Bus & Tram Journeys Multiple bus rides made in a one hour period count as a single bus journey.

Tube & train journeys.

Your fare is

JavaScript is disabled

Please enable JavaScript in your browser in order to use OysterCalculator.

Easy London Budget Calculator: How Much Does it Cost to Visit London?

How much does it cost to visit London? That all depends.

A lot of estimations out there are outdated, have the wrong average prices for hotels, and don’t factor in things like what attractions you want to see or what your dining style is.

Plus, a London trip budget pre-pandemic looks a lot different from a London trip budget post-pandemic. Prices have changed dramatically.

To give you a better idea of your real London trip budget, I’ve created a London budget calculator for you using the most up to date pricing.

Take it from someone who lives here and spends (too much) everyday: sticking to a budget in this city is hard but it can be done!

I want you to be able to visit our incredible city with a realistic sense of how much things cost and make the most out of your time and money here.

Let’s calculate your London trip budget!

London Budget Calculator for 2024

Use the London budget calculator below, and read on to find out how I came up with these figures and how to save the most money.

Keep in mind these are estimated figures and it’s only to give you a realistic idea of how much things will cost.

Your total spend in London may be more or less because there are so many factors that I can’t include all of here.

How Much Does it Cost to Visit London in 2024?

To create my London budget calculator, I pulled real-life, current 2023 prices for everything from attractions to hotels from their actual websites.

For figures where I needed averages, I analyzed a sample of current prices and came up with the most accurate average price I could.

Below may contain some affiliate links, for which I may receive. small commission if you make a purchase. It doesn’t cost you anything extra!

Accommodation Cost in London

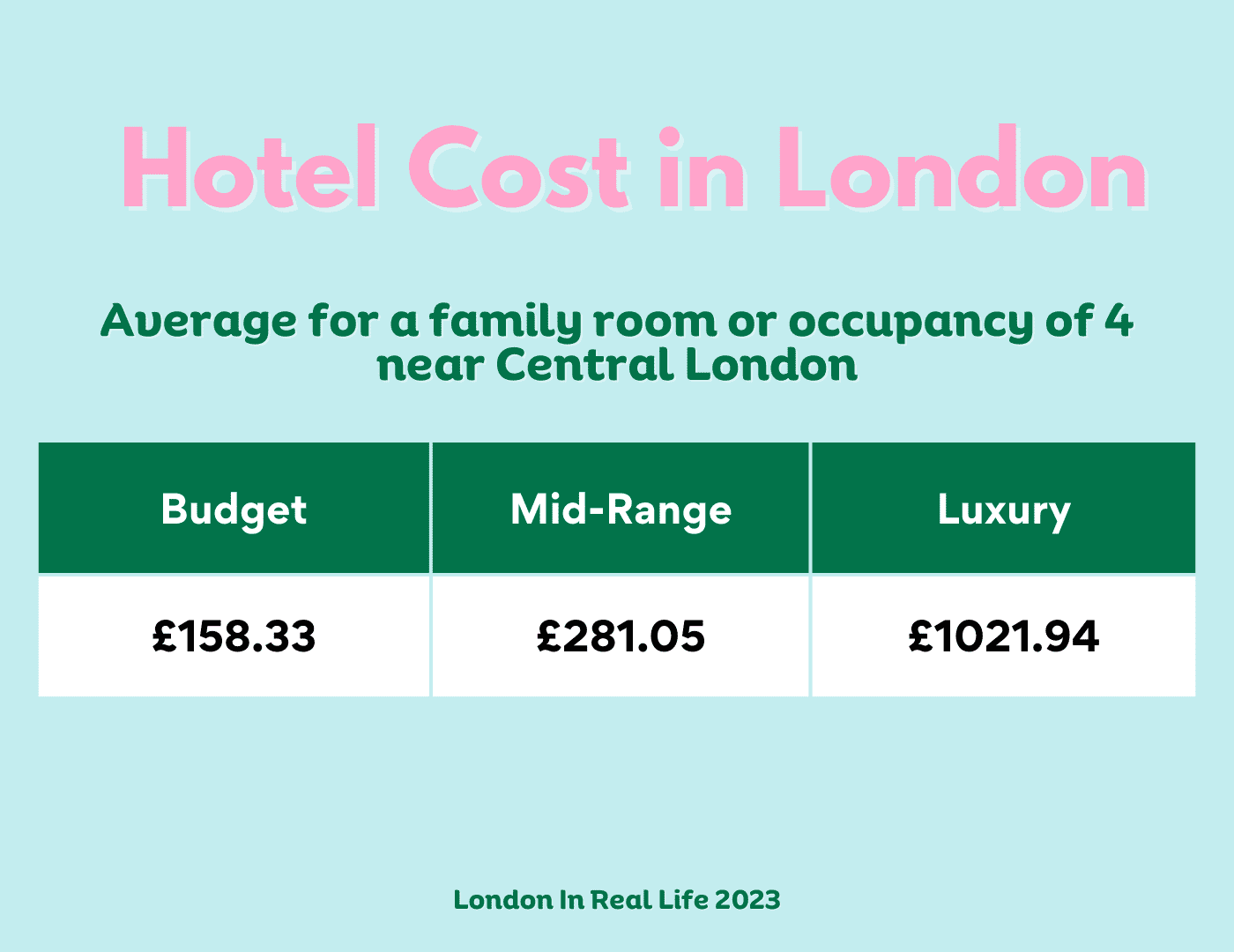

Looking for the average cost of accommodation in London, I came away unsatisfied. The numbers looked too low to me, so I did my own research and analyzed the data.

To calculate the average prices of Airbnbs and hotels in London, I needed real figures of actual listed properties. So I took a sample from each category, ran the numbers, added average fees, and came up with a good representation of the average cost.

You can see my full breakdown of the average costs of hotels and Airbnbs in London in my post here.

What’s the Average Cost of Airport Transport in London?

To calculate the average cost of private airport transfers in London, I sampled prices from Uber and several private car companies that you can book ahead.

- Average price of Public Transport from London Airports (not calculated in above calculator; add to total if you’re using this method): £12.50pp (Underground) – £25pp (Express trains)

- Average price of UberX from London Airports: £60

- Average price of private car from London Airports to Central London: £120

- Average price of private van or people carrier from London Airports to Central London: £200

🤑 Money Saving Tip:

Take public transport from London airports ! It’s so much cheaper, plus fast and efficient.

The only time I wouldn’t do this is if you are a large family with a lot of luggage. Navigating the tube or trains with lots of bags isn’t ideal, as not everywhere has step-free access and lifts.

What’s the Average Cost of Daily Transportation in London?

Daily transportation costs within London can vary widely depending on which method of transportation you want to use.

I needed to do a little estimating here, as the cost of Uber, taxis, and private cars totally depends on how far you’re going, what traffic is like (bad, generally) and which company you use.

For public transport, prices are divided by zone and capped per day depending on how many zones you travel through, though most tourists don’t generally go outside of Zone 3.

- Average cost of public transport per person per day: £9 ( using an Oyster card or contactless payment method)

- Average cost of using some public transport and some private (some Uber or Taxis per person per day): £25

- Average cost of using only private transport (taxis & Uber only) per person per day: £60

🤑 Money Saving Tip:

Use public transport in London! It’s fast, efficient, and completely affordable. Use CityMapper or Google Maps to get easy to follow instructions from place to place.

What’s the Average Daily Food Cost in London?

Other than accommodation, food may be your second largest expense in London.

I’m not going to lie: I cringe at our grocery and restaurant bills in London. But there are ways to keep it affordable.

To pull real data, I created a bunch of sample checks from real London cafes, restaurants, grocery stores, pubs, and coffee shops.

I also went through my own family expenses for food, and averaged all of these numbers out to a rough estimation.

- Average daily cost of budget dining in London (sticking to only fast-type food, grocery stores, and cheap restaurants and takeaways. Not including alcohol): £26 per person

- Average daily cost of mid-range dining ( some cheap restaurants, some more expensive, not including alcohol ): £55pp

- Average daily cost of fine dining ( not including alcoho l): £130 pp

Picnics are your very best friend in London to keep eating affordable.

UK grocery stores have a much larger selection of prepared foods than other countries do, so it’s quite easy (and cheap!) to pop into a grocery store and create your own ready-to-eat meal. Take it to a park and have a lovely lunch!

For restaurants, stay off the high street . In touristy areas, go away from the crowds to find hidden gems, or enjoy a lovely food hall.

If you want to experience afternoon tea, here’s my full list of afternoon tea on a budget options!

London Trip Budget: Attractions and Day Trips

In my London budget calculator I have plugged in the current 2024 per person attraction ticket prices. Children’s tickets are usually only a few pounds less.

For the London Eye, for example, adult tickets are £38 and children’s are £34. Not much difference.

Keep in mind that there are so many attractions and museums in London that are totally free! These are just the most popular paid attractions you might want to see.

For day trips , I have found prices from tour companies that offer these day trips including transportation.

It may be cheaper if you book your own trains and navigate these day trips on your own.

🤑 Money Saving Tip

Take advantage of all of the free museums that London has to offer! Consider booking day trips yourself and not using a tour company to save the most cash.

You can also potentially save money on attractions using the London Pass or similar program.

London Trip Budget: Final Tips

How much does it cost to visit London? I hope if you’ve used my London budget calculator you now have a better idea of how much you’ll need to visit our incredible city.

Keep in mind that accommodation cost in London will by far be your biggest expense, but there are tons of ways to maximize your hotel or Airbnb budget.

More on Budgeting for London

31 Costly London Tourist Mistakes & How to Avoid Them

Is the London Pass Worth it? Analysis & Easy Calculator

What NOT to do in London: The Truth About these 15 Tiring Tourist Traps

Is Tipping in the UK Expected? A Super Simple Guide

Is the London Pass Worth it? Use the Calculator

Your Ultimate Guide to a Family Trip to London on a Budget

The Perfect Ladies Day Out in London: 3 Itineraries for Every Budget

The Best Thrift Shops in London: 7 Areas to Score the Best Second Hand Bargains

What’s the Closest Country to London? 10 Incredible Trips to Take Today

Similar Posts

Visiting Battersea Power Station: Everything You Need To Know (2024)

Wanting to visit Battersea Power Station? I have all the details for you to make the most of your visit, no matter your budget.

How to Use Google Maps in London: A Simple Beginner’s Guide

Learning how to use Google Maps in London can start off confusing, but with a few simple steps, you can learn how to travel London with ease.

