Travel, Tourism & Hospitality

Global tourism industry - statistics & facts

What are the leading global tourism destinations, digitalization of the global tourism industry, how important is sustainable tourism, key insights.

Detailed statistics

Total contribution of travel and tourism to GDP worldwide 2019-2033

Number of international tourist arrivals worldwide 1950-2023

Global leisure travel spend 2019-2022

Editor’s Picks Current statistics on this topic

Current statistics on this topic.

Leading global travel markets by travel and tourism contribution to GDP 2019-2022

Travel and tourism employment worldwide 2019-2033

Related topics

Recommended.

- Hotel industry worldwide

- Travel agency industry

- Sustainable tourism worldwide

- Travel and tourism in the U.S.

- Travel and tourism in Europe

Recommended statistics

- Basic Statistic Total contribution of travel and tourism to GDP worldwide 2019-2033

- Basic Statistic Travel and tourism: share of global GDP 2019-2033

- Basic Statistic Leading global travel markets by travel and tourism contribution to GDP 2019-2022

- Basic Statistic Global leisure travel spend 2019-2022

- Premium Statistic Global business travel spending 2001-2022

- Premium Statistic Number of international tourist arrivals worldwide 1950-2023

- Basic Statistic Number of international tourist arrivals worldwide 2005-2023, by region

- Basic Statistic Travel and tourism employment worldwide 2019-2033

Total contribution of travel and tourism to gross domestic product (GDP) worldwide in 2019 and 2022, with a forecast for 2023 and 2033 (in trillion U.S. dollars)

Travel and tourism: share of global GDP 2019-2033

Share of travel and tourism's total contribution to GDP worldwide in 2019 and 2022, with a forecast for 2023 and 2033

Total contribution of travel and tourism to GDP in leading travel markets worldwide in 2019 and 2022 (in billion U.S. dollars)

Leisure tourism spending worldwide from 2019 to 2022 (in billion U.S. dollars)

Global business travel spending 2001-2022

Expenditure of business tourists worldwide from 2001 to 2022 (in billion U.S. dollars)

Number of international tourist arrivals worldwide from 1950 to 2023 (in millions)

Number of international tourist arrivals worldwide 2005-2023, by region

Number of international tourist arrivals worldwide from 2005 to 2023, by region (in millions)

Number of travel and tourism jobs worldwide from 2019 to 2022, with a forecast for 2023 and 2033 (in millions)

- Premium Statistic Global hotel and resort industry market size worldwide 2013-2023

- Premium Statistic Most valuable hotel brands worldwide 2023, by brand value

- Basic Statistic Leading hotel companies worldwide 2023, by number of properties

- Premium Statistic Hotel openings worldwide 2021-2024

- Premium Statistic Hotel room openings worldwide 2021-2024

- Premium Statistic Countries with the most hotel construction projects in the pipeline worldwide 2022

Global hotel and resort industry market size worldwide 2013-2023

Market size of the hotel and resort industry worldwide from 2013 to 2022, with a forecast for 2023 (in trillion U.S. dollars)

Most valuable hotel brands worldwide 2023, by brand value

Leading hotel brands based on brand value worldwide in 2023 (in billion U.S. dollars)

Leading hotel companies worldwide 2023, by number of properties

Leading hotel companies worldwide as of June 2023, by number of properties

Hotel openings worldwide 2021-2024

Number of hotels opened worldwide from 2021 to 2022, with a forecast for 2023 and 2024

Hotel room openings worldwide 2021-2024

Number of hotel rooms opened worldwide from 2021 to 2022, with a forecast for 2023 and 2024

Countries with the most hotel construction projects in the pipeline worldwide 2022

Countries with the highest number of hotel construction projects in the pipeline worldwide as of Q4 2022

- Premium Statistic Airports with the most international air passenger traffic worldwide 2022

- Premium Statistic Market value of selected airlines worldwide 2023

- Premium Statistic Global passenger rail users forecast 2017-2027

- Premium Statistic Daily ridership of bus rapid transit systems worldwide by region 2023

- Premium Statistic Number of users of car rentals worldwide 2019-2028

- Premium Statistic Number of users in selected countries in the Car Rentals market in 2023

- Premium Statistic Carbon footprint of international tourism transport worldwide 2005-2030, by type

Airports with the most international air passenger traffic worldwide 2022

Leading airports for international air passenger traffic in 2022 (in million international passengers)

Market value of selected airlines worldwide 2023

Market value of selected airlines worldwide as of May 2023 (in billion U.S. dollars)

Global passenger rail users forecast 2017-2027

Worldwide number of passenger rail users from 2017 to 2022, with a forecast through 2027 (in billion users)

Daily ridership of bus rapid transit systems worldwide by region 2023

Number of daily passengers using bus rapid transit (BRT) systems as of April 2023, by region

Number of users of car rentals worldwide 2019-2028

Number of users of car rentals worldwide from 2019 to 2028 (in millions)

Number of users in selected countries in the Car Rentals market in 2023

Number of users in selected countries in the Car Rentals market in 2023 (in million)

Carbon footprint of international tourism transport worldwide 2005-2030, by type

Transport-related emissions from international tourist arrivals worldwide in 2005 and 2016, with a forecast for 2030, by mode of transport (in million metric tons of carbon dioxide)

Attractions

- Premium Statistic Market size of museums, historical sites, zoos, and parks worldwide 2022-2027

- Premium Statistic Leading museums by highest attendance worldwide 2019-2022

- Basic Statistic Most visited amusement and theme parks worldwide 2019-2022

- Basic Statistic Monuments on the UNESCO world heritage list 2023, by type

- Basic Statistic Selected countries with the most Michelin-starred restaurants worldwide 2023

Market size of museums, historical sites, zoos, and parks worldwide 2022-2027

Size of the museums, historical sites, zoos, and parks market worldwide in 2022, with a forecast for 2023 and 2027 (in billion U.S. dollars)

Leading museums by highest attendance worldwide 2019-2022

Most visited museums worldwide from 2019 to 2022 (in millions)

Most visited amusement and theme parks worldwide 2019-2022

Leading amusement and theme parks worldwide from 2019 to 2022, by attendance (in millions)

Monuments on the UNESCO world heritage list 2023, by type

Number of monuments on the UNESCO world heritage list as of September 2023, by type

Selected countries with the most Michelin-starred restaurants worldwide 2023

Number of Michelin-starred restaurants in selected countries and territories worldwide as of July 2023

Online travel market

- Premium Statistic Online travel market size worldwide 2017-2028

- Premium Statistic Estimated desktop vs. mobile revenue of leading OTAs worldwide 2023

- Premium Statistic Number of aggregated downloads of leading online travel agency apps worldwide 2023

- Basic Statistic Market cap of leading online travel companies worldwide 2023

- Premium Statistic Leading online travel companies worldwide 2020-2022, by revenue CAGR

- Premium Statistic Leading online travel companies worldwide 2022-2023, by EV/EBITDA

Online travel market size worldwide 2017-2028

Online travel market size worldwide from 2017 to 2023, with a forecast until 2028 (in billion U.S. dollars)

Estimated desktop vs. mobile revenue of leading OTAs worldwide 2023

Estimated desktop vs. mobile revenue of leading online travel agencies (OTAs) worldwide in 2023 (in billion U.S. dollars)

Number of aggregated downloads of leading online travel agency apps worldwide 2023

Number of aggregated downloads of selected leading online travel agency apps worldwide in 2023 (in millions)

Market cap of leading online travel companies worldwide 2023

Market cap of leading online travel companies worldwide as of September 2023 (in million U.S. dollars)

Leading online travel companies worldwide 2020-2022, by revenue CAGR

Revenue compound annual growth rate (CAGR) of leading online travel companies worldwide from 2020 to 2022

Leading online travel companies worldwide 2022-2023, by EV/EBITDA

Enterprise-value-to-EBITDA (EV/EBITDA) of selected leading online travel companies worldwide in 2022, with a forecast for 2023

Selected trends

- Premium Statistic Global travelers who believe in the importance of green travel 2022

- Premium Statistic Sustainable initiatives travelers would adopt worldwide 2022, by region

- Premium Statistic Airbnb revenue worldwide 2017-2023

- Premium Statistic Airbnb nights and experiences booked worldwide 2017-2023

- Premium Statistic Technologies global hotels plan to implement in the next three years 2022

- Premium Statistic Hotel technologies global consumers think would improve their future stay 2022

Global travelers who believe in the importance of green travel 2022

Share of travelers that believe sustainable travel is important worldwide in 2022

Sustainable initiatives travelers would adopt worldwide 2022, by region

Main sustainable initiatives travelers are willing to adopt worldwide in 2022, by region

Airbnb revenue worldwide 2017-2023

Revenue of Airbnb worldwide from 2017 to 2023 (in billion U.S. dollars)

Airbnb nights and experiences booked worldwide 2017-2023

Nights and experiences booked with Airbnb from 2017 to 2023 (in millions)

Technologies global hotels plan to implement in the next three years 2022

Technologies hotels are most likely to implement in the next three years worldwide as of 2022

Hotel technologies global consumers think would improve their future stay 2022

Must-have hotel technologies to create a more amazing stay in the future among travelers worldwide as of 2022

- Premium Statistic Travel and tourism revenue worldwide 2019-2028, by segment

- Premium Statistic Distribution of sales channels in the travel and tourism market worldwide 2018-2028

- Premium Statistic Inbound tourism visitor growth worldwide 2020-2025, by region

- Premium Statistic Outbound tourism visitor growth worldwide 2020-2025, by region

Travel and tourism revenue worldwide 2019-2028, by segment

Revenue of the global travel and tourism market from 2019 to 2028, by segment (in billion U.S. dollars)

Distribution of sales channels in the travel and tourism market worldwide 2018-2028

Revenue share of sales channels of the travel and tourism market worldwide from 2018 to 2028

Inbound tourism visitor growth worldwide 2020-2025, by region

Inbound tourism visitor growth worldwide from 2020 to 2022, with a forecast until 2025, by region

Outbound tourism visitor growth worldwide 2020-2025, by region

Outbound tourism visitor growth worldwide from 2020 to 2022, with a forecast until 2025, by region

Further reports Get the best reports to understand your industry

Get the best reports to understand your industry.

Mon - Fri, 9am - 6pm (EST)

Mon - Fri, 9am - 5pm (SGT)

Mon - Fri, 10:00am - 6:00pm (JST)

Mon - Fri, 9:30am - 5pm (GMT)

Reimagining the $9 trillion tourism economy—what will it take?

Tourism made up 10 percent of global GDP in 2019 and was worth almost $9 trillion, 1 See “Economic impact reports,” World Travel & Tourism Council (WTTC), wttc.org. making the sector nearly three times larger than agriculture. However, the tourism value chain of suppliers and intermediaries has always been fragmented, with limited coordination among the small and medium-size enterprises (SMEs) that make up a large portion of the sector. Governments have generally played a limited role in the industry, with partial oversight and light-touch management.

COVID-19 has caused an unprecedented crisis for the tourism industry. International tourist arrivals are projected to plunge by 60 to 80 percent in 2020, and tourism spending is not likely to return to precrisis levels until 2024. This puts as many as 120 million jobs at risk. 2 “International tourist numbers could fall 60-80% in 2020, UNWTO reports,” World Tourism Organization, May 7, 2020, unwto.org.

Reopening tourism-related businesses and managing their recovery in a way that is safe, attractive for tourists, and economically viable will require coordination at a level not seen before. The public sector may be best placed to oversee this process in the context of the fragmented SME ecosystem, large state-owned enterprises controlling entry points, and the increasing impact of health-related agencies. As borders start reopening and interest in leisure rebounds in some regions , governments could take the opportunity to rethink their role within tourism, thereby potentially both assisting in the sector’s recovery and strengthening it in the long term.

In this article, we suggest four ways in which governments can reimagine their role in the tourism sector in the context of COVID-19.

1. Streamlining public–private interfaces through a tourism nerve center

Before COVID-19, most tourism ministries and authorities focused on destination marketing, industry promotions, and research. Many are now dealing with a raft of new regulations, stimulus programs, and protocols. They are also dealing with uncertainty around demand forecasting, and the decisions they make around which assets—such as airports—to reopen will have a major impact on the safety of tourists and sector employees.

Coordination between the public and private sectors in tourism was already complex prior to COVID-19. In the United Kingdom, for example, tourism falls within the remit of two departments—the Department for Business, Energy, and Industrial Strategy (BEIS) and the Department for Digital, Culture, Media & Sport (DCMS)—which interact with other government agencies and the private sector at several points. Complex coordination structures often make clarity and consistency difficult. These issues are exacerbated by the degree of coordination that will be required by the tourism sector in the aftermath of the crisis, both across government agencies (for example, between the ministries responsible for transport, tourism, and health), and between the government and private-sector players (such as for implementing protocols, syncing financial aid, and reopening assets).

Concentrating crucial leadership into a central nerve center is a crisis management response many organizations have deployed in similar situations. Tourism nerve centers, which bring together public, private, and semi-private players into project teams to address five themes, could provide an active collaboration framework that is particularly suited to the diverse stakeholders within the tourism sector (Exhibit 1).

We analyzed stimulus packages across 24 economies, 3 Australia, Bahrain, Belgium, Canada, Egypt, Finland, France, Germany, Hong Kong, Indonesia, Israel, Italy, Kenya, Malaysia, New Zealand, Peru, Philippines, Singapore, South Africa, South Korea, Spain, Switzerland, Thailand, and the United Kingdom. which totaled nearly $100 billion in funds dedicated directly to the tourism sector, and close to $300 billion including cross-sector packages with a heavy tourism footprint. This stimulus was generally provided by multiple entities and government departments, and few countries had a single integrated view on beneficiaries and losers. We conducted surveys on how effective the public-sector response has been and found that two-thirds of tourism players were either unaware of the measures taken by government or felt they did not have sufficient impact. Given uncertainty about the timing and speed of the tourism recovery, obtaining quick feedback and redeploying funds will be critical to ensuring that stimulus packages have maximum impact.

2. Experimenting with new financing mechanisms

Most of the $100 billion stimulus that we analyzed was structured as grants, debt relief, and aid to SMEs and airlines. New Zealand has offered an NZ $15,000 (US $10,000) grant per SME to cover wages, for example, while Singapore has instituted an 8 percent cash grant on the gross monthly wages of local employees. Japan has waived the debt of small companies where income dropped more than 20 percent. In Germany, companies can use state-sponsored work-sharing schemes for up to six months, and the government provides an income replacement rate of 60 percent.

Our forecasts indicate that it will take four to seven years for tourism demand to return to 2019 levels, which means that overcapacity will be the new normal in the medium term. This prolonged period of low demand means that the way tourism is financed needs to change. The aforementioned types of policies are expensive and will be difficult for governments to sustain over multiple years. They also might not go far enough. A recent Organisation for Economic Co-operation and Development (OECD) survey of SMEs in the tourism sector suggested more than half would not survive the next few months, and the failure of businesses on anything like this scale would put the recovery far behind even the most conservative forecasts. 4 See Tourism policy responses to the coronavirus (COVID-19), OECD, June 2020, oecd.org. Governments and the private sector should be investigating new, innovative financing measures.

Revenue-pooling structures for hotels

One option would be the creation of revenue-pooling structures, which could help asset owners and operators, especially SMEs, to manage variable costs and losses moving forward. Hotels competing for the same segment in the same district, such as a beach strip, could have an incentive to pool revenues and losses while operating at reduced capacity. Instead of having all hotels operating at 20 to 40 percent occupancy, a subset of hotels could operate at a higher occupancy rate and share the revenue with the remainder. This would allow hotels to optimize variable costs and reduce the need for government stimulus. Non-operating hotels could channel stimulus funds into refurbishments or other investment, which would boost the destination’s attractiveness. Governments will need to be the intermediary between businesses through auditing or escrow accounts in this model.

Joint equity funds for small and medium-size enterprises

Government-backed equity funds could also be used to deploy private capital to help ensure that tourism-related SMEs survive the crisis (Exhibit 2). This principle underpins the European Commission’s temporary framework for recapitalization of state-aided enterprises, which provided an estimated €1.9 trillion in aid to the EU economy between March and May 2020. 5 See “State aid: Commission expands temporary framework to recapitalisation and subordinated debt measures to further support the economy in the context of the coronavirus outbreak,” European Commission, May 8, 2020, ec.europa.eu. Applying such a mechanism to SMEs would require creating an appropriate equity-holding structure, or securitizing equity stakes in multiple SMEs at once, reducing the overall risk profile for the investor. In addition, developing a standardized valuation methodology would avoid lengthy due diligence processes on each asset. Governments that do not have the resources to co-invest could limit their role to setting up those structures and opening them to potential private investors.

3. Ensuring transparent, consistent communication on protocols

The return of tourism demand requires that travelers and tourism-sector employees feel—and are—safe. Although international organizations such as the International Air Transport Association (IATA), and the World Travel & Tourism Council (WTTC) have developed a set of guidelines to serve as a baseline, local regulators are layering additional measures on top. This leads to low levels of harmonization regarding regulations imposed by local governments.

Our surveys of traveler confidence in the United States suggests anxiety remains high, and authorities and destination managers must work to ensure travelers know about, and feel reassured by, protocols put in place for their protection. Our latest survey of traveler sentiment in China suggests a significant gap between how confident travelers would like to feel and how confident they actually feel; actual confidence in safety is much lower than the expected level asked a month before.

One reason for this low level of confidence is confusion over the safety measures that are currently in place. Communication is therefore key to bolstering demand. Experience in Europe indicates that prompt, transparent, consistent communications from public agencies have had a similar impact on traveler demand as CEO announcements have on stock prices. Clear, credible announcements regarding the removal of travel restrictions have already led to increased air-travel searches and bookings. In the week that governments announced the removal of travel bans to a number of European summer destinations, for example, outbound air travel web search volumes recently exceeded precrisis levels by more than 20 percent in some countries.

The case of Greece helps illustrate the importance of clear and consistent communication. Greece was one of the first EU countries to announce the date of, and conditions and protocols for, border reopening. Since that announcement, Greece’s disease incidence has remained steady and there have been no changes to the announced protocols. The result: our joint research with trivago shows that Greece is now among the top five summer destinations for German travelers for the first time. In July and August, Greece will reach inbound airline ticketing levels that are approximately 50 percent of that achieved in the same period last year. This exceeds the rate in most other European summer destinations, including Croatia (35 percent), Portugal (around 30 percent), and Spain (around 40 percent). 6 Based on IATA Air Travel Pulse by McKinsey. In contrast, some destinations that have had inconsistent communications around the time frame of reopening have shown net cancellations of flights for June and July. Even for the high seasons toward the end of the year, inbound air travel ticketing barely reaches 30 percent of 2019 volumes.

Digital solutions can be an effective tool to bridge communication and to create consistency on protocols between governments and the private sector. In China, the health QR code system, which reflects past travel history and contact with infected people, is being widely used during the reopening stage. Travelers have to show their green, government-issued QR code before entering airports, hotels, and attractions. The code is also required for preflight check-in and, at certain destination airports, after landing.

