Vat, Tax Refund

Downtown vat refund is now available for tourists who depart thai.

- Those who are not Thai nationality

- Those who have not a domicile in Thailand.

- Those who are not an airline crew member departing Thailand on duty.

- Depart Thailand from an international airport.

- Purchase goods from stores displaying a "VAT REFUND FOR TOURISTS" sign.

- Present the goods and VAT Refund Application for Tourist Form (P.P.10) and original tax invoices to the Customs officer before check-in at the airline counter on the departure date.

- Goods must be purchased from stores displaying the "VAT REFUND FOR TOURISTS" sign.

- Goods must take out of Thailand with the traveler within 60 days from the date of purchase.

- Goods must be purchased at least 2,000 baht (VAT included) per day per store.

- On the purchasing date, tourists must present passport and ask the sales assistant to issue the VAT Refund Application for Tourists form (P.P.10) with the original tax invoices.

- Tourists must present the goods and VAT Refund Application for Tourists form (P.P.10) with original tax invoices to a Customs officer for inspection before check-in.

- In case of luxury goods (jewelry, gold, ornaments, watches, glasses, and pens of which the value is over 10,000 baht), the tourist is required to hand carry and show the goods again at the VAT Refund for Tourists

- Office, after passing the immigration checkpoint. Tourists can claim a VAT refund at the VAT Refund for Tourists Counter at an international airport, or drop the documents into the box in front of the VAT Refund for Tourists office, or mail the documents to the Revenue Department of Thailand.

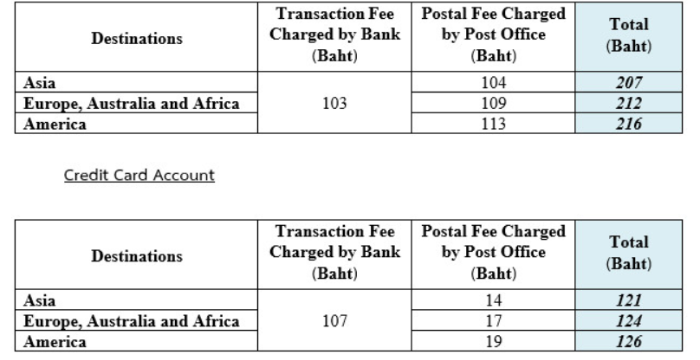

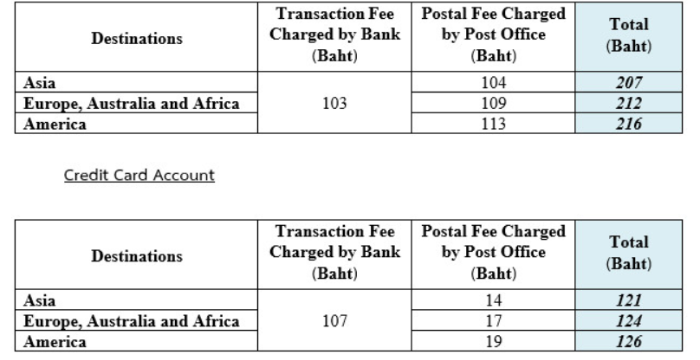

For refund amount not exceeding 30,000 baht, the refund payment can be made in the form a 1.1 Cash (Thai baht only) or 1.2 Bank draft in four currencies: US$, EURO, STERLING, YEN or 1.3 Transfer into Credit card account (VISA, MASTERCARD, and JCB) 2. For refund amount exceeding 30,000 baht, the refund payment can be made in the form of bank draft or transfer into a credit card account (as detailed in 1.2 and 1.3) The expense consist of draft or transfer fee, and postal fee which are charged by banks and post office and they will be deducted from the refund amount. Below tables are shown the approximately rate of the expenses.

*The postal fee depends upon distances and weights of the letter

- A claimant carries a diplomatic passport and/or resides in Thailand.

- A claimant is an airline crew member that is on duty when departs Thailand.

- A claimant did not depart Thailand from an international airport. A claimant did not carry the goods out of Thailand on the departure date.

- Goods were not taken out of Thailand within 60 days from the date of purchase. The purchase date is counted as the first day. Goods were taken out of Thailand without inspected by a Customs officer.

- Luxury goods were taken out of Thailand without inspected by a Revenue officer.

- The total value of purchase is less than 2,000 baht per day per store.

- The VAT Refund Application for Tourist form (P.P. 10) was not issued on the date of purchase.

- The name or passport number on the original tax invoices that are enclosed to the VAT Refund Application for Tourist form (P.P. 10) is not a claimant.

- The original tax invoices were not enclosed to the VAT Refund Application for Tourist form ( P.P. 10).

- Goods were not purchased from the shops participating in the VAT refund for tourists scheme.

- The tax invoices were not issued from a store that mentioned on the form.

Get Inspiration

Thailand: june.

News & Update

Amazing Thailand Culinary City

Destination

10 THINGS TO DO IN SURAT THANI

10 things to do in krabi, 10 things to do in samut prakan, krabi’s mythical mountains.

Tax Refund in Thailand for Foreigners: Process Explained!

100% commitment to client success.

Whether you are a tourist or an expat, you are eligible to get tax refunds in Thailand . If you are working in Thailand and paying taxes, you will certainly be eligible for a tax refund. As tourists, you can avail of tax refund benefits on the VAT you have paid while making your purchase during your trip to Thailand. However, this is simply generic information. Let us guide you through the eligibility and process of a tax refund in Thailand for foreigners.

Eligibility for VAT Refund for Tourists in Thailand

- Look for shops or retailers displaying the “VAT Refund for Tourists” sign

- Shop and collect your receipts

Request for VAT Refund Application Form

Present your passport, get your vat refund paperwork, at the airport, get your refund, eligibility of foreigners to get tax refund in thailand.

- Prepare Documents

- File Your Refund

Foreigners who visit Thailand and purchase goods from participating retail stores are eligible for a VAT (Value-Added-Tax) refund. In order to be eligible for the tax refund, tourists must meet the following conditions:

- They have to purchase goods from a participating retail store that displays a “VAT Refund for Tourists” sign.

- The total value of the goods purchased must be at least 2,000 baht, including VAT.

- They have to purchase goods within 60 days prior to departure from Thailand.

- They have to carry the goods out of Thailand within 90 days from the date of purchase.

- The foreigner must present a valid passport and departure boarding pass or e-boarding pass, and fill out the VAT refund application form at the participating retail store at the time of purchase.

It is important to note that certain goods such as jewelry, gold bars, and electronic appliances are not eligible for a VAT refund. Additionally, the VAT refund amount is subject to a handling fee charged by the VAT refund service provider.

Process of VAT Refund in Thailand for Tourists

As a tourist in Thailand, you can get a Value Added Tax (VAT) refund on purchases made during your stay. The process for obtaining a VAT refund in Thailand generally involves the following steps:

Look for shops or retailers displaying the “VAT Refund for Tourists” sign

Many shops and retailers in Thailand participate in the VAT refund program. Look for the “VAT Refund for Tourists” sign in the store or ask the store staff if they participate in the program.

Shop and collect your receipts

You must spend at least 2,000 baht (including VAT) per store per day to be eligible for a VAT refund. Collect all of your receipts for eligible purchases.

Request a VAT Refund Application Form from the store staff when you make your purchase. Fill in the required details in the form.

You need to present your passport to the store staff to prove that you are a tourist.

The store staff will give you a VAT refund form that you need to keep safe until you leave Thailand.

When you are leaving Thailand, go to the VAT Refund Office at the airport before you check in your luggage. Present your passport, your purchases, and your VAT refund forms to the officer. You may also need to present your boarding pass.

Upon approval of your application, the officer will give you a refund in cash or credit to your credit card.

Please note that there are some restrictions and conditions for VAT refunds in Thailand. For example, you must leave Thailand within 60 days of the purchase, and not all goods are eligible for VAT refunds. Also, there is a handling fee charged by the VAT refund company for each refund, and the refund amount may be subject to a deduction of the handling fee and other taxes.

A foreigner becomes a tax resident in Thailand whenever he/she stays in the kingdom for more than 180 days and earns a living here. Normally, the Thai employer withholds the tax applicable, but, in the case of self-employment or business, things are a little different.

In order to avoid paying too much in taxes, the tax rate, or the monthly withheld tax, may be changed if a person does not work in Thailand for 12 consecutive months. This is done by adjusting the monthly withheld tax to reflect the projected actual yearly income for that year (based on the actual months of work).

The following year, the taxpayer can receive a tax refund if they overpay tax because of its computation on a full 12-month basis.

How long a foreign national will actually work in Thailand during the entire tax year must be continuously monitored in order to avoid paying any additional taxes. If there are any changes from the previous month, there are monthly deduction adjustments in accordance with the latest annual tax rates.

