- Search Please fill out this field.

- Manage Your Subscription

- Give a Gift Subscription

- Sweepstakes

- Airlines + Airports

How to Use Airline Flight Credits — So You Never Lose Out Again

Here’s what you need to know about using flight credits — including the specific rules for Delta, American, and other top airlines.

:max_bytes(150000):strip_icc():format(webp)/ProfilePicturewithPurpleBackground-664a02d95891481192058cd33c92d512.png)

What are flight credits?

How to use a flight credit, what to know about flight credit expiration policies.

- Airline-specific Flight Credit Rules to Keep in Mind

Ralf Hahn/Getty Images

Fight credits can come in many different forms, but they are usually the result of a canceled flight. Since the ability to cancel or change a flight without fees has become more commonplace over the last few years, flight credits have also become something frequent fliers are dealing with more often.

Using flight credits can be confusing because their terms and conditions aren’t universal — every airline has its own set of rules regarding flight credits. Here’s everything you need to know about flight credits, including how to use them, when they expire, and how to extend them. Plus, we’ll look at flight credit policies from five major U.S. airlines.

Related: What to Do If Your Flight Is Canceled, According to a Travel Expert

Flight credits, also referred to as travel credits, are credits received after canceling a flight. They are usually tied to the original ticket, so keep that information handy when you are ready to re-book your flight.

Generally, you’ll be able to book a new flight using a credit on your airline’s website. If your original ticket had multiple forms of payment, you may need to call to complete a booking using a flight credit.

If you booked the original ticket through a travel agency, you’ll need to contact the travel agency to cancel the flight and again when you want to book a new ticket with the flight credit.

Flight credits usually have an expiration date. While the length of time a credit is valid varies by airline, more often than not, they are good for one year.

Remember that some airlines start the one-year clock when the original ticket was issued, not when the flight credit was generated. So, if you book a flight and then need to cancel it six months later, your flight credit may only be valid for an additional six months.

Anna Harrison, a travel advisor and owner of Travel Observations, an affiliate of Gifted Travel Network, who is also a member of the American Society of Travel Advisors, always reminds clients of another important factor when considering flight credit expiration dates. “Remember ‘fly by’ dates can be different than ‘book by’ dates,” she stresses.

Check with your specific airline to see if you need to book your travel by the flight credit expiration date or if you actually need to travel by that date. Whether or not you can extend a flight credit after its expiration depends on the specific airline. However, most flight credits can’t be extended after their original expiration date.

Caroline Purser/Getty Images

Airline-specific Flight Credit Rules to Keep in Mind

Delta air lines ecredits.

Delta Air Lines flight credits are called eCredits, and they can be used toward the payment of any Delta flight, including taxes and fees. Passengers can use up to five eCredits at a time.

Delta eCredits can be generated from an unused or partially used ticket, as compensation for service issues, from ticket exchanges that result in unused funds, or from e-gift certificates.

To redeem your Delta eCredit, you’ll need your 13-digit eCredit number that begins with 006.

Delta eCredits are valid for one year from the day the original flight was booked, and travel must be booked by the expiration date.

American Airlines Flight Credits

American Airlines has three types of travel credits: trip credit, flight credit, and travel vouchers. We’re focusing on flight credits, which are issued for canceled flights or unused tickets. AA flight credits can be used to book non-award flights only. These credits can’t be applied to extras like seat charges or baggage fees .

The flight credit must be used on travel that begins within one year of the original travel date, not from when you cancel the original flight. If you book your flights far in advance, this can leave you with a short amount of time to use the credit.

Reservations using flight credits can be booked online for flights within the U.S., Puerto Rico, and the U.S. Virgin Islands using the record locator or ticket number of the original flight. For reservations using more than one flight credit or for international travel, you’ll need to call American Airlines to book. American Airlines flight credits aren’t transferable — they can only be used for the person named on the original flight — and they can’t be extended past their expiration dates.

JetBlue Travel Bank Credits

JetBlue flight credits are also called travel bank credits. Travel credits can be used for JetBlue flights, including taxes, the air portion of a JetBlue Vacations package, change fees on Blue Basic fares, and increased flight costs due to a change on a Blue Basic ticket. The passenger name doesn’t have to match the name of the travel bank account holder, so it’s easy to use your JetBlue flight credits for someone else.

JetBlue travel credits can’t be used for any other charges, including baggage fees , Even More Space seats, or pet fees.

To redeem your JetBlue flight credits without a TrueBlue account, you’ll need to create a Travel Bank account. Once you have travel credits, you’ll get 2 emails from JetBlue containing your Travel Bank username and a temporary password, which will allow you to set up an account. If you have a TrueBlue account, you’ll be able to see the amount of your flight credits in the Travel Bank Credit section of your online account.

JetBlue travel credits are valid for one year from the original ticketing date. Unlike many airlines, you only need to book your travel by the expiration date, but travel can be completed after the credit expires. If a reservation made using a JetBlue travel credit is canceled, the credit expiration date will not reset. JetBlue travel credits can’t be extended.

United Airlines Future Flight Credits

If you cancel a United Airlines flight or change to a less expensive itinerary, you’ll receive a future flight credit. In addition to airfare, these flight credits can be used for extras like seat selection when they are chosen during the booking process. Future flight credits can only be used for the person named on the original flight that was canceled or changed.

To use a flight credit, choose your flight on the United website or mobile app as you normally would. During the checkout process, select Travel Credits as your payment method, and any credits you have will be applied to your total. You can combine multiple future flight credits to pay for one transaction, but they can’t be combined with travel certificates.

If you want to combine your future flight credits with PlusPoints, book your flight with the flight credits first, then request a PlusPoints upgrade.

Future flight credits expire one year after the date they were issued, and your travel must begin by that date to use the credit. Credits can’t be extended.

Southwest Airlines Flight Credits

Southwest flight credits, previously called travel funds, are created after canceling a flight or changing a flight to a lower-priced itinerary. They are easy to use online, and they never expire .

These flight credits are tied to your original flight number. When paying for a new flight, look for the payment section labeled Apply Flight Credits, LUV Vouchers, and gift cards . Then, enter the confirmation number from the original flight and the passenger’s first and last name.

If the original flight that generated the flight credit was a Wanna Get Away fare, it’s non-transferable. If the flight credit was generated from a Wanna Get Away Plus, Anytime, or Business Select fare, it can be transferred to someone else.

How to use travel credits when booking a flight on all 11 major US airlines

- The upcoming holiday travel season is the perfect time to offload travel credit from flights canceled during the pandemic.

- Travel credit is often issued in lieu of a refund so an airline can keep the cash paid for the original flight.

- Each airline is different in how flyers can use credit and this step-by-step guide for all 11 major US airlines explains how to book flights using it.

- Visit Business Insider's homepage for more stories .

If you voluntarily canceled a flight during the pandemic, chances are that you received a travel or flight credit and not a cash refund.

Issuing a credit is the preferred method for airlines instead of cash refunds. It's almost like an interest-free loan for airlines as it lets them keep the money paid for a flight without having to provide the service until a later date.

With the holiday season fast approaching, travelers are contemplating returning to the skies, and now is the perfect time to use up that credit before it expires.

Each airline is different in what they'll allow the credit to be used for. Some airlines require that the same passengers use the credit while others are transferable. Credits may also be used to purchase extras like seat assignments or baggage allowance, depending on the airline.

Prospective flyers seeking to use a credit should call their airline to confirm what it can be used for and if their credit can be used multiple times if the full amount won't be used up in one trip. But once that's all done and it's time to book, the process is quite simple.

Here's a step-by-step guide on how to use travel credits when booking a flight on all 11 major US airlines.

