly country. However, Moscow is one of the more welcoming cities with a blooming LGBTQ+ community and many friendly restaurants, bars, clubs, and other venues. Hate crimes in Russia have increased since the 2013 anti-gay propaganda law. Openly LGBTQ+ tourists in this conservative country may experience homophobic remarks, discrimination, or even violence, especially if traveling with a partner. Also, while women hold hands or hug publicly—whether romantically involved or not—men should avoid public displays of affection to prevent being insulted or other issues.

Safety Tips for BIPOC Travelers