Buy now, pay later with KAYAK and Affirm

Don’t let budget get in your way – enjoy monthly installments for select flights, stays and rental cars booked on KAYAK.

What is Affirm?

Book today and pay over time.

Feel good about what you book and how you pay for it. With Affirm, you can make thoughtful purchases and pay over time while staying on budget. See here for additional details .

Affirm benefits

Quick and easy

Select Affirm as your payment method when booking and choose the payment plan that works for you.

No hidden fees

Affirm helps you break up payments with no fees or surprises, so you’ll know exactly how much you owe.

Real-time eligibility check

Answer a few questions to check your eligibility -or prequalify to see how much you can spend without affecting your credit score.

Images below are for illustrative purposes only

How to use Affirm on KAYAK

Step 1 – look for the kayak logo **.

Once you find the flight, stay or rental car perfect for you, look for the KAYAK logo when choosing which provider to book with.

**Applicable bookings may be labeled with “Instant booking” and/or a thunderbolt icon.

Step 2 – Select “Affirm” as your method of payment

When choosing your payment option, select Affirm as the method of payment for your booking.

Step 3 – Check your eligibility on Affirm

Simply enter your mobile number to confirm your account and answer a few questions to check your eligibility. Don’t stress–this won’t affect your credit score.

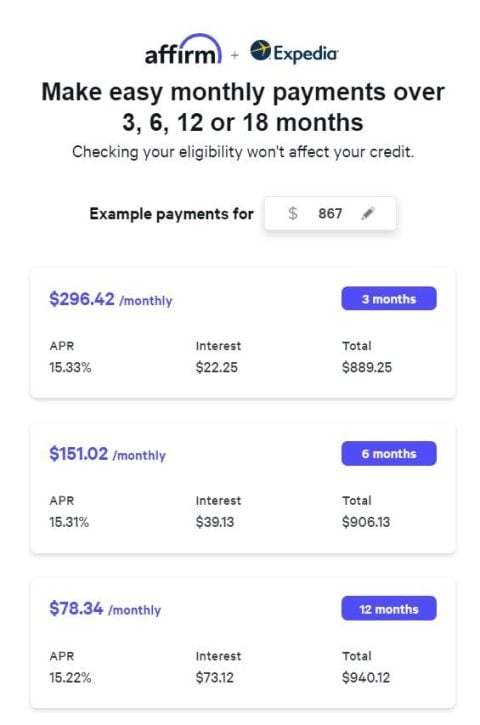

Step 4 – Compare your payment plan options

Quickly and easily compare the payment plan options available for your booking.

Step 5 – Review your final payment plan

Review the payment options for your booking and complete your reservation by paying with Affirm.

*Rates from 10–36% APR. For example, a $800 purchase might cost $72.21/mo over 12 months at 15% APR. Payment options through Affirm are subject to an eligibility check and are provided by these lending partners: affirm.com/lenders . Options depend on your purchase amount, and a down payment may be required. CA residents: Loans by Affirm Loan Services, LLC are made or arranged pursuant to a California Finance Lenders Law license. For licenses and disclosures, see affirm.com/licenses .

Search now and pay with Affirm

Frequently asked questions.

Yes! There’s no penalty for paying early.

You can make or schedule payments at affirm.com or in the Affirm app for iOS or Android. Affirm will send you email and text reminders before payments are due.

No—your credit score won’t be affected when you create an Affirm account or check your eligibility. If you decide to buy with Affirm, this may impact your credit score. You can find more information in Affirm’s Help Center.

Yes, your travel booking must be $150 or greater.

For any cancellation or change requests, please reach out directly to the merchant via customer support service number provided in your booking confirmation emails.

Yes, you’ll need a mobile phone number from the U.S. or U.S. territories. This helps Affirm verify it’s really you who is creating your account and signing in.

You can visit their website at affirm.com .

California consumers have the right to opt out of the sale * of their personal information. For more information on how we securely process personal information, please see our Privacy Policy .

Do not sell my info ON

* The definition of "sale" under the California Consumer Privacy Act is applicable only to California consumers.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

Should I Use Affirm for Travel?

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Affirm is a "buy now, pay later service" that offers consumers the option of paying for their purchase in installments instead of requiring the whole payment upfront. It can be used for a wide range of products, from clothing to electronics, furniture, and even travel. Many travel companies, including Expedia, Priceline, Orbitz and American Airlines, use Affirm.

If you're considering using Affirm to pay for your travel, read on to learn more about the service, how it works and whether using it is a smart money move.

What is Affirm?

While you may not have heard of Affirm, the buy now, pay later or BNPL service has become quite popular, with over 12.7 million customers as of June 2022. From January to March of the same year, it extended roughly $3.9 billion of loans. BNPL services like Affirm are especially popular among younger generations — an estimated 75% of all BNPL users are either Gen Zers or millennials.

Affirm offers two types of payment plans:

Affirm Pay in 4. This option allows you to pay in four equal installments every two weeks with no interest or impact on your credit score.

Monthly payments. This option is a loan that allows you to pay in either three-month, six-month or 12-month installments at varying interest rates based on your credit score.

Affirm also offers a savings account and a virtual card, which can be used like a credit card (even at locations that don't accept Affirm).

» Learn more: Should you use buy now, pay later services for travel?

Who can use Affirm?

To use Affirm, you must:

Be a U.S. resident.

Be at least 18 years old (or 19 years old for Alabama residents and some Nebraska residents).

Have a Social Security number.

Own a phone number that is registered in the U.S. and can receive SMS text messages.

In addition to the above criteria, Affirm will also consider the following when deciding if you qualify for a loan with them:

Your credit score.

Your credit utilization .

Your payment history with Affirm.

How long you've had an Affirm account.

The number of loans you have with Affirm.

Verification of your income and debts.

Recent bankruptcies.

Store policies.

Because approval is based on several factors, if you're shopping at a website that uses Affirm, we recommend having a backup plan in case you do not qualify for a loan.

» Learn more: What is a good credit score?

Where can you use Affirm to pay for travel?

Affirm has partnered with several popular travel companies. Examples of those that allow you to pay with Affirm include:

American Airlines .

Delta Air Lines .

Priceline .

Travelocity.

If you choose to get an Affirm virtual card, you can use it to book on other travel sites, including Hotels.com and Booking.com.

» Learn more: NerdWallet's review of Affirm buy now, pay later

How to use Affirm to pay for travel

There are two ways to use Affirm to pay for your travel:

Book on a website that includes Affirm as a payment option.

Use an Affirm virtual card.

Here's a closer look at both options.

Use Affirm as a payment option

To give you an example of booking travel on a website with Affirm as a payment option, we looked at booking the Hyatt Ziva Puerto Vallarta for three nights in August on Expedia.

This stay would cost $867 total if you decided to pay for it with either a credit or debit card or PayPal, but you can also click "Monthly Payments" and you'll see an option to pay with Affirm.

When you click "Learn more," Affirm gives you examples of what your monthly payments would look like based on whether you pay in three-month, six-month or 12-month increments, as well as your total payment amount and how much you'll pay in interest.

The monthly payment for the 12-month plan is only $78.34, as opposed to $296.42 on the three-month plan. However, keep in mind that if you choose this option, you'll pay $940 for your hotel stay instead of the $867 you'd have paid with a card or PayPal — an additional $73.

The payment options above are only examples — you'll need to apply to find out if you qualify for Affirm. You may also be asked for a down payment or be given different interest rates based on your financial situation.

If you decide you want to pay with Affirm, you'll need to provide your cellphone number and create an account with some basic personal information.

After doing so, you'll receive a real-time decision on whether your request was approved. You'll then be able to use Affirm to pay for your travel based on the payment schedule you select.

» Learn more: How to travel without a credit card

Use an Affirm virtual card

If you'd like to use Affirm, but you're not offered the option to do so when booking, you may be able to use a virtual credit card.

To get started, you'll need to download the Affirm app and choose the "Virtual Card" option. You'll then select "Pay with a one-time-use virtual card" and enter the approximate amount your purchase will cost.

You'll receive an immediate decision, and if you're approved, you'll get a virtual card you can add to your phone's wallet. Then, when you're ready to pay, enter the card details as you would with any other credit card. Keep in mind, however, that you'll need to complete your transaction within 24 hours of being approved for the virtual card.

» Learn more: Is BNPL a smart way to finance travel?

When should I use Affirm to pay for travel?

There are a couple of instances where it may make sense for you to pay for your travel with Affirm:

You're able to use Affirm Pay in 4

Since Affirm Pay in 4 allows you to pay in four installments with zero interest and no impact on your credit score, this can be a great option if you don't have the cash to pay upfront and can't wait to make your purchase.

For instance, if a flight costs $800, you’d pay four installments of $200 – the first installment due at time of purchase. Just remember to budget for these additional payments over six weeks.

You're booking essential travel but lack the funds to pay in full

As much as we love to travel, we generally don't recommend booking a trip unless you have the funds to pay for it or can pay off the charge immediately before any interest accrues.

But if there's essential travel that you need to book — for instance, a family or medical emergency — and you can't pay in full, Affirm can be a useful option if you don't have a credit card or if it offers a better interest rate than your credit card.

However, suppose you're considering using Affirm because the interest rate is lower than your credit card. In that case, we recommend calling your credit card company to see if they can provide you with a lower promotional rate.

Aside from the limited examples above, you're likely better off paying for travel on your credit or debit card or with another payment option.

» Learn more: Watch out for these buy now, pay later traps

If you're thinking of using Affirm on travel

While you may be tempted to use Affirm so that you don't need to pay for your travel in total upfront, buy now, pay later services can be detrimental to your finances if not used wisely.

Unless you can use Affirm Pay in 4 to quickly pay off your loan with no interest, Affirm charges a high interest rate that you're better off avoiding where possible. It's better used to help in a pinch, such as when you're traveling for a last-minute emergency.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's over $900 when you redeem through Chase Travel℠.

1.5%-5% Enjoy 5% cash back on travel purchased through Chase Travel, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

Up to $300 Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back!

on Capital One's website

2x-5x Earn unlimited 2X miles on every purchase, every day. Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options.

75,000 Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel.

- Travel Planning Center

- Ticket Changes & Refunds

- Airline Partners

- Check-in & Security

- Delta Sky Club®

- Airport Maps & Locations

- Flight Deals

- Flight Schedules

- Destinations

- Onboard Experience

- Delta Cruises

- Delta Vacations

- Delta Car Rentals

- Delta Stays

- In-Flight Wi-Fi

- Delta Trip Protection

- How to Earn Miles

- How to Use Miles

- Buy or Transfer Miles

- Travel with Miles

- SkyMiles Partners & Offers

- SkyMiles Award Deals

- SkyMiles Credit Cards

- SkyMiles Airline Partners

- SkyMiles Program Overview

- How to Get Medallion Status

- Benefits at Each Tier

- News & Updates

- Help Center

- Travel Planning FAQs

- Certificates & eCredits

- Accessible Travel Services

- Child & Infant Travel

- Special Circumstances

- SkyMiles Help

Delta Vacations is offering customers a new way to pay for travel. With Affirm, you can choose to make easy monthly payments to go on your vacation without having to pay for it all up front.

How Affirm Works:

- When paying for your travel, select Affirm, provide five simple pieces of information 1 and receive a credit decision in seconds.

- Once approved, you have the option to spread out the cost of your trip over 6, 12, 18 or 24 monthly installments, 2 with any interest shown in simple dollars rather than as a hard-to-calculate interest rate.

- There are no late or hidden fees, so you will never pay a dollar more than you agreed to upfront.

- Upon successful completion of your Affirm loan process, you will receive payment information directly from Affirm. You will also receive an email confirmation from Affirm.

- If you’re unsuccessful obtaining an Affirm loan, you can speak to a Delta Vacations Specialist or call 1-800-800-1504 about other payment options.

For additional information, visit affirm.com , opens in a new window .

Experience everything an island paradise offers with a Delta Vacations Caribbean getaway, from sandy white beaches and breathtaking all-inclusive resorts to every water sport imaginable.

Terms & Conditions

- Your rate will be 10-36% APR based on credit, and is subject to an eligibility check. Payment options through Affirm are provided by these lending partners: affirm.com/lenders . Options depend on your purchase amount, and a down payment may be required.

- Affirm only needs five pieces of information for most credit decisions: name, phone number, email address, date of birth and the last four digits of your social security number.

- For example, a $2,000 purchase might cost $124.77/mo over 18 months at 15% APR.

Learn more about us.

Your elevated vacation experience starts here. Choose from flights, hotels, rides and activities all over the world, all in one place.

WE’RE HERE FOR YOU

As trusted experts, we’ll help with recommendations, booking and support — whenever and wherever you need it.

PREFERRED BY SKYMILES® MEMBERS

We make it easier to get more from your miles while also earning bonus miles and earning toward Medallion® Status.

TRAVEL WITH CONFIDENCE

Things come up, and we’ve got you covered, from flexible changes and cancellations to travel protection plans .

- Investor Relations

- Business Travel

- Travel Agents

- Comment/Complaint

- Browser Compatibility

- Accessibility

- Booking Information

- Customer Commitment

- Tarmac Delay Plan

- Sustainability

- Contract of Carriage

- Cookies, Privacy & Security

- Human Trafficking Statement (PDF)

- Things to do

Explore > Company > News > Book your flight and hotel now, pay later

Book your flight and hotel now, pay later

We are always looking ahead at new payment options and technologies to help alleviate the stress of booking your dream vacation. Are you on a tight budget, or perhaps you just prefer to pay for big purchases over time? Great news, we now have you covered!

Expedia recognizes there’s no one-size-fits-all approach to budgeting for vacation so next time you’ve caught the wanderlust bug or need to get home for Christmas but are struggling to pay for those flight and hotel reservations upfront, you can now breathe a sigh of relief. We’ve recently expanded our partnership with online lender Affirm to give you the flexibility of spreading out the cost of your flight and hotel package booking over numerous payments instead of paying the full amount of your trip upfront.

Our team is incredibly passionate about making travel accessible for all—everyone deserves a vacation! We’ve received positive feedback from our customers who have used Affirm to book and pay for hotels on Expedia , and now we are excited to bring this payment offering to Expedia customers shopping for flight and hotel packages as well.

Ready to take advantage of more payment flexibility when you travel? Here’s how you can use Affirm on Expedia to book your next hotel and flight package.

1) Visit expedia.com , search for and select a flight and hotel.

Upon selecting your package, select the Monthly Payments tab .

2) Click on “Continue to Affirm”

3) Create an account or sign in to Affirm

You will be transferred to a secure Affirm sign-in page. Shoppers apply using top-of-mind information about themselves and receive a real-time decision at checkout.

4) Complete your reservation with Affirm

Now you’re ready to jet set!

Expedia also offers exclusive Book Now, Pay Later hotel deals , so there’s no reason to let the cost of accommodation keep you from your travel plans.

What’s holding you back? Plan and book your next dream vacation today!

More Articles With Company

Book now, pay later

Vacation financing through Affirm is available for U.S. stays with a total rent of at least $250. Select "Pay later with Affirm"* at checkout.

How Affirm works

See if you’re eligible by providing some basic information. You’ll get a real-time decision (and your credit score won’t be affected).

Know exactly what you’ll owe before you commit. No hidden costs, no surprises.

Choose to pay in installments over 3, 6, 12, or 18 months*—even after the date of your trip.

Your trip, your way

When you finance your vacation with Affirm, your payment schedule is just one of the things you won't have to worry about.

Our professional property management includes 24/7 guest support, premium cleaning, and seamless check-in for your most relaxing vacation yet.

Sign up for emails

Curated tips & inspiration for your next vacation.

Choose from thousands of places to stay

Affirm travel FAQ

Who is eligible to apply for affirm financing on a vacasa stay.

While Affirm requires you to be at least 18 years old, you must be at least 21 to book a Vacasa home. (Some of our homes and destinations require a higher minimum age to rent the property—you'll see that specified on the property listing, if applicable.)

You must also be a U.S. resident booking a home within the U.S.

Does Affirm do a credit check, and how does it impact my credit score?

If you choose to pay with Affirm, we ask for some basic personal information to see if you're eligible. You'll get a real-time decision on whether you prequalify for a vacation loan. This process includes a quick credit check—but it does not affect your credit score.

How do I make my payments?

After you complete your Vacasa trip purchase, look out for an email directly from Affirm about your vacation payment plan. You can make secure payments on Affirm's website, or through their app. Visit Affirm's help center for more details on making loan payments.

Can I amend my order after my purchase has been processed?

If you need to adjust your reservation after purchase, you can do so in your Trip Manager . For any changes that come with additional fees (such as adding pets or pool heat), you'll need to pay for those with a credit card. Those charges cannot be added to your existing loan through Affirm.

And, if you end up needing to change dates or cancel your reservation, good news—trips paid for with Affirm still fall under our worry-free booking policy . You'll also see your change and cancellation options in your Trip Manager.

Can you make payments on a trip to Hawaii?

Yes, you can. We offer vacation payment plans through Affirm on U.S. stays, including those in Hawaii (as long as the rent totals at least $250).

Where to next?

Rates from 0–36% APR. For example, a $700 purchase might cost $63.18/mo over 12 months at 15% APR. Payment options through Affirm are subject to an eligibility check and are provided by these lending partners: affirm.com/lenders . Options depend on your purchase amount, and a down payment may be required. See affirm.com/licenses for important info on state licenses and notifications.

Book now, pay later with Affirm

We partner with Affirm to provide more ways to pay for your Surprise Vacation. Affirm allows you to pay for your getaway over time, rather than all at once.

No Added Fees

No late fees, no prepayment fees, no annual fees, and no fees to open or close your account.

0% APR or 10-36% APR

Depending on your creditworthiness. Terms of purchase are given when you check out with Affirm.

Don’t worry, pay easy:

Using Affirm with Pack Up + Go

The ultimate way to pay over time, stress-free.

What is Affirm?

Affirm lets you pay off purchases over time. That way, you can take your Surprise Vacation without the stress of spending big! Pack Up + Go, offers Affirm as a payment option right at checkout.

How do Affirm payments work?

Affirm offers multiple payment schedules, with APR ranging from 0% APR to 10-36% APR. You'll never pay more than you agree to upfront when you decide on your payment schedule.

How do I use Affirm for my Surprise Trip?

Select Affirm as a payment option when purchasing your Surprise Vacation.

Interested? Learn how to create an account, see if you prequalify, or buy with Affirm.

Still have questions? Visit Affirm’s FAQ !

Your rate will be 0-36% APR based on credit, and is subject to an eligibility check. For example, a $700 purchase might cost $63.18/mo over 12 months at 15% APR. Payment options through Affirm are provided by these lending partners: affirm.com/lenders . Options depend on your purchase amount and a down payment may be required.

- Anaheim, CA Colorado Springs, CO Grand Mound, WA San Francisco / Manteca, CA Scottsdale / Salt River, AZ

- Atlanta / LaGrange, GA Charlotte / Concord, NC Dallas / Grapevine, TX Houston / Webster, TX Naples, FL Williamsburg, VA

- Chicago / Gurnee, IL Cincinnati / Mason, OH Kansas City, KS Minneapolis / Bloomington, MN Sandusky, OH Traverse City, MI Wisconsin Dells, WI

- Baltimore / Perryville, MD Boston / Fitchburg, MA Mashantucket, CT Pocono Mountains, PA

- Niagara Falls, Ontario

- Hello, Name

Play Now, Pay Later

For as low as 0% APR

- Anaheim, CA

- Colorado Springs, CO

- Grand Mound, WA

- San Francisco / Manteca, CA

- Scottsdale / Salt River, AZ

- Atlanta / LaGrange, GA

- Charlotte / Concord, NC

- Dallas / Grapevine, TX

- Williamsburg, VA

- Chicago / Gurnee, IL

- Cincinnati / Mason, OH

- Kansas City, KS

- Minneapolis / Bloomington, MN

- Sandusky, OH

- Traverse City, MI

- Wisconsin Dells, WI

- Baltimore / Perryville, MD

- Boston / Fitchburg, MA

- Pocono Mountains, PA

- No items related to your search

Choose Your Destination

Play Now, Pay Over Time

Don’t wait to plan your next essential getaway. With flexible payment plans through Affirm, you can book now and pay over time for as low as 0% APR with no late or hidden fees.

How It Works

Rates from 0–36% APR. For example, a $700 purchase might cost $63.18/mo over 12 months at 15% APR. Affirm is available as a form of payment only when at least 1 overnight stay of $50+ is booked and to any add-on products to that booking. Payment options through Affirm are subject to an eligibility check and are provided by these lending partners: affirm.com/lenders . Options depend on your purchase amount, and a down payment may be required. See affirm.com/licenses for important info on state licenses and notifications.

We use cookies to improve your experience on this site, to show you personalized advertising, and to gather web traffic data. To find more, please read our Privacy Policy and Cookie Policy .

How to Use Affirm on Expedia: A Comprehensive Guide

Booking a dream vacation can be an exciting experience, but it can also come with financial stress. Fortunately, the travel industry is adapting to the changing needs of consumers, and there are now multiple payment options available to make booking travel easier and more affordable. One such option is Affirm, a leading buy-now-pay-later financing company that has partnered with Expedia. With Affirm, you can spread the cost of your travel purchases over time, making it more manageable and affordable. In this blog post, we’ll take a closer look at how to use Affirm on Expedia to book your next getaway stress-free.

Setting Up Affirm on Expedia

To start using Affirm on Expedia , you will first need to create an account with Affirm. The process is straightforward and can be done in a few simple steps. First, navigate to Affirm’s website and click on the “Sign up” button. You will be prompted to enter your personal information, including your name, address, and social security number. Affirm uses this information to verify your identity and assess your creditworthiness. Once you’ve provided all the required information, Affirm will conduct a soft credit check to determine if you are eligible for a loan. If you are approved, you can then link your Affirm account to your Expedia account.

When linking your Affirm account to Expedia, you will need to follow a few more steps. First, select the travel itinerary you want to purchase on Expedia and proceed to checkout. When prompted to select a payment method, choose “Monthly Payments with Affirm” from the list of options. You will then be redirected to Affirm’s website to complete the purchase process. During this process, you will need to provide some additional information, such as your income and employment status, to help Affirm determine the best loan option for you. After you’ve completed the purchase process, you will receive an email confirmation from both Expedia and Affirm.

Searching for Travel Deals on Expedia

Expedia is one of the largest online travel agencies, offering a wide range of travel deals for destinations around the world. To find the best travel deals on Expedia, start by entering your desired travel dates and destination into the search bar. You can then filter your search results by price, location, hotel amenities, and other factors to find the perfect travel deal. Expedia also offers daily deals and last-minute travel deals, so be sure to check those sections of the website for additional savings.

One of the benefits of using Affirm on Expedia is that it allows you to book travel deals that may be slightly out of your budget. By spreading the cost of your travel purchase over time, you can take advantage of deals and promotions without breaking the bank. Additionally, booking with Affirm means you can pay for your travel purchase in fixed monthly payments, rather than one large lump sum, which can make budgeting for your trip easier.

Using Affirm to Pay for Your Expedia Purchase

Once you’ve found the perfect travel deal on Expedia, it’s time to use Affirm to pay for it. Using Affirm is straightforward, and the payment process is similar to that of other payment methods. When you reach the payment screen on Expedia, select “Monthly Payments with Affirm” as your payment method. You will then be prompted to enter some additional information, such as your income and employment status, to help Affirm determine the best loan option for you.

After you’ve entered all the necessary information, Affirm will present you with a few different loan options. These options will include the loan amount, interest rate, and monthly payment amount. Review each option carefully to choose the one that best fits your budget and payment preferences. Once you’ve selected your loan option, you will be redirected to Affirm’s website to complete the purchase process. Here, you’ll need to provide your banking information to set up automatic payments. Affirm offers autopay to make paying your monthly installments more convenient, and you can choose the payment date that works best for you. Once you’ve completed the payment process, you’ll receive a confirmation email from both Expedia and Affirm.

One important thing to keep in mind when using Affirm on Expedia is that you will be charged interest on your loan. The interest rates vary depending on the loan option you choose and your creditworthiness. It’s important to review the terms and conditions of your loan carefully before accepting it to ensure you understand the total cost of your travel purchase.

Managing Your Affirm Account

Once you have set up Affirm on Expedia and used it to make a purchase, it’s important to keep track of your payments and loan status. Affirm offers a user-friendly online account portal that allows you to manage your loan and payments easily. Here are some of the things you can do in your Affirm account:

- View your loan details: You can view the terms and conditions of your loan, including the interest rate, repayment schedule, and total amount owed.

- Make payments: You can make payments manually through your Affirm account or set up automatic payments to ensure you never miss a due date.

- Change your payment method: If you need to update your banking information or switch to a different payment method, you can do so easily through your Affirm account.

- Monitor your credit score: Affirm reports your payments to credit bureaus, which means that responsible borrowing can help you improve your credit score over time.

- Contact customer support: If you have any questions or concerns about your loan or payments, you can contact Affirm’s customer support team directly through your account portal.

Managing your Affirm account is a crucial part of using the service responsibly and ensuring that you can continue to take advantage of its benefits for future travel purchases.

Understanding Affirm’s Fees and Interest Rates

Using Affirm on Expedia can be a great way to budget for your travel expenses. However, it’s important to understand the fees and interest rates associated with using Affirm. Affirm’s interest rates vary depending on your creditworthiness and the loan option you choose. Additionally, Affirm charges a one-time origination fee, which ranges from 0-10% of the loan amount, depending on your creditworthiness. It’s important to review the terms and conditions of your loan carefully before accepting it to ensure that you understand the total cost of your travel purchase. With responsible use, Affirm can be a helpful tool for budgeting your travel expenses.

Tips for Using Affirm Responsibly

While using Affirm on Expedia can be a great way to budget for your travel expenses, it’s important to use it responsibly to avoid getting into debt. Here are some tips for using Affirm responsibly:

- Only borrow what you can afford to pay back: Before accepting a loan from Affirm, review your budget carefully to ensure that you can afford the monthly payments.

- Choose the shortest repayment period possible: While longer repayment periods may seem more affordable on a monthly basis, they can result in more interest charges over time. Try to choose the shortest repayment period that fits within your budget.

- Make payments on time: Late payments can result in additional fees and interest charges, which can make your travel purchase more expensive. Set up automatic payments or reminders to ensure that you never miss a due date.

- Avoid borrowing for unnecessary expenses: While using Affirm on Expedia can be a helpful way to finance your travel expenses, it’s important to avoid borrowing for unnecessary expenses. Stick to a budget and only borrow what you need for your travel purchase.

By using Affirm responsibly, you can take advantage of its benefits for budgeting your travel expenses without getting into debt.

Advantages and Disadvantages of Using Affirm on Expedia

Using Affirm on Expedia can have both advantages and disadvantages, depending on your financial situation and travel needs. Some advantages of using Affirm include:

- Budget-friendly payments: Affirm allows you to spread the cost of your travel purchase over time, making it easier to budget for your trip.

- No hidden fees: Affirm charges a one-time origination fee, but there are no hidden fees or prepayment penalties.

- Flexible repayment options: You can choose from several repayment periods and payment dates to find the option that works best for you.

- However, there are also some potential disadvantages to using Affirm, including:

- Interest charges: Affirm charges interest on your loan, which can make your travel purchase more expensive over time.

- Credit requirements: To use Affirm, you must have a good credit score and credit history. If you don’t meet these requirements, you may not be eligible for a loan.

- Limited use: Affirm is only available for certain travel purchases on Expedia, so it may not be the best option for all types of travel expenses.

Before using Affirm on Expedia, it’s important to weigh the advantages and disadvantages to determine if it’s the right option for your travel needs and financial situation.

Using Affirm on Expedia can be a game-changer for travelers looking for a more affordable way to book their dream vacations. With Affirm, you can spread the cost of your travel purchase over time, making it easier to budget for your trip. To use Affirm on Expedia, start by creating an account with Affirm and linking it to your Expedia account. Then, search for the best travel deals on Expedia and select “Monthly Payments with Affirm” as your payment method at checkout. Finally, review the loan options presented by Affirm carefully before choosing the one that best fits your budget and payment preferences.

Remember to use Affirm responsibly and to only borrow what you can afford to pay back. With careful planning and budgeting, Affirm can help you turn your travel dreams into reality. Happy travels!

Home | Explore Vrbo | Vacations made easy with Affirm

Vacations made easy with Affirm

Finally, you don’t have to pay for your whole trip all at once. Happy days! Affirm makes it easy to find a payment plan that suits you and your family so you can focus on letting the good times roll.

Paying with Affirm is as easy as 1, 2, 3!

- Search on Vrbo using the Affirm filter to find your dream vacation home. When you’re ready to book, select Affirm at checkout to see if you qualify*.

- Choose a monthly payment plan that suits you. Don’t worry, you’ll never pay more than you agreed to upfront.

- Pay in your chosen installments on the Affirm website or app . Affirm will send you reminders so you never forget a payment.

3 reasons to pay for your vacation home with Affirm

- Transparency: you’ll be told the total cost upfront and will never be charged any more than agreed.

- Flexibility: there’s plenty of options to choose from, so you can decide a payment schedule that suits you.

- Fair policies: you will never be charged any late fees or penalties of any kind.

Ready to find a family vacation now and pay later?

Start searching with affirm..

Paying for your beach vacation is easy-breezy

Spread out in a home with lots of outdoor space., make big family vacations happen..

Terms & Conditions

- Requirements to apply for Affirm:

- Cancelled bookings:

- Booking and payment confirmation:

*Your rate will be 10–36% APR based on credit and is subject to an eligibility check. Payment options through Affirm are provided by these lending partners: affirm.com/lenders. Options depend on your purchase amount, and a down payment may be required.

Related Articles

Explore Vrbo

#VrboReunionContest is on! You could win one of 30 vacay giveaways over 30 days.

A place for all starts with understanding, celebrating 25 years with 25 vacation giveaways, 25 séjours en cadeau pour nos 25 ans, vrbo is deepening our commitment to diversity and inclusion.

9 One-of-a-Kind Vacation Rentals We’re Booking Now and Paying for Later

It’s easy to get nostalgic for travel right now. In fact, a recent study shows that shows that 46 percent of Americans are planning to use their tax refund for travel this year. With the promise of a vaccine in everyone’s very near future, that first post-pandemic trip is slowly becoming a reality. Whether it be an opportunity to connect with loved ones or a chance to simply escape your own four walls, your first vacation will likely be a meaningful one.

Thankfully, Affirm has partnered with Vrbo to allow you to book that dream getaway today while paying for it over time. It’s kind of the perfect scenario for this environment and Kay of The Mom Trotter agrees. “I have been dreaming about spending a month [with my family] at beach front property in the Caribbean,” says Kay. “I love Affirms ‘buy now, pay later’ option because it allows me to plan a trip ahead of time without the worry of needing to pay for it upfront. Also, the fact that there are no late or hidden fees gives me peace of mind.”

So whether you’re itching for that family reunion on the beach or a getaway in the mountains, check out these nine Vrbo rentals all available to book using Affirm. Editor’s note: While most experts agree that renting a vacation home is relatively safe , please remember to follow all social distancing guidelines and local travel recommendations. You may also want to reach out to your Vrbo host to ensure that they are using additional cleaning and sanitation practices.

1. The Pond House In Woodstock, Ny

Sleeps: 5 Rate: As low as $216/mo with Affirm*

Featured in Icon Design magazine, this newly renovated artist’s home is what relaxation dreams are made of. The setting with a private waterfall bordering public preserves, as well as the attention to architectural detail is not only unique, but majorly ’gram-worthy. You’ll find trails through the woods to downtown Woodstock, outdoor dining with charcoal grill and multiple outdoor lounge areas. Reserve your stay now because it’s booking up fast.

2. Lake Atitlan Retreat In Solola, Guatemala

Sleeps: 7 Rate: As low as $77/mo with Affirm*

Private lake access. Heated pool. Panoramic views. Full kitchen amenities. This rental is a gem. Perfect for meditation, a creative retreat, romance or healing, guests boast “It was a truly exceptional experience from beginning to end.” Views aside, we love that it also offers concierge services, transport coordination and site seeing resources. The hosts can even arrange for a chef to come to the property or someone to do your food shopping.

3. Smith Mountain Lake Castle In Moneta, Va

Sleeps: 12 Rates: As low as $267/mo with Affirm*

This 7,087 square foot, three-story French Chateau castle with lake views from every room has a large outdoor pool, five bedrooms, five-and-a-half bathrooms, an inside hot tub, an exercise room, a wet bar, spectacular game rooms, a library, two fireplaces, a 75" smart TV in the living room and two more TV's in the game rooms… and Wi-Fi. The Castle is located on a quiet cove with very minimal boat traffic allowing you to have an amazing experience and enjoy nature without the constant noise from the boats that zip around in the main part of the lake.

4. The Rass Mandal Residence In Santa Fe, Nm

Sleeps: 10 Rate: As low as $354/mo with Affirm*

Featured on HGTV's House Hunter's on Vacation , Rass Mandal is the most sought-after adobe vacation residence in Santa Fe. Situated on a mountain range of pine forests with spectacular views, the house and 20-acre grounds feature a large private (heated) pool, jacuzzi style five-person hot tub, plunge pool and sauna. In other words, there’s no shortage of ways to get a taste of the beach in the middle of the desert. The best of both worlds, if you ask us.

5. Red Sands Ranch In Mason, Tx

Sleeps: 37 Rate: As low as $461/mo with Affirm*

Planning a big family reunion? Look to this exclusive private rental. With charming native-stone cabins, poolside cabana, waterslide, lighted tennis court, fitness center, full-court basketball, pickleball, game room, hot tub, river rapids, fishing and miles of trails, there’s legitimately something for everyone. Red Sands Ranch is located on the crystal-clear Llano River between the towns of Mason and Fredericksburg in Texas. If you happen to get a reservation, just know we will be supremely jealous.

6. Fully Staffed Beachfront Villa In Montego Bay, Jamaica

Sleeps: 10 Rate: As low as $345/mo with Affirm*

COVID-19 Certified, this villa is furnished with modern amenities, luxurious spa-style bathrooms, air conditioning in every bedroom, and a truly Caribbean feel. Two of the bedrooms have breathtaking views of the sea from their own private veranda. If a Caribbean getaway is on the brain, look no further.

7. Lake House (with A Pool) In Mountain Home, Ak

Sleeps: 30 Rate: As low as $451/mo with Affirm*

Set up high on the ridge with plunging views of Lake Norfork lies this undiscovered gem of the Ozarks. With clear, still waters, it’s the perfect lake for a family vacation. You can swim, boat, water-ski, fish, take a sunset cruise—or simply relax and enjoy the mesmerizing views from your luxury lodge. There’s even access to a 24-ft pontoon that comfortably seats up to 11 people.

8. Newly Renovated Beach House In Grand Turk, Turks And Caicos

Sleeps: 12 Rate: As low as $128/mo with Affirm*

The layout of this new home may seem odd—all bedrooms are located on the main floor with open kitchen, dining and living room on the upper level. However, the advantage of this are the private oceanic views and constant cool breeze while cooking family meals, socializing on the sofa or relaxing on the balcony with friends and family. The upstairs balcony facing the ocean has recently added a screen in area allowing the cool breeze in while keeping the buzzy mosquitos out.

9. The Lanes At Meemo’s Farm And Resort In Hershey, Mi

Sleeps: 6 Rate: As low as $144/mo with Affirm*

The Lanes offers highly-rated accommodations with an extra twist—there’s a bowling alley inside. Surrounded by mature forest with pure Michigan wilderness at your doorstep, the Lanes provide breathtaking scenery while providing complete privacy and relaxation. A state of the art kitchen, high vaulted oak beamed lounge and dining room, and beautiful bedrooms that ooze with warmth and character.

Disclosure: *Monthly prices based on 15.27% APR over 12 months. Your rate will be 0% APR or 10–30% APR based on credit, and is subject to an eligibility check. For example, a $700 purchase might cost $63.25/mo over 12 months at 15% APR. 0% APR is available until 4/11/2021. Payment options through Affirm are provided by these lending partners: affirm.com/lenders . Options depend on your purchase amount, and a down payment may be required.

VP, Design + Branded Content

- Today's news

- Reviews and deals

- Climate change

- 2024 election

- Fall allergies

- Health news

- Mental health

- Sexual health

- Family health

- So mini ways

- Unapologetically

- Buying guides

Entertainment

- How to Watch

- My Portfolio

- Latest News

- Stock Market

- Premium News

- Biden Economy

- EV Deep Dive

- Stocks: Most Actives

- Stocks: Gainers

- Stocks: Losers

- Trending Tickers

- World Indices

- US Treasury Bonds

- Top Mutual Funds

- Highest Open Interest

- Highest Implied Volatility

- Stock Comparison

- Advanced Charts

- Currency Converter

- Investment Ideas

- Research Reports

- Basic Materials

- Communication Services

- Consumer Cyclical

- Consumer Defensive

- Financial Services

- Industrials

- Real Estate

- Mutual Funds

- Analyst Rating

- Technical Events

- Smart Money

- Top Holdings

- Credit cards

- Balance Transfer Cards

- Cash-back Cards

- Rewards Cards

- Travel Cards

- Personal Loans

- Student Loans

- Car Insurance

- Morning Brief

- Market Domination

- Market Domination Overtime

- Opening Bid

- Stocks in Translation

- Lead This Way

- Good Buy or Goodbye?

- Fantasy football

- Pro Pick 'Em

- College Pick 'Em

- Fantasy baseball

- Fantasy hockey

- Fantasy basketball

- Download the app

- Daily fantasy

- Scores and schedules

- GameChannel

- World Baseball Classic

- Premier League

- CONCACAF League

- Champions League

- Motorsports

- Horse racing

- Newsletters

New on Yahoo

- CA Privacy Notice

Yahoo Finance

Q3 2024 affirm holdings inc earnings call, participants.

Max Roth Levchin; Founder, CEO & Chairman; Affirm Holdings, Inc.

Michael A. Linford; CFO; Affirm Holdings, Inc.

Zane Keller; Head of IR; Affirm Holdings, Inc.

Bryan Connell Keane; Research Analyst; Deutsche Bank AG, Research Division

Dan Dolev; MD & Senior Equity Research Analyst; Mizuho Securities USA LLC, Research Division

James Eugene Faucette; MD; Morgan Stanley, Research Division

Jason Alan Kupferberg; MD in US Equity Research & Senior Analyst; BofA Securities, Research Division

John Hecht; MD & Equity Analyst; Jefferies LLC, Research Division

Ramsey Clark El-Assal; Research Analyst; Barclays Bank PLC, Research Division

Reginald Lawrence Smith; Computer Services & IT Consulting Analyst; JPMorgan Chase & Co, Research Division

Robert Henry Wildhack; US Capital Markets Specialty Financials Analyst; Autonomous Research US LP

Unidentified Analyst

Presentation

Good morning, and welcome to the Affirm Holdings' Third Quarter fiscal 2024 earnings call. (Operator Instructions) As a reminder, this conference is being recorded, and a replay of the call will be available on our Investor Relations website for a reasonable period of time after the call. I'd now like to turn the call over to Zane Keller, Director, Investor Relations. Thank you. You may begin.

Zane Keller

Thank you, operator. Before we begin, I would like to remind everyone listening that today's call may contain forward-looking statements. These forward-looking statements are subject to numerous risks and uncertainties, including those set forth in our filings with the SEC, which are available on our Investor Relations website. Actual results may differ materially from any forward-looking statements that we make today. These forward-looking statements speak only as of today, and the company does not assume any obligation or intent to update them, except as required by law. In addition, today's call may include non-GAAP financial measures. These measures should be considered as a supplement to and not a substitute for GAAP financial measures. For historical non-GAAP financial measures, reconciliations to the most directly comparable GAAP measures can be found in our earnings supplement slide deck, which is available on our Investor Relations website. Hosting today's call with me are Max Levchin, Affirm's Founder and Chief Executive Officer; and Michael Linford, Affirm's Chief Financial Officer. In line with our practice in prior quarters, we will begin with brief opening remarks from Max before proceeding immediately into Q&A. On that note, I will turn the call over to Max to begin.

Max Roth Levchin

Thank you, Zane. Thank you for joining us today. (inaudible) our mission. As you can do, we're trying something new, a premarket open earnings call, live from New York and our awesome remote work be damned, very well-attended office in Manhattan. We're excited to see some of you in person later this week. But for now, as you can tell, we had another excellent quarter. I think it's all in our note. So let's jump straight into Q&A. Back to you, Zane.

Thank you, Max. With that, we will now take your questions. Operator, please open the line for our first question.

Question and Answer Session

Our first question comes from the line of Rob Wildhack with Autonomous Research.

Robert Henry Wildhack

Maybe one on the quarter and then one bigger picture question, too. But near term, the slides called out that the majority of the benefit from pricing initiatives will be realized by the end of this fiscal year. That all makes sense. But wondering if you could quantify how much the pricing initiatives have been helping volume growth in recent periods.

Michael A. Linford

It's hard to quantify, to be completely honest. We don't couple these measures super tightly because it's very dangerous to decide that one thing leads to the other. So we have a wider APR range, obviously, it serves us well in the world of increased rates, but we still underwrite every transaction. We still decide which transaction's going on, et cetera. And so I would struggle to put a distinct number on it, certainly wouldn't want to make any prognostications about the future impact. Obviously, we are very keen on growing. We're still growing really well. We benefit from the pricing quite nicely. But ultimately, we are in the risk measurement and management business here. And so we will, first and foremost, do no harm to that as we grow.

Maybe the only thing I'd add, if you look at the letter, we bridged for you the year-over-year change in our revenue less transaction cost measure. And you can see that the revenue growth roughly offset the increase in funding costs, other transaction costs and the incremental provision cost. And the real governor here for us is making sure that we post positive unit economics. And so the way to think about it is the revenue was what we needed to offset the change in rates in the business. And we feel like we've done that allows us to be back to more business as usual.

Okay. And then bigger picture, Max, you've talked a lot about unbundling the credit card, but elsewhere in the industry, you've got Capital One tying up with Discover and kind of a rebundling of the credit card. So I'd love to get your thoughts on how you think that could impact the industry more broadly? And then also, if you see this kind of rebundling as a new or unique competitor to Affirm in any way?

First of all, I think that is singularly the most impactful and interesting thing that's happened in financial services, probably in the last 10 years. So like huge kudos to Capital One foreseeing the opportunity and executing on it like nothing, but extreme respect for the leadership team there for being -- having the hotspot to go do this. I think creating another network given Discover's reach is especially powerful and so lots of good things to sort of -- from their point of view, I think, to do that. I think -- any incremental network building, whether it's open or not entirely open is a good thing for us because it just creates more plurality in the market and validates the idea, frankly, with even our investors that there's still a chance to build another giant network. That's certainly the business we're trying to have here. I'm not sure the products that are intended to run on top of this newly, whatever the name is going to be Discover, Capital One network, is meant to be any different from what happens currently on Visa and Mastercard. As you know, ours is fundamentally different. We look at SKU level data and integrate directly with merchants at a much richer degree of bandwidth to make sure that we can underwrite transactions and equally importantly, offer APR subsidies to consumers to motivate purchasing. So I think the network itself is a little bit more of the same, but I do think that the actual deal is a profoundly interesting thing, certainly from the Capital One point of view.

Our next question comes from the line of Jason Kupferberg with Bank of America.

Jason Alan Kupferberg

So just coming off very strong GMV growth performance here in the quarter, obviously, well ahead of your guide, up 36%. I think the midpoint for the fourth quarter is implying more like 25%. Year-over-year comps a little bit harder, but I think from a seasonal perspective, you might expect typically stronger quarter-over-quarter growth in GMV in Q4 than what's implied in the guide. So just wondering if there's any particular call-outs or any plans to tighten underwriting or more cautious to you on the consumer? Or just any additional color there would be great.

I'm sure Michael will have some words in a second, but let me tell you how I feel. We don't run the business on a quarter-by-quarter basis. It is just a fundamentally wrong way to look at a payments company that wants to be around 100 years from now. Like what do you get to next quarter, we're trying to grow. We're trying to make sure that we grow really well. Yes, carefully, we take risk. But most importantly, the fact that we have a forecast to share with you or a guide to share with you for next quarter has fairly little impact on our planned growth initiatives on some randomly chosen time boundary that is not measured in quarters. So I think it's just really important to know that -- I certainly do not think of Q4 numbers through -- from a growth point of view, like you definitely care about other numbers like risk, et cetera, that's really important, but growth is measured in years, and that's certainly how we think about it from the product point of view.

Yes. And then just a couple of things about the quarter. So fiscal Q4 is a seasonally stronger quarter. We see strength in categories like travel ticketing, and you see that reflected in our guide. Our guide at the high end does imply faster year-on-year growth in Q4 of this year than we had in last year. So that's a year-on-year acceleration in growth. And of course, last year in Q4, as you point out, it was a pretty tough comp because it grew quite quickly from Q3. Some context there, as we called out in our shareholder letter last year. We did have some new deals with travel merchants like Cathay Pacific and Booking.com. And we had some expansion projects with merchants like Royal Caribbean. And yes, we also launched the adoption of 36% APR caps in many merchants. All those things contributed to a really strong Q4 last year, making the comp very hard. If you look at a 2-year growth rate, the higher -- the high end of our guide implies about 58% growth, which is a slight decel from Q3, but really isn't all that material.

Okay. No, that's good color. I wanted to also ask just on Affirm Card. I think it said in the shareholder letter that the recent cohorts are actually using the product more than some of the initial cohorts. I think conceptually, we might have thought that the early adopters would kind of be the heaviest users, but just curious to get your take on that, Max. And then just any thoughts you guys might have on how card GMV might trend in Q4.

So, great question. And that is definitely something that I keep a much closer eye on than even quarterly measure. This is a day by day, week by week, my last conversation before I walked into this one was with one of our card leaders right outside this room, just to give you a sense for where I spend my time. So you're totally right. It would seem to reason that early adopters would just convert and put their card -- put our card at the top of their wallet and go and you should see some normalization that has not happened. I didn't necessarily predicted that way, but the reason for it is simple. I didn't say one of the analysts now said it, but it's a unique product. Every time you launch a new product, you are teaching the market or teaching the consumer anyway, a bunch of new modalities that they have not experienced yet, which is for some people a tool there, and for some people a vision that they're trying to pursue. And I hope I'm in the latter, but perhaps sometimes in a former category, too. As you offer the product to the market, you get consumer feedback. And we have 1 million cards out there now with lots and lots of feedback and some people love it, and some people have issues, which we are very attentive to. The last quarter, we've launched unaccountable number of tweaks and fixes to the user interface, most importantly, and just made the card more and more comprehensible and easy to use and easier to understand than just eliminating surprise user experiences and an end. And so as we do that, we find another point, another 3 points of usage where people say, "Oh, okay, so now I get what I'm supposed to do in a gas station or now I'm supposed to do this in a restaurant". And like these are real examples like a restaurant pay later mode is a little bit trickier because you might get a tip. And so the number you see on your bill is not the same number, et cetera, et cetera. And so as we just go and make the card smoother and smoother, we find new usage. That's why we think the usage increased. One interesting stat, we were roughly 6% pay now. Last quarter, we are closing in on 10% paying out this quarter. Still incidentally, those are not top of wallet numbers, like that's still climbing, but that's a really good clip, and we're going to keep growing until we get more. We think there's a lot more consumer spend to capture from the card and that's certainly what we are aiming for.

Our next question comes from the line of Dan Dolev with Mizuho.

I just have one question. With rising interest rates, I'm actually surprised to see how resilient GMV is and margins are going up. Like what is driving this resiliency? I mean it's pretty amazing to see that.

Thank you. That's a very nice complement. So we said it before, I sometimes tweet about it, but I'm not sure people read my tweets, maybe a good thing. Higher for longer, is, okay, with us. We are not super rate-sensitive so long as rates move in subtle increments, 25 bps up or down just doesn't change our cost of capital in a dramatic way. And our resilience is not secret, it's just the fact that the business isn't ultimately all that sensitive to minor rate movements. I think other lending businesses speaking differently. Ours has this really nice property where we are just not that rate-sensitive. And we are very, very comfortable operating the business at this growth, at the rates that the Fed has set for us, and we'll continue growing with or without rate cuts.

Our next question comes from the line of Bryan Keane with Deutsche Bank.

Bryan Connell Keane

Max, I just want to ask about Affirm Card. I know it was down a little bit sequentially, but it sounds like that was mostly seasonality. And just as we think about the longer picture trajectory of the card and the adoption of the card, how do you think about volume growth on Affirm Card? Just trying to get a sense of what the trajectory will look like given you probably have a pretty good idea of what the pipeline looks like.

It is entirely seasonal. That's certainly the correct assumption. I think we talked about it last quarter, so it should not be in any way a surprise. Very happy with the clip. We're still not promoting it nearly as aggressively as we feel we could because, as I just said, we have a bunch more to do just on the user interface and product improvements. I'm not sure I will offer a specific shape of the curve for the card growth just now given that it's still in this hyper-growth stage, so easier to be wrong than right. But we have a huge number of things to ship there. We're still experimenting very actively with various kinds of rewards. Obviously, we want to be careful with margins, but it's a product that we're very excited about. We feel that it's just has lots and lots of room to grow. I think one sort of a good measure, like we really started to just offer it widely just -- if you wanted to stretch it 2 years ago, if you wanted to sort of take it a little bit more narrowly a year ago, it's now very squarely trending towards multibillion dollar business. So just from a pure like where have you been, where are you going. I'm not sure if there are any other financial services companies that can figure at that launch a card product for the first time and end up in multibillion dollars within 12 to 18 months. And so we have a lot of features to roll out. I promised myself I'll never pre-announce things on these calls, so I won't, but we've got some really cool stuff coming.

Yes. And the only thing I'd add, Bryan, is if you look at spend on a trailing 12-month basis to capture cancel out some of that seasonality, we actually saw a spend per user increasing at a pretty healthy clip from Q2 to Q3. So we feel very, very good about the engagement on the product right now.

Got it. Got it. And the adjusted operating margin keeps kind of beating expectations. And I think in the fourth quarter, we're guiding of 15% to 17%. Can you just talk about what you're seeing on the margin? And is that a good jumping off point as we go into next year? Or are there some other puts and takes to think about?

It's a great question. Yes, I think this year has been a real year where we've been able to drive pretty meaningful operating leverage in the business. That's a function of us really driving strong growth in our unit economics with the revenue less transaction costs growing very quickly and are flat or even reducing fixed operating expenses. And so we would expect some of those trends to play out. However, we do still feel very optimistic about the opportunities ahead of us. So there's lots of exciting things that we're working on that will need resources. And so we definitely not want folks to think that we're going to be much above our framework that we gave investors in November. We think we continue to have revenue growth rate numbers that are well above our 20% threshold that we put out there in November. And we expect us to live within the operating -- adjusted operating income framework that we put out in November.

Our next question comes from the line of James Faucette with Morgan Stanley.

James Eugene Faucette

Thanks for doing it this morning. I appreciate the call out on increasing exposure given the credit performance and the yields that you're generating right now, which seems like it could create some potential for near-term delinquency increases. But I'm wondering, is there a framework of how we should be thinking about GMV versus credit right now? It seems like if we look at the 30-day plus DQs on some of your prior deals that there's still a fair way to go to a high watermark. So just how should we think about that balance of driving volume growth versus where some of these other delinquency measures and credit measures may move?

Good question, thank you, James. So what I meant in my note is that we are over earning, as Michael would put it, which means that we have capital to invest in growth. That does not necessarily mean loosening. In fact, summer, in particular, is a seasonally high delinquency rate time. And so there will be undoubtedly seasonal fluctuations in delinquencies, more likely up than down. We're very, very concerned with delinquencies at any given time just because of that's single most important part of the job here. But having a little extra money on hand to invest doesn't always mean so let's take a little bit more risk. What it does mean, for example, that, but also you could invest that in APR subsidies, which go towards the higher credit quality borrowers and create positive selection bias in the credit portfolio. And so we'll definitely reinvest the extra gains. We will still maintain an extremely vigilant watch over credit. As we've always said and we'll continue to say and behave, we don't use credit as a growth driver or limiter. Credit is a thing we manage entirely discretely. There's not a conversation about, well, if we just tighten a little bit, the growth will slow down, and we don't want that. We want growth as much as we can responsibly handle but not before we have credit results that we like, and most importantly, our capital markets partners like. And so we'll look at, we'll manage that entirely separately and we'll find all the intelligent ways that we can possibly grow. And I don't think we're supposed to offer a framework for that, but I just want to double stress, there's no coupling there, and there should not be coupling there.

Great. That's great answer there, Max. And then I wanted to ask a follow-up on the Affirm Card, and clearly, a lot of work going into the user interface and points where you can reduce friction. In previous comments, you've talked about some of the things that you're doing on the customer service side, and I think have also called out even using AIS systems to help improve those customer support costs. I just want to hear from you, where we're at on that process and kind of what are the additional things that can be done to bring down cost of support versus reducing upfront usage friction and where you feel like you're at on that process?

Great, complex question to spend the next 30 minutes diving into all that stuff. That's what I like talking about. So on the card, I think I mentioned this before, so it shouldn't come as a surprise, but we have a whole -- we think of these things in work streams. So we have a work stream called SUX, so surprise user experience. And the card is a new product, as I've mentioned just now, and there's plenty of surprises that we do not want our consumers to have with the card on. So we've been very, very busy just polishing the rough edges. And that's a long list. And if you use the card, you will see what we've done there. It's -- some of it is very apparent and some of it is a little bit more sophisticated, but just to give you like a glimpse into this. Because the card sometimes runs over Visa rails, sometimes runs over our own, there are situations where you have to match a transaction or somebody, for example, wants a partial refund, et cetera. And so just a logic around transaction matching going back sometimes 30 days, et cetera, is fairly complicated. And the more intelligent you are in transaction matching, the better you can serve somebody, somebody who calls your [CAPS] with you and saying, "Hey, this transaction, I have to cancel it, showed up not as described. I have a chargeback, whatever". If you know exactly what it is, the call will go faster and the consumer will be happier. And so that sounds like a small thing, but it's a major cost reducer, for example. And there's like 3 dozen more where they came from. On the AI side of things, because I'm always terrified of sounding like too much of a nerd, because I am, we try to make sure our AI strategy is technology that is real versus PR, which is what we're encountering a lot in industry right now or at least pure PR. And so we've been, generally speaking, fairly quieting dismiss about it. But we've been investing really heavily in this idea that most -- certainly, GenZ consumers really love chatting versus calling and they have no problem chatting with an AI, especially if the AI is intelligent. There's lots and lots of really complex things. One is, obviously, everybody sort of knows hallucination is a thing in AI, and you have to be very careful. But there's a bunch of really smart solutions that people in the industry have come up with, us, including where hallucination is not a problem, and we can very, very quickly satisfy a query certainly around a question of what do you do or what's your policy or what do I do as a consumer, if I have an issue or a problem, et cetera. And that's been working really, really well. And the -- it's very early, like we expect to do a lot more there. No one has yet to lose their job to be replaced by robot at a firm. So that's not a short-term cost saving. But in terms of our ability to scale our customer service and base as we employ AI more and more, that's certainly going to be a saving over the next 1, 2, 3 years. We expect for consumers to always be able to reach a human. I think that's really important. But by the time they get to a human, they want to hear someone who's an expert, who has a really deep understanding of what's happening with that particular account, that transaction, whatever dispute or questions they may have. And you can prework a lot of that with AI. And so that's where we're spending a lot of our cycles and like super excited about that. Again, we try to not talk too much about it because it's just the cacophony of everybody being AI-powered is a little too low right now. But it's a really exciting tech, and we're super (inaudible) deployed.

Our next question comes from the line of Reginald Smith with JPMorgan.

Reginald Lawrence Smith

Congrats on the quarter. I had two questions. The first, and I'm not sure if you guys have disclosed this, but I was curious if there's a way to talk about like where you're seeing your Affirm Card or the type of customers you're resonating with, within your base, so thinking about income or credit band. Is there a way to kind of talk about that? Were you seeing traction in particular in any given segment? And then I have a follow-up question.

Two questions. Obviously, this is essentially a transaction card or a transactor card for habitual revolver. I think that's probably the best way to describe the near perfect product market fit with the card. We have all the expectations and designs to do -- to address many other bands of credit. But the idea of someone saying, "I don't want to be in debt in a way that I can't predict. I like the ability to finance some things and to not finance others very explicitly", that is the purpose of the card. That's the marketing message. That's the story we tell to our consumers when they say, why do I need a have the card. And so that is the user. The user says, hey, some things need to be paid over time and some things need to be paid for right now. And I don't want to comingle the two. I'm not going to pay interest on a cup of coffee. That is the buyer. And that's what we have today, and you can see it in all the stats.

Okay. That's helpful. And then thinking about you guys break out quarterly the number of kind of new transactors, you also give like a mix of volume. I was curious, and my guess is that it probably doesn't track your volume mix. But if you were to think about where your new customers have come in, whether it's paying for core 0 or installment, what's that mix? And then the second piece of that question is, in cases or intents where you're not the only BNPL solution on a website, how does that impact, I guess, new user adoption? Is there any [slippage] your impact from being, I guess, the exclusive of BNPL provider on certain platforms in terms of acquiring new customers, if that makes sense.

Yes. It's a good question, a lot of depth to this. I'll start my guess as Michael will have some stats that he is willing to share, may, maybe not. In terms of exclusivity versus not, we don't need exclusivity to win. We are very, very comfortable being right alongside other BNPL providers because we offer products that are quite unique. And so wherever an active checkout shows up, that is, generally speaking, what that particular customer base needs and so our ability to predict what might be best for that user is really good and et cetera, et cetera. We also have underwritten 50 million people in the United States alone. So the brand speaks for itself. We are unique or mostly unique at this point, which is actually to the good that we don't charge late fees, we don't compound interest. We don't have deferred interest, et cetera. And so our customer knows who we are, they seek us out. And even the ones that don't haven't an Affirm account yet, there's now a meaning to what Affirm stands for. And I think that takes a long time to persuade the market that we really are not lying or not kidding when we're saying there are no hidden fees, but it seems to be working at this point. And so in terms of exclusivity, not a hugely important thing. I'm confident that people who love their brand X competing product probably go through that door. So I'm sure we are not alone in the feeling of our users love us, but our users do seem to love us. And if you read my letter, I have a little bit of a dramatic story from a recent store trip where this woman was just, we couldn't have scripted it better. She was gushing about us and comparing us to the competitors say, "Oh, my god, you're so much better than everybody else and like so you're very familiar with the market and you made a choice." So I think from sort of anecdotally and in the numbers, we don't suffer from being side by side with anybody. I don't know if Michael has anything to add on the specifics of where we pick up the new users?

No. I think it definitely tracks where we currently have distribution in the products that we have distributed there. Every time we're shown on a product display page, every time we're seeing a checkout, it's a chance to acquire a user, but also chance to reengage new users. The only thing I would add is that it is the case that when we are launched side-by-side, maybe as a second or third BNPL product on an existing merchant site. We do see higher repeat rates there. And I think that's the power of our network on display. And oftentimes, merchants really quickly understand that adding us is incremental because of that.

Yes. Actually, one other thing that I should have said earlier, one of the niceties of being as large as we are, is our ability to sort of barge into some of the checkouts that used to be exclusive property of another player and say, "Hey, we're not telling you what to do, but we do have 50 million people, we've underwritten that at least a large percentage of really like this, you probably should add us alongside the competitor". And I said it before and I'll say it again, the first fundraising deck that I've ever put together for this company, featured a mockup obviously, of a convenience store door that showed Visa, Mastercard, Amex, Affirm sort of the ultimate goal of this company is to be a brand that everybody just expects in a grocery store door. We're starting to get there. We're not quite there yet, and I don't know if we're going to be there, certainly not next quarter, just if we go back to the we don't run the business by quarter thing. But that is the future we're trying to get to. And we're now in a place where merchants say, "Well, yes, I probably should add you guys because there's a lot of people who want to use Affirm".

No, that makes sense, and I appreciate that. The reason I ask is we, obviously, we've got a lot of questions about Walmart and then introducing their own thing. And I think it's good to hear how you guys compete or just how viable the product is even with a competing [brand and button]. So I appreciate the color there.

Our next question comes from the line of John Hecht with Jefferies.

Just looking at AOV. Now I know AOV has been really impacted over the last several quarters by kind of a mix shift from some of the larger transaction partners that you've had. But I'm wondering what you're seeing at the point of sale now, and if you're seeing any trends for what users are using to buy now pay later for now relative to water in recent quarters and what that tells you about usage in the future.