Recommended Travel Insurance for Peru

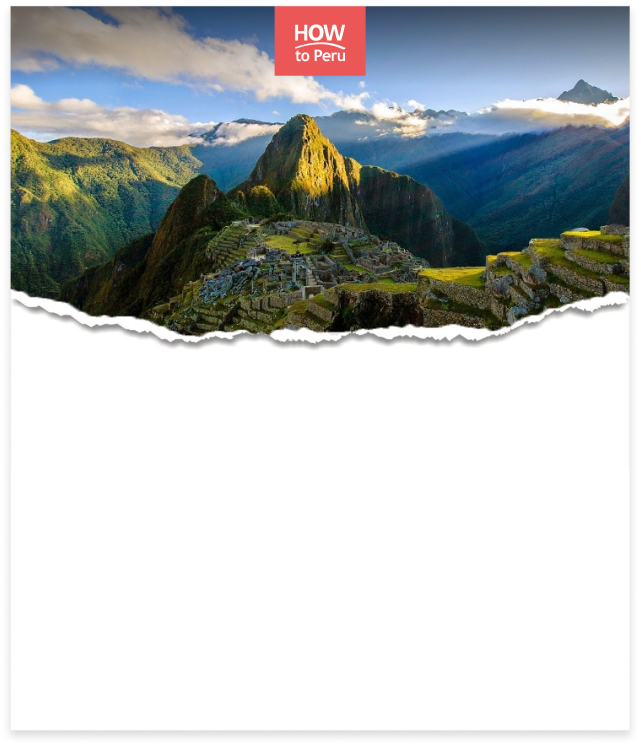

Whether you’re exploring Machu Picchu or seeing the sights in Lima , having travel insurance for Peru is essential. Travel insurance not only helps in case of emergencies but also gives you peace of mind. We will go over some tips on travel insurance that will help allow you to enjoy your time in Peru.

Travel Preparations

International travel can be a lot of fun, especially when visiting interesting places like Peru. Peru offers tourists a truly unique South American experience unlike anything else. When planning a trip to Peru there are a number of issues to take into consideration. Of those concerns, one of the most pressing is the decision to get some type of travel insurance.

When traveling internationally you really need to be prepared because things do happen regardless of the best planning. Travel insurance will help to reimburse you the cost to replace your broken camera or lost luggage. Most health insurance has very limited to no coverage outside of the country. If you have a medical emergency or your wallet is stolen, travel insurance can help you in both matters and more.

Be sure to make arrangements for travel insurance for Peru prior to your departure to South America. There are a few travel insurance companies out there so be sure to do your research. Our preferred travel insurance carrier is World Nomads Travel Insurance .

World Nomad Travel Insurance

When it comes to travel insurance, very few companies have the reputation of World Nomads . World Nomads has made getting and using travel insurance on the go a lot easier. They offer plans for both individual travelers as well as families, with coverage for over 150 adventure activities.

Travel Insurance for Inca Trail

Policies for travel insurance can vary depending on the company and coverage. Typically if you plan on sightseeing and relaxing, usually, traditional travel insurance should be adequate for your trip. However, when you visit remote locations and pretty much any location that is over 4,000 meters, at that altitude your standard policy will no longer cover you. This is something to consider if you plan on doing activities like biking, hiking or climbing in areas far from medical facilities. For travel insurance plans for the Inca Trail that can fully cover you, World Nomads Travel Insurance is a well-trusted and reputed brand that we would recommend.

With the highest point of the Inca Trail being well over 4,000 meters, you will definitely want to find a policy that covers the cost of evacuation and proper medical treatment. Even though accidents that take place on a Machu Picchu trek are rare they do occasionally occur. It is common for some people to have ailments like “altitude sickness” and sprained ankles if you’re not careful. Some minor problems can become potentially life-threatening in this remote area if you’re not properly prepared.

From stumbling and dropping your camera to falling and twisting your ankle, having travel insurance for Peru’s Inca Trail trek when you visit will help to give you peace of mind and financial reimbursement. When you go out on activities you can feel confident that should anything happen, you have a plan that will handle getting you to safety or medical care.

Travel Policy Features

With World Nomads travel insurance for Peru , if you happen to run out your policy, or your policy has ended but you still want to travel, you can extend it and add more time while on your trip. All of the travel plans offered by World Nomads also come with 24/7 multi-lingual assistance in case of emergencies. So regardless of where you are in the world, you can easily get the assistance that you need.

Travel Policy Benefits

World Nomad’s policy for travel insurance comes with a number of benefits that can really come in handy when you need it.

Like many traditional travel insurance policies, they offer coverage of all your items like baggage, passports, as well as your tech. So when the airport loses your bags, your purse gets left behind, or even if your camera gets damaged, they have you covered.

We all try our best to have fun safely while traveling, but accidents do happen. Having a policy can put your mind at ease knowing that you have coverage for things like medication if you happened to forget yours back at home for example. They cover both emergency dental or medical expenses including medical evacuations and repatriation if you become sick or hurt.