19 Hidden Gem Hotels in London Voted on By Frequent Travelers

Frequent London travelers told me their favorite hidden gem hotels in London. Here are their answers!

Exactly How to Spend 5 Days in London: Free Itinerary

Here’s exactly how to spend 5 days in London, from a local guide.

Expert’s Easy Itinerary for 3 Days in London

Here’s a Londoner’s easy itinerary for 3 days in London. See the best bits, grouped together for easy travel.

21 Best Nicknames for London and England That People Actually Use

There are so many nicknames for London and nicknames for England…but which ones do people still use today?

- Places to Visit

- Sightseeing

- Practical Tips

- Where to Stay

London Underground Tickets & Travelcards

The Travelcard is a transport pass for London that gives you unlimited travel in London within certain zones . The prices vary according to the number of zones you need to travel through. Central London is in zone 1.

Travelcards are valid for 1 day, 7 days, 1 month or 1 year.

The passes are valid for travel on all types of transport in London including:

- the Underground (the tube)

- the local suburban trains within London

- the Elizabeth Line (not west of West Drayton)

- the Docklands Light Railway (DLR)

- the London Overground

- the buses all over London. A Travelcard for any zone allows you to use the buses in all zones (zones 1-6)

The 3 Day Travelcard, weekend Travelcard, Zone 1-2 & 2-6 One Day Travelcards are no longer available.

Visiting London for 1-7 days? See our guide to London’s transport tickets & passes . The Travelcard may not be the best ticket for your stay.

Single Underground Tickets

Single paper tickets on the London underground are expensive if you buy them from a tube station ticket machine:

- £6.70 for one journey in zone 1 (central London) and between zone 1 and zones 2 to 6

- See single ticket prices for all zones .

One Day Travelcards: 2024 prices

Using a Pay as you go Oyster card or a contactless card are the cheapest ways to pay for travel if you’re in London for 1-5 days. The daily cap is £8.50 per day for zones 1-2

If you really don’t want to use an Oyster card or don’t have a contactless card, the One Day Travelcard is the next best money-saving pass.

The paper Off peak One Day Travelcard for zone 1-6 is £15.90. This is expensive, but still cheaper than paying the full cash fare for 3 underground trips in central London (3 x £6.70 = £20.10 ).

One Day Travelcard fares from 3 March 2024

Peak v anytime travelcards.

One Day Travelcard prices are different if you travel during peak or off-peak times:

Anytime Travelcard Valid for travel at anytime. Off-Peak Travelcard For travel after 9.30am Monday–Friday and all day Saturday, Sunday and public holidays.

Top Tip: An Off-Peak One Day Travelcard for zones 1–6 costs £10.40 with a Railcard .

Weekly Travelcards: 2024 prices

If you stay in London for 6–7 days and use the underground, trains, and buses every day, the weekly Travelcard is the most cost-effective travel pass.

The one-week pass including central London (zones 1-2) is £42.70.

- It can start on any day of the week

- It’s valid for travel at anytime; there is no peak or off-peak rate.

Most places sell weekly Travelcards loaded onto a plastic Oyster card. There’s a £7 fee for the Oyster card.

Your fare on an Oyster card will automatically cap at the weekly Travelcard fare (this is already available on contactless cards). The cap starts on Monday and ends Sunday, so it mainly benefits Londoners or those working in London.

Weekly Travelcard fares from 3 March 2024

- See weekly Travelcards prices for all other zones (2, 3, 4, 5 and 6)

Monthly Travelcards: 2024 prices

For longer stays in London, monthly Travelcards are available. You won’t save much compared to buying 4 x weekly Travelcards – but you’ll save time renewing it. Like the weekly Travelcard, it can start on any day of the week and is valid for travel at any time. See monthly Travelcard prices for all other zones (2, 3, 4, 5 and 6)

Monthly Travelcards from 3 March 2024

Where to buy travelcards.

One day, weekly and monthly Travelcards are available from:

Underground stations

Travelcards are available from all underground station ticket machines (there are no longer any underground tickets offices). The busier stations in central London have staff to help you use the machines.

Local shops and newsagents

Travelcards are also available from Oyster ticket stops . These are newsagents and local shops licensed to sell London transport tickets and Oyster cards. One Day Travelcards are not available from Oyster ticket stops.

London train stations

One Day Travelcards are available from all London train station ticket offices and ticket macines. Paper weekly and monthly Travelcards are no longer available from train stations . They are available to buy, but they are loaded onto an Oyster card and may only be available from ticket machines, not ticket offices.

London Transport Visitor Centres

TfL Visitor Centres at Victoria train station, Kings Cross/St Pancras International station, Heathrow Terminal 2 & 3 tube staion, Liverpool St station & Piccadilly Circus tube station.

How to use a Travelcard

On the underground.

If you have a paper One Day Travelcard or single ticket from a ticket machine, insert the card into the slot on the front of the ticket barrier. The barrier opens when you take the ticket from behind the yellow reader, on the top.

If you have a paper One Day Travelcard, just show it to the driver when boarding the bus.

See How to use an Oyster card if you have a weekly Travelcard on an Oyster card.

Top Tip: Do you want a cheaper way to travel around central London? If you only travel by bus , it costs £5.25 per day or £24.70 per week.

Related pages

- Guide to London’s transport tickets

- Weekly and monthly Travelcards for zones 2, 3, 4, 5 & 6

- Oyster card

- How to use a contactless card to pay for transport

- Bus tickets & passes

- London Transport zones

Last updated: 22 February 2024

Transport tickets & passes

- Guide to London's transport tickets

- One day & weekly Travelcards

- Zone 2–6 weekly Travelcards

- Bus tickets & passes

- Oyster single tickets

- Oyster card refunds

- Contactless cards

- Child tickets & passes

- Local train tickets

Useful information

- Plan your journey

- London transport zones

Popular pages

- Left luggage offices

- Congestion Charge

- 2 for 1 discounts at London attractions

- Oyster cards

- Top free museums & galleries

- Cheap eating tips

- Heathrow to London by underground

Copyright 2010-2024 toptiplondon.com. All rights reserved. Contact us | Disclaimer | Privacy

Cost of Living Estimator in London, United Kingdom

Currency: EUR USD --- AED AFN ALL AMD ANG AOA AUD AWG AZN BAM BBD BDT BGN BHD BIF BMD BND BOB BRL BSD BTN BWP BYN BZD CAD CDF CHF CLF CLP CNH CNY COP CRC CUC CVE CZK DJF DKK DOP EGP ERN EUR FJD FKP GBP GEL GGP GHS GIP GMD GNF GTQ GYD HKD HNL HRK HTG HUF IDR ILS IMP INR IQD IRR ISK JEP JMD JOD JPY KES KGS KHR KMF KPW KRW KWD KYD KZT LAK LKR LRD LSL LYD MAD MDL MGA MKD MNT MOP MRU MUR MVR MXN MYR MZN NAD NIO NOK NPR NZD OMR PAB PEN PGK PHP PKR PLN PYG QAR RON RSD RUB RWF SAR SBD SCR SDG SEK SGD SHP SLL SOS SRD STD STN SVC SYP SZL THB TJS TMT TND TOP TRY TTD TWD TZS UAH UGX USD UYU UZS VES VND VUV WST XAF XAG XCD XDR XOF XPF YER ZAR ZMW ZWL Sticky Currency

Members of your household:

Eating lunch or dinner in restaurants: 0.0% 2.0% 5.0% 10.0% 20.0% 30.0% 40.0% 50.0% 60.0% 70.0% 80.0% 90.0% 100.0% of the time

When eating in restaurants, you are choosing inexpensive restaurants: 0.0% 10.0% 20.0% 30.0% 40.0% 50.0% 60.0% 70.0% 80.0% 90.0% 100.0% of the time

Drinking Coffee outside of your home: A lot High Moderate Low No

Going out (cinema, nightlife, etc.): none very low (twice per month per household member) low (three times per month per household member) average (once per week per household member) high (twice per week per household member) very high (3-4 times per week per household member)

Smoking (household overall): packs of cigarettes per day

Alcoholic beverages (consume): A lot Moderate Low No

At home, we are eating: Western Asian food

Driving car: A lot Moderate Low No

Taking Taxi: Daily one round trip Two round trips per Week One round trip per Week One round trip per Month No

Paying for public transport tickets: Monthly, All Members Monthly, 2 Family Members Monthly, 1 Family Members On-Demand, around 5 round trips weekly per family member On-Demand, around 4 round trips weekly per family member On-Demand, around 3 round trips weekly per family member On-Demand, around 2 round trips weekly per family member On-Demand, around 1 round trip weekly per family member None

Sport Memberships: All Household Members 1 Household Member 2 Household Members No

Vacation and Travel: Three per year (one week each), relatively expensive Two per year (one week each), relatively expensive Once per year (one week each), relatively expensive Twice per year (one week each), relatively inexpensive Once per year (one week each), relatively inexpensive None

Buying Clothing and Shoes : A Lot Moderate Low

Rent: none Apartment (1 bedroom) in City Centre Apartment (1 bedroom) Outside of Centre Apartment (3 bedrooms) in City Centre Apartment (3 bedrooms) Outside of Centre Sharing a Room in 3 Bedroom apartment City Centre Sharing a Room in 3 Bedroom apartment Outside of Centre Mortgage for 1 bedroom apartment (approximate) Mortgage for 3 bedroom apartment (approximate)

Number of your children going to kindergarten:

Number of your children going to the private school:

* Our estimator doesn't include insurance, health-related expenses, parking fees, or domestic help. It doesn't take into calculations income tax.

Copyright © 2009-2024 Numbeo. Your use of this service is subject to our Terms of Use and Privacy Policy

Travel Europe on a Budget

The Savvy Backpacker

City Guides .\33 a132798-3f3b-4585-954d-7e70cf863447{fill:#231f20}

London price guide | calculating the daily costs to visit london.

How to estimate your budget for food, hostels, hotels, attractions, alcohol & more for visiting London on a budget.

London is a world-class city but It’s also one of the most expensive cities in the world. Luckily, hostels are reasonably affordable (at least for a major city) and there are plenty of great free museums. However, the cost of attractions and food prices will put a major dent in your budget.

In this London travel price guide, we’ll outline the estimated travel expenses for food, accommodation, attractions, alcohol, and other things that you’ll experience so you can better budget your trip to London.

This London Price Guide is part of our City Price Guide Series where we break down the travel costs of Europe’s most popular cities.

