- Skip navigation

- Find a branch

- Help and support

Popular searches

- Track a parcel

- Travel money

- Travel insurance

- Drop and Go

Log into your account

- Credit cards

- International money transfer

- Junior ISAs

Travel and Insurance

- Car and van insurance

- Gadget insurance

- Home insurance

- Pet insurance

- Travel Money Card

- Parcels Online

For further information about the Horizon IT Scandal, please visit our corporate website

- Travel Money

- Currency Buy Back

Currency buyback

What is currency buyback.

If you’ve come back from your holiday with some spare cash, take it to a Post Office branch that deals in foreign currency and we’ll buy it back from you.

If your holiday’s been cancelled and you bought your currency from us, you can get a 100% refund within 28 days of purchase with our refund guarantee .

Calculate how much you’ll get back

- UAE Dirham AED

- Australian Dollar AUD

- Barbados Dollar BBD

- Bangladesh Taka BDT

- Bulgarian Lev BGN

- Bahrain Dinar BHD

- Bermuda Dollar BMD

- Brunei Dollar BND

- Canadian Dollar CAD

- Swiss Franc CHF

- Chilean Peso CLP

- Chinese Yuan CNY

- Colombian Peso COP

- Costa Rican Colon CRC

- Czech Koruna CZK

- Danish Kroner DKK

- Dominican Peso DOP

- Fiji Dollar FJD

- Guatemalan Quetzal GTQ

- Hong Kong Dollar HKD

- Hungarian Forint HUF

- Indonesian Rupiah IDR

- Israeli Sheqel ILS

- Icelandic Krona ISK

- Jamaican Dollar JMD

- Jordanian Dinar JOD

- Japanese Yen JPY

- Kenyan Shilling KES

- Korean Won KRW

- Kuwaiti Dinar KWD

- Cayman Island Dollar KYD

- Mauritius Rupee MUR

- Mexican Peso MXN

- Malaysian Ringgit MYR

- Norwegian Krone NOK

- New Zealand Dollar NZD

- Omani Rial OMR

- Peru Nuevo Sol PEN

- Philippino Peso PHP

- Polish Zloty PLN

- Romanian New Leu RON

- Saudi Riyal SAR

- Swedish Kronor SEK

- Singapore Dollar SGD

- Thai Baht THB

- Turkish Lira TRY

- Taiwan Dollar TWD

- US Dollar USD

- Uruguay Peso UYU

- Vietnamese Dong VND

- East Caribbean Dollar XCD

- French Polynesian Franc XPF

- South African Rand ZAR

- Brazilian Real BRL

- Qatar Riyal QAR

You will receive:

Today’s online rate:

Rates may vary by branch. This rate is for guidance only. T&Cs apply .

How does currency buyback work?

Pop in to see us.

Find a branch that sells travel money and pop in with your leftover foreign cash.

Sell us your cash

More than 2,500 branches can buy your travel money back without seeing a purchase receipt (but smaller ones will need to).

You’re done!

Pay cash straight into your UK Bank account at the counter. You can save yourself a couple of trips in future with a Travel Money Card , allowing you to swap between currencies.

Thinking of going away again?

If you need travel money, you’ve got loads of options with Post Office.

Order online for great rates and 0% commission

Collect US dollars and euros within 2 hours

Get next-day collection on other currencies

Or choose to have your currency delivered to your home the next day

For added ease and security, get a Travel Money Card

Our Travel Money Card holds 22 currencies and can be used anywhere you see the Mastercard® sign, including with contactless

Order travel money

Ready to get your holiday cash sorted?

Need some help?

Travel money help and support.

Read our travel money FAQs or contact our team about buying currency online or in branch:

Visit our travel money support page

Post Office Travel Money Card is an electronic money product issued by First Rate Exchange Services Ltd pursuant to license by Mastercard International. First Rate Exchange Services Ltd, a company registered in England and Wales with number 4287490 whose registered office is Great West House, Great West Road, Brentford, TW8 9DF, (Financial Services Register No. 900412). Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated.

- Make a day of it

- Getting here

- Opening Hours

- Family friendly

- Facilities & Accessibility

- Personal Shopping

- Our Restaurants

- Offers and Loyalty

- Our 15th Anniversary!

- Experiences

- Student Offers

- Commercial Opportunities

Currency Buy Back at Barrhead Travel

Bought all your souvenirs and have foreign currency left? Don't worry, Barrhead Travel give you a preferential exchange rate to change it back!

It's even easier now with their new partnership with No1 Currency. Simply secure the best rate online ( Barrheadtravel.com ) and sell your currency in store.

They'll even give you a 2 day exchange rate guarantee* on all currencies to exchange your leftover currency into pounds.

Why not visit us in-store to find out more!

*T&Cs apply.

Store Details

For 43 years, Barrhead Travel has been helping people to plan their perfect trips. We’re the experts – the UK’s leading independent British travel agents, with an array of awards to our name. We’re dedicated to providing you with the best prices, impartial advice and the widest variety of holidays, combined with top-notch customer service.

Barrhead Travel has exclusive holiday products that you won’t find anywhere else, so let us help you to plan your next journey, no matter where in the world you want to go. Where can Barrhead Travel take you to next?

Contact Details

02890 233366

Visit Website

More Store Details

Related Offers

Foreign Exchange at Barrhead Travel

25% off Q-Park parking at COSMO

Let's keep in touch.

Don’t miss out on great events, news and in-store only deals

- Travel Money >

- Currency buy back

Compare currency buy-back

Change your foreign currency back to pounds, covent garden fx travel money.

NM Money Travel Money

eurochange Travel Money

The Currency Club Travel Money

Travel FX Travel Money

How to compare currency buyback exchange rates

Enter your currency and amount.

Tell us how much travel money you have to sell and which currency you need to exchange .

Compare your options

Use our comparison tables to compare different firms and check their fees and charges to find the best currency buy back deal.

Choose delivery mode

If you send the money by post, you may have to pay for recorded delivery, so take the extra cost into account when making your choice.