The last thing you want to happen while on vacation is to have it come to an end earlier than expected due to unforeseen circumstances. With travel insurance, you can rest easy because you have coverage to help cover the financial costs of some unexpected events. Things like being hospitalized, or the death of a family member, even sudden illness, insurance helps to cover costs associated with all these types of events.

Staying Protected While Active

When visiting Peru, there’s no limit to the number of outdoor activities that are available for you to do. Find activities like swimming or biking are readily available. You can hike the Rainbow Mountain or trek the Inca Trail. For those daring, you can trek all four days to reach Machu Picchu. Participating in outdoor activities like these come with their own inherent risks. With a World Nomads policy, you can enjoy knowing you have coverage for over 150 outdoor activities. Their policies can cover you for a range of activities from camel riding to hot air ballooning, snorkeling and a whole lot more.

Anytime you plan on traveling either domestically or internationally, having some type of travel insurance is a good idea. Be proactive and protect yourself from inconveniences like lost bags and luggage. Having insurance can not only save you potentially hundreds of dollars but also give you peace of mind. Having more money and peace of mind will surely make your time visiting Peru much more enjoyable.

Although Peru is a beautiful and vibrant place, there are still some areas that are off-limits to tourists. For personal safety and the protection of your items, World Nomads travel insurance for Peru offers all the protection you need in order to have the best time in Peru.

BOOK YOUR TRAVEL INSURANCE NOW

YOU MAY LIKE

1 comment for “ #1 Rated Day Trips From Lima To Unforgettable Destinations ”

Leave a reply cancel reply.

Your email address will not be published. Required fields are marked *

Start planning your trip to Peru in 2021!

Sign up to get all you need to know about Peru destinations for 2021!

Get your FREE sample trip plan from our HowToPeru travel experts!

How many days will you have in peru, how many people traveling.

Thanks! Your personalised itinerary will be emailed very soon!

PERU TRIP PLANNER

Get your sample trip plan from our

HowToPeru travel experts!

Peru Travel Insurance

Travel insurance for peru.

Machu Picchu and Lake Titicaca are just two of the wonders that draw travelers to Peru each year. There are numerous other sights to see as Peru is rich with Incan ruins, sand dunes, seabirds, marine life and so much more.

If you want to join the thousands of tourists who flock to the lovely country of Peru each year, you will want to learn how travel insurance can assist with certain unexpected accidents or mishaps that could spoil an amazing trip.

- What should your Travel insurance cover for a trip to Peru?

- How does Travel Insurance work in the Peru?

- Do I need Travel Insurance for the Peru?

- How much does Travel Insurance cost for Peru?

Our Suggested AXA Travel Protection Plan

- What types of medical coverage does AXA Travel Protection plans offer?

Are There Any COVID-19 Restrictions for Travelers to Peru?

Traveling with pre-existing medical conditions , what should your travel insurance cover for a trip to peru.

At a minimum, your travel insurance should cover trip cancellation, trip interruption and emergency medical expenses. When it comes to international travel, the US Department of State outlines key components that should be included in your travel insurance coverage. AXA Travel Protection plans are designed with these minimum recommended coverages in mind.

- Medical Coverage – The top priority is making sure your health is in order. With AXA Travel Protection, you can have access to quality healthcare during your trip overseas in the event of unexpected medical emergencies.

- Trip Cancellation & Interruptions – Assistance against unexpected trip disruptions can dampen the mood, AXA Travel Protection offers coverage against unforeseen events.

- Emergency Evacuations and Repatriation – In situations where transportation is dire, AXA Travel Protection offers provisions for emergency evacuation and repatriation.

- Coverage for Personal Belongings – AXA offers coverage for your belongings with assistance against lost or delayed baggage.

- Optional Cancel for Any Reason – For added flexibility, AXA offers optional Cancel for Any Reason coverage, allowing you to cancel your trip for non-traditional reasons. Exclusive to Platinum Plan holders.

In just a few seconds, you can get a free quote and purchase the best travel insurance for Peru.

How Does Travel Insurance Work in the Peru?

Many visitors enjoy a tour to Vinicunca, commonly known as Rainbow Mountains, to see the colorful striations on the mountains. While this tourist site is generally safe, the high altitude can make it difficult for some tourists to breathe, especially for those who are not well-hydrated. High altitudes can cause unexpected health symptoms such as headaches, nausea or vomiting.

With an AXA Travel Protection plan, you get assistance with getting emergency care and navigating the medical system in Peru. The right guidance will allow you to resume your itinerary as soon as possible. Here is how travelers can benefit from an AXA Travel Protection Plan:

Medical Benefits:

- Emergency Medical Expenses: Should you fall ill or have an accident during your trip, your policy may offer coverage for medical expenses, including hospital stays and doctor's fees.

- Emergency Evacuation & Repatriation: In case of a serious medical emergency, your policy may include provisions for evacuation to the nearest appropriate medical facility or repatriation.

- Non-Emergency Evacuation & Repatriation : In non-medical crises (e.g., political unrest), your policy may cover evacuation or repatriation, subject to policy terms.

Baggage Benefits:

- Luggage Delay: If the airline delays your checked baggage, your policy might offer reimbursement for essential items like clothing and toiletries.

- Lost or Stolen Luggage: In the unfortunate event of permanent loss or theft of your luggage, your policy may offer reimbursement for its value, assisting you in replacing your belongings.

