Rail Staff Travel Guide for Safeguarded National Rail Staff - Rail Staff Travel is part of the Rail Delivery Group

- Download HTML

- Download PDF

- Arts & Entertainment

- Government & Politics

- World Around

- Hobbies & Interests

- Food & Drink

- Uncategorized

- Health & Fitness

- Home & Garden

- IT & Technique

- Cars & Machinery

- Style & Fashion

The Man in Seat 61

'Priv' travel on European trains

Rail staff travel in europe.

- Buy train tickets

- Buy ferry tickets

- Book a hotel

- Privacy & cookies

- Home

Train travel UK & Ireland...

Train travel in europe..., train travel in asia..., train travel in africa..., train travel in america..., train travel in australasia, a great perk if you work for a uk train company.

If you have worked for a British train operating company for over 12 months and are entitled to reduced rate or free travel on British trains, you are almost certainly entitled to free or reduced rate travel on most European trains as well. Your partner and dependent children also qualify. This is an amazing perk, though it's often not 'advertised' by your employer. Network Rail safeguarded staff employed before 31 March 1996 also get this perk, although NR staff who joined after this date don't.

How does it work?

There are two basic options for travelling in Europe on 'privs': (1) using an FIP International Reduced Rate card to get a discount or (2) using FIP International Free Travel Coupons for (in most cases) completely free travel.

(1) FIP International Reduced Rate Card & how to get one

There are special rates on Eurostar for holders of FIP cards, you can buy these from Eurostar telesales or from agencies such as International Rail, 0333 003 0423 or via www.bookmyrst.co.uk .

London to Paris or Brussels costs £34.50 each way in standard or £52.50 in standard premier (1st class) with an FIP card.

London to Any Belgian Station costs £46.50 each way in standard or £70.50 in standard premier (1st class) with an FIP card.

London to Rotterdam or Amsterdam costs £44.50 each way in standard or £62.00 in standard premier (1st class) with an FIP card.

(2) FIP International Free Coupon Tickets & how to order them

How to make reservations, more information, a discussion forum & to read up on the small print, how to apply, more information welcome.

Feedback would be welcome , if you're a member of rail staff and use your free or reduced rate European travel facilities.

Back to top

Back to home page

European Traction

Diesel and electric haulage on the Continent

Tickets – FIP Travel (Rail Staff Travel)

One of the most treasured benefits of working on the railway (for an organisation that is a member of ATOC/RDG, at least) is that after a year of employment, you qualify for your free international passes, or FIP. This is my non-exhaustive guide!

It is, perhaps, bizarre to think that if you, like me, joined the railway after privatisation, you need to pay to travel a few miles down the road if it happens to be on another TOC’s service, but you can travel for absolutely nothing from Calais all the way to within sight of Africa or Russia if you choose – but this is the case.

FIP comes in two forms – your annual allocation of passes (coupons) for free rail travel in each country, and your FIP “International Reduced Rate” card (essentially, an international priv card) that gives you significant discounts on walk-up fares.

How to apply

Coupons need to be requested for each country you intend to visit individually. You select which countries you want by way of tick boxes on the online form at this link . Applications must be submitted between 3 months and 3 weeks before your trip – you stipulate the start date of your ticket when you apply and each coupon is then valid for four 48-hour periods within the following 3 months. Your entitlement for each country is refreshed annually – for some countries (e.g. France, Belgium and the Netherlands) you get two coupons per year.

To request your International Reduced Rate card, fill in the form at this link . You only need one of these, regardless of how many countries you intend to visit. As these operate on much the same principal as our domestic priv cards, they are worth getting into your possession as soon as possible, even if they just gather dust in your wallet until it’s time for renewal.

There is no provision for FIP travel at all in Sweden, nor on many of the private railway operators in other countries – some of which have quite extensive networks e.g. ALEX in Germany or Trenord in Italy. Additionally, there is no free coupon provision for Bosnia-Herzegovina, but there are discounted single tickets available with the FIP card.

Some single journeys within metropolitan areas, particularly in Germany, do not qualify for FIP discount, as these fares are set by the local transport authorities rather than the train operator. This is irritating, but unavoidable.

Journeys on high-speed services such as Eurostar and Thalys are subject to special FIP fares and coupons are not valid. There are also some individual services on which you can’t use any FIP discounts – mainly “premium” services such as the (loco hauled) “City Airport Train” (CAT) between Wien and its airport or the Airport Express services between Oslo and Gardermoen airport, etc.

It is best to refer to and keep an eye on the Rail Staff Travel section of the RDG website for updates regarding international rail staff travel and its validity.

Ticket machines

When buying a discounted ticket with your FIP card, it is far better to seek out a booking office where you can do this with a human. In the same way as you can’t buy a priv ticket here, most ticket machines do not allow you to buy a FIP ticket directly.

There is no magnetic strip or equivalent in a FIP coupon so barriered stations can sometimes be tricky to navigate. There is no common solution to this – for the Netherlands, your coupon arrives with a another slip containing a QR code that will open station barriers. However, I’ve had problems on the RER in Paris, among others – despite being completely valid on the trains, I’ve had no means of opening the unmanned barriers to enter or egress the system, and with time ticking away for a flight on one memorable morning (whilst en route from Boulogne to work!), had to double-up with locals through barriers at both ends of my journey.

However, it must be seen that the pros massively outweigh the cons!

Family and Dependents

If you have family or dependents who are entitled to priv travel through you at home, then they also qualify for an element of FIP. More info at the online form here .

Reservations

Having FIP travel documentation does not absolve you of the responsibility to purchase reservations where they are compulsory.

It is fair to say that the benefits of FIP are not well known among British railway staff as a whole (especially those who aren’t cranks), and surprisingly this does extend to some revenue staff on trains and at stations abroad. Our hobby has a habit of taking us to places that are well away from the tourist trail, and it is not uncommon to find your ticket scrutinised from every possible angle as it is the first one they’ve come across.

One thing to really bear in mind, however, is that each box on a FIP coupon is valid for 48 hours, not 24. Therefore, if you write a date on your ticket, say 01/06/17, then this sees you through to close of play on 02/06/17. Many grippers seem unaware of this – it is not uncommon on the second day of a box for them to try and “helpfully” write that day’s date in the next box for you (thus depriving you of two days’ validity!) so do be vigilant of this if they take your coupon off you for a closer look. The “two day rule” is written in four languages on your coupon so you should be able to make yourself understood.

It must be said though, that once they realise that you are fellow railway staff, many will treat you like an old friend and sit down and have a chat (even if you share no common language!).

Share this:

- Already have a WordPress.com account? Log in now.

- Subscribe Subscribed

- Copy shortlink

- Report this content

- View post in Reader

- Manage subscriptions

- Collapse this bar

- BTPF Constitution

- Data Protection Policy Statement

- Fred Olsen – Black Friday Offer

- Fred.Olsen FREE Drinks Offer

- Fred. Olsen World Cruise 2025

- Fred. Olsen Affinity News

- Railway Children

- RBF – Make a FREE Will Month

- Staff Travel Facilities Information

- Railway Benefit Fund

- Railtrail Tours

- B.T.P.F. / Railway Benefit Fund

- NPC Campaign Bulletins

- First Class Concession

- Guarding Passengers

- The Railway Industry Memorial

- Get In Touch

Staff Travel News

Staff travel news, staff travel card renewal for 2024/25 – updated 20 march 2024.

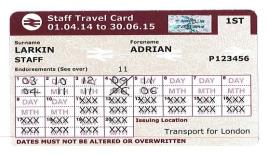

This news item applies only to safeguarded staff who entered rail service on or before 31 March 1996 and hold a Staff Travel Card. This news item does not apply to those who hold the Rail Staff Leisure Card or RST Online Leisure Card.

Staff Travel Cards for employees and eligible family members valid from 1 April 2024 to 30 June 2025 were posted out starting on 19 March. If we hold an email address for you, we will email you to let you know when they have been sent.