How to get the best rates when selling foreign currency

If you have euros, dollars or other currencies left over from a trip abroad, you can sell them to a currency buy-back service that will convert them into pounds.

When you sell foreign currency, you get a buy-back rate from your chosen provider, which tells you how many pounds you can get for your unwanted travel money.

For example, if the best euro buy-back rate available is 0.85, you will get 85p for every euro you sell.

But to find the right deal, you need to look beyond the best currency buy back rates.

Delivery costs, fees, and commissions also affect how much you receive, so work out what you'll get back in pounds after any expenses when you sell travel money.

Source: Money.co.uk currency buyback data for 2022

Currency buy-back FAQs

Where can you find the best travel money buy-back rate.

You can look for the best currency buy-back rates on the high street, but you could miss out if you ignore what’s available online. Use this comparison to check currency buy back rates including the best euro buy back rate from our selection of online providers.

Rates may differ due to the fluctuating nature of currency exchange, so for the latest rate, please check with the provider.

What does it cost to sell currency online?

The costs you incur when you sell travel money can vary widely. So, you need to factor in:

The exchange rate: choosing the highest foreign currency buy back rate available should help to ensure you get the best possible deal

Any delivery costs: you will usually have to pay to send your cash to the buy-back provider

Some providers do not guarantee currency buy-back rates before you send your money to them, which could affect the amount you get back.

You can use any of the providers in this comparison to sell euros or other foreign currencies and exchange them back into pounds.

Here is more information on dealing with leftover currency

Can I sell any foreign currency?

No. You can sell euros, dollars, and other common currencies, but buy back services are not available for all currencies. Check with providers to make sure you can exchange your money, then compare rates and charges to find the best deal.

Can I swap my foreign currency into another?

Yes, if the travel money provider you choose allows it, you can exchange one currency for another; you could, for example, switch euros to US dollars.

Am I guaranteed to get the rate I see online?

Not always. Check the terms and conditions when comparing rates online – some currency buy back providers only agree a rate once they receive your money, which could make a big difference to how much you receive.

Can I send coins to be exchanged?

No, only notes are accepted, and some providers only take specific denominations, so it’s also worth checking this when choosing where to exchange any unused currency.

Can I exchange multiple currencies at once?

Yes. Provided the currency exchange you've chosen accepts all of them, you can swap more than one currency at a time.

How long do I have until my foreign currency goes out of date?

This depends on the currency.

US dollars never go out of date, while other countries periodically 'expire' older bank notes.

In many cases, they will still be accepted anyway. For example, new euro notes were introduced between 2013 and 2019, but the old versions have retained their value and can be exchanged.

Turkish lira from before 2005, however, is no longer accepted by businesses including foreign currency buy back services.

About our comparisons

Who do we include in this comparison.

We include every company that gives you the option of buying euros online. Discover how our website works .

How do we make money from our comparison?

We have commercial agreements with some of the companies in this comparison. We get paid a commission if we help you take out one of their products or services. Find out more here .

You do not pay any extra and the deal you get is not affected.

Learn more about travel money

Didn't find what you were looking for?

Below you can find a list of currencies to exchange

Other products that you might need for your trip

About the author

We’ve been featured in

Customer Reviews

Not waiting too long

I wanted a lot of extras like curtesy …

Easy site to navigate and quick and…

Barrhead Travel Blogs

5 tips to make the most of your travel money

Exchanging your money is one of those holiday admin tasks that has to be done. While it might seem like a straightforward task, there are a few things to consider to ensure that your holiday budget will go far. Here are our top 5 tips on making the most of your travel money.

1. Exchange your money in advance

Unless you’re visiting a country with a closed currency (meaning, you physically can’t get the notes and coins outside the country) then it’s always cheaper to get your money in advance. And this includes exchanging your money before the airport, where profit margins and commission are typically much higher.

2. Use a credit card rather than debit card abroad

Generally, it’s still cheaper to withdraw from an ATM via a credit card rather than debit card. However, you should shop around for a good one. We also recommend logging into your internet banking while abroad and paying off the balance as soon as you can.

3. Book your car hire in advance too

This is something that you will likely pay a premium price for when you are abroad, so book it in advance. We work with several car hire companies and can work it into your itinerary.

4. Remember your travel insurance

Travel insurance is one of those things that feels like an extra at the time, but if you’ve ever needed it – you know it’s worth organising. Don’t skip it.

5. Exchange your money back once you’re home

A lot of people like to hold onto their holiday money as a souvenir, which is great if you arrived home with only a few coins to spare. But if you’ve returned with several notes than we can buy your currency back. Sometimes if the exchange rate is good you can actually receive a surplus!

P.S. Remember to read our other money-related blogs: tipping in 20 different countries and 7 ways to eat for less on holiday .

Foreign Currency at Barrhead Travel

???????????????????????????????? ???????? ???????????? ???????????????? ???????????????????????????? ???????????????????????????????? ???????????????????????? ???????????? ????????????????????????!

The suitcase is packed, the passports are looked out and it’s time to get your spending money.

Barrhead Travel is the perfect place to get your foreign currency, take advantage of these incredible offers;

- No commission

- 50+ currencies

- Competitive rates

Why not visit them in store to find out more!?

Leftover Currency? They’ve got you covered.

Bought all your souvenirs and have foreign currency left? Don’t worry, they’ll give you a preferential exchange rate to change it back!

It’s even easier now with their new partnership with No1 Currency. Simply secure their best rate online and sell your currency in store.

They’ll even give you a 2 day exchange rate guarantee* on all currencies to exchange your leftover currency into pounds.

Why not visit them in-store to find out more!

Share this post

Subscribe to stay up to date, privacy overview.

- Travel Money

- Book an Appointment

- Store Locator

- Find An Expert

Foreign Exchange

There's still time for Barrhead Travel Foreign Currency to organise your holiday spending money whilst you get ready for take-off!