Pre-Departure Travel Benefits:

- Trip Cancellation: You may be eligible for reimbursement if you cancel your trip due to a sudden illness or injury.

- COVID-19 Travel Insurance: Coverage is available for trip cancellation and medical expenses related to COVID-19, subject to policy terms and conditions.

- Trip Delay: If your flight faces delays due to unforeseen circumstances, you may have coverage for additional expenses such as meals and accommodations.

Post-Departure Travel Benefits

- Trip Interruption: In case of an unexpected event, you could be eligible for reimbursement for the unused portion of your trip.

- Missed Connection: If you miss a connecting flight due to delays or cancellations, this coverage may help with expenses like rebooking fees and accommodations.

Additional Optional Travel Benefits

- Rental Car (Collision Damage Waiver): Exclusive to Gold & Platinum plan policy holders, this optional benefit gives travelers extra coverage on their rental car against damage and theft.

- Cancel for Any Reason: Exclusive to Platinum plan policy holders; this optional benefit gives travelers more flexibility to cancel their trip for any reason outside of their standard policy.

- Loss Skier Days: Exclusive to Platinum plan policy holders, this optional benefit offers reimbursement to mitigate some costs associated with pre-paid ski tickets that you or your traveling companion cannot use due to specified slope closures.

- Loss Golf Days: Exclusive to Platinum plan policy holders, this optional benefit offers reimbursement to mitigate the expenses linked to prepaid golf arrangements that you or your travel companion are unable to utilize due to specified golf closures.

Do I Need Travel Insurance for the Peru?

The Peruvian government does not require travelers to obtain travel insurance . Nonetheless, medical expenses can be quite expensive. Medicare and United States health insurance policies will not likely cover medical emergencies. For these reasons, an AXA Travel Protection Plan can take care of unexpected medical expenses. Why? There are several reasons:

Medical Emergencies: Your health is a top priority. If you face a sudden illness or injury in New York, travel insurance offers the means to receive prompt and quality medical care.

Lost Baggage: Airlines sometimes mishandle baggage, and the last thing you want is to be without your essentials in an unfamiliar place. Travel insurance offers to cover the cost of replacing necessary items, allowing you to continue on.

Flight Delays: Travel disruptions like flight delays can happen. If you miss a connecting flight or incur additional expenses due to delays, travel insurance can help cover the costs.

How Much Does Travel Insurance Cost for Peru?

In general, travel insurance costs about 3 – 10% of your total prepaid and non-refundable trip expenses. The cost of travel insurance depends on two factors for AXA Travel Protection plans:

- Total Trip cost: The total non-prepaid and non-refundable costs you have already paid for your upcoming trip. This includes prepaid excursions, plane tickets, cruise costs, etc.

- Age: Like any other insurance type, the correlation is rooted in increased health risks associated with older individuals. It's important to note that this doesn't make travel insurance unattainable for older individuals.

With AXA Travel Protection, travelers to Peru will be offered three tiers of insurance: Silver, Gold and Platinum . Each provides varying levels of coverage to cater to individual's preferences and travel needs.

AXA presents travelers with three travel plans – the Silver Plan , Gold Plan , and Platinum Plan , each offering different levels of coverage to suit individual needs. Given that Peru hospitals often do not accept U.S. health insurance or Medicare, we genuinely recommend travelers consider purchasing any of these plans, particularly for the crucial coverage they offer for emergency accident and sickness medical expenses.

The Platinum Plan is a great choice if you are looking for extra coverage while traveling in Peru. It offers optional benefits such as " Cancel for Any Reason " coverage, which expands the trip cancellation coverage by allowing you to cancel your trip for any reason. The Collision Damage Waiver covers losses such as collisions, theft or other damage to a rental car while sightseeing in Peru. Golfers can take advantage of Lost Golf Rounds coverage with the Platinum Protection Plan if weather causes a cancellation in their golf game in Peru.

What Types of Medical Coverage Do AXA Travel Protection Plans Offer?

AXA covers three types of medical expenses:

- Emergency medical

- Emergency evacuation & repatriation

- Non-medical emergency evacuation & repatriation

Emergency medical: Can cover injuries or illnesses such as broken bones, sprains, or unexpected illnesses such as malaria, typhoid and yellow fever which are common risks in Peru. Emergency evacuation and repatriation: Can cover your immediate transportation home in the event of an accidental injury or illness. Non-medical emergency evacuation and repatriation: Can cover expenses for non-medical emergencies as Peru is located on the Ring of Fire in the Pacific which is known for earthquakes and volcanic activity.

No. Peru has dropped all COVID-19 restrictions for travelers from the United States.

Traveling with pre-existing medical conditions can complicate your plans, but with AXA Travel Protection, we're here to support you during your trip.

Our Gold and Platinum plans offer coverage for pre-existing medical conditions. The Platinum plan, in particular, is our highest-offered choice for travelers who want our highest coverage limits and optional add-ons,

What does this mean for you? If you've got a medical condition that's been hanging around, you can qualify for coverage under our Gold and Platinum plans with a pre-existing medical condition , so long as it’s within 14 days of placing your initial trip deposit and in our 60-day look-back period. We're here to ensure you travel easily, no matter your health situation.