Average Daily Cost For Visiting London

It costs around £60-£95/day ($75-$115) to visit London comfortably as a budget traveler. These prices are based on what you’ll need to visit the city comfortably as a budget traveler.

If you want to upgrade your accommodations, add another £40-£100/night depending on your stay. These prices also don’t include things like big nights out at the bar/pub, club entry fees, souvenir/clothing shopping, tours, random purchases, nicer food, etc.

Daily Cost of Budget Travel in London: £92 (Approx. $115)

- Attractions: £20 (one paid attraction + any free museums)

- Breakfast: £4

- Dinner: £15

- Treat (dessert/beer/wine): 4

- Transportation: £8

- Accommodation (hostel): £33/night

Daily Cost of Frugal Travel in London: £57 (Approx. $70)

- Attractions: £10 (visit one of the many free museums and do a free tour)

- Breakfast: £2

- Lunch: £6 (ethnic street food or takeaway shop fare)

- Dinner: £10 (cook your own meal in the hostel or cheap takeout)

- Transportation: £2.30 (single tube ride)

- Accommodation (cheap hostel bed): £23/night

London Attraction and Museum Prices

Good news… London has amazing museums and most of them are completely free. Bad news… all the other attractions are expensive. However, you might be able to save some money by using the London Pass if you plan on visiting multiple attractions. Read our London Pass Review for more information.

- Tower of London : £29.90

- London Eye : £31-£53

- St. Paul’s Cathedral : £20.50

- Buckingham Palace : £30-£33

- Westminster Abbey : £27.00

- British Museum : Free

- Victoria and Albert Museum : Free

- National Gallery : Free

- Imperial War Museum : Free

- Tate Modern : Free

- Natural History Museum : Free

- Walking Tours: Free (but you should tip the guides) — £20+

Tip: Many attractions now offer online booking and there is often a small discount for booking online vs buying tickets at the door (and you get to skip the ticket line).

London Food Prices

England isn’t traditionally known for great food but London does have a world-renowned food scene—but that high-end food is a budget killer. Budget travelers will have to stick to the basics, and even then, the food isn’t cheap. If you’re on a tight budget, you might want to cook for yourself as much as possible.

Check out The Savvy Backpacker’s Guide To London On A Budget because it has a ton of great budget-friendly restaurants.

Budget Breakfast Prices in London: £ 3-£10

- Many hostels will offer a free, simple breakfast that normally consists of cereal, bread/croissant, and maybe milk, coffee, tea, or juice (some hostels will offer more and some less).

- A traditional English breakfast from a typical café will cost £6-£9.

- You can also find plenty of budget-friendly options at the bakery or grocery store. Croissants and other baked goods start at around £1.50. Coffee from a typical café will cost around £2.50-£4.

Budget Lunch Prices in London: £5-£15

- Super-budget travelers can make a super cheap lunch of bread, cheese, and fruit from any grocery store for a few pounds.

- Takeaway meals (like kebabs with fries) or similar dishes from a takeaway shop will cost about £7-£9.

- Check out street markets for pizza, falafel, tagines, burritos, curries, wraps, and sandwiches for £5-£9.

- A simple, yet filling and tasty, lunch from a local (i.e. non-touristy) restaurant will cost about £10-£15.

Budget Dinner Prices in London: £7-£18

- Budget travelers will want to seek out the many ethnic restaurants in London. It isn’t too tough to find a good meal for about £12-£18.

- McDonald’s combo meal (burger, fries, and a drink) will cost about £7.

- Fish and chips from a quality fish and chips shop will cost around £8-£12 for takeaway and a bit more to dine in.

- A simple, yet filling and tasty, meal from a local (i.e. non-touristy) restaurant will cost about £12-£18.

- Many of the options from the Budget Lunch section above also apply to dinner.

Drinks and Alcohol Prices in London

- Pint of standard beer out: £3.20-£6+

- Pint of beer from a grocery store: £1-£2

- A glass of the house wine at a restaurant: £4-£5+

Local-Favorite Budget Restaurants in London:

Here are a few budget restaurants that I pulled from our Guide To London On A Budget .

FISHCOTHEQUE

This traditional hole-in-the-wall joint is tucked under a bridge and serves up generous portions for a reasonable price. They’re a local favorite so it can get busy during lunch and dinner.

- Order of Fish and Chips: £15-£18

- See On Google Maps

Opened in 1982, this bustling award-winning shop serves up some of the best traditional fish and chips in London. Dine-in or takeaway.

- Order of Fish and Chips: £10-£14

GIGS FISH & CHIPS

Opened in 1958, Gigs obviously knows what they’re doing if they’ve survived this long in a city that seems to have a chippy everywhere you look.

- Order of Fish and Chips: £9 (takeaway) – £14.50 (dine-in)

- See on Google Maps

REGENCY CAFE

Cheap, no-frills, delicious, and always busy (get there early to avoid a long wait). This authentic spot has been around since 1946 and is a local favorite.

- Full English Breakfast: Starts at £6.00

TERRY’S CAFE

Old-school, family-run cafe. Quality food for a good price. A local favorite since 1982.

- Full English Breakfast: Starts at £8.50-£12

Expect long lines and excellent Bombay-style comfort food at this popular restaurant. The prices are fair, the atmosphere is buzzing, and the quality of food and drinks is excellent. Many people say this is their favorite Indian restaurant in London.

- Main Dishes: £9-£15

Solid Italian-style pizza at a solid price.

- Prices: £5.50-£8.50

GODDARDS AT GREENWICH (BRITISH)

This traditional pie mash restaurant has been around since 1890 and they serve up handmade pie & mash daily at a fair price. They have some nice traditional British desserts as well.

- Main Dishes: £5.50-£9

SÔNG QUÊ CAFÉ (VIETNAMESE/PHO)

Excellent Vietnamese place to get authentic beef pho at a great price. Super popular so expect a line.

- Main Dishes: £7.50-£10

London Transportation Prices

London is a big city so you’ll need to use public transportation a few times during your visit. Unfortunately, it can be kind of expensive and it can be a bit confusing because London has multiple travel zones which determine the price.

You should use an Oyster Card (a refillable travel card) or contactless payment as these methods greatly reduce the ticket price vs buying a single one-way ticket.

- Single One-Way Ticket: £6.30

- Single One-Way Fare with Oyster Card: £2.80 (peak), £2.70 (off-peak)

- Max Day Fare: £8.10 (you’ll never pay more than £9.10 in a single day when using the Oyster Card)

- Heathrow Express (fast train between LHR and London— travel time 15min): £22.50-£25

- London Underground (between airport and city — travel time 60min): £5.70

- Heathrow Connect (30min journey): £10.30

- Bus from LHR airport into the city (60-80min): £6-£10

- Taxi LHR airport into the city: £50 – £70

London Hostel, Hotel, & Rental Apartment Prices

London has plenty of hostels throughout the city and all the competition helps lower hostel prices—but you still shouldn’t expect cheap prices. Don’t expect much from budget hotels as most are small, rundown, and dingy. Apartment rentals can be a very attractive option if you’re traveling with two or more people.

Hostel Prices in London: £23-£47/night

The nightly price of a well-rated hostel in London starts around £30 per person—although many hostels raise their prices on the weekend. Remember, these prices are for a bed in a shared dorm room. Private rooms start are around £110-£160/night. Check out the latest London hostel prices at Hostelworld .

Here is a list of the top-rated hostels in London:

- Wombats City Hostel London

- Astor Hyde Park

- Astor Queensway

- Barmy Badger Backpackers

- MEININGER London Hyde Park

Check out The Savvy Backpacker’s guide to The Best Hostels in London to get a more in-depth look at London’s various hostel options.

Budget Hotel Prices in London: £90-£150 /night

Budget hotels in central London start around £70-£95/night but the quality will be low. A well-rated budget hotel in London starts at around £130-£145/night. Prices do rise if you book last minute—especially during the summer and Christmas.

We suggest checking out Booking.com to see hotel prices for your dates since they’re always changing.

Rental Apartment Prices in London: £90-£170+ /night

London has a lot of rental apartments throughout the city. They can be a good option for large groups or travelers who want a little more space (and a kitchen). On the other hand, you may also have to deal with inconvenient check-in processes and things like extra cleaning fees and service charges. For short stays, we prefer hotels/hostels but rental apartments can be a nice option for longer stays. Airbnb is always popular but you can sometimes find cheaper/better options on our list of Airbnb Alternatives .

LEARN MORE ABOUT EUROPE TRAVEL COSTS

Check out our guide on How Much It Costs To Backpack Europe to learn more about budgeting your entire trip (including many more city price guides).

Be sure to also check out our London Travel Guide and our Guide to London on a Budget for more London travel tips.

- Recent Posts

- Best Prepaid UK eSIM | Data Plan Buyer’s Guide - April 21, 2024

- How to Avoid Pickpockets in Europe — Tips for Outsmarting the Thieves - April 19, 2024

- Best Prepaid eSIM For Italy | Data Plan Buyer’s Guide - April 18, 2024

No Funny Business

The Savvy Backpacker is reader-supported. That means when you buy products/services through links on the site, I may earn an affiliate commission—it doesn’t cost you anything extra and it helps support the site.

Thanks For Reading! — James

Questions? Learn more about our Strict Advertising Policy and How To Support Us .

Related Reads

A backpacker’s guide to the best hostels in london | london hostels.

The best hostels in London based on amenities, price, location, and overall quality.

Guide To London On a Budget | How To Save Money in London

How to visit London on a budget — what to do, see, and eat for cheap!

London Travel Guide | The Ultimate Guide To London

The best things to do, see, and eat in London.

London Pass Review

Wondering if the London Pass is worth the price? Check out our in-depth review of the London Pass and analysis of its value.

City Guides

Choosing travel insurance, travel packing lists, budget travel newsletter.

The best budget travel tips sent straight to your inbox.

Join My Journey

Europe travel tips, advertising & privacy policies.

TheSavvyBackpacker.com is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to amazon.com.

© 2010 - 2024 The Savvy Backpacker

Website Design by FHOKE

Calculating Monthly Transportation Costs For Living In London

Transportation expenses are an essential component of the cost of living in any city, and London is no exception. As one of the world’s most visited and bustling cities, transportation in London is a vital aspect of daily life. With a vast public transportation network serving both the city and its suburbs, it can be challenging to determine how much one should budget for transportation expenses when planning to live in London.