- Accessibility Statement [Accesskey '0'] Go to Accessibility statement

- Skip to Content [Accesskey 'S'] Skip to main content

- Skip to site Navigation [Accesskey 'N'] Go to Navigation

- Go to Home page [Accesskey '1'] Go to Home page

- Go to Sitemap [Accesskey '2'] Go to Sitemap

- Private Banking

Everyday banking

Online services & more

How to get online

- Set up the Mobile Banking app

- Register for Internet Banking

- Login to Internet Banking

- Reset your login details

Mobile Banking app

- Setting up the app

- App notifications

Profile & settings

- Change your telephone number

- Change your address

- Open Banking

Card & PIN services

- View your card details

- Report your card lost or stolen

- Order a replacement card

- View your PIN

- Payments & transfers

- Daily payment limits

- Pay someone new

- Cancel a Direct Debit

- Cheque deposit

- Send money outside the UK

Statements & transactions

- See upcoming payments

- Search transactions

- Download statements

Help & security

We're here for you

Fraud & security

- Protecting yourself from fraud

- Latest scams

- Lost or stolen card

- Unrecognised transactions

Money management

- Managing someone's affairs

- Financial planning

Life events

- Buying a home

- Separation & divorce

- Bereavement

Difficult times

- Money worries

- Mental health support

- Financial abuse

- Serious illness

Customer support

- Support & wellbeing

- Banking online

- Accessibility & disability

- Banking with us

- Feedback & complaints

Bank accounts

Accounts & services

- Classic Account

- Silver Account

- Platinum Account

- Youth & student accounts

- Joint accounts

- Compare our bank accounts

Travel services

- Using your card abroad

- Travel money

Features & support

- Switch to us

- Everyday Offers

- Fees & charges

- Save the Change

- Bank account help & guidance

- Mobile device trade in service

Already bank with us?

- Mobile banking

Cards, loans & car finance

Credit cards

- Credit card eligibility checker

- Balance transfer credit cards

- Large purchase credit cards

- Everyday spending credit cards

- Loan calculator

- Debt consolidation loans

- Home improvement loans

- Holiday loans

- Wedding loans

Car finance

- Car finance calculator

- Car finance options

- Car refinance

- Car leasing

- Credit cards help & guidance

- Car finance help & guidance

- Borrowing options

Already borrowing with us?

- Existing credit card customers

- Existing loan customers

- Existing car finance customers

- Online services

Your Credit Score

Thinking about applying for credit? Check Your Credit Score for free, with no impact on your credit file.

Accounts & calculators

- First time buyer mortgages

- Moving home

- Remortgage through us

- Existing mortgage customers

- Buying to let

Mortgage calculators & tools

- Mortgage calculators

- Base rate change calculator

- Overpayment calculator

- Conveyancing service

- Mortgage help & guidance

- Buying a home in Scotland

- Frequently asked questions

Already with us?

Existing Halifax mortgage customers

Existing Bank of Scotland mortgage

- Manage your mortgage

- Switch to a new deal

- Borrow more

- Help with your payments

Mortgage support

Worried about paying your mortgage? We have various ways that we can help you.

Accounts & ISAs

Savings accounts

- Advantage Saver

- Access Saver

- Fixed rate bond

- Monthly Saver

- Children's Saver

- Compare savings accounts

- Help to Buy ISA

- Stocks & Shares ISA

- Junior Cash ISA

- Investment ISA

- Savings calculator

- Savings help & support

- Guide to ISAs

- Rates & charges

- Personal Savings Allowance (PSA)

Already saving with us?

Existing customers

- Transfer your ISA

Pensions & investments

- Compare investing options

- Share Dealing Account

- Invest Wise Accounts (18 - 25 year olds)

- Ready-Made Investments

ETF Quicklist

- Introducing our ETF Quicklist

- View our ETF Quicklist

Guides and support

- Understanding investing

- Research the market

- Investing help and guidance

- Regular Investments

- Trading Support

- ETF Academy

- Our Charges

Pensions and retirement

- Ready-Made Pension

- Combining your pensions

- Pension calculator

- Self-employed

- Pensions explained

- Top 10 pension tips

- Retirement options

- Existing Ready-Made Pension customers

- Share dealing SIPP

Wealth management

- Is advice right for you?

- Benefits of financial advice

- Services we offer

- Cost of advice

Already investing with us?

- Login to Share Dealing

Introducing the new Ready-Made Pension

A simple, smart and easy way to save for your retirement.

Home, life & car

View all insurance products

Home insurance

- Get a home insurance quote

- Compare home insurance

- Buildings & contents insurance

- Contents insurance

- Buildings insurance

- Retrieve a home insurance quote

- Manage your home insurance

Car insurance

- Compare car insurance

- Car insurance help & guidance

- Log in to My Account to manage your car insurance

Life insurance

- Critical illness cover

- Life cover help & guidance

- Help with your life insurance policy

Other insurance

- Business insurance

- Landlord insurance

- Make a home insurance claim

- Make a life insurance claim

- Make a critical illness claim

- Make a car insurance claim

Already insured with us?

Support for existing customers

- Help with existing home insurance

- Help with car insurance

- Help with your existing life insurance

Wherever you’re heading, be confident that you’re covered.

- Branch Finder

- Help centre

- Accessibility and disability

- Search Close Close

- In this section

- Help and support

- Using your cards abroad

Order Travel Money

Get next-day delivery on travel money before your next trip.

Log in to order travel money

You can do this online

- Order online by 3pm for free next working day delivery at home or collection from a branch .

- Get a wide range of currencies, including popular ones like U.S. dollars and euros.

- No hidden fees and preferential rates with a Platinum account .

You need a Bank of Scotland current or savings account, and Internet Banking access.

View delivery timescales and cut-off times

How to do it

We'll take it step by step.

Mobile Banking app guide expandable section

Internet banking guide expandable section.

- Log in and go to the Other services menu on the left. Select Travel money .

- Select the currency you'd like to buy. Then enter the amount you want.

- Review your quote. If you're happy, select delivery type.

- Choose your delivery option. We can send your order to your home address. Or you can collect it from a branch of your choice.

- Select your payment option on the payment details page.

