- Regional Support Office for Asia and the Pacific (RSOAP)

- Member States in Asia and the Pacific

- SUSTAINABLE TOURISM OBSERVATORIES (INSTO)

World Tourism Barometer: January 2024

International Tourism to end 2023 close to 90% of Pre-pandemic levels

According to the first UNWTO World Tourism Barometer of the year, international tourism ended 2023 at 88% of pre-pandemic levels , with an estimated 1.3 billion international arrivals . The unleashing of remaining pent-up demand, increased air connectivity, and a stronger recovery of Asian markets and destinations, are expected to underpin a full recovery by the end of 2024 (UNWTO Tourism Barometer January 2024 – Press Release) .

An estimated 1286 million international tourists (overnight visitors) were recorded around the world in 2023, an increase of 34% over 2022. International tourism recovered 88% of pre-pandemic levels, supported by strong pent-up demand (UNWTO Tourism Barometer January 2024-Excerpt) .

International tourism is expected to fully recover pre-pandemic levels in 2024, with initial estimates pointing to 2% growth above 2019 levels. This central forecast by UNWTO remains subject to the pace of recovery in Asia and to the evolution of existing economic and geopolitical downside risks (UNWTO Tourism Barometer January 2024 – Press Release) .

Asia and the Pacific reached 65% of pre-pandemic levels, with a gradual recovery since the start of 2023 following the reopening of several markets and destinations. However, performance among subregions were mixed, with South Asia recovering 87% of pre-pandemic levels and North-East Asia, 55% (UNWTO Tourism Barometer January 2024-Excerpt) .

There is still significant room for recovery across Asia. The recent reopening of several source markets and destinations is expected to boost recovery in the region and globally (UNWTO Tourism Barometer January 2024- Excerpt) .

Read more on the UNWTO Tourism Barometer (January 2024 excerpt) here .

About the UNWTO World Tourism Barometer

The UNWTO World Tourism Barometer is a publication of the World Tourism Organization (UNWTO) that monitors short-term tourism trends regularly to provide global tourism stakeholders with up-to-date analysis of international tourism. The information is updated several times a year and includes an analysis of the latest data on tourism destinations (inbound tourism) and source markets (outbound tourism). The Barometer also includes three times a year Confidence Index based on the UNWTO Panel of Tourism Experts survey, which provides an evaluation of recent performance and short-term prospects for international tourism.

Regional Support Office in Asia and the Pacific (RSOAP)

Rsoap a to z.

- Sustainable Tourism Observatories(INSTO)

UNWTO A to Z

- About UNWTO

- Affiliate Members

- Member States

- Tourism in the 2030 Agenda

- World Tourism Day

- Technical Cooperation

- ASIA AND THE PACIFIC

- MIDDLE EAST

- RESOURCES/SERVICES

- Sustainable Development of Tourism

- Ethics, Culture and Social Responsibility

- Market Intelligence

- Tourism Data Dashboard

- Publications

- UNWTO Academy

Partners links

© UNWTO Regional Support Office for Asia and the Pacific (RSOAP)

International travel levels tipped to soar again in 2022

A sense of optimism has returned to the tourism sector. Image: Unsplash/Blake Guidry

.chakra .wef-1c7l3mo{-webkit-transition:all 0.15s ease-out;transition:all 0.15s ease-out;cursor:pointer;-webkit-text-decoration:none;text-decoration:none;outline:none;color:inherit;}.chakra .wef-1c7l3mo:hover,.chakra .wef-1c7l3mo[data-hover]{-webkit-text-decoration:underline;text-decoration:underline;}.chakra .wef-1c7l3mo:focus,.chakra .wef-1c7l3mo[data-focus]{box-shadow:0 0 0 3px rgba(168,203,251,0.5);} Felix Richter

.chakra .wef-9dduvl{margin-top:16px;margin-bottom:16px;line-height:1.388;font-size:1.25rem;}@media screen and (min-width:56.5rem){.chakra .wef-9dduvl{font-size:1.125rem;}} Explore and monitor how .chakra .wef-15eoq1r{margin-top:16px;margin-bottom:16px;line-height:1.388;font-size:1.25rem;color:#F7DB5E;}@media screen and (min-width:56.5rem){.chakra .wef-15eoq1r{font-size:1.125rem;}} Travel and Tourism is affecting economies, industries and global issues

.chakra .wef-1nk5u5d{margin-top:16px;margin-bottom:16px;line-height:1.388;color:#2846F8;font-size:1.25rem;}@media screen and (min-width:56.5rem){.chakra .wef-1nk5u5d{font-size:1.125rem;}} Get involved with our crowdsourced digital platform to deliver impact at scale

Stay up to date:, travel and tourism.

- Until the COVID-19 pandemic, the global tourism sector had seen almost uninterrupted growth for decades.

- Now there are signs the travel sector is bouncing back after 'the worst year in tourism history'.

- The UNWTO's latest World Tourism Barometer shows an increase of 182% for international tourism in the first three months of 2022 compared to the previous year.

- While optimism builds, the tourism industry is still vulnerable to new variants of COVID-19, the war in Ukraine and global economic conditions.

While few industries have been spared by the impact of the Covid-19 pandemic over the past two years, even fewer have been hit as hard as the tourism sector . After " the worst year in tourism history ", international tourist arrivals increased by just 5 percent in 2021, as travel restrictions remained in place for protracted periods in many parts of the world. International tourist arrivals once again fell more than one billion short of pre-pandemic levels, keeping the industry at levels last seen in the late 1980s.

Prior to the coronavirus outbreak, the global tourism sector had seen almost uninterrupted growth for decades. Since 1980, the number of international arrivals skyrocketed from 277 million to nearly 1.5 billion in 2019. As our chart shows, the two largest crises of the past decades, the SARS epidemic of 2003 and the global financial crisis of 2009, were minor bumps in the road compared to the Covid-19 pandemic.

A sense of optimism for the tourism industry

Almost six months into 2022, a sense of optimism has returned to the tourism sector, as travel demand finally shows signs of a significant uptick. According to the UNWTO's latest World Tourism Barometer , international tourism increased by 182 percent in the first three months of 2022 compared to the previous year. While that's still 60 percent below 2019 levels, the uptick in international arrivals gathered pace in March, pointing towards a strong second quarter leading into the summer holiday season.