1.Can you buy travel insurance after booking a flight?

You can buy travel insurance even after your flight is booked.

2.When should I buy Travel Insurance to Peru?

It's advisable to purchase travel insurance for your trip as soon as you have made your initial trip deposit (prepaid and non-refundable trip costs.) AXA Travel Protection offers coverage as soon as you purchase your protection plan. We can give coverage against unforeseen events before you leave for your trip. Additionally, our policies offer coverage for preexisting medical conditions and Cancel for Any Reason if you purchase your protection within 14-days of making your initial trip deposit.

3.Do Americans need travel insurance in Peru?

No, travel insurance is not currently required to visit Peru.

4.What is needed to visit Peru from the USA?

If you are visiting Peru from the USA, all you need is your passport. Your passport needs to be valid at least six months beyond the date of your arrival. Immigration authorities may also require proof of return travel.

5.What happens if a tourist gets sick in Peru?

If you become sick in Peru, travelers with AXA Travel protection can contact the AXA Assistance hotline 855-327-1442 . Contact information is typically provided within the insurance documentation. Please ensure to read through your policy details and information.

Disclaimer: It is important to note that Destination articles are for editorial purposes only and are not intended to replace the advice of a qualified professional. Specifics of travel coverage for your destination will depend on the plan selected, the date of purchase, and the state of residency. Customers are advised to carefully review the terms and conditions of their policy. Contact AXA Travel Insurance if you have any questions. AXA Assistance USA, Inc.© 2023 All Rights Reserved.

AXA already looks after millions of people around the world

With our travel insurance we can take great care of you too

Get AXA Travel Insurance and travel worry free!

Travel Assistance Wherever, Whenever

Speak with one of our licensed representatives or our 24/7 multilingual insurance advisors to find the coverage you need for your next trip.

Travel Insurance for Peru – Best Options

Written and researched by Michael Kays (Travel Insurance Expert) | Fact Checked by Danya Kristen (Insurance Agent).

Peru is a magical place that offers some of the world’s most stunning landscapes, from the ancient Incan city of Machu Picchu to the vibrant city life of Lima.

However, with adventure comes risk, making travel insurance an essential part of your travel plans .

It provides the safety net you need to explore Peru with peace of mind, covering everything from medical emergencies to lost luggage.

Here, we’ll explore some of the best travel insurance options for your trip to Peru.

In this article...

1. World Nomads

World Nomads has long been a favorite among globe-trotters and for a good reason. They offer comprehensive coverage tailored for adventurous travelers.

Their plans cover a wide range of activities, including hiking up to 6000 meters, perfect for those planning to trek the Inca Trail.

Besides, World Nomads provides excellent coverage for emergency medical expenses, trip cancellation , and baggage protection.

Another perk is the flexibility of their policies – you can buy and renew your policy online, even if you’re already on the go.

Recommended Plans

✅ Atlas America

Up to $2,000,000 of Overall Maximum Coverage, Emergency Medical Evacuation, Medical coverage for eligible expenses related to COVID-19, Trip Interruption & Travel Delay.

✅ Safe Travels Comprehensive

Coverage for in-patient and out-patient medical accidents up to $1 Million, Coverage of acute episodes of pre-existing conditions, Coverage from 5 days to 364 days (about 12 months).

✅ Patriot America Platinum

Up to $8,000,000 limits, Emergency Medical Evacuation, Coinsurance for treatment received in the U.S. (100% within PPO Network), Acute Onset of Pre-Existing Conditions covered.

2. IMG Travel Insurance

IMG’s travel insurance plans are versatile and robust, with packages designed for all sorts of travelers, including backpackers, families, and business travelers.

The “Patriot Travel Plan”, for instance, offers a maximum limit of $2,000,000 for medical expenses, with coverage for adventure sports and activities.

IMG also provides trip cancellation insurance through its “iTravelInsured” packages.

They offer different levels of coverage to suit various needs and budgets, and include benefits for trip interruption, travel delay, and lost baggage.

3. Allianz Global Assistance

Allianz Global Assistance provides several travel insurance plans suitable for trips to Peru.

Their OneTrip Prime Plan is a well-rounded package that offers substantial medical protection, trip cancellation, interruption benefits, and baggage loss or delay coverage.

Allianz’s multi-trip plan can be a good fit if you’re a frequent traveler, providing coverage for unlimited trips within a year for a single payment.

Plus, their 24/7 travel assistance service can be invaluable in case of emergency situations.

4. Travelex Insurance Services

Travelex is another reliable choice for travel insurance, offering two main packages – Travel Basic for budget-conscious travelers and Travel Select for a more comprehensive cover.

Both plans include trip cancellation, interruption, delay, and medical expense benefits.

Travelex’s Travel Select plan also provides optional upgrades, like the Adventure Sports Coverage, which would be beneficial if you’re planning to engage in high-risk activities like white water rafting or zip-lining in Peru.

5. AIG Travel Guard

AIG’s Travel Guard plans are also worth considering, especially their Preferred Plan. It offers a balance of value and coverage, including trip cancellation, interruption, travel delay, medical expenses, and baggage coverage.