Please allow Royal Mail sufficient time to deliver these. We are not able to start issuing replacements for cards not received until 4 April. If you haven’t received them by this date, please contact us by email at [email protected] confirming:

- your full name, address and postcode

- which member of your family has not received their passes.

Please do not contact us before 4 April to report non-delivery as we are not be able to issue replacements until after that date.

If you don’t receive your cards, you must let us know by 31 July 2024 providing the information as detailed above for us to issue replacements for free. Any emails received after 31 July 2024 reporting non receipt of Staff Travel Cards will incur a replacement fee per card. A replacement fee will also be charged per card if you have moved address and not advised RST and cannot retrieve your card(s).

Cards will arrive in the same envelope, unless:

- you have a child dependant aged 18 or over and you had to submit a child declaration. These will generally be sent a little later, but we will email you once they have been posted to you.

- you have submitted an application to add a new family member to your record in the last few weeks. Again, we will email you once they have been posted to you.

From the Rail Delivery Group – 20th March 2024

Luton dart – update.

Luton DART is a private commercial service between Luton Airport Parkway station and Luton Airport.

There are no agreements in place for the acceptance of any rail staff travel product on Luton DART services to allow for free travel. If you are using a staff travel product for free travel (i.e. Status Pass, Staff Travel Card with a dated box, or a TOC specific product) on National Rail services to Luton Airport Parkway and wish to use the Luton DART service to travel to Luton Airport, you must obtain a ticket at the public rate from the Luton DART company.

Until 3 March 2024 you can purchase staff discounted (priv-rate) through tickets to travel from National Rail stations via Luton Airport Parkway to Luton Airport, which includes travel on Luton DART, but the pricing of that ticket only provides the staff discount (priv-rate) on the National Rail leg of the journey.

From 3 March 2024 Luton DART will accept priv-rate tickets. You will be able to purchase staff discounted (priv-rate) through tickets to travel from National Rail stations via Luton Airport Parkway to Luton Airport, which includes travel on Luton DART. All other staff travel products for free travel will not be accepted.

From the Rail Delivery Group – 14th February 2024

Priv rate on caledonian sleeper.

To enable a full review of the available capacity on Caledonian Sleeper services, new bookings for berth-inclusive priv fares on Caledonian Sleeper won’t be taken for the next 3 weeks. We will update this news page once we have further information.

From the Rail Delivery Group – 13th February 2024

Lithuanian railways.

The implementation of FIP within LTG-Link, the passenger division of Lithuanian Railways, scheduled from 1 January 2024 did not happen .

FIP International Reduced Rate Cards are not valid on LTG-Link services and the ability to order FIP coupons is being withdrawn.

We will provide a further update if there is any change to this situation.

From the Rail Delivery Group – 6th February 2024

Travel tips for europe updated.

A new version of the Travel Tips for Europe has been uploaded to the Where Can I Go and Restrictions page. The main updates in this version are:

- A list of stations in the Netherlands where FIP discounted tickets can be purchased at a ticket office.

- Updates to pages on travel in Norway on Vy Group services.

- Significant updates to pages on travel in France on SNCF services.

From the Rail Delivery Group – 18th January 2024

New ticket types with staff discount (priv rate) on some lner routes.

As part of the simpler fares initiative, LNER are introducing new ticket types on some routes from 16 January 2024 for travel from 5 February 2024 and withdrawing Off-Peak tickets. Anytime ticket types will still be available on all routes.

As an alternative to Off-Peak tickets, staff discounts (priv rate) will be available on a particular 70min Flex price point, and also an Advance Purchase price point. For more details on the terms and conditions associated with the 70min Flex fare please see this page on the National Rail website www.nationalrail.co.uk/ticket-types/tickets/dma

Details of the terms and conditions associated with Advance Purchase ticket types are available at www.nationalrail.co.uk/tickets-railcards-and-offers/ticket-types/advance-tickets

The terms and conditions attached to the staff discounted (priv rate) 70min Flex fare and Advance Purchase fare, including the rules around refunds and changes, are the same as those which apply to public rate versions of these ticket types. These tickets are quota controlled, so subject to availability and Break of Journey is not permitted.

You will be able to purchase these tickets through RST Online. If you hold a Staff Travel Card or Rail Staff Leisure Card, then you can also purchase them from a National Rail ticket office. Please note that these ticket types cannot be sold on board a train.

The announcement on the LNER website about the public versions of these ticket types is here www.lner.co.uk/news/lner-launches-pioneering-pilot-to-further-simplify-fares

From the Rail Delivery Group – 16th January 2024

IMPORTANT – see updated information 6th February 2024

LTG-Link, the passenger division of Lithuanian Railways, is joining the FIP scheme from 1 January 2024.

FIP International Reduced Rate Cards issued by Rail Staff Travel held by active and retired employees and their dependents will be valid for discounted travel on LTG-Link services from 1 January 2024. The list of carriers on the FIP International Reduced Rate Card does not currently include LTG-Link but the cards will be accepted for discounted travel. When the FIP cards are renewed in December 2024, LTG-Link will be added to the list of carriers.

FIP coupons are available for active employees only with a travel date of 1 January 2024 or afterwards. The allocation is one per calendar year.

FIP Coupons are not available to:

- Retired employees (including those who retire before the 1 January 2024 and use coupons from their 9 or 45 month allocations)

- The dependants of active or retired employees

From the Rail Delivery Group – 7th December 2023

Rovers and rangers in rst online.

It is now possible to purchase staff discounted (priv rate) Rovers and Rangers from RST Online. You can do this if you hold a Staff Travel Card, a Rail Staff Leisure Card or an RST Online Leisure Card.

If you are not sure what Rovers and Rangers are, there is more information on the National Rail page here www.nationalrail.co.uk/tickets-railcards-and-offers/ticket-types/ranger-and-rover-tickets/

The option to purchase is available in the desktop version of the website. The ability to purchase in the mobile version of the website will follow later. If you are using a smartphone or tablet you can access the desktop view of the website using the menu option on the top right hand side of the screen.

Only Rovers and Rangers which can be sold with the staff discount (priv rate) are available. Those which have no staff discount (priv rate) are not sold by RST Online.

You can purchase a Rover or Ranger with a start date of between 7 and 14 days from the date of purchase. Rovers and Rangers are printed and posted to you by 1 st class post. There is no other fulfilment option available.

If you purchase a Rover or Ranger and no longer require it, then you can apply for a refund up to the start date.

From the Rail Delivery Group – 4th August 2023

New rst po box and address.

Following an office move, RST has a new PO Box for the receipt of items via Royal Mail. Please use this address to post letters or passes to us:

From the Rail Delivery Group – 1st August 2023

UNCLASSIFIED (U)

allowable travel and miscellaneous expenses

(CT:LOG-392; 03-20-2024) (Office of Origin: A/LM)

14 FAM 561 POLICY AND AUTHORITIES

14 FAM 561.1 Policy

(CT:LOG-381; 09-26-2023)

It is the general policy of the U.S. Government that less-than-premium-class accommodations must be used for all modes of passenger transportation. The policies in 14 FAM 567 govern the use of common carrier accommodations and apply to travel while on official U.S. Government business.

14 FAM 561.2 Exercising Care in Incurring Expenses

An employee traveling on official business is expected to exercise the same care in incurring expenses that a prudent person would exercise if traveling on personal business and expending personal funds. Excess costs, circuitous routes, delays, or luxury accommodations and services unnecessary or unjustified in the performance of official business are not acceptable under this standard. Employees will be responsible for excess costs and any additional expenses incurred for personal preference or convenience.