As the following chart shows, the UNWTO now expects international tourist arrivals to reach 55 to 70 percent of 2019 levels this year, which is equivalent to a 90 to 140 percent improvement over 2021. While confidence is slowly building in the industry, there are some big ifs to consider. Not only could Covid make a comeback in the fall or whenever a more lethal variant emerges, but the war in Ukraine, inflation and global economic conditions could also stifle tourism's return.

The Forum’s Platform for Shaping the Future of Advanced Manufacturing and Production pioneered the Global Lighthouse Network in 2018. Now, 69 factories / sites are a part of the network, prioritizing workforce and skills development to protect jobs and build resiliency

A new report launched in March 2021 also shows that despite the COVID-19 pandemic’s unprecedented disruption, 93% of Global Lighthouse Network factories achieved an increase in product output and found new revenue streams.

The future belongs to those companies willing to embrace disruption and capture new opportunities. The lighthouses are illuminating the future of manufacturing and the future of the industry.

The Global Lighthouse Network an initiative of the Forum’s Platform for Shaping the Future of Advanced Manufacturing and Production , is conducted in collaboration with McKinsey & Company.

Companies can apply to join the Global Lighthouse Network via the Platform for Shaping the Future of Advanced Manufacturing and Production .

Have you read?

Towards resilience and sustainability: travel and tourism development recovery, a positive future for tourism, how global tourism can become more sustainable, inclusive and resilient, don't miss any update on this topic.

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Related topics:

The agenda .chakra .wef-n7bacu{margin-top:16px;margin-bottom:16px;line-height:1.388;font-weight:400;} weekly.

A weekly update of the most important issues driving the global agenda

.chakra .wef-1dtnjt5{display:-webkit-box;display:-webkit-flex;display:-ms-flexbox;display:flex;-webkit-align-items:center;-webkit-box-align:center;-ms-flex-align:center;align-items:center;-webkit-flex-wrap:wrap;-ms-flex-wrap:wrap;flex-wrap:wrap;} More on Industries in Depth .chakra .wef-17xejub{-webkit-flex:1;-ms-flex:1;flex:1;justify-self:stretch;-webkit-align-self:stretch;-ms-flex-item-align:stretch;align-self:stretch;} .chakra .wef-nr1rr4{display:-webkit-inline-box;display:-webkit-inline-flex;display:-ms-inline-flexbox;display:inline-flex;white-space:normal;vertical-align:middle;text-transform:uppercase;font-size:0.75rem;border-radius:0.25rem;font-weight:700;-webkit-align-items:center;-webkit-box-align:center;-ms-flex-align:center;align-items:center;line-height:1.2;-webkit-letter-spacing:1.25px;-moz-letter-spacing:1.25px;-ms-letter-spacing:1.25px;letter-spacing:1.25px;background:none;padding:0px;color:#B3B3B3;-webkit-box-decoration-break:clone;box-decoration-break:clone;-webkit-box-decoration-break:clone;}@media screen and (min-width:37.5rem){.chakra .wef-nr1rr4{font-size:0.875rem;}}@media screen and (min-width:56.5rem){.chakra .wef-nr1rr4{font-size:1rem;}} See all

Industry government collaboration on agritech can empower global agriculture

Abhay Pareek and Drishti Kumar

April 23, 2024

Nearly 15% of the seafood we produce each year is wasted. Here’s what needs to happen

Charlotte Edmond

April 11, 2024

How Paris 2024 aims to become the first-ever gender-equal Olympics

Victoria Masterson

April 5, 2024

5 ways CRISPR gene editing is shaping the future of food and health

Douglas Broom

April 3, 2024

How Japan is attracting digital nomads to shape local economies and innovation

Naoko Tochibayashi and Naoko Kutty

March 28, 2024

The Paris Olympics aims to be the greenest Games in history. Here's how

- Press Releases

- Press Enquiries

- Travel Hub / Blog

- Brand Resources

- Newsletter Sign Up

- Global Summit

- Hosting a Summit

- Upcoming Events

- Previous Events

- Event Photography

- Event Enquiries

- Our Members

- Our Associates Community

- Membership Benefits

- Enquire About Membership

- Sponsors & Partners

- Insights & Publications

- WTTC Research Hub

- Economic Impact

- Knowledge Partners

- Data Enquiries

- Hotel Sustainability Basics

- Community Conscious Travel

- SafeTravels Stamp Application

- SafeTravels: Global Protocols & Stamp

- Security & Travel Facilitation

- Sustainable Growth

- Women Empowerment

- Destination Spotlight - SLO CAL

- Vision For Nature Positive Travel and Tourism

- Governments

- Consumer Travel Blog

- ONEin330Million Campaign

- Reunite Campaign

Economic Impact Research

- In 2023, the Travel & Tourism sector contributed 9.1% to the global GDP; an increase of 23.2% from 2022 and only 4.1% below the 2019 level.

- In 2023, there were 27 million new jobs, representing a 9.1% increase compared to 2022, and only 1.4% below the 2019 level.

- Domestic visitor spending rose by 18.1% in 2023, surpassing the 2019 level.

- International visitor spending registered a 33.1% jump in 2023 but remained 14.4% below the 2019 total.

Click here for links to the different economy/country and regional reports

Why conduct research?

From the outset, our Members realised that hard economic facts were needed to help governments and policymakers truly understand the potential of Travel & Tourism. Measuring the size and growth of Travel & Tourism and its contribution to society, therefore, plays a vital part in underpinning WTTC’s work.

What research does WTTC carry out?

Each year, WTTC and Oxford Economics produce reports covering the economic contribution of our sector in 185 countries, for 26 economic and geographic regions, and for more than 70 cities. We also benchmark Travel & Tourism against other economic sectors and analyse the impact of government policies affecting the sector such as jobs and visa facilitation.

Visit our Research Hub via the button below to find all our Economic Impact Reports, as well as other reports on Travel and Tourism.

The outlook is sunny: the global travel forecast for 2024

As a new year begins, it is a good opportunity to reflect on international travel in 2023 and to also look ahead….

The global travel industry courageously navigated the pandemic’s severe ramifications and continues to demonstrate tremendous resilience post-Covid-19. It’s been nearly four years since the pandemic was declared in March 2020, swiftly followed by travel bans and restrictions and an inevitable reduced consumer appetite for travel. The long road to recovery continued throughout 2023.

