- Vacation packages

- Things to do

- AARP Member Savings

- Create an Account

- List of Favorites

- Not ? Log in to your account

Create your free account

Sign in to your account, travel protection plans, package protection plan.

Take travel woes into account with the Package Protection Plan. This plan covers you from the moment you book your vacation until you return home.

- Change or cancel your trip for any reason one time prior to departure

- Enjoy coverage from the time you book until you return home

- Provides reimbursement for emergency medical expenses, lost luggage, and more

For a pre-travel plan only, consider the Vacation Waiver

Please see Terms and Conditions for full terms, including limitations and exclusions.

- Plan Coverage

- What's Not Covered

- Claim Instructions

- Terms Of Coverage

- Definitions

Important: This program is valid only if the appropriate plan cost has been received by Expedia, Inc. Please keep this document as your record of coverage.

SECTION I: Expedia Vacation Waiver

IMPORTANT: Benefits under Section I are provided by Expedia, Inc. Details regarding cancellation penalties, terms and conditions are fully outlined here.

Change or cancel for any reason

The Expedia Vacation Waiver helps protect you against life's unexpected occurrences. Your group is allowed to change or cancel your trip for any reason one (1) time prior to the scheduled start time* of your trip without being charged any change or cancellation fees. If canceling, any monies paid will be returned to the customer who booked the travel except the cost of published airfare, which may be made available as a credit for future travel.**

Note: The waiver is valid once you have paid the appropriate waiver cost and your booking is confirmed.

*Scheduled Start Time is defined as the originally scheduled departure time of your flight or, if you haven’t booked a flight as part of your package, the scheduled check-in time of your hotel at the time of booking. Other terms and conditions apply. Please see Terms and Conditions below.

**For a published air ticket , credit may be issued per applicable airline policies less airline change fees and Expedia, Inc. will absorb the change fees. The actual airfare could be higher at the time of rebooking; in that event the price differential would be your responsibility. You are allowed to change or cancel your trip for any reason one (1) time prior to the start of your trip.

Refund Instructions

When your group purchases Expedia Vacation Waiver you will be asked to print your voucher. Please keep your voucher handy as a reference. You do not need to redeem your voucher at any time. You will also be able to access your information from the voucher in your online itinerary once your booking is confirmed. The Expedia Vacation Waiver is valid for redemption only by the person(s) named on the voucher. The waiver is not transferable, has no cash value, and may be redeemed only once. Once the voucher has been utilized it cannot be reused. The Expedia Vacation Waiver must be purchased at the time of booking; waivers cannot be purchased after booking.

You must call contact Expedia at 1-800-675-4318 to cancel or change your vacation package.

Terms & Conditions

The Expedia Vacation Waiver is valid for redemption only by the person(s) named on the voucher. It is not transferable, has no cash value, and may be redeemed only once. The Expedia Vacation Waiver must be purchased at the time of booking; waivers cannot be purchased after booking. The Vacation Waiver excludes the price of the Expedia Vacation Waiver.

If you change or cancel your trip for ANY REASON prior to the scheduled start time* of your trip, all package cancellation fees imposed by the Booking Agent will be waived, except the cost of Published Air.

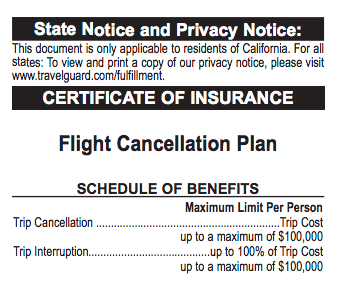

SECTION II: Coverages offered by Insurer

Stonebridge Casualty Insurance Company Travel Insurance Certificate Policy Number MZ0911076H0002A

DESCRIPTION OF COVERAGE

- Schedule: Expedia, Inc Maximum Benefit Amount

PART A. TRAVEL ARRANGEMENT PROTECTION

- Trip Cancellation Up to Total Vacation Cost

- Trip Interruption Up to Total Vacation Cost

- Trip Delay $500, Up to $100/day

PART B. MEDICAL PROTECTION

- Emergency Evacuation/Repatriation of Remains $15,000

- Accident Medical Expense $5,000

- Sickness Medical Expense $5,000

PART C. BAGGAGE PROTECTION

- Baggage/Personal Effects $1,000

- Baggage Delay $500

PART D. TRAVEL ACCIDENT PROTECTION

- Accidental Death & Dismemberment Air Common Carrier $50,000

PART E. WORLDWIDE EMERGENCY ASSISTANCE (On Call International)

- CareFree™ Travel Assistance 24/7

- Medical Assistance 24/7

- Emergency Services 24/7

The benefits provided in this program are subject to certain restrictions and exclusions. Important: Please read this brochure in its entirety for a complete description of all coverage terms and conditions. Note: Words beginning with capital letters are defined in this text.

SUMMARY OF COVERAGES

Trip Cancellation and Trip Interruption Benefits

Pre-Departure Trip Cancellation

We will pay a Pre-Departure Trip Cancellation Benefit, up to the amount in the Schedule for non-refundable cancellation charges imposed by Expedia, Inc. if you are prevented from taking your Covered Vacation due to your, an Immediate Family Member’s, Traveling Companion’s, or Business Partner’s Sickness, Injury or death or Other Covered Events as defined, that occur(s) before departure on your Covered Vacation.

The Sickness or Injury must: a) commence while your coverage is in effect under the plan; b) require the examination and treatment by a Physician at the time the Covered Vacation is canceled; and c) in the written opinion of the treating Physician, be so disabling as to prevent you from taking your Covered Vacation.

Pre-Departure Trip Cancellation Benefits

We will reimburse you, up to the amount in the Schedule for the amount of prepaid, non-refundable, and unused Payments or Deposits that you paid for your Covered Vacation. We will pay your additional cost as a result of a change in the per person occupancy rate for prepaid travel arrangements if a Traveling Companion’s Covered Vacation is canceled and your Covered Vacation is not canceled.

Note: As respects air cancellation penalties, you will be covered only for air arrangements booked through Expedia, Inc. and flights connecting to such air arrangements booked through Expedia, Inc. We will not pay benefits for cancellation charges imposed on any other air arrangements you may book on your own.

Post-Departure Trip Interruption

We will pay a Post-Departure Trip Interruption Benefit, up to the amount in the Schedule, if: 1) your arrival on your Covered Vacation is delayed; or 2) you are unable to continue on your Covered Vacation after you have departed on your Covered Vacation due to your, an Immediate Family Member’s, Traveling Companion’s, or Business Partner’s, Sickness, Injury or death or Other Covered Events as defined.

For item 1) above, the Sickness or Injury must: a) commence while your coverage is in effect under the plan; b) for item 2) above, commence while you are on your Covered Vacation and your coverage is in effect under the plan; and c) for both items 1) and 2) above, require the examination and treatment by a Physician at the time the Covered Vacation is interrupted or delayed; and d) in the written opinion of the treating Physician, be so disabling as to delay your arrival on your Covered Vacation or to prevent you from continuing your Covered Vacation.

Post-Departure Trip Interruption Benefits

We will reimburse you, less any refund paid or payable, for unused land or water travel arrangements, and/or the following:

- the additional transportation expenses by the most direct route from the point you interrupted your Covered Vacation: a) to the next scheduled destination where you can catch up

- the additional transportation expenses incurred by you by the most direct route to reach your original Covered Vacation destination if you are delayed and leave after the Scheduled Departure Date. However, the benefit payable under (1) and (2) above will not exceed the cost of a one-way economy air fare by the most direct route less any refunds paid or payable for your unused original tickets.

- your additional cost as a result of a change in the per person occupancy rate for prepaid travel arrangements if a Traveling Companion’s Covered Vacation is interrupted and your Covered Vacation is continued.

- reasonable additional accommodation and transportation expenses (up to $100 per day) incurred to remain near a covered traveling Immediate Family Member or Traveling Companion who is hospitalized during your Trip.

In no event shall the amount reimbursed under Trip Cancellation or Trip Interruption exceed the amount you prepaid for your Trip.

Important: You, your Traveling Companion and/or your Immediate Family Member booked to travel with you must be medically capable of travel on the day you purchase this coverage. The covered reason for cancellation or interruption of your Trip must occur after your effective date of Trip Cancellation coverage.