- Confirm you’ve read the terms and conditions. Then select Confirm order .

- Once completed, you'll see a success message. Your order will then be ready for you, as explained here .

- Log in and select the more menu from your account. Then choose Order travel money .

- Review your quote. If you're happy, choose Select delivery .

- Select your delivery option. We can send your order to your home address. Or you can collect it from a branch of your choice.

- Choose your payment option on the payment details page.

- Once completed, you'll see a success message with your order reference number. Your order will then be ready for you, as explained here .

Getting started online

Scan to download

- Join our 1 million app users.

- Simple and secure log in.

- Stay up to date with notifications.

More about our app

Internet Banking

Log in to view or manage your accounts on our website.

Log in to Internet Banking

- More about our app

If you don't bank online expandable section

You can visit your nearest branch to buy travel money. If you need travel money fast, you can get euros and U.S. dollars instantly over the counter.

At the moment, you can't order travel money by phone.

A look at the details

How much you can order expandable section.

The minimum amount you can order is £200 and the maximum is £3,000. You can make multiple orders, up to the value of £7500 in a single day.

We'll provide your order in whatever denominations are available. For example, if you order $500 you may receive this in any combination of notes.

Where we deliver to expandable section

We can deliver your travel money to your home address. This must be in the British mainland or Northern Ireland.

We use Royal Mail First Class signed for delivery. The delivery needs a signature.

You can also have your order delivered to your local branch and collect it from there.

You can't collect travel money or sell it back at a counter-free branch.

Delivery timescales expandable section

For home delivery.

Place your order by 3pm on a working day for next-day delivery. Home delivery will take place before 1pm on the next working day. The delivery needs a signature.

If you place an order after this time, delivery will take place on the second working day. For example, if you order on a Saturday, delivery takes place on Tuesday.

To collect from a branch

Place your order by 3pm on a working day for next-day collection. You can collect your order from your chosen branch after 1pm on the next working day.

If you place an order after this time, you can collect it on the second working day. For example, if you order on a Saturday, the money will be available on Tuesday.

Cut-off times and working days

Next-day delivery cut-off times apply to working days. Working days are Monday to Friday. Saturday, Sunday, bank and public holidays are not working days. If Monday is a bank holiday, delivery will take place on the next working day.

If you live in Scotland, Northern Ireland, or a remote area, delivery may take longer.

Please note – once you’ve confirmed your order, we can’t change your delivery address or day.

Fees and commission expandable section

No, we don’t charge commission and there are no fees. Deliveries to your home address or a Bank of Scotland branch are completely free of charge.

What to do with unused travel money expandable section

You can take leftover travel money to one of our branches with a counter service . We’ll buy them back from you based on the exchange rate on that day. This rate may have changed since you bought your travel money. If the amount is too low, we won't be able to buy it back. We may not be able to buy back some currencies or Travellers' Cheques.

If you change your mind expandable section

You can’t cancel your order once you’ve confirmed it. You can exchange your money back to Pounds Sterling (GBP) at one of our branches with a counter service once you’ve received it.

Orders sent to a branch are kept there for 10 working days after the delivery date. After that date we'll cancel your order and return it to the processing centre.

We refund cancelled and returned orders at the buy-back exchange rate of the day we process them.

Important information about travel money

We send home delivery orders using Royal Mail Special Delivery . Royal Mail’s Special Delivery conditions apply. Copies of these are available from Royal Mail on request.

Different timescales may apply to Scotland and Northern Ireland. We may not be able to guarantee deliveries to certain remote areas within the United Kingdom. We can only deliver to the British mainland and Northern Ireland and it must be to the cardholder’s billing address.

Orders sent to a branch are kept there for 10 working days from the delivery date you chose. After that date we'll cancel your order and return it to the processing centre.

We refund cancelled and returned orders at the buy-back exchange rate of the day we process them. This means you'll usually receive back less than you originally paid. Refunds can take up to two weeks to reach your account. If you would like an immediate refund please visit a branch.

We may stop buying back certain foreign currency bank notes and travellers cheques at any time and without notice.

The Internet Banking service is generally available 24 hours a day, 365 days a year. There may be periods when it isn’t available because of routine maintenance .

Make sure you're set before you go abroad.

Other travel services

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

Traveling Internationally? Order Foreign Currency Before You Go

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Upon landing in a foreign country, expect a lot of lines. There’s immigration, passport control and customs inspection. But there’s one line you can — and absolutely should — skip: the airport currency exchange.

Not only does the airport currency exchange counter’s line cut into precious time abroad, but it’s typically a terrible money move. Airport currency exchange rates are among the worst you’ll find.

It’s not uncommon to see airport exchanges charging 14% more than the current International Monetary Fund (IMF) exchange rate. NerdWallet even found some premiums exceeding 17%. Some also charge additional fees on top of the poor exchange rate.

So what do you do if you need cash upon arrival to order a cab or tip the bellhop? Consider ordering foreign currency before you fly.

Most banks allow you to order foreign currencies, which you can typically pick up at a local branch before your trip. Some banks offer to ship currencies to you, and sometimes they don’t even charge extra for postage if you order a certain amount.

Plus, the exchange rate can be good. For instance, at Bank of America, the exchange rates we checked in January 2024 average roughly 6% more than the IMF rates — and less than half of what the airport currency exchanges are charging.

» Learn more: The best travel credit cards right now

How to order foreign currency from your bank

While the exact process varies by bank, most major banks make it easy to order online.

Typically you can access the currency exchange webpage through your bank’s website or mobile app, or by phone. From there, you usually enter the currency you need, add the desired amount, select the pickup method and place your order.

While you can generally expect a solid exchange rate, use a trusted source such as Reuters or the International Monetary Fund to find current exchange rates and ensure you get a fair deal.

Additionally, understand all the fees involved. For example, Citi charges a $5 service fee for transactions under $1,000, though it’s waived for clients with premium bank accounts .

Or you might get charged a shipping fee. Bank of America’s standard shipping costs $7.50, but overnight shipping is $20. Sometimes you can avoid shipping fees by opting to pick up the cash at a local branch or by being a loyal customer. Bank of America Preferred Rewards program members get free standard shipping.