According to some experts, the industry won’t fully recover until 2024 or later. Despite this, 2023 was a strong year for international travel. According to data from the UN World Tourism Organization (UNWTO), international arrivals reached 85 per cent of pre-pandemic levels in the second quarter of 2023, and 90 per cent in July. “International arrivals are higher than 2022 in all regions across the world and we expect this trend to continue in 2024, with many regions surpassing 2019 levels by the end of [the] year,” confirmed Virginia Messina, Senior Vice President, Advocacy and Communications at the World Travel & Tourism Council (WTTC).

Signs point to continued growth in 2024 and the opportunity for pre-pandemic focus areas to come back into the spotlight for the industry. A spokesperson for UK travel agents’ association ABTA told ITIJ: “It is likely that international travel will continue to grow in 2024, with passenger numbers achieving or surpassing pre-pandemic levels. In the UK, many travel companies are already reporting record numbers for 2023 and healthy interest in forward booking for 2024.”

The reparative power of technology For many, accelerating digital transformation became a priority during the pandemic, with innovations such as QR scanning, biometric facial recognition and thermal scanning technologies replacing manual processes. This focus continued in 2023 with, for many, technology playing a key role in recovery and being seen as paramount to enhancing global travel.

William Raillant-Clark, Communications Officer, Office of the Secretary General, International Civil Aviation Organization (ICAO), told ITIJ: “Much of the operational rethink and technological innovations resulting from the Covid-19 pandemic will change and improve the travel experience, for example in the area of facilitation, with the use and implementation of biometric identity technologies taking great steps forward.”

Looking ahead throughout 2024, it is anticipated that technology will continue to be a key driver for change and innovation in travel and tourism. “Digital transformation, artificial intelligence (AI), and data analytics will continue to reshape the sector,” stated Messina. “We expect the widespread adoption of virtual reality (VR) and augmented reality (AR) for immersive travel experiences, allowing travellers to explore destinations from the comfort of their homes before making decisions.”

International arrivals are higher than 2022 in all regions across the world and we expect this trend to continue in 2024, with many regions surpassing 2019 levels by the end of the year

ITIJ also spoke with Roi Ariel, General Manager, Global Sustainable Tourism Council (GSTC), who agreed that advancements in technology will be a catalyst for change: “Particularly in the simplification of processes through the utilisation of AI and data analytics. As technology continues to evolve, it will reshape how we plan, book and experience travel, and hopefully enhance the overall sustainability in the industry,” he said.

A decarbonisation revolution Sustainability is another current and future focus for the international travel community, and is closely related to innovation, with important targets such as decarbonisation hinging on disruptive technologies, such as zero-emission aircraft and novel sustainable aviation fuel (SAF) technologies.

“Long-term sustainability is a vital element in any medium-term business plan, and aviation is no exception,” highlighted Raillant- Clark. “Moreover, governments have agreed to work towards the total decarbonisation of flying by 2050. The global air transport sector welcomes these developments as they provide certainty and vision. Sustainability is not seen as a threat but as an opportunity for new and highly dynamic development, and the technological and operational rethink that decarbonisation requires also presents an opportunity to deeply revolutionise operations as we know them today.”

Digital transformation, artificial intelligence (AI), and data analytics will continue to reshape the sector

Ariel underlined that sustainability will play a pivotal role in the recovery of international tourism and is a shared and crucial factor that is rising higher and higher on stakeholders’ agendas. “Travellers and stakeholders increasingly prioritise sustainable and responsible tourism practices. Embracing sustainability is not just a trend; it’s becoming a fundamental factor that will shape the future of the travel industry,” he said.

Consumers are demanding sustainable travel products, with 81 per cent of respondents to a Booking.com survey saying that sustainable travel is important to them, while, according to Simon-Kucher’s Global Travel Trends Study 2023 report, almost one in three consumers are willing to pay more for sustainable options. This consumer commitment, in tandem with the global race to decarbonise the travel and tourism sector and achieve net zero by 2050, means that initiatives to boost sustainability are more important than ever.

“Businesses are expected to intensify sustainability initiatives and look for ways to further reduce carbon footprints,” stated Catherine Logan, Regional Senior Vice President – EMEA and APAC, Global Business Travel Association (GBTA). “Business travel is an obvious focus area. Protecting the planet is one of the biggest challenges the global business travel sector faces, like so many other industries around the world. Reducing carbon emissions must be part of our collective mission. In our latest poll, 37 per cent of respondents put sustainability as a top strategic priority and 45 per cent of respondents plan to invest in sustainability initiatives in the year ahead.”

Sustainable tourism is not just a catchphrase In addition to embracing eco-friendly practices and harnessing innovation for sustainability, the importance of environmental conservation and responsible tourism can’t be overstated. “Sustainability must be viewed holistically, not just our impact on the environment but ensuring that local people benefit from tourism and that those employed in the industry are paid a decent wage,” an ABTA spokesperson highlighted. Interest among consumers in sustainable accommodation is increasing, with travellers recognising the importance of selecting a responsible hotel brand or opting to stay in sustainable accommodation in order to help reduce their environmental impact.

“The Singapore Tourism Board announced the launch of the Hotel Sustainability Roadmap,” said Ariel. “By 2025 its goal is for 60 per cent of hotel room stock to achieve hotel sustainability certification through a GSTC-accredited certification body.

Embracing sustainability is not just a trend; it’s becoming a fundamental factor that will shape the future of the travel industry

“We are witnessing a significant shift towards a better understanding, adoption and demand for sustainable tourism practices. Sustainable tourism has already become a mainstream term, and now it’s time to apply this term in a proper manner and not just as a catchphrase.”

The benefits of these practices will extend far and wide, said Messina: “As travellers become increasingly conscious of their impact on the environment and local communities, the sector’s commitment to sustainability will not only benefit the planet but also provide authentic and meaningful travel experiences and ensure these have a positive impact.”

Recovery isn’t linear Considering possible roadblocks for 2024 and beyond, Ariel said that the biggest challenge for the future of international travel will be achieving a sustainable balance between tourism growth and conservation, while also addressing issues related to overtourism and eliminating any negative environmental, cultural or social impacts from tourism activities. “While the trajectory is positive, continuous effort, innovation and commitment from the travel and tourism industry as a whole are essential to ensure that tourism benefits both the planet and its inhabitants for generations to come,” he stated.