Other Covered Events means only the following unforeseeable events or their consequences which occur while coverage is in effect under this Policy: a change in plans by you, an Immediate Family Member traveling with you, or Traveling Companion resulting from one of the following events which occurs while coverage is in effect under this Policy:

- being directly involved in a documented traffic accident while en route to departure;

- being hijacked, Quarantined, required to serve on a jury, or required by a court order to appear as a witness in a legal action, provided you, an Immediate Family Member traveling with you or a Traveling Companion is not: 1) a party to the legal action, or 2) appearing as a law enforcement officer;

- having your Home made uninhabitable by fire, flood, volcano, earthquake, hurricane or other natural disaster;

- Your involuntary termination of employment or layoff which occurs after your effective date of coverage and was not under your control. You must have been continuously employed with the same employer for 1 year prior to the termination or layoff. This provision is not applicable to temporary employment, independent contractors or self- employed persons.

If your Covered Vacation is delayed for 12 hours or more, we will reimburse you, up to the amount shown in the Schedule for unused land or water travel arrangements, less any refund paid or payable and reasonable additional expenses incurred by you for hotel accommodations, meals, telephone calls and economy transportation to catch up to your Trip, or to return Home. We will not pay benefits for expenses incurred after travel becomes possible.

Trip Delay must be caused by or result from:

- Air Common Carrier delay;

- loss or theft of your passport(s), travel documents or money;

- being Quarantined;

- natural disaster;

- a documented traffic accident while you are en route to departure;

- unannounced strike;

- a civil disorder.

Medical Expense/Emergency Assistance Benefits

We will pay this benefit, up to the amount on the Schedule for the following Covered Expenses incurred by you, subject to the following: 1) Covered Expenses will only be payable at the Usual and Customary level of payment; 2) benefits will be payable only for Covered Expenses resulting from a Sickness that first manifests itself or an Injury that occurs while on a Covered Vacation; 3) benefits payable as a result of incurred Covered Expenses will only be paid after benefits have been paid under any Other Valid and Collectible Group Insurance in effect for you.

We will pay that portion of Covered Expenses which exceed the amount of benefits payable for such expenses under your Other Valid and Collectible Group Insurance.

Covered Expenses:

Accident Medical Expense/Sickness Medical Expense:

- expenses for the following Physician-ordered medical services: services of legally qualified Physicians and graduate nurses, charges for Hospital confinement and services, local ambulance services, prescription drugs and medicines, and therapeutic services, incurred by you within one year from the date of your Sickness or Injury;

- expenses for emergency dental treatment incurred by you;

Emergency Evacuation:

- expenses incurred by you for Physician-ordered emergency medical evacuation, including medically appropriate transportation and necessary medical care en route, to the nearest suitable Hospital, when you are critically ill or injured and no suitable local care is available, subject to the Program Medical Advisors prior approval;

- expenses incurred for non-emergency medical evacuation, including medically appropriate transportation and medical care en route, to a Hospital or to your place of residence, when deemed medically necessary by the attending Physician, subject to the Program Medical Advisors prior approval;

- expenses for transportation not to exceed the cost of one round-trip economy class air fare to the place of hospitalization for one person chosen by you, provided that you are traveling alone and are hospitalized for more than 7 days;

- expenses for transportation not to exceed the cost of one-way economy class air fare to your place of residence, including escort expenses if you are 25 years of age or younger and left unattended due to the death or hospitalization of an accompanying adult(s), subject to the Program Medical Advisors prior approval;

- expenses for one-way economy class air fare to your place of residence, from a medical facility to which you were previously evacuated, less any refunds paid or payable from your unused transportation tickets, if these expenses are not covered elsewhere in the plan.

Repatriation:

- repatriation expenses for preparation and air transportation of your remains to your place of residence, or up to an equivalent amount for a local burial in the country where death occurred, if you die while on your Covered Vacation.

Losses Not Covered:

Please Note: In no event will all benefits paid for Emergency Evacuation and Repatriation expenses exceed the coverage limit of $15,000.

Please note: Benefits under Parts A & B (except Emergency Evacuation and Repatriation) are subject to exclusions listed on Pages 12-13.

Baggage and Personal Effects Benefit

We will reimburse you, less any amount paid or payable from any other valid and collectible insurance or indemnity, up to the amount shown in the Schedule, for direct loss, theft, damage or destruction of your Baggage during your Covered Vacation.

Valuation and Payment of Loss

Payment of loss under the Baggage and Personal Effects Benefit will be calculated based upon an Actual Cash Value basis. For items without receipts, payment of loss will be calculated based upon 80% of the Actual Cash Value at the time of loss. At our option, we may elect to repair or replace your Baggage. We will notify you within 30 days after we receive your proof of loss.

We may take all or part of a damaged Baggage as a condition for payment of loss. In the event of a loss to a pair or set of items, we will: 1) repair or replace any part to restore the pair or set to its value before the loss; or 2) pay the difference between the value of the property before and after the loss.

Items Subject to Special Limitations

We will not pay more than $1,000 (or the Baggage and Personal Effects limit, if less) on all losses to jewelry; watches; precious or semi-precious gems; decorative or personal articles consisting in whole or in part of silver, gold, or platinum; cameras, camera equipment; digital or electronic equipment and media; and articles consisting in whole or in part of fur. There is a $500 per article limit.

Baggage Delay Benefit

We will reimburse you, less any amount paid or payable from any other valid and collectible insurance or indemnity, up to the amount shown in the Schedule for the cost of reasonable additional clothing and personal articles purchased by you, if your Baggage is delayed by an Air Common Carrier for 24 hours or more during your Covered Vacation. You must be a ticketed passenger on an Air Common Carrier.

Accidental Death and Dismemberment

Air Common Carrier Benefits We will pay this benefit, up to the amount on the Schedule, if you sustain a covered loss in an Accident which occurs: 1) while a passenger in or on, boarding or alighting from an Air Common Carrier or 2) being struck or run down by an Air Common Carrier of a regularly scheduled airline or an air charter company that is licensed to carry passengers for hire while you are on a Covered Vacation and covered under the plan, and you suffer one of the losses listed below within 365 days of the Accident. The Principal Sum is the benefit amount shown in the schedule.

- Loss Percentage of Principal Sum Payable

- Both Hands; Both Feet or Sight of Both Eyes 100%

- One Hand and One 100%

- One Hand and Sight of One Eye 100%

- One Foot and Sight of One Eye 100%

- One Hand; One Foot or Sight of One Eye 50%

If you suffer more than one loss from one Accident, we will pay only for the loss with the larger benefit. Loss of a hand or foot means complete severance at or above the wrist or ankle joint. Loss of sight of an eye means complete and irrecoverable loss of sight.

Not a care in the world... when you have our 24/7 global network to assist you

CareFree™ Travel Assistance

- Medical Assistance

Emergency Services

Travel Arrangements

- Arrangements for last-minute flight and hotel changes

- Luggage Locator (reporting/tracking of lost, stolen or delayed baggage)

- Hotel finder and reservations

- Airport transportation

- Rental car reservations and automobile return

- Coordination of travel for visitors to bedside

- Return travel for dependent/minor children

- Assistance locating the nearest embassy or consulate

- Cash transfers

- Assistance with bail bonds

Pre-trip Information

- Destination guides (hotels, restaurants, etc.)

- Weather updates and advisories

- Passport requirements

- Currency exchange

- Health and safety advisories

Documents and Communication

- Assistance with lost travel documents or passports

- Live email and phone messaging to family and friends

- Emergency message relay service

- Multilingual translation and interpretation services

Medical Assistance and Managed Care

- Medical case management, consultation and monitoring

- Medical Transportation

- Dispatch of a doctor or specialist

- Referrals to local medical and dental service providers

- Worldwide medical information, up-to-the-minute travel medical advisories, and immunization requirements

- Prescription drug replacement

- Replacement of eyeglasses, contact lenses and dental appliances

- Emergency evacuation

- Repatriation of mortal remains

- Emergency medical and dental assistance

- Emergency legal assistance

- Emergency medical payment assistance

- Emergency family travel arrangements

CareFree™ Travel Assistance, Medical Assistance and Emergency Services can be accessed by calling On Call International at 1-800-618-0692 or, from outside the U.S. or Canada, call collect:* 1-603-328-1711

* If you have any difficulty making this collect call, contact the local phone operator to connect you to a US-based long-distance service. In this case, please let the Assistance Provider answering the phone know the number you are calling from, so that he/she may call you back. Any charges for the call will be considered reimbursable benefits.

Note that the problems of distance, information, and communications make it impossible for Stonebridge Casualty Insurance Company, Berkely, Expedia, Inc., or On Call International to assume any responsibility for the availability, quality, use, or results of any emergency service. In all cases, you are still responsible for obtaining, using, and paying for your own required services of all types.

Section I: Cancellation Fee Waiver

You may Change or Cancel your trip for ANY REASON one (1) time prior to the start of your trip. All cancellation fees will be covered by Expedia, except the cost of published air. Credit, pursuant to applicable airline policies, may be issued less airline change fees, and Expedia, Inc. will absorb the change fees. The actual airfare could be higher at the time of rebooking; in that event the price differential would be your responsibility.