14 FAM 561.3 Authorities

In addition to the authorities listed in 14 FAM 511.4 , the following authorities apply:

(1) State Department Delegation of Authority No. 462, dated January 9, 2019, delegates the Secretary of State's travel authority to the Under Secretary and Deputy Under Secretary of State for Management;

(2) 22 U.S.C. 4081 is the travel payment authorization provision of the Foreign Service Act that provides for a domestic relocation allowance;

(3) The Federal Travel Regulation (FTR) 41 CFR 301.10-124 addresses coach-class seating upgrade programs;

(4) FTR 41 CFR Part 301-13 addresses travel of employees with special needs, and

(5) The General Services Agency's (GSA) FTR Bulletin FTR 09-02, dated 31 Dec. 2008, clarifies the seat choice options and other miscellaneous fees Federal agencies may reimburse their employees while on official travel.

14 FAM 562 EXPENSES ALLOWABLE

14 FAM 562.1 Miscellaneous Expenses not Covered by Per Diem

(CT:LOG-392; 03-20-2024)

a. The following travel expenses, when actually incurred and necessary, can be itemized and reimbursed over and above the per diem allowance for lodging and meals and incidental expenses (M&IE):

(1) Official telephone calls and faxes in connection with official business; internet access fees while performing official business. Reimbursement for expenses must be authorized in advance of travel on the travel authorization;

(2) Commissions for conversion of currency; fees to obtain travelers checks, money orders and certified checks; transaction fees for use of ATMs and other vendors such as hotels when using a U.S. Government contractor-issued charge card. For locally employed (LE) staff who use their personal charge cards and for other travelers who the Department has determined may not be issued a U.S. Government charge card or who have been authorized to use their personal charge cards for official travel, transaction fees for the use of ATMs and other vendors such as hotels may be allowed, if stated on the travel authorization in advance of travel;

(3) Lodging taxes in domestic and nonforeign areas (see FTR, 41 CFR 301-11.27); energy surcharge and lodging resort fees when such fees are not optional;

NOTE : Lodging taxes and mandatory fees in foreign areas are incorporated into the per diem rate for lodging for those areas. In order to be fully reimbursed, the sum total cost of lodging plus mandatory taxes and fees in foreign areas must be within the prescribed lodging component of per diem for that area;

(4) Fees in connection with the issuance of passports and visas and other legally required costs; photographs for passports and visas; certificates of birth, health and identity, and affidavits attesting thereto; foreign country entrance and exit fees;

(5) Inoculations that cannot be obtained for free through a Federal dispensary (reimbursement must be authorized on the travel authorization before travel begins). For yellow fever inoculations, there is no requirement for prior authorization for reimbursement; and

(6) Expenses associated with the transport of human milk expressed by an employee or Eligible Family Member (EFM) while on TDY, approved medical travel, or on PCS travel (including for the authorized PCS travel to post for new infants following a parent's authorized obstetrical medevac) in accordance with the FTR, 41 CFR 301-13.2, up to a maximum of $1000. Reimbursement for expenses must be authorized in advance on the travel authorization and the traveler must submit all receipts, regardless of amount, with the travel voucher. Expenses may include commercial shipping fees, excess baggage, disposable storage bags, cold shipping packages, refrigeration, transport, and non-durable containers. Durable containers that are not reimbursable include canvas, polypropylene, and soft- or hard-sided containers . For special cases of TDY travel where expenses exceed $1000, the traveler may receive reimbursement above $1000 only when authorized in writing by the EX Director (or agency equivalent) of the funding bureau in advance of travel. Such authorization must also accompany the travel authorization and the travel voucher. Travelers are ultimately responsible for arranging all transport of human milk and for handling all related logistics. See 3 FAM 3860 for more information on the Department’s lactation policy.

b. For Agriculture only : Foreign Agricultural Service allows for reimbursement of authorized telephone calls of a personal nature during official travel. For foreign travel, the maximum reimbursement is $15.00 per day. For domestic travel, the maximum reimbursement is $5.00 per day. The maximum aggregate amount that may be approved for each travel period (i.e., consecutive days of official travel) cannot exceed the amount equal to the daily reimbursement rate multiplied by the number of lodging nights. This reimbursement is not an automatic claim and should only be reflected on a voucher if actual expenses were incurred while in a TDY travel status.

c. For USAID only : ADS 633.3.6.1 Financial Management Aspects of TDY, and ADS 549, Telecommunications Management, defines some telephone calls to family as “Official” and allows for reimbursement of those telephone calls when an employee is traveling on government business. See those ADS chapters for further details.

14 FAM 562.2 Transportation Expenses

a. The following transportation expenses, when actually incurred and necessary, can be itemized and reimbursed if not paid directly by the U.S. Government:

(1) Travel on railroads, aircraft, sailing vessels, buses, streetcars, and other usual means of common carrier conveyance;

(2) Transfer, storage, and checking of baggage necessary for the purpose of the official travel;

(3) Charges for transfer, storage, checking, and porters' fees and tips for handling U.S. Government property carried by the traveler;

(4) Transportation charges for authorized excess official baggage;

(5) Shipments by express or freight of U.S. Government property not classed as baggage and not admissible to the mail (normally made on U.S. Government bills-of-lading (GBLs) where feasible);

(6) Packing and necessary preparation for shipment, cost of unboxing at destination, and necessary cartage of unaccompanied baggage or personal effects, or baggage accompanying traveler;

(7) Hire of a boat, automobile, taxicab, aircraft, or other conveyance when authorized or approved as advantageous to the U.S. Government and when employee is engaged in official business within or outside employee's post of duty;

(8) Daily travel to procure meals or lodging at the nearest available place when such cannot be procured at a temporary duty station; and

(9) Transportation by bus, subway, streetcar, taxicab, transportation network company (TNC), or innovative mobility technology company (IMTC) (see 14 FAM 511.3 for definitions):

(a) Between places of business;

(b) Between place of lodging and place of business at a temporary duty station;

(c) Between place of lodging or employee’s home and common carrier transportation terminal in connection with official travel;

(d) From employee's office to a common carrier transportation terminal on the day of departure from the office on an official trip requiring at least one night's lodging.

b. Use of taxicabs, TNCs, or IMTCs (see 14 FAM 511.3 for definitions):

(1) When suitable common carrier transportation is available for travel between points other than those listed above, but the traveler elects to use a taxicab or TNC, or IMTC, detailed remarks noting the circumstances must be furnished on the travel voucher;

(2) Taxicab, TNC, or IMTC reimbursement in excess of $75.00 plus tip must be supported by a receipt along with a statement justifying the use of such conveyance;

(3) The maximum tip allowable under this section is 20 percent of the reimbursable fare;

(4) In lieu of the use of a taxicab, TNC, or IMTC as provided in this section, payment on a mileage basis at the approved rate, as described in 14 FAM 566.2-2 , is allowed for the mileage of a privately owned automobile used for a purpose detailed above, provided that the amount of reimbursement for mileage does not exceed the estimated taxicab, TNC, or IMTC cost, including allowable tip, for transportation between the applicable points;

(5) Membership or application fees, tickets, fines, cancellation fees or fees charged for waiting for the traveler, or other such expenses associated with TNCs or IMTCs are not reimbursable. Only actual usage charges, booking charges, and reservation charges made directly with the TNC or ITMC (not a third-party company) are eligible for reimbursement; and

(6) Travelers may not know prior to beginning a trip what ground transportation options will be available at a particular location. Thus, travel authorizations that contain advance authorization for a taxi, a TNC, or an IMTC are considered to confer authority to use any or all of those ground transportation options. When completing a travel voucher, however, it is necessary to specify whether a taxi, TNC, or IMTC was actually utilized for each instance of ground transportation in order to facilitate preparation of certain congressionally mandated reports.