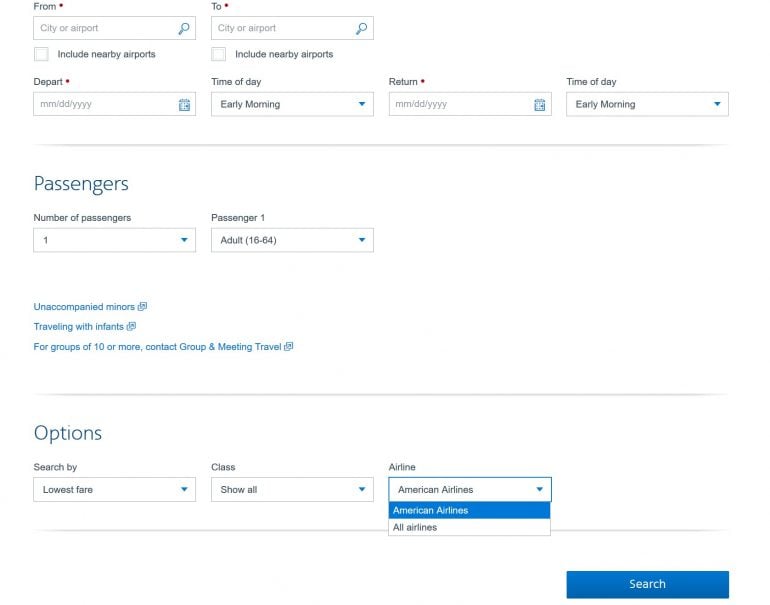

American Airlines: Start by searching for a flight as you normally would from the airline's homepage.

Then, select the flight you'd like to take.

Once you're ready to book, move forward through the booking process as normal. Enter your passenger information, select your seats, and so on.

Once you arrive at the "review and pay" page, that's when you can enter your travel credit information.

Scroll down to "how do you want to pay for your trip" and select "add flight credit."

It will open this window and ask for your ticket number from the canceled flight for which you received a credit.

That can be found in the booking email.

Just scroll down to the payment information and the ticket number should be right there.

Once that's in, enter your credit card information (if there's a difference between the credit amount and the fare) and pay as normal.

Delta Air Lines: Start by searching for a flight as you normally would from the airline's homepage.

Once you arrive at the "review and pay" page, that's when you can enter your travel credit.

Scroll down to "payment" and select "use eCredits" in the top right corner.

It will open this window and ask for up to three eCredit numbers from the canceled flight or flights for which you received a credit. Delta will have sent an email with the eCredit number.

United Air Lines: If you have a future flight credit with United, you wouldn't start the booking process as normal.

Instead, go to "my trips" on the homepage. It will ask for the confirmation number for the flights in which you canceled to receive the credit, and your last name.

The website will then show you how much credit you have to use and by when you need to rebook. When you're ready to proceed, hit "book with credit."

Then, search for a flight as normal.

Prices will then reflect the difference you'll have to pay, not the actual cost of the flight.

Select the flight you wish to take.

Then, you can book as normal since the discount is already applied.

If United gave you an electronic travel credit, you'll have to start over and search for the flight as if it was a new booking altogether.

Once you've selected your flight and have reached the payment page, scroll down to "payment information" and select "travel certificates."

You can then enter the pin code and your last name to retrieve the credit. Once applied, you can book as normal.

Southwest Airlines: Start by searching for a flight as you normally would from the airline's homepage.

The "passenger & payment info" page is where you'll enter the travel credit information.

Once you've entered in all the required passenger information, hit "continue to payment."

Scroll down to and click "apply travel funds, LUV vouchers, and gift cards." You'll then enter in the confirmation number and passenger information from the canceled flight for which the credit was issued.

Frontier Airlines: Start by searching for a flight as you normally would from the airline's homepage.

Once a flight is selected, proceed normally through the booking process by entering passenger information, choosing any extras, and so on.

The "payment" page is where you'll enter the travel credit information.

Scroll down to "add additional payment" under the credit card section and select "Frontier voucher."

It'll then ask for the email address and confirmation number of the canceled flight for which the credit was issued.

You can use some of the credit or all of it. You should also check to see if any residual value will go back to the credit as some airlines choose to operate under a one-time use policy when it comes to travel credits.

The amount of the credit with then be taken off of the purchase price.

Spirit Airlines: Start by searching for a flight as you normally would from the airline's homepage.

Scroll down to "redeem a voucher or credit" just above the credit card section.

It'll then ask for the voucher number – if you have a voucher – or the confirmation number of the canceled flight for which the credit was issued.

JetBlue Airways: Start by searching for a flight as you normally would from the airline's homepage.

If you're a TrueBlue member, you should sign in as it makes it easier to access the credit on the next page.

The "review trips" page is where you'll enter the travel credit information.

Scroll down to "payment details" and find "apply JetBlue funds" just above the credit card section.

Click the box for "travel bank" and if you're logged into TrueBlue, the credit amount should come up. If you're not a TrueBlue member, a separate travel bank account with login information would've been emailed to you.

You can use any amount of the credit and any unused portion will remain until its expiration date.

The discounted price will then show under "payment amount."

Alaska Airlines: Start by searching for a flight as you normally would from the airline's homepage.

The "checkout: review and complete payment" page is where you'll enter the travel credit information.

Scroll down to "wallet and certificates" just above the credit card section. If you're logged in to Mileage Plan, the travel credit should appear until "wallet funds." If you're not logged in, you can check the "use certificates or gift cards (not deposited in a wallet account)" box.

You'll then be asked to enter the certificate code and pin, followed by a security verification check.

Allegiant Air: Start by searching for a flight as you normally would from the airline's homepage.

The "payment information" page is where you'll enter the travel credit information.

Scroll down to "do you have an Allegiant voucher or promo code" section, just under the travel insurance offer.

You'll then be asked to provide a voucher number from the canceled flight for which the credit was issued.

Sun Country Airlines: Start by searching for a flight as you normally would from the airline's homepage.

The "review & pay" page is where you'll enter the travel credit information.

Scroll down to the "payment" section, and select "use a Sun Country flight credit or voucher."

You'll then be asked to provide the confirmation code and last name or a voucher number from the canceled flight for which the credit was issued.

Hawaiian Airlines: The airline requires customers booking with a travel credit to call its reservations department at 1-800-367-5320 for US and Canada residents.

Flyers can also call the reservations department of any airline for assistance with booking using a credit.

- Main content

Our system is having trouble

Please try again or come back later.

Please tell us where the airport is located.

Any searches or unfinished transactions will be lost.

Do you want to continue your session?

What are the perks of a Southwest, American Airlines credit card?

If you’re a frequent flyer, you may want to consider a credit card with your favorite airline.

According to NerdWallet, credit cards with airlines can quickly be justified with their annual fees if you take advantage. Some perks include bonus miles that can be redeemed for free travel, free luggage and more. Some cards also grant access to airport lounges usually only given to those with elite frequent flyer status or taking international trips.

The redemption value of points and miles varies between airlines and can change at any time.

Here’s what Southwest , American , Delta and United all offer for their credit cards.

Southwest Airlines

Southwest offers its own Rapid Rewards credit cards in four different kinds: plus ($69 annual fee), premier ($99 annual fee), priority ($149 annual fee) and a business card. Every credit card earns a certain amount of points on the card owner’s anniversary.

Currently, there’s a promotion to earn 50,000 points after you spend $1,000 on purchases in the first 3 months from account opening. There are no foreign transaction fees and each card earns 1 point per $1 spent. Cardholders can also earn two points for every $1 spent on Southwest purchases.

The Southwest credit card is a Chase Visa card.

American Airlines

American offers AAdvantage credit cards in four different types: Platinum Select World Elite ($99 annual fee), MileUp (no annual fee), Executive World Elite ($595 annual fee) and a Business World Elite card ($99 annual fee).

American also offers a promotion for bonus miles earned after a certain amount of purchases placed on each card. The Platinum Select World Elite card offers 50,000 bonus miles after $2,5000 in purchases are made within the first three months of opening. Cardholders also earn miles with every purchase.

The AAdvantage credit cards are Citi Bank Mastercards.

United Airlines

United Airlines offers four Mileage Plus credit cards: the United Gateway (no annual fee), United Explorer ($95 annual fee), United Quest ($250 annual fee) and the United Club Infinite card ($525 annual fee). There are also business and business club cards marketed towards small business owners.

United currently has a promotion for bonus miles on each card, depending on the card you get. The United Gateway card, for example, offers 20,000 bonus miles for an introductory offer.