Raillant-Clark said that a big challenge will be addressing the decarbonisation of air transport. “This will call for cooperation within and beyond the aviation sector at unprecedented levels,” he said. “This will require states to recommit to multilateralism at a time when many signposts appear to be very unfortunately pointing in the opposite direction.”

Messina agreed: “According to our data, 40 per cent of our sector’s greenhouse gas (GHG) footprint comes from transport. If we are to reach our net zero targets as a sector, it is therefore critical that we decarbonise transport but, of course, transport is considered a hard-to-abate sector due to its dependence on fossil fuels. In the case of aviation, the solution most widely being touted is SAF, but this will require governments around the world to rapidly pick up the pace in incentivising SAF production and to set ambitious targets to produce adequate quantities.”

Ariel has seen multi-stakeholder collaboration leading to meaningful change: “We see that tourism stakeholders, including governments, local communities and industry leaders, are collaborating to create policies and infrastructure that support sustainability.” It is only with this collective effort and passion that meaningful change can be achieved.

Tourism stakeholders, including governments, local communities, and industry leaders, are collaborating to create policies and infrastructure that support sustainability

It was perhaps inevitable that the travel industry would recover from the unprecedented strain placed upon it by the pandemic but healing isn’t linear and we can likely expect more bumps in the road in 2024. “The fact that travel patterns have resumed in tandem with the lifting of restrictions is proof of the continued social and universal importance of travel generally, with air transport being no exception,” said Raillant-Clark.

As the shadow cast by the pandemic continues to lift, pre-pandemic priorities can come back into focus, with socially, economically and environmentally responsible models of tourism representing a shared interest and technological transformation reshaping the sector. The global travel industry has experienced a real resurgence in 2023 and it will be interesting to see what 2024 brings.

US Travel Header Utility Menu

- Future of Travel Mobility

- Travel Action Network

- Commission on Seamless & Secure Travel

- Travel Works

- Journey to Clean

Header Utility Social Links

- Follow us on FOLLOW US

- Follow us on Twitter

- Follow us on LinkedIn

- Follow us on Instagram

- Follow us on Facebook

User account menu

Travel forecast.

FORECAST January 17, 2024

Driven by Tourism Economics' travel forecasting model, the latest U.S. Travel Forecast projects the following:

International travel to the U.S. is growing quickly but is still far from a full pre-pandemic recovery.

An expected global macroeconomic slowdown, a strong dollar, and lengthy visa wait times could inhibit future growth, with volume reaching 98% of 2019 levels in 2024 (up from 84% recovered in 2023) and achieving a full recovery in 2025. Spending levels, when adjusted for inflation, are not expected to recover until 2026.

Other countries with whom the U.S. directly competes have recovered their pre-pandemic visitation rates more quickly, and some countries—such as France and Spain—have even increased their share of the global travel market. Meanwhile, U.S. global market share is declining.

Business travel is still expected to grow in 2024, albeit at a slower rate.

Volume in the sector is expected to end the year at 95% of 2019 levels—up from 89% recovered in 2023. Slowing economic growth will hinder domestic business travel’s recovery, with a full comeback in volume not expected until 2026. Domestic business travel spending is not expected to recover to pre-pandemic levels within the range of the forecast.

Domestic leisure growth decelerated through three quarters of 2023 as consumer spending slowed amid higher borrowing costs, tighter credit conditions and the restart of student loan repayments.

The sector achieved a full recovery to pre-pandemic levels in 2022.

To complement the travel forecast table, U.S. Travel has released an accompanying slide deck , which provides context for the latest projections. This document, which appears on the right under "downloads," is available exclusively to U.S. Travel members.

Member Price: $0

Non-Member Price: Become a member to access.

- Global City & International State Travel

Global Travel Service

- Air Passenger Forecasts

- Custom Forecasts

- Cruise Forecasts

- Visitor Economy

- Travel Industries

- Marketing Investment

- Events & Projects

- Testimonials

- Budget Analysis

- Policy Analysis

- Marketing Allocation Platform

- Project Feasibility

- In the News

- Client Login

Contact Us | Request Demo

- Oxford Economics

Detailed travel data and forecasts for 190 countries

The most comprehensive data-set of its kind, the Global Travel Service (GTS) includes travel and economic activity for 190 countries. The user-friendly interface provides access to detailed information on traveler origins, destinations, trip purpose, spending, and mode of travel.

The database includes almost thirty years of historical data and 10-year forecasts based on the tested Oxford Economics global macroeconomic model. GTS users can conduct extensive global market analysis in minutes, complete with tables, charts, and maps.

What the service includes:

Extensive data-bank. Over 100,000 indicators of tourism activity, including international visitor arrivals, nights, trip purpose, model of travel, and visitor spending with detail for every major origin and destination pair across 190 countries

Detailed forecasts of travel and macroeconomic drivers. Ten-year forecasts are developed based on the Oxford Economics economic outlook—the most widely used global economic model in the world. The database is updated three times per year with the latest travel data and key economic drivers.

Advanced analytical functions. Our web-based data-bank allows users to quickly build custom queries with complete flexibility and visualize the data in tables, charts, and maps. Searches can be saved for future reference and downloaded quickly to Excel and Adobe formats.

Economist support. We provide full client support to answer questions about our data or forecasts.

Service Coverage Overview:

Global Travel Service provides hundreds of indicators for each destination, including:

- Visits —international visitor arrivals to each destination by trip purpose and mode of transportation

- Departures —outbound international travelers from each destination

- Origin -destination flows—visits and nights across major origin and destination pairs

- Travel spending —inbound, outbound, and domestic spending by purpose

- Economic and demographic forecast - the drivers behind the forecast model

- Price indicators —exchange rate, interest rates, and inflation.

UN Tourism | Bringing the world closer

Share this content.

- Share this article on facebook

- Share this article on twitter

- Share this article on linkedin

Tourism Set to Return to Pre-Pandemic Levels in Some Regions in 2023

- All Regions

- 17 Jan 2023

After stronger than expected recovery in 2022, this year could see international tourist arrivals return to pre-pandemic levels in Europe and the Middle East. Tourists are nonetheless expected to increasingly seek value for money and travel closer to home in response to the challenging economic climate.