14 FAM 562.3 Unaccompanied Minor Charges

Most airlines provide a service for children traveling unaccompanied on their airline without the presence of a legal guardian, but fees for this service differ by airplane. This charge is reimbursable when:

(1) The EFM child (16 years of age or younger) is the only individual entitled to travel at U.S. Government expense for the type of official travel authorized (e.g., travel of children of separated families, educational travel, educational allowance, or on authorized or ordered departure); and

(2) The child is engaged in direct travel with no deviation from the authorized itinerary; and

(3) The fee is authorized on the travel authorization in advance of travel.

14 FAM 563 EXPENSES NOT ALLOWABLE

14 FAM 563.1 Items Included in Per Diem

The following items are included within the lodging and/or meals and incidentals (M&IE) portions of the per diem allowance (see definition in 14 FAM 511.3 ) and may not be paid, itemized, or reimbursed separately:

(1) Charges for lodging, including:

(a) Overnight sleeping facilities;

(b) Personal use of room and bath during daytime;

(c) Telephone access fee; and

(d) Service charges for fans, televisions, air conditioning, heaters, microwaves, and refrigerators in rooms;

(2) Charges for meals, including:

(a) Expenses for breakfast, lunch, and dinner; and

(b) Related tips and taxes;

(3) Incidental expenses, including:

(a) Fees and tips given to waiters, porters, baggage handlers, bellhops, hotel personnel, restaurant staff, and similar employees;

(b) Transportation between place of lodging or business and places where meals are taken, except as specified in 14 FAM 562.2 , subparagraph a(8); and

(c) Bottled water;

(4) Complimentary meals provided by common carriers or hotels (e.g., complimentary breakfast meals on airplanes, etc.) have no impact on per diem rates paid per FTR, 41 CFR 301-11.17.

14 FAM 563.2 Personal and Other Expenses

Costs of a personal nature are not reimbursable, such as:

(1) Personal telephone calls or faxes, including messages, requesting leave, inquiring as to status of salary, expense vouchers, advance of funds, and reply thereto, or any other matter of personal nature. This section does not apply to Agriculture or USAID employees (see exceptions for Agriculture employees in 14 FAM 562.1 , paragraph b, and for USAID employees in 14 FAM 562.1 , paragraph c);

(2) Internet access fees for conducting personal business; internet service provider (ISP) fees (e.g., monthly charges for satellite, fiber, cable, or DSL internet access);

(3) Transaction fees for use of ATMs and other vendors, such as hotels, with a personal charge card except when authorized in accordance with 14 FAM 562.1 , subparagraph a(2);

(4) Laundry, dry cleaning, and pressing when traveling OCONUS or when traveling in CONUS for less than four consecutive nights;

(5) Alcoholic beverages;

(6) Entertainment expenses;

(7) Any expenses incurred for other persons; and

(8) Miscellaneous service fees (i.e., administrative, booking, and third-party fees) resulting from booking transportation or lodging outside a government-contracted travel management center or government lodging program (e.g., FedRooms).

14 FAM 564 Fare types

14 FAM 564.1 Unrestricted Fare Policy

(CT:LOG-381; 09-26-2023) (State and USAID)

a. In general and when possible, the Department utilizes the lowest-cost unrestricted fares available for travel between authorized origin and destination, respecting the terms of the General Services Administration (GSA) city-pair program, for all official travel.

b. An individual may request the purchase of a restricted or penalty fare for official travel based on personal convenience (e.g., taking an indirect route for personal reasons or wishing to travel in a class of service other than the one authorized), but the individual is responsible for any and all additional costs and/or penalties incurred in connection with such fares regardless of whether those costs are due to official or personal reasons. See 14 FAM 561 for an employee's responsibility to exercise due care.

c. When an individual is authorized an unrestricted fare but engages in indirect (cost-constructed) travel and elects to use a restricted fare, the cost of that restricted fare, in the class of service and the route used by the traveler, must be compared to the cost of an unrestricted fare along the authorized route in the authorized class of service in order to determine whether the individual’s deviation results in an additional cost to the U.S. Government:

(1) If an additional cost would be incurred because of the individual’s decision to engage in indirect travel and/or travel in a class of service other than the one authorized, the individual must pay, to the TMC or air carrier issuing the ticket, the difference in fare between the restricted fare elected by the traveler and the unrestricted fare that would have been purchased by the U.S. Government; and

(2) If no additional cost would be incurred, the U.S. Government may purchase the restricted fare along the indirect route and/or in the class of service other than the one authorized. Any cost saving associated with the purchase of a restricted fare in this case is not transferrable to the traveler, and a fare saving may not be used to offset change or cancellation fees incurred as a result of the individual’s decision to use a restricted fare.

d. Whenever a cost comparison is made, documentation of the specific flight itineraries and their respective costs must be retained and included in the travel authorization for future reference and to meet auditing requirements.

14 FAM 564.2 Restricted Fare Policy

a. Restricted penalty fares should be authorized for official travel only when their use is practical and economical to the U.S. Government. Round-trip tickets with such fares should be authorized only when, based on the journey as planned, the traveler knows or reasonably anticipates that such tickets will be utilized in accordance with their restrictions (see 14 FAM 542 for details of contract city-pair fares). The use of prohibited ticketing practices, such as “throw-away,” “hidden city,” or “back-to-back” ticketing, is not permitted for any part of either authorized or cost constructed travel itineraries because those tactics violate air carrier contracts of carriage.

b. A mission or bureau has the option of developing a policy requiring the use of restricted, penalty fares subject to the conditions set out in paragraph a of this section. The authorizing mission or bureau will assume financial responsibility for any penalties associated with these fares, should changes or cancellations be required by the U.S. Government. The employee will be responsible for any penalties incurred for personal convenience.

c. If a mission or bureau chooses to use restricted, penalty fares, the mission or bureau must provide the travel management center with a written policy for the use of these fares and the appropriate fare type (restricted or unrestricted) must be indicated in the remarks of each travel authorization. At posts where a travel management center does not exist, the written policy must be provided to the travel section in the general services office.

d. When an employee is authorized a restricted fare under 14 FAM 564.2 , paragraph b, and engages in indirect (cost-constructed) travel also using a restricted fare, penalties incurred due to changes or cancellations required by the U.S. Government are reimbursable up to the cost that would have been incurred for similar modifications to the authorized routing. The employee will be responsible for any penalties incurred for personal reasons.

14 FAM 564.3 Disposition of Airline Promotional Items

a. All Department employees, their dependents, and others whose travel is funded by the Department may retain for personal use promotional items (i.e., frequent flyer miles, upgrades, access to carrier lounges) earned from official travel under terms available to the general public and at no extra cost to the U.S. Government.

b. Travelers may accept free upgrades of services to business-class or first-class accommodations if they are obtained under terms available to the general public and at no extra cost to the U.S. Government.

c. Travelers may redeem frequent flier miles (or use personal funds) to upgrade to business or first-class accommodations when performing official travel.

d. It is the responsibility of each traveler to communicate directly with a service provider to establish his or her frequent travel promotional benefits account. Costs associated with establishing this account are to be paid by the traveler and are not a reimbursable expense.

e. Travelers need not report as taxable income promotional items obtained from official travel.

14 FAM 564.4 Compensation Received from Airlines for Denied Boarding

a. Voluntary : A traveler may keep payments from a carrier for voluntarily vacating a transportation seat. However, no additional expenses (per diem or miscellaneous reimbursable) may be paid because of the traveler’s delay. Additional travel expenses incurred because of voluntarily giving up a seat are the traveler’s financial responsibility.

b. Involuntary : If a traveler is involuntarily denied a transportation seat, the traveler enters an onward travel status for per diem and miscellaneous travel expense reimbursement. Any monetary compensation (including meal and/or lodging vouchers) for the denied seat belongs to the U.S. Government.

14 FAM 565 CANCELED RESERVATIONS

14 FAM 565.1 Service/Cancellation Expenses

When a train, sailing vessel, or hotel reservation is canceled because of unavoidable, nonpersonal delay or because of official necessity, the cost of a service fee or cancellation expense charged by the service provider is allowed. Fees paid for cancellations of reservations for personal reasons or avoidable delays in notifying the service provider are not reimbursable.