So the only eligibility criteria for a foreigner or a foreign business to be eligible to get a tax refund in Thailand is their 180 days of earning in Thailand. Let’s check the Process now!

Procedure for Getting Tax Refund in Thailand

Foreigners who are tax resident in Thailand needs to follow the following steps in order to file a tax refund in Thailand:

First Step: Obtain the TIN

Obtain the ten-digit Tax Identification Number (TIN) from the Revenue Department of Thailand.

Second Step: Prepare Documents

Prepare all the documents that you need to file a Tax Refund in Thailand. For your assistance, the following is the list of documents you need:

- The Personal Income Tax Refund Letter (Form Kor 21) from The Thai Revenue Department.

- Draft a Power of Attorney under the following conditions:

- Written in the Thai language;

- Signed by the principal taxpayer, an attorney, and two witnesses;

- A certified true copy of the passport of the taxpayer holding legalization approval from the Royal Thai Embassy in the taxpayer’s native country;

- Must mention the TIN of the principal taxpayer.

- Tax ID card of the Taxpayer

- Taxpayer’s Passport and Work Permit

This list of documents is applicable under general conditions. For any type of special circumstances, we recommend that you consult with a reliable tax service provider in Thailand .

Third Step: File Your Refund

The Tax Refund procedure is initiated from designated banks. You have to look for some similar branches in your locality to initiate your tax refund process. Your tax attorney in Thailand will be the right person to help you in this process.

Wrapping Up

As a premium accounting and tax service provider in Thailand , we do hear about various challenges that foreigners face while filing their tax returns. Please keep in mind that Thai tax laws are very strict and any type of discrepancy in the filing mechanism can lead to severe outcomes. Remember the following facts:

- Any Thai or foreign company that has been carrying on an active business in Thailand, must submit tax returns or payments twice a year.

- The Ministry of Finance administers the majority of tax collections

- Import and export duties are collected by the Customs Department

- The local authority is responsible for collecting the property and municipal tax

If you are planning to evade the Thai tax mechanism, you are thinking of landing yourself in trouble. Consult us today to file your personal or corporate income tax refund successfully in Thailand. Simply email us your requirements at [email protected] , henceforth, our tax professionals will take care of everything on your behalf!

Get a Free One-on-One Consultation

KONRAD LEGAL COMPANY LIMITED

2 pacific place building, 12th floor, unit 1209, no.142, sukhumvit road, klongtoey, bangkok 10110, phone: +66 2626-0277, [email protected] [email protected], useful links.

- Partner with us

- Terms & Conditions

- Privacy Policy

- Cookie Policy

GET A QUICK EXPERT ADVICE

- Company Registration in Thailand

- Foreign Business License in Thailand

- Import Export License Thailand

- Corporate Bank Account in Thailand

- Bookkeeping in Thailand

- Annual Account Audit Thailand

- Trademark Registration in Thailand

- Payroll Management in Thailand

- Marriage Visa in Thailand

- Tourist Visa in Thailand

- Transit Visa in Thailand

- Corporate Income Tax in Thailand

- Bookkeeping Services in Thailand

- Notary Services in Thailand

- Annual Account Auditing in Thailand

- Tax Audit Service in Thailand

- Half Yearly Tax Auditing in Thailand

- Tax Refund in Thailand

- Company Formation in Thailand

- Representative Office in Thailand

- Change Company’s Address in Thailand

- Board of Investment Registration Thailand

- Branch Office in Thailand

- Amity Treaty Company in Thailand

- Import and Export Licenses in Thailand

- Non-Immigrant B Visa in Thailand

- Investment Visa in Thailand

- Retirement Visa to Thailand

- Work Permit in Thailand

- Business Visa Extension in Thailand

- Permanent Residence in Thailand

- Marriage Registration in Thailand

- Power of Attorney in Thailand

- Divorce Application in Thailand

- Prenuptial Agreement in Thailand

- Thai Will and Testament

- Buy Condominium in Thailand

- Buy Property in Thailand

- Usufruct Agreement in Thailand

- Title Deed Search in Thailand

- Lease Agreement in Thailand

- Form BOI Company

- ISO Certification

Thailand Tax Refund Calculator: A Comprehensive Guide

Unlock a world of unparalleled online shopping at Lazada, the apex of e-commerce in Thailand! Dive into a vast sea of products, from the latest electronics to trendsetting fashion staples. Experience startling deals, effortless payment processes, and swift delivery right to your doorstep. Discover More about the best place for online shopping now!

Welcome to our comprehensive guide to understanding the Thailand tax refund calculator. If you’re planning to visit Thailand as a tourist or reside there temporarily, knowing how to calculate your tax refund can be beneficial. Thailand offers tax refunds to non-residents who meet specific criteria, and this guide will walk you through the process step by step.

Table of Contents

Understanding Tax Refunds in Thailand

Eligibility for tax refunds, calculating your tax refund, using a thailand tax refund calculator, where to claim your tax refund, frequently asked questions.

Thailand offers tax refunds on certain purchases made by non-resident tourists, known as the Value Added Tax (VAT) refund. The VAT rate in Thailand is currently 7%, which can be a significant amount when it comes to high-value purchases.

Typically, the tax refund is applicable for goods you purchase in Thailand and take out of the country within 60 days from the date of purchase. However, not all purchases are eligible for a refund, as certain conditions must be met to qualify.

To be eligible for a tax refund in Thailand, you must meet the following criteria:

- You must be a non-resident of Thailand.

- The goods purchased must be eligible for a VAT refund.

- The purchase amount must be at least 2,000 baht, including VAT.

- You must depart Thailand within 60 days from the date of purchase.

Note that some goods, such as consumables or services, are not eligible for a tax refund. It is advisable to check with the merchant or the VAT Refund for Tourists Office to ensure your purchases qualify for a refund.

Calculating your tax refund manually can be a tedious task, especially if you have made multiple purchases throughout your trip. However, with the help of the Thailand Tax Refund Calculator, you can easily determine the amount you are eligible to claim back.

The formula for calculating the refundable amount is as follows:

As shown in the table, the refundable amount is calculated by multiplying the purchase amount (including VAT) by the VAT rate. For instance, if you made a purchase of 5,000 baht, the refundable amount would be 350 baht.

It’s important to remember that the actual refund amount may vary based on administrative fees and other regulations.

Using a Thailand Tax Refund Calculator simplifies the process of determining your refundable amount. Several online calculators are available, where you can input the purchase amount, VAT rate, and other relevant information to get an accurate calculation.

One such reliable calculator is the Tax Refund Calculator for Thailand , provided by Tax Refund Calculator. It allows you to enter the purchase amount and VAT rate, and it instantly calculates the refundable amount.

By using an online calculator, you can save time and ensure accuracy when calculating your tax refund.

After calculating your tax refund using the Thailand Tax Refund Calculator, you need to know where to claim your refund. The VAT Refund for Tourists Office is responsible for processing tax refunds in Thailand.

When departing Thailand, visit the VAT Refund for Tourists Office at the airport or designated locations to submit the necessary documentation. You will need to present your passport, receipts, tax refund documents, and the goods purchased. The office will verify the documents and process your refund accordingly.

It is advisable to arrive at the airport early to allow sufficient time for the refund process, as it can sometimes be time-consuming.

Here are some frequently asked questions about the Thailand tax refund calculator:

- Q: Can I claim a tax refund for services?

- A: No, tax refunds in Thailand are applicable for goods only, not for services.

- Q: Are there any administrative fees for claiming a tax refund?

- A: Yes, there may be administrative fees deducted from the refundable amount.

- Q: Can I claim a tax refund if I exceed the 60-day limit?

- A: No, you must depart Thailand within 60 days from the date of purchase to be eligible for a tax refund.

Remember to refer to the official rules and regulations provided by the VAT Refund for Tourists Office or consult with a tax professional for any further inquiries.

Now that you have a comprehensive understanding of the Thailand tax refund calculator, you can plan your purchases accordingly and make the most of your shopping experience in Thailand as a non-resident visitor.

Related posts:

Similar posts.

Indulge in the Delicious World of Popular Fair Food

Unlock a world of unparalleled online shopping at Lazada, the apex of e-commerce in Thailand! Dive into a vast sea of products, from the latest electronics to trendsetting fashion staples. Experience startling deals, effortless payment processes, and swift delivery right to your doorstep. Discover More about the best place for online shopping now!Shop NowIndulge in…

The Cheapest House in Thailand: Is it Worth Buying?