To live comfortably in London, one must consider the cost of public transportation, including buses, underground trains, and overground trains. The cost of a single journey on the London Underground varies depending on the zones travelled through, with prices starting at £2.40 for a single fare in Zone 1. Meanwhile, bus trips start from £1.50 for a single journey, while overground trains cost £1.80 at off-peak times within Zones 1-3.

Additionally, London’s famous black cabs and ride-sharing services are more expensive modes of transportation. Black cabs’ fares and prices for ride-sharing services differ and depend on several factors, including the distance travelled, traffic congestion, and peak hours.

Overall, the cost of transportation in London can add up quickly, which is why it’s vital to budget for such expenses while planning to live in London. By knowing how much to allocate for transportation expenses and finding ways to save money, individuals can manage and live comfortably in one of the world’s most exciting and dynamic cities.

Transportation Costs

Transportation costs are an integral part of the cost of living in London. London is a large and diverse city, and the cost of getting around can vary greatly depending on where you live and work. The most common form of transportation are buses and the London Underground, which offers a comprehensive network of trains and underground lines. The cost of a single bus fare is £1.50, while a single trip on the underground can range from £2.40 to over £5 depending on the zones you are travelling through. The cost of a monthly travelcard can range from around £81.50 to £225, depending on the zones covered and the type of travelcard selected. Many Londoners also travel by car, but this can be expensive due to high fuel costs and the daily congestion charge that applies in central London. Overall, the cost of transportation in London can add up quickly, and it is important to factor this into your budget when considering the cost of living in the city.

Living In London

Living in London can be expensive, with the cost of living varying depending on individual lifestyles and habits. The estimated monthly living expenses in London, including accommodation, food, transportation, and other expenses, can range from £1,200 to £2,500 per month per person. The cost of accommodation in London is on the higher side, with the average rent for a one-bedroom apartment in the city center ranging from £1,000 to £2,000 per month. Utilities such as electricity, gas, and water can add up to an additional £150-200 per month. Eating out in London can vary depending on the location and restaurant, with an average meal costing around £15-20. In terms of transportation, the cost of a monthly pass for public transport in London is around £135, while taxis and ride-hailing services can be much more expensive. Other costs such as entertainment, clothing, and personal care can also add up. While living in London can be expensive, there are ways to save money such as living outside central London, cooking at home instead of eating out, and using public transportation instead of taxis.

Monthly Budgeting

Monthly budgeting is an important aspect of managing your finances while living in London. To cover basic expenses, such as rent, utilities, groceries, transportation, and entertainment, you should aim to have a budget of approximately £1,500-£2,000 per month.

Housing costs will likely be your biggest expense, and the amount you spend will depend on the area you choose to live in and whether you share a flat with roommates. Expect to pay around £900-£1200 per month for a small studio or one-bedroom apartment in central London, while sharing a larger apartment with roommates could bring costs down to about £600-£800 per month.

Food and groceries will typically cost around £300-£400 per month, and you can save money by shopping at affordable supermarkets such as Lidl or Aldi.

Transportation costs will vary depending on how often you use public transportation, but expect to spend around £130-£160 per month for a monthly travelcard.

Entertainment expenses such as going out to dinner, drinks, or seeing a movie will depend on personal preferences, but budgeting around £200 per month for leisure activities should be sufficient.

Overall, budgeting around £1,500-£2,000 per month is a good starting point to cover basic expenses while living in London.

Public Transport Expenses

In order to have a good idea of how much you need to live in London, it’s important to consider the expenses of public transport. Public transport is an essential part of getting around in London, and there are a few key factors to keep in mind.

Firstly, an adult travelcard for zones 1-2 costs £135.10 per month, or £1,578 for a year, and this provides unlimited travel on buses, the London Underground, Overground, and certain National Rail services within these zones. If you need to travel outside these zones, the cost of a travelcard will increase.

Secondly, if you’re a student, you may be eligible for a discounted travelcard, which can save you up to 30% on the cost of a regular adult card. The cost of a student travelcard for zones 1-2 is £81.50 per month, or £936 for a year.

Thirdly, it’s worth investigating whether you qualify for any other discounts or concessions, such as the 60+ Oyster card or the disabled person’s travel card.

Overall, the cost of public transport will depend on how frequently you use it and which zones you need to travel in. However, regardless of your circumstances, it’s essential to factor in the cost of public transport when calculating your expenses for living in London.

Tube Fares And Passes

The cost of tube fares and passes is an essential part of living in London. For a single adult journey in Zones 1-2, the fare with an Oyster card or contactless payment is £2.40. However, the daily cap on these types of cards is £7.20, meaning you won’t pay more than that for unlimited travel in one day.

For regular commuters, purchasing a Travelcard or a Bus & Tram Pass might be a more cost-effective option. A 7-day Travelcard for Zones 1-2 costs £35.10, while a monthly pass is £134.80. For frequent bus users, a Bus & Tram Pass costs £21.90 for 7 days or £84.10 monthly. Students and children can also get discounted fares.

For those living in outer London or commuting from further afield, the fares will be higher, depending on the location and zones. The cost of tube fares and passes is likely to vary according to individual circumstances and travel habits, but it is an important consideration when calculating the cost of living in London.

Bus Fares And Passes

Bus fares and passes are essential transportation options for those living in London. As of 2021, a single bus fare costs £1.55 for those who use an Oyster or contactless card, while cash fares cost £2.50. For those who regularly use public transportation, buying a Travelcard or a Bus & Tram Pass can provide significant savings.

A Weekly Bus & Tram Pass costs £21.90, a Monthly Bus & Tram Pass is priced at £84.10, and an Annual Bus & Tram Pass costs £848.00. A Travelcard, which provides unlimited travel across buses, trams, tubes, and trains, can cost anywhere from £13.50 to £88.80 per week depending on the number of zones they cover. For instance, a weekly Travelcard covering zones 1-2 costs £35.10, while one covering zones 1-6 costs £62.30.

The cost of living in London can be high, with the average monthly rent for a one-bedroom apartment ranging from £900-£1,500 depending on the area. A single person living in London would need to spend between £1,000 and £1,500 on basic living expenses per month, including rent, food, utilities, and transportation.

In summary, London bus fares and passes can provide cost-effective transportation options for those living in the city. For those on a tight budget, buying a Bus & Tram Pass or Travelcard can save a considerable amount of money on transportation costs, especially if they use public transportation regularly.

Cycling Expenses And Safety

Cycling expenses in London can vary depending on the type of cyclist you are. If you are a commuter, you will need to invest in a good quality bike as well as safety accessories such as a helmet, lights, and reflective clothing. These expenses can range from around £200-£500 for the bike, and £50-£100 for safety gear.

In terms of ongoing costs, there are some minor expenses such as bike maintenance and replacement parts such as tires, chains, and brake pads. Depending on how much you cycle, this can cost anywhere from £50-£200 per year.

When it comes to cycling safety, it is important to invest in high-quality safety gear to prevent accidents. This includes not only a helmet and lights but also reflective clothing and accessories, such as a horn or bell to alert pedestrians and other cyclists. The price of safety gear can vary, but it is important to prioritize quality over price.

Overall, cycling can be a cost-effective and efficient mode of transportation in London, but it’s important to prioritize safety and invest in proper safety gear.

Car Ownership And Parking

Car ownership and parking in London can be quite expensive, and may not be a necessity for everyone. The cost of a car may include many factors such as buying or leasing the car, insurance, fuel, maintenance, road tax and parking.

Parking in London can be challenging and may take up a substantial portion of living expenses. London has some of the highest parking fees in the world, and costs can vary depending on the area. Residential parking permits are available for some areas but come at an additional cost.

Additionally, London has an extensive public transportation system making car ownership unnecessary for many people. The London Underground, buses, and trains provide access to all parts of the city and surrounding areas. Using public transportation is often cheaper than driving when taking into account the overall cost of car ownership.

In conclusion, car ownership and parking in London can be quite expensive, and may not always be necessary. The cost of owning a car may outweigh the benefits, especially when considering the city’s well-connected public transportation system.

Congestion Charge And Ulez

The Congestion Charge is a fee charged for driving a vehicle within Central London to reduce traffic congestion. The daily charge for driving within the Congestion Charge zone is £15, and it is in operation from 7 a.m. to 10 p.m. every day except Christmas Day. The Ultra-Low Emission Zone (ULEZ) is a charge that is applied in addition to the Congestion Charge for older, polluting vehicles. The ULEZ covers the same area as the Congestion Charge Zone and holders of vehicles that do not meet the ULEZ standards are required to pay a charge of £12.50 per day.

If you live in London, you need to consider the cost of the Congestion Charge and ULEZ if you regularly drive a vehicle within the zone. If you own an older, polluting car, you will need to pay an additional £12.50 per day. Living in London can be costly, with necessities such as accommodation and food adding up quickly. The average monthly rent for a one-bedroom apartment outside of Central London is around £1,200, and a weekly grocery bill for one person can cost around £50-£60.

Overall, living in London can be expensive, and residents need to consider the additional costs of the Congestion Charge and ULEZ on top of other daily expenses.

Budgeting For Unexpected Costs

Budgeting for unexpected costs is an important factor to consider when planning how much money you need to live in London. It is recommended to have some money set aside for emergencies, such as medical or household repairs, which can arise unexpectedly.

To live comfortably in London, the cost of living will depend on various factors such as accommodation, transportation, food, and entertainment. According to a study by Numbeo, the average monthly cost of living for a single person in London is around £1,050 to £1,800, depending on the location and lifestyle choices.

Housing is the largest expense in London, with renting a one-bedroom apartment in the city center costing an average of £1,600 per month. Transportation costs can range from £100 to £250 per month depending on the mode of transport used. Food expenses can also add up quickly, with an average meal costing around £15 in a mid-range restaurant.

In addition, it is important to account for unexpected costs such as medical emergencies, car repairs or replacing household items. It is recommended to have at least 3-6 months worth of living expenses saved up for emergencies.

Overall, budgeting for unexpected costs is crucial when planning how much money you need to live in London. With careful planning and budgeting, it is possible to live comfortably in this vibrant city.

In conclusion, the cost of living in London can vary greatly depending on a variety of factors, including location, accommodation type, transportation, food choices, and lifestyle. However, the general consensus is that London is one of the most expensive cities in the world, with high rent and living expenses. To comfortably live in London, it is recommended that individuals should have a minimum of £1,100 to £1,200 per month for basic expenses, such as rent, bills, food, and transportation. However, this amount can significantly increase depending on individual factors, such as personal preferences and lifestyle choices.