14 FAM 565.2 Liquidated Damage Payments to Traveler

a. When carrier tariffs require liquidated damage payments to travelers for the carrier's failure to provide confirmed reserved space, such payments by the liable carrier are to be by check, made payable to the "Treasurer of the United States." In no case is the traveler permitted to accept from the carrier a check showing the traveler as payee.

b. The traveler is to acknowledge receipt of the check and submit a copy of the acknowledgment and the check with travel voucher. Payment of denied boarding compensation to the Treasurer of the United States is a U.S. Government requirement and is no reflection on the carrier (see 4 FAM 470 ).

14 FAM 566 TRAVEL BY PRIVATELY OWNED VEHICLE OR PRIVATELY OWNED CONVEYANCE

14 FAM 566.1 Policy

a. Travel by common carrier is generally considered the most advantageous method to perform official travel. Other methods of transportation may be authorized if they are determined to be more advantageous to the U.S. Government. A determination that another method of transportation is more advantageous to the U.S. Government than common carrier transportation will not be made based on personal preference or inconvenience to the traveler.

b. In determining whether the use of a privately owned vehicle is advantageous to the U.S. Government, consider:

(1) The feasibility of using common carrier transportation or U.S. Government-owned conveyances based on availability, suitability of schedules, and other applicable requirements;

(2) The total cost to the government, including per diem, overtime, lost work time, actual transportation costs, total distance of travel, number of points visited on official travel, the number of travelers, and energy conservation;

(3) The advantages resulting from the more expeditious transactions of the public business, economy, and employee performance effectiveness; and

(4) Any other advantages and/or disadvantages to the U.S. Government in the particular case.

c. The authority to travel by privately owned vehicle (POV) contained in this section is applicable to the employee and/or other family member(s) authorized to travel. The vehicle to be used must be the property of the employee or family member prior to the initiation of travel and must be driven or shipped to the ultimate destination stipulated in the travel orders. Only such vehicles as are eligible for shipment at U.S. Government expense are authorized to be driven on a mileage per diem basis under this provision.

d. Any reimbursement for travel by POV, under the mileage (see 14 FAM 566.2-1 ) per diem basis authorized by this section is limited to the actual mileage between authorized points on a direct route plus related per diem, not to exceed 10 days to each authorized destination.

14 FAM 566.2 Use Advantageous to the U.S. Government

14 FAM 566.2-1 General

(CT:LOG-388; 01-19-2024)

a. When the authorized travel from origin to destination (combined with TDY, consultation and/or home leave, as applicable) can be performed entirely using a privately owned vehicle (POV), such use may be authorized.

b. Travel by POV to separation address in the United States, when not otherwise covered under 14 FAM 566.1 , is hereby authorized from the port of discharge of the vehicle to the separation address via consultation point (as applicable). In accordance with 14 FAM 618.4 , however, this authorization does not apply to vehicles acquired en route to a separation point.

c. When an employee's vehicle is authorized emergency storage in accordance with 14 FAM 626 , an authorizing officer may determine that it is advantageous for the vehicle to be driven all or part of the distance to the designated storage point.

d. An employee who acquires a vehicle at a point on a direct route to the post of assignment abroad, and who has not previously shipped a vehicle under the provisions of the authorizing travel orders, may drive the POV to the destination. The point of acquisition is considered the point of origin. In no case may the cost of driving the vehicle from where it is acquired exceed the cost to the U.S. Government had the vehicle been shipped from the point of origin specified in the travel authorization to the authorized destination.

e. Travel by a POV is considered advantageous to the U.S. Government when the authorized or actual point of origin and the final destination are:

(1) Connected by a hard-surface, all-weather highway or by vehicular ferry, or both (see 14 FAM 615.1 ); and

(2) Within the continental United States or Canada or one of the following Mexican border posts:

(a) Ciudad Juárez;

(b) Matamoros;

(c) Nuevo Laredo;

(d) Tijuana; or

(e) Nogales.

f. When use of a rental vehicle in the United States is authorized, reimbursement for rental fees and actual expenses for fuel (gas, diesel, electricity, etc.) and tolls is authorized. U.S. Government-contracted rental vehicle services should be used whenever possible. Collision damage waiver (CDW) is included in the contract amount and should not be accepted at extra cost. When renting from companies not on the U.S. Government contracting list, travelers will not be reimbursed for CDW. However, payments for damages to a rental car company or reimbursement to the employee, up to the deductible amount contained in the rental contract, are authorized, providing the employee was acting within the scope of his or her employment at the time of the incident.

g. When use of a rental vehicle abroad is authorized, reimbursement may include rental fees, including value added tax (VAT), and actual expenses for fuel and tolls. U.S. Government-contracted rental vehicle services should be used whenever possible. The contract rate includes CDW, VAT, and unlimited mileage. When renting from companies not on the U.S. Government contracting list, CDW, VAT, and unlimited mileage will not usually be included. CDW is a reimbursable expense abroad. In addition, payments for damages to a rental car company or reimbursement to the employee are authorized up to the deductible amount contained in the rental contract, providing the employee was acting within the scope of his or her employment at the time of the incident.

h. When use of a rental vehicle is authorized for official travel, the least expensive “compact” car available must be used unless one of the following exceptions for another class of vehicle applies and is indicated on the travel authorization:

(1) When use of other than a compact car is necessary to accommodate a medical disability or other special need, and all applicable requirements set forth in 41 CFR 301-10.450(c)(1) have been met;

(2) When additional room is required to accommodate multiple employees authorized to travel together in the same rental vehicle;

(3) When security circumstances (as defined in writing by DS or the RSO) require a larger vehicle;

(4) When necessary for other safety reasons, such as during severe weather or having to travel on rough or difficult terrain;

(5) When travelers must carry a large amount of U.S. Government material incident to their official business, and a compact rental vehicle does not contain sufficient space; or

(6) When the cost of other than a compact car is less than or equal to the cost of the least expensive compact car.

i. For non-electric rental vehicles, t ravelers may not be reimbursed for purchasing prepaid refueling options. Therefore, travelers must refuel prior to returning the rental vehicle to the drop-off location. NOTE : If it is not possible to refuel completely prior to returning the vehicle because of safety issues or due to the location of closest fueling station, travelers will be reimbursed for vendor refueling charges. For electric rental vehicles, travelers may be reimbursed for pre-paid charging costs and/or necessary costs paid via credit card or billed back to the rental vehicle company to recharge the vehicle before return.

j. Travelers will not be reimbursed for fees associated with rental car loyalty points or the transfer of points charged by car companies.

14 FAM 566.2-2 Mileage Reimbursement

Mileage reimbursement rates for automobiles (including trucks, vans, etc.), airplanes, motorcycles, and motor scooters are set by GSA. The current rates may be found on the GSA website.

14 FAM 566.3 Privately Owned Vehicle (POV) Use for Personal Convenience

14 FAM 566.3-1 General

When no determination of advantage to the U.S. Government is made (see 14 FAM 566.2 ), the employee may elect to use a privately owned vehicle for personal convenience. Any reimbursement for expenses for travel will be the lesser of:

(1) Mileage for the authorized mode of travel at the rates provided in 14 FAM 566.2-2 , plus related per diem; or

(2) For the portion of the route connected by air service, reimbursement may not exceed the constructive cost of the authorized U.S. Government fare for the authorized mode of travel on a direct route, plus related per diem and other expenses. For any portion of the route not connected by air service, reimbursement may not exceed the constructive cost of commercial fares on a surface common carrier.

14 FAM 566.3-2 Use of Rental Vehicle

When the employee elects to use a rented vehicle for personal convenience, and use of the rental vehicle has not been specifically authorized, per 14 FAM 566.2-1 , paragraphs f and g, reimbursement for travel expenses will be the lesser of:

(1) Mileage, plus per diem and other expenses allowable on the authorized mode of transportation stated in the travel authorization; or

(2) The constructive cost of the U.S. Government airfare on a direct route, plus per diem and other expenses. For any portion of the journey not connected by air service, reimbursement may not exceed the constructive cost of less than premium-class accommodations on a surface common carrier.

14 FAM 566.4 Computing Expenses

14 FAM 566.4-1 Distances

When travel is performed by a privately owned motor vehicle, distances are to be determined by use of standard highway mileage guides. Travelers must explain any substantial deviation from distances shown in the standard highway mileage. When travel is performed by privately owned airplanes, distances are to be determined from airways charts issued by the National Oceanic and Atmospheric Administration, Department of Commerce. If a detour is necessary on account of adverse weather, mechanical difficulty, or other unusual conditions, the additional highway or charted air mileage may be included but must be explained.

14 FAM 566.4-2 Allowable Travel Time

Allowable time for travel by privately owned conveyance is limited to that which is reasonably required. Variations in driving conditions do not permit the establishment of daily mileage requirements. In the United States, however, 360 miles per day is considered the average normal driving distance. Where road, climate, and other factors beyond the control of the traveler cause interruptions and deviations resulting in longer than normal travel time, the traveler will include a full explanation on the travel voucher. The traveler must also explain any unusual circumstances that influence the elapsed time for travel by privately owned aircraft.

14 FAM 566.4-3 Shared Expenses

When two or more authorized travelers share the same privately owned conveyance, payment of mileage expenses is made to only one of them.

14 FAM 567 ACCOMMODATIONS

14 FAM 567.1 Accommodations on Trains and Vessels

a. U.S. Government employees who travel by train or sailing vessel (ship/ferry) are authorized the lowest class of accommodation on the train or sailing vessel. For overnight train travel, employees must use slumber coach sleeping accommodations or the lowest level of economy sleeping accommodations available. For overnight travel on a sailing vessel, employees must use the lowest-cost stateroom. First-class train or steamer accommodations may be used only as permitted in 14 FAM 567.1-2 .

b. In some countries, the lowest class of train or sailing vessel service available locally may be considered by posts to be unacceptable by U.S. standards and not comparable to what would be considered as a reasonable basic class of accommodation as defined in 14 FAM 511.3 . For example, train service described as first class at some posts may only equate to the coach-class definition in the United States. Accordingly, posts may establish a policy re-defining the acceptable level of local train accommodations that would meet each definition and document this in a written policy for travelers, inspectors, and U.S. Government Accountability Office (GAO) auditors.

c. If a train has only two classes of accommodation available (i.e., first and business), then the business class accommodation is deemed to be classified as coach class for the purposes of official travel since it is the lowest class offered. In such cases, the travel authorization should reflect that use of the lowest class of service available is authorized. While such travel may take place in the train’s business class compartment, is not reportable to GSA as premium class travel and no Form DS-4087 is required.

14 FAM 567.1-1 Authorization and Approval for the Use of Business- or First-Class Train or Sailing Vessel Accommodations

a. First class : Heads of agencies, or their designees as listed in 14 FAM 567.2-3 , may authorize or approve the use of first-class train or sailing vessel accommodations under criteria specified in 14 FAM 567.1-2 .

b. Business class : Officials listed in 14 FAM 567.2-4 may authorize or approve the use of business-class train or sailing vessel accommodations under criteria specified in 14 FAM 567.1-2 .

14 FAM 567.1-2 Use of Business- or First-Class Train or Sailing Vessel Accommodations

The use of business- or first-class accommodation may not be authorized strictly based on position or rank. When business- or first-class accommodations are authorized under the following circumstances, only the next higher available accommodations satisfying the needs may be used; for example, business-class accommodations should be utilized before going to first-class accommodations. Circumstances justifying the use of business- or first-class train or sailing vessel accommodations are limited to those listed below ( NOTE : 14 FAM 567.1-2 , subparagraph (4), applies only to trains):

(1) No reasonably available coach-class train accommodations or lowest class sailing vessel accommodations :

(a) Trains : The use of business-class train accommodations may be authorized when no coach-class train accommodations are reasonably available. For this paragraph, "reasonably available" means coach-class train accommodations that are scheduled to leave within 24 hours of the employee's proposed departure time or scheduled to arrive within 24 hours of the employee's proposed arrival time. In the case of a direct route that requires overnight travel, "reasonably available” must be based on the availability of slumber coach, or lowest economy, sleeping accommodations. "Reasonably available" does not include any accommodation with a scheduled arrival time that is later than the employee's required reporting time at the duty site, or with a scheduled departure time that is earlier than the time the employee is scheduled to complete duty;

(b) When the traveler determines that coach seats are unavailable for reservation for the day he or she must travel to arrive at a destination in time to conduct official business, the traveler may proceed to obtain a reserved seat in the next higher class where a reserved seat is available. This is only permissible when the traveler has made a good-faith effort to obtain a reservation in coach class at the earliest practicable time, i.e., the employee cannot unreasonably delay or postpone making reservations and travel plans to justify premium class travel; and

(c) Sailing vessels : The use of the next higher-class accommodations may be authorized or approved only when lowest-class accommodations are not available on the vessel;

(2) Travel on trains or sailing vessels by an employee with a disability : The use of business- or first-class train or sailing vessel accommodations may be authorized or approved when necessary to accommodate an employee's disability or other physical impairment, and the employee's condition and need for business- or first-class train or sailing vessel accommodations are substantiated in writing by MED or the regional medical officer or other competent medical authority. The use of business- or first-class accommodations may also be authorized for an attendant, when the employee is authorized use of business- or first-class train or sailing vessel accommodations and MED, or the regional medical officer or other competent medical authority certifies that the employee's disability or other physical impairment requires the services of an attendant en route;

(3) Security reasons aboard trains or sailing vessels : The use of business- or first-class train or sailing vessel accommodations may be authorized or approved when exceptional security circumstances require such travel. Exceptional security circumstances include but are not limited to:

(a) Travel by an employee whose use of coach train or lowest-class sailing vessel accommodations would endanger the employee's life or U.S. Government property;

(b) Travel by agents in charge of protective details and accompanying individuals authorized business- or first-class accommodations; or

(c) Travel by couriers or control officers accompanying controlled pouches or packages and the lowest-class accommodations cannot fulfill the mission; and

(4) Inadequate foreign coach-class train accommodations (foreign trains only) : The use of business- or first-class train accommodations may be authorized or approved when coach-class accommodations on a foreign rail carrier lack adequate sanitation or health standards.

14 FAM 567.1-3 Reporting Requirements for Business- or First-Class Travel on a Train or Sailing Vessel

a. Refer to 14 FAM 567.2-5 for instructions on reporting the use of business- or first-class train or sailing vessel travel to GSA.

b. Extra-fare train service does not need to be reported to GSA if the traveler was ticketed in the lowest class of service offered, even if that class of service was business class.

c. Travel that has been authorized under 14 FAM 567.1-2 , subparagraph (4) for inadequate sanitation or health standards does not need to be reported to GSA.

14 FAM 567.1-4 Extra-Fare Train Service (Express Trains)

a. Extra-fare train service is enhanced performance (i.e., faster speed or fewer stops) relative to other trains available between the same origin and destination.

b. Use of extra-fare trains is not authorized unless determined more advantageous to the U.S. Government or required for security reasons.

c. To justify time savings as an advantage to the U.S. Government, the extra-fare train must reduce overall journey time by one hour or more. Authorizing officials are reminded that air travel may be less expensive than extra-fare trains and, if so, should be the authorized mode of transportation.

d. To justify cost savings as an advantage to the U.S. Government, a ticket for the lowest class of service available on an extra-fare train must, relative to a ticket for the lowest class of service available on a standard train:

(1) Have the same restrictions;

(2) Be less expensive; and/or

(3) Depart within 3 hours of the standard train that would otherwise be booked.

e. Authorizing officials listed in 14 FAM 567.1-1 must approve this and the requirements of 14 FAM 567.1-2 must be met to authorize business class (when it is other than the lowest class of service offered on the train) or first class on an extra-fare train.

14 FAM 567.2 Airplanes

a. See 14 FAM 583 .

b. U.S. Government employees who use commercial air carriers for domestic and international travel on official business must be authorized coach-class airline accommodations. When available, the use of contract-air carriers offering discount (city-pair) fare is mandatory (see 14 FAM 542 , paragraph b). First-class air accommodations may be authorized only as permitted in 14 FAM 567.2-3 . Business-class air accommodations may be authorized only as permitted in 14 FAM 567.2-4 .

14 FAM 567.2-1 Seat Selection and Assignment

a. Each traveler, regardless of age, is entitled to occupy a seat on an airplane.

b. The policies and business practices of the airline(s) operating and/or marketing a particular flight determine whether a seat selection is available and, if they are available, whether a fee must be paid to obtain a seat.

c. Inability to obtain a seat selection or assignment, either for "free" or upon payment of a fee, does not confer an exception to the mandatory use of contract carriers ( 14 FAM 543 ), the provisions of the Fly America Act ( 14 FAM 583 ), or the requirement to authorize travel on the carrier offering the lowest fare that is consistent with all travel regulations.

d. Except as specified in subparagraphs d(1) through d(3) of this section, travelers are eligible for reimbursement of charges to obtain an economy class seat selection in an amount not to exceed $300 (each way) between any two authorized duty locations (i.e., origin and destination pairs), as indicated on a travel authorization. When a traveler qualifies for and is authorized a rest stop, the rest stop location is not considered a separate duty location for the purposes of this provision:

(1) If a bureau/post has a written policy stating that it wishes to limit this benefit, a traveler’s authorizing official may cap reimbursement at a lower amount for a particular instance of travel. In such cases, the authorizing official must specify, in advance of travel, the amount authorized for reimbursement between each duty location and should offer the traveler an explanation for the reduction;

(2) Seat selection fees are not reimbursable for any segment(s) of travel:

(a) Conducted in an indirect manner; or

(b) For which a traveler has cost-constructed to use accommodation in business or first class; or

(c) For which a traveler has been authorized business class or first-class accommodations; and

(3) The "value" of a seat selection fee cannot be applied towards the cost of obtaining a ticket in an other-than-coach class of service or be considered as part of any cost-construct calculation.

e. Payment of a seat selection fee must be made directly to the airline by the traveler. TMCs are not authorized to pay for seat selection fees, either by charging them directly to the U.S. Government or by facilitating payment on behalf of the traveler.

f. Reimbursement for a seat selection fee must be approved on the travel authorization prior to commencing travel and can only be approved for authorized direct travel (see 14 FAM 511.3 ).

g. Receipts are required for reimbursement of seat selection fees, regardless of amount.

h. For the purposes of determining eligibility for reimbursement, a seat selection in any cabin except business class or first class will be considered an economy class seat selection. Travelers may purchase any seating product, including those that offer increased seat width, additional legroom (formerly referred to as “extended economy seating”), or which are bundled/packaged with enhanced onboard or on-ground service, if the seating product is not business class or first class. For example, whether an airline calls a seating product Economy Plus, Premium Economy, or Preferred Seats has no bearing on eligibility for reimbursement as long as the seats are not business or first-class seats.

i. Travelers, not the TMC or airline, are responsible for making accurate determinations regarding whether a particular airline product is eligible for reimbursement as an economy-class seat assignment. Because some airlines have developed branded names that do not give direct indication of their product’s status as business or first class (e.g., United Polaris, Delta One, Copa Dreams Class), travelers who are uncertain whether a product qualifies for reimbursement as an economy class seat selection fee may request a determination of eligibility, before travel commences, by contacting [email protected].

14 FAM 567.2-2 Requirements

14 FAM 567.2-2(A) Authorization

a. Authorization for first-class or business-class air accommodations must be made in advance of the actual travel and must be documented in accordance with 14 FAM 567.2-2(B) . The designated approving official must not be subordinate to the traveler except that the Executive Secretary may approve first-class or business-class air accommodations for the Secretary and the Deputy Secretaries.

b. If the documents required under 14 FAM 567.2-2(B) cannot be completed in advance of travel due to an emergency, the employee must obtain advance approval from an agency official not subordinate to the traveler or from the chief of the agency’s transportation and travel management division or other designated office and must submit the required documents with the appropriate signatures at the earliest possible time.

c. If the employee does not obtain written authorization in accordance with this section, the employee is responsible for the difference between the first-class or business-class air accommodations used and the authorized coach-class or equivalent accommodations.

14 FAM 567.2-2(B) Documentation

a. Authorization : All requests for authorization must contain the name, grade, and position of the travelers; points between which first-class or business-class air accommodations are authorized; additional cost to the U.S. Government resulting from the difference between first-class or business-class and coach-class air accommodations; beginning date of travel; and an explanation of circumstances justifying the use of first-class or business-class air accommodations:

(1) Authorization for first-class air accommodations must be reflected in the travel authorization and accompanied by a memo from the appropriate agency head or designee (see 14 FAM 567.2-3 );

(2) Authorization for business-class air accommodations must be reflected in the travel authorization and accompanied by the appropriate form signed by the designated approving official (see 14 FAM 567.2-4 ):

(a) State : Form DS-4087, Authorization Request for Business-Class Air Travel; or Form DS-4086, Special Seating Request Form for Air Travel, if the justification for use of premium-class accommodations is authorized for disability or special need under 14 FAM 567.2-4 , subparagraph (b)(3);

(b) USAID : Form AID-522-2, Business Class Memorandum to M/MS/TTD;

(c) Commerce : Form CD-334, Request for Approval of Other Than Coach-Class Accommodations;

(d) USDA/FAS : Memo requesting premium-class travel;

(e) APHIS : Memo to approving official; and

(f) USAGM : Memo to approving official.

b. Ticketing : The travel management center (where applicable) will not ticket first-class or business-class accommodations without the appropriate documentation. Posts that do not have a travel management center must retain the required documentation for the record.

c. Blanket orders : The use of blanket travel authorizations for first-class or business-class accommodations is prohibited (State Department personnel). Each trip involving first- or business-class travel accommodations must be separately authorized.

d. Couriers : A courier who flies first class when business-class air accommodations are not available, must complete and sign Form DS-3031, Certification for Use of First-Class Air Accommodations. A copy of the certification must be retained by the courier and the original is to be maintained in the courier's regional office.