GENERAL PLAN EXCLUSIONS

In parts a & b:, we will not pay for any loss caused by or incurred resulting from:.

- mental, nervous, or psychological disorders, except if hospitalized;

- being under the influence of drugs or intoxicants, unless prescribed by a Physician;

- normal pregnancy, except if hospitalized; or elective abortion;

- riding or driving in any motor competition;

- declared or undeclared war, or any act of war;

- service in the armed forces of any country;

- operating or learning to operate any aircraft, as pilot or crew;

- any unlawful acts, committed by you or a Traveling Companion (whether insured or not);

- any amount paid or payable under any Worker’s Compensation, Disability Benefit or similar law;

- Elective Treatment and Procedures;

- medical treatment during or arising from a Covered Vacation undertaken for the purpose or intent of securing medical treatment;

- business, contractual or educational obligations of you, an Immediate Family Member or Traveling Companion;

- failure of any tour operator, Common Carrier, or other travel supplier, person or agency to provide the bargained-for travel arrangements;

- a loss that results from an illness, disease, or other condition, event or circumstance which occurs at a time when the plan is not in effect for you.

ITEMS NOT COVERED WE WILL NOT PAY FOR DAMAGE TO OR LOSS OF:

- property used in trade, business or for the production of income, household furniture, musical instruments, brittle or fragile articles, or sporting equipment if the loss results from the use thereof;

- artificial limbs or other prosthetic devices, artificial teeth, dental bridges, dentures, dental braces, retainers or other orthodontic devices, hearing aids, any type of eyeglasses, sunglasses or contact lenses;

- documents or tickets, except for administrative fees required to reissue tickets;

- money, stamps, stocks and bonds, postal or money orders, securities, accounts, bills, deeds, food stamps or credit cards,

- property shipped as freight or shipped prior to the Scheduled Departure Date.

THE FOLLOWING EXCLUSIONS APPLY TO THE ACCIDENTAL DEATH AND DISMEMBERMENT COVERAGE:

- We will not pay for loss caused by or resulting from Sickness of any kind.

- You, your Traveling Companion’s, or Immediate Family Member’s booked to travel with you, suicide, attempted suicide, or intentionally self-inflicted injury, while sane or insane (while sane in CO & MO);

- participation as a professional in athletics;

- participation in organized amateur and interscholastic athletic or sports competition or events;

- nuclear reaction, radiation or radioactive contamination;

- mountain climbing, bungee cord jumping, skin diving, scuba diving, snow skiing, skydiving, parachuting, hang gliding, parasailing or travel on any air supported device, other than on a regularly scheduled airline or air charter company.

LOSSES NOT COVERED WE WILL NOT PAY FOR LOSS ARISING FROM:

- theft or pilferage from an unattended vehicle;

- mysterious disappearance;

- EMERGENCIES ARISING DURING YOUR TRIP: Please refer to Part E. Worldwide Emergency Assistance

- TRIP CANCELLATION CLAIMS: Contact Expedia, Inc. and BerkelyCare IMMEDIATELY to notify them of your cancellation and to avoid any non-covered expenses due to late reporting. BerkelyCare will then forward the appropriate claim form which must be completed by you AND THE ATTENDING PHYSICIAN, if applicable. If you are cancelling due to a death, a death certificate will be required.

- ALL OTHER CLAIMS: Report your claim as soon as possible to BerkelyCare. Provide the policy number, your travel dates, and details describing the nature of your loss. Upon receipt of this information, BerkelyCare will promptly forward you the appropriate claim form to complete. If you are interrupting due to a death, a death certificate will be required.

Online: www.travelclaim.com

Phone: 1-(800) 453-4079 or 1-(516) 342-2720

Mail: BerkelyCare 300 Jericho Quadrangle, P.O. Box 9022, Jericho, NY 11753 Office Hours: 8:00 am - 10:00 pm ET, Monday - Friday; 9:00 am - 5:00 pm ET, Saturday

IMPORTANT: In order to facilitate prompt claims settlement upon your return, be sure to obtain as applicable:

Accident & Sickness Medical Claims – receipts from the treating Physicians, etc. stating the amounts paid and listing the diagnosis and treatment; submit these first to your other medical plans. Forward a copy of their final disposition of your claim to BerkelyCare.

- You must provide us with all bills and reports for medical and/or dental expenses claimed.

- You must provide any requested information, including but not limited to, an explanation of benefits from any other applicable insurance.

- You must sign a patient authorization to release any information required by us, to investigate your claim.

- You must receive initial treatment within 90 days of the accident, which caused the Injury or the onset of the Sickness.

Your duties in the event of a Trip Interruption & Trip Delay Claims: Medical statements from the Physicians in attendance in the country where the Sickness or Injury occurred. These statements should give complete diagnosis, stating that the Sickness or Injury prevented traveling on dates contracted. Or, verification of the Common Carrier’s mechanical or scheduling problems, or verification of other covered reason causing delay. Provide all unused transportation tickets, official receipts, etc.

Your duties in the Event of a Baggage/Personal Effects Loss: In case of loss, theft or damage to Baggage and Personal Effects, you should: 1) immediately report the situation incident to the hotel manager, tour guide or representative, transportation official, local police or other local authorities and obtain their written report of your loss; and 2) take reasonable steps to protect your Baggage from further damage, and make necessary, reasonable and temporary repairs. We will reimburse you for these expenses. We will not pay for further damage if you fail to protect your Baggage. Submit claim first to party responsible, as well as your regular property insurer. Forward copies of the outcome of your claim to BerkelyCare with the appropriate documentation, including copies of receipts for the lost, stolen, or damaged articles, if available.

When Coverage Begins

All coverages (except Pre-Departure Trip Cancellation and Post-Departure Trip Interruption) will take effect on the later of: 1) the date the plan payment has been received by Expedia, Inc.; 2) the date and time you start your Covered Vacation; or 3) 12:01 A.M. Standard Time on the Scheduled Departure Date of your Covered Vacation.

Pre-Departure Trip Cancellation coverage will take effect at 12:01 A.M. Standard Time on the day your plan payment is received by Expedia, Inc. Post-Departure Trip Interruption coverage will take effect on the Scheduled Departure Date if the required plan payment is received.

When Coverage Ends

Your coverage automatically ends on the earlier of:

- the date the Covered Vacation is completed;

- the Scheduled Return Date;

- your arrival at the return destination on a round-trip, or the destination on a one-way trip;

- cancellation of the Covered Vacation covered by the plan.

In the certificate, “you”, “your” and “yours” refer to the Insured. “We”, “us” and “our” refer to the company providing the coverage. In addition certain words and phrases are defined as follows:

Accident means a sudden, unexpected, unintended and external event, which causes Injury.

Actual Cash Value means purchase price less depreciation.

Air Flight Common Carrier means any air conveyance operated under a license for the transportation of passengers for hire.

Baggage means luggage, personal possessions and travel documents taken by you on the Covered Vacation.

Business Partner means an individual who is involved, as a partner, with you in a legal general partnership and shares in the management of the business.

Covered Vacation means a period of travel away from Home to a destination outside your city of residence; the purpose of the Vacation is business or pleasure and is not to obtain health care or treatment of any kind; the Vacation has defined departure and return dates specified when the Insured enrolls; the Vacation does not exceed 6 months.

Common Carrier means any land, water or air conveyance operated under a license for the transportation of passengers for hire.

Domestic Partner means a person who is at least eighteen years of age and you can show: 1) evidence of financial interdependence, such as joint bank accounts or credit cards, jointly owned property, and mutual life insurance or pension beneficiary designations; 2) evidence of cohabitation for at least the previous 6 months; and 3) an affidavit of domestic partnership if recognized by the jurisdiction within which they reside.

Elective Treatment and Procedures means any medical treatment or surgical procedure that is not medically necessary including any service, treatment, or supplies that are deemed by the federal, or a state or local government authority, or by us to be research or experimental or that is not recognized as a generally accepted medical practice.

Home means your primary or secondary residence.

Hospital means an institution, which meets all of the following requirements:

- it must be operated according to law;

- it must give 24 hour medical care, diagnosis and treatment to the sick or injured on an inpatient basis;

- it must provide diagnostic and surgical facilities supervised by Physicians;

- registered nurses must be on 24 hour call or duty; and

- the care must be given either on the hospital’s premises or in facilities available to the hospital on a pre-arranged basis.