Based on UNWTO's forward-looking scenarios for 2023, international tourist arrivals could reach 80% to 95% of pre-pandemic levels this year, depending on the extent of the economic slowdown, the ongoing recovery of travel in Asia and the Pacific and the evolution of the Russian offensive in Ukraine, among other factors.

All regions bouncing back

UNWTO anticipates a strong year for the sector even in the face of diverse challenges including the economic situation and continued geopolitical uncertainty

According to new data UNWTO, more than 900 million tourists travelled internationally in 2022 – double the number recorded in 2021 though still 63% of pre-pandemic levels. Every global region recorded notable increases in international tourist numbers. The Middle East enjoyed the strongest relative increase as arrivals climbed to 83% of pre-pandemic numbers. Europe reached nearly 80% of pre-pandemic levels as it welcomed 585 million arrivals in 2022. Africa and the Americas both recovered about 65% of their pre-pandemic visitors, while Asia and the Pacific reached only 23%, due to stronger pandemic-related restrictions which have started to be removed only in recent months. The first UNWTO World Tourism Barometer of 2023 also analyses performance by region and looks at top performers in 2022 , including several destinations which have already recovered 2019 levels.

International Tourist Arrivals, World and Regions

UNWTO Secretary-General Zurab Pololikashvili said: "A new year brings more reason for optimism for global tourism. UNWTO anticipates a strong year for the sector even in the face of diverse challenges including the economic situation and continued geopolitical uncertainty. Economic factors may influence how people travel in 2023 and UNWTO expects demand for domestic and regional travel to remain strong and help drive the sector's wider recovery."

Chinese tourists set to return

UNWTO foresees the recovery to continue throughout 2023 even as the sector faces up to economic, health and geopolitical challenges . The recent lifting of COVID-19 related travel restrictions in China , the world's largest outbound market in 2019, is a significant step for the recovery of the tourism sector in Asia and the Pacific and worldwide. In the short term, the resumption of travel from China is likely to benefit Asian destinations in particular. However, this will be shaped by the availability and cost of air travel, visa regulations and COVID-19 related restrictions in the destinations. By mid-January a total of 32 countries had imposed specific travel restrictions related to travel from China, mostly in Asia and Europe.

At the same time, strong demand from the United States , backed by a strong US dollar, will continue to benefit destinations in the region and beyond. Europe will continue to enjoy strong travel flows from the US, partly due to a weaker euro versus the US dollar.

Notable increases in international tourism receipts have been recorded across most destinations, in several cases higher than their growth in arrivals. This has been supported by the increase in average spending per trip due to longer periods of stay, the willingness by travelers to spend more in their destination and higher travel costs due to inflation. However, economic situation could translate into tourists adopting a more cautious attitude in 2023, with reduced spending, shorter trips and travel closer to home.

Furthermore, continued uncertainty caused by the Russian aggression against Ukraine and other mounting geopolitical tensions, as well as health challenges related to COVID-19 also represent downside risks and could weigh on tourism's recovery in the months ahead.

The latest UNWTO Confidence Index shows cautious optimism for January-April, higher than the same period in 2022. This optimism is backed by the opening up in Asia and strong spending numbers in 2022 from both traditional and emerging tourism source markets, with France, Germany and Italy as well as Qatar, India and Saudi Arabia all posting strong results.

Related links

- Download the News Release in PDF

- UNWTO World Tourism Barometer | Volume 21 • Issue 1 • January 2023 | EXCERPT

- World Tourism Barometer (PPT version)

- UNWTO Tourism Recovery Tracker

Category tags

Related content, international tourism to reach pre-pandemic levels in 2024, international tourism to end 2023 close to 90% of pre-p..., tourism’s importance for growth highlighted in world ec..., international tourism swiftly overcoming pandemic downturn.

Select your preferred language

- Deutsch English English (Australia) English (China) English (India)

- English (United Kingdom) Español (Latinoamérica) Español (España) Français Italiano

- Português (Brasil) Suomi Svenska 中文

.png)

Global Business Travel Forecast

Understand future pricing in air, hotel and ground transportation to build and budget your travel and events program.

Build and budget your business travel & events program

Now in its ninth year, the CWT GBTA Travel Price Forecast 2024 helps businesses understand market pricing for airfares, hotel room rates, ground transport and meetings and events. The forecast also explores where prices are heading, as well as the drivers of change.

Through interviews with leaders at CWT and GBTA , and in-depth analysis from acclaimed global futurist and New York Times best-selling author, Dr. Shawn DuBravac (Avrio Institute) , you’ll be one step ahead of the curve.

Hilton lifts profit forecast on international travel demand

- Medium Text

Sign up here.

Reporting by Aishwarya Jain in Bengaluru and Doyinsola Oladipo in New York; Editing by Milla Nissi

Our Standards: The Thomson Reuters Trust Principles. New Tab , opens new tab

Business Chevron

BYD unveils third ultra-luxury model under Yangwang brand

Chinese electric vehicle maker BYD unveiled the U7, its third ultra-luxury model under the Yangwang brand, on Thursday, as it makes a push upmarket to increase profitability amid an intensifying price war.

You are using an outdated browser. Upgrade your browser today or install Google Chrome Frame to better experience this site.

- IMF at a Glance

- Surveillance

- Capacity Development

- IMF Factsheets List

- IMF Members

- IMF Timeline

- Senior Officials

- Job Opportunities

- Archives of the IMF

- Climate Change

- Fiscal Policies

- Income Inequality

Flagship Publications

Other publications.

- World Economic Outlook

- Global Financial Stability Report

- Fiscal Monitor

- External Sector Report

- Staff Discussion Notes

- Working Papers

- IMF Research Perspectives

- Economic Review

- Global Housing Watch

- Commodity Prices

- Commodities Data Portal

- IMF Researchers

- Annual Research Conference

- Other IMF Events

IMF reports and publications by country

Regional offices.