14 FAM 567.2-3 First-Class Travel

a. Authorization or approval : Authority to approve the use of first-class air accommodations is limited to the respective agency heads (the Secretary of State, the Administrator of USAID, the Secretary of Commerce, the Director of the U.S. International Broadcasting Bureau of the Broadcasting Board of Governors (USAGM/IBB), and the Secretary of Agriculture) or their designees. Designees are as follows:

(1) State : The Under Secretary for Management (M) per State Department Delegation of Authority No. 198, dated September 16, 1992, except that the Executive Secretary may approve the use of first-class air accommodations for the Secretary and the Deputy Secretary;

(2) USAID : The Deputy Administrator;

(3) Commerce : The Chief Financial Officer and the Assistant Secretary for Administration except in cases of medical necessity or emergency evacuation when the Deputy Assistant Secretary for International Operations is delegated authority to approve. First-class travel will only be authorized if no other commercial service is reasonably available or such travel is necessary for reasons of disability or medical condition (for details on Commerce’s policy on use of business-class accommodations, contact the Office of Foreign Service Human Capital);

(4) USDA/FAS : The Administrator, Foreign Agricultural Service;

(5) APHIS : The Under Secretary for Marketing and Regulatory Programs; and

(6) USAGM : The Director of the International Broadcasting Bureau or as specified in the Manual of Administration.

b. Use of first-class accommodations : Circumstances justifying the use of first-class air accommodations are limited to those listed below:

(1) No other reasonably available accommodations : The use of first-class air accommodations may be authorized or approved when coach-class air accommodations or business-class air accommodations are not reasonably available. "Not reasonably available" means no other class of accommodations other than first-class accommodations is available on any scheduled flight in time to accomplish the purpose of the official travel;

(2) Travel by an employee with a disability : The use of first-class air accommodations may be authorized or approved when necessary to accommodate an employee's disability or other physical impairment, and the employee's condition and need for first-class air accommodations are substantiated in writing by MED or the regional medical officer or other competent medical authority. The use of first-class air accommodations also may be authorized for an attendant(s) who is authorized to accompany the employee, when the employee is authorized first-class air accommodations and MED or the regional medical officer or other competent medical authority or the Disability/Reasonable Accommodation Division (GTM/ER/DRAD) certifies in writing that the employee's disability or other physical impairment requires the services of the attendant(s) en route;

(3) Security reasons : The use of first-class air accommodations may be authorized or approved when exceptional security circumstances require such travel. Exceptional security circumstances include but are not limited to:

(a) Travel by couriers or control officers accompanying controlled pouches or packages when business-class air accommodations are not available (see 14 FAM 567.1-2 , subparagraph (3)(c)); or

(b) Travel by agents in charge of protective details accompanying first-class travelers; and

(c) When required because of agency mission.

14 FAM 567.2-4 Business-Class Travel

a. Authorization or approval :

(1) State : For PCS travel, the designated approving official is the Executive Director, Bureau of Global Talent Management (GTM/EX). Except where otherwise indicated, business-class air accommodations may be authorized only with approval from the officials below (or their designated representative(s)) as provided to TMP. For travelers not mentioned below, the designated approving official must not be subordinate to the traveler:

(2) USAID : The Chief of the Travel and Transportation Division (M/MS/TTD), the director of the funding bureau, office, or mission or designee;

(3) Commerce : The Chief Financial Officer and the Assistant Secretary for Administration except in cases of medical necessity or emergency evacuation when the Deputy Assistant Secretary for International Operations is delegated authority to approve. Business-class travel will only be authorized if no other commercial service is reasonably available or such travel is necessary for reasons of disability or medical condition (for details on Commerce's policy on the use of business-class accommodations, contact the Office of Foreign Service Human Capital);

(4) USDA/FAS : The Under Secretary for Farm and Foreign Agricultural Services and the USDA Chief Financial Officer;

(5) APHIS : The Under Secretary for Marketing and Regulatory Programs and the USDA Chief Financial Officer; and

b. Justification : Travelers may use business-class air accommodations when an approving/authorizing official specifically approves or authorizes the travel in accordance with one or more of the following reasons:

(1) Coach-class air accommodations not available : Business-class air accommodations may be authorized when regularly scheduled flights between the authorized origin and destination points (including connection points) provide only business-class air accommodations;

(2) No space available in coach-class air accommodations : Business-class air accommodations may be authorized when space is not available in coach-class accommodations on any scheduled flight in time to accomplish the purpose of the official travel;

(3) Travel by an individual with a disability or special need : Upon the recommendation of the Bureau of Medical Services (MED), other competent medical authority in exigent circumstances, or the Disability/Reasonable Accommodation Division (GTM/ER/DRAD), business-class air accommodations may be authorized when necessary to accommodate an employee's disability or special need. Other competent medical authority must certify in writing (to include the supporting clinical findings) the traveler’s condition and need for business-class air accommodations. Upon the recommendation of MED or, in exigent circumstances, other competent medical authority, business-class air accommodations may also be authorized for an attendant authorized to accompany the traveler when the traveler is authorized use of business-class air accommodations. Authorization for an attendant to accompany the traveler, by other competent medical authority, must include written certification that the traveler’s disability or other special need requires the services of the attendant en route;

(4) Security or exceptional circumstances : Business-class air accommodations may be authorized when such accommodations are required for security purposes or because exceptional circumstances, as determined by the agency head, or his or her designee, make their use essential to the successful performance of the agency's mission. NOTE : Exceptional circumstances may include, but are not limited to, a chief of mission (COM) and their eligible family member spouse (whether traveling together or at different times) going to post for the first time or leaving post the last time, in accordance with protocol and diplomatic practice for a COM. The tandem spouse of a COM assigned to the same post may also be authorized business class on this basis. Other eligible family members who accompany either the COM or spouse may be authorized business class. If consultations are authorized en route to and from post, business-class accommodations may be authorized to and from the consultation location(s);

(5) Overall cost savings : Business-class air accommodations may be authorized when such accommodations would result in an overall savings to the U.S. Government, including by avoiding additional subsistence costs, overtime, or lost productive time while awaiting coach class accommodations. Whenever a cost comparison is made, documentation of the specific flight itineraries and their respective costs must be retained and included in the travel authorization for future reference and to meet auditing requirements:

(a) If a traveler is otherwise authorized an unrestricted economy fare and seeks to be authorized a business-class fare under this provision, the unrestricted economy fare must be compared to the cost of an unrestricted business-class fare;

(b) If a traveler is otherwise authorized a restricted economy fare and seeks to be authorized a business-class fare under this provision, the restricted economy fare must be compared to the cost of a restricted business-class fare;

(6) Agency mission : Business-class air accommodations may be authorized when required due to agency mission. State only : Business-class travel of 14 hours or less based on this criteria must be approved by the traveler's under secretary or equivalent in their supervisory chain. Deputy secretary and under secretary business-class travel is approved by the Executive Secretary;

(7) Acceptance of payment from non-Federal source : Business-class air accommodations may be authorized when the employee's transportation is paid in full through agency acceptance of payment from a non-Federal source in accordance with 2 FAM 962.12 (g) and 41 CFR 304-5.5; and

(8) Travel in excess of 14 hours for temporary duty (TDY) travel, or medical evacuation travel (exception : USAGM; for further USAGM guidance on when business-class accommodations can be authorized, refer to USAGM’s Manual of Operations and Administration (MOA) directive PART IV Section 636.3, Business-Class Travel Exceptions):

(a) TDY travel to receive training: Business-class air accommodations are not authorized for TDY travel over 14 hours where the primary purpose of the travel, as determined by the funding bureau or post approving/authorizing officer, is for the traveler to receive training or instruction;

(b) TDY travel not related to training: For TDY travel over 14 hours, travelers are authorized economy-class accommodations with a rest stop or a paid day pass to a business-class lounge at an intermediate point on the traveler’s authorized itinerary. However, the funding bureau's executive director or authorizing official at post may determine that circumstances warrant issuance of a business-class ticket provided the following criteria are met:

(i) The origin and/or destination is outside the continental United States;

(ii) The scheduled flight time (including stopovers, but not including rest stops) on the usually traveled route is in excess of 14 hours;

(iii) The purpose of the trip is urgent and cannot be postponed. The traveler must physically report to the duty location immediately upon arrival or the following day, and work until the urgent requirements are fulfilled; and

(iv) Travelers taking leave during or near the dates of their travel indicate that there are no urgent duties requiring the traveler’s immediate departure or return. Travelers who do not report for duty immediately upon arrival or no later than the next day, or take leave within days of their TDY travel should not be authorized business class travel. The traveler may be held liable for excess business class accommodations;

(c) Travelers in U.S. Government-funded business class are not entitled to a U.S. Government-funded rest stop en route to or upon arrival at the duty site. They are not eligible for a U.S. Government-funded business-class lounge day pass, (see 14 FAM 584 ). For definition of travel in excess of 14 hours and rest stop en route, see 14 FAM 567.2-4 , subparagraph b(10)(d);