For those seeking accommodation, renting a one-bedroom apartment can cost anywhere from £800 to £1,500 per month, depending on the location, while a shared apartment can cost around £500 to £800 per month, excluding bills. Transportation costs can also add up, with a monthly travelcard costing approximately £135.

Food expenses can also vary depending on one’s food choices and lifestyle. Eating out at a restaurant can cost around £15 to £30 per person, while cooking at home can cost around £30 to £50 per week. Additionally, individuals may need to account for entertainment and personal expenses, such as gym memberships or leisure activities, which can add to their monthly expenses.

In summary, living in London can be an expensive endeavor, and individuals should have a financial plan in place before making the move. The recommended minimum amount for basic living expenses is around £1,100 to £1,200 per month, but this can significantly increase based on lifestyle choices and personal preferences. By carefully budgeting and living frugally, individuals can successfully manage the high cost of living in London.

- Travel Planning Guide

United Kingdom Travel Budget - Visit United Kingdom on a Budget or Travel in Style

- Is the United Kingdom Expensive?

- How much does a trip to the United Kingdom cost?

- UK On-Your-Own Itineraries

- Northern Ireland

- UK Hotel Prices

- UK Cities: Hotel Prices by City

- Best Family-Friendly Hotels in the United Kingdom

- Best Hotels for One Week in the United Kingdom

- Best Hotels for First Time Visitors in the United Kingdom

- Best Romantic Hotels for Couples in the United Kingdom

- Best Beach Hotels in the United Kingdom

- Best Pet-Friendly Hotels in the United Kingdom

- Best Hotels for One Night in the United Kingdom

- Best Hotels for Skiing in the United Kingdom

- Best Hotels for Scuba Diving in the United Kingdom

- Best Adults Only Hotels in the United Kingdom

- Best Party Hotels in the United Kingdom

- Best Luxury Hotels in the United Kingdom

- Best Cheap Hotels in the United Kingdom

- Best Hotels for a Weekend Getaway in the United Kingdom

- Best Business Hotels in the United Kingdom

- Hostel Prices & Reviews

- UK Activities

- UK Tour Prices

- The Best Family-Friendly Tours to UK

- The Best Hiking & Trekking Tours in UK

- The Best Historical Tours in UK

- The Best One Week (7-Day) Tours in UK

- The Best 3-Day Tours in UK

- The Best Bicycle Tours in UK

- Tours for Outdoor and Nature Lovers in UK

- The Best Christmas & New Years Tours in UK

- The Best Coach Bus Tours in UK

- The Best Adventure Tours to UK

- The Best Eco Tours in UK

- The Best Sightseeing Tours in UK

- The Best Cultural Tours in UK

- The Best Romantic Tours for Couples in UK

- The Best Tours Under $1000 in UK

- The Best Luxury Tours to UK

- The Best Budget Tours to UK

- The Best Tours for Seniors to UK

- Lake District National Park

- How much does it cost to travel to the United Kingdom? (Average Daily Cost)

- The United Kingdom trip costs: one week, two weeks, one month

How much do package tours cost in the United Kingdom?

Is the united kingdom expensive to visit.

- How much do I need for a trip to the United Kingdom?

- Accommodation, Food, Entertainment, and Transportation Costs

- Travel Guide

How much does it cost to travel to the United Kingdom?

You should plan to spend around $191 (£153) per day on your vacation in the United Kingdom. This is the average daily price based on the expenses of other visitors.

Past travelers have spent, on average for one day:

- $46 (£37) on meals

- $36 (£29) on local transportation

- $190 (£152) on hotels

A one week trip to the United Kingdom for two people costs, on average, $2,668 (£2,142) . This includes accommodation, food, local transportation, and sightseeing.

All of these average travel prices have been collected from other travelers to help you plan your own travel budget.

- Travel Style: All Budget (Cheap) Mid-Range Luxury (High-End)

- Average Daily Cost Per person, per day $ 191 £ 153

- One Week Per person $ 1,334 £ 1,071

- 2 Weeks Per person $ 2,668 £ 2,142

- One Month Per person $ 5,717 £ 4,590

- One Week For a couple $ 2,668 £ 2,142

- 2 Weeks For a couple $ 5,336 £ 4,284

- One Month For a couple $ 11,434 £ 9,179

Help other travelers! Answer some quick questions about your past travels. Click here: let's do it!

How much does a one week, two week, or one month trip to the United Kingdom cost?

A one week trip to the United Kingdom usually costs around $1,334 (£1,071) for one person and $2,668 (£2,142) for two people. This includes accommodation, food, local transportation, and sightseeing.

A two week trip to the United Kingdom on average costs around $2,668 (£2,142) for one person and $5,336 (£4,284) for two people. This cost includes accommodation, food, local transportation, and sightseeing.

Please note, prices can vary based on your travel style, speed, and other variables. If you're traveling as a family of three or four people, the price per person often goes down because kid's tickets are cheaper and hotel rooms can be shared. If you travel slower over a longer period of time then your daily budget will also go down. Two people traveling together for one month in the United Kingdom will often have a lower daily budget per person than one person traveling alone for one week.

A one month trip to the United Kingdom on average costs around $5,717 (£4,590) for one person and $11,434 (£9,179) for two people. The more places you visit, the higher the daily price will become due to increased transportation costs.

Organized tours are usually more expensive than independent travel, but offer convenience and peace of mind that your trip has been planned by a travel expert.

The average price for an organized tour package in the United Kingdom is $282 per day. While every tour varies by total price, length, number of destinations, and quality, this is the daily average price based on our analysis of available guided tours.

- 4 Day Cornwall, Devon & Stonehenge Small-Group Tour from Bristol 4 Days - 16 Destinations $ 792

- Hot Tam!: Scotland By Design 9 Days - 12 Destinations $ 2,699

Independent Travel

Traveling Independently has many benefits including affordabilty, freedom, flexibility, and the opportunity to control your own experiences.

All of the travel costs below are based on the experiences of other independent travelers.

The United Kingdom is a moderately priced destination to visit. It's about average with most other countries for travel costs. The prices for food, accommodation, and transportation are all fairly reasonable.

Within Europe, which is known to be an expensive region, the United Kingdom is moderately priced compared to the other countries. The overall cost of travel here is comparable to the Netherlands or Denmark.

For more details, see Is the United Kingdom Expensive?

How much money do I need for a trip to the United Kingdom?

The average United Kingdom trip cost is broken down by category here for independent travelers. All of these United Kingdom travel prices are calculated from the budgets of real travelers.

Accommodation Budget in the United Kingdom

Average daily costs.

Calculated from travelers like you

The average price paid for one person for accommodation in the United Kingdom is $95 (£76). For two people sharing a typical double-occupancy hotel room, the average price paid for a hotel room in the United Kingdom is $190 (£152). This cost is from the reported spending of actual travelers.

- Accommodation 1 Hotel or hostel for one person $ 95 £ 76

- Accommodation 1 Typical double-occupancy room $ 190 £ 152

Hotel Prices in the United Kingdom

Looking for a hotel in the United Kingdom? Prices vary by location, date, season, and the level of luxury. See below for options.

Find the best hotel for your travel style.

Actual Hotel Prices The average hotel room price in the United Kingdom based on data provided by Kayak for actual hotel rooms is $113. (Prices in U.S. Dollars, before taxes & fees.)

Kayak helps you find the best prices for hotels, flights, and rental cars for destinations around the world.

Recommended Properties

- Abergavenny Hotel Budget Hotel - Kayak $ 173

- East Horton Farmhouse Luxury Hotel - Kayak $ 114

Local Transportation Budget in the United Kingdom

The cost of a taxi ride in the United Kingdom is significantly more than public transportation. On average, past travelers have spent $36 (£29) per person, per day, on local transportation in the United Kingdom.

- Local Transportation 1 Taxis, local buses, subway, etc. $ 36 £ 29

Recommended Services

- One Way Taxi Transfer from London to Stansted Airport Viator $ 190

- One-Way Taxi Transfer from Stansted Airport to London Viator $ 189

What did other people spend on Local Transportation?

Typical prices for Local Transportation in the United Kingdom are listed below. These actual costs are from real travelers and can give you an idea of the Local Transportation prices in the United Kingdom, but your costs will vary based on your travel style and the place where the purchase was made.

- Oyster Card £ 27

- Train to Gatwick Airport (2) £ 22

- Toll Way - Mersey tunnel £ 1.70

- Parking £ 1.70

- Parking in Manchester £ 3.00

- City bike hire Liverpool £ 6.00

- Parking £ 2.00

- Ferry to Isle of Wight £ 16

Food Budget in the United Kingdom

While meal prices in the United Kingdom can vary, the average cost of food in the United Kingdom is $46 (£37) per day. Based on the spending habits of previous travelers, when dining out an average meal in the United Kingdom should cost around $19 (£15) per person. Breakfast prices are usually a little cheaper than lunch or dinner. The price of food in sit-down restaurants in the United Kingdom is often higher than fast food prices or street food prices.

- Food 2 Meals for one day $ 46 £ 37

Recommended

- Traditional English Walking Food Tour With London Food Tours Viator $ 95

- Durham Food Tour Viator $ 94

What did other people spend on Food?

Typical prices for Food in the United Kingdom are listed below. These actual costs are from real travelers and can give you an idea of the Food prices in the United Kingdom, but your costs will vary based on your travel style and the place where the purchase was made.

- Lunch for 2 £ 23

- Lunch for 2 £ 46

- Nice lunch at Fleece £ 61

- Coffee (2) £ 4.80

- Turkish Delight £ 1.40

- 2 Coffees and Scones £ 5.80

- Soup at the Pub £ 5.90

- Lunch for 2 £ 17

Entertainment Budget in the United Kingdom

Entertainment and activities in the United Kingdom typically cost an average of $34 (£27) per person, per day based on the spending of previous travelers. This includes fees paid for admission tickets to museums and attractions, day tours, and other sightseeing expenses.

- Entertainment 1 Entrance tickets, shows, etc. $ 34 £ 27

Recommended Activities

- Agatha Christie walking tour - the story of her extraordinary life Viator $ 25

- Cotswold Walks & Villages Tour from Stratford-upon-Avon or Moreton-in-Marsh Viator $ 107

What did other people spend on Entertainment?

Typical prices for Entertainment in the United Kingdom are listed below. These actual costs are from real travelers and can give you an idea of the Entertainment prices in the United Kingdom, but your costs will vary based on your travel style and the place where the purchase was made.