They also provide a 24/7 emergency travel assistance service, helping you handle unexpected situations during your trip.

Why is travel insurance important for Peru?

Let’s explore some reasons why securing travel insurance is particularly important for a trip to Peru.

High-Altitude Activities

Peru is home to some of the highest peaks in the world, including Huascarán, which stands at an astounding 22,205 feet.

With such elevation, it’s no surprise that many travelers flock to Peru for high-altitude treks, mountain biking, and other outdoor activities.

However, these adventures also come with risks. High-altitude sickness can affect even the most experienced climbers, and accidents can happen.

Comprehensive travel insurance ensures that you’re covered for medical emergencies, including evacuation and treatment for altitude sickness.

Unpredictable Weather

Peru’s diverse geography means it experiences a variety of weather conditions, ranging from hot desert climates to cold mountainous regions.

Such diversity can lead to unpredictable weather, causing disruptions to your travel plans.

Travel insurance that includes coverage for trip delays, interruptions, or cancellations can help protect your investment if severe weather affects your plans.

Health Risks

While Peru has made significant strides in healthcare, medical facilities outside of major cities can be limited.

In case of a medical emergency, having travel insurance with comprehensive medical coverage can ensure you get the necessary treatment, even if it means being transported to a hospital in a larger city or back home.

Safety Concerns

While Peru is generally safe for tourists , like anywhere else, crime can be an issue, especially in larger cities. Instances of pickpocketing and theft are not uncommon.

Travel insurance policies that include coverage for stolen or lost belongings can provide compensation and help mitigate such losses.

Remote Locations

Many of Peru’s most spectacular sights, like Machu Picchu and the Amazon Rainforest, are in remote locations. Reaching a hospital or healthcare facility from these areas can be challenging and expensive.

A comprehensive travel insurance policy can cover the cost of an emergency evacuation to get you the medical attention you need promptly.

So, securing travel insurance for your trip to Peru is more than just a precautionary measure. It’s a safety net that protects you from unexpected costs and provides peace of mind, letting you fully enjoy the beauty and adventure that Peru offers.

While these are some of the best travel insurance options for your trip to Peru, it’s essential to read the policy details to understand the coverage limits, exclusions , and terms.

Consider your travel plans, health conditions, and the activities you’ll be undertaking, and choose a plan that best suits your needs.

Remember, while travel insurance adds to the trip cost, it can save you from substantial financial loss in case of unforeseen situations.

As you set out to explore the awe-inspiring beauty of Peru, let the peace of mind that travel insurance provides be your trusted travel companion.

Frequently Asked Questions about travel insurance for Peru

Q: Do I need travel insurance for Peru?

A: While travel insurance may not be mandatory for entry into Peru, it is highly recommended. Unpredictable situations like medical emergencies, travel disruptions, or theft can happen, and having insurance ensures that you’re covered for these unforeseen incidents.

Q: What should my travel insurance policy for Peru include?

A: A comprehensive travel insurance policy for Peru should ideally include medical coverage (including evacuation), trip cancellation/interruption, lost/stolen baggage coverage, and potentially high-altitude activity coverage if you plan to participate in mountainous treks.

Q: Does travel insurance cover high-altitude sickness?

A: Some travel insurance policies cover treatment for altitude sickness. However, this is not universal, and you should confirm with your provider, especially if you plan to hike in high-altitude areas like Machu Picchu.

Q: Will travel insurance cover trip cancellation due to bad weather?

A: Most travel insurance policies offer coverage for trip cancellations due to severe weather conditions. However, this can vary between providers, so it’s always best to read the fine print of your policy.

Q: What if I lose my belongings or they are stolen during my trip to Peru?

A: Most travel insurance policies offer coverage for lost or stolen belongings. However, there are usually limits on the payout, and high-value items may need additional coverage.

Q: Can I buy travel insurance after I’ve already started my trip?

A: Some travel insurance providers offer coverage even if you’ve already started your trip. However, the options may be more limited, and the coverage will only start after the policy has been purchased.

Remember, it’s always a good idea to thoroughly review your travel insurance policy and understand what’s covered before you begin your journey.

Get Free Consultation

Safe Travels USA Cost Saver

January 24, 2020

Safe Travels USA Comprehensive

January 23, 2020

Patriot Platinum

Visitors Care

Patriot International

Patriot America

January 22, 2020

Patriot America Plus

January 21, 2020

Atlas America

January 16, 2020

Nationwide Prime Travel Insurance Review

September 21, 2023

Nationwide Luxury Cruise Travel Insurance Review

Nationwide choice cruise travel insurance review, nationwide universal cruise travel insurance plan review, nationwide essential travel insurance plan review, all clear travel insurance – all you need to know.

August 4, 2023

CoverMore Travel Insurance: Everything You Need to Know

Staysure travel insurance: everything you need to know, post office travel insurance – everything you need to know, argentina expatriate health insurance – ultimate guide.

August 2, 2023

Visitcover.com is a travel insurance review portal that will help you choose the right travel insurance plan for your next trip. By bringing you unbiased, fact-checked, verified information about travel insurance companies, plans, claim processes, and everything that's usually mentioned in the fine print. Make informed decisions, with us!

