10 of the Best Travel Credit Cards in the Philippines

Best travel credit cards for frequent fliers.

- share

- Share on Facebook

- Share on Twitter

10 Best Credit Cards for Travel in the Philippines: A Comprehensive Guide

Table of Contents

If you’re planning a vacation, having the right credit card can make all the difference. From earning miles to getting discounts on travel expenses, the best travel credit cards in the Philippines can help you save money and make your trip more enjoyable. In this article, we’ll introduce you to the 10 best credit cards for travel in the Philippines.

Whether you’re a frequent traveler or just planning a one-time trip, there’s a travel credit card that’s right for you. Some cards offer generous rewards programs that allow you to earn miles for every purchase you make, while others provide discounts on travel expenses like airfare and hotel bookings. With so many options available, it can be difficult to choose the right card for your needs. That’s why we’ve compiled this list of the top 10 travel credit cards in the Philippines.

Before you choose a travel credit card, it’s important to consider your travel habits and spending patterns. Do you travel frequently or only occasionally? Are you looking for a card that offers rewards for everyday purchases or one that provides discounts on travel expenses? You can narrow down your options and choose the right card by answering these questions. So, without further ado, let’s take a look at the 10 best credit cards for travel in the Philippines.

Understanding Travel Credit Cards

These cards are specifically designed to provide rewards and perks to make your travels more enjoyable and affordable. Here are some things you should know about travel credit cards:

Earning Rewards

Most travel credit cards offer rewards in the form of points or miles. These rewards can be earned by using your card to make purchases and can be redeemed for travel-related expenses such as flights, hotel stays, tour packages, and car rentals.

Sign-Up Bonuses

Many travel credit cards offer sign-up bonuses to new cardholders. These bonuses typically require you to meet a spending threshold within a certain amount of time and can be worth a return flight or a certain number of miles.

Annual Fees

Some travel credit cards come with annual fees. These fees can range from Php1,500 to Php5,000 per year. However, many cards offer enough rewards and perks to offset the annual fee cost.

Foreign Transaction Fees

If you plan on using your travel credit card outside of the Philippines, it’s important to be aware of foreign transaction fees. These fees can add up quickly, so looking for a card that doesn’t charge them is a good idea.

Travel Insurance

Many travel credit cards offer travel insurance as a perk. This insurance can cover travel cancellations, lost luggage, and medical emergencies.

Other Perks

In addition to rewards and travel insurance, many travel credit cards offer other perks, such as airport lounge access, free checked bags, priority check-in, priority boarding, and concierge services. These perks can make your travels more comfortable and convenient.

A travel credit card can be an excellent tool for frequent travelers. Just be sure to research and choose a card that fits your needs and budget.

10 Best Travel Credit Cards in the Philippines

A travel credit card can be a game-changer if you’re a frequent traveler. With the right card, you can earn rewards and perks to make your trips more enjoyable while earning miles that you can use for your future trips. Here are the 10 best travel credit cards in the Philippines that you should consider:

Citi PremierMiles Mastercard

The Citi PremierMiles Visa is among the best credit cards for earning miles. You can earn 1 PremierMile for every PHP 30 spent locally and abroad. Plus, you can earn up to 30,000 bonus miles when you spend PHP 100,000 within the first 3 months of card issuance.

Convert your miles to redeem airline miles (1.6 PremierMiles = 1 mile) for your future travels or redeem cash credits (5 PremierMiles = 1 PHP) that you can use to offset your next purchase. You can redeem your miles for flights, hotel stays, and other travel-related expenses. The best thing about Citi PremierMiles is that it does not expire, and you can use it anytime.

Read More: https://www.citibank.com.ph/credit-cards/travel/premiermiles-card .

HSBC Platinum Visa Rebate Credit Card

The HSBC Platinum Visa is a great card for travelers who want to earn rewards points. You can earn 1 reward point for every PHP 20 spent locally and abroad. You can redeem your points for flights, hotel stays, and other travel-related expenses. Plus, you can enjoy exclusive discounts and privileges at over 27,000 establishments worldwide. If you love road trips, This card offers a 6% Rebate on your first Caltex transaction and a 3% rebate on your Caltex fuel purchases year-round.

Earn a 5% rebate on online shopping and travel spending, 1% on insurance, and 0.5% on all other spending.

Read More: https://www.hsbc.com.ph/credit-cards/products/platinum-visa/

UnionBank Miles+ Platinum Visa

The UnionBank Miles+ Platinum Visa is a great card for earning miles. You can earn 1 mile for every PHP 25 spent locally and abroad for nontravel-related transactions, while you can easily earn 1.5 points for all travel-related spend. Plus, you can earn up to 10,000 bonus miles when you spend PHP 100,000 within the first 3 months of card issuance. You can redeem your miles for flights, hotel stays, and other travel-related expenses. You also have complimentary access to selected airport lounges and enjoy free travel insurance.

Read More: https://www.unionbankph.com/cards/credit-card?id=161-pop .

PNB-PAL Mabuhay Miles World Mastercard

The PNB-PAL Mabuhay Miles World Mastercard is a great card for earning miles. Get a 2,000 Mabuhay Miles welcome gift. You can earn 1 mile for every PHP 33 spent locally and abroad. Plus, you can earn up to 30,000 bonus miles when you spend PHP 100,000 within the first 3 months of card issuance. You can redeem your miles for flights, hotel stays, and other travel-related expenses.

Read More: https://www.pnb.com.ph/index.php/credit-card/pnb-mabuhay-miles-world-mastercard-premium-rewards?tpl=revamp

EastWest Bank Singapore Airlines KrisFlyer Platinum Mastercard

The EastWest Bank Singapore Airlines KrisFlyer Platinum Mastercard is a great card for earning miles. You can earn 1.5 KrisFlyer miles for every PHP 45 spent locally and abroad. Plus, you can earn up to 5,000 bonus miles when you spend PHP 10,000 within the first 60 days of card issuance. You can redeem your miles for flights, hotel stays, and other travel-related expenses.

Take advantage of your EastWest Singapore Airlines KrisFlyer Platinum Mastercard’s free Priority Pass™ membership and treat yourself to a luxurious and comfortable experience while waiting for your flight. Enjoy complimentary refreshments, spa treatments, and even sleeping areas in over 1,300 airport lounges worldwide. Plus, you can bring a guest with you to share the experience! For more details, download the Priority Pass mobile app or check out their website at www.prioritypass.com.

Read More: https://www.eastwestbanker.com/creditcards/krisflyer-platinum-mastercard .

RCBC Bankard AirAsia Credit Card

The RCBC Bankard AirAsia Credit Card is great for earning AirAsia BIG points. You can earn 1 AirAsia BIG point for every PHP 22 spent locally and abroad. Plus, you can earn up to 8,000 bonus points when you spend PHP 20,000 within the first 60 days of card issuance. You can redeem your points for flights, hotel stays, and other travel-related expenses.

Take advantage of airasia rewards Final Call and exclusive deals available to AirAsia Cardholders every quarter. Redeem free flights and vouchers from Lazada, SM Gift Pass, Grab, and many more through the airasia Super App and www.airasia.com/rewards with your airasia points. Enjoy the convenience of accessing thousands of rewards with just a few clicks!

Read More: https://rcbccredit.com/airasia

Metrobank Travel Platinum Visa

The Metrobank Travel Platinum Visa is a great card for earning rewards points. You can earn 1 point for every PHP 20 spent locally and abroad. Plus, you can earn up to 10,000 bonus points when you spend PHP 50,000 within the first 90 days of card issuance.

Discover the ultimate travel card that rewards you with miles quickly at 1 mile for every P17* spent on airline tickets, hotel stays, and foreign currency transactions. Enjoy complimentary airport lounge membership and a free first supplementary card! You can redeem your points for flights, hotel stays, and other travel-related expenses.

Read More: https://www.metrobankcard.com/cards/metrobank-travel-platinum-visa

Security Bank Complete Cashback Platinum Mastercard

The Security Bank Complete Cashback Mastercard is a great card for earning cashback. Get Php3,000 EGC from The Travel Club for your travel essentials. You can earn 5% cashback on travel-related expenses like flights, hotels, and transportation. Plus, you can earn 1% cashback on other purchases. There’s no limit to the amount of cashback you can earn.

Read More: https://www.securitybank.com/personal/credit-cards/rebate/complete-cashback-platinum-mastercard/.

AUB Platinum Mastercard

The AUB Platinum Mastercard is a great card for earning rewards points. You can earn 1 point for every PHP 20 spent locally and abroad. Plus, you can earn up to 10,000 bonus points when you spend PHP 50,000 within the first 90 days of card issuance.

You can redeem your points for flights, hotel stays, and other travel-related expenses. Transfer your Rewards Points to Mabuhay Miles Frequent Flyer Program. Enjoy complimentary airport lounge access when you travel. This card offers no Annual Membership fee for life.