- Lunch £ 12

- Comedy Show £ 8.00

- London Pass £ 47

- Warwick Castle (2) £ 59

- Thermal Bath Spa £ 35

- Luss Highland Games Entrance Fee (for 2) £ 12

- Two Bike Rental £ 34

Tips and Handouts Budget in the United Kingdom

The average cost for Tips and Handouts in the United Kingdom is $31 (£25) per day. The usual amount for a tip in the United Kingdom is 10% - 20% .

- Tips and Handouts 1 For guides or service providers $ 31 £ 25

Scams, Robberies, and Mishaps Budget in the United Kingdom

Unfortunately, bad things can happen on a trip. Well, you've just got to deal with it! The average price for a scam, robbery, or mishap in the United Kingdom is $92 (£74), as reported by travelers.

- Scams, Robberies, and Mishaps 1 $ 92 £ 74

Alcohol Budget in the United Kingdom

The average person spends about $16 (£13) on alcoholic beverages in the United Kingdom per day. The more you spend on alcohol, the more fun you might be having despite your higher budget.

- Alcohol 2 Drinks for one day $ 16 £ 13

- Shakespeare Distillery Tour - 11am Ticket Viator $ 25

- Tayport Distillery Tour & Tastings Viator $ 19

What did other people spend on Alcohol?

Typical prices for Alcohol in the United Kingdom are listed below. These actual costs are from real travelers and can give you an idea of the Alcohol prices in the United Kingdom, but your costs will vary based on your travel style and the place where the purchase was made.

- Half Pint at Tollbooth Tavern £ 1.65

- Ciders at Kilted Skirlie £ 3.50

- Bottle of Wine £ 12

- Drinks at the Walnut Pub (for 2) £ 10

- Pitcher of Pimms £ 15

- Drinks at the Pub (for 2) £ 7.55

- Beer & Wine £ 14

- Beers £ 8.00

Water Budget in the United Kingdom

On average, people spend $4.99 (£4.00) on bottled water in the United Kingdom per day. The public water in the United Kingdom is considered safe to drink.

- Water 2 Bottled water for one day $ 4.99 £ 4.00

Related Articles

The united kingdom on a budget.

At A Glance

- London is notoriously expensive. It's easily the cheapest city to fly into, but once you arrive you'll find your money quickly disappears. If you're hoping to keep costs down, spend more time in the other areas around the United Kingdom and less time in London. In the more rural communities you'll find that your expenses are far less.

- The countries that make up the United Kingdom each have their own set of bank holidays. Look at a calender before you schedule your trip to make sure that your vacation does not overlap any of these bank holidays. If it does, you will find that prices are higher and attractions are more crowded.

- There are many discount airlines that fly into and out of London and the United Kingdom. If you book tickets through one of these airlines, make sure that you understand all of the restrictions as well as what's included in the price. Some flights fly into inconvenient airports as well, so confirm that there are transportation connections available to where you need to go.

- If you're traveling by train, there are usually discounts available for children or groups. Also, there are regional railcards available if you plan to take several different trips within the area. Research all of the restrictions on these cards prior to purchasing them. If you do decide to buy single tickets, it is best to buy them in advance when the prices are often lower. Great Britain is an area where you will benefit from having a set schedule and itinerary in advance of your trip.

- There are several different bus companies available throughout the country. The buses are usually of high quality and they generally run on schedule. The more popular bus companies include National Express, Megabus, CityLink, and Dot2Dot. Some companies are focused on specific regions, while other serve the entire country. Some companies are also notoriously cheaper than others.

Top Tourist Attractions

Popular foods, more related articles.

We've been gathering travel costs from tens of thousands of actual travelers since 2010, and we use the data to calculate average daily travel costs for destinations around the world. We also systematically analyze the prices of hotels, hostels, and tours from travel providers such as Kayak, HostelWorld, TourRadar, Viator, and others. This combination of expenses from actual travelers, combined with pricing data from major travel companies, gives us a uniqe insight into the overall cost of travel for thousands of cities in countries around the world. You can see more here: How it Works .

Subscribe to our Newsletter

By signing up for our email newsletter, you will receive occasional updates from us with sales and discounts from major travel companies , plus tips and advice from experienced budget travelers!

Search for Travel Costs

Some of the links on this website are sponsored or affiliate links which help to financially support this site. By clicking the link and making a purchase, we may receive a small commission, but this does not affect the price of your purchase.

Travel Cost Data

You are welcome to reference or display our travel costs on your website as long as you provide a link back to this page .

A Simple Link

For a basic link, you can copy and paste the HTML link code or this page's address.

Travel Cost Widget

To display all of the data, copy and paste the code below to display our travel cost widget . Make sure that you keep the link back to our website intact.

- Privacy / Terms of Use

- Activities, Day Trips, Things To Do, and Excursions

Our 2024 Casual Tourist Guides are here ✨

Country/region

- GBP £ | Afghanistan

- GBP £ | Åland Islands

- GBP £ | Albania

- GBP £ | Algeria

- GBP £ | Andorra

- GBP £ | Angola

- GBP £ | Anguilla

- GBP £ | Antigua & Barbuda

- GBP £ | Argentina

- GBP £ | Armenia

- GBP £ | Aruba

- GBP £ | Ascension Island

- GBP £ | Australia

- GBP £ | Austria

- GBP £ | Azerbaijan

- GBP £ | Bahamas

- GBP £ | Bahrain

- GBP £ | Bangladesh

- GBP £ | Barbados

- GBP £ | Belarus

- EUR € | Belgium

- GBP £ | Belize

- GBP £ | Benin

- GBP £ | Bermuda

- GBP £ | Bhutan

- GBP £ | Bolivia

- GBP £ | Bosnia & Herzegovina

- GBP £ | Botswana

- GBP £ | Brazil

- GBP £ | British Indian Ocean Territory

- GBP £ | British Virgin Islands

- GBP £ | Brunei

- GBP £ | Bulgaria

- GBP £ | Burkina Faso

- GBP £ | Burundi

- GBP £ | Cambodia

- GBP £ | Cameroon

- CAD $ | Canada

- GBP £ | Cape Verde

- GBP £ | Caribbean Netherlands

- GBP £ | Cayman Islands

- GBP £ | Central African Republic

- GBP £ | Chad

- GBP £ | Chile

- GBP £ | China

- GBP £ | Christmas Island

- GBP £ | Cocos (Keeling) Islands

- GBP £ | Colombia

- GBP £ | Comoros

- GBP £ | Congo - Brazzaville

- GBP £ | Congo - Kinshasa

- GBP £ | Cook Islands

- GBP £ | Costa Rica

- GBP £ | Côte d’Ivoire

- GBP £ | Croatia

- GBP £ | Curaçao

- GBP £ | Cyprus

- GBP £ | Czechia

- GBP £ | Denmark

- GBP £ | Djibouti

- GBP £ | Dominica

- GBP £ | Dominican Republic

- GBP £ | Ecuador

- GBP £ | Egypt

- GBP £ | El Salvador

- GBP £ | Equatorial Guinea

- GBP £ | Eritrea

- GBP £ | Estonia

- GBP £ | Eswatini

- GBP £ | Ethiopia

- GBP £ | Falkland Islands

- GBP £ | Faroe Islands

- GBP £ | Fiji

- GBP £ | Finland

- EUR € | France

- GBP £ | French Guiana

- GBP £ | French Polynesia

- GBP £ | French Southern Territories

- GBP £ | Gabon

- GBP £ | Gambia

- GBP £ | Georgia

- EUR € | Germany

- GBP £ | Ghana

- GBP £ | Gibraltar

- EUR € | Greece

- GBP £ | Greenland

- GBP £ | Grenada

- GBP £ | Guadeloupe

- GBP £ | Guatemala

- GBP £ | Guernsey

- GBP £ | Guinea

- GBP £ | Guinea-Bissau

- GBP £ | Guyana

- GBP £ | Haiti

- GBP £ | Honduras

- GBP £ | Hong Kong SAR

- GBP £ | Hungary

- GBP £ | Iceland

- GBP £ | India

- GBP £ | Indonesia

- GBP £ | Iraq

- EUR € | Ireland

- GBP £ | Isle of Man

- GBP £ | Israel

- EUR € | Italy

- GBP £ | Jamaica

- GBP £ | Japan

- GBP £ | Jersey

- GBP £ | Jordan

- GBP £ | Kazakhstan

- GBP £ | Kenya

- GBP £ | Kiribati

- GBP £ | Kosovo

- GBP £ | Kuwait

- GBP £ | Kyrgyzstan

- GBP £ | Laos

- GBP £ | Latvia

- GBP £ | Lebanon

- GBP £ | Lesotho

- GBP £ | Liberia

- GBP £ | Libya

- GBP £ | Liechtenstein

- GBP £ | Lithuania

- GBP £ | Luxembourg

- GBP £ | Macao SAR

- GBP £ | Madagascar

- GBP £ | Malawi

- GBP £ | Malaysia

- GBP £ | Maldives

- GBP £ | Mali

- GBP £ | Malta

- GBP £ | Martinique

- GBP £ | Mauritania

- GBP £ | Mauritius

- GBP £ | Mayotte

- GBP £ | Mexico

- GBP £ | Moldova

- GBP £ | Monaco

- GBP £ | Mongolia

- GBP £ | Montenegro

- GBP £ | Montserrat

- GBP £ | Morocco

- GBP £ | Mozambique

- GBP £ | Myanmar (Burma)