A Hospital is not: a rest, convalescent, extended care, rehabilitation or other nursing facility; a facility which primarily treats mental illness, alcoholism, or drug addiction (or any ward, wing or other section of the hospital used for such purposes); or a facility which provides hospice care (or wing, ward or other section of a hospital used for such purposes).

Immediate Family Member includes your or the Traveling Companion’s spouse, child, spouse’s child, son-daughter-in-law, parent(s), sibling(s), brother-sister, grandparent(s), grandchild, step brother-sister, step-parent(s), parent(s)-in-law, brother-sister-in-law, aunt, uncle, niece, nephew, guardian, Domestic Partner, foster-child, or ward.

Injury means bodily harm caused by an accident which: 1) occurs while your coverage is in effect under the plan; and 2) requires examination and treatment by a Physician. The Injury must be the direct cause of loss and must be independent of all other causes and must not be caused by, or result from, Sickness.

Insured means an eligible person who arranges a Covered Vacation and pays any required plan payment.

Insurer means Stonebridge Casualty Insurance Company.

Other Valid and Collectible Group Insurance means any group policy or contract which provides for payment of medical expenses incurred because of Physician, nurse, dental or Hospital care or treatment; or the performance of surgery or administration of anesthesia. The policy or contract providing such benefits includes group or blanket insurance policies; service plan contracts; employee benefit plans; or any plan arranged through an employer, labor union, employee benefit association or trustee; or any group plan created or administered by the federal or a state or local government or its agencies. In the event any other group plan provides for benefits in the form of services in lieu of monetary payment, the usual and customary value of each service rendered will be considered a Covered Expense.

Payments or Deposits means the cash, check, or credit card amounts actually paid to the Expedia, Inc. for your Covered Vacation.

Physician means a person licensed as a medical doctor by the jurisdiction in which he/she is a resident to practice the healing arts. He/she must be practicing within the scope of his/her license for the service or treatment given and may not be you, a Traveling Companion, or an Immediate Family Member of yours.

Policy means the contract issued to the Policyholder providing the benefits specified herein.

Policyholder means the legal entity in whose name this Policy is issued, as shown on the benefit Schedule.

Program Medical Advisors means On Call International.

Quarantined means the enforced isolation of an Insured and/or the restriction of free movement of an Insured suffering or suspected to suffer from a contagious disease to prevent the spread of contagious disease.

Schedule means the benefit schedule shown on the Certificate for each Insured.

Scheduled Departure Date means the date on which you are originally scheduled to leave on your Covered Vacation.

Scheduled Return Date means the date on which you are originally scheduled to return to the point where the Covered Vacation started or to a different final destination.

Scheduled Vacation Departure City means the city where the scheduled trip on which you are to participate originates.

Sickness means an illness or disease of the body which: 1) requires examination and treatment by a Physician, and 2) commences while the plan is in effect.

Traveling Companion means one person whose name appears with you on the same Trip arrangement and who, during the Trip, will accompany you.

Usual and Customary Charge means those charges for necessary treatment and services that are reasonable for the treatment of cases of comparable severity and nature. This will be derived from the mean charge based on the experience in a related area of the service delivered and the MDR (Medical Data Research) schedule of fees valued at the 90th percentile.

Vacation means a scheduled trip for which coverage has been elected and the plan payment paid, and all travel arrangements are arranged by the Expedia, Inc. prior to the Scheduled Departure Date of the trip.

What is the Package Protection Plan?

Part I: Cancel for ANY Reason waiver provided by Expedia.com

- Passengers can cancel or change their vacation one time for ANY REASON not covered under Part II prior to the start of their trip and receive CASH back for all cancellation fees and penalties, except the cost of Published Air.

- The value of Published Air may be used within a year of original ticket issue date, and Expedia will absorb the change fee. The actual airfare could be higher at time of rebooking.

Part II: Travel insurance plan administered by BerkelyCare

- A package of insurance benefits payable for covered reasons, as well as travel assistance services.

- Benefits include coverage for trip cancellations, interruptions and delays; medical coverage including emergency evacuations and repatriations; baggage losses and delays; and 24-hour emergency travel assistance.

Insurance is underwritten by Stonebridge Casualty Insurance Company, Columbus, OH.

Why should I purchase the Package Protection Plan?

You've saved, you've waited, and now you're all set to go on the vacation of your life - an Expedia vacation. Preparing for your vacation should include covering yourself against unfortunate occurrences that can interfere with even your best-laid plans. By purchasing the Package Protection Plan, you can be reimbursed for cancellation penalties, medical costs, baggage loss, and delays due to covered reasons, as well as gain access to a wide range of traveler's assistance services.

Unexpected situations can happen to anyone, even immediate family members that are not traveling with you, and provide you with a reason you might need to cancel or interrupt your trip. Plus, even after departure, there are important coverages included such as reimbursement for expenses caused by trip delays and baggage delays. And of course, having coverage that pays for unexpected medical expenses, most notably pricey evacuation expenses, is critical.

Did you know that the Package Protection Plan can reimburse covered expenses if:

- You become ill and can't travel.

- Someone in your immediate family has an illness or injury and you must cancel or interrupt your trip, even if he or she is not scheduled to travel with you.

- You must cancel your vacation plans for a work related reason.

- The wedding is off and you are no longer going on the honeymoon.

- Your house becomes uninhabitable due to a hurricane.

- An immediate family member back home passes away and you must return from your vacation early.

- You twist your ankle and must visit a doctor while traveling.

- Many other unforeseeable events as listed in the Description of Coverage.

What does the Package Protection Plan cover?

The Package Protection Plan includes coverage before and during your trip for the following:

Part I: Trip Cancellation Waiver

Expedia provides a Trip Cancellation Waiver that lets you cancel your trip for ANY REASON whatsoever. The Waiver allows passengers to cancel or change their vacation one time for ANY REASON not covered under Part II prior to the start of their trip and receive CASH back for all cancellation fees and penalties, except the cost of Published Air. If passengers have published air tickets, they can cancel their trip and receive a voucher equal to the published air ticket value. To learn more about covered cancellations, please read the information below.

Part II: Covered reasons for Cancellation and post departure coverages provided by Stonebridge Casualty Insurance Company, Columbus, OH. and administrated by BerkelyCare

Trip Cancellation and Trip Interruption

If you must cancel or interrupt your trip for a covered reason, the plan provides coverage for covered penalties and expenses up to the cost of your originally booked vacation package.

Covered reasons include illness, injury or death to you, a traveling companion or an immediate family member. Additional covered reasons for cancellation include jury duty, the issuance of a subpoena for court or administrative hearing, job loss, unannounced strike, loss or theft of your passports, having a home made uninhabitable by a natural disaster, hijacking, quarantine and being involved in a documented traffic accident en route to departure.

If you should miss the departure of your vacation due to Common Carrier caused delays or other reasons including a quarantine; hijacking; natural disaster; civil commotion or riot.; or delays caused by a traffic accident, en route to a departure, in which you or your Traveling Companion are involved, there is coverage to reimburse you up to $500 per person for costs such as accommodations, meals, and transportation expenses in order to catch up to the trip or to return home.

Emergency Evacuation/Repatriation of Remains

If an injury or illness requires emergency medical transportation to the nearest adequate medical facility, the plan includes coverage for up to $15,000 for covered transportation expenses. In the event of your death, the plan includes coverage for up to $15,000 toward the covered expenses associated with transporting your remains.

Medical Protection

If you become ill or injured while on your trip, the plan includes coverage to reimburse you to $10,000 in covered medical expenses. Medical coverage while traveling overseas is particularly important as Medicare and some HMO's may not cover medical expenses incurred outside the U.S. Note that medical coverage is excess to any other insurance you may have for these expenses.

Baggage Protection

If your baggage and/or personal effects should become lost, stolen or damaged during or while in transit to or from your trip, the plan includes coverage to reimburse you up to $1,000. The plan also includes baggage delay coverage, for up to $500 for the purchase of necessary items in the event your luggage is delayed by a common carrier for more than 24 hours during your trip. Note that baggage coverage is excess to any other insurance you may have for these expenses.

24-Hour Worldwide Emergency Assistance

24-hour emergency telephone assistance hotline provided by On Call International to help with travel-related emergencies ranging from cash transfer, legal, dental, or medical referral, lost travel documents assistance as well as medical consultation and monitoring.

Will my current home, renters, credit card, or health insurance policies cover me during my vacation?

The Package Protection Plan has a wide range of travel benefits which credit card, and renters insurance policies often do not offer. Other insurance policies may not offer coverage while you travel due to benefit limits, territory restrictions, and deductibles. Most people don't have any insurance coverage at all if they must cancel their trip, and even if they do, reimbursement for cancellations due to any reason is rare. However, you should review your own policies carefully to see what is covered.