Read More: https://www.aub.com.ph/creditcards/goldandplatinum

Cebu Pacific Gold Credit Card by UnionBank

If you’re a frequent Cebu Pacific flyer, the UnionBank Cebu Pacific Gold Travel Benefits card is the perfect travel companion! With this card, you’ll earn miles and exclusive perks with the low-cost airline, including 1 Go Rewards Point for every Php200 spent, and 1 Go Rewards Point for every Php100 spent at Cebu Pacific. Plus, you’ll enjoy automatic transfer of points to your Go Rewards number and exclusive access to Cebu Pacific seat sales. It’s the perfect way to get the most out of your travels!

Read More: https://gorewards.unionbankph.com/cebupacific

Criteria for Choosing a Travel Credit Card

Choosing a travel credit card can be a daunting task, but it doesn’t have to be. Here are some criteria to consider when selecting the best travel credit card for you:

Rewards Program

The rewards program is one of the most important factors to consider when choosing a travel credit card. Look for a card that offers rewards that align with your travel preferences. Some cards offer points that can be redeemed for flights, hotels, or car rentals, while others provide cashback or discounts on travel-related expenses.

Sign-Up Bonus

Many travel credit cards offer sign-up bonuses that can be a great way to earn rewards quickly. These bonuses usually require you to spend a certain amount within a specified timeframe. Make sure you can meet the spending requirement before applying for the card.

Most travel credit cards come with an annual fee. Consider whether the rewards and benefits of the card outweigh the cost of the fee. Some cards may waive the yearly fee for the first year, so be sure to check for any introductory offers.

If you plan to use your travel credit card overseas, make sure to check if the card charges foreign transaction fees. These fees can add up quickly and negate any rewards you earn from using the card.

Travel Benefits

Look for a travel credit card that offers additional benefits such as travel insurance, airport lounge access, or concierge services. These perks can make your travel experience more comfortable and enjoyable.

Considering these criteria, you can select the best travel credit card for your needs and preferences.

Benefits of Travel Credit Cards

Travel credit cards are designed to help you earn more rewards and perks when you travel. Here are some of the benefits of using a travel credit card:

Earn Rewards Points or Miles

Most travel credit cards allow you to earn points or miles for every peso you spend on your purchases. These rewards can be redeemed for flights, hotel stays, car rentals, and other travel-related expenses. Some cards also offer bonus points or miles when you make purchases from specific merchants or when you book your travel through their partner websites.

Enjoy Travel Perks

Many travel credit cards offer exclusive perks such as free airport lounge access, hotel and fuel discounts, and exclusive shopping and dining deals from merchants worldwide. Some cards also offer free travel and accident insurance coverage, which can help you save money on your travel expenses.

No Foreign Transaction Fees

You may be charged a foreign transaction fee when you use your credit card to make purchases in a foreign country. However, many travel credit cards waive this fee, which can save you significant money on your travel expenses.

Fraud Protection

Travel credit cards often come with additional security features, such as fraud protection and zero liability for unauthorized purchases. Knowing that your credit card is protected against fraudulent activity can give you peace of mind when traveling.

Build Your Credit

Using a travel credit card responsibly can help you build your credit score over time. By making your payments on time and keeping your balances low, you can demonstrate to lenders that you are a responsible borrower and improve your creditworthiness.

Travel credit cards can be a great way to earn rewards and save money on your travel expenses. However, it’s important to choose a card that matches your spending habits and travel needs and to use it responsibly to avoid racking up debt.

How to Apply for a Travel Credit Card

The process is quite simple if you’re interested in applying for a travel credit card in the Philippines. Most banks and financial institutions offer online applications, making applying from home easy. Here are some steps to follow:

- Research and compare credit cards: Before applying for a travel credit card, it’s important to research and compare the options available. Look at each card’s rewards, benefits, fees, and interest rates to determine which will best suit your needs.

- Check your eligibility: Each credit card has its own eligibility requirements, such as minimum income, age, and credit score. Make sure you meet the criteria before applying.

- Prepare your documents: When applying for a credit card, you’ll need to provide personal and financial information, such as your name, address, income, and employment details. Make sure you have all the necessary documents, such as your ID, payslips, and bank statements, ready to go.

- Apply online: Once you’ve chosen a credit card and checked your eligibility, you can apply online through the bank or financial institution’s website. Fill out the application form and attach any required documents. Some credit cards may require a minimum spend within a certain period to qualify for sign-up bonuses.

- Wait for approval: After submitting your application, you’ll need to wait for approval from the bank or financial institution. Depending on the card and your creditworthiness, this can take anywhere from a few days to a few weeks.

- Activate your card: Once approved for a travel credit card, you’ll need to activate it before you can start using it. Follow the instructions provided by the bank or financial institution to activate your card, which may involve calling a hotline or visiting a branch.

Following these steps, you can easily apply for a travel credit card in the Philippines and earn rewards and benefits on your next trip.

Frequently Asked Questions

What are the top credit cards for travel rewards in the philippines.

Some of the top credit cards for travel rewards in the Philippines include the HSBC Platinum Visa, Citibank PremierMiles Card, and BPI Skymiles Platinum Mastercard. These cards offer generous rewards points or miles for travel-related purchases and other perks like airport lounge access and travel insurance.

Which credit card offers the best travel insurance for international trips?

Several credit cards in the Philippines offer travel insurance for international trips, but the coverage and terms may vary. Some of the credit cards with comprehensive travel insurance coverage include the Citibank PremierMiles Card, BDO Platinum Mastercard, and Metrobank Travel Platinum Visa.

What are the benefits of using a travel credit card in the Philippines?

Using a travel credit card in the Philippines can offer several benefits, including earning rewards points or miles that can be redeemed for travel-related expenses like flights, hotels, and car rentals. Travel credit cards also offer perks like airport lounge access, travel insurance, and discounts on travel-related purchases.

Which Philippine credit cards offer access to airport lounges?

Several Philippine credit cards offer access to airport lounges, including the HSBC Platinum Visa, Citibank PremierMiles Card, and BPI Skymiles Platinum Mastercard. These cards typically offer a certain number of free lounge visits per year or access to a network of lounges.

What are the best credit cards for earning miles on travel purchases in the Philippines?

The best credit cards for earning miles on travel purchases in the Philippines include the Citibank PremierMiles Card, BPI SkyMiles Platinum Mastercard, and Metrobank Travel Platinum Visa. These cards offer generous rewards points or miles for travel-related purchases and other perks like airport lounge access and travel insurance.

Which credit card is recommended for use abroad by Philippine residents?

Several credit cards in the Philippines are recommended for use abroad by Philippine residents, including the Citibank PremierMiles Card, BDO Platinum Mastercard, and Metrobank Travel Platinum Visa. These cards typically offer low foreign transaction fees and other perks like travel insurance and airport lounge access.

Follow the Out of Town Travel Blog on Facebook , Twitter , Instagram , and Pinterest if you want more travel and food-related updates.

Read: Travel the World with UnionBank Miles+ Visa Platinum Card

Written by Team Out of Town

What do you think.

Roman Pan Pizza ‘al Taglio’ Master Alice Pizza Debuts its First Franchise in Asia

How Doc Nielsen cares for dogs — and how you can too

© 2024 by Team Out of Town

With social network:

Or with username:.

Username or Email Address

Remember Me

Forgot password?

Enter your account data and we will send you a link to reset your password.

Your password reset link appears to be invalid or expired.

Privacy policy.

To use social login you have to agree with the storage and handling of your data by this website. Privacy Policy

Add to Collection

Public collection title

Private collection title

No Collections

Here you'll find all collections you've created before.

- Skip to primary navigation

- Skip to main content

- Skip to primary sidebar

Thrifty Hustler

Hustling Towards Financial Independence

Best Travel Credit Cards in the Philippines – Updated October 2023

October 26, 2023 by Thrifty Hustler

If you are fond of traveling or if you travel frequently because of your work, then I highly suggest that you get yourself a travel credit card. The best travel credit cards in the Philippines are highly marketed toward frequent flyers.

They have awesome benefits that will help us travel more comfortably.

Most of these travel credit cards offer free travel insurance , enable users to earn miles or points convertible to miles that can be transferred to participating frequent flyer programs, give access to airport lounges (for free or for a fee), and more.

The best travel credit cards in the Philippines for me are the one that offers at least two out of the three main benefits that I mentioned a while ago.

Table of Contents

What are the best of the best travel credit cards in the Philippines?

The best travel credit card for you will depend on your travel needs and wants.

As travelers, our frequent destinations vary. If you frequently travel only locally then the best travel credit cards for you may be the airline co-branded credit cards in partnership with the frequent flyer programs in the Philippines .

For those who are at the entry salary level at the time being, the Best Travel Credit Cards that you may want to consider are the RCBC Bankard Classic Cards. For only a P1,500 Annual Fee, you have access to airport lounges (for a fee), travel insurance, and the ability to earn points.

For those who are earning somewhere between P400K to P1M, then you have a lot of choices. Check out Security Bank and RCBC Credit Cards as they both offer generous airport lounge access.

The best travel credit card for free lounge access for me is RCBC Bankard JCB Platinum if your frequent destination is local (Philippines), Japan, China, and Hawaii. With RCBC Bankard JCB Platinum, you get unlimited free access to the Skyview Airport Lounge and Club Manila Lounge for the Principal cardholder plus one travel companion.

You’ll also have free & unlimited use of airport lounges in Japan, Hawaii, and China and up to two times per card in one year in Hong Kong, Singapore, Korea, and Thailand.

If you’re a businessman who frequently goes to Japan and China then this is the best card for you.

If these recommendations do not suit your needs, check out the other travel credit cards listed below.

Please note that I arranged these cards based on income requirements so you could easily sort out which travel credit cards you could qualify on.

Note to Readers: Please be advised that the information written here is valid as of the time of writing but may have been updated by the time you see/read this post. Please refer to the linked Philippine bank’s web pages to get the updated details. If the links are not working by the time you see the article, please go to the bank’s homepage.

Here is my list of the best travel credit cards in the Philippines :

Income Requirement: P500,000 and below

Pnb mabuhay miles now mastercard.

Miles/Points Accrual:

- Free 1,000 PAL Mabuhay Miles welcome gift when you activate your card (for new and first-time PNB PAL Mabuhay Miles principal cardholders)

- Low Point-to-Mile Ratio

Travel Insurance:

- Up to P1M covered when you charge your entire roundtrip land, air, or sea tickets to your PNB-PAL Mabuhay Miles NOW Mastercard. Travel-related concerns such as flight delays and lost luggage are covered.

Lounge Access:

Other Info:

- Priority Check-in at PAL Business Centers at Terminal 1, 2 & 3

- Free Purchase Protection Insurance of up to 250K (for first-time PNB Mabuhay Miles Mastercard Cardholder)

- Exclusive 5% Discount on select PAL international flights when you book online via www.philippineairlines.com

- P1000/Year for the Principal Card after the first three years

- Income Requirement: At least P120,000 Gross Annual Income

Click here to learn more about PNB Mabuhay Miles NOW Mastercard

AirAsia Credit Card powered by RCBC

- Welcome gift of up to 8,000 AirAsia BIG Points when you spend at least Php20,000 within the first sixty (60) days from the card issuance date

- Qualified existing RCBC Bankard cardholders will receive 4,000 AirAsia BIG Points

- 2 Big Points for Every P25 AirAsia Spend

- 1 Big Point for Every P28 Non-AirAsia Domestic Spend

- Earn 1 Point for Every P22 Non-AirAsia Overseas Spend

- Not mentioned on its website as of the time of writing

- Access the PAGSS International Lounges in NAIA Terminals 1 & 3 for a fee of US$25. The fee is reversible when you charge a single-receipt or accumulated overseas spend of at least ₱20,000 or US$400 to your RCBC Credit Card, within 90 calendar days from lounge access. To request the access fee reversal, just call (02) 8888-1888.

- Instant upgrade to AirAsia BIG Platinum Membership Status for the first year of card issuance which means you are entitled to priority check-in, boarding, and Xpress Baggage

- You can also use your AirAsia BIG Points to redeem free flights or vouchers from Lazada, SM Gift Pass, Grab, and many more.

- P300/Month for the Principal Card Holder and P150/Month for the Supplementary Card

- Please confirm with RCBC the Income Requirement

Click here to learn more about AirAsia Credit Card powered by RCBC

Diners Club International

- Earn one (1) Travel Mile for every P50

- Free travel insurance up to P5M

Airport Lounge Access:

- As Diners Club International Cardholder, you can avail of one (1) FREE Diners Club airport lounge access per year

- Dual Currency Billing Options

- Access to Diners Club Privileges®

- Income Requirement: At least P33,000 Gross Fixed Monthly Income

- The Principal Card membership Fee is P250/Month

Click here for more information about Diners Club International

Citi Premier Miles Credit Card

Here are some of the benefits of owning a Citi PremierMiles Card:

- Earn 1 PremierMile for as low as P30 (1.6 PremierMile = 1 mile (Effective December 20, 2020) or redeem cash credits (5 PremierMiles = 1 PHP) that you can use to offset your next purchase.

- Never expiring miles

- Up to PHP 1 million in insurance coverage when you charge your travel tickets to Citi PremierMiles

- VIP lounge access at select lounges here and abroad with a FREE DragonPass Membership with two complimentary visits per membership year

- Redeem for flights, hotel stays, car rentals, and activities through Citi ThankYou Rewards

- Income Requirement: At least P360,000 Gross Annual Income

- The Principal Card membership Fee is P5000/Year. The first-year fee is waived.

Click here if you want to apply or if you want more information about Citi PremierMiles and other Citi credit cards

Related Post: Citi PremierMiles Credit Card Review

Cebu Pacific Gold Credit Card by Unionbank

- Earn 1 Go Rewards Point for every P200 Spend

- Earn 1 Go Rewards Point for every P100 Cebu Pacific Spend

- Enjoy a preferential earn rate from Cebu Pacific when you use your card to pay. Earn 1 Go Rewards point for every Php20 spent

- Points are automatically credited to your Go Rewards account

- Not mentioned on the website

- Early alerts to Cebu Pacific Seat Sales plus exclusive sales

- P3000/Year for the Principal Card

Click here to learn more about Cebu Pacific Gold Credit Card

Income Requirement: P501,000 to P999,999

Cebu pacific platinum credit card by unionbank.

Please note though that since this card is a level higher than the Gold, the annual fee is of course more expensive.

- Free travel insurance of up to Php10,000,000

- Complimentary access to the Pacific Club Lounge at NAIA Terminal 3

- P5000/Year for the Principal Card

- Income Requirement: At least P600,000 Gross Annual Income (Please confirm with Unionbank if they have changed this already)

Click here to learn more about Cebu Pacific Platinum Credit Card

American Express® Explorer™ Credit Card

- Earn 1 Membership Rewards® Point for every PHP40 you spend. Points do not expire.

- Convert your Membership Rewards® Points into air miles (1 Membership Rewards® Point = 1 air mile) for free flights with any of the 6 Frequent Flyer Program partners or hotel loyalty points for complimentary stays at 2 Frequent Guest Program partners.

Get up to PHP10,000,000 complimentary travel accident protection when the entire travel fare is charged to your American Express Explorer Credit Card.

- Travel Accident Protection – Up to PHP10,000,000

- Travel Delay – PHP5,000; max of PHP10,000 per family (minimum of 4 hours)

- Emergency Trip Cancellation – Up to PHP200,000

- Missed Connecting Flight – PHP5,000; max of PHP10,000 per family (minimum of 4 hours)

- Baggage Delay – PHP5,000; max of PHP10,000 per family (minimum of 6 hours)

- Baggage Loss or Damage – PHP30,000; Max of PHP80,000 per family and subject to per item limit of PHP5,000

- Complimentary lounge access to Marhaba Lounge in NAIA Terminals 1 and 3 from July 1 to December 31, 2023.

- You can also get 2,000 Bonus Membership Rewards ® Points upon card anniversary when you spend PHP600,000 per annum.

- Your retail purchases are also insured from theft, loss, or damage within 30 days from purchase for up to PHP50,000 per occurrence or a max of PHP250,000 per year. Applicable only when you charge your entire fare to your American Express Explorer Credit Card.

- The Principal Card membership Fee is P4000/Year.

- Minimum Gross Monthly Fixed Income Requirement: ₱ 66,000

Click here for more information about American Express® Explorer™ Credit Card

Metrobank Travel Platinum Visa

Here are some of the benefits of owning a Metrobank Travel Platinum Visa:

- Earn 1 Rewards Point for every P20 spend in all your transactions.

- Earn 1 mile for every P17 spent overseas and on airlines & hotel accommodations

- Please confirm with Metrobank.

- Priority Pass Membership is Free – Pls confirm with Metrobank if access to airport lounges entry fee is free or not

- Exclusive lifestyle offers

- The first supplementary card is Free for Life

- Access to great deals with M Here partner establishments

- Access to VIP Concierge service

- Income Requirement: At least P700,000 Gross Annual Income

- The first-year annual fee is waived. The annual fee is P5,000.

Click here for more information about Metrobank Travel Platinum Visa

Metrobank Femme Signature Visa

Here are some of the benefits of owning a Metrobank Femme Signature Visa:

- Triple (3) Rewards Points for hotel accommodations, hospital bills, salons, spas and all overseas spend

- Exchange points for miles – Asia Miles, PAL Mabuhay Miles, Singapore Airlines KrisFlyer

- Priority Pass Membership is Free – Pls confirm with Metrobank if access to airport lounges entry fee is free or not.

- Priority Pass Membership (Optional) – Pls confirm with Metrobank if access to airport lounges is free or with a fee

- Free 1st supplementary card annual fee

Click here for more information about Metrobank Femme Signature Visa

Security Bank Platinum Mastercard

Here are some of the benefits of owning a Security Bank Platinum Mastercard:

- Earn 2 Points for every P20 spent (Points can be redeemed for miles). Points do not expire.

- Free Travel Insurance. Click here to see the full details.

- Get 2 complimentary lounge access annually (for cardholders and guests combined) in more than 1,000 lounges in 500 airports worldwide via LoungeKey ™

- Please note that starting December 29, 2023, Platinum and World cardholders will be able to access any of the 1,300+ lounges in airports worldwide through Mastercard Travel Pass.

- You will also get unlimited access to the Marhaba Lounge NAIA Terminals 1 and 3. Your card should be active and valid to access the lounge. Travel companions are subject to a USD20 fee per person per visit.

- Dual-currency Billing

- Enjoy exclusive, automatic cashback offers from participating overseas merchants when you travel, shop, and pay with your Platinum Mastercard credit card.

- The first-year annual fee is waived. The annual fee is P4,000.

- Gross Annual Income of at least P780K

Click here for more information about Security Bank Platinum Mastercard

Diners Club Premiere

- Earn one (1) Mile for every P30 charged to your BDO Diners Club Premiere Credit Card.

- For those enrolled in the Dual Currency feature, earn two (2) Travel Miles for every $1 spend.

- Free travel insurance up to P20M

- As Diners Club International Cardholder, you can avail of two (2) FREE airport lounge access per year

- High Credit limit

- Minimum Gross Fixed Monthly Income Requirement: ₱77,000

- The annual fee is P4500/Year for the Principal Card

Click here for more information about Diners Club Premiere

Income Requirement: P1M and Above

Security bank world mastercard.

- Earn 3 Points for every P20 spent ( Points can be redeemed for Miles )

- Get 6 complimentary lounge access annually (for cardholders and guests combined) in more than 1,000 lounges in 500 airports worldwide via LoungeKey ™

- Enjoy exclusive, automatic cashback offers from participating overseas merchants

- Free Accor Plus Membership with One Night Complimentary Stay and 50% discount on dining (as of the time of update). There’s a minimum spend requirement of P90,000 within sixty (60) calendar days from the card approval date (“spend period date”).

- Income Requirement: At least P3M Gross Annual Income (Please confirm with Security Bank)

Click here for more information about Security Bank World Mastercard

PNB Mabuhay Miles Platinum Mastercard

If Philippine Airlines (PAL) is the airline of your choice then consider getting this card instead. Philippine Airlines is known as the flag carrier of the Philippines and it’s one of the most popular choices of airline among locals. It serves a lot of direct routes to international destinations that are frequent by both Filipino tourists and Overseas Filipino Workers.

- Free 2,000 PAL Mabuhay Miles welcome gift when you activate your card (for new and first-time PNB PAL Mabuhay Miles principal cardholders)

- Earn 1 Point for every P48 Spend (1 Point = 1 Mile)

- Additional Free 10000 Mabuhay Miles upon reaching P100K worth of transactions at PAL (for first-time PNB Mabuhay Miles Mastercard Cardholder)

- Free Travel Insurance of up to 3M

Other Benefits:

- Free annual fee for life for all your PNB Supplementary Credit Cards

- Choice of either single or dual currency billing

- P3000/Year for a Principal Card or redeem 12,000 Rewards Points to pay for the Annual Fee

- Gross Annual Income of at least P1.2M (Please confirm with PNB)

Click here to learn more about PNB Mabuhay Miles Platinum Mastercard

PNB Mabuhay Miles World Mastercard

Miles Accrual:

- Additional Free 10,000 Mabuhay Miles upon reaching P100K worth of transactions at PAL (for first-time PNB Mabuhay Miles Mastercard Cardholder)

- Free Travel Insurance of up to 10M

- Airport lounge access with Mastercard Airport Experiences (MCAE)

- P6000/Year for the Principal Card

- Gross Annual Income of at least P2.4M (Please confirm with PNB)

Click here to learn more about PNB Mabuhay Miles World Mastercard

EastWest Singapore Airlines KrisFlyer Platinum Mastercard

- 3 KrisFlyers for every P45 Spend on Singapore Airlines, SilkAir, Scoot & KrisShop spend and International/cross-border, hotel, travel agency, airline, online & international cash advance

- 1 KrisFlyer for every P45 Local Spend

- 3,000 KrisFlyer miles for Php100,000 spend within 3 months from the card activation date (For new card applications only)

- 5,000 KrisFlyer miles for Php100,000 spend within 12 months from the card approval date, and within 12 months between anniversary dates thereafter

- You and your family are covered for up to Php20 Million with comprehensive travel accident and inconvenience insurance when international/domestic air, land, and sea travel fares are purchased using your EastWest Singapore Airlines KrisFlyer Platinum Mastercard.

- Priority Pass membership, inclusive of two (2) complimentary access for you and your guest per year

- Access to Mastercard® Travel and Lifestyle Services

- Eligible for Mastercard® Flight Delay Pass

- P4000/Year for the Principal Card

- Free for life for the 1st Supplementary

- Gross Annual Income of at least P1.2M

Click here to learn more about EastWest Singapore Airlines KrisFlyer Platinum Mastercard

EastWest Singapore Airlines KrisFlyer World Mastercard

- 3 KrisFlyers for every P36 Spend on Singapore Airlines, SilkAir, Scoot & KrisShop spend and International/cross-border, hotel, travel agency, airline, online & international cash advance

- 1 KrisFlyer for every P36 Local Spend

- 6,000 KrisFlyer miles for Php200,000 spend within 3 months from the card activation date (For new card applications only)

- 15,000 KrisFlyer miles for Php100,000 spend within 12 months from the card approval date, and within 12 months between anniversary dates thereafter

- Up to four (4) complimentary access for you and your guest per year to over 1,100 lounges in over 500 airports worldwide (130+ countries), regardless of your airline, frequent flyer membership, or ticket class held via Mastercard® Airport Experiences provided by LoungeKey™ (MCAE)

- The annual fee is P5000/Year for the Principal Card

- Gross Annual Income of at least P2.6M

Click here to learn more about EastWest Singapore Airlines KrisFlyer World Mastercard

EastWest Platinum MasterCard

- Earn one (1) Platinum Rewards Point for every Php40

- Points can be redeemed for Asia Miles, Krisflyer Miles, and Mabuhay Miles

- Free Comprehensive Travel Accident & Inconvenience Insurance of up to Php20 Million

- Free Priority Pass Membership (Usage fee applies)

- Access to Premium Perks and MasterCard Moments

- Free EastWest Platinum Virtual Card

- Access to MasterCard Concierge Service

Click here for more information about EastWest Platinum MasterCard

American Express® Platinum Credit Card

Here are the benefits of owning an American Express® Platinum Credit Card:

- Earn 1 Membership Rewards® point for every P45/1USD spent. Points do not expire.

- You can redeem 1 air mile with every 1 Membership Rewards ® Point.

- Travel Accident Protection – Up to PHP20,000,000

- Travel Delay – PHP15,000; max of PHP30,000 per family (minimum of 4 hours)

- Missed Connecting Flight – PHP15,000; max of PHP30,000 per family (minimum of 4 hours)

- Baggage Delay – PHP15,000; max of PHP30,000 per family (minimum of 6 hours)

- Baggage Loss or Damage – PHP40,000; max of PHP80,000 per family and subject to per item limit of PHP 5,000

- Your retail purchases are insured from theft, loss, or damage within 30 days from purchase for up to PHP75,000 per item or a max of PHP400,000 per year. Applicable only when you charge your entire fare to your American Express Platinum Credit Card. Terms & Conditions apply.

- Complimentary lounge access to Marhaba Lounge at NAIA Terminals 1* and 3. Please note that complimentary access to Marhaba Lounge in NAIA Terminal 1 is until December 31, 2023 only.

- You can book and access premium airport lounges worldwide with LoungeBuddy starting at USD25 – no elite status, lounge memberships, or class of service required.

- Access to Travel Concierge

- Exclusive travel discounts and privileges

- Access to global travel assistance for medical and legal emergencies

- Minimum Gross Fixed Monthly Income Requirement: ₱ 139,000

- The annual fee is P5000/Year for the Principal Card. This is automatically waived when you spend PHP 600,000 in a year.

Click here for more information about American Express® Platinum Credit Card

Metrobank World Mastercard

Here are some of the benefits of owning a Metrobank World Mastercard:

- Earn 1 point for every Php20

- Earn double (2) rewards points for international transactions

- Travel insurance details may have been updated by Metrobank, please confirm with Metrobank.

- Get automatic worldwide insurance for online item purchases with E-Commerce Protection.

- Airport lounge access via LoungeKey network (Usage fee applies)

- Access to premium perks and privileges

- Exclusive invites to special events

- Income Requirement: At least P4M Gross Annual Income

- P6000/Year for the Principal Card. The first year’s annual fee is waived.

Click here for more information about Metrobank World Mastercard

Exclusive and by Invitation Only

Eastwest priority banking visa infinite credit card.

Here are the other benefits of owning an EastWest Priority Banking Visa Infinite Credit Card:

- Each Php10 qualified spend corresponds to one (1) Infinite Rewards Point

- Points can be exchanged for Asia Miles, KrisFlyer miles, and Mabuhay Miles

- VIP Airport Lounge Access – Existing Priority Clients who meet the minimum required Total Relationship Balance can enjoy up to four (4) complimentary access per year.

- Enjoy up to two (2) complimentary access per year to the Marhaba Lounge at NAIA Terminal 3 (Principal Cardholder).

- Access to Premium Perks for Elite Credit Cards

- Access to Global Visa Infinite Privileges

- Concierge Service

- Perpetual Waiver of Annual Membership Fee

- Income Requirement: Exclusive to Priority Banking Clients only

Click here for more information about EastWest Priority Banking Visa Infinite Credit Card

Others – Contact Bank for Income Requirement

Rcbc bankard classic cards.

Here are some of the benefits of owning an RCBC Bankard Classic Cards:

- Earn 1 Point for every Php36 on other spend, or for every Php125 spend on supermarkets, drugstores, or gas stations or, for every Php250 Fast BillPay transaction

- Flexible rewards program – You can exchange points to Airmiles which you could later convert to Asia Miles, PAL Mabuhay Miles, or airasia Points.

- Free travel insurance (Travel Plus Lite)

- Principal cardholders can have access to PAGSS International Lounges in NAIA Terminals 1 & 3 for $25. You can have the access fee reversed when you charge a single-receipt or accumulated overseas spend of at least ₱20,000 or US$400 to your RCBC Credit Card, within 90 calendar days from lounge access (need to make a call to request the reversal).

- 0% Installment for your purchases abroad

- Free purchase protection

- Income Requirement: Contact RCBC

- The annual Fee is P1,500

Click here for more information about RCBC Bankard Classic Cards

RCBC Bankard Gold Cards

Here are some of the benefits of owning an RCBC Bankard Gold Card:

- The annual Fee is P3,000

Click here for more information about RCBC Bankard Gold Cards

RCBC Bankard Diamond Card Platinum Mastercard

Here are some of the benefits of owning an RCBC Bankard Diamond Card Platinum Mastercard:

- Earn 1 Point for every Php50 on other spend, or for every Php125 spend on supermarkets, drugstores, or gas stations, or for every Php250 Fast BillPay transaction

- Free Travel PLUS insurance

- Principal cardholders can have UNLIMITED FREE ACCESS to PAGSS International Lounges in NAIA Terminals 1 & 3 and if you have more than one (1) travel companion, an access fee of US$25 per person.

- You can have the access fee reversed when you charge a single-receipt or accumulated overseas spend of at least ₱20,000 or US$400 to your RCBC Credit Card, within 90 calendar days from lounge access (need to make a call to request the reversal).

- The annual Fee is P2,500

Click here for more information about RCBC Bankard Diamond Card Platinum Mastercard

RCBC JCB Bankard Platinum Credit Card

- Earn 1 Point for every Php36 on other spend, or for every Php125 spend on supermarkets, drugstores, or gas stations, or for every Php250 Fast BillPay transaction

- Earn 1 Point for every Php25 retail transaction in Japan

- Complimentary Travel Insurance & Purchase Protection. See Terms & Conditions on their website.

- RCBC JCB Platinum & Gold Credit Cardholders can enjoy access to Airport Lounges in Japan and Hawaii up to 6 times until March 31, 2024. The lounges can be used once per boarding pass either at departure or during arrival.

- JCB Platinum Concierge Desk

- The annual Fee is P3,600

RCBC Bankard Black Card Platinum Mastercard

Here are some of the benefits of RCBC Bankard Black Card Platinum Mastercard:

- Free-for-Life Supplementary Card (maximum of 5)

Click here for more information about RCBC Bankard JCB Platinum

RCBC Bankard Visa Platinum Card

Here are some of the benefits of RCBC Bankard Visa Platinum Mastercard Card:

- Earn 1 PREFERRED AIRMILE for as low as Php25 for overseas spend or Php48 for local spend. 1 PREFERRED AIRMILE is equivalent to 1 point of your chosen mileage program – Asia Mile, Mabuhay Mile, airasia RewardsPoints

- Free Travel Insurance of up to Php5,000,000 and Purchase Protection when you charge all your international travel-related needs to your card

- e-Commerce Purchase Protection of up to US$1,000 per claim per year for possible losses on online purchases which include non-delivery, wrong or incomplete delivery, or damaged purchases.

- Complimentary Priority Pass™ membership

- Unlimited free access to the PAGSS Lounge in Terminal 1 & 3 for the Principal cardholder plus one travel companion

- Visa Concierge Service for flight, hotel, restaurant reservations, trip planning, and more, available to you 24/7 anywhere in the world

- Increased purchasing power with up to 100% temporary increase in credit limit during your travel period

- The annual Fee is P5,000

Click here for more information about RCBC Bankard Visa Platinum Card

Related Post: RCBC Bankard Visa Platinum Review

RCBC Bankard Visa Infinite Card

The welcome gift to New-to-RCBC Credit Card RCBC Visa Infinite Credit Cardholders can get 100,000 Rewards Points (“Welcome Gift”) for the combined retail spend of at least Php60,000 using their RCBC Visa Infinite Credit Card within 60 days from card delivery. Once the spend requirement is met, simply register here to claim this Welcome Gift .

Here are some of the card’s benefits:

- Flexible rewards program – You can exchange points to Airmiles which you could later convert to Asia Miles, PAL Mabuhay Miles, or airasia Rewards Points.

- Get 5 Rewards Points for every Php30 card usage on overseas in-store or online transaction

- Get 3 Rewards Points for every Php30 card usage on local online transaction

- Get 1 Point for every Php30 card usage on other transactions including purchases at supermarkets, drugstores, and gas stations.

- Get 1 Point for every Php250 Fast BillPay transaction.

- Free Travel Insurance & Purchase Protection

- Unlimited free access to the PAGSS Lounge in Terminal 1&3 for the Principal cardholder plus one travel companion

- 24×7 VISA CONCIERGE SERVICE

- Free-for-Life Annual Fee for Supplementary Card (maximum of 9)

- The annual Fee is P6,000

Click here for more information about RCBC Bankard Visa Infinite Card

RCBC Bankard World Mastercard

- Complimentary Travel Insurance with Travel Medical & COVID-19 coverage and Purchase Protection when you charge all your international travel-related needs to your card

- Worldwide coverage of up to US$200 for your international and local purchases with Mastercard e-Commerce Purchase Protection

Click here for more information about RCBC Bankard World Mastercard

Bank of Commerce World Mastercard

Here is a summary of the benefits of owning a Bank of Commerce World Mastercard:

- Earn 1 Reward Point for every P25 Spend

- Earn as much as 5x Rewards Points with select merchants

- Points can be converted to airmiles with participating frequent flyer miles programs.

- All Principal and Supplementary cardholders up to 70 years old are covered for up to Php 5 million in Travel Accidents, Medical Expenses, and Inconvenience Benefits every time you charge your entire fare for travel (airline tickets and other means of public transport) to your Bank of Commerce Platinum credit card when you travel abroad.

- It provides protection up to a maximum of 15 days for international travel while taking a trip on a common carrier conveyance or scheduled flight, as a fare-paying passenger.

Airport Lounge Access:

- Membership with Loungekey with two (2) complimentary visits per cardholder. Succeeding visits shall be charged to the cardholder.

- Dual-currency

- Luxury Hotels and Resorts Privileges

- World Mastercard® Rewards & Experiences

- Mastercard® Concierge

- Annual Membership Fee: P6,000

- Income Requirement: Contact Bank of Commerce

Click here to learn more about Bank of Commerce World Mastercard

How to know which card is right for you?

1. The first step in identifying which card is right for you is to know these two basic things:

- Does your current annual gross income meet the requirement of your target credit card/s?

- Are you financially ok with paying the corresponding annual fee of your target credit card/s?

2. Are the benefits of the card sufficient for your travel needs? All of the cards mentioned above offer (a combination of) access to airport lounges (for free and for a fee), travel insurance, and the capability to earn miles or points.

You should determine among the list which one offers the most benefit in accordance with your needs.

3. Compare additional value-add services, once you have narrowed down your choices then check out their value-add services. For example, some travel credit cards have cashback options on top of their travel benefits.

Related Posts:

- 10 Things I Wish I Knew Before I Applied for my First Credit Card

- How to Keep Your Credit Card Safe – 10 Important Guidelines

- Should You Get a Credit Card or Not?

This post was originally published on June 16, 2019, and last updated on October 26, 2023.

Are you using one of the above-mentioned credit cards? What are the cards that you consider the best travel cards in the Philippines? Feel free to share your tips and recommendations in the comment section below.

Thank you for visiting Thrifty Hustler: I hope you find value in reading my blog posts. If you liked and enjoyed this article please support this blog by sharing it! You can also follow me on Facebook , Twitter , Pinterest , and Instagram or you can get my updates straight to your email by subscribing.

If you're new here. please check my Start Here page to help you with the navigation. You can also check out my Recommendations page if you wish to see the products and services that I use and that I recommend. Most of the links on that page are my affiliate links and I will earn some commission at no extra cost to you if you use any of my affiliate links. Thank you in advance!

And also, please be advised that posts here are based on my own opinion and personal experience and should not be taken as a recommendation to buy and sell investments, products, services, etc. Please do your own due diligence before making any financial decisions or before purchasing from any links from this blog. Please see my full disclosure here .

Reader Interactions

June 17, 2019 at 3:43 pm

Wow, these are completely different from the ones I’m used to here in the States. Which I guess makes sense, but it’s still surprising that I didn’t see any overlap at all.

Travel cards really are great if you’re planning a trip or just take them regularly. I love the ones where you can apply points to erase credit card charges. I did this once so that I booked a hotel through Mr. Rebates (cash back site), then erased the charges once they hit the card. Doing it that way, I got $40 for my hotel stay… Which I didn’t pay a cent for!

June 18, 2019 at 3:24 am

Thanks Abigail for dropping by 🙂

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Best Travel Credit Cards In Philippines For Air Miles!

The top travel credit cards in Philippines can allow you to earn miles and make it easier to travel on your next trip. Every purchase earns you miles or points. If you are a frequent flyer, then you should check out your preferred airline’s co-branded credit card.

Citi Premiermiles Card

Best for travel, shopping, groceries, dining, entertainment, bill payment.

Main Feature

1 never-expiring PremierMile for every ₱30 spent

Annual Fees

Monthly Interest Rate

Min Annual Income

HSBC Platinum Visa Credit Card

1 air mile for as low as every ₱25 spent

RCBC Bankard Visa Platinum

Best for travel, shopping, groceries, bill payment, fuel.

1 Preferred Air Mile per ₱25 overseas spend/₱48 local spend

Metrobank Travel Platinum Visa

Best for travel, shopping.

1 mile per ₱17 overseas spend

RCBC Bankard Black Card Platinum MasterCard

Best for travel, rewards.

1 non-expiring Rewards point per ₱36/ USD 1 spend on shopping and dining

3.50% / 2.50%

Maybank Visa Infinite

Best for travel, shopping, cash back, rewards.

1% Cashback on Overseas Spend*

Maybank Platinum MasterCard

Best for travel, cash back, pnb-pal mabuhay miles world mastercard.

1 point = 1 Mabuhay Mile

Security Bank Platinum MasterCard

Best for travel, shopping, rewards.

Travel perks and 1 Point for every ₱20 spent

BDO Diners Club Premiere

Best for dining, travel.

1 Travel Mile per ₱30 spend

BDO JCB Platinum

Best for shopping, travel, rewards.

1 Point per ₱40 spend

EastWest Priority Visa Infinite Card

Best for no annual fee, travel, shopping, rewards.

No annual fees for life and 1 Infinite Rewards Point per ₱10 spend

Maybank Visa Platinum

Best for cash back, travel, shopping, rewards.

1% cash back on overseas spend

Bank of Commerce World MasterCard

Best for rewards, travel, shopping, dining, rewards.

5x Rewards Points for travel-related spending

PNB Platinum MasterCard

1 point per ₱70 spend

Notice of Temporary Pause:

We are currently in a period of pause and are not accepting new product applications. We apologize for any inconvenience this may cause and appreciate your understanding during this time. Thank you for your continued support.

Travel Bulletin

10 Best Credit Cards For Travel In The Philippines

- Aug 19, 2022

- CELIA GRACE NACHURA

Travelers typically don’t hold on to their cash for very long before spending it all on a seat sale, a cute hotel room, or an absolutely necessary spa retreat. Hey, we get you! And that’s how we know it’s a must to plan and manage your finances well to hit every destination on your bucket list without going broke.

One of our essentials? A good credit card. In and out of the Philippines, credit cards make spending money easier, more convenient, and more manageable on the wallet. Not to mention, making payments via credit card can be safer when you’re abroad. Plus, perks like airport lounge access, free travel insurance, discounts, and extra miles on frequent flyer programs allow us to enjoy more and spend less. (So that we can travel even more, obviously.)

Citi PremierMiles Card is one of the best credit cards if earning miles is your number one priority. Travellers earn one (1) PremierMile for every ?30 they spend, and as a bonus, these PremierMiles never expire. Anytime you’re planning a trip, these PremierMiles can be converted into miles for flights on over 60 airlines around the world. They can also be converted into hotel points or cash rebates.

At a glance:

- Points/Miles: 1 PremierMile for every ?30 spend

- Insurance Coverage: Up to ?1 million

- Airport Lounge Access: VIP lounge access in local and international airports

- Other Perks: Welcome gift of 30,000 never-expiring miles

- Annual Membership Fee: ?5,000 (first year free)

- Interest Fee: 2%

- Income Requirement: ?360,000 per year

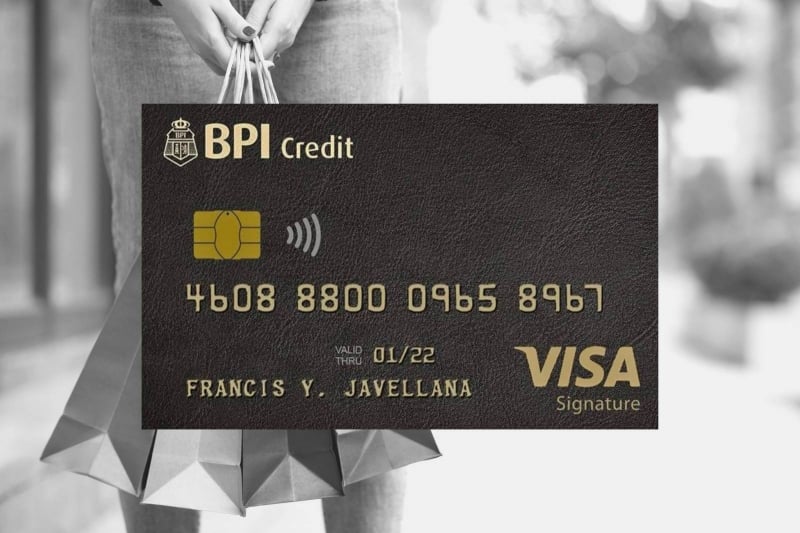

2. BPI Visa Signature Card

If you’re a big spender abroad, BPI Visa Signature Card may be the right pick. The credit card offers surprisingly low foreign exchange rates (1.85%), making it perfect for shopping trips in other countries. Credit card holders also earn one (1) reward point for every ?20 spent, which they can then redeem for miles, shopping credits, or gift certificates. You’ll also enjoy exclusive discounts all year round.

Meanwhile, frequent road trippers looking for credit cards in the Philippines may prefer the BPI Petron Mastercard to get 3% fuel rebates at Petron.

- Points/Miles: 1 point every ?20 spend (can be converted into miles)

- Insurance: Up to ?20 million

- Lounge Access: Access to Pacific Club Lounge at NAIA 3

- Other Perks: Ayala Rewards Circle membership

- Annual Membership Fee: ?5,500 (first year free)

- Interest Fee: 1.82%

- Income Requirement: ?960,000 per year

3. UnionBank Miles+ Platinum Visa Card

Travellers will have a couple of credit cards to choose from at UnionBank. Out of all the options, we’d recommend UnionBank Miles+ Platinum Visa Card to make the most of the bank’s fully-loaded travel program. Local travellers even enjoy more points for travel-related expenses! UnionBank Cebu Pacific Gold and UnionBank Cebu Pacific Platinum are both solid options, too, especially if you’re a frequent Cebu Pacific flyer.

- Points/Miles: 1 point every ?25 spend; 1.5 points every ?25 travel-related spend (can be converted into miles)

- Insurance: Up to ?10 million

- Lounge Access: Access to lounges in NAIA 1 and 3

- Other Perks: Visa payWave experience

- Annual Membership Fee: ?3,000

- Income Requirement: ?600,000 per year

4. HSBC Platinum Visa Rebate Credit Card

Fans of cashbacks won’t be disappointed with HSBC Platinum Visa Rebate Credit Card. Expect high year-round rebates; for essential travel and shopping expenses, you’ll get an impressive 5% cashback. Even your gas money will earn you cashbacks! It’s also ideal for travellers who prefer road trips, with year-round rebates on Caltex fuel purchases.

- Rebates: 5% on shopping and travel, 1% on insurance, and 0.50% on all other transactions

- Insurance: Purchase Protect insurance

- Lounge Access: N/A

- Other Perks: 3% rebate on Caltex fuel year-round

- Annual Membership Fee: Free (until 31 Dec 2022)

- Income Requirement: ?500,000

- Also read: Here’s Why We Should Shift Towards Cashless Payments

5. EastWest Singapore Airlines KrisFlyer Platinum Mastercard

Look no further than EastWest Singapore Airlines KrisFlyer Platinum Mastercard to rake in the miles — specifically, KrisFlyer miles. It has a relatively high annual income requirement, but if you can afford it, this Mastercard is definitely one of the best travel credit cards in the Philippines. Thanks to the generous spend-to-miles conversion rate of EastWest, travellers can earn a bunch of miles quickly and travel more as a result. The low foreign currency conversion fee (1.70%) is also a plus.

- Miles: 3 KrisFlyer miles for every ?45 Singapore Airlines, Scoot, and KrisShop spend; 3 KrisFlyer miles for every ?45 international/cross-border, travel agency, hotel, online, and international cash advance; 1 KrisFlyer mile for every ?45 local spend

- Lounge Access: Priority Pass membership for access to more than 1,300 airport lounges worldwide

- Other Perks: Welcome gift of 5,000 KrisFlyer miles; Priceless Cities Program

- Annual Membership Fee: ?4,000

- Income Requirement: ?1,200,000 per year

6. PNB-PAL Mabuhay Miles World Mastercard

Fly Philippine Airlines often? Then you’ll appreciate the PNB-PAL Mabuhay Miles World Mastercard. As the name suggests, this credit card is designed to maximise your purchases and earn as many Mabuhay Miles as possible to take you around the world. It has a pretty steep income requirement, but if you missed the mark, go for other traveller-friendly PNB-PAL credit cards: PNB-PAL Mabuhay Miles NOW Mastercard or PNB-PAL Mabuhay Miles Platinum Mastercard.

- Points/Miles: 1 Mabuhay Mile every ?30-55 spend

- Lounge Access: 1 free lounge access per year with Mastercard Airport Experiences

- Other Perks: Welcome gift of 2,000 Mabuhay Miles, World Assist concierge service, Priority Check-in at PAL Business Class Counters

- Annual Membership Fee: ?6,000

- Income Requirement: ?2,400,000 per year

7. Security Bank Platinum Mastercard

With an extremely low spend-to-miles conversion, Security Bank Platinum Mastercard makes it extra easy for you to collect rewards points that you can redeem as miles. It’s the main draw of this credit card, although Mastercard’s other perks like concierge services and lounge access are also welcome — it’ll definitely make you feel like you’re a VIP while soaring the skies.

- Lounge Access: 2 free lounge access per year in more than 1,000 lounges worldwide via LoungeKey; Unlimited access to Marhaba Lounge Terminal 1 and 3

- Other Perks: Mastercard concierge services

- Income Requirement: ?780,000 per year

8. RCBC AirAsia Credit Card

RCBC AirAsia Credit Card is your ticket to flying non-stop on the budget airline AirAsia. This co-branded credit card lets you haul in the miles without spending too much. Moreover, cardholders get dibs on exclusive AirAsia rewards and Final Call sales and deals every quarter. And even better, it has one of the lowest minimum income requirements, so it’s accessible even to travellers on a strict budget.

- Miles: 1 airasia point every ?22-25 spend

- Insurance: N/A

- Lounge Access: Access to airport lounges worldwide

- Other Perks: Welcome gift of up to 8,000 airasia points; Priority check-in, boarding, and baggage pick-up

- Membership Fee: ?300 per month

- Income Requirement: ?250,000

- Also read: How to Ditch the Travel Itch When You’re Too Broke to Book a Flight

9. Metrobank Travel Platinum Visa

Featuring the lowest spend-to-mile conversion on this list, Metrobank is undoubtedly among the credit cards in the Philippines that travellers should consider. Great benefits like unlimited lounge access and premium customer service make it even more appealing to travellers who spend most of their time on the go.

- Miles: 1 mile every ?17 spend on airlines, hotels, and foreign currency transactions; 1 mile per ?50 spend on other categories

- Insurance: Up to ?5 million

- Lounge Access: Unlimited access to more than 950 airport lounges worldwide

- Other Perks: 24-hour concierge service

- Annual Membership Fee: ?5,000

- Income Requirement: ?700,000

10. Cathay Pacific American Express Credit Card

If you’ve ever dreamed of swiping your AmEx in your globe-trotting adventures, now’s your chance. Get your Cathay Pacific American Express Credit Card and unlock an array of benefits, including earning Asia Miles instantly upon using your card. High flyers can opt for Cathay Pacific American Express Elite Credit Card for an even more premium experience.

- Miles: 1 Asia Mile every ?42 spend locally or overseas; 2 Asia Miles every ?42 spend on Cathay Pacific

- Lounge Access: Access to more than 1,300 airport lounges around the world

- Other Perks: Free Marco Polo Club membership, 24/7 Global Travel Assistance

- Membership Fee: ?200 per month

Image credit: Johnstocker via Canva Pro

Also read: Bank Transfer Fees + Online Banks With No Bank Charges

Do you have a credit card you use specifically for travel? Let us know what other credit cards in the Philippines you find handy to tote around during your trips!

- ← Previous Post

- Next Post →

Recent post

Photo Ideas for Your Trip to El Nido

The Best Places to Visit in El Nido

How to Survive the Van Transfer from Puerto...

Important notice

To comply with BSP Circular 1160, we have updated the terms and conditions for our cards, personal loan, home loan, and AssetLink products. Please refer to the updated terms and conditions .

We use cookies to give you the best possible experience on our website. By continuing to browse this site, you give consent for cookies to be used. For more details please read our Cookie Policy .

HSBC Platinum Visa Rebate Credit Card

Hsbc platinum visa rebate credit card - earn 5% rebate on online shopping and travel spend, 1% on insurance and 0.5% on all other spend..

Enjoy rebate on shopping, travel, insurance and all other spend

You must have the following:

- An existing locally-issued primary credit card owned for at least 6 months

- A minimum annual income of PHP500,000 for HSBC Platinum Visa

- Compare with other credit cards

- More information

- Guide for applying for an HSBC Credit Card online

Earn 5% rebate on shopping and travel transactions

Enjoy this year-round offer on your shopping (including online) and travel transactions.

Earn 1% rebate on insurance

All rebates are automatically credited to your account monthly.

Earn 0.50% rebate on all other transactions

Start earning on all your HSBC Platinum Visa Rebate Credit Card spend.

Enjoy these other card features:

- Enjoy an annual fee waiver on the 1st year

- Enjoy free Travel Insurance coverage Find out more about free Travel Insurance

- Enjoy fuel savings 6% Rebate on your first Caltex transaction and 3% rebate on your Caltex fuel purchases year-round. Find out more .

- Contactless Credit Card No swiping is necessary when paying for your transactions. Simply tap your card at designated Contactless Credit Card payment terminals here and abroad. Find out more .

- Autocharge HSBC Autocharge is a facility that automatically charges bills to your HSBC Credit Card so you never forget to pay your bills. Find out more .

- Cash Advance You can use your credit card just like an ATM Card to withdraw money here or abroad. Find out more .

- eStatement Get your HSBC Credit Card statements delivered to your email. Find out more .

- Online Banking and Mobile Banking access Conveniently monitor your finances and pay your bills wherever, whenever. Find out more .

HSBC Credit Card features and services

Card Instalment Plan

Enjoy instalment deals with 0% interest and up to 36 months with your HSBC Credit Card.

Cash Instalment Plan

Get cash from your credit card and pay it off on instalment at low interest rates.

Card Balance Transfer

Transfer balances from your non-HSBC Credit Card to your HSBC Credit Card and get big savings!

Card Balance Conversion Plan

Convert your recent expenses on your HSBC Credit Card to affordable instalments, payable up to 24 months.

You might also be interested in

Rewards vs cashback

Are you looking for a credit card that suits your personality and lifestyle? Do you know which one you would prefer more - rewards or cashback?

Things you should know

Related documents .

- *Accelerated Rewards Terms & Conditions (PDF) *Accelerated Rewards Terms & Conditions (PDF) click to download accelerated rewards terms and conditions Download link

- HSBC Visa Platinum Credit Card Rewards Catalogue (PDF) HSBC Visa Platinum Credit Card Rewards Catalogue (PDF) click to download Visa Platinum Credit Card Rewards Catalogue (PDF) Download link

- HSBC Reward Program General Terms & Conditions (PDF) HSBC Reward Program General Terms & Conditions (PDF) click to download accelerated rewards terms and conditions Download link

- HSBC Credit Card Fees & Charges (PDF) HSBC Credit Card Fees & Charges (PDF) click to download credit card fees and charges Download link

- Credit Card Products Terms & Conditions (PDF) Credit Card Products Terms & Conditions (PDF) click to download credit card products terms and conditions Download link

- Credit Card Application Form (PDF) Credit Card Application Form (PDF) click to download credit card application form Download link

*A maximum accumulated monthly spend of PHP60,000 across all qualified merchant categories shall earn accelerated points. HSBC’s Accelerated Terms and Conditions apply (see PDF above).

Fees and Charges

Finance charges:.

- Retail Monthly Nominal Interest Rate: 3% per month

- Retail Monthly Effective Interest Rate: 2.89% per month

- Cash Advance Monthly Nominal Interest Rate: 3% per month

- Cash Advance Monthly Effective Interest Rate: 3.04% per month

Annual fees:

Your annual fee is waived for the first year from your card's issue date. From year 2 onwards, the annual fee will be:

- Primary Card: PHP5,000

- Supplementary Card: PHP2,500

How to apply for an HSBC Platinum Visa Rebate Credit Card

Make sure you read the requirement before applying .

You must have:

- A minimum annual income of PHP500,000

- Proof of Identity with Complete name (at least one of the following) i. Passport, Driver's License, SSS/TIN ID plus NBI Clearance or Voter's ID Note: Proof of Identity should be valid (not expired), photo-bearing and contain date of birth.

- Proof of Residence (Note: Must be under the name of the applicant) i. Valid ID containing the address of the applicant ii. Utility bills (electricity, landline phone, mobile phone or cable TV issued within the last 3 months and must match the permanent and primary address)

Apply in branch

Find your nearest branch and apply in person.

Frequently asked questions

What documentation do i need to provide when applying for an hsbc credit card .

- Passport, Driver’s License, SSS/TIN ID plus NBI Clearance or Voter’s ID Note: Proof of Identity should be valid (not expired), photo-bearing and contain date of birth.

- Valid ID containing the address of the applicant

- Utility bills (electricity, landline phone, mobile phone or cable TV issued within the last 3 months and must match the permanent and primary address)

How long will it take to process an HSBC Credit Card application?

Around 5-10 business days upon submission of a completed application forms and all required documents.

How to avail free Travel Insurance?

You are eligible for free Travel Insurance when you purchase your travel fare using your HSBC Platinum Visa Rebate Credit Card. Terms and conditions apply.

Find out more about free Travel Insurance

How do I get a credit card rebate?

You can get a credit card rebate whenever you use your HSBC Platinum Visa Rebate credit card to book your travels (5% rebate), spend on shopping (5%), pay for insurance (1%), and all other purchases (0.5%). Terms and conditions apply.

Offers and rewards

HSBC Visa offers

Exclusive privileges with your HSBC Visa Credit Card.

Red Hot Deals with HSBC Credit Cards

Exciting offers on shopping, dining, beauty and travel only with your HSBC Credit Card.

Latest offers

Explore all the latest HSBC Credit Card offers available.

Related products

HSBC Premier Mastercard Credit Card

Discover a world of privileges and rewards.

HSBC Gold Visa Cash Back Credit Card

Receive cash back from every transaction and get more savings on every purchase.

HSBC Red Mastercard Credit Card

Enjoy 4x bonus points plus miles.

For inquiries or complaints, please call HSBC's Customer Service at (02) 8858-0000 or (02)7976-8000 from Metro Manila, +1-800-1-888-8555 PLDT domestic toll-free, (International Access Code) + 800-100-85-800 international toll-free for selected countries/regions, or talk to us through Chat by clicking on the icon at the bottom right of our homepage. If you want to find out more about HSBC's customer feedback procedures, please visit hsbc.com.ph/feedback .

The Hongkong and Shanghai Banking Corporation Limited is an entity regulated by the Bangko Sentral ng Pilipinas (Bangko Sentral) https://www.bsp.gov.ph . You may get in touch with the Bangko Sentral Consumer Protection and Market Conduct Office through their Email: [email protected] ; Webchat: http://www.bsp.gov.ph ; Facebook: https://www.facebook.com/BangkoSentralngPilipinas or SMS: 021582277 (for Globe subscribers only).

Deposits are insured by PDIC up to PHP500,000 per depositor.

Note: Do not provide your account or credit card numbers or disclose any other confidential information or banking instructions through chat.

Connect with us

- Credit Cards

- ® " data-destinationurl="https://www.citibank.com.ph/citigold/?lid=PHENCBGCGMITLCitigold" href="https://www.citibank.com.ph/citigold/?lid=PHENCBGCGMITLCitigold" rel="" innerhtml="Citigold ® ">Citigold ®

- Citi Priority

- Personal Banking

- Investments

- Digital Services

- ATMS & BRANCHES

- Citi PremierMiles Mastercard

READY WHEN YOU ARE

Earn never-expiring miles with the Citi PremierMiles Mastercard.

No Citi credit card yet? Know more about our welcome gift here .

Key benefits of PremierMiles Card

1 PremierMile for every PHP30 spend

Convert your miles to redeem airline miles (1.6 PremierMiles = 1 mile) for your future travels or redeem cash credits (5 PremierMiles = 1 PHP) that you can use to offset your next purchase.

Never-expiring miles; use anytime you want

Citi PremierMiles Mastercard features

Use your Citi PremierMiles to pay for any purchase

Convert your big ticket purchase into small payments

Apply for cash in under a minute with the enhanced Citi Mobile App

Freedom to do more with the new citi mobile ® app "> freedom to do more with the new citi mobile ® app.

Everything at a glance

Activate a new card

Secure your transaction

Lock and unlock your card

Powerful features on demand

See your Citi PremierMiles balance

Citi PremierMiles ongoing promotions

ONLINE CARD FEATURES

Pay for your bills with Citi One Bill® and make payments usually paid through a local bank account with Citi PayAll.

Pay for your bills with Citi One Bill® and make payments usually paid through a local bank account with Citi PayAll.

DINE SO FINE

Dine from the comfort of your home by ordering take out or delivery from your favorite restaurants, plus pay a lot less.

LOVE TO CLICK

Enjoy exclusive online shopping deals with your Citi PremierMiles Card and have these delivered to you.

Your world of Citi PremierMiles in less than 15 minutes

Get a new Citi PremierMiles Mastercard ® from your mobile phone or computer in an easy, paperless signup process. A deposit account with Citi is not required.

Get a new Citi PremierMiles Mastercard ® from your mobile phone or computer in an easy, paperless signup process. A deposit account with Citi is not required.

Annual membership fee of PHP5,000. First year free.

Minimum income of PHP360,000 per year

Age 21 or older

Age 21 or older

Welcome gift of 30,000 never-expiring miles

Documents required to apply for a Citi PremierMiles Card

Required Documents: 1 photo-bearing government-issued ID ^

^ For resident foreigners, Foreign Government-issued passport and Alien Certificate of Registration issued by the Bureau of Immigration are acceptable IDs for resident foreigners and must be submitted with any of the following proofs of local residency: a. Immigrant Certificate of Residency (ICR) b. ACR-I-Card with Visa status "Permanent", otherwise, should be valid for more than 1 year c. Visa and Work Permit/Alien Employment Permit (AEP) with validity of more than 1 year d. Special Resident Investors Visa (SRIV) e. Special Resident Retirement Visa (SRRV) f. If employed with the Top 2000 companies, employment contract or letter from company HR printed on company letterhead with name, position and confirmation of term.

Note: valid TIN, SSS, GSIS or UMID number and active landline or mobile phone number are required.

^ For resident foreigners, Foreign Government-issued passport and Alien Certificate of Registration issued by the Bureau of Immigration are acceptable IDs for resident foreigners and must be submitted with any of the following proofs of local residency: a. Immigrant Certificate of Residency (ICR) b. ACR-I-Card with Visa status "Permanent", otherwise, should be valid for more than 1 year c. Visa and Work Permit/Alien Employment Permit (AEP) with validity of more than 1 year d. Special Resident Investors Visa (SRIV) e. Special Resident Retirement Visa (SRRV) f. If employed with the Top 2000 companies, employment contract or letter from company HR printed on company letterhead with name, position and confirmation of term.

Note: valid TIN, SSS, GSIS or UMID number and active landline or mobile phone number are required.

Required Documents: 1. 1 photo-bearing government-issued ID ^   2. Proof of income   a. Latest one month pay slip, or   b. Latest income tax return (BIR 2316) with a BIR (Bureau of Internal Revenue) stamp or with a signature of your employer’s authorized representative, or   c. Original and signed Certificate of Employment that includes your status as an employee, length of service and compensation. 3. Bank statement of your Payroll Account showing your one-month salary