Three ways using Trust My Travel will benefit your business

It is a difficult time to be a travel business. For months, the pandemic decimated demand for travel and restrictions limited people’s options and reduced their confidence in the sector. The situation worsened when some travel businesses acted deceptively to protect cash flow, further degrading consumer trust.

Now that the worst is behind us and the industry is recovering, travel providers must do all they can to increase customer confidence. That’s where Trust My Travel comes in. Our payment, financial protection and fraud solutions make Trust My Travel a must-have addition to your business.

Access a world of payments

Merchant facilities for travel companies, especially start-ups, can be hard to come by. Trust My Travel has the solution. We help immediately by removing risk by financially protecting payments with Protected Processing and Trust Accounts. Additionally, you can instantly appeal to customers in new regions by offering the locally recognised currencies and payment methods they trust.Our solution allows you to utilise our cost-effective partners to sell to customers in North America, South America, Europe, Asia, Australasia and Africa via our centralised solution.

Moreover, we are PCI Level 1 compliant and meet PSD2 requirements by supporting Strong Customer Authentication on checkout. Using Trust My Travel ensures that you will automatically be compliant with PSD2, meaning customer payments are better protected from fraudsters. Additionally, users can enjoy efficient reconciliation with instant records of all of your protected transactions. The Trust My Travel platform houses all reporting, whether you take payment via email link, website or through a Point-of-Sale system. Find live payments data on considerations such as your chargeback ratio on your Trust My Travel dashboard. You can learn more about our payment services here .

Trust Account Payments

A trust account offers the ideal solution for many travel providers: it is the most straightforward and most transparent form of payment protection. Even better, trust accounts benefit both travel providers and customers. After a deluge of refund requests and travel provider insolvency during the pandemic, travellers are feeling understandably nervous about the safety of their money between product purchase and delivery. If a travel provider uses a trust account, their customers can feel confident that their money is protected should things go wrong. You can learn more about Trust My Travel trust account payments here .

We fight fraud, so you don’t have to

Fighting fraud in your travel business is a time-consuming but essential task. Trust My Travel provides a full-scale fraud prevention system designed to lower the chance of outright fraud, friendly fraud and your chargeback ratio. Our monitoring system flags suspicious transactions based on the card/cardholder characteristics. Additionally, dynamic fraud settings based on your traveller’s location protect your business whilst maximising conversion. Users also benefit from specific fraud rule settings developed over years of processing bookings in the travel industry. Trust My Travel’s dedicated fraud specialists handle all fraud and chargeback cases, giving you more time to focus on running your business. You can learn more about Trust My Travel’s fraud tools here .

If you’re interested in learning more about Trust My Travel, please browse our website to learn more about our multi-faceted offering. Please don’t hesitate to contact us if you have any questions about our solutions.

Why The Travel Industry Needs To Embrace Data-Led Insurance: Interview with Sami Doyle

Why The Travel Industry Needs To Embrace Data-Led Insurance: Interview with Sami Doyle 1. How

Four ways to increase conversion at…

Now that travel is on the road to recovery, you’ll want to ensure that your checkout page

Three ways to grow your market effectively

If your goal is to push beyond your current market and attract new, international travellers, there are

2022 Trust My Group All rights reserved. Trust My Group is a trading name of Qubotic Limited.

Registered in England & Wales: 07686 704 VAT Number: 123 332 066

© 2022 All Rights Reserved

Trust My Travel

Last Updated: 2 months ago in Payment Gateways Tags: Payments Settings

Trust My Travel is a global payment gateway. The Rezgo integration allows for direct e-commerce payments through your Rezgo website and Rezgo POS / Back office.

Sign-up for Trust My Travel

To find out more about Trust My Travel and to apply for payment gateway or merchant services on the Trust My Travel website .

Set-up Credentials

Once your account has been created and approved, you will be provided the following credentials:

Attach the Gateway to Rezgo

Copy and paste this information into your Rezgo account by following these instructions:

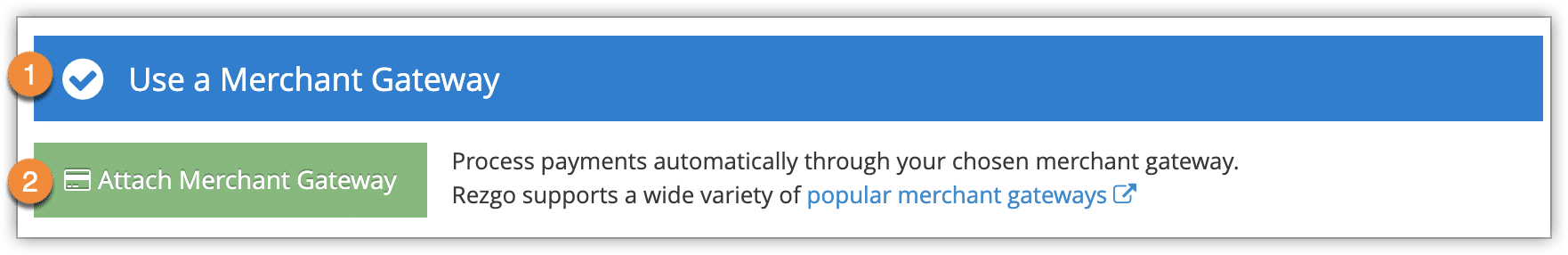

1. Navigate to Settings in the main menu and click Payments You Accept .

2. Click Use a Merchant Gateway (1) and then Attach Merchant Gateway (2).

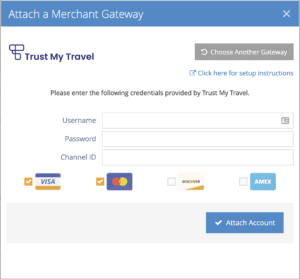

3. Select Trust My Travel from the list of supported gateways.

4. Enter your Username, Password & Channel ID into the spaces provided. Select the credit cards you want to accept.

If successful, the system will show the following success message:

Contact Support

Need onboarding help.

Talk to our customer success team about our onboarding services.

API Documents

Documentation

Latest Support Articles

- How to lock closed desks out of the point of sale

- How to require Ref IDs on point-of-sale bookings

- Release Notes: Rezgo 12.14

- Release Notes: Rezgo 12.13

- How to include transaction comments on order details and receipts

Support Tags

Marketplace

- Finance and Accounting

Trust My Travel (Trust Protects)

Trust My Travel provides payment processing with competitive rates around the world.

FREE TO INSTALL

Financial Protection

Your customers pay an approved Trust Protects Provider safe in the knowledge that their booking is protected against the provider’s insolvency.

Search Tool

With the search tool, customers can quickly and easily check whether their payment has been protected by Trust My Travel.

Increased Consumer Confidence

Trust Protects increases your consumers’ confidence, and it is a great way to demonstrate to consumers you put their financial protection first.

Trust Protects offers intelligent surveillance, digital payment solutions and modernized financial protection for the entire travel payment ecosystem. Trust Protects is the consumer-facing brand that checks and confirms consumers’ payment is protected by a recognized financial failure protection scheme. They work to verify whether the customer’s payment is protected or not and help them should the worst happen. It provides tour operators with increased consumer confidence and a great way to demonstrate to consumers they put their financial protection first.