Homeowners and renters plans may offer coverage for lost possessions. However, these plans may not fully cover your loss fully due to high deductibles.

The medical coverage included in the Package Protection Plan may be valuable for people whose health insurance policies do not pay for covered medical expenses incurred outside of the United States (e.g., Medicare, certain HMOs, etc.). Even if it your insurance does, you may not be covered for the full amount due to deductibles and co-insurance. Plus, many plans do not pay for evacuations, which can be very expensive. Of course, having your own medical coverage does not insure you against cancellation.

Many credit cards have only limited coverage and assistance service, with only a few including coverage to reimburse in the event of a cancellation or an evacuation. Check your credit card documentation carefully.

Is there help while I'm traveling?

One of the valued benefits offered in The Package Protection Plan is the 24-Hour Emergency Assistance Service. On Call International is a leader in this field. With On Call International, you have around the clock access to the services of a highly trained, multi-lingual staff who can assist you with such emergencies as cash transfers, lost documents, medical or legal monitoring, or referrals. They are also equipped to respond to many unexpected circumstances, such as providing potentially costly air ambulance transportation in medical emergencies. If an emergency should arise during your trip, call On Call International immediately and give the details of your problem or medical emergency.

- Seeking pre-trip advice such as immunization and visa requirements.

- If you leave your prescriptions at home and need help finding a local pharmacy and having your prescriptions called in.

- If you lose your passport and need assistance in finding the nearest passport office or embassy and getting the correct paperwork.

- If your wallet is stolen and you need help filing the proper police reports and getting money wired to you from home accounts.

- Finding a local doctor, hospital or, for severe medical emergencies, arranging a medical evacuation.

Who can I contact for more information?

You may contact BerkelyCare, the plan administrator, with any questions regarding the Package Protection Plan. Their CustomerCare representatives will be happy to assist you.

Via email: [email protected] Via phone: 1-800-453-4079 or 516-342-2720 Via mail: BerkelyCare P.O. Box 9022 300 Jericho Quadrangle Jericho, NY 11753 Office Hours: 8AM-10PM (EST), Monday-Friday, 9AM-5PM (EST), Saturday

This program was designed and administered for Expedia, Inc.’s clients by BerkelyCare SM

IN CALIFORNIA: BerkelyCare SM is a service mark of Aon Direct Insurance Administrators, CA Insurance License # 0795465.

IN ALL OTHER STATES: BerkelyCare SM is a division of Affinity Insurance Services, Inc. in all states other than CA, except: AIS Affinity Insurance Agency, Inc. in MN and OK and AIS Affinity Insurance Agency in NY.

When is payment for the plan due?

Payment for the plan is due with your initial trip payment.

How do I enroll in the Package Protection Plan?

The option to enroll is presented to you while booking your vacation package. If you would like to purchase the Package Protection Plan, simply select it and the cost of the plan is automatically included in the total amount due for your trip. Simply pay the amount indicated to purchase the plan.

When does coverage go into effect and will it cover me for the entire length of my vacation?

The Trip Cancellation coverage takes effect upon receipt of the required plan cost by Expedia. All other benefits will take effect at 12:01 A.M. on your scheduled departure date and location. Your coverage will remain valid until 11:59 P.M. on your scheduled completion date or your return to your origination point as stated on your tickets, whichever is earlier.

I am not a U.S. or Canadian resident; can I purchase the plan?

The Package Protection Plan is available only to U.S. residents and non-U.S. residents traveling to the U.S. who book their travel arrangements with Expedia.

What happens if I need to cancel my vacation?

Please contact Expedia and BerkelyCare as soon as possible in the event of a claim, as the insurer will not reimburse you for any additional charges incurred due to a delay in notifying Expedia of your cancellation. BerkelyCare will then forward you the appropriate claim form in order to file a claim.

What happens if my traveling companion cancels his/her vacation but I still want to travel?

If a person booked to share accommodations with you cancels for a covered reason under the Package Protection Plan and you must pay a "change in occupancy" fee (or single supplement charge), the plan includes coverage for this expense.

What happens if my flight is delayed or cancelled?

- the cost of a one-way economy ticket (less any refunds paid or payable for your original tickets) to catch up to your vacation or to return home.

- the cost of any unused prepaid land or sea arrangements; and/or;

- the cost of additional reasonable accommodations and travel expenses

Other covered reasons coverage include: traffic accident en route to a departure in which you or your traveling companion is not directly involved; lost or stolen passports; travel documents; or money; quarantine; hijacking; natural disaster, civil commotion or riot.

How do I get reimbursement if my bags and/or personal items are damaged/stolen/lost while I am traveling?

First, obtain verification from the appropriate authority to whom you reported the loss (for example, airline, hotel, transportation official, police, etc.). The baggage coverage in the plan includes reimbursement for the cost of repair or replacement of the luggage and covered contents inside the luggage. Upon your return home, simply request a claim form by visiting www.travelclaim.com or calling BerkelyCare at 1-800-453-4079.

If I require medical care while on my vacation, are my medical bills covered?

Yes, for covered expenses. The insurer reimburses up to $5,000 for a covered accident and up to $5,000 for a covered illness that occurs during your trip. In order to be reimbursed, save any receipts and statements from the treating physician. Upon your return home, simply request a claim form by visiting www.travelclaim.com or calling BerkelyCare at 1-800-453-4079. You will be asked to forward copies of your medical bills, as well as any explanation of benefit forms you may receive from your regular health insurer in regard to this loss, as the medical coverage in this plan is excess to any other insurance you may have for these expenses.

Please also note that should you require follow up care for your illness or injury once you return home, the plan includes continued medical coverage for up to 52 weeks from the onset of the illness or injury, or until you have exhausted the coverage limit. In the event of a medical emergency while traveling, the plan also includes emergency assistance services through On Call International. Should your medical condition necessitate your medical evacuation to another facility or home, these arrangements are made by On Call International

How do I file a claim?

You may request a claim form online via www.travelclaim.com or alternatively, call BerkelyCare, the plan administrator, at 1-800-453-4079 from 8:00 AM to 10:00 PM EST Mon-Fri or 9:00 AM to 5:00 PM EST Sat. Please note that you may want to have a copy of your Expedia invoice handy as there are some details that will be needed in order to initiate your claim. This information includes your travel dates, date of cancellation, booking number, and some brief information regarding your reason for cancellation, or other type of loss (i.e., trip delays, baggage loss or delay, medical claims, etc.). Important: If you are canceling your vacation, be sure to also contact Expedia to notify them of the cancellation, as well as to avoid additional expenses due to late reporting. For covered emergencies during your trip which require evacuation, interruption, or other travel-related emergencies, call On Call International at the telephone number provided with your travel documents and provide them with your plan number and emergency details.

Who is considered an "Immediate Family" member under the plan?

Our definition of "Immediate Family" is quite broad. It's not just the family members who reside with you. "Immediate Family" includes: spouses, domestic partners, parents, grandparents, siblings, siblings-in-law, children, grandchildren, aunts, uncles, nieces, nephews, and business partners. See the Definitions section of the Description of Coverage for a full listing.

Are there exclusions?

Certain restrictions do apply. For example, the coverage in the plan does not provide duplicate payments if there are other sources of reimbursement available.

Is there a Pre-Existing Condition Exclusion?

The Package Protection Plan does not have a pre-existing condition exclusion.

Contact Information

This program was designed and administered for Expedia, Inc.’s clients by BerkelySM:

IN CALIFORNIA: BerkelySM is a service mark of Aon Direct Insurance Administrators, CA Insurance License # 0795465.

IN ALL OTHER STATES: BerkelySM is a division of Affinity Insurance Services, Inc. in all states other than CA, except: AIS Affinity Insurance Agency, Inc. in MN and OK and AIS Affinity Insurance Agency in NY.

This plan is underwritten by: Stonebridge Casualty Insurance Company. Please see Terms and Conditions for full details include plan terms, conditions and exclusions.

U.S. News takes an unbiased approach to our recommendations. When you use our links to buy products, we may earn a commission but that in no way affects our editorial independence.