There’s also generally a minimum amount of foreign currency you can order ($100 or $200 is common) and a maximum ($10,000 within a 30-day period is common).

Other good ways to pay abroad

If it’s too late to order foreign currency from your bank, here are other ways to curtail currency fees :

Find an in-network ATM abroad

Major banks usually have branches abroad or partner with other banks to create a network. Using those ATMs often provides a decent exchange rate while eliminating out-of-network ATM fees.

If you end up using a non-network ATM, pay attention to ATM fees , which vary but usually run about $5 per transaction. Given that, consider limiting ATM debit transactions by withdrawing the amount you think you’ll need for the entire trip, or at least a large portion of it.

ATM availability is more common in some places than others. Macau has the highest number of ATMs per capita with 316 ATMs per 100,000 adults, based on 2021 data from the World Bank Group. Uruguay, Canada and Austria are other destinations with the most ATMs per capita.

But other countries tend to have far fewer. For example, Kenya had fewer than 7 ATMs per 100,000 adults and Nepal had only 20 ATMs per 100,000 adults, according to the same data.

Pay with a credit card that doesn’t charge foreign transaction fees

Depending on the card, you might get dinged with foreign transaction fees of 1%-3% when you make purchases at non-U.S. retailers abroad.

That’s why it’s wise to carry a no-foreign-transaction-fee credit card abroad.

on Chase's website

Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠. .

Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel. .

Earn a one-time $200 cash bonus after you spend $500 on purchases within the first 3 months from account opening. .

» Learn more: The best no-foreign-transaction-fee cards

And more international merchants are taking plastic. This wider card acceptance and increased security are reasons travelers are ditching cash, according to the Visa Global Travel Intentions Study 2023, which polled more than 15,000 people in the Asian Pacific region between April and June 2023.

While this type of card won’t help you pay at cash-only businesses or get money for tips, it’s otherwise one of the smartest ways to pay internationally.

» Frequent travelers: Consider a multicurrency account

Try paying in cash dollars

If all else fails, offer to pay in U.S. dollars. In fact, some merchants or individuals accepting tips prefer it in certain countries. You might find vendors willing to give you an even better deal if you pay with U.S. dollars.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

On a similar note...

What to know before exchanging currency for an international trip

Editor's Note

Whether you're making your way to Morocco or escaping everything in Thailand , successful globe-trotting requires a smart approach to avoiding extra fees when you make purchases. While you can make sure you have a card that does not charge foreign transaction fees, know that your card can't cover everything. Whether you find yourself in a hole-in-the-wall restaurant with no credit card payment terminal or you're hoping to tip the service staff at your hotel , you're going to need some cash. Here are four currency exchange tips to help you get the best deal on those dollars, yen, rand or whatever you're putting in your wallet.

1. Avoid airport kiosks

While exchanging currency at the airport is convenient, it comes with an extra cost. Those kiosks you see in high-profile locations in airport terminals pay huge rents and to make money they either charge you a significantly lower rate than the market rate or charge a sizable "transaction fee" — or both.

Multicurrency ATMs at U.K. airports that can dispense pounds, euro and U.S. dollars are also likely to give you an awful rate in exchange for this convenience.

If you do want to exchange cash before you leave, shop around for locations in towns and cities that are less convenient, but where there is more competition. A low-rent corner shop that advertises money exchange may be able to do a great rate for you. If you see a hole-in-the-wall exchange place with a queue down the road, they may have great rates too.

In general though, note that it is likely you will receive a better rate at your destination for your dollars even at an expensive but convenient airport kiosk. Ideally, try and find somewhere in a town or city at your destination rather than at an airport as they are likely to provide even better rates.

2. Plan ahead

If you are exchanging large amounts of money either before you go or at your destination, you may need to order it in advance. That booth on the high street may not have thousands of dollars of a certain currency on hand each day waiting for a big exchange to come in.

The more obscure the currency, the less actual currency the exchange operator is likely to have on hand. They might have thousands of U.S. dollars or euro, but New Zealand dollars or Mexican pesos may be required to be ordered.

For large amounts, especially if they are less common currencies, place an order at least a few days in advance to ensure you can pick up as much as you need. You'll probably be able to lock in the exchange rate then and there.

Related: How to avoid hidden costs when traveling

3. Your bank may reward you

If you want to exchange currency before a trip abroad, consider the rates at your local bank (though of course shop around, as discussed above). If you are comparing this to a high street exchange kiosk that has a slightly lower rate but does charge a transaction or service fee, you may still come out on top.

Related: Should you use a credit card to withdraw cash while traveling?

4. Know your ATM options

No matter how well you plan ahead, it's easy to find yourself in a cash crunch. If you do, don't just wander to the ATM on the next corner. Be prepared and know whether your bank has a network of partner institutions where you can save on costly ATM fees.

If you have an account with an international bank like HSBC or Santander, your account may be eligible for free ATM withdrawals in foreign currency at your bank's branded ATM anywhere in the world.

Just be absolutely sure you are aware of the fees and limits of this option before blindly withdrawing cash as you may be stung with multiple fees if you aren't certain of what you can do for free.

Bottom line

Exchanging cash before traveling can be a bit of a minefield with bad rates and high fees commonplace. Ideally use a no foreign transaction fee card to pay for purchases abroad as much as possible, so you don't have to exchange the cash in the first place or handle a foreign currency throughout your trip.

Where you must have cash, do your homework, shop around and try and get a rate as close to the market rate as possible.

Additional reporting by Ben Smithson.

YOUR MONEY YOUR WAY

Travel money, hays travel foreign exchange, 4 great ways to buy your holiday money, click & collect.

Great rates & currency expertise come as standard with our Click & collect service & with no minimum spend, your holiday money is just a few clicks away.

This brings the total quotes to £000.00

£000.00 for currency

£000.00 for Buy Back Guarantee

Guarantee Peace of mind when buying your currency from Hays Travel

Save money on your unused currency with our Buyback Guarantee^

Return your unused currency for the same rate as you purchased it.