4. Enabling a digital and analytics transformation within the tourism sector

Data sources and forecasts have shifted, and proliferated, in the crisis. Last year’s demand prediction models are no longer relevant, leaving many destinations struggling to understand how demand will evolve, and therefore how to manage supply. Uncertainty over the speed and shape of the recovery means that segmentation and marketing budgets, historically reassessed every few years, now need to be updated every few months. The tourism sector needs to undergo an analytics transformation to enable the coordination of marketing budgets, sector promotions, and calendars of events, and to ensure that products are marketed to the right population segment at the right time.

Governments have an opportunity to reimagine their roles in providing data infrastructure and capabilities to the tourism sector, and to investigate new and innovative operating models. This was already underway in some destinations before COVID-19. Singapore, for example, made heavy investments in its data and analytics stack over the past decade through the Singapore Tourism Analytics Network (STAN), which provided tourism players with visitor arrival statistics, passenger profiling, spending data, revenue data, and extensive customer-experience surveys. During the COVID-19 pandemic, real-time data on leading travel indicators and “nowcasts” (forecasts for the coming weeks and months) could be invaluable to inform the decisions of both public-sector and private-sector entities.

This analytics transformation will also help to address the digital gap that was evident in tourism even before the crisis. Digital services are vital for travelers: in 2019, more than 40 percent of US travelers used mobile devices to book their trips. 7 Global Digital Traveler Research 2019, Travelport, marketing.cloud.travelport.com; “Mobile travel trends 2019 in the words of industry experts,” blog entry by David MacHale, December 11, 2018, blog.digital.travelport.com. In Europe and the United States, as many as 60 percent of travel bookings are digital, and online travel agents can have a market share as high as 50 percent, particularly for smaller independent hotels. 8 Sean O’Neill, “Coronavirus upheaval prompts independent hotels to look at management company startups,” Skift, May 11, 2020, skift.com. COVID-19 is likely to accelerate the shift to digital as travelers look for flexibility and booking lead times shorten: more than 90 percent of recent trips in China were booked within seven days of the trip itself. Many tourism businesses have struggled to keep pace with changing consumer preferences around digital. In particular, many tourism SMEs have not been fully able to integrate new digital capabilities in the way that larger businesses have, with barriers including language issues, and low levels of digital fluency. The commission rates on existing platforms, which range from 10 percent for larger hotel brands to 25 percent for independent hotels, also make it difficult for SMEs to compete in the digital space.

Governments are well-positioned to overcome the digital gap within the sector and to level the playing field for SMEs. The Tourism Exchange Australia (TXA) platform, which was created by the Australian government, is an example of enabling at scale. It acts as a matchmaker, connecting suppliers with distributors and intermediaries to create packages attractive to a specific segment of tourists, then uses tourist engagement to provide further analytical insights to travel intermediaries (Exhibit 3). This mechanism allows online travel agents to diversify their offerings by providing more experiences away from the beaten track, which both adds to Australia’s destination attractiveness, and gives small suppliers better access to customers.

Governments that seize the opportunity to reimagine tourism operations and oversight will be well positioned to steer their national tourism industries safely into—and set them up to thrive within—the next normal.

Download the article in Arabic (513KB)

Margaux Constantin is an associate partner in McKinsey’s Dubai office, Steve Saxon is a partner in the Shanghai office, and Jackey Yu is an associate partner in the Hong Kong office.

The authors wish to thank Hugo Espirito Santo, Urs Binggeli, Jonathan Steinbach, Yassir Zouaoui, Rebecca Stone, and Ninan Chacko for their contributions to this article.

Explore a career with us

Related articles.

Make it better, not just safer: The opportunity to reinvent travel

Hospitality and COVID-19: How long until ‘no vacancy’ for US hotels?

A new approach in tracking travel demand

Official websites use .gov A .gov website belongs to an official government organization in the United States.

Secure .gov websites use HTTPS A lock ( A locked padlock ) or https:// means you’ve safely connected to the .gov website. Share sensitive information only on official, secure websites.

- Search ITA Search

Travel & Tourism Industry

International travel plays a critical role in the US economy. Prior to the COVID-19 pandemic, in 2019, international visitors spent $233.5 billion experiencing the United States; injecting nearly $640 million a day into the U.S. economy. The U.S. travel and tourism industry generated $1.9 trillion in economic output; supporting 9.5 million American jobs and accounted for 2.9% of U.S. GDP. At 14.5% of international travel spending globally, international travelers spend more in the United States than any other country. As recovery efforts continue, the International Trade Administration actively supports the industry via the twin pillars of the National Travel and Tourism Office (NTTO) and the U.S. Commercial Service . Working together, we provide a range of data and related products to support the international outreach and promotion efforts of U.S. destinations and attractions. With over 100 offices throughout the United States and in 75 countries around the world, we are where you are and where you want to be.

What We Do For You:

- Promote U.S. policies that encourage the competitiveness of the U.S. travel industry

- Provide business counseling, match-making and promotional support services to help U.S. destinations and attractions penetrate new markets and increase market share

- Seek to ensure that U.S. regulations and other programs do not adversely impact U.S. industry competitiveness

- Provide information, trade data, and market analysis to the U.S. travel industry, partners and policy makers

- Maintain close relationships with the U.S. travel industry to focus and construct programs that enhance the industry’s competitiveness and overseas profile

Featured Events & Resources

How Can We Help You Attract International Visitors?

Travel and Tourism Market Intelligence

Katowice Airport presented its investment program for 2024-2028 . The plan includes the expansion of all airport zones, i.e. passenger, technical and cargo.

As Taiwan recovers from the Covid-19 impact on the tourism industry, Taiwan travelers and the U.S. tourism exports to Taiwan has reached its peak since 2020.

The European Commission proposed a new policy package to foster the growth of net-zero technologies and the development of resilient supply chains.

Fraudulent Email Alert

We are aware of an individual fraudulently claiming to represent ITA in order to solicit personal information. Individuals have reported receiving emails and phone calls “regarding a possible recent scam involving your vacation property.” The recipient is then instructed to complete a complaint form with personal information to receive support from ITA.

This is a scam and was not sent by ITA or any of its employees. If you receive such a communication, please do not respond or provide any personal information.

If you believe that you have been a target to such a scam, please notify the Department of Commerce, Office of Inspector General, immediately and file a report.

- Discovery Platform

- Innovation Scouting

- Startup Scouting

- Technology Scouting

- Tech Supplier Scouting

- Startup Program

- Trend Intelligence

- Business Intelligence

- All Industries

- Industry 4.0

- Manufacturing

- Case Studies

- Research & Development

- Corporate Strategy

- Corporate Innovation

- Open Innovation

- New Business Development

- Product Development

- Agriculture

- Construction

- Sustainability

- All Startups

- Circularity

- All Innovation

- Business Trends

- Emerging Tech

- Innovation Intelligence

- New Companies

- Scouting Trends

- Startup Programs

- Supplier Scouting

- Tech Scouting

- Top AI Tools

- Trend Tracking

- All Reports [PDF]

- Circular Economy

- Engineering

- Oil & Gas

Share this:

- Click to share on Facebook (Opens in new window)

- Click to share on Twitter (Opens in new window)

- Click to share on LinkedIn (Opens in new window)

Top 9 Travel Trends & Innovations in 2024

How are the latest trends in the travel industry reshaping trip planning and enhancing tourist experiences in 2024? Explore our in-depth industry research on the top 9 travel trends based on our analysis of 3500+ companies worldwide. These trends include AI, immersive tourism, IoT, contactless travel & more!

Technological advancements in the travel industry meet the growing demand for personalized experiences, safety, and sustainability. Post the COVID-19 pandemic, emerging travel trends mark a shift towards contactless travel through digital payments, self-check-ins, and more. Additionally, artificial intelligence (AI), the Internet of Things (IoT), and blockchain are automating various hospitality and travel-related operations.

For instance, smart hotels make use of internet-connected devices to remotely control rooms. Further, businesses offer virtual tours by adopting extended reality (XR) technologies like virtual reality (VR) and augmented reality (AR). Travel companies also leverage data analytics to personalize marketing. At the same time, traveler assisting solutions like chatbots and voice technology aid them in booking accommodation and optimizing journeys. These travel trends improve the overall profitability of the tourism industry and enable it to make operations more sustainable and safe.

This article was published in July 2022 and updated in February 2024.

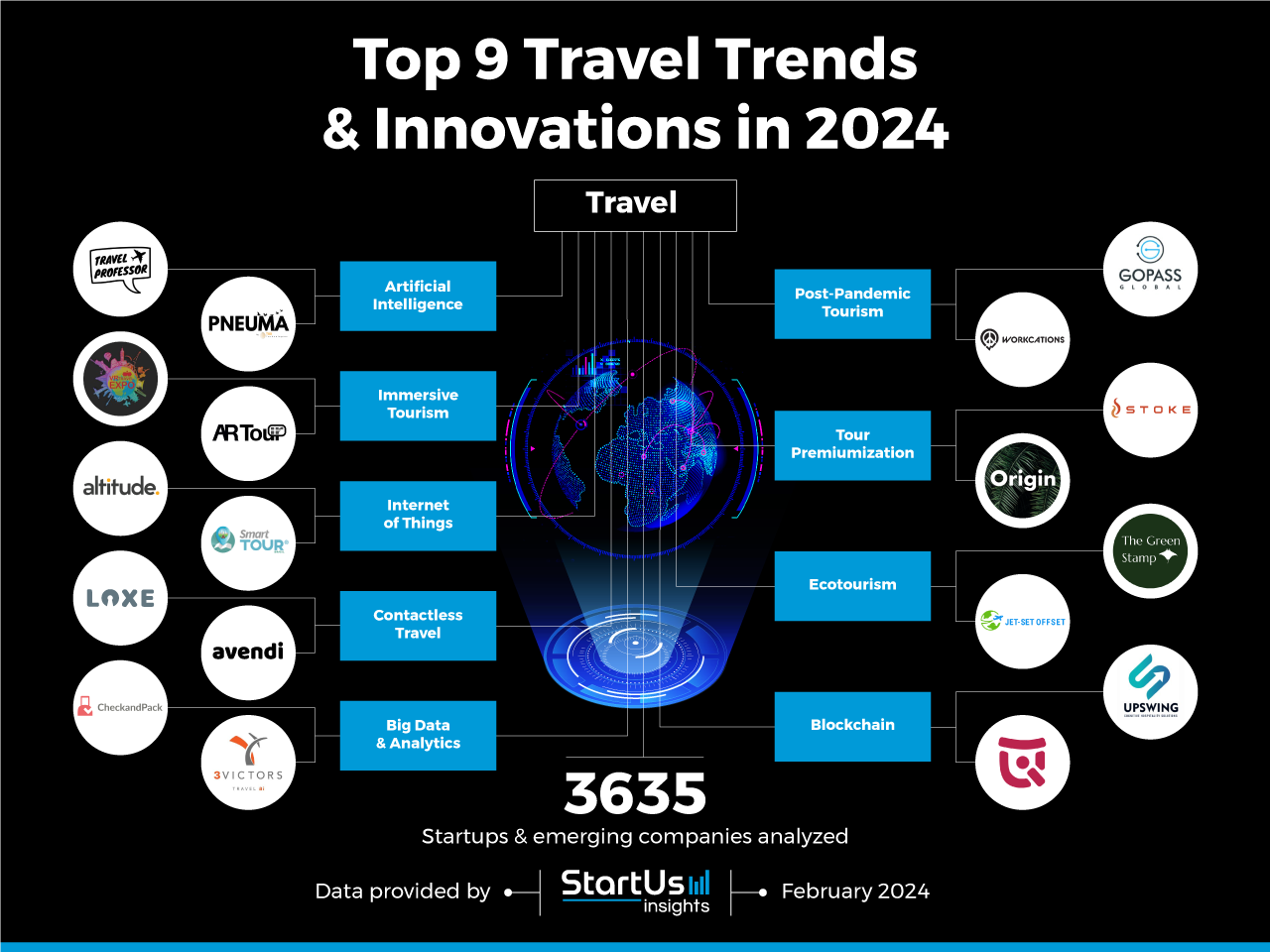

Innovation Map outlines the Top 9 Travel Trends & 18 Promising Startups

For this in-depth research on the Top 9 Trends & Startups, we analyzed a sample of 18 global startups and scaleups. The result of this research is data-driven innovation intelligence that improves strategic decision-making by giving you an overview of emerging technologies & startups in the travel industry. These insights are derived by working with our Big Data & Artificial Intelligence-powered StartUs Insights Discovery Platform , covering 2 500 000+ startups & scaleups globally. As the world’s largest resource for data on emerging companies, the SaaS platform enables you to identify relevant startups, emerging technologies & future industry trends quickly & exhaustively.

In the Innovation Map below, you get an overview of the Top 9 Travel Trends & Innovations that impact travel & tourism companies worldwide. Moreover, the Travel Innovation Map reveals 3 500+ hand-picked startups, all working on emerging technologies that advance their field.

Top 9 Travel Trends

- Artificial Intelligence

- Immersive Tourism

- Internet of Things

- Contactless Travel

- Big Data & Analytics

- Post-Pandemic Tourism

- Tour Premiumization

Click to download

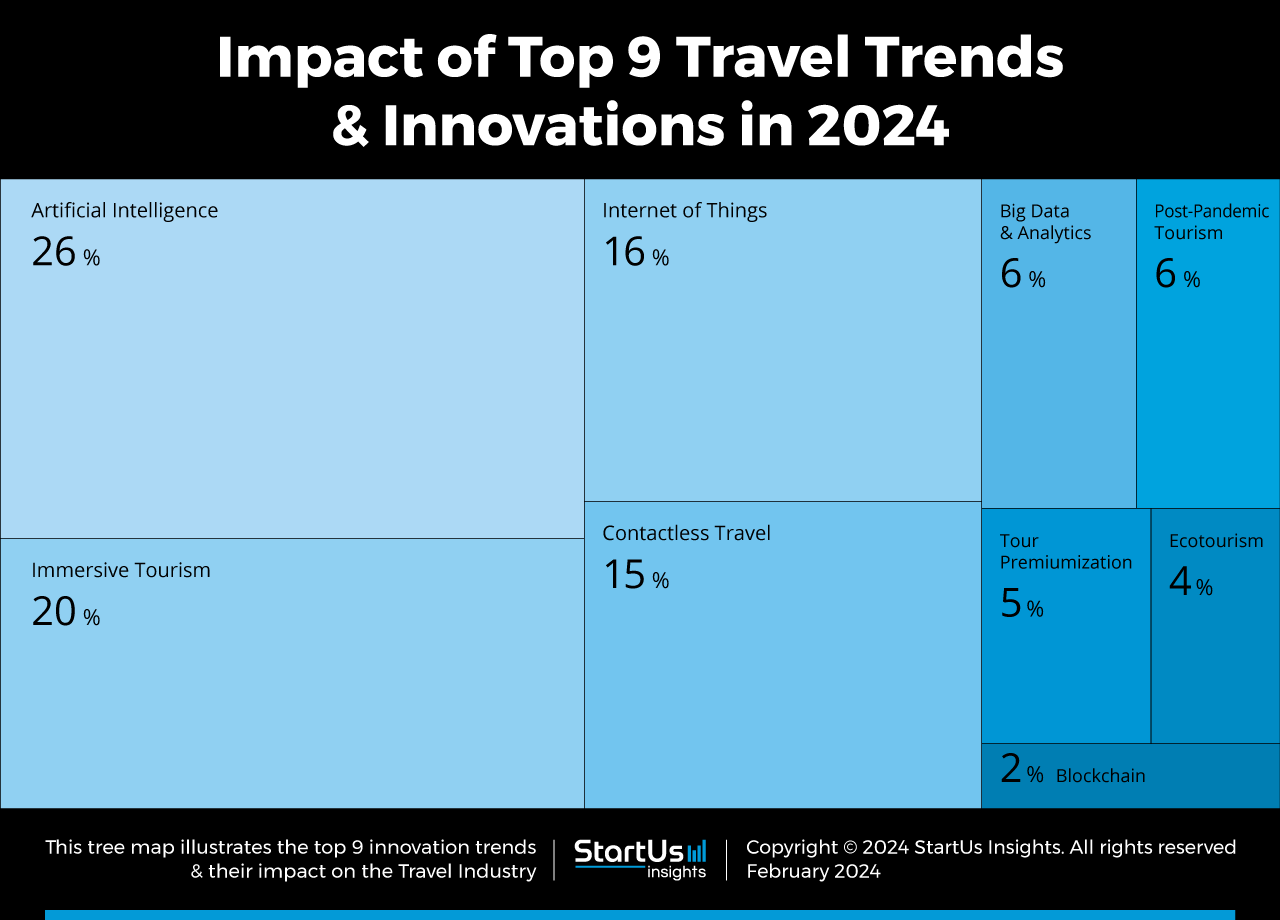

Tree Map reveals the Impact of the Top 9 Travel Trends

Based on the Travel Innovation Map, the Tree Map below illustrates the impact of the Top 9 Travel Industry Trends in 2024. Startups and scaleups are enabling contactless travel using technologies like biometrics, radio-frequency identification (RFID), and near-field communication (NFC). This is due to increasing health and hygiene concerns post the pandemic. The use of AI in tourism ensures hassle-free trip planning while AR and VR allow tourists to virtually visit various locations and excursions. IoT increases visibility into tourism industry operations and allows passengers to track their luggage more efficiently. Further, the demand for personalized and luxurious travel is rising. Several startups enable recreational space travel as well as offer sustainable travel options to passengers.

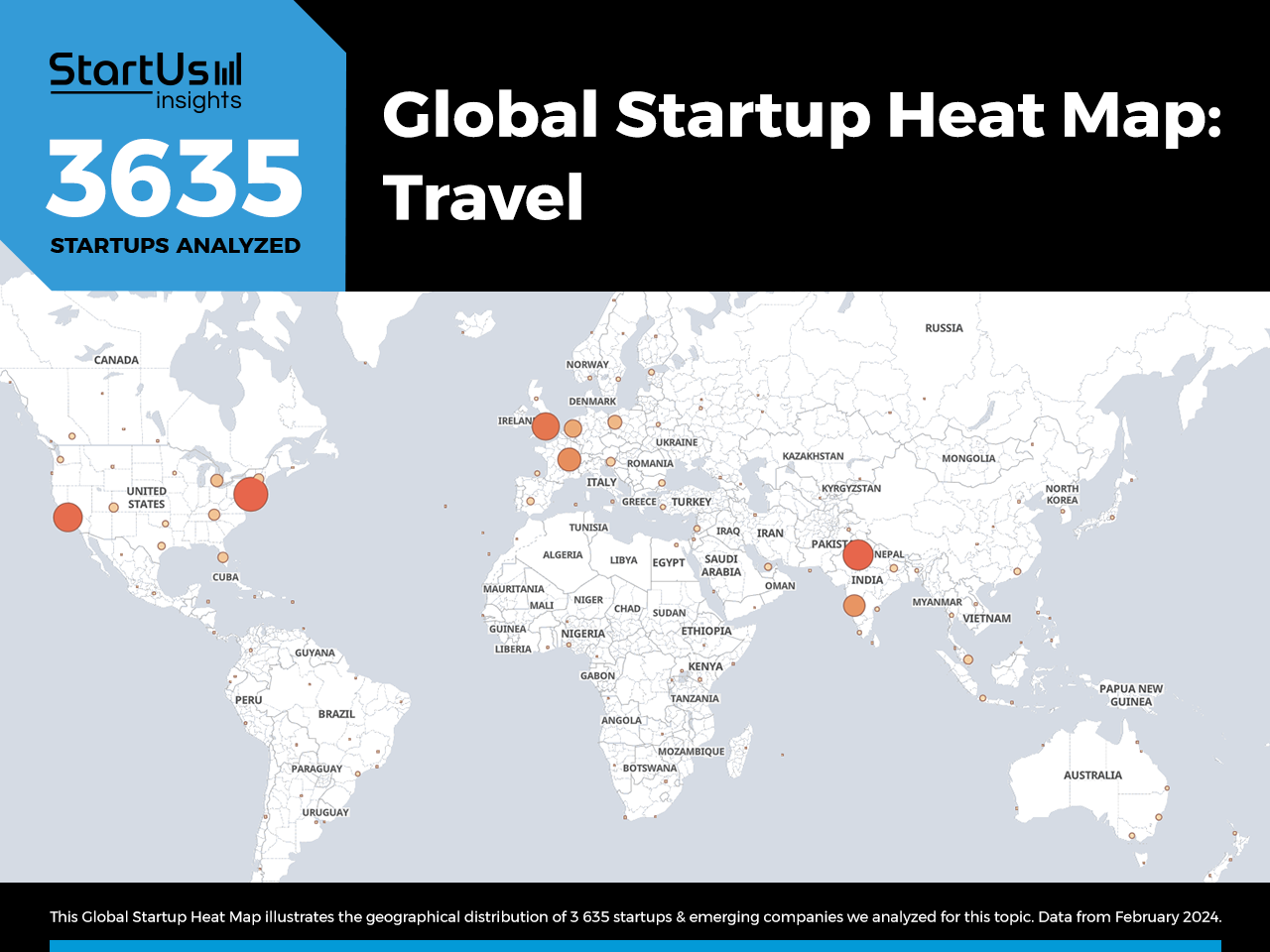

Global Startup Heat Map covers 3 635 Travel Startups & Scaleups

The Global Startup Heat Map below highlights the global distribution of the 3 635 exemplary startups & scaleups that we analyzed for this research. Created through the StartUs Insights Discovery Platform, the Heat Map reveals that the US, Europe, and India see the most activity.

Below, you get to meet 18 out of these 3 635 promising startups & scaleups as well as the solutions they develop. These 18 startups are hand-picked based on criteria such as founding year, location, funding raised, and more. Depending on your specific needs, your top picks might look entirely different.

Interested in exploring all 3500+ travel startups & scaleups?

Top 9 Travel Trends in 2024

1. artificial intelligence.

Hotels employ intelligent chatbots, powered by AI, to provide quick and personalized responses to traveler inquiries. These chatbots simplify the booking process and gather customer reviews, aiding potential travelers in making informed decisions. Moreover, AI-based robots enhance the customer experience by automating hotel disinfection and delivering room service.

At airports, these robots guide travelers and assist with luggage handling. Facial recognition technology, driven by AI, expedites identity verification at airports, enhancing security and offering a swift alternative to traditional methods. Startups are developing AI-powered trip planning solutions, optimizing journeys, and personalizing travel experiences.

Travel Professor develops a Travel Chatbot

UK-based startup Travel Professor offers an AI-enabled chatbot for travelers. The startup’s chat widget software monitors multiple flight deals and notifies users when their preferences match. It also provides travel destination recommendations and flight price alerts. This allows travelers to book economical flights and have a budget-friendly tourism experience.

Pneuma Travel facilitates Travel Planning

US startup Pneuma Travel develops a voice-assisted digital agent, Sarah , to streamline the process of travel planning. This assistant, powered by AI, excels in arranging flight and accommodation bookings and assists travelers in discovering a variety of activities. Sarah , available round the clock, provides continuous support for all travel-related inquiries.

Moreover, Sarah customizes travel options according to individual preferences and budgetary constraints. The agent further enhances the travel experience by providing insights into local attractions in unfamiliar cities. Importantly, Sarah enables real-time modifications to travel plans, in compliance with specific airline policies, thereby minimizing waiting times for users.

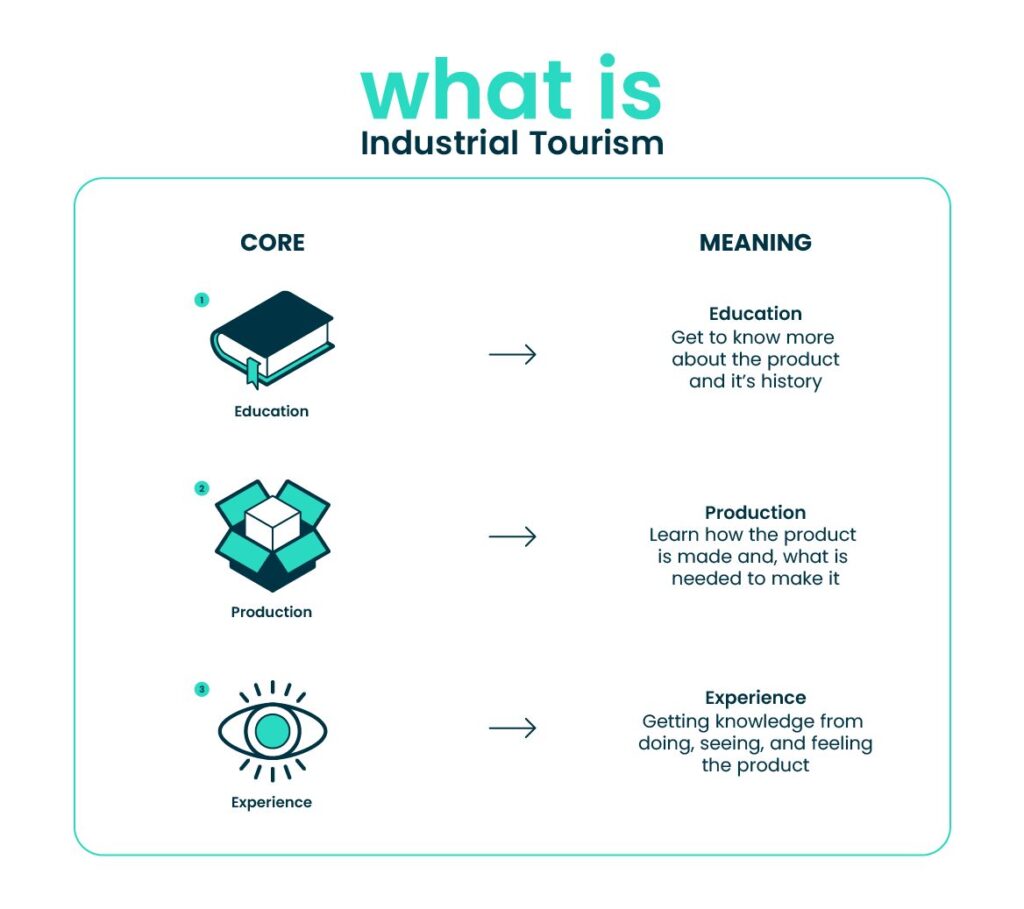

2. Immersive Tourism

Immersive tourism caters to the growing demand for meaningful experiences among travelers, leveraging AR, VR, and mixed reality (MR). VR simulates original locations through a computer-generated environment, allowing tourists to virtually explore destinations. It provides travelers with a comprehensive 360-degree tour of points of interest.

AR enhances the travel experience with interactive elements such as navigation maps and ads. Travel companies employ AR and VR-based gamification to heighten tourist attractions. Moreover, these technologies enable hotels and resorts to present amenities and rooms in an engaging, interactive manner.

VR Travel Expo offers VR-based Travel Plans

US startup VR Travel Expo develops a VR travel application to transform the way people research and book travel. The application enables users to plan their vacations more efficiently. It provides an engaging platform for users to explore and expand their knowledge of the world. Moreover, it employs 3D geospatial technology that creates real-time digital twins of the world. This further enhances the travel planning experience.

AR Tour makes AR Glasses

Italian startup AR Tour offers AR-powered tours. The startup’s AR glasses superimpose reconstructed images of archaeological ruins to show how the site originally was. Its tour informs the tourists about the site’s history and significance via an audio-visual package. Moreover, the startup designs lightweight AR glasses to prevent motion sickness among tourists, improving convenience.

3. Internet of Things

IoT generates ample data that tourism companies leverage to personalize services in their subsequent visits. Hotels use IoT sensors to enable smart rooms that automate room lighting, temperature, and ambiance control, enhancing guest comfort. These sensors adjust appliances in vacant rooms, conserving energy and reducing the building’s carbon footprint.

Startups harness IoT to deliver location-specific information to customers, including real-time luggage tracking via IoT tags, minimizing lost items. Airlines also incorporate IoT-based solutions into seats, monitoring passenger temperature and heart rate for proactive health management.

Altitude enables Smart Hotels

New Zealand-based startup Altitude creates an IoT-based hotel software and hardware to develop smart hotels. The startup makes self-service kiosks to automate reservations, room up-gradation, payments, as well as check-in and check-out. Its hotel management platform further enables contactless engagement with guests. Additionally, Altitude’s mobile keys allow guests to open doors using mobile phones, providing convenience and saving time for travelers.

Smart Tour provides Smart Itineraries

Brazilian startup Smart Tour offers smart itineraries using IoT and quick response (QR) codes. The startup recommends travel routes and destinations based on the user’s preference in real-time. This facilitates a seamless experience for travelers. Besides, the user-generated data enables tourism managers to better understand consumer behavior and indulge in proximity marketing. The startup also offers a contact tracing solution to monitor COVID-19 infected travelers and ensure public safety.

4. Contactless Travel

Travelers benefit from contactless recognition technologies like retina scanning, which replace traditional travel documents, speeding up passenger identification and reducing airport queues. QR codes offered by travel companies allow tourists to access relevant information on their mobile devices, enhancing engagement.

Hotels have introduced contactless self-check-ins, enabling visitors to arrange services before arrival. Additionally, contactless payment modes are available in hotels and restaurants for swift and secure transactions. Moreover, wearable devices are transforming the travel experience by providing real-time notifications and touch-free access to services and information.

Loxe designs Smart Hotel Keys

US-based startup Loxe makes smart mobile keys for hotels. The startup’s smartphone app replaces key cards with contactless mobile keys that allow users to unlock doors using smartphones. It also reduces operational costs incurred in the manufacturing of conventional keys or plastic cards. Moreover, the startup designs a Bluetooth retrofit module that converts normal door locks into mobile-ready door locks. This allows hotel owners to easily convert their existing locks into smart ones without additional expenses while improving guest safety and convenience.

Avendi provides Contactless Payment

Singaporean startup Avendi offers contactless and cashless payments for travelers. The startup allows tourists to accumulate expenses throughout their trip and pay at the end of the journey. Avendi’s app utilizes QR codes to add all the billed expenses and shown through its dashboard. The user settles the tab amount in the preferred currency, preventing the inconvenience of cash withdrawal or credit card payments.

5. Big Data & Analytics

Big data empowers travel companies with customer trends for strategic marketing. Analyzing traveler behavior, they offer tailored recommendations for hotel bookings, cab hires, flight reservations, and ticket purchases.

Predicting future demand is another advantage of big data and analytics, helping hotels and airlines identify peak periods to optimize revenue. Advanced analysis of transactional data aids in detecting cyber fraud, and safeguarding sensitive customer information such as credit card details and biometric data.

CheckandPack creates a Travel Platform

Dutch startup CheckandPack offers a big data travel platform. It runs marketing campaigns to gather traveler data and understand tourism trends. Based on these insights, the platform enables businesses to approach travelers with a customized appeal. It also provides travelers with holiday planning.

3Victors provides Travel Data Analytics

US-based startup 3Victors offers travel data analytics. The startup’s product, PriceEye Suite , proactively monitors the prices of numerous airlines to provide insights into competitor prices. It creates a dashboard to display travelers’ location of interest, allowing travel airlines to better manage their revenue and pricing strategy.

6. Post-Pandemic Tourism

Post-pandemic tourism focuses on safe, sustainable, and flexible travel options, responding to evolving traveler preferences and health guidelines. Enhanced health and safety protocols, including regular sanitization and contactless services, become standard in airlines and hotels, ensuring traveler confidence.

Destinations and operators emphasize outdoor and less crowded experiences, catering to a heightened demand for nature-based and wellness travel. Flexible booking policies and trip insurance gain prominence, offering peace of mind amid uncertainties. Sustainable travel gains traction, with tourists and businesses prioritizing environmental impact and community well-being.

GOPASS Global enables Pre-travel Risk Management

Singaporean startup GOPASS Global provides a travel risk analytics platform against COVID-19. It analyzes the biosecurity risk elements involved in a trip, such as border restrictions, quarantine requirements, airport type, and airline transit points or seating in real-time. This allows travelers to assess risk factors and plan their trips accordingly.

Moreover, the startup creates world maps displaying information regarding COVID-prone areas, testing areas, and vaccine coverage. This provides travelers with a preview of the current situation, allowing them to ensure safety during business and leisure travel.

Workcations enables Work from Anywhere

Indian startup Workcations provides properties at tourist destinations for remote-working individuals. It offers amenities like internet connectivity, food, and a quiet ambiance, allowing tourists to work in a peaceful environment without hindrance. This increases employee productivity, motivation, and retention.

7. Tour Premiumization

Hyper-personalization in travel experiences is on the rise, with tourists eager to immerse themselves in diverse cultures. Luxury travelers enjoy tailored experiences and intuitive services through tour premiumization. Health and wellness packages offered by travel startups help tourists unwind.

These retreats enhance health and offer detoxifying food options. Space tourism is another exciting development, offering leisure or research trips to space. Lastly, travel startups are fostering customer loyalty and building strong relationships through membership or subscription models.

STOKE provides Space Tour

US-based startup STOKE facilitates space travel using everyday-operable rockets. The startup’s rockets are reusable and deliver satellites to any desired orbit. This enables on-demand access to space, paving way for space tours for exploration, recreation, and research. The startup also emphasizes the economical and rapid development of its hardware for feasible spacecraft launches, advancing space tourism.

Origin offers Travel Personalization

Dutch startup Origin provides premium travel personalization to tourists. The startup utilizes machine learning and travel curators to plan creative vacations. It also arranges flights and accommodation for travelers. Further, the startup measures the carbon output of itineraries and offers sustainable tourism options.

8. Ecotourism

Traveling responsibly minimizes tourism’s environmental impact and supports local communities’ well-being. Ecotourists strive to reduce their carbon footprint during their journeys. Startups contribute by developing sustainable transport, ecolodges, and solar-powered resorts.

Airline passengers have the option to offset carbon emissions during flight bookings. Local tourism stimulates small businesses economically and creates job opportunities. It also emphasizes minimum littering, which lowers pollution and the time spent on cleanups.

Jet-Set Offset simplifies Flight Carbon Offset

US-based startup Jet-Set Offset creates a carbon-offsetting platform for air travel. The startup partners with non-profit organizations working against climate change and connects them with travelers. Each time travelers book flight tickets via the startup’s platform, Jet-Set Offset contributes a certain amount per mile for their journey to environmental organizations. This way, the passenger’s journey promotes mileage-based donations to offset carbon emissions.

The Green Stamp facilitates Ethical Wildlife Tour

Dutch startup The Green Stamp provides a platform to book ethical wildlife tours. It curates tours based on the tourists’ inclinations toward certain locations or wildlife. Exploration of these projects allows travelers to indirectly contribute to their cause as these wildlife projects donate to the welfare of local communities and the environment.

9. Blockchain

Blockchain provides the travel industry with operational transparency and security. Traceable payments, particularly for international travel, are a key application, that fosters trust among parties involved in transactions.

Automation and enforcement of agreements in travel insurance and supplier contracts are achieved through smart contracts. This strengthens reliability and cuts administrative costs. Travel firms establish customer loyalty programs where points are exchanged for cryptocurrency. Lastly, blockchain increases data storage security, reducing the risk of information leaks.

Upswing facilitates Guest Profiling

Indian startup Upswing creates AURA , a blockchain-powered platform for guest profiling. It provides a holistic view of guests, their preferences, and purchase patterns. The platform associates a score with each guest and suggests improvements in their service. This facilitates hotels to provide a personalized experience to their guests and, in turn, increase sales.

UIQ Travel develops a Solo Traveling App

US-based startup UIQ Travel develops a blockchain-based app to connect solo travelers. It discovers people with shared interests and suggests tours or attractions. Such hyper-personalized recommendations assist in experience discovery and also increase traveler engagement.

Discover all Travel Trends, Technologies & Startups

Tourism, although severely impacted by the pandemic, now continues to rapidly grow across the globe. Post-pandemic trends indicate an increasing emphasis on hygiene and safety during travel. The industry is witnessing the widespread adoption of disruptive technologies like AI, XR, IoT, and blockchain. The travel industry utilizes big data to understand traveler trends for targeted marketing. The transition to ecotourism is accelerating as businesses integrate zero-emission transit and carbon offset programs to reduce their carbon footprint.

The Travel Trends & Startups outlined in this report only scratch the surface of trends that we identified during our data-driven innovation and startup scouting process. Among others, personalization, decarbonization, and travel safety will transform the sector as we know it today. Identifying new opportunities and emerging technologies to implement into your business goes a long way in gaining a competitive advantage. Get in touch to easily and exhaustively scout startups, technologies & trends that matter to you!

Your Name Business Email Company

Get our free newsletter on technology and startups.

Protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Discover our Free Travel Report

Book a call today!

Mobility 22 pages report

Railway 22 pages report, cleantech 19 pages report.

Leverage our unparalleled data advantage to quickly and easily find hidden gems among 4.7M+ startups, scaleups. Access the world's most comprehensive innovation intelligence and stay ahead with AI-powered precision.

Get started

Your Name Business Email Company How can we support you? (optional)

Business Email

Protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

A travel boom is looming. But is the industry ready?

An increase in travel is expected between countries which have moderate COVID-19 caseloads and vaccine access. Image: Unsplash/William Hook

.chakra .wef-1c7l3mo{-webkit-transition:all 0.15s ease-out;transition:all 0.15s ease-out;cursor:pointer;-webkit-text-decoration:none;text-decoration:none;outline:none;color:inherit;}.chakra .wef-1c7l3mo:hover,.chakra .wef-1c7l3mo[data-hover]{-webkit-text-decoration:underline;text-decoration:underline;}.chakra .wef-1c7l3mo:focus,.chakra .wef-1c7l3mo[data-focus]{box-shadow:0 0 0 3px rgba(168,203,251,0.5);} Vik Krishnan

Darren rivas, steve saxon.

.chakra .wef-9dduvl{margin-top:16px;margin-bottom:16px;line-height:1.388;font-size:1.25rem;}@media screen and (min-width:56.5rem){.chakra .wef-9dduvl{font-size:1.125rem;}} Explore and monitor how .chakra .wef-15eoq1r{margin-top:16px;margin-bottom:16px;line-height:1.388;font-size:1.25rem;color:#F7DB5E;}@media screen and (min-width:56.5rem){.chakra .wef-15eoq1r{font-size:1.125rem;}} Travel and Tourism is affecting economies, industries and global issues

.chakra .wef-1nk5u5d{margin-top:16px;margin-bottom:16px;line-height:1.388;color:#2846F8;font-size:1.25rem;}@media screen and (min-width:56.5rem){.chakra .wef-1nk5u5d{font-size:1.125rem;}} Get involved with our crowdsourced digital platform to deliver impact at scale

Stay up to date:, travel and tourism.

- A new age of travel could be on the horizon, as vaccinations increase and caseloads become more manageable.

- A McKinsey survey reveals that travel is the second-most-desired activity in the U.S., after eating out.

- However, if the travel industry is not prepared, it could buckle under this new pressure.

- Building capacity, investing in digital innovation and revisiting commercial approaches will be key if countries want to seize value from this surge.

If things go well, we might be at the threshold of a new age of travel. Although COVID-19 variants may affect conditions, it seems only a matter of time before travelers in some parts of the world hit the road and take to the skies again, thanks to rising vaccination rates and manageable caseloads. Some countries have begun gingerly relaxing travel restrictions and reopening borders.

As the worst effects of the COVID-19 pandemic ebb, most indicators point to travel coming back—with a vengeance—as people look to reconnect, explore new destinations, or revisit reliable favorites. Many just want to get away from the confines of their homes. A McKinsey survey reveals traveling to be the second-most-desired activity among respondents (in first place: dining out). In the United States, air travel has hit two million daily passengers, closer to the prepandemic level of around 2.5 million than to the low of around 90,000, in April 2020. Hotel reservations and rental-car bookings are surging.

All these trends should taste sweet for the industry, but ill-prepared companies may find themselves facing the wrath of a cohort of leisure-focused vacationers who might already be struggling to keep up with new travel protocols. If the industry doesn’t work to increase capacity now, the ecosystem may buckle under the pressure, forcing travelers to endure long wait times and inflated prices.

This article projects two broad trajectories of how travel will likely bounce back, comparing countries that have near-zero caseloads with those that have more, but manageable, caseloads and higher vaccination rates. In both scenarios, travel companies that don’t prepare themselves for the forthcoming influx of travelers risk missing out on a valuable opportunity to recoup losses incurred during the height of the pandemic. On the flip side, we believe that by focusing on four key areas—building capacity, investing in digital innovation, revisiting commercial approaches, and learning from critical moments—travel companies can seize value as they exceed the needs and demands of their customers.

The tale of two travel recovery paths

Wherever in the world you look, you’ll see people itching to travel. Most high-income earners have not lost their jobs. In the United States, the savings rate among this demographic is 10 to 20 percent higher now than before the pandemic, and such people are eager to spend their money on travel. Leisure trips are expected to lead the rebound, with corporate travel trailing behind.

A recent survey of 4,700 respondents from 11 countries around the world, conducted by the International Air Transport Association (IATA), revealed that 57 percent of them expected to be traveling within two months of the pandemic’s containment, and 72 percent will do so as soon as they can meet friends and family. In our China travel survey, we see more and more respondents yearning for leisure trips further afield; 41 percent say they want their next trip to be outside China, the highest level we’ve seen, despite borders remaining sealed.

Yet it’s worth noting that despite the near-universal desire to travel, countries will likely manage their plans to reopen differently. Two main factors come into play here: current COVID-19 caseloads and vaccination rates. People living in countries with limited access to vaccines and uncontainable levels of cases—such as a number of countries in Africa and Southeast Asia—will continue to be bound by tight travel restrictions for some time to come.

Have you read?

These could be the most popular travel destinations after covid-19, covid-19 could change travel – but not in the way you think, how the travel industry can influence sustainable growth, travel will take off in and between countries with manageable caseloads.

We can expect a surge in travel in (and between) countries with manageable and moderate COVID-19 caseloads and vaccine access. These regions are willing to accept rising case levels as long as death and hospitalization rates stay low. In many European countries and the United States, a significant portion of the population has been inoculated. Such people feel safe enough to travel both domestically and internationally, especially with the introduction of safety measures such as the EU-issued digital health certificates given to people vaccinated against COVID-19. Despite fluctuating rates of new caseloads in these regions, the efficacy of the vaccine so far (to reduce the spread of the disease and avoid its worst effects) gives many people enough feeling of security to travel.

Countries in Europe that have gotten used to living with manageable caseloads of COVID-19 have begun to welcome visitors without asking them to quarantine: Iceland (March 2021), Cyprus (May 2021), and Malta (June 2021). In addition, Europe is open to vaccinated US travelers. After the US Centers for Disease Control and Prevention (CDC) started approving cruise vessels with conditional sailing certifications to enter the country, a Florida federal court ruled in June 2021 that CDC-issued regulations should serve only as nonbinding guidelines, further reducing restrictions on tourists.

If past instances serve as indicators, we’ll see travel demand soaring once travel restrictions are eased and freedom of mobility returns.

Domestic trips will lead the recovery of travel in near-zero countries

However, a slightly different picture is emerging for countries with near-zero caseloads. Countries in this group include Australia, China, New Zealand, and Singapore. Their governments face a difficult trade-off. They can open up national borders without quarantines—which will almost certainly lead to increased local transmissions of COVID-19 and an increase in new cases, especially in countries with low vaccination rates, such as Australia and New Zealand. Or, they can choose to continue imposing strict restrictions and quarantine measures until the pandemic has truly passed, which would deter all but the most determined of travelers. Unlike places that have adjusted to living with COVID-19, even a moderate increase of cases in countries with caseloads near zero would likely be unacceptable to the public.

That’s not to say there are no travel opportunities in these countries. First, we’ll likely see increased interest in domestic travel, especially for large countries with sizable home markets, such as Australia and China, which have traditionally been net exporters of tourists. With few international destinations open to visit, this group of travelers will likely seek out vacation experiences within their nations’ borders. China has seen hordes of tourists flood many scenic destinations and tourist sites, especially during peak travel seasons.

Second, even though travel bubbles have had only limited success so far, it may soon be possible for territories with very low COVID-19 caseloads and no local transmissions to open up access to each other. Mainland China, for instance, has been allowing citizens to travel to and from Macau without quarantine requirements. Hong Kong and Singapore have also restarted negotiations on a potential travel bubble between the two cities. The key is establishing common standards and trust in the public-health protocols and testing regimes of the participants in the travel bubble.

Four actions travel players must consider

Despite these promising signs, the tourism industry will likely struggle to capitalize on the imminent spike in travel demand, especially in Europe and the United States. From airlines and car rentals to hotels and airport restaurants, the entire travel supply chain is already showing signs of strain. Wait times at security checkpoints are stretching into hours at some airports, while popular vacation destinations, including Arizona, Florida, and Hawaii, are facing rental-car shortages.

Needless to say, bad news travels fast, and a negative experience can quickly become fodder for a viral video and bad publicity, leading customers to look for alternatives more in their control, including nearby drives and rental properties.

While the process is daunting, clear-sighted travel leaders know that preparing their organizations for a surge of travelers is also an opportunity to redefine their value propositions and make their offerings distinctive. This will not only reinstill confidence in travel but also increase customer loyalty. Leaders and executives would be wise to focus on the following four areas.

1. Bring back capacity

The most pressing imperative for all companies across the travel supply chain is bringing back capacity or, at the very least, ensuring that they’re able to do so. Many contract and temporary workers in the restaurant industry who were laid off during the pandemic have found other employment and are reluctant to go back to their former jobs, resulting in a labor crunch. In the United Kingdom, more than one in ten workers left the hospitality sector last year. In the United States, there was still a shortfall in April of around two million leisure and hospitality jobs—far greater than before the pandemic. Global aviation capacity levels are still well below prepandemic levels as many planes remain in long-term storage and staff remain furloughed. We believe that even though reactivating airline pilots and cabin crews, preparing grounded aircraft for service, and rehiring and training service staff can be pricey, the cost of standing by and doing nothing would be higher.

2. Invest innovatively to improve the entire customer journey

While cash might continue to be in short supply, an area still worth considering for overinvestment is digital operations. Remember that the customer experience is shaped across the entire end-to-end journey, from booking to travel to the return home. Even seasoned travelers will have to adapt to new protocols, such as digital health certificates and safety measures. Travelers now need more, not less, assistance. Furthermore, certain critical journeys and moments—such as a family vacation, an important business trip, or a last-minute emergency—carry a disproportionate weight in consumers’ minds when they plan their next trip. The anticipated volume of traffic during the summer and peak holiday periods will only compound these issues and bring about greater inconvenience in the overall system.

In our work in this sector, we have found that if even one pain point in the customer journey is not satisfactorily resolved, the entire perception of a travel company can be degraded. The industry needs to make sure that processes are smooth for reopening and that adequate assistance is available for travelers to help them adapt to new ways of traveling. It is likely that international trips will need additional documentation for some time. These requirements will vary by country and potentially by transit hub. They may include proof of COVID-19 vaccination (when, as well as which vaccine) and testing requirements (type of test and recency).

As the long wait times at airport checkpoints attest, manually navigating these complexities at the check-in desk is highly inefficient and prone to human error. Some airports are testing camera-powered and AI-based digital technologies to monitor crowd densities and reduce time spent standing in line—which makes the airport experience more bearable for travelers and ensures safe physical distancing. Autonomous robots are also being deployed to maintain hygiene standards; some are equipped with UV-light cleaners to disinfect areas, and others are outfitted with body-temperature sensors to help minimize the risk of virus outbreaks.

3. Reimagine commercial approaches

Travel companies may rethink their commercial approaches. The profiles of airline passengers and hotel guests will be different: more leisure guests, later booking windows, and higher demand for flexible tickets. Historical booking curves are no longer a good indicator of current behavior. Travel companies need to use every source of insight they can to anticipate demand and optimize pricing . Flexible pricing models can also ease customer discomfort with today’s heightened levels of unpredictability. For example, EasyJet now offers a Protection Promise program that gives fliers free changes up to two hours before the flight.

Hotels will need to find new purposes for meeting and conference spaces, which will be slower to fill. Airlines need to figure out how to fill intercontinental business class, likely with premium leisure promotions. For all travel companies, the boom may be higher in traveler numbers than in profits, as the most lucrative corporate business has been slow to return.

One year on: we look back at how the Forum’s networks have navigated the global response to COVID-19.

Using a multistakeholder approach, the Forum and its partners through its COVID Action Platform have provided countless solutions to navigate the COVID-19 pandemic worldwide, protecting lives and livelihoods.

Throughout 2020, along with launching its COVID Action Platform , the Forum and its Partners launched more than 40 initiatives in response to the pandemic.

The work continues. As one example, the COVID Response Alliance for Social Entrepreneurs is supporting 90,000 social entrepreneurs, with an impact on 1.4 billion people, working to serve the needs of excluded, marginalized and vulnerable groups in more than 190 countries.

Read more about the COVID-19 Tools Accelerator, our support of GAVI, the Vaccine Alliance, the Coalition for Epidemics Preparedness and Innovations (CEPI), and the COVAX initiative and innovative approaches to solve the pandemic, like our Common Trust Network – aiming to help roll out a “digital passport” in our Impact Story .

4. Learn from critical moments—and the wider ecosystem

Aside from streamlining processes and personalizing the customer experience, investing in digital analytics can allow companies to identify opportunities to differentiate their services. Companies would also be able to discern emerging trends and hiccups before they turn into nightmares. Industry players, such as online travel agents, may also be a trove of useful insights pertaining to how the external ecosystem is evolving; their experiences may be beneficial for hotels and airlines to explore potential partnerships with them.

The various parts of the travel industry have to work together as a whole to usher in a safe return of travel. Even as individual companies improve their internal operations, they should also keep a close eye on industry-wide developments, watching for collaboration opportunities. The industry and governments will have to reach consensus on safety standards and requirements. The IATA travel pass is a plug-in that could be used on airlines’ mobile apps, for example. Currently being tested by many airlines as a way to ensure passenger health, the app would allow travelers to manage verified certifications for COVID-19 vaccines and test results. Governments, in turn, could consider accepting and embedding the app into the flight check-in workflow.

It’s been a long time coming, but we see several factors aligning that could lead to a short-term travel boom, although not all countries and customer segments will boom at the same time. With continued perseverance, travel companies can ensure that travel is not just back but better.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Related topics:

The agenda .chakra .wef-n7bacu{margin-top:16px;margin-bottom:16px;line-height:1.388;font-weight:400;} weekly.

A weekly update of the most important issues driving the global agenda

.chakra .wef-1dtnjt5{display:-webkit-box;display:-webkit-flex;display:-ms-flexbox;display:flex;-webkit-align-items:center;-webkit-box-align:center;-ms-flex-align:center;align-items:center;-webkit-flex-wrap:wrap;-ms-flex-wrap:wrap;flex-wrap:wrap;} More on Travel and Tourism .chakra .wef-17xejub{-webkit-flex:1;-ms-flex:1;flex:1;justify-self:stretch;-webkit-align-self:stretch;-ms-flex-item-align:stretch;align-self:stretch;} .chakra .wef-nr1rr4{display:-webkit-inline-box;display:-webkit-inline-flex;display:-ms-inline-flexbox;display:inline-flex;white-space:normal;vertical-align:middle;text-transform:uppercase;font-size:0.75rem;border-radius:0.25rem;font-weight:700;-webkit-align-items:center;-webkit-box-align:center;-ms-flex-align:center;align-items:center;line-height:1.2;-webkit-letter-spacing:1.25px;-moz-letter-spacing:1.25px;-ms-letter-spacing:1.25px;letter-spacing:1.25px;background:none;padding:0px;color:#B3B3B3;-webkit-box-decoration-break:clone;box-decoration-break:clone;-webkit-box-decoration-break:clone;}@media screen and (min-width:37.5rem){.chakra .wef-nr1rr4{font-size:0.875rem;}}@media screen and (min-width:56.5rem){.chakra .wef-nr1rr4{font-size:1rem;}} See all

How Japan is attracting digital nomads to shape local economies and innovation

Naoko Tochibayashi and Naoko Kutty

March 28, 2024

Turning tourism into development: Mitigating risks and leveraging heritage assets

Abeer Al Akel and Maimunah Mohd Sharif

February 15, 2024

Buses are key to fuelling Indian women's economic success. Here's why

Priya Singh

February 8, 2024

These are the world’s most powerful passports to have in 2024

Thea de Gallier

January 31, 2024

These are the world’s 9 most powerful passports in 2024

South Korea is launching a special visa for K-pop lovers

10 Economic impacts of tourism + explanations + examples

Disclaimer: Some posts on Tourism Teacher may contain affiliate links. If you appreciate this content, you can show your support by making a purchase through these links or by buying me a coffee . Thank you for your support!

There are many economic impacts of tourism, and it is important that we understand what they are and how we can maximise the positive economic impacts of tourism and minimise the negative economic impacts of tourism.

Many argue that the tourism industry is the largest industry in the world. While its actual value is difficult to accurately determine, the economic potential of the tourism industry is indisputable. In fact, it is because of the positive economic impacts that most destinations embark on their tourism journey.

There is, however, more than meets the eye in most cases. The positive economic impacts of tourism are often not as significant as anticipated. Furthermore, tourism activity tends to bring with it unwanted and often unexpected negative economic impacts of tourism.

In this article I will discuss the importance of understanding the economic impacts of tourism and what the economic impacts of tourism might be. A range of positive and negative impacts are discussed and case studies are provided.

At the end of the post I have provided some additional reading on the economic impacts of tourism for tourism stakeholders , students and those who are interested in learning more.

Foreign exchange earnings

Contribution to government revenues, employment generation, contribution to local economies, development of the private sector, infrastructure cost, increase in prices, economic dependence of the local community on tourism, foreign ownership and management, economic impacts of tourism: conclusion, further reading on the economic impacts of tourism, the economic impacts of tourism: why governments invest.

Tourism brings with it huge economic potential for a destination that wishes to develop their tourism industry. Employment, currency exchange, imports and taxes are just a few of the ways that tourism can bring money into a destination.

In recent years, tourism numbers have increased globally at exponential rates, as shown in the World Tourism Organisation data below.

There are a number of reasons for this growth including improvements in technology, increases in disposable income, the growth of budget airlines and consumer desires to travel further, to new destinations and more often.

Here are a few facts about the economic importance of the tourism industry globally:

- The tourism economy represents 5 percent of world GDP

- Tourism contributes to 6-7 percent of total employment

- International tourism ranks fourth (after fuels, chemicals and automotive products) in global exports

- The tourism industry is valued at US$1trillion a year

- Tourism accounts for 30 percent of the world’s exports of commercial services

- Tourism accounts for 6 percent of total exports

- 1.4billion international tourists were recorded in 2018 (UNWTO)

- In over 150 countries, tourism is one of five top export earners

- Tourism is the main source of foreign exchange for one-third of developing countries and one-half of less economically developed countries (LEDCs)

There is a wealth of data about the economic value of tourism worldwide, with lots of handy graphs and charts in the United Nations Economic Impact Report .

In short, tourism is an example of an economic policy pursued by governments because:

- it brings in foreign exchange

- it generates employment

- it creates economic activity

Building and developing a tourism industry, however, involves a lot of initial and ongoing expenditure. The airport may need expanding. The beaches need to be regularly cleaned. New roads may need to be built. All of this takes money, which is usually a financial outlay required by the Government.

For governments, decisions have to be made regarding their expenditure. They must ask questions such as:

How much money should be spent on the provision of social services such as health, education, housing?

How much should be spent on building new tourism facilities or maintaining existing ones?

If financial investment and resources are provided for tourism, the issue of opportunity costs arises.

By opportunity costs, I mean that by spending money on tourism, money will not be spent somewhere else. Think of it like this- we all have a specified amount of money and when it runs out, it runs out. If we decide to buy the new shoes instead of going out for dinner than we might look great, but have nowhere to go…!

In tourism, this means that the money and resources that are used for one purpose may not then be available to be used for other purposes. Some destinations have been known to spend more money on tourism than on providing education or healthcare for the people who live there, for example.

This can be said for other stakeholders of the tourism industry too.

There are a number of independent, franchised or multinational investors who play an important role in the industry. They may own hotels, roads or land amongst other aspects that are important players in the overall success of the tourism industry. Many businesses and individuals will take out loans to help fund their initial ventures.

So investing in tourism is big business, that much is clear. What what are the positive and negative impacts of this?

Positive economic impacts of tourism