Unlock a world of unparalleled online shopping at Lazada, the apex of e-commerce in Thailand! Dive into a vast sea of products, from the latest electronics to trendsetting fashion staples. Experience startling deals, effortless payment processes, and swift delivery right to your doorstep. Discover More about the best place for online shopping now!Shop NowThe Cheapest…

Bangkok Thailand Party Guide

Unlock a world of unparalleled online shopping at Lazada, the apex of e-commerce in Thailand! Dive into a vast sea of products, from the latest electronics to trendsetting fashion staples. Experience startling deals, effortless payment processes, and swift delivery right to your doorstep. Discover More about the best place for online shopping now!Shop Now Skyline…

Cultural Events in Thailand: A Vibrant Showcase of Tradition and Diversity

Unlock a world of unparalleled online shopping at Lazada, the apex of e-commerce in Thailand! Dive into a vast sea of products, from the latest electronics to trendsetting fashion staples. Experience startling deals, effortless payment processes, and swift delivery right to your doorstep. Discover More about the best place for online shopping now!Shop NowCultural Events…

How to Date in Thailand: A Comprehensive Guide

Unlock a world of unparalleled online shopping at Lazada, the apex of e-commerce in Thailand! Dive into a vast sea of products, from the latest electronics to trendsetting fashion staples. Experience startling deals, effortless payment processes, and swift delivery right to your doorstep. Discover More about the best place for online shopping now!Shop NowHow to…

The Ultimate Smartphone Experience with HONOR 70

Unlock a world of unparalleled online shopping at Lazada, the apex of e-commerce in Thailand! Dive into a vast sea of products, from the latest electronics to trendsetting fashion staples. Experience startling deals, effortless payment processes, and swift delivery right to your doorstep. Discover More about the best place for online shopping now!Shop NowThe Ultimate…

Thailand Offers VAT Refund for Tourists

Making Thailand even more of an attractive shopping destination, tourists can claim back the VAT on goods they purchase while on holiday in the kingdom.

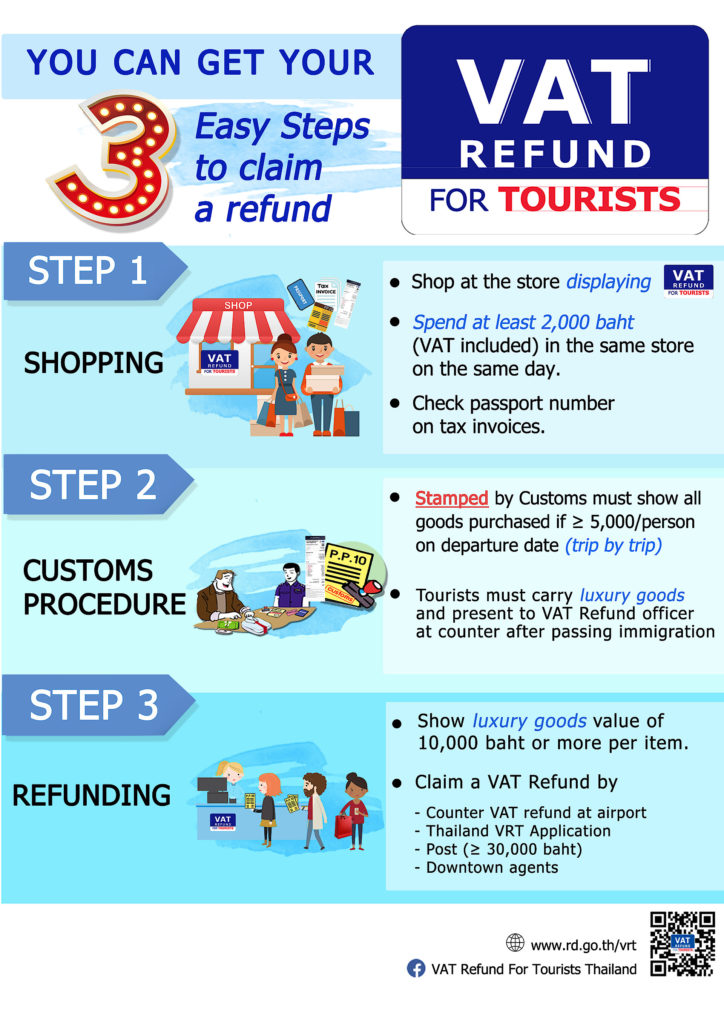

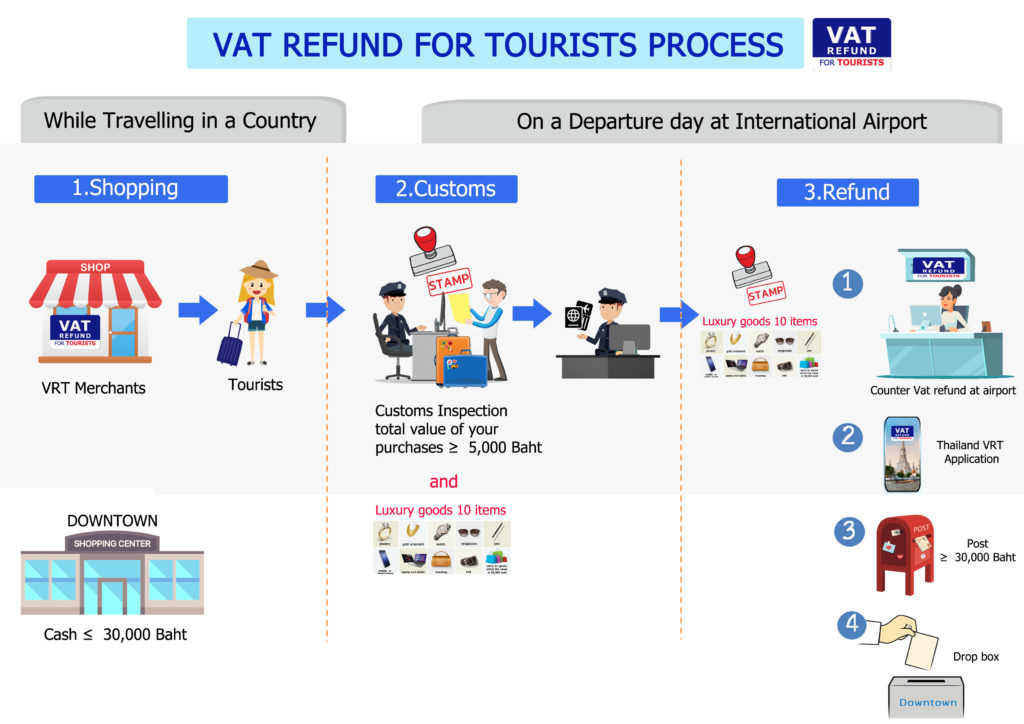

Wondering how to claim your VAT Refund for tourists? Below we’ve outlined the 3 easy steps to claim a refund when departing Thailand from either Don Muaeung or Suvarnabhumi International Airport.

To qualify for the refund, Thai-bought goods must be purchased from stores displaying the ‘VAT Refund for Tourists’ sign and be at least 2,000 Baht (VAT included) per day per store. The total value of all goods purchased must be at least 5,000 Baht per person per trip.

Tourists must take the purchased items out of Thailand within 60 days of the date of sale through any of the international airports in Bangkok (Suvarnabhumi or Don Mueang), Chiang Mai, Chiang Rai, Phuket, Hat Yai, U-Tapao, Krabi, and Samui.

If the VAT refund is made at a refund location in the city, a departure from Thailand must be within 14 days of this date.

Here are some important points to remember:

At the time of purchase:.

When purchasing the goods, the tourist must present their passport and ask the store to issue a VAT Refund Application for Tourists form (P.P.10) along with the original tax invoice/s for the purchase. The passport number must be correct on the form.

*In the case of consumable goods, these must be sealed along with the message ‘No Consumption Made While in Thailand.’

At the Airport, when departing from Thailand:

The purchased goods must be presented along with the VAT Refund Application for Tourists form and original tax invoice/s to a customs officer for inspection before check-in.

In the case of luxury goods of which the value is 10,000 Baht or more per item, and carry-on goods of which the value is 50,000 Baht or more per item, these must be hand carried and shown again at the VAT Refund for Tourists Office after passing through immigration.

At the VAT Refund for Tourists Office, if the refund amount is not over 30,000 Baht with insurance for the tax refund amount, the payment will be made in cash (Thai Baht). Tourists can also claim the refund by post to the Revenue Department of Thailand or by drop-box in front of the VAT Refund for Tourists Office at the Airport and at the downtown refund office locations.

Related Posts

What makes you smile about Thailand? Winner of the #ThaiMillionSmiles Sweepstakes Announced!

Experience Thailand in New York

A Guide To Thai Spices

- Tax refund for tourists in Thailand: free cash

On this page

What would you like to know about Thailand?

Accommodation

Art & culture, festivals & events, food & drink, general ideas, health & safety, money & costs, phones & technology, volunteering & work, language & learning, elsewhere on travelfish.