Available on all currencies sold in cash.

Available on multiple currency transactions

Available Instore & online

Terms & Conditions

Exchange Rates

Always great value and no minimum spend*

- Euro 1.1451

- US Dollar 1.2292

- Australian Dollar 1.8539

- Bulgarian Lev 2.1474

- Canadian Dollar 1.6564

- Czech Koruna 27.604

- Danish Krone 8.2959

- Hungarian Forint 430.9569

- Icelandic Krona 161.1415

- Indonesia Rupiah 18103.7713

- Mexican Peso 18.9803

- New Zealand Dollar 2.0123

- Norwegian Krone 12.9451

- Polish Zloty 4.6384

- South African Rand 22.5343

- Sweden Krona 12.8164

- Swiss Franc 1.1074

- Turkish Lira 37.0208

- Thai Baht 42.7213

- United Arab Emirates Dirham 4.2886

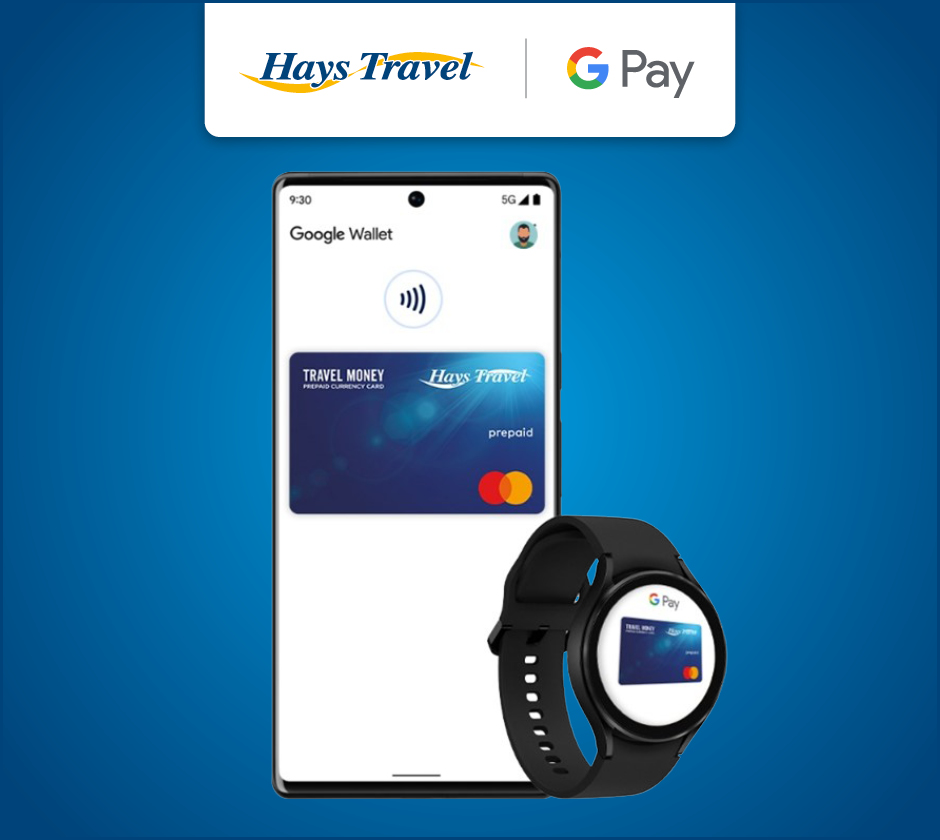

Travel Money Card

- Use anywhere Mastercard® prepaid is accepted worldwide.

- Carry less cash.

- Top up in 15 currencies including Euro, US Dollar, Australian Dollars and UAE Dirhams.

- Phone support available worldwide 24/7.

- Manage on the go via Hays Travel Currency Card App.

Connect to your google pay wallet

You can now link your Hays Travel Mastercard with Google Pay for swift and secure transactions wherever you go. Say goodbye to carrying physical cards and hello to effortless payments with just a tap of your phone. Simplify your travel experience today!

BUY YOUR HAYS TRAVEL MASTERCARD

The Hays Travel Money Card is the safe and easy way to take your money on holiday!

It is free to use in millions of locations worldwide where Mastercard Prepaid is accepted: including restaurants, bars, and shops when you spend in a currency loaded on the card.

This easy-to-use pre-paid card allows contactless transactions, chip and PIN, worldwide cash withdrawals wherever you see the Mastercard Acceptance Mark, and also 24/7 phone support.

Take your money card with you on every holiday, simply top up and go!

- BUY IN BRANCH

WHY CHOOSE HAYS TRAVEL?

For your next departure, buy your holiday money from Hays Travel. Always commission free currency with competitive online and high street exchange rates.

- Wide selection of currencies available

- Hundreds of nationwide Hays Travel branches offering on-demand Foreign Exchange; buy from branch to receive high quality customer service from the travel experts or order online for convenient home delivery

- 0% commission when we buy and sell foreign currency

Home Delivery

Ordering currency from the comfort of you own home has never been easier, with our great rates & over 60 currencies to choose from as well as next day delivery why not chose your currency to be delivered to your doorstep?

Holiday Money to your door

Order before 3pm for next working day home delivery via Royal Mail Special Delivery. *Customer must be home to sign for delivery. Over 60 currencies to select from. Free delivery on all orders £500 and over Convenient Saturday delivery available for no extra charge Minimum order value of £200 up to a maximum of £2500 Peace of mind, your local Hays Travel branch will buy back any leftover currency purchased through Hays Home Delivery commission free

Call Into a Branch

With over 400 branches to choose from arranging your holiday money has never been more convenient – Why not call into branch today where one of our experienced & Friendly Foreign Exchange Consultants will be on hand with our great rates, expert advice & fantastic service.

Bank on our branches for your Holiday Money

Over 400 branches Nationwide - Use our branch locator to find your nearest Hays Travel branch.