Launched on March 1st 2010

Integrates with

- Zaui Online Booking Engine

- Zaui Point of Sale

Available for Zaui Enterprise Customers

Worldwide payment processing

- Available for Zaui Enterprise customers.

- eCommerce payments and Mobile Payments

- Seamless integration end to end with Zaui

This app is supported by Trust My Travel

- Get support

- [email protected]

- TMT Knowledge Base

- TMT Contact #

Apps similar to Trust My Travel (Trust Protects)

Providing millions of businesses of all sizes - startups to enterprise - with Stripe you can accept payments seamlessly in Zaui and manage all payment aspects of your travel business.

PayPal Payflow Pro

Add Payflow Pro Payments to your Zaui system and accept payments easily and securely. Payflow works seamlessly with your Zaui platform.

Authorize.net

Authorize.net is a leader in payment processing and is a great choice for those suppliers operating in the United States.

Login to Sandbox

Forgot Password?

Don't have an account? Sign up

TourCMS, a leading online booking and channel management solution is operated by Palisis.

Contact Info

- Terms & Conditions

- Terms of Service

- Privacy Policy

home > support > credit cards > Trust My Travel

Merchant facilities for travel companies, especially start-ups, can be hard to come by. Trust My Travel specialise in offering payment solutions for travel companies, either with one of their group schemes, or with your own merchant account covered by their trust account.

Configuration

Once you are signed up with Trust My Travel they will give you an API token that can be used with TourCMS.

To set up your Trust My Travel gateway in TourCMS, head to "Setup" > "Credit card payments", create a new gateway of type "Trust My Travel" and enter the following:

You can obtain that info logging into your account in TMT backoffice. https://dashboard.trustmytravel.com

Integration

Tourcms hosted solutions.

Trust My Travel (TMT) is fully integrated within the regular TourCMS hosted booking engine, email token based payment process (for requesting payments via email) and back office refunds.

Integrate TMT into your own solution

If you want to work with your own integration of Trust My Travel you should follow instructions for the TMT modal .

Once you have your payment stored, you should use the TourCMS create payment API and pass the required info such as the payment psp reference and the amount to the TourCMS booking. To enable refunds, pass the Trust My Travel reference as follows (this example assumes the TMT infinity gateway is configured in your TourCMS Channel as the web gateway):

- Card fees/email requests

- Trust My Travel

- More gateways...

- Booking Engine Support

- Support index

Introduction

Authentication string, allocations, form configuration, token_error, booking_logged, booking_exists, booking_error, transaction_result_available, transaction_logged, transaction_failed, transaction_timeout, transaction_error, close_window_attempted, modal_closed, transaction validation, existing booking payments, extended authorisation string, environment, disableclosewindowprompt, disablelang, paymentcurrency, transactiontype, nothing happens, form submits, init errors, required field errors, invalid token, expired token, allocation errors, payment failure, invalid data token, tokenex failed to load, authentication, get all api tokens, create an api token, delete a token, delete all tokens, refresh tokens, replace refresh token, get all channels, get a channel, create a channel, update a channel, delete a channel, get all bookings, get a booking, create a booking, update a booking, payment request urls, delete a booking, get all suppliers, get a supplier, get all transactions, get a transaction, create capture transaction, create void transaction, update a transaction, allocations schema, refund a transaction, chargebacks, linked transaction rates, get all payments, get a payment, get all statements, get a statement, get a statement export, get all ledger entries, get a ledger entry, get channel total in ledger.

- Knowledge Hub

- Dashboard Login

The Trust My Travel Payment Modal allows you to process 3DS transactions in multiple currencies with no API use required. It is PCI Level 1 compliant with all sensitive credit card data tokenised by a PCI approved third party vendor.

You have the option of completing the transaction process in the app using a purchase transaction, or retaining control of the transfer of funds by using the app to authorize the customer's card and following this up with a capture request to our API.

- Latest version: 3.6.1

To test the modal implementation in a sandbox environment, you will need to include the following script on your checkout page. This script must always be loaded from tmtprotects.com

<script src="https://payment.tmtprotects.com/tmt-payment-modal.3.6.1.js"></script>

If you don't want to use the TmtAuthstring class you can write your own authentication string generation method based on the example below

Make sure to replace MYCHANNELSECRET123 with the channel secret of the channel you are transacting in.

In order for the Payment Modal to authenticate itself, it passes an authorisation string to the API.

To generate this, you will need:

- A Trust Protects account

- A channel on your Trust Protects account that is ready for processing

- A secret key for that channel.

- The base currency of the channel

- Your Trust Protects site path

These values are used to create a hashed and salted authentication string.

TMT provide a helper class for PHP users via the TmtAuthstring\Create class on the TMT Github Page .

In order to validate the string you generate, you can input your Channel Secret, Channel ID, Currency and Total values into the Auth Test page and ensure that the value you have generated is a correct match.

To further extend integrity of data by including additional fields in the auth string, please refer to the Extended Authorisation String section

Once you are confident that you are successfully generating valid authentication strings, you will need to decide on whether you wish to initialise the modal by passing in an object of required data , or if you would like the modal to injest required data from a HTML form .

Object Configuration

Make sure to replace SITE_PATH with your site path, and AUTHENTICATION_STRING with the authentication string generated as instructed in the previous section.

Once you have generated a valid authentication string , it can be used along with the required values below to configure the modal for use.

In addition, the environment option must be set to test

^Booking data is not required if booking_id is set to the ID of an existing booking

- ^^Optional field

Example: £10.00 of a total of $220.00 is being allocated to a channel with the ID: 23. TMT's charges for the transaction will be deducted from this channel and not the master channel

Example 5% of a total of $220.00 is being allocated to a channel with the ID: 23. TMT's charges for the transaction will be deducted from this channel and not the master channel

Example: £10.00 of a total of $220.00 is being allocated to a channel with the ID: 23. TMT's charges for the transaction will be deducted from the master channel with id = 2. There is no need to indicate this via the request as TMT payments are deducted from the master channel by default.

The Data Object implementation also allows for allocating funds to alternative channels. These allocations can be flat amounts or percentages of the transaction total. You can also nominate which channel incurs our charges.

Allocation Object Fields

Additional Request Fields

- Allocations are only permitted via the Data Object implementation

- Allocation data can be protected from tampering via the verify option

- If you are using the verify option, ensure you order allocation objects the same in the verification as the instantiation

- The channel that incurs TMT's charges must be left with sufficient funds to cover the cost of the charges.

- The total of all allocations + TMT's charges must not be greater than the transaction total.

- test channel to test channel

- live channel to live channel

- live channel to affiliate channel

- If you are setting the transactionType option to "authorize", you cannot include allocations.

Now that you have your modal configured and ready for use, you need to listen on the relevant callback for details on the transaction process.

In order to allow you to capture relevant API data as the modal process occurs, we provide the following callbacks:

If you don't want to use the TmtAuthstring class you can write your own verification method based on the example below:

Once the transaction process is complete, the transaction_logged or transaction_failed callbacks would have been called with the transaction response passed to them. Should you wish to validate a response, you will need to obtain the values for id, status and total as well as the channel secret for the channel you are using.