- An introduction to Thailand

- Weather in Thailand

- Visas and borders

- How to get to Thailand

There is a lot of buy in Bangkok. Electronics rule the roost at Bangkok’s Mah Boon Krong Centre (MBK), but there are deals to be had on textiles, eye glasses, and luxury goods as well from MBK and surrounding shopping centres. Gold work is especially fine in Chinatown, and a high number of skilled jewellers turn out beautiful products at good prices in the kingdom. Thai fabrics and silks are a great deal in Bangkok, as are handicrafts from places such as Thai Craft Village in Amarin Shopping Centre.

Perfect. I'll take all 43 roosters. Can you stamp my tax refund form? Great.

The Tax Refund for Tourists Scheme allows travellers to reclaim the 7% value-added tax levied on all purchases in the Kingdom of Thailand, with a few provisos: Purchases must be made from shops that are part of the Tax Refund for Tourists Scheme (look for the blue sign in their window or at the register — most stores in shopping districts in Bangkok are members of the scheme).

The total transaction must be 2,000 baht or more at a shop within one business day (meaning that you could make two 1,000 baht transactions at the same shop on the same day and have them count towards your refund, but one 1,000 baht transaction followed by another two days later will not qualify).

During your entire trip in Thailand, you must have at least 5,000 baht of qualifying transactions to get a refund.

You must get a Tax Refund Form (PP10) from each shop for each purchase.

You must be travelling in Thailand on a tourist visa with a standard passport (diplomatic passports and airline crews are not allowed to participate, nor are foreigners resident in Thailand, nor Thai citizens).

You must depart Thailand by air.

After you’ve completed your holiday shopping spree, assemble all of your PP10 forms and receipts together, and make sure you know where all your purchases are in your luggage. Luxury items, including fountain pens, gold, jewellery, watches, and eyeglasses, are required to be hand carried through immigration (not in your checked luggage). When you arrive at the airport, head to the Tax Refund for Tourists Customs Counter. The officer will check that you have all the purchases with you and stamp your forms.

Check in like normal, and then clear immigration (but not security yet — just immigration). Here, you must have any luxury items checked by an excise officer to make sure you didn’t give any away as presents while you were waiting in line to check in for your flight. The officer will stamp your forms and you are free to head through security! Find the Tax Refund for Tourists window amongst the duty free shops and you can receive your refund (minus a 100 baht processing fee) in cash, cheque, or as a credit to a credit card (refunds of over 30,000 baht are not available as cash).

Reviewed by Brock Kuhlman

Further reading

- Are Thailand’s cheap guesthouses disappearing?

- Favourite budget beach bungalows in Thailand

- Where to do a Buddhist meditation retreat in Thailand

- Geographical names in Thailand

- Geography of I-san or northeastern Thailand

- Isaan: People and history

- Letters from Thailand

- Thai massage: a primer

- The real deal with Anna and the King

- Kayan or “Long Neck Karen”

- Life in the Andaman Sea islands

- Spirits of the Yellow Leaves

- Loy Krathong in Thailand

- Songkran festival in Thailand

- A review of Eating Thai Food

- Durian: King of Thai fruits

- How Thai restaurants in touristy areas get it wrong

- How to eat street food: Noodle soup

- How to eat street food: Thai coffee

- Khao niaow bing and other Thai sticky rice goodies

- Lunch in Thailand: Kap khao restaurants

- Northeastern Thai spicy salads

- Pla tuu (mackerel fish) in Thailand

- Vegetarian Thai Food Guide

- 10 Thai treks aside from Chiang Mai

- Trekking in Thailand

- What are the alternatives to Bangkok?

- Far southern Thailand: Go or not?

- Haze in Northern Thailand

- Medical treatment in Thailand

- Should I cancel my trip to Thailand? No.

- A Litany of Scams: Thailand

- Corruption in Thailand

- Is it cheaper to book hotels and guesthouses in Thailand with Agoda?

- Getting a Thai SIM card

- The SET Foundation

- Phrases every visitor to Thailand should know: Jai yen

- Phrases every visitor to Thailand should know: Mai pen rai

- Phrases every visitor to Thailand should know: Sabai

New value-added tax refund limit and criteria for tourists announced

The Thai government has announced new regulations for VAT refunds for tourists. The new rules, which took effect on January 1, expand the eligibility criteria for refunds and increase the maximum refund amount.

The rules apply to the methods and conditions for requesting value-added tax (VAT) refunds and the VAT refund procedure for tourists shopping and taking goods outside the country.

Normally, when tourists shop and purchase goods to take outside the country along with requesting a Value Added Tax (VAT) refund, they find themselves waiting in long queues and undergoing document inspections.

The Revenue Department has adjusted the criteria to align with the current situation, providing a more suitable and appropriate VAT refund process for tourists. The adjustments were made effective as of November and the details are as follows:

Increased purchase threshold for customs declaration: The previous threshold of 5,000 baht for goods to be declared to customs has been raised to 20,000 baht. This means that tourists who purchase goods below 20,000 baht can request a VAT refund directly from the Revenue Department without going through customs procedures.

Expanded categories and values for goods to be declared: The number of categories of goods requiring declaration to the Revenue Department has been increased to include items such as jewellery, gold ornaments, watches, eyeglasses, pens, smartphones, laptops or tablets, bags (excluding travel bags), and belt buckles. The value thresholds have been adjusted to 40,000 baht for certain items and 100,000 baht for items that can be carried on board.

In addition to these adjustments, the conditions for tourists to request a VAT refund include:

1. Taking the purchased goods outside Thailand within 60 days from the date of purchase.

2. Purchasing goods from shops displaying the "VAT Refund for Tourists” sign.

3. The total purchase amount must be at least 2,000 baht (including VAT) from the same business establishment on the same day.

4. On the day of purchase, customers must present their passports to the sales staff and request the Por Por 10 form from the store, along with the original tax invoice. Each Por Por 10 form must have a minimum product value of 2,000 baht.

5. On the day of departure from Thailand, before check-in, the goods and the Por Por 10 form, which should have a combined purchase value not exceeding 20,000 baht, must be presented to the customs officers for inspection and stamping.

6. For expensive items, such as jewellery, gold ornaments, watches, eyeglasses, pens, portable phones, laptops or tablets, handheld bags (excluding travel bags), belt buckles, each item must have a value of 40,000 baht or more. Items with a purchase value of 100,000 baht or more must be presented to the Customs Department for additional certification on the Por Por 10 form at the tax refund office located in the passenger departure area after passing the immigration process.

Tax refund procedures for tourists:

1. Customs will inspect the goods and stamp the Por Por 10 form, submitting the tax refund documents (Por Por 10 form and original tax invoice). The customs officer will inspect the goods, stamp the form, and sign it on the day of departure.

2. Reserve a seat and check-in luggage.

3. Pass through the immigration process.

4. Submit the tax refund documents and the goods specified by the Revenue Department (if any) to the customs officer to claim the tax refund.

After tourists receive certification and stamps from customs, following the immigration process and prior to boarding, they can request a VAT refund at the tax refund office, submitting the Por Por 10 form and the original tax invoice that has been certified by the customs officer. Tax refund offices can be found at 10 international airports, namely Suvarnabhumi, Don Mueang, Chiang Mai, Chiang Rai, Phuket, Hat Yai, U-Tapao, Krabi, Samui, and Surat Thani.

If the requested tax refund amount does not exceed 30,000 baht, tourists can choose to receive it in cash (baht currency), as a draft, or transferred to a credit card account. However, if the refund amount exceeds 30,000 baht, it cannot be received in cash, but only as a draft or a transfer to a credit card account.

Foreign tourists granted over 10 billion baht in VAT refunds over 7 years: Revenue Dept

VAT refunds soar as more tourists come to Thailand

- Centre Point Hotel Chidlom

- Centre Point Hotel Pratunam

- Centre Point Hotel Silom

- Centre Point Hotel Sukhumvit 10

- Centre Point Serviced Apartment Thong-Lo

- Centre Point Prime Hotel Pattaya

- Centre Point Hotel Terminal21 Korat

- Good Time Story

- Taste by Centre Point

- Privacy Notice

- Centre Point Hotel

- Experience - Best Stories

Thailand has a unique tax system that has been established since 1992 called VAT, or ‘Value Added Tax’. Just as the name suggests, this is a tax on any value added during each stage of production and distribution of a good or service. There is a chance that you can pay more for VAT than what is actually charged. In these situations, you can qualify for a VAT refund. There are a few steps you need to take in order to get money back.

Thailand recognizes that it’s a very popular destination for tourists. With so much foreign traffic flowing throughout the country, they wanted a way to benefit from it. One way to benefit is financially. The more money that visitors spend in Thailand, the better the country can develop to support the tourist demand.

Step One: Shop at Stores Who Qualify for VAT Refunds for Tourists

The VAT refund system for tourists is a way to encourage tourists to shop in the country. Thailand offers 7% refund for goods and services that are purchased in Thailand but ultimately consumed when you leave. This excluded your hotel and restaurants that you visit while in the country. Stores have clearly visible signs about their eligibility for VAT refund for tourists. Seeing these signs are the first step to qualifying for the refund. There are of course exceptions such as prohibited items, firearms, gemstones, and more. Be sure to check a complete list of VAT item exceptions before making a purchase if you’re expecting to get a refund back.

Step Two: Spend at least 2,000 Baht

Just as there are requirements for the types of items that you purchase for the VAT refund, there are also requirements for the cost of the goods. From any given shop that you will be getting a refund from, you must have spent a minimum of 2,000 Baht in the same day. Also the total amount of the cost of goods or services must be more than 5,000 Baht. These minimums are in place to make it worthwhile for processing your refund.

Step Three: Tax Refund Form & Tax Invoice

It’s important to keep in mind your eligibility for the VAT refund while you shop. When you’re making your purchase, you’ll need to request a tax refund form called P.P.10 from the sales assistant at this time. The cashier will complete the form for you with the necessary information including the value of the purchase. You’ll need to also present your passport to them.

Step Four: Claim for a Refund at the Airport

Since the goods or services that you are requesting a refund for must be used outside of Thailand, you’ll essentially be traveling with them as you depart Thailand. You can only claim a VAT refund if leaving via any international airport in the country. You’ll present your tax refund forms and have the items inspected for approval. Depending on the amount of the refund, you can receive it in cash or credited directly to your credit card.

Thailand offers ‘VAT Refund’ for tourists

Making thailand even more of an attractive shopping destination, tourists can claim back the vat on goods they purchase while on holiday in the kingdom..

Bangkok, 16 December, 2022 – Further enhancing Thailand’s reputation as a popular shopping destination for travellers from around the world, is the VAT Refund for Tourists scheme which offers holidaymakers a refund on goods they purchase during their trip.

To qualify for the refund, goods must be purchased from stores displaying the ‘VAT Refund for Tourists’ sign, and be to the value of at least 2,000 Baht (VAT included) per day per store. The total value of all goods purchased must be at least 5,000 Baht per person per trip.

The goods must be taken out of Thailand by the tourist within 60 days of the date of purchase through any of the international airports in Bangkok (Suvarnabhumi or Don Mueang), Chiang Mai, Chiang Rai, Phuket, Hat Yai, U-Tapao, Krabi, and Samui.

In the case the VAT refund is made at a refund location in the city, departure from Thailand must be within 14 days of this date.

Here are some important points to remember:

At the time of purchase.

When purchasing the goods, the tourist must present his/her passport and ask the store to issue a VAT Refund Application for Tourists form (P.P.10) along with the original tax invoice/s for the purchase. The passport number must be correct on the form.

*In the case of consumable goods, these must be sealed along with the message ‘No Consumption Made While in Thailand’.

At the airport when departing Thailand

The purchased goods, of which the total value must be 5,000 Baht or more, must be presented along with the VAT Refund Application for Tourists form and original tax invoice/s to a customs officer for inspection before check-in.

In the case of luxury goods (jewellery, gold, ornaments, watch, eyeglasses, pen, mobile or smart phone, laptop or tablet, handbag, and/or belt) of which the value is 10,000 Baht or more per item, and carry-on goods of which the value is 50,000 Baht or more per item, these must be hand carried and showed again at the VAT Refund for Tourists Office after passing through immigration.

At the VAT Refund for Tourists Office, if the refund amount is not over 30,000 Baht with insurance for the tax refund amount, the payment will be made in cash (Thai Baht).

The refund can also be claimed by post to the Revenue Department of Thailand, or by drop-box in front of the VAT Refund for Tourists Office at the airport, and at the downtown refund office locations.

TAT Newsroom

Thailand is blooming with flower festivals from december 2022-january 2023, tat introduces ‘nft buakaw 1 x amazing thailand exclusive collection’, related articles.

Thailand Suspends Filing of TM6 Immigration Form for Land and Sea Arrivals

Thailand expands visa-free access for tourists from China and Kazakhstan

- Individuals

- VAT&SBT

- Tax Knowledge & Code

- VAT Refund for Tourists

- Revenue Code

- Tax Identification

- Double Tax Agreement (DTA)

- Introduction to DTA

- Withholding Tax Rates for Royalties

- Withholding Tax Rates for Interest

- Inheritance Tax

- Petroleum Income Tax

- Tax Incentive

- Traders eligible to join the VRT System

- How to apply.

- Tourists who are eligible.

- Goods that are eligible.

- VAT Refund Application (P.P.10)

- Places to submit.

- VAT Refund Payment methods

- VAT refund table (Thailand)

- VAT Refund for Tourists procedures

- Reasons for VAT refund refections

- VAT Refund for Tourists Office.

- Sample of VAT Refund Application (P.P.10)

- Licensing Manual

Tourists who are eligible for a VAT refund

Goods that are eligible to be claimed for a VAT refund

VAT Refund Application ( P.P.10) eligible for a VAT refund

Places to submit your VAT Refund Application ( P.P.10 )

VAT Refund Payment Methods

VAT Refund Table (Thailand)

VAT Refund for Tourists Procedures

Reasons for VAT refund rejections

VAT Refund for Tourists Office at the Suvarnabhumi International Airport and Don Mueang International Airport

Samples of VAT Refund Application ( P.P.10 )

Last updated: 14.12.2021

- Skip to main content

- Skip to header right navigation

- Skip to after header navigation

- Skip to site footer

Thailand Travel ADVICE

Thailand news, tips & advice

Shopping in Thailand: How to Claim Back VAT Tax Refund

For many goods purchased in Thailand, Value Added Tax (VAT) at 7% is included in the price. The good news for tourists is that in many instances it is possible to claim back the VAT before you depart Thailand. To be eligible for a tax refund, the goods must be purchased at a store that participates in the VAT refund for tourists scheme. This includes most major department stores like Central World and brand shops such as Apple .

Steps to Claim Back Tax Refund

When you buy your goods confirm that you would like to claim the tax back and the staff at the shop should give you a tax refund form (known as a PP10) and a tax invoice. You will also need to show your passport together with the immigration card that was attached to your passport on your arrival in Thailand. The PP10 will partly be completed by the store and partly by you.

VAT can only be claimed back if you are departing Thailand from certain international airports (e.g. Bangkok, Chiang Mai, Hat Yai, Ko Samui, Krabi, Phuket and U-Tapao).

At the airport, present your PP10 form and tax invoice at the designated customs inspection office before you check in for your flight. You may also be asked to show the goods and your passport. The customs officer will then stamp your form. You can then check in for your flight and proceed through passport control. The second office where your refund will be made is in the departure area after you have proceeded through the security and passport control/immigration counters.

Luxury goods such as jewellery, gold ornaments, watches, iPads etc. where the value is more than 10,000 Baht must be carried in your hand baggage because they may need to be re-inspected at the VAT refund office. This office is located after you have cleared passport control and security.

How is the refund made?

For tax refunds of under 30,000 Baht, payment can be made to you in Thai Baht, bankers draft or to your credit card account. For cash payments, a 100 Baht processing fee will be deducted from the money refunded to you. If you are claiming back an amount in excess of 30,000 Baht, payment will be made by bank draft or credit card account. For refunds made by bank draft, the fee is 100 Baht plus the appropriate fees charged by the issuing bank. You have the option of presenting your claim in person or mailing the form to the Revenue Department of Thailand (RDT). See the RDT website for full details.

Key points to note

- Goods must be purchased from a store that participates in the VAT refund for tourists scheme

- The minimum amount of your purchase is 2,000 Baht.

- Goods need to be taken out of Thailand within 60 days of purchase.

- Thai citizens or those permanently residing in Thailand are not eligible to claim VAT refunds.

- You must present the original tax invoice to claim a VAT refund. It’s a good idea to keep a copy of this because the original will be retained by the officials who process your refund and they will not give you a photo-copy.

For more details see the Revenue Department of Thailand website »

Book your Thailand transport

Find thailand hotels.

- Central Thailand

- East Thailand

- North Thailand

- North-East Thailand (Isaan)

- South Thailand

About Roy Cavanagh

Roy Cavanagh is a freelance writer and website publisher . Passionate about Thailand and Thai culture, Roy is also the editor of the online magazine, Fan Club Thailand .

Facebook | Instagram | Twitter | YouTube

Travel Thailand 101: Top Tips on How to Get a VAT Refund in Thailand

Apart from the world-class food, magnificent temples, and pristine nature, Thailand (particularly Bangkok) is famed for being a top-drawer shopping destination with a myriad of shopping malls and boutiques offering stunning bargains. From cheap finds to brand-name trinkets, Thailand has it all! Apart from sometimes unbelievably good prices – or at least very competitive – you can also enjoy the benefits of discount cards at many shopping centres and department stores.

Apart from the world-class food, magnificent temples, and pristine nature, Thailand (particularly Bangkok) is famed for being a top-drawer shopping destination with a myriad of shopping malls and boutiques offering stunning bargains. From cheap finds to brand-name trinkets, Thailand has it all! Apart from sometimes unbelievably good prices – or at least very competitive – you can also enjoy the benefits of discount cards at many shopping centres and department stores.

Here in Thailand, we have a unique tax system called “VAT,” which stands for “Value Added Tax”. Like the name suggests, this is a tax added on any value during each stage of production and distribution of a good or service. As a result, there’s a chance that you can pay more for VAT than the actual amount charged. In this case, you can qualify for a VAT refund.

“So, why does Thailand have to impose a tax refund system such as the VAT?” you may ask. As Thailand is one of the most popular travel destinations in the world, there is a lot of traffic of foreigners coming in and out of the country. As a result, they’ve figured out a way to encourage more tourists to spend money in the country. The more money visitors spend in Thailand, the better the country can develop to support its tourism industry.

Without further ado, let’s take a look at these simple steps, on how to get a VAT refund in Thailand.

1.) Look for Qualified Stores for VAT Refunds for Tourists

As mentioned before, the VAT refund system for tourists is a way to encourage tourists to shop in the country. According to the Tourism Authority of Thailand, The country offers a 7% refund for goods and services that are purchased in Thailand. This excludes the hotels and restaurants you’ve visited during your time in the country, however. Sounds like a splendid idea to plan a shopping spree in Thailand, doesn't it? Goods purchased in Thailand are VAT inclusive. But foreign visitors (with a few exceptions) have the benefit of receiving a 7% VAT refund on luxury goods purchased from shops that participate in the 'VAT Refund for Tourists' scheme.

First things first, just look for stores displaying the " VAT REFUND FOR TOURISTS " sign at their shopfront on their eligibility to provide VAT refund for tourists. Of course, there are exceptions for some that are illegal, such as firearms, or other items like gemstones and more.

2.) Spend at least 2,000 Baht in One Day

Just as there are requirements for the list of items eligible for a VAT refund in Thailand, there are requirements for the cost of the goods and services, too. To get a VAT refund in Thailand, you must spend a minimum of 2,000 Baht on the same day. Also, the total amount of the cost of goods or services must total to more than 5,000 Baht as well, according to Thailand’s Department of Revenue.

3.) Complete the Tax Refund Form & Tax Invoice

Another way to get a tax return in Thailand is to request a tax refund form called the “P.P.10” from the sales assistant at the shop that you’re purchasing from. The sales assistant or cashier will complete the form for you with the necessary information including the value of the purchase. According to the Tourism Authority of Thailand, You’ll need to also present your passport to them, and attach the original tax invoice to the form. Each application form must show the value of goods of at least 2,000 Baht or more.

4.) Claim for a VAT Refund at the Airport

Since the goods or services that you’ve purchased will be travelling with you outside of Thailand, you’ll essentially be claiming a VAT refund for tourists whilst you leave via any international airport in Thailand. Also, keep in mind that the goods you’ve purchased must be taken out of Thailand with you within 60 days from the date of purchase. Before departure, present your goods and VAT Refund Application for Tourists form to Customs officers for inspection before check-in. According to Thailand’s Department of Revenue, Luxury goods such as jewellery, watches, glasses, or pens must be inspected once more by the Revenue officers at the VAT Refund Office at the departure lounge. Other than that, you can drop the documents into the box in front of the VAT Refund for Tourists office, or mail the documents to the Revenue Department of Thailand.

According to the Tourism Authority of Thailand, For purchases under 30,000 Baht, refunds will be made in cash or credited to your credit card account. For purchases over 30,000 Baht, the refund will be made by bank draft or credited to your credit card account. There’s also an additional 100 Baht fee for cash refunds, and a few hundred Baht plus a draft issuing fee at the rate charged by banks plus postage fees for a bank draft refund. For credit to credit card account refund, a few hundred Baht plus a money transfer fee at a rate charged by banks and postal fees will be further added.

So, Who can claim a VAT Refund in Thailand?

- Those who are not Thai nationals

- Those who do not have a residency in Thailand.

- Those who are not airline crew members departing Thailand on duty

- Depart Thailand from an international airport.

- Purchase goods from stores displaying a "Vat Refund For Tourists" sign.

- Present the goods and VAT Refund Application for Tourist Form (P.P.10) and original tax invoices to the Customs officer before check-in at the airline counter on the departure date.

Vat Refunds in Thailand Will Not be Made If:

- You carry a diplomatic passport and reside in Thailand.

- You are an airline crew member departing Thailand on duty

- Your stay in Thailand exceeds 180 days in a calendar year

- Goods were not taken out of Thailand within 60 days after the date of purchase

- You didn't depart Thailand from an international airport

- The name or passport number does not match those on the original tax invoice attached to the VAT Refund Application form

- The value of goods purchased is less than 2,000 Baht per day per store

- Your purchased items fall under the following category: gemstones, firearms or explosives, prohibited items

- VAT Refund Application for Tourist form was not prepared on the date of purchase

- The total value of goods claimed for refund is less than 5,000 Baht

- Original tax invoices were not attached to the VAT Refund for Tourist form

- You did not carry the goods out of Thailand on the day of your departure

- Goods were not purchased from shops participating in the VAT Refund for Tourists Scheme

- The quantity of goods shown in the VAT Refund Application for Tourist form is less than that shown in the original tax invoice

- Goods were taken out of Thailand without being inspected by Customs or Revenue officers

- Luxury goods were taken out of Thailand without being checked by the Revenue officers

- Tax invoices attached to the VAT Refund Application for Tourists were issued from a different store than mentioned on the form.

To conclude, getting a Vat Refund for Tourists in Thailand can be trouble-free for you if you follow these simple steps and other essential conditions in mind. Even though there are a few conditions that you have to remember, we advise all travellers to have this information with you if you want to go on a splurge while you’re in the kingdom. Other than being a culinary, and historical paradise, Thailand is a place for shoppers. From quaint flea markets to upscale malls, Thailand is a place for every type of shopper and traveller alike. For a smooth holiday in Thailand, we recommend you to get the TAGTHAi App on your mobile phone for all the essential information. For an even smoother holiday here in Thailand, the TAGTHAi Pass provides a comprehensive introduction to your stay in the “Land of Smiles”.

Vat, Tax Refund

Who can claim a VAT refund

- Those who are not Thai nationality

- Those who are not a permanent resident of Thailand.

- Those who are not a crew member of an airline departing from Thailand.

- Those who are departing from Thailand from an international airport.

- Those who purchase goods from stores displaying a “VAT REFUND FOR TOURISTS” sign.

- Those who purchased goods of at least 2,000 baht (VAT included) from each store per day.

Vat Refund Payment Methods

For refund amount not exceeding 30,000 baht, the refund payment can be made in the form a 1.1 Cash (Thai baht only) or 1.2 Bank draft in four currencies: US$, EURO, STERLING, YEN or 1.3 Transfer into Credit card account (VISA, MASTERCARD, and JCB) 2. For refund amount exceeding 30,000 baht, the refund payment can be made in the form of bank draft or transfer into a credit card account (as detailed in 1.2 and 1.3)

The expense consist of draft or transfer fee, and postal fee which are charged by banks and post office and they will be deducted from the refund amount. Below tables are shown the approximately rate of the expenses.

*The postal fee depends upon distances and weights of the letter

Why the VAT refund are disapproved

- A claimant carries a diplomatic Passport and/or resides in Thailand .

- A claimant is an airline crew member that is on duty when departs Thailand.

- A claimant did not depart Thailand from an international airport. A claimant did not carry the goods out of Thailand on the departure date.

- Goods were not taken out of Thailand within 60 days from the date of purchase. The purchase date is counted as the first day. Goods were taken out of Thailand without inspected by a Customs officer.

- Luxury goods were taken out of Thailand without inspected by a Revenue officer.

- The total value of purchase is less than 2,000 baht per day per store.

- The VAT Refund Application for Tourist form (P.P. 10) was not issued on the date of purchase.

- The name or passport number on the original tax invoices that are enclosed to the VAT Refund Application for Tourist form (P.P. 10) is not a claimant.

- The original tax invoices were not enclosed to the VAT Refund Application for Tourist form ( P.P. 10).

- Goods were not purchased from the shops participating in the VAT refund for tourists scheme.

- The tax invoices were not issued from a store that mentioned on the form.

Tourism Authority of Thailand Singapore Office

- c/o Royal Thai Embassy 372 Orchard Road Singapore 238870

- +65 6235 7901

- [email protected]

- +603 2162 3480

- [email protected]

- Mon - Fri: 9:00 - 17:00

VAT Refund Calculator

How to calculate your tax-free refund by country, what is tax-free shopping and how does it work.

You can get reimbursed for the VAT (value added tax) fees you pay on any of your personal trips to Europe. Getting a tax refund allows you to shop tax-free and pay less for the products you buy.

The tax-free system not only ensures that tourists coming to the country are not charged consumer taxes, but also makes the stores more attractive to tourists.

There are 3 basic steps you need to take to get a tax refund.

- Fill out the tax-free form while still at the store

- Have your form approved at customs before leaving the country

- Complete your transaction by visiting the tax-free agent’s offices

How to Calculate VAT Refund for Tax Free Shopping?

On this page, you can find a list of the European countries where VAT refunds are available and at what rates. These tax-free rates vary parallel to the individual VAT rates of each country. Thus, if the VAT charged in a certain country is high, the refund you receive on products you buy there will also be high.

Here is an example to better explain the tax-free calculation process. The VAT rate in Germany is 19%. In other words, when you make a purchase of 1190 euros, you are actually paying 190 euros in VAT fees. That is to say, if you take 190/1200, you get a 16% VAT refund in Germany. Yet, there is one more step involved in the tax-free calculation process.

The company you work with to get the tax money back will also take commission on the refund you receive. In our example transaction the tax refund company would usually apply a commission of approximately 20%. As the amount of shopping you do increases, the percentage of commission you pay to the firm will decrease. In Germany, for 1200 euros’ worth of shopping, you will receive about 156 euros back. You will receive a 13% tax refund on the total price you paid.

To summarize, your tax-free refund depends on 3 things:

- The country's VAT rate

- The VAT rate specific to the product you purchased

- The commission of the company you work with

European Countries with the Highest and Lowest VAT Rates

The VAT rates in Europe vary from country to country. This directly affects the VAT refund you will receive on your purchases.

In addition to these varying rates, VAT rates are not the only variable involved in getting a larger refund, as the commission rates of the company you work with can also vary from country to country.

You can find out which countries offer larger VAT refunds via the table on our site.

The 5 Countries with the Highest VAT Rates

- Hungary - 27%

- Croatia - 25%

- Denmark - 25%

- Norway - 25%

- Sweden - 25%

The 5 countries that apply the highest VAT rates on shopping in Europe are Hungary, Croatia, Denmark, Norway and Sweden. In these countries, the VAT rate is 25% or higher. In other words, the VAT rate you pay for your purchases is higher than in other countries. This ensures that the VAT refund you will receive on your personal travels to these countries is larger.

The 3 Countries with the Lowest VAT Rates

- Switzerland - 7.7%

- Luxembourg - 17%

- Turkey - 18%

When compared to the standard VAT rates of other countries within Europe, the countries where you pay the lowest VAT rates are Switzerland, Luxembourg and Turkey. For this reason, the VAT rate for your purchases from these countries will be low. This will mean a reduction in the VAT fees you receive back. In addition, countries may also apply lower VAT rates to specific products. In such cases, the VAT refund you receive may be even lower.

Country-Specific Terms for Tax-Free Shopping

Regulations may vary from country to country regarding certain types of tax-free products, affecting the amount of money you can get back. For example, some countries do not refund VAT fees on product groups sold at a lower VAT rate.

In order to be exempt from consumer taxes when shopping in the European Union, it is generally required that the tourist reside outside of the EU. In countries like Turkey that are not members of the European Union, anyone living outside of Turkey can get a VAT refund.

While some countries require that purchases be made by individuals over the age of 18, other countries do not have such restrictions.

To find out more about product-specific terms and country regulations please review our country-specific Tax-free Shopping and Tax-free Refund Calculator pages.

Important Things to Know about Tax-Free Shopping

When leaving the country with your tax-free purchases, you must verify your tax-free forms at customs.

If you want to receive your tax-free payment in cash, you will be charged extra commission.

In some countries there are offices within the city where you can get a tax refund payment before going to the airport. In such an event, you must send the tax-free form that’s been verified at customs to the company by post once you have received your payment, otherwise your card may be penalized.

Any tax-free items you have purchased must remain unused until leaving the country.

clock This article was published more than 1 year ago

Thailand is adding a tourism tax on foreign visitors

Starting in june, visitors can expect to pay a small tax to enter the country.

A trip to Thailand is about to get a little more expensive. Starting June 1, the country will impose a tourism tax on international visitors, the government approved Tuesday.

Those who arrive by air will be taxed 300 baht (roughly $9, which will be added into airfare) and those by land or water transportation will be charged 150 baht ($4). The year-round tax will only apply to those staying overnight in the country, children under 2 or those traveling on diplomatic passport s or work permits.

What to know about traveling to Asia

The tax, which was proposed by the National Tourism Policy Committee and has been under consideration since before the pandemic, has been criticized by the local tourism industry, the Bangkok Post reported.

Government officials say it will help offset medical costs tourists accrue at public hospitals, which totaled between $8 million and $11 million from 2017 and 2019, the tourism and sports minister Phiphat Ratchakitprakarn told reporters on Tuesday. It will also support domestic tourism development. This year alone, the tax could generate more than $115 million.

Marijuana is now legal in Thailand. What does that mean for tourists?

Beyond the upcoming tourism tax, there are no restrictions for U.S. leisure travelers to enter Thailand, other than having a passport with at least six months of validity from your arrival. Americans don’t need a visa for stays fewer than 45 days , but Thai immigration officials or airline staff may require proof of an onward or return ticket. All coronavirus restrictions have been lifted .

Tourism in Thailand is seeing a major rebound, which is resulting in the country increasing the number of immigration counters and taxis at Bangkok’s airport to keep up with the recent surge. Thailand’s tourism authorities expect to welcome 25 million visitors in 2023.

Since Thailand reopened for tourism, Angela Hughes, owner of Trips & Ships Luxury Travel , has had significant interest from clients to visit. But as tourism numbers climb, she’s concerned for the return of overtourism to country’s most popular travel destinations, namely its beaches.

Overtourism has been an ongoing issue for Thailand. The country had to close destinations such as Koh Tachai and Maya Bay (made famous by the 2000 movie “The Beach”) to rehabilitate them from tourism damage.

Hughes recalls scenes of Ko Phi Phi Don island choked with thousands of tourists before the pandemic and is now encouraging clients to explore beyond the beach. “I’m shifting people north to Chiang Mai and Chiang Rai,” Hughes says.

Jason Martin, U.S. branch director for InsideAsia Tours , says his company is also sending travelers north and avoiding places like Pattaya , the beach city on Thailand’s eastern gulf coast known for its nightlife, which he says has been destroyed by overtourism. But clients are showing interest outside of Thailand’s “beaches and beer” culture on their own, too, requesting vacations that dive deeper into the country.

Thailand will join other popular travel destinations implementing visitor entrance fees. Europe is planning to launch its European Travel Information and Authorisation System (or ETIAS) in November, which will require a 7 euro fee for visitors 18 to 70 years old. Venice has postponed a new tourist entry fee but it’s expected to launch this year. Bhutan reopened last year and now requires a $200 daily visa fee.

A previous version of this story incorrectly stated that Americans can stay in Thailand without a visa for 30 days. It's 45 days. The article has been corrected.

More travel news

How we travel now: More people are taking booze-free trips — and airlines and hotels are taking note. Some couples are ditching the traditional honeymoon for a “buddymoon” with their pals. Interested? Here are the best tools for making a group trip work.

Bad behavior: Entitled tourists are running amok, defacing the Colosseum , getting rowdy in Bali and messing with wild animals in national parks. Some destinations are fighting back with public awareness campaigns — or just by telling out-of-control visitors to stay away .

Safety concerns: A door blew off an Alaska Airlines Boeing 737 Max 9 jet, leaving passengers traumatized — but without serious injuries. The ordeal led to widespread flight cancellations after the jet was grounded, and some travelers have taken steps to avoid the plane in the future. The incident has also sparked a fresh discussion about whether it’s safe to fly with a baby on your lap .

iCalculator™ TH: Thailand Tax Calculators

Welcome to iCalculator™ TH , your comprehensive suite of free tax calculators for Thailand. iCalculator™ has provided free tax calculators for Thailand since 2019. Since those early days we have extended our resources for Thailand to includes Tax Guides, Tax Videos and enhanced the tax calculators and supporting tax information. The Thailand Tax Calculator and salary calculators within our Thailand tax section are based on the latest tax rates published by the Tax Administration in Thailand . In this dedicated Tax Portal for Thailand you can access:

- Income Tax Calculator 2024

- Income Tax Calculator 2023

- 2024 Tax Tables

- 2023 Tax Tables

- Thailand Salary Calculators

- Thailand Salary Examples

- Salary Comparison Calculator

- Thailand Income Tax Rates

- Thailand VAT Calculator

- Thailand Reverse VAT Calculator

- Payroll Calculator

- Recruitment Cost Calculator

- Employment Cost Calculator

- FlexiTax Calculator

- Far East Tax Calculators

Thailand Tax Calculator 2024/25

- Employees in Thailand to calculate their annual salary after tax.