- IMF Resident Representative Offices

- IMF Regional Reports

- IMF and Europe

- IMF Members' Quotas and Voting Power, and Board of Governors

- IMF Regional Office for Asia and the Pacific

- IMF Capacity Development Office in Thailand (CDOT)

- IMF Regional Office in Central America, Panama, and the Dominican Republic

- Eastern Caribbean Currency Union (ECCU)

- IMF Europe Office in Paris and Brussels

- IMF Office in the Pacific Islands

- How We Work

- IMF Training

- Digital Training Catalog

- Online Learning

- Our Partners

- Country Stories

- Technical Assistance Reports

- High-Level Summary Technical Assistance Reports

- Strategy and Policies

For Journalists

- Country Focus

- Chart of the Week

- Communiqués

- Mission Concluding Statements

- Press Releases

- Statements at Donor Meetings

- Transcripts

- Views & Commentaries

- Article IV Consultations

- Financial Sector Assessment Program (FSAP)

- Seminars, Conferences, & Other Events

- E-mail Notification

Press Center

The IMF Press Center is a password-protected site for working journalists.

- Login or Register

- Information of interest

- About the IMF

- Conferences

- Press briefings

- Special Features

- Middle East and Central Asia

- Economic Outlook

- Annual and spring meetings

- Most Recent

- Most Popular

- IMF Finances

- Additional Data Sources

- World Economic Outlook Databases

- Climate Change Indicators Dashboard

- IMF eLibrary-Data

- International Financial Statistics

- G20 Data Gaps Initiative

- Public Sector Debt Statistics Online Centralized Database

- Currency Composition of Official Foreign Exchange Reserves

- Financial Access Survey

- Government Finance Statistics

- Publications Advanced Search

- IMF eLibrary

- IMF Bookstore

- Publications Newsletter

- Essential Reading Guides

- Regional Economic Reports

- Country Reports

- Departmental Papers

- Policy Papers

- Selected Issues Papers

- All Staff Notes Series

- Analytical Notes

- Fintech Notes

- How-To Notes

- Staff Climate Notes

Regional Economic Outlook

The Western Hemisphere

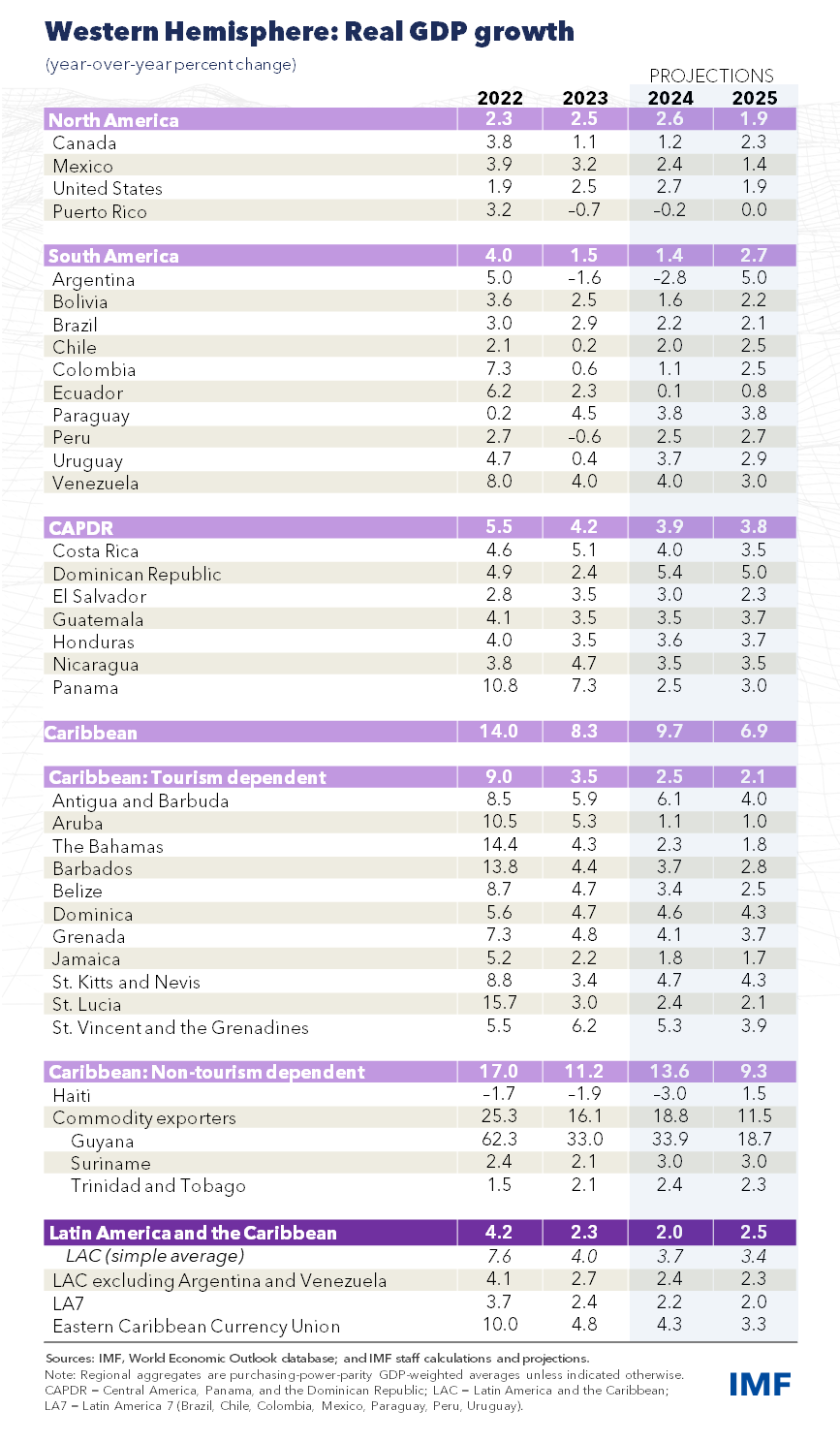

- Projections Table

Regional Economic Outlook for the Western Hemisphere, April 2024

The Latin America and the Caribbean region has shown remarkable resilience in the face of recent global challenges, rebounding more strongly than expected from the pandemic. Growth is now moderating, from 2.3% in 2023 to 2.0% in 2024, as most economies are operating at potential. This moderation is also due to a weaker external environment and the ongoing impact of tight policies aimed at curbing inflation. Inflation is on a downtrend, thanks to prompt measures by the region's central banks and global disinflation trends. With inflationary pressures subsiding, monetary policy easing can continue, striking a balance between durably bringing inflation back to target and avoiding an undue economic contraction. Fiscal policy should focus on expediting consolidation efforts to rebuild policy space by mobilizing revenue while safeguarding essential social expenditures to uphold social cohesion.