Opening hours

09.00 - 22.00

09.00 - 18.00

09.00 - 16.00

4422 Flamingo Villas, Ajman Media City, United Arab Emirates

Call Us: +1-972-985-4400

© 2023 VisitCover.com

Descargate tu Planificador de Viajes

Touristear Travel Blog

Síguenos en Instagram!

Travel Insurance for Peru: Coverage and Why Do You Need It

Traveling to Peru is an exciting and enriching experience. With its breathtaking scenery, rich history and culture, and world-renowned cuisine, it is no wonder that this South American country is an increasingly popular tourist destination.

However, as with any trip, there is always the possibility that something unexpected may occur and affect our itinerary or our health. That is why purchasing travel insurance before traveling to Peru is important.

In this post, we will tell you everything you need to know about travel insurance in Peru, from what it covers to how to choose the best one for your travel needs.

So if you are planning a trip to Peru, read on to make sure you are prepared for any eventuality.

- Book your insurance here AND GET A 5 % DISCOUNT .

- Peru Travel Guide

Why do You Need Travel Insurance to Travel to Peru?

If you are planning a trip to Peru, you must consider the importance of taking out travel insurance.

Although it is not mandatory to enter the country, having travel insurance will give you the peace of mind and protection you need to enjoy your trip without worries.

Common Risks During a Trip to Peru

High altitude : Much of Peru is at high altitudes, which can cause altitude sickness and other health problems.

Altitude sickness can make you feel tired, dizzy, and have a headache or shortness of breath. Travel insurance can help you get the medical care you need to treat these symptoms.

Robbery and theft : Although Peru is a safe country, you can be a victim of pickpockets and theft. This may include the theft of wallets, cell phones, cameras, and other valuables. Travel insurance provides financial protection in case of loss of your belongings.

Insect-borne diseases and illnesses : In Peru, you may be exposed to insect-borne diseases such as dengue fever, malaria, and yellow fever. However, the most common is to suffer from traveler’s diarrhea.

The latter usually happens by drinking tap water, eating poorly washed fruits, drinking natural fruit juices that you are not used to, etc. Travel insurance can help you get the medical care you need in case you get sick.

Benefits of having travel insurance in Peru

Medical coverage.

One of the main reasons to purchase travel insurance for Peru is medical coverage. In case you suffer an illness or injury during your trip, having travel insurance guarantees you the necessary medical assistance without having to worry about the high costs this may imply.

Check that your travel insurance includes medical care, hospitalization and medical repatriation in case of emergency.

Here is an example of travel insurance coverage Mondo for Peru. For a two-week trip, the price ranges from 42€ with medical coverage of 100,000€ to 96€ for coverage of 6,000,000€.

Undoubtedly, the amount is much lower than you might imagine for the coverages it has.

Cancellations and refunds

Another aspect to consider when searching out travel insurance for Peru is cancellations and refunds in case of unforeseen events.

If, for any reason, you have to cancel your trip or modify your plans, having travel insurance allows you to recover part or all of the expenses you have incurred.

In addition, in case of loss of luggage or important documents such as passports, travel insurance can cover the necessary expenses for their recovery or replacement, thus avoiding major inconveniences during your trip.

In summary, taking out travel insurance for Peru is a wise and necessary decision to guarantee protection and peace of mind during your trip.

Make sure you choose insurance that suits your needs and provides you with the necessary coverage to enjoy your trip without worries.

We have been using Mondo travel insurance for years and have also used Chapka travel insurance . I will tell you what their coverages are below.

What Does Travel Insurance for Peru Cover?

Below, we explain what is covered by travel insurance for Peru.

Medical emergencies

Travel insurance for Peru covers you in case of medical emergencies. This includes medical expenses, hospitalization, medication, and medical repatriation if necessary.

Please note that some travel insurances also cover pre-existing conditions and treatments for chronic illnesses.

It is important that before contracting a travel insurance policy, you check the conditions and coverage offered by each plan.

For example, the Mondo travel insurance in its most basic plan covers $250.000, repatriation and early return included, luggage coverage of $1700, and electronic equipment is optional.

Theft or loss of baggage

Another coverage included in travel insurance for Peru is protection against theft or loss of luggage. In case your luggage is stolen or lost at the airport, the insurance provides you with financial compensation so that you can replace your belongings.

It is important that before contracting a travel insurance policy, you check the conditions and coverage offered by each plan. Check if the insurance covers valuables such as cameras, cell phones or jewelry, as in some cases they may be an exclusion.

In the case of Mondo insurance, they differentiate common luggage from electronic equipment, which is fine, especially if you’re like us who carry more in photographic equipment than anything else.

Flight Cancellations

Travel insurance for Peru also covers you in case your flight is canceled or delayed. In these cases, the insurance provides you with financial compensation to cover any additional expenses that may arise, such as accommodation or transportation.

Check if the insurance covers flight cancellations due to causes beyond your control, such as extreme weather conditions or strikes, as they may be an exclusion in some cases.

- Read: What to visit in Lima in one day

How to Choose the Best Travel Insurance for Peru?