The United Airlines Mileage Plus cards are Chase Visa cards.

Delta Air Lines

Delta Air Lines offers three Sky Miles credit cards : the Delta SkyMiles Gold ($150 annual fee), the Delta SkyMiles Platinum ($350 annual fee) and the Delta SkyMiles Blue (no annual fee).

All three cards offer bonus miles when you open them, depending on purchases within the first six months of owning the card. For example, the Delta SkyMiles Blue card offers 10,000 bonus miles after $1,000 in purchases is made within the first six months.

The Delta SkyMiles cards are American Express credit cards.

©2024 The Dallas Morning News. Visit dallasnews.com. Distributed by Tribune Content Agency, LLC.

American Airlines changes its frequent flyer rules—again

Looking to achieve frequent-flyer status with American Airlines? Book direct.

The carrier has announced another round of changes to its loyalty program, saying passengers will only receive Loyalty Points and AAdvantage miles if they book directly with American, one of its partners, or a “preferred” travel agency. Flights booked elsewhere won’t earn miles.

The new rules go into effect in July.

At present, there’s no word on which agencies qualify as “preferred”—and it could be early June before that’s cleared up. The Wall Street Journal says that classification will depend “on whether they have adopted modern booking technology.”

“Booking with us provides a better travel experience,” the carrier argued in its announcement. “You can manage your trip online, receive travel credit for canceled trips and more. Plus, you’ll continue to earn miles and Loyalty Points through our non-airline partners and on eligible purchases with an AAdvantage credit card.”

Direct booking also lowers costs for the carrier.

For passengers who opt for basic economy fares, booking direct is the only way they’ll earn AAdvantage Miles or Loyalty Points. Preferred travel agency bookings will not be eligible.

American last announced a major overhaul of its frequent-flyer program in 2021, doing away with using how far or often someone flew to calculate status. That’s when Loyalty Points were introduced, which could be earned via travel or spending on branded credit cards.

Other airlines have followed its lead, with Delta announcing a big overhaul on its SkyMiles rewards program last year, which resulted in a bit of a rebellion among that company’s customers, forcing Delta to walk back some of its changes .

American noted that any existing reservations booked with third parties or non-preferred travel agencies will earn miles or Loyalty Points.

Latest in Finance

- 0 minutes ago

Viral squatting stories are scaring homeowners. How bad is the problem really?

What current CFOs can learn from a pair of ‘qualitatively different’ accounting scandals

Why Owner cofounder and CEO Adam Guild is serving up software especially for mom-and-pop restaurants

Celebrity members club Soho House has lost money for nearly 30 years. Now its CEO is under mounting pressure to turn $22 cocktails into profits

To compete with Asia’s rising dominance, French billionaire Bollore wants to build an EV battery plant in eastern France which will cost $2.1 billion

Swedish companies are going bust at a ‘remarkable’ rate, with bankruptcies up 72% since last year

Most popular.

Furious Mexican farmers are ripping out water pumps for avocado orchards and berry fields, risking cartel reprisal

Gen Z job seeker refused to do 90-minute task because it ‘looked like a lot of work’—now the CEO who complained about it is being slammed

Novo Nordisk’s market value of $570 billion is now bigger than the entire Danish economy—creating a ‘Nokia risk’ for Denmark

Starbucks flags unusual phenomenon for ‘disappointing’ sales: It’s too popular with morning commuters

Baby boomers are losing their life savings to phone scammers claiming to provide tech support, authorities say

Exclusive: Ikea is rolling out its third round of price cuts in a year across thousands of products as it eases shoppers’ inflation pain

Best credit cards for American Airlines flyers of May 2024

The best American Airlines credit cards offer benefits for both occasional and frequent American flyers. Whether you’re looking to earn AAdvantage miles and unlock perks like lounge access and free checked luggage or seeking a more general travel rewards card that offers flexible rewards and benefits across multiple airlines, there’s a great option for you.

We have firsthand experience getting and utilizing many of the best American Airlines credit cards — so check out our analysis of the current offers below from our partners.

- Citi® / AAdvantage® Executive World Elite Mastercard® : Best for American Airlines lounge access

- The Platinum Card® from American Express : Best for luxury benefits

Browse by card categories

Comparing the best credit cards, more details on the best credit cards, maximizing american airlines credit cards, how we rate, what is american airlines, how to choose the best american airlines credit card.

- Ask our experts

Pros + Cons of American Airlines credit cards

Frequently asked questions, citi® / aadvantage® executive world elite mastercard®.

The Citi® / AAdvantage® Executive World Elite Mastercard® is best for American Airlines flyers who value lounge access. It provides a full Admirals Club membership, as well as a number of other benefits that make flying American Airlines more enjoyable, such as a free checked bag, priority check-in, priority airport screening and priority boarding privileges, along with a boost toward elite status.

- Offers Admirals Club lounge access

- Priority check-in, airport screening, boarding and a free checked bag for you and up to 8 travel companions

- 25% discount on inflight food and beverages

- Receive a Global Entry/TSA PreCheck Fee Statement Credit

- Miles redemption limited to American Airlines and its Oneworld partners

- 25% inflight credit doesn't include Wi-Fi

- Earn 70,000 American Airlines AAdvantage® bonus miles after spending $7,000 within the first 3 months of account opening.

- Admirals Club® membership for you and access for up to two guests or immediate family members traveling with you

- No Foreign Transaction Fees on purchases

- Earn 1 Loyalty Point for every 1 eligible AAdvantage® mile earned from purchases

- First checked bag is free on domestic American Airlines itineraries for you and up to 8 companions traveling with you on the same reservation

The Platinum Card® from American Express

The Amex Platinum is unmatched when it comes to travel perks and benefits. If lounge access, hotel elite status and annual statement credits are important to you, this card is well worth the high annual fee. Read our full review of the Platinum Card from American Express .

- The current welcome offer on this card is quite lucrative

- This card comes with a long list of benefits, including access to Centurion Lounges, complimentary elite status with Hilton and Marriott, and at least $500 in assorted annual statement credits and so much more (enrollment required)

- The Amex Platinum comes with access to a premium concierge service that can help you with everything from booking hard-to-get reservations to finding destination guides to help you plan out your next getaway

- The $695 annual fee is only worth it if you’re taking full advantage of the card’s benefits. Seldom travelers may not get enough value to warrant the cost

- Outside of the current welcome bonus, you’re only earning bonus rewards on specific airfare and hotel purchases, so it’s not a great card for other spending categories

- The annual airline fee credit can be complicated to take advantage of compared to the broader travel credits offered by competing premium cards

- Earn 80,000 Membership Rewards® Points after you spend $8,000 on purchases on your new Card in your first 6 months of Card Membership. Apply and select your preferred metal Card design: classic Platinum Card®, Platinum x Kehinde Wiley, or Platinum x Julie Mehretu.

- Earn 5X Membership Rewards® Points for flights booked directly with airlines or with American Express Travel up to $500,000 on these purchases per calendar year and earn 5X Membership Rewards® Points on prepaid hotels booked with American Express Travel.

- $200 Hotel Credit: Get up to $200 back in statement credits each year on prepaid Fine Hotels + Resorts® or The Hotel Collection bookings with American Express Travel when you pay with your Platinum Card®. The Hotel Collection requires a minimum two-night stay.

- $240 Digital Entertainment Credit: Get up to $20 back in statement credits each month on eligible purchases made with your Platinum Card® on one or more of the following: Disney+, a Disney Bundle, ESPN+, Hulu, The New York Times, Peacock, and The Wall Street Journal. Enrollment required.

- $155 Walmart+ Credit: Cover the cost of a $12.95 monthly Walmart+ membership (subject to auto-renewal) with a statement credit after you pay for Walmart+ each month with your Platinum Card®. Cost includes $12.95 plus applicable local sales tax. Plus Up Benefits are excluded.

- $200 Airline Fee Credit: Select one qualifying airline and then receive up to $200 in statement credits per calendar year when incidental fees are charged by the airline to your Platinum Card®.