With poverty and inequality still high in the region, it is imperative to boost potential growth—which averages about 2.5%, lagging behind peer economies,. Structural reforms to raise growth should focus on enhancing the rule of law, improving the business environment, boosting labor force participation—especially of women—and addressing informality. Tackling crime and violence can also deliver substantial social and economic gains.

GDP Growth Projections

Inflation Projections

We've detected unusual activity from your computer network

To continue, please click the box below to let us know you're not a robot.

Why did this happen?

Please make sure your browser supports JavaScript and cookies and that you are not blocking them from loading. For more information you can review our Terms of Service and Cookie Policy .

For inquiries related to this message please contact our support team and provide the reference ID below.

Hilton lifts profit forecast on international travel demand

(Reuters) -Hotel operator Hilton Worldwide raised its annual adjusted profit forecast on Wednesday, banking on international travel demand to offset normalizing domestic travel in the U.S.

International travel demand is expected to remain strong this year as global air connectivity increases and travelers flock to Asian and Latin American countries, while demand for domestic travel plateaus in North America.

The company forecast 2024 adjusted profit of between $6.89 and $7.03 per share, up from the previously forecast $6.80 to $6.94 per share.

Hilton, which also owns brands such as Waldorf Astoria Hotels & Resorts, reported quarterly revenue per available room (RevPAR) of $104.16, up 2% from the same period last year.

"US RevPAR turned negative but Americas and Middle East & Africa accelerated ... implying global travel demand still robust," Richard Clarke, analyst at Bernstein, wrote in a note.

Hilton's shares were up 2.5% in light premarket trade.

The hotel operator reported an adjusted profit of $1.53 per share for the first quarter, compared to analysts' average estimate of $1.42 per share, according to LSEG data.

Total quarterly revenue was $2.57 billion. Analysts were expecting revenue of $2.53 billion.

(Reporting by Aishwarya Jain in Bengaluru and Doyinsola Oladipo in New York; Editing by Milla Nissi)

Tourism Web Portal

About the portal.

A technological tool for effective communication between the leading players in the Moscow tourism market and representatives of the foreign/regional tourism industry through online events. OBJECTIVES: • Building long-term cooperation with foreign/regional representatives • Raising awareness among foreign/regional representatives of the tourism industry of the tourism opportunities, measures and attractiveness of the city of Moscow in the field of tourist infrastructure development

Moscow City Tourism Committee

The Tourism Committee, or Mostourism, is the executive body of the Moscow City Government that oversees tourist activities in the capital. The Committee is responsible for legislative initiatives, congress and exhibition activities, and event and image projects. As the brand manager for an attractive tourism image for Moscow, Mostourism constantly analyses global trends, offers Russian and foreign tourists what they want, and also uncovers new opportunities for the capital in terms of interesting and rewarding leisure activities.

ANO «Project Office for the Development of Tourism and Hospitality of Moscow»

Syundyukova Yulia [email protected] Mezhiev Magomed [email protected]

Video materials about Moscow

- Companies & Markets

- Banking & Finance

- Reits & Property

- Energy & Commodities

- Telcos, Media & Tech

- Transport & Logistics

Consumer & Healthcare

- Capital Markets & Currencies

Hilton lifts 2024 profit forecast on international travel demand

HOTEL operator Hilton Worldwide raised its annual adjusted profit forecast on Wednesday (Apr 24), banking on international travel demand to offset normalizing domestic travel in the US

The company forecast 2024 adjusted profit of between US$6.89 and US$7.03 per share, up from the previously forecast US$6.80 to US$6.94 per share.

International travel demand is expected to remain strong this year as global air connectivity increases and travelers flock to Asian and Latin American countries, while demand for domestic travel plateaus in North America.

Hilton, which also owns brands such as Waldorf Astoria Hotels & Resorts, reported quarterly revenue per available room (RevPAR) of US$104.16, up 2 per cent from the same period last year. REUTERS

GET BT IN YOUR INBOX DAILY

Start and end each day with the latest news stories and analyses delivered straight to your inbox.

KEYWORDS IN THIS ARTICLE

- Hilton is in talks to buy campus-focused Graduate Hotels brand

- CDL in talks to buy Hilton Paris Opera hotel from Blackstone at reported price of 244 million euros

BT is now on Telegram!

For daily updates on weekdays and specially selected content for the weekend. Subscribe to t.me/BizTimes

France's Casino supermarket chain to axe up to 3,200 jobs

Prada outshines rivals with 16% revenue lift boosted by miu miu, toymaker hasbro posts quarterly profit beat, slower sales decline, china knockoff raid jolts a global throng of fake-fashion influencers, roche cuts pipeline after research setbacks and sales drop, support south-east asia's leading financial daily.

Get the latest coverage and full access to all BT premium content.

Browse corporate subscription here

- International

- Opinion & Features

- Startups & Tech

- Working Life

- Events & Awards

- Breaking News

- Newsletters

- Food & Drink

- Style & Travel

- Arts & Design

- Health & Wellness

- Paid Press Releases

- advertise with us

- privacy policy

- terms & conditions

- cookie policy

- data protection policy

SPH MEDIA DIGITAL NEWS

MCI (P) 064/10/2023 © 2024 SPH MEDIA LIMITED. REGN NO. 202120748H

COMMENTS

International tourism is expected to fully recover pre-pandemic levels in 2024, with initial estimates pointing to 2% growth above 2019 levels. This central forecast by UNWTO remains subject to the pace of recovery in Asia and to the evolution of existing economic and geopolitical downside risks. The positive outlook is reflected in the latest ...

The second UNWTO World Tourism Barometer of the year shows that the sector's swift recovery has continued into 2023. It shows that: Overall, international arrivals reached 80% of pre-pandemic levels in the first quarter of 2023. An estimated 235 million tourists travelled internationally in the first three months, more than double the same ...

International tourism recovered 88% of pre-pandemic levels, supported by strong pent-up demand (UNWTO Tourism Barometer January 2024-Excerpt). International tourism is expected to fully recover pre-pandemic levels in 2024, with initial estimates pointing to 2% growth above 2019 levels. This central forecast by UNWTO remains subject to the pace ...