- GBP £ | Namibia

- GBP £ | Nauru

- GBP £ | Nepal

- EUR € | Netherlands

- GBP £ | New Caledonia

- GBP £ | New Zealand

- GBP £ | Nicaragua

- GBP £ | Niger

- GBP £ | Nigeria

- GBP £ | Niue

- GBP £ | Norfolk Island

- GBP £ | North Macedonia

- GBP £ | Norway

- GBP £ | Oman

- GBP £ | Pakistan

- GBP £ | Palestinian Territories

- GBP £ | Panama

- GBP £ | Papua New Guinea

- GBP £ | Paraguay

- GBP £ | Peru

- GBP £ | Philippines

- GBP £ | Pitcairn Islands

- GBP £ | Poland

- EUR € | Portugal

- GBP £ | Qatar

- GBP £ | Réunion

- EUR € | Romania

- GBP £ | Russia

- GBP £ | Rwanda

- GBP £ | Samoa

- EUR € | San Marino

- GBP £ | São Tomé & Príncipe

- GBP £ | Saudi Arabia

- GBP £ | Senegal

- GBP £ | Serbia

- GBP £ | Seychelles

- GBP £ | Sierra Leone

- GBP £ | Singapore

- GBP £ | Sint Maarten

- GBP £ | Slovakia

- GBP £ | Slovenia

- GBP £ | Solomon Islands

- GBP £ | Somalia

- GBP £ | South Africa

- GBP £ | South Georgia & South Sandwich Islands

- GBP £ | South Korea

- GBP £ | South Sudan

- EUR € | Spain

- GBP £ | Sri Lanka

- GBP £ | St. Barthélemy

- GBP £ | St. Helena

- GBP £ | St. Kitts & Nevis

- GBP £ | St. Lucia

- GBP £ | St. Martin

- GBP £ | St. Pierre & Miquelon

- GBP £ | St. Vincent & Grenadines

- GBP £ | Sudan

- GBP £ | Suriname

- GBP £ | Svalbard & Jan Mayen

- GBP £ | Sweden

- GBP £ | Switzerland

- GBP £ | Taiwan

- GBP £ | Tajikistan

- GBP £ | Tanzania

- GBP £ | Thailand

- GBP £ | Timor-Leste

- GBP £ | Togo

- GBP £ | Tokelau

- GBP £ | Tonga

- GBP £ | Trinidad & Tobago

- GBP £ | Tristan da Cunha

- GBP £ | Tunisia

- GBP £ | Türkiye

- GBP £ | Turkmenistan

- GBP £ | Turks & Caicos Islands

- GBP £ | Tuvalu

- GBP £ | U.S. Outlying Islands

- GBP £ | Uganda

- GBP £ | Ukraine

- GBP £ | United Arab Emirates

- GBP £ | United Kingdom

- USD $ | United States

- GBP £ | Uruguay

- GBP £ | Uzbekistan

- GBP £ | Vanuatu

- EUR € | Vatican City

- GBP £ | Venezuela

- GBP £ | Vietnam

- GBP £ | Wallis & Futuna

- GBP £ | Western Sahara

- GBP £ | Yemen

- GBP £ | Zambia

- GBP £ | Zimbabwe

Item added to your cart

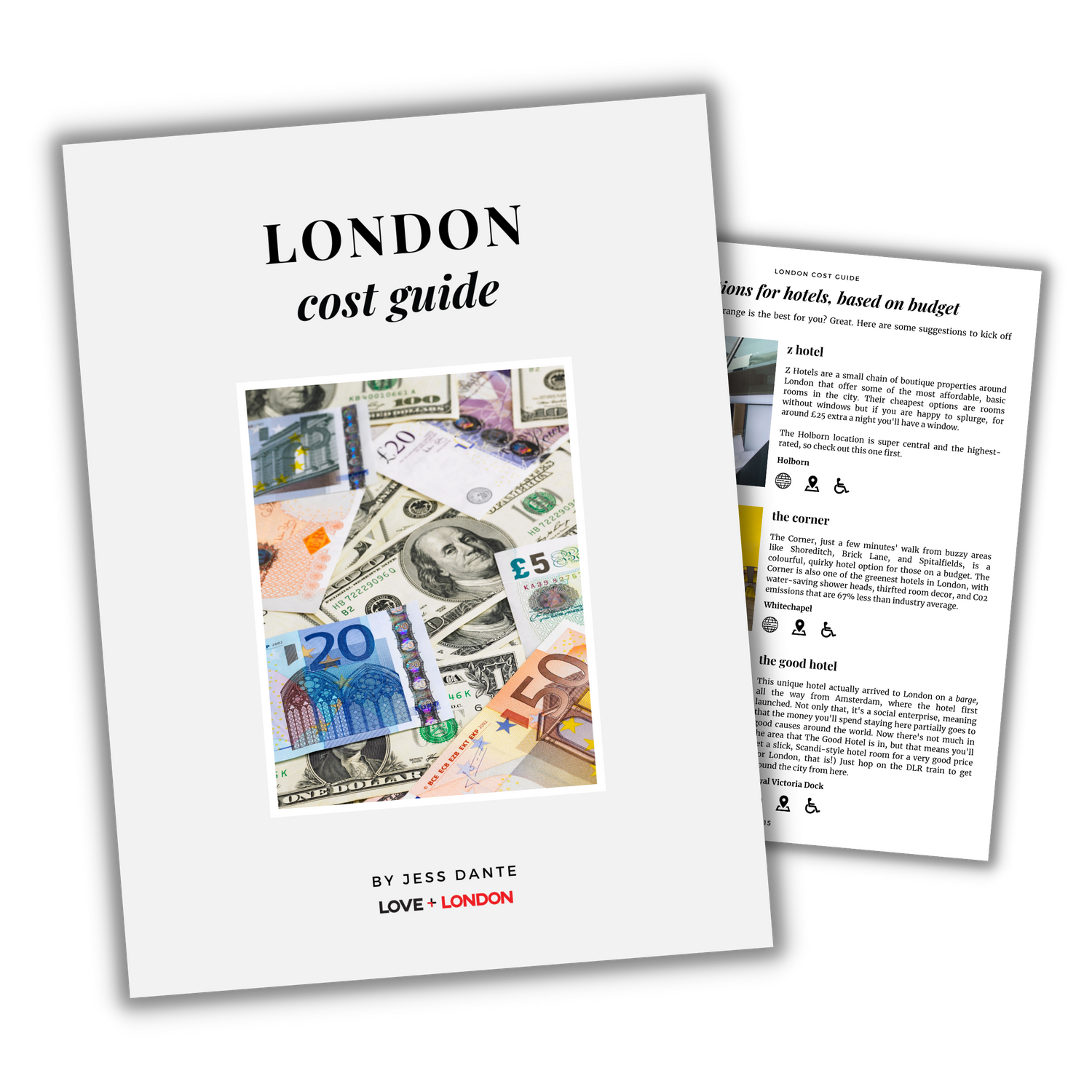

London Spending Guide

Couldn't load pickup availability

Struggling to figure out the budget for your London trip?

The London Spending Guide is a tool that does just that. It comes with:

1. London Cost Guide - a PDF filled with advice about getting and spending money in London, plus guides for how much you can expect to pay for certain parts of your trip, and recommendations for hotels, food, drink and activities for every budget level.

2. London Budget Tracker - an easy-to-use but incredibly comprehensive Google Sheets template. Calculate how much money you need to save each month to pay for your trip, figure out the total amount you can spend, play with your numbers to see where you want to splurge and where you want to save, and keep track of your daily spending while in London so you can stay on budget. It's available for 30+ different currencies (see which ones in the FAQ section below.)

Keep scrolling for more information, FAQs, a sneak peek inside, and more.

Are you struggling to create a budget for your London trip?

London is SUCH an expensive city, so it’s really easy to crush your budget without even noticing, especially when you’re also dealing with trying to do currency conversions in your head on the fly.

It’s also really hard to get a good idea of how much every part of your trip is going to cost, thinking about food, drinks, and little things like a late-night Uber ride after emerging from the club at 3am…

So to help you figure out your London trip budget and stick to it, there's the London Spending Guide.

BTW, if you love a spreadsheet, you’ll geek out over this 😉

What do you get with the London Spending Guide?

1. The London Cost Guide, a PDF with:

- Money and spending tips

- Price ranges to expect for hotels, transport, food and more

- Specific recommendations from Jess for "budget", "mid-range" and "luxury" restaurants, hotels, bars and activities

... and more

2 - London Budget Tracker

A comprehensive, but easy-to-use Google Sheets template to help you:

- Figure out how much you need to save from each pay period to reach your trip savings goal (in your currency, 30+ are available!)

- Calculate your total trip budget for the type of travel you want to do (budget, luxury, etc.)

- Play around with your budgets for each category so you know where you want to spend more and where you want to save money

- Keep track of your daily spending so you know how much you have left in your budget and when you've overspent

A breakdown of the London Spending Guide...

Getting and spending Great British Pounds

Information about our currency, cash vs. card, foreign transaction fees on your credit/debit cards, how to get cashed contactless payment methods.

London's Tipping Culture

We break down tipping for you... with information on when to tip in restaurants, bars and pubs, hotels, tour guides, taxis, salons, spas...

Info about London's Public Transport

How to pay for public transport, the cost of it and how to estimate your spending, kids discount, other travelling methods and a map of London zones (1-3).