- $200 Uber Cash: Enjoy Uber VIP status and up to $200 in Uber savings on rides or eats orders in the US annually. Uber Cash and Uber VIP status is available to Basic Card Member only. Terms Apply.

- $300 Equinox Credit: Get up to $300 back in statement credits per calendar year on an Equinox membership, or an Equinox club membership (subject to auto-renewal) when you pay with your Platinum Card®. Enrollment required. Visit https://platinum.equinox.com/ to enroll.

- $189 CLEAR® Plus Credit: Breeze through security with CLEAR Plus at 100+ airports, stadiums, and entertainment venues nationwide and get up to $189 back per calendar year on your Membership (subject to auto-renewal) when you use your Platinum Card®. Learn more.

- $100 Global Entry Credit: Receive either a $100 statement credit every 4 years for a Global Entry application fee or a statement credit up to $85 every 4.5 years for a TSA PreCheck® (through a TSA official enrollment provider) application fee, when charged to your Platinum Card®. Card Members approved for Global Entry will also receive access to TSA PreCheck at no additional cost.

- Shop Saks with Platinum: Get up to $100 in statement credits annually for purchases in Saks Fifth Avenue stores or at saks.com on your Platinum Card®. That's up to $50 in statement credits semi-annually. Enrollment required.

- $300 SoulCycle At-Home Bike Credit: Get a $300 statement credit for the purchase of a SoulCycle at-home bike with your Platinum Card®. An Equinox+ subscription is required to purchase a SoulCycle at-home bike and access SoulCycle content. Must charge full price of bike in one transaction. Shipping available in the contiguous U.S. only. Enrollment Required.

- Unlock access to exclusive reservations and special dining experiences with Global Dining Access by Resy when you add your Platinum Card® to your Resy profile.

- $695 annual fee.

- Terms Apply.

The Citi AAdvantage Executive card has a massive $595 annual fee (see rates and fees ). But we love it for the valuable perks it provides to frequent American Airlines flyers — including full membership access to Admirals Club lounges and up to 20,000 additional Loyalty Points each AAdvantage status-qualifying year.

The card is a great option if you want Admirals Club access before and after eligible same-day flights marketed or operated by American Airlines (or marketed and operated by any other Oneworld carrier). These privileges even extend to two guests (or immediate family members). Authorized users on your card also get access to Admirals Clubs during eligible travel. However, you’ll need to pay $175 per year for up to three authorized users (and $175 for each authorized user after that).

“I frequently find myself on American out of Miami International Airport (MIA), and I love that I can access the Admirals Club with my immediate family. I can also add up to three authorized users for an additional $175 (total) per year — and each of them gets club access as well. Beyond that, I save hundreds of dollars a year thanks to Citi Merchant Offers on the card.” — Nick Ewen , director of content

If you want a card that earns American Airlines miles with a lower annual fee, consider the Citi® / AAdvantage® Platinum Select® World Elite Mastercard® . You won’t get Admirals Club access, but you’ll enjoy preferred boarding and a first checked bag free on domestic American Airlines itineraries. The information for the Citi Platinum Select has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

The Amex Platinum carries a hefty $695 annual fee (see rates and fees ). But we still love it due to the sheer number of cardmember perks it offers. This includes a up to $200 airline fee credit , a up to $189 Clear Plus credit and 5 points per dollar on flights booked directly with airlines or through American Express Travel (on up to $500,000 on these purchases per calendar year, then 1 point per dollar). Enrollment is required.

If you want to earn Amex Membership Rewards points on your purchases, have a Centurion Lounge at airports you frequently transit, don’t need perks specific to American Airlines flights and will use many of the benefits and statement credits offered by the Amex Platinum, then it may be the right card for you.

“Whilst this card has a high annual fee, it more than justifies itself for frequent travelers like me. The lounge access options that come with the Platinum are unrivaled by competitors. I put all of my flights — whether bought with cash or points — on this card to earn 5 points per dollar spent (on the first $500,000 per calendar year) and trip protection insurance. I make sure to take full advantage of the Uber, Saks Fifth Avenue, Hulu/Disney+ and Clear credits (enrollment required). And, honestly, pulling a Platinum card out of your wallet to pay for something does feel pretty fancy.” — Matt Moffitt , senior credit cards editor

If you don’t frequently see Centurion Lounges in your travels and don’t want to squeeze value from the Amex Platinum’s many statement credits, the Chase Sapphire Reserve® might be a better premium travel rewards card for you. You’d earn Chase Ultimate Rewards points instead of Amex Membership Rewards points, but the Sapphire Reserve’s $300 annual travel credit is easy to use, and you’d earn at least 3 points per dollar on all your travel purchases.

Decide what benefits are important

If you are searching for an American Airlines credit card, you may want one that provides perks when you fly American Airlines. For example, if you want Admirals Club access when flying American Airlines and select partners, the Citi® / AAdvantage® Executive World Elite Mastercard® is the best card. Meanwhile, if you don’t need lounge access but want preferred boarding and a first checked bag free on domestic American Airlines itineraries, the lower-annual-fee Citi® / AAdvantage® Platinum Select® World Elite Mastercard® might be best.

However, if you frequently fly other airlines besides American Airlines, you may want to get a card like the Chase Sapphire Reserve® that offers Priority Pass Select lounge membership and statement credits for travel purchases you make with your card.

Choose the rewards you want to earn

Some of the cards we’ve highlighted above earn American Airlines miles. These miles are valuable, but you can only redeem them with the American Airlines AAdvantage program.

However, some cards earn transferable rewards you can redeem in many ways. For example, a card that earns Chase Ultimate Rewards points allows you to book travel on any airline through the Chase travel portal, but you can also redeem points for hotels, rental cars and even activities. Alternatively, you can transfer points to one of Chase’s fantastic partners . These rewards are much more flexible than miles associated with an individual airline loyalty program.

Earn Loyalty Points through spending

One other aspect to consider is whether you’re hoping to earn Loyalty Points when you spend on your credit card. Loyalty Points are the metric American Airlines uses for elite status qualification, and you can spend your way to AAdvantage elite status using cobranded American Airlines credit cards.

However, know that bonuses and accelerators will earn redeemable miles but not Loyalty Points. As such, you’ll earn 1 Loyalty Point per dollar spent with the cobranded American AAdvantage cards highlighted above.

American Airlines is a major airline headquartered in Fort Worth, Texas.

American Airlines pins its start to a flight in 1926 when a chief pilot of Robertson Aircraft Corporation stowed a bag of mail in his DH-4 biplane. In 1940, American Airlines opened airport lounges for its customers. And in 1981, American Airlines launched the AAdvantage loyalty program.

Types of American Airlines credit cards

Each cobranded American Airlines credit card offers its own set of valuable perks and benefits. Here are a few that should factor into deciding which might be best for you.

Frequent travelers who are loyal to American Airlines will enjoy the perks of having a cobranded credit card that provides them with benefits that include lounge access. The Citi® / AAdvantage® Executive World Elite Mastercard® offers Admirals Club access where cardholders can enjoy snacks, made-to-order food, drinks and more.

American Airlines credit card benefits

Cobranded American Airlines credit cards offer many benefits for travelers. Here’s a look at what you can expect from some of the AAdvantage credit cards we discussed above.

All of the cobranded American Airlines credit cards earn AAdvantage miles. Here’s a look at how many miles you’ll earn on purchases with some of the best American Airlines credit cards:

- Citi® / AAdvantage® Executive World Elite Mastercard® : 10 miles per dollar on eligible hotels booked through aa.com/hotels and eligible car rentals booked through aa.com/cars, 4 miles per dollar on eligible American Airlines purchases (5 miles per dollar after you spend $150,000 on your card in a calendar year), and 1 mile per dollar on other purchases

- Citi® / AAdvantage® Platinum Select® World Elite Mastercard® : 2 miles per dollar on eligible American Airlines purchases and at restaurants and gas stations, and 1 mile per dollar on other purchases

- American Airlines AAdvantage® MileUp® : 2 miles per dollar on eligible American Airlines purchases and at grocery stores, and 1 mile per dollar on other purchases

- AAdvantage Aviator Red World Elite Mastercard : 2 miles per dollar on eligible American Airlines purchases and 1 mile per dollar on other purchases

The information for the Citi AAdvantage Platinum Select, American Airlines AAdvantage MileUp, and AAdvantage Aviator Red Mastercard has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

You can often earn a sign-up bonus if you’re approved for a new American Airlines credit card and meet the minimum spending requirements for the bonus. Many of the current offers are available in this story — though be sure to review our guide to credit card application restrictions and our history of Citi welcome bonuses to ensure you’re maximizing your chances of approval and getting the best possible offer.