- Employers to calculate their cost of employment for their employees in Thailand.

Taxation in Thailand: Types and Compliance Overview

Thailand's taxation system comprises various taxes, each with its own compliance requirements. This overview provides a general understanding of the main tax types and compliance processes in Thailand, tailored for iCalculator™ TH users.

1. Personal Income Tax

Personal Income Tax (PIT) in Thailand is levied on the income of individuals residing in Thailand. Residents are taxed on their global income, while non-residents are only taxed on income sourced in Thailand. Compliance involves annual tax filings and potential advance tax payments, depending on income levels.

2. Corporate Income Tax

Corporate Income Tax (CIT) applies to companies and juristic entities operating in Thailand. It covers profits derived from business activities within the country. Companies are required to file semi-annual and annual tax returns, along with necessary financial statements.

3. Value Added Tax

Value Added Tax (VAT) is a consumption tax imposed on the sale of goods and services. Businesses exceeding a certain revenue threshold must register for VAT and comply with monthly filing and payment obligations. VAT is also applicable to imports.

4. Specific Business Tax

Specific Business Tax (SBT) targets certain service sectors like banking, finance, and real estate. Entities in these sectors are subject to SBT instead of VAT. Compliance includes monthly filings and payments.

5. Stamp Duty

Stamp Duty is imposed on certain legal documents, including contracts and property-related transactions. The duty must be paid before or at the time of registration of the document.

6. Property Tax

Property Tax in Thailand is levied annually on property owners, based on the assessed value of the property. It applies to both residential and commercial properties.

7. Excise Tax

Excise Tax is a consumption tax imposed on specific goods like alcohol, tobacco, and vehicles. Businesses dealing in these products must comply with excise tax regulations, including periodic filings and payments.

8. Withholding Tax

Withholding Tax applies to specific types of payments to both residents and non-residents, including salaries, dividends, and royalties. The payer is responsible for withholding and remitting the tax to the authorities.

9. Compliance and Penalties

Compliance with Thailand's tax laws involves accurate record-keeping, timely filings, and payments. Non-compliance can result in penalties, including fines and interest on unpaid taxes.

For iCalculator™ TH users, it's important to understand these tax types and compliance requirements to effectively manage financial obligations in Thailand.

IMAGES

VIDEO

COMMENTS

Vat Refund Payment Methods. For refund amount not exceeding 30,000 baht, the refund payment can be made in the form a. 1.1 Cash (Thai baht only) or. 1.2 Bank draft in four currencies: US$, EURO, STERLING, YEN or. 1.3 Transfer into Credit card account (VISA, MASTERCARD, and JCB) 2.

Look for shops or retailers displaying the "VAT Refund for Tourists" sign. Shop and collect your receipts. Request for VAT Refund Application Form. Present your passport. Get your VAT refund paperwork. At the airport. Get your refund. Eligibility of Foreigners to Get Tax Refund in Thailand. Procedure for Getting Tax Refund in Thailand.

The Revenue Department. 90 Soi Phaholyothin 7 Phaholyothin Road, Phayathai, Bangkok 10400

Traveling and shopping by foreign tourists in Thailand is a stimulus to the overall economy of the tourism and service sector. One action that tourists should take before leaving Thailand is to apply for a VAT refund. Tourists may check and follow these procedures: ... the original tax invoices, and the VAT Refund Application for Tourists form ...

- In cases where the tax refund amount is not more than 30,000 Baht, tourists can choose to receive the refund in cash (Baht), as a money order (draft), or credit to a credit card account. - In cases where the tax refund amount exceeds 30,000 Baht, tourists can apply for the refund via a money order (draft) or credit to a credit card account.

7%. 700 baht. As shown in the table, the refundable amount is calculated by multiplying the purchase amount (including VAT) by the VAT rate. For instance, if you made a purchase of 5,000 baht, the refundable amount would be 350 baht.

To qualify for the refund, Thai-bought goods must be purchased from stores displaying the 'VAT Refund for Tourists' sign and be at least 2,000 Baht (VAT included) per day per store. ... the tourist must present their passport and ask the store to issue a VAT Refund Application for Tourists form (P.P.10) along with the original tax invoice/s ...

The Tourist Tax is a tax collected from foreign tourists as a fee for administering tourism programs. This amount is deposited in the National Tourism Promotion Fund, which was established under the National Tourism Policy Act B.E. 2562 (2019) ... VAT REFUND for tourists is a tax measure to promote tourism ... Thailand prepares to collect ...

A request for a refund of VAT goods (Por Por. 10) along with the original tax invoice and all purchased goods starting from 5,000 Baht per 1 tourist and per trip are required for inspection of the products at the customs counter on the day of departure prior to checking in. Presenting to the customs officer at an international airport where the ...

The officer will stamp your forms and you are free to head through security! Find the Tax Refund for Tourists window amongst the duty free shops and you can receive your refund (minus a 100 baht processing fee) in cash, cheque, or as a credit to a credit card (refunds of over 30,000 baht are not available as cash). Reviewed by.

He said the department has streamlined VAT refund process into three simple steps: 1. Tourists spending more than 2,000 baht (including tax) at shops bearing the logo "VAT refund for tourists" get the refund form (P.P.10) from the shop the same day. They must also show their passport so the shop can enter the passport number on the tax ...

1. Taking the purchased goods outside Thailand within 60 days from the date of purchase. 2. Purchasing goods from shops displaying the "VAT Refund for Tourists" sign. 3. The total purchase amount must be at least 2,000 baht (including VAT) from the same business establishment on the same day. 4.

Centre Point Hotel Silom. Centre Point Hotel Sukhumvit 10. Centre Point Serviced Apartment Thong-Lo. Pattaya. Centre Point Prime Hotel Pattaya. Korat. Centre Point Hotel Terminal21 Korat. Thailand has a unique tax system that has been established since 1992 called VAT, or 'Value Added Tax'.

To qualify for the refund, goods must be purchased from stores displaying the 'VAT Refund for Tourists' sign, and be to the value of at least 2,000 Baht (VAT included) per day per store. The total value of all goods purchased must be at least 5,000 Baht per person per trip. The goods must be taken out of Thailand by the tourist within 60 ...

Places to submit your VAT Refund Application ( P.P.10 ) VAT Refund Payment Methods . VAT Refund Table (Thailand) VAT Refund for Tourists Procedures . Reasons for VAT refund rejections . VAT Refund for Tourists Office at the Suvarnabhumi International Airport and Don Mueang International Airport . Samples of VAT Refund Application ( P.P.10 )

For many goods purchased in Thailand, Value Added Tax (VAT) at 7% is included in the price. The good news for tourists is that in many instances it is possible to claim back the VAT before you depart Thailand. To be eligible for a tax refund, the goods must be purchased at a store that participates in the VAT refund for tourists scheme.

To get a VAT refund in Thailand, you must spend a minimum of 2,000 Baht on the same day. Also, the total amount of the cost of goods or services must total to more than 5,000 Baht as well, according to Thailand's Department of Revenue. 3.) Complete the Tax Refund Form & Tax Invoice.

Those who purchased goods of at least 2,000 baht (VAT included) from each store per day. Vat Refund Payment Methods. 2. For refund amount exceeding 30,000 baht, the refund payment can be made in the form of bank draft or transfer into a credit card account (as detailed in 1.2 and 1.3) The expense consist of draft or transfer fee, and postal fee ...

Vat Refund Payment Methods. Go Top. For refund amount not exceeding 30,000 baht, the refund payment can be made in the form a. 1.1 Cash (Thai baht only) or. 1.2 Bank draft in four currencies: US$, EURO, STERLING, YEN or. 1.3 Transfer into Credit card account (VISA, MASTERCARD, and JCB) 2.

Denmark - 25%. Norway - 25%. Sweden - 25%. The 5 countries that apply the highest VAT rates on shopping in Europe are Hungary, Croatia, Denmark, Norway and Sweden. In these countries, the VAT rate is 25% or higher. In other words, the VAT rate you pay for your purchases is higher than in other countries. This ensures that the VAT refund you ...

3 min. A trip to Thailand is about to get a little more expensive. Starting June 1, the country will impose a tourism tax on international visitors, the government approved Tuesday. Those who ...

Updated 2023-07-11. 1592. Thailand prompt to collect tourist tax 300 baht, starting June 1, 2023. The "tourist tax" is a fee for administering tourism fees from foreign tourists when entering Thailand. There are many countries that collect a tourist tax, including Europe, Japan, Malaysia, most of which are included in the airfare or room ...

The Thailand Tax Calculator below is for the 2024 tax year, the calculator allows you to calculate income tax and payroll taxes and deductions in Thailand. This includes calculations for. Employees in Thailand to calculate their annual salary after tax. Employers to calculate their cost of employment for their employees in Thailand.