A wide selection of currencies & Hays Travel Money Cards available Instantly in-store

Competitive high street rates and always commission free

Exotic Currency Ordering service – Over 70 currencies available to order

Buyback Guarantee – Save money on your leftover Currency.

All major currencies Bought Back Commission Free

Experienced & Friendly Staff instore

- FIND YOUR NEAREST BRANCH

Barrhead Travel exchange rates: What you need to know

Jan 2, 2019

Barrhead Travel , Exchange Rates , Travel Money , UK

CurrencyFees » Fee Guides » Barrhead Travel exchange rates: What you need to know

Barrhead Travel offers a convenient way to buy a multitude of different currencies. However, foreign exchange rates represent a major pricing point and there is often little clarity around them. We researched Barrhead Travel’s travel money exchange rates to provide you a table showcasing their currency rate spread. Hopefully we can help you save money on your holidays.

Barrhead Travel exchange rates: Information and tips

Know the latest interbank exchange rate for your currency pairs.

The interbank rate (also called mid-market rate) is the midpoint between the buy price and sell price of two currencies on the currency markets. Barrhead Travel does not offer the interbank rate but instead adds a margin to it, which makes the foreign currency transaction more expensive for you. Before using Barrhead Travel for your travel money needs, make sure to know the current interbank exchange rate. That way, you’ll be able to calculate FX losses on the currency conversion. You can find the latest interbank rates using our currency converter.

How to calculate exchange rate loss

Here’s what you need to do in order to determine how much Barrhead Travel’s travel money exchange rate spread is going to cost you:

- Find the current interbank rate for your currencies using our currency converter

- Multiply your original amount by the current interbank rate

- Multiply your original amount by the exchange rate Barrhead Travel offers

- Subtract the first amount from the second amount

- This is the amount you’ll lose through currency conversion with Barrhead Travel

Order your currency online and in advance

Ordering your foreign currency before your trip allows you to compare with rates and fees of other providers. Ordering it online also is usually much cheaper than buying currency at the airport or on arrival to your holiday destination. Make sure to always compare exchange rates before finalising an order.

For the best exchange rates, we highly recommend TransferWise . Enjoy your first transfer for free on transfers up to £500.

Barrhead Travel exchange rate research

The exchange rate spreads below are for ordering foreign currency online. Rates on other services might differ. Those exchange rate margins are indicative at the time of research. Use the Barrhead Travel currency converter or visit the nearest branch to get the latest rates.

How we collect our data & advertiser disclosure

Barrhead Travel’s exchange rate was collected from Barrhead Travel’s website on 09/11/2018. Interbank rates collected from x-rates.com on 09/11/2018. The information displayed on this site is subject to change at any time and we do not guarantee 100% accuracy of the information. For the today’s rates, visit Barrhead Travel’s website, contact Barrhead Travel’s customer support or log into your online banking and search for their exchange rate calculator. Currencyfees.com is not liable for any financial decisions based on the above information. Currencyfees.com is supported by referral compensations by some of the companies listed in our articles.

Share Tweet Share 0 Shares

Leave a comment cancel reply.

You must be logged in to post a comment.

Wells Fargo USD exchange rates: What you need to know

Visa USD exchange rates: What you need to know

Bank of America USD exchange rates: What you need to know

Western Union USD exchange rates: What you need to know

Asda exchange rates: What you need to know

Tesco exchange rates: What you need to know

Buy Currency

Top up card.

Enter the currency you need, or if you don't know what currency you need for your trip, simply enter the country that you're travelling to

Rate last updated Thursday, 11 April 2024 15:03:13 BST

[fromExchangeAmount] [fromCurrencyCode] British Pound

[toExchangeAmount] [toCurrencyCode] [toCurrencyName]

You can choose to receive cash via home delivery or pick up from store.

Enter the card number of the prepaid card you would like to top up

Card validated

Select the currency you would like to load or top up to your card

Enter how much you'd like to load or top up, either in Pounds Sterling, or in the foreign currency amount for the currency you have selected

How do we compare? Every day we check the exchange rates of major banks and high street retailers and adjust our rates accordingly to ensure that we give you a highly competitive overall price on your foreign currency.

- [name] [amount]

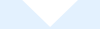

You can now add your Travelex Money Card, powered by Mastercard ® to the Apple Wallet

Get started in a few easy steps

- Travel Money Card

Secure spending abroad made easy.

- Safe and secure

- Choice of 22 currencies

- Seamless spending with Apple Pay and Google Pay

- Manage your travel money effortlessly via the Travelex Money App

- In case your card is lost, stolen, or damaged, our 24/7 global assistance team is here for you

Buy foreign currency

Order the currency you need online for our best rates. Pick up in store (including airports) or get it delivered to your home.

- Store Finder

Locate your nearest UK Travelex store. Order your currency online and collect in-store.

Join our Mailing List

Be the first to know about exclusive sales, competitions, product news and more.

Find your foreign currency now

Whether you're going to Australia or Thailand, we've got you covered. With a choice of over 40 currencies and our Travelex Money Card, we make it easy for you to get your travel money. Have it delivered straight to your door next day or pick it up from any of our UK stores at major airports, ports and retail locations.

How it Works

Choose from 40+ currencies

Select to have your currency delivered to your home or collect at one of our stores across the UK

Relax knowing that your travel money has been taken care of by the world's leading foreign exchange specialist

The Travel Hub: Tips & Guides

Discover top tips, indulgent guides and no end of travel inspiration at The Travel Hub! From the hottest destinations to last minute travel and family fun, here's to making your next trip the best one yet.

Quick Links

- Exchange Rates

- Bureau de Change

- Max Your Foreign Currency

- Compare Your Travel Money

- Travellers Cheques

- Precious Metals

About Travelex

- Download Our App

Useful Information

- Help & FAQs

- Privacy Centre

- Terms & Conditions

- Travelex Money Card Terms & Conditions

- Statement of Compliance

- Website Terms of Use

- Safety & Security

- Modern Slavery Statement

Customer Support

Travelex foreign coin services limited.