Three of the cobranded American Airlines credit cards we highlighted above offer a first checked bag free on domestic American Airlines itineraries for you and up to a set number of companions traveling with you on the same reservation.

Cardholders of the Citi / AAdvantage Executive World Elite Mastercard get a first checked bag free for up to eight companions, while cardholders of the Citi / AAdvantage Platinum Select World Elite Mastercard and AAdvantage Aviator Red World Elite Mastercard get a first checked bag free for up to four travel companions.

Many credit cards offer a Global Entry or TSA PreCheck application fee credit . This credit usually provides a statement credit for an eligible Global Entry or TSA PreCheck application fee charged to your card every four to five years. A few of the cards highlighted in this guide offer this perk, including:

- Citi® / AAdvantage® Executive World Elite Mastercard® : Get a statement credit of up to $100 every four years when you pay a Global Entry or TSA PreCheck application fee with your card.

- The Platinum Card® from American Express : Get a statement credit of up to $100 for Global Entry every four years or up to $85 for TSA PreCheck every 4.5 years when you pay for the respective application fee with your card. Enrollment is required.

- Chase Sapphire Reserve® : Get a statement credit of up to $100 every four years when you pay for a Global Entry, TSA PreCheck or Nexus application fee with your card.

The information for the Citi AAdvantage Platinum Select, and AAdvantage Aviator Red Mastercard has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

For rates and fees of the Amex Platinum, click here . For rates and fees of the Bilt Mastercard, click here . For rewards and benefits of the Bilt Mastercard, click here .

- 1 Sign-up bonus Choose the best American Airlines card that offers a solid sign-up bonus you can use for future trips. Additionally, consider the minimum spend threshold required to earn a sign-up bonus and make sure your budget and spending align with that figure.

- 2 Annual fee Depending on what your goals are when opening a new credit card, you may want to opt for a budget-friendly, low annual fee card or a premium travel card — with premium protections and benefits — with a premium annual fee.

- 3 Bonus categories The best American Airlines credit cards feature various bonus categories for different types of travelers and spenders. Whether you want a cobranded airline card or a travel card that’s also great for general everyday purchases, one of our top picks is sure to suit your needs.

- Using American credit cards responsibly can help you build your credit score

- American credit cards can earn AAdvantage miles (or flexible travel rewards) every time you use them

- Spending on cobranded American Airlines cards helps you unlock AAdvantage elite status

- Many American credit cards include perks to enhance your travel experience — including lounge access, free checked bags and priority boarding

- Spending beyond your means with an American credit card can damage your credit score

- Earning American AAdvantage miles means you’re limited to awards through that program

- You may not travel with American and its partners enough to make an AAdvantage credit card worthwhile

The best American Airlines credit card will vary depending on your needs. If you want Admirals Club access, the Citi / AAdvantage Executive World Elite Mastercard will be the best American Airlines card. But if you are primarily interested in getting your first checked bag free on domestic American Airlines flights, one of the cards with a lower annual fee will likely be best.

An American Airlines card may be worth getting if its perks provide more value than the cost of the annual fee. For example, you'd only need to check a bag four times per year to cover the cost of the mid-tier AAdvantage cards. And the annual fee on the Citi AA Executive card is less than the cost of an Admirals Club membership.

You can apply for some American Airlines cards, including the Citi AA Executive card, by clicking the hyperlinked card names on our page. You can apply for other American Airlines cards by searching for the card on the Citi or Barclays websites. You can also pick up a paper application for the Aviator Red on board some American Airlines flights.

Only one major credit card currency allows transfers to American AAdvantage: Bilt Rewards . These transfers occur at a 1:1 ratio, and they usually process within 24 hours. You also have the ability to transfer Marriott Bonvoy points at a 3:1 ratio, which allows you to leverage various Marriott credit cards to earn American miles. However, we only recommend transferring Marriott points to airline programs for very specific redemptions.

Most American Airlines credit cards don’t have foreign transaction fees. But some, including the AAdvantage MileUp card, do charge foreign transaction fees. So, check the fine print before assuming your American Airlines credit card doesn't have foreign transaction fees.

You can use your cobranded American Airlines credit card to make purchases at most merchants that accept credit cards.

Cardholders of the Citi AA Executive card automatically get priority boarding in Group 4. Cardholders of most other eligible AAdvantage cards get preferred boarding in Group 5. You won’t get preferred boarding with the AAdvantage MileUp card , though.

Some American Airlines credit cards, including the Citi AA Executive card, offer worldwide car rental insurance coverage when you pay for your rental with your card. See your card's guide to benefits to determine whether your card offers rental car coverage and, if so, the coverage details.

You'll typically need good credit — which means a credit score of at least 670 — to be approved for an American Airlines credit card. However, you can improve your chances of getting approved with an excellent score in the high 700s or low 800s.

- Compare Cards ↴

AAdvantage® Aviator® Business Mastercard®

- AAdvantage® Aviator® World Elite Business Mastercard®

Earn AAdvantage® miles on Business Expenses

Explore exclusive cardmember benefits and more below

Explore the benefits of your AAdvantage® Aviator® World Elite Business Mastercard®¹

First eligible checked bag free on domestic American Airlines itineraries for you and up to 4 companions traveling with you on the same reservation

Preferred boarding for you and up to 4 companions traveling on the same reservation on American Airlines operated flights

Receive 25% savings on inflight food and beverage purchases when you use your card on American Airlines operated flights

Each anniversary year, earn a Companion Certificate good for 1 guest at $99 (plus taxes and fees) if you spend $30,000 on purchases and your account remains open for 45 days after your anniversary date

Earn 2X AAdvantage® miles for every $1 spent on eligible American Airlines purchases

Earn 2X AAdvantage® miles for every one dollar spent on eligible American Airlines purchases

Earn 2X AAdvantage® miles for every $1 spent on select telecom, office supply, and car rentals

Earn 1X AAdvantage® miles for every $1 spent on all other purchases

5% AAdvantage® mileage bonus earned every year after your account anniversary date based on the total number of miles earned using your card

$0 Fraud Liability protection means that if your card is lost or stolen, you’re not responsible for any charges that you did not authorize

As an AAdvantage® Aviator® Mastercard® cardmember, you have access to preferred programs that offer even more ways to earn miles while using your AAdvantage® Aviator® World Elite Business Mastercard®

More ways to earn and redeem your AAdvantage® miles

Get rewarded for shopping.

Use your AAdvantage® Aviator® Mastercard® on all your purchases to earn miles to redeem on travel, plus Loyalty Points* toward AAdvantage® status.

Get a 10% discount on a Dream Vacation

Did you know you get a 10% discount every time you book an American Airlines Vacations package, just for being an AAdvantage® Aviator® Mastercard® card member? Conveniently book all elements of your vacation together, including:

- Ground transfers and activities

Use this dedicated link to benefit from the 10% discount

Explore exclusive AAdvantage® offers

Visit the promotions tab in your AAdvantage® account to see your exclusive offers and promotions from American Airlines as well as other partners – like hotels, cars, dining, and more.

Discover all the ways to save while earning miles and Loyalty Points toward status. Where will you go next?

Hungry for AAdvantage® miles?

Earn miles for dining – Get carry out or order delivery from a participating AAdvantage Dining℠ restaurant and earn up to 5 miles per $1 spent on your meal.

Just use your AAdvantage® Aviator® Mastercard® when you pay.

Redeem your AAdvantage® miles for Mastercard priceless experiences

U.S. American Airlines AAdvantage® Mastercard® credit card holders can now use miles or a combination of miles and dollars to book Mastercard priceless experiences.

Enjoy culinary, sporting, theatrical events and more to fuel your passions and make priceless memories.

Easily make payments online or through the Barclays mobile app. No stamps, fees or worries about postage delays. Need help getting started? Simply watch the instructional video.

Add authorized users to your account, such as a child heading to college, a loved one or a trusted friend, to earn miles on their purchase¹

Compare our AAdvantage® Aviator® credit cards

Compare our, aadvantage® aviator® credit cards.

Select up to three cards above to compare their great benefits

† The AAdvantage® Aviator® World Elite Business Mastercard® is for commercial use

Change your credit card selection ►

– ¹Benefit Information

+ ¹Benefit Information

Earning AAdvantage ® Miles

You earn AAdvantage® miles for purchases less credits, returns and adjustments (“Net Purchases”) made by you and/or any authorized user(s) of the Card Account as follows: • You earn 2 AAdvantage® miles for every $1 spent on Net Purchases – on eligible tickets and goods and services purchased directly from American Airlines (“American Purchases”). Eligible American Purchases are items billed by American Airlines as merchant of record and, as applicable, booked through American Airlines channels (aa.com, American Airlines reservations, American Airlines Vacations reservations, Google Flights and American Airlines airport and city ticket counters). Products or services that do not qualify as American Purchases are car rentals and hotel reservations, purchases made through online third party travel agencies. • You earn 2 AAdvantage® miles for every $1 spent on Net Purchases – on eligible office supply merchants, telecommunications merchants, and car rental merchants. Office supply merchants are defined as stand-alone merchants that primarily sell stationery and office supplies for business consumption. Telecommunications merchants are defined as merchants that sell telecommunications equipment such as telephones, fax machines, pagers, and cellular phones, along with providers of telecommunications services including local and long-distance telephone calls and fax services. Car rental merchants are defined as providers of short-term or long-term rentals of cars, trucks, or vans. This does not include merchants that rent motor homes or other recreational vehicles. Purchases made through travel agencies, Rocketmiles.com, tour operators and online third party travel sites are not eligible. Purchases must be submitted by merchants using the merchant category codes for purchases in the office supply, telecommunications and car rental categories to qualify for the additional AAdvantage® miles. • You earn 1 AAdvantage® mile for every $1 spent on all other Net Purchases. • AAdvantage® Miles earned will be posted to the signing individual’s AAdvantage® Account typically within 4-6 weeks but it could take as long as 8-10 weeks. • Barclays and American Airlines are not responsible for incorrectly coded purchases. Additional AAdvantage® miles may not be earned if the merchant submits the purchase using a mobile or wireless card reader or if you use a mobile or digital wallet to pay for the purchase. Additionally, purchases made through third parties, including online marketplaces and resellers, or using a third-party payment account will not earn additional AAdvantage® miles. Balance transfers, cash advances (including cash equivalent transactions such as, but not limited to, the use of your Card Account to obtain money orders, traveler’s checks, foreign currency and lottery tickets), fees, interest charges and unauthorized/fraudulent purchases are not considered Net Purchases and do not earn AAdvantage® miles.

Free Checked Bag

The Signing Individual may check one bag free of charge when traveling on domestic itineraries marketed and operated by American Airlines or on American Eagle® domestic itineraries marketed by American Airlines and operated by Air Wisconsin Airlines, Envoy Air Inc., ExpressJet Airlines, Inc., Piedmont Airlines, Inc., PSA Airlines, Inc., Republic Airline Inc., or SkyWest Airlines, Inc. This benefit will not be available for travel on codeshare flights booked with an American Airlines flight number but operated by another airline. Up to four (4) customers traveling with the eligible Signing Individual will also get their first checked bag free of charge if they are listed in the same reservation. For this benefit to apply, the Card Account must be open 7 days prior to air travel AND the reservation must include the Signing Individual’s AAdvantage® number 7 days prior to air travel. If your Card Account is closed for any reason, these benefits will be cancelled. This benefit cannot be combined with any existing AAdvantage® elite program benefits, or Premium cabin benefits, including any waiver of baggage charges. The First Checked Bag benefit does not apply to overweight or oversized bags. Please see aa.com for baggage weight and size restrictions. Applicable terms and conditions are subject to change without notice

Preferred Boarding

An eligible Signing Individual will board after Priority boarding is complete, but before the rest of economy (Main Cabin) boarding. The boarding benefit will display on your American Airlines boarding pass as Group 5. Up to four (4) customers traveling with and listed in the same reservation as the Signing Individual are eligible to board at the same time as the Signing Individual. For this benefit to apply, the Card Account must be open 7 days prior to air travel AND the reservation must include the Signing Individual’s American Airlines AAdvantage® number 7 days prior to air travel. If your Card Account is closed for any reason, this benefit will be cancelled. This benefit applies to flights marketed and operated by American Airlines or on flights marketed by American Airlines and operated by Air Wisconsin Airlines, Envoy Air Inc., ExpressJet Airlines, Inc., Piedmont Airlines, Inc., PSA Airlines, Inc., Republic Airline Inc., or SkyWest Airlines, Inc. This benefit will not be available for travel on codeshare flights booked with an American Airlines flight number but operated by another airline. Applicable terms and conditions are subject to change without notice.

25% Statement Credit for Inflight Purchases

A Signing Individual whose Card Account is in good standing will qualify for a 25% savings on eligible inflight Purchases. Eligible Purchases include the inflight purchase of food and beverages on American Airlines operated flights when purchased using the Card Account. Savings does not apply to any other inflight Purchases, such as wireless internet access or inflight Entertainment. This offer is available on eligible flights as long as supplies last. This benefit applies to domestic flights marketed and operated by American Airlines and operated by Air Wisconsin Airlines, Envoy Air Inc., ExpressJet Airlines, Inc., Piedmont Airlines, Inc., PSA Airlines, Inc., Republic Airline Inc., or SkyWest Airlines, Inc. where credit card transactions are accepted. This benefit will not be available for travel on codeshare flights booked with an American Airlines flight number but operated by another airline. This savings will appear as a Card Account statement credit 6–8 weeks after the Purchase is posted to the Card Account. Additional terms, conditions and restrictions may apply. Applicable terms and conditions are subject to change without notice.

American Airlines Companion Certificate

At each card anniversary, the signing individual will earn 1 domestic economy fare companion certificate redeemable for 1 companion ticket at $99 (plus taxes and fees) if you spend $30,000 or more on eligible Net Purchases with your Card Account that have a transaction date within your cardmembership year (each 12-month period through and including your Card Account anniversary month) and your Card Account remains open for at least 45 days after your anniversary date. After the companion certificate is earned, please allow 1-2 weeks for it to be added to the primary cardmember’s AAdvantage® account. When the companion certificate is used according to its terms, you will pay a $99 companion ticket fee plus government taxes and fees, the amount of which will depend on the itinerary (as of the date of these Card Account Reward Rules government taxes and fees range between $37.23 to $55.83), for a round-trip qualifying domestic economy fare ticket for a companion when an individual round-trip qualifying domestic economy fare ticket is purchased and redeemed through American Airlines Meeting Services. Companion certificate eligible travel must be booked and purchased from select economy inventory. The Companion certificate will be valid one year from the issue date. Companion certificate eligible travel is defined as travel on flights within the 48 contiguous United States, on flights marketed and operated by American Airlines, or on flights marketed by American Airlines and operated by Air Wisconsin Airlines, Envoy Air Inc., Republic Airline Inc., SkyWest Airlines, Inc., PSA Airlines, Inc., or Piedmont Airlines, Inc. This is not available for travel on codeshare flights booked with an American Airlines flight number but operated by another airline. For residents of Alaska and Hawaii, companion certificate eligible travel is defined as round-trip travel originating in either of those two states and continuing to the 48 contiguous United States. Applicable terms and conditions are subject to change without notice. Details, terms and conditions, certain restrictions, and restricted dates apply and will be disclosed on the companion certificate. This benefit may not be achievable based on the assigned credit line and ability to maintain that credit line.

5% AAdvantage® Mileage Bonus

Each Cardmembership Year, the Signing Individual will earn a 5% American Airlines AAdvantage® mileage bonus on eligible Purchases provided that the following conditions are met: (1) the Signing Individual renews the annual cardmembership, and (2) the Card Account remains open for at least 45 days after the anniversary date. Balance transfers, fees, cash advances, items returned for credit and finance charges are not Purchases. The 5% AAdvantage® mileage bonus will be calculated as a percentage of the eligible Purchases made on the Card Account during the Cardmembership Year and will post to the Signing Individual’s AAdvantage® account 6-8 weeks after the above requirements are met.

* 1 Loyalty Point per eligible AAdvantage® mile

1 Loyalty Point accrues for every eligible AAdvantage® mile earned on purchases, excluding balance transfers, cash advances, checks that access your credit card account, items and services returned for credit, unauthorized charges, interest and account fees, traveler’s checks, purchases of foreign currency, money orders, wire transfers (and similar cash-like transactions), lottery tickets, and gaming chips (and similar betting transactions). Eligible AAdvantage® miles include the base miles earned on purchases, and do not include any bonus miles or accelerators. Loyalty Points may be earned on miles on purchases made by primary credit cardmembers and authorized users. Loyalty Points earned will be posted to the primary credit cardmember’s AAdvantage® account in 8-10 weeks.

**Please refer to your Cardmember Agreement as amended from time to time for pricing, rates, fees and other terms of your account.

Customer Service

If you have any questions about your Card Account, please contact the Customer Service phone number on the back of your card.

The AAdvantage® Aviator® World Elite Business Mastercard® is issued by Barclays Bank Delaware pursuant to a license from Mastercard International Incorporated. Mastercard, World Elite Mastercard for Business, and the circles design are trademarks of Mastercard International Incorporated.

© 2024 Barclays Bank Delaware, Member FDIC.

- AAdvantage® Aviator® Silver Mastercard®

- AAdvantage® Aviator® Red Mastercard®

- AAdvantage® Aviator® Blue Mastercard®

- AAdvantage® Aviator® Mastercard®

Dynamic title for modals

Are you sure.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

The Complete Guide to American Airlines Partners

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

American Airlines airline partners

Earning miles with american airlines partners, redeeming miles with american airlines partners, how to book partner flights on aa.com, elite benefits on partner airlines.

You don't have to fly with American Airlines just to earn and redeem American Airlines AAdvantage miles. Thanks to a robust network of American Airlines partners, you can transfer your miles to about two dozen other airlines, getting yourself to more than 1,000 destinations around the world.

While American Airlines primarily serves destinations in the U.S., even international travelers can flex their status and miles to travel all around the world.

American is a founding member of the Oneworld Alliance , a network of about a dozen member airlines offering seamless travel between partners, transferable elite status perks and expanded options for earning and redeeming miles. That opens massive possibilities for ways you can earn American Airlines miles when flying with those airlines — while also allowing you to redeem American Airlines miles for flights on other airlines.

American also has plenty of other partners outside the Oneworld Alliance as well, providing even more opportunities for flexible flying.

Here’s everything AAdvantage members need to know about American Airlines partners.

AAdvantage members can earn by flying the following Oneworld carriers and other partners. Flights on these airline partners are bookable with AAdvantage miles and many can be booked directly through the American Airlines website.

Other airline partners

You will have to call customer service for assistance to book partners that you do not see on AA.com.

In 2022, American Airlines overhauled how elite status is earned with the airline. EQMs, EQDs and EQSs are gone, which simplifies things by eliminating complicated alphabet soup. Instead, flyers earn Loyalty Points, which can be earned when flying on American Airlines and its partners; spending through AAdvantage credit cards ; and shopping, dining and making transactions with American’s other partners.

To learn all about earning status under the new program, check out our guide to American Airlines elite status .

If you fly on a Oneworld partner airline, you can expect to earn Loyalty Points on the base miles earned according to the distance flown plus cabin bonuses where applicable.

If you fly on American Airlines, you’ll receive Loyalty Points for the base AAdvantage miles earned according to the ticket price (excluding government-imposed taxes and fees). No cabin bonus applies. If this sounds confusing, you're not alone — Loyalty Points are kind of hard to earn .

When it comes to earning AAdvantage miles that can be redeemed for award flights, know this: The number of miles earned will depend on your status level, with general members earning 5 miles per $1, to Executive Platinum Elites earning 11 miles per $1.

When flying with partners, always make sure that your AAdvantage number is in the reservation and also printed on your boarding pass. Save boarding passes and ticket receipts from partner flights so that if miles don’t post to your account, you can request missing AAdvantage credit retroactively .

When it comes to redeeming AAdvantage miles, things can change quickly. In Spring 2023, American switched to fully dynamic award pricing. Award rates will now vary by demand, regardless of fare class.

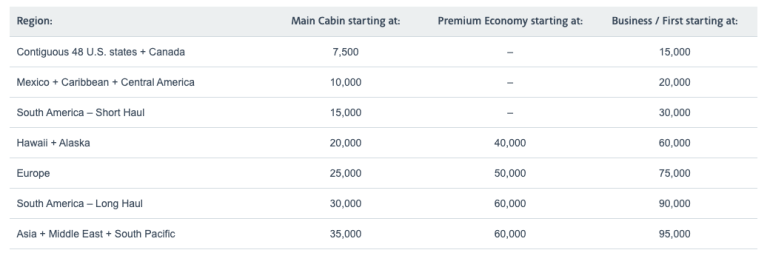

Even so, the airline has published an "award chart," but note that there are no guarantees you'll be able to get the starting rate, depending on when you travel:

American’s website can be finicky. It's important to play around with it when looking for award availability since results can appear differently depending upon how you sort them on the page.

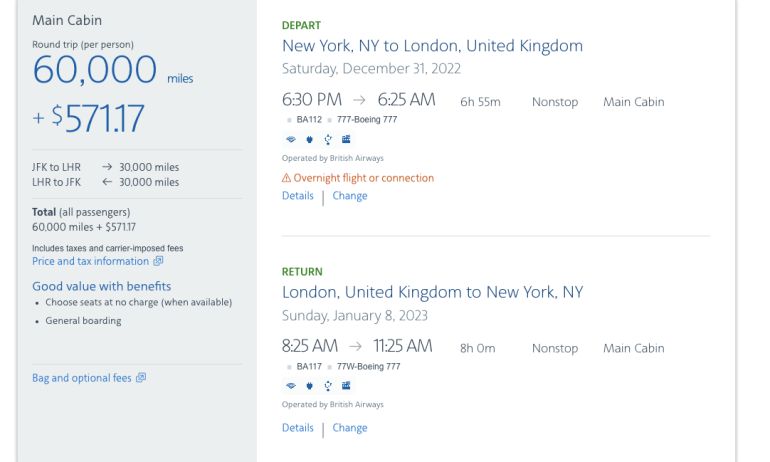

Watch out for taxes

While points redemptions can be a swell deal on partner airlines, beware of one caveat: taxes and fees.

You'll almost always still have to pay taxes and fees when booking on points. For flights within the U.S. on American, the fees are typically a negligible amount (starting $5.60 per person, per award).

However, that's often not the case when booking flights via American transfer partners. Here's an example when you book British Airways awards through American AAdvantage that shows how taxes and surcharges on these awards are through the roof. The example below shows American’s 60,000-mile round-trip award pricing, but when it comes with nearly $600 in fees, the value changes significantly.

With this mix of dynamic pricing and award chart standards, it can be hard to gauge how many miles will be needed for an award flight. Still, American deserves accolades for not deleting its award charts entirely. American publishes “region definitions” at the bottom of this page if you are unsure of how the airline categorizes each country.

» Learn more: How to save on American Airlines flights by redeeming other miles

Since American’s website does not provide every possible route, a phone reservation agent might be able to search for more options. All Oneworld airlines appear in AA.com search results, but airline partners may not always appear. For airlines like Etihad, AAdvantage members should call American to redeem miles.

To book flights, use the search tool from the homepage or select flights from the “Plan Travel” dropdown at the top of AA.com.

This will take you to a page where you can enter your travel information with the option to select “All Airlines” at the bottom of the page.