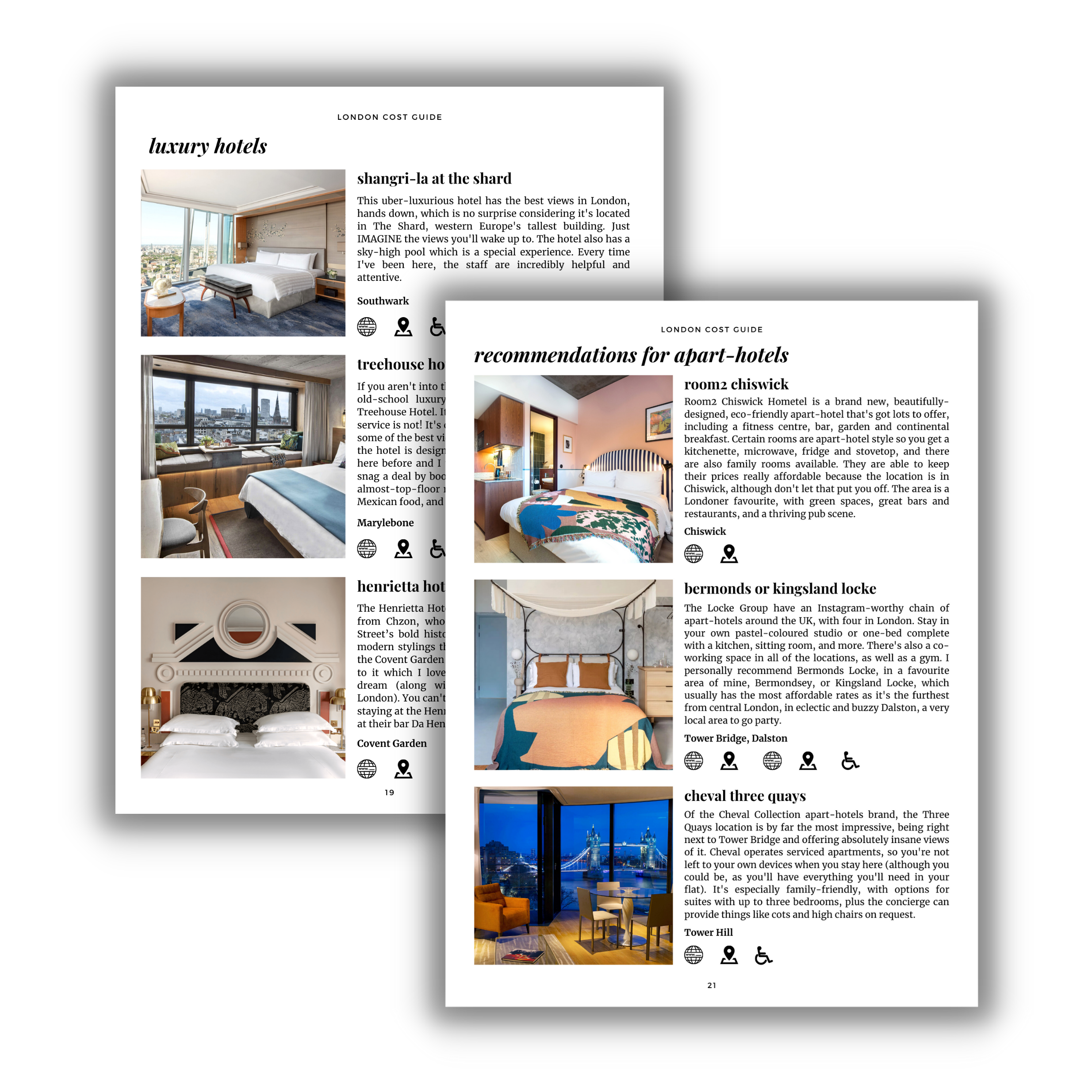

Accommodation

While London is a super expensive city, there are plenty of accommodation options no matter what your budget is.

Includes recommendations of hotels (budget, mid-range and luxurious options), hostels and apart-hotels.

Activities and Experiences

There are SO many fun things to do around London, from cheese classes to free museums to helicopter rides.

Includes recommendations of free, budget, mid-range and luxurious activities/experiences.

Food and Drinks

No matter what your budget, you can eat well and have a few drinks without breaking the bank.

Includes recommendations for budget, mid-range and luxury travellers.

Day trips from London

How to figure out how much it will cost you to get to your destination, train tickets discounts and some recommendations.

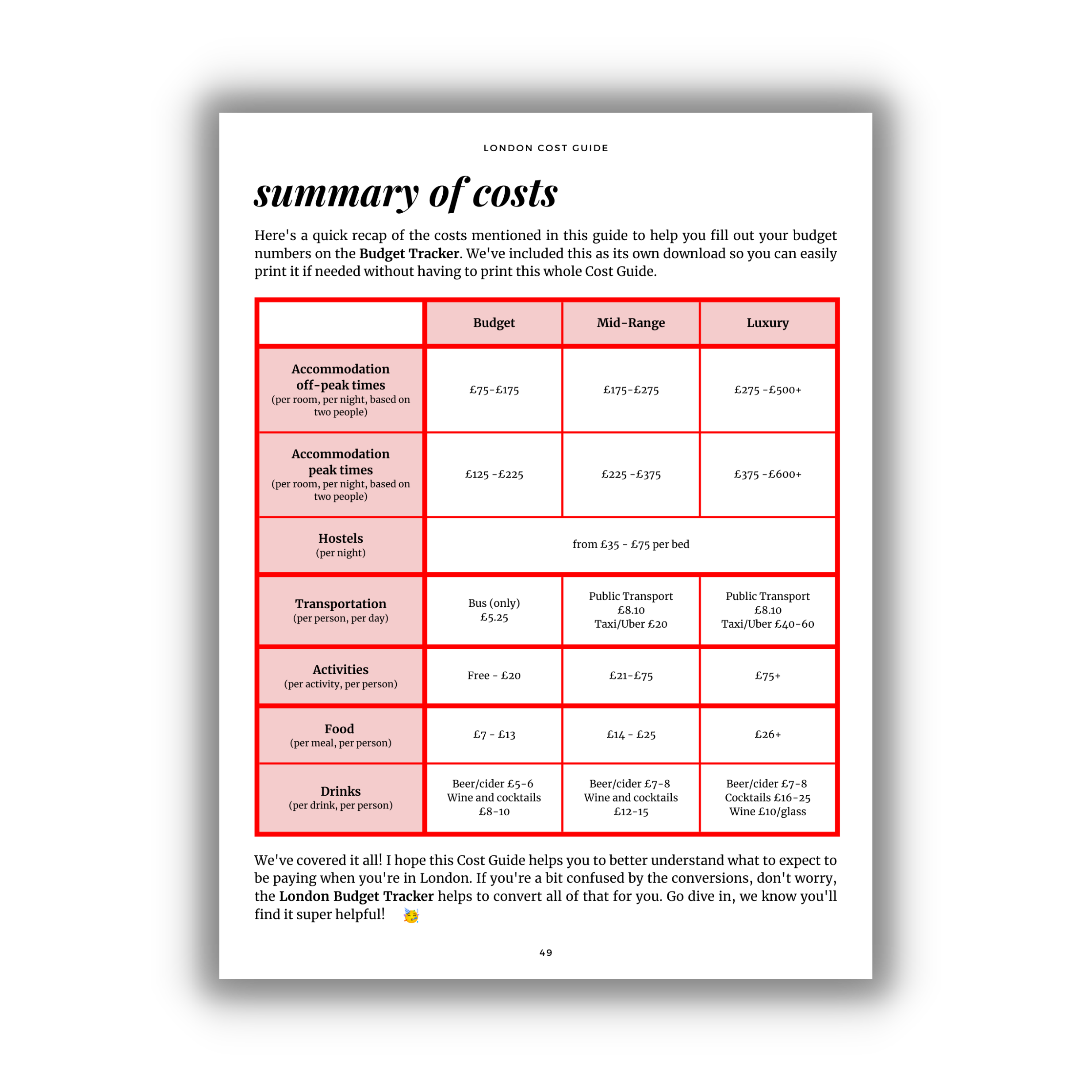

Summary of the Costs

A quick recap of the costs mentioned in this guide to help you fill out your budget numbers on the Budget Tracker .

Budget Tracker

30+ currencies available!

Budget breakdown of all the costs.

Daily Spending Record

Final dashboard

See how the Budget Tracker works...

Frequently Asked Questions

How long does it take to receive the london spending guide.

You'll receive this guide immediately upon purchase via digital download. The links will be sent to your email address.

How does the London Budget Tracker work?

You'll get a link to download the Google Sheets template within your files.

We also provide you with plenty of instructions on how to use the sheet, both in the document and via a video tutorial.

How tech saavy do I need to be to use this?

You'll want to know the basics of how Google Sheets works, but otherwise we provide you with plenty of instructions and all of the formulas are protected so it's almost impossible you to mess anything up.

Of course if you have any problems or questions you can email us at [email protected] and we'd be happy to help.

Can I print the London Cost Guide?

We'd prefer if you didn't, it has lots of links in it which obviously won't work if you print it, plus it'll be a waste of paper and ink. It's designed to be used digitally so try to keep it that way :)

Do I need to have a Google account to use this?

Yes, you just need a Google Docs account via Gmail to save your file to.

Do you have recommendations in the Cost Guide for budget travelers?

Yes! We have a "budget" category for each section and we also recommend some hostels.

We're traveling as a family, does this work for us?

While the Cost Guide doesn't have a family-specific section, we included a few notes about which recommendations are kid-friendly (up to 13 years old). The Budget Tracker has a spot where you enter how many people you're traveling with and then the spreadsheet does all the math for you, when relevant.

Which currencies does this support?

It works with British Pounds (as you'll pay for most of your London things in ££) and it converts the following currencies:

United States dollar - US$ Euro - € Japanese yen - 円 / ¥ Pound sterling £ Australian dollar - A$ Canadian dollar - C$ Swiss franc - CHF Renminbi - 元 / ¥ Hong Kong dollar - HK$ New Zealand dollar - NZ$ Swedish krona - kr South Korean won - ₩ Singapore dollar - S$ Norwegian krone - kr Mexican peso - $ Indian rupee - ₹ Russian ruble - ₽ South African rand - R Turkish lira - ₺ Brazilian real - R$ New Taiwan dollar - NT$ Danish krone - kr Polish złoty - zł Thai baht - ฿ Indonesian rupiah - Rp Hungarian forint - Ft Czech koruna - Kč Israeli new shekel - ₪ Chilean peso - CLP$ Philippine peso - ₱ UAE dirham - د.إ Colombian peso - COL$ Saudi riyal - ﷼ Malaysian ringgit - RM Romanian leu - L

Customer Reviews

With so many things to see and do it was a little overwhelming. The Love and London guide has helped us tremendously.

We purchased the four day itinerary. It has been so helpful in our planning. The check lists and reminders about what needs to be booked in advance has really helped us get organized and be more relaxed! Thank you.

This guide helped us plan 5 days in London with ease. The recommendations and proximity planning really makes a world of difference for someone who is not familiar with the city at all. I would highly recommend this to anyone who's feeling overwhelmed or even just needs a little guidance on what to do and when.

I always love reading through these guides because I know they have been compiled with care by an independent expert with no agenda or sponsor.

The London Spending Guide is easy to use and a wonderful budget planner. In addition to a detailed budget calculator, it also includes a detailed expense tracking worksheet. This is very useful because, while you are on vacation, you can see when your spending exceeds budget and make adjustments. At the end of your trip, you can review your total budget versus actual spending which will help you create a better budget for future trips. I also love the trip savings plan. After you calculate your budget, the savings plan helps you determine the amount you need to set aside from each paycheck to fund your trip to London. Jess and the Love and London team did a wonderful job with this spending guide.

- Choosing a selection results in a full page refresh.

- Opens in a new window.

Let customers speak for us

The paid itinerary, in addition to the free YouTube videos from this channel (using Citymapper, transportation from the airport to Paddington, etc.) were extremely helpful. Enjoyed the mix of local gems with the more famous sites, and having the list of sites divided out in manageable groupings per day - already done for us - saved soooooo much planning time. We tried many of the restaurant recommendations - all good and aligned to the review in the itinerary. It was nice to know what to expect. The digital Google map was very nicely done. The toilet guide was a lifesaver! Highly recommend this purchase. It’s a great value considering the amount of self-research time it saved (not to mention the resident tips that couldn’t have been found easily elsewhere). :)

4-Day London Itinerary 2024

Packing Guide