Last year, EIU expected global tourism arrivals to recover to near pre-pandemic levels by the end of 2023, as fear of covid-19 recedes and restrictions are lifted. However, Russia's invasion of Ukraine in ... our forecast for a tourism recovery firmly into 2024, with considerable turbulence likely in the interim. Even so, the depth of the ...

The UNWTO's latest World Tourism Barometer shows an increase of 182% for international tourism in the first three months of 2022 compared to the previous year. While optimism builds, the tourism industry is still vulnerable to new variants of COVID-19, the war in Ukraine and global economic conditions.

In 2023, the sector is forecast to reach $9.5TN, just 5% below 2019 pre-pandemic levels when travel was at its highest. 34 countries have already exceeded 2019 levels. According to the research conducted by WTTC in collaboration with Oxford Economics, the global tourism body also forecasts that the sector will recover to 95% of the 2019 job level.

Tourism outlook 2023. Global tourism arrivals will increase by 30% in 2023, following growth of 60% in 2022, but will remain below pre-pandemic levels. The economic downturn, sanctions on Russia, and China's zero-covid strategy will delay recovery. EIU's guide to tourism in 2023 provides a comprehensive view of the challenges, opportunities ...

The travel and tourism industry's GDP is seen hitting $8.35 trillion this year and $9.6 trillion in 2023, a return to its pre-pandemic level. Tourism jobs are projected to recover to 300 million ...

In 2022, the global online travel market amounted to as much as 474.8 billion U.S. dollars, a figure that was forecast to exceed one trillion U.S. dollars by 2030.

Tourism in 2022 Forecast. The travel and tourism industry continues to be one of the hardest hit by the coronavirus pandemic, with global international arrivals in 2022 set to remain 30% below 2019 levels. Differing levels of border control and variations in vaccine passports will continue to drive tourism trends and make international travel ...

In 2023, the Travel & Tourism sector contributed 9.1% to the global GDP; an increase of 23.2% from 2022 and only 4.1% below the 2019 level. In 2023, there were 27 million new jobs, representing a 9.1% increase compared to 2022, and only 1.4% below the 2019 level. Domestic visitor spending rose by 18.1% in 2023, surpassing the 2019 level.

Contribution of China's travel and tourism industry to GDP 2014-2023 Passenger traffic at Dubai Airports from 2010 to 2020* Growth of inbound spending in the U.S. using foreign visa credit cards

The Travel & Tourism market worldwide is projected to grow by 3.47% (2024-2028) resulting in a market volume of US$1,063.00bn in 2028. ... Revenue analytics and forecasts ... the Global Consumer ...

Tourism Statistics. Get the latest and most up-to-date tourism statistics for all the countries and regions around the world. Data on inbound, domestic and outbound tourism is available, as well as on tourism industries, employment and complementary indicators. All statistical tables available are displayed and can be accessed individually ...

A spokesperson for UK travel agents' association ABTA told ITIJ: "It is likely that international travel will continue to grow in 2024, with passenger numbers achieving or surpassing pre-pandemic levels. In the UK, many travel companies are already reporting record numbers for 2023 and healthy interest in forward booking for 2024.".

Travel Forecast. FORECAST January 17, 2024. Driven by Tourism Economics' travel forecasting model, the latest U.S. Travel Forecast projects the following: International travel to the U.S. is growing quickly but is still far from a full pre-pandemic recovery. An expected global macroeconomic slowdown, a strong dollar, and lengthy visa wait times ...

Global Travel Service - Tourism Economics. Tourism Economics US Headquarters. 303 West Lancaster Avenue, Suite 2E. Wayne, PA 19087. U.S. +1 610 995 9600. Tourism Economics Europe Headquarters. Abbey House. 121 St Aldates. Oxford, OX1 1HB.

All Regions. 17 Jan 2023. After stronger than expected recovery in 2022, this year could see international tourist arrivals return to pre-pandemic levels in Europe and the Middle East. Tourists are nonetheless expected to increasingly seek value for money and travel closer to home in response to the challenging economic climate.

According to the global tourism body's 2024 Economic Impact Research, Travel & Tourism will contribute an additional $770 billion over its previous record, thereby solidifying its stature as a ...

This global website presents OFFICIAL weather observations, weather forecasts and climatological information for selected cities supplied by National Meteorological & Hydrological Services (NMHSs) worldwide.The NMHSs make official weather observations in their respective countries. Links to their official weather service websites and tourism ...

Build and budget your business travel & events program. Now in its ninth year, the CWT GBTA Travel Price Forecast 2024 helps businesses understand market pricing for airfares, hotel room rates, ground transport and meetings and events. The forecast also explores where prices are heading, as well as the drivers of change.

The company forecast 2024 adjusted profit of between $6.89 and $7.03 per share, up from the previously forecast $6.80 to $6.94 per share. International travel demand is expected to remain strong ...

IMF upgrades global growth forecast as economy proves ... - CNBC

Regional Economic Outlook for the Western Hemisphere, April 2024. The Latin America and the Caribbean region has shown remarkable resilience in the face of recent global challenges, rebounding more strongly than expected from the pandemic. Growth is now moderating, from 2.3% in 2023 to 2.0% in 2024, as most economies are operating at potential.

India's forecast was lifted to 6.8% for this year, from 6.5%. In an unusually strong criticism of the US, the IMF said that while the nation's recent economic performance is "impressive ...

Hilton's shares were up 2.5% in light premarket trade. The hotel operator reported an adjusted profit of $1.53 per share for the first quarter, compared to analysts' average estimate of $1.42 per ...

About the portal. A technological tool for effective communication between the leading players in the Moscow tourism market and representatives of the foreign/regional tourism industry through online events. OBJECTIVES: • Building long-term cooperation with foreign/regional representatives. • Raising awareness among foreign/regional ...

The company forecast 2024 adjusted profit of between US$6.89 and US$7.03 per share, up from the previously forecast US$6.80 to US$6.94 per share. International travel demand is expected to remain strong this year as global air connectivity increases and travelers flock to Asian and Latin American countries, while demand for domestic travel ...

CNN —. A year's worth of rain unleashed immense flash flooding in Dubai Tuesday as roads turned into rivers and rushing water inundated homes and businesses. Shocking video showed the tarmac ...