For the best results, use the calendar search. Another trick is to search for award space segment by segment using the form above.

Let’s say you are flying between New York and Helsinki. Try searching New York to a Oneworld hub like London or Madrid first. If you find space, then search for flights from that hub to Helsinki. Once you find both, try to see if you can price the entire itinerary together as one award. Sometimes, longer connections that don’t appear in the initial search might prove fruitful.

American is generous in that it allows travelers to hold award tickets, giving you more time to search for a better option or other parts of your trip. This means you can call American and have a specific award ticket set aside for you (without paying for it) while you finalize plans or search other options. The allowable length of hold times varies based on when the award flight is scheduled for departure and can last as long as five days. Not all award tickets are eligible for holds, so it's best to call the airline.

Once you purchase the award, changes or cancellations result in a fee for award tickets, which varies based on where the reservation was made.

One of the perks of achieving elite status is enjoying benefits when flying partner airlines .

When you hold elite status with American Airlines, you'll have automatic elite status benefits when flying on other Oneworld partners. Here's how each American Airlines elite status tier maps to Oneworld elite status:

Among the top benefits of each tier of Oneworld elite status :

Oneworld Emerald

Access to business and first class lounges.

Access to priority check-in.

Fast track at select security lanes.

Priority boarding.

Preferred or reserved seating.

Priority status on standby waitlists.

Priority baggage handling.

Extra baggage allowance.

Oneworld Sapphire

Access to business class lounges.

Oneworld Ruby

How to maximize your rewards.

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Capital One's website

2x-5x Earn unlimited 2X miles on every purchase, every day. Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options.

75,000 Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel.

on Citibank's application

1x Earn 1 Loyalty Point for every 1 eligible AAdvantage® mile earned from purchases.

70,000 Earn 70,000 American Airlines AAdvantage® bonus miles after spending $7,000 within the first 3 months of account opening.

- Skip to main content

- Keyboard shortcuts for audio player

Airlines are ordered to give full refunds instead of vouchers and to stop hiding fees

Travelers and their luggage in a terminal at Los Angeles International Airport in August 2023. Mario Tama/Getty Images hide caption

Travelers and their luggage in a terminal at Los Angeles International Airport in August 2023.

WASHINGTON — In an effort to crack down on airlines that charge passengers steep fees to check bags and change flights, the U.S. Department of Transportation has announced new regulations aimed at expanding consumer protections .

One of the final rules announced Wednesday requires airlines to show the full price of travel before passengers pay for their tickets. The other will force airlines to provide prompt cash refunds when flights are canceled or significantly changed.

"Passengers deserve to know upfront what costs they are facing and should get their money back when an airline owes them - without having to ask," said Transportation Secretary Pete Buttigieg in a statement announcing the new rules.

Taking on junk fees is popular. But can it win Biden more voters?

Surprise junk fees have become a large and growing source of revenue for airlines in recent years, according to the DOT.

"Today's announcements will require airlines to both provide passengers better information about costs before ticket purchase, and promptly provide cash refunds to passengers when they are owed — not only saving passengers time and money, but also preventing headaches," Buttigieg said.

The airline industry is unlikely to welcome the new rules. At a hearing on the proposed fee rule in March 2023, an industry lobbying group representing American, Delta and United said it would be too difficult for airlines to disclose their charges more clearly.

"The amount of unwanted and unneeded information forced upon passengers" by the new policy would only cause "confusion and frustration," warned Doug Mullen, the deputy general counsel at Airlines for America . "Very few, if any, need or want this information, and especially when they are initially trying to understand schedule and fare options."

But the DOT insists its new rule will give consumers the information they need to better understand the true costs of air travel.

Transportation Department cracks down on airline 'junk fees'

"I believe this is to the benefit of the sector as a whole," Buttigieg said in an interview with NPR's Morning Edition , because passengers will have "more confidence in the aviation sector."

The new rules require airlines to disclose all baggage, change, and cancellation fees, and to share that information with third-party booking sites and travel agents.

The regulation also prohibits bait-and-switch tactics, the DOT says, that disguise the true cost of flights by advertising a low base fare that does not include all mandatory fees.

"This is really about making sure that we create a better experience for passengers, and a stronger aviation sector in the United States," Buttigieg said in the NPR interview.

- Diversity, Equity & Inclusion at Delta

- Racial and Ethnic Diversity

- LGBTQ+ Diversity

- People with Disabilities

- Veterans and the Military

- Sustainability

- Awards & Recognition

- Global Partners

It’s back by popular demand — Delta and American Express unveiled the next iteration of the limited-edition Boeing 747 Delta SkyMiles Reserve Card on the heels of the overwhelming response from Card Members when first launched in 2022 .

The new limited-edition cards are cloud-white in color and made from two Delta Boeing 747 aircraft 1 that were retired after more than 27 years of service and feature each plane’s history, including their first and last flights, tail number and number of miles flown.

The card is available exclusively for new and existing Delta SkyMiles Reserve and Reserve Business Card Members from April 25 through June 5, 2024, while supplies last. The new design comes after recent enhancements made to the Delta SkyMiles American Express Cards to improve the travel experience and deliver everyday value to Members, both in the air and on the ground.

“At Delta, innovation and experience are at the core of everything we do,” said Prashant Sharma, V.P. of Loyalty at Delta Air Lines. “Each card carries the legacy of countless journeys and embodies the spirit of exploration that drives our customers and all of us at Delta. When combined with the recently upgraded benefits, these cards provide a nod to our storied past and symbolize the elevated experiences our customers can expect in their future travels.”

In 2022, Delta and American Express launched the first iteration of the limited-edition Boeing Delta 747 Card design, one of the most iconic airplanes in aviation history. The new design is made with 33% metal from a retired Delta Boeing 747 plane and has a white glossy finish, which is inspired by clouds.

“We’re bringing back one of our most popular Card designs ever with a new look honoring the ‘Queen of the Skies,’” said Jon Gantman, Senior Vice President and General Manager of Cobrand Product Management at American Express. “Given the strong response from customers with our first Card design, we wanted to find another exciting opportunity for aviation enthusiasts and Card Members to have a piece of aviation history in their wallets.”

The Delta SkyMiles Reserve and Reserve Business American Express Cards offer premium travel benefits for Delta loyalists, including an enhanced Companion Certificate each year after renewal 2 , an MQD Headstart that helps you get closer to Status, miles accelerators, access to exclusive reservations through Global Dining Access by Resy 3 , and more.

For more information about the Delta SkyMiles Reserve and Reserve Business Cards, visit go.amex/747card .

1 The new limited-edition Boeing 747 Card design is made with 33% metal from retired Delta Boeing 747 aircraft.

2 The Companion Ticket requires payment of the government-imposed taxes and fees of no more than $80 for roundtrip domestic flights and no more than $250 for roundtrip international flights (both for itineraries with up to four flight segments). Baggage charges and other restrictions apply. See terms and conditions for details.

3 Card Members must add their Delta Skymiles Reserve or Reserve Business American Express Card to their Resy profile to access Global Dining Access by Resy.

- American Express

- Delta Reserve Business AMEX Credit Card

Not finding what you need?

Electrostal History and Art Museum

Most Recent: Reviews ordered by most recent publish date in descending order.

Detailed Reviews: Reviews ordered by recency and descriptiveness of user-identified themes such as wait time, length of visit, general tips, and location information.

Electrostal History and Art Museum - All You Need to Know BEFORE You Go (2024)

- (0.19 mi) Elektrostal Hotel

- (1.21 mi) Yakor Hotel

- (1.27 mi) Mini Hotel Banifatsiy

- (1.18 mi) Elemash

- (1.36 mi) Hotel Djaz

- (0.07 mi) Prima Bolshogo

- (0.13 mi) Makecoffee

- (0.25 mi) Amsterdam Moments

- (0.25 mi) Pechka

- (0.26 mi) Mazhor

IMAGES

COMMENTS

Learn about different types of travel credit issued by American Airlines: Trip Credit, Flight Credit, and Travel Vouchers. Find out how to redeem them, their validity, and their terms and conditions.