From there, you can use the TmtAuthstring\Validate class on the TMT Github Page following the example shown.

Extended Use

Bookings can be created in advance of prompting the user for payment. This allows you to create a booking and charge a user a deposit or balance amount rather than the full amount of the booking.

To achieve this, you will need to:

- Generate an API token

- Create a booking

You would then use the ID of the booking as the value of the input with class tmt_booking_id if you are using the form configuration or pass it in via the booking_id field if you are using the object configuration .

If there are other items included in the transaction that you wish to insure against tampering, these values can also be included in the authstring.

The following fields can be included in any implementation:

You can also include the following in the object configuration if you are using allocations

- allocations

- charge_channel

- If you include additional values in the authstring, you must declare them via the verify option.

- Values must be concatenated in alphabetical order of the field they relate to with the timestamp appended afterwards

- If you are including allocations in your authstring, the order of the fields in the allocation objects must match the order of the fields passed to the init method.

- Arrays must be json encoded

- Remove the envirnoment option or set to to live

- Ensure that the channel you are using is in live mode

- The path of your Trust Protects site with no preceeding or trailing slashes.

- The ID of the form containing the required booking and transaction data

- Mandatory for the Form Configuration .

- An object containing all required booking and transaction data

- Mandatory for the Object Configuration

- Different versions of the third party tokenisation tool are used according to whether a channel is in test mode or not. If the channel you are implementing the modal for is in test mode, you will need to set the environment option to test

- For live channels, you do not need to define environment as it defaults to live. You can however set it to live if this suits your implementation

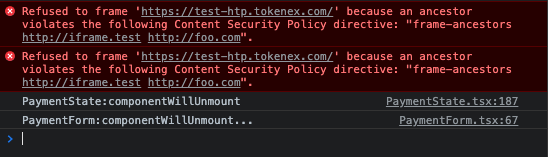

Example, foo.com is an iframe that is serving up the modal within a file on bar.com:

If you are serving up the payment modal from within an iframe, all ancestors in the chain must be defined in a comma separated list with the parent listed first, followed by the origin that will render it and so on up the chain.

Set debug = true to enable validation and error logs in console.

If you have your own means of handling user attempts to close the browser or refresh during transaction you may wish to disable the in-built onbeforeounload close window prompt.

If the translations you require for your customer base are not available, you can disable the translation picker.

The modal is rendered in English by default. Should you know that the user prefers an alternate language, the modal can be set to load in that language should a translation be available . Once loaded, the user is still free to switch languages should they wish. The language which the modal is in at the point of transaction determines what language the user's payment receipt shall be in.

The default behaviour of the payment modal is to offer payment in the base currency of your channel, and allow the customer to change the payment currency as required. Should you know that the customer making payment is based in a country that does not use your channel's base currency, you can improve the user experience by defining their currency to default the payment modal to.

For example, if the base currency of your channel is USD and your customer is based in Germany, you would define the paymentCurrency as EUR as shown.

Should you wish to display your prices in currencies other than your base currency, you will need to utilise your channel's forex feed

We now allow for pre-authorizing a card via the modal leaving you to make a Capture request via an API call in order to capture the payment.

NB: If you intend to use this option, please note the following:

- An authorize transaction will not result in funds being removed from the customer's account. You must complete a capture request in order to complete the transaction

- Authorize transactions are subject to a per transasction fee as are capture transactions

- Authorize transactions can only be captured within a short time frame. This is generally up to 5 days but can differ according to the bank processing the payment. We would advise that you remain well inside 5 days for this to avoid losing transactions

- Allocations are not permitted on authorize transactions and must be included with the Capture request

If you wish to extended the authstring to include other booking and transaction values, you will need to include the verify option in order to pass in an array of the fields that you have included in the authstring.

The following fields can be used in the verify array in any implementation:

You can also include the following in the Object Configiuration

- If you are including allocations in your authstring, the order of the fields in the allocation objects must match the * order of the fields passed to the init method.

Troubleshooting

If you are having difficultly integrating the Payment Modal, please read through the troubleshooting guides below.

Form Implementation

- Can't Initialise Modal

- Token is Invalid

- Token is Expired

- Payment Fails unexpectedly

- Invalid Data/Token

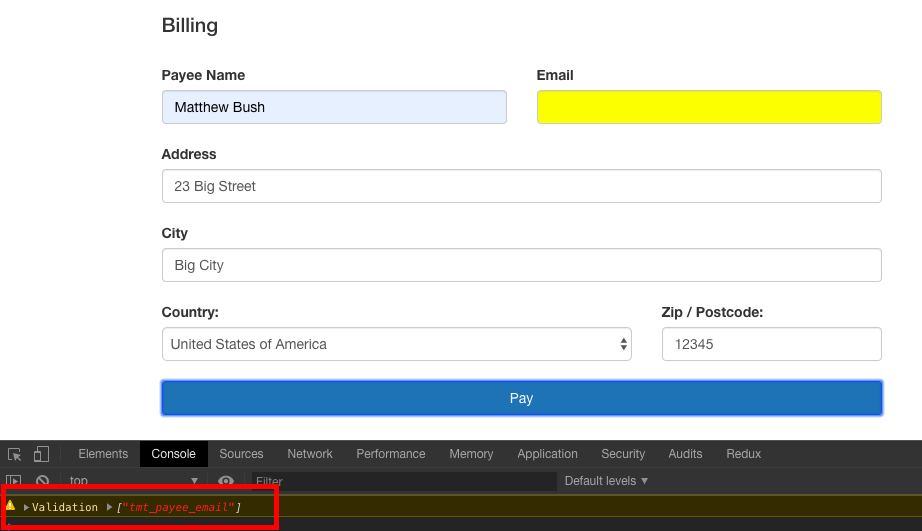

Example of a form implementation input that has been flagged as it has not been completed

You are confident you have completed the integration, you visit your test payment page, click to pay, and nothing happens!

Please check the following:

- That you have an input with the class tmt_payee_name and a value

- That you have an input with the class tmt_payee_email and a value

Note that if either or both of these inputs are visible, then a style attribute would be attached to them in the event of no value being supplied as shown in the code example to the right.

If you have set either or both of these inputs to hidden, then its not immediately obvious if no values are present. If this is the case, it is recommended that you enable debug mode . You should then see output to this effect.

You are confident you have completed the integration, you visit your test payment page, click to pay, and the payment form submits without triggering the modal

Please check the following

- That you have correctly included the Payment Modal scripts

- That no other javascript included on your payment page is triggering errors in console

Example of the path and form ID being correctly passed in for the form implementation

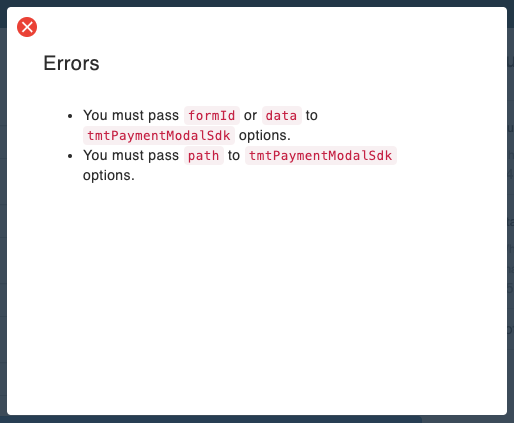

If you do not init the modal with the mandatory options for the implementation you require, then the modal will be triggered as per the screenshot below informing you which mandatory fields are missing.

This error would be resolved by passing a formId and path to the modal init call as per the example on the right

To successfully trigger the Payment Modal, required data must be present and correctly referenced depending on the implementation you are using:

- Form implementation

- Data Object implementation

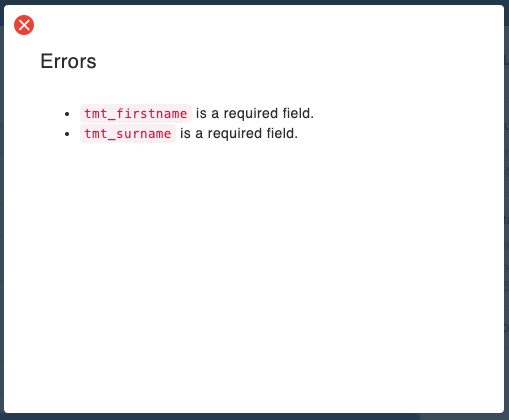

If you do not include all the required fields, the modal will trigger with a error output to indicate the missing fields similar to the below. If you have debug mode enabled, the missing fields will also be output to console.

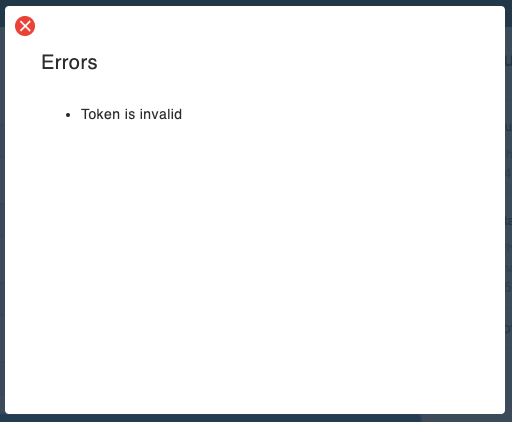

To identify yourself to the modal, you need to pass it a valid authstring . Failure to do this will result in output as per the screenshot below.

Should you receive this error, please check the following:

- Are you concatenating the fields in alphabetical order for the auth string ?

- Are you using the same channel ID as that passed in the form or data object?

- Are you using the base currency for the channel with the ID passed in the form or data object?

- Are you salting the authstring with the channel secret for the channel with the ID passed in the form or data object?

- Have you used the same timestamp in the authstring as the timestamp which is appended to it?

- If you are using additional fields in the authstring, have you declared them in the Verify Option ?

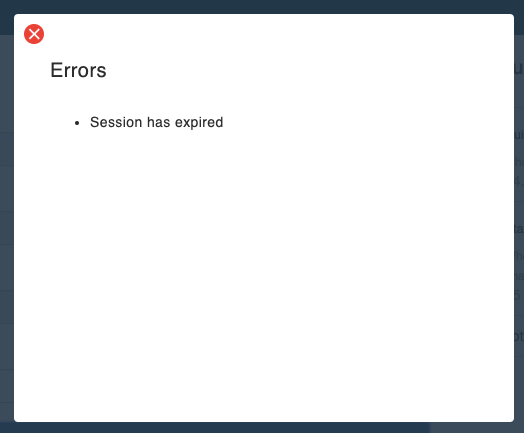

To prevent reuse of tokens, they are only valid for 15 minutes. In order to prevent reuse of expired tokens, a timestamp is added to the authstring and then appended to it so that a duplicate authstring can be built API side for comparison. If you fail to append the timestamp, or if it is older than 15 minutes, you will receive output as per the screenshot below:

Should you receive this error, please check the followung:

- Are you using and appending the same timestamp?

- Are you generating a timestamp in GMT?

- Are you ouputting your timestamp in the format YYYYDDMMHIS?

Example One: Channel 23 receives allocation and incurs charges

Example Two: Channel 23 is master channel and incurs charges

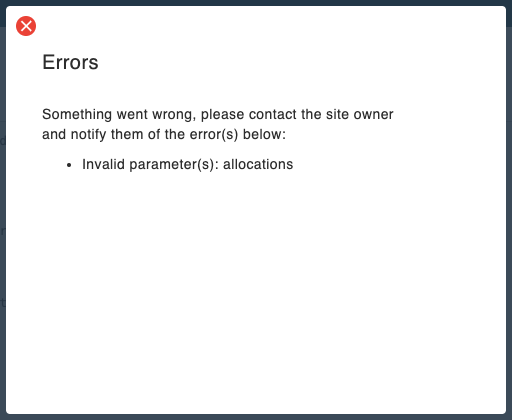

If you are using the data object implementation and including allocations , you may receive output as per the screenshot below after having successfully triggered the modal and entered credit card details:

Should you receive this error, please ensure that the channel that is incurring charges has sufficient funds to meet those charges.

For example, consider a channel with ID = 23, which has a per transaction fee of USD 0.50 and has a credit card percentage of 3.5% applied. The two examples shown on the right would result in too little being available to meet those charges.

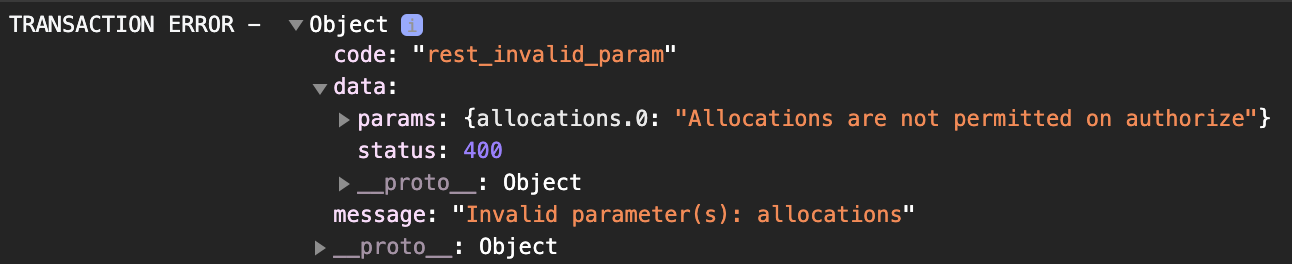

If payments are failing unexpectedly, for example when testing with credit cards that should be passing, please listen on the transaction_error callback as this should give you feedback on where you are going wrong. The example below shows a transaction attempt that has failed as allocations were included on an authorize transactions.

If you successfully run a transaction from end to end, but the transaction fails with "content": "Invalid data/token." , then you have triggered the modal in an environment that does not match that of the channel you are running the transaction in. Cards are tokenised in the environment specified in modal instantiation. API requests made via the tokeniser to the payment gateway are made in the environment of the channel (live or test). If a channel has an account_mode of "live" and the modal is instantiated with environment "test", the card will be tokenised in the test token environment where-as the request will be routed via the live environment. No token will exist in the live environment so the response of "Invalid data/token" will be returned, and the transaction will fail.

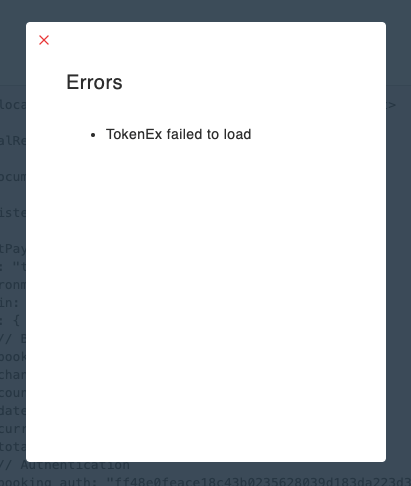

TokenEx are our third party provider for tokenising cards. When the modal is triggered, we initialise their scripts. If we can't initialise their scripts, we can't process payments and this error is displayed.

If you are serving the modal up within an iframe, this error has likely been caused by an incorrect, or no value for origin . This can be verified by checking console logs for errors like the below:

API Reference

All API requests require an authentication header in the form of:

Authorization: Bearer %TOKEN%

where %TOKEN% is replaced with a valid api token or a token retrieved from an authentication request .

On first release of this API, all requests had to be signed with a valid JWT token. In order to facilitate two factor authentication for app users, as well as reducing the requests per round trip, we now provide endpoints for generating API tokens, which can be stored to your environment and used to sign requests. Both methods are included here, but it is recommended that you use api tokens for your integration if you are starting afresh.

Authentication (API Tokens)

Make sure to replace {{path}} with your site path and {{token}} with a valid API or JWT token.

The above command returns JSON structured like this:

HTTP Request

GET https://tmtprotects.com/{{path}}/api-tokens

POST https://tmtprotects.com/{{path}}/api-tokens

Make sure to replace {{path}} with your site path, {{token_id}} with a valid token ID and {{token}} with a valid API token.

DELETE https://tmtprotects.com/{{path}}/api-tokens/{{token_id}}

If you have two tokens, and need to create a new one, you will have to delete one of the existing two tokens even if it has expired.

Make sure to replace {{path}} with your site path, and {{token}} with a valid API token.

DELETE https://tmtprotects.com/{{path}}/api-tokens

Authentication (JWT Tokens)

Make sure to replace {{username}} with your site username, and {{password}} with your password.

POST https://tmtprotects.com/wp/wp-json/jwt-auth/v1/token

Make sure to replace {{path}} with your site path and {{refreshToken}} with a valid API refresh token.

All authentication payloads include a refresh_token in the response. This token can be retained indefinitely and used to obtain a valid JWT token via the refresh token endpoint. The token returned in the refresh token response can be used to sign subsequent API requests.

POST https://tmtprotects.com/wp/wp-json/jwt-auth/v1/token/refresh

Make sure to replace {{path}} with your site path and {{token}} with a valid API token.

You may wish to rotate your refresh token on a regular basis. To do so, make a DELETE /token/refresh request signed with a valid user token. You will receive a new refresh token the next time you complete an auth request.

DELETE https://tmtprotects.com/wp/wp-json/jwt-auth/v1/token/refresh

- All bookings and transactions are created within a channel.

- When making requests to create bookings and transactions, you will need to refer to the ID of the channel they are being created in.

- Bookings can only be created with a currencies values that matches the currencies value of the channel that they are being created in

- Transactions can be paid in currencies that do not match the currencies value of the channel

GET https://tmtprotects.com/{{path}}/wp-json/tmt/v2/channels

Query Parameters

Make sure to replace {{channel_id}} with a valid channel ID, {{path}} with your site path and {{token}} with a valid API token.

GET https://tmtprotects.com/{{path}}/wp-json/tmt/v2/channels/{{channel_id}}

POST https://tmtprotects.com/{{path}}/wp-json/tmt/v2/channels

Make sure to replace {{path}} with your site path, {{id}} with a valid channel ID and {{token}} with a valid API token.

PUT https://tmtprotects.com/{{path}}/wp-json/tmt/v2/channels/{{id}}

DELETE https://tmtprotects.com/{{path}}/wp-json/tmt/v2/channels/{{channel_id}}

GET https://tmtprotects.com/{{path}}/wp-json/tmt/v2/bookings

Make sure to replace {{booking_id}} with a valid booking ID, {{path}} with your site path and {{token}} with a valid API token.

GET https://tmtprotects.com/{{path}}/wp-json/tmt/v2/bookings/{{booking_id}}

POST https://tmtprotects.com/{{path}}/wp-json/tmt/v2/bookings

Make sure to replace {{path}} with your site path, {{id}} with a valid booking ID and {{token}} with a valid API token.

PUT https://tmtprotects.com/{{path}}/wp-json/tmt/v2/bookings/{{id}}

Bookings response including payment request url:

POST https://tmtprotects.com/{{path}}/wp-json/tmt/v2/bookings PUT https://tmtprotects.com/{{path}}/wp-json/tmt/v2/bookings/{{id}}

Should you wish to make use of our Payment Request App, which generates secure URLs to redirect customers to in order to allow them to complete payment, you can request a secure URL when creating or updating a booking by including a payment_request_url=true parameter.

DELETE https://tmtprotects.com/{{path}}/wp-json/tmt/v2/bookings/{{booking_id}}

GET https://tmtprotects.com/{{path}}/wp-json/tmt/v2/suppliers

Make sure to replace {[supplier_id}} with a valid supplier ID, {{path}} with your site path and {{token}} with a valid API token.

GET https://tmtprotects.com/{{path}}/wp-json/tmt/v2/suppliers/{{supplier_id}}

Transactions

The outcome of a transaction is reflected in its status. If a transaction does not have a status of complete then there has been no movement of money (or in the case of authorize transactions, no money has been ring-fenced). In most cases, POST /transactions requests will return a status of complete or failed unless 3DS has been applied, in which case they remain as pending while the customer completes 3DS validation. However, other statuses are possible as detailed below:

GET https://tmtprotects.com/{{path}}/wp-json/tmt/v2/transactions

Make sure to replace {{transaction_id}} with a valid transaction ID, {{path}} with your site path and {{token}} with a valid API token.

GET https://tmtprotects.com/{{path}}/wp-json/tmt/v2/transactions/{{transaction_id}}

POST https://tmtprotects.com/{{path}}/wp-json/tmt/v2/transactions

If you opted to use the modal to create an authorize transaction by using the transactionType option you will need to capture the transaction via an API call. You can apply allocations at this stage if it suits your use case.

If you opted to use the modal to create an authorize transaction by using the transactionType option and decide not to go ahead with capturing the transaction, you should void the transaction via an API call.

Make sure to replace {{path}} with your site path, {{id}} with a valid transaction ID and {{token}} with a valid API token.

PUT https://tmtprotects.com/{{path}}/wp-json/tmt/v2/transactions/{{id}}

- The channel that incurs charges must be left with sufficient funds to cover the cost of the charges.

- You cannot allocate on a transaction that has been paid out

- Allocations cannot be made to channels with account_mode: "protected-processing" if the channel allocating has account_mode: "trust"

- If allocation channel is account_mode: "protected-processing" , default statement_date is today

- If allocation channel is account_mode: "trust" , default statement_date is date of booking

- If allocation channel is account_mode: "trust" , and the channel has a trust override defined, the default statement_date is date of booking - trust override.

To refund a transaction, you make a POST request to the transactions endpoint and include a reference to the ID of the transaction being refunded in the linked_id field. If you are refunding a transaction that included allocations, you can reverse the allocation by including an allocations object in the request. Note that the original transaction must not be released in order for allocations to be refunded.

Allocation Schema

Chargebacks match transactions responses but have additional fields

Chargebacks are applied to your account by TMG staff. Whenever a chargeback is applied, an email is sent to the email address for the channel notifying of the chargeback. Subsequent changes to the outcome status of a chargeback will result in further emails being sent to indicate the change in status.

Chargeback payloads contain relevant transaction and booking data along with additional fields indicating the ARN Number, reason for the chargeback, date the chargeback was raised and when a challenge is due along with the chargeback status and outcome status. All possible values for these fields shown below.

- Transactions that include forex are transactions where the booking total and currency are different from the transaction total and currency

- The booking object must always contain a booking in the base currency of the channel in use and a total in that currency

- The transaction currency can then be set to any currency that the channel provides rates for with the total being set to the converted value

- Any transaction that requires a bookings object can have forex applied to it

- When refunding a transaction that involved forex, the same currency and rate must be used as was used for the original transaction

Obtain rate from transaction response.

If one of the following transactions is being created

The forex_rate returned in the original transaction response can used.

Alternatively, if you are processing the full amount shown in the response, you can simply reuse the totals and currencies shown.

Conversion Example

Once you have obtained a valid rate the tranasction total is caluclated by multiplying it by the total of the booking that is to be acted on.

The rate acquired would give a transaction total of $121.55, which would be passed in as 12155

The payments endpoint returns all internal payments made against a transaction. These payments include processing fees, reserves, forex credits and allocations.

GET https://tmtprotects.com/{{path}}/wp-json/tmt/v2/payments

Make sure to replace {{payment_id}} with a valid payment ID, {{path}} with your site path and {{token}} with a valid API token.

GET https://tmtprotects.com/{{path}}/wp-json/tmt/v2/payments/{{payment_id}}

On Monday and Friday of every week, a statement will be generated indicating total money in and deductions.

GET https://tmtprotects.com/{{path}}/wp-json/tmt/v2/statements

Make sure to replace {{statement_id}} with a valid statement ID, {{path}} with your site path and {{token}} with a valid API token.

GET https://tmtprotects.com/{{path}}/wp-json/tmt/v2/statements/{{statement_id}}

GET https://tmtprotects.com/{{path}}/wp-json/tmt/v2/statements/{{statement_id}}?csv_url=true

As well as viewing a single statement, you can also request a URL for a CSV download that includes the transactions that the statement is based on. This is done by including the csv_url parameter and setting it to true

The URL for the CSV download will be included in response._links.self[0].csv

The ledger endpoint returns all monies ready for release in the next payout period. This includes published statements and ad-hoc credits and debits.

GET https://tmtprotects.com/{{path}}/wp-json/tmt/v2/ledger

Make sure to replace {{ledger_id}} with a valid ledger ID, {{path}} with your site path and {{token}} with a valid API token.

GET https://tmtprotects.com/{{path}}/wp-json/tmt/v2/ledger/{{ledger_id}}

Make sure to replace {{channel_id}} with a valid channel ID, {{status}} with "pending" for ledger owing or "publish" for ledger paid {{path}} with your site path and {{token}} with a valid API token.

GET https://tmtprotects.com/{{path}}/wp-json/tmt/v2/ledger?channels={{channel_id}}&status={{status}}&aggregate=total

The API uses the following error codes:

- Fixed bug where window.onload was not reset ahead of the transaction_result_available callback being triggered. This results in warning dialogs being served to the user if a redirect is attempted within the callback.

- Addition of transaction_result_available callback

- Forced lookups on 3DS outcome

- Prevent AMEX transactions on non-supported currency

- Rename currency and language picker IDs to prevent duplicate declarations

- Fixed bug where transaction_logged callback is triggered twice

- Improvements to 3DS validation outcome look-up

- Enhancements for use with new payment gateway

- Additional browser data captured for 3DS2 transactions

- Updates to TMT branding

- Fixed bug where not all available payment currencies were made available

- Added enhancements for 3DS2

- Installments

- Patch for bug where card tokeniser used incorrect environment settings.

Download WP Travel

Please enter your email to download WP Travel and also get amazing WP Travel offers and Newsletters.

How to Choose Payment Gateway for Travel Agency in 2024?

Home » Blog » How to Choose Payment Gateway for Travel Agency in 2024?

Ensuring a secure and dependable payment process is essential for improving the customer experience.

Whether it’s online payments or contactless payments, optimizing your checkout process can give you an advantage over competitors.

Payment gateways play a crucial role in offering safe and convenient payment methods for customers to book and pay for their purchases.

So, before we dive into the wise process of choosing a payment gateway for a travel agency, I was curious if you are;

Thinking of creating a travel and tour booking website within minutes, without any hassle of coding and hiring highly paid developers? Get WP Travel Pro and start creating a travel booking website instantly.

Little things can matter when you are about to start a travel blog like using the Best Tour Operator Plugin that allows you to create a travel website within minutes versus spending money on hiring highly paid developers consuming weeks of time

You can explore and test the best travel agency themes and templates to find the one that perfectly aligns with your website. This way, you can ensure your website suits your needs and preferences seamlessly.

It’s no surprise that payment gateways have become integral to the payment infrastructure.

Having a travel agency WordPress plugin that includes a payment gateway offers your travel agency the convenience of accepting online payments around the clock.

Whether you’re taking a break on weekends or enjoying a peaceful sleep at night, you can rest assured knowing that the system is active and capable of processing transactions in an instant.

Understanding the significance of having an integrated payment gateway for your travel agency, you might be curious about how to choose the right one to meet your specific needs.

Well, there are a few important factors to consider before selecting a payment gateway for your travel company.

There are several factors to consider when making a decision, but don’t worry, we’ve got you covered. By paying attention to these protocols, you can ensure a seamless payment experience for both you and your customers.

With numerous payment gateway providers available, selecting the right platform for your business can be a challenging task.

Before we delve into the factors you should consider when choosing a payment gateway provider, let’s first understand what payment gateways are and how they function.

Useful article : 10 Reasons Why WP Travel is the best WordPress plugin for travel agencies in 2024.

Table of contents

What are payment gateways , 1. improved cash flow:, 2. swift and efficient payments:, 3. enhanced security:, 1. availability of internet connection, 2. selecting the right online payment system, 3. awareness of service fees, 4. preparedness for increased customer base, 1. system compatibility:, 2. setup time:, 3. budget calculation:, 4. security:, 5. customer experience:, 6. payment methods and currency:, 7. smooth and effortless checkout experience:, 8. customer support availability:, 9. mobile-friendly checkout:, 10. additional features:.

Payment gateways are systems that enable businesses to accept card payments from customers.

These gateways securely collect customers’ card information and transmit the data to the payment processing network.

When a customer books a tour and makes a payment, whether online or in-person using a card or other payment methods, the payment gateway facilitates the transaction by authorizing the card and ensuring the operator receives the payment.

Popular payment gateway providers include PayPal , Stripe , and Authorize.net .

For in-person services, a payment gateway is integrated into a point-of-sale (POS) system or card reader that processes the transaction.

When it comes to online bookings, the cloud-based software connects customers to the operator’s account.

Using a payment gateway provides businesses with a reliable and secure method of processing payments, instilling confidence in customers to engage in transactions.

Additionally, it allows businesses to accept international transactions in various currencies, expanding their global reach.

Moreover, it streamlines the checkout process, offering customers a smooth and hassle-free user experience.

Essential article : How to add different payment systems to your travel website wisely?

Why Do You Need a Payment Gateway For Your Travel Agency?

An online payment gateway integrated into your tour booking system WordPress enhances the transaction process for your clients, ensuring a smooth and secure payment experience.

It guarantees seamless fund settlement, eliminating any concerns or issues for your customers.

By integrating different payment gateway options on your travel website, you gain the ability to accept payments 24/7.

This means your customers can book services and make instant payments at any time, providing convenience and flexibility.

Here are the key reasons why an online payment gateway is essential for your travel agency:

An online payment system offers better cash flow by enabling customers to book and pay for services simultaneously.

This eliminates the need to wait for payment days after the booking, ensuring prompt and hassle-free transactions.

Additionally, you can offer discounts and establish flexible payment schedules for larger transactions, enhancing customer satisfaction.

With an online payment gateway, you can swiftly approve or decline payments, ensuring efficient service.

By setting up clear payment policies upfront, you can avoid delays in receiving payments from customers.

Online payment systems provide a secure environment for conducting business. They minimize the risks of credit card scams and fraud, protecting both your business and customers.

Payment gateways prioritize the safeguarding of customer information and data, instilling trust and confidence in your travel agency as a reliable operator.

What do you need to consider while choosing Payment Gateway?

While utilizing an online payment system offers convenience, there are important factors to consider:

Operating an online payment system requires a reliable internet connection.

If your travel agency operates in remote areas with limited internet access, relying on an online payment system may become burdensome.

Not all online payment systems are equal in terms of features and customer support. Choosing a system that doesn’t meet your business requirements can lead to frustration.

Conduct thorough research to find an online payment system that offers comprehensive features and excellent customer support.

Look for a system that accepts a wide range of payment methods to cater to diverse users.

Before opting for a payment gateway, it is essential to understand the associated service and processing fees.

These may include address verification fees, cancellation fees, chargeback fees, monthly minimum fees, statement fees, and transaction fees.

Familiarize yourself with these fees to avoid any surprises or misunderstandings.

Implementing a web-based online payment system can attract new customers to your travel agency.

However, be prepared for potential challenges if your business has limited resources or staff to handle a sudden influx of customers.

How to Choose a Payment Gateway for Your Travel Agency?

When it comes to enhancing the online transaction process and handling high transaction volumes for your travel business, knowing how to add different payment systems to your travel website is crucial.

Integrating a payment gateway into your travel website is essential, but before making a choice, there are important factors to consider.

Verify that the payment gateway is compatible with your website hosting service and can be seamlessly integrated into your travel website.

Assess the setup time required by the payment gateway. If you need a quick implementation, look for providers that offer a merchant account-free setup, such as PayPal and Stripe.

Evaluate the fee structure of the payment gateway and ensure it aligns with your company budget.

Consider transaction fees, monthly fees, and additional charges like address verification fees, cancellation fees, chargeback fees, monthly minimum fees, statement fees, and transaction fees.

Prioritize security by selecting a payment gateway provider that is Level 1 compliant with the Payment Card Industry Data Security Standard (PCI DSS).

Look for built-in security measures like tokenization to protect customer data.

Choose a payment gateway that provides a user-friendly interface for customers and offers effective customer support.

Ensure the system supports your website and enables a seamless payment and transaction process.

Check if the payment gateway accepts multiple currencies and payment methods, especially if you cater to international customers.

Verify if the accepted card types align with the preferences of your target markets.

To ensure a seamless booking process, it is crucial to have an intuitive and user-friendly customer interface.

Any disruptions or complications during checkout can lead to customer frustration and abandonment of the booking.

A reliable payment gateway platform should offer a hassle-free checkout experience across all devices. It should be optimized for mobile devices and accommodate different network types.

In addition to accepting various payment methods like major credit cards, debit cards, and digital payments, the payment gateway should support multiple languages to cater to customers’ preferences.

A broken payment process can be detrimental to your business. Having access to 24/7 customer support is invaluable in case any issues arise.

Knowing that you can easily reach out to customer support for assistance provides peace of mind during system hiccups or technical difficulties.

Optimize your travel website for mobile devices and choose a payment gateway that offers a responsive and easy checkout experience across various devices and network types.

Consider the specific needs of your travel agency.

Look for payment gateways that offer global solutions, accept various credit cards and currencies, support electronic invoicing, provide smart chargeback management, and offer text/email reminders for customers.

By carefully considering these factors, you can select the most suitable payment gateway that meets the requirements of your travel agency and enhances the overall customer experience.

You might be interested : Guideline of a Complete WordPress Tour Booking System

In conclusion, selecting the right payment gateway for your travel agency is a critical decision that can greatly impact your business’s success.

By considering various factors such as system compatibility, setup time, cost, security, customer experience, payment methods, and device compatibility, you can make an informed choice.

A payment gateway that seamlessly integrates with your travel website offers a user-friendly interface, and supports multiple payment methods will enhance the overall customer experience and build trust.

Additionally, prioritizing security measures and ensuring compliance with industry standards like PCI DSS will protect both your business and your customers’ sensitive information.

Remember to evaluate service fees and understand the terms and conditions associated with the payment gateway to avoid any surprises.

Being prepared for an influx of customers and having reliable customer support available are also vital considerations.

By carefully assessing these factors and conducting thorough research, you can choose a payment gateway that aligns with your travel agency’s requirements, streamlines your payment processes, and ultimately contributes to the growth and success of your business.

If you’re seeking additional information about travel business websites, such as a travel agency WordPress theme for your travel website,

WP Travel could be the answer you’ve been looking for. Offering comprehensive features, WP Travel ensures a seamless and efficient online booking process through its WP Travel Booking Plugin.

Explore this option for an exceptional travel website experience from one of the top travel booking plugins in the market.

If you liked this article, then subscribing to our YouTube Channel for WordPress video tutorials would be the cherry on top.

You can also find us on Facebook , Instagram, Twitter, Linkedin , TikTok , Pinterest , Reddit , and our dedicated engaging Facebook user community ,

Further, if you have any queries, please submit them to our contact page .

Get WP Travel Pro and start creating your travel and tour booking website within minutes without any hassle of coding.

Yam Bahadur Chhetri is a content writer and vivid contributor to the WordPress community and a WordPress enthusiast with an experience of 7+ years in the relative field. He also loves to develop WordPress Themes, Plugins, and custom WordPress development for clients.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

- Join 6000+ WP Travel Users Community Subscribe the newsletter to get new offers, discounts, and product updates frequently.

Get WP Travel Pro

Create Stunning , SEO friendly and Fully functional Travel website within minutes . No Coding Required !

Suitable for any

- Travel Agency

- Tour Booking Services

- Travel Bloggers

Drive more Sales and Revenues from today !