If you are planning a trip to Peru, you must choose the best travel insurance to protect you in case of any emergency. Here are some factors to consider when choosing the best travel insurance for Peru.

Type of Trip

The type of trip you plan to take is an important factor to consider when choosing travel insurance for Peru. If you plan to do adventure activities such as hiking or extreme sports, you should make sure that the insurance you choose covers these types of activities.

In addition, if you plan to travel with your family, you should look for insurance that offers coverage for all family members.

In the case of Mondo travel insurance, you have primary and complete coverage for adventure sports, depending on your insurance type.

Coverage is one of the most important factors to consider when choosing travel insurance for Peru. You should ensure that the insurance you choose provides adequate coverage for medical expenses, emergency medical evacuation, and repatriation in the event of death.

You should also look for insurance that covers flight delays, lost luggage and trip cancellations.

According to HeyMondo, some of the best travel insurance options for Peru are those that offer medical expense coverage of at least €100,000 and emergency medical evacuation coverage of at least €250,000.

Price is another important factor to consider when choosing travel insurance for Peru. You should look for insurance that offers good value for money and fits your budget. However, you should not compromise the quality of coverage for a lower price.

Some of the companies such as Mondo Insurance, have excellent coverage and some of the best prices in the market .

If you plan a trip to Peru, you must consider the importance of buying travel insurance. Although it is not mandatory, having adequate coverage will give you peace of mind and protection in case of any medical emergency or unforeseen event during your trip.

When choosing travel insurance, you must consider your needs and the type of trip you are planning. Be sure to read the policy details carefully and understand the exclusions and limitations of coverage.

In addition, it is essential that you choose a reliable insurance company with experience in covering international travel. We rely on travel insurance Mondo, and Chapka are some of the leading travel insurers offering coverage for Peru.

Remember that although Peru is a safe country, it is always better to be prepared for any eventuality. Taking out travel insurance is an investment that can save you a lot of money and worry in case of an emergency.

Plan Your Trip to Peru

- Printable PDF trip planner

- Itinerary to travel through Peru in 12 days

- What to see on your first trip to Lima

- How to get from Lima to Machu Picchu

- What to see in Cuzco

- Guide to visit Machu Picchu

- Visit the Huacachina Oasis

- Flying over the Nazca Lines

- Loreto, visit the Amazon

- Recommendations to prevent altitude sickness

Last Updated on 6 September, 2023 by Veronica

Disclosure: Some of the links on this post are affiliate links, meaning at no additional cost to you, I may earn a small commission if you click through and make a purchase.

Author: Veronica

Vero, a seasoned traveler, has explored 25 countries and lived in five, gaining a rich perspective and fostering an infectious passion for travel. With a heart full of wanderlust, Vero uncovers the world’s hidden gems and shares insights, tips, and planning advice to inspire and assist fellow adventurers. Join Vero and let the shared passion for travel create unforgettable memories.

Soy Verónica, una apasionada de los viajes, me gusta compartir mis experiencias viajeras en mi blog. He estudiado Empresas y actividades turísticas y ando metida en el mundo del Marketing Digital. Me gusta aprender algo nuevo cada día, conocer nuevos lugares y culturas diferentes.

Similar Posts

Best Travel Insurance Coverage COVID-19 + DISCOUNT

How to Get from Lima to Machu Picchu

A Luxury Journey by Train from Cuzco to Puno

How Much Does a Trip to Machu Picchu Cost?

The Best Travel Insurance for Route 66 + 7% OFF

The Best Travel Insurance for New York City

Leave a reply cancel reply.

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

This site uses Akismet to reduce spam. Learn how your comment data is processed .

- +51 984 004 472

- Machu Picchu, Cusco, Perú

- Mon-Sat: 10 AM – 5 PM

Travel Insurance for Trekking in Peru

Peru travel insurance.

You've already chosen a tour in Peru, and everything is ready for your trip. However, now you may be wondering:

Do I need travel insurance for Peru? Which travel insurance is suitable for Peru?

These are good questions. While travel insurance is not mandatory for all Peru tours, it is typically necessary for high-risk activities and tours such as rafting, ziplining, biking, and others. For these activities, it is mandatory for each traveler to be adequately insured against accidents and medical expenses. Travel insurance is also highly recommended for participation in any of our trips.

Although insurance is not obligatory , we strongly recommend getting travel insurance. This is especially important in case you lose your flight ticket or experience a personal emergency, which may disrupt your trip . Having travel insurance provides peace of mind and ensures you're covered in unexpected situations.

Travel insurance for Peru

Would you like to see for yourself if it is safe to travel to Peru? We're sure you'll fall in love with this South American country, but remember that one of the keys to a successful trip is to travel with good travel insurance. Get the best travel insurance for Peru, World Nomads travel insurance , specially designed for such a trip. Then you will have the following covers:

- Unlimited medical assistance, 24 hours a day, with no deductible and no obligation to pay in advance. Also includes protection against coronavirus.

- Help in your own language and without problems

- Transfer to the hospital

- Insurance protection in case of accidents. Also includes rescue/evacuation.

- Theft and violent damage to baggage.

We would like to offer you the best travel Insurance for Peru. Tierras Vivas is working with World Nomads for all trips to Peru . If you want to book your travel insurance, below you can fill up all information.

This T ravel Health Insurance for Peru Covers Expenses Such As:

- Emergency treatment, following hospitalization, surgery, and outpatient treatment in Peru.

- Appointment at registered doctors in Peru.

- Medicament prescription.

- Air ambulance and other transport.

- In urgent cases, it covers overseas dental care, such as an unexpected dental infection, a broken tooth, accidental injury to the mouth or jaw.

- If necessary, it involves travel rearrangement of your initial travel plans or repatriation.

- Moreover, if you travel during pregnancy and suddenly become ill, injured, or have unexpected complications during pregnancy, the travel insurance guarantees urgent medical treatment, hospitalization, ambulance, repatriation to continue treatment at the home country (if necessary), and a 24/7 multilingual team assistance while in Peru.

- It insures against unexpected cancelation of travel in case of an accident during the trip. In this case, a doctor needs to certify that you are not fit to travel, or you, your travel buddy, or a close relative is hospitalized or dies.

- The insurance covers delayed, stolen, or damaged baggage too.

- In addition, it might cover stolen credit cards, passports, iPhones, Smartphones, iPads, eBooks, tablets, cameras, lenses, laptops, etc.

We strongly recommend travel insurance for trekking in Peru to offer you a calm trip and avoid inconveniences throughout the tour. The insurance is suitable for Peru's Inca Trail , Salkantay Trek , a Machu Picchu hike , or other hikes in Peru. Buying insurance does not mean that there is a risk when traveling to Peru, in fact, the rate of tourist accidents is very low. We would simply like to provide you with an unforgettable experience with peace of mind. Do not hesitate to ask us for more details, we will be happy to advise you!

Can I book the travel insurance by myself?

Sure, you can book your travel insurance by yourself.

It emphasizes that you should take out travel health and repatriation insurance “for the duration of your stay abroad”. It is therefore essential to travel to Peru with the best travel insurance.

Don't forget and take out an international policy now with Covid-19 and other coverages 100% tailored to your destination to Peru.

Some tips for safe travel in Peru

As you can see, millions of travelers are encouraged to travel to Peru. It is one of the most attractive countries in South America and also one of the safest. But like any other adventure, it's important that you take some precautions. Here are the tips for a safe trip to Peru that we wish we had on our first visit:

- Protect yourself with the best travel insurance for this destination, IATI Backpacker. This gives you unlimited medical coverage, including costs related to the coronavirus.

- Be discreet Don't keep flashing expensive electronics or cameras. Wear normal clothes that don't look like you have a lot of money with you. And if you withdraw money from the ATM, do so discreetly too.

- Don't carry a lot of cash and try to spread it out over several locations. Leave your documents at the hotel and only take one photocopy with you.

- Ask local people for tips if you want to go out. For example, the hotel reception will be able to tell you which areas are dangerous.

- If you are the victim of a robbery, do not resist.

- If you have problems on your trip to Peru , report them to the relevant authorities and keep the documents for later complaints. In addition, it is advisable to report this to the German consulate or embassy. You can find the telephone numbers on the Ministry's website.

- It is likely that you will use a lot of buses in Peru. Bus travel in Peru is safe. There are very good companies with unique security measures (check out the Cruz del Sur company for example), but we still recommend that you don't pack any valuables in your luggage, which you put in the hold. It is best to take everything with you and keep it safe.

- Be careful when paying with a credit card and make sure that you are always present when paying and that nobody takes your card away with you. There are sometimes cases of credit card cloning.

- Even in the tourist areas, you should avoid lonely corners and try to go out in groups.

- Visiting the Peruvian Amazon? In this case, you should make sure your boat is safe; especially if you are traveling in the rainy season as the rivers are often flooded.

- Please don't even think about doing drugs in Peru. The penalties are even imprisonment. The Foreign Office advises that consuming the famous ayahuasca is very dangerous as it poses serious health risks and cases of mugging, sexual aggression and robbery have occurred due to the condition it leaves.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum. Lorem ipsum dolor sit amet, consectetur adipisicing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat cupidatat non proident.

All Categories

- Inka Trail: Exploring the Ancient Path of the Andes

- Salkantay Mountain

- Machu Picchu

- Amazon Rainforest

- Ollantaytambo

- Nazca Lines

- Lima Peru: Capital city of Peru

- Colca Canyon

- Lake Titicaca

- Sacred Valley of the Incas

- Choquequirao

- Inca Quary Trail Peru

Condor Bird in Peru: The largest bird in the world

Traditional Peruvian Clothing

Aguas Calientes: Everything you need to know before to visiting Machu Picchu village

Inca Sun God

Love where your're going, explore your life, travel where you want.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua.

Our Partners

Our awesome partners.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore.

Top Destinations

Explore top destinations.

Tierras Vivas Travel offers the best all-inclusive Inca Trail to Machu Picchu tours in Peru.

Trekking & Hiking

Culture / History

Adventure Holidays

Mixed-Adventure Tours

Family Travel

Don't have an account? Register

Already have an account? Login

IMAGES