Worldwide House Thorpe Wood Peterborough PE3 6SB

Reg Number: 02884875

Your safety is our priority. Click here for our latest Customer update

IMAGES

VIDEO

COMMENTS

Find your foreign currency. We offer great travel money exchange rates on over 50 currencies at 0% commission. Get your travel money from your local Barrhead Travel store and find the best rate on the your chosen currency today. Order Euros, Dollars, Turkish Lira and more online today to get our enhanced web rates and Click & Collect orders:

In-store, secure peace of mind by adding the £4.95 Buy Back Guarantee per currency. 2. Enjoy Your Trip. Travel confidently: knowing you can exchange leftover currency at purchase rate within 30 days. 3. Redeem. Exchange your leftover currency to Pounds at the original rate, up to £500 covered by the guarantee. Order Travel Money Now.

It's our currency Buyback Guarantee - no more balancing. Just more great holiday memories. Return up to 30% of your travel money at exactly the same exchange rate for up to 30 days after your purchase date. This costs £4.00 with a minimum purchase of £150 worth of travel money required and a maximum purchase of £2,500 worth of travel money.

Use our currency buy back to sell your unused travel money from your holiday. Sell unused foreign currency at over 2,500 Post Office branches.

Discover over 60 stores, 15 Restaurants, 8 Cinema Screens and our iconic 'Dome', situated in the heart of Belfast.

Buy Back Guarantee >> Other Stores Nearby. No1 Currency Glasgow St. Enoch Centre Distance: 0.4 miles; Barrhead Travel Forge, Glasgow Distance: 2.5 miles; Barrhead Travel Silverburn Shopping Centre, Glasgow Distance: 4.2 miles; ID Requirements. For all Click & Collect and Click & Sell Orders

When you sell foreign currency, you get a buy-back rate from your chosen provider, which tells you how many pounds you can get for your unwanted travel money. For example, if the best euro buy-back rate available is 0.85, you will get 85p for every euro you sell. But to find the right deal, you need to look beyond the best currency buy back rates.

Barrhead Travel Money. Exchange currency with Barrhead Travel - order online or in-store from one of our 40 Barrhead Travel stores in the UK. For our best rate, reserve online with Click & Collect. When your order is ready, collect and pay in-store. Click &.

5. Exchange your money back once you're home. A lot of people like to hold onto their holiday money as a souvenir, which is great if you arrived home with only a few coins to spare. But if you've returned with several notes than we can buy your currency back. Sometimes if the exchange rate is good you can actually receive a surplus!

Simply secure their best rate online and sell your currency in store. They'll even give you a 2 day exchange rate guarantee* on all currencies to exchange your leftover currency into pounds. Why not visit them in-store to find out more! Read more about the foreign exchange service that is available at Barrhead Travel.

There's still time for Barrhead Travel Foreign Currency to organise your holiday spending money whilst you get ready for take-off! Great exchange rates just for you. Quick and easy secure online ordering 24/7 or visit us in branch. Free delivery on orders over £500. From next day business day delivery if you order by 2pm.

Typically, you can save up to10% or £100 on a £1,000.00currency buy back. You can save 10% - 15% by selling your travel money with us versus the banks or at the airport. You can see the comparison on the table above.

Internet Banking guide. Log in and select the more menu from your account. Then choose Order travel money. Select the currency you'd like to buy. Then enter the amount you want. Review your quote. If you're happy, choose Select delivery. Select your delivery option. We can send your order to your home address.

Airport currency exchange rates are among the worst you'll find. It's not uncommon to see airport exchanges charging 14% more than the current International Monetary Fund (IMF) exchange rate ...

Here are four currency exchange tips to help you get the best deal on those dollars, yen, rand or whatever you're putting in your wallet. 1. Avoid airport kiosks. While exchanging currency at the airport is convenient, it comes with an extra cost. Those kiosks you see in high-profile locations in airport terminals pay huge rents and to make ...

^Please speak to one of our Hays Travel colleagues for the full Terms & Conditions of the Hays Travel Buy Back Guarantee. ^^In-branch rates will differ from our online rates. The rates displayed online are for currency banknotes pre-order only, and guaranteed if currency is collected before close of business on Thursday 11/04/2024

All you need to do is take out our Buy Back Promise when you buy your travel money and, after your trip, we'll buy back your leftover currency from you at the original transaction exchange rate. For a fee of just £4.99, we will buy leftover foreign currency up to a maximum of £250. Any value above this limit will be completed using the ...

Barrhead Travel's exchange rate was collected from Barrhead Travel's website on 09/11/2018. Interbank rates collected from x-rates.com on 09/11/2018. The information displayed on this site is subject to change at any time and we do not guarantee 100% accuracy of the information.

We make it easy for you to buy travel money today at a great exchange rate, giving you the option to collect in-store, or conveniently get your travel money securely delivered to your home address. Money exchange Belfast, Victoria Square. Great travel money exchange rates at 0% commission. Wide range of currencies.

Whether you're going to Australia or Thailand, we've got you covered. With a choice of over 40 currencies and our Travelex Money Card, we make it easy for you to get your travel money. Have it delivered straight to your door next day or pick it up from any of our UK stores at major airports, ports and retail locations.

We make it easy for you to buy travel money today at a great exchange rate, giving you the option to collect in-store, or conveniently get your travel money securely delivered to your home address. Order Travel Money. Currency exchange Selby. Great travel money exchange rates at 0% commission. Wide range of currencies.

Currency Exchange Rates. From Euros to Zloty, we offer a wide range of currencies. Buy and sell your foreign currency with us, and enjoy excellent exchange rates with no commission fees. Check out today's online rates for our services: Click & Collect, Home Delivery and Click & Sell. Click &.

Currency exchange Newton Mearns. Great travel money exchange rates at 0% commission. Wide range of currencies. ... Buy Back Guarantee >> Other Nearby Stores. Barrhead Travel Silverburn Distance: 2.9 miles; No1 Currency Glasgow, St. Enoch Centre Distance: 5.6 miles; Barrhead Travel Gordon St., Glasgow Distance: 6.1 miles;