$ 99 99 USD per year

📢 Santa has sent the gift for Christmas and New Year sales on all WP Travel Pro plans. 🛍️ Use coupon code "XMAS_NEWYEAR2024" at checkout.

Related posts

Why should you create travel booking site using WordPress(2024)?

How to Scale Up Your Travel Webdesign Business Online?

WP Travel Engine Alternatives 2024 (Top 9)

Wp travel modules.

Need more features to save your time and to boost your travel business? WP Travel Pro comes with more powerful modules . While our core travel plugin provides almost all the features that a travel and trekking websites generally needs, our add-ons boost it’s capacity further to make it the best travel engine on WordPress. Whether you want to add new payment method to your site or brush up your trekking listings with beautiful maps show casing your trips, we have all your imagination covered. See all our add ons below to boost your travel website’s features further.

Weather Forecast

Import Export

Partial Payment

Connect with wp travel to join the travel conversation, documentation →.

Explore More

Customer Support →

We are here to help.

Facebook Group →

User Community Forum

Follow On Twitter →

Connect with us on Twitter

Non EU/UK businesses

If your business is based outside of the UK or the EU we can still assist you.

The subscription remains the same along with its benefits.

Essential Trust Account – £99.00 monthly subscription fee.

This includes:

- 250 transactions per month

- 20 IACH Payouts per month

- PCI Level 1 Payment Gateway

- Twice Weekly, Weekly or Monthly Pay-outs

Add Your Heading Text Here

However, the processing fees differ for those outside the uk/eu:.

1.5% bank transfers

2.5% UK/EU cards

3.5% non-EU cards

Application form

We understand that nobody wants to go through a complicated and long application process, that is why we have made sure that our process is quick and easy to complete. All you need to do is fill out our online form. We’ll take care of the rest.

Thank you for your message and interest in Trust My Travel.

COMMENTS

Trust My Travel is a fully managed subscription solution for travel businesses who need to provide package travel protection for their travellers. Use the platform to receive, protect, and allocate consumer payments for their travel bookings. ... PCI Level 1 Payment Gateway. Twice Weekly, Weekly, or Monthly Pay-outs. B2C Financial Protection ...

Overview. Trust My Travel provides a financially protected payment solution, exclusively available to Travel Providers. They connect a worldwide network of partners and institutions to combine multiple payment products in one solution, currently being used by tour operators and OTAs alike, in over 70 countries.

Trust My Travel offers travel merchants a straightforward, scalable and sustainable way to protect their travellers and accept global payments: Trust Account, Protected Processing, Multi-Currency Pricing and Supplier Payments - all available through one digital platform. Perfect for: Travel Merchants. The behind the scenes API technology that ...

That's where Trust My Travel comes in. Our payment, financial protection and fraud solutions make Trust My Travel a must-have addition to your business. Access a world of payments. Merchant facilities for travel companies, especially start-ups, can be hard to come by. Trust My Travel has the solution.

Trust My Travel specializes in offering payment solutions for travel companies, either with one of their group schemes or with your own merchant account covered by their trust account. ... To set up your Trust My Travel gateway in TourCMS, head to "Setup" > "Credit card payments", create a new gateway of type "Trust My Travel" and enter the ...

3. Select Trust My Travel from the list of supported gateways. 4. Enter your Username, Password & Channel ID into the spaces provided. Select the credit cards you want to accept. 5. Click Attach Account . If successful, the system will show the following success message: Trust My Travel is a global payment gateway.

Trust My Travel: Payment Modal. Demos and Documentation. Latest Version: Version 3.6.1 Supported Versions. Version Demo; 3.6.1: Version 3.6.1 Demo: 3.6.0: Version 3.6 ...

Trust My Travel (Trust Protects) Trust Protects offers intelligent surveillance, digital payment solutions and modernized financial protection for the entire travel payment ecosystem. Trust Protects is the consumer-facing brand that checks and confirms consumers' payment is protected by a recognized financial failure protection scheme.

Trust my Travel can see the need for an out of the box solution with a payment gateway and financial failure insurance all in one place. No shopping around for separate insurances or policies . Why Now? With PTR reform on the horizon and more travel providers not wanting to have a Bond we want to offer an alternative, more cost effective ...

Once you are signed up with Trust My Travel they will give you an API token that can be used with TourCMS. To set up your Trust My Travel gateway in TourCMS, head to "Setup" > "Credit card payments", create a new gateway of type "Trust My Travel" and enter the following: You can obtain that info logging into your account in TMT backoffice ...

Overview. To begin using the Trust My Travel Payment Modal, you will need: A TMTProtects account. A channel on your TMTProtects account that is ready for processing (nb this can be a channel in test mode). A secret key for that channel. The base currency of the channel. Your TMTProtects site path. See the Channel Data page and Site Path page ...

The Trust My Travel Payment Modal allows you to process 3DS transactions in multiple currencies with no API use required. It is PCI Level 1 compliant with all sensitive credit card data tokenised by a PCI approved third party vendor. You have the option of completing the transaction process in the app using a purchase transaction, or retaining ...

Overview. Trust My Travel provides a financially protected payment solution, exclusively available to Travel Providers. They connect a worldwide network of partners and institutions to combine multiple payment products in one solution, currently being used by tour operators and OTAs alike, in over 70 countries.

Set Up Payment Gateway: Authorize.net. Set Up Payment Gateway: Beanstream (Now Bambora) Set Up Payment Gateway: eWay. Set Up Payment Gateway: First Data. Set Up Payment Gateway: Flywire. Set Up Payment Gateway: Gestpay. Set Up Payment Gateway: Nab Transact (API) Set Up Payment Gateway: Payway. Set Up Payment Gateway: Secure Pay (API)

This must be dated within the last 3 months and show your business name and address. If you are in a serviced building, then a rental invoice will be sufficient. Examples of utility bills accepted are Water, Gas, Electric, Internet. Office Phone. The best number for us to contact you between 9am - 5pm UK time.

To begin using the Trust My Travel Payment Modal, you will need: A TMTProtects account A channel on your TMTProtects account that is ready for processing (nb this can be a channel in test mode). A secret key for that channel. The base currency of the channel Your TMTProtects site path See the Channel Data page and Site Path page for further detail.

Look for built-in security measures like tokenization to protect customer data. 5. Customer Experience: Choose a payment gateway that provides a user-friendly interface for customers and offers effective customer support. Ensure the system supports your website and enables a seamless payment and transaction process.

If you are looking to find a particular transaction or payment that is included in your statement, you can do so by clicking either of the below tabs; Transactions. By clicking the 'Transactions' button you can view each transaction that is included in the statement. Payments. By clicking the 'Payments' button you can view each credit ...

Our payment gateway integrations allow merchants to reach new shoppers across different regions and countries using methods they recognise and trust - sometimes even more than traditional card payments! ... Expand your payment options with the ability to accept credit card payments instantly and use debit, mobile and a broad range of ...

The subscription remains the same along with its benefits. Essential Trust Account - £99.00 monthly subscription fee. This includes: 250 transactions per month. 20 IACH Payouts per month. PCI Level 1 Payment Gateway. Twice Weekly, Weekly or Monthly Pay-outs.