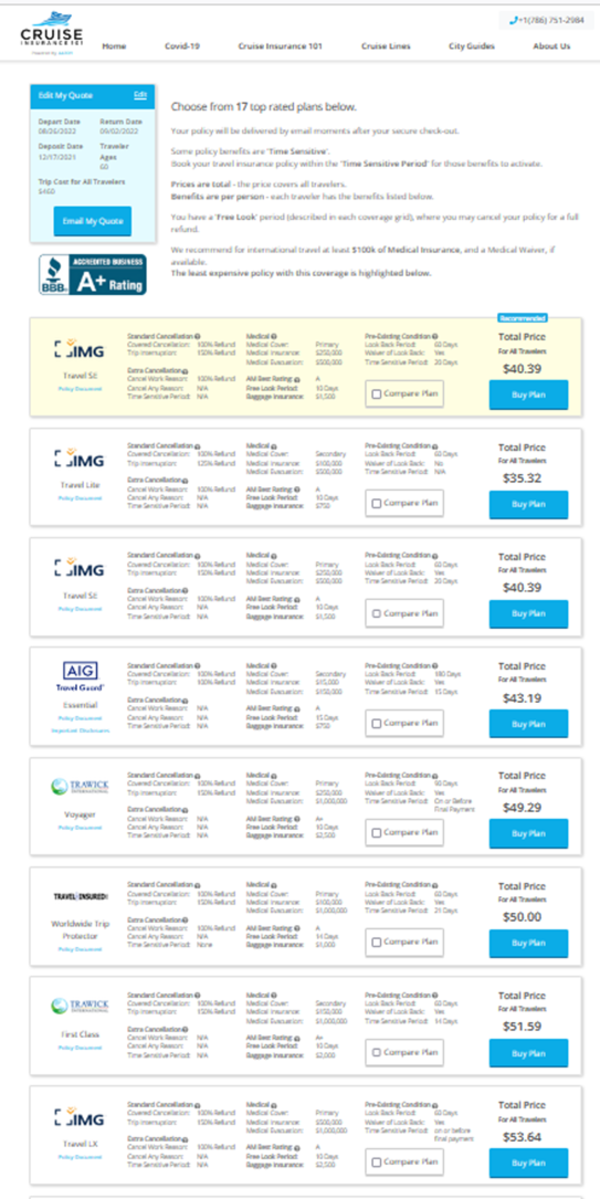

Cruise Insurance: Why You Need It + 4 Best Options for 2024

Seven Corners »

Travelex Insurance Services »

AXA Assistance USA »

Berkshire hathaway travel protection ».

Why Trust Us

U.S. News evaluates ratings, data and scores of more than 50 travel insurance companies from comparison websites like TravelInsurance.com, Squaremouth and InsureMyTrip, plus renowned credit rating agency AM Best, in addition to reviews and recommendations from top travel industry sources and consumers to determine the Best Cruise Insurance Plans.

Table of Contents

- Seven Corners

- Travelex Insurance Services

Cruise vacations come with the same considerations as any other trip, including the potential for trip cancellations, trip interruptions, unforeseen medical expenses and even a need for emergency medical evacuation. Add in the potential for unruly weather during hurricane season , and it's easy to see why cruise insurance plans are so popular and recommended.

Read on to find out which cruise travel insurance plans U.S. News recommends and how they can protect the investment you made in a cruise when something goes wrong.

Frequently Asked Questions:

All cruise insurance plans are unique, and some have different coverages than others. However, most travel insurance plans for cruises cover the following:

- Trip delays, interruptions and cancellations: This kind of coverage is essential any time of the year, but especially during hurricane season when storms can impact your travel plans.

- Protection for medical emergencies: This type of coverage can help pay for unexpected medical bills if you're injured on board the ship or hurt during a shore excursion. You can also choose a cruise insurance plan that covers emergency medical evacuation from the ship or to the nearest hospital.

- Coverage for lost or delayed baggage: Coverage for baggage is important for cruises just like any other trip. This type of insurance can pay for essential items you need to buy if your bags are lost or stolen and don't make it on the ship.

With each of these protections, a coverage limit is listed with your plan. This means you may get reimbursed for your losses or prepaid travel expenses up to this limit, but only when a covered reason applies to your claim.

One of the main reasons to buy cruise insurance is for medical emergencies. Note that, once you're on a cruise ship or visiting a destination outside the United States, your own U.S. health insurance plan will not apply. The same truth applies if you have government health coverage like Medicare.

You can purchase cruise insurance through your cruise line, but these plans are often very basic with low limits for medical expenses and other coverages. For example, cruise line travel insurance policies often come with just $25,000 in coverage for emergency medical expenses and up to $50,000 in coverage for emergency medical evacuation, which may not be enough.

Fortunately, you can buy cruise insurance from any travel insurance provider when planning this type of trip. By buying coverage from an independent travel insurance provider instead of your cruise line, you get to select the exact coverages and limits you need for the best protection possible.

- Seven Corners: Best Overall

- Travelex Insurance Services: Best for Families

- AXA Assistance USA: Best for Medical Emergencies

- Berkshire Hathaway Travel Protection: Best Cost

Plan is cruise-specific

Get coverage for missed cruise connections and tours

Medical expense coverage is secondary if you opt for lower-tier Basic plan

- Up to 150% in reimbursement for trip interruption

- Up to $250 per person, per day in trip delay coverage ($2,000 maximum)

- Up to $250 per day in missed tour or cruise connection coverage ($1,500 maximum)

- Primary emergency medical expense coverage worth up to $500,000

- Medical evacuation and repatriation of remains coverage worth up to $1 million

- Political and security evacuation coverage worth up to $20,000

- Up to $2,500 in protection for baggage and personal effects (limit per item of $250)

- Up to $100 per day ($500 maximum) in coverage for baggage delays of six hours or more

Travel Select plan offers coverage with pricing for kids included

Customize your plan with additional medical coverage, adventure sports coverage and more

Only $1,000 in coverage for baggage and personal effects

$200 maximum coverage for baggage delays

- Trip cancellation coverage worth up to 100% of total trip cost (maximum $50,000)

- Trip interruption coverage worth up to 150% of trip cost (maximum $75,000)

- $2,000 in trip delay coverage for a delay of at least five hours ($250 per day)

- $750 in coverage for missed connections (delay of at least three hours required)

- Emergency medical expense coverage worth up to $50,000 (dental emergency sublimit of $500 included)

- Emergency medical evacuation coverage worth up to $500,000

- $1,000 in protection for baggage and personal effects

- Up to $200 in coverage for baggage delays (at least 12-hour delay required)

- Travel assistance services

Provides comprehensive coverage for all aspects of cruising

High policy limits for medical expenses and emergency evacuation

Does not offer cruise-specific travel insurance

- Trip cancellation coverage up to 100%

- Trip interruption protection up to 150%

- $1,250 in travel delay coverage ($300 per day)

- $1,500 in protection for missed connections

- Emergency accident and sickness coverage up to $250,000

- Emergency medical evacuation coverage up to $1 million

- Nonmedical emergency evacuation coverage up to $100,000

- $50,000 in accidental death and dismemberment coverage

- Baggage and personal item coverage up to $3,000

- Baggage delay coverage worth up to $600

Comes with enhanced medical and luggage benefits, protections for cruise ship disablement, and more

Cruise delay coverage kicks in after five hours

Baggage delay coverage is only for $200 and doesn't kick in for 24 hours

No option to purchase CFAR coverage

- Up to $75,000 in protection for emergency medical care

- Emergency evacuation and repatriation of remains coverage worth up to $750,000

- Cruise cancellation coverage for 100% of trip cost up to $25,000 per person

- Cruise interruption coverage for 150% of trip cost up to $37,500 per person

- Cruise delay coverage worth up to $1,000 ($200 per day for delays of five hours or more)

- Missed connection coverage worth up to $500 (for delay of three hours or more)

- Cruise ship disablement coverage worth up to $500

- Up to $1,500 in coverage for baggage and personal effects

Why Trust U.S. News Travel

Holly Johnson is a professional travel writer who has covered international travel, travel insurance and cruises for more than a decade. Johnson has researched and compared all the top travel insurance options for her own family for trips to more than 50 countries, some of which have included cruises all over the world. Johnson lives in Indiana with her two children and her husband, Greg – a travel agent who has been licensed to sell travel insurance in 50 states.

You might also be interested in:

9 Best Travel Insurance Companies of April 2024

Holly Johnson

Find the best travel insurance for you with these U.S. News ratings, which factor in expert and consumer recommendations.

How Much Does a Cruise Cost?

Gwen Pratesi

The average cost of a cruise varies by ship, destination, trip length and more. Use this guide to learn more about cruise costs.

Cruise Packing List: 56 Essentials Chosen by Experts

Gwen Pratesi and Amanda Norcross

This cruise packing list includes all of the essentials – plus items you didn't know you needed.

The 12 Best All-Inclusive Cruises for 2024

When most of the extra costs are paid before you sail, you can truly enjoy your cruise.

- français

- Find a Center

Postal Code:

Call us today.

Protect Yourself with Manulife World Travel Insurance

If you’re getting ready to go on a trip, and planning on doing a lot, make sure you protect all your plans with Manulife Insurance. It gives you the coverage you need when dealing with unexpected situations – whether you’re venturing within Canada or to another country. Manulife Insurance provides you with the products and emergency assistance services that fit nicely with all your travel plans.

Keep in mind that you’ve invested a lot of time and money into planning the perfect vacation. Why take a chance that an unexpected event will mean you lose your investment? With Manulife's affordable travel insurance packages, you can travel knowing you’re financially protected against most unexpected travel situations.

In addition, if you have a medical emergency while travelling, one toll-free call – anytime day or night – puts you in touch with a multilingual professional who will refer you to a local doctor or facility in order for you to receive the care you need.

What type of insurance is right for you?

With Manulife offering several different travel insurance packages, it’s important to figure out which insurance package best suits your needs. From single-trip insurance to multi-trip annual insurance, choose the package that’s right for you!

Premium Protection Plan

The Manulife Premium Protection Plan is designed for residents of Canada who:

- are covered with a government health insurance plan for the policy duration;

- are age 74 or younger (at the time of purchasing the policy);

- are travelling for a maximum of 30 days inclusive of any extension (including the date you leave on your trip and including the date you return home);

- are listed as Insured Person(s) on the confirmation of coverage and

- purchased the plan within 72 hours of making a deposit or initial payment on the trip travel arrangements.

Coverage includes Trip Cancellation and Trip Interruption, Travel Disruption, Emergency Medical, Baggage Loss, Damage and Delay and Travel Accident. These benefits provide coverage for ACCIDENTS, INJURIES, UNEXPECTED ILLNESSES AND OTHER UNFORESEEN EVENTS that occur during the policy period unless the event or situation causing your claim is specifically excluded in the section WHAT DOES THIS POLICY NOT COVER? *

- Family Rates available up to age 60

- No Medical Questionnaire required

Cancel For Any Reason (CFAR) Coverage - if your reason for cancellation is not covered under this policy:

- You may cancel your trip 7 days or more before the scheduled departure date stated on your confirmation of coverage and we will pay up to 80% of the covered amount for the non-refundable prepaid travel arrangement costs.

- You may also cancel your trip 6 days to 24 hours immediately before your scheduled departure date (and time) stated on your confirmation of coverage and we will pay up to 80% of the covered amount for the non-refundable prepaid travel arrangement costs up to $2,500.

This is a general summary only. For a full listing of benefits please read the policy as limitations and exclusions apply.

*For a full listing of benefits please read the policy as limitations and exclusions apply.

All Inclusive

This single-trip coverage for travellers of any age (eligibility requirement must be met for 75yrs and over) is the most comprehensive package offered by Manulife. This package includes the following benefits*:

- Emergency medical

- Trip cancellation and interruption

- Loss/damage of baggage and personal effects

- Baggage delay

- Flight and travel accident coverage

Trip Cancellation

This single-trip coverage for travellers of any age covers the risk of unexpected cancellation and interruption. This package includes the following benefits*:

Non-medical Inclusive

This single-trip coverage for travellers of any age (family plans for under the age of 60 also available) looking for a package to complement their existing travel emergency medical coverage. This package includes the following benefits*:

Global Medical under Age 60

This single-trip Emergency Medical coverage is for travellers under the age of 60. No medical questionnaire required. This package includes the following benefits*:

Our Promise

At Expedia Cruises, we are navigators of spectacular vacation experiences. As part of the number one brand in travel, this is our promise to you:

Advice you can trust.

The best choice and prices., expedia extras., more than cruises., always there., find an expedia cruises near you.

The 5 best cruise travel insurance plans

While smooth sailing will always be the aim, cruising today is often about expecting the unexpected. You can prepare yourself by taking out an insurance policy that can compensate you when your vacation at sea does not go as planned.

Need to cancel your trip last minute due to an accident or illness? Did your bags get delayed or lost? Do you need to exit the sailing early to take care of an emergency back home? Was there a mechanical issue with the ship that required a change of itinerary, causing you to miss your flight home?

For cruise news, reviews and tips, sign up for TPG's cruise newsletter .

All of these contingencies and more can be covered; it's just a matter of finding the best insurance policy for you. Here's how to evaluate which plan is the right choice for you, as well as five of the best cruise travel insurance plans available.

The best cruise travel insurance plan will always be a 3rd-party option

No plan will meet the needs of all cruise travelers, so there is little benefit to booking the one insurance option recommended by your cruise line during the booking process other than convenience.

You'll often find more affordable rates, comprehensive coverage and favorable terms utilizing third-party insurance companies. You'll have a wide choice of plans, so you can pick the one that works the best for your situation.

If you're wondering where the best place is to purchase third-party insurance, "No one comparison site is getting preferential deals," says Stan Sandberg, co-founder of TravelInsurance.com . "Insurance carriers' rates are the same anywhere." However, these insurance comparison sites can help you directly compare the pricing and coverage of multiple policies by a range of preferred providers.

Look for the following coverage options and compare coverage amounts to determine which third-party plan is the best cruise insurance option for your upcoming trip.

Related: Cruise travel insurance: What it covers and why you need it

Trip cancellation

You'll want to be reimbursed if an unexpected event forces you to cancel your cruise. Be sure to read the fine print of your policy, detailing which specific reasons for canceling your trip are covered and not covered.

Trip interruption and travel delays

You'll also want to be covered if issues occur after travel begins. It's important to find "a plan that offers trip interruption if something does happen during your trip, along with a plan that offers emergency medical evacuation, coverage for travel delays and missed connection benefits," adds insurance expert Meghan Walch from InsureMyTrip .

Related: What happens if you miss your cruise

COVID-19 contingencies

Walch advises all travelers booking a cruise to consider a plan that includes cancellation coverage for COVID-19. Note that you'll need more than a home test to file a claim. According to Walch, "You'll need a doctor saying that you have been diagnosed with COVID and specify that you are unable to travel."

In addition, look for coverage if you get sick and need to isolate away from home. "Some plans offer additional trip delay coverage, put in place as a result of needing additional or higher limits for instances that might include if the policyholder gets quarantined in a location," Sandberg adds.

Cancel for any reason

A cancel-for-any-reason optional upgrade offers the most flexibility. You can get a refund of up to 75% if you cancel your voyage for reasons not usually covered by travel insurance. However, it adds about 40% to your premium and can only be purchased within a limited window of time after your cruise purchase.

Related: What happens if my cruise line changes my itinerary or ship?

Lost or delayed baggage

Baggage loss insurance covers your luggage if it is lost, damaged or stolen during your trip. In the case that you make it on the cruise and your bags do not, the insurance agency can assist with locating and redirecting the bags to your next port, reimbursing you for items you may need to purchase to get you through your travels while you are without your belongings and covering your losses in the case that the bag is actually gone for good.

Note that certain high-cost items such as electronics, luxury watches and fine jewelry are not always covered by baggage loss insurance. Consider purchasing additional coverage for such items or — better yet — keep those items with you at all times.

Health coverage

Medical coverage is another consideration. "Most domestic health coverage [including Medicare] does not cover travel abroad, so it is important to look at a travel insurance policy that offers medical coverage during your trip, just in case anything happens," says Walch. "If you fall ill or are injured during the trip, it can be pretty expensive – even when going to the ship's onboard medical facility."

Related: How to avoid getting sick on a cruise

Hurricane coverage

Extreme weather and hurricanes are typically not covered if the cruise commences as scheduled, though you might be eligible for trip interruption coverage if weather cancels the cruise or cuts the itinerary short. There are also insurance plans that offer trip reimbursement if a destination on your itinerary is under a National Oceanic and Atmospheric Administration-issued hurricane alert or warning.

How much will cruise travel insurance cost?

Insurance pricing is dependent on the trip cost and the age of the insured travelers. Sandberg estimates that "travelers in their 30s or 40s can ballpark insurance coverage somewhere around 5% to 7% of the trip costs, with rates that can get lower depending on the extent of coverage."

Insurance is a tiered product that gets more expensive as you age. "As you get older, that range can expand to 10% of trip costs," notes Sandberg. "Adding bells and whistles, like 'cancel for any reason' [coverage], rates can rise to 11% to 12% of the cost of your trip."

Related: How cruising newbies waste money on their 1st cruise

5 best cruise travel insurance plans

Following extensive research scouring the fine print, we've selected five of the best cruise insurance plans that will appeal to a variety of seagoing travelers.

All five plans provide coverage for COVID-19-related trip cancellation and interruption.

For the leisure cruiser: TravelSafe Classic Plan

TravelSafe's Classic Plan is the best value all-around for the average cruiser, with superior coverage limits at a fair rate.

This plan's coverage includes an impressive $1 million per person for medical evacuation and a high $2,500 coverage limit for bag loss. You have extra time – 21 days – from your initial deposit to add a cancel-for-any-reason upgrade to your plan. The accident and sickness medical coverage is primary, with coverage up to $100,000.

The policy's $750-maximum trip delay coverage begins after a six-hour delay and includes kennel fees for up to $100 per day, along with coverage for additional meal and accommodation expenses.

For the budget conscious: AXA's Silver Plan

AXA's Silver Plan is the company's entry-level offering, with more value added than most budget insurance options — most notably the company's concierge service. Coverage under this plan includes robust trip cancellation and interruption coverage, both at 100% of the costs, along with $100,000 for emergency medical evacuation.

The plan also offers identity theft assistance in case your wallet or passport gets stolen while traveling, assisting with filing and obtaining police and credit reports, taking inventory of lost or stolen items, and even wiring emergency funds to you when you're really in a bind.

You won't have the option to purchase a cancel-for-any-reason add-on or opt in for a collision damage waiver on this lowest-tier plan.

For the luxury cruise traveler: John Hancock's Gold Plan

John Hancock's Gold Plan offers robust medical evacuation and repatriation coverage up to $1 million per person, ideal for those luxury cruises that rove to the farthest reaches of the globe. The plan has excellent baggage loss coverage at up to $2,500 per person, along with a low three-hour minimum travel delay ($1,000 per person, $200 daily limit) benefit.

Preexisting medical conditions are covered by this policy, though you must purchase your policy within 14 days of your trip deposit.

For increased medical coverage: Seven Corners' RoundTrip Choice Plan

Seven Corners' RoundTrip Choice Plan offers primary medical coverage for emergency accident and sickness medical expenses up to $500,000, while many other plans only offer secondary coverage. The plan's medical evacuation coverage is high at $1 million, and preexisting conditions are covered with a few conditions that apply, namely that you purchase the policy within 20 days of your initial trip payment.

The policy also offers detailed, robust COVID-19 coverage, including reimbursement for medical care if you contract COVID-19 while traveling. Its coverage also includes meals, local transportation and lodging if you're delayed six or more consecutive hours due to quarantining with COVID-19.

Coverage options on the plan may vary slightly depending on which U.S. state you claim as your residence.

For the adventurous cruiser: World Nomads' Explorer Plan

World Nomads is one of the few insurance companies that will cover more than 200 adventure activities on your travels, including scuba diving, skydiving and bungee jumping. The coverage for the long list of activities includes emergency medical expenses while outside the U.S., medical evacuation and repatriation, along with trip interruption.

World Nomads' Explorer Plan also offers $25,000 in coverage for nonmedical emergency evacuation for covered events, such as a natural disaster or political or security situations.

Travelers 70 and older are required to add a "Silver Nomads" policy, offered through TripAssure.

Bottom line

Cruising isn't always a blissful week spent relaxing on the pool deck or snorkeling among multicolored reefs. Mishaps occur, whether it's losing luggage, missing a flight or falling ill.

The best cruise insurance policies are the ones that won't let you sail without a safety net, charging a fraction of your trip expenses in exchange for the peace of mind that there's a plan in place should something go wrong. With a range of pricing and coverage options available, you can feel confident that you can find a policy to suit your travel needs.

Planning a cruise? Start with these stories:

- The 5 most desirable cabin locations on any cruise ship

- A beginners guide to picking a cruise line

- The 8 worst cabin locations on any cruise ship

- The ultimate guide to what to pack for a cruise

- A quick guide to the most popular cruise lines

- 21 tips and tricks that will make your cruise go smoothly

- 15 ways cruisers waste money

- The ultimate guide to choosing a cruise ship cabin

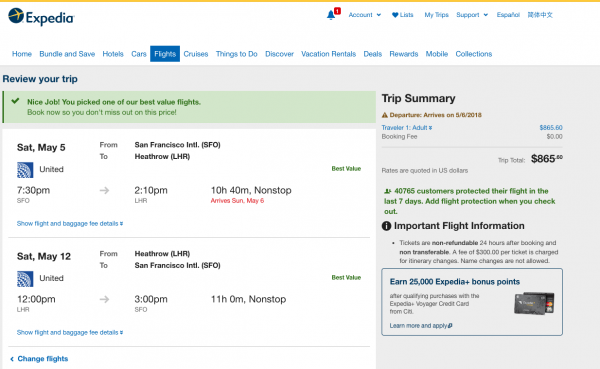

Home » Online Shopping » Flights / Hotels » How to Get Travel Insurance from Expedia

How to Get Travel Insurance from Expedia

Now that you’ve learned all about booking flights, hotels, car rentals, vacations, and cruises with Expedia , you might be thinking about planning a trip. If you’re looking for a little extra peace of mind on your trip, you might be considering purchasing one of Expedia’s travel protection plans, in order to be ready for the unexpected.

Just a heads-up that some of the services we’re reviewing here have affiliate partnerships with us, so we may earn a commission if you visit one of them and buy something. You can read more about how this works at https://techboomers.com/how-to-support-techboomers .

In this article, we’ll explain how to get protection from Expedia, and what types of plans you can choose from. Read on to learn more!

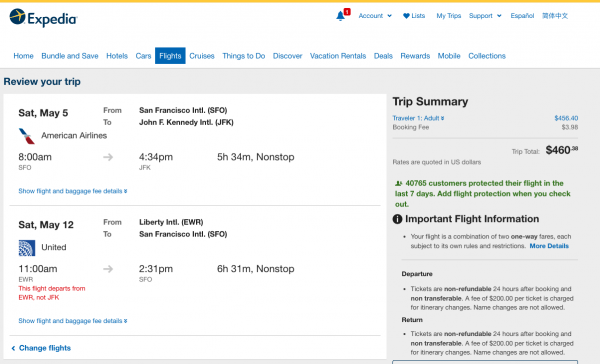

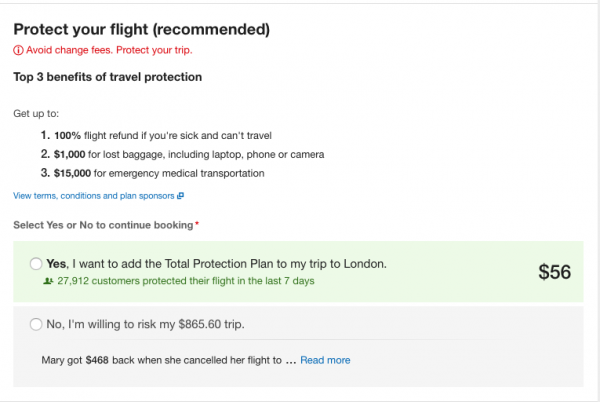

How Expedia travel insurance works

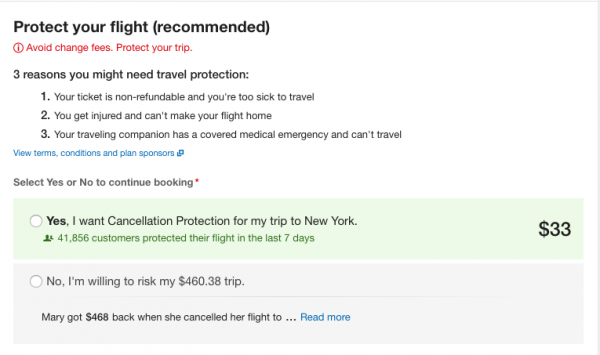

Expedia travel insurance is a protection plan for your trip which will entitle you to a refund in the event that the conditions of the insurance are met. By purchasing insurance with or after your booking, you are protecting yourself if the trip is cancelled or if unfortunate circumstances occur while on your trip.

We all know vacations can be expensive. By purchasing an Expedia protection plan, essentially you are preparing for a situation out of your control, so you don’t lose all of the money you spent on your trip. Depending on the protection you purchase, you could be reimbursed for the cost of your trip for situations such as illness, bad weather, or missing your flight.

You will be given the option of adding travel insurance while booking, but this is completely optional. You will need to purchase protection plans during booking, prior to the completion of your transaction. You can however purchase the Car Rental Insurance Plan up until the day before you leave for your trip.

How do I get a Travel Protection Plan from Expedia?

You will automatically have the option to add a travel protection plan whenever you are booking an itinerary for which that plan is applicable.

Types of Travel Protection Plans that Expedia offers

Expedia package protection plan – for before, on, or after the trip..

This plan applies mainly to vacation packages, usually consisting of at least a flight and hotel booking. It is meant to protect you from elements